“Why the current tightening cycle is unlike anything we’ve observed in the past.”

By Wolf Richter for WOLF STREET.

When Canada’s Consumer Price Index for May was released a couple of days ago, it was – “as expected,” I would say – a lot lot worse than expected, and exceeded once again by a huge margin the inflation forecasts by the Bank of Canada. According to the exasperated economists at the National Bank of Canada, CPI inflation runs 1.5 percentage points above the BoC forecasts of CPI, outrunning those forecasts at every step along the way. May was “the biggest miss yet in what has been a systematic underestimation of inflation,” they wrote in a note.

“So if May’s CPI report doesn’t set alarm bells ringing at Governing Council [of the Bank of Canada], someone should check their collective pulse,” they noted.

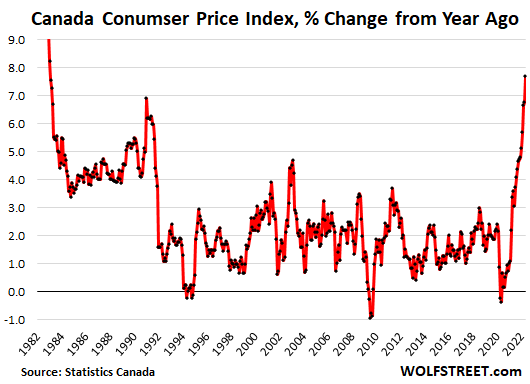

The headline CPI for Canada spiked by 7.7% in May compared to a year ago, the worst inflation rate since 1983, according to Statistics Canada:

The BoC has already hiked its policy rates by 125 basis points, to 1.50%. At its last meeting, it included hawkish language of more and bigger hikes than expected, such as a 75- basis point hike at the July meeting. The BoC has also embarked on QT, and its balance sheet has been shrinking since March 2021. But the rate hikes and the hawkish language of future rate hikes were based on the BoC’s inflation forecasts which have been “a systematic underestimation of inflation.” So this rate-hike cycle is going to get interesting.

On a month-to-month basis, CPI jumped by a stunning 1.4% in May from April, not seasonally adjusted; and by 1.1% seasonally adjusted. As expected, I would say, those spikes totally blew away the expectations.

The month-to-month CPI rates of March, April, and May, annualized, spiked to an annual rate of 12.5%.

The red-hot month-to-month increases came across the board, and not just in a few commodities-linked items. It gave the BoC more than enough reasons to pull the trigger on a 75-basis point hike at its meeting on July 13.

“Inflation forecasts aren’t worth the paper they’re written on.”

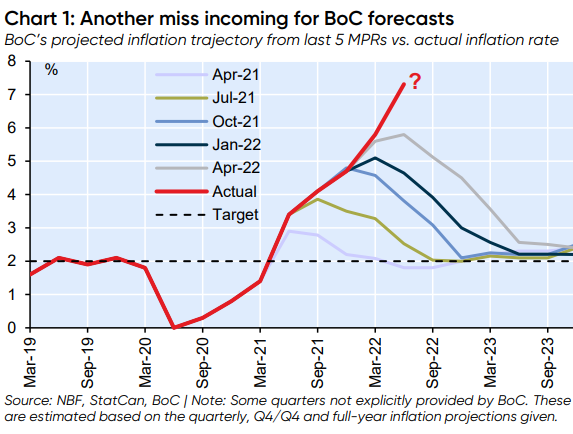

The BoC’s inflation forecasts that it released at each of its prior meetings going back to April 2021 are depicted in different colors in the chart below from National Bank of Canada’s Financial Markets shop. The red line is the actual CPI rate for each quarter. The BoC’s estimates start at each meeting with the then current CPI rate.

So at its April 2021 meeting (light blue, first line from the bottom), as inflation had begun to surge, the BoC estimated that CPI would peak at just under 3% by mid-2021 and then decline to 2% by March 2022, hahahaha.

Then at its July 2021 meeting, the BoC forecast that inflation would top out at 3.8% by Q3 2021, then drop to 3% by about right now, hahahaha, and to 2% by Q3.

The above chart shows how ridiculously far off these inflation forecasts were, and how this inflation is a big wild card that just keeps getting worse, even as commodities prices have started to come down.

“For BoC watchers trying to compare today’s inflation trajectory with earlier monetary tightening episodes, give up. There’s simply no comparison in the overnight rate target era (that started in the mid-1990s). That’s why the current tightening cycle is unlike anything we’ve observed in the past,” said National Bank of Canada’s Warren Lovely and Taylor Schleich in their note.

“As aggressive as the past couple of BoC actions may have seemed at the time, it’s time to turn the screws even tighter,” they said.

“A 75 bp rate hike on July 13th won’t fix Canada’s inflation problem, not with labour markets as tight as they are. As an aside, job vacancy data are clearly worrying, and Canada’s acute labour shortage won’t be remedied quickly despite a resumption of healthy population growth [through immigration],” they wrote.

And they added – sprinkled with stark inflation humor:

“To summarize: We have out-of-control inflation. Simply sending more money to households like some governments have done (or intend to do) is just like adding gasoline (itself already expensive) to the fire.

“Inflation demands an uber-forceful BoC reaction, including a 75 bp hike in three weeks’ time.

“Exceptional rate hikes have done little to control prices (so far) but have turned housing markets upside down. Consumer psyches bear watching and recession risks have mounted.

“Indeed, with inflation data like this, securing a ‘soft landing’ might be like threading the eye of a needle. We haven’t totally abandoned hope, but today’s CPI report should sober up even the most enthusiastic among us.”

The Fed was also ridiculously off with its inflation forecast every step along the way and by now has gotten burned at the stake for its use of “temporary” and transitory.” The ECB too has been ridiculously far off with its inflation forecasts. And their monetary policies – their refusal to hike rates starting in early 2021, and their refusal to end QE and start QT at the same time – were driven by this ridiculous underestimation of inflation. But now they’ve gotten the memo.

It is an interesting turn of events that economists at the big banks in Canada as well as the US and everywhere are exhorting their respective central banks to crack down on inflation by raising rates further and harder as this inflation is threatening to spiral out of control, after which the economic and financial damage from runaway inflation is going to be huge.

Stock and bond markets have already reacted sharply to this tightening scenario, and in Canada, housing markets have already “turned upside down,” and central banks have just started to tighten, and nothing central banks did in recent decades can be compared to what comes next, and if a recession is part of the deal of getting this runaway inflation under control, so be it.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I have a good feeling about this.

I don’t have a good feeling about this. I think the plan was:

1. To say there is no inflation

2. Then to say inflation is transitory

3. Then to Jawbone markets with tightening with the hope that inflation would evaporate.

That plan has failed:

1. Current -7% real rate (1.6% Fed rate – 8.6% BLS infation) is already heavy on market.

2. Inflation is still very far from under control.

3. Any “Real tightening” (= Real positive interest rate) would just crash all Asset prices.

4. Our economy is hopelessly depended on Asset Prices to keep our Balance Sheets Balanced!

5. I don’t see a happy path (softish landing) here.

There was no plan. They were shooting from the hip responding ad hoc to the situation du jour.

Correct.

They were simply wrong, again. Occam’s razor is a better explanation than some nefarious conspiracy.

Organisms without vertebrae are incapable of planning.

I will add some Spanish to the Latin and French: no Bueno

Not only do they have no plan, soon raising rates won’t work either. (Owning US$ will make more sense than the Looney.)

Canada is living on hope and fresh air at the moment.

HAVE THEY EVER??

Sheila Washington,

NO ALL-CAPS. You can configure your keyboard to where you can use lower-case keys. Problem solved.

The plan is just greedy human nature:

1) It seems what we were doing was making us and our friends lots of money and they let us do it

2) if we do more of that for longer we will make more money

3) just a little more, I’m getting used to this lifestyle

4) maybe just one more time, who will notice

5) Uh oh. Seems we have to cut back, but just a little.

6) Oh shit. I better cash in my soft chips for hard farmland.

They have been very reluctant to acknowledge what they themselves hath wrought. Denial is a strong defense mechanism.

Hope every Canadian landlord loses everything they ever had!

It really has been disgusting to see Canadians one owner ambivalence as prices outstripped wages.

Shoe is now on the other foot.

The Bank of Canada hasn’t broke the local Chinese yet in Ontario to the point where they have to liquidate everything. Out west has barely fallen. The Chinese have zero money in stocks and everything in residential real estate. The bottom end of the housing market is holding up a lot better than the top of the housing market but the bottom end will get crushed if rates go high enough forcing the Chinese to liquidate. As always the Chinese never buy into any falling markets of any type.

that would include me who didn’t charge my 2 tenants rent last year when I could have legally done so . so I should lose everything I ever had eh?

I’m assuming you’ve never been a landlord, had to deal with the costs of owning depreciating property and tenants who leave you with a week or two of cleanup and repairs.

most coins have 2 sides and the landlord/tenant one does too izall ima say’n. :)

Real Tony, yeah it would be even more amazing if the cold war stepped up more and there were capital controls with China.

Listened to a high level O&G guy and he said that we are currently -4 billion bpd in order to match demand levels. The last time supply was this low was the ’08 financial crisis.

If the FED has to raise rates for demand to match supply, it’ll be very bad.

Thank you. The plan is status quo at any price. That is what keeps the bureaucracy and politicians employed. The US is right now soft defaulting on its debt via inflation. This will continue until there’s significant civil unrest. It’s the easiest way out of the mountain of debt and the government knows it. A repeat of the 40s.

There’s nothing wrong with 3 it’s the cure to 4. The suffering from higher interest rates IS the recovery. Embrace a detoxifying recession.

totally agree esp. with #4- a policy long favoured by Ottawa and Victoria;

it was an easy way out for the politicians from the beginning

Just tax the assets that are inflating. Tax back the printed money wherever it lands. (Looking at you top 1%)

This is the ‘land tax’ economists began in the pre-WW1 era. You take the asset inflation out by taxing the top 1% who run everything and have boosted inflation along with their outsized profits. Adam Smith warned that nations with high profit margins are the heading quickly for ruin.

I’d like to see that Adam Smith quote.

Think about it. Excessive profit margins means what? Greater and greater concentration of wealth at the top. Increasing wealth inequality. Eventually the economic blood runs dries from the vampires siphoning off it, who trundles off the empty husk to seek fresh prey.

Welfare recipients aren’t parasites and freeloaders in a functioning society, that’s capitalist-think hiding their pursuit of oligopoly and libertarian principles favoring them and theirs at the expense of the rest’s *welfare.*

That’s a “no duh” no-brainer if I ever heard one. Makes perfect sense, which (very sadly) is why it will not happen in our current (fill in the blank) climate.

No, it isn’t if your idea is to actually spend this fake “wealth” in the real economy.

That’s the idea behind the recent wealth tax proposal in the US Congress and is yet more proof that they are collectively economic illiterates.

This idea is based upon pure envy, as 99%++ of the 1% had nothing to do with the policies either of you dislike.

“This idea is based upon pure envy,”

Envy is way down on the list. It’s a natural response to gross injustice and a misallocation of the nation’s wealth.

My Libertarian friends are always telling me “Inflation is Always and Everywhere a Monetary Phenomenon”.

So why not tax some of the excess money out of the system?

OG:

You don’t tax the money out of existence, you just move it to be released into the economy by someone else (the government). I doubt that the Treasury would simply save it or destroy it.

They’d buy more stuff that goes “boom”.

El Katz.

So money printing is not the cause of inflation ?

People are.

El Katz, if the government used the tax revenue to pay down debt the money would be taken out of circulation.

@Old Ghost

Your Libertarian friends are right

actually that isn’t how money is created or destroyed in our system as far as I understand it.

Money is created when a bank or other lender originates a loan. A loan based upon an asset or a future revenue stream. But a loan.

The Wealth Effect by keeping interest rates low has caused the value of assets to rise. This allowed lenders to create more and more money.. This created the inflation. Interest rates below the rise of asset values. Inflation is/was not necessary.

Defaulting on loans will drive the asset values down and destroy money in the system.

Higher interest rates can easily cause this to happen.

The Fed’s problem is that inflation destroys the value of money and raising interest rates can so easily cause a cascade of defaults. Once defaults start and the psychology changes, fear becomes the main driver and at this level of insane indebtedness, things can get out of control very easily.

Whether the government taxes and pays off debt is irrelevant to this other than when it taxes, it can remove liquidity that is servicing debts and can cause the same cascade in defaults.

You really don’t want raising taxes and raising interest rates at the same time unless you are an extreme masochistic.

If there is a job guarantee to help offset the economic effects of raising taxes and raising interest rates such that I can have essentials covered, I say hit me, Daddy.

I wouldn’t want a Libertarian anywhere near the levers of government power. That’s like letting Mark Zuckerberg chair the FTC or having a politically active NRA with major influence on gun control policies.

Oh, wait.

I do not. We may soon see manufacturers cut production due to a weakening market and increasing cost. Soon we will see if farmers have done that this spring around here.

What might be different this time is the supply side reaction to inflation.

Yes, many insightful comments here on what is wrong with the system, yet not many suggestions on how to reengineer it!

But if mortgage rates go to ten percent by December, fair to assume big housing and stock crash.

But it is not obvious yet to some people that these perennial problems require re-engineering the financial system! After all, even after inflation is vanquished, how long do you think it will be to the next crisis?

So to reengineer, I suggest:

1) Scrap the income tax.

2) Go to consumption taxes – much better inflation inhibiting effects.

3) Implement Capital Transfer Securities to constrain offshoring and promote reshoring.

I discuss the above in the link associated with my name above, for what it is worth …

Who said madness is doing the same thing over and over and expecting a different result?

Simple fix flat tax in a rising income format ,everyone pays individual,corporations,trusts,also charitable trusts at half price . No lobbyist but then there is no corruption

Curious that all forecasting that is in error…..is in error in the same direction.

Also curious, that we never hear from the Fed that prices must come down…we just hear that they have to go up at a SLOWER rate. This IMO is a “tell”.

So, based on what Powell said in testimony, if prices are right here, 12 months from now with an added rate 2%….the Fed will have succeeded.

Nonsense. People can’t handle these prices!

They packed 4 years of their “target” rate into one year, unexpectedly. Yet, they do not recalibrate, they do not adjust to the unforeseen event, as a business would.

Instead they apparently assume the 8% is “baked in”.

IMO, and if they were ever really on the “2% a year and no more” program, they should now be pulling for a retracement of the 8% spike, negative rate of prices for a few years, to get down to their still curious 2% annual goal…..but why promote ANY inflation?

Where did that averaging program go?

If I remember right, the big change like a year and a half ago, was that the Fed said they were fine with overshooting their target of 2% inflation, and if they did then it would come back down. Since they’ve been under the inflation target for decades, despite ZIRP, it might have been easy to think significant inflation wasn’t even a possibility.

add up the CPI inflation in the decade after 2009 until 2020….

you will get circa 20%…..then add in the compounding…

So this nonsense about averaging back is lame. The Fed being under their “inflation target” is nonsense.

The Fed HAVING an inflation target is nonsense. It is not consistent with their mandate of stable prices.

2% for ten years is 22% loss in purchasing power of the dollar.

How can that be considered “stable prices”?

And if inflation is a TAX, then who is the Fed to lay a tax on the holders of dollars? Taxation is a Congressional power.

And because WE as a citizenry have no representation on the Fed, this is “Taxation without Representation.” Ring a bell?

Lies lies lies. They knew what inflation would be. Never mind Putin or anything else. This was monetary policy that was bad before Covid and went crazy in response to Covid. Inflation has always and will always be caused by monetary policy. Now they just pretend to be surprised so we don’t string the lot of them up by their necks. P.M. sparkle socks first.

Follow the Money

No one seems to notice, the Fed never speaks of getting these prices down…..the just want to add on a smaller rate of increase.

So telling.

Powell’s outlined victory would be these current elevated prices, 12 months from now, with a 2% increase added on. I dont think the citizenry can handle that. The unforeseen 8% spike has not forced the Fed to adjust their inflation “target”…..that is ridiculous……

I don’t. The Bank is wed to models constructed on economic developments and trends continuing on ‘as if’ they do in our world of supply shocks, accelerating climate change, Covid, and increasing international tensions and wars. These affect food, household and productive energy, weather conditions and potash needed to grow food stocks.

There is little to no room for judgement in such models; and, my experience is that judgement is more needed than ever when using such models.

About a half century ago I could not agree with models which based their forecasts on women’s labor market participation rates continuing to be low, so I developed my own building in the judgement that this would not and could not be the case if only because well-educated women, in the majority, would not likely be stay-at-home spouses.

My judgements wound up being adopted eventually.

Me too. A price correction after gasoline was 88 cents per liter during the spring of 2020. Looking at the graph, it shows decadal deflation rather than inflation.

Me too

this will strengthen Democracy!!

I just wanted to be first. I like to watch how the ads change. At the moment my theory is being partially debunked.

I can speak to the manufacturing side of that. I’m seeing my clients (precision manufacturers) – a tier or two down from the Boeings of the world – struggling like never before. Impossible situations like material input costs vs. LTA’s (long-term agreements) negotiated before inflation went haywire. Labor shortages – that’ve been present in that industry since the late 1970s – reaching beyond-critical levels. Old school (the old farts who really know what they’re doing) craftsmen and professionals throwing in the towel and selling/retiring early.

One of the many, many “unintended consequences” of out-of-control money printing, asset buying, and other shenanigans by Federal Reserve Bank around the world… a sad saga chronicled so adeptly and accessibly by Wolf Richter. Cheers.

When America decided to be a high tech society and outsource ,meaning less jobs = manufacturing we’ve went downhill. Give me a phd I can fuck up a pay toilet .Over educated idiots with no common sense. We need to elect people who are commenters they live in the real world

I’d describe it more as financializing the economy than choosing to become “high tech”.

It’s too late to put the toothpaste back in the tube. No remotely possible election outcome is going to result in the outcome you imply,

Part of it was transition to be a rentier nation. Earn money on lisensing intlectual property, asset value inflation, interest rates and expansion of US dollar debt. That have worked fine for a while. May not continue to work that well.

Well put Degobah

Its all about magical thinking. If you magic think your way into a slow down of inflation or deflation, their next wish is for FED to turn around that ship from QT to QE. This is the magical La La land narrative they are selling to MSM nowadays..it’s just around the corner so get in the market now buy that dip before it’s going back up to the moon again after the QE train roll back into town due to popular demand..

Please don’t feed the zombies. And please oppose the Fed’s inclinations to do so!

Volcker lowered rates too soon and inflation came roaring back. I hear a lot of talk about the “bullwhip effect” where inflation falls only to come raging back even stronger than before.

I see the comment if its correct and with the midterms in November:

If the CPI drops substantially in July, August & September those on Social Security will get a low cost of living increase in January since they use the CPI from those 3 months to determine the next COLA.

My theory is the same as the guy posting the video hyperinflation after a very brief period of falling inflation because of the midterms and that comment.

Real Tony

‘Volcker lowered rates too soon and inflation came roaring back. I hear a lot of talk about the “bullwhip effect” where inflation falls only to come raging back even stronger than before’

You are WRONG!

The 10 yr bond yield peak was 15.4% in 1981 (Average yield 11.3%) came sliding down & down for the past 40 yrs to 0.3 or less. The greatest BULL mkt in Bonds! and then turned into greatest BULL mkt in Equities! Now reversion to the mean has started!

fyi

https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart

He is not wrong… Volcker raised rates as soon as he was confirmed in August of 1979… but lowered rates in 1980 starting in April and running through November. Inflation came roaring back (in reality it had never left… it was just a bit suppressed).

But in Volcker’s defense, Jimmy Carter had put the arm on him to back off. Ronald Reagan never did that (people forget that Reagan’s undergraduate degree was in Classical Economics) and THAT is why Volcker became the most famous Fed Chairman in history.

Spencer G

Did you look at the chart on the link?

I was here in 80s!

It took nearly 18 months from( after he got the confirmed) 1979 thru mid 1981 to contain inflation by raising rates(continuously) to almost 20%! I had invested in 10y bond with yield over 14%+ in mid 1980.

Sizing up the long-term cost of inflation

Year Annual Average CPI(-U) Annual Percent Change

(rate of inflation)

1979 72.6 11.3%

1980 82.4 13.5%

1981 90.9 10.3%

1982 96.5 6.1%

During 1981, inflation in both retail and primary markets slowed to the lowest pace since 1977. The Consumer Price Index for All Urban Consumers (CPI-U) moved up 8.9 percent, following increases of 13 .3 and 12 .4 percent in 1979 and 1980. All major categories of consumer spending, except medical care, registered smaller increases in 1981 than in the previous year

The moderation in the housing and transportation components, along with a sharp deceleration in the food and beverage index, were largely responsible for the slowdown in the overall CPI in 1981 .

CRAIG HOWELL AND JESSE THOMAS

https://www.bls.gov/opub/mlr/1982/04/art1full.pdf

Sunny…

I think it is cute how you think you are the only commenter on Wolf’s site who was around in the 1980s. I suspect that describes most of us actually.

That said… YES… I did see the chart in the link you provided. Did YOU not see the dip in April of 1980 just like I said was there? There was nothing “continuous” about the Fed’s raising of interest rates in 1980. YOUR OWN CHART shows that.

So you buying a 10-year bond for 14% interest tells us very little. The price of bonds does NOT automatically follow the Fed Funds Rate… competition for those bonds also has a say… so do people’s EXPECTATIONS of inflation (which weren’t helped by Volcker going all wobbly).

The point is that even the famed Paul Volcker had to account for political pressure back in the day. He backed off his Fed Funds rate hikes and 1980 had some of the worst inflation of the decade as a result.

Just like The Real Tony told you to begin with…

That isn’t exactly how the SSA COLA works. They were compare the price level for the 3rd Quarter of 2022 to the third Quarter 2021 price level.

Not just in the MSM. I read this type of sentiment here, all the time.

Those who are negative still seem to think there is some magical way to escape the worst of the consequences from the country’s extended social decay and economic rot. After all, this is “America” and somehow, someway, this country is exempt from the reality which applies to everyone else throughout history.

The resolution (there is no solution) doesn’t lead to just a “temporary spot of bother” with another GFC-type event and a temporary decrease in fake paper “wealth”.

It’s long-term economic stagnation or a crash landing in living standards for most of the population. The country isn’t actually that much wealthier versus when I was growing up in the 70’s and 80’s, only somewhat so. Living standards are higher predominantly due to the asset mania and loose financial conditions. Remove the artificial support and most, all, or even more of the fake prosperity disappears.

The majority of the population are destined to become poorer or a lot poorer, not just financially but materially and in their quality of life.

The Magical Thinking comes from the Exorbitant Privilege of the U.S. dollar having the same (short term) value whether earned or printed.

Unfortunately for America, Politicians and their employees at the Federal Reserve have worked overtime to destroy the purchasing power of the U.S. dollar by monetizing today’s consumption with tomorrow’s earnings (taxes). Exponential printing, absurdly low real interest rates (by dictat) have increased nominal values in the paper/electronic “asset” world.

Now the Piper shall be paid.

This may be as big of a miss in planning and perceptions as 2008.

Spewing money and credit was the path of least resistance politically for organizations supposedly politically independent. Writing a check is the easiest thing in life. It is the dilemma of democracies (where the public clamors for free stuff but tolerates no taxes to realistically pay). That tail wagged the dog.

But the dilemma cannot be spent-away. The spool was run out on debt, now on money printing. “Interesting,” for sure. This is quite a pickle for these elite bankers who seem in some sort of shared mental bubble. I don’t fully comprehend what Japan and China are doing, but they seem the outliers, and of course Russia. But the US dollar is still our currency and everybody’s problem (a quote from the 1970s).

We are in the cheap seats. They are steering the ship, and we are nobodies down in steerage somewhere, caught in the tides.

The 300 PHDs at Fed are not foolish. They should have known that they would lose control of inflation. Most probably they could not find an acceptable solution, so they just kept postponing with hope that someone else will take care of the problem.

Its like a Pilot who is flying over North pole and found that his Aircraft has lost both engines.

1. He first choses to keep the passengers happy by not sharing the bad news and kept flying high.

2. Then, when the plane stalls and started going down, the Pilot tells the passenger that he would make a soft landing on the ice.

3. Why tell anyone that he has no control and even if he did manage to land in north pole, passenger’s and crew’s fate is essentially sealed.

Those Ph.D.s might not be foolish, but that doesn’t mean they understand how economies, with billions of constantly moving pieces, work in the real world. Haven’t you ever wondered why we have so many schools of economic thought (e.g., Keynesian, Austrian, Marxist, Chicago)? If economists truly understood how economies work, wouldn’t one school of economic thought be sufficient?

We would at least have one school that taught the right stuff!

But, then what would they do with all the extra teachers?

The Austrian economists seem to have pretty good explanations for things, and a comparatively excellent ability to forecast. But their advice is not in line with big government and is therefore blithely ignored.

Neither is the Austrian economists in line with big money and banks.

Economics is a social science. Yes, they use math, but they also try to model social inputs – think emotions. There really isn’t much science to go with it. It’s like asking a child why they did something wrong and getting the answer I don’t know.

I am in the natural sciences. We have laws that govern things- think gravity on earth working downwards.

“If economists truly understood how economies work, wouldn’t one school of economic thought be sufficient?”

Confused, I agree with KDMaz above. Economics is descriptive and not predictive, although it pretends to me.

Maybe they need to collectively play the game of Monopoly, altering the money supply during the game to observe the consequences.

Doesn’t seem much more complicated than that!

I’ve always assumed economists predominantly believe their own conventional economic quackery.

They think and maybe are smarter than most everyone else, so in their hubris and group think, can’t imagine being wrong. A circle of conformists in a bubble echo chamber.

I’ve long speculated that Fed policy has been dealing with the lingering results of the GFC never really being addressed. As in, rates have been suppressed to hide solvency issues in companies like Citi.

We have long-term money flows, the volume and velocity of money (the proxy for inflation), at the highest rates-of-change in history.

Good start, but confused by the FACT that ”economics” is NOT SCIENCE.

It is simply the aggregation of opinions, similar to all the other ”social sciences.”

And for the same reasons, one of which you are apparently NOT confused about, eh?

As to the PhD ”issue”,,, I had the opportunity, after a thorough grounding in the sciences of physics and chemistry at the best public universities in USA 50 years ago ( — and perhaps still today,,,) to read a hundred or so theses approved as part of PhD degrees awarded at those same universities; at least half of them contained ”conclusions” that were absolutely NOT supported by the data in the monograph.

And subsequently worked in various capacities with several folks with PhDs who were consistently over educated in one very very narrow ”concept” and extremely under educated in everything else.

Anecdotal, far shore, but SO consistent…

Confused,

From what I’ve read mainstream Neoclassical Economics, which describes the school that 90% of academic economists belong to, doesn’t accept that there are any other systems of thought worth teaching. That’s right, most university economics courses teach just one model, not the history of economic thought.

On top of that this single model is not even intended to describe any real economy. For example, the neoclassical model doesn’t include debt as part of the economy’s function.

As I stated before early last summer professor Steve Hanke and an associate predicted inflation was going to be between 6 – 9% by Dec 2022 based on simple money supply calculations. Unfortunately he sees inflation running at elevated levels for approximately another 18 months.

His big fear now is Fed is going to over tighten and put us in recession. They have already put the money pig in the Python and it’s going to take time for the money dump to pass through.

Old School

‘Fed is going to over tighten and put us in recession’

The Fed’s policy error(s) is already imbedded in their current policies. Way behind the curve. Too little, too late

Lag time of 6- 12-18 months between rate hikes and the response of inflation.

After 13 yrs of easy-peasy financed stock mkts reaching nearly 400% (S&P) since March of ’09, why any one is moaning, whining and complaining for the coming recession is unforgiveable. All the days cannot sunny, for ever!

Being in the mkt since ’82, this was a SURREAL BULL mkt with absolutely NO fundaments but easy-peasy money printed out of thin air!

The consequences of their ill thought out monetary policies are bearing the fruits. Recession is just one of them. Complaining won’t change the KARMA of their actions!

I goofed on my date. I should have said Dec 2021, but you get the point. You don’t pump up the money supply without the money getting spent.

My son has PhD in theoretical math. What he learned after a master’s degree was useless in the real world. He became a teacher at a community college.

Raj

It is well known FACT that any economist of standing ( including. yeh, those PhDs) will have NO career in USA, if s/he contradicts the Fed’s monetary policies.

The only critiques gutsy enough to voice their opinion are are those retired from the Fed/Govt like Larry Summers and William Dudley (former Chair of NY Fed!) and Richard W. Fisher ( former chair of Dallas Fed) The later voiced his objections while being member of FOMC!

fyi

Transcripts of the Federal Open Market Committee in May 2007 showed Fisher sounded the alarm on the housing crisis even as many of his peers on the Committee expressed doubts: “On the housing front, I have been bearish—more bearish than anybody at this table. I am more concerned than I was before. We can go through the numbers, but I think it is best expressed by the CEO of one of the five big builders, who said that in March he was arguing internally with his board that the headlines were worse than reality and now reality is worse than the headlines.”[5]

At the Dallas Fed in 2013, Fisher was outspoken in opposition to the way quantitative easing was being pursued by Fed chair Ben Bernanke and the board.[6]

As US equity markets began to unravel barely two weeks after Yellen’s December 18 rate hike announcement, Fisher came out on CNBC decrying the Federal Open Market Committee’s decision to launch QE3 saying that he, “voted against doing QE3” and that QE3 was, “one step too far.”

Daniel Tarullo former Fed Gov 2017 wrote a paper Monetary policy without a working theory of inflation. This of course when the Phillips curve was found not to be operating as predicted by trading off higher unemployment and lower inflation. So the Fed invented their own models that have never been proven to work in an economy with different banking regulation and QE out the wazoo and tax cuts. Notice the long bond 10y going down while manufacturing is slowing and economic sectors declining like we are already in a recession called by Dr Copper. If the Fed raises rates again we might hit deflation and more chaos. It looks like a world wide problem, Japan debt crisis, Euro debt, Russian collapse. I just read Factset analysts yearly estimates are in a positive normal range so something might still be functioning as the economy might muddle threw it if the Fed does force rates too quickly. This is hitting the boomers as there is no place to hide or maybe hope long bonds go down at the next easing cycle if one takes the bet. Superb coverage here by Wolf at the bleeding edge again.

Those PHD s are not stupid but cunning and shrewd. They are not even working for America or American people, but they are working for extra rich (billionaires)

“Writing a check is the easiest thing in life.”

Spending other people’s money on anything you like is even more fun.

“But the US dollar is still our currency and everybody’s problem”

But, but, but….The U.S. dollar can still shrink, lose value and faith, even if most other world currencies go into the same Black Hole with it.

Churning and skimming with claims upon claims of apparent but not real paper assets is a con game. Priced in U.S. dollars.

“where the public clamors for free stuff”

Not to pick on you specifically, but I keep reading quotes of this nature. I certainly don’t know all of the public, but I don’t know of anyone who has been clamoring for free stuff.

What I see is a bunch of very bright, ethically deficient, people who enter the world of finance and stocks and bonds, who figure out new ways to obscure that they are enriching themselves via various leveraging schemes. As that world starts to crumble, the big banks and the FED rush in (QE, for exampe) to shore up the mess and prevent a collapse. Whether the FED and the banks were “in on it” from the getgo, I can’t decipher. We are all going to be hurt. Especially those who don’t have a lot of feathers packed into their nests already.

I am most concerned if I am leaving behind anything resembling the promise of freedom and individual sovereignty inherent in the U.S. Constitution. Without that, actual recovery is a fantasy.

I agree with your last paragraph wholeheartedly and with the impotence it implies.

I’m with you, Roy. If you want to find people clamoring for free stuff, start with the lobbyists on K Street in DC. Then move on to all the employers who pay for 40 hours but expect 60, or the ones who want you to buy your own tools to do the job they’re asking you to do, or buy your own uniforms without reimbursement. Then when employees just get too problematic, ship the jobs to China or Mexico or Vietnam, and what you can’t send overseas, you reclassify as contractors.

There’s widespread resentment about poor people who take advantage of whatever they can get away with, but nobody remembers that those people are still poor when it’s all over. Yet somehow the rich and even the upper middle class who got there by ripping off other people “earned their way honorably”. Might as well have just robbed banks and mugged people but they did it with a nice suit on, so at least they looked good doing it.

You want to deal with cultural rot, there’s a few places to start.

Forgot to mention, I predict RE prices in China will go down over 80% ultimately. This Amazon tablet changed mostly to “most in y.” Is that in some other language?

As Mr. Richter said this is the most accommodating FED ever. I know inflation is a problem but I am not sure how to invest in an inflation-increasing environment that is different from an increasing rate environment.

Most people aren’t “investing”, they are speculating. They just don’t know it and if they did, might behave differently.

Sometimes there is no good outcome. I think this is one of those times. Only a low or very low proportion of the population are going to be able to escape the consequences of the end of the asset mania. The nominal value of their wealth is either going to be crushed by the upcoming bear market, currency debasement, or both.

This should be entirely expected, since the value of financial claims exceeds the economic capacity of the real economy to a historic extreme. Look at household net worth to GDP. and GDP is also substantially artificially inflated.

Augustus Frost

“Most people aren’t “investing”, they are speculating. They just don’t know it and if they did, might behave differently”

When speculation has achieved S&P nearly 400% since ’09, who cares about investing, fundamentals like PEs+. ZRP+QEs+Fed’s put made sure they wil win NO MATTER what! When QE1 failed, then came QE2, QE 3 and 4! In addition there was ‘twist’ suspension of mkt to mkt accounting standard! Why bother about earnings when Buy-Back do the same!

Now the piper is demanding payment for consequences of repeated insane credit creation and financializing the economy!

I think they teach you in finance MBA school that Fed and elected politicians have a natural conflict as politicians always need to pass out money to get elected and a true central bank is to make sure that can’t happen if it is going to cause inflation.

Old School

There is NO Ethics class in any of MBA programs in the country. I know. I enrolled at USFL ( MBA for post MDs) around 2000, got fed up with what’s going on at Wall ST, dropped out 5 credits. short of graduation. No regrets ever since!

In order to work after graduation – Insurance Co, Hospitals, Wall St, one has to first sell the SOUL and act- Hear no evil, See no evil and Speak no evil. No surprise to me what’s going in Health/Medical institutions, in this Country!

We’ll just eat NFTs and volcano bonds until we aren’t hungry anymore.

Echoes of Marie Antoinette.

“To summarize: We have out-of-control inflation. Simply sending more money to households like some governments have done (or intend to do) is just like adding gasoline (itself already expensive) to the fire.”

Tell that to the ZeroHedge and Goldman crowd who are predicting rates cuts to zero and massive QE later this year. I believe there will be no appetite for another round of stimulus and QE no matter what happens to the stock and housing markets.

I agree. Watching Powell this week, replying to senators, I got zero we vibes from him.

Don’t put anything pass Trudeau. Canada has the second greatest housing bubble in the world and Trudeau’s solution is a $40,000 tax free savings account to save for a down payment. Which will push prices even higher. Seniors age 75 and older are already getting free money from the government in Canada.

The Real Tony

Do you know, why?

B/c Housing is almost 50% of Western Economies. Once it starts deteriorating , so is the Consumption based) Economy!

That’s why we had GFC and now, bust of ‘everything’ bubble economy. Housing Bust 2 is on the way, once the deep recession arrives. Not if but WHEN!?

–

“A tidal wave of evictions could be ahead. More than eight million Americans are behind on rent payments, and the CDC’s series of eviction moratoriums has long since expired. In other words, the government safety net to keep people off the streets is gone.

With no federal eviction moratorium in place, 8.4 million Americans, or about 15% of all renters, who are behind on rent, are at risk of being evicted. The new figures were part of a Census Bureau survey conducted between June 1 to June 13 of households and was first reported by Bloomberg”

—

Next will be 2nd and vacation home owners!

Sunny129

And the only reason that there has been a housing market for more than 15 years is the Fed dictating, suppressing interest rates/conjuring money, so savers subsidize via Net Present Value, higher and higher prices for housing/shelter.

O/N RRPs just hit $2,473,338. That should be reported as a decline in the FED’s assets, but it is not.

Who really knows what is going to happen? We have so much debt, that asset prices are going to be very unstable I fear. Just look at house price roller coaster over the last 20 years . Add to that stock and bond market volatility.

If asset prices go down enough that system starts melting down I think they will print again.

ZeroHedge is Goldman and Google.

Pillow Fight Club.

Ghosting everywhere. Discussion and argument long gone.

Why is ANYONE suddenly believing the BS Goldman puts out??? This company is a deception machine:

https://wolfstreet.com/2022/04/18/the-2021-creatures-of-goldman-sachs-its-ipos-spacs-and-direct-listings-are-now-imploding-after-bonuses-spiked-to-a-record/

Perhaps they missed the book on the required reading list for investors: “Where are the Customers’ Yachts? – or A Good Hard Look at Wall Street” by Fred Schwed Jr.

I don’t know about Goldman Sachs, but, ZeroHedge has been running information operations for years and years.

Maybe Russia now needs the “Market” to recover?

Inflation is not a problem for the Grifter’s of The Empire. Their position on inflations impact on me is STFU piss ant. This is the price for freedom. Ohhhhh…..I feel better now. I think I’ll do the Nancy P. Knuckle Rub Shimmy Shammy.

These central bankers are like guys hunting a grizzly bear with a pea shooter. Inflation doesn’t care about your wussy little 75 point hikes. Bring out the elephant gun and level them with a 500 point rate increase! You want to be taken seriously? Then get serious!!!

I wonder how many market participants are consciously playing a game of chicken here.

Well there goes your pension ,s welfare Medicare plus many other social programs. Riots in the streets ,what fun .Be careful what u wish for

Most civil service pensions are indexed to inflation. They will get +6% this year and next, while the rest of us, paying the taxes, will get 3% if we are lucky.

In a depression there are no pensions ,now probably just chaos as society has changed since 1930s

The Mandarins (government employees) have bargained with their Political Cohorts to pick the bones of the Private Sector employee and retiree, while know full well there would never be enough taxes to pay their guilded pensions.

kam……yeah, that GDG!

But Corporate (private industry) Salvation is just around the corner! And they will provide jobs with excellent benefits and pensions that you seek….they just need to shrink the GDG more so they can provide jobs without so much useless GDG interference.

Patience!

I prefer the constant false dawn’s, giving hope to the degenerate gamblers who go long the triple Q or crypto hoping for rates to go back to zero like Pavlov’s dogs.

One reason that the projections have been off probably is linked to inaccurate data sources.

For example the Canadian Institute of Actuaries is very concerned about the couple of decades of inaccurate guidelines for how much is needed in condo reserve fund pools (so time that could have been used to build the funding up with somewhat higher maintenance fees over the years was squandered. So there will be huge and unavoidable shocks coming to condo owners as a result of this. Exacerbated now of course by current inflation.

Shane’s Dingman of the Globe and Mail has also written about this pending raincheck that has not been included in calculations for the cost of housing.

So if the data feed is erroneous. And both the bank of Canada and retail (prospective homeowners especially for condos have not gotten proper disclosure this is also likely to feed into further nasty surprise. Plus interest rate hikes become an inflationary self reinforcing loop given the magnitude of repeat special assessment and the need to resort to Helocs or reverse mortgage to anti up plus except for landlords set ups there is not the ability to use tax write off to cushion these costs in Canada.

So what else has not be culled so that the Bank of Canada keeps getting caught off guard.

Yes there are factors beyond the B of C control but if their core data is not as comprehensive as it needs to be from its usual sources (right down to those poor status reports section 12 for condos then of course inaccuracies will pile up

But they could nationalize all gold,oil ,lumber .Mightbring ship upright

At least long enough for all the politicians to rob and plunder it all.

The Canadian government under Trudeau was showing zero gold reserves in 2016 after he sold it to China along with some gold mines. There’s some government-minted Maple leafs from previous years in bullion circulation. They may have surreptitiously bought a hundred tonnes last year but nothing’s certain, the World Gold Council says they made a mistake in reporting. Quite a boo-boo. They will not want to confirm a reversal in policy, especially concerning a purported inflation hedge like gold, after they dumped it for more negotiable investments.

I’m considering exchanging some of my clown cad for xau

Trudeau is a WEF/Great Reset disciple. Anointed “Young Global Leader” by Klaus Schwab and Yuval Harari. He gets his marching orders from Davos.

“He gets his marching orders from Davos.”

Stan, it’s called ‘build back better.’

Been seeing a lot of that lately.

Why doesn’t Canada nationalize the Federal Government and sell this efficient, modern sack of snakes to some other unsuspecting buyer?

Still waiting for that closed parentheses in your narrative. ;-)

“One reason that the projections have been off probably is linked to inaccurate data sources.”

No. When the models go wrong, it’s because it doesn’t reflect the behavior of actual human beings. It doesn’t matter how accurate your data is when your assumptions are wrong.

Garbage in, garbage out.

Garbage in, garbage out needs to be modernized.

Garbage in, Garbage Algorithm, Garbage Out.

Genuinely funny.

Thank you for todays laugh.

Even more than reigning in inflation, I want to reign in central bankers. For good. These greedheads have been destroying the world for over 30 years, with the worst effects over the past 25. It’s time for change.

Hear,hear,don’t forget lobbyist about equal ,SCUM

Inflation is reigning during the Central Bankers’ reign. You might be looking at reining in both. Otherwise, it’s going to rain on everyone’s parade :-)

I made the mistake not once, but twice. Uggh.

There seems to be mass hallucination among the speculators who have been pouring out of the woodwork lately to announce that the FED is going to pivot any day now, because they just won’t allow asset prices to fall.

Inflation in 1980 was 13.55%. The Fed funds rate started out the year about 14%, dipped to 9%, then shot back up to nearly 19% by years end. We’ve pumped $11T into our economy in the last 24 months and the current FFR is at 1.5%. The Fed has only rolled off $47.5B in bonds & MBS from its $8.9T in assets with full tilt not due for another 3 months.

We have lingering supply chain issues that may take years more to shake.

Real inflation if housing & rent were properly accounted for would be within reach of 1980. Joe Biden’s entire administration is hostile towards fossil fuels. Biden hasn’t approved a new oil/gas lease in the 18 months he’s been in office. The median price of an existing home just reached $414,200. Anecdotally, my dinky 1,200 SF home increased in value over 29% in the last 12 months alone, per Zillow.

Climate change puts the USA one bad harvest away from food scarcity which would result in real hyperinflation. We have over a million new mouths to feed with thousands more arriving every day. Everyone is screaming about a lack of housing, including affordable, which will get worse as another 3-4 million arrive before 1/20/2025. These millions of extra mouths to fed, educate, provide healthcare have to have some place to live. The reality is this avoidable situation will put enormous strain on the lower end housing & rentals, creating even more economic pain for the lower class. Setting aside the politics, this is a significant economic issue and will create incremental pressures on inflation. How can it not?

There’s a trillion dollars in Congressional infrastructure spending coming online. There’s $2.2T in reverse repo monies being parked with the Fed from all sorts of financial institutions.

Counties across the country a flush with cash from historically high property taxes. Lots of people, including teachers like myself, are getting raises.

Yes, I agree that a lot of Wall Street gurus are hallucinating if they think inflation is going to subside anytime soon. Larry summers has been right the whole time, but he might have the 1 year of 10% unemployment wrong. It might take 2 to 3 at that level. After the great recession, unemployment was at or above 5% starting for 8 years from 2008 through 2015, and inflation averaged 1.5%. During the two years prior to the great recession, inflation averaged 3.3% and unemployment averaged 4.65%

So our inflation rate prior to the looming recession is realistically (i.e., the BLS properly captured rent & housing costs) three times more and our unemployment rate is a full 1% lower.

Like the WSJ said the other day: Biden is practically engineering a recession, and it’s not going to be mild.

To Jay

“Climate chinge puts the USA one bad harvest away from food scarcity which would result in real hyperinflation. ”

The Northern States and Canada have had a very cool and wet spring with many crops behind in not only in their growth but also in their quality. The desert growing states are growing in a desert and anything can happen. Add that many farmers use 2000 gallons of diesel a month plus fertiliser costs going up 300% plus massive rises in insecticide and weed killers and you can see that you don’t need, in theory, different types of weather to put the price of food up, as the farmers have already had their “bad” weather……

Great points as to why food costs will keep rising for quite sometime. Thanks!

The winter wheat harvest in Oklahoma is done. The results are about 18 bushels per acre. Test weight and protein are good because of the drought, but yield is very low.

On Monday, 20 June, “I’m now in southern Kansas. If this crop yields 20 bushels per acre, we’ll be lucky.” – U.S. Custom Harvesters President, J.C. Schemper.

A good hard red spring wheat crop in Fargo & Grand Forks area, can pull down 100 bushels per acre, but that ain’t gonna happen this year. I would guess that what acres are in will produce 50 bushels or so. Lots of disease pressure this season, and late planting equals less yield at harvest time.

The USDA will have its June 30 Acreage Report out soon, and North Dakota and northwest Minnesota will get the numbers. “We’re going to see less wheat, less corn, more soybeans and more sunflowers.” -Randy Martinson, Martinson Ag Risk Management

And, cattle in the central plains of the USA have been dying off, by the thousands, from the heat wave recently.

Lake Meade has dropped 40 feet since June two years ago. Water restrictions have fallowed 350,000 acres in the Sacramento Valley. The Colorado River irrigated 5 million acres and supplied drinking water to 40 million people.

David Hall, and the first to lose water will be the farmers. Far more water goes to agriculture than suburban faucets.

First they’ll pay them to furlough their land in exchange for their water, then they’ll tell them to take a hike.

I guess the answer and question, to the often problems of growing food in the USA, is why the Great Plains were in fact plains and not great forests….

VERY good point IMHO A:

And the simple answer IS:

Every place west of the Mississippi River in USA is basically, sooner AND later, a desert.

Hard to ”fathom” for those there in the last several decades,,, but those who were there before and during the last great DUST bowl know that truth…

VERY very bad decisions to plow out the ”native grasses” and the results were clearly an indication of the recklessness prevailing then and for many decades before then, with folks doing ”stuff” by which I mean, of course, manure stuff based on nothing at all except ”hopium”….

and I, for one, certainly wish and, yes, hope, WE, in this case the entire humn WE can do better and sooner, as in ASAP…

Certainly does not appear likely based on continuing war(s) and other forms of disability to work this and many other kinds of misunderstanding, SO FAR…

kinda/sorta gotta agree with AF re: likely ”outcomes” from current situation, both ”globally” and locally…

Asset prices will plummet immensely. Obviously.

Boc would backtrack in a heartbeat.

Luckily Powell is going to force them to follow, however reluctantly.

BoE has been left behind.

Boj has too.

I will convert some cad to usd just in case boc decides to ease up.

Exactly right about the Bank of Canada as the only reason they’re raising rates is because America is raising theirs’. Canada is a liberal country where they only help the poor at the expense of the rich. Debt is off the charts at 185 percent and climbing. Canada will be in a deep and prolonged recession ages before America ever ends up in a real recession not a fake one where they tell you two quarters of negative growth while they can’t find any workers.

Agree with that. I think if the economy goes into deep recession, there’s a chance that ZIRP comes back, but I think it’s much less likely that QE comes back, now that it’s been exposed for what it is.

That Chart 1. is a real eye opener!

How could the central bankers in Canada look at this from month to month and not do anything?

Canada only caters to the poor and foreign money laundered or not coming into our housing market. That’s all they care about. Trudeau tries to help everyone and run up the deficit but it always ends up the poor get everything and the rich fund it.

Please get help

hahahah oh yeah is that so Tony?

What a load of B.S.

We live in interesting times. That being said, any of you guys know how to read a balance sheet? BMW pays like 8% dividend. Is that normal? What am I missing?

BMW is an excellent and very profitable company.

Where I live all the Chinese buy Mercedes Benz cars. A lot used to buy BMW but they fall apart after about 100,000 miles and repairs are costly. Virtually none of them buy BMW cars now.

Typical Canadians they always say this will never happen to them and somehow their housing market is special. Well most Canadian mortgages are 5 year ARMs. Talking about sitting on a time bomb.

Many companies in Europe pay, 5,6,7% dividend…..

Culture :).

In Europe, the stock of the big companies are mostly held by “Old Money”. Those families prefer to keep their shares forever because they wield power and influence by controlling the boards of big companies. They still need income, so their profits must come from dividends.

If a company pays dividends, it’s old money, if it’s all rolled into stock price “growth” it’s fast/new money, and those “people giving away influence for mere money”, therefore thrash :).

Curiouscat: “There was no plan.”

Really? The Helicopter Man himself: “The US government has a technology, called a printing press, that allows it to produce as many dollars as it wishes at essentially no cost. Under a paper money system, a determined government can always generate higher spending and, hence, positive inflation.”

By “no cost” the great man means no cost to the government but plenty of cost to you if you are a saver or a wage earner

95% of money is digital

With no serial numbers.😉

It will be interesting to see what the lagged impact of rate increases is.

The reactions at the moment have a bit of a feeling of someone who has turned their boat, but doesn’t realize it takes a while for the boat to actually turn, so they keep turning the wheel further and further.

I’m skeptical the wheel needs to go further than 75bp more, but I guess time will tell.

It all comes down to debt levels in each country. Higher interest rates will destroy Canada due to the obscene debt levels but in America debt is moderate and Europe debt is even lower.

Who would have guessed it’s that simple?! I feel much better now. /s

I feel more like it’s a boat that’s been weighed down by trillions of new dollars piled into the boat in a shockingly short amount of time while the boat was catching some waves, and even though we can all see that the boat is sinking and we’re already treading water, the steering wheel is still technically above water, even though it can’t steer the boat anymore, and we’re all about to drown (except the captain and his buddies, who will be given life vests… And actually there could be more life vests, but these assholes are each going to wear layers and layers of life vests, because they can, so sadly there are none left for the rest of us), all while the captain and crew are telling us it’ll be a soft landing (Perhaps a soft landing on the ocean floor). Hold your breath! But maybe that’s just me.

Zoltan Pozsar said at a Young Scholar’s Initiative talk with Adam Tooze, that he thinks the Fed is going to do a Volcker: massive wealth destruction.

It is because the Fed cannot control supply problems – regardless if supply is due to commodity supercycle, sanctions, supply chain etc etc so the only alternative is to crush demand by destroying wealth and wealth effect.

I would normally dismiss such talk, particularly in an election year, but Pozsar is ex-Fed albeit on the research side.

Also with Powell now on his renewed term it is the perfect time for the grown-ups to take charge.

USD is a weapon against China and the USA is going to use it.

Restrict supply via high rates and continue to squeeze until different countries come crying for help.

One of the first will be the UK.

Boris: help America we can’t repay our USD denominated debts!

USA: sure thing Boris, we just have a list of stuff that will harm China that we need you to implement, including money laundering into London

Boris: oh we can’t do that! my donors!

USA: okay bye

Boris: no wait, okay

This is geopolitical. If anyone thinks that the Fed are going to deflect from this course because landlords are getting wrecked they’d best think again.

The way Powell affirms his fight against inflation I also feel market is not getting his determination to quell inflation.

This is also due to the Fed’s lack of credibility due to its rescuing the market whenever it sneezed during the last decade. Also why wall street gets suckers by showing them The Fed “money cake” – rates and QE – is at hand. Can’t help it. Suckers are destined to be the bag-holders

Canadians thought they had invented a perpetual motion machine.

House prices up. Build a few more, add even more immigrants.

House prices up again.

Turns out it was just cutting rates all along.

Time to learn the hard way, my Canuck friends.

The problem in Canada is the Chinse will pay any amount for a house. Price is irrelevant to them. Rising interest rates mean they have to buy less homes which pushes prices down. I don’t know if the Bank of Canada rate will ever get high enough to squeeze most of them into liquidating everything as most believe it or not have mortgages because by taking out mortgages they can buy more real estate. If they pay cash they have to buy less real real estate so most take out mortgages. Out west the foreign Chinese are the problem but in Ontario the local Chinese are the problem. All the rich Chinese stopped coming to Canada in 2016. Most immigrants coming to Canada today are penniless but they make the rental market tighter.

China has the biggest debt bubble on the planet. That’s where the money for much of the purported 60MM+ empty apartments originated.

The government will undoubtedly do everything they can to prevent the bubble from collapsing, but they aren’t going to succeed any more than western countries.

Timing is a wildcard though.

Just note that Chinese central bank and monetary system are not arranged like the FED, US dollar, BoE, Pound or any other «western» currency. Predictment based on «western» standards might be way off.

Exactly – the “quality” of the immigration goes down as the standard of living falls.

To begin with Canada got high quality immigrants. They had good jobs that elevated the tax base. In exchange the immigrant got reasonable housing, services, etc.

But as the establishment printed through land the balance changes. The same high quality immigrants can qualify for many countries as their skills are in demand. They start to go elsewhere and you get the next leg down. They still contribute to the tax base but less so. Then housing goes up again. The next tranche of immigrants choose to go elsewhere.

Now we are left with people who really have no choice and those who are seeking to use Canada as a staging post for a USA job.

But Canadian hubris prevents them from comprehending this. They think prices are up “because Canada is amazing”. And they don’t understand the wider dynamic with regards to immigration.

The big one is China, if that implodes it might see money trying to get out to laundering hubs like Canada, or the CCP might restrict foreign transfers, or even Chinese selling up in Canada to cover losses at home. That dynamic seems to me to be of unknown outcome right now.

Right now most of the immigrants coming to Canada are from Nigeria. Numbers are way down on the immigrants coming here from Pakistan and India because of the cost of living in Canada. Minimum wage doesn’t cover rents in Ontario and British Columbia even for most apartments.

“….Exceptional rate hikes have done little to control prices (so far) but have turned housing markets upside down…”

Did I miss something? I thought most of Canada was still blowing air into the housing bubble ??

Yes, you missed something, namely the part in the article about how housing markets in Canada have “turned upside down.” Yup, they’re a little ahead of the US, and their housing markets are starting to go through major gyrations.

Home prices are imploding in Ontario and and to a lesser extent British Columbia which is two thirds of Canada’s population. Halifax and New Brunswick where prices shot up just recently due to people from Ontario and British Columbia migrating there are giving back a lot of those gains. Alberta is holding, Saskatchewan and Manitoba are declining slightly in price.

“Saskatchewan and Manitoba are declining slightly in price.”

This makes me laugh!!

What gorgeous country….

Good farm land south of Winnipeg, Manitoba, clear on down to North Dakota and Minnesota.

In the winter, it’s dark a lot of the time, and it does, sometimes, get a bit cold and windy.

Plenty of daylight now, I reckon.

“Did I miss something?”

Yeah, like the whole article.

Below chart “1”

“inflation forecasts where” Should be changed to “were”.

Thanks.

Isn’t inflation an artifact of government throwing a shite ton of money up in the air due to Covid? Yes the banks were very accommodative in their credit interest conditions and that did see credit expansion go up fast and furiously. But here in NZ over half the population was paid to stay home and do nothing over the lockdowns. Mo’ money, less produced. Equals mo’ money chasing less shiny things. Credit conditions were to blame for NZ property going up vertical, but this broad based inflation definitely is due to government intervention in the productive sectors of the economy. Oil at highs doesn’t help either. But you could argue govt ban on oil and gas exploration contributes to NZ exposure to global effects. The RBNZ wants to crush demand too. Which is like the Aztec priests crushing the demand of 30,000 sacrificial victims by ripping out their hearts. Can’t buy beer and fish and chips when you have no job and suicidal depression. Can’t buy corn when your heart is bouncing down the steps of the Pyramid of the Moon. Good for the economy! That’s what’s going on right now.

Isn’t inflation an artifact of government throwing a shite ton of money up in the air due to Covid?

The answer to that is “Yes.” But it is a bit more complicated. Oil prices are up because of OPEC cutbacks and sanctions against Iran and Russia… so that doesn’t fit the normal definition of inflation. Food prices are up because of the war in Ukraine… again a different problem than typical inflation.

I don’t know how all of this shakes out but we are in a real mess right now.

That’s a good summary of the uk too.

My wife is a self employed dental hygienist and during covid she was paid 80% of her wage for the tax year even though she went back to work for 6 months of that year so she actually got a higher wage for less work.

Then for those dental hygienists that wanted even more money they could sign up to work as a covid tracker phone operator. My wife’s friend did this and in 6 months she took two phone calls.

Look at the bigger picture.

The UK has used the same pattern since 1997:

* cut rates

* housing goes up

* housing plateaus

* increase immigration

* cut rates

* housing goes up

etc…

Guess what happens when you keep cutting rates? They go to zero.

Guess what happens when they get to zero? Big inflation.

Covid simply accelerated the last few steps. We were already on this trajectory.

Yeh that is pretty much correct apart from the government throwing in some gimmick like help to buy, stamp duty holiday, remove house prices from the inflation rate etc to prevent collapse

It doesn’t matter what they do to the inflation stats in Canada.

The Fed will raise until they are done, and the BoC has to follow.

There can be no fudging of the stats.

They tried help to buy before but prices are *so* detached from wages that hardly anyone took it up. The “help” wasn’t enough.

There’s no way to square the circle when compared to the overwhelming shift in interest rates.

“The ECB too has been ridiculously far off with its inflation forecasts. And their monetary policies – their refusal to hike rates starting in early 2021, and their refusal to end QE and start QT at the same time – were driven by this ridiculous underestimation of inflation. But now they’ve gotten the memo.”

Is ‘it’ interest rates?

“Why is Switzerland’s rate of inflation so much lower than that of Britain and the USA? . . .

Switzerland’s record is that it has a central bank which believes in the importance of monetary control to inflation. ”

“Why is Switzerland’s rate of inflation so much lower than that of Britain and the USA?”

One thing for sure: Switzerland is already a HUGELY expensive country to live in.

Do you know of data re: cost of living versus income for Switzerland and other countries than USA and

Canada Wolf?

It would be interesting to see how means and medians for various places look charted against others as your chart so well above explains this particular situation up north.

JP RRP is 50% of the o/n market. The Fed isn’t fighting inflation.

The Fed is fighting deflation.

Eastern Europe put a spell on Canada & US.

It will get worse.

Doesn’t RRP remove money from the system, thus fighting inflation?

China & India are buying Russian oil at $30 – $40 discount.

Lower prices in the spot markets, large discounts to privileged

consumers, lower inflation at least until next winter.

India is re-blending the crude oil and selling it to the EU. So much for sanctions.

Anybody with half a brain knew that all of Russia’s oil would make it to market. It’s just that the path would change, and a lot of virtue-signaling, lying politicians would have you believe otherwise.

Right on Depth Charge, it’s gonna go somewhere. Foolish to think otherwise. Speaking of foolish, Washington DC is plum full of Dem fools.

Repubs are on board also. Sanctions are driving massive profits for oil companies.

DId Canada spew trillions of free money into their economy as did the US, and if so, how did it compare on a per capita basis?

Go and look up charts on Canadian housing.

Housing has gone up 50% in 5 years.

That is free money, for zero effort.

Canada is an “economy” based on running a land pyramid scheme in one of the least densely populated, largest countries on earth.

Canadians are financially remedial. They will argue, with a straight face, that Canada is short of land. They will argue that there are endless numbers of highly skilled would-be immigrants who want to pay nearly 50% tax, get lower wages, higher food costs and pay $1mm for a very average home. They will argue that home prices “have to stay high because the boomers need them to retire”. They will argue that the BoC controls its own interest rates independently of the Fed.

But reality is at the door.

Home prices went up about 100 percent in the last 7 years for two thirds of Canada’s population. Ontario and British Columbia. Residential rents also doubled in the past 7 years in those two provinces if you ended up a new renter or rented anything built in 2017 or newer.

sure, whatever the % the point is that when home prices rise versus wages / productivity, it’s printing money without adding value, which is inflationary.

Canada has been printing for a long time.

And they are doing it by running a land pyramid scheme in a massive country, with a tiny currency that can’t stand alone on a different interest rate than the USA.

It’ll be interesting to watch, far shore.

How some ever, ”fairly funky” older houses 50-70 years old or so, have gone from $70-80/SF in ’15 to $300-350/SF today in our ”working class” local hood in the saintly part of the tpa bay area georg!

Reading most of the driving force is from older folks fleeing high taxes coming with cash, and younger folks coming to work for good money in rapidly growing tech and similar companies also coming for better biz basics in FL these days.

Very little for sale here now and last few months.

“…one of the least densely populated, largest countries on earth.”

Most of the land is uninhabitable by normal standards, ergo the vast majority of Canadian inhabitants live within 100 miles of the US border.

Canadians got more money but it only went to people who needed it unlike in America where it basically went to people making under $500,000 a year. The same with businesses. The net effect was much less inflation in Canada. You had to have a job or worked so many weeks in the past 50 weeks to get free money. Retirees got nothing as did the unemployed. They did give the very poor 500 dollars but only the ones with no job. Newborn babies in Canada didn’t get a free 500 dollar bill.

Inflation rate in CA is pretty similar to US.

Canadian were getting 500 dollars a week during Covid-19. They have to pay tax on that money. It was reduced to 300 dollars a week for a short time before all the free money ran out. I think students got free tuition or some paid for tuition. A lot of business went under as only certain small business got free money. Large businesses got everything during Covid.

One thing I’ve not yet seen mentioned much on this site – raising rates is inflationary.

As BoC raises rates it will feed through into mortgage repayments. Most are on a 5 year so 20% will renew per anum, though many are on variable so it’s probably going to be over 20%.

Mortgage repayments are a component of CPI so this will make inflation increase.

What does the BoC do when inflation increases? Raise rates!

What happens when they raise rates? Inflation!

We will see the same dynamic to a lesser extent in the USA as many are on 30 year fixed, so the Fed raising rates will not have this feedback loop, which lets them do it more. BoC have to follow the Fed but have this additional constraint.

One other thing: I predict Canadian brokers have been doing the “due diligence” for Canadian banks on lending, allowing the big banks to claim they are following all the regulations / stress test stuff. I bet this will be more scandal to come.

Dr. Oz, lower cpi/ higher SPY, Raw vs Weeds might change the political odds.

RRP provide good collateral to the o/n market. When clogged JP

provide more collateral to fight deflation, not inflation.

Radical hike provide the 10Y vector up to prevent inversion.

We don’t know how long it last.

you vil eat ze bugs…

Degobah,

In the construction industry, our suppliers and subs have refused to provide their products and services for the previously agreed to prices. Some of these contracts were established in 2020 and 2021. They simply refuse.

It’s breach of contract. So we ask our legal department to take action and the response was “just amend the contract and pay them the higher price. The legal costs, time, losses due to finding another supplier are greater than jus paying them more.”

We are basically held hostage for our supplies and services.

If we had an effective and efficient legal system, then people could enforce contracts without all the legal expense.

A country without rule of law, or an effective and honest legal system, can never deliver on the promises of democracy.

Lawyers have made a mockery of our legal system, enriching themselves, at the expense of all clients.

I’m sure there are some great lawyers out there, but the jokes about lawyers are generally true.

If by democracy you mean the universal franchise, it’s one of the biggest problems. It’s based upon the supposed collective wisdom of a bunch of morons – the public.

In America, a substantial minority can’t or can barely manage their own life. They have no business having any input into anyone else’s.

Good idea, AF: leave the governing of the country to the oligarchs. Maybe it’ll be better if the “public” just does more praying and less thinking. They don’t think very well.

The bunch of morons are in D.C.

I don’t think Tesla suppliers would dare do this to Tesla. Musk in an angry rage would just cut them off hard – and they know it. But Musk/Tesla has a whole lot of supply-chain worries and trouble nonetheless, and making his numbers work going forward deeply worries him.

The suppliers have one more card to play, bancrupcy. If they go out off business they do not fullfill their contracts anyway. With rising energy cost we may start to see this soon.