Wait a minute… Six weeks ago, Goldman Sachs & JP Morgan talked investors into buying $600 million of new debt.

By Wolf Richter for WOLF STREET.

This isn’t a recent IPO or SPAC-merger creature that is now collapsing, but a storied telecom, software, and services company that has become a Wall Street enrichment device at investor expense time after time over the past 20-plus years.

Avaya was spun off by telecom equipment giant Lucent Technologies at the end of the dotcom bubble. Lucent was spun off by AT&T in 1996, boomed during the dotcom bubble, and collapsed during the dotcom bust. Avaya was acquired in 2007 by PE firms TPG and Silver Lake and loaded up with debt to pay rich gains back to them. In 2009, Avaya acquired the collapsed telecom giant Nortel.

In January 2017, buckling under its debts, Avaya filed for Chapter 11 bankruptcy. In December 2017, Avaya emerged from bankruptcy, and its new shares started trading at the time.

“This is the beginning of an important new chapter for Avaya,” said CEO Jim Chirico at the time. More on him in a moment.

It’s these new shares we’re talking about.

This morning, the company confirmed the previously warned-about plunging revenues and a gigantic loss 2.4 times the size of its revenues. In addition, it disclosed an investigation into its financial reporting. And it warned, that it might not be able to pay off its bonds due in June 2023, though it had just raised $600 million by selling new debt in order to pay off these bonds, and that as a consequence of all of this, “there is substantial doubt about the Company’s ability to continue as a going concern.”

So, this is a bankruptcy candidate. If it files for bankruptcy, it would be the second time.

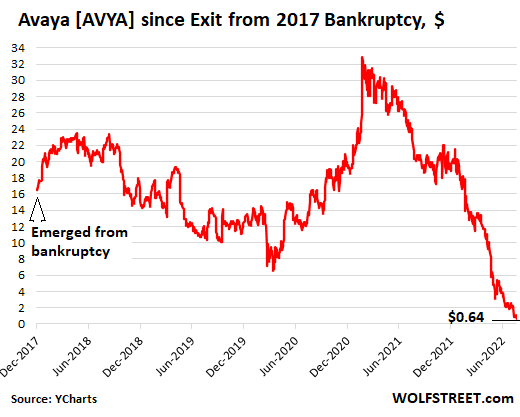

The already imploded shares collapsed another 42% to $0.64 at the moment, down by 98% from their high in February 2021 – yes that infamous February when it all started coming apart.

But you can’t even see the 42% plunge this morning in this dollar-chart that shows how investors have gotten relentlessly wiped out since February 2021. Today’s plunge was just the little extra at the bottom (data via YCharts):

Plunging revenues, huge losses, investigations into financial reporting.

Avaya disclosed this morning in an SEC filing that it booked a $1.4 billion loss for the quarter through June 30, including an impairment charge of $1.27 billion, as revenues plunged 19% from a year ago to $577 million.

It disclosed an internal investigation into its financial results through June 2022.

It disclosed that “separately, the Audit Committee has also commenced an internal investigation to review matters related to a whistleblower letter that remains ongoing.”

It disclosed that it is “also reviewing matters related to potential material weaknesses in the Company’s internal control over financial reporting with respect to the appropriate maintenance of its whistleblower log and the proper dissemination of materials and correspondences related thereto to certain parties other than its Board of Directors.”

It disclosed that, “As the investigations are not complete, the Audit Committee requires additional time to complete its initial assessments.”

It disclosed that the 10-Q report for the quarter through June 30, due today, could not be filed with the SEC, because of these ongoing investigations.

Avaya’s new CEO Masarek said today that the results “reflect operational and executional shortcomings.” He announced “cost-cutting initiatives.” He said, “We are taking aggressive actions to right-size Avaya’s cost structure to align with our contractual, recurring revenue business model.”

“Furthermore…” this could be the end.

Back on June 27, the company announced a $600-million private-placement debt sale, that had been “upsized from previously announced $500 million due to robust demand.” It consisted of $350 million in Senior Secured Term Loans and $250 million in Exchangeable Senior Secured Notes. The sale was arranged by Goldman Sachs and JP Morgan Chase.

The proceeds of this debt offering were supposed to be used to pay off $350 million in convertible notes due in June 2023. But wait…

A month later, on July 28, Avaya hammered hapless investors with an epic warning about revenues and earnings for the quarter ended June 30 and said it would release full results on August 9, which it did today, except they’re still “preliminary” because of the investigations into its financial reporting.

Also on July 28, Avaya disclosed that it had “removed” CEO Jim Chirico.

So back to that $600 million in new debt to pay off the $350 million in old debt next June…

The company reported today that it had $217 million in cash and cash equivalent left as of June 30, predating the proceeds from the new debt issuance. This was down from $324 million in the prior quarter. It’s burning cash hand-over-fist. There are four quarters to burn cash before June 2023, when it has to have enough left over to pay off $350 million in debt plus have enough cash left over by then to keep burning cash. So…

“Furthermore” the company said, we may not be able to pay off those convertible notes after all. If it cannot, it would trigger a default which would trigger a bankruptcy filing:

“The Company is currently engaging with its advisors to address the Convertible Notes, but there can be no assurance as to the certainty of the outcome of that assessment.”

The “advisors” it has engaged are law firm Kirkland & Ellis, which has a large restructuring and bankruptcy group, and consulting firm AlixPartners, best-known for its turnaround and bankruptcy work. This was reported just now by the WSJ.

“As a result” of this “furthermore” and “in addition to” the “decline in revenues” and the “negative impact of significant operating losses on the Company’s cash balance,” the company might not make it:

“The Company has determined that there is substantial doubt about the Company’s ability to continue as a going concern.”

Old bonds cliff-dive, new debt plunges.

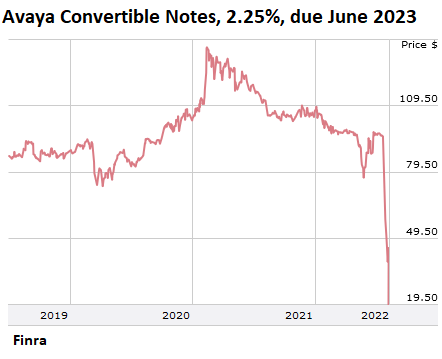

These $350 million in unsecured four-year notes, issued in June 2019 with a coupon interest of 2.25%, have performed a cliff-dive. S&P rates them CCC, meaning substantial risk, but that’s still four notches above D for default (my cheat sheet for corporate bond credit ratings). Today, they traded at around 19.5 cents on the dollar (chart via Finra/Morningstar):

And prices of the $600 million in loans and notes that the company issued in June, and which Goldman Sachs and JPMorgan Chase talked investors into buying, including Brigade Capital Management and Symphony Asset Management, have plunged, and investors have taken losses “exceeding $100 million” on it, according to the Wall Street Journal, citing analyst commentary and data from MarketAxess and Advantage Data.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

You have to hand it to Warren Buffett and a few like him that can grow a company for 55 years and avoid making any fatal mistakes. Mainly it’s sticking to following principles laid down 90 years ago by Ben Graham. One was making sure the company had a robust balance sheet.

Didn’t Berkshire Hathaway held Airline stocks during share buybacks. These Aielines then received $50 Billion in pandemic aid : https://wolfstreet.com/2020/03/17/after-blowing-4-5-trillion-on-share-buybacks-corporate-america-airlines-boeing-other-culprits-want-taxpayer-fed-bailouts-for-these-shareholders/

Uncle Buffy tips his paperboy to get his newspaper delivered first every morning!

You mean tomorrow’s paper today.

Nope. He sold them all when Pandemic started and took the loss.

… and he has several times said nobody should invest in airlines!

whistleblower log?

What the heck is that, and why would a private corporation have one?

It’s a compliance gimmick to scam employees into thinking they have protection if they disclose corruption. Right after they disclose any wrong doing, they get fired.

Ahahah, right. Same kind of gimmick with the “open-door policy” most management claim they adhere to. It’s “open-door” as long as you don’t rock the boat, e.g. ask inconvenient questions or bring up non-trivial issues.

“My door is open…as security escorts you out of the building.”

“That f*cker came out of nowhere!”

(40y/o Virgin)

Yeah, this was really hard to see coming.

Holy cow !

Unbelievable.

What . . . a . . . scandal !

As George Bailey said:

Where’s that money you stupid, silly old fool?

Where’s the money?

Do you realize what this means?

It means bankruptcy and scandal and prison — that’s what it means!

One of us is going to jail — and it’s not going to be me!

Avaya’s biggest problem is the lack of a viable business. Their original line of business was office telephone systems, back in the days of Very Expensive PBX systems.

Today, if somebody told me that I need to provide telephones for 200 employees, I’d buy a couple of pallets of commodity VoIP telephones, a few PoE Ethernet switches and medium sized server to run FreePBX (or SwitchVox, or…). Total cost is a fraction of what Avaya would have traditionally charged for a 200-extension PBX w/phones.

That’s assuming I would even bother with office telephones. Last few companies I worked at didn’t bother, just assumed everybody would use their cell phones for everything.

Yes, the last time I was in a conference room, there were Avaya phones on the conference table.

Those are IP phones and probably were much much cheaper than the older Lucent Merlin / Partner / Magix business phones used to cost.

The name is still around, but I would guess there is way more Cisco phones on corporate desks than Avaya these days.

Lucent had big central office and mobile phone switches too, but that went with the merger to Alcatel, which is now Nokia.

Yep. A lot of companies today, assuming people will use the cell phones for everything, pay employees a stipend each month to cover cell phone service. This way, employees can’t whine that they’re being expected to use a personal phone they pay for for work purposes.

Company I retired from people refused to use there personal phones ,they issued company phones as needed. Worked well except for dummies watching porn .

Or you could just use Zoom and get web meetings, chat AND full phone service with call routing, DIDs and every other feature. No phones required, just Bluetooth or any headset for your laptops. Thats what I did when I took my company fully remote in 2020. Works perfect. I have a number of clients that are Avaya customers and they all hate them. The telecoms are now fighting the software guys who are cheaper and have created great products. Legacy telecom is hosed.

Until communication towers get knocked out in war

Or a storm. One of my lasting memories of Hurricane Katrina was people parking on tops of bridges trying to get a cell phone signal to make a call.

True, they can get free VOIP from the desktop or laptop via sites like Talkatone, TextNow, Google Voice, and TextPlus.

Issue a headset to each desktop and laptop. That is if you all want a bare bones operation for phone numbers assigned to each desk or cubicle with minimum startup costs.

I work in a casino call center. We use Avaya software for routing and monitoring our phone calls. I am not sure if the rest of the casino uses them or not.

Their business, at least part of it, is IVR for businesses and call centers.

The company I work for does business with them for many many years. I personally work with Avaya people. I have seen the quality of people at that company deteriorate before my eyes. It is well-known within our team that whoever at Avaya we have to work with must be absolutely clueless, often even with regards to their own products. Many of those people are there only to pass the buck and rely on us to do the work.

So, I’m not surprised this company is going down the drain. Incompetence attracts more incompetence and it must have been plaguing the company from top to bottom for years.

I am one who wound up working for AVAYA after spin off from Lucent. We watched the stupid moves by ATT, Lucent, and finally AVAYA when they ditched the premises gear maintenance. That was the final gasp of a dying industry killed from the inside!

What fool bought those bonds?

Well, they sold $350 million… so I’m guessing a lot of fools.

“Well, they sold $350 million… so I’m guessing a lot of fools.”

The larger recent debt-float of $600 million was to be used to pay to pay off that $350 million you mentioned. Those foolz were therefore even foolier.

Who’s the more foolish? The fool or the fool who follows him?

Those foolz probably did not even know they were buying them. Their friendly non-fiduciary investment agent probably made a nice commission adding them to their 401K.

Pension funds.

“$350 million in unsecured four-year notes, issued in June 2019 with a coupon interest of 2.25%”… UNSECURED…

You see this is what happens when money is printed, Malinvestment and 2.25% you lost money to inflation.

This I have on my desk after 2001…

Rule 1 – Preservation of capital is everything

Rule 2 – See rule1

I still lost money this year but a lot less than Buffet even of a % basis

What fool bought the bonds ?

Why Goldman and J.P. Morgan, of course…

Wall Street, no more honest a rent-a-thrill, will you ever meet.

SoftBank hahaha 🤣

How is it possible that the action by GS and JPM in peddling this stuff is not illegal? I guess I don’t understand finance.

Yeah, I’m blown away by this!

GS and JPM will have to say they couldn’t have known because the information they were given was fraudulent. For that they need a fall guy (or group) inside Avaya. Looks like the ex-CEO is one.

Fall guy?

Out of the $600 million there would be plenty of f/o money.

The classic way a CEO exits a sinking ship is to get fired on purpose. This way they can cash out their options before the equity totally disappears.

The Bear Stearns president got himself fired right before that ship sank and got to cash out his options while the company still had equity.

That was Jimmy Cayne. A world-class bridge player. Always thinking at least three moves ahead.

They got away with it during sub-prime. Seriously, this is how it works in the real world.

Enron too. The big banks were pumping money in, while the party was raging, in and around all the dodgy deals, and got away with it. Most of the off-balance-sheet structures designed to accomplish massive accounting fraud could never have happened without big bank participation. Arthur Anderson accounting firm signed off, everybody took their cut and looked the other way. Pump and dump, right down to the screwed employees locked into their Enron shares as they plummeted.

Arthur Anderson was kind of held accountable. They went BK and most partners lost all their equity.

Where was the due diligence by Goldman Sachs and JP Morgan? Why are they not held to a standard of care and ethics?

It sounds so much like Fraud that BK will likely not happen and this may be an opportunity.

GS and JPM will bail them out themselves before they allow this to go under.

I’m sure the SEC will be all over this with their “A” Team! /s

Plenty of paperwork with risk disclosure. I’m as inclined to blame whatever fund managers bought this trash. It is a portrait of mental laziness, decadence.

Yes, the people who bought this crap are the problem, is there no due diligence?

JPM stole my pension money. If they steal from their employees with no impunity why not everybody else.

I can’t think of one time in the 100 plus years of JP Morgan’s existence that they operated with any standard care or ethics. Morgan himself operated by the Machiavellian principal of the ends justify the means. This is the same guy who bragged about his ability to manipulate the markets, put numerous business into bankruptcy by bring years long frivolous litigation against companies he wanted to get rid of, single handly put two of the most important inventors of the 19th and 20th Century into the poor house, after taking all their patents, and had every US president in his back pocket, doing his biding from the White House, until TR…he never could bribe TR.

Really? You really don’t get it. Nothing new here. The big banks and brokerages would sell their grandmother a juicy turd if they could make money on the transaction. These entities are dishonest and corrupt, and have been for the decades I’ve been alive.

For Private Equity firms this is standard operating procedure. They have been doing this for decades.

Considering the armies of jobs lost, it is amazing that employees don’t have a case against PE firms that suck all the wealth out of their companies.

PE firms then take the companies public (don’t know how they even qualify to be publicly traded) and they end up bankrupt.

David Stockman talked about a number of these deals in: The Great Deformation.

He would know, he was a partner is PE for some time and they made money the same way.

And everybody’s former hero, Sen Sinema, singlehandedly got the carried interest loophole preserved in the Build Back Inflation Better bill that passed the Senate.

“How is it possible that the action by GS and JPM in peddling this stuff is not illegal? I guess I don’t understand finance.”

Because they’re “doing God’s work.”

What, like sending a flood to wipe out humanity?

So lets see if I have this right. Back in 2019, I as an individual investor could have bought an Avaya bond with a coupon interest of 2.25%. Probably thru my brokerage Fidelity. Mistakenly thinking it was not very risky. And I might not get my money back? If Avaya does go into bankruptcy would I get any money back?

If that is true, what a shame. 6 month treasury bills are now paying more than 2.25%

Just trying to understand how this works.

Bondholders used to be first in line in a bankruptcy.

Then the GM bankruptcy threw 100 years of contract law into the toilet.

Well, being first in line in this BK may get you a big cardboard box full of old telephones.

Just think Harv, you would have gotten 2.25% annually for the last couple of years on your investment. That should make you feel nice. However………

A big phrase in 2008 (with the wisdom of hindsight) was “the mispricing of risk.” The conventional wisdom of always-low-interest-rates-and-never-inflation-and-always-corporate-credit-bailouts finally became dangerous dogma. But he fol/ks closest to the action of course saw it coming and dumped their end, in a timely way. Financial advisors said “buy 60-40 including corporate bond funds,” and they are immunized too, of course.

Maybe pennies on the dollar, which is what the current trading price of 19.5 cents on the dollar is telling you. Interestingly, investors could have sold the bonds for a nice profit (above $1.00) during most of 2020 after the FED took rates to zero.

Given the timing of the June bond issue, I wonder if fraud will be discovered in any of the investigations.

My wife managed the IT function of a regional bank that used Avaya in the 2005-2010 period. The invoices were never correct. She had to create a full time position just to reconcile the invoices.

Good time to short HYG/ JNK?

i was in that trade earlier this year , cashed out and was thinking about getting back in.

Funny how pump and dump works. This is why I manage my own money.

Ditto

Just prior to the dotcom bust I was working with Lucent Micro Technologies when it was spun off into Agere. We were developing a software USB modem that would be a win for LMT and for Apple. If you kicked Lucent in the shins, they fessed up their invoices. Apple had to be arm-twisted to get out what wasn’t, ahem, correclty disclosed in their SDK. The meeting food was really good, though.

“An impairment charge.” Isn’t that when put another round of drinks on the credit card at last call, when you’re already wasted?

“Executional shortcomings.” That’s when a company, such as Avaya that burns cash hand-over-fist, and has accounting fraud, is not taken out promptly and earthed.

I like it. Wolf Street is the best finance fraud porn site there is. Hmmmmm……. A Fink,Dimon and Jerome three-way with Jim Cramer holding the light. I just got a tingle…..somewhere. It’s hard to nail the location down at 70.

PREACH

I retired from Avaya in 2001 and followed this sad journey closely. Wolf correctly points out that “Avaya was acquired in 2007 by PE firms TPG and Silver Lake and loaded up with debt to pay rich gains back to them”. Avaya was debt free at the time with almost a Billion in free cash flow and they were number one in market share with a bright future. Saddled with a huge debt load, they never recovered. An American tragedy.

People always point to these stories as reasons that LBOs are bad. But it’s not the LBO that’s the cause. It’s the fact that lenders are willing to loan the target company money for LBOs. If the lenders weren’t there, the structure wouldn’t work either, and the buyout companies would actually have to do a normal buyout, not a leveraged one. Or at the very least, they’d have to guaranty the debt.

It’s always easier to risk someone else’s money. That’s the private aspect of financial intermediation moral hazard.

Right, that’s true, but that’s true for any investment or loan, not just one made in connection with an LBO.

Without the Fed, there would be no LBO’s.

That’s not really true. LBOs really started in the 1980s, long before the modern interest rate suppression/QE era. It’s correct that the Fed has made things worse in recent times, but LBOs are hardly a new thing.

And Senator Sinema just strongarmed another huge tax saving for those PE pirates.

2 million goes a long ways ,but it’s about her constituents.I want to barf vote her out

I am not sure how much strong arming actually went on…seemed more like kabuki theater to me and everyone played their parts perfectly.

“Avaya was acquired in 2007 by PE firms TPG and Silver Lake and loaded up with debt to pay rich gains back to them”.

Sounds like a Mitt Romney wet dream.

It’s like a blast from the dot.com era. Results look similar too.

And the bond assets for corporate bonds is how big? Federal and municipal debt?

Stock buyback debt? And now crypto debt?

I remember the Lucent story well as many Friends and Family worked there. Pensions evaporated and happy people went broke. I see your point on Feb 21 and ever since you wrote that I have been trying to find a Fed statement or action from that month. Something big happened that Wall street suddenly stopped the overspeculation. My skeptical mind thinks fed insiders told the wall street ceo’s the tightening would begin. But I don’t see the smoking gun in the repo activity. It’s like everyone on wall street got the memo but no one in the public got it.

Have you looked at the reverse repo activity?

RRP didn’t take off until March 2021, according to the Federal Reserve data (FRED).

4-Week T-Bill yields did drop a bit at the end of January 2021. 0.08% to 0.03% isn’t a big change but it was noticeable on the graph.

Still, “sudden demand for T-bills” is simply the flip side of “drop in demand for stocks”, not a causation…

TK,

Boeblingen is right in terms of the reverse repos. But why did they start ballooning, and what does it mean? I explained it here:

https://wolfstreet.com/2022/06/23/whats-behind-the-collapse-of-so-many-stocks-since-feb-2021-2/

Thanks for reminding us of the June article!

I agree with the interpretation that by Feb 2021, inflation was beginning to accelerate. Investors smarter than me could have concluded that the only politically palatable policy response would be raising interest rates, putting pressure on stocks. Note also the ongoing surge in commodities, and that bonds had topped out in August and would also do poorly with rising rates. If you need to get out of stocks, don’t want to be in bonds, and are maybe constrained (or don’t want to chase) commodities, that leads to demand for money-market funds and hence the RRP flood.

Sadly the RRP balance has only stabilized since late June and shows no sign yet of rolling over. Is the QT too slow?

RRPO is a reality check on QE and Fed tightening.

@TK – suggest looking more broadly, because the Feb ’21 thing was a global tipping point. Chinese indices topped then too (DJCHINA, Hang Seng).

The one big event I’m aware of was the change of Administration and associated major US policy changes at that time – did that add up to a general change in business climate? But if so – why February and not November?

Or was there also a major change in Chinese policies at that time, the run-up to the 2021 National People’s Congress: new power struggles over zero-COVID policy, crackdowns on housing bubble, new party hostility to certain major companies emerging then?

On the econ side, Feb ’21 was BEFORE the CPI-U really got going. The Feb’21 CPI print was the last to come in below 2% inflation.

This kind of thing happens more and more often when no one goes to prison for rampant fraud.

The enforcers and legislators tend to go into private equity, lobbying, consulting, paid talks, and other similar positions after their “public service” is done, so I wouldn’t expect any of them to be in a hurry to anger their future employers. Heck, even a couple of Fed governors were known to be front running Fed policy moves. They were allowed to bow out quietly with no real penalties. And those were only the ones who were caught. Even at the highest levels of financial governance, fraud has become the rule while ethical action is the rare exception.

Exactly, which is why the US is finished, IMO. The corruption is too embedded. Top to bottom, the government is shot through with it. Once you get to that level, there’s no going back.

The 2-party system conquered America. The seesaw lasted about 100yrs but now it’s clear whether you’re a Republican or Democrat voter that 2-sides do nothing but create a divide as big as Moses splitting the Red Sea. The Constitution is desperately begging for a Independent/3rd party that holds 20-25% of the Legislative branch of government to bring back some glimpse of its checks n balances function. If Americans continue loving Red or Blue more than Crips N Bloods while refusing the implementation of another option…. yes America is finished and will cannabilize itself from within

I don’t know about you all, but I am getting emails from JPMorgan Chase just about every day. Today’s email:

“Get up to $625 when you open a J.P. Morgan Self-Directed Investing Account”.

Just trash the ones from JPM that start out “We have a great new bond offering for you to invest in”……..

I got it too. $625 if you invest $250000 or more. What a deal.

I think they’re courting people who don’t realize yet that they can earn interest again, and think $625 is better than $0.

$250,000 will earn something like $500/month in T-Bills right now. It’s still pathetic (2 or 2.5%), especially vs. inflation, but very few banks are anywhere near the market interest rate.

Then again, in T-Bills or a government money-market fund, you’re sponsoring the profligate U.S. Gov’t… in a prime money market fund you’re funding the too-big-to-jail banks… maybe time to figure out which states’ muni bonds are worth a look…

@Wisdom – thank you for this. I’m moving my money right now!

Today everything is dumped on the Government/taxpayer. It is not a new scheme but it could be one of the all time biggest.

1) DH Horton monthly BB : Mar/May 2004, 27.38/ 18.47. It peaked in

Jan 2005, Jan 2006 high was a test of 2005 high.

2) In 2006 they sold a house, in a new track, for $400K including expansion & renovations that delayed completion.

3) When the house was ready in 2008 DHI agreed to a $150K discount.

4) Three years after Nov 2008 low DHI reached it’s BB in Jan 2012. Mar 2020 low found support from the BB.

5) DHI peaked in Dec 2021. It’s now down to Sept 2020/ Jan 2021 congestion zone.

6) After a test DHI might make a rd trip the it’s BB.

7) For entertainment only.

Ahhhhh, such a waste! .. as is most of the wallstreet/digiCONomy..

ALWAYS there is $afety in janky numbers within a scaled-up Corp($e)

I’ll bet that mr. CEO ‘removed’ was handsomely ‘let go’, no?

Avaya shares down 45% today during regular trading hours.

Welcome to the Predators Ball (and Banquet) – You’re the main course, “Investors”

Yet this season is seeing folks throwing cash at risk assets like the punchbowl was just restored ??? Risk assets are one step down the ladder from debt. Yet some are taking big baths on some bonds, as the zombies are (or should be) shaken hard.

I wish I was on the list to get the memo!

crooks the the left of me scoundrels to the right here I am stuck in the middle with JPM and GS!

Trillions in new $, 9% (my azz) inflation, rediculus asset valuations, rising interest, crooked investment firms, crooked banks, 87K new “collectors”, unafordable real estate, rent, food, fuel increases, equal protection no longer exists.

no where to run to baby, nowhere to hide.

From Yahoo —–

Maintains Goldman Sachs: to Buy 8/3/2022.

These guys are just criminals.

1) Down with wall street vultures, from their mouth a bloody venom drip, putrefying investors.

2) Down with these rabid dogs, abject animals.

3) Let’s put an end once and for all to these miserable hybrid of foxes

and pigs, these stinking corpses, who want to tear the flowers of our

society….

4) Andrei Vyshinsky, procurator general, productivity master mind, from about a hundred years ago

Not the most vivifying headline, but it sent a little shiver up my spine once I RTFGDA. We’re getting closer and closer to the “Lehman” moment of the coming kablooie.

The largest shareowners of the New York Fed are the following five Wall Street banks: JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley, and Bank of New York Mellon. Those five banks represent two-thirds of the eight Global Systemically Important Banks (G-SIBs) in the United States. The other three G-SIBs are Bank of America, a shareowner in the Richmond Fed; Wells Fargo, a shareowner of the San Francisco Fed; and State Street, a shareowner in the Boston Fed.

G-SIBs have the ability to inflict systemic contagion on the entire global banking system (as happened in 2008) and thus must be monitored closely for financial stability. JPMorgan Chase, Citigroup, Goldman Sachs, and Morgan Stanley are also four of the five largest holders of high-risk derivatives. (Bank of America is the fifth.)

The five mega banks that are the major shareowners of the New York Fed are also supervised by the New York Fed, despite participating in the election of two-thirds of its Board of Directors. Jamie Dimon, Chairman and CEO of JPMorgan Chase, previously served two three-year terms on the Board.

checking out my local real estate. Inventory, after rising pretty much since Feb dropped the past month.

Probably because of interest rates dropped from 6 to 5.3 and end of the summer selling season. I think inventory usually drop going into fall.

Nothing to see here folks, move along hahahaha

Way off topic, but I just heard Sen. Schumer say there’s a new 1 percent tax on share buybacks. How will Wall Street react to that?

Not well.

“Six weeks ago, Goldman Sachs & JP Morgan talked investors into buying $600 million of new debt.”

It gives new meaning to the term ‘bank robbery’.

Banks have been fined over $330 Billion over the last twenty years, enough to make you think bank regulators are actually doing something when it’s really just a cost of doing business.

I would take all that new debt and convert it into bitcoin, take my market cap 110% digital currency. The Fed has put in a bottom here. Later on they can figure out some kind of business, or maybe just get the Reddit crowd to fund them.