Now trying to avoid “a blow that would be irreversible.”

By Wolf Richter for WOLF STREET.

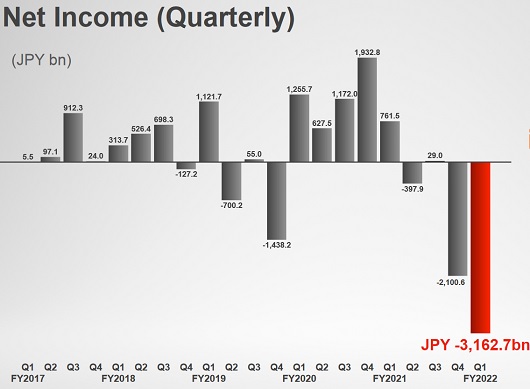

SoftBank reported its biggest loss in history, as it said in its presentation today, of ¥3.16 trillion, or about $23.5 billion, for the quarter through June (its fiscal Q1), mostly due to mega-losses in its Vision Fund segment, and some due to exchange-rate losses of the yen, after having already lost ¥2.1 trillion, or about $15.6 billion in the prior quarter, for a combined six-month loss of $39 billion (chart via SoftBank’s presentation):

Imploded Stocks & Mega Losses: “I am quite embarrassed and remorseful.”

SoftBank has become infamous for the waves it goes through during which it douses and dazzles the startup world with huge amounts of money, at valuations that create pop-up unicorns.

The latest wave occurred in 2020 and 2021. Now valuations have collapsed, and some of its prior investments also collapsed, such as Katerra and Greensill. And a slew of its companies that went public via SPAC merger or IPO over the past two years have now joined my Imploded Stocks, whose share prices have collapsed by 70% or 80% or more from their highs, including Grab, the biggest SPAC ever, Compass, WeWork, and Didi.

“When we were turning out big profits, I became somewhat delirious, and looking back at myself now, I am quite embarrassed and remorseful,” said CEO Masayoshi Son at the briefing on Monday.

“Now seems like the perfect time to invest when the stock market is down so much, and I have the urge to do so, but if I act on it, we could suffer a blow that would be irreversible, and that is unacceptable,” he said.

The Vision Funds Fiasco.

Its two Vision Funds and predecessor booked investment losses of $22 billion in the quarter, after having booked losses of $22.2 billion in the prior quarter, for a combined $44 billion in losses.

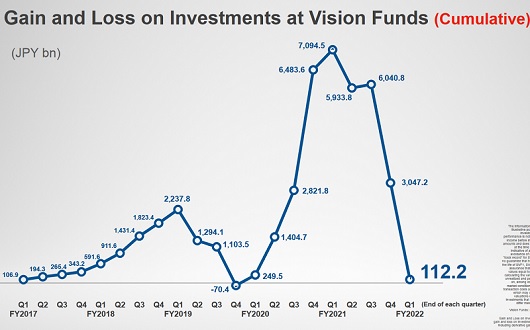

These losses over the six-month period annihilated the cumulative crazy-bubble gains since Q1 2017, when the Vision Fund 1 was launched. Losses were spread across the portfolio of over 300 companies (chart via SoftBank’s presentation):

Vision Fund 1, launched in 2017, with over half of the $100 billion coming from Saudi Arabia’s and Abu Dhabi’s wealth funds, booked a loss of $27.6 billion over the past two quarters, wiping out most of its cumulative gains, and leaving the fund with a gain since inception of $11.2 billion.

Vision Fund 2 – for which SoftBank could not rope in foreign investors, and that it then funded itself with $56 billion – lost $13.8 billion over the past two quarters, leaving the fund with a loss of $10 billion since inception.

After buying at the top and losing shirt: Cost-Cutting and “discipline.”

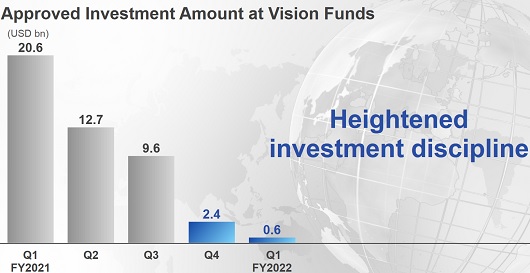

SoftBank splattered $45 billion in its fiscal 2021 on nearly 200 companies, even after many of the high-fliers that had gone public were already collapsing, starting in that infamous February 2021. The Nasdaq peaked in November 2021, and SoftBank was still splattering money around. In other words, it was buying just before the top, at the top, and then on the way down.

But now, there is another wave “discipline” being imposed by Mr. Son on his empire, similar to the “discipline” that he’d imposed on his empire after it had lost many billions of dollars on WeWork, including during WeWork’s bailout, after the IPO was scuttled.

And the Vision Funds division is going to be subjected to cost cutting of operational expenses, Mr. Son said.

“Heightened investment discipline,” it says on the slide of the presentation, as investments in Q1 through June collapsed to just $600 million, after the $45 billion binge in the prior four quarters:

Alibaba, Arm, and T-Mobile.

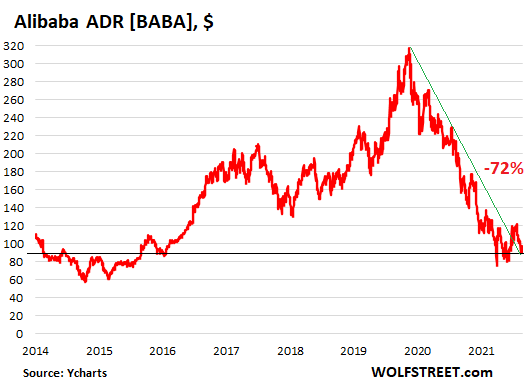

SoftBank was one of the early investors in Alibaba and had booked enormous gains as Alibaba went public (not part of the Vision Funds). Back in June 2021, SoftBank valued its Alibaba stake at $92 billion. But Alibaba’s shares [BABA] started to collapse in November 2020 and by now have collapsed 72% from that peak, and the value of SoftBank’s stake at the end of June 2022 has plunged to $33 billion (data via YCharts:)

Other mega deals that SoftBank made over the years that are not part of the Vision Funds: Arm and T-Mobile. SoftBank wrote up its stakes in both of them.

To prop up the stock: Incinerating cash on share buybacks & raising more cash to incinerate.

SoftBank’s losses were kind of expected, as the plunge in share prices and valuations of SoftBank’s investments was not a secret. SoftBank’s own shares, listed in Tokyo, managed to bounce back each time they sold off since March amid huge share buybacks.

Since the peak in February 2021 – yes that infamous February when it all came apart – the SoftBank ADR [SFTBY] has plunged about 58%, despite the share buybacks. And those were massive: Between November 2021 and June 2022, SoftBank repurchased ¥705 billion ($5.2 billion at today’s exchange rate) of its own shares.

Under its old repurchase program, it planned to repurchase an additional ¥295 billion ($2.2 billion) between the end of June through November 2022.

Today it announced a new repurchase program of ¥400 billion ($3.0 billion) from August this year to August next year.

To raise cash for the share buybacks, SoftBank has been selling some of the publicly traded stocks in its portfolio, including unloading its Uber shares for a $1.5 billion profit.

And it raised about $17 billion in cash leveraging its Alibaba shares – of which $10.5 billion in the quarter through the end of June, and another $6.8 billion since then – by entering into “prepaid forward contracts (floor contracts, collar contracts, and forward contracts)” where it gets the cash up front with the promise to settle the contracts later either with cash or with Alibaba shares.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

guess you’d call this DEFLATION of asset bubble

borrowing against the value of shares is a good way to have some big players target your stocks and take them down. they know that at some point, you are forced to liquidate at a much lower price.

this guy is a gambler who will go down as a huckster. surprising that he grew up in Japan, which is famously conservative.

“Now seems like the perfect time to invest when the stock market is down so much, and I have the urge to do so, but if I act on it, we could suffer a blow that would be irreversible, and that is unacceptable,” he said.

Dude, that’s already happened.

Uber sold at a small profit. While it is coming under regulation. It has spent a lot on breaking ground but seems to dry up to the alternative of owning a non shared car. Why? Because the cars equip with plastic sheets and rapists.

However Alibaba has still operational problems. Unbelievable. To look young. So alternatives will pop up. According to the CCP. Most Han want a Danish state while the CCP is inclined to raise their living standard by dredging the Pacific… exports via via. A brand new world. Exports through the Salomon’s, Kenya, Pakistan, Sri Lanka, Greece. Talk of vision. Advertising space.

The comment of not buying the dip epitomises a short term vision. To envision a garage growing to trillion co. requires convexity. Essentially, just dump the whole lot in one go Sonny.

Buy the dip you fools!

“Now seems like the perfect time to invest when the stock market is down so much, and I have the urge to do so, but if I act on it, we could suffer a blow that would be irreversible, and that is unacceptable,” he said.

Seppuku is next.

Only if he’s a samurai.

For the purposes of Seppuku, he could identify as a Samurai.

And sell tickets to his investors to be his second.

3rd generation Zainaichi Korean. Samarai were hereditary Japanese nobles. He would have no chance of becoming a samurai.

Hold on Soft Bank because Jim Bob Cramer is getting all lathered up hitting the Big Red Buy,Buy Buttons on his console. What can go wrong? This is the bottom. Dow 50k and Nas-Nasty at 25k at light speed when the Fed pivots and turns on the QE fire Hose. Ah……so gooood, reminiscenting in the waning glow of the past QE excitement. A few measly rate hikes by the Fed has already tamed inflation. Why wait for the monthly prints to catch up just STFU and BTFD and get rich bitch. I have to stop now because Nurse Ratchet needs to give me my medication.

Markets are all up the past month.

Gee whiz fellow, you don’t know the term “bear market rally”?

Hare coursing with Pikeys…. Now you get the following

Now look: She needs the Hector-2 roof lights, uh… the stylish ash-framed furniture and the scatter cushions with the matching shag pile covering.

And she’s terribly partial to the periwinkle blue. Have I made myself clear, baays?

Place your bets!! Does the big rabbit gets proper fucked?

Hey that is what happens whenever I buy! The stock always goes down. Maybe I shoul put $ into equities just to start the crash. ha

I’ll bet I’m a worse investor than you are. My buys are registered as Weapons of Financial Destruction.

Two words. Opposite George.

Funny money boosts hubris geometrically. It is a drug.

Almost every high-flying “genius” jumps the shark, sooner or later. It is the parabolic arc of life. KaBOOM!

Every lucky investor will brag about their skill. Then, the fall.

Taleb’s fooled by randomness should be required reading.

One of the best books of all time.

In the middle of Anti-Fragile, and it has made me aware of how fragile our current economic system truly is.

The pandemic didn’t bring any awareness of that?

The pandemic did jack diddly squat. It was the ridiculous sky screaming over reaction of locking down the entire global economy that sent matters into a tailspin.

fwiw, I’ve known the world was fragile ever since I was eight years old, and learned that the atoms that make up everything are mostly empty space

That’s what makes quantum physics so fascinating. 99.8% of every atom is energy. So while we often think we live in a physical world, at the atomic level, there’s only 0.2% matter. I still struggle sometimes to wrap my head around that.

Matter and energy are the same thing. Einstein proved that with his famous equation E=MC^2

From whence comes the energy to keep atomic particles and sub-atomic particles spinning?

Amazing how free fake money is like water ,either it flows into a lake and accumulates or into a river never to be seen again. Don’t these professional investors know about stop losses ,to protect yourself

I assume stop loss won’t work if no one is willing to buy at your stop loss price?

Thin market for this kinda product these days?

A stop loss turns into a market sell order at its tripwire level. If a stock is free-falling, the sell can happen far below the hoped-for level.

Not to worry, it is the Saudi’s & the UAE losing their shirts… maybe Cathie Wood & ARK too!

WolfGoat,

You beat me to it! Already wondering what Cathie Wood’s explanation will be…

Those are the losses of SoftBank, not the Saudis. The Saudis get to worry about their own losses separately.

Vision Fund 1 (outside participation) is still up $11B despite the tanking.

Vision Fund 2 (SoftBank internal fund) is down $10B.

So the Saudi and other outside investors are doing better.

The fact that SoftBank is raising cash to buy back its own shares, rather than invest in other companies, or even to save the cash for future investments at better prices, is quite interesting.

Yes, and it’s actually SELLING some of its holdings in order to fund buying back its own shares. And it’s borrowing against its holdings to buy back its own shares.

Guess it will be worth a lot when they have sold all its holdings and owns all it’s shares, so they can raise capital by selling shares. Exciting times.

There is no way this can go wrong!

Yeah…..sounds like overall, since 2017, even though investors have not profited, they have basically not lost any principal (based on current valuations).

Yes, kind of like Michael Saylor borrowing against his bitcoin to buy more… BITCOIN!!! He’s on his way to his third multibillion $ bankruptcy and was just fired as CEO of MSTR.

I wonder… one reason why SoftBank might need to borrow in order to do a buyback is if there’s a particular partner or large shareholder that demands an exit, but they don’t want to tank their own share price…

The US dollar has risen to provide a somewhat elevated cushion for the Nasdaq’s fall.

“Now seems like the perfect time to invest when the stock market is down so much, and I have the urge to do so, but if I act on it, we could suffer a blow that would be irreversible, and that is unacceptable,” he said.

The very definition of “buy high, sell low”.

Frankly, he should stick to raising the funds, and have some sort of cut-out between himself and the decision-makers.

Or just fire himself.

All that this economy is waiting for is a failure so huge, the mainstream media WON’T be able to sweep it under the rug.

Unfortunately, the meat puppets pretending to be journalists could have their broadcast studio burst into flames live and on the air, and they’d still be insisting that “Everything is Awesome!!!”

unless there’s a Republican president

“SoftBank reported its biggest loss in history, as it said in its presentation today”

Who would have thought that there would be an even bigger loss for SoftBank than WeWork.

The TV Series “WeCrashed” truly shows how this economy is becoming nothing but a con job. Perhaps we should go down to Wolf’s neighborhood and watch it together.

After you see that show, you need to watch “The Dropout” about Elizabeth Holmes.

I think poor Elizabeth was a pawn. No mercy in Wall St cons. GS said their staff is told to eat what they kill.

Poor Elizabeth? Wow. Folks like you are bread and butter for trial lawyers. I know, I was one. We lick our chops when we find somebody like you. Slather on another layer of conspiracy theory and bingo, another vacation in Italy!

She defines the term grifter

Yep poor Bernie Madoff as well… both of them should get the Nobel peace prize. sarc/

No chance imo. The company was aimed at the healthcare market and the technology never showed any sign of working. People would have been severaly harmed or died if she had been able to con more people (I think a few people were anyway). Second, they forged a document from another company. If that isn’t a red flag nothing is. She was a scammer from the get go.

SoftBank is the microcosm of the entire Western World (and China) economy.

Nothing is real.

Reminds me of a cartoon seen long ago in New Yorker, I can only loosely quote:

Young woman to her parents, she is introducing scruffy hippie guy to:

“It’s OK, mom and dad, we’ll just dance and sing until we’re not hungry anymore.”

This seems like a surefire investment strategy: find out what Softbank is doing/buying and then do the exact opposite.

Yes! Excellent point!!! +1,000!

There are ETFs already built around that concept. Check out SARK, which does that with Cathie Woods’ holdings.

Unfortunately for Mr Son, this is far from over. Fortunately for Mr. Son and his Saudi friends, they will continue to fly in their corporate Jets and live in 10 million penthouses for the rest of their lives.

At least Mr son confesses to being embarrassed and remorseful, which is something you will never hear from an American executive.

Softbank seems like a money pit. I can’t remember the last time when they actually made money.

I’ve never understood why ANYONE would keep on investing in a company that never turns a profit. How do they expect to make money if the company can’t?

Sammy,

You just don’t get it. I think you’re a hopeless case. You missed the entire paradigm shift to the new paradigm: losses are good. This is followed by the second paradigm: The bigger the losses, the better. Markets are now solely looking at the hype-and-hoopla ratio of a company. You need to get with the program :-]

That’s too complicated Wolf. Positive P/E is out, negative P/E is in.

Only losers invest based on positive P/E.

Jerry Seinfeld : If every instinct you have is wrong, then the opposite would have to be right.

George Costanza : Yes, I will do the opposite. I used to sit here and do nothing, and regret it for the rest of the day, so now I will do the opposite, and I will do something!

In the Weimar Republic, they had an objective of paying down unpayable debts to France and Britain.

In the Western World, Central Banks have an objective of reviving Feudalism.

In the 1950s “I Love Lucy” saw this coming. When Lucy decides to sell salad dressing, Ricky asks how much each jar costs to produce and what they’re selling them for. Lucy admits they’re losing money on each jar, but then says it’s OK because they’ll make it up in volume. I suspect nearly every viewer got the joke. Amazingly, we now encourage public corporations to operate this way.

The entire rotten business reminds minds me of Mel Brooks “The Producers”,the plot of which involves shady characters trying to find an entertainment vehicle so dire to invest in , that its failure will lose money on a grand scale. The nazi theme was supposed to make it so objectionable that no on would buy tickets to see the show. instead of which it was a roaring success. This was a criticism of the lax moral standards when people seen enthusiastic about nazism. Integrity and ethics seem to be alien to business executives.

Until venture capital gets wiped out enough to learn… again.

I’m glad I made it through Pets.com, Garden.com, Commerce One, eToys, Egghead Software, etc. back in 1999-2000.

It was no different this recent time. Palantir Technologies is one that quickly comes to my mind.

At least Microsoft, Ebay, EMC, Amazon, Dell, Cisco Systems, Western Digital, Oracle, and Microstrategy lived through it.

I guess nobody saw that Berkshire Hathaway lost $43 billion last quarter?

Warren outdid Mr. Son

Did a little digging on this one and Warren Buffett and Son are like polar opposites.

Buffett doesn’t really invest in startups, so Berkshire isn’t really an Investment Bank… some people equate it more to an Insurance Company that invests for annuities. He’s looking for profitable well run companies that can maintain solid cash flow from profits.

That being said, it’s still possible to lose money in this market…. go figure!

Yep. I don’t like the accounting changes that started about five years ago. It makes following Berkshire more difficult as profits swing wildly depending on stock holdings prices.

This type of gain and loss should be booked directly to equity, not the income statement.

Not a fan of Warren, but how a GAAP adjustment on a very liquid balance sheet doesn’t quite equate to SoftBank’s roulette table.

Roofstock, Fundrise. They still seem to be doing okay pulling in new mom and pop housing investors.

Need to keep a close eye on them. Probably one of the canaries in the coal mine.

———-

Fundrise claims to be the first platform to enable people to invest in private real estate via an app, and regular folks are rushing in. It says it now boasts about 350,000 investors, mostly millennials age 25 to 40. Since the start of 2021, the equity portion of its portfolio—capital contributed by investors—has more than doubled, from $1.5 billion to well over $3 billion. Total dollar holdings, including debt, stand at around $6 billion.

More recently, Miller decided Fundrise could grow much faster if it could acquire large numbers of new homes in big packages. Those abodes would be more appealing to families, require less maintenance, and command higher rents. A milestone in the campaign came in February 2021, when Fundrise paid builder D.R. Horton $35 million for an entire fully built 120-home community called the Woodlands, near Houston. Since then, Fundrise has bought five more single-family rental projects from D.R. Horton, encompassing 600 homes, at a total equity investment of almost $140 million.

To avoid overpaying, Miller has developed a second blueprint: partnering with developers to finance some new homes—and buying them before they go to auction. That formula lowers the builders’ risk, while enabling Fundrise to buy at a discount of 6% to 10% to the price all comers pay once the fliers start flapping at the grand opening.

“A milestone in the campaign came in February 2021, when Fundrise paid builder D.R. Horton $35 million for an entire fully built 120-home community called the Woodlands, near Houston.” Is a small portion of the Woodlands, not the entire Woodlands? The Woodlands as a community has been around at least since I moved to the area in the late 90s, and is much larger than 120 homes.

I live in The Woodlands (30 years now), which is the only township in Texas. Our township paid Houston $18 million a few years ago to NOT be annexed by them. The Woodlands has been here since the late 1970’s when George Mitchell of Mitchell Energy started the community.

Right now there are about 130,000 residents here in The Woodlands in (I think) 9 separate “villages”.

Whatever D.R. Horten built is NOT part of The Woodlands. From memory, I believe that 120+ home tract is several miles north of The Woodlands in the same county (Montgomery) as The Woodlands.

I’m having trouble coming up with a comment that’s snarky enough to cover this.

Please stand by.

People who buy shares in companies with no earnings/profits are assuming risk. Such investments have ruined many poor men and women.

Amazon is an exception. It lost money for years before turning a profit. In 2002 shares sold for $0.70. Today it is about $138. A 20 yr return of close to 200 times the original investment. That is why some people did not short the stock in 2002.

“ Today it is about $138…”

Did you remember the 20-1 stock split…

One trouble is, entrepreneurial culture sparks innovation, but this culture is very entrepreneurial in flim-flam, pushing story-stocks and crypto fads with no substance behind them. And there is an endless supply of suckers born every minute. Wisdom has to be learned in each generation, and this is harder in a world of constant flashy noise. Being dumb has a steep price, especially if the stimmies ever stop coming. Bailouts and stimmies-wise, I keep waiting for that moment when I can confidently quote the great film Margin Call, “I don’t — hear — a thing.”

I told my friends several years ago, when Softbank was beginning to pay ridiculous valuations to fund startups, that they were going to go bankrupt. Everyone laughed. I still believe it’s a real possibility, and no one’s laughing now.

$10 Mil for the first 10%, followed by $50 mil for the next 10%, then $500 mil for the pre IPO 30%. Now IPO’s are dead and even the first round at $10 mil was too much

I strongly believe ms wood has an ark full of money – her “investors” not so much

“Vision Fund 1, launched in 2017, with over half of the $100 billion (from Saudi Arabia and UAE) … (is left) with a gain since inception of $11.2 billion.

^ This is a huge reason why the CEO must publicly state he is “embarrassed and remorseful”.

Sovereign wealth funds need 7% per year to meet their projections. And the consequences of a huge miss like this isn’t just academic or limited to the rarefied field of the super yacht class. There are a ton of political promises made based on the revenue they throw off.

The 11.2% return SoftBank provided didn’t cover inflation. So it’s a substantial loss. Can the Saudis and UAE pull out at this point? If they did, I suspect it would destroy the company. Hopefully his apology works.

Inflation in Saudi is much lower than in the US. Energy costs are a lot lower.

They might pull out the bone saw.

The Saudi have turned out to be horrible investors. They own a large stake in Lucid and my bet is that company eventually falls in an epic way. The market for super expensive BEV cars is finite and there are plenty of competitors like Mercedes, Audi, etc. The only reason Lucid’s stock hasnt crashed yet is the Saudis buying. At some point they can own 100% of a very minor car maker and the stock price will eventually collapse.

In the short term markets are all manipulated by big money, in the long term company performance is all that matters.

Find the best managed companies and have a long term time horizon.

The timeless expression comes to mind: “A fool and his or her money are soon parted”. 2022 politically correct version of Shakespearean quote.

You omitted the (at least 2) other pronouns. You get a C- in political correctness.

I remember when getting my MBA that one of the professors said that when a company would rather spend its cash on buybacks rather than growing its business that it is telling you that it can’t find new opportunities.

Likewise, a mezzanine VC firm that would rather spend money on buybacks than invest in companies is telling all of us to stay away from the market right now.

Good management can always find a way to invest cash in their business, because they have a big vision for growth. And if their current business has limited upside, they will enter a different or adjacent business.

Not necessarily. Sometimes there is no possible growth… an increasing share of a decreasing market leads to ruin… as the famous Danny Devito speech pointed out about investing in the company that makes the best darned buggy whip you ever saw.

There is nothing wrong with closing up shop, selling off the assets, and giving the investors back their own money. It is far more moral than “good management” sucking the shareholders dry with financial tricks designed to keep a company afloat until it crashes.

When a company spends money on share buybacks they’re telling you they want to liquidate the company slowly away and give it to insiders. Exhibit A: Starbucks.

1) DXY monthly, Jan 1974 fractal zone : 105.90/109.50.

2) July 2022 high reached 109.294, was rejected, leaving behind a large selling tail.

3) In order to move higher there must be a monthly close > July 2022 high.

In order to move to move lower there must be a close < July 2022 low.

4) Judy Garland "The Wizard of Dr Oz" might send DXY down to Mar/May

2015 backbone : 100.39/96.17 for a sling shot.

For a global deleveraging this is pretty orderly so far. Wonder how much of this is currency related. The cost of hedging that risk is rising but the direction is fixed and strongly biased toward the dollar, and most saying that there is little chance anything will change, perhaps for years. This guy just needs to take out a loan in dollars.

I notice that the stocks that will need additional financing get better coverage from analysts than the stocks that dont need external funding.

If what Micron sees is an accurate picture of the market, it’s not just PC chips that are slumping.

This is a big story, if true.

It’s old hat. Micron warned about PC and smartphone demand — after everyone spent the last two years buying PCs and smartphones and now don’t feel like buying again for a while. Lots of companies have warned about that. And it warned about supply issues in China, what else is new!

1) Easy come/easy go : high end Russian programmers escaped, Ukraine’s

programmers are either in the army or dead. The ones in Kyev work for

half prices, because USD/UAH is breaking out. High end refugees

will cannibalized themselves to survive.

2) Higher Ed risky trade. STEM input : $400K/ output : zero. After

six mount when new fresh grads enter the markets, they are dead stem cells. It might repeat itself in sequels.

3) Russian oil for 1/3 discount. WTIC is down, because Russian sold to India and China is trading in the futures market.

4) Easy come/easy go. BRK/B monthly backbone : Jan/Feb 2018. The horizontal vector From Jan 2018 to May 2020 is equal to the diagonal

vector to Mar 2022 high. BRK/B might reach/ breach the BB to test or breach Mar 2020 low.

Amazing article largest loss ever and softbank keeps buybacks intact. Same as USA with borrowed money for stock buybacks representing about 60 percent of stock gains since 2008 or maybe 2001 i Forget but lots of leverage in buybacks

World’s Largest Asset Manager BlackRock Lost $1.7 Trillion in First Six Months of 2022

BlackRock’s losses are a combination of recession, inflation, rising interest rates, and poor performance of stocks and bonds in the first half of 2022.

>>> Compare with Blackrock $1.7 trillions loses in 2022, Softbank doing quite well. :)

SIMON LUI,

You get this completely wrong. Blackrock MADE money. Blackrock sells mutual funds, ETFs and other funds, and makes money from fees. It made $1.4 billion in Q1 and $1.0 billion in Q2. Look it up, it’s a publicly traded company that is very profitable.

Its CLIENTS lost $1.7 trillion. The folks who invested in its mutual funds and ETFs and other funds, the people with its funds in their 401ks, etc. Those are the losers. Blackrock cashes in on the fees no matter how much money investors in its funds lose.

You people have got to quit getting your info from reading headlines. It really dumbs you down.