A six-quarter surge, with first signs that some of it has started to unwind.

The inventory pileup I have been discussing for a while played a big role in the surprisingly strong 3.2% GDP growth reported on Friday, but it also played a big role in 2018. And it played a big role in 2014 and early 2015 before it got wound down, as inventory pileups always do, in a series of events that triggered the “transportation recession” of 2015 and 2016 (here is a taste from May 2016: “Freight Rail Traffic Plunges: Haunting Pictures of Transportation Recession: 292 Union Pacific engines idled in Arizona Desert”). As a consequence, the overall economy in 2016, still propped up by growth in services, grew at merely 1.6%, the stingiest growth since the Great Recession.

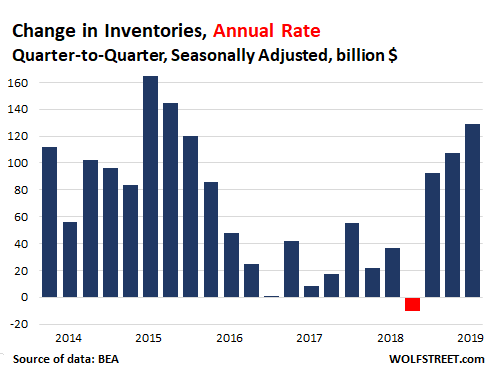

The Bureau of Economic Analysis reported that private inventories in Q1 grew at an annual rate of $129 billion from Q4 last year, seasonally adjusted. “Annual rate” means that if inventories keep growing at this rate, the total increase for the whole year would be $129 billion. But it wasn’t as big as Q1 and Q2 2015.

Increases in inventories are considered an investment and are added to GDP as such; conversely, decreases in inventories are subtracted from GDP.

This increase in inventories in Q1 2019, adjusted for inflation, added +0.65 percentage points to GDP, according to the BEA. Without this increase in inventories – so with flat inventories from Q4 to Q1 – the 3.2% GDP growth would have been 2.55%.

In 2018, changes in inventories impacted GDP growth this way:

- Q4 2018: +0.11 percentage points

- Q3 2018: +2.33 percentage points

- Q2 2018: -1.17 percentage points

- Q1 2018: +0.27 percentage points

The chart below shows the quarter-to-quarter increase or decrease in inventories expressed as an annual rate:

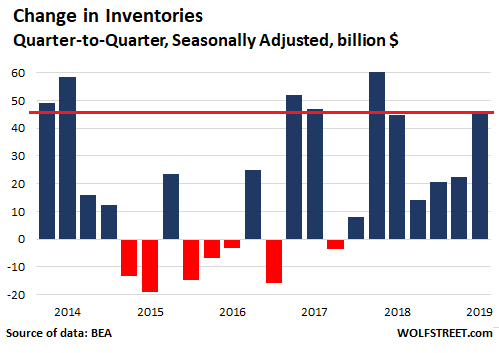

In terms of actual increase in inventories, not an annual rate: Inventories rose by $46.3 billion in Q1 from the prior quarter, seasonally adjusted. The chart below shows the quarter-to-quarter changes. The jump in Q1 2019 was just a tad larger than in Q1 2018 ($44.8 billion) and was smaller than in Q4 2017, Q4 2016, Q2 2014, and Q1 2014:

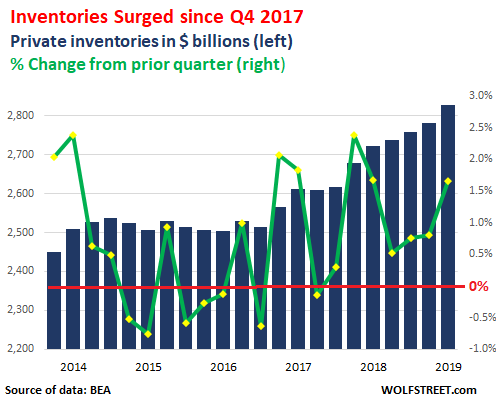

In terms of total private inventories, they hit a record of $2.83 trillion (seasonally adjusted) in Q1. At the business level, inventories are valued at cost, and the final sales amount of those $2.83 trillion in inventory will be a lot higher. In other words, there’s a lot of stuff in inventory.

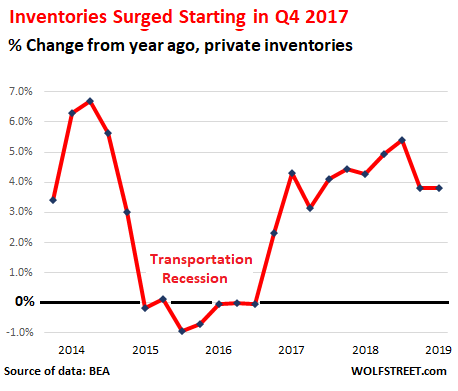

The inventory level of $2.83 trillion was up 3.8% year-over-year, matching the year-over-year increase in Q4. But those two were the lowest year-over-year increases since Q2 2017. But when businesses whittle down their inventories by ordering less, it ripples through the economy, lowers GDP growth – and in 2015 and 2016 triggered the “transportation recession”:

On a quarter-to-quarter bases, in Q1 2019, inventories grew 1.7% from the prior quarter, same as in Q1 2018, but lower than the 2.4% jump in Q4 2017. This inventory pileup has been going on essentially for six quarters, over which inventories have ballooned by $210 billion, or by 8%.

The chart below shows total private inventories in billion dollars (blue columns, left scale) and the quarter-to-quarter percentage change (green line, right scale), seasonally adjusted:

The largest categories in the $2.83 trillion in total private inventories are manufacturers, wholesalers, retailers, and farms.

Farm inventories have been on a relentless down trend since their peak in 2014, dropping 26% (not adjusted for inflation) from $237 billion in 2014 to $173 billion in Q1 2019, according to the BEA.

Inventories at manufacturers rose 3.6% year-over-year in February to a record $692 billion (not seasonally adjusted), according to the latest data available from the Commerce Department. But from mid-2014 through December 2016, manufacturers had trimmed their inventories, hitting a low point of $615 billion in December 2016. This whittling down of inventories had contributed to the miserably slow growth of GDP in 2016 of 1.6% and to the “transportation recession.”

Inventories at retailers, including auto dealers, rose 4.3% year-over-year in February (latest data available from the Commerce Department) to $661 billion.

These inventories at retailers include $249 billion in inventories at new- and used-vehicle dealers and at auto-parts dealers, whose inventories inched up by $1.8 billion in February, and by $5.5 billion in January (the most recent data available), after having fallen in December by $7.3 billion. This data is not adjusted for price changes.

Based on consumer demand, automakers have been switching to more expensive pickups, SUVs, and crossovers (“trucks”), whose sales have surged by 38% from 2014, and away from cars, whose sales have collapsed by 30% over the same period. Hence, the composition of those inventories at dealers has also changed in favor of those more expensive “trucks,” and the value in dollars of those inventories has risen in part because of this shift.

Since this shift from cars to “trucks” took off with a vengeance (a shift that I’ve long called “Carmageddon”) in late 2014, the total value of auto inventories has surged by 42%! So a part of this increase in value of those inventories is structural and is unlikely to reverse.

Inventories at merchant wholesalers soared 6.9% year-over-year to $669 billion in February.

Within this group, wholesale inventories of durable goods, in February at $415.6 billion, started surging in mid-2018 and reached double-digit year-over-year growth rates in December (+10.7%), January (+11.6%), and February (+10.6%). But February, on a month-to-month basis, already marked a slight down-tick from January, a first sign that businesses have started efforts to whittle down their inventories.

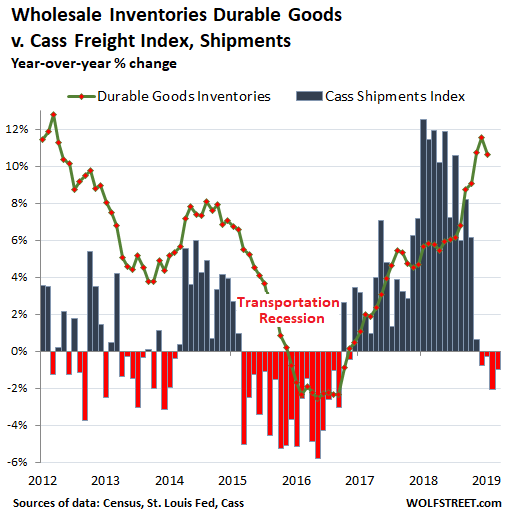

Now a similar pattern is forming as we had seen before and during the last transportation recession in 2015 and 2016: Durable goods inventories have been piling up at wholesalers since late 2017, while shipment volume of goods, as tracked by the Cass Freight Index, after a historic boom in 2018, have now declined four months in a row.

The chart below shows the Cass Freight Index for Shipments (columns) and wholesale inventories of durable goods (green line), both expressed as percent change from the same month a year earlier. Inventories follow shipments with a lag:

So where is this going?

On the retail side, there is some seasonality in auto inventories, but this data is also seasonally adjusted. Overall, the structural shift to more expensive new-vehicle types (“trucks”) will continue to do its magic until that shift has run it course. Given some quarter-to-quarter seasonal fluctuations, I expect the value of vehicle inventories to rise overall in 2019 and act as a boost to GDP.

But the likely process of whittling down inventories at wholesalers and manufacturers will act as a drag on GDP, with the first signs cropping up perhaps as early as the second quarter and spreading into next year. How much of a drag will depend on how rapidly inventories are being whittled down. For now, the signs do not point at a massive panic-style culling of inventories, but rather a careful and slow process that does not impact GDP in a dramatic fashion.

“Patient” may become less patient. Read… I Just Hope the Fed Won’t See This: US Economy Has Blowout First Quarter

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Question from a layman.

Something like an auto/truck has inventories and sales movement all along the supply and production line to the final resting spot in someone’s garage. It is sold along the way and bought along the way, in pieces, many times over. Is the inherent GDP in the auto product measured all along the way and every time something changes hands? And if it sits unsold on the lot, was it really false reporting? Yes, there was measureable activity, but it looks like there is a point where it is more like digging holes and filling them in as being an indicator of a healthy economy. The $50,000 truck gets sold for $500K before it hits the consumer as far as GDP is concerned.

Thanks in advance for someone’s opinion/answer.

You know enough to ask the questions, you know enough to figure out the answers. Give yourself some credit.

I’ll stick my neck out, hoping nobody cuts it off. Not that I’d blame them.

=>Is the inherent GDP in the auto product measured all along the way and every time something changes hands?

Yes. Every expenditure adds to GDP, all along the chain.

=>And if it sits unsold on the lot, was it really false reporting?

No. That just means its inventory. It’s value should be written down the longer it sits, though.

What you seem to be questioning relates to one of the major criticisms of how GDP is measured. Under the rules, it is not false reporting. GDP measures spending, but it doesn’t look at whether the money was wasted, or if it reflects any truly worthwhile improvement in the economy.

I would relate it to the previous article by Don Quijones: GDP in Spain increased, but so did unemployment, which shows that whatever economic improvement there may have been in Spain’s economy, that improvement meant little, if anything, to those who lost their jobs and to those who couldn’t get one.

Thanks for explaining it. I thought it was such, but it is still a bit mysterious.

No, GDP only includes final sales.

Let’s clarify then. Spending on intermediate goods and services is included in spending on final goods and services.

From “The Manufacturer’s Dilemma” from today’s Foreign Policy:

The expenditure approach to calculating GDP makes it unnecessary to add up spending at each step, which might be unknowable.

My apologies for incorrectly assuming that was clear.

The cited article describes a real, related difficulty, the near-impossibility of securing complex supply chains from attack by malicious actors, compounded as they are by outsourcing and globalisation. As significant as these risks have proven to be, they are outside the normal scope of discussions here, which I find complex enough as it is.

I built up inventory in 1st quarter – sales were excellent and then BANG – end march literally stopped(sales)

I’m now full with lots of inventory sitting – sales in April 4 units with 40 in stock

now offering real deals to move product and NOT BUYING SHIT until inventory is reduced

btw 0% is financed so I can hold product until it sells

Craig’s List is utterly dead. I have 3 ukuleles I want to sell and have cut down the price to $100 each (new they’re in the $150-$300 range) and I’m just getting no calls.

I’m considering just printing up paper flyers and tacking them up on telephone poles around town …

Wolf, what I would like to know is how many truck drivers and their families live permanently in their Rigs.

That’s a good question. If more people became self contained truck drivers that could help solve the housing shortage. If anyone can find an answer to your question Wolf can. If Wolf can’t, no one can.

I’ve asked that question too. A lot of truckers do live like that, but neither the logistics industry, nor the federal government, nor the Teamsters seem to track the numbers. At least so far as I’ve been able to determine, but then, I have significant occiolist limitations.

One might think it’s a cheap way to live, but as we know, not all costs are financial.

I need to do a better job of keeping my its and it’s straight.

The answer, I guess, is about one tenth of the number of Uber drivers that live in their automobiles.

When I see an older model conversion van these days, I assume that the driver lives in it.

Something got into 3M…

No, 3M is getting stuck in their own scotch tape.

In a slowdown when the retailers quit buying, manufacturers quit producing, and wholesalers start dumping these record inventories…the seeds will be sown for negative GDP numbers. Really negative GDP numbers. And it could start at any time. I wasn’t going to buy puts until after a trade deal was announced, but that could go south too for many months…if it happens at all. The stock market can wait for only so long.

=> The stock market can wait for only so long.

The stock market recovered, and then some, even while the real economy was still declining. Which shows that, generally speaking, equities have not much dependence on what’s happened on the ground. Because liquidity is abundant and cheap, the stock markets can stay up so long as Wall St. can continue to bleed the real economy. Anybody expecting a crash could be waiting a very long time, even after the real economy has gone into recession, even if the overall economy has not.

In certain very real terms, it has been argued that the 2000 recession never ended, much less the Great Recession.

@Unamused – “In certain very real terms, it has been argued that the 2000 recession never ended, much less the Great Recession.”

Wonder if you could elaborate – this is something I’ve sort of vaguely felt, but can’t seem to get much solid data. Any recommendations appreciated. Thanks!

I will beg Mr. Richter’s indulgence and offer one last comment today in response.

To be brief, I would refer you to It’s Worse Than You Think by Keith Quincy. Separate out the financial economy from the real economy and a clever person can use it to generate statistical series indicating that the real US economy really has not recovered since 2000.

The statistics I use represent the results of proprietary research and I’m in no position to present them here, and I’m constrained from presenting them elsewhere besides, at least for the time being. If you are determined, try googling up “economic indicators for the poor and middle class”, and be prepared to make an ongoing hobby out of chasing down all the leads: statistics related to employment, costs, debt, and opportunity for those who are not well-off, and make normative valuations in addition to financial ones. They really are out there, and there are a lot of them. Then, just figure out how to put them together to form a picture, one that is more accurate than the official one. The Economic Policy Institute and the Organisation for Economic Co-operation and Development could be good places to start.

Let us cut to the chase. If your circumstances are unsatisfactory, or those of your family, friends, neighbors, and acquaintances, then it does not matter what the official statistics say, as those can be good, bad, intentionally or accidentally misleading, and politically motivated, and do not refer to you specifically in any case. Economics and finance can be very subjective things, and rightfully so.

I’m sorry, sir, I can only hope that this helps.

Well said, equities are no longer tied to the real economy. This appears to be the result of the investor class gaining access to huge sums of ultra-cheap money, facilitated by the Fed, using this money to buy up hard assets and paying back the easy money with inflated dollars worth only a fraction of what they borrowed. If this process is repeated often enough the investor class eventually owns everything and that includes real estate and stocks that pay them dividends and grow with inflation and are protected by a free put from the Fed.

What I find interesting is the Fed obviously knows the above statement to be true yet they continue the process, unafraid of the victims rising up. The Fed seem aware that wage earners have no agency and pose no threat so they simply don’t care if they get pissed – there are no pitch forks or torches to fear.

One could go a step further and suggest robots and AI can handle most of the tasks performed by wage earners of the past and as such the investor class is probably looking at various solutions to bring about a die-off of these “eaters”. What if you could feed this mass of redundant humans adulterated, industrial foods that give them metabolic diseases. What if you could get them to willingly purchase questionable pharmaceuticals that may even cause them to commit suicide (anyone want some Abilify – they seem to think you need it), what if they can use the incompetent, overpriced medical industry to bankrupt them and further damage their health with unnecessary procedures. I’m not saying the investor class is trying to kill you off but I would suggest that if someone was looking for a way to rid society of the surplus population these might be worthwhile efforts.

Everyone’s favorite Nebraska billionaire claims he lives on three cokes a day and junk food from fast food drive-through when in fact he likely has a very closely monitored diet and is looking into ways to preserve his telomeres.

All through these astonishing monetary shenanigans the Fed has lied to us. First Bernanke said QE was a temporary and finite emergency measure, then he gave us QE2, twist and QE3 with a chaser of permanent low interest rates – he lied about his intentions all the way to keep ordinary citizens afraid of buying assets. Janet repeated the process (although one could argue she was just a well meaning idiot) and now Powell, just one more liar, chased mom and pop out of the stock market and then reversed course and jammed markets higher into a rally seldom witnessed in history. Either the Fed is totally incompetent or we have been jobbed.

“…there are no pitch forks or torches to fear.” – van down by river

In the 1940s you must remember the huge creaky castle oak door opening into the lightning storm with Igor answering that, “Dr. Frankenstein isn’t home.” They feared pitchforks and torches back then.

“… if someone was looking for a way to rid society of the surplus population these might be worthwhile efforts.” – down by the van

That was done in the 1973 movie “Soylent Green” starring Charleston Heston, Edward G. Robinson, and Chuck Connors. They just scooped up the unwashed masses into giant dump trucks and processed them into green wafers to feed the living masses they hadn’t scooped up yet, to save on social security, and pensions.

“Everyone’s favorite Nebraska billionaire claims he lives on three cokes a day and junk food from fast food drive-through…” – van down by river

I believe he has been quoted as drinking 7 cokes per day. With 17 teaspoons of sugar in each coke that’s 119 teaspoons of sugar each day. He probably says this because he owns shares in Coca Cola and hamburger chains. The truth is, if he really did this he probably would have died at 38 rather than be alive at 88.

Consider this:

When obamacare started we gave more than a few million free Medicade and others subsidized healthcare access.

We also allowed loans for college.

The two of these account more or less for all of economic growth which also fit in with debt growth of 1.5 trillion a year run rate while the 20 trillion economy is growing by 5% including inflation, if that high.

We add diversity departments at colleges and other adm staff

This is not productive growth, but it adds debt.

Now in addition to US govt debt growth, we have state and local debt growth the consumer debt growth and then corporate debt growth. 3 trillion plus in all.

Anybody see a problem. We are pushing the limitets.

Here’s what mystifies me – why DON’T they fear the pitchforks and torches? I sense that they’re not so far away… maybe currently manifesting themselves as alt-right shinola, mass shootings by home-grown crazies, suicides among the young, and election of people who could never have gained traction in years past?

Is anyone tracking the sales of yellow vests? ;)

This article explains the strangeness of the stock market really well. If corporate buybacks continue in large numbers this year, stocks will soar regardless of the underlying economy.

https://wolfstreet.com/2019/04/08/what-would-stocks-do-in-a-world-without-buybacks-goldman-asks/

Direct quote:

The net effect of these investor groups is that they together shed $1.1 trillion of shares (included in these categories, and spread over them, are ETFs). But the $1.1 trillion of shares that these investor groups shed over those five years was overpowered by $2.95 trillion of share buybacks over those five years.

The problems start to arise when companies who have been borrowing to buy back shares stop to maintain credit ratings in the face of declining revenues and higher costs.

For 2019Q1 a couple of big companies have halted buybacks/dividends, and if layoffs grow/consumer spending weakening continues, plenty more will as well (on top of if the dollar continues to gain strength and pricing out consumers of US companies products and services in international markets which make up nearly have of their revenues).

Boeing just suspended its 8 billion buyout program, becasue the company has been illiquid and now it has a MAX problem which is spreading thru the company like a virus.

It also has been paying out cash dividends of 3 billion a year and has net negative tangible net worth and not that much book net worth.

No emergency funds there while they build 42 737 max aircraft a month and not selling them

I have heard that stock buybacks are over exaggerated. Companies buy back shares with one hand, while the other hand is dowling out shares to executives as stock based compensation or due to company takeovers. An announced 6 percent buyback may only be with all things being equal 2 or 3 percent..

Doling them out, even.

Predicting the future is not about having the most persuasive arguments, it is about being right.

No one can argue with Wolf’s arguments but he was wrong in believing that the ten year would hit 5% and Fed continue to unwind the balance sheet. We know how all that ended.

There is no recession before the next presidential election and as I have said here before Dow will hit 30k before any downturn if ever.

The stock market has become the measuring stick of everything successful, the President is behind it, the media and most importantly the Fed with infinite capacity to print dollars and support valuations. Don’t fight the Fed.

You don’t even understand what drives the markets, not sure if you are trying to convince yourself or others that you know what you just typed ?

Look into Turkey,India,Argentina,China,US Liquidity and spreads… When liquidity evaporates, Institutions sell. When Institutions sell, it’s game over… 90 % + of equities trading is Passive or Algo, the means the trend is always heavily biased in either direction, when markets go up they go up like stairs, but on the way down in this trading environment, it’s an elevator. Extremely fast and vicious, especially when there are no buyers. When Market makers houdini, it’s freefall like in end 08. Dow lost 10 % of value in 8 trading days in December 2018, no defaults nothing happened, just liquidity tightening

End 08 will happen again, same liquidity issues already flashing red, scary part this time is EM Central Banks have been fighting liquidity issues since 2018 and they can’t stop it, it’s always little temp boost that fade just as quick cause of too much debt servicing, liquidity soaks up instantly… Every Major Central Bank has been injecting massive stimulus in there economies for years, and they can’t fight it anymore… Central Banks can’t even stop what is coming, that’s when you know the end of credit cycle is here

Now The Fed is a different beast, and they will step in once markets are down 30-40 %, given the speed of sell-off, it will be a meltdown… American markets will be fine once rates at 0 and Helicopter Money is in, cause US banking system is healthy somewhat. The Pension funds and Japan are gonna get it cause of the corporate CLO debacle, and the rest of the world… Deep recession

The Primary driver of Deleveraging won’t be around to Import Inflation and Export Deflation ( China )… It’s weird to see people thinking CB’s can fix anything at any time. If they cancel all consumer debt, then yes we are going to the moon, but with amount of Debt Servicing going forward, wtf will earnings look like ? Quite a few corporations will struggle with debt load going forward, and a number of consumers are taped out. Real Inflation is far outpacing Wage growth

@ Lemko

You sound like You have many certain beliefs but live by none…why don’t you just go and short this market and report back to us in 6 months…

=>Predicting the future is not about having the most persuasive arguments, it is about being right.

Sort of. For nearly everybody the world is stuck on ‘Play’. The Pause and Reverse buttons do not work, and the Fast Forward button isn’t connected to anything.

All my buttons work. Don’t tell anybody.

@Memento

This is unfortunately true, but rest assured we are trading short term gratification for long term real economic growth and productivity. The austerity that is required to deleverage is untenable is this day and age of immediate gratification. This isn’t a good thing. Take advantage of the market while it lasts. We all are, but there’s no free lunch.

Corporations can declare bankruptcy (as the POTUS has done many times), but it doesn’t work out that way for the government. There are horrendous social ramifications…..

Memento mori,

I also completely underestimated just how much SLIGHTLY higher mortgage rates would hit the most inflated housing markets, such as on the West Coast. I thought we would need to see average 30-year fixed rates closer to 6% before we’d see an impact. But the impact started to happen in the mid-4% range. And now I’m not even sure that the weakness we’re seeing in those markets since last year is from those slightly higher mortgage rates or from other dynamics. It’s mysterious out there!

What west coast weakness are you talking about exactly?

I guess posting links is a no-no…but this was from the San Jose Mercury News, April 26, 2019.

“Meanwhile, after hitting the lowest level in 12 months in February, the statewide median home price bounced back and rose 5.9 percent to $565,880 in March, up from $534,140 in February and up 0.2 percent from a revised $564,820 in March 2018.”

Just Some Random Guy,

You’re really a handful in cherry-picking words out of context just to troll this site so persistently. That increase you cited was from February to March — month-to-month, and seasonal. But year-over-year in March, the median price for the state overall was flat, and in 12 of California’s most expensive coastal counties, the median price fell in March from March a year ago. In those cities, including SF, prices were down from a year ago. Same data from the CAR. So here is the whole thing:

https://wolfstreet.com/2019/04/17/house-prices-fall-year-over-year-in-12-of-the-16-most-expensive-california-coastal-counties/

Then there is the by now very well established weakness in Seattle, among other cities:

https://wolfstreet.com/2019/03/26/the-most-splendid-housing-bubbles-in-america-deflate-further/

You have made some good points.

The Fed takes it’s direction from the S&P 500. If the S&P 500 “overheats” in the near term, then the Fed will kick start it’s rate hike psychobabble signaling rhetoric again.

Most of us kow at this point that listening to the Fed over and over again and expecting something different is behaviour best left to Sigmund Freud to analyse.

If you can wait until the end of June, it will be great time buy a car as dealers panic to make their numbers.

Hello Dan. For those of us who are unaware, what is the significance of June w/r/t auto dealers? FYE?

How many 737 Max planes are in inventory and not being used.

Had to add somewhat to the number. Also did I read somewhere that increasing inventories were responsible for .7% of the 3.2%?

Anybody know?

Only aircraft at Boeing that hasn’t been delivered would count as “inventory.” Since Boeing keeps producing them but stopped delivering them, this is going to be a problem going forward. The Ethiopian Air crash happened in March, and by mid-March airlines started refusing deliveries. So this data hasn’t shown up in Q1 yet. But it will show up going forward.

And now there is a report about the 787 Dreamliner hydraulics issue. Sounds like they may also be grounded or at least have additional inspections. And stories about Boeing’s plants being to rushed and not doing great job.. Boeing’s reputation is waining. Could be some hard times ahead for that company..

Sometimes, inventory increases come before a recession. However, more often, an inventor increase comes because business owners are bullish about the future and need inventory for sales growth. My take is this inventory increase is bullish.

The ghost cities in China that apparently could house tens of millions of people got built and they counted toward their GDP. They have sat empty for years along with malls, infrastructure etc. So is this bullish?

Well, to support Wolfe’s analyses I have only two data points of a local nature. A guy in a neighborhood I ride my bike through drives a big rig. And starting last week it has been parked in his yard for the first time in the five years I’ve been riding by. Has the name of a large shipper stenciled on the side.

Also new library and police precinct building the city was going to build are on hold because the tariffs on structural steel have raised the prices too much to resolve in the short term. Contractor said commercial/industrial construction for small businesses is down because of the structural steel cost increases. It seems they raised the tariffs on a product not available here in sufficient quantities. I’m sure with more investment the US steel industry will be able to meet the demand but I guess that could take a while.

I went to the cherry blossom festival in Cupertino yesterday so I rode the bus along San Carlos/Stevens Creek Blvd. from downtown San Jose out to C’tino, and it’s amazing the number of empty buildings and defunct businesses there are.

Just a reminder that the Q1 GDP deflator (using real inflation numbers would make it even worse) is a joke.

Using CPI-U GDP would have been ~1.6.

1) Car shipments from Mexico is rising, because USMC might

not be confirmed, and car mfg preempt.

2) The SPX might make an all time high,

but the DJ Transport is lagging behind, isn’t confirming a higher high.

The Dec 2018(L) was a below the Nov 2014 high. That did not happen

on the SPX, or the DOW.

The NYSE Composite Index, the largest capitalization index on the planet, has not come close to recapturing its ATH set in Jan 2018. Has made lower highs and lower lows since.

Was repelled at 13K this week.

Likewise the KBW Bank Index has not come even remotely close to breaching its ATH, also set in Jan 2018. The index has also been doing the “lower highs, lower lows” two-step.

Yet equities continue to levitate until corporations get the tap on the shoulder to address the mess on the balance sheet. That’s the point at which Wolf has indicated that the term “shareholder-friendly” goes the way of the dodo, to be replaced by “creditor-friendly”.

So Wolf, this inventory-boosting of the Q1 GDP number would seem to negate the what-will-the-Fed-do thrust of your “I Just Hope the Fed Won’t See This: US Economy Has Blowout First Quarter” article of a few days ago, would it not? Because assuming the Fedsters see the same data you cite, and we know that they of course do, the obvious conclusion would be that sans this one-time pulled-forward effect, Q1 GDP growth was in fact right around the consensus estimate, at a much tamer 2.5%.

It doesn’t negate it at all. It adds color and detail. I did mention the inventory pileup in the article but didn’t dive into the details because it’s a vast topic, as you can see.

What I said today, including in the conclusion, inventories are unlikely to do anything drastic: “For now, the signs do not point at a massive panic-style culling of inventories, but rather a careful and slow process that does not impact GDP in a dramatic fashion.”

Auto inventories will do a little seasonal dip, if any, and rise later in the year for structural reasons.

Wholesale and manufacturing inventories will likely flatten out or decline, but slowly and spread over several quarters, and it won’t make a huge quarter-to-quarter dent, which is what GDP measures. So there will be a drag on GDP from that corner, but it won’t be huge.

Also remember, there is another complexity that I didn’t discuss: When inventories decline because items get sold faster, those sales add to GDP when they become “consumption.” So stronger sales by wholesalers and manufacturers when they eventually translate into consumption would boost GDP even though their declining inventories of those items would be a drag on GDP from the other side. In other words, lowering inventories by increased sales on net adds to GDP. It’s a plus-minus situation. It’s when sales stay flat (the “plus” is missing, and orders in the supply chain fall to reduce inventories that GDP feels the heat because the “plus” is missing.

For example, on the retail side, if suddenly auto sales surge in Q3 and Q4, and this unexpected surge draws down inventories at dealers, the decline in inventories would be a drag on GDP but the surge in sales would be a larger boost. So on net, such a sales surge that lowers inventories would still add to GDP.

So GDP may feel a slight drag in Q2 and Q3 from declining inventories, but it won’t be huge. Q2 GDP looks on track so far. This scenario, as always, assumes that nothing big blows up.

The thing about Q1 was that GDP growth was supposed to be pretty bad, but it wasn’t. There weren’t and still aren’t a lot of worries about Q2 and Q3. Everyone expects them to be pretty decent and within range.

I did note in my prior article that I expect that Q1 GDP growth of 3.2% will be revised lower in the second estimate. I said this in part because I expect that the inventory boost will be revised lower. The “advance” estimate of GDP that we got on Friday still doesn’t include the March inventory data. They used a rough estimate to fill that gap. The second estimate will include that data. And my guess is that wholesale inventories will have ticked down some in March. But I don’t think that the inventory revisions are going to huge.

I’m not surprise to see inventory gluts. Reselling is a huge business now in the US. When I was growing up only the truly poor bought used items, now everybody thrift shops. The financial crisis changed the way America shops forever.

Luxury items are big sellers in the reselling world. Recently, I saw high end designer handbags being sold in a discount big box store, discounted 30-50%. Those prices are competitive with prices in the used markets where counterfeits proliferate.

where do you live that everyone thrift shops?? And the prices charged at these “second hand shops” are insane and hardly justify buying used clothing. Unfortunately this isn’t the 1950s where people were honest and everyone wasn’t out to scam or get over on others (as it is in NYC & the Boston area now).. The only thing I will buy ‘used’ is off Amazon or Ebay or a refurbished item that comes with the same after sales protection (return policy etc…) as a regular item — ex. Amazon Warehouse deals….

Buying from some random person off craigslist or Facebook??? I don’t think so, not these days when most people (yes most) will do anything to scam or get over on others…

And judging by the recent & current retail sales numbers (redbook weekly chain store sales), consumer spending has bounced back to where it was last year at this time.. Retail sales still running at 5% – 7% year over year gain and vehicle sales still at 17.5 – 18.00 million SAAR

There is entire world of reselling platforms out there. Every western country has its favorites. One of the popular ones here is Poshmark but there are a bunch out there. Some resell only luxury goods, others resell any well known brands. Millennials are really into buying used items, it is part of their green living ideology.

Most of these platforms exist because the terms on the platforms you mentioned are not attractive to these resellers. Instagram is also becoming popular for resellers.

{}{Luxury items are big sellers in the reselling world. Recently, I saw high end designer handbags being sold in a discount big box store, discounted 30-50%. Those prices are competitive with prices in the used markets where counterfeits proliferate.}}}

Uh what discount store is this and seriously the actual tag price for apparel and ‘handbags’ is insane so a 30% discount seems huge… By the way the depreciation ‘curve’ for clothing & “handbags” is greater than that for a used car.. How much is that $100 shirt or $700 pair of shoes worth after a few wearings?? and usually bought on credit at 12% + APR.. Millenials & Gen Z are as pathologically obsessed with ‘labels’ as gen X & boomers have been.

The depreciation curve for vintage items from brands like Chanel can be non existent. Some of these vintage item sell for more than original price. I have a vintage bag, French label, which I can sell for more than twice its original price. The quality of some of these items is no longer available at any price.

It is probably very confusing to conflate Inventory and GDP together.

One (inventory) is considered a leading indicator while GDP is a coincident indicator.

Consumption (consumer spending) is now running ahead of inventory growth so even if inventories fall in 2nd & 3rd quarter consumer spending will more than compensate.. There is not one scintilla or iota or actual evidence that consumer spending on any level is falling….

The government shutdown was actually good for the economy because it provided for that soft landing and thereby causing mortgage rates & auto loan rates to fall as well as a temporary fall in gas prices (back over $3.25 in the northeast) so the fed would be able to remain on hold for the forseeable future

> There is not one scintilla or iota or actual evidence that consumer spending on any level is falling

Real retail sales have still not recovered to where they were in October https://fred.stlouisfed.org/series/RRSFS

Very possible GDP is overestimated because inflation is underestimated.