Companies buying back their own shares has “consistently been the largest source of US equity demand.” Without them, “demand for shares would fall dramatically.” Too painful to even imagine.

Goldman Sachs asked a nerve-racking question and came up with an equally nerve-racking answer: What would happen to stocks “in a world without buybacks.” Because buybacks are a huge deal.

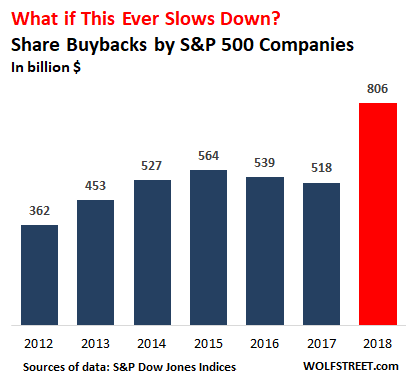

In the fourth quarter 2018, share repurchases soared 62.8% from a year earlier to a record $223 billion, beating the prior quarterly record set in the third quarter last year, of $204 billion, according to S&P Dow Jones Indices on March 25. It was the fourth quarterly record in a row, the longest such streak in the 20 years of the data. For the whole year 2018, share buybacks soared 55% year-over-year to a record $806 billion, beating the prior record of $589 billion set in 2007 by a blistering 37%!

Share buybacks had already peaked in 2015 and ticked down in 2016 and 2017. Then the tax reform act became effective on January 1, 2018, and share buybacks skyrocketed.

The record buybacks in Q4 came even as stock prices declined on average 5.3%, according to S&P Down Jones Indices. On some bad days during the quarter, corporations were about the only ones left buying their shares.

For the year 2018, these were the top super-duper buyback queens:

- Apple: $74.2 billion

- Oracle: $29.3 billion

- Wells Fargo $21.0 billion

- Microsoft: $16.3 billion

- Merck: $9.1 billion

But who, outside of corporations buying back their own shares, was buying shares? Goldman Sachs strategists answered this question in a report cited by Bloomberg, that used data from the Federal Reserve to determine “net US equity demand.” These are the largest investor categories other than corporate buybacks, five-year totals:

- Foreign investors shed $234 billion.

- Pension funds shed $901 billion, possibly to keep asset-class allocations on target as share prices soared.

- Stock mutual funds shed $217 billion.

- Life insurers added 61 billion

- Households added $223 billion.

The net effect of these investor groups is that they together shed $1.1 trillion of shares (included in these categories, and spread over them, are ETFs). But the $1.1 trillion of shares that these investor groups shed over those five years was overpowered by $2.95 trillion of share buybacks over those five years.

So it all worked out. As investors were selling, companies were buying back their own shares. And markets boomed. But what would happen to stocks in a “world without buybacks?”

Share buybacks were considered securities fraud under most conditions until 1982 but then became legal under a new set of loose rules. Now some folks in Congress from both parties, who are worried about corporate governance and the like, have targeted share buybacks in some of their speeches and have proposed some legislation. Goldman is apparently worried that they might get some traction. And so it created its scenario of a world without buybacks.

It would be a truly unspeakably, nay, unthinkably gruesome nightmare that no politician would want to be responsible for: a world in which stock prices would decline!

“Repurchases have consistently been the largest source of U.S. equity demand,” the Goldman strategists wrote in their note. “Without company buybacks, demand for shares would fall dramatically.”

Volatility would rise. To figure this out, the strategists looked at 25 years of quarterly blackout periods that restrict some buybacks around earnings release dates. These blackout periods start five weeks before earnings releases and last until two days afterwards. But they’re not blackout periods: They restrict only spur-of-the-moment buybacks. Scheduled buybacks around earnings release dates are not restricted (my discussion of the rules governing buybacks and blackout periods).

By looking at stock performance during those blackout periods, the strategists discovered that, according to Bloomberg, “return dispersion and volatility during blackout windows have been higher compared with non-blackout periods: 16 percentage points versus 14 percentage points, and 16.4 points versus 15.8 points, respectively.”

In addition, earnings-per-share would dwindle. Share buybacks reduce the number of shares outstanding, and total earnings divided by fewer shares outstanding gives a larger earnings-per-share number. But without share buybacks, earnings-per-share growth and actual earnings growth would be the same. That would be devastating.

They note that over the past 15 years, for the median S&P 500 company, earnings-per-share growth, powered by the reduction in the stock outstanding, was on average 2.6 percentage points higher than actual earnings growth.

In this manner, in a world without buybacks, “forward EPS growth could be trimmed by 250 basis points,” they said. This type of reduction, they said, has historically corresponded to a 1-point decline in forward price-earnings multiples.” In other words, valuations would fall.

And then there is the biggie: The question of just “demand,” no matter what earnings or earnings-per-share may be.

“Eliminating the largest source of equity demand could lower the demand curve if other investor categories do not replace the corporate bid from buybacks,” they warned. And the bull market would lose the force that powered it.

Share buybacks are the relentless bid, buying at any price, buying not to acquire assets at a low price but buying with the specific purpose of pushing up prices.

Letting the stock market fend for itself and embark on its own price discovery without the relentless bid of share buybacks would be a true nightmare. No one would be ready for it. This type of world is just too painful to even imagine these days.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

According to Martin Hutchinson, Market Watch, hollowed out blue chips, Fortune 500, are the next subprime. We in WA State are watching Boeing like the proverbial hawks and are very worried. Boeing has been buying back their stocks with cheap money for years and now that piper could be playing his swan song. If the 737 Max order cancelations spread to other production lines, and it looks like they might, Boeing could be in real trouble. A significant slowdown in the economy could put other corporation in a similar pickle.

Couldn’t happen to a nicer bunch of Military Industrial parasites. Boeing should stick to killing people with drones – something that’s legal, immensely profitable, and has no litigious downside.

And with The War Party of the Rich at their back- how can they lose ?

“Boeing is all over Capitol Hill. They have 100 full time lobbyists in Washington, D.C. Over 300 members of Congress regularly take campaign cash from Boeing. The airlines lather the politicians with complimentary ticket upgrades, amenities, waivers of fees for reservation changes, priority boarding, and VIP escorts. Twice, we sent surveys about these special freebies to every member of Congress with not a single response.” Ralph Nader

Said the person who never flew on a Boeing jetliner. Get real and go somewhere else for your nasty trolling.

Does it matter?

Isn’t the truth about Corporatocracy running American Congress?

You seem pleasant and not unhinged.

A company paying out over $8 in dividends yields only 2%.

Gee, people might have to invest in RE and hope for asset increase. :-)

As for Boeing, this is the union busting company that periodically threatens to pick up and move to ‘right to work’ states every contract negotiation, isn’t it? This is the same company that got Trump to levy 300% tariffs on Canadian built Bombardier C class (737 competition)…the same aircraft that Airbus now owns the manufacturing rights?

If you can’t make enough profits on product you reach for tariffs, self regulation for new certifications, lobbying, and spin. They’ll be lucky to survive, especially if rising fuel costs and low cost carriers continue to fail.

Boeing—the company taken over by McDonald-Douglas, under the guise of Boeing buying MD—-MD personnel now run Boeing—–

ALL good things come from Californica

How do I get connected to a guy like you?

According to an article in the 5/22/2018 online edition of Forbes executive compensation was 361 times the average rank and file worker. Back in the 60s ,70s and 80’s the comparable # was below 50 and only started its stratospheric increase about 1990. It was also about this time that companies went on a binge to relocate plants overseas, thus screwing domestic workers

I believe in capitalism , but the system that we currently have is not capitalism , but corporate fascism where the corporations employ hordes of lobbyists to write laws that benefit themselves and have resulted in the hollowing out of the middle class. In many ways the corporations of today have an amoral attitude similar to Marie Antoinette prior to the French Revolution.Eventually the people are coming for the greediest among us and will demand the modern day version of the guillotine for the corporate greedy pigs

Only when they turn hungry and desparate. Just like in Marie Antoinettes time.

“corporations employ hordes of lobbyists to write laws that benefit themselves”

To benefit themselves — that is capitalism. Just because it’s through lobbyists doesn’t make it less so. People with money and power make the rules, like the far west — that is the purest form of capitalism.

“amoral attitude”

That is also part of capitalism.

Even in Adam Smith’s Scotland, there were basic rules of trade, including currency. “Capitalism” requires many competing enterprises, but that is anathema to today’s Globalist World. The current objective, polished over at least a generation, is to squeeze out small players, using Central Bank money/credit.

And that means the few hands remaining get to set prices.

To the article, I sometimes wonder what the endgame is? What happens once a corporation has bought up 100% of its own shares?

Kam, great point. It is indeed about concentrating power, pricing power or simply power. And this is not capitalism, it is cronyism or crony capitalism. GE was a poster child for this movement, Amazon and many others.

Capitalism is good as long as corporate money cannot influence politics and anti-trust regulators do their jobs to prevent “too big to fail” enterprises and enforce fair competition. We haven’t had those safeguards in place for a long time, so the system has become “crony”.

I have known a number of very successful businessmen. They consider their employees as integral parts of their business and would never move their factories overseas just to line their pockets . Today’s leveraged buyouts fire employees left and right while paying themselves fees and bonuses . You are correct this iteration of capitalism is not amoral ; immoral is closer to the truth

Businesses have always been been with politicians. But the what happens currently now dwarfs anything that happened in the past

I don’t agree that the purest form of capitalism is “people with money and power make the rules.” It is a lot more subtle and nuanced than that. This statement conflates the market place with the political system. They are not the same.

Those with money have always been able to influence politicians. But like all things, the degree of that influence is cyclical, and it seems like we are at an extreme. Evidence of this would be the current ratio between the wealthiest people and the wealthiest corporations and the median person or business.

The problems we have today seem to be the result of the interaction between this extreme wealth gap and the fact that there are the same number of of Congressmen today (535) as we had in 1911. However, the US population in 1911 was 93 million versus 236 million today. This means that each House member has over 535,000 constituents.

The issue of the number of representatives per citizen was vigorously debated after the Revolutionary War. Washington thought it should not be more than 1 rep for every 30,000 people. Other founding fathers wisely recognized that the size of the House of Representatives should balance the ability of the body to legislate with the need for legislators to have a relationship close enough to the people to understand their local circumstances, and that their power be diluted enough to limit their abuse of the public trust and interests.

If I recall correctly, it was also generally recognized that too many constituents would enable takeover by special interests. It seems to me that this concern has be validated.

These subtleties seem to have largely been lost to the citizens of our our modern world of Facebook, Instagram and infotainment.

Madison also said that a small a number of representatives on a proportional basis would be an unsafe depositary of the public interests. They would not have a proper knowledge of the local circumstances of their numerous constituents.

Why are you so concerned about how much your boss makes? Worry about yourself.

Because there is only so much to go around . When the top 1/10 of 1% and top 1% siphon off so much , there is increasingly less for everyone else

Those who have received little of the pie,have little vested interest in the status quo and will vote for demigods even if these politicians fail to follow through on their promises. Numerous surveys have indicated that younger people support socialism . Why is this?

Worrying about how much the boss makes means worrying about rent-seeking and what it’s doing to our societies. We’re seeing full-blown breakdowns in the economy, people unable to afford vital services and a total stagnation of real wages in the face of asset price inflation. It’s stagflation grand mal.

Most of a CEO’s pay isn’t wage income but rather capital appreciation. When a CEO earns 157+ times that of the average worker in their company it’s an indicator that compensation in every single nation around the world has skewed away from people who actually make things in favor of people who merely hold paper. That’s untenable and bound to cause violent social instability at some point, which is an outcome no one wants.

Your kind of true, genuine ‘American Capitalism’ based Mkt driven Economy died on March ’09 in the hands of Fed!

All you have now is CRONY Capitalism at it’s worst! No wonder Millennial are disillusioned and disheartened with this ‘kind of CRONY capitalism’ and long for the Socialism for the wrong reason! Crony cap is providing all the necessary tools, to bring their own demise! AOC and her kind are waiting!

What we have is ‘Finan$ial Capitalism’—-what we need is ‘Free Market Capitalism—–one that totally disallows market control. For every % of market control over 30, the tax goes up 5 points.

ALSO—-no more ‘soulless’ corporations:

Single proprietorship, Partnerships—where ALL owners are liable.

Now when in the past has GS asked any question that that it does not already know the answer? GS sees a train coming and this is is the first pitch to sanitize themselves . They are getting out in front of the optics . Do not forget they are a reserve bank. GS thinking out loud , as the Gerald Celente easy button says “this ain’t even bull s..t ,this is horse s..t. It’s late the doctors going to self medicate on a single malt.

I think the real question is… What would Stocks do in ” a world without Central Bank buying ” =)

10 Trillion US got added to Global Equities in Q1 2019, according to Bloomberg, calculating Indexes market caps and we all know that ain’t from Buybacks. I have to admit tho, US Stocks would suffer without buybacks but they will never stop, the amount of Exec pay based in Options and Stock ” Performance ” is too high… Might get passed with a Left winged Democrat president, but it will be a phase, not something to be permanent, too much lobbying power involved

Praying that never happens, would definitely hurt the industry

When has there ever been a Left winged Democratic president except for FDR?

The most Left Winged President in recent times was Richard Nixon.

Socialist Democrat would salivate at passing a bill stopping buybacks… A moderate democrat, a Bill Clinton or Obama type, wouldn’t bother with it

Dems aren’t socialists, unfortunately. Why on Earth do you think they are?

You apparently missed the 8 yrs of 0’bama

Worst of all, the fees generated by Goldman Sachs’ Corporate trading desk would be much smaller.

What happens to the passive indexers who buy like clockwork at atrocious prices when deeply indebted companies stop buying back shares?

The broad market yielded between 3-5% in dividends between the 1950s and the 80s when buybacks became legal. Between 2001-2018, dividend yields have averaged 1.94%. The buyback yield has been usurping its place.

This shifts the balance from dividends taxed now to an uncertain future return at an uncertain future tax rate and increases market speculation.

Dividends are taxed very heavily and twice, 1st as corp earnings and 2nd as investor income. Share buy-backs are not taxable. Also, firms are incented to lever up because debt also offers tax benefits. Tax policy alters behavior.

Uncertainty in regulations incents management to pursue strategies with less risk, i.e. a buy-back is much safer for management if reg’s and/or taxes are expected to change.

I don’t like the abuse, but also don’t like throwing the baby out with the bathwater.

Ah! Yet again (and again and again, ad nauseum) it’s the fault of the regulators/government! Of course!

FORCING these companies into buyback programs with their horrible tax policies and regulation!

Oh brother.

No wonder nothing ever changes when people like you are so easily gulled…

Not really fault – it’s the incentive that’s created.

CEO wishes to bump up the price of the stock – why? because her/his compensation depends on that.

What are the artificial means of increasing demand for the stock? Pay good dividends or buy back shares. Under current tax structure, guess which option would the CEO choose?

Is there an Option C – capital investments?

“CEO wishes to bump up the price of the stock – why? because her/his compensation depends on that.”

Correct, but the private market determined that metric not governments. This is a bad incentive that was created by private markets in the lack of government regulation blocking it as it once did before Reagan, which worked really well to prevent these issues.

Nat, that’s an interesting thought. Are you suggesting government should decide compensation of private company executives? If that’s the case, how would we stop conflicts of interest, revolving doors, nepotism, stealing company secrets, etc?

Trading one set of ‘unfairness’ with another set doesn’t help much, no?

“hat’s an interesting thought. Are you suggesting government should decide compensation of private company executives? ”

That is not what I am saying at all. I was just saying 1. the bad incentive being discussed here is created by the private market not government, 2. the worst result of this bad incentive used to be plugged by regulation that mostly prevented share by-backs.

You are completely twisting my words.

@MD When I look at my tax bill, it affects my plans and behavior. It is really that simple.

It is not a matter of fault. It is simply impossible for an 800 pound gorilla to expect to go unnoticed.

@MD BTW, why put the word “forcing” in all caps? I never said anything (or implied anything) about force. Nice straw man. Actually the idea here is the opposite of force. It is about having the ability to make a choice about how we use our cash (or ability to borrow).

The abuse of this choice by some is a problem. How much are we willing to pay or sacrifice to solve the problem? Hopefully, not more than is gained.

If taxes were spent on more productive things like infrastructure, paying taxes would be much more attractive. Unfortunately, taxes are not utilized by politicians with the same degree of concern, so they throw $ down a military rat hole or other special interest.

@MD

It’s comments like yours that don’t help educate anyone, so please either make a counter point or don’t comment. Just throwing around straw men and accusations gets us no where.

=>Dividends are taxed very heavily and twice, 1st as corp earnings and 2nd as investor income.

Trillions in tax cuts for the rich say you’re pursuing a remarkably phony agenda.

Taxes are for little people. Dozens of the wealthiest corporations pay no tax at all. Tax evasion is known to cost the world’s governments way north of three trillion a year, every year. It’s why the US government has over $20 tn in debt that’s still skyrocketing.

FYI – If they don’t pay taxes, they can’t get a tax cut.

Actually, I am very much in favor of spending money, including paying taxes, when the money is well spent. Politicians simply have a poor track record, not to mention kings, queens, dictators.

One of life’s greatest joys is actually giving money away. Why do some want to be the middle man?

Here’s an example of a “remarkably phony agenda” … actually paying education expenses plus more in taxes so a politician can promise to forgive someone’s student debt. My bet is that agenda will get prime time billing over the coming months.

=>If they don’t pay taxes, they can’t get a tax cut.

No, if they get tax cuts they don’t pay taxes.

You have it backwards, as usual.

Your POTUS, for example, has NEVER paid taxes. Prove otherwise. You can’t.

GP,

You said: “…tax revenues … are up again so far this year?”

You’re lying to preach your twisted agenda. Here are the actual numbers from the US Treasury Dept — tax receipts in millions of dollars:

First 5 months of fiscal year through Feb 2019: $1,278,482

First 5 months of fiscal year through Feb 2018: $1,286,173

The economy grew about 3% year-over-year and tax receipts dropped by $7.7 billion year-over-year so far.

https://www.fiscal.treasury.gov/files/reports-statements/mts/mts0219.pdf

Wolf, a year according to the calendar is not unreasonable when there has been so much discussion about the “trillions in tax cuts for the rich”. Those tax law changes were NOT made at the beginning of the fiscal year. Thus far, tax revenues are close to flat with much higher tax receipts last month vs. same month a year ago, despite the tax cuts.

And frankly, I have had a lot of respect for the content here. But calling people liars with twisted agendas for what GP wrote and not calling out the comment he was responding to, e.g. “trillions in tax cuts for the rich” … Seriously?

Setarcos,

GP has been saying the same thing like a broken record: corporate tax cuts increase tax revenues. But it’s BS. Corporate tax cuts do not increase tax revenues. That has been established a long time ago, over and over again, and it’s being re-established right now. But he is spreading this propaganda, and he is using my platform for it repeatedly.

When the economy increases 2-3%, tax revenues should increase somewhere in that range. If tax revenues are flat or decline after a corporate tax cut, in an economy that grows 2-3%, it means that these tax cuts did NOT increase tax revenues but lower tax revenues (because without those tax cuts revenues would have increased 2-3%). There is no magic here, but there are decades of propaganda about this that just refuses to die.

But I agree with you, I shouldn’t have called him a liar. I should just delete this type of propaganda like I do with stuff from trolls that crop up here, and not waste my time shooting it down with real numbers from the Treasury Department, and then having to waste my time dealing with the fallout from it.

You deleted that? Wow. Okay, got it.

Wolf, thanks for the backstory. I need to examine the impact of corp tax rates more fully. This also sounds like a great opportunity for a blog post – perhaps I simply missed it.

I am considering a move to a more tax-friendly state …or Country. That will certainly reduce tax receipts for my current state. Admittedly, I thought that many corporations simply went through the same exercise.

“Dividends are taxed very heavily”

Not really. In tax year 2018, individuals who made less than $38,600 in taxable income, and married couples who made less than $77,200 in taxable income, paid 0 percent taxes on qualified dividends and long-term capital gains.

Beyond that exemption qualified dividends attract 15% tax and the cap is is 20%.

IP, Shareholders with less than $39k in income would definitely prefer more dividends.

IP, shareholders with less than $39k incomes would definitely prefer more dividends.

“Repurchases have consistently been the largest source of U.S. equity demand,” the Goldman strategists wrote in their note. “Without company buybacks, demand for shares would fall dramatically.”

Such is the logic that governs the Market now! Gone is the principle of ( price discovery) in a ( FREE MARKET).

call me a old fashioned, but you tweak the market by your manipulation, and scare and bribe policy makers into submission ( submission to a corrupt methods that caused Not one but three recessions since 1987)!

Three decades of feeding the public Bull Crap should suffice to topple those tardy ( law makers).

The problem is those same law makers are engaged in splitting this nation into hundreds pieces , making the people enemies of each other and the while stealing the fortunes and the future of the weak .

The brazenness in selling access is breathtaking. The new chairman of the Senate Banking Commiittee, Republican Sen. Mike Crapo has launched “Senator Mike Crapo’s 2019 Max Out Package”.

This my Senator, btw. Try contacting his office for anything. They will ignore you.

“Got $15,000? If so, Sen. Mike Crapo’s campaign invites you and a guest to a dinner with Senate banking subcommittee chairmen.

$10,000 raised or donated gets you one seat. But giving or raising either sum allows access to a good time with Crapo, the Senate Banking Committee chairman, including fishing on the Chesapeake Bay or a fall retreat at the posh Greenbrier Hotel in West Virginia.”

All perfectly legal.

I feel your pain IdahoPotato.

That’s the problem there in your last words “ all perfectly legal”!

That part have to change, to win back your country and feel normal again.

The divide that the US is in is allowing “criminals “ to take the helm of verity of life’s aspects be it political, economic or even on social level.

This system has to change, but you can’t shoot the opposition!

The more divisive the politics are , the more the country is torn apart.

It used to be that a representative once elected, represented every one in their constituency . Not anymore.

Rhetorical question 1: why aren’t rating institutions downgrading companies that use buybacks?

Rhetorical question 2: How is this different from a teacher who is forced to give an A to a student because cheating is now legal.

Rhetorical answer 1: because the odds of an investor revolt are 0.001%

Rhetorical answer 2: because the odds of Congress doing anything are 0.001%

Rhetorical answer 3: because the odds of a market collapse when executives panic and flood the market with the billions of shares accumulated in the last 10 years are 99.9%

Old dog,

Great questions there. There is an old saying that goes like this:

“ if you’re secure in the knowledge that you won’t be punished, then you’ll do what you like”!

I guess the opacity in the rules that governs our lives have gone too far.

But the Natural flow of events , just like the planet we live on have their way of correcting these anomalies.

The sad part is depend on the event’s size and the area of coverage ( some Criminals do escape to other geographical locations, beyond the reach of the correcting forces)!

Stay healthy

‘This type of world is just too painful to even imagine these days.’

Exactly, and that’s why I have no doubt the Fed will not only cut rates and restart QE but have no trouble obtaining approval from Congress to start buying corporate bonds aka ECB and BoJ (so the buybacks can continue). Just watch! You ain’t seen nothing yet when it comes to the extreme monetary ‘policies’ they’ll resort to.

When viewed as a crime scene you have to look at ‘means’ and ‘motive’ for market action. The Fed has the means via a strong Dollar with attractive yields compared to European and Japanese debt. And Powell, Trump, and the entire Fed have made their motive abundantly clear.

For all the naysayers that the Dollar will crash, consider that once the Fed returns to QE, the ECB and BoJ will certainly resume and ramp up their programs too. DXY is all that matters to the Fed (not inflation). And DXY is primarily made up of the Euro, Yen and Pound. How does DXY slip very far if all 3 of those are falling faster? Remember that the foreign goods Americans enjoy are priced ‘relative’ to the USD vs foreign currencies. It’s local goods that suffer most from Dollar inflation and it’s those goods that (like or not) Americans are increasingly less dependent upon.

I don’t know the future, but I’m betting it’ll go the other way; I needed some earbuds with a mic and got some delivered next day for ten bucks. It came with a good quality cardboard box, a faux-suede case (for what purpose i cant imagine), extra earpieces and instructions. worst of all, these things are the best earbuds I’ve ever used. i just cant imagine anything imported getting cheaper.

also, as far as consensus being a contrarian indicator, pretty much everyone across the board is saying u.s. is ‘cleanest dirty shirt’ fwiw.

What a nice PONZI scheme…

Still don’t know why Bernard Madoff was arrested!

He wasn’t buying stocks. Not even with someone else’s money.

He was just a few years too far ahead of his time. Being too early (or late) is the same as being wrong.

I’d be interested to know what’s happened to US corporates’ debt/equity ratio over, say, five years, and by how much debt has increased.

Buybacks are a legitimate way to return surplus cash to stockholders, but the use of debt for this purpose should never have been permitted.

Replacing flexible equity (you can cut divs in adversity) with debt (whose cost of servicing is fixed) seems close to a definition of madness, or at least a case of micro logic which is macro madness.

Totally agree. There are companies I refuse to buy because they are too leveraged. There are companies I own that I plan to sell if they increase leverage further. My expectations about future interest rates is a key metric in that analysis. If a company abuses their choices, they should not get bailed out. For example, many banks have failed numerous times, e.g. Citibank, and we still bail them out time after time!

When debt was encouraged with ZIRP year after year after year because the economy was “weak”, it created many adverse consequences. Management that did not increase leverage to some degree in this environment would soon be unemployed.

What is ironic is the disdain for management who did what was encouraged/ incentivized, i.e. borrow at low rates, while govt “managers” who have consistently behaved badly regardless of the cost of the debt are seen as the same people to try to solve the buy back abuses.

Indeed. Of course, ZIRP was a “temporary” and “emergency” expedient, it’s just that the temporary emergency has now outlasted the combined duration of the First and Second World Wars.

Perhaps the most frequent question asked on my own site now is “are we mad?”

Not really mad, people will keep spending more to get a smaller return because a higher return is not possible without spending more :-/

The recent tax cuts which fueled the 2018 stock buy backs were funded by debt. It just wasn’t corporate debt but pubic debt. All to keep the market going up..

So much leverage dependent upon a consumption based economy.

Tell me how the inflation some see as inevitable can happen without crushing the geese that lay the golden eggs?

If those at the top hold and control most of the money and as seen, are the biggest tax payers because of it, who is going to pay to service all this debt? Corporate and private? Are they willing?

There will come a point when this Ponzi financing will crush itself and the entire system will crash. Borrowing does imply repayment.

…”but the use of debt for this purpose should never have been permitted.”

And that’s the real BIG problem for all the stockholders. Cuz, really NO SURPLUS CASH is being returned to any stockholders other than the cash that the top Corporate management- glean to put directly into their pockets- leaving new “DEBT” to roll over to the 99% of the stockholders. This subsequently turns the organization into a shell that is floating for a while ONLY on debt. NO capital investment, no Research and Development, NOT nothing else except rolled over debt. Any inflate “price” of the stock is really nothing other than debt pushed to the rest of any stockholders, that’s the ponzi scheme. Admittedly, it’s just occurring at a much slower mass cycle- presently for 10 years, but really way back to the 80’s…..

Enough Said.

Stock Buybacks = Chapter 11 Bankruptcy

You had a better chance buying stocks in the summer of 1929 than today.

The solution is obvious:

The Fed needs to start (or continue?) to buy stocks just like some other central banks/governments.

No need to have companies buy stocks or a middle class, 401Ks, retirement funds, defined pension plans…let’s just cut out the middle man (in the this the the Middle class and organizations we refer to as companies that actually do business and make stuff and services) and have the Fed buy stock directly.

Then, each and every President can run on their awesomest record of having created the bestest and highest stock market.

Boeing has that same flavor of the Howard Hughes movie Aviator.

For more context, $806B is a little more than the DoD budget or about 1/6th of federal spend (if my arithmetic is right).

Goldman need not worry. The billionaires and their sicophants will not allow stock buybacks to end. Of course if the Corporate sector actually runs out of money, or starts to, the Fed and other Central banks will buy up stocks in their stead. I thought Marco Rubio had the most sensible idea, removing the tax advantage for buybacks, promoting investment or return of cash to actual investors, who could in turn invest in something of their choosing. A rather silly idea, since proping up markets and churning stocks is all that matters for those in charge.

We should all pray that the stock buyback party doesn’t end at the same time a Hindenburg Omen starts, and the GPS clock reset occurs.

Really folks, we need to stop worrying about short term blips, theoretical worries, normal (and paranormal) factors, and ask “will the stock market be higher in 20 years, than it is today?” People have been calling the top for this market since 2012, and all of them have been wrong, dead wrong, but man were they certain when they made their predictions. I have listened to people rant about student loan debt, auto loan debt, baby boomer retirement, terrorism, immigration, yield inversion, “10 year bull market must end because of age”, forward, backward and sideways, trailing, leading regular, Schiller, and WTF P/E ratios, China tariffs, Brexit (will she or won’t she) bullshit, asteroids, impeachment, sea level rising, and now stock buybacks ending.

Someday, we will be enter a bear market, and whoever is crowing about some pending disaster just beforehand, will instantly be crowned by the media as a market Guru, and all of the investing sheeple will look to them for when it is safe to get back into the market.

I know it is fun to speculate as to when (and why) the market will crash, and the world will end, but I pity the fool that sold all their stocks in 2009, and has not re-entered the market because of the parade of doomsday predictions since then. Only when the markets reach euphoria, will they feel it is safe to get back in (and no, we ain’t there yet based on the above comments). When investor sentiment is off the charts, that will be the time to exit.

Until then, let the armchair speculation continue……

Is euphoria necessary for market top?

Euphoria is necessary for a market “high”, a ringleader is required for a market “top”.

It was necessary for 1929, 2000, and 2009, keeping in mind that it was real estate euphoria, and the spillover hangover that caused that little dust up in the markets in 2009.

Not so sure about 1974, but if memory serves me, the “nifty fifty” bullshit happened beforehand.

So, to answer your question, I would say yes, for every major bust, there was a preceding time of euphoria, although, I am sure the is a rare exception. It also helps to have leverage at the time of euphoria to magnify the subsequent damage. What good is wild speculation, if you can’t borrow money to amplify the effect? Margin was used for 1929, and 2000, and mortgages were used for 2008. Hell, I can remember stories about how people took out mortgages and credit card debt to finance butcoin speculation in 2017, although I find it hard to believe that people would be that stupid, so this may have been fake news, though the losses were real enough.

For additional reading, check out John Templeton on the web. Other than Jack Bogle, he is my hero.

“will the stock market be higher in 20 years, than it is today?”

In 20 years time you’ll be like Britain now.

A country that’s still think they’re above the rest of Europe and the world, a country in denial.

Another Collapsed heap ( killed by hubris and exuberance)!

Sorry, I forgot to mention, by stock market, I was referring to a balanced portfolio of global stocks (US and all other countries). My bad.

In 20 years, stocks will be higher.

In 10 years, stocks will be higher.

within 10 years, nobody knows.

But here is the thing, how much higher?

John Hussman and Russal Napier has rigorous study showing at this current “valuation” levels, 12 year forecast for US stock market is 0% annually with >95% probability given 100 yearUS historical data that went through 1930 depression, 1979 inflation two world wars.

The conclusion is that if you just ladder 1 year treasury bills, you will beat ANY stock portfolio 10 years from now on with 95% probability.

Yes, there is NO way to speculate what happens within 3 years.

BTW, the draw down within the 10 years is likely more than -65% with >than 75% probability.

There is NO discussion about debt, boomer, house, tech bubble of anything, simply valuation and inflation quantification.

Will the forecast be “right”? It is 95% probability so the 5% surprise is always there. But that is a rigorous educated forecast.

Your kind of true, genuine ‘American Capitalism’ based Mkt driven Economy died on March ’09 in the hands of Fed!

All you have now is CRONY Capitalism at it’s worst! No wonder Millennial are disillusioned and disheartened with this ‘kind of CRONY capitalism’ and long for the Socialism for the wrong reason! Crony cap is providing all the necessary tools, to bring their own demise! AOC and her kind are waiting!

‘In 20 years, stocks will be higher’

??

Checkout the mkt performance between 1964 and 1982!

Mkt went down took 18 yrs to recover!

If there were some capital investment occurring in the US, then the “monetization” would not necessarily cause a major collapse. However, there is limited investment occurring in the US, nation wide. (AND that’s a big period-all puns intended) Look at the map of the Chinese plan for their belt and road initiative, their mergers with Russia, and Europeans, and Middle East, and Far East is encompassing the entire continent. The US corporate structure is NOT getting a piece of that pie. (Again, that’s the real big period, that really emphasizes how bad the scenario could PERHAPS be for the US.) Now, considering there is so much under-the-table black market dealings internationally, the super sovereign individuals may just skate by fine world-wide. The small fry that have no real paid-off assets, regardless of national currency, are the ones that will be dumped on. The super wealthy have already skimmed the real assets and so-called profit, that really isn’t profit ( it’s a term used in-error pretty much worldwide) at all. The dynamics of money-flows is not being interpreted correctly (of course, totally my opinion) for what that money-flow dynamic reveals through time, usually a 50 year cycle or so…..

Don’t worry Lisa,

We’re sending War ships and troops to some obscure rock in the pacific to curtail the Chinese Evil plans ! :)

Indeed, what would stock PEs be if there was real price discovery?

What would consumer prices be if corps. didn’t overcharge so as to buy back their shares?

I can imagine it and I have to resist laughting.

No mention of QE, the fuel for buybacks, or QT, the cold water. The ultimate goal of owning all your own stock is to take your company private. They could conceivably gut the S&P to fifty. Capital formation and investment, through shadow banking will continue to evolve and gain a regulatory backstop, or at least a channel to a GSE charter bank. No angry shareholders, no capricious rating agencies, access to cash for funding, constitutional rights, and no responsibility.

I wonder why these corporations are allowed to borrow money. After all, they are just imagined things of a legal and accounting nature with no physical reality and no life spirit as a person.

Why are these imagined things allowed to have such financial power?

How about we end the borrowing privilege and if corporations need money to expand they can sell more shares. Then they can buy back all the shares they want by spending stockholder equity.

Once again, uncontrolled debt of a dubious nature is the source of our financial disease.

What would happen? I am a contrarian here:

(1) companies would not be able to invest all this cash. It’s just not possible. They would still need to pay it out (or sit on billions of unproductive cash, or make really bad investments to get rid of the cash).

(2) they would do that dividends or special dividends (with negative tax consequences for some but not all investors)

(3) this would give some of these stocks extremely high yield compared to other investments

(4) this would make them attractive

(5) they would increase in share price until the yield is reasonable

basically – nothing would change. You would get a bit of a tax leak and maybe some companies that would make bad investments. Look at the 80s for that. We had utility companies owning rental car companies and similar unproductive silliness. Not a corporate world I want back

It’s a myth that buybacks mean companies don’t invest enough. They can’t invest and should give this money back

If share buybacks were again made illegal, then companies would probably be forced to spend their next $2.95 trillion on product improvements and new innovations instead of on artificially supporting their companies stock price, and boosting the performance based compensation of their management.

“then companies would probably be forced to spend their next $2.95 trillion on product ”

WRONG

They would not have that 2.95t.

If buybacks are again halted (which they should be) without a long notice period, stock prices will drop a long way for some and they will all get finance calls (a lot of corporate finance has Minimum stock price requirements )and not be able to refinance as their stock prices and revenues would not support the finance requirements.

Without the debt fueled finance game much of corp[orate America is going under.

America is the most politically and commercially CORRUPT nation on the planet. It dosent feature as such in the global corruption listings as the vast majority of this corruption has been LEGALISED..

Lots of companies buy back shares and not necessarily to retire them. Many company 401Ks only let you buy into the company’s shares, they buy the shares on the open market to manipulate the price up. If there’s a match, the employee may vest slowly and never get to keep the match, but the shares are purchased anyway which increases the expressed demand. These same companies may pay profit sharing in stock also, reinforcing demand for the shares.

It doesn’t surprise me that a Wall Street firm is the one raising the issue. When I worked on Wall Street the firm engaged in all the above practices.

The question is not if but when the corporate buybacks will succumb to the exhaustion of self induced capital recycling.

This will end when USG starts buying dollars and retiring them

David Rosenberg states that companies sporting BBB bonds are going to scale back buybacks to enable them to 1) roll over maturing bonds 2) pay coupons on existing bonds (transcript here https://www.macrovoices.com/podcast-transcripts/537-david-rosenberg-stocks-yields-headed-lower ). If he’s right, that’s bad news for the buyback bonanza

I’m in favor of anything that Gold-Sacks is against. After all, I’m not on their payroll. And I do vote Socialist!

Great article. Knowing where the demand for the underlying security really comes from is the most important thing to investing, second only to luck.

I knew share buybacks were a significant market driver, but I had no idea that they dwarfed other buyers a source of relative demand for shares.

Wolf, thank you for bringing the buyback issue up front. To me, your article says that the stock market index values are as phony as a three-dollar bill, and that the market has actually been in a gradual crash that began five or more years ago. I was wondering how it could continually rise into the stratosphere despite so much bad economic news. Now I finally understand how the Dow and other indices are cunningly manipulated by the big corporations via buybacks. The wonder is that this scam has gone over the heads the news media. What happens when the corp’s have finally bought up all their outstanding shares?

Study HP before its split (I use HP as an example as the information is relatively easy to find(and wolf will confirm my position on HP)), after 10 + years of buybacks, there was more HP stock in the market than there was at the beginning.

As they issued shares and most of the brought back stock was gifted to senior administration in remuneration when the admins resold back to the company (Through the Market) again, at a huge profit. Nothing but a legal corporate shareholder asset strip.

Most US buyback schemes follow a version of this model.

Hence the stock options packages that are part of the buy back game.

The people being bilked in the buy back game are the genuine “Investors/Stockholders” all those pension funds fueled by OPM Etc..

Stock buybacks are an admission that mgmt is so lame it can’t generate a return sufficient to interest enough investors. It’s mgmt’s way of saying it needs to be replaced but will reward its own incompetence in the meantime because they’re crooks who are entitled to rob their employer.

You just can’t get good help these days.

Letting the stock market fend for itself and embark on its own price discovery without the relentless bid of share buybacks would be a true nightmare. No one would be ready for it. This type of world is just too painful to even imagine these days.

I REALLY hope that you’re kidding here, perhaps pointing out the sarcasm would be helpful next time. It’s time for the great American reset.

Your hopes were on target :-]

“Share buybacks were considered securities fraud under most conditions until 1982.”

Nobody wants to talk about the pink elephant in the room. Central Banks have been buying securities since the time of FDR.

For example, The Central Bank of Switzerland was holding something like $90 billion in stocks a few years ago.

Imagine what markets would look like without that.