On top of whatever unrealized losses (cumulative $1.3 trillion at end of Q3) from its securities holdings. But losses don’t matter to the Fed.

By Wolf Richter for WOLF STREET.

The Federal Reserve released its preliminary financial information for 2023 today (audited annual financial statements will be released in a few months).

The Fed’s red-ink era began in September 2022, when it started losing money after its rate hikes had increased the interest rate it pays banks for their reserve balances at the Fed (5.4% currently) and the interest rate it pays the counterparties of the overnight Reverse Repos, mostly money market funds (5.3% currently).

And those surging interest expenses have far surpassed the interest income from its now dwindling portfolio of much lower yielding securities that it had bought during QE mostly years ago — since QT began in the summer of 2022, the Fed has shed $1.02 trillion in Treasury securities and $308 billion in MBS.

The total loss from operations (estimated income minus total expenses) nearly doubled to $114.3 billion in 2023 (from a loss of $58.8 billion in 2022).

How its $114.3 billion loss came about:

Interest income at $174.2 billion (compared to $170 billion a year earlier).

- Interest income from mostly low-yielding securities the Fed bought years ago fell to $163.8 billion in 2023 (from $170.0 billion in 2022).

- Interest income from loans to banks, such as the Bank Term Funding Program (BTFP) amounted to $10.4 billion.

Other income: $0.5 million from payment and settlement services; and $0.1 billion net income from the tail end of the Covid emergency programs

Interest expenses spiked by 175% to $281.1 billion in 2023 (from $102.4 billion in 2022), as the Fed paid much higher interest rates on reserve balances and ON RPPs as a result of its rate hikes. Since the last rate hike in July 2023, the Fed has been paying banks 5.4% on the cash they put on deposit at the Fed (“reserve balances”); and it has been paying ON RRP counterparties, mostly money market funds, 5.3% in interest.

This increase of $178.7 billion in interest expense arose from paying banks $116.3 billion more in interest on their reserve balances in 2023 than a year earlier, and paying money market funds and other ON RRP counterparties $62.4 billion more in interest.

Operating expenses roughly unchanged at $5.5 billion. These are the expense of running the 12 Federal Reserve Banks (FRBs), such as the New York Fed, the San Francisco Fed, the Richmond Fed, etc.

In addition, the 12 FRBs had to pay:

- $1.0 billion for the costs related to producing, issuing, and retiring currency (paper dollars).

- $1.1 billion in expenses by Federal Reserve Board of Governors, a government agency, funded by the 12 FRBs.

- $0.7 billion in expense to operate the Consumer Financial Protection Bureau, a government agency funded by the 12 FRBs.

The incomes, expenses, and losses here are those of the 12 Federal Reserve Banks, which are owned by the largest financial institutions in their districts. The Federal Reserve Board of Governors, of which Powell is Chair, is a government agency, and Powell is a government employee appointed by the President and confirmed by the Senate. But it is an independent Agency, funded by the 12 FRBs (not by Congress).

Statutory dividends rose to $1.5 billion (from $1.2 billion in 2022). The dividends are paid to the shareholders of the 12 FRBs.

The Fed’s 100% income tax bracket.

The Fed is required to remit all its leftover income – after paying its expenses and statutory dividends – to the US Treasury Department, a form of a 100% income tax bracket.

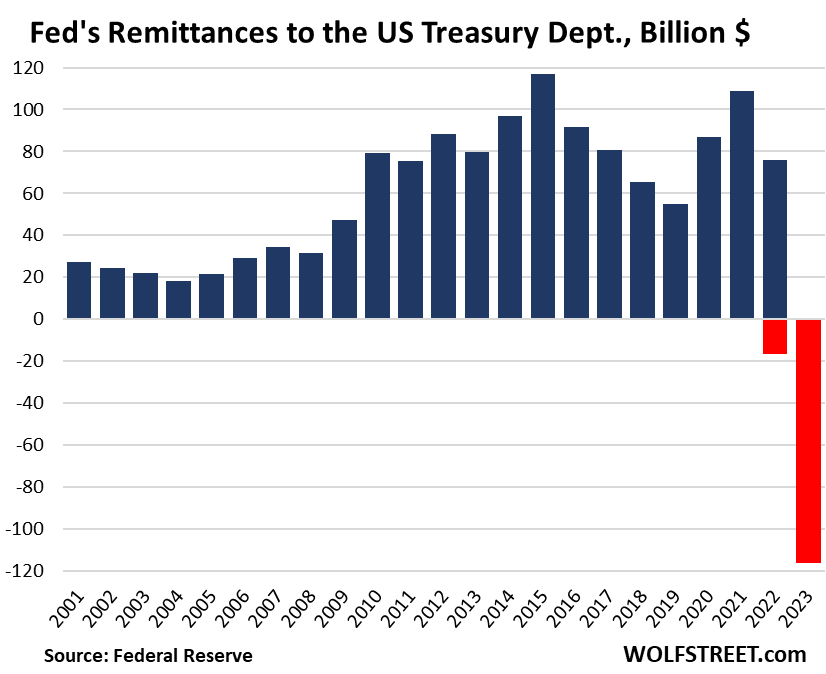

Since 2001, the Fed has remitted $1.36 trillion to the US Treasury. Even over the first eight months in 2022, the Fed still remitted $76 billion to the US Treasury. The remittances stopped in September when it started to lose money.

Over the last months in 2022, the Fed booked $16.6 billion in losses against future remittances (red for 2022 in the chart below); and in the year 2023, it booked $116.4 billion in losses against future remittances.

The Fed puts the income it has to remit to the US Treasury into an account on the liability side of its balance sheet, called “Earnings remittances due to the U.S. Treasury.” Since the income remittances were paid regularly, the amounts didn’t accumulate.

But the losses are now accumulating in that account and show up with a negative value. As of December 31, the accumulated losses were $130 billion, per the Fed’s preliminary financial statement today. This negative liability – “deferred asset” – is an amount of future income that the Fed doesn’t have to remit to the Treasury department.

The Fed will continue to lose money for a while. But as QT progresses, those losses will slow.

ON RRP balances are returning to their normal non-QE status of zero or near zero, at which point the interest payments on ON RRPs will be minimal. ON RRPs have already dropped from over $2.2 trillion in 2022 and early 2023 to $603 billion today.

And the reserve balances will decline further, though they will remain “ample,” is what the Fed now calls this, and interest paid on reserves will decline. Reserve balances have dropped from $4.2 trillion in late 2021 to $3.5 trillion now. And they have more room to fall under QT.

In addition, when the Fed cuts its five policy rates, including the interest rates it pays on reserves and ON RPPs, its interest expenses will fall further – paying lower rates on smaller amounts. And at some point, it will start making money again.

At that point, instead of remitting the income to the Treasury Department, it will take this income against the negative balance in “Earnings remittances due to the U.S. Treasury” until the balance turns positive. This will likely take years. And once the balance turns positive, it will start remitting its income to the Treasury.

Unrealized losses: Not part of today’s annual financial report, but part of its most recent quarterly financial statement, the Fed reported $1.3 trillion in cumulative unrealized losses on its portfolio of Treasury securities and MBS. They lost market value as yields rose.

But these unrealized losses are irrelevant for the Fed since it will not sell the securities. It holds Treasury securities to maturity, when it receives face value for them. And from its MBS, it constantly receives pass-through principal payments as the underlying mortgages of the MBS get paid off or get paid down, which amounts to a flow of repayments at face value.

Yields fell in November and December, and so the cumulative unrealized losses as of December 31 will be lower than those reported for September 31. We’ll know the answer in a few months when the Fed releases its audited annual financial statement.

But losses don’t matter to the Fed. The Fed creates its own money, and so it cannot become insolvent. And its capital, which is capped by Congress, is not impacted by the losses because the Fed carries the losses as a “deferred asset” in a liability account on its balance sheet, rather than taking the losses against capital. So its “total capital” on its balance sheet has actually ticked up by $1 billion over the past 12 months to $42.8 billion.

The losses do matter to the Treasury Department though – which is no longer getting the remittances from the Fed. And so the Fed’s losses are swelling the deficit and the debt indirectly via the absence of remittances for years to come.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I was hoping the feds next tool used from its forever expanding toolbox used on itself this time will include a ‘bogo’ feature. That would be so rad.

Great idea, I will internalize it.

Meanwhile, please thank be again. After all, I am sticking billions of dollars of losses to taxpayers and enriching you.

Oh, you are not in the club.

My bad, wrong audience, please move on.

So, does the treasury send those earlier “profits” back to the Fed to cover the current losses?

My guess is “no way” Jose!

Cheers,

Yes, they do.

No need to. The way the Fed accounts for losses is simple…they are carried on the books to be extinguished by future profits.

Those future Fed profits (should/when they occur) will NOT get to the Treasury until all the past losses have been covered, so it may be a while before the government’s gravy train rolls again.

Brewski,

Correct, No way Jose!!!

But the Fed isn’t sending its profits to the Treasury either until all the losses got eaten up.

The accounting is explained in detail in the article above for those who are interested.

“Explained in detail in the article above” I hope you’re not implying that people just read the headline and maybe the summary directly below, then jump to the comments section

Ohhhhh no, nooooo, absolutely not. But it’s a pretty long piece, and the accounting part is kinda toward the bottom and complicated and not everyone’s cup of tea.

Wait, so the money that the treasury isn’t receiving from the Fed has to be made up somewhere, right?

Or is that just funny money that no one cares about?

It’s real money and it has to come from somewhere else (taxes or borrowing).

Wolf. My take away was the earlier “profits”, had already been remitted. These present loss, liabilities, will be paid back from future profits, then, remittance to the treasury annually as long as they remain positive. So those profits were already remitted Jose. Didn’t the Fed remitt billions annually to the T from. ’01 to ’21? Thank you for the very through explanation of this, to me, black art of financial magic.

J²

So you gotta go up to Brewski’s original comment to know what my reply was about.

The profits were remitted through Aug 2022. After that no profits were remitted, and losses piled up.

Brewski’s “no way Jose” refers to the idea of the Treasury refunding the post-September 2022 losses to the Fed on a two-way street where the Fed remits its profits to the Treasury, and it the Fed loses money, the Treasury refunds the Fed for its losses, and that was what Brewski’s “no way Jose” referred to, it’s not a two-way street. And I confirmed that.

It is the same as borrowing money from the public to subsidize the low interest loans on the book. Seems like socialism to me.

It is Socialism. For the few. Paid by the many.

No, of course not.

Can someone explain those ‘statuatory dividends’? What’s the law behind those? Naively, I’d assume that there should be zero dividends to FED shareholders if it’s operating with a loss.

“Statutory” means by law, means by Congress.

Stockholder Dividends.

https://www.federalreserve.gov/aboutthefed/section7.htm

Huh – never realized the Fed had shareholders.

How can one buy shares of the Fed? Seems like an easy way to earn 6% risk free.

one can only buy them indirectly, by buying a national bank incorporated in the district of the federal reserve bank whose shares you wish to own. national banks are/were required to invest a specific amount based upon their capitalization

MM,

Those shares are not traded. No one can buy them directly. Financial institutions that hold them can never sell them. If a bank collapses, the shares revert to the Fed. Banks carry the shares at cost. Ownership of the shares can get transferred via an acquisition of the bank.

You can search for the shares in the 10-Q quarterly SEC filings of a bank. For example, Wells Fargo, which is headquartered in San Francisco, and therefore holds shares of the San Francisco Fed:

1. Click on this link for the latest 10-Q of Wells Fargo

https://www.sec.gov/ix?doc=/Archives/edgar/data/72971/000007297123000170/wfc-20230930.htm

2. Then use your browsers search function (Ctrl F) and search for: federal reserve bank. You will get three references to the SF Fed’s shares, including carrying amounts, which are intermingled with its shares of the FHLB of San Francisco.

The FRBs are corporations. For example, the Federal Reserve Bank of San Francisco’s shares are owned by the financial institutions in its district (the 12th district). Those bank executives form the board of directors of the FRBs, such as SVB CEO Greg Becker who was on the Board of Directors of the San Francisco Fed under whose watch SVB collapsed.

These shareholders (represented by the executives of the financial institutions) decide by vote who is going to be the president and CEO of the FRB. For example, they voted to make Mary Daly the president and CEO of the SF Fed, and thereby she is also on the rate-setting FOMC, and she votes on monetary policy during the year that the SF Fed has a rotating voting slot.

The SF Fed district includes Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, and Washington, plus further out American Samoa, Guam, and the Commonwealth of the Northern Mariana Islands. This is the largest district and includes a lot of financial institutions that hold SF Fed shares. SVB was one of the shareholders, Republic Bank was one of the shareholders, and the shares reverted to the SF Fed when the banks collapsed.

This causes all kinds of problems when it comes to banking supervision because the CEO of those banks sit on the boards of the FRBs that supervise them.

I think this is a good read?

https://wolfstreet.com/2023/03/24/powell-discussion-of-silicon-valley-bank-regulatory-failure-shows-why-the-fed-should-be-fired-as-bank-regulator/

So I’ll just repeat this here:

The Fed is a hybrid organization.

The Federal Reserve Board of Governors is a government agency, and all its employees are federal government employees with a government salary and a government pension, including the seven members of the Board, including Powell. These seven members of the Board of Governors are appointed by the President and confirmed by the Senate. The Board of Governors has lots of employees, and they’re all employees of the Federal Government. They’re headquartered in the Eccles Federal Reserve Board Building, the main office of the Board of Governors of the Federal Reserve System. This is a federally owned building on 20th St. and Constitution Avenue in Washington, DC.

The 12 regional Federal Reserve Banks are private organizations that are owned by the largest financial institutions in their districts. They include the New York Fed, the San Francisco Fed, the Dallas Fed, etc. All their employees are private-sector employees.

The FOMC – the policy-setting committee – consists of the 7 members of the Board of Governors who are federal employees and have permanent votes on the FOMC. The New York Fed governor also has a permanent vote. The other 11 regional FRBs rotate into and out of 5 voting slots annually.

The FOMC is designed to give the 7 government employees a voting majority over the 6 presidents of the regional FRBs.

My local newspaper had an earnings report today for Cenex Harvest States, or CHS Inc. Profits are down 33% from the recent quarter that ended on Nov. 30, but the company has had two straight years of very good results. CHS had revenue of $11.4 billion in this quarter; down 11% from last year.

What I did not know, but learned in the article, is that the CEO and President of Cenex, Jay Debertin, was recently appointed to the board of directors for the Federal Reserve Bank of Minneapolis.

Huge deficit is massive fiscal stimulus. Coming interest rate cuts will be https://wolfstreet.com/2024/01/12/fed-reports-operating-loss-of-114-billion-for-2023-as-interest-expense-blows-out/meaningful monetary stimulus. The amount of debt needed for $1 of GDP growth must be near $1. It seems MMT thinking prevails throughout Washington. $34T approaches infinity for any practical purpose. The number has lost meaning.

Flownover-

Yours are good thoughts tersely stated.

Imagine that Debt Growth challenges GDP Growth to a race, and the winner gets currency depreciation or depression (or both) as the “prize.”

This is the the reality of a “command economy.” A “laissez-faire” approach to money in the banking system, and balanced budgets for public spending, recommended by several (of us) curmudgeons on this sight, painful though they would be, deserve to be re-examined.

Government interventions into the economy on this scale lead to disaster. This is one of the messages that made Mises famous in some sectors, and infamous in others.

Agreed. No one ever think we’ll pay it back at this point. We crossed that rubicon, in my opinion, in 2009. At this point, it’s just keep going until it collapses. the people in charge are hoping they’re dead by the time that happens, as they’re selfish people who don’t care about their children or grandchildren.

I’ve heard MMT requires tax increases when inflation arises. That’s a hard money theory relative to the bottle rocket Bernanke lit up.

Once you light it, it’s not coming back.

A question not a comment: I am not knowledgeable about “ownership” of the Federal Reserve Banks. Just a question on the empirical data used in these dividend calculations:

“Statutory dividends rose to $1.5 billion (from $1.2 billion in 2022). The dividends are paid to the shareholders of the 12 FRBs.”

How are these dividends “awarded” and can Fed Policy serve maximizing those dividends for shareholders at the expense of other Fed policy/statutory duties? Who would enforce such an action against the shareholders? It seems like paying the C Suite handsomely, even as the Company heads to bankruptcy.

See my comment above.

Howdy Lone Wolf. Article is way over this retirees bald head. But thanks anyway….. Think I ll go find some aspirin.

Nevermind, its all going to come together as the Fed cuts rates 7 times in 2024.

There are not going to be any rate decreases by the Fed.

No, that’s way too slow. The Fed is going to start with an emergency Zoom meeting this weekend, 50-basis-point cut to be announced Sunday Jan 14; another emergency Zoom meeting next weekend good for another 50 basis points to be announced Sunday Jan 21; then 100 basis points at its regular meeting Jan 31, followed by an in-between-meeting cut of 100 basis points to be announced Feb 18, followed by an emergency cut of 200 basis points on leap day Feb 29 to 0.5%, followed by a 500 basis point cut at its regular meeting on March 20, to -4.5%, followed by an emergency cut the next day of 550 basis points to -10%.

What are the reasons for all these cuts? There are no reasons, same as for your cuts. You’re just too timid with your piddly 7 cuts of 25 basis points spread out over a year 😍

Howdy Lone Wolf. I think I read exactly the same thing at ZeroHedge.

HEE HEE Negative Rates by 2025

They are nothing but irrational totally crazy morons.

Your so droll Wolf.

While you’re trying to be hyperbolically facetious you have just described the Fed’s wet dream. Perhaps you should make your suggestion, in modified form, to the ECB who are also loath to make their corresponding cutting.

Any rate above a minuscule amount throws a wet blanket on the new Golden Are of Prosperity.

Play on you mofos!

This money juggling between various entities of the same government always seemed to me to be like giving a patient a transfusion by withdrawing blood from the left arm and then reinjecting it into the right arm.

But they’re the government, they got the guns, so all must be right.

The Federal Reserve simply won’t be able to spend any funds to subsidize the US Federal deficit so long as it has losses.

I think they can as the FED can’t go bankrupt. They will not let the Treasury debt expense get out of control. They will choose Inflation, Austerity and a weaker dollar. I think we’re in for a lost decade, or possibly longer.

You totally miscomprehend how the Federal Reserve operates and how it is required to operate by the law (FRACT) that created it.

The law can be changed by the congress.

Remember fed was not to buy mbs and corporate bonds but congress made it possible.

You should read the Fed transcripts of one Mariner Eccles in the 40s, when the Fed conspired with the Treasury to ignite inflation to burn off the debt created during WWII. That’s the blueprint for the Covid debacle. Also the Fed has been buying insane amounts of MBS through the loopholes of government backed mortgages. By their own admission, they monetized government debt in 2020. Goes on and on. With Congress direction, they bought junk rated bonds in 2020! They will do anything to prop up the system, and the dollar is next in line to blow up.

But losses don’t matter to the Fed.

I cant believe Wolf wrote this.

They don’t. If I could create money the way the Fed does, losses wouldn’t matter to me either. Modern central banks are very unique creatures. They don’t even have a “cash” account on their balance sheet because they create and destroy cash every time they pay for something or get paid for something. Central-bank accounting is in a category of its own in terms of headache (Look Mom, no cash account!).

They may not matter much to the Federal Reserve (in theory), but they very much matter to capital markets because everyone understands that the end of the day, the US government will issue more debt and thereby increase the available “HQLA” collateral that’s available in capital markets. (side note: I remain deeply skeptical of the US government to also increase taxes or to have effective enforcement at scale to offset any existing debt or new issuance, you can see this play out at the state level in certain areas in response to migration matters when it comes to taxation and revenue, but that is only one aspect of my skepticism…)

And that’s excluding when we all know they will step in during during “emergencies” and re expand their balance sheet for privileged actors to first feed from, at the expense of anyone else who was not in an “emergency” or hedged. Which will also increase the capital in capital markets.

Capital “markets” matter very much to the Fed in practice… wouldn’t have Permanent “Open Market” Operations Desk at frbny if they didn’t matter to them.

Don’t worry. We’re communist now. The Fed doesn’t have to care, just like the Politburo doesn’t have to care. At least until tbe “social stability” collapses, which is a big hill to climb, at least as long as USD is still the reserve currency.

I am pretty sure you have never lived in a communist country before. If you had, you wouldn’t be making such silly statements.

No matter how much the doom and gloomers try and wave their hands and repeatedly pray for the end, the USA is still a capitalistic economy. The FED doesn’t change any of that.

JimL,

“the USA is still a capitalistic economy.”

Not so much when the G has created many trillions (in excess of annual US physical output) of unbacked money, to influence/impose its will (on interest rates and everything else) at the inescapable cost of creating inflation (currency dilution) for every USD holder on Earth.

Their money, their control, our costs.

Won’t this cause a problem for Banks? Will the interest in MM funds decrease?

It won’t cause a problem for banks unless an individual bank’s reserves drop too far.

MM fund interest is largely depended on short-term Treasury yields and commercial paper yields. If and when the Fed cuts rates, that’s when MM fund yields go down.

Fed creates money out of thin air so losses don’t matter to Fed and fed can never default.

LOL. Trying to summarize the section under the bold subheading: “But losses don’t matter to the Fed.” So I’ll repeat it here just for you, because there’s a little more to it than a simplistic one-liner:

“The Fed creates its own money, and so it cannot become insolvent. And its capital, which is capped by Congress, is not impacted by the losses because the Fed carries the losses as a “deferred asset” in a liability account on its balance sheet, rather than taking the losses against capital. So its “total capital” on its balance sheet has actually ticked up by $1 billion over the past 12 months to $42.8 billion.”

Isn’t the Fed legally required not to lose money? We all know it’s a joke. But that’s the letter of the law, right? So how are they distorting reality to lose a trillion dollars while claiming they’re not losing money?

You could see it like this: everybody is acting on Newtonian laws = “something exists for everyone to see”. Except for the CB’s which are using quantum mechanic laws = “now you see it, now you don’t and it doesn’t matter”. Both laws are true and can be useable at the same time, but not by the same bodies in the same place.

Too difficult to understand? Don’t worry. Most physicists don’t get it either. I’m baffled too, every time someone tries to explain it to me. I can only repeat it.

crv-

Funny, and appropriate to your comment, that Isaac Newton was Master of the Mint during the tumultuous first quarter of the 18th century.

Regarding your “too difficult to understand” question, you might have added this quote:

“I can calculate the motions of heavenly bodies, but not the madness of people.” (Attributed to Issac Newton, c. 1721, after having lost huge amounts of money in a “South Sea Bubble” experience).

He was fixated on gold too. Almost appears that Newton was an Austrian!

I thought today’s WSJ headline list was rather poetic.

On one line, Fed loses $114 Billion

Next line, Blackrock spends $12 Billion in an acquisition.

For every loser there is a winner.

I guess when you can create money it doesn’t matter but 5.5 billion for operating the fed and regional banks? I looked it up they have about 22-23k employees, what are they doing with this money?

You’ve never looked at the detailed expenses of a company, have you? Usually over half — and with high-end service organizations a lot more than half – of the operating costs are payroll-related costs.

So here we go, we can look at it. This link is for the quarterly financial report for Q3 for the consolidated FRBs. Go to page 6 of the PDF (it’s numbered “Page 3”) which gives you a summary of the income statement, including operating expenses, including:

$966 million Salaries and benefits (incl. healthcare) + $146 million Pension cost = $1.112 billion total employment cost in Q3.

x4 = $4.44 billion annual employment costs. So about 80% of the system’s $5.5 billion in net operating expenses was spent on employment costs, seems pretty typical for a high-end service organization with highly-paid staff.

I just looked up the job offers at the New York Fed (the largest of the 12 FRBs), and the median salary listed for the job openings was $195K. So now add to that payroll taxes, healthcare and other benefits, pension costs, etc….

On Indeed I found that the range of salaries is from $70k for a “student researcher” to $300k. Nearly all jobs reported on Indeed were in the six figures.

In terms of equipment costs ($61 million in Q3, or $244 million in 2023), the Fed is the center of the national payment system for the banks, the system by which funds flow between banks (your mortgage payment and car payment etc. go through that). It is also the entity that deals with physical paper dollars (banks send worn bills to the Fed, which disposes of them, and it gets the new bills and sends them to the banks). It deals with physical paper checks, which are routed through the FRBs, etc. etc. Tons of stuff.

Probably pretty low-budget compared to corporate America with their super-fancy offices and mega-salaries, bonuses, and stock compensation plans.

$114.3 billion is a pile of crisp, new $100 bills 72 miles high just to give a concept of how much a billion dollars is (0.63 miles per billion).

Also fits on a smart key in post analog currency. The current metrics are related to wafer thickness and information density. Digital makes diamonds look value. Bubbles and busts now cycles of days and weeks. As long as the lights stay on..

Sorry. Should read, “make diamonds look low value”,

Which happens to be pretty close to 1 kilometer per billion. The metric conversion I guess.

///

Grandma FEDs recipe for the worst meat loaf ever

First the FED gives the banks money at negative interest rates.

The banks get liquidity and profit from the nice discount you give them.

Over time inflation drives the interest rate up. That is the perfect time to deposit the money with the FED – the same money you got with a discount.

Since you are holding their money, you pay them back interest…Not the old one but the new one with the extra $$$ for the banks.

All the while preventing remittances to fill budget gaps, exerting pressure on an ever inflating debt cycle.

And there we have it, the worst meat loaf ever!

To recap: You give them discounted money, and now you pay interest for the same, while draining the budget!

Good old Grandma FED!

///

Interest on required reserves was incentivized by Friedman. Interest on all reserves was perpetrated by Volcker. So much for higher learning.

The usual explanation for these losses by the mainstream media is that they are a result of the Fed’s inflation fight. There is usually no mention that these losses are a result of the arbitrary, reactionary, and abrupt actions of the Fed during the last decade or so, and specially during the last 3 years: acquisition of a unusually large portfolio of very low-yielding securities that were in turn prompted by its ultra-low interest rate policy followed by the abrupt raising of interest rates. From ultra loose monetary policy to an abrupt shift to relatively tight monetary policy. Or as one US senator put it: like a drunk driver flooring the gas and them slamming on the brakes.

There is no mention of the mistakes that all these actions imply. Very little criticism by the media of the Fed. Not a single congressional committee to investigate what went wrong. There is no accountability of actions that have negatively affected the lives of millions of people. A housing bubble of historic proportions that has devolved into a frozen housing market, historic inflation that has resulted in huge purchasing power losses for a large many and for a windfall for a select few.

How many of the PhDs at the Fed been fired as a result? As is the case of private enterprises when they lose money, the Fed should engage in a round of cost cutting by trimming a lot of those useless economists it employs.

1. You got this backwards. The losses are caused by the Fed’s own rate hikes (to push up short-term rates) and QT (to push up long-term rates). That’s what caused the losses.

2. QE and 0% made the Fed a ton of money, as you can see in the chart. But the Fed ended QE and 0% in early 2022.

3. I lambasted the Fed for most of the existence of this site for its interest-rate repression and QE. But I’m not going to lambaste the Fed when it’s finally doing the right thing: higher rates and QT. So you need to do some thinking about what you blame the Fed for.

4. Here’s who is disagreeing with you, and that’s a lot of people and include members of Congress: People who have owned their homes for years and rode up the QE-fueled housing bubble, people who rode up the QE-fueled stock market bubble and the crypto craze, etc., people in finance who’ve made a ton of money due to the effects of QE and interest rate repression, etc. They all disagree with you. The Fed’s QE made them wealthier, and they’re not going to blame the Fed for making them wealthier. And now they’re mad at the Fed for finally doing the right thing — hiking rates and QT – and they want the Fed to reverse course, which is all you hear now from Wall Street.

The interest rates being higher are only an atrocity because of IORB. The fact that the fed is taking taxpayer dollars (interest from treasuries) and paying it to member banks for LITERALLY NOTHING is a grift of the American taxpayer.

It ticks me off hearing how the Fed is supposedly “generating profits” for the Treasury when in fact it’s just taking a lot of money from the Treasury and then giving a portion back.

Well, OK, but if the Fed didn’t pay interest on reserves, the banks would move their cash into T-bills, and then the government would pay the banks directly all that interest, rather than via the Fed. Not much difference. The banks are going to put their cash somewhere where it earns interest risk free and is liquid, and one way or the other, the government is paying for it because that’s part of its debt.

Said Wolf : Well, OK, but if the Fed didn’t pay interest on reserves, the banks would move their cash into T-bills, and then the government would pay the banks directly all that interest, rather than via the Fed. Not much difference.

well, there is a difference imho. Is banks move their cash into T-bills then interest rates might go to zero and government would pay nada to banks in interest.

Or the bank might think of making loans to people in the private sector which is their purpose in society , not?

“… banks move their cash into T-bills then interest rates might go to zero and government would pay nada to banks in interest.”

In your imagination, as per your prior comments, interest rates always go back to zero no matter what happens. Which I find kind of funny.

Your accurate portrayal of the Fed’s actions is why many of us are loyal readers of this site. My rant is directed at the mainstrain media and their puff pieces on the Fed.

Maybe I didn’t explain myself well. My point is that the current measures (QT and 500 basis point increase in such a short period of time) would not have been necessary had they not done what you have criticized them for in the past.

I’m glad they have finally started doing the right thing but they still have a lot to do in my opinion. So far it seems like too little too late.

I agree with you the Fed is doing the right thing now (but their messaging is still too dovish, in my opinion, or the market woudln’t be pricing in 7 rate cuts), but that doesn’t even come close to making up for their 13 years of malfeasance.

A dictator who causes the mass starvation of 10 million people doesn’t get a pass because he volunteers at a soup kitchen for one night.

Regarding 4, those people don’t disagree in good faith. Wanting free shit is not a principle, whether it’s a poor person or a rich person.

ZIRP = Yield starvation.

Not mass murderous, but ruinous all the same.

If inflation is higher than the government’s reported figures, as I believe it is, then the Fed should not only NOT cut rates, but rather raise rates. Service inflation going up at double digits right now and shows no sign of abating. As I reported in previous posts, every services item expenditure in my monthly budget is up 10% or more YoY. JP should do the right thing, Raise rates, just like Volcker did. That will send a clear message to the crooks in Wall Street and the big spenders in Congress.

Exactly! It’s about time wall street didn’t get what was in their best interest for once, and had to suffer some consequences. Raising rates further or increasing QT is what is needed to really end this ridiculous finance orgy

You raised all the right issues in your psot.

But the problem is: Policy Makers and people in power don’t think FED has made a mistake.

One of the reason is: These gusy themsleves benefitted big time because of FED.

No one would hold accountable to FED for all the mistakes they did for last few decades unless French like revolution happens.

Wolf,

Canada’s federal government introduced legislation to temporarily let the BOC retain earnings to offset losses. Once the BOC is back in black; back to business as usual.

I just looked up its operating losses in 2023. Through Q3, it had a net loss of $4.5 billion, including a loss of $1.5 billion in Q3. Doesn’t look like the operating losses have stopped yet.

https://www.bankofcanada.ca/2023/11/quarterly-financial-report-third-quarter-2023/

The BOC has a deal with the government to where the government needs to refund to the BOC the actual losses it might incur on its pandemic bond portfolio. The BOC tracks this amount as an asset on its balance sheet called “Indemnity,” currently around $23 billion. This indemnity will not be triggered unless the BOC actually sells the bonds. But it’s on the balance sheet, and I discusses this before.

Hhmmm, wonder what that newly created $30 billion in the first week of January was directed towards? I believe it was anticipated that indemnity payments would take 2 to 4 years before returning to business as normal. This is the 2nd year; with the increase in CPP contributions it will help pad reported gdp – or at least help absorb a potentially increasing unemployment rate.

“Hhmmm, wonder what that newly created $30 billion in the first week of January was…”

That’s a BS number that you got from some moron blogger that doesn’t know how repos operate. The BoC has been doing repos forever, including every business day in 2023. They’re part of its policy tools that it uses to set short-term interest rates.

These repos mature the next day, the BOC gets its money back, and the repos vanish. And then it does another round to mature the next day.

Total repos outstanding will all mature on Monday Jan 15, and amount to $5.9 billion, not $30 billion. There are no other repos outstanding. your moron blogger added up a weeks’ worth of repos but didn’t subtract the matured repos, LOL.

That $5.9 billion to mature on Monday is lower than most days last year. For example, the repo that matured on Monday Jan 16, 2023 amounted to $15.5 billion.

Two comments in a row, two manipulative BS numbers in a row, tsk, tsk, tsk. I don’t have time for this.

The main goal of the Bank of Canada is to prevent any housing market crash no matter what the inflation rate is or what the economic conditions are. It’s crystal clear when you live in Canada.

Great article start to finish.

Why do you think the money markets moved (and continue to move, I assume) so much of their money out of the RRP at the Fed? The rate hasn’t moved due a while. And where are they moving that money to? Government debt secondary market (speculating)? Are they speculating rate cuts and trying to front run the destination market (whatever that is…I speculated secondary bond market)? Those money market funds are limited in terms of what they can do with their cash. For example, I don’t think they can buy equity with it; they’re limited to safe assets.

“Why do you think the money markets moved (and continue to move, I assume) so much of their money out of the RRP at the Fed?”

MM funds moved their funds to T-bills and the regular repo market both of which pay more than ON RRPs.

ON RRPs pay 5.3%. T-bills of 2 months or shorter pay over 5.5%; 3-month bills pay 5.46%, even 4 month bills pay 5.4%. Regular overnight repo rates are close to 5.4%. Term repos with longer terms, such as two weeks or two months, have higher yields (above equivalent T-bill yields). Corporate paper pays more too.

The New York Fed reported on that a little while ago. The MM funds are going back to normal, relying on T-bills (lots of supply), regular repo market overnight and term repos (MM funds have always been big lenders to the repo market), and corporate paper, rather than ON RRPs. They do this to boost MM returns. This is why the normal condition of ON RRPs is zero or near zero:

Thanks!

These are probably esoteric follow up questions, but are the MM-funds buying T-Bills at auction via dealers or in the secondary markets? (Guessing the former) And, in the regular repo market you mentioned, that is a secondary market by definition, right? So MM-funds ‘buying’ T-bills in the regular repo market will push those short term yields down, right?

Just trying to make sense of the recentish downward yield moves. I wonder if the MM-fund actions are ‘moving needles’ elsewhere. Seems like it would!

1. Both. All big banks and broker/dealers have MM funds, and they buy at auction, but they also buy in the market. In the market, they can buy anything, such as 10-year Treasury notes with three months left before maturity, which trades like a three-month T-bill.

2. Yes, the repo market is a secondary market.

3. No, MM funds are not buying T-bills in the repo market. They’re LENDING to others in the repo market as part of a trade and earn the interest. These are “repurchase agreements.” So for example, MMF A engages in a 2-week term repo handing out $1 million in cash for a rate of 5.6% APR and takes Treasuries as collateral. After two weeks, the MMF gets its cash back plus interest and returns the collateral, and then it renews the same trade.

New year resolution: not to buy any new stuff. Already cut most unnecessary services, got rid of a car, and started cooking at home in the last two years. Stopped ordering Uber for my hot Asian girlfriend almost everyday. Take that Core CPI!

Thanks for fielding my follow up Qs.

Yeah, my bad, I used the word “buy” way too loosely there. They lend their money out in exchange for government debt like you said.

Whatever they receive as collateral (e.g., T bills) is off the market though, right? Meaning the MM fund can’t sell it (unless the counter-party borrower defaults, of course). If they can’t (normally) sell it, then wouldn’t the sum of these transactions (1 trillion bucks) be similar to trying to hoard the various types of collateral, which would end up boosting the price of those types of collateral in their respective secondary markets (and lowering yields), all other things being equal?

That’s my logic tying those huge sums of money to recent downward yield movements. Those movements have been across the various durations, but more so in the short end than in the long end. Anyways, thanks again for your input on my previous two posts.

Hi Wolf,

Will the ‘Bond Vigilantes’, Inflation or the ‘Market’ give the FED discipline ever again ?

We live in disappointing and surreal times

Thank you

…will their recklessness continue….or do you now see them on the right track ?

since it started hiking rates and doing QT in 2022, the Fed has been on the right track. If its policy rates remain above the rate of inflation and if it continues to bring down its balance sheet, it’s on the right track. The screaming in the markets and on Wall Street and by “economists” that the Fed MUST cut rates pronto by a lot and MUST end QT now, confirms to me that the Fed is on the right track.

Thank you

Lots of interesting discussion and comments here.

My bottom line is that our central bank has evolved into a giant Ponzi scheme. “Round and round it goes; where it will stop nobody knows!”

The top 1% do very well. Maybe the next 5% do well. Unfortunately, 95% of our 335 million citizens suffer in varying degrees. Adding insult to injury, the average Fed employee is also doing VERY well. Not to mention government insiders, lobbyists and the rest.

History paints a not so pretty picture of how this may end.

Cheers,

b

True but the bulk of the US does well compared to the world population as a whole, although simply measuring on basic things as obviously a lot of subjectivity. It’s all perspective!

That picture may slowly change given trade alliances shifting, BRICS eventually cutting into the power of the US dollar as reserve currency and of course unknowns.

The GDP of BRICS is already larger than G7 so interesting how it all places out but it will be measured in decades more than likely.

I don’t understand how you get to Ponzi scheme with the FED, I am guessing it has to do with the sources if information you use feeding you populist BS to maintain control of you, but maybe it is something else.

Anyway, the saddest thing about all of this is how many people have turned off their brain and just blindly swallow the crap they are fed.

For example, one of the biggest ways a government can help the masses is through basic healthcare. Making it widely available at little or no cost to the people makes a huge difference to standard of living of the masses. Every other 1st world country in the world has figured this out, yet somehow the USA can’t figure it out because the is a large percentage of the population that votes against its own interst because they swallow the BS they are fed.

Time to jump in and lock in those 5% yields on 30 year Treasuries, like Michael Burry is doing. Buy them on 10 to 1 leverage. You can’t get hurt. Go for it!

You’re right wish I’d been smart enough to go all in on Venezuelan debt yielding 10%!

I wish the word “transfer” could be used instead of “loss” so more people could be aware of whats happening.

i.e. 114 billion transfer to the financial sector by the Fed

UK is even worse, the government is still paying the interest on debts incurred for a transfer to banking system over the 2008 banking rip-off.

When the Fed made a ton of money year after year and remitted this money ($1.36 trillion in total since 2001) to the government/taxpayer, you didn’t come around and complain that this was a “transfer” of $1.34 trillion FROM the financial sector to the Fed, and from there to government/taxpayers via the remittances.

So you let decades of this transfer FROM the financial sector to the taxpayer pass, and now that we have the first ever annual loss, and the transfer reverses, you come around and complain?

Wolf – during the period you mention, what was the amount of dividends (6% by statute) distributed to the Federal Reserve shareholders?

How does that amount compare to the dividends distributed when the Fed returned NO funds to the Treasury?

Why would I care about that? Bunch of companies in the US have paid dividends for many decades, and have increased them year after year, whether or not they lost money. The amount in dividends that the FRBs pay is minuscule compared to the amount in total dividends paid. $588 billion in 2023 by just the S&P 500 companies. And you’re fretting about $1.5 billion, which represents 0.3% of S&P 500 dividends paid?

Hell Wolf – With that ridiculous argument, nothing is of any concern if you can make an absurd comparison. Why do you keep a list of failed unicorns if they are miniscule compared to an economy measured in trillions?

The Fed remitted $1.3 Trillion with a T to the Treasury since 2001. And you get all tangled up because the Fed paid the statutory dividend (= required by law passed in Congress) of $1.5 billion with a B though the Fed has losses for the first year ever????

“hy do you keep a list of failed unicorns if they are miniscule compared to an economy measured in trillions?”

1. I report on them just like I report on the Fed’s dividend.

2. There are over 1,000 of them, including some big companies each of which had drops in market value of 10s of billions.

This nonsense discussion is over.

Just calling an argument ridiculous doesn’t make it so. Just admit you cannot refute what he said.

Inequality. UnAmerican. Insulting. Fraud.

The FED has losses supposedly, what happens to their operations? NOTHING. They just print out their salaries and bonuses.

The rest of us have to cut back on something.

I think a good look at American history and current statistics shows that inequality is the American way. This has been increasing especially since the late 1970s until now but these are universally accepted facts. Clearly a solid product of a “representative” democracy.

Glen

Wasn’t it JFK who said “Life is unfair”

Easy to say as a Kennedy!

Inequality based on effort or luck is one thing. What we have with the FED’s existence is inequality based on access to ability to print $$. This is Un-American.

The Federal Reserve runs a very lean and mean and tight bank and has no need to cut back on anything.

According to the Fed’s website, the Fed employs 400 PHDs…….cant get along with 200?

Did they all buy into “transitory”?

“Inequality. UnAmerican. Insulting. Fraud.”

Little of that has to do with the FED. More hasbto do with the laws of the country and how a certain segment of the population are naive enough to keep electing people who do not have their best interests in mind.

“The FED has losses supposedly, what happens to their operations? NOTHING. They just print out their salaries and bonuses.”

This shows that you literally have no understanding of how and why the FED operates. You are just angry and your political masters have directed you to blame it on the FED in order to distract you. Don’t worry, tomorrow they will direct your anger to Guatemalan terrorists coming though the “open borders” of this administration.

Rather than get angry over things you do not understand, I think it is better to invest the time to educate myself and understand them better.

This sure hasn’t aged well:

Your comment doesn’t make sense at all, given what the article (link removed) actually said. Maybe you forgot to read it.

Nevertheless, the piece, written by a guest author from the UK, dragged SF through the mud in a stupid manner. But I knew the guy, so I posted it, but shouldn’t have. So now I took it off. Thanks for reminding me. I meant to do that years ago.

The Fed’s losses seem inflationary to me. Until recently, the Feds profit was paid back to the gov. All money that entered the Fed left the Fed on a cash flow basis. Now that there are losses, there is a net cash outflow from the Fed that flows to private hands. More printed money in the system.

Add this to the list of things working against the Fed in it’s inflation battle. Growing fiscal deficits, QT nullified by RRP drawdowns, stock market and RE wealth effect, record low unemployment, etc.

Is the Fed still fighting with rate increases paused and RRP drawdowns offsetting the QT? With inflation ticking up again, it would be a great time to pull a gun from the holster and sell some MBS.

The Fed’s losses are an “asset” on the Fed’s balance sheet.

Banks can over value their collateral when borrowing from special programs.

The Fed can deal / has dealt in non govt backed securities. (SPVs)

The Fed has partnered up with outside entity (Blackrock)

The Fed has purchased Trillions in long term debt.

The Fed has promoted inflation.

All of the above were unthinkable 20 yrs ago.

I think this resembles “agency creep”.

Bernanke got the Nobel Prize for “breaking the mold” of the Fed. (see above list)

But, IMO, the “mold” was there for a reason, and we are now seeing the ramifications of breaking that “mold”.

“Statutory dividends rose to $1.5 billion (from $1.2 billion in 2022). The dividends are paid to the shareholders of the 12 FRBs.”

Shareholders are (roughly 60%):

Citibank, Chase Manhatten, Morgan Guaranty Trust, Chemical Bank, Manufacturers Hanover Trust, Bankers Trust Company, National Bank of North America, and the Bank of New York

Now who owns these banks? Take a guess – 1) the top 1%, 2) the bottom 99%.

1. The banks that hold shares of the FRBs are owned by their shareholders, and you can buy those shares and collect dividends, and people have them in their 401k and stock funds and in their portfolio, and ownership is spread far and wide. Your 1% remark is copy-and-paste nonsense.

2. Most of the banks on your list are in the district of the New York Fed and only hold shares of the New York Fed.

3. The largest banks hold the most shares.

4. In terms of votes for the board of directors of the FRB, each bank has one vote, not related to how many shares it holds.

5. As of 2018, New York Fed shareholders: Citibank (42.8%), JPM (29.5%), Morgan Stanley (3.7%), Goldman Sachs Bank USA (4%), Bank of New York Mellon (3.5%)…

1. I may be off in percentage – sources vary – But the point is the same.

” Families in the top 10% of income earners accounted for 70% of the dollar value of all stock holdings in 2019, with a median of $432,000 worth of stock per invested household. Meanwhile, the bottom 60% of income earners owned only 7% of all stock that year.”

https://usafacts.org/articles/what-percentage-of-americans-own-stock/

“The wealthiest 10% of American households now own 89% of all U.S. stocks”

https://www.cnbc.com/2021/10/18/the-wealthiest-10percent-of-americans-own-a-record-89percent-of-all-us-stocks.html

2. True, I don’t have all day to research. I grabbed the first list I found. It’s representative.

3. My point.

4. So it is commercial banks that vote for FRB directors. Although I don’t see what that has to do with a dividend set by statute.

5. The full list is not a quick Google search. Why don’t you list them all?

That’s different than “1%”

Had they just left interest rates where they were in 1981 the government wouldn’t be losing money today and everyone would be rich especially retirees and savers. I guess that made too much sense.

Despite the challenges faced in 2023, it’s commendable to see the Federal Reserve navigating through the complexities and contributing to economic stability. The transparency in reporting an operating loss of $114 billion is a testament to accountability and the commitment to address issues head-on. As we move forward, it’s crucial to focus on collaborative solutions for sustained financial resilience.

Do private investors into feds have to pay for the recapitalisation, or do they just get the dividends?

There is no recapitalization by investors. The Fed sets up its losses as a liability that it won’t owe the Treasury department (negative liability) and that’s it. Its capital has actually gone up. I explained this in greater toward the end of the article.

This begs the question why can’t individuals invest in local feds, sounds like a great investment.

6% only sounds good now. But it was also 6% when Treasury securities yielded over 15% and inflation was over 15%. It’s always 6%, and for decades, that wasn’t a good deal.