How this mess came about is actually kind of funny, in a costly way.

By Wolf Richter for WOLF STREET.

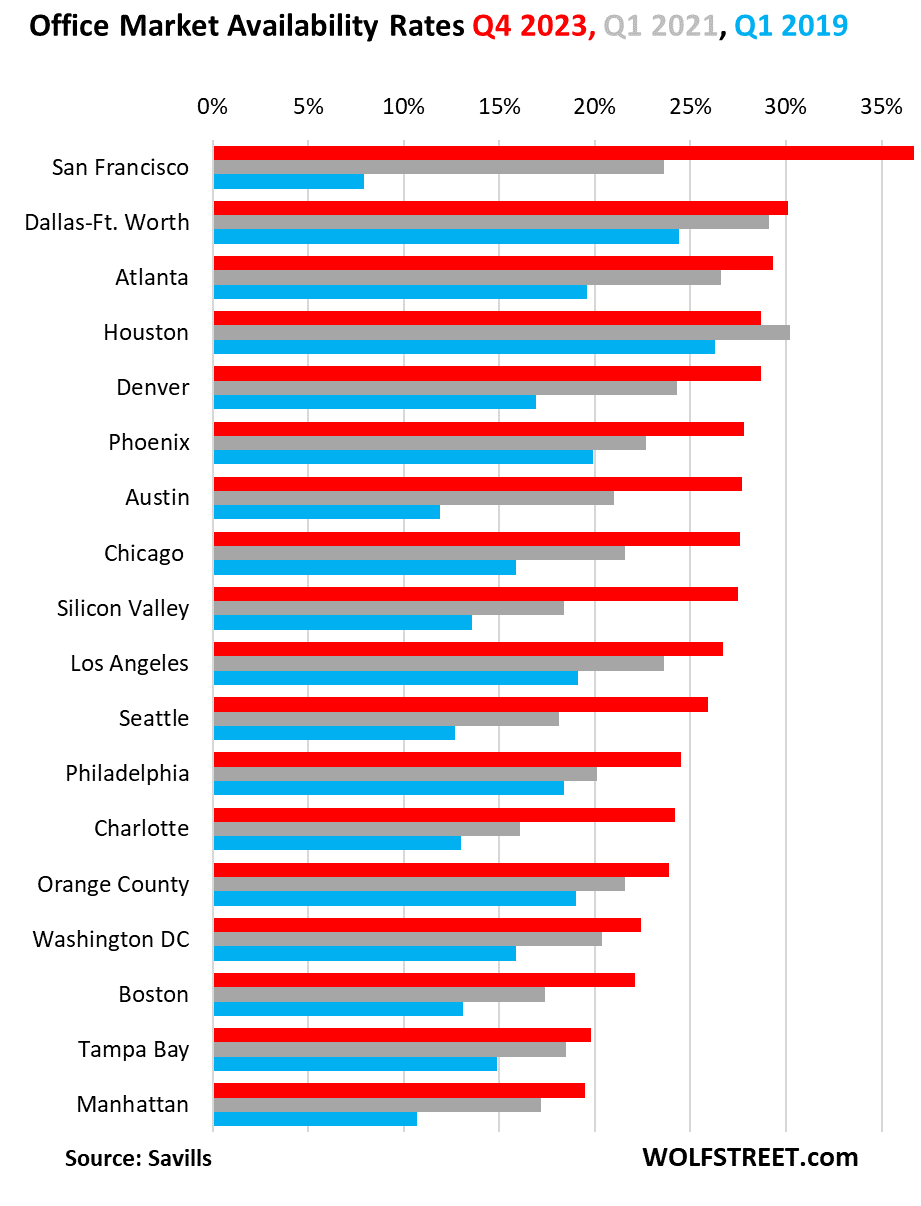

Availability rates in the office sector – office space that is on the market for lease either by the landlord directly or by a tenant as a sublease – keeps getting worse in nearly every major office market.

To set the mood, here is a chart that shows the availability rates in 18 large office markets. Data by Savills. Red shows the availability rates for Q4 2023; gray for Q1 2021, and blue for Q1 2019, which were the Good Times.

San Francisco, after having been the hottest office market in 2019 with an availability rate of 7.9% amid constant hype about the “office shortage,” has become the worst office market with a record catastrophic availability rate of 36.7% in Q4 2023.

The deterioration in Q4 came despite two major lease signings by, you guessed it, OpenAI for 486,600 sf, and AI startup Anthropic for 230,325 sf. But the AI hype is just not enough?

Major companies have put vast amounts of office space on the market as sublease, including Salesforce, Meta, Microsoft, Twitter, Amazon, etc. Charles Schwab has been shrinking its way out of the City for many years, and in 2019 finally moved its headquarters to Texas, and it continues to shrink its footprint.

Houston had been the worst office market since the Great American Oil Bust that started in late 2014. Within a few years, availability rates were over 30%, while San Francisco’s were in the single digits. But it has recently been benefiting from the renewed oil and gas boom, and from the export boom of petroleum products and LNG. The US has become the largest producer of crude oil and natural gas in the world, and in 2023 became the largest exporter of LNG in the world; and it has the largest petrochemical industry in the world. Much of the oil and gas industry is headquartered in Houston, and so Houston was the only one of the 12 office markets that has improved since Q1 2021.

But Houston’s market is still in terrible shape, with an availability rate of 28.7%, one of the worst in the country, but less bad than San Francisco and Atlanta.

Silicon Valley’s availability rates have lost their grip, after hanging in there for a while, and in Q4 jumped to 27.5%, despite all the AI hoopla about hiring and office leasing.

The issue is actually kind of funny, in a costly way.

San Francisco, Silicon Valley, Manhattan, etc. went from super-hyped “office shortage” in the years through 2019 to office glut overnight because in 2019 and the years before, companies were grabbing office space as soon as it came on the market because there was an office shortage, and no one could get enough office space because there was no office space on the market because as soon as something hit the market, some company would lease it in order to get ahead of the others, and they didn’t need the office space at the time, and they didn’t think they would need it for years, but they needed to grab the office space because these people were paid bonuses on how much office space they could grab? And they were hogging office space that then stood empty and unused in order for the company to grow into sometime in the future.

But the future didn’t come, and instead Covid came, and the executives sat around the house and took a deep breath, and with lots of time to think between Zoom meetings, this question occurred to them – to all of them at the same time: “What the hell are we going to do with all this unused office space?”

And that precise moment, the office shortage swung to an office glut. And we’re now deeply into this new era of the office glut – endless amounts of often highly leveraged empty office space.

It was called “The War for Space”

So back in Q1 2019, when San Francisco’s office market availability rate was 7.9%, making it the hottest office market in the US, Savills’ quarterly office market report laid out the issue this way:

“New supply is limited with only a handful of projects underway, and all new product completing this year has already been pre-leased to-date. The technology, advertising, media and information (TAMI) and coworking sectors continue to dominate the war for space.

“Rapid rise of coworking offers flexible options WeWork, HQ by WeWork, and Knotel accounted for five of the ten largest leases in San Francisco during Q1. These leases alone added 260,000 sf to an already robust coworking inventory.”

May I interrupt here for a moment to mention a detail about both coworking companies named here: Knotel filed for bankruptcy in January 2021. And WeWork, with billions of dollars in bailout funding from SoftBank, was able to drag out its bankruptcy filing until November 2023.

Part of the reason they filed for bankruptcy was to get out from under the ridiculous amounts of office leases they’d taken on during the “office shortage.”

Back to Savills, Q1 2019, San Francisco:

“The rapid growth of coworking provides a variety of options for all types of users seeking flexibility. It provides smaller companies and start-ups with the ability to have office space in a price-restrictive market. It also allows larger, more established companies the flexibility to maneuver employees into offices while waiting for bigger blocks of space to open up in such a tight market.”

And Savills went on in Q1 2019:

“Even with the rapid pace of coworking expansion, tech companies and the TAMI sector still account for the bulk of leasing activity in the market. This quarter, Google took an additional 189,000 sf at One Maritime Plaza, mere weeks after taking 300,000 sf at One Market, backfilling Salesforce’s prior headquarters. Asana snapped up the last significant block of space in the construction pipeline, taking all 272,000 sf available at 633 Folsom Street.

“The supply demand imbalance is pushing tenants to look well into the future to stake their claim on new space. Both Salesforce and Pinterest have recently secured buildings that have not even received entitlements to begin construction yet, with Pinterest committing to 490,000 sf at 88 Bluxome Street this quarter.”

In August 2020, Pinterest paid $89.5 million to get out of the lease and walked away from the unbuilt high-rise project at 88 Bluxome Street.

Those were the Good Times – grabbing office space that hadn’t even been built yet, to keep others from grabbing it, even though no one actually needed it or could see any use for it. This kind of game was played in all major office markets. But it was played to perfection in San Francisco.

It was also played to perfection in Houston during the prior oil boom until it began to deflate in late 2014. Years of that oil boom had triggered a huge wave of new construction of office towers amid endless optimism about oil going to the moon. And even as the vacant office space got piled on the market, new towers were still getting built. The flight to quality caused older office towers to be vacated and end up getting sold in foreclosures auctions with something like 80% haircuts for the creditors, the CMBS holders.

In San Francisco, construction on a two-tower mega project, the Oceanwide Center, with an original budget of $1.6 billion was halted in 2020 after it reached grade. By that time, it was hopelessly over budget. Commercial viability was in doubt. The Chinese developer, China Oceanwide Holdings, ran out of money. The general contractor withdrew from the project. Unpaid contractors filed for mechanics liens. The project defaulted on the debt and was seized by creditors. In October, a court in Bermuda ordered the liquidation of China Oceanwide Holdings. And the project has turned into a big ulcer.

The photo by Wolf Richter, taken on May 24, 2021, shows only part of the project. And it still largely looks like that except the last remaining construction crane has been removed. In the background is the gleaming Salesforce Tower, the City’s tallest building, with big portions of its space on the sublease market.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The Oceanwide skyscraper curse reminds me of The One liquidity problems in Toronto.

A huge project building an 80-something luxury tower at the heart of Yonge-Bloor across the street of an already built high condo tower, not far from luxury stores such as LV, Hermes, Gucci, Swarovski.

People would’ve guessed that there would be demand for downtown business centres and condos.

10 years ago, the only high tower in that area were bank towers.

Time to thank me again. By running the economy hot with 0% interest rates, QE, continuous bailout programs and MBS purchases, I have ensured a construction boom in face of falling demand. I have also ensured extreme consumerism.

Think of all the construction concrete that releases CO2, all the ships that burn oil and ferry unneeded goods across oceans. I made 2023 the hottest year on record. By heating the human Footprint on the world, I am responsible for more damage to our environment, our climate and our planet than anyone else.

I still sleep like a baby with sweet dreams of scorched earth.

Ya had me J. 😆

Then ya lost me. ☹

I still have both Presidents and both parties. Doesn’t matter how you vote :P

Hey! Don’t mess with J. Pow!

It makes me think I’m going to cry.

It cares so deeply.

Don’t Cry for Me J. Pow. You are the spiritual leader of the nation.

Now back to CRE.

I read through all the comments, and did not see where anyone mentioned this parallel.

The years before the Great Depression in the USA were marked by a sky scraper building boom. Many of you may have heard of the Empire State Building in NYC. If memory serves me correctly, it was finished in the early1930’s, and sat mostly empty until World War II.

How does the saying go: “History never repeats exactly, but it rhymes”.

Howdy Old Ghost. History rhymes and plays the same music. Cable TV is running Saturday Night Fever constantly. John Travolta in a new commercial where Boogie Fever is back.

Ready Yourselves Youngins

70s 80s are coming????????

Curse of the Cranes. I have heard of this before.

Old Ghost-

You’re right. Nothing new under the sun.

“Panics do not destroy capital; they merely reveal the extent to which it has been previously destroyed by its betrayal into hopelessly unproductive works.”

— John Stuart Mill, 1867

Equity contrarian investors have long believed in the skyscraper indicator, and if I recall correctly it was originally developed by Andrew Lawrence. Massively tall and expensive buildings are a sign of extreme optimism and confidence. It takes several years or more of good times, with no end in sight, before developers will commit to these projects. By the time they are started, it’s typical late too in the cycle.

Ironically, the tall luxury condo across the street (One Bloor) was delayed because of something with the Lehman Brothers during 2008.

Speaking of which, Nordstrom appears to be no longer renting the coveted ground floor of that condo, and Apple was planning to rent the ground floor of the receivership condo under construction (The One).

It appears that American companies which depend on consumer spending don’t want to invest in the heart of downtown Toronto. Canadians are tapped out. Time for ZIRP 0% rates and more condos!

Don’t forget the guy who castigated JP when JP dared to take baby steps to raise rates six years ago,

That could soon be “Emperor Guy” if people don’t WISE up.

At least D Jr and his shrieking harpy GF still have him on the toot for important public appearances (like the acceptance speech….snort, snort, motor mouth) and then if needed a COFEFE-like come down (Ambien).

Even Howard Stern told him to try not to snort, but when ya get real wound up on your own revelations (especially pathogenic liars) it’s hard not to.

Jr and his GF are younger and can play Valley of the Dolls…….longer……an overweight 77 year old is asking for a cardio event or a stroke. Already on Lipitor type drugs, and if lifestyle and diet are as claimed, he is pushing it.

PS; VGV, not VVV , (my error, but maybe he used that too?) Is silent…..no comment on that verbal beating he got here for hypocrisy. Should have picked complicated topic like climate change, where BS is easily hidden. (from some)

What promoted “facts” would come next?

Also starting to like that picture as an artwork

I blew it up and titled it , “The End”. May even frame it.

Everything that will destroy this planet (for how many people remains to be seen, but it will be a VERY high percent of 7-8 B, and could easily be all) is there.

Although it isn’t specifically the “CRE Game”, but thousands like it over the centuries. Many wrong turns led to this day, and I have kept myself busy (especially during the last 20 years) studying them…..all the way back to our split from the chimps.

Why? Just curious.

Also curious why Wolf deleted sentence below but left “punch line”. Surely he is aware of what a Steve Bannon type and his monied backers could do with the martyr story…..It’s perfectly Jesus-like, and that is their game and primary audience.

NBay,

I could not believe that you wrote what you wrote. That stuff can get you and me thrown into jail — in addition to it being just horrible. Yes, I understood the nuances, and so within those nuances, it wasn’t that horrible. But nuances don’t matter in a case like this. It’s the explicit language. And you just cannot publicly say that kind of thing.

Got it, plus you are risking a lot more than I, as site publisher/editor…..they are all under the gun lately.

Words are becoming almost as dangerous as during the Spanish Inquisition, or Salem witch trials, or other Medieval times. I’m sorry, and maybe that’s why I am better as a reader only.

“What a reasonable person would conclude” is losing what little legal meaning it had, in these weird and divided times, yes?

I noticed Congress last night is “Going to get to the bottom of UFOs” (now called UAPs?) and they were dead serious about it (a national security threat) and the three witnesses and their supporters and the weird whistleblower were tickled pink to get GOVERNMENT attention for their pastime……I wonder what “safe” bipartisan laws will be passed, while REAL problems (and controversies) go ignored.

Aristophane’s “Men of brass”.

J. Pow,

Carbon dioxide in the atmosphere? Yes, earth’s atmosphere is 0.04% carbon dioxide. About 3% of that 0.04% is from human activity. 5% of that 3% is from the USA.

But earth has water vapor in the atmosphere too. This percentage of H2O varies, but can be 4%. Cloud cover is 200 times more important than CO2 for atmospheric temperature stability and effect.

Two years ago, on 15 January 2022, a huge volcano erupted undersea near Hunga Tonga-Ha’apai. The amount of water released into the atmosphere, and sent up between 12 and 53 kilometers, was the equivalent of 60,000 Olympic swimming pools. This added an extra 10% more water vapor to the atmosphere. The time to decay back from this event and diminish this water vapor will be about eight years.

The surface temperatures across large portions of the earth’s landmass in 2023 were increased by 1.5 degrees Celsius as a result of this event nearly two years ago. (Martin Jucker, Chris Lucas, and Deepasree Dutta. Vlimate Change Resource Center, University New South Wales)

Now, Iceland is having climate change activity near the town of Grindavik. I would think that this might impact commercial real estate, although the town is pretty empty.

Veritas

I read a lot of climate denial stuff for fun and haven’t even seen some of your figures. Care to provide sources?

Matt B,

Just look up the volcano event in scientific journals.

A good one:

“Long-term surface impact of Hunga Tonga-Hunga Ha’apai-like stratospheric water vapor injection”

It can be found with a search on researchgate dot net.

It was published in August 2023 & written by the three people cited above.

It is not “climate denial stuff.” It is something that happened to the earth’s very complex being. But no, it does not fit the narrative of those who are about to meet in Davos this week.

When the underwater blast happened two years ago, 160 billion liters of water went up into the air over the course of two or so days. Earth is warmer as a result. The WEF will blame man, but it is in Mother Nature’s hands, by an order of magnitude, more so.

Normally, I’d let ‘J.Pow’s’ comment go, but not this time . . .

Congrats on confusing some readers with some facts.

If one really would like to read a few pages about an event (not caused by man) that happened 251 million years ago and darn near killed off all the planet’s living creatures, read up on the Great Dying. Google it.

Thanks for the interesting facts, VGV.

That’s a predictive modelling study on the the effects of water vapor from a specific eruption, on specific regions of the planet. They’re not discounting global warming, they’re arguing it’s likely to exacerbate the regional effects of global warming that’s already happening.

It’s already known that volcanoes can’t describe the observed warming or rise in greenhouse gas concentrations. The IPCC estimates +/- 0.1C of warming for solar and volcanic factors combined. Saying that this one specific submarine volcano is in fact making it worse doesn’t disprove that.

What I was more interested in was where you got those percentage figures. I’ll quote the IPCC by contrast:

“Observed increases in well-mixed GHG concentrations since around 1750 are unequivocally caused by GHG emissions from human activities. In 2019, atmospheric CO2 concentrations reached 410 parts per million (ppm), CH4 reached 1866 parts per billion and nitrous oxide (N2O) reached 332 ppb…Concentrations of CH4 and N20 have increased to levels unprecedented in at least 800,000 years (very high confidence), and there is high confidence that current CO2 concentrations are higher than at any time over at least the past two million years. Since 1750, increases in CO2 (47%) and CH4 (156%) concentrations far exceed – and increases in N2O (23%) are similar to – the natural multi-millennial changes between glacial and interglacial periods over at least the past 800,000 years (very high confidence).”

-AR6 Synthesis Report p42

Matt B,

The percentage of atmospheric CO2 caused by humans and from USA are from Dave Collum’s ‘2023 Year In Review’.

A good read is also:

‘Atmosphere and Greenhouse Gas Primer’ by W. A. van Wijngaarden, Department of Physics and Astronomy, York University, Canada & W. Harper, Department of Physics, Princeton University. Published 3 March 2023.

From the Introduction:

“Worldwide industrialization and the associated combustion of fossil fuels have increased the concentrations of carbon dioxide (CO2) and methane (CH4) since 1750. These gases along with nitrous oxide (N2O) and assorted lesser players like halocarbon refrigerants are examples of “greenhouse gasses.” It should be noted that by far the most abundant greenhouse gas in the atmosphere is water vapor. There is little that one can do about water vapor on our watery planet Earth, with 70% of its surface covered by oceans.”

That was the first paragraph of the introduction.

From the second paragraph of the Summary:

“Increasing carbon dioxide will cause a small additional surface warming. It is difficult to calculate exactly how much, but our best estimate is that it is about 1 C for every doubling of CO2 concentration, when all feedbacks are correctly accounted for. Alarming predictions of dangerous warming require large positive feedbacks. The most commonly invoked feedback is an increase in the concentration of water vapor in the upper troposphere. But most climate models have predicted much more warming than has been observed, so there is no observational support for strong positive feedbacks.”

One last sentence from their Summary:

“Earth’s atmosphere works like an extremely complicated engine that transforms heat from the Sun into work that drives the winds, the weather and ocean dynamics.”

Matt, I would definitely be interested in your take on this paper written by these two physicists if you review it.

-All the best to you.

Good job misleading people. It has been well established that the earth is warming faster at any point in its history. Earth does go through climate cycles over MILLIONS over years. This current cycle is playing over decades.

You can literally find any one event and make a short term correlation. The science behind climate change is a comparison of where earths temperatures should be vs. where they are considering its 100s of millions of years of existence.

It’s BS like this that will never stop. No one will be coming back 8 years later to check on your BS. You’d have moved onto new BS.

The BIG elephant you’re missing or omitting is that water wapor has an warming or an COOLING effect depending on altitude (ever heard of clouds?)

And water vapor will quite quickly rain aout of the atmosphere again. Good luck waiting for that to happen to CO2 or methane.

Matt B.-

To use the term “climate denial” seems intended to marginalize any questioning of current science brought up by opposing theories. Why squelch competing facts, observations and theories?

In past ages, great thinkers humbly recognized the sea of truths they DID NOT know:

E.g.-

“I do not know what I may appear to the world, but to myself I seem to have been only like a boy playing on the sea-shore, and diverting myself in now and then finding a smoother pebble or a prettier shell than ordinary, whilst the great ocean of truth lay all undiscovered before me.”

— Isaac Newton, quoted in Memoirs of the Life, Writings, and Discoveries of Sir Isaac Newton (1855) by Sir David Brewster (Volume II. Ch. 27)

An admirable thought, IMHO

themsicles,

On 9 October 2023, The Royal Society Journal of Mathematical, Physical and Engineering Sciences published:

“A radiocarbon spike at 14 300 cal yr BP in subfossil trees provides the impulse response function of the global carbon cycle during the Late Glacial”

History shows that Earth’s climate cycles do not need millions of years to occur.

The point I was trying to make in my reply to J. Pow is that a very influential event with regards to climate happened two years ago. This event was not caused by humans. Dr. Wyss Yim, recently retired from the University of Hong Kong, has researched this topic for decades. Rainfall, drought, temperature and jetstream flows are heavily influenced by volcanic and submarine volcanic eruptions. “Volcanic eruptions and climate variability.” by Dr. Yim (on Rumble) is an interesting look & listen at this.

Man’s influence on the climate does indeed matter. But there is so much more to what happens on planet Earth that is out of man’s control, and under-reported to a large degree, by legacy media and the Environmentalist Movement.

The change in climate for 2023, which is making the news for record warmth, is, for the most part, a direct result of the submarine volcanic explosion two years ago today. It will stay that way for a few years too.

“Misleading people?” No, it is better to “Educate people.”

I don’t see any mention of climate change on Dave Collum’s financial blog.

All of van Wijngaarden’s papers that I can see are published on arxiv (a preprint server with no peer review), on his own website, or on climate denier websites like co2coalition, where he’s listed as a member. (I would stop calling them deniers if they would provide evidence that isn’t completely misleading). Seriously go read that website. It’s like it’s written by a ten-year-old.

And again you’re cherry picking with the late glacial spike. Everyone knows about that. There are natural sources of CO2. None of that discounts human-caused global warming and it doesn’t even compare to it in scale either. I’ll direct you to skepticalscience dot com, climate myth #1.

“The myth that current climate change is natural because past climate changed naturally makes an implicit, and incorrect, assumption. It assumes that because the climate has changed from natural causes before, it can only be changing from natural causes now. This is committing what is known as the single cause fallacy. As the name suggests, this is when a phenomenon is falsely attributed to a single cause, even though other causes are possible. It would be similar to saying that smoking cannot cause cancer because people were getting cancer before cigarettes were invented. In the following sections we will look at different examples of past climates commonly used in the myth.”

So you are not going to give sources of your climate denial crap (yes, it is climate denial)?

I am guessing you are not going to provide sources because you just hears this crap fed to you and you swallowed it.

Just like Aaron Rodgers does his research….

Matt B,

I always find it hilarious (sad, but hilarious) that people try and make the argument that since climate can change for natural reasons, the carbon humans spew onto the air somehow do not matter.

It is like since airplanes regularly take ascend while taking off and then decend to land, no one should be worried about being on a plane going down because it has had wing blown off. They would be on the plane going “planes go up and down all of the time, not need to worry just because it is going down now”.

This blog is STILL attractive to intelligent people!

Just come out of woodwork! Took a few bites (probably understood by few, but they don’t have time to write a book) out of the biggest materialistic phony and “look at me” hypocrite I have ever seen on this site…..at least a regular one.

I wish I had the time to find the commenting from a few years ago where VVV (his third screen name since this incident) was thoroughly verbally thrashed as he tried to defend his obvious hypocrisy, which was “free market libertarianism” vs his actual “NIMBY” behavior having to do with blocking needed housing that was going to wreck his view or otherwise F UP his “prestigious” lifestyle.

He knows damned well what I speak of and if Wolf would dig it out it would make my day. In the meantime VVV better learn about biofilms….may be harder for him to BS away and truly informative as it will not be agenda driven opinion.

I said I was just going to read and not comment anymore, so I’m lacking something some may call a strength or a virtue of some kind…….maybe I still just like my 2 cents in print. But to me, I have had a belly full of DR,PR, or VVV, and his planet killing consumerism and even bragging about it.

I couldn’t take seeing him use more hypocritical BS defenses.

Sorry.

Nobody reads this far back, anyway.

I’m glad to see, someone pointing out the fact that Nature is running things.

Pow Pow given out J Jobs to the top .01

Urban Dictionary: J Job

When the rich get richer under Jerome Powell

“Hey Trent you get your J Job yet?”

“Yeah buddy! Gonna buy a sports team! Aaaaaaaah”

/s

Reminds me of Toronto’s Bay-Adelaide Centre, originally conceived as a 57 storey office tower (with a smaller 12 storey companion building) construction of which began in 1989. In 1991 construction was halted when all that had been built was the underground parking and the first six storeys of the central elevator core. Work was expected to resume in 1994 in a better rental market but, in 1993, the $1 billion project was axed for good, leaving the concrete block a monument to the over-expansion of the 1980s.

“The Stump” stood in this form as a symbol of the 1990s recession until its demolition in 2006. Eventually in 2009 a 51 storey West Tower was completed on part of the site, followed by the 44 storey East Tower in 2016, and finally the 32 storey North Tower in 2022.

Crime, the elephant in the room everyone refuses to talk about in this

strange age of self-regulated speech.

How is crime an elephant in the room? There jas always been crime and there always will be. If you use good sources of information you would know that in the past crime has been far worse than it has been recently.

What does any of this have to do with vacant office space?

Greed is inherent in humans.

This will happen with the housing market, it just takes time.

The housing market will never experience haircuts like the CMR. Not going to happen. What will happen (in USA) will mirror what’s happened over the last couple decades in other places (like Spain or Italy). The banks won’t foreclose, because that would mean they have to write off a loss. Even when they take possession they will keep it on the books at the (inflated) value of the loans against it. And the property will sit empty because no one will buy it at the price the bank needs to get to be able to sell it. And it will deteriorate and the value will decrease, and the bank will be stuck, but unable to bail.

There are tens of thousands of properties like this. There’s one just down the street from where I live. It was bought at the top of the market, the owner ran out of cash in the middle of the “remodel”, It’s currently and over grown stripped shell with trash and overgrown yard, but the bank won’t consider less than top dollar for what was a very nice house in a good neighborhood. So it sits.

If banks were required to calculate their assets at current market values I doubt even the FED could stop the wave of bankruptcies. That’s why they’re doing everything they can not to devalue assets.

I don’t know about the USA, but here in Europe, the Bulgarian bank transfers the property to a private bailiff, who sells the property at half price and transfers part of the amount to the bank, and the buyer, in addition to being left without a property, also owes the bank the remaining amount.

I think it depends on the number of forced sales.

When you owe money to the bank, it is not a problem for them, but only for you, when a large borrower or many debtors with smaller amounts owe money, then the bank may have problems.

In addition, what happened in Italy and Spain in 2008 was terrible.

Thousands of people were left homeless and the market in these countries has not yet fully recovered. Prices fell by up to 45 percent

Already happened after GFC. RE Signs ‘banked owned’ everywhere and banks forced to sell as over 500 banks liquidated by Fed.

@KGC Your comment is my question. Since all these structures are currently empty, because price discovery evidently is the last thing ‘they’ want, Who is keeping the cmbs and mbs markets propped up and solvent each and everyday, as we all know each mortgage was sliced and diced and bought up and put into tranches? In other words, who is making good on these payments and keeping this system intact with all these structures empty?

Banks don’t hold residential mortgages on their books in the US. The vast majority of mortgages are originated onto warehouse lines of credit, which are quickly sold into mortgage-backed securities (“BMS”) owned by all types of investors. When a mortgage defaults, it goes through the process of eventually being repossessed and sold for whatever the market will bear and the losses are taken by the diverse set of holders of that particular MBS. While jumbo mortgages are typically held at the bank/originator level, they represent less than 10% of all mortgages.

Greed with no consequences of being greedy.

haha, the whole article above explains very well what the consequences are.

Up to 80 percent loss on investment in office centers.

Aren’t these serious consequences?!

When is the last time a higher banker executive went to jail?

Losing cash is much more painful than jail!

That’s why DEA hit the money of the mafia first and then it itself.

There is nothing criminal about these people being incompetent. Never ceases to amaze me how angry people (normally angry at life types) want to imprison people that screwed up. Any society that locks up people for failure makes others less willing to try.

@ JD:

Ever heard of the infamous “Brampton mortgage” where real estate agents and mortgage underwriters collude to falsify information on mortgage applications?

In Ontario, there was an incident where an expectant mother on welfare died under house arrest, because she was not aware that taking student loans would’ve disqualified her from the system, due to welfare reform laws.

The courts put a pregnant woman on house arrest, and she died during a heatwave. This was in the early 2000s when Ontario literally gave away Highway 407 to a foreign company for pennies on the dollars under a perpetual lease. Canadians get rewarded with high tolls and price gouging.

Meanwhile, the mortgage industry is rife with fraud and insurance scams, and the cops shrug their shoulders.

Agree with Julian.

Also, Losing money by buying at the top is not a jail-able offense, so far as I know.

This quote from nearly 30 years ago is still apt: “ The purpose of a bear market is to return money to its rightful owners.”

— The Trouble With Prosperity

Who takes the loss? The Fed? The taxpayer? Or does it all fall on pensions and insurers? Where the loss occurs will matter a lot.

JeffD

If you read the article you will know who takes the loss

@Julian,

I’m one of the one percent who always reads the articles.

Losing money in real estate isn’t a crime.

I am sad that our country has become a place where there are calls to jail people based off of nothing more than jealousy and hatred.

https://en.m.wikipedia.org/wiki/Chicago_Spire

Chicago spire. It looks like every city has at least one eyesore.

Survival instinct is. Greed is quite another thing and in some circumstances counterproductive to survival. Greed exists because of the lack of recognition that with will much of it could be eliminated.

Hey (A) I have got some office space with your name on it!

Lol

There is mucho irony.

The AI investment craziness boom is all about replacing humans.

So…why would they need lots of CRE?

Only if you believe Facebook and other uninformed people.

AI (like most other tools) will replace the least skilled and help the rest of us be more effective at our jobs.

Every time I hear someone fear mongering about AI, it’s inevitably someone with low skill and often low education/knowledge.

Well, arguably those low e/k persons you identify as fearful might rightfully feel threatened should AI replace them at work and cause their permanent unemployment.

They’ll still need shelter food and clothing. Will the cost of that welfare be offset by AI productivity???

Probably because the “genius” AI’s are making the RE decisions.

Contrarily, it might be that SkyNet plans to destroy us, not through nuclear self-destruction, but through asinine CRE decisions (with big assist from Fed’s version of WOPR computer (called CRAPr) making the ZIRP calls for 20 years).

Mr. Wolf: I do not follow your comment: “…keeps getting worse in nearly every major office market.” I looks like the office availability rate is increasing; i.e., getting better with a better relationship of supply to demand. These are the types of graphs that lower overheated inflation rates; this is exactly what we want to see all over the economy.

This is a devastating situation for CRE investors and creditors, and also for cities that have to deal with nearly empty buildings in central business districts and scattered around elsewhere, and that have to digest the plunge of tax revenues from those buildings whose values have collapsed, and that have to deal with them when they become blight. Tenants, if any, might benefit. But that’s not the topic here.

“…this is exactly what we want to see all over the economy.” yes, if you’re rooting for the Big Collapse of Everything, as some people here are.

If a “big collapse” just rubs out three years of excessive asset inflation encouraged by unsustainable monetary largesse, count me in as one of the people hoping for it. It would transfer wealth from those who got lucky to those who add value in the future.

This is spoken by someone who pushed a few buttons to get into the lucky category. Fairness and merit should be overriding considerations in a sensible economic system. Picking winners (asset holders) and losers (workers and conservative investors) for sake of a avoiding mild recessions seems unfair and counterproductive in the long run.

Hopefully the Fed can encourage asset price deflation without severe impacts onemployment. But do they they even think asset inflation is a problem? I doubt it, based on past actions and pursuit of an illegitimate wealth effect. They wanted artificial asset price appreciation and got it. The hard part is removing it. Takes LOTS of commitment to public service, selflessness, and telling powerful people what they don’t want to hear.

Bobber-

Thanks for making excellent points on:

– Picking winners and losers (via Fed actions)

– Asset bubbles (caused by Fed actions)

– Difficulties of going off monetary stimulants (administered by Fed 2009-2022)

Agree…with qualifications.

It’s not just the Fed. These people all have senior control structures, political influences, cultures, social environments, corporate/financial contacts, personal interests, academic/experience histories…family.

The whole system has drifted off the reservation. As wealth distribution inequities continue to become even more skewed, there is no apparent amelioration, let alone solution, in sight.

The idea that AI could write this article at this time is laughable.

“…this is exactly what we want to see all over the economy.” yes, if you’re rooting for the Big Collapse of Everything, as some people here are.

Last time, consumer debt triggered the recession; this time CRE is front and center.

When President Haley takes over, the government spending is drop.

FWIW, I also intuitively read “worse” and “better” as meaning “cheaper is better”. But it is clear from context that Wolf is writing from the perspective of CRE investors, so the words have the opposite meaning. It took me a few paragraphs to orient myself.

Though yes, in this case the price movements are so extreme that they could cause widespread economic damage, in which case “cheaper” is not necessarily “better”.

Hi Wolf,

Thanks for the summary of the state of the US office space market.

I have no idea how the British market is placed, but I would bet it’s in a similar state.

Best wishes from a frosty but dry England!

One would think there would a corresponding plunge in CRE rents to fill that massive supply of now available empty CRE.

But…nope.

Zbanana, to answer why rent’s haven’t dropped to fill in all the open office space…..

That only happens in ‘free markets’.

Yes, that’s called ‘price discovery’.

But this nanny fed doesn’t like price discovery as evidenced by 2007-2009 then they bot up all those damaged mortgage backed securities at par. Oh my another tool soon to be revealed from that mighty tool box to prop up cmbs! Oh, how special. I can’t wait. Free markets bad/fed good.

And people wonder why such massive inflation recently? You can’t make this up.

2banana

Published figures are “asking rents,” not actual rents that tenants pay, and they don’t include concessions. So we don’t really know what actual rents are doing.

Asking rents don’t collapse with it because it would entail the default of the building on its loans. There is a basic calculation: rents must be high enough at x% occupancy rate to service the debt, pay taxes, insurance, maintenance, etc. So a landlord cannot really drop rents below that because it would put them into default on their mortgages.

Landlords have several options:

1. They offer concessions, including for big improvements, periods of free rent, somewhat lower actual rents (which we don’t have figures for, and they cannot go too low) etc. to bring in or retain tenants. That’s the primary route landlords are taking. But it doesn’t always work.

2. They default and let the lender have the building (landlord loses the investment), and the lender will sell it for cents on the dollar (lender takes loss on the loan), and a new landlord with a lower cost base can fix up the building and offer space at a lower rent. But this takes years.

3. They default and arm-twist the lender into renegotiating the loan (that’s happening a lot now) because lenders don’t want to end up with the building.

BTW, asking rents in SF are down about 14% from the 2019 peak – but they’re still too high. But that hasn’t happened in other markets to that extent. In some markets, asking rents are actually up, but there’s also not a lot of leasing going on, so it’s just theoretical.

With employers’ ‘return to the office’ efforts progressing very slowly in practice, expect these stats to continue getting worse for office landlords as multi-year office leases expire and companies re-evaluate their office space needs.

We no doubt reached peak office space at the beginning of the pandemic. Since then, commercial construction’s focus has shifted to multifamily units. However, there are only so many rental apartments you can build before you totally saturate that market as well.

Two weeks to break curve…

That’s a difficult call. All the apartment dwellers would have to live remotely somewhere else.

The new normal is hybrid telework. A couple days a week or even a month in the office. Some occupations of work must always go in to work, but office jobs are typically not those kind of occupations.

My company rented office space in Silicon Valley for over a decade. It was definitely not prime office space. During that time, the landlord raised rental rates every year. During lease negotiations, the landlord’s attitude was take it or leave it. I accepted the constant rent increases as the effect of supply and demand. What I found strange was the landlord’s continued rent rate increases over the past three years. This year we just shut down the office after another proposed rent increase. Any insights to the landlord’s attitude? It’s too easy to say “stupidity and greed.” The landlord uses a building management company, surely they must know the market. Under what scenario is no rent better than lower rent?

Here are a couple of guesses:

1. The landlord has a variable rate mortgage that went from 3% to 7% or similar over the past three years, and wasn’t hedged or not hedged enough to deal with it, and either has to raise rents or default on the mortgage and let the building go back to lenders. This is currently a common situation in CRE.

2. Another common situation is that the term of the 3% interest-only mortgage is coming up, and it needs to be refinanced with a 7% mortgage, and only higher rents would make that work. If it cannot be refinanced, the building will go into repayment default.

These higher interest rates have thrown CRE into turmoil after years of interest-rate repression. I covered these variable rate mortgages here last June:

https://wolfstreet.com/2023/06/28/revenge-of-the-variable-rate-commercial-debts/

Thank you.

Wolf, those (good) guesses are reported on in my newspaper; 17 November 2023:

“Though office workers are steadily returning to their desks, there’s growing unease across the metro about what will happen when billions of dollars in office building loans come due in the next couple years. In the Twin Cities, that’s forcing many owners to buy time with loan extensions and modifications aimed at riding out the worst of today’s commercial credit crunch.”

“Unlike home buyers who typically purchase with 30-year mortgages, short-term loans — typically five years or fewer — finance most office buildings, and many have floating rates.”

I wonder if there are any homeless tents cropping up on the office foundation shown in Wolf’s photo.

There is a big fence around the site, and they have security inside that accosted me when I took the photos.

I like it. the ruined, abandoned, non building has workers, paid for by someone? I guess the bank?

Paid for by the creditors that seized the property, I assume (investors, not banks).

It could be an invite only skate board park. It would be like Mavericks is to surfers, for super hard core only. Plus, unlike Mavericks, you could actually see them get injured or die. X-sport.

Guaranteed LARGE TV audience. Super high 30sec advertising costs might even recoup $$$$s. Bag holders wouldn’t care.

This and other stories of what turned out to be abject lunacy by those who are/were supposed to be at the tippy top of their games, calls to mind one of my favorite quotes from “Mary Poppins” (scene when the women are marching around the living room in support of suffrage)…

“… while I adore men individually, I do agree that, as a group, they’re rather stupid.”

(As another movie – “:Grand Canyon” – stated “All of life’s questions are answered in the movies.”)

Off topic here:

U.S. men love war. Can’t get enough of it. U.S. women not so much. For 225 years since 1776, the U.S. has been at war.

The women’s movement of early 20th century culminated into 19th Amendment in 1920, but did not have a corresponding anti-war movement leading up to / during WWI.

Likewise at that time the Brit women participated in the psyop of The White Feather propaganda.

Perhaps the men in charge of upholding imperialism and the economic system enjoy war. The mostly poor and disadvantaged that fight in them so not. My dad, who fought in Korea spent his whole life ensuring that I would never have to be drafted, which meant college and education.

@DS: The folks who make the rules are not stupid even if it seems that way. All the folks at the top are playing with other people’s money…and pulling out as much as they can into their personal accounts – by way of huge salaries, commissions, bonuses, etc.

They have also built too-big-to-fail banks and financial institutions. Witness the clout of BlackRock, JP Morgan Chase, etc. and billionaires like Ackman, Koch Bros, and the deceased Sheldon. These institutions and billionaires can literally write their own rules. Why would they write rules that are in the common interest?

The Golden Rule: One Who Has the Gold Makes the Rules.

Greed, yes. Narcissm, Yes. Selfishness, Yes.

But there is no stupidity.

History is full of examples of revolutions and overthrows of existing systems. The time will eventually come but things are far to good in Western “democracies” for that. Unfortunately the pain suffered has to reach a point where there no alternate and of course in the US have to realize the choice between political parties is a choice between disaster and catastrophe. The evolution of a political system into the illusion of choice is the leaders greatest coup.

Glen-

Fair enough. Our political system is frayed, and lineage of blame is difficult to follow. Perhaps revolution is on the way.

In that case, best to follow the wisdom of Stanislaw Lec:

“When smashing monuments, save the pedestals, they come in handy.”

Respectfully

If you know political parties are corporations and monopolies too, it is easier to understand they don’t represent the voters, they represent their customers, the donors. Keep that in mind this year.

“Choice is an illusion created by those with power for those who have none” -from The Matrix

Can you connect the dots: Who’s taking the haircut?

I imagine that all of the debt for these projects has been collateralized. Whose pocket, ultimately, is getting picked?

Most of the blown-up office debt so far has been in CMBS, mortgage REITs, CLOs, PE firms, and other investor-held instruments. Most of these investors are pension funds, insurers, bond funds, etc. Some of the debt is held by banks, and they have taken some losses, but not nearly as much as investors. Seems that banks sold the riskiest worst mortgages to investors by securitizing them or by selling them directly to mortgage REITs, PE firms, etc. So this pain is spread fairly thinly far and wide.

Affected landlords are losing their investments in the buildings.

Well now that I cut off my little toe in the water for REITs to take a tax loss, it will surelyl take off again! I gotta stop listening to those pundits lol.

Isn’t this the very hallmark of a bubble, when people buy something, not because they need it, but due to Fear Of Missing Out (FOMO)?

You’ve got it!

What’s going to happen in the residential RE sector when rates begin to come down more and the Big companies holding inventory begin to unload and flood market with available homes for sale? Still waiting on residential RE market bubble to pop.

Interest rates will be going up, and not coming down at all.

@socalbeachdude, interest rates cannot go up because the dow might slip below 35,000 causing jimmy cramer to tell the fed how to do its job again on tv, creating a crying of all the wallstreet shills on cnbs. That certainly won’t be allowed. No, its best cre remains empty, and the dow continues its upward climb to the moon alice! What people do not know cannot hurt them, so they believe….

I believe what Wolf described in CRE is happening now in SFR construction, with the big landlords buying up entire developments for rentals. I don’t think those renters will materialize. There are towns now with hundreds of these homes on the rental market and still empty.

@Petunia: If what you are saying is accurate about homes being empty, that can be extrapolated to an extreme question: Can what is happening in China with their real estate collapse (Evergrande, etc.) happen here in the US?

It is already happening in certain places. SF has a new rental building across the street from a Google Building that has a big vacancy rate. The value of the building is now less than the loan.

I also saw a recent video ad for a condo building in Austin, which I had seen during the summer, prices were down $300K across the board, from $800K – 1.3M to now $500K – 1M. That’s a big drop for a “booming” job and real estate market.

“I don’t think those renters will materialize. There are towns now with hundreds of these homes on the rental market and still empty.”

But remember, real estate is local. While this may be true, in other areas there are wait lists for apartments.

I don’t see residential rents coming down anytime soon.

Rents are coming down in Austin along with tech salaries. I have been watching for a long time now.

You may believe that, but it doesn’t make it true.

Wolf has posted many times on this site the amfact that corporate owned single family housing is miniscule. It is a boogeyman.

JimL,

Over the entire country the impact of mega landlords is not large. Unfortunately, they congregate their purchases in specific areas where their impact is tremendous, both economically and politically.

When I lived in FL they bought almost every single nice home that got foreclosed in my town. This made them one of the most powerful owners in the town because they paid local taxes to the town at a rate higher than “homesteaded” owners. They also bankrolled the election of a sheriff to insure they got fast evictions when needed. My impression at the time was the county commissioners were also taking donations.

And the CMBS refi keeps resetting and probably renegotiated. I doubt banks want to foreclose and take on the building taxes and overhead if the rent does not cover the fixed costs. Soft landing in my mind means softening inflation, margins, and eventually a drop in rates which I think will trigger the drop in asset prices further as economy contracts.

There is a demand for Chicago office buildings to be converted to residential.

Howdy Shiloh 1 Govern ment could easily subsidize office building renovations to residential.

As has often been said here, it’s not as easy as one might think to modify an office building to residential. Plumbing/sanitation is often inadequate as is wiring and other considerations.

Depends on the building. My cousins used to have units in an old pencil factory converted to condos in Chicago. Roscoe Village. Nice place with massive ceilings and concrete columns and walls. Was quiet minus the train running nearby every once in a while lol.

The key is “old pencil factory”. Many of the modern office buildings are skeleton buildings which, unlike the pencil factory, are not built to last. The pencil factory was likely two or three stories, built from brick (because Chicago and that’s what they did back then), and that size building didn’t yield 1,000 condos/apartments.

We live in a what was once a small semi-rural area with a Snotsdale, AZ zip code. Our water and sanitation infrastructure was once suitable for the population density. The money grubbers have discovered “the beauty” of the area and are hell bent to destroy it (Troll Brothers is the lead pony). As a result, the once adequate infrastructure is barely capable of handling what’s being thrown at it now and, with the proposal of another @1,000 “luxury” homes and a commercial plaza, will definitely be overwhelmed. (I can’t wait until the buyers of these new homes realize that they’re downwind of the horse breeders / cattle ranches that get pretty ripe when in use).

The same would happen in the cities if those office buildings were converted to residential. Commercial buildings don’t contribute as much effluent nor consume as much water as residential. It’s not just the building that can’t handle it… it’s what’s under the streets as well.

Demand from whom? Freeloaders?

“Played to perfection” in San Fran — a fine phrase, making homage, I guess, to the nifty concept of “unintended consequences.” That’s with a tip of the hat for the latter term, to sociologist Robert Merton (not his son Robert C. Merton the finance genius, who got in his own mess-ups, having been on the board of the ill-fated Long Term Capital Management). Robert the senior, I think, also coined the phrase “self-fulfilling prophecy.” Apropos to all these Mertons and ourselves, humans (sometimes amusingly for some other humans, as Wolf alludes to) anchor to narratives and are dazzled by “futuristic” visions. The smarter (if less ethically squeamish) ones deploy other peoples’ money in those directions, having also extracted their fees up front, and bought their tickets out of town. The less bright ones wallow in their momentary victories even as the clouds loom up, and for some of us, are the most fun to watch.

and they say there is no place to put the homeless?

Yes, they could be used that way.

But given the fact that so many of the homeless are addicts and/or mentally ill, they’re going to need lots of supervision. And those aren’t the kind of jobs that sane people are lining up to take.

@LPM, evidently it depends on the homeless… You see iam reading the illegal homeless that are bussed are finding no problems finding shelter from the cold. It appears one has to become illegal for the government to help one out….but then again, that’s what i’m reading…and you can’t believe everything you read.

Wolf,

So when does all this come crashing down as hard to see a real recovery in many of the markets? I assume all these places have significant debt and of course other costs whether full or empty. There is a knock on effect as well to local economys and governments as well.

In your judgment, what was the magnitude, if there was any, of the new office projects kicked off in 2019, and what part of this new glut do those that have not been cancelled, represent now? Any notable projects yet to come to market?

Whole thing seems like a perfect storm scenario

“office shortage” … “housing shortage”

Funny how there’s only a ‘fundamental shortage’ when rates are low and assets are awash in cheaply-borrowed money, but as soon as rates rise those same assets crash. It’s almost like those bubbles weren’t built on fundamentals at all.

This will also be housing’s fate soon.

It isn’t clear to me that the housing sector will crash, at least based on what we see now. 30 year mortgages ensure that to some degree and at this point the economy is chugging along. It will be interesting to see what does evolve out of this however but likely something that is impossible to predict at this point. Even if the housing market had a significant correction it would still have high asset prices in many areas. The real challenge at this point seems to be the obvious entry point challenge for new home buyers. Perhaps this will result in the way we design and build things as is already happening or perhaps other shifts occur.

Winter is coming. Unemployment is coming. That in my opinion is the looming cause of a housing breakdown.

When? There are trillions of dollars still sloshing arount in short term money accounds. It’s hard to get one’s head around the magnitude of money that was dumped into the economy in the span of about one year.

It’s very uncertain, but if Powell chooses to support current RE prices, I imagine there will be significant migration across regions, from high cost to low cost. Realtor comments and price movements are already confirming this shift. We may be in the early innings of that. Plus with Chinese wealth taking hits, that should have some impact in certain preferred areas like the West Coast.

Young families with kids are generally locked out of West Coast markets right now, without support from wealthy parents. The condos won’t work for them. The exception are young families with more than $300k income. Nurses, clerks, teachers, and government workers? Forget about it. They might squeeze by if they don’t mind financial stress, poor school districts, and living in a trailer-type residence. But they can live like kings in the Midwest and South. Wolf says Oklahoma is nice.

It’s a sad state of affairs when families are uprooted to please RE investors and speculators.

That used to be true in Texas. I actually bought a nice little house in 1995 for $30,000. You never saw a homeless person back then and almost everyone could easily afford a house. Those days are long gone and now the place is a dystopian nightmare. The best bet for a young family now is to leave the country entirely.

I kinda like the concept. Keep our prices sky high here in Denver metro until 25% of new population leaves. Free up highways, water & infrastructure.

The writing is on the wall for CA. Budget deficits, or more accurately balancing the budget will get more and more difficult. Already they are using accounting tricks. CA makes it because of high wage earners combined with significant capital gains which are treated as ordinary income. I doubt I will retire here but right now house is paid off and solidly employed.

Proposed but won’t be built until the smaller units are completed and occupied.

Come to OKC,OK

“The Boardwalk at Bricktown skyscraper will be the second-tallest building in the USA, as well as the second-tallest in the entire Western HemisphereAO”

“

It will reach a considerable height of 1,750 ft (533.4 m). To put this into perspective, this is just 26 ft (almost 8 m) short of the USA’s current tallest building, the One World Trade Center, which stands at the symbolic height of 1,776 ft“

Primary use of the building will be residential .

Assuming the FED engineered asset price inflation, including residential real estate, one must wonder if the purpose might be to increase the divide between halves and have nots, thereby distancing themselves from the mess they created?

Unlikely.

The AirB&B wannabes who missed out on the last chance to screw their first time homebuyer kids will jump at the second chance should single family housing prices decline with interest rates.

I hope that housing crashes for the benefit of the younger generations.

Housing crash would hurt me as I own few homes in San Diego but I think country desperately needs it .

A lot of people though the same about J

Hb1 may be this time is different.

One thin i can tell you is this.. affordability is worst.

You can help things along by selling…

That’s been my argument, and I’m sticking with it. The problem might be “unfixable” because tax policy acts as a forcing function for investor hoarding. No amount of construction can change that.

Off topic, but could the expiration of the BTFP in March have any effect on bank’s interest rates paid to CD buyers, depositors, etc.?

Probably not. If anything, it might push those banks that rely on the BTFP for funding to offer more attractive rates to depositors to replace the BTFP funding.

In the historic capital Kraków in Poland, there was a construction project started just prior to the fall of communism, today decades later it still looks a little bit like the picture in this article 😆, meanwhile the rest of the city has been renovated and modernized into a very beautiful city, the eye sore remains. I’m sure San Francisco will sort these things out a bit quicker(hopefully) than that but it was the first thing that popped into my mind when I saw the pic from SF circa 2021 😆.

.. somehow I posted my story as a reply to this when I meant to do a new thread. Sorry.

Once again the irrational anarchy of capitalism on display…

Matthew Scott-

Are you suggesting that the use of central price-boards, rationing, more public works projects, and redistribution of wealth would be a less “irrational,” and a more effective system?

Or am I misreading your short comment…?

Respectfully.

Too many folks believe that the heavily manipulated, and bastardized markets are somehow “capitalism at work”. There is little capitalism left that is unspoiled by the hand of massive Gov, trying to pick and choose winners and losers mostly based upon their political support.

That is a very ideological statement that has little to do with reality.

In the real world, people in the U.S. get rich or go bust based on their own actions. Always have and still do.

What has cropped up recently is a whole industry the extremely wealthy use to take advantage of the losers by making them feel like it isn’t their fault. It must be some one else’s fault like the FED or the Mexicans or such.

I don’t know of a single Fortune 500 worker who’s been able to work remotely 100% of the time since COVID stabilized around 2022, except for a very select few who were originally hired as remote since before COVID.

The stricter employers (Goldman, Apple, Tesla, etc.) mandate a certain number of office days per week. The looser employers don’t have specific recurring mandates but teams will still be called to the office every so often for collaboration. When my manager asks me to show up in-person on , I have to go.

Maybe startups have greater flexibility, but their workforces are much smaller than F500.

So I’m not sure where all these office vacancies are coming from. Maybe for San Francisco, some employers relocated to lower-cost locations. But all the evidence I’ve seen suggests offices aren’t obsolete yet.

For those of you with 100% WFH jobs, do you mind sharing your employer’s name?

Those offices were never used to begin with. They were leased for the future, to grow into, and to keep someone else from grabbing them — that’s the big theme in the article, supported by quotes from 2019, when this was in effect.

Yes I read the article but it’s hard to believe preemptive grabs + relocations accounted for that much empty office space.

My son is WFH for years now. Roper Tech/ Vertifore.

Son in law does go into the office periodically in the South Bay area now with a pharm co.

I can’t share my employers name for security reasons, but I’m at a mid-sized organization and have been 100% remote since the pandemic. Before my current employer I worked for a software startup and a mid-sized company and was also WFH.

The big fortune 500 companies that make noise about demanding a RTO/RTP (return to office/return to the past) get the attention, but consider that most job creation does not come from the Fortune 500. It comes from small businesses.

I work for fortune 100 company and we are mandated to return to office 3 days a week at least.

The permanent office space has been taken away and given temporarily space on demand basis.

Bottomline.. office space needed has been greatly reduced.

I have a son in law that works full time from home. One of my grandsons works full time from home. Two of my granddaughters work full time from home.

They are all adamant about not returning to the office and are good enough at what they do that the companies they work for accommodate them.

I work for one of the (few & large) Canadian banks and I am 100% WFH.

Would love to see this SF Oceanwide development completed. Time all us WS readers form a spac and get the job done.But getting two WS readers to agree on anything is near impossible… I continue to dream.

The CRE Bank blowup seems inevitable. I assume the government will try some sort of bailout based on previous actions.

So I know there is logistics issues with converting office spaces but how about the government buys all this empty office space and turns it into ultra low cost or free housing options.

Kinda ironic to me that we have nearly 40% vacancy in San Fran in these giant buildings and also exploding homeless populations.

I’m sure if (a big if) CRE / CMBS defaults ever become a large-enough problem to take down the economy, the Federal Reserve will instantly step in with another one of their Section 13 alphabet-soup programs to buy up every toxic asset in sight.

They did that with JUNK BONDS during covid. Junk bonds, a fundamental pillar to economic stability. 🤡 They also bought out the exact same municipal bonds that certain FOMC governors just coincidentally happened to be invested in.

@Jackson. That was very thoughtful of the fed you know to do all that for their Brothern.

@Jackson. Not only will the fed most likely buy back every toxic asset, if CRE becomes a big problem, but the fed will buy back every toxic asset at PAR. Which means the previous bag holder gets too re-up with another bet on the feds dime. Now thats what i call a team player!

No it won’t because:

1. It just won’t, you’re goofball-day-dreaming.

2. It won’t because INVESTORS are on the hook for most of the defaulted stuff, not banks. Banks sold this stuff to investors, by securitizing the debts into CMBS and CLOs and selling them to huge global investors, such as pension funds, bond funds, insurers, etc. Other investors that hold this debt are mortgage REITs, PE firms, hedge funds, distressed debt funds, etc. And those investors, just take their losses and go on. Many of them are in other countries. And the Fed doesn’t give a hoot about that or them. For the Fed, it’s all about the US banks. But office CRE isn’t going to take down the US banking system because US banks don’t hold relatively little of the office CRE debt. All the big defaulted debts so far with big losses were debts that investors held, not banks.

@american dream. I like that moniker. I was always a big Dusty Rhodes wrestling fan! But on another note if government gets all that empty CRE, doesn’t that give us a look of being in the USSA? Capice? Just sayin, that ain’t gonna happen.

The tech companies in Seattle don’t want to settle for a building that is older. They abandoned the old stuff and built new stuff. This explains the high vacancy rate. Microsoft tore down its entire main campus to rebuild a new one.

These same tech companies claim to be environmentally friendly. Not sure about that. Lots of wasted buildings sitting around or nice buildings destroyed prematurely. I’d love to see the numbers.

I know there’s other sides to it, such as need to make money and efficient use of space. Regardless, I cringe every time I see a nice office building get torn down, or nice-looking functional kitchens get town out on HDTV, just because they are not the “latest and greatest.”

To each his own I guess. Some like to conserve. Some like to throw things away. Easy money facilitates purchases and a throw-away mentality, so maybe people are just following the incentives our fiscal and monetary authorities put in place.

Great post. Billions invested, nowhere but up, what could possibly go wrong? To the moon!!!

And then a black swan event. Wow.

Some incredibly sobering numbers here that you’ve shared, and all in one place! Thank you.

Some perspective on CRE, specifically, office cre:

Office space is ~20% of commercial real estate. Office space is less than multifamily cre, which is larger by a small margin = $3.8T vs office re at $3.2T. Total commercial real estate is ~$20.7T.

According to the Federal Reserve’s Z.1 Financial Accounts for the United States Report (2023, Q1), total “assets” for the U.S. stood at $269T. All of commercial real estate is ~7.7% of assets with office cre ~1.1%.

And, not all of office cre is approaching default.

Finally, a guy from a financial institution comes out and says what Wolf has been saying for months:

On Bloomberg: Sticky US Inflation Will Wrongfoot Fed Rate Bets, Hildebrand Says”

He makes the same points as Wolf that prices of goods have been coming down but services inflation will be stickier due to increased wages. So the mainstream rah-rahs may be making the wrong bets in terms of pricing in 5-6-7 interest rates cuts this year.

Wolf is so far ahead of this guy. And light years ahead of the mainstream unless the mainstream just thinks they can make the Fed do what they want.

And, to be honest, they very well can twist the Fed…unless inflation retains its iron tentacles squeeze around the Fed’s cajones.

Houston recovered.

LOL, not “recovered,” but made the first baby steps toward less horrible, as explained in the article in greater detail.

The CMBS default rates in Houston on office mortgages are amid the highest in the nation.

Houston has been overbuilt for many years. However, using the three points in time you referenced, Houston is faring better than the other listed cities showing more improvement in their economy in comparison. I’m a glass half full kind of guy. You have to start somewhere.

Yes, RTGDFA. Especially the section about Houston, the oil and gas business and the petrochemical business.

Semi-sarcastic question: if office vacancies are so high, why is there still so much traffic at rush hour??

Part of it could be the proliferation of after-school functions for kids, which are also business opportunities for paid coaches, instructors and program administrators, both private and public.

I see it happening because I have kids. I know many parents that drive for hours during rush hour carting kids from here to there. It wasn’t always that way. In addition, I sense more parents are driving their kids to/from school for whatever reason. The lineup of cars surrounding any elementary or middle school is incredible in the morning and afternoon.

Take a look around during rush hour. Lots of vehicles have kids in the back, playing with their tablets and phones.

I often wonder the same, especially since the peak traffic is earlier than what would suggest an 8 hour (+1 hr for lunch) work day. Part of it is that Americans just don’t work that many hours, despite the media b.s. saying they do. The other part is a huge proportion are construction related, and they tend to yabbdabbadoo at 3:00:01….

Lots of consumer STUFF being home-delivered by a vast quantity and array of vehicles.

Because those offices were vacant in 2019 and before. They didn’t become vacant. They were never used. RTGDFA.

I find it ironic that all these so-called tech “visionaries” missed one of the biggest technologically-driven trends of the past 3 decades, the rise of remote work.

I guess they were too busy counting their stock options to pay attention to their own workforce.

When you have that much money , but then you don’t . We don’t have a market , we have a casino that’s my take anyway

The market is just a tool. Some choose to use it as a casino to meet their immediategamblong fix, others use it when it suit them to find good deals.

Just because others use it as a casino does not mean you need to use it that way.

Just because someone can get instantaneous bid and ask prices on a security does not mean they have to pay attention to them.

I wonder if Spirit Halloween will adjust their business model and start using office space of they can get it cheap enough.

The graph mentions Orange County. Irvine Company has apparently noticed:

https://therealdeal.com/la/2024/01/03/irvine-company-replaces-plans-for-oc-offices-with-homes/