Rate-Cut Mania died, mortgage rates re-jumped to 7.5% today, but here’s what home prices did during Rate-Cut Mania.

By Wolf Richter for WOLF STREET.

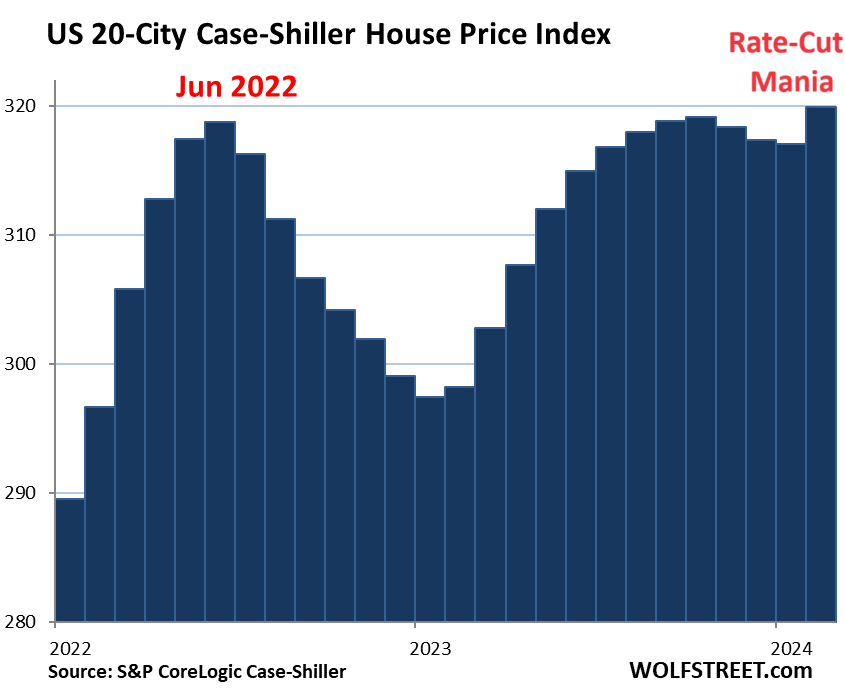

The brief and now bygone era of Rate-Cut Mania. Today’s S&P CoreLogic Case-Shiller Home Price Index, dubbed “February,” is a three-month moving average of home prices whose sales were entered into public records in December, January, and February. Today’s data therefore reflects Rate-Cut Mania that lasted from the beginning of November until February 13, when the Consumer Price Index showed with brutal frankness that inflation was rearing its ugly head again.

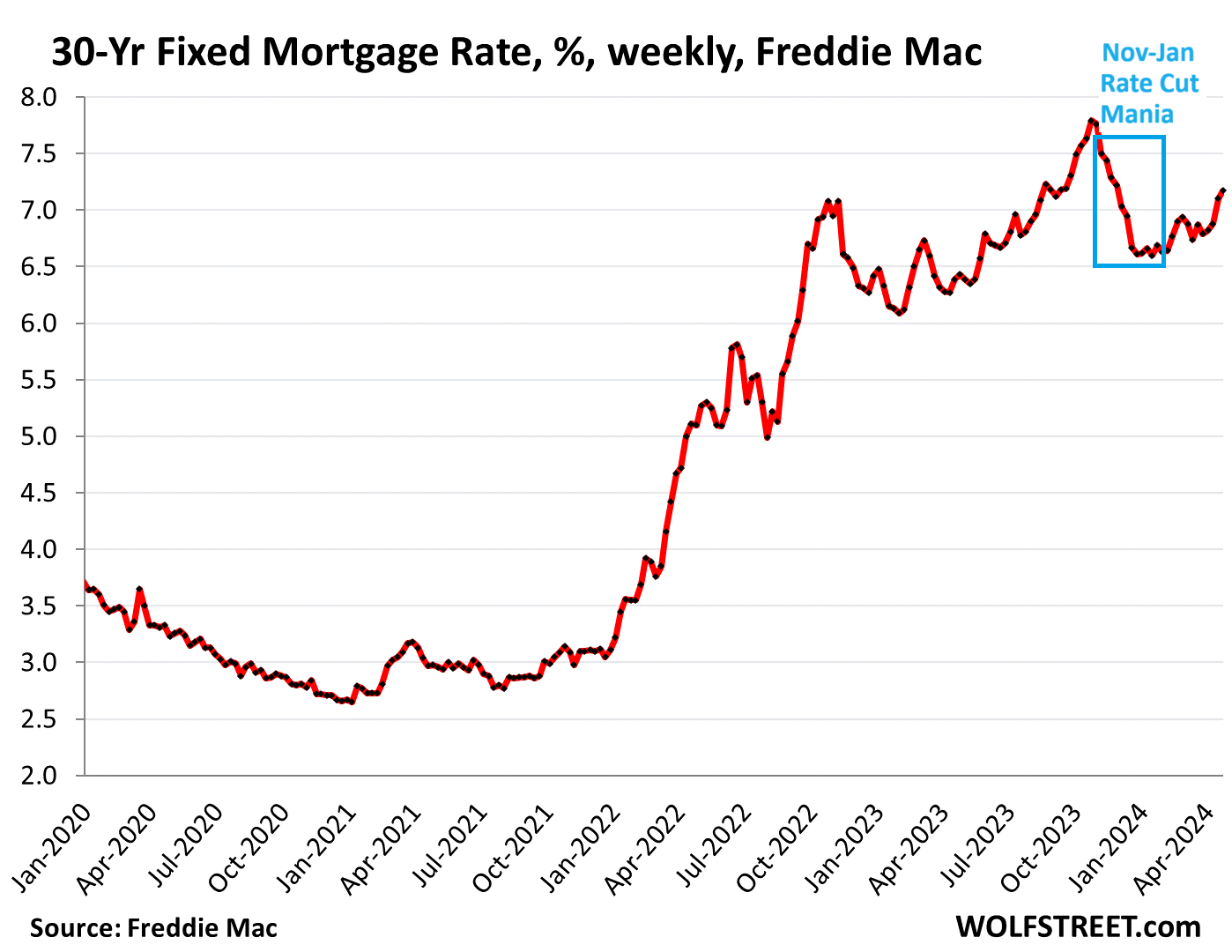

During Rate-Cut Mania, the average 30-year fixed mortgage rate plunged from 7.8% at the end of October to the 6.6% range through February 13. That’s when the CPI report ended Rate-Cut Mania, and mortgage rates began to rise again, as Fed heads fanned out to explain with that patience of the exasperated that the six rate cuts markets were seeing for 2024 were delusional. And inflation has gotten worse every month since then. Rate-cut hopes for 2024 got dialed back bit by bit, and by now, a no-rate-cuts-in-2024 scenario has cropped up.

The daily measure of 30-year fixed mortgage rates by Mortgage News Daily rose to 7.51% today. The weekly measure by Freddie Mac last week rose to 7.17%. What the Case-Shiller Home Price Index reported today occurred in the blue box:

0.4% higher than in June 2022. Today’s Case-Shiller Home Price Index for the 20 metros it covers jumped by 0.9% in the December-through-February period from the November-through-January period, eking out a new high, by being 0.4% higher than in June 2022. In the year-over-year comparison to the trough a year ago, the index rose 7.3%:

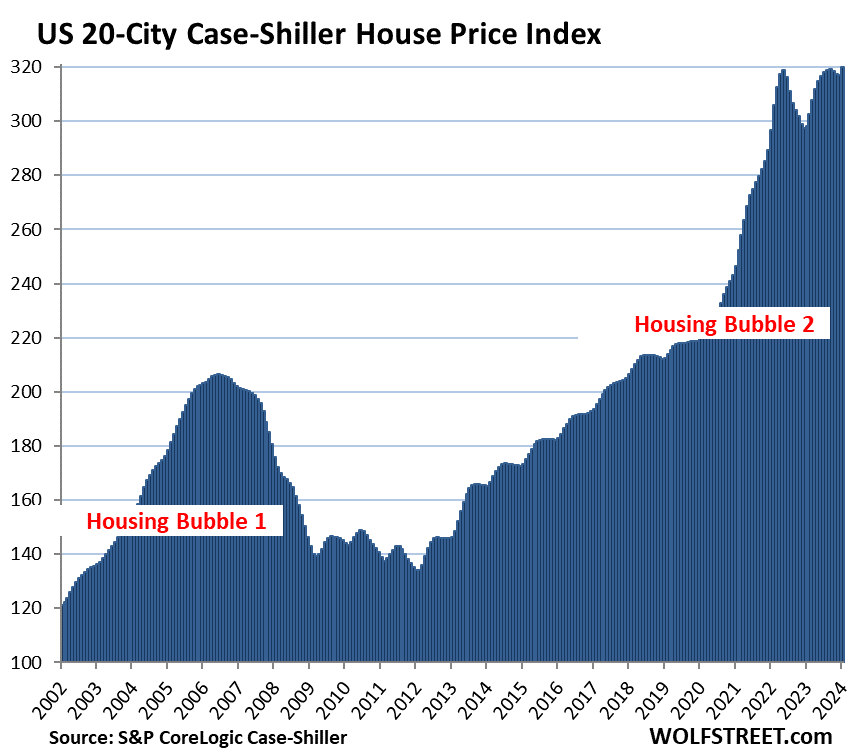

The long view of the 20-Cities Index depicts the mind-blowing surge through June 2022, the bizarre non-seasonal double top that has never occurred in the history of the index, with the first top in June 2022 and the second top in October 2023, and now this Rate-Cut Mania thingy:

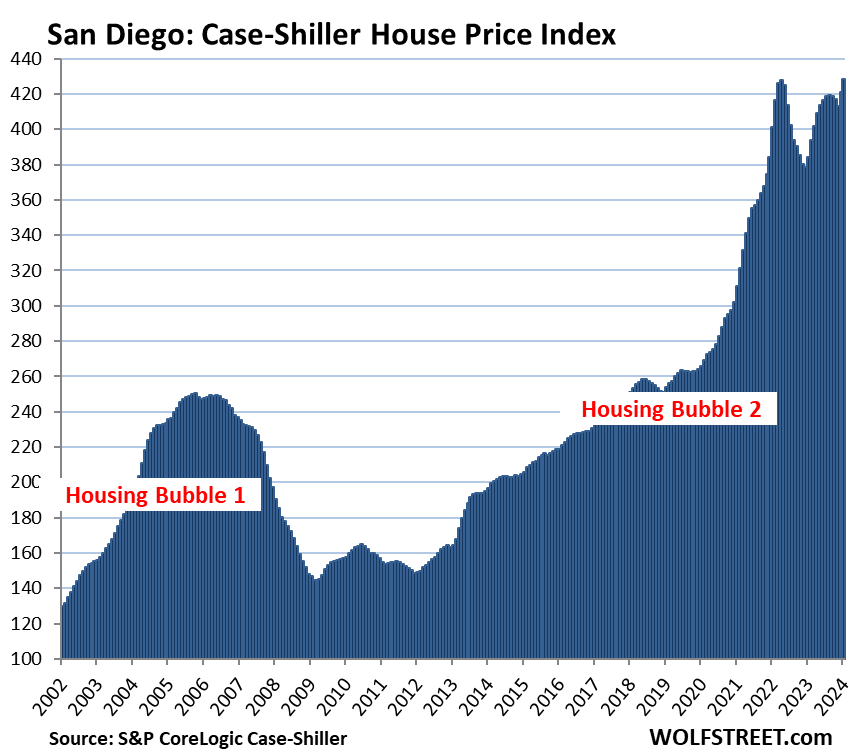

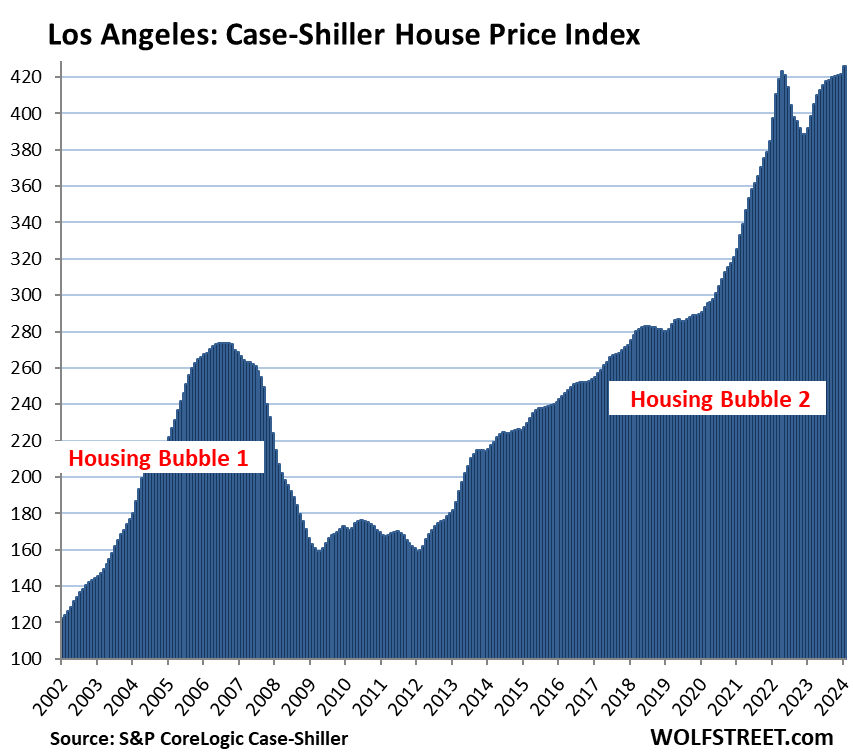

Prices were below their 2022 peaks in 7 metros, of the 20 in the Case-Shiller index. Two metros that had been on this list surpassed their 2022 high by a hair and thereby came off this below-2022-peak list: San Diego, 0.1% higher than May 2022; and Los Angeles, 0.7% higher than May 2022.

The list shows the 7 metros, of the 20 in the index, that were below their respective peak in 2022 (month of peak):

- San Francisco Bay Area: -12% (May 2022)

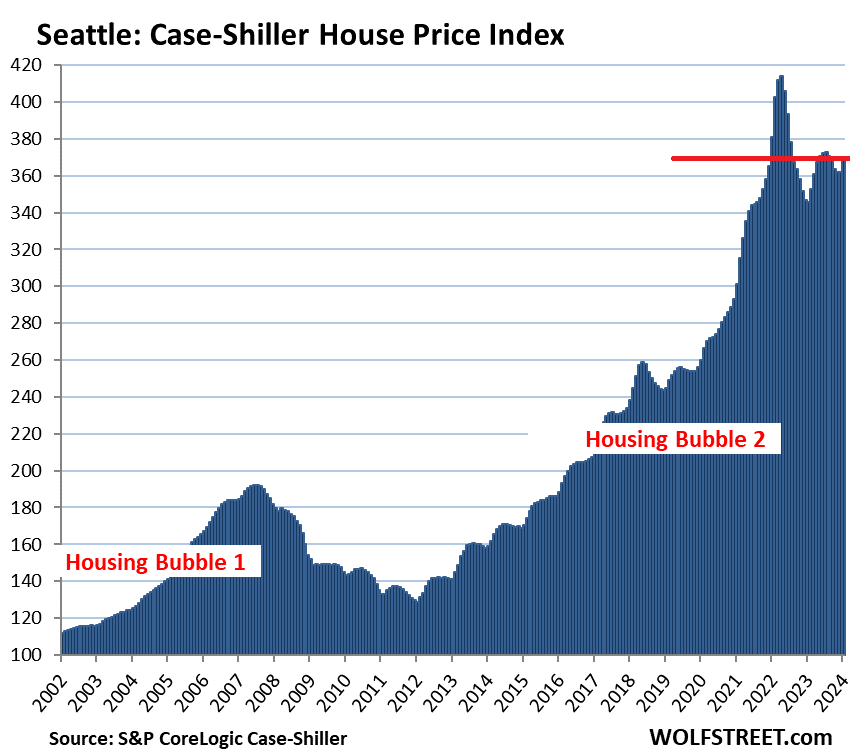

- Seattle: -10.6% (May 2022)

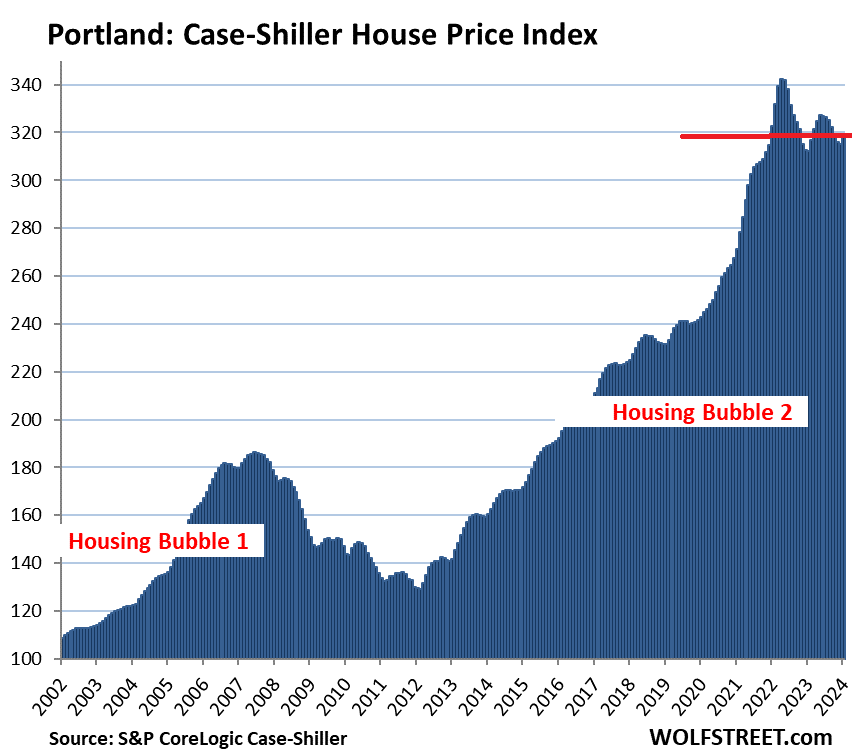

- Portland: -6.8% (May 2022)

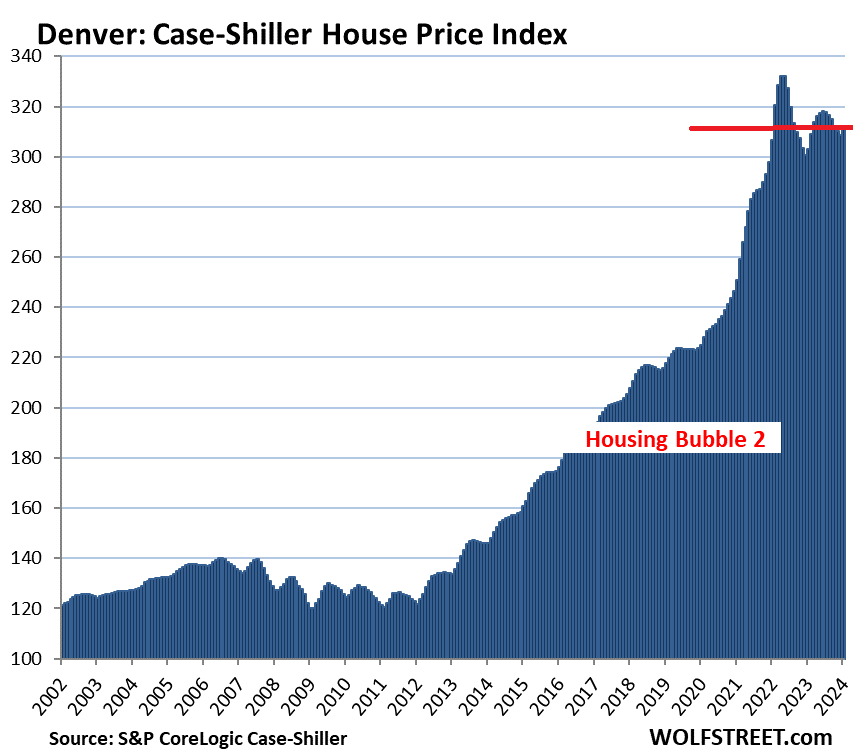

- Denver: -6.3% (May 2022)

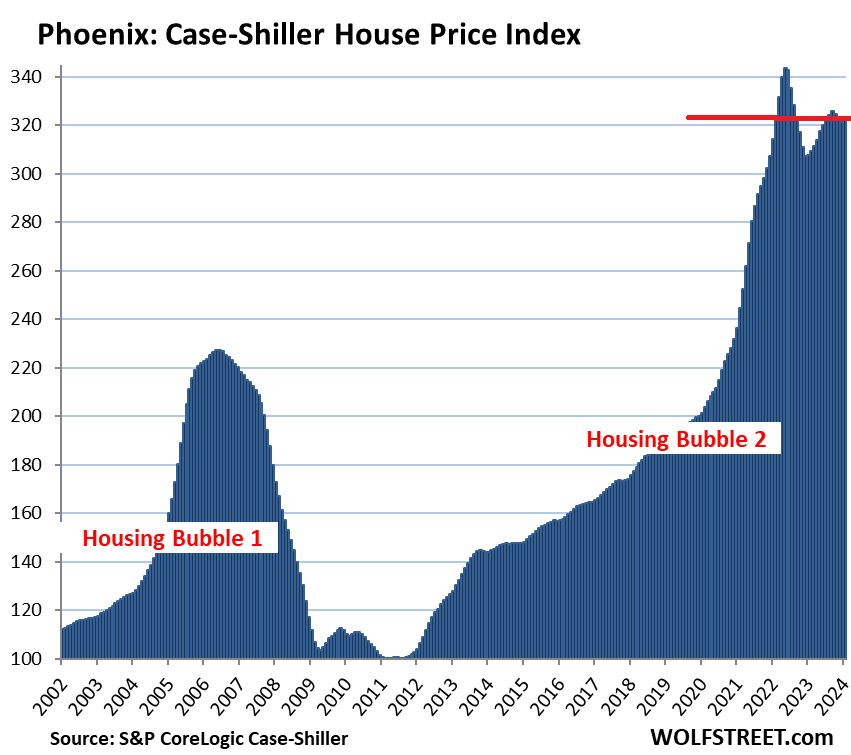

- Phoenix: -6.0% (June 2022)

- Dallas: -5.3% (June 2022)

- Las Vegas: -4.5% (July 2022)

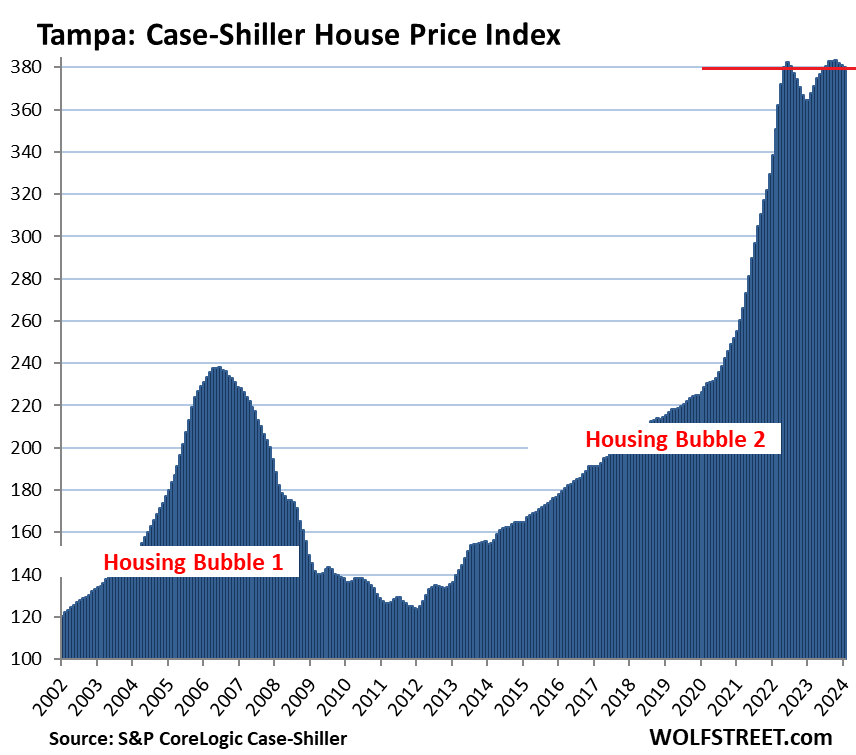

Month-to-month: The only two metros, of the 20 in the index, that had a month-to-month decline were Tampa and Cleveland. Miami was about flat for the month.

The remaining cities had month-to-month increases, some of them big ones. The biggest month-to-month increase occurred in Seattle (+2.3%), which left it 10.6% below its May 2022 peak.

The most splendid housing bubbles by metro.

San Francisco Bay Area single family houses: the San Francisco metro in the Case-Shiller Index covers a five-county portion of the nine-county Bay Area (San Francisco, San Mateo, Contra Costa, Alameda, and Marin).

- Month to month: +1.7%

- Year over year: +5.7%. From two years ago: -5.5%

- From the peak in May 2022: -12.0%.

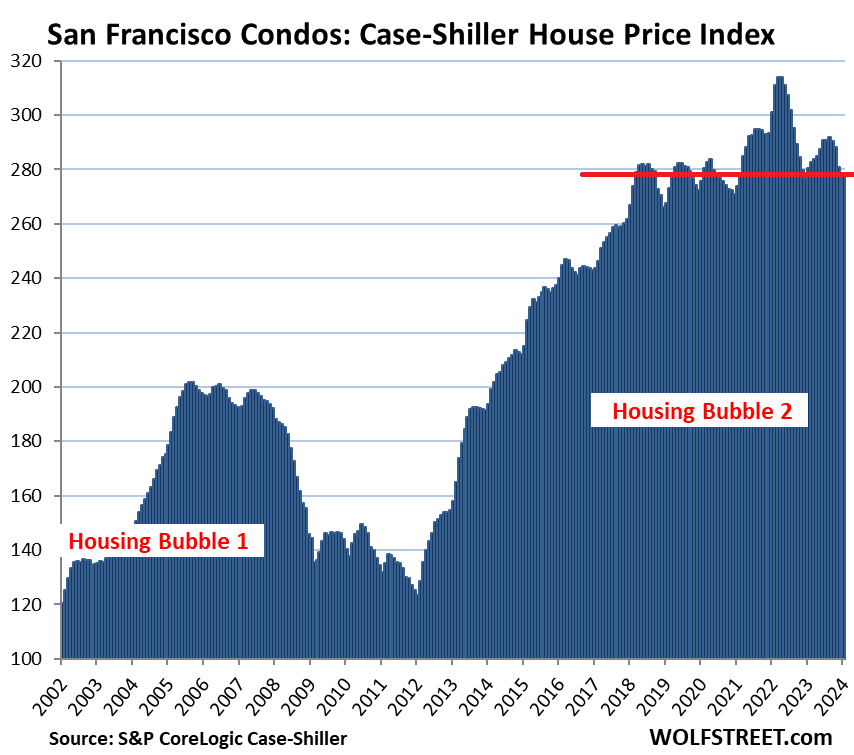

San Francisco Bay Area condos: Condos are a big part of the market in the Bay Area. In San Francisco itself, they dominate the market (data for a five-county portion of the Bay Area).

- Month to month: +0.2%.

- Year over year: -1.0%. From 2 years ago: -7.8%.

- From the peak in May 2022: -11.5%.

- Back to April 2018.

Seattle metro:

- Month to month: +2.3%.

- Year over year: +7.1%. From two years ago: -2.9%.

- From the peak in May 2022: -10.6%.

Portland metro:

- Month to month: +1.2%.

- Year over year: +2.2%. From two years ago: -1.2%

- From the peak in May 2022: -6.8%.

Las Vegas metro:

- Month to month: +0.6%.

- Year over year: +7.3%.

- From the peak in July 2022: -4.4%.

Denver metro:

- Month to month: +0.9%.

- Year over year: +2.7%.

- From the peak in May 2022: -6.3%.

Phoenix metro:

- Month to month: +0.5%.

- Year over year: +4.9%.

- From the peak in June 2022: -6.0%.

Dallas metro:

- Month to month: +0.6%.

- Year over year: +3.5%.

- From the peak in June 2022: -5.3%.

San Diego metro:

- Month to month: +1.7%.

- Year over year: +11.4%.

- Now 0.1% above the prior high in May 2022.

Los Angeles metro

- Month to month: +1.1%.

- Year over year: +8.7%.

- Now 0.7% above the prior high in May 2022.

Tampa metro:

- Month to month: -0.3%, back to May 2022.

- Year over year: +4.3%.

- From high in November 2023: -0.8%.

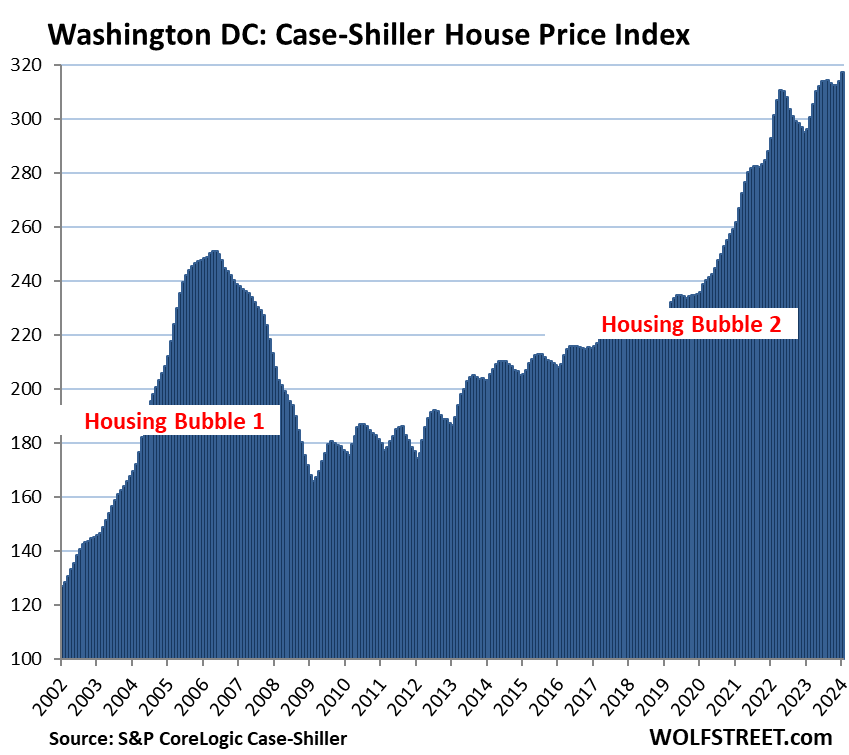

Washington D.C. metro:

- Month to month: +1.1%.

- Year over year: +7.1%.

- Set new high.

Boston metro:

- Month to month: +1.0%.

- Year over year: +8.0%.

- From high in October 2023: -0.5%.

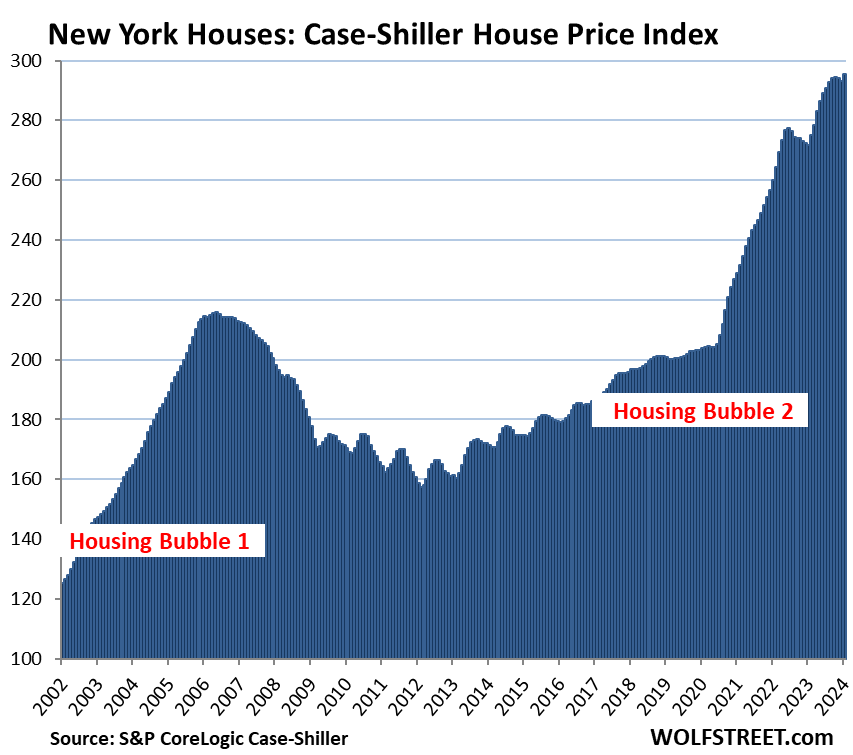

New York metro:

- Month to month: 0.8%.

- Year over year: +8.7%.

- Set new high.

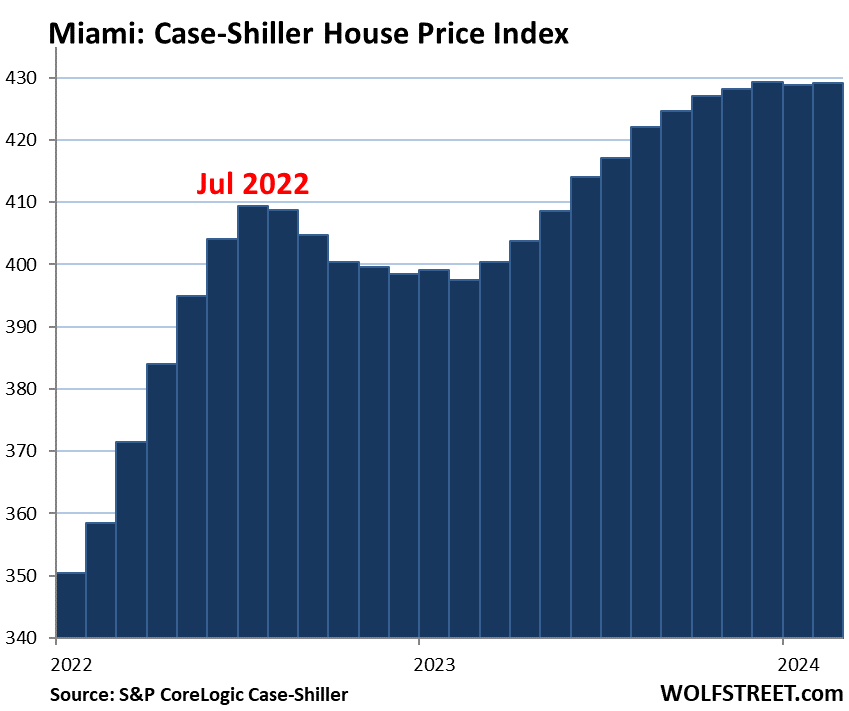

Miami metro:

- Month to month: +0.1%, essentially unchanged for three months.

- Year over year: +8.0%.

- A hair below the high set in December 2023.

To qualify for the Most Splendid Housing Bubbles, the metro must have experienced home-price inflation since 2000 of at least 180%. The indices were set at 100 for the year 2000. Today’s index value for Miami of 429 is up 329% since 2000, making Miami the most splendid housing bubble on this list, a hair ahead of San Diego and Los Angeles.

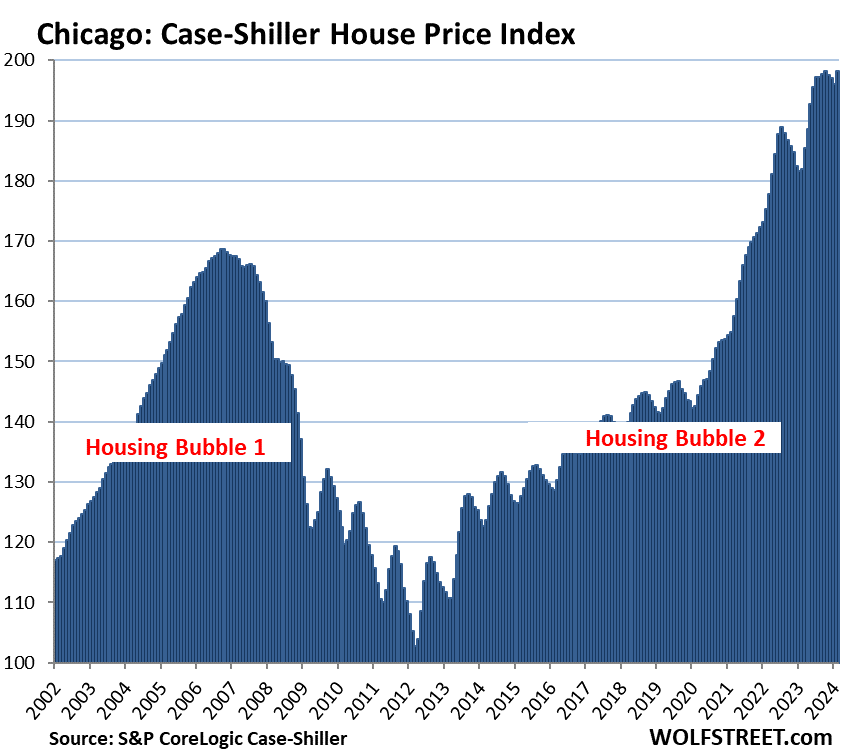

The remaining 6 of the 20 metros in the Case-Shiller index (Chicago, Charlotte, Minneapolis, Atlanta, Detroit, and Cleveland) had less home-price inflation than 180% since 2000, despite the price spikes in recent years.

Chicago, with an index value of 198 is up by 98% from 2000, and therefore far from qualifying for this list of the Most Splendid Housing Bubbles. But since March 2020, house prices spiked by 37% into the blue sky, and so here is Chicago anyway:

- Month to month: +1.0%

- Year over year: +8.9%.

- Down a hair from the high in October 2023.

Methodology. The Case-Shiller Index uses the “sales pairs” method, comparing sales in the current month to when the same houses were sold previously. The price changes are weighted based on how long ago the prior sale occurred, and adjustments are made for home improvements and other factors. This “sales pairs” method makes the Case-Shiller index a more reliable indicator than median price indices (37-page methodology).

Home-Price Inflation. By measuring how many dollars it takes to buy the same house over time via the “sales pairs” method, the Case-Shiller index is a measure of home-price inflation. Miami had 329% home price inflation since 2000, while the Consumer Price Index, which tracks price changes of consumer goods and services, rose 85% over the same period.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Freaking depressing to see…guess all the housing bulls are right, this time is different and not in these areas….also probably explain why I am seeing more listings in Redfin and Zillow lately with price increase in the listing and the starting price wasn’t cheap to begin with…

Los Angeles metro

Month to month: +1.1%.

Year over year: +8.7%.

Now 0.7% above the prior high in May 2022.

San Diego metro:

Month to month: +1.7%.

Year over year: +11.4%.

Now 0.1% above the prior high in May 2022.

The good news is that active listings/housing supply has been slowly building y/y since 2022. Unfortunately for first time buyers we haven’t hit that magic level where more people are selling their houses than people are buying. I’m hoping we get into a 1990’s situation here in SoCal where both interest rates and housing prices slowly drop over time. The big catalyst in any event would need to be a recession and job losses/wage deflation causing a domino effect of people selling their homes. Not banking on it though.

Moving so slowly that a geriatric facility rather than a house purchase is likely for many. Jerome Powell and his buddies F**KED the young.

Yes indeed they did.

On a positive note, I saw an article yesterday where several states are considering putting big taxes on all these major rental home buyers. As we all know, the average Joe can’t compete with hedge funds, Blackrock or even mid-sized rental holding companies.

Letting deep-pocketed investors buy up housing makes about as much sense as letting the infinitely, deep-pocketed Fed buy up MBS.

Both are absolutely asinine.

oh he Fxxk them good alright…not just the young but also people that don’t want to freaking overpay for crapshack and can be convince a sh**ty place in the ghetto should be asking for a mil to start…what a joke.

I do love in one of his speech, he said something to the effect oh younger people need a housing reset, so sincere when he said it..lol

@SocalJohn: It’s not everyone in the older generation – only a few people who push and pull the levers to amass more and more wealth for themselves and their fellow banksters and cronies. Everyone else is watching and wondering what the F is going on and how they can survive and lead a decent life. And how their kids and grandkids can lead a decent life. They cannot do anything even if they try their damnedest.

“Jerome Powell and his buddies F**KED the young.”

True…but the graphs themselves provide the proof about just how quickly artificially inflated home prices can collapse (see post 2008).

The more fundamental problem is that the breakdown of DC’s ZIRP phoney/doomed booms are treated like a national emergency, while the phoney booms themselves (built on the back of ZIRP expropriation of savers) are treated like some sort of “fix” for the “crisis”.

This has been the habitual history of DC for over 20 years.

I used to think of it as Weimar America.

Now I think of it as end-stage America.

Housing prices = higher for longer. ;-)

I can’t see the future, but the past and present are pretty clear and all the permabear, housing crash 2.0 folks are eating crow so far.

Could we have a correction? Sure. Is a 2008 style crash coming? Of course not, simply because too many people expect exactly that to happen. And we know from history the majority is always wrong.

I have a saved search on one of the RE apps for San Diego. It emails me new listings in my price range (<$900k). For over a year the emails came in at a trickle, but for the past month, I have been flooded with far too many emails to open. When I do open some emails, the homes are no longer cockroach hotels, but more like livable small houses. New listings are going to explode when the data catches up with what’s happening now.

Reports are coming in that AZ and FL are seeing decent inventory increases as well.

The amazing/idiotic/disgusting/mysterious thing is that somehow inventory levels managed to be anchored at 60% of norms for 2 *years* following the rise of rates from the ZIRP sewers.

I don’t expect stock market like sensitivity in SFH pricing…but taking *years* to adjust to market/pricing signals is just so slow as to be frighteningly dangerous.

That truth once again makes a mockery of the Fed’s appointed role as central (mis) manager of the macro economy.

20 years of ZIRP led to,

1) trillions expropriated from savers for decades,

2) a ruinous boom/bust by 2008

3) *another* ruinous boom/bust by 2022.

And in exchange for what?

DC getting to ignore the fundamental problems of the US economy (lack of competitiveness) for 20 years.

The Establishment’s idea of macroeconomic health care is hookers and blow in the back room.

How are the housing bulls right? Because there hasn’t been a collapse, bulls are right? National prices stagnant for 2 years with a complete collapse in sales, while the new house price has collapsed almost 20%? I’d say the jury’s still out on this one. But go ahead, for the housing bulls this is their “mission accomplished” moment.

Housing bulls are so quick to declare victory over bears as if we’re already at 2% and this credit cycle is over.

News flash: it’s not, and if anything were further away from 2% than before and more hikes are most likely necessary.

Nobody should be saying “it’s all over” until the fed reaches their goal. Until that happens all bets are off.

What you are seeing is currency devaluation, not home price increases. You have to remember that. Prices will continue to go up markedly.

Absolutely false. The US Dollar is just a unit by which to value assets in our global economy.

Right. And that unit is continually devalued. Or are you saying the money supply will meaningfully shrink and never go beyond where it’s at now?

Eventually money supply will increase again as the economy grows. But over the next year or two, it will decrease, as long as QT keeps chucking along.

The ruler has lost an inch.

Remember the CS lags. Rates have come up a lot since Feb and will continue to rise.

Sure it wasn’t closer to 6.66% range on 30 years in the big house?

The majority of southern US cities got hit hard in 2011 and 2012; touching 2002 levels.

The dip has more to go overall. Unfortunately here in Canada real estate wants to be too big to fail by packing people like sardines in slum shacks. All the best fellow Americans because Canada is fighting very hard to ensure that house prices don’t collapse to 2012 levels.

All of Canada’s economic reports and news are meant to drive interest rates lower and home prices higher. Everything is still selling above ask where I live. The PMI will likely never get to 50 for 50 years.

I keep thinking that these housing price increase graphs reflect inflationary pressures and the devaluation of the dollar as much as a “price bubble.” I see increases in prices nearly everywhere here in Scottsdale and I think it reflects a dollar that has less value.

Fiscal policy is all spending – 10 trillion since COVID began- and now we are going to see student loans forgiven! $2 trillion in deficits per year ad infinitum?

What can a young couple do today? We bought homes in 1997, 2000, and again in 2010 when markets were depressed. Housing is up steady over the past 12 year!

All I can say is “buy in a very nice location, improve the home and property, and enjoy your family.”

True. Everything else costs more dollars but house prices have been more or less flat for two years as whole. Asking prices for houses, denominated in dollars, have even gone down in certain markets even while the dollars they’re asking for are losing value.

In 2024 the choice isn’t whether to buy into the “American dream” or not. The choice is between a home and a family: pick one.

If you pick home, then you’re buying into a bubble. Saying that it’s just because of currency devaluation implies that prices cannot go down relative to everything else, and therefore current prices make sense. It looks a lot less appetizing when you see it for what it is; irrational prices based on speculative feedback effects, dependent on artificially cheap debt, backed by the government on the premise that they can continue to print money in an inflationary environment.

Yeah, I’ll just reach into my magic satchel and pull out the two million-plus dollars that it takes to buy even a tiny house in a “very nice location.” Great advice!

C-19 is nothing like the GFC. Housing prices fell in the GFC because M1 NSA money stock, our “means-of-payment” money peaked on 12/27/2004 @ 1467.7. It didn’t exceed that # until 10/27/2008 @ 1514.2. I.e., there was no growth in the primary money stock for 4 consecutive years.

Contrariwise, Powell has held the money stock steady for only 2 years. It’s unlikely that we’ll see comparable housing price declines this time around.

When folks buy a new house they should just pay cash for it rather than financing it at all and then whatever mortgage rates are simply don’t matter the slightest bit of a hoot. By the way, Coral Gables in Florida just surpassed Beverly Hills as the wealthiest city in America and most folks in both areas always just pay cash through their banks when buying a new house for themselves.

and most people should just be really wealthy then they wouldn’t have to worry about anything financially

Ooh, I like that.

Jackson Wy 1st Qtr home sales ; avg sale price $7.1 million ; 35 sales vs 45 last yr ; lowest priced listing 1 acre 1977 house 950 sq ft 2 bdrm

1 bath ( fixer-upper ); gotta like the mountains !

If you’re middle class it usually drives down your income tax. Paying cash saves you a fortune on soft costs and no need for home or mortgage insurance.

Sure, I’ll just summon the cash fairy and ask him for a lump sum equal to twenty years of my income. Why didn’t I think of that before?

Wolf, It’s time to stop referring to this as a housing bubble. This is not a repeat of the GFC. The dynamics are different this time. This is the result of money printing where physical assets appreciate or better said purchasing power erodes.

I have used this term since 2017 to describe the stupendous surge in house prices, and I won’t change it even if prices sink a gazillion percent. If you don’t like it, go trolling somewhere else.

Bubbles pop. This is the great debasement of currency. Your title is misleading.

Yes, bubbles pop. And they already have popped in a bunch of cities. You can see that in the chart above. And they have popped in a lot of cities that are not included here, such as Austin and San Antonio. If you don’t like the title, go trolling somewhere else.

For what it’s worth, re your last sentence, Dilbert podcast guy said that today. I think he’s in the Bay Area.

He didn’t say Housing Crash, he said “Housing Bubble”.

The last bubble was fueled by low interest rates after the dotcom bubble burst plus terrible lending standards. Will the whole system collapse this time, probably not…but always hard to know what wall street is doing. Will there be some depreciation of real estate asset prices in a recession? Most likely. I was a with a friend last night (real estate professional who bought up a lot of assets during the 2008 crash) who said he contested his property tax bill for his personal home with the argument that this was a bubble and the numbers aren’t real and gave them the value of what he thought a realistic value was and he won. The government basically agreed with him it was a bubble and the valuation was stupid. He actually got the assessment down by 25K from the one that preceded the most recent assessment. Also from what I’ve seen in the Denver metro lending standards aren’t that great this time around either. Loans here for the last decade have been made on the premise that housing prices will just keep going up so there’s nothing to worry about even if a buyer were to default.

Another thing to think about with this argument is asset prices are determined by supply and demand. Asset prices can only appreciate as high as people can pay. So for real estate assets to continue to appreciate the way they have the last decade, you’d need salaries to continue to increase.

Plus housing is special in the sense that its actual cost (monthly payment) changes dramatically with interest rates. At 3% mortgages a lot of people could afford a $650K house. At 7% mortgages a lot less people can afford a $650K house. What the actual monthly payment is has a big effect on the supply/demand curve for housing.

The direction that housing prices move will most likely depend on what significantly increases first, supply (probably caused by a recession or people just not being able to wait anymore) or demand (probably caused by interest rate drops of 1% or more while the economy is still at fully employment). While supply and demand both stay where they are (somewhat balanced) prices should stay somewhat flat.

Washington D.C. metro:

Month to month: +1.1%.

Year over year: +7.1%.

Set new high.

Yep, no RE recession here. You now have to go buy in a crime ridden neighborhood to get a deal. Even there, expect to pay top dollar.

To be fair, the whole of Washington D.C. is full of crime.

Agreed

Especially the government offices. Couldn’t resist.

“One lawyer with his briefcase can steal more than a hundred men with guns”

Now as through this world I ramble,

I see lots of funny men,

Some rob you with a six gun,

And some with a fountain pen.

— Woody Guthrie in “Pretty Boy Floyd”

I think Millennials like to live in crappy neighborhoods; makes them feel hip or something.

My city – I’m the greater DC area – all the houses on the worst street have sold recently at astronomical prices – slumlords finally getting out. But I swear, that street seems in demand. It might just be word of mouth or “I want to buy where my friend bought”, or just that people are willing to sell there. Very fascinating, but I know from experience the disenchantment they’ll feel when they find their stoops getting puked and defecated on nightly.

Then, the ghetto is not so cool anymore.

Muss – sounds a lot like the time-tested, always protracted, urban process/battle of ‘gentrification’…

may we all find a better day.

Thank You Wolf!

Housing prices are not dropping much despite high mortgage rates. Many people must be full of FOMO and money.

Could you also post your Case Schiller graph vs OER? Is OER rising?

When they intersect like they did in 2012, my son will stop renting and buy a house.

I think OER represents inflation (driven by mostly wage and income increases (stock market, BTC, etc). Rent prices track inflation. House prices are speculative based on FOMO and inflation income increases.

Bobe, House prices are based on supply and demand.

Right now supply is short because theres a seller’s strike and folks who dont need to sell aren’t selling.

Apparently there are more people out there who need or want to buy regardless of whether it’s FOMO or more kids or more money in the bank or higher incomes or whatever. It really doesnt matter.

Sellers still have the upper hand in most markets, even now in late April – except for maybe on the west coast.

Nah — just a whole lot of suggestible trigger-happy suckers who were brainwashed by marketing whizzes from right outta the chute. “Buy now or be priced out forever!” READ: “Buy high/sell low!”

I agree that limited supply is also maintaining house prices.

Do you think the Fed were geniuses and deliberately lowered mortgage rates to below 3% to lock in millions of homeowners who now see not selling as a financial excellent decision? It now costs more to sell with fees and taxes for people who want to buy again with a mortgage and downsize. If you sell your house for $1M, you may get hit with 60K in RE commissions and over 100K in capital gains taxes(above the exemption). You may need a 7% mortgage for the next smaller house. Why sell?

As long as supply stays low, and the stock market stays high, prices will remain stable at a high value.

FOMO will continue with houses in short supply and stock values elevated to pay any downpayment.

Contrasted with 2008-2012 when both the house prices and stock market fell. The FED lowered rates at a pitiful pace.

History will repeat if the stock market crashes again causing all demand for housing to drop which will then cause house prices to drop 20-30% putting massive amount of homeowners under water. Panic selling will occur just like in 2008. We may see 3% mortgages again very quickly if the Fed reacts quickly.

The CS-Rent chart comes with the CPI report. Gotta wait till then.

Thank you!

I track a couple markets and sales were pretty hot in February with people paying 2-4x what a place sold for in the past 4-5 years. Just madness, can’t explain it other than some people might still be fleeing the big crime infested cities and willing to pay anything. But in the past few weeks sales have dried up and more inventory has come onto the market. Of course they have for the most part absurd asking prices. I think by summer this data will look a bit different.

The data shows that all categories of crime in US cities have fallen from 2022 to 2023 by over 12%.

And CA population is climbing again after all the fear mongering about it going down forever. Meanwhile two friends who left for NC and TN are telling me they want to come back. Apparently their respective moves weren’t all they were cracked up to be.

The data shows some people believe some weird stuff, like… Their dream house is waiting for them soon, or that they can take a midnight stroll downtown with their sweety.

It might be interesting to layer on the cost of home insurance in these markets.

I think AI would have to be employed to make a chart that fantastic happen.

It’s like when you had amazing expectations for your teachers in school, but their ability and worldviews ground those away. 😆

Read MIT review’s “The dark secret at the heart of AI.”

It shouldn’t be surprising when an inflation index actually shows inflation during a period of massive inflation, but somehow every time people are surprised.

Splendid bubble here in Miami. You won’t believe the home prices just from a few years ago (as Wolf documented here). No wonder that people spend like there is no tomorrow. Majority of middle class is flashed with cash (plus the 5% yield on market money accounts), the FED is insignificant at this point. I don’t see rate cuts until 2026-2027. But that should be finally normal to bring some of the bubble prices in houses down. But I guess that Miami was and will always be a ‘bubble’ to live.

As a disinterested person, those graphs show without any lipstick that the Fed has engineered the bubble of ALL bubbles.

It is just impossible to comprehend how foolish they were to keep rates low while printing to the moon late in the blowoff stage.

All bubbles burst……. every time.

Howdy Thunderdownunder. You underestimate the US Govern ment mate.

I believe that is correct. Asset price inflation is off the Feds radar. Prices and wealth concentration could skyrocket from here and the Fed wouldn’t care so long as CPI inflation doesn’t move higher. If you have a job and can rent a shack, you should be happy in the Feds view.

It’s about time the Fed realizes asset inflation is just as damaging to the bottom half as CPI inflation.

And Jerome Powell had said this back in January. Housing prices are not the primary focus of the fed, however I don’t see CPI falling to any significant degree until home prices fall to a significant degree. Even if rents have fallen by a little bit in some areas they are still high in many cities. Unless there is an exodus from these high rent cities, perhaps like Austin right about now, I don’t see how the demand for rentals eases up. I’m not an economist but my common sense just isn’t seeing a way that the fed can squash high CPI without dealing with the housing market at some point, wether it’s their job or not.

Ive’ been thinking that way for a while now. My views fits in nicely with what people are now calling “fiscal dominance”. It’s the idea that government spending and large deficits crowd out private investment. When debts and deficits get too large, central banks can’t stop the fiscal madness without triggering a major recession, so they think they must step in to support asset prices when necessary to prevent economic carnage. With these sky-high asset price levels, the economy and asset prices are tied at the hip.

Prior to 2004, central banks could let a recession happen and know it wouldn’t cause lasting damage. Now, after 20 years of insane easy monetary policy and artificial stimulus, central banks can’t let the financial world sneeze without risking a huge sustained increase in unemployment.

I say so what. Let asset prices fall. Let the economy suffer a cleansing recession. The outcry from that will force legislators to implement policies to more fairly distribute income to those who earn it, not those who sit on electronic cash piles.

It took a Great Depression to enable Roosevelt to implement policies that helped the working class. He might have done too much, but the results of his work produced growth and prosperity for the vast majority that lasted for many decades. Somewhere along the line, Wall Street and the passive investment/arbitrage crowd took control of things again. They dismantled unions, cut tax rates at the top, outsourced production, opened the borders, and removed upward mobility.

It’s time for a reset that is favorable to the bottom 80%. The Fed and its threats of QE and rate repression are the only thing standing in the way at this point.

IMO, the way to go is balanced budgets, steady debt-to-GDP and liquidity-to-GDP ratio over time, progressive tax rates, incentives for domestic production, reasonable controls over immigration, and balanced trade policy. Basically, you want to reverse the harmful policies that brought us here.

Powell in 2022 was singing a different tune, signaling an intent to bring house prices gently down to earth with his quip about buyers needing a “reset.”

Two years later, having failed to deliver that reset (prices briefly became very slightly less stratospheric, then went back up again), he has pivoted to “not my job.”

They have an old run down restaurant across from the graveyard, buildings been there say…90 years, my aunt and myself sitting down for breakfast were talking about getting a small plot of land there in the bone yard, maybe raising some worms in the future, she’s 83 I’m 66.

Small town in Arizona, kids riding in the back of the pickup truck, roosters crowing, clear-clean air, neighbors saying hello, wolf street playing an old familiar tune.

“Miami the most splendid housing bubble on this list”

Ciprian/Wolf, Dont forget there was also a 30% increase in population in the Miami MSA from 2000-2024 – and probably a lot more if you add undocumented immigration, which is high in Miami.

That kind of population growth alone is enough to send property prices through the roof. Huge demand = huge home prices

Absolutely, easily noticable in the day to day operations here.

How dead is the 2024 “spring bump” by now, in most places?

Howdy MARmageddon New Residential Construction should keep the bubble hissing for awhile. The 3% might even grow a pair and HELOC to prosperity? We shall see……

There is almost no seasonality in the Case Shiller. But do read the FIRST TWO PARAGRAPHS.

Powell screwed the non asset holders bigly is not a big deal but Powell locked out non house holders out of housing market is pretty bad.

I don’t see prices going down unless big races hits.

If big recession hits followed by job losses..mortgage payment suspended and rent forgiven would be coming like 2020 and 2021..

Howdy Folks. 7 to 8 % mortgage rates are normal. Get over it. Better hope and pray the FED raises rates before they lower them….. The Lone Wolf charts on FED Plateaus is where to look in the coming months.

And we have a candidate for president who wants to loosen monetary policy, perhaps by becoming directly involved. I’ve read several reviews of this from sources tied to both parties, and every one agrees that his goals will exacerbate inflation. If this happens, the long end of the bond market will react. He might succeed in lowering the short end, but the long end will go up. This will make today’s mortgage rates look low. We could easily blow by 10% if the short end is no longer used to fight inflation.

Howdy SocalJohn Right or Left, the Spending and ZIRPing set our future. Expect the unexpected but history will repeat so to speak.

Using a lava lamp currently as my crystal ball…….

SoCal John – He will force the FF rate down and distort the already ridiculously distorted market even more. All asset prices to the moon. That’s for sure. And inflation will go through the moon even more. I’m a

Private Lender and I’m not committing to any new loans that are longer term than 6 months until after this election.

Do you originate fixed rate or variable loans? I’d think it would make sense to originate a lot of fixed rate loans now if you believe rates will be lower later.

Personally I’m not committing to any duration but for the opposite reason: I think rates will go up not down.

That could cause a wave of selling pressure and I think tptb are aware of that. I have a fair amount of in the red bond funds, mortgage reits, and small caps that I want to get out of. Might also be the case for some people who bought houses as investments.

Exactly the case 30 years ago, and all was right with the world.

Everyone jumped back in because of rate cut mania.

I live in San Diego and multiple coworkers told me I had to buy now because when rates drop housing is going to start booming again. Housing demand will remain until the fed makes it very clear that rates aren’t going to go down.

I’m old enough to have heard the same but now or you’ll lose out mantra spouted by people who think they’re financial geniuses. Didn’t believe it then and don’t believe it now.

In Seattle they routinely list the price below the comps so everyone will go crazy clicking on it and make it “hot house” on redfin. Then it gets a special icon that draws more attention than other houses. Is this maybe the cause of the data difference you’re seeing?

Wolf, why is the Vegas graph formatted differently?

cause I forgot to trim off the white margin. Thanks.

If we check Miami was the last on this list to drop its price in 2007, while all real estate began to collapse everywhere Miami was still at the peak, you can see it in the graph, reaching 280 and being the only one on this list to get there , once it fell, Miami real estate lost 50% of his value , bellow 140, the same thing that may be happening now, too much speculation in a city where household income does not justify this increase, something going to happen, I live here and believe me guys this is insane.

The Marx brothers produced a movie about the land boom and bust in Florida during the 1920s. It was called Cocoanuts. Nothing changes except the faces.

I think the delta between listing & closing prices is due to sellers’ unreasonable expectations of what their homes are worth.

When I browse zillow I only look at closed sales. Listing prices don’t seem relevant. Anyone can list their house for whatever they want, but something is only worth what someone else is willing to pay for it.

Counties can cut owner-occupied property tax in half and double non-owner-occupied. Disclaimer: YMMV.

Wouldn’t it be something if those lag effects suddenly showed up

Kids going to need bigger bootstraps than grampy to pull themselves up to this.

Here’s hoping Lockheed Martin can come up with some kind of portable anti-gravity device for attaching to said bootstraps.

…may need to obtain some boots, first…

may we all find a better day.

I laughed out loud when I read this article. Thanks Wolf. It’s comical that the mere “rumor” of the Fed lowering the FF rate actually resulted in both, investors offering lower rate mortgages, and housing prices going up again! All because of the “rumor” of lower rates on the horizon. Imagine what happens when/if the Fed does lower the FF rate in 2024? Real estate prices through the moon baby!

If investment funds buy houses to generate derivatives that are leveraged multiple times to one, then that fund could care less what the underlying real estate asset price to buy is. In such a case the real money is to be made on investment fund leveraging, the housing price increase from investment fund demand would just be a side effect.

This fiscal policy reminds me of a Tsunami 🌊.

Once it recedes, clear the dead bodies and rebuild.

We are in the 7th or even the 8th inning of this housing price rally. It was a no brainer paying super high prices with 2.5% mortgage rates. Now, it is a tough call. If you are getting in now, only the best of quality location as a hedge against a price drop.

Funny thing about baseball though – in theory it can go on forever

realestateball moreso with rules changed every inning to bring said outcome

Things must be very bubbly if even SocalJim is sounding alarmish on the housing market. Of course, I am assuming this is the OG SocalJim.

The prices or the index looks like FED balance sheet since 2008. They are not going to come down to the low number in my life or for ever. Wolf would justify FED balance by GDP, money in circulation etc. But the housing indexes at least came down (half circle from 2002 to 20112).

None of this makes any sense to me anymore. How are people paying peak 2022 prices with 2-3x mortgage rates?

None of this makes any sense to me anymore. How are people paying peak 2022 prices with 2-3x mortgage rates?

Wages/salaries. I’m in my 60’s, self employed.

We simply lost track of what able/experienced workers

can make today.

Of course I’m in flyover, so these kids are not trying to buy

a sfh in Wolfs zipcode.

People are not able to afford it hence thr crash un sales volume.

Soke People may say the wages are increasing in same proportion but it is not true

If you look at the hosting affordability level.. it is historically low.

Sellers are holding from selling in hope of lower rates..

If Fed burst the bubble of no rate cut then sellers may come out in droves

Also would need a good recession…

Sadly, interest rates nearly always has a time lag, which is why Wolf always talks about housing markets taking 3 to 4 years to decline. We are roughly eighteen monnths into the rises, with the slowest lag also being unemployment. As true unemployment rises and inflation sticks around, we find ourselves, of course, in classic stagflation.

Rate Cut Mania Died. QT is alive and well. In the 1970’s I was astonished what interest were. Who ever had money back then made a killing risk free. I got a feeling those days are back! Thanks Wolf love the headline.

Consider the after-tax/after inflation rates of the 1970’s, as well as the severe volatility in bond prices over the decade.

The 1970’s were not a picnic for fixed income investors, in spite of the extraordinarily high yields that graced the headlines, unless you possessed uncanny timing and nerves of steel.

You made your point.

Mortgage rates are very powerful in respect to housing bubbles. More powerful than a locomotive, faster than a speeding bullet.

If rates continue to rise, those home prices are going to drop – full employment notwithstanding. Full employment won’t last. General inflation will force those rates up and housing will devalue. Same for other assets – like stocks – if the cost of credit keeps increasing, those profit margins are going to drop as will the price of stocks.

Home construction is a leading indicator. Employment is a lagging one.

And… the Fed can’t lower rates to stimulate if there’s ongoing inflation, aka: Stagflation. Morphine won’t help; they need to use a tourniquet.

When i got into the mortgage business in 2012, the Fannie Mae conforming loan limit was $417,000. The high balance loan limit (for high cost areas) was $625,500. Today, the conforming loan limit is $766,550, and the high balance loan limit is $1,149,825.

Just an interesting way to look at how home prices have skyrocketed in the last 12 years.

I checked the web on this one, wondering what the rate was when I bought my first home, in the early ’70s. The Fannie Mae conforming loan limit was $33,000. Anything more was a “jumbo loan”.

HowNow that is just wild to me to think about. Thanks for the research.

Congress really ought to ask why they are subsidizing $M homes.

Fannie Mae is backing and subsidizing loans over $1M driving up housing prices.

The IRS is capping mortgage interest deductions to 750K max loans.

The IRS is also limiting property tax and state income tax deductions to 10K.

Both of these make it more expensive to own a home.

These policies are contradictory.

Thank you Wolf. I love your blog even though I don’t always understand the content. But I understand this article.

Being one of those who are waiting on the sidelines for the housing market to turn, I must admit I was a bit surprised and disappointed in the report. However, I have to remind myself that we are two full months past this data. I could be deceiving myself but I am seeing more articles of real estate woes in the last month than the prior 6 months. If we are not at the top, we are lot closer than we have ever been. I don’t expect the turn to happen overnight either but I do believe we are in the beginning of it.

I am going with a “dead cat bounce” on this latest surge. :)

Time will tell.

Dead cat bounce from what? Before this mini-surge, prices either hadn’t fallen or had barely fallen (depending on metro) from the greater 2023 surge.

Hello Gabriel, very interesting that we can read this same article and come to such different conclusions. Unfortunately I believe you will be waiting quite a while for the housing market to turn, and by then you may have already given up and bought right before the turn at the worst possible moment. I have experienced this myself, have seen others go through it, and you can learn more about it by googling The Cycle Of Market Emotions. Its very difficult to break away from this cycle, I have tried and have had some success and more failure and through it all I have turned into a believer. Anyways, this market is interest rate sensitive, so much so that with approximately 3 months of declining mortgage rates we were able to see an increase in the housing index charts, just crazy to me since I have always considered housing like a huge container ship, nearly impossible to change momentum so quickly but here it is. So where mortgage rates go housing will follow (in the opposite direction of course), so where will they go? I’ll answer the million dollar question by saying that during the rate-cut mania I was certain that rates were going down soon, now I still believe they will go down but not so sure when anymore.

Read the article and all comments and simply trying to get a handle on this situation. My takeaway is mainly people’s shortsightedness, a belief that when conditions are in effect for a few years they think it is normal. Take the stock market and crazy valuations for the weird. The idea that housing prices will eventually and always rise, or that 3% mortgage rates are normal.

Then, there is this: “According to Steinway Moving and Storage, the average American moves 11.7 times in their life.” That stat does include childhood, but the stat for adults is a move every 5 years, according to census data.

Looks to me like housing is almost everything else rather than a home linked to community. As such we should expect nothing more than volatility when interest rates have been artificially Zirped and a belief that 7% rates are only temporary. My grandparents lived in their Minnesota house their entire lives. Why? They had no money and limited access to more. Besides, it was their home. They would have never left it. My folks moved a few times for career with a move to Canada in the 60s. It seems nowadays people move like changing a phone plan. It’s a different mindset, entirely. Then people placate unhappiness with experiences, substances, vacations, better vehicles with distinctive logos, and angry politics.

If you found your home, you have a refuge and a place to grow a life. Might be a good time to hunker down and keep your eyes open, and your debts down.

regards and thanks for the data and comments.

Terrific comment. Moreover, as someone who moves ~ every 5 years and has never lived anywhere for ten years straight since birth, I can attest to your data points.

Thanks for providing this thoughtful reflection, Paul.

Paul S./bul – an addition to the excellent observations-fewer ‘Muricans spend their working lives with a single firm, as many did in the past (often buying in a comfortably-established community of similarly-employed folks, reducing the urge/necessity to move as often…).

may we all find a better day.

Agreed on keeping eyes open and debts down. That’s all you can do while this insanity continues.

You have no clue. 30 year fixed 3% mortgages has had a chilling effect on people moving and will do so for years to come.

Maybe tied in with the flip to a consumer economy from a manufacturing one…inequality and real wealth is in the elite big data sector/big finance aiding this ideological shift. Labour get inflated housing assets and the latter like Oracle CEO earns a Hawaiian island. (Or 98% of one)

‘In Toronto since mid-2022, 11,595 units over 29 projects have been delayed as interest rates remain high and confidence in the market weakens, according to a recent report from real estate research firm Urbanation. Developers drastically reduced the number of new launches in the first quarter of 2024, with just four projects brought to market.’

Above is from Toronto Star

The piece describes all kinds of incentives: all aimed at enticing buyer without lowering base price. Free parking is not surprising but offering to pay mortgage for first year or two is kind of. Here is another that seems a bit odd: raising commission for buyer’s agent to 10 %, with part of that being kicked back to buyer.

Guess it’s up to the lender to decide how much of these tricks to tolerate. Any monetary benefit to buyer i.e. a ‘credit back’ has the effect of lowering the actual price, which should lower the appraisal. Then there is the supervisor of banks to keep happy, and lately he hasn’t been.

Rates are still low and should be increased. News Flash – anyone can lower their effective rate – they call it a down payment!

Building a lake house in a non coastal area. Everything is way up and skilled workers are few and far between.

Even paying cash it will cost much more than expected. Home prices are not ever coming down, as costs are going up double digets for new and used.

The truth is, home prices are not too high. We got used to them being too low. Same with interest rates.

I’m paying 1/2 the cost for building materials than I was just a few years ago. Yes, new housing prices are expensive but many people are still looking for fancy countertops, more bathrooms than bedrooms, etc etc. Relatives getting quotes for new home construction are all over the map in what they have been told, by hundreds of thousands dollars in one case. In the 70s I built houses with my brother and also worked for bigger companies on larger projects. We were all unionised in those days and in fact my employer paid me 1$ an hour over union rate, which would be the equivalent of $5-6 dollars more per hour now. We were far better paid relative to what carpenters earn today. And yes, working people like myself could afford to buy a home….I did at age 24 at over 7% mortgage interest rate. I think a big big problem for today is excess local regulations, finance leeches, permitting fees, engineering requirement instead of local taxpayer funded building inspectors, and downloaded infrastructure costs like curbs and gutters for new subdivisions. Add in some greedy generals meeting up with loco buyers steeped on home improvement shows and the baseline goes up and up.

My buddy’s dad was a building inspector for Victoria, eons ago. He used to carry a 50lbs box of nails in his trunk and if he saw deficient nailing in headers etc he would pitch in and help fix before the sub trades came in. I remember inspectors stopping by and telling us to go look at such and such house to see what not to do. They don’t even have inspectors anymore. Now you have to purchase a plan for an extra $1500 for an engineered stamp on it. The municipality has a department that looks at the plans…for the stamp. The only folks that go to the jobsite around here are people connected to archeology and God help you if any bones are found.

Here is one more example. Nowadays, rural folks like myself have to pay for an engineered septic system for sewerage. The cost is $25K to $38K for the required licensed installer. All in. One installer I know states he will not do any job without a $10 K profit, after expenses…..and this is two days work, max. Don’t like it? Call someone else, but they need the ticket. I have a friend who has installed hundreds of systems over the years, but refuses to play the game so he has reduced his work scope to general backhoe services. He would charge less than $10K, for everything…. I replaced my own system for less than $4K because I have a backhoe. It took one day.

The crazy costs are so high because people still pay them. High interest rates should reduce housing prices because of affordability, but as long as people sidle up out of fear of not getting into the market, the costs will never come down.

@BH: You said: “The truth is, home prices are not too high. We got used to them being too low.”

That’s the weirdest thing I have heard in a long while.

It’s part of the humor here?

The truth does that.

…when racing motos, we used to call those (very expensive) materials and processes: “…adding lightness…” as opposed to the simple subtractive: “…weight reduction…”.

may we all find a better day.

Home prices are still way too krazy high. A lot of the buying public (especially younger folk) have just become inured to getting screwed. It’s like muscle memory for the over-the-barrel position.

It’s a bit like paying $18 for a bottle of filtered microplastic-laden tap water and some toxic trail-mix at the airport & self-soothing with the idea that — “well, this is just how it is at the airport” — only now the airport model has snuck over into the model for in-town consumption, and so you gaslight yourself with the thinking that “hey, maybe this water & trail-mix has just been too cheap this whole damn’d while!”

No.

(No.)

…when the admiration and acceptance of overpriced ostentation (rather than it’s risibility and a resolve to firmly buyer-strike) slowly sneaks into the tent of value-perception of common goods…

may we all find a better day.

I’ve mentioned before – there was a study some years ago which explored something sociologists dubbed the ‘chivas regal’ effect. This described a curious form of buyer behavior in which consumers perceived a good or service to be exceptional or of a premium grade if they paid a sufficiently onerous amount for it. The desire to lay claim to something not everyone could readily afford or aspire to afford conferred a kind of exclusivity on said good/service. This applied to everything from automobiles, educations and, of course, zip codes. In fact, when one university raised its tuition to a conspicuous degree from one year to another, the applications soared.

This might play into the psychology behind the rationale for overpaying for anything.

It would be nice to think that one day there will be a shift in values; when the needle of popular regard gradually drifts from over-manicured displays of wealth and waggles ever so haltingly over to the guy in the 20 year-old Mazda 3 with a brown bag lunch, a pair of resoled boots and cash enough in the bank – or credit union, preferably. (After all, no-one ever cast the hero in a film, song or painting as tycoon or a landlord.)

bul – well said.

may we all find a better day.

“Home prices are not ever coming down”

__________________________

Yes, yes, I am sure that you are right.

Love,

1990-1996

2007-2012

2026-????

I am so desperate for the BEAR to be back in charge…

Brown bears, black bears, polar bears, gummy bears…

BRING IT ON!!!

@BVW: Not too fast though. Powell has been looking for just about any excuse to satisfy the banksters with slower or no QT and lower interest rates. I’m looking for a slow, extended leak that would first sedate the bulls and over time get slaughtered by the bears. LOL

And there’s the QT reduction.

Treasuries: –$60B/month to –$25B/month

MBS: stays at –$35B/month, but anything above the cap now gets reinvested in Treasuries instead of MBS.

Surprised stock markets aren’t roaring higher given the large reduction in QT. This is immediate & guaranteed, while “higher for longer” and a theoretically smaller terminal balance sheet depends on continued economic strength & can be called off at the first hint of recession.

1. starts in June, many people expected to start now.

2. rate cuts moved further into the distant future

3. S&P 500 and Nasdaq ended in the red today

https://wolfstreet.com/2024/05/01/fed-holds-rates-at-5-50-top-of-range-qt-slowdown-starts-in-june-acknowledged-inflation-is-a-problem-again/

Anecdotally, Tampa rent prices for 1- to 3-bedroom, 1-bathroom houses have decreased generally between 3-10% from January to the end of April. Very well could just be seasonal though.