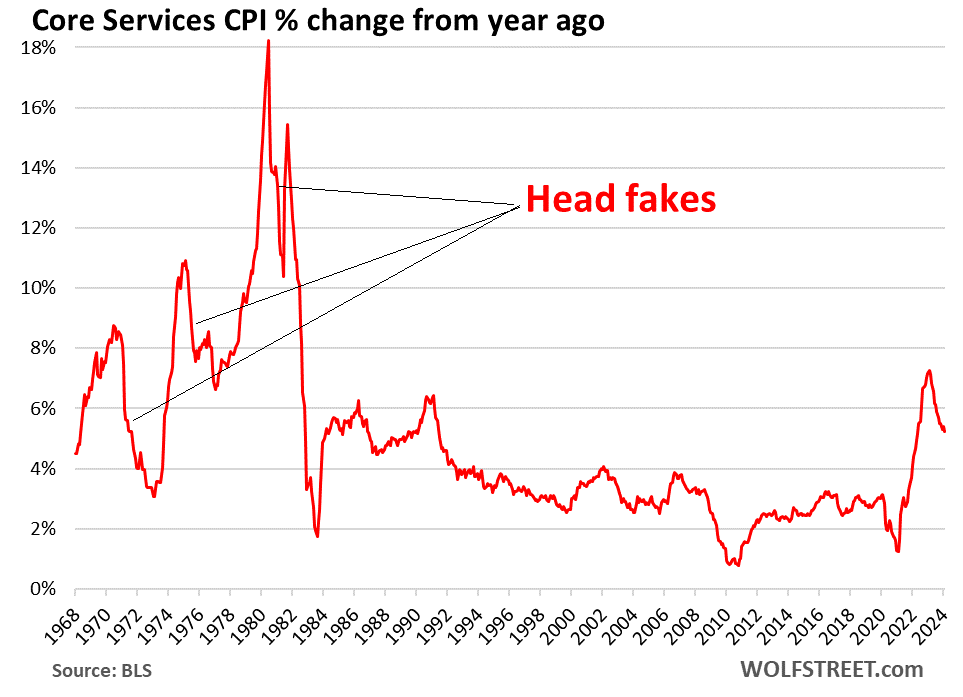

Core services CPI — 61% of total CPI and infamous for historic head fakes — is approaching 6% annualized six-month average.

By Wolf Richter for WOLF STREET.

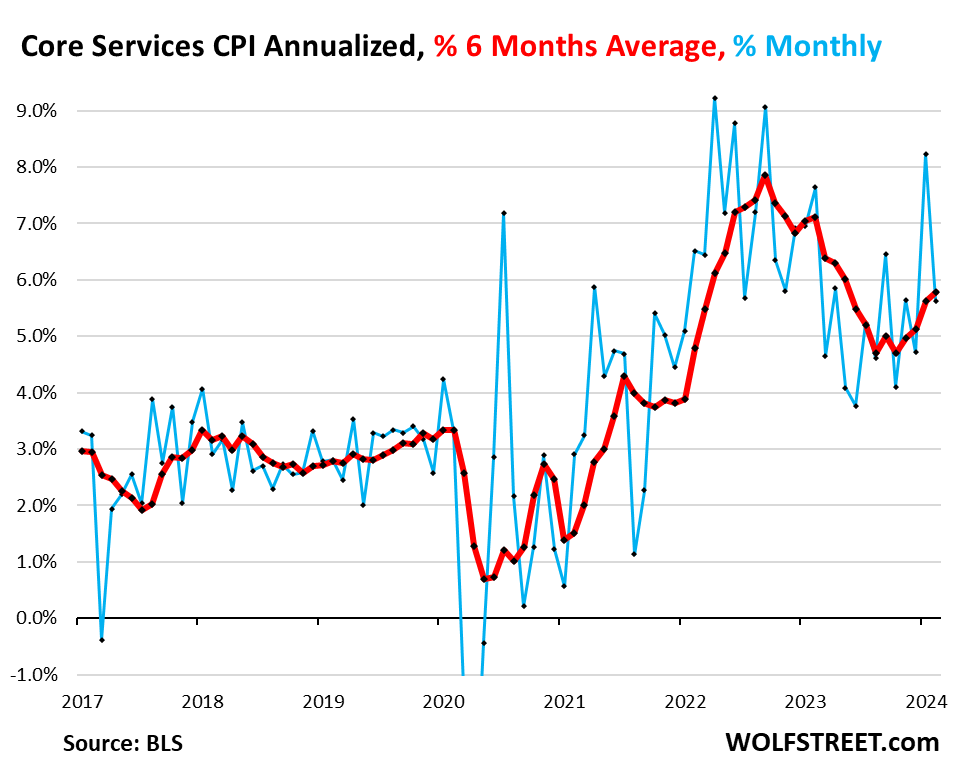

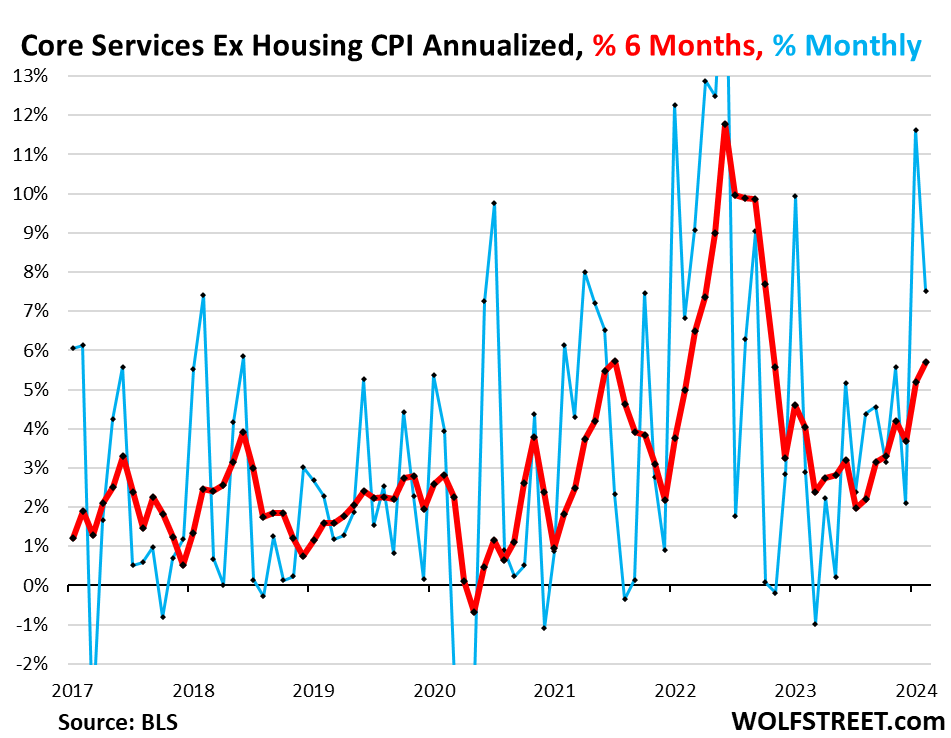

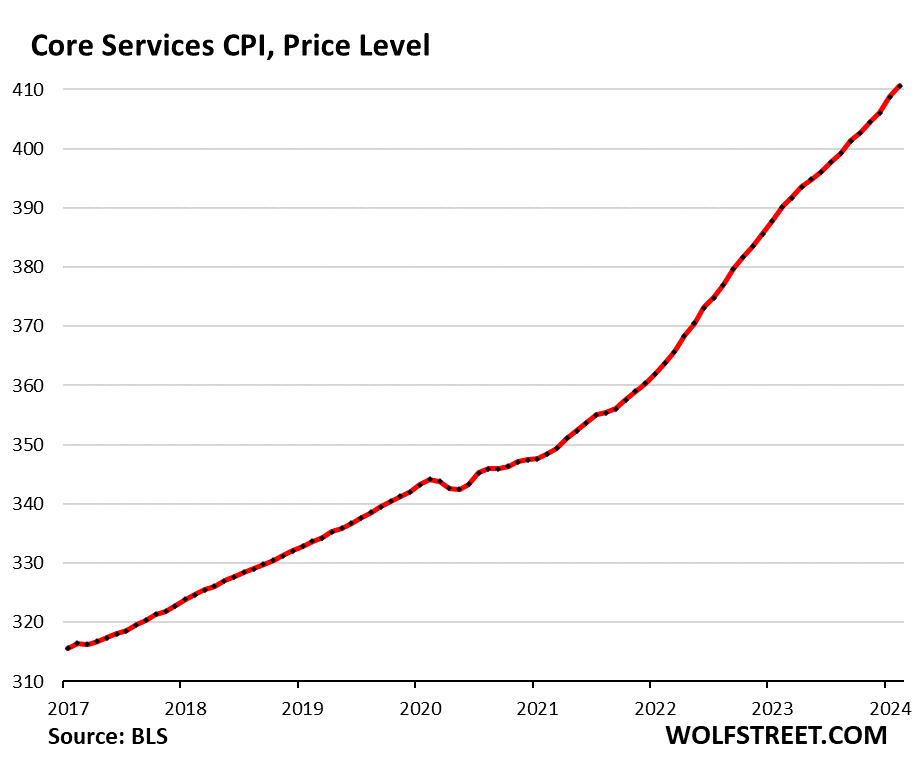

The “core services” CPI (services minus energy services) is crucial. The majority of consumer spending goes to core services, and Powell keeps talking about it. Core services includes housing costs, expressed in rent factors. And people, including Powell, have been saying that rents will eventually come down, we know that, etc., etc., so we also look at core services without housing. And both measures have been re-heating for months – with both their six-month moving averages approaching 6% annualized!

The overall CPI has been pushed down by plunging energy prices and by dropping durable goods prices. But it has also been re-accelerating on a month-to-month basis for the past three months, rising 0.44% in February from January (5.4% annualized), the worst increase since August, and accelerated year-over-year to 3.2% (from 3.1%).

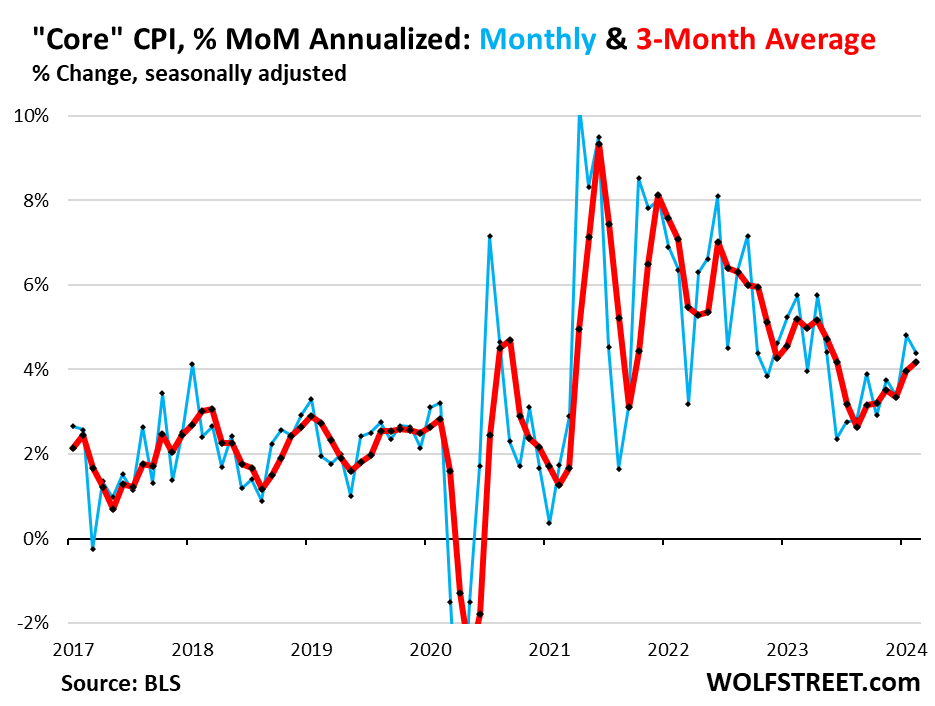

And the core CPI, which excludes food and energy, has been pushed down by dropping durable goods prices, but it has been accelerating on a month-to-month basis since June, and the three-month moving average reached 4.2% annualized in February, the highest since May, according to data from the Bureau of Labor Statistics today.

The Fed has been in search of “confidence” that inflation continues to cool. But this is not a confidence-inspiring chart. Maybe they’ll have to search for confidence a little longer.

The guilty party: Core Services CPI.

We’ve been disconcerted here for months how inflation in core services, after cooling a bunch, has been reheating. But that’s how inflation is – it produces head fakes and then serves up nasty surprises.

“Core services” CPI jumped by 5.6% annualized in February from January (blue), on top of the 8.2% spike in the prior month.

The six-month moving average accelerated to 5.8% annualized, the worst since May 2023. Month-to-month data is very volatile, but the six-month moving average shows the trend, and the trend has been getting hotter in a very disconcerting way since mid-2023:

And for your amusement, here are some of the historic head fakes of core services:

“Core Services without Housing” CPI – we’ll get to housing in a moment – jumped by 7.7% annualized in February from January, on top of the 11.6% spike in the prior month. But the month-to-month data is super-volatile. So we look at the six-month moving average to see the trend, and the trend is horrible.

The six-month moving average jumped by 5.7% annualized, the hottest since October 2022.

The housing components of core services CPI.

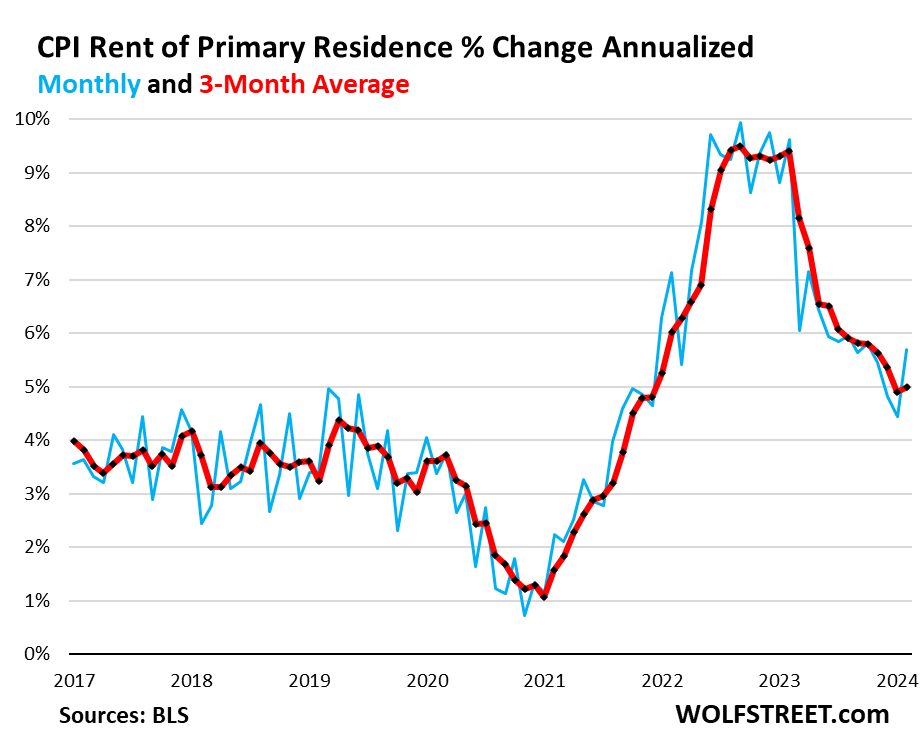

Rent of Primary Residence CPI jumped by 5.7% annualized in February from January, after the 4.4% jump in the prior month.

The three-month moving average accelerated to 5.0% annualized. This was the first month since peak-rent-inflation in February 2022 that the three-month moving average re-accelerated.

The Rent CPI accounts for 7.7% of overall CPI. It is based on rents that tenants actually paid, not on asking rents of advertised units for rent. The survey follows the same large group of rental houses and apartments over time and tracks the rents that the current tenants actually paid in these units.

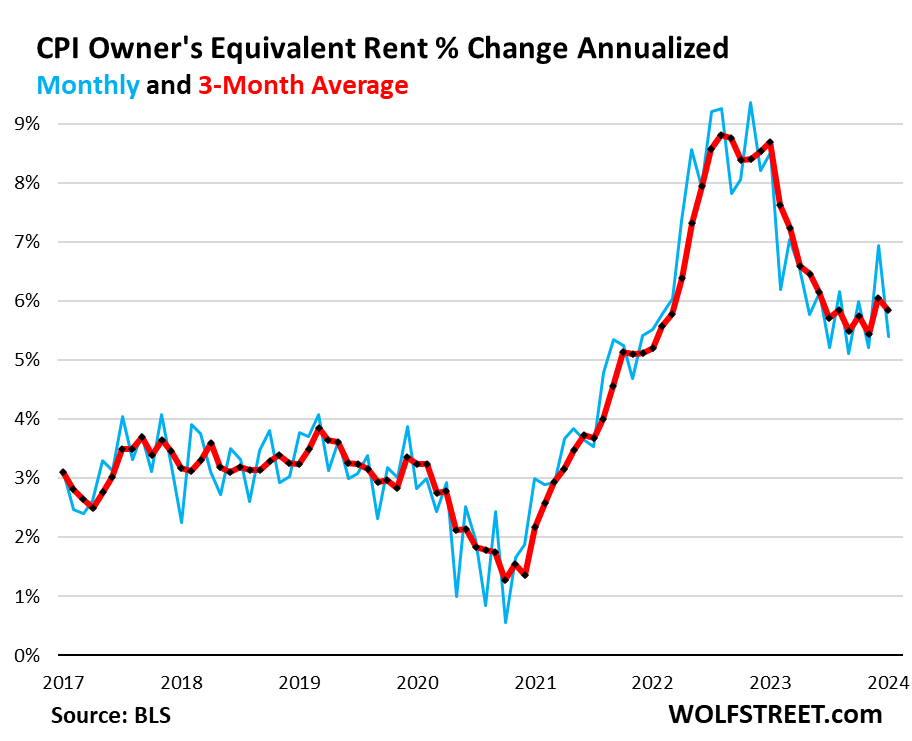

The Owners’ Equivalent of Rent CPI jumped by 5.4% annualized in February from January, on top of the 6.9% spike in the prior month.

The three-month moving average jumped by 5.9% annualized in February from January, after the 6.0% jump in the prior month. The three-month moving average has been in the near-6% range since June, and the long-awaited further cooling remains awol.

The OER index accounts for 26.8% of overall CPI. It is designed to estimate inflation of “shelter” as a service for homeowners and is based on what a large group of homeowners estimates their home would rent for.

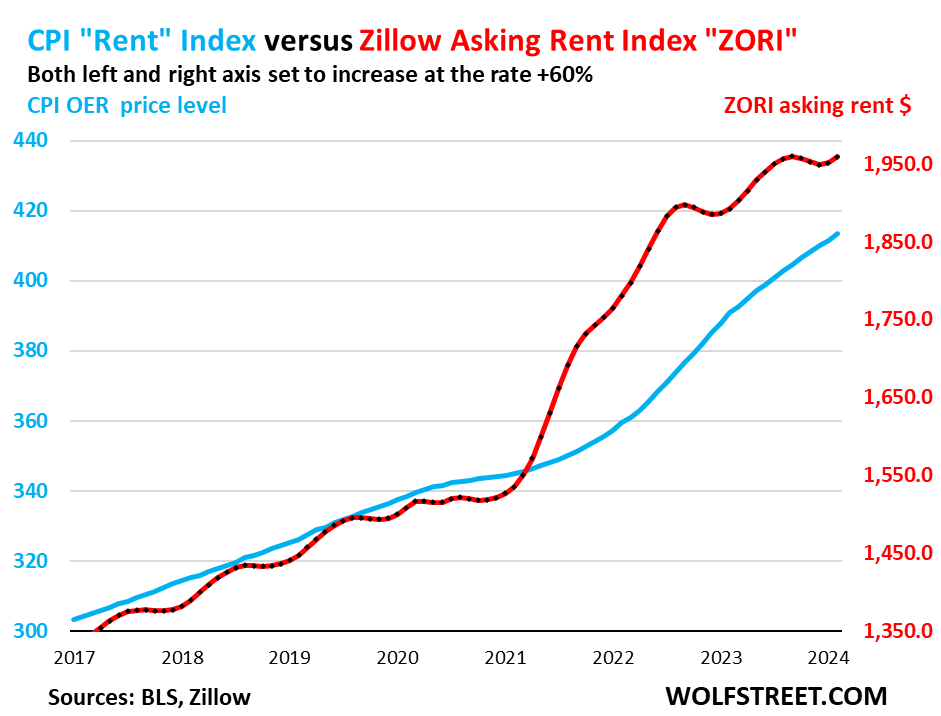

“Asking rents…” The Zillow Observed Rent Index (ZORI) and other private-sector rent indices track “asking rents,” which are advertised rents of vacant units on the market. Because rentals don’t turn over that much, the ZORI’s spike in 2021 through mid-2022 never fully translated into the CPI indices because not many people actually ended up paying those asking rents.

The ZORI rose to $1,959 in February, the second month of month-to-month increase after the seasonal dip late last year.

The chart shows the CPI Rent of Primary Residence (blue, left scale) as index value, not percentage change; and the ZORI in dollars (red, right scale). The left and right axes are set so that they both increase each by 50% from January 2017, with the ZORI up by 48% and the CPI Rent up by 36% since 2017.

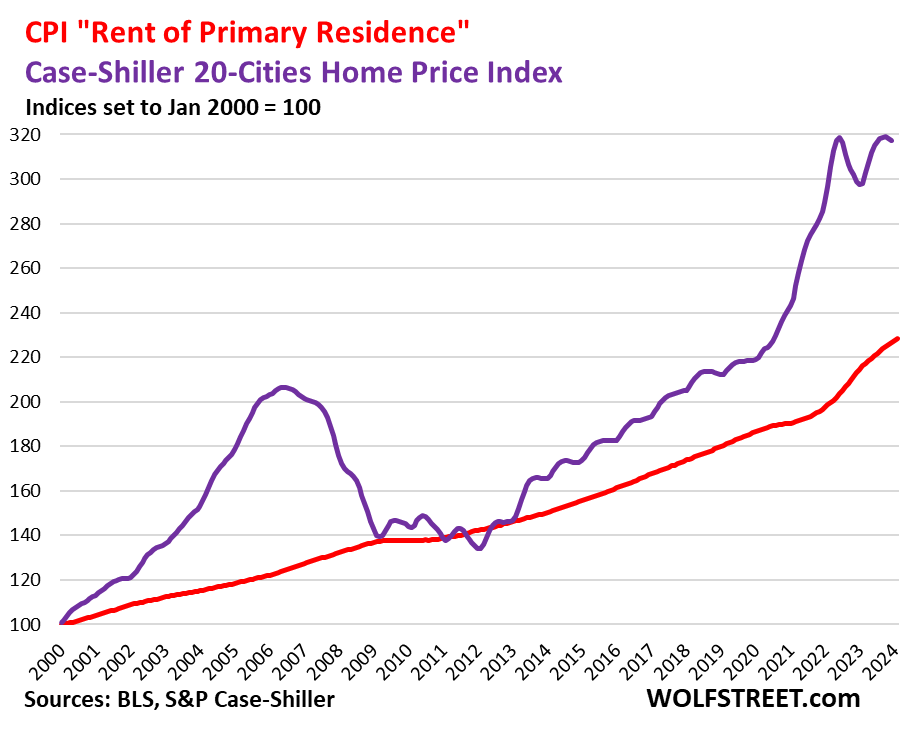

Rent inflation vs. home-price inflation: The red line represents the CPI for Rent of Primary Residence (tracking actual rents) as an index value, not percent change. The purple line represents the Case-Shiller Home Price 20-Cities Composite Index, which lags a few months and has now put in a double top, with the second decline in a row (see our “Most Splendid Housing Bubbles in America”). Both lines are index values set to 100 for January 2000:

Core services by category. The table is sorted by the components’ weight in the overall CPI.

| Major Services without Energy | Weight in CPI | MoM | YoY |

| Services without Energy | 61.0% | 0.5% | 5.2% |

| Owner’s equivalent of rent | 26.8% | 0.4% | 6.0% |

| Rent of primary residence | 7.7% | 0.5% | 5.8% |

| Medical care services & insurance | 6.5% | -0.1% | 1.1% |

| Education and communication services | 5.0% | 0.5% | 1.5% |

| Motor vehicle insurance | 2.8% | 0.9% | 20.6% |

| Admission, movies, concerts, sports events, club memberships | 1.9% | 4.5% | 4.8% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.5% | -0.6% | 5.1% |

| Motor vehicle maintenance & repair | 1.2% | 0.8% | 6.5% |

| Water, sewer, trash collection services | 1.1% | 0.5% | 5.3% |

| Video and audio services, cable, streaming | 0.9% | 0.5% | 4.2% |

| Lodging away from home, incl Hotels, motels | 1.4% | 0.1% | -0.4% |

| Pet services, including veterinary | 0.4% | 1.0% | 5.9% |

| Airline fares, other public transportation | 1.1% | 3.6% | -6.1% |

| Tenants’ & Household insurance | 0.4% | -0.1% | 4.1% |

| Car and truck rental | 0.1% | 3.8% | -10.0% |

| Postage & delivery services | 0.1% | 2.2% | 3.2% |

Core services price level. Since March 2020, the core services CPI has increased by 19.4%. This chart shows the core services CPI as index value, not as percentage-change of that index value. You can see that the curve of price levels has become steeper in recent months.

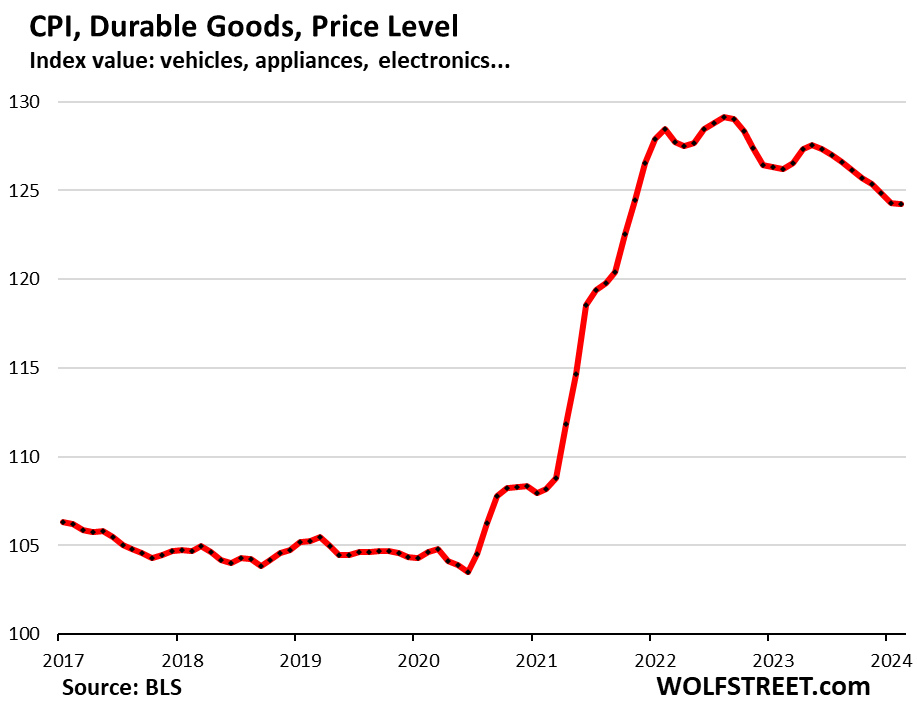

Durable goods CPI.

New and used vehicles are the biggies here. Durable goods also include information technology products (computers, smartphones, home network equipment, etc.), appliances, furniture, etc.

The index edged down 0.06% (-0.7% annualized) for the month and by 1.6% year-over-year. Prices started declining in the second half of 2022 as the shortages, supply bottlenecks, and transportation chaos faded, and driven by a historic plunge in used vehicle prices that followed the mindboggling spike.

From March 2020 to the peak in August 2022, durable goods prices spiked by 23.4%. Since then, they have dropped 3.8%, having given up about 20% of the pandemic spike.

| Major durable goods categories | MoM | YoY |

| Durable goods overall | -0.1% | -1.6% |

| New vehicles | -0.1% | 0.4% |

| Used vehicles | 0.5% | -1.8% |

| Information technology (computers, smartphones, etc.) | 0.2% | -5.9% |

| Sporting goods (bicycles, equipment, etc.) | -0.6% | -1.8% |

| Household furnishings (furniture, appliances, floor coverings, tools) | -0.3% | -2.3% |

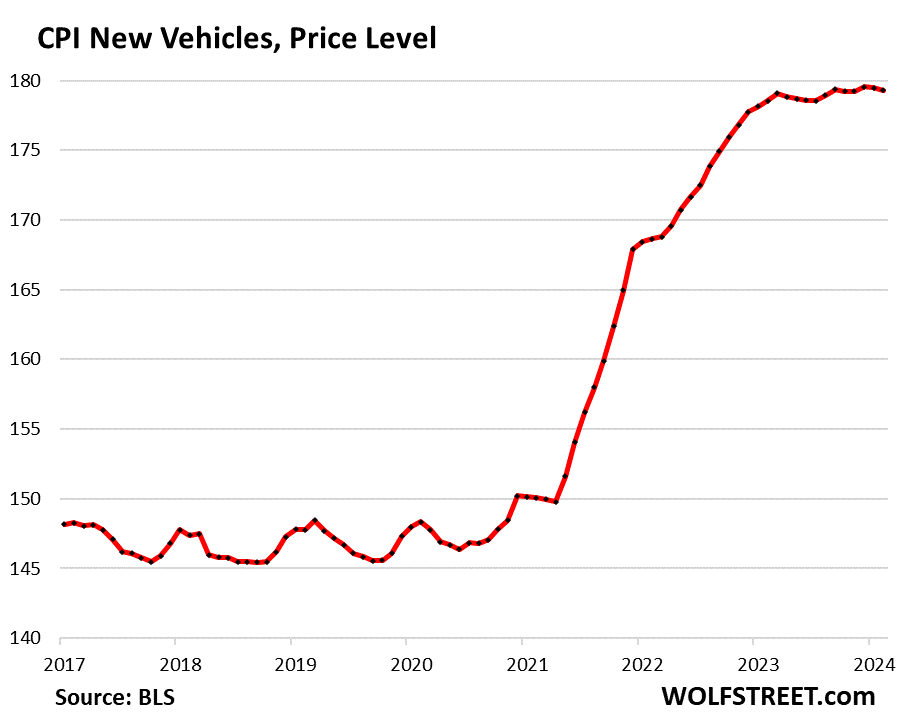

New vehicles CPI has remained essentially unchanged since March 2023, after the 20% price spike in 2021 and 2022. Unlike used vehicles, new vehicle prices have not given up any of that price spike.

In the years before the pandemic, the new vehicle CPI was also meandering along a flat line, though vehicles were getting more expensive. This is the effect of “hedonic quality adjustments” applied to the CPIs for new and used vehicles and other products (chart and detailed explanation of CPI’s hedonic quality adjustments).

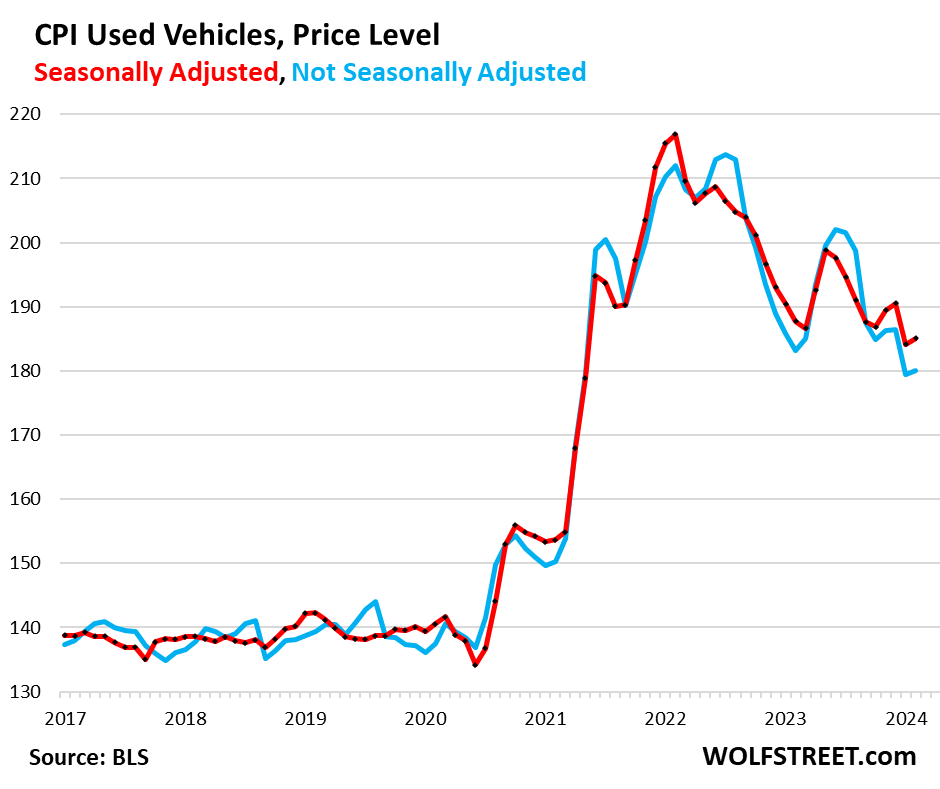

Used vehicle CPI rose by 0.5% seasonally adjusted in February from January (6.2% annualized), undoing the plunge in the prior month.

Used vehicle CPI had spiked by 53% from February 2020 through January 2022. From that peak, it has dropped by 14.1%, having given up 40% of its pandemic spike.

Food CPI.

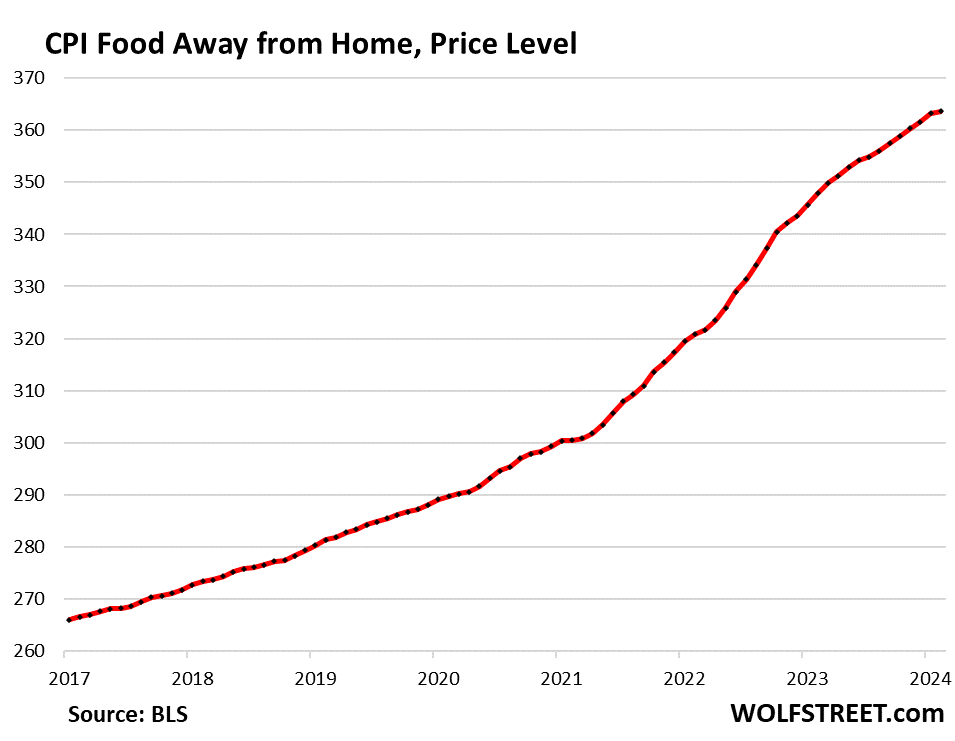

Food away from Home CPI increased only 0.1% in February from January, after the 0.5% jump in the prior month. Whether that small 0.1% increase is the beginning of a change in trend or just a one-month volatility blip remains to be seen.

Year-over-year, the index rose 4.5%. Since February 2020, the index has soared by 25%.

The category includes full-service and limited-service meals and snacks served away from home, food at schools and work sites, food from vending machines and mobile vendors, etc.

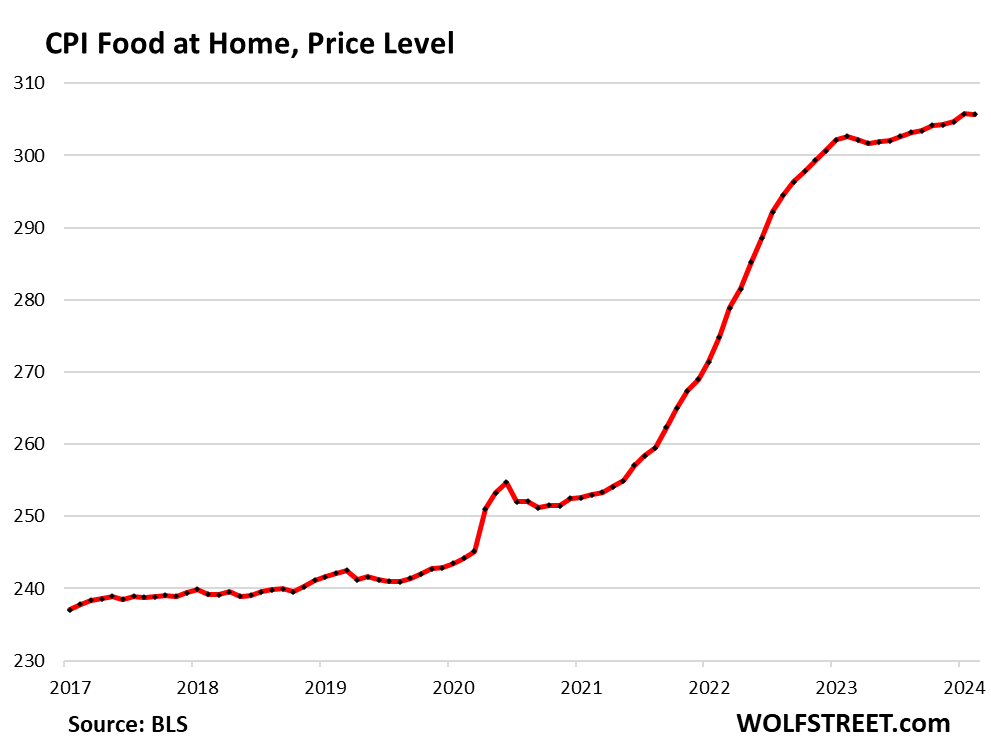

Food at home CPI – food purchased at stores and markets and eaten off premises – was unchanged in February from January, and was up 1.0% from a year ago. But the index is up 25% from February 2020, and prices are painfully high.

Energy.

The CPI for energy products and services jumped by 2.3% in February from January seasonally adjusted (31% annualized). Compared to a year ago, the index was down 1.9%.

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | 2.3% | -1.9% |

| Gasoline | 3.8% | -3.9% |

| Utility natural gas to home | 2.3% | -8.8% |

| Electricity service | 0.3% | 3.6% |

| Heating oil, propane, kerosene, firewood | 0.7% | -4.3% |

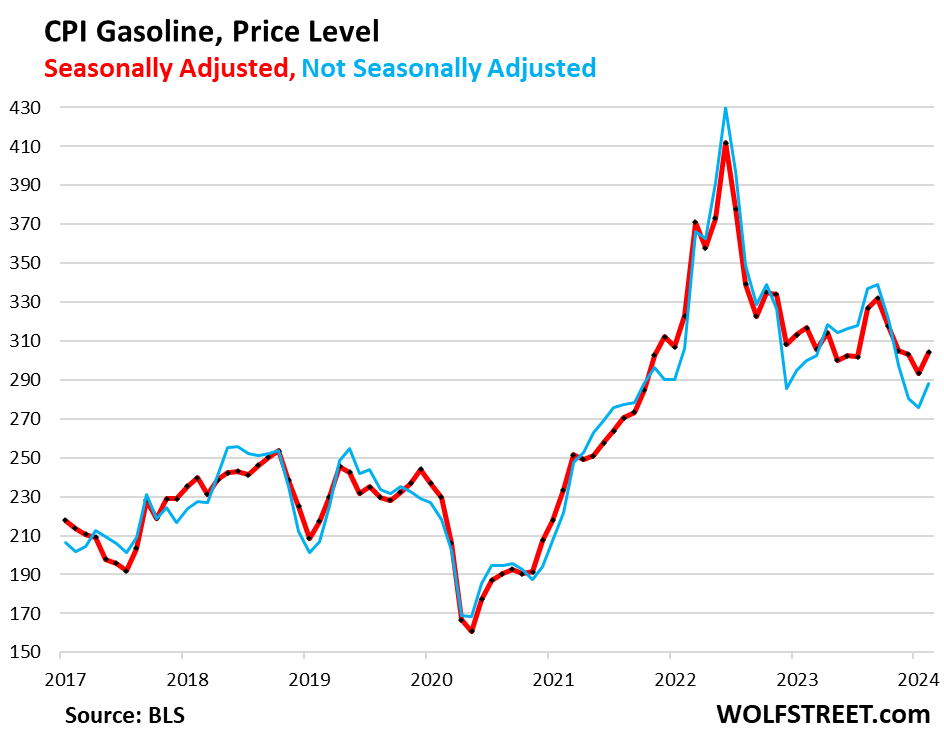

Gasoline accounts for about half of the energy price index. And it’s seasonal with the lowest prices in December/January and the highest prices during drive-time in the summer. The chart shows both, the seasonally adjusted price levels (red) and not seasonally adjusted price levels (blue).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks Wolf,

Very concerning! Higher for longer without a doubt!

I can’t speak to the other components of the CPI, but I know the rental business well and rents ARE NOT going down.

RE taxes, insurance premiums, interest costs and maintenance expenses from utilities to services to materials, are all going up by ridiculous amounts, not to mention the cost to buy the property.

Who would drop rents with every simgle cost going up. No one.

This is called a HASTY GENERALIZATION. And FWIW, I’ve seen rents falling first-hand in Austin along with rentals sitting on the market for between 4-7 months. I have properties/addresses I can provide.

No need to provide addresses. From ApartmentList.com:

Austin MSA, overall rent estimates:

August 2022 (Peak): 1,634

Feb 2024 (Current): 1,443

Austin MSA rents are down 11.7% from their peak.

Johnny5,

Those are ASKING RENTS and NOT actual rents that tenants actually pay.

Huge difference. RTGDFA.

And for the Austin MSA vacancy rate (ApartmentList.com):

February 2024: 9.7%

This is the highest ever vacancy rate recorded for the Austin MSA data series (but the data only goes back to Jan 2017). The minimum for this data series was 4.1% in September/October of 2021.

Real estate is very local. Cannot conflate Wolf’s analysis in this way. Rents in Bill, Wyoming are up. Population 112.

No one is conflating the overall actual rents used in the CPI with asking rents in local markets. Our comments have nothing to do with Wolf’s discussion on CPI rents.

Bulfinch and I were responding to CCCB’s rhetorical question: “Who would drop rents with every single cost going up. No one.”

Austin landlords are, on average, ASKING for much lower rents. This will translate into lower actual rents in Austin as rental units turnover.

RTGDF comment thread.

Johnny5,

If you are responding to CCCB, why are you discussing ASKING rents? You seem to have injected that into the comment thread, because it’s not in CCCB’s comment which I read to be discussing actual rents. Providing figures regarding how much rents have actually gone down on average in Austin may be relevant to CCCB’s comment. That said, CCCB was obviously talking from personal experience and a market exception to everything can be found in a country the size of the United States.

Three of my examples are friends & neighbors so I maybe know a little something about ACTUAL realized numbers, too.

Falling, not rising rents are the anomaly. Pull up any long term national rent chart dating back 50-80 years and see if you can find any sustained downtrends.

bulfinch,

So you call out a “HASTY GENERALIZTION” with a some anecdotes? I’m not sure that’s any better. It’s probably different people seeing different things depending on where they’re located.

Austin is probably the most absolute extreme analogy for this take. Austin has as many units in their pipeline as they do in their inventory.

Core, Gateway markets are all showing major rent growth due to the new capital market requirements, and resulting crushed supply

Prediction:

On Wolf’s wonderful CPI OER vs CS home price chart, both lines eventually converge somewhere in the 260-280 range.

Rents will keep rising and home prices will continue their decline.

If I were to apply stocks charts rules-convergence more like between 220-260 range -assuming everything else stays the same.

No one knows where the lines converge or if they converge. We only have one cycle in the past. That’s not enough to predict.

Fair point – that they converge at all is also an assumption.

It’s not a matter of dropping rents, but not being able to increase them more. Tenants’ ability to pay isn’t linked to the landlords’ costs, especially if they purchased at bubble prices.

The going on 7-year Core Services CPI Price graph is extremely telling. It reminds us that about the only way services prices to go down is from a recession.

A recession is the ONLY cure for housing price crisis. There’s not an interest rate crisis or number of houses being built crisis. THERE’S A PRICE CRISIS. Everyone knows this.

Again, a recession is the ONLY cure for anything that even remoted resembles normalizing prices back to the mean.

Housing, Stocks, & Crypto all need a big fat recession. Heck, unemployment will probably rise up to about 4.5% just from people re-entering the job market as their non-household debt levels rise to astronomical levels.

BULLISH!

/s

The stock market rocketed up today, a mirror image of the reaction to January’s numbers, despite February’s numbers being slightly hotter (0.4% M/M on both headline & core, instead of just core.)

Over the last 3 months, FOMC members have only reinforced the message that further rate increases are unlikely; their bias is clearly towards easing; a few months of high inflation doesn’t make a trend; and high inflation likely just means higher for longer instead of starting a new rate hike cycle. Is it any surprise Wall Street is so giddy?

Treasury market not very “giddy.” 10-year yield rose nicely.

The 10‐year has been slowly climbing in yield, and then at the latest auction the high yield exceeded the when-issued.

I’m sensing a teensy bit of reduced investor appetite for duration at these yields…

Adidas, a footwear and apparel retailer, reported the first quarterly loss in 30 years. North American sales down 21% in the first quarter 2024. !000 Family Dollar stores closing.

Higher for longer.

Ecommerce, competition directly from China, brand problems. Nike doing pretty good. revenues and net income up.

One company’s results only tell about one company.

Ehh, this looked more algo driven to me than anything else. Even with no more hikes and just a few cuts, 4.75% means that equities are absurdly overvalued, when you consider the risk free rate.

Interest rates are at where they were in 1991. Inflation moderated for the next 20 years then thanks to (among other things) a shift in supply chains.

Now Covid shifted supply chains again. Then labor arbitrage; now AI and automation.

The fed funds sits at 5% and mortgage at 7% and nothing breaks. People are spending like drunken sailors. Inflation is persistent but under control as long as rates are in restrictive territory.

I think there is definitely a bullish case to be made.

I think the housing market seizing up means “something broke.”

Sellers are holding out for a return to ZIRP, but they won’t (or won’t be able to) hold out forever.

You will know interest rates are restrictive when the government actually cuts spending.

Misemeout:

Interest rates will NEVER bee too restrictive for other people to spend other people’s money!

The cost of debt service, government shutdowns, war and pandemics don’t phase a lifetime salaried government employee.

The system is “too big to fail” and the “only game in town” mentality. It doesn’t end well, but the music is still playing (just like the Titanic)!

When does “higher for longer” actually include the possibility of “higher”………..?

@gimp: I don’t foresee Powell going higher than where we are unless something changes drastically…all we can hope for is longer.

Inflation will probably have to exceed 5% CPI / 4% PCE year-over-year before they (very reluctantly) reopen the possibly of more rate increases. A U-turn from their current easing bias would make them look like fools and piss off Wall Street, so they’ll hold off as long as they possibly can.

The current 3-4% CPI / 2-3% PCE range is above-target but “low” enough to make continued dovishness politically tenable. Many Wall Street analysts predicted back in 2022 that the Federal Reserve’s inflation-fighting resolve would diminish in the last mile.

Jackson Y:..

WHAT easing bias??? The Fed has been doing QT and rate hikes for two years now without a single sign that they intend to back off (other than some anonymous dot plots at the end of each year that they quickly disavow).

The “many Wall Street analysts” that you cite have been hoping and wishing that the Fed would back off… but it hasn’t happened at all. And far from pissing off Wall Street, the Fed ACTUALLY backing off of inflation fighting would be greeted by Wall Street with Hallelujah’s.

Not so innocent question. But why do we raise interest rates? From my viewpoint that just further enriches the class who buys Treasuries. Which is inflationary. I think we’ve forgotten how to regulate the economy so that it benefits the most citizens, not just a small wealthy minority.

Perp – the rate increases are supposed to slow the economy and thus inflation but with all the money printing the last few years still sloshing around it appears to be interfering with that quite a bit.

My take on it is we won’t see reduced economic activity/inflation/interest rates until that wad of cash gets “absorbed” somehow. As to the how I suspect it’s going into hard assets and the stock market plus consumption but I’m no economist, etc…

@Spencer

Let’s face it, there hasn’t been a ton of vigor to the Fed’s QT. Even when letting assets roll off the sheet, they cap it at roughly 1/2 of 1% per month ($60B). They also talked about QT for a year before taking any action, after a year+ of obvious BS about “transitory” inflation at 8%

Most importantly, the caps will be lowered to even less meaningful roll offs next year, as Wolf identifies in a recent article on the subject.

Of the $9T printed in the last 15 years, it’s hard to see the Fed removing even half of that before they cook up another excuse to print again. Some of that is just the reality that the biggest customers for our debt are backing out of the market. We’ve borrowed too much with no end in sight, and there are fewer lenders available for us. The rest is a shameful (and illegal) wealth tax to pay for spiraling entitlement costs.

The better inflationary fight would have been yanking all the capital out of the system more quickly. Soft shoeing it with these caps is preposterous.

Boston Developer:

I couldn’t disagree more strongly. It is NOT in the Fed’s interest… or the nation’s… for them to blow up the economy just in order to make their Balance Sheet look prettier, faster. The whole point of a Central Bank is to limit the boom-and-bust cycles that laissez faire economic systems are prone to.

There is little doubt that the Fed would have continued the QT started in 2017 past 2019 if the Repo market hadn’t blown out. As you say they now have the COVID-era additions to deal with as well. But the WHOLE POINT of the proposed lowering of roll-offs is to EXTEND Quantitative Tightening… not to end it altogether.

As the previous article by Wolf makes clear, the Fed may not need to lower the rolloffs at all as QT will slow on its own in 2025. But kudos to the Fed for trying to come up with a plan to prevent a rehash of 2019. They don’t need to speed up QT as long as it is achieving their goals at the present pace. As we have seen with the Bank of Canada and others when it comes to QT… the race is not always to the swift but to those that endure.

lol gas prices up,food,up entertainment up,but none of that matters companies have to borrow at higher rates. This is why lay- offs started . Your prices are going UP . Simple math

When people say “higher for longer,” they pretty much mean “this high for longer.”

Are further hikes impossible? No; if inflation really takes off again like it’s threatening to, there may be another grudging hike later this year or next. But they’re really unlikely, and if they happen they’ll likely be too late again. The Fed lacks the stomach to get out ahead of inflation and stomp on it once and for all, and they’ve signaled their recent squeamishness very clearly (the December dot plot, hinting publicly about rate cuts even as disinflation threatened to reverse).

There is little doubt that the Fed is hoping to avoid raising interest rates in the middle of an election year. That is an institutional bias on their part. Even Paul Volcker lowered rates at the start of 1980… by a LOT. But that doesn’t signal squeamishness on their part… just realism of the possibility of outside interference going forward.

Literally no one doubted Volcker’s willingness to crush inflation when he DROPPED rates in early 1980… so why the concern that Jerome Powell lacks what it takes when he merely holds rates steady in 2024?

Powell may have been slow to address inflation in the beginning… but most Central Bankers are. The only one who I can think of who jumped on inflation early was Alan Greenspan who raised interest rates to almost twice the inflation rate for the period of 1987-1990… and he produced a recession bad enough that it is widely believed to have cost the first George Bush his re-election. Amazingly enough Greenspan did it again in 1999-2000 and got blamed for the Dot Com Bust (recession) that “caused” Al Gore to lose in 2000.

Before you start writing Powell off as weak on inflation… wait to see what he does in November after the election is over. THAT is when the famous “inflation dove” Paul Volcker jacked the Fed Funds rate up to 15-20% for eighteen long months.

The Fed *thinks* they can stamp out inflation, as does most of the populace.

But what if they’re wrong? What if monetary policy is NOT the solution?

There’s a case to be made that fiscal policy is what is required for inflation management.

Mr. Market just wants to be “high for longer”…

It’s a fair question. The 10yr isn’t really higher than the multiple cycle average. Higher than rock bottom? Yea. But these talks of rate cuts are hilarious. Full employment, high inflation. Rates need to go up, not down.

Would be interesting to see each of the inflation measures comparing today’s reading versus where the measures were in March of 2022. Just eyeballing the charts it seems they would be pretty close, with a few a little lower like used car prices and a few higher like food. Time to start raising rates again but we know the idiots in charge didn’t get their jobs based on their intelligence but their ability to go with the political winds.

It’s very similar to the mission accomplished banner being displayed when nothing could be further from the truth. Unless of course the whole point is to funnel billions to corporations via war just like this phony war on inflation is enriching the billionaires that are selling their shares to the public suckers as fast as they can. When is the doge coin ETF coming out?

I doubt many billionaires are trying to scam the public. They’ve already made it — they don’t need to engage in fraud on top of the sugar they’ve already collected.

I believe you’re wrong here. First off, temperamentally, the type of people who score billions are relentlessly greedy in the first place. Those tigers rarely change their stripes. Second, once they’ve made a billion, they’re often locked-in to whatever they’ve been doing (owners’ equity cuts both ways). Third, among billionaire society, it seems that the social-emotional cost of having your fortune downgraded (relative to “peers”) is unbearable; it’s a relentless game of one-upmanship down there. Finally, if they don’t need to engage in fraud or scamming the public, why is it that so many of them feel a need to buy up a major newspaper or media outlet to help with “messaging”?

I still say by and large the billionaires are not the culprit.

You mention them buying newspapers. I don’t believe they buy papers to make money or for “messaging” purposes. There is an urge to have an influence in society which comes with high position, and that’s what’s driving them.

How do you think they got there? You think their behavior will change?

Larceny often contains a pathological element.

You clearly don’t follow any of the profitless “tech” companies, many of which went public during covid. You can read their press releases and compare with their SEC filings, it can be night and day. And I put tech in quotes because in may cases they are in industries that are old and rather dull but thanks to the miracle of AI or blockchain or the cloud they are going to revolutionize the industry. The amount of money they lose is insane but I don’t think alarms people as much because uncle scam sets such a bad example.

And as far as billionaires/100 millionaires, I’ve known people in the trades that have done work for them and they typically have said they’re both mean and miserable. Many but not all are cheap. I think it could be a very tough life actually but we need less of them and a much bigger, healthier middle class. Part of that is to put a stop to all these constant asset bubbles.

Yes, let’s not pick on the poor, altruistic billionaires!

They all have the best in mind for “others.” Especially once they’re dead and they have their name on the foundation, building and bank.

I don’t believe one HAS to be a sociopath to acquire that much wealth, but it seems to happen along the way without fail.

It’s the exaltation of Self in the name of accumulation of excess.

Yeah but the wannabe Paul Volcker is itching to cut the rates.

His only legacy will be to make Burns look like a genius.

Absolutely agreed.

With respect to core services CPI, the real fed funds has once again gone negative, THAT’LL get this inflation down, surely!

Yeah, my teacher used to read Burn’s correspondence to his money and banking class. He like Powell, was clueless.

If the Fed cared about inflation as much as it claims, it would have pushed back against the narratives that have caused conditions to loosen as much as they haven.

I’m with Depth Charge. They want this inflation.

They need to show it with action. The March Dot-Plot needs to show two cuts or less. Anything more means they are kowtowing to Wall Street.

Based on the Fed talk I’d be surprised if they don’t remove at least one of the previously “penciled” in cuts.

Especially with markets at ATH seems like time for a reality check

“If the Fed cared about inflation as much as it claims”

I think that is the issue…they don’t. My guess is they have decided to prioritize low unemployment over inflation.

Whether they actually want the inflation is another matter. Is the FED trying to assist in managing the national debt when they make decisions? Are they concerned that inflation helps to enable deficit spending?… which contributes to inflation?

It could be they are just trying to get out of the QE mess and they are actually pleased with 3% inflation, but they also know they can’t tell anybody that without upsetting the applecart.

“It could be they are just trying to get out of the QE mess and they are actually pleased with 3% inflation, but they also know they can’t tell anybody that without upsetting the applecart.”

BINGO

If they allow inflation to sit at 3-4% indefinitely, yields will blow out. It’ll happen anyway, but no way investors will pay for 30 year bonds at 4% with a “target” of 6-7% (including years of printing during “emergencies”)

Perhaps its a distinction without a difference, but I’m drawing a potential distinction in intent. The FED feeling like they are trying to thread a needle with their hands tied, while politicking their messaging, is not the same as them being central in a conspiracy to inflate away the national debt.

Regardless, as Wolf says, inflation has always been the way massive debts are handled. So maybe it’s just that simple, whether the FED is along for the ride or they are driving the bus.

At some point, I would think the yield curve has to correct itself, either short term rates come down or long rates go up. And I agree that the longer term rates seem like a bad investment, unless that highly anticipated recession happens…

I dunno – yields didn’t blow out when inflation was higher.

I think you could see the 10-year bounce around between 6 & 7% if the mkt eventually “accepts” a 3% inflation avg. That would put mtg rates at 9-10%, “junk” bond rates at 15-20%… not really that crazy if you think about it.

As long as the Fed can continue doing QT and there are still buyers for treasuries, they don’t really have a problem.

Of course they want it. Inflation is a regressive tax which hurts the working class and the poor, and takes their money and hands it to the wealthy who are the ones in total control of the US government now.

We are in the later stages of a massive class war where the billionaires have taken huge percentages of the wealth of everybody below them, and now they are just making a mockery of everything and everyone – the entire system.

What I would propose at this point is to start wealth-stripping all billionaires and hundred millionaires by any means necessary. The livelihood of the future generations is dependent upon it.

And when they start talking about personal carbon footprints, the first step should be to outlaw all houses over, say 10,000 square feet. No grandfathering them at all, they have to be demolished. Same for all oceanfront properties. That’s not healthy for the seashore or good for “the climate.” Buh-bye – raze them all.

And, before any emissions restrictions can be placed upon personal vehicles, all small jets need to be banned. Further, there should be no more “first class” on airline travel. It’s the same seating for everybody. Let’s start making these people who have hijacked our system live by the same rules as everybody else, and face them every day.

This would be a good start, but rather than stripping the oligarchs (especially the banksters and tech billionaires) of their wealth, I’d recommend putting them in detention camps.

There all building bunkers ,good luck finding them ,though I hear lots of them heading to New Zealand,you can run but you can’t hide

If you think the speak the “correct” way your wealth will be safe, no need for you to be detained.

I believe history suggests this always seems like a better idea than it actually is because you quickly find yourself identified as an oppressor once you’ve eliminated the 500 or so billionaires.

Are we really suggesting gulags are the answer?

Correct on all accounts.

And us Americans had better start getting to doing what we need to do before us & everyone around us are broke and destitute.

Let me tell you DC that I am a big fan of yours and your comments echoes my thoughts exactly.

A drink on me if we ever meet IRL.

I would take a different approach but nice to see some class consciousness! This is a massive lift with both an education component and equally important organization component. The ground is getting more fertile given the changing material conditions. Impossible to predict where it will go next.

“Of course they want it. Inflation is a regressive tax which hurts the working class and the poor, and takes their money and hands it to the wealthy who are the ones in total control of the US government now.”

I dunno, that’s a diabolical bridge too far for me.

Perhaps you should familiarize yourself with campaign finance, pork barrel legislation, and most important of all – Wolf’s wealth distribution charts showing the growing disparities over the past 25 years.

If Wolf would be so kind as to post his chart showing the wealth gap, and how they benefited especially over the past 4 years, it speaks for itself.

There is wealth disparity in all systems of governance. Systems like communism only make it worse because more people are truly impoverished. Also, the billionaires have little incentive to do what you are talking about. They are only taking advantage of a system created by bad government. They just want to make money, and a system that allows innovation and economic growth benefits everyone. Unfortunately, not everyone benefits the same, but the US has produced more wealth for more people than any other country. The goal should be a system that rewards hard work with social mobility, and a higher standard of living for the inevitable relatively poor people that have always existed and always will.

Government interventions are the problem.

“Government interventions are the problem.”

What part of THIS did you miss?

“…the wealthy who are the ones in total control of the US government now…”

It’s not “government interventions,” it’s billionaires telling lawmakers what to do.

Go back to the bank bailouts. Who were the people “in the room” for those meetings? Jamie Dimon, etc. Remember that worm Tim Geithner talking about “foaming the runway?”

How about Angelo Mozillo, his crooked Countrywide Mortgage, and his “friends of Angelo” (politicians) loan programs? Why isn’t he in jail? He made off with all the loot. You seem to not understand what’s going on.

Chs,

China industrialized rapidly and brought their entire population out of extreme poverty. It came with mistakes, such as the cultural revolution, but they appropriately utilized Marxism and realized you need to adapt and they will continue to.

The idea that private capital is what brings about innovation misses that 70% of the iPhone technology was originally developed in the public sector with tax payer money. The Soviet Union while also making mistakes industrialized rapidly, defeated fascism almost single handedly and then were the first to the moon. Western capitalism fails to be honest with its mistakes, including dividing up most of the world to exploit including the genocide of 15 million native Americans and of course only not being at war for 17 years of our history, installing dictators if it suited our needs(Chile for example).

Do you think capitalism/ imperialism is the highest society can evolve as I sure that position was taken when slavery and fuedal systems existed?

Marx actually created theories more apt to industrialized countries in mind so that education, shelter, healthy food, employment would all be accessible. There is no utopian system but hopefully you can agree the wealthiest country in the world might have one of its goals of taking care of its citizen rather than surplus value going into the pockets of the view?

I understand everything in our society from Hollywood to media coverage wants to keep the status quo but where would we be without those that challenge it?

“What part of THIS did you miss?”

I didn’t miss it, I just think you put the cart before the horse. The rich folks have a seat at the table because the corrupt politicians like campaign contributions. I don’t agree that billionaires are in control of the government. Its simple quid pro quo.

Let me put it this way…you can bulldoze all the big houses and put all the billionaires in prison camps, but it won’t make a damn bit of difference because the political elite currently in charge get their power from keeping their voters disenfranchised, angry, and dependent on the government.

Chs,

The political elite are part of the bourgeoisie. Theoretically in our country people could be educated and organized to affect change. The way change would occur in one place would be different from others, especially in the global South. As you stated however the political class is very savvy at keeping the working class from uniting by sowing discord. It gets more irrational and hopefully people will see through it but until then education and organization and of course while small changes to help peoples quality of life are usually not permanent it is still a good thing.

Empires can take hundreds of years to fall or can happen all at once but the US will need to come to terms with a changing world. It will likely be longer term and will likely get worse before better. You can already see however how much of the global South is resisting the power of the US, even if they are small things such as blowing off US summits.

I truly hope all of this evolves peacefully as in our country technically the people have control and if not perhaps many Americans need a hard look in the mirror!

Glen, I always appreciate your perspective, honestly. But it will not surprise you that I see it a bit differently. The Soviet Union Industrialization came by way of Stalin’s threats of the Gulag if the people did not work and conform, and ultimately the system failed as people rebelled against oppression. China floundered under Maoist communism until Deng Xiaoping liberalized its economy, and its cheap labor force was exploited. Now that Xi has reinvigorated communism, they are starting to have problems.

I also don’t believe in Utopia, but so far in human history, Capitalism has produced the better results. I see a history where, on balance, higher government intervention creates more problems than it solves. I don’t think that this time will be different and communism can work without violent authoritarianism.

But, as I have said before, reforms are needed. We should strive to limit the power of politicians to the extent possible and should strip government of its authority to the extent that only necessary functions are maintained.

@Glen, first comment up above,

Chinese communism killed at least 50 million people. “Came with mistakes” indeed.

The Soviet Union also “made mistakes” like killing millions in the Ukraine and imprisoning millions in the gulag.

I suppose you would also suggest tge third Reich also made mistakes but improved industrial capacity in Germany?

You are free to immigrate to Venezuela if you are fond of socialist dictatorships. 1/4 of the country has left so they need the people.

Immediately cancelling my current 8000 sq ft addition on my 1200 ft home.

Hang in there DC. Love your posts.

LOL

You really confuse me sometimes, DC. I understand all your anger towards the Fed, but I thought you liked Trump & his policies months and years past?

Stripping all the oligarchs’ wealth may eventually become a necessity with the huge federal debt & higher interest rates, anyway.

Taking out first class seating on commercial airliners would be the ultimate socialism ‘chef’s kiss’ I suppose.

Doctrinaire Marx/ Lenin. Which led to REAL problems like famine that you folks with personal computers haven’t experienced.

Sure, writing the first translator code for the hobby Altaire computer in the 70’s began MS, that made Gates hugely wealthy, but it began the PC revolution that enabled yr comments.

For 500 $ you can get a million bucks worth of comp power

circa 30 years ago.

There are middle paths as in Scandinavia. A guy in Sweden got a multi- thousand dollar fine for speeding. In Sweden fines are proportional to yr income. He was a millionaire so…

But if he could afford luxuries, fine. No revolution needed.

This childish ‘ bring on the pitchforks’ BS? that is trotted out in every comment? You think Powell is corrupt and just wants to enrich his friends? Ya we know. You told us already.

BTW: first class air seats are much more profitable. The flier pays dearly for marginal differences for a few hours. Remove that extra profit and the coach ticket would have to rise in price to balance the books.

More PS cuz just so much BS. . The Mao communists like the Bolsheviks in Russia destroyed the economy which in both backward places was agriculture. One difference: China had known famine before. Not Russia. The Bolsheviks brought about Russia’s true Asiatic- type famine. This is where folks eat their babies after horses and dogs gone.

Today, after the CCP ‘miracle’, Taiwan’s GDP per capita is triple the Mainland. If the Chinese Nationalists had won the civil war, China would have been the world’s largest economy 30 years ago.

Why is psycho Mao’s face still on the money bills? At least Stalin was denounced by the Soviet Union’s Politburo.

Fundamental challenge for China: moving on from the CCP.

Let’s just hope the Security Force doesn’t become a new royalty, like the KGB which took over Russia.

The poster child of excessive entitlement IMO is Ajay Thokore, have a look at the video.

No worry DC…

Global warming/nuclear war will be the great levelers.

maybe AI will save them (LMAO/sarc).

Also, it’s not even just the poor and working class, but nearly all of the middle class too. Current policy besides the top 5-10% at most

All right!

and “BY ANY MEANS NECESSARY”, too.

For DC.

For DC…..somewhere I have the original author of that….somewhere on my cluttered desktop…..raised quite a stir…still does.

They don’t want a recession. The Federal deficit is already out of control.

Howdy Prisoners. To the Lone Wolf. Please do NOT seek public office or a Gorvern ment position. You will be killed. HEE HEE. Thanks and will wait for your comments concerning Powell and the Dot plot which you taught me about……

Expanding money supply, shrinking workforce, drop off in cheap imports, lots of structural problems. The really big one is loose financial conditions created by markets, which inflate asset prices (like houses and cars). The worst is the multiple bitcoin ponzi ETFs, whose managers must own the same product. I congratulate the Fed and the SEC for orchestrating the election year bubble, while sitting on a normal fed funds rate and professing that conditions are restrictive and to the Treasury and Fed for throwing regional banks under the bus, for owning treasury bonds, while they stoke a stock market mania.

The money supply shrank in the last month and year on year.

Hear hear! Just lovely job of pouring fuel on the fire. Somebody explain why Powell just had to kiss the ring and guarantee 2024 rate cuts.

Seems contrary information as to whether wage gains are keeping up with inflation. My sense those numbers don’t mean nearly as much as how people are actually feeling and perceiving it. Seems like Fed numbers and policy are just shrugged off by the markets and what we see will continue. Perhaps another year of QT will have a significant enough affect or we simply settle into a new normal of significantly higher prices in some areas than just a few years back. I’m sensing the latter.

Politicians and Central Bankers are prone to saying that “inflation is coming down”… but what citizens/voters HEAR is that “prices are coming down”… and they can see with their own eyes THAT isn’t true.

Hence the disconnect.

Most people are following the trend and are thinking inflation is coming down. They probably will be wrong.

This “head fake” chart including the 70s is nice. Never forget to look left (long term) on any chart.

Finally getting a little return $$$ from my T-Bills…..

This is why the Fed’s policy of decoupling interest rates from money supply is failing. If you push rates to 5% without curtailing credit availability meaningfully, all that happens is debtors pay more interest to creditors. Creditors tend to be wealthier than average and more prone to saving than spending, so at first the interest payments get plowed into asset bubbles. The debtors slowly scream in agony at the double-whammy of inflation in living costs plus higher debt costs, but so long as more credit is available to them, it takes a long time time for that pain to show up as reduced demand.

In the 1970s-80s version of this movie, both credit supply and interest rates were moved tightly together, there were no “ample reserves” or whatever BS, and it was when the credit spigot was shut off that inflation was slain. It wasn’t “just” high interest rates.

The whole current policy is a giant charade of one-eyed economists-in-error fooling the blind public.

“all that happens is debtors pay more interest to creditors”

Debtors pay more in nominal dollars – but inflation erodes the purchasing power of those future loan payments to the creditor.

“The debtors slowly scream in agony at the double-whammy of inflation in living costs plus higher debt costs”

Unless they’re also getting big raises due to wage inflation, and took out long-term debt when rates were low.

How many other folks are arbing rates right now, and paying off their 3% mortgage as slowly as possible while earning 5-6% on T-bills & agency debt?

I literally refinanced and sat on the cash for a year waiting for this to happen. So me (2.65%)!

As for the Core CPI head-fakes, it looks like the Fed dropped the FFR ~2% between Sept ’73 and Fed ’74, which could’ve played a part in reigniting inflation into mid-’75.

The Fed also raised to almost 13% by mid-74, which likely caused the 2nd head-fake into ’77. And like complete tools, the Fed then dropped rates far too quickly starting in mid-74 and reignited it right into the early 80s.

Seems to me Fed FFR intervention likely led to those head-fakes.

Wolf, to check my math, can you overlay the Fed FFR chart on top of the Core CPI chart?

Not going to check your math.

But it’s the head fakes that CAUSED the Fed to loosen its monetary policy, after which inflation soared again. It’s the Fed that gets fooled by these head fakes — which is one of the reasons the Fed is in no hurry to cut this time. Powell already borrowed my description of this phenomenon and term “head fake” to explain why they’re in no rush. They’re in wait-and-see mode.

I worded that so badly. I’m having a hard time braining today.

My thinking here is that the Fed’s FFR actions helped reignite inflation, not cause the head-fakes.

That’s why it would be nice to see the FFR overlaid on the CPI, just to make it easier to see how their lowering actions helped ramp inflation again after having initially stifled it with the raises.

Hopefully that makes more sense.

You were there first.

The cause-and-effect relationship between “interest rates” and “inflation” is not so well established that one can say with certainty “rate cuts reignited inflation”. They certainly didn’t reignite inflation from 1982-2019, just asset-price bubbles! Just because “everyone believes it” doesn’t make it true – especially in economics.

In the 1970s economy, driven mainly by manufacturing, credit availability was tightly linked to rates, in a way that is no longer true in todays service-based economy with “ample reserves”.

Also, the Federal Reserve managed differently in the 1970s; the Federal Funds Rate was not set the same way it is now, nor linked to other rates. In 1974 the 3-month T-Bill maxed out around 9% (nowhere near the 13% blip in Fed Funds). Today the T-Bill rate hugs Fed Funds because of Interest on Reserves and other arrangements that didn’t exist in the 1970s.

Finally, in the 1970s, oil-supply and labor politics came in waves, and those episodes drove inflation too.

I think we’re about to rediscover how little we really know about the causes of inflation. This won’t stop economists from claiming omniscience about it all…

It’s what priesthoods do.

Thanks for all the graphs. It looks like Powell has to first climb a staircase (if not wall) of worries to get the inflation really under control.

I he, FED is anxious to start the cut in June as otherwise the election date would make their task look political.

Everything has a political dimension in the economic system. Plus, regardless of what they choose it will be sold with whatever narrative those want to choose. Reality is that whatever happens in November, the systemic issues will continue to exist so the political backdrop is window dressing. America, besides other issues, finally has something resembling an economic competitor, and both sides will push for a new “cold war” which won’t be beneficial for most. Interesting shifts afoot!

Wolf, would be interesting to see a deep-dive into the factors driving increases in insurance!

Auto insurance is a product of higher labor costs at repair shops, higher parts costs, and much higher replacement costs when a vehicle gets totaled. Replacement costs are nuts. They’re 50% higher than they used to be in early 2020. There are some other factors too, but those are the biggies.

Seems like an interesting analysis to put on your list of potential content for the site. I’d find it an interesting read. Thanks for all you do!

Do you insurance premium’s going up? Is this just a lagged effect on CPI that has now played out, or will it continue to fluctuate?

I definitely discount insurance, maintenance and repairs as effects of replacement costs, not base-driving. It follows the asset prices. I’m not writing the articles but I think this is very reasonable logic. Insurers also have bad balance sheets l, they’re just like banks and had lots of duration risk.

Small but good and ”legal” shop that was $40/hr a few years ago now $120.

Buick shop that was $55, now $200 per hour.

I’m surprised auto insurance is not higher, just considering those numbers seen this week.

Turns out he’s no Volker. Obvious since the real Volker needed a wheelbarrow to carry his stones. So everybody gets to suffer another few years of his indecision just because it turns out he’s just a wannabe who won’t follow through and do what’s needed and instead, dithers. Looks like Wall Street pegged him for what he is when they wouldn’t believe him. Hard to fool the beast.

CPI went to 15% early in Volcker’s first term. We’re far from 15%. Inflation was really wild back then.

“Inflation was really wild back then”

Inflation didn’t hurt me back then during Volcker’s first term. I had just bought a house and was paying back the loan (9.85%) with cheaper dollars. Also, I remember getting over 10% interest on my money market fund. Other than energy prices, things were not going up across the board like they are now. Real estate prices actually declined from 1979 to 1982. I would take Volcker 2.0 over this crap we have to endure today.

Yes, wouldn’t we all. Unfortunately, I think the Debt:GDP ratio might be a problem. We cannot go “full Japan”, at least not as the world’s reserve currency…

Interesting times.

Except for property taxes, my costs haven’t changed much buy everything on sale. Don’t go out to eat ,only go to shit depot when necessary .But I’m retired don’t drive as much or have lunch out much mow my own grass do my own maintenance.Works for me people need to get off there ass quit complaining and be more self sufficient

Volcker didn’t stop inflation until he imposed reserve requirements on NOW accounts in April 1981.

Volcker was caught by surprise with the “time bomb”, (which Dr. Leland Prichard foretold), the widespread introduction of ATS, NOW, and MMMF accounts at 1980 year-end — which vastly accelerated the transactions velocity of money (all the demand drafts drawn on these accounts cleared thru demand deposits (DDs) – except those drawn on Mutual Savings Banks (MSBs), interbank, and the U.S. government).

Was CPI calculated the same way back then? If calculated the same way, would todays CPI be higher?

Back then was a different life. We have products and services today that didn’t exist back then. So CPI changes constantly to accommodate changes in life and purchasing patterns. People didn’t even know what smartphones or streaming or the internet were back then. Cars were basic death-traps and all-around POS back then compared to today’s vehicles. I lived through those years as an adult, and inflation was really really bad back then, no comparison to today.

Great job Mr. Burns.

“[Core CPI] moving average reached 4.2% annualized”

A better measure here might be to multiply three months of consecutive monthly increases for the “moving average”, then take that figure to the fourth power to “annualize”. Monthly inflation is mulplicative, not additive, and with the monthly changes this large, it can make a big difference, especially for something that increases even faster, like rent.

Annualizing core inflation using this technique would be calculated as below:

(1.004*1.004*1.003) ^ 4 = 4.48% vs 4.2%

PS Cell formula for a spreadsheet table of monthly inflation increases:

=product(arrayformula(A1:A3 + 1.0))^4

BS. You’re using numbers that are rounded to the first decimal: 0.4% and 0.4% and 0.3% from the BLS press release. That’s the only difference. And it’s a huge lazy bullshit mistake.

The numbers rounded to the third decimal are: 0.358%, 0.392%, and 0.275%

Your three rounding errors all went into the same direction, becoming additive, and then you annualized that rounding error, which multiplied your fuck-up.

The formula to annualize a monthly percentage (which I use throughout) is this: =(1+x%)^12-1

If I use that formula for your rounded figures (0.4%, 0.4%, and 0.3%), the three-month average becomes 4.49% annualized, which is what you got. All you did was fuck up by using figures that were rounded to first decimal, and then you added and multiplied the rounding error.

Dealing with this BS is such a waste of my time.

when I grow up….i want to be just like Wolf!

But the stock market hit a new record high with this great inflation report today. It’s election year so I bet that plays huge role. Even Biden mentioned that he is expecting a cut soon on his state of the union speech.

The guidance of rate cuts long before the problem of the tight labor market was fixed was clearly wrong. But it was also likely desired, as inflation seems to be the chosen path to fix the public debt problem. We are having a 3% target inflation rate long before it’s going to be made official. I expect many more excuses about exceptional circumstances, supply chains, OPEC or Putin’s fault, need for more evidence/patience, etc before that finally hapens. The bond market, which lately has been the dumb money, is only slowly coming towards acceptance. But some realization is here, and 5Y breakeven rates have osciallated in the 2-2.5% range lately rather than trending further down towards the pre pandemic range of 1.5-2%.

Excellent report Wolf. Thank you.

Agreed. The coverage of inflation in the media has gotten so poor, that when I see a news story on an inflation report, I don’t bother reading it, just take it as a marker to check in here later in the day for a proper summary of what is going on.

Same here.

Treasury yields have been in a range but can’t break though 4.25% to the upside. Yields seem to not want to break out higher.

I personally think we won’t get much past 4.25% on the 10 yr yield. Purchase mortgage apps are already at what 30 yr lows with a 7% rate? A 4.5% 10 yr UST will put mtg rates at 8%? That will grind home purchases to a halt. Maybe a few new homes with rates bought down to 5.5% get bought. But the existing home sales market will basically almost stop. And that will cause the conditions of the 10 yr to come right back down to 4%. I see a range of 3.75%-4.25% for a while. Unless we get a bad unforseen recession.

I agree with existing home sales. New homes? We are swamped with

new home jobs. 30+ yrs in the business….one strange spring.

The 10-year is as low as it is because many bond speculators still think rates will be cut, and they’ll be able to get a cap gain.

10-year “junk” bond rates are 7-12% right now ‐ obviously those have credit risk as well as duration. But the 13 week bill is stil ~5.3%, which is the risk-free rate.

10 year notes should be priced to reflect the duration risk – and will once the mkt digests that inflation is putting up a fight and not going away so easily.

8% mortgages are the historical average – home prices & homebuying behavior more generally will adjust to higher rates.

Praise God and all politicians for blessing us with cheaper smart TVs — and smartphone that allow us to use AI to search for cheaper data plans!

Note the Tenants’ & household insurance at .4% of the CPI only includes contents insurance for homeowners. The majority of skyrocketing homeowners insurance premiums covering the structure must be buried somewhere in Owner’s Equivalent Rent. This should continue to elevate that metric in the future.

Yes. It is part of the cost of homeownership and is reflected in homeowners’ estimates of their OER.

All you need to know is that this is going to be like this for the foreseeable future.

To think anything else is naive.

To plan for any other scenario would be a risky move.

Count on inflation, entertain the possibility of more inflation than you thought possible.

Do you want to be tapped out, cornered and out of options because you thought Powell was on your side ? Maybe you thought your interests and his overlapped by pure coincidence ?

Look at what every other government issuer of fiat currency has chosen in 99.99% of all past “hard choices”.

Don’t lie to yourself, don’t believe their lies, don’t trust people who are lying to themselves.

Agreed, that’s why I’ve been buying physical gold.

Gods money wish I could afford some

Gold is headed for $20 an ounce.

Someone slip some fentanyl into your Starbucks? I’m not a gold bug but Stevie wonder can see it ain’t going to 20 ever again. Lotsa cultures around the world value it, its just this country that prefers paying 70k for a bunch of 1s and 0s you have to hide in an electronic wallet.

Are you not concerned that the animal spirits pushing up stocks & bitcoin are also pushing up gold right now?

Articles on those assets are taking on a very bubbly tone. FOMO! YOLO!

Sure, to some extent, but I figure gold at most has 15-20% to go down, while Bitcoin could go down 80-90%, and Nvidia could drag the S&P down by 40-50% if this bubble bursts.

Sinhalese study history,lots of FREE info, when depression hit everything went down gold and gold miners were first to recover,because FDR stold the only money .GOLD,SILVER

High……that is the problem…….are interest rates high?

Only in your fed fantasy dreams…….they are still a give away to the borrowers. We are handing the treasury cash for 10 years (quite a long time) and receiving around 4 percent. After tax and inflation a negative return…..and the government is not AAA anymore. Everybody is so spoiled that paying anything for money is a burden.

Inflation is running hot……and we’ve had three years of mumbling and plans and hopes and dithering by a bunch of over educated corrupt administrators.

Grow a pair and act……get the damn FF rate up…….but…..maybe Johnny might need to actually go to work instead of sitting home pretending to work and having a boss too scared to fire him because nobody is available to hire.

Is not the curve already inverted? Only in your fed twisted dreams…..only in dc is an injection of 5 trillion of cash into the economy and a draining of 2 progress. It’s inflation…..big time inflation. Long term rates should be much higher. If they were at the level the market would set without fed interference the FF rate would be low in comparison.

But….. we have to protect the rich and powerful from losses so they stay in charge……in a capitalistic economy. So go slow.The governments are now more than 40% of the economy. Whatever happened to risk? You want to make a million….take risk and you deserve it…. take no risk and why shouldn’t the mob take what you have.

This is Russia……it is over……and they wonder why Bitcoin is exploding.

Planned economies have never worked. As we drain the well and wonder how much longer this farce will continue.

Excellent , Fred. Btw say hi to Barney. Seriously. Not sure what’s coming, but gather friends and family and maintain a positivity stance.

CPI and PCE are more or less in line with each other. If I was on the FOMC I start discussing increasing another 25 basis point. Going gradually vs trying to overcome inflation when it’s more entrenched/higher is wasting time. I think inflation is not stabilizing. I think the gradual increases are the way. Gotta look ahead.

My .02 cents

1) Inflation is not coming down and not going lower right now. I said that months ago here that it would start to rise and it is doing just that. Services inflation is a major problem.

2) The Fed is not going to lower or raise interest rates in 2024. They are not going to screw around in an election year with political forces stepping on their throats. They will continue to play hawkish and dovish at the same time to keep things level through an election year. They will not lower rates right now with the major risk of inflation ripping to the upside again.

3) All the eviction moratoriums are going to be over come 2025. The can kicking down the road is done for in soon time, finally. See point 2, everything will be stalled out for the sake of the election year, Then its done and real estate is going to start to collapse in 2025 and 2026. A real collapse, not the little itty bitty collapse wolf shows in his real estate charts. FHA and Fannie are already doing this by not letting foreclosures hit the real market. They are stalling everything with junk mods / forbearances. There will be a tidal wave of new homes on the market because of this.

4) The unemployment rate and jobs numbers are clearly being juiced by the government. You are going to see a massive rug pull on this after the election is over. The blowoff top in the market is right here. Every month there are downward revisions on the jobs numbers so the headlines appear rosy and the stock market remains high and elevated. This is all done because, ding ding ding, its an election year.

5) Real Estate, Inflation, and the FED gets hit by a runaway freight train in 2025 and it does not matter who is president at that time. With US debt going over 40 trillion in no time, a massive, massive correction is coming. And it is beyond needed.

6) The baby boomers will crush the real estate market. They will finally cash out of their 2nd, 3rd, 8th, etc.. vacant shadow homes they are sitting on and all the fat cows will be running for a tiny little exit door at the same time with no buyers to be had. Or they will die, divorce, go in a nursing home, etc.. in the next few years. Housing inventory is going to explode within the next 24 months, and this will also collapse the air bnb market. When the stock market starts to collapse, its going to collapse a lot faster than it went up.

7) The fed will try to cut rates after the recession starts / happens. Temporarily inflation will be reduced because of the recession, but the FED will be

a) late to the party to cut and

b) sit on the cut rates far too long again, which will

c) cause inflation to explode higher all over again

The real estate and stock market party is over. This is the final year of this nonsense. And if Trump gets in and tries to jawbone the fed to cut rates to 0, you are going to see permanent high inflation way higher than it is now with a severe recession on top of it.

7) All eyes are on the bank stocks. Just like the GFC, when banks stocks cratered during the GFC and needed bail out money, thats when wall street, real estate, lending, helocs, and everything else cratered. Lending is starting to get tighter as we go forward. More banks are going to collapse and be bought up for peanuts on the dollar by the big main players. Heavy consolidation is coming imo. And when I mean heavy consolidation is coming, its not coming just for the banks, its coming all over the place.

8) No one is going to buy US “junk” debt in the future. Other countries are already stepping away from this sinking ship. The Fed / US can only manipulate the bond market for so long.

There is no way, none, the FED is going to QE its way out of this mess with inflation where it is and where its going in the future. That trick worked in the GFC and the covid crises. No way it works this time around with inflation ready to rip higher. If they dare do it instead of letting the recession play out, the manipulated cpi reports will be as bad as the Volker days. And we might be on a 1 way train to hyper inflation.

“4) Every month there are downward revisions on the jobs numbers so the headlines appear rosy”

No, for example, there was a HUGE up-revision in January for December and November. Up-revisions don’t stick in the memory, do they? So the rest of your paragraph is therefore also BS.

But your comment is kind of a funny doom spiral all the way down to hell in no time. Maybe you spend too much time on YouTube?

Howdy Darth Vader or is it Micheal Snyder? HEE HEE. Doubt you will sell many survival kits here.

re: “thats when wall street, real estate, lending, helocs, and everything else cratered.”

The distributed lag effects for inflation and real output are mathematical constants.

Bernanke drained legal reserves for 29 contiguous months popping the housing bubble. Then he let short-term money flows crater in the last half of 2008 (predicted in Jan 2007). It was a double whammy.

Pretty much agree with your assessment, unfortunately. I don’t see a way that it doesn’t end this way. You can’t blow this big of a bubble for decades and not have it end very badly. You didn’t even mention that a lot of the shale plays are rolling over, immigration issues and the yield curve may uninvert next year.

So you’re calling for both recession and inflation in 2025. Got it.

No

Im calling for inflation to rise from here.

Then a recession which will temporarily lower inflation with rate cuts coming.

Then the FED holds rates far to low and long, which later reignites inflation.

That is called stagflation, and happens a lot.

It’s weird to lay out 7 points on how an asset bubble is about to pop and the GFC to reach an inflation conclusion. This type of crisis leads to catastrophic deflation. And who cares if other countries don’t buy our debt, they’re all poor and in debt too. We’re the ones buying it and we owe it to ourselves. The fed has reduced it’s balance sheet in 18 months by a number that’s larger than any single foreign holder of our debt and no one has even noticed. Oh scary China.

With all this hand wringing about the direction of inflation, the undisputed fact seems to be that debt is going to keep rising and spiral out of control. Do any of these discussions ever provide any actionable advice such as whether we should buy into the stock market at insane valuations because assets are the only way to protect yourself? I’m all for deep dives into the data to understand, but unless it’s going to put money in our pockets what’s the point?

For free advice as to what stocks to buy, or if and when, you go to CNBC or similar (buy, buy, buy). For broader financial advice, you need to pay a financial advisor. If that’s what you’re looking for, you’re in the wrong place.

Presumably people who follow this website and its articles have enough grey matter between their ears to make some extrapolations themselves. If not, as Wolf suggests, find a sensible advisor (which is easier said than done).

This is not financial advice, but I recently bought into a couple high yield bond & senior secured loan funds. I like these instruments because they are higher in a company’s capital structure than equity.

Only a handful of U.S. stocks have “insane” valuations. These drive the capital-weighted indexes and the hype-media-machine. Buy the boring stocks in businesses that are ignored. Better yet, buy the stocks that lefty elites hate: oil, gas, plastics, cigarettes, etc.

Not all valuations are insane it just takes quite a bit of work to find them. Case in point: Target when it was $105 when everyone was making fun of them for having rainbow sections in the store. The best thing is to subtract the overwhelmingly bearish sentiment in the comments and stick to Wolf’s articles for data to use in your overall arsenal.

I keep seeing reports that, despite this re-acceleration in core and core services inflation, the Fed futures market is still expecting the Fed to cut rates in June.

I’m not sophisticated enough to know where to find what that market is saying, but is this true? And if so, any ideas why? I assume the people investing in this market lose money if they’re wrong, so it doesn’t seem like merely /wanting/ a rate cut in June would justify putting skin on it happening without an actual belief that it will.

In December, fed funds futures market was expecting cuts starting in January. They were expecting 7 cuts in 8 meetings, LOL They gave up on that. The fed funds futures market is nearly always wrong. There are hilarious chart out there about it.

CME FedWatch should be renamed Fed WishList.

Not sure if links are okay:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

thanks a lot, I’d always had a hard time finding this! Wolf’s explanation that the Fed futures market is simply wrong all the time helps to resolve my dissonance. the next step is figuring out how to get a piece of that market, so we to profit off if its misguidedness! 🤣

The 1980 “head fake” was no such thing. Jimmy Carter leaned on Paul Volcker’s Fed to back off of rate hikes in lieu of a dopey inflation-fighting program Carter wanted to implement. Volker decided to go along with the President who had appointed him… maybe he just wanted to teach a nuclear engineer that he wasn’t as smart as the thought he was.

Regardless… once the election yielded a President with an actual college degree in Classical Economics that he could work with… Volcker raised rates to the moon for eighteen months. The previous cuts were no head fake… Volcker KNEW what the likely outcome would be.

Howdy SpencerG and Trump did the same thing. Decades prove they are really not that smart after all.

That’s a myth.

The Chicago School Of Econ = “Classical Econ” ?????????!!!!!!!!!!!!

You need to do some READING….lot of absorbed (but not thought about at all) prejudices to get straight on.

Thanks for the laugh, anyway.

NBay:

It is YOU who needs to do some reading. “Classical Economics” refers to an Economics degree that predates Keynesian Theory. Ronald Reagan graduated from Eureka College in 1932… while John Maynard Keynes wrote his opus The General Theory of Employment, Interest and Money in 1936.

Reagan was an interesting man in a lot of respects… certainly for a politician. He was interested in Economics throughout his life… and refused to stay stuck in a rut of one theory or another. In the late 1930s during the depths of the Great Depression he was a full-blown liberal Keynesian dedicated to getting the people working.

But by the late 1950s he had seen the excesses of that approach (a 90% top marginal tax rates so that government can pay one set of workers to dig a hole and another set of workers to fill it… huh???) so he became more of a balanced-budget “Green Eyeshade Republican.” But 20 years later he saw the value in removing restrictions on the economy and became a Supply Side Republican… right in time to win the 1980 election.

It is that history that allowed Ronald Reagan to back Paul Volcker to the hilt for the eighteen months of extreme interest rate hikes that it took to break the back of inflation. Reagan did so at great political cost… by backing Volcker he lost working control of the House of Representatives in 1982 and would have lost his own re-election bid in 1984 if inflation hadn’t moderated and the economy start leaping forward. Instead he won re-election with a 49-state victory and the nation enjoyed low inflation for FOUR DECADES… until the present predicament brought on by lesser politicians.

I live in a rural area, and my same coverage auto insurance for the same 2 vehicles just went from $2,503 annually to $3,087 annually. An increase of $584, or 23%. I’ve made no changes had no tickets, and no claims in 32 years. Sing along now, “Liberty Liberty Liberty….”

With the transition to EVs and cars with various sensor technology, the average repair and insurance cost/vehicle increases. For an example, my recent side-mirror replacement was over $2000. Contrast to a childhood memory of going to a junkyard with my friend and his dad. The dad bought a side mirror for a few dollars and he replaced the broken mirror in the junkyard parking lot. The drive to the junkyard took longer than the DYI repair.

My cars are 20 and 15 years old. Insurance $1500/yr with no collision, just legally required liability. County property tax about $250. I looked at buying new cars and I would be up at $3-4K insurance and $3-4K property taxes. I plan on running these suckers forever. I hate paying bureaucrats for their “permission” to own a car.

I can’t speak to your individual case, but in mine, when I replaced a 2007 Toyota Camry with a new Toyota Highlander, my insurance actually went DOWN (and that’s with comprehensive on the new car), because the theory is that you’re more likely to avoid an accident (and thus, them having to pay on liability claims) with a car with modern safety features, like blind spot monitor, rear cameras, parking assist, etc.

Taxes and insurance always depend on where you live. I base my costs on where I am pretty much forced to live. Property taxes are based on the year and price of the car. They never go down. But of course you can always move to a new area. My estimate to move is min $50K and I have no mortgage. I am not going to live long enough to amortize that.

Something to consider on insurance is if area cost averaging is introduced. Either by companies or the government through cost controls. I would not put it past them.

A lot of it has to do with where you live – where the car is ‘garaged’ in insurance lingo.

My 2011 is $748 to insure for this year, even with extra coverage such as comprehensive. But at my old apartment in Lowell, this car cost almost $1800/yr with the exact same coverage (back in 2020). At the time I recall the insurance agent saying Lowell is the most expensive city in MA to insure a car in.

We are trapped in this price rise because the roads we are on have more expensive cars/repairs, more menacing cars (many EVs heavy and lots of torque), more stoned and uninsured drivers, etc. Just wait until the promised mass deportations induce even more uninsured and unlicensed drivers to hit and run from accident scenes (and witnesses to vanish as well). The responsible people are being trapped in insurance pools to subsidize the irresponsible, to whatever degree, so we pay twice, once by being more vigilant and careful, and then by paying higher premiums. Home and heath insurance is similar.

Correct, but what else would you expect from a system that has been rewarding BAD behavior (buying MBS and bailing out bad bets with QE) and punishing good behavior (destroying savers with ZIRP and production with regulation)?

If you reward bad behavior, you will definitely get more bad behavior!

Isn’t that emblematic of America as a whole? The responsible subsidize the irresponsible, as the irresponsible are allowed to vote.

Allowing everyone with a pulse 18 and over to vote was the worst mistake America ever made.

Amen to that. I get reminded by every heathcare.gov commercial I see, how I get to pay exorbitant rates so that others can get the same plan for $10.

The worst part of it all is that nobody can put that genie back in the lamp unless the whole system collapses — and then there’s much bigger issues to address when that happens.

Dirty Work, yes, that’s the problem with expanding the franchise. Once you do so, you can never eliminate the voting of the people who have newly gained them, as they’ll never vote to remove their own voting privileges. It only happens after a collapse, and a dictator takes over.

You gotta be kidding me. The US has a dismal voter participation rate and it shows. Countries like Uruguay with a high participation rate actually have governments that reflect the will of the people.

That is not how insurance works at all.

You’re close to CPI target, LOL. The auto insurance CPI is up 20.6%.

Get used to your Sparrow’s share. We got a lot of Horses to feed here. You have to pick around some, but it IS free.