Retail sales by major segment: huge winners (on top: ecommerce and general merchandise retailers), and some big losers.

By Wolf Richter for WOLF STREET.

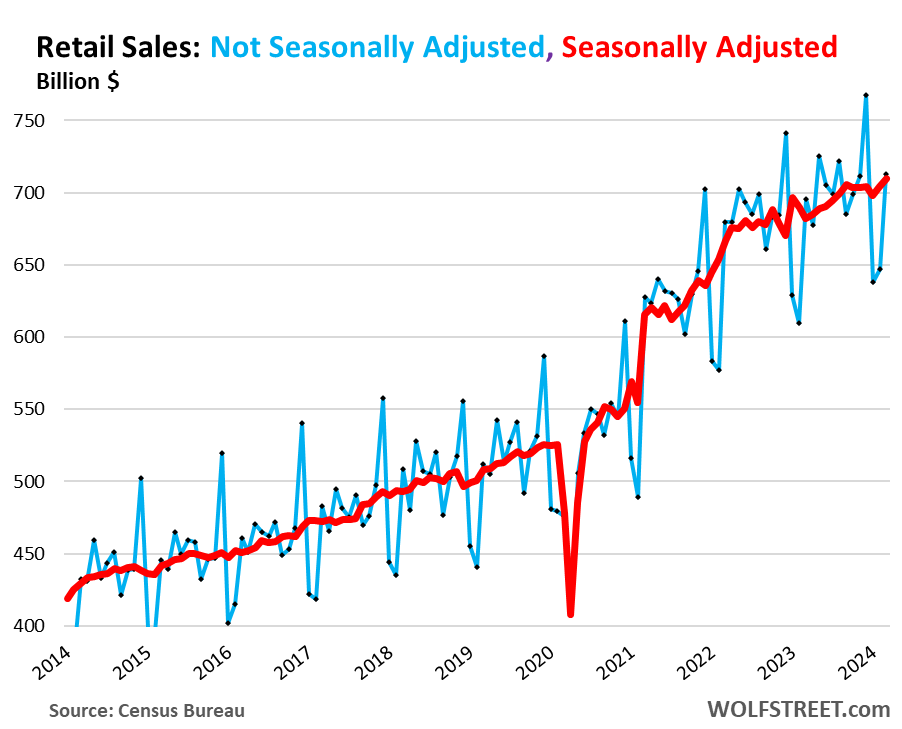

Total retail sales jumped by 0.7% seasonally adjusted in March from February, after having jumped by an upwardly revised 0.9% in February from January (red line in the chart below). Year-over-year, retail sales jumped by 4.0%.

Not seasonally adjusted (blue line), retail sales jumped 10.1% in March from February to $712 billion. We can see what happened: widespread harsh winter conditions in January added to the normal plunge in January from December. This was followed by a strong bounce in February, when normally retail sales fall further. And then in March, there was another strong bounce as is typical.

These increases in sales came despite price decreases in many goods that retailers sell, particularly durable goods – motor vehicles, electronics, appliances, furniture, etc., with prices dropping month-to-month and year-over-year for over a year. But retail sales are from the retailers’ point of view, they’re not adjusted for inflation/deflation, just like Walmart doesn’t adjust quarterly earnings to inflation. Adjusted for the negative inflation rates in many of the goods that retailers sell, retail sales would have jumped even more. And so this data will boost the inflation-adjusted consumer spending and GDP figures nicely.

The biggest drivers of the growth in retail sales on a year-over-year basis were: ecommerce (+11.3% YoY), food services and drinking places (+6.5% YoY), “miscellaneous retailers” which includes cannabis shops (+6.1% YoY), and general merchandise retailers (+5.7% YoY).

Some of the dying brick-and-mortar retailer categories – a phenomenon I’ve called since 2016 the Brick-and-Mortar Meltdown, caused by the shift to ecommerce – continue to suffer from year-over-year declines, including department stores, furniture and home-furnishing stores, and electronics & appliance stores.

Where does this money come from?

- A record number of people are employed, and these workers have received big pay increases that outran CPI inflation in 2023 and so far in 2024.

- People are getting 5%-plus on their money-market funds and CDs, up from near 0% two years ago.

- Mom-and-pop landlords (1-9 rentals) got big rent increases on the 11.2 million single-family houses they rent out.

- Stocks have been on cloud 9 over the past 12-plus months.

And some of this income gets spent, and the rest is saved.

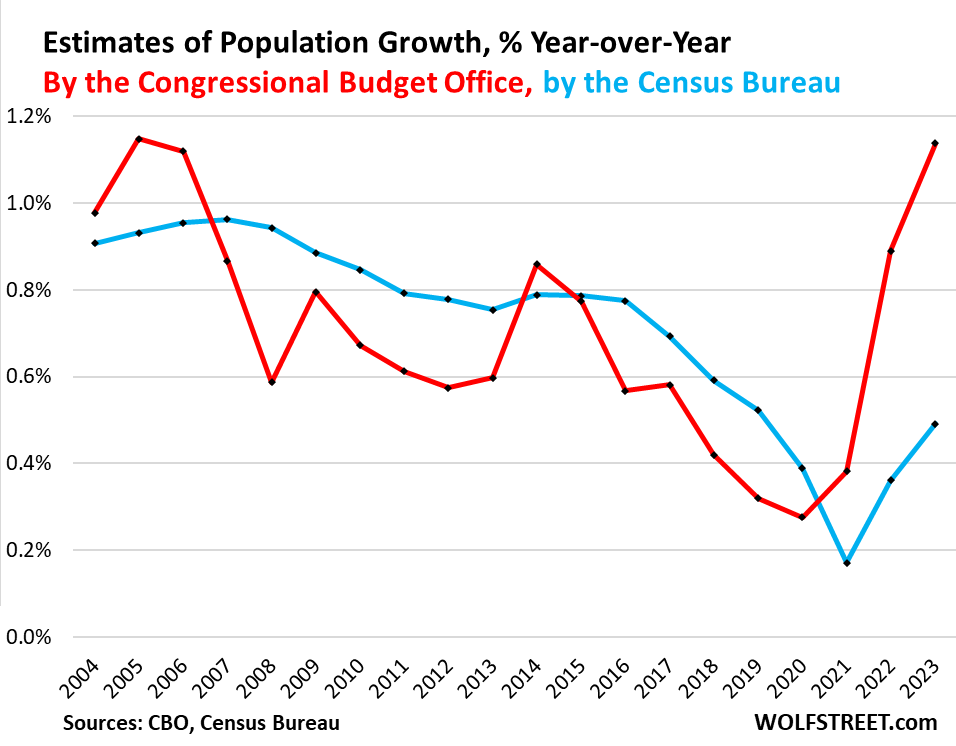

On top of it, there is a huge wave of immigrants, 6 million in 2022 and 2023 combined, according to the CBO (the Census Bureau’s algo however have not yet picked up on the surge in immigrants in 2022 and 2023), and most of these people are quickly joining the labor market, and they’re starting to make money and are spending it. Immigration has caused the US population to grow by 1.14% in 2023, the fastest growth since 2005. These are consumers:

The Fed is watching this nervously.

Back in December, the Fed’s rate-cut views – maybe three in 2024 – were all prefaced by inflation going back toward its 2% target. But now we’ve had the third bad inflation report in a row so far this year, and rate-cut expectations are getting scaled back or are vanishing. And consumers on a buying binge – acting like Drunken Sailors, as we’ve come to call them lovingly and facetiously – are adding to inflationary pressures.

Retail sales by major segment of retailers.

For most charts below, we use the three-month moving average which irons out some of the month-to-month squiggles.

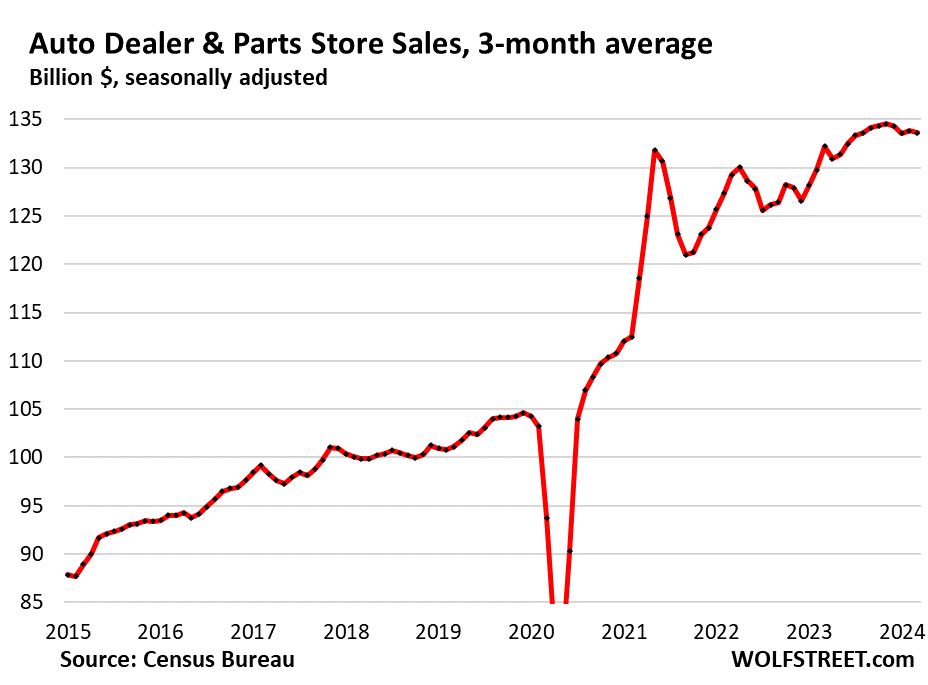

New and Used Vehicle and Parts Dealers (19% of retail trade). These retail sales at auto dealers are in part an expression of the historic price drops in used vehicles that are in the process of unwinding part of their pandemic spike; new vehicle prices also edge down.

- Sales: $134 billion

- From prior month: -0.7%

- From prior month, 3mma: -0.1%

- Year-over-year, 3mma: +1.1% (despite the price drops!)

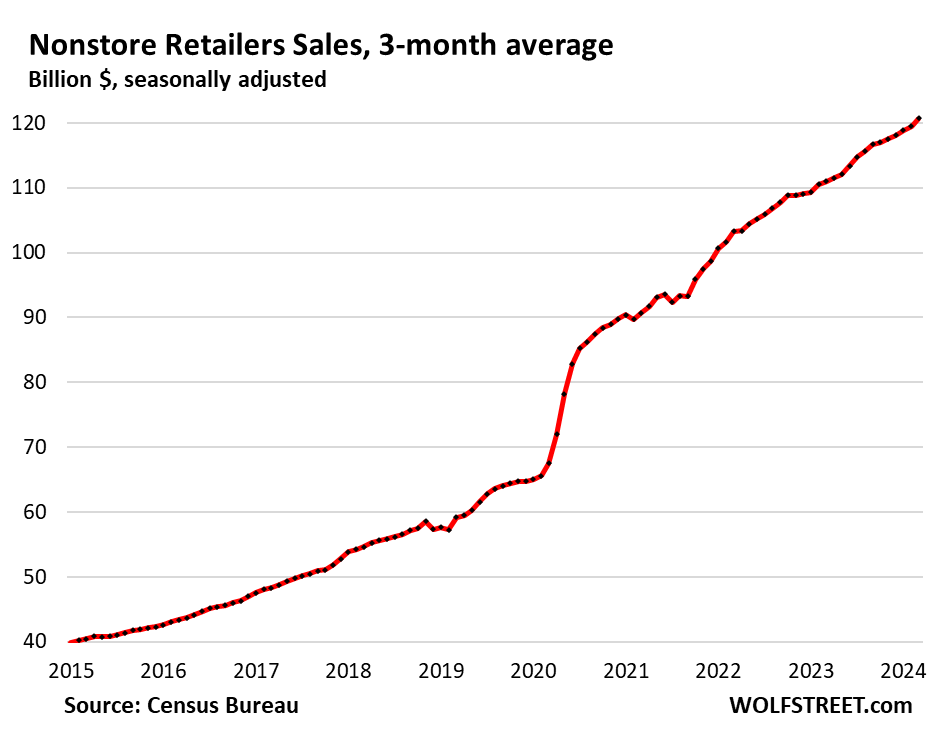

Ecommerce and other “nonstore retailers” (17% of total retail trade), ecommerce retailers, ecommerce operations of brick-and-mortar retailers, and stalls and markets:

- Sales: $123 billion

- From prior month: +2.7%

- From prior month, 3mma: +1.0%

- Year-over-year, 3mma: +8.7%

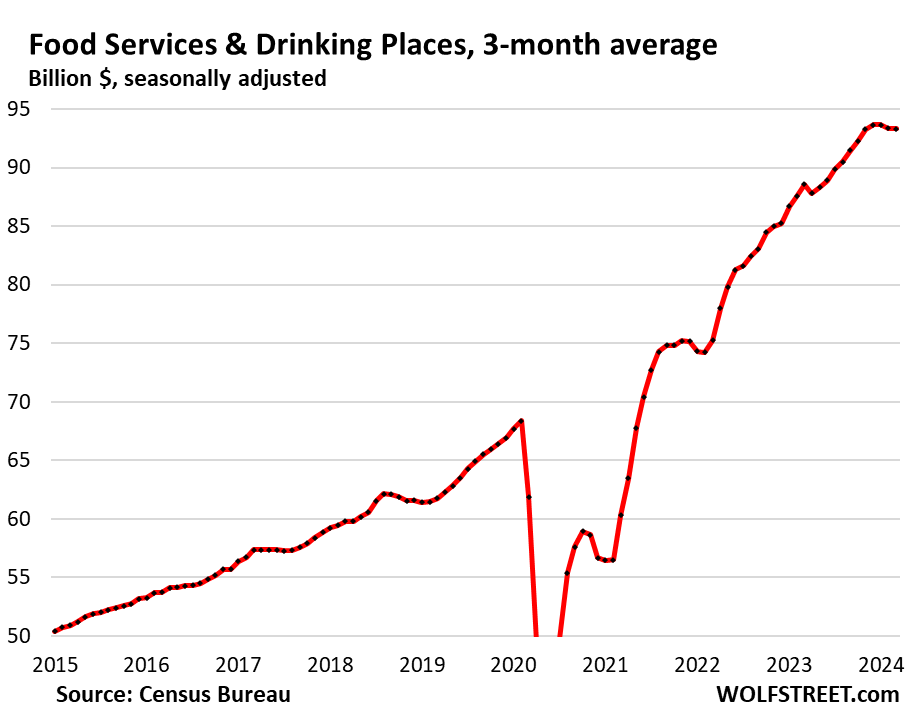

Bars & restaurants (13% of total retail):

- Sales: $94 billion

- From prior month: 0.4%

- From prior month, 3mma: +0%

- Year-over-year, 3mma: +5.4%

Bars & restaurants, not seasonally adjusted and monthly… In the chart above, the seasonally adjusted three-month average has stagnated with sales at astronomically high levels. But there have been brief flat spots and even dips before as well, and then they were followed by a renewed surge.

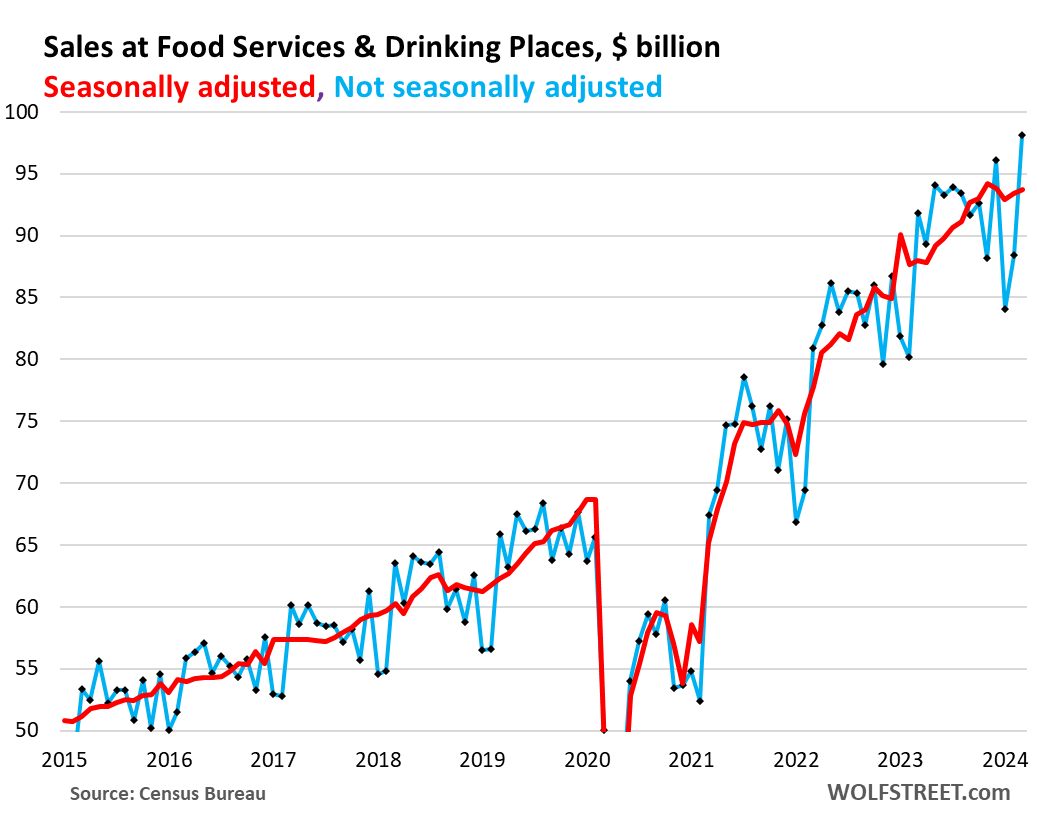

The chart below sheds some light on this. It shows the monthly figures, not three month-averages: seasonally adjusted (red) and not seasonally adjusted (blue).

In the blue line, we can see what happened: perhaps due to bad weather in a big part of the US, sales in January fell more than normal, bounced back some in February, and exploded in March to a new record, with sales up 11% from February, and 6.8% from a year ago. Marches are not the seasonal high of the year, so we can expect further increases in 2024:

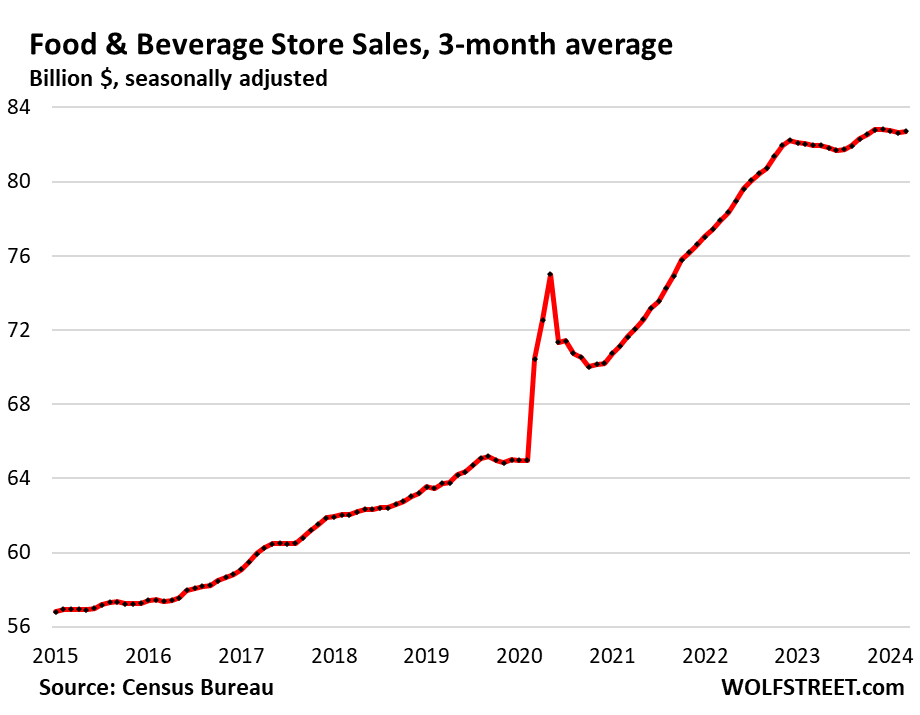

Food and Beverage Stores (12% of total retail):

- Sales: $83 billion

- From prior month: +0.5%

- From prior month, 3mma: +0.1%

- Year-over-year, 3mma: +0.9%

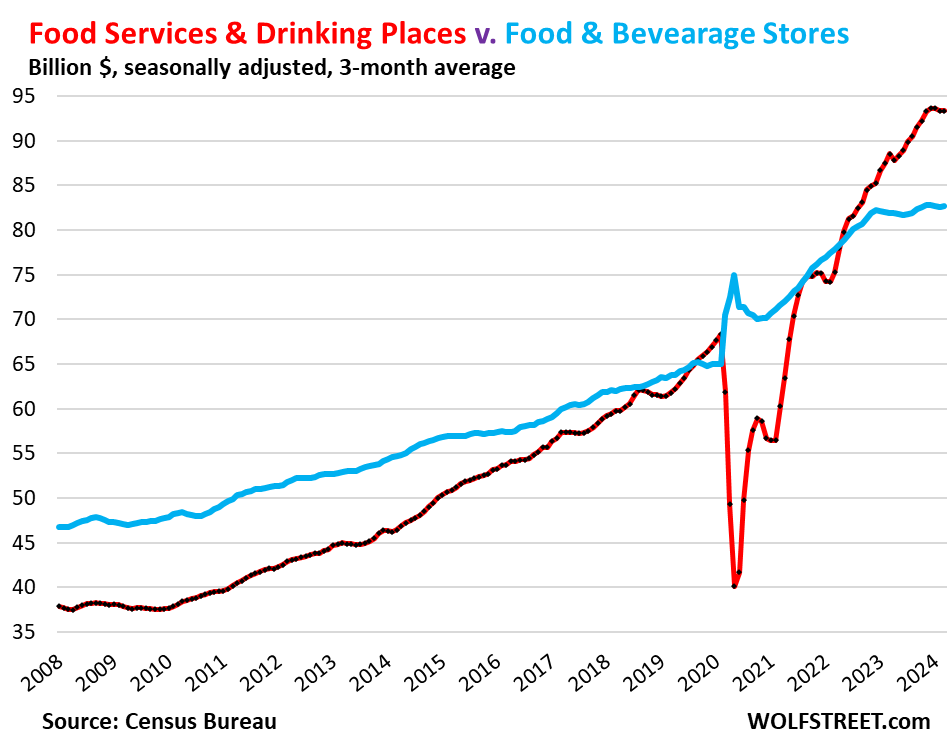

Hallmark of our Drunken Sailors: Americans are now spending vastly more money eating and drinking out than at grocery stores, eagerly paying for the “experience” or the convenience, rather than just the food. They could save a lot of money by eating at home or packing lunch, but no, our Drunken Sailors are going for the experience and the convenience – another sign that they’re flush with money and don’t mind spending it. This is an astounding phenomenon:

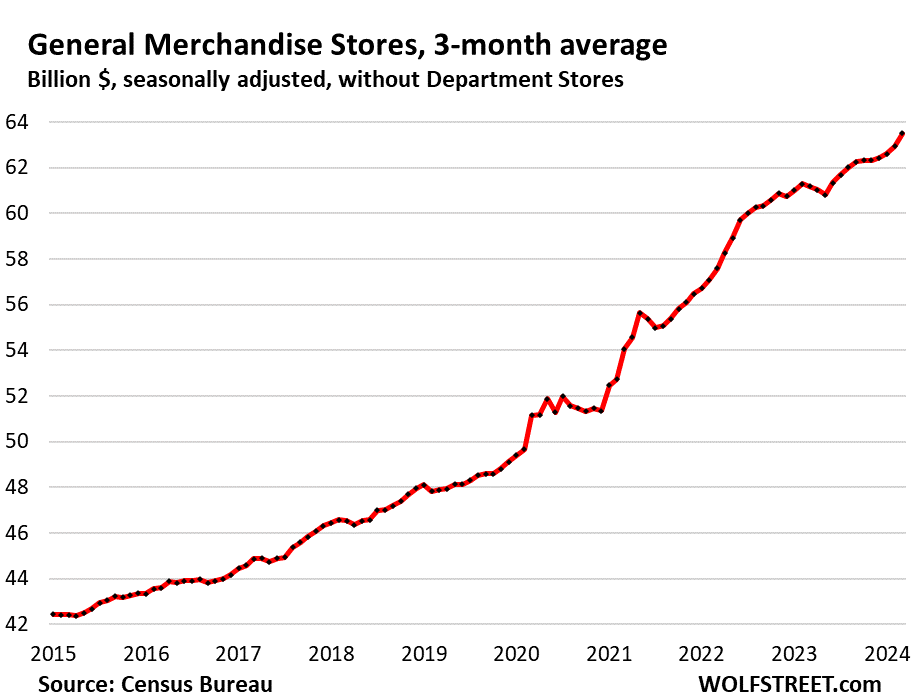

General merchandise stores, without department stores (9% of total retail).

- Sales: $64 billion

- From prior month: +1.5%

- From prior month, 3mma: +0.9%

- Year-over-year, 3mma: +3.8%

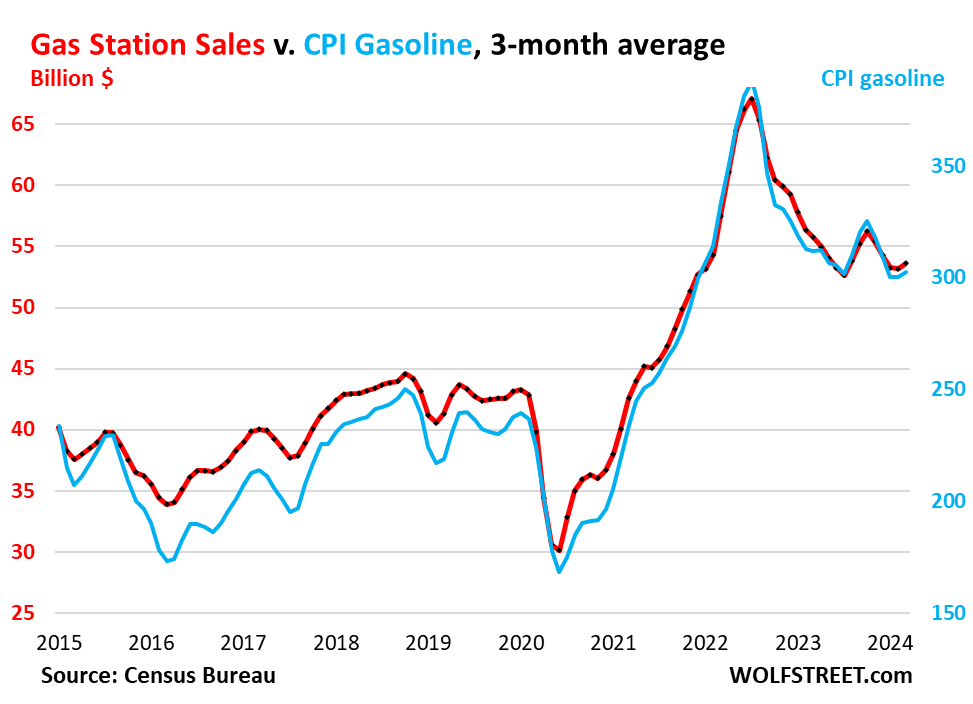

Gas stations (8% of total retail sales). Sales at gas stations move in near-lockstep with the price of gasoline:

- Sales: $55 billion

- From prior month: +2.1%

- From prior month, 3mma: +0.8%

- Year-over-year, 3mma: -3.9%

This chart shows sales in billions of dollars at gas stations, including other merchandise that gas stations sell (red, left axis); and the CPI for gasoline (blue, right axis):

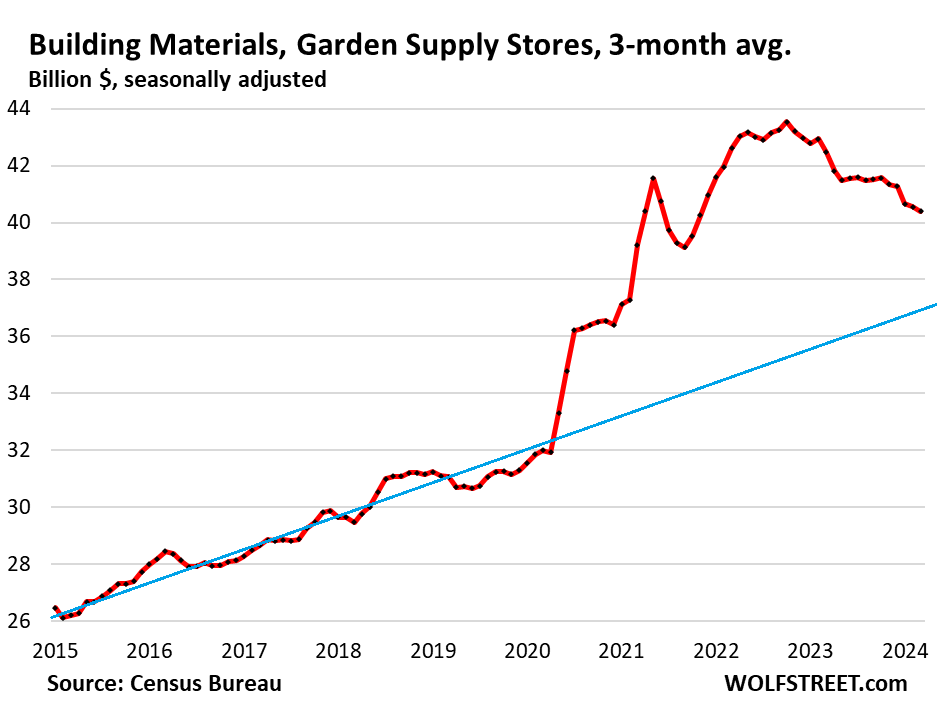

Building materials, garden supply and equipment stores (6% of total retail). Pandemic bubble peaked in October 2022, and then deflated. Just for kicks, we have included a prepandemic trendline:

- Sales: $41 billion

- From prior month: +0.7%

- From prior month, 3mma: -0.4%

- Year-over-year, 3mma: -4.9%

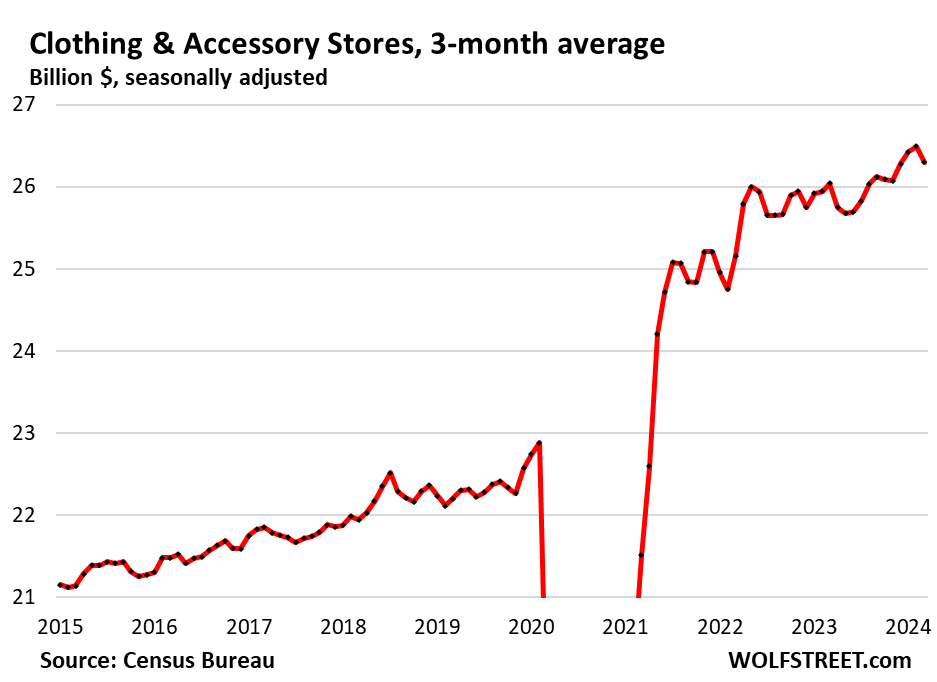

Clothing and accessory stores (3.7% of retail):

- Sales: $26 billion

- From prior month: +1.6%

- From prior month, 3mma: -0.7%

- Year-over-year, 3mma: +1.0%

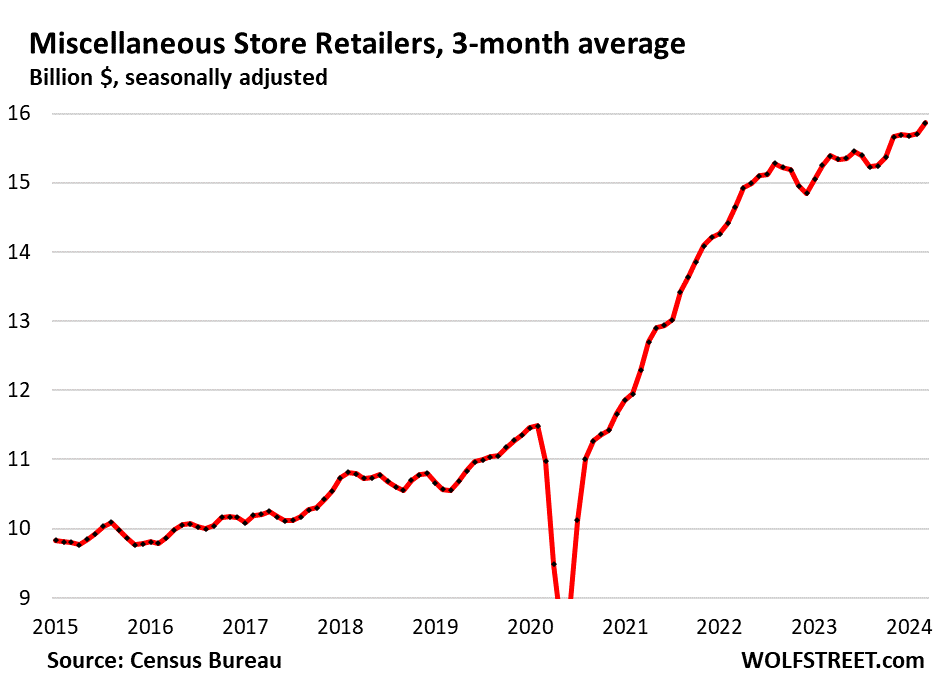

Miscellaneous store retailers (2.2% of total retail): Specialty stores, including cannabis stores.

- Sales: $16 billion

- Month over month: +2.1%

- Month over month 3mma: +1.0%

- Year-over-year, 3mma: +3.1%

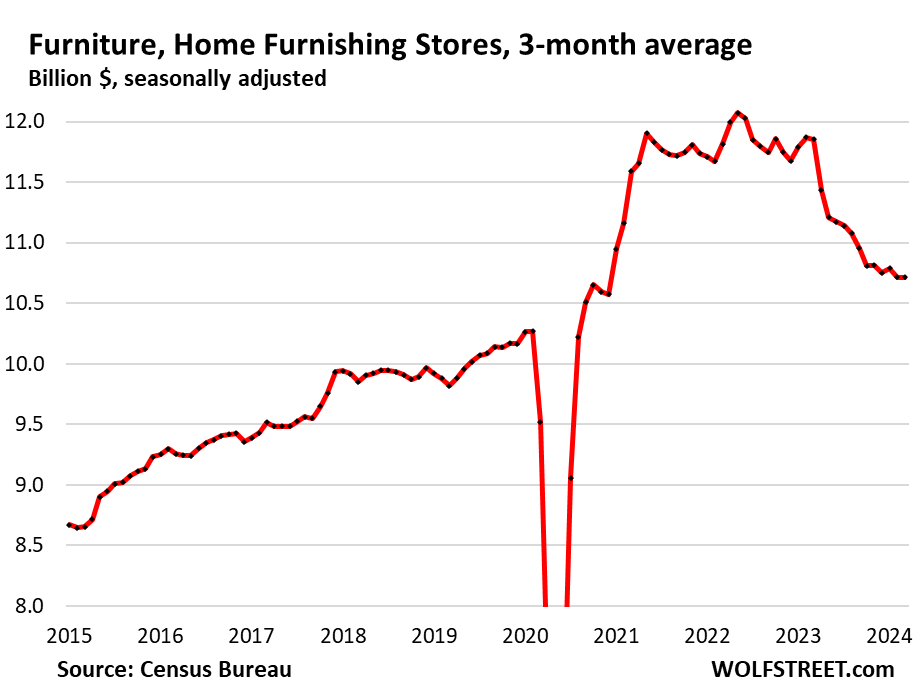

Furniture and home furnishing stores (1.6% of total retail). Much of furniture and furnishing sales have moved to ecommerce. This is what’s left over at brick-and-mortar retailers that specialize in furniture and furnishings:

- Sales: $10.7 billion

- From prior month: -0.3%

- From prior month, 3mma: 0%

- Year-over-year, 3mma: -9.6%.

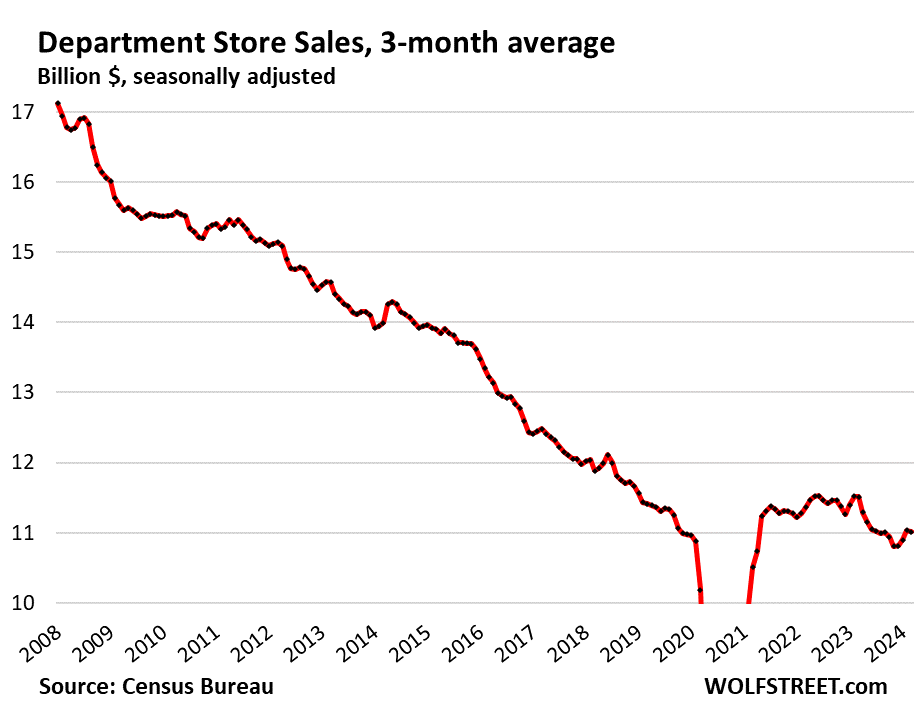

Department stores (now just 1.5% of total retail sales, from around 10% in the 1990s). Ecommerce sales by department store chains are not included here, but are included in ecommerce retail sales above.

- Sales: $10.9 billion

- From prior month: -1.1%

- From prior month, 3mma: -0.2%

- Year-over-year, 3mma: -4.3%

- From peak in 2001: -43% despite 22 years of inflation.

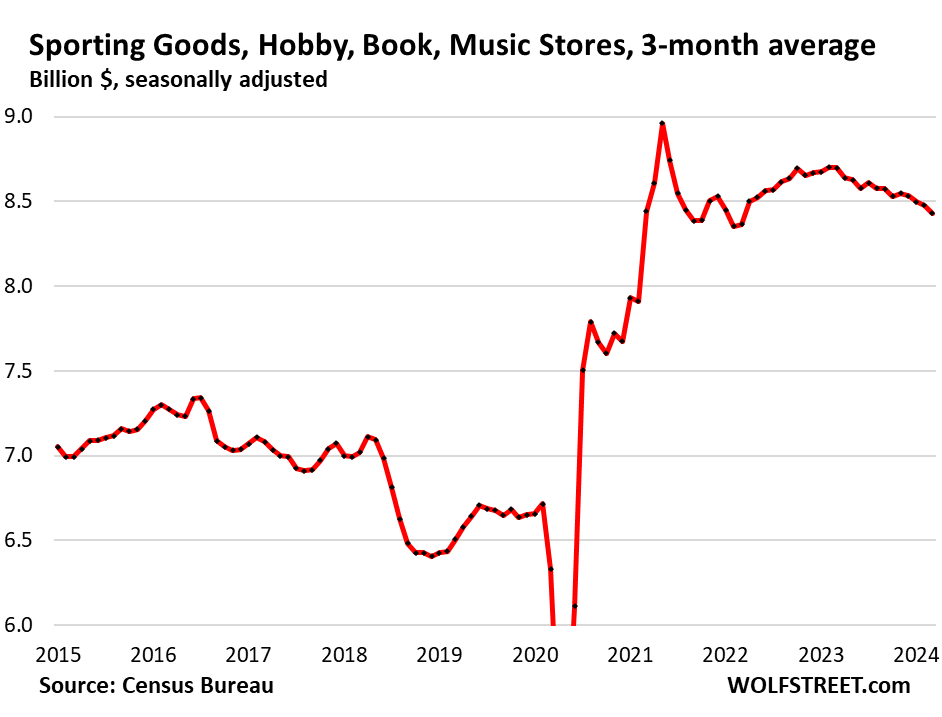

Sporting goods, hobby, book and music stores (1.2% of total retail).

- Sales: $8.4 billion

- Month over month: -1.8%

- Month over month, 3mma: -0.5%

- Year-over-year, 3mma: -3.1%.

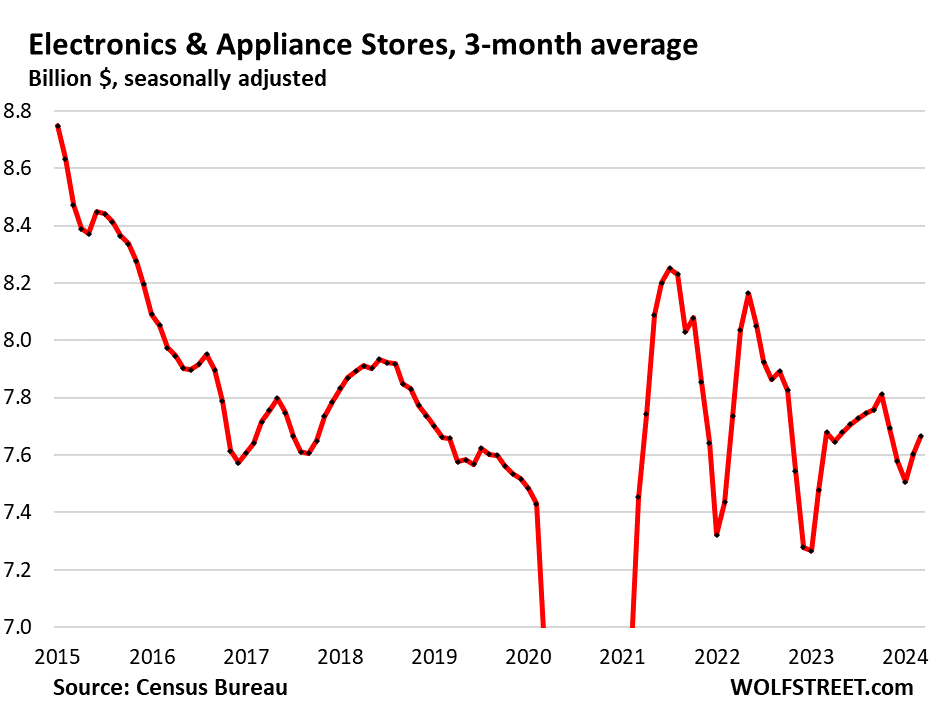

Electronics & appliance stores (1.1% of total retail):

- Sales: $7.6 billion

- Month over month: -1.2%

- Month over month, 3mma: +0.8%

- Year-over-year, 3mma: -0.2%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I bet the increase in spending on dining and drinking out is by the folks in the top 10-20%. I think this group is driving the inflation. And then the owners of these establishments make more money and they spend. It’s all a circular phenomenon amongst the top owners of wealth. The bottom 50% are broke. And that’s why the Fed is nervous.

You once again completely underestimate the wealth and income of the top 50%. The bottom 25% of the income spectrum are poor and cannot spend a lot, not the bottom 80% or 90%, that’s just dumb clueless BS.

You people keep coming up with this stuff about the top 10% to 20% or whatever, or the top 1%, and everyone else is poor and tapped out and living from paycheck to paycheck or whatever BS. That’s not the case, and we have documented this here time and again. And then you people are surprised by the strong consumer spending. You people who think that most Americans are poor will never understand the US economy; you will always be surprised by it and come up with conspiracy theories to explain it.

Also the majority of eating and drinking places are fast-food chain places, normal bars, delis, sandwich shops, cafes, things like that. These places are everywhere, in every small town, along highways, in big cities, that’s where people drop money.

5.35% T-bills help after 15 year of Zirp or Near Zirp. That’s 30% annual pay raise for my household!

Brad,

If the interest income is in a taxable account, the tax bite is too big for me. I’m looking for alternatives.

I’ve been thinking about putting more money in less risky areas of the stock market, avoiding tax altogether by not selling, and limiting downside with out-of-money put options. Buying put options to protect downside causes leakage, but not as much as a 33% tax bite!

Plus, I’d get all the upside if there is any. I wouldn’t be surprised if Jerome prints another $4T this year should a fiscal crisis unfold. You don’t want to be in bonds if/when that happens.

You wrote in the article that the money, which is spent, comes from stock returns, bigger wages etc. Could you provide the private debt figures in some charts (company debt, household debt…).

Companies are over-indebted and the government is, but households are not. This is total household debt including mortgages, student loans, credit cards, auto loans, etc.

“Americans are now spending vastly more money eating and drinking out than at grocery stores, eagerly paying for the “experience” or the convenience, rather than just the food. They could save a lot of money by eating at home or packing lunch, but no, our Drunken Sailors are going for the experience and the convenience – another sign that they’re flush with money and don’t mind spending it. This is an astounding phenomenon”.

After 2 years of pandemic “stay at home” and now also “working from home”, it is normal to search to socialize with family, friends or coworkers. And the best place, time, …. it seems to be to eat, drink together. Life proved to be sometimes short :)

Grocery costs went up significantly

Incomes have increased and so you’re seeing a time preference. Time spent at the grocery store, time spent preparing food, time spent cleaning up after…if my time is worth more then well there you have it – I am going to spend a few more greenbacks Vs. Hours of my time

Around here everything is still a mad circus. It doesn’t matter what time of day or what day of the week, everything is consistently packed. So what Wolf is saying seems to make complete sense. Then you look at the price of everything and you have to wonder.. how on earth are people doing it? Maybe you add up 30% of houses are paid for, plus the 3% mortgage gift from J-Pow, add in the pay increases and bitcon income, and this party is nowhere close from being over?

People are simply drowning their economic sorrows at bars a restaurants.

You may want to add sports betting to the mix. Maryland is expanding opportunities to part with your money betting on everything in site.

I stopped going pretty much after the pandemic.

Might grab a Starbucks every now and again. And that’s a minimum of $8 with their tip.

A sit down restaurant might bankrupt me! 😆

Hello Wolf, you are one of the guy who is very good with stats. Kudo to you and work. But…. when burgers go from 5 bucks to 12 bucks or more all the hockey stick graphs are just like that. Drunken sailors will shell 12 bucks for that burger and think they got a deal. Ha Ha Ha

Burgers are in eating and drinking places. LOOK AT THE CHART!!!!

Don’t extrapolate from burgers to used cars. That stuff is just stupid. RTGDFA.

And last time I had burger was about a week ago, and it cost $3 and was delicious, I made it at home, and it was faster than going to a grease joint, and a lot better.

3 bucks for a burger even at home is total BS! Did you just throw a frozen patty on the grill and eat it without anything else? Bun, tomato, cheese, lettuce, mayo, ketchup, mustard, onion. Cook time, heat the grill, clean the grill, wash the plate. Not to mention, go to the store, purchase all the items, wash, cut, etc. OR maybe your wife did all this work and so you’re not counting it? 1 lb of ground beef costs at least 3.99. then depending on the size of your family – you may have food waste to consider. Just seems a little oversimplified to me.

Crystal,

$6 for a pound of premium ground beef = 3 burgers ($2 ea); no bun but two hand-cut slices of actual bread with a crust (20 cents maybe), a thick slice of a big onion that we buy in 10-pound bags at Costco (1 cent?); several leaves of arugula that we buy in a big box (5 cents?), slices of grilled mushrooms (mushrooms in bulk = $4/lb at Costco, a pound of mushrooms is a lot of bulk, so a few sliced pieces might be 10 cents?), some freshly ground pepper that we buy in bulk. Grilled not on the grill but in a cast-iron skillet on the stove, not much to clean, plus the cost of natural gas for maybe 6 minutes, so I probably had a few cents left over.

No food waste.

I’m the hamburger-cooker and kitchen cleaner-upper in our house.

Not sure what your problem is.

Wolf- did I read that right? 10 lbs of onions? You eat a pound of onions a day? How do you have no waste? I’d love to buy in bulk but there is no way I’m eating a pound of onions in a day.

Onions are absolutely the best vegetable. Cut a big slice of onion and grill it, and see what it tastes like. Onions go into everything. When I make a big bowl of lentil salad, it has one big chopped onion in it that I pickle for 15 minutes beforehand. We go through lots of onion.

A yellow onion, if you keep it cool, dry, and dark, doesn’t spoil in ten days. It’ll last a lot longer. The secret is cool, dry, and dark. If you leave them out in the open, or if it’s humid, they start sprouting or rotting. Red onions are more fragile and you’ve got to pay attention. We don’t buy 10-pound bags of red onion for that reason, but smaller quantities. But our staple onion is the yellow onion, and it’s also the cheapest onion.

That’s why I like you Wolf – you counterbalance a lot of the other sources I read. I think the actuality is somewhere in the middle. You give current data, and the others project based on the expected actions of the Professional Drunken Sailors. All this chatter is about the amateurs. The Pros are racking up debts, deficits, and war spending budgets out the wazoo. There are many actions that can potentially cut this party short. But who knows, best to follow a balanced diet of news.

What do you mean, “You People”?. Just kidding Wolf as I had to inject this humor into my reply (from the movie Tropic Thunder). Great article as usual on trending in the retail sector as no real surprises are present. Ecommerce/DTC continue to take market share from traditional B&M and goods inflation seems to be leveling off as the real inflation action is in services. If will be interesting to see if China pursues a strategy of exporting deflation in the near future given their excess capacity and need to invigorate their economy. While this may offer some inflation relief with goods, China really can’t do much to impact services inflation.

I’m with you Jim, the drickle down of the top 10% of households spending finds its way to the rest. Eventually this drickle will slow and govt. spending will slow, then we will see the dreaded slowdown. Unless of course uncle Sam fires up the printing presses once again to protect the wealth of the top 10%.

I agree 100%.

With all of the money the top 40% earners are making on the savings, tax returns & investments, who would be surprised by this big blowout number?

Not me. That’s for sure and nor should JPowell.

If the bottom 50% are broke, it’s because they waste too much money eating out. But of course we know from this column that people are actually saving some money as well.

What gets me is that you always, always hear about younger people upset that they’ll never achieve the lifestyle of their parents, but I’ll bet most of their parents were frugal – maybe even cheap – and didn’t waste it all on useless crap. Companies didn’t coerce them into believing that everything purchased needs to be a subscription with re-occurring fees. Stand up for yourselves, people, take on some accountability, and stop wasting money. …or else quit complaining.

Uh oh…I’m starting to sound like Bubba…

“And the fed watches them nervously.” Not restrictive enough?! That’s my thinking. These rates now are normal imo. Rates are rising today without the fed hiking. Curve still inverted tho. Another 25 needed! Thanks for your forcasting Wolf!

Yes, I always get annoyed whenever I hear JPow getting worried about the unsustainable fiscal path. All WE can do is sit by and watch hopelessly, but HE can actually do something about it. And he acts completely oblivious to the fact that it was his low rates that definitely incentivized bigger deficit spending, and then the insane QE on top of that monitizing the debt on top of that to do away with any consequences whatsoever. It’s like hmmm, I wonder how we came to be in this precarious situation…?

Anyone who is in charge of the system, that then needs to call in a Systemic Risk Exemption, should just step down the next day and admit they screwed up and are not fit to lead.

Wolf:

Maybe you covered this but I think the spending is largely coming from the folks who re-financed their old mortgage with the result of pretty large savings for them. At the moment, they are spending those savings as a result of this mortgage rate reduction. What say you? There are millions of those folks by the way.

No it’s not. I told you where it’s coming from. RTGDFA.

We are a 60-70% comsumer driven economy and society. Consumers consume (ie. spend) lol.

Charts show most things to be back on their normal trajectories – covid was just an aberration. I expect it to continue, driven by further inflation.

When consumers expect future inflation, they consume now before things get even more expensive.

…and every consumer always expects future inflation, as our politicians and central banks have made it abundantly clear that they won’t tolerate any deflation whatsoever. Shop till our ecosystems drop people!

Spending on food and drink outside the home has surged past spending for food and drink at home. As Wolf says, this is astounding, as it seems like a sure waste of money in a world where everyone is complaining about how hard it is to get by financially. Beyond that, eating out is generally incredibly unhealthy, with amazing calorie counts that come with those delicious meals loaded with salt, cream, butter, sugar and fat. Eating out should be a treat, not a lifestyle. Even if you think it’s an individual right to eat as you please, we all pay for the healthcare costs of unhealthy eating. It’s both a health issue and a financial issue for all of us.

This cracks me up. People work to spend on things they enjoy. So what if they enjoy a meal out. You’d be shocked at how unhealthy the cheap food is at your local grocery store. The restaurant industry is vibrant, socially engaging, community building, and small business promoting. Clearly people of all ages and economic status are happy to pay the premium, even with inflation, for dinner out on the town.

I keep my nose out of other people’s business. The “so what” is when other people’s choices cost me personally, and that’s exactly what is going on with the skyrocketing cost of healthcare. Unhealthy diet is a major contributor to declining health across all demographics. So, it matters.

I’d posit that the most poor, who are also the most unhealthy, cannot afford to buy quality food at the grocery store. Many do not even have access to a grocery that sells healthy fresh food. So they opt for the cheap calories (soda and potato chips). They do not pay the premium to eat out. Restaurants are not the problem.

Go into an elementary school, anywhere, it looks like a little pig farm. These little porkers ( not all) will be adding to the 17% of e-commerce sales (wolf chart) because the can’t get off the couch.

I don’t know where you are living, Home toad, but I have spent some time in our school district’s two elementary schools. No, they are not little porkers. In fact I rarely see an obese child in our school district.

Tom S., BS. The poor eat unhealthfully because they’re largely myopic and don’t think about the future. I see people on line with EBT cards buying potato chips, when there are plenty of reasonably priced frozen vegetables available at that exact store.

I’m tired of no one holding them accountable. There are many areas where the poor are getting a raw deal. This isn’t one of them.

Making a point maybe escierto

74% of adults in US are overweight, 43% are obese, these are the parents to the little squealers.

Discipline is a very good snack, goes with a cool glass of moderation.

Einhal,

I would respond but I’m fairly sure at this point you’re just here trolling.

Tom, Einhal doesn’t need me to defend him, but I seriously doubt he is trolling. You both have valid perspectives. There is lack of accountability in society and there is a lack of good food available in inner city areas. The closing of grocery stores in inner city areas likely has as much to do with crime, but that’s a whole other off topic can o’ worms.

Escierto, Home toad is just mixed up in his age demographic. Obesity starts to set in around middle school through the 20’s, when kids stop growing and metabolic dysfunction sets in. It’s more of a result of the food they are eating than of them being “little porkers”.

Not trolling at all. Go into a grocery store in a poor area. It’s clear what is happening.

No one is forcing people to buy junk food over frozen vegetables or canned beans.

I’m not saying there are no places where it’s hard to get good fresh produce. But in the absence of fresh produce, getting potato chips and cookies is not a good substitute.

“Clearly people of all ages and economic status are happy to pay the premium, even with inflation, for dinner out on the town.”

Alternatively, they are working 60 hour weeks (both parents) and are so exhausted that three boxes of Popeye’s “Chicken” (can anybody really say for sure?) is all they have the energy for.

This is not long term healthy or sustainable (see McDonald’s 2021-2 boom followed by more recent earnings panic).

$650 billion+ in annual “restaurant” spending ain’t coming from salads at wine bars. It is coming from the time-starved desperate grasping for whatever at the nearest fast food joint.

Why do think this country has an obesity epidemic?

Hey Cas! Enjoy your comments in the last several years.

I think this comment nails it, probably more than most want to admit.

Both my wife and I work full time, with a 5 year old and about to have another daughter.

We try to meal plan, and we do cook at home most nights, but there’s more times than I’d like to admit where we order out because we are just very tired or time constrained.

Also, I would often rather spend the time I would be cooking playing with my daughter. No dishes to clean up etc etc. It’s a time saver for us more than anything. Especially with my wife 8 months pregnant, it’s mostly me doing the cooking and cleaning, after a long day of work.

Neither my wife or I really like this, but it’s a modern reality for many families now.

Best,

-Bio

There’s healthy fast food options out there for people who want to eat healthy. If anything, the spending on food away from home seems to indicate the economy is roaring at the moment, which should have positive effects on general health. Consider the alternative scenario, spending on food away from home is catering, there’s mass layoffs in one of the largest employment sectors, hard to imagine that being positive for healthcare costs in America.

Agreed, this speaks to the overworked and underpaid ethos that we all feel. Even more so with inflation eating away at what’s left.

Bioorganic, best of luck to you guys! Very relatable situation. We used to use a service called gobble.com for meal delivery (we liked it much better than similar blue apron), which allowed us to cook restaurant level dishes at home in under a half hour. They don’t deliver to our area any more otherwise we would still be customers. Would highly recommend.

Grocery stores here have turned into junk food distribution centers. They’ve eliminated healthy foods, no more soup and salad bars. Fish is flown in from China. I have to go to a high end store to get decent produce. I’ve started taking out leftovers from restaurants and use them for a healthy meal the next day.

Soup and salad bars went the way of the dodo bird during Covid restrictions (our local grocery store sold all the soup “bags” once destined for the salad bar @ retail at that time) and replaced them with clamshells full of the same stuff (salad fixin’s) and small containers of soup (some national brands, some store brand). It’s still there, just in different format. Weight is somewhat fixed (you can’t take more or less).

They even closed down the olive bars for awhile (now open again). It’s still amazing how much of a mess people can make of an olive bar, which probably explains why the salad bars of yore haven’t returned. Too much waste and questionable human behavior.

Restaurants use a TON of butter and salt.

Def not healthy AT ALL.

They use a ton of seed oils and salt, butter is too expensive.

Much of the cheep food at my local grocery store is pretty healthy. I eat a lot of rice, beans, wheat flour, corn tortillas, eggs, bananas, oats… Modest amounts of chicken, yogurt, sausage, cheese onions/peppers/spices… All augmented by locally sourced meat, when it’s available inexpensively. In proportion, cost is probably about $1.50 to $2/lb. About 2500 calories a pound, and say 5000 cal/day (I’m very active) so can be done well under $5 a day. I checked my food records for 2021-23, and food came to $5.48/day. Eating unhealthy is totally a personal choice!!

“Eating unhealthy is totally a personal choice!!”

And an educational issue, people aren’t taught what is health to eat.

“… an educational issue, people aren’t taught what is health to eat.”

Public schools have it in their curriculum. Government posts the info, free. We have had more and better info than any society ever, but a huge cloud of noise also.

People are distracted and damaged by bad early family influence, and the exploiters willing to sell them junk. If a nation’s ethics are degraded enough, it stands to fail. Welcome to now. Bailout consciousness is pernicious, and pervades all, if unconsciously. I have seen prior examples of sleepwalking societies, think Europe 1914, USA 2004.

Typical liberal who thinks he knows best and wants to make everyone live and do as he says

But being obese creates costs that are thrown onto others, which educated people (“typical liberals” or not) label as negative externalities.

It is another perhaps “typical” kind of person believing these costs are not dumped onto others by bad behavior (unregulated pollution as well). In any event, I am sad to see this tone of belligerence creeping onto this site. This site is special for keeping its sights and discourse higher, and not degenerating into the “typical” online shouting match.

Yup…most of the new jobs are in bars and restaurants and health care. It is a virtuous circle for the economy. Eat out … get ill … go to doctor … pay for drugs … Not the sign of a healthy economy.

I do everything I can to avoid eating out (especially in the US). Hard to find anything that is edible and/or even remotely healthy.

I don’t think natural fats are actually bad for you. It’s the gross additives and chemicals they use. Even most non-chain restaurants (in the States) use gross processed food from Sysco, U.S. Foods, etc.

Wolf. How does inflation factor into the spending increase if the statistics are not inflation adjusted?

RTGDFA.

If you cannot force yourself to read the article, don’t comment about the article. Commenting guideline #1:

https://wolfstreet.com/2022/08/27/updated-guidelines-for-commenting-on-wolf-street/

your comment is just stupid ignorant manipulative BS. Adios.

Are these higher balances putting increased pressure on household finances? That depends on several factors, including the growth in other types of household debt, interest rates, and disposable income. Between 2020 Q1 and 2023 Q3, nominal personal disposable income rose by more than nominal credit card balances. As the red line shows, relative to disposable income, credit card balances were actually slightly smaller in 2023 Q3 than they had been in 2020 Q1. Of course, interest rates have risen substantially over this period, so the cost of carrying a balance has increased. – FRED – “Three Measures of CC Debt”

Maybe not too drunk…just partying like it’s 1999?

Waiono

“Maybe not too drunk…just partying like it’s 1999?”

Correct. Hence “…Drunken Sailors, as we’ve come to call them lovingly and facetiously” (from the article).

https://wolfstreet.com/2024/02/09/our-drunken-sailors-credit-cards-balances-burden-delinquencies-and-available-credit/

https://wolfstreet.com/2024/02/06/auto-loan-balances-subprime-delinquencies-and-income-who-are-those-drunken-sailors/

No soup for you!

I come here for the awesome info and stay for the double barrel goose gun.

LOL what is the next question for Wolf going to be?

“Uuugh, hey Wolf, do you think our Drunken Sailors are Binging despite Higher Interest Rates, and the Fed Watches them Nervously?”

This is why I am here— RTGDFA!!!

Been reading the articles for a little over a year now. I love the data and no BS. Comments make me chuckle.

Howdy Lone Wolf. “This is an astounding phenomenon: ”

From a sober sailors point of view.

” Just continuing to do what we have always done. “

Something is slightly Armageddon-ish about the magnitude of this spending spree. Particularly the spending on food services and drinking places.

Are these drunken sailors ever going to run out of monetary bourbon? Given these charts, they certainly seem to think the supply is endless.

If this continues, bye-bye 2024 rate cuts.

Maybe we are in the roaring 2020s!

Exactly what I was thinking this morning…and what it is going to lead to.

“slightly Armageddon-ish”

Well, 40-80% price hikes in SFH following a pandemic that killed off a million plus does give off the whiff of…imbalances…

Yes! The psychological effect on time preference caused by the pandemic coupled with the psychological effect of “oh the government will save us no matter what happens” has set off an entirely new consumer and they are not drunk they no longer care even when they’re sober and this is way more dangerous from an economic stability standpoint

Honestly from the chart we’re about 150 billion off of the normal trajectory.

A good bit of that is inflation, some corporate greed and some opportunistic economy pumping. We’re the coal and America is the train.

Choo chooooo!! 🚂 🇺🇸

I’m gonna tell the conductor that I need a raise…

Party like it’s 2004? Maybe the credit bubble dynamics are not the same, but they might rhyme. There can be new ways of pooling of risk, and, despite the obvious and widespread nature of the phenomenon, as in 2004, it can find its way to a surprising blow-up.

Hello 🐺. So awaiting your posting about a certain stock joining the pantheon 😀

Tesla? It was inducted with great fanfare into my pantheon on Dec 24, 2022, but then inexplicably weaseled out again. It appears to be coming home though.

https://wolfstreet.com/2022/12/24/tesla-joins-my-imploded-stocks-70-from-peak-object-of-religious-veneration-turns-into-automaker/

Sorry for the obscurity, a bit on purpose: D J T

And the purpose was a special vehicle, and not Tesla LOL

I see vehicle car sales are up by dollar amount. I wonder if the number of cars being sold has also increased or if they are selling more luxury cars that cost more.

Too bad to see electronics retailers being pushed out of business by online shops. I generally don’t like buying expensive technology equipment online and would rather go to the store. That way I can get it home safe and sound in my car rather than risking shipping damage. But maybe I’m just old fashioned.

Q1 new vehicle retail sales were pretty good. Adjusted for selling days, +4.5% YoY. March sales were up 11% YoY. Including fleet sales, March sales +12%.

Financing is usually cheaper for a new vehicle than a used vehicle. Whether it is

financially the right move is another question.

Used vehicle retail sales in March increased by 7% yoy (Cox Automotive), with supply coming down to 42 days.

As someone who works in e-commerce order fulfillment, I’ve wondered at what point package theft and CNP chargeback fraud makes e-commerce lose its competitive edge (in certain categories) vs brick & mortar.

All it takes is one major chargeback to erase an entire week of gross profit, at least at the company I work for.

But theft, including by employees, has been a problem in brick and mortar from day one. It’s part of the cost of doing business.

Back in the day when I still ran a big car dealership, people stole vehicles from us, LOL. Where there are humans, there’s theft.

Wolf,

I’m curious, what happens to these vehicles after they are stolen? We have a major Auto theft problem here in the Swamp. Up 200% in the last year. None of the news shows or law enforcement people ever say what happens to these stolen vehicles. Why are they ignoring this. It seems that one way to curb the theft would be to catch the perpetrators including those who purchase these stolen cars.

Today, from what I know, there are essentially two options for a stolen vehicle:

— a chop shop, which turns stolen vehicles into parts, such as entire doors, engines, etc. for sale to repair shops and body shops;

— or exporting the entire vehicle (but that can get people caught).

When they bust a chop shop, it’s always an interesting read. These people specialize in certain models.

To find out what happens to stolen vehicles, google for something like: chop shop stolen vehicles

Often they are recovered. A lot of cars stolen are by people with drug problems. When they are recovered, a good insurance company will test them for drug residue, like meth. If they test positive, the vehicle is totaled by the the insurance company to avoid the liability. The vehicle is then auctioned, cleaned, and sold on some used car lot.

True, there’s no free lunch. I guess I feel like stealing from an actual store requires a bit more… fortitude.

Stealing from websites is easy – just order the thing and then file a chargeback with your CC.

E-commerce will have a big problem if enough people figure out how easy it is to commit credit card fraud and get free product.

There was a country song back in the late 70s or early 80s about a guy working in a car plant who, over time, stole enough parts to build his own car. I forgot the name and the singer, though.

Johnny Cash… 1976… “One Piece at a Time”

Interesting to see the Building Materials and Garden Supplies Stores has been trending down since it peaked about 18 months ago. Did people lose interest in gardening post-pandemic?

As someone who unfortunately follows SMG, generally speaking yes. Gardening was a huge beneficiary of the covid, things to do when everything is closed list. When things opened up, well, it was more of a what can we spend our money out doing things on instead? As someone who personally gardens, my own anecdotes are that people don’t have the time and the patience for gardening. Attention spans are short. As SMG notes in multiple earnings calls, demand fell off a cliff. They’ve also had to put through a number of commodity related price increases onto consumers so I’m not sure how much of an impact that had as a deterrent. Based off data posted here, people would rather spend time and money on experiences.

Interesting. I had a look at SMG; brutal chart. What are other retail related tickers that you follow?

AMZN, FIGS, FND, SIG, and TGT.

They are going out to dinner instead of working in their yards.

Made me think of:

“If you want to be happy for a day, get drunk; for a month, get married; for life, be a gardener.”

The e-commerce sales make up 17% of total retail sales.

Your charts show declining sales in brick and mortar stores, furniture/appliance/ electronics, etc.

E-commerce sales from these stores are not included, so I’m to think, that the companies that run these stores could actually be doing quite well, the charts in the corporate office could look quite different.

Without looking these charts are probably included in other articles.

This is not about companies but about retailer locations – retailers’ brick and mortar stores are listed by category. In addition, there is ecommerce.

Ecommerce sales are included in ecommerce. Macy’s brick and mortar stores are dead. It has been closing them by the dozens and hundreds every year for years as leases expire. And it has sold a bunch that it owned. But Macy’s ecommerce site is vibrant and big (included in ecommerce). Same thing with BestBuy, big ecommerce site, dead stores, and has been closing stores as leases expire. What’s working at Walmart are ecommerce with huge growth of 25% to 35% every year; and groceries (largest grocer in the US). Walmart has become the second largest ecommerce retailer in the US behind Amazon. At its stores, the aisles outside of grocery are declining despite all efforts to keep them alive. Walmart said as much in its earnings call:

https://wolfstreet.com/2024/02/20/walmart-and-ecommerce-sales-in-the-us/

“The aisles outside of grocery are declining despite all efforts to keep them alive.”

Hell, they are way too expensive. Walmart stopped doing sales in value and volume long ago and wants the big markup. It’s all overpriced cheap-made junk. Good luck.

So the newcomers to the States get a higher chance of earning more money than the current mess that we have in Canada?

A lot of newcomers, in particular young single men and married men are not happy that they moved to Canada. They regret it. They believed they would get a job in their fields, save money, go up the property ladder.

Instead, they are working for minimum wage just to exist to pay rent and food. Can’t even afford a McDonalds at the end of the month.

You mean from India immigration. Those folks got sold a bill of goods by their unscrupulous countrymen back home. Now they make sure Amazon packages get delivered, Uber eats has drivers, and retail has cashiers. Of course they have also driven rents sky high and made colleges a wasteland of diploma mills. Yes a real mess.

America is very strict with immigration. Got to get a green card, be sponsored or get hired by an American company after going through a process.

What I hear about Canada is that unscrupulous employers post ghost listings online, but they already have a plane load of workers being shipped in from low income states in Asia working like modern day wage slaves.

Sounds about right, wifey showed me a listing for a condo/house listed for rent at 2100sqft in ok part of Long Beach. Asking $6500 a month and no, not in front of the beach and nothing special, townhome in a large planned community from the 80s..yup this is the kind of insanity we have to deal with now with this “transitory” inflation…what a joke.

Looking at all these charts, I see no sign that the current level of interest rates has slowed the economy in the least. Show me a reason why rate cuts are justified. Rates clearly need to go higher if 2% inflation is the goal.

Monetary policy, for the first time in our lifetimes, is becoming less powerful in controlling inflation, recessions, jobs, etc. Fiscal dominance is the big player now. You will be hearing more about this as it becomes common knowledge.

Monetary policy wasn’t very powerful in the 1970s either. It took VERY high interest rates and a nasty double-dip recession to finally get inflation back down and it took decades to get it to 2%.

CPI inflation was above 5% nearly the entire time between 1972 and 1983. It took until the 1990s before CPI was somewhat consistently around the 2.5% line.

The federal funds rate was above 10% for a big part from 1973 to 1984, with a few years in between when it was below 10% and as low as 5%.

In the seventies we did not have millions walking over the border.

They get jobs, buy houses, increase demand for inelastic supply items.

Thus another driver of inflation orthodox tools struggle to address?

Immigration might be contributing to higher for longer.

I retract my previous post because I Reread The Blessed Article….

🤣❤️

Ha. It took the DIDMCA of March 31st, 1980. This destroyed the velocity of circulation.

Just one data point, but my family has definitely been eating out more this year. Some of it is pandemic catch up (2.5 years of rarely going out) some is due to being on the road more and a little is due to plain laziness.

On the flipside, being a remote worker has cut office trips to eat out with coworkers to nearly zero.

Same case for me. 4 years of 100% telework with maybe 3 times a year in office. No lunches out except with friends every few weeks, no parking costs and fill RAV4 ICE about once a month. That goes into a combination of healthy and unhealthy food 3 to 4 times a week. Admittedly might have to go back two days a week as state politics might be sending us back.

If you really took 2.5 years off for the pandemic, that’s on you. Most people were back to normal after vaccination (March-May of 2021). If you continued locking yourself away for the next 16-18 months, you have no one else to blame.

I am just saying that we have spent more eating out in the past 12 months than we did in the previous 2.5 years…it did not go to zero during that time but it was mostly cheap tacos from the place up the street.

Wolf, I don’t think you’ve brought up immigration in previous consumer spending articles.

Has per capita spending also gone up, or is all/most of the spending increase attributable to the increased population?

Or does this not matter?

per-capita doesn’t matter at all, zero, in these discussions. This isn’t a social studies report. This is about retail sales and demand in the US economy.

No, the Philips Curve was denigrated in the early 60’s.

I dont know if you are cheerleading for illegal immigration. But I’d be happy to forgo the economic “benefit” of 6 million new residents whose first action is the break our laws by entering the country – even if you want to advocate for the idea that there are no laws to be broken any longer.

I’m not sure if this latest wave of new people is really world sending us their best and brightest.

At least where I live, the state pays little to no benefits to anyone so the south-of-the-border folks who show up here do go to work and stay out of trouble. I’ve not met any of the “new” border crossers. The guys I know are mostly desirable additions. Work hard, enterprising, reliable, work to acquire skills.

Most of them that I know, if they are indeed our “replacements” will disappoint most politicians of either party by their utter indifference to politics or anything other than their own business. Ironically they complain about border conditions because many of them, over the years, have gotten enough documentation to go home and come back without too much worry, but now conditions are less predictable through any of the “legal” routes.

However it’s also true that they are not at all prone to worry much about procedural details like car insurance and things like that and are not attached to the community such that if they do have a problem and are not held in jail, they immediately disappear and we soon discover that we never even really knew their names.

LOL, I’m not “cheerleading for illegal immigration.” I’m pointing out the effects of this huge sudden wave of immigration on demand and inflation.

“Much of furniture and furnishing sales have moved to ecommerce”

Hmm…since the G has historically broken out total retail sales into the various categories you list (so that data doesn’t come out in one indigestible/un-analytical lump), maybe it wouldn’t be too much to ask that the “online sales” pile start being broken down too. (Otherwise it is going to look like certain sectors are vanishing).

People are buying furniture just fine. Wayfair, which is online only, had $14 billion in furniture sales during the pandemic-bubble and $12 billion in 2023 (up from $9 billion in 2019). That’s just one company, and it does what equates 10% of the total US brick-and-mortar furniture business. We’ve bought ALL our furniture online for the past 15 years. Before the internet, I bought mostly by mail-order. Furniture stores are a waste of time. You go there, and they don’t have what you want, then THEY have to go through the catalogues and try to find something that you like, and usually they don’t, and if they do, they order, and then weeks later you might get it. Everyone figured this out. Buy online from the beginning. The world is at your fingertips.

I agree furniture stores are terrible, but I do like to go to IKEA occasionally, though mostly because I’m determined to find a shortcut to to the exit.

There is an IKEA near us and it is astonishing how its parking lot seems always to be jammed.

Yeah, garbage from China at your fingertips. Ecommerce for electronics, books etc. Clothes, furniture, etc.? how do you gauge quality, via pictures? Race to the bottom in quality imo.

It’s interesting that psychologically many Americans are down about the economy (per numerous polls) yet they’re spending like it’s the best of times. There will be case studies in business schools about this time trying to understand this phenomenon.

All it says to me is that Americans hate inflation.

And yet they’re feeding the inflation beast with this spending.

If money loses value super fast, you try to get rid of it as soon as possible. Hence, voracious spending. That said, there are definitely signs that the bottom 70% of incomes are slowing their roll.

I don’t get why this is a surprise, stock market near all time highs and lots of people who made 40% in equity since COVID. People feel rich, and if they feel rich, they’re going to keep spending. I don’t think we’ll stop inflation as long as those two keep making new highs.

That was supposed to say in home equity since COVID

I’m sooo appreciative of the higher property taxes my fake home equity has “earned” me…

10 year note hit 4.6% today. I see a FOMO buyer’s panic occurring as we speak. Mortgage rates are heading up to 8% before the summer.

IIRC that’s what it was 30 years ago. It was fine, back then most were buying no more than 3x annual income.

How could this surprise anybody? We are at the peak of the most massive everything bubble in the history of the world. When speculative assets like crypto, with zero intrinsic value, are minting new millionaires based upon nothing but the greater fool theory, these are the results you get – reckless spending and gambling everywhere. There is simply too much money sloshing around, and we are nowhere near the end.

We could very well be near the end… I’d say much closer to the end then the beginning for sure. The debt is just unsustainable.

If they’d just let assets fall we could’ve been done with this by now

However seems to me we will be stuck in a feedback loop with asset prices driving consumption until they don’t anymore… Maybe when spx is back to 4100 the partying will stop.

We’ve been hearing about the end coming for years upon years, yet they just continue to devalue the dollar and pump up asset prices. I am sure that’s their plan for the foreseeable future. Even Wolf himself is resigned that QE is a permanent fixture. This country is finished.

True but I think the masses are more upset about it now then in the past.

The wealth gap has never been bigger

Capability of obtaining the American dream has never been more difficult

It’ll probably just lead to a war… Or revolution, now wouldn’t that be fun… Just like that movie that just can’t out, but I doubt California and Texas would be on the same side lol

Of course a $1.8 trillion federal deficit can’t hurt. That’s about $5,000 for EVERY american. Helps keep the plates spinning… and that is with full employment.

Yeah, this looks like the most salient factor to me as well.

Here’s my boots on the ground report: The local Mexican place was packed this weekend, with entire families out dining. I shopped the sale at my favorite store, spent $175 for clothes retailing for $450. Last month I bought a designer bag for over 50% off. After scrimping since Xmas, we had enough. Austerity to begin anew shortly.

A note on the luxury markets: The high end designer brands are raising prices on their popular items by a lot. Customers are pulling back by a lot too. Those popular items with the higher prices are not selling, and now the “newer” items have more reasonable price points. The outlets are also showing more current styles sooner. My recent purchase was a very high end item at over 50% off, I waited over six months for it to be discounted.

Well, if you want to trade good deal stories, I recently closed on a property that was 50% off list. I am expecting more deals coming my way when you have cash and ability to close quick without any real contingencies. Closed in 20 days start to finish. Property speculators are going to get destroyed this round without cash to back it up. Cash is king.

Good luck.

A designer bag which is 50% off is still 99% over priced.

Just get the bag from Temu for $5, its not even really a fake since its from the same production line, lmao.

You can make an Italian sports car from a kit, or buy the kit built, but it is not the same experience. Besides, I can spot the obvious fakes. I have decades of experience from watching the ladies at the nail salon.

Speaking of fakes, there is nothing worse than a poser, in a cheap suit.

Thanks Wolf for responding to my question; “What’s in the punchbowl that is driving these retail sales increases. For certain all the factors you mention, record employment, huge bump up in CD rates, beefy increases in rents due to Mom & Pop landlords, stock wealth effect and population growth are factors. Is this really the complete picture? Where does the $Trillions of government spending come in? Where do the $Trillions of generational wealth transfer come in? Here in California they raised the minimum wage for fast food workers to $20/hr and the expectations are the minimum wage will quickly rise to $20/hr. Wolf, can you at least give us a rough approximation pie chart of the ingredients of this punch bowel. We need to know what our sailors are drinking.

For “government spending” to become “retail sales,” consumers will have to get this money first. And consumers get this money via the items on my list. If consumers don’t get this money, it cannot go into retail sales. And that’s covered on my list.

So consumers get government money via salaries from government jobs, including military and intelligence jobs; and as contractors and consultants; and via salaries at private sector jobs funded in part by government subsidies of the industry (for example, construction workers building chip plants, where the chipmakers get billions in direct funding from the government to build those plants under the CHIPS Act); via other public construction projects, such as highways; via student loan borrowers whose student loans were forgiven (which increased the deficit), and now they have more spending money; via transfer payments such as Social Security (but note, Social Security benefits only increased by 3.2% in 2024, so that’s not much help). All this is included in the list I mentioned (employment, retirees, etc.)

30% of tax receipts are now spent on interest payments, and consumers get some of that, and they spend it. That’s also on my list.

Generational wealth transfer takes place every day of every year and has for thousands of years. So that really hasn’t changed. Sure, the values are a lot bigger because inflation has devalued the dollar, and so the dollar amounts have grown bigger, but also everything costs a lot more, so it balances out. To blame the increase in retail sales over the past few months on a generational thing that takes decades is just nuts.

The $20 minimum wage in California is included in my list, the line about wage increases. Note, that it’s still a starvation wage in many cities in CA, especially since most of these jobs are part-time, and have split shifts, etc. Very few fast-food workers on minimum wage get to work 40 hours a week every week in one job.

Naive question: is there a breakdown on who actually receives the interest on this soaring debt? Isn’t just the 0.1% of bankers & their shareholders feeding off the elan vital of citizens…the age old story; easier to rule slaves with debt than with force?

“…who actually receives the interest on this soaring debt? Isn’t just the 0.1% of bankers & their shareholders feeding off the elan vital of citizens…”

LOL. This stuff never stops, does it? This entire comment section is full of commenters who receive the interest, and they’re loving it. I receive some too, my wife does too. You can too. All you need is a brokerage account or a TreasuryDirect account and $1,000 to invest.

“easier to rule slaves with debt than with force”

But you’ve got it backwards – by holding Treasuries, you’re loaning money to the government. I.e. the gov’t is in debt to you.

Viva America, let the good times role….

It’s been like this since I was a child.

There is $6+ Trillion resting peacefully in money market accounts, waiting to be spent and compounding to the tune of about $250 billion of additional future spending per year. That is all you need to know about current inflation and future inflation. We will have at least two more years of inflation, QT and mild recession be damned.

On a positive note, the reverse repo balance is at $327 billion today. I will be gleeful when this abomination drops to $0 and the markets start feeling some liquidity pain.

Surprised sporting goods, music and books are kinda flat. I’m definitely doing my part and will continue to take one for the team lol!

Are you buying online? If yes, it’s included in nonstore retailers (mostly ecommerce).

I buy ALL my sporting goods online.

Too much money sloshing around the economy. All this money printing over last 5 years is still changing hands driving growth. When we do get a confidence hit i.e. SVB collapse, govt. steps in and backstops to contain, failure is a natural thing, without risk of failure where is line drawn for bailouts. Wonder what’s going to happen when growth does slow, tax revenues drop and inflation still 4-5 percent.

There’s an interesting theory recently published on Bloomberg that higher interest rates are driving higher consumer spending. The main reason is US government debt has increased massively in recent years, meaning that more people are beneficiaries of higher bond payments. Apparently, the revenue received from bond payments is almost 3 times higher than the debt paid by consumers (excluding mortgates). I assume that excluding mortgages undermines this thesis but there must be plenty of baby boomers who have paid their mortgage. In the US, unlike other countries, there are also lots of people who have locked in lower mortgate rates when interest rates were close to zero.

Based on Wolf’s excellent analysis, higher rates aren’t curtailing spending as much as during previous rate tighting cycles – and maybe this will continue.

Anecdotally, I see a lot of people have tabled their real estate purchasing dreams and climbed on board the Drunken Sailor ship. In the current real estate (bubble?) economy that might actually be a rational decision

Imagine being a a sailor out on the sea for 6 months and when you make it onto shore, the price of everything has gone up yet again?

Been there… done that… REPEATEDLY!!!

Per Bloomberg today, the International Monetary Fund said the USA’s recent high performance among advanced economies is partly driven by unsustainable fiscal policy. So I guess this is a bipartisan party (maybe like it’s 2004)? I see it as a bailout before a crisis. Each side seems to lavish its (our) wealth on favorite bailees, with lots of punchbowl spillover for all.

It’s not the “sides” (being Democrats and Republicans) who are to blame. It’s the American people.

Something like 60%+ wants to cut spending, but only 20% can agree to cut any particular item. So basically, everyone wants to cut spending only in the abstract, and only so long as someone else’s ox is gored.

So, is it a race between (1) raising (or sustaining) rates until something breaks (something which was flimsy and ill-constructed to start with, due to monetary and fiscal follies), and (2) borrow-and-spend until something breaks? The combinatorics are incalculable: potential chaos, nonlinear crackups.

I am reminded of my surfing days: bizarre cross-chops and colliding waves on the ocean surface. Some were quite spectacular.

I remember 2005-2006 like it was yesterday, because I’m old. Was living in a Housing Bubble Boomtown at the time, and the cash out refis were paying for everything in sight. The middle of the bell curve people bringing down $80-100k in the household pulled $200k out of their houses and thought they were millionaires. A lot of flat screens, lifted trucks, jet skis and fake breasts were paid for with big refi money. Important stuff, good for the economy.

People are living large now too. $100 dinners at Chili’s for a family of four. Vacations. Still plenty of credit to tap on the old CCs, and if you vote right you might just get that pesky student loan paid off by Joe taxpayer too. Party on.

1) Funds moving out of the O/N RRPs increase both the supply of new money and the supply of new reserves. Retail MMMFs are not money creating institutions. They are nonbanks. They do not reflect “money”.

2) Further large CDs should be included in M2. Also, the CU’s and S&L’s correspondent balances should not be included in the money stock figures.

3) The ratio of transaction accounts to gated deposits has risen.

https://fred.stlouisfed.org/series/LTDACBM027NBOG

Large CDs, over 100,000 dollars, are simply transfers from other deposit classifications in the payments’ system. It’s a differentiation between the money school and the credit school.

Federal government current expenditures: Interest payments

Personal income is up.

I gave you the chart of interest payments by the Federal government within its context – see below. Putting up a 50-year chart of interest payments by itself (the link you provided and that I linked) is BS.

https://wolfstreet.com/2024/03/31/curse-of-easy-money-us-government-interest-payments-on-the-ballooning-debt-v-tax-receipts-amid-higher-interest-rates-inflation/

Wolf,

Apologies if I failed to RTGDFA; but I didn’t recall seeing any mention of it (and, genuinely, I may just be dumb).

Is E-Commerce versus B&M broken out to exclude going to a brick and mortar where they push you to their online platform for the sale? I worked for Sears back in 2011-2013 during college and did a short stint there again in 2015 selling mattresses (and wow, the margins). They made a big stink about using their iPads to complete the sales/transactions. The iPads linked to (essentially) their e-commerce site but would allow them to track our commissions (we hoped). I suspect this was done to drive traffic to their E-Commerce site. Buying furniture with my wife when we first moved into our apartment, the sales person also directed us to an online ordering system.

Obviously they’re able to use their brick and mortar locations as a showroom – and they can justify having it open as they don’t have to maintain inventory beyond floormodels and various nick-nacks… but do they _actually_ count sales for the brick and mortar locations if they’re being purchased “online” if even at the store? Or, perhaps a different question, especially with Walmart, I’ve seen a decent deal on their website (most recently a TV), made the purchase and went to go pick it up at the store. Where does that sale go?

Same with the introduction of online ordering for grocery stores.

Ecommerce is when YOU buy and pay for the product online, no matter how the product gets into your house, whether they deliver it you have to go get it yourself.

It’s not ecommerce When you go to the store to buy, and they don’t have it, and the guy there orders it on his iPad, and you pay at the store.

I’ve asked Wolf this before. Its essentially where payment is tendered.

CNP transactions done thru the website count as e-commerce regardless of how the merch is delivered (shipping or store pickup). And anything paid for by reading the card’s chip counts as in-store, even if the product is later shipped.

I worked at BestBuy around the same time as your Sears stint. We had a system (OMS) for shipping stuff to customers when the stuff wasn’t in stock locally. My CSM always pushed me to do that instead of sending people to the website so the store would get credit for the sale.

Currently, BBY’s store pickup system tenders payment thru their website, so those sales would count as e-commerce.

This is a consequence of underreported inflation.

One would gain much better insight with counts, volumes, and mass then $ amounts.

How much beef steak in tons? How many airfare tickets at which average distance? How many cars of each type? How many movie tickets? How many Bitcoins? How many ounces of gold? Tons of wheat? Tons of copper?What are they buying and how much?

Money spent has lost all its meaning.

Nonsense. You can count houses and cars and barrels of gasoline. But to produce nationwide counts of disparate products, from nails to bananas, with a gazillion products, and a gazillion differences and versions, as an indication of anything is just bullshit.

That is one of the primary reason a currency exists, so you can denominate stuff in that currency, and you don’t have produce these meaningless stupid counts of nails (what kind?), underwear (what kind), socks (what kind?), apples (what kind?)… use your brain first.

WR, very useful article and many of the comments were interesting as well. Thanks!

Is there a reason only the building materials got the trendline, but nothing else? Seems like almost every graph would would paint a picture of the current detail being > the trendline pre-pandemic.

Specifically my issues are:

I do not like to cook after wage slaving 8 to 10 hrs.

I do not like to clean, again when I have no energy left.

We would absolutely have food waste in my household at the volume that you listed that gets you the lower cost.

Lol, and I spend too much time reading your articles and the comments. I do enjoy both so Thank you!