But banks are having profit problems.

By Wolf Richter for WOLF STREET.

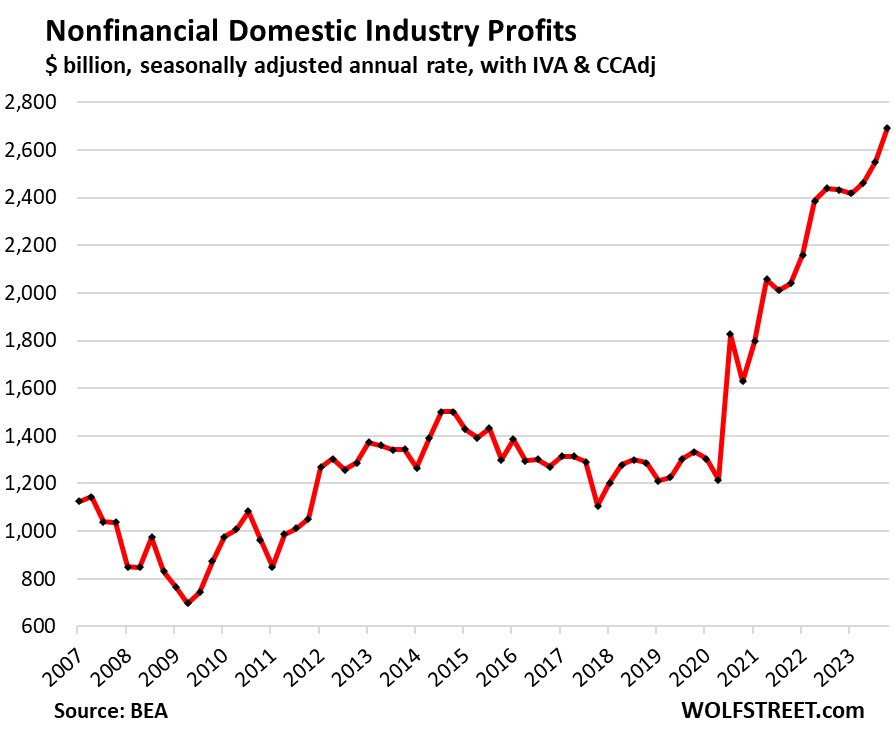

Corporate pre-tax profits in all nonfinancial domestic industries combined – this excludes our suffering banks and other financial companies – jumped by 5.6% in Q4 from Q3, and by 10.7% year-over-year to a record seasonally adjusted annual rate of $2.69 trillion, according to data by the Bureau of Economic Analysis today.

The BEA’s measure of corporate profits tracks “profits from current production” by all businesses that have to file corporate tax returns, including LLCs and S corporations, plus some organizations that do not file corporate tax returns. It’s based on income tax data from the IRS and on financial statement data filed with the SEC.

The re-heating inflation scenario.

As we can see in the chart above: During the inflation surge in 2021 and 2022, corporate profits spiked as price increases were outstripping cost increases, with a huge quarter-to-quarter spike of 10.5% in Q2 2022, which coincided with the peak in core CPI inflation. Then there was a lull in the growth of corporate profits in Q3 2022 through Q2 2023.

But then in Q3 and Q4 2023, it started all over again with big jumps in profits, coinciding with reaccelerating core CPI inflation.

This spike in profitability in inflationary times is a sign that companies hiked prices much faster than their costs – including labor costs – went up, that they were able to do so without losing customers, and that they were confident that they would not lose customers by hiking prices, and thereby doing their part in refueling the inflationary momentum we’ve been seeing for the past few months. Companies are able to do it because their customers are willing and able to pay those prices.

First some definitions.

IVA: The “inventory valuation adjustment” removes “profits” derived from inventory cost changes. Profits derived from inventory cost changes are like a capital gain rather than “profits from current production.”

CCAdj: The “capital consumption adjustment” converts the tax-return measures of depreciation (based on historical-cost accounting) to measures of consumption of fixed capital, based on current cost with consistent service lives and with empirically based depreciation schedules.

Capital gains & dividends received are excluded to show “profits from current production,” rather than financial gains.

Profits by major industry category.

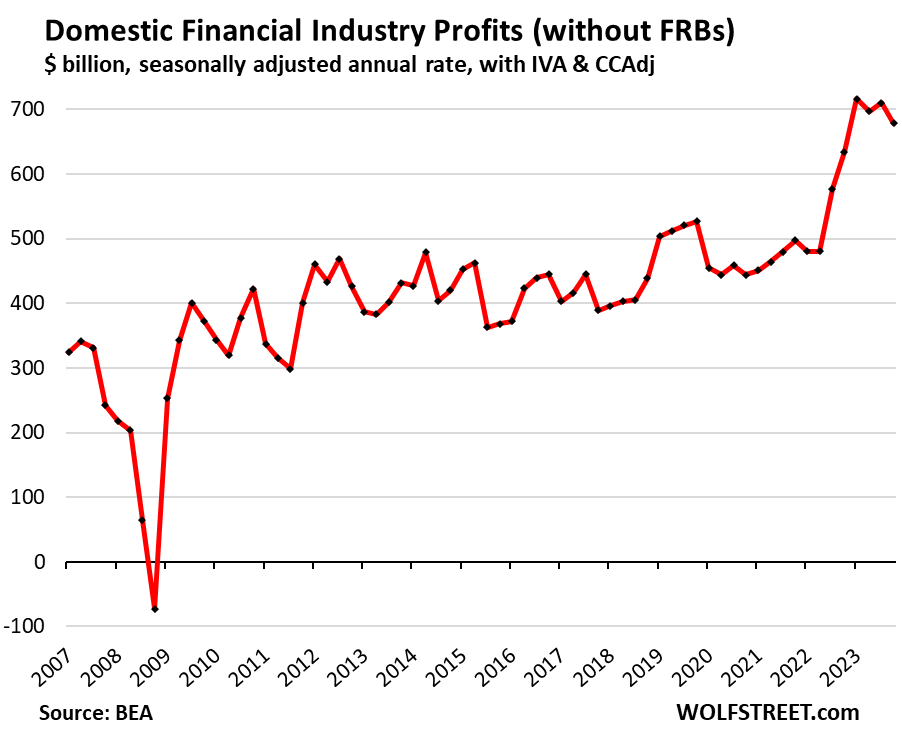

Financial domestic Industries: Profits fell by 4.5% in Q4 from Q3, to a seasonally adjusted annual rate of $679 billion, but was still up 7.0% year-over-year. This was the only major industry where profits fell in Q4.

Banks and bank holding companies are a big part of this industry. Near the end of Q1 2023, the bank panic broke out. And profits began to sag in Q2 2023.

In addition to banks and bank holding companies, the industry includes firms engaged in other credit intermediation and related activities; securities, commodity contracts, and other financial investments and related activities; insurance carriers and related activities; and funds, trusts, and other financial vehicles.

Their customers are paying for those profits by paying higher prices, fees, insurance premiums, etc., which fuel the inflation in services.

Excluded here are the 12 Federal Reserve Banks (FRBs) whose shareholders are the biggest financial institutions in their districts. The Fed has booked $114 billion in losses in 2023, spread over those 12 FRBs, but the losses are irrelevant for corporate profits, they’re a result of the Fed’s paying interest on reserves and ON RRPs. And so we exclude them here.

Despite the decline in profitability, these financial companies are still immensely profitable:

Durable-goods manufacturing: Profits jumped by 6.3% in Q4 from Q3, and by 13.2% year-over-year to a record seasonally adjusted annual rate of $425 billion. Since Q4 2019, profits have spiked by 115%.

These companies produce motor vehicles, trailers, machinery, fabricated metals, computers, electronics, electrical equipment, appliances, components, and other durable goods.

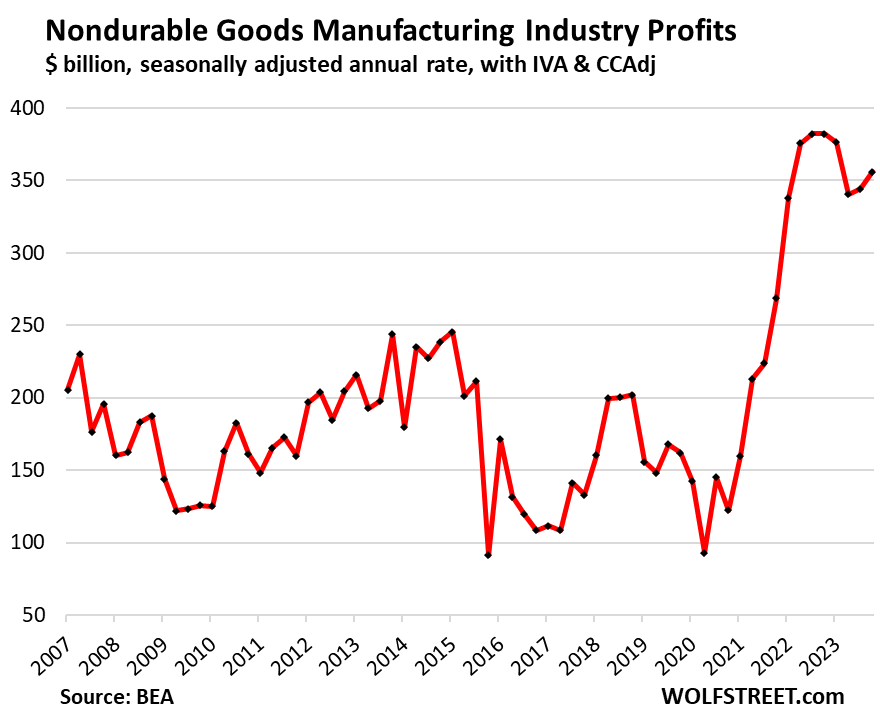

Nondurable-goods manufacturing: Profits rose by 3.5% in Q4 from Q3, to a seasonally adjusted annual rate of $356 billion.

In the first half of 2023, as prices of energy products plunged, so did profits in this industry. And compared to a year ago, profits were still down by 6.9%.

These industries produce food, beverages, petroleum products (including gasoline and diesel), coal products; chemical products; and other nondurable goods.

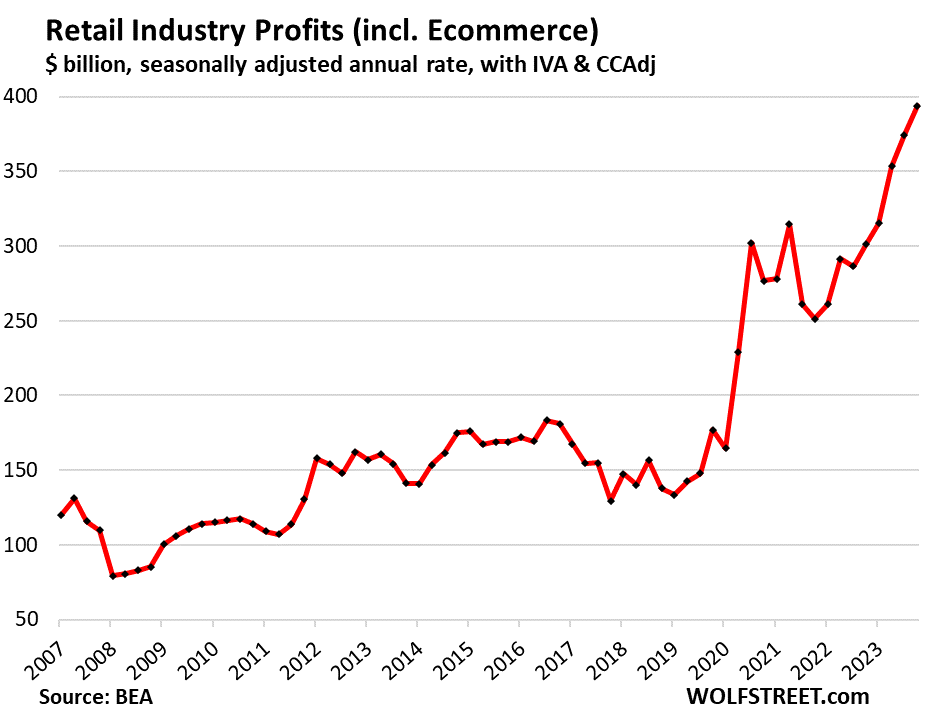

Retail trade, including Ecommerce: Profits spiked by 5.2% in Q4 from Q3 and by 30.6% year over year, to a record seasonally adjusted annual rate of $394 billion.

For the retail industry, including ecommerce, inflation is a massive profit-generator when consumers are willing and able to pay these whatever-prices after the inflationary mindset has set in where companies are confident that they can raise their prices faster than their costs go up, knowing that consumers will pay those higher prices, and that they will not lose sales after having raised their prices:

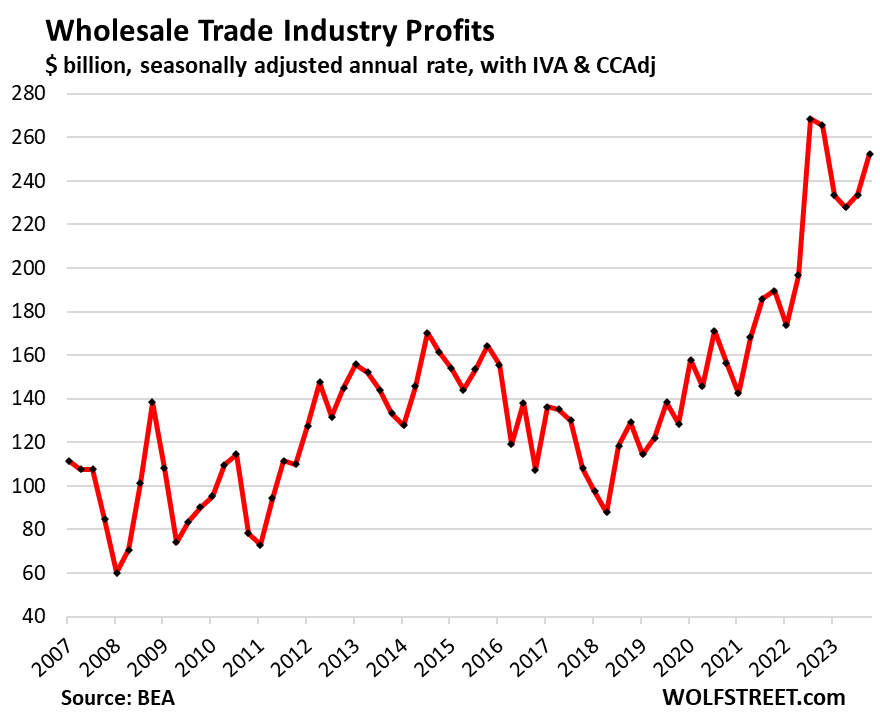

Wholesale trade: Profits rebounded by 8.1% in Q4 from Q3, after the slump that had started at the end of 2022, to a seasonally adjusted annual rate of $252 billion. Compared to a year ago, profits were down by 4.9%:

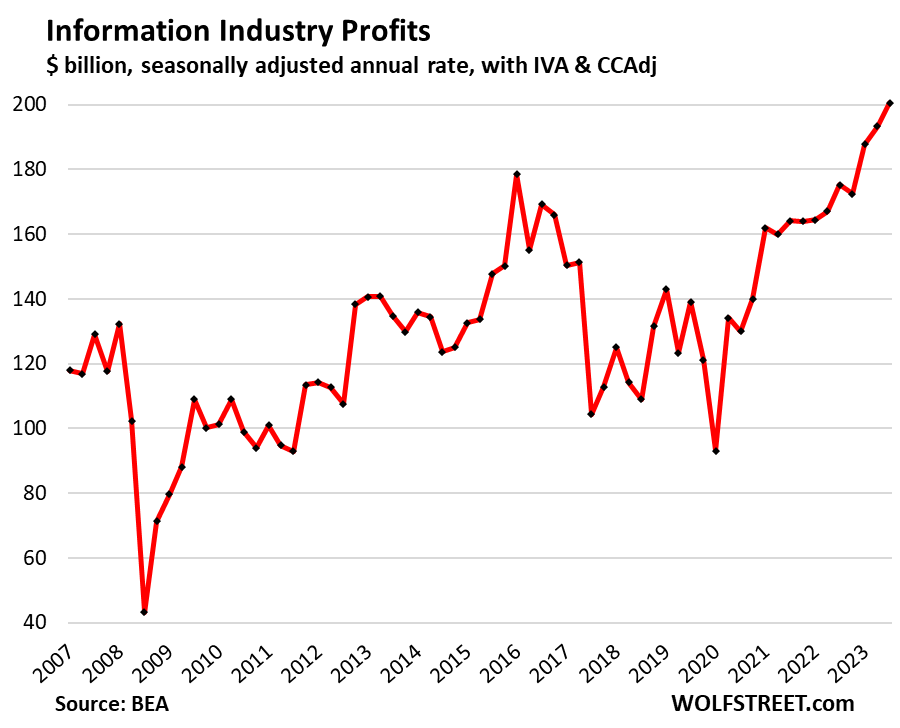

Information: Profits jumped by 3.8% in Q4 from Q3 and by 14.4% year-over-year, to a record seasonally adjusted annual rate of $201 billion. The layoffs in 2022 and early 2023, dumping office real estate, and other cost cuts likely helped boost those profits.

Despite its small size – with about 3 million employees – the sector generates huge profits. It includes web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications.

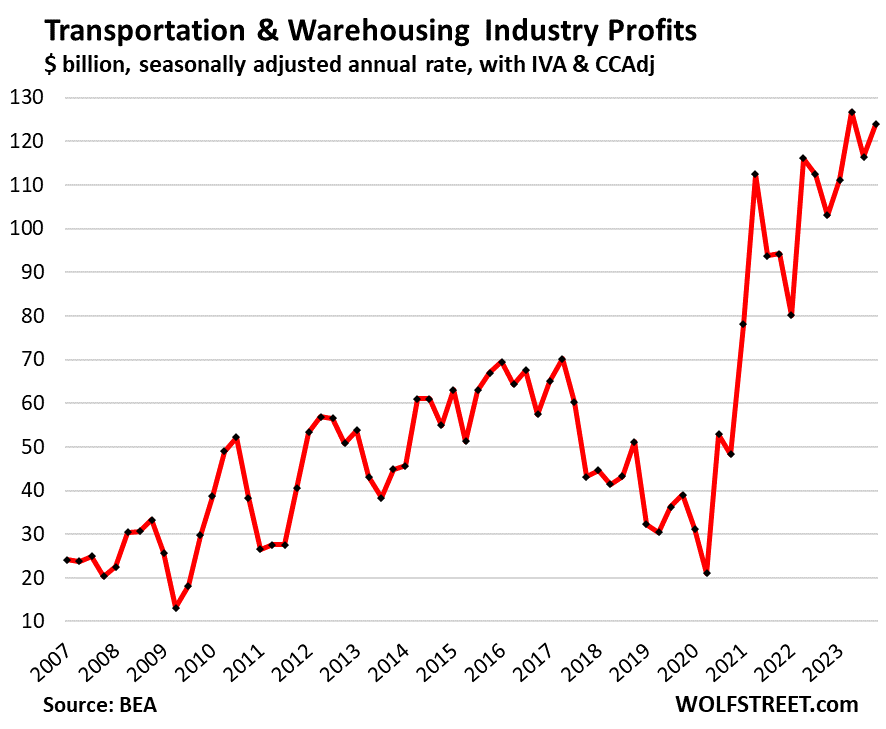

Transportation & warehousing: Profits rebounded by 6.4% in Q4 from Q3, after the drop in the prior quarter, to a seasonally adjusted annual rate of $123 billion. Year-over-year, profits spiked by 20.2%.

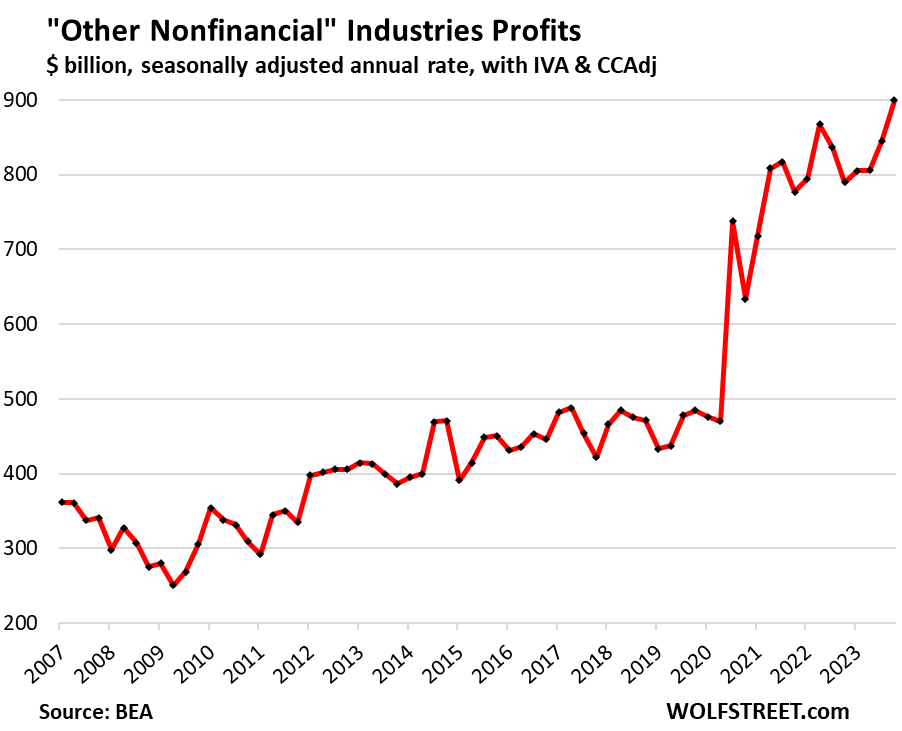

“Other nonfinancial” industries: Profits in this huge catch-all category that includes all the companies not included in the categories above – the largest category here in terms of profits – spiked by 6.5% in Q4 from Q3, and by 13.9% year-over-year, to a record seasonally adjusted annual rate of $900 billion.

The category includes companies in mining; construction; real estate and rental and leasing; professional, scientific, and technical services (where some of the tech and social media companies are); administrative and waste management services; educational services; health care and social assistance; arts, entertainment, and recreation; accommodation and food services; agriculture, forestry, fishing, and hunting; and other services, except government.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

This inflation (and consumer sending) is not going away without a major job loss and recession….

Howdy Concerned guy. Or double digit interest rates?

Double digit interest rates would dramatically increase my net interest income.

Wow…

In theory, increasing corporate taxes or eliminating loopholes could also accomplish what you’re describing.

I agree that the poverty in America is per facto evidence that the US tax rates are too low.

How about adequately funding Social Security and Medicare? That we continue to run deficits (without even adequately funding these programs) in this strong of an economy is very troubling.

High interest rates by the Fed will cause job loss and a recession.

Except it didn’t.

You can’t look back at the 1980’s to figure out the state of the economy today.

The HELL it didn’t. You were either not there, or doing well wealth wise.

I’m not even going to try to describe to you the human wreckage to working people AND their descendants AND the economy to THIS day it caused. It brought us Reagan, and Uncle Milty for starters.

Wasn’t your screen name corrupt?….crapp….I’m probably wasting my time on a troll……again…..not that it’s very valuable.

GREAT article though, just pretty stupid comments so far.

Actually, all those talk radio programmed and economically trashed generations still alive since then may just bring us a dictatorship, this time, along with climate change denial policy. Nice mix.

Hope not. Go pray if you can talk to the universe….so far it hasn’t said jackshit to me. In fact I’d probably start drinking again if it did.

I agree, it was a hard time to be a blue collar worker in the interior states during a recession. Context is everything.

The inflation and corporate profiteering show that there is insufficient competition among businesses out there. We live in an oligopolistic world now, with a handful of major companies in each sector, each of which has merged to grow into giants that can view with disdain the consumers they are pledged to serve. It is this narrow slice of the market — the few operating companies, particularly in Big Tech — that actively conspire to limit competition. For instance, Steve Jobs of Apple was incensed that another tech firm was trying to lure away his workers with better pay. He thought they were violating an unspoken agreement not to be competitive on wages. The companies hold down costs through illicit dealings and jerk up prices through oligopolistic concerns.

But even a monopoly has a profit maximizing price where MC=MR above which (and below which ) profits fall. What we are seeing is demand-pull inflation caused by too much liquidity…

Recall the antitrust settlement w/Apple et al was merely ~$400M if memory serves.

It’s a feature of the system. Big money eventually influences governments, leading to deregulation or just turning a blind eye (Microsoft is an obvious example), leading to collusion in prices and wages, to concentration and consolidation of markets, to oligarchy, plutocracy, etc.

In the jungle, big cats avoid fighting one another.

Collusion of pricing is a side show compared to hiring the CCP ( the communist party of China) to undercut the American manufacturing as the low cost competitor with nothing left too lose.

What of the shared interests of businesses and employers as a whole, or as a class? This side of the equation often escapes the same kind of notice or critique. Many prefer to think of corporations, businesses, and employers as simply separate interests competing in — and disciplined by — the market. And, because this is indeed true on one level, many fail to recognize how these separate interests can also unite and act as a class with broader sets of shared interests and agendas in opposition to labor — consciously coordinated or not. As Adam Smith reminds us, an attempt to truly understand economic tensions and competing interests beyond the most individual levels is off to a bad start if it doesn’t include recognizing businesses as a distinct class with interests separate from that of the general public.

Good comment XLOVELI! Does blue mean you have a blog/website?

Oh, “same kind of notice or critique……as UNIONS get”. It’s rephrased, but is taken from of Wealth of Nations…I can’t write that well. Wolf shouldn’t have taught me to cut and paste.

Yes America has become the providence of the wolf overseeing the welfare of the sheep. We pay 656 business lobbyist’s salaries too legislate against our, the tax payers, interests.

Thanks too the perfect example of corruption as the ultimate result of human community. I’m referring to the SCOTUS, drunk with power.

Far enough removed from the actual tragedy that sponsored the instigation of the populist democracy that America claims to hold near and dear.

LOL…can’t help myself….inflation is transitory so they say….

Guess close to 5.4% and current QT is not restrictive enough OR we’re still hoping for that great lag effect that Danielle DiMartino Booth likes to point out over and over again…I guess it’s a lag if you time measurement is for the 10yrs a time…broken clock is right twice a day..at some point a recession will happen but wealth effect is ohh so embedded and proof is in the pudding unfortunately.

Boy, that 1st chart sure looks a home price graph, doesn’t it?

And how about that massive $600B jump in profits over the 1st half of 2020? I wonder what caused that? And that’s with a government induced recession for ~ 6-8 weeks. Oh, I forgot. That’s when trillions of $$$ started being pumped into the economy for an COVID IFR of < .5%.

I remember reading a CEO's quote from about 18 months ago.

"Corporations LOVE inflation. It's gives us a reason to jack up prices."

We'll maybe he didn't say "jack up", but we all know what he meant.

Outside of a recession, I don't see a scenario whereby core PCE inflation continues to move towards 2% this year. If so, then we've really need to question the BLS' impartiality.

1st-time unemployment claims have tracked along in the very low 200K's for 5 straight months, despite all the layoffs hysteria. After 3-4 months, the announcements should have caught up with actual layoffs, but it hasn't.

DD Booth, that Fed insider, has been saying for 2 months now that March was going to be when it all starts to fall apart. Well, we've got 1 more business day, I guess.

Market is closed tomorrow for good friday, too late. I do like the reference to Booth as DD – quite accurate ;)

I must concur with your latter statement ;)

Totally unintentional; I would agree, but still not sure about here latest predictions. Seems like the deterioration of the economy is much slower than she’s predicting. And, she was talking about the macro side of things, not just the markets.

Cheers!

Hasn’t she been saying that since ca. 2022?

Maybe. Probably wants to short the market. Eventually, the tightening will really start to catch up with the economy.

The questions is, though, has the Fed tightened enough or will they be patient enough with $2.12T in deficit spending this FY and probably next year as well?

As much as I hate inflation, the stock dividends are more than making up for it. I took a gamble during lockdowns and bought energy stocks. There were no cars on the road or planes in the air. My GF and I walked the town alone and in total silence. The market acted like nobody would never drive or fly again.

In a crisis, betting americans have a short memory isn’t a very tough bet.

Hi Wolf,

Possible typo:

‘ the sector is generates ‘

Best wishes from a cold and rainy England!

Thanks!!

There was absolutely no reason to pause rate hikes. They should have continued hiking another 100 basis points at least. But the FED is catering to billionaire speculators and politicians. This is still the most reckless, diabolical FED ever. Nothing will change before the election, either. Get ready for more massive inflation.

Agreed. The stock market bubble is becoming insane. The Fed needs to break this bubble.

Forget stocks, look at crypto and all the massive speculation on things of zero intrinsic value. There’s too much liquidity out there, and they know it but they are ignoring it. Money needs to be MUCH more expensive than it currently is. This is, first and foremost, a CREDIT bubble, and they have completely failed to reign it in.

*rein

Don’t sweat it. Was obvious what you meant, and “reign” spellcheck Freudian slip makes sense, too.

Excellent everyone is making money ! Let the good times roll.

Happily retired since Autumn of 2015. Leaving in May for the biannual two month scuba adventure in Waikoloa Beach Hawaii with my wonderful scuba buddy and Wife. Keep Smiling !

SteveO

Godzilla is out their lurking in the depths, if you don’t see him on your swim it means he’s came ashore.

The fat lady has no chance against this inflation beast. (Fat lady is US economy)

All of wolf articles as of late, lead to one conclusion, destruction and… death of the dollar.

Your opinion. Wolf has not been nearly as catastrophic as you described.

I am a bit free with my words, trying to find my nitch. I’ll try again.

“All of wolfs articles as of late lead to one conclusion, more great articles to come”.

Usd would do just fine like it has done for last 30 years or so

For the last few decades usd has lost most of its purchasing price.

For example .. a hoke which cost 400k in 2000 now cost 1.5 million in my neighborhood.

True, the usd will do just fine, your example of the past 24 years shows.

I watch my money very closely, it has a habit of wandering off never to be seen again. I watch my health even closer.

USD, stocks, real estate, inflation, debt, it gonna do just fine like the last X years… until it doesn’t.

Death of the dollar? If the dollar is dying I don’t know what this says about the yen, the pound, the loonie, and the rest of the currencies that are absolutely being destroyed by the USD.

Escierto

The fat lady is singing the blues.

But if you’re satisfied with your dollars on a personal level.

Pound and loonie are doing worse because their own central banks are even more outrageously loose than the Fed in the face of inflation and asset bubbles, and Canada and UK have even worse housing bubbles, it’s a different story depending on different policies. (BoJ is a weird case because they’ve actually wanted inflation for years and deliberately kept things loose, though now maybe got more than they bargained for)

And, the fact that gold and silver, and especially this crypto lunacy is still going to the moon shows the US dollar is absolutely not healthy and is losing more and more trust with such reckless money-printing. Not a crypto fan myself or much into precious metals, but as barometer, their surge as indication of loss of trust and confidence in the dollar. No the USD isn’t dying but the Fed at times seems determined to make that happen. If there ever was time to have a new Paul Volcker step in this would be it

Toad,

You said you watched your health closest of all.

Any thoughts on helping the condition of the planet or what you put down your throat?

Always a good niche*.

*(that’s the way we Biologists say it)

It always looks like a good deal for businesses with inflation until they have to roll over their debt. The government can pour gasoline on the inflation fire for a while before it catches up with them. They can charge more but inflation makes business unpredictable and your suppliers might demand earlier payment, interest charges go up and banks start to withdraw credit for risk.

And then the layoffs and the recession for real.

Perhaps I’m mistaken, but I believe GAAP earnings have been falling for many quarters, suggesting something about the nature of profits.

Goodwill and window dressing are ephemeral, but such is life.

You’re gonna hafta read the article.

This is NOT the S&P 500 earnings per share.

1. Read the definition of profits in the article. This is not just the S&P 500 but ALL businesses in the US, including my Wolf Street Media Mogul Empire.

2. Note that the second word in the first sentence of the first paragraph in the article is “pre-tax”

3. You’re gonna hafta read the entire second paragraph in its absolute entirety at least three times out loud.

4. Read several times the section: “First, some definitions.” There are three items in it that you MUST understand.

5. In terms of the S&P 500, which is irrelevant here, but anyway, earnings per share fell in 2022 from a huge spike in 2021. But they started rising again in 2023.

Wolf, have you ever published a category by category reconciliation analysis between CPI vs PCE?

PCE has different weightings (for example much lower shelter component) as well as more categories (portfolio management fees which aren’t in CPI), and usually runs lower than CPI.

But the current gap between 1-year core CPI (+3.8%) and core PCE (+2.7%), a 1.1% difference, is historically large for current levels of inflation. The last time [Core CPI – Core PCE] exceeded 1% was in summer 2022 when inflation was near double-digits. Most of the time Core PCE only runs ~0.5% below Core CPI.

If this difference is atypical, is it due to temporary factors that will likely reverse? Or should we continue to expect such large differences going forward? (So the 2-2.5% Core PCE target effectively becomes 3-3.5% when applied to Core CPI?)

1. PCE is built differently and is far broader than CPI, and it has categories that CPI doesn’t have. It’s related to the GDP deflator which measures inflation for businesses and governments not just inflation for consumers. One of the big differences is that housing only weighs 15% in the PCE price index, while it weighs about 33% in CPI.

2. The only reason I even look at PCE is because the Fed looks at it.

Do think the core PCE tomorrow will be higher than expected? It seems that Powell already knows what the number is and he has determined to lower rate by June.

I never care about “expected” — who is doing the expecting and why? Why is this even in the headlines? What matters are the actual numbers.

I’m quite surprised! It seems like these huge profitability surges give credibility to the White House’s “greedflation” narrative.

(Which I personally think is nonsense, but I’m wrong about a lot of things.)

No. This inept admin is talking about the size of Snickers bars when auto insurance is up over 50%.

While I can agree our entire political system is inept the Snickers bar relates to shrinkflation which is different but of course still greedy. Fundamentally the base issue is our economic system. As they teach in school the goal is to maximize profit for stakeholders and they are doing just that. Strange basis for a society.

Strange? You are being much too kind, Glen. How about FD!

And DC’s information sources sometimes seem to be also.

But really I hope I’m wrong. I guess it’s just where I have heard that Snickers phrase before.

This talk of “greedflation” makes me wonder if the talkers understand we have a market-based economy. Companies will charge as much as they possibly get away with. To think otherwise is incredibly naive.

Let’s just stop the greedflation talk, along with any notions that corporations will do the right thing. They respond to monetary incentives and disincentives, pure and simple.

Exactly right. Some commenters seem to feel we live in an economy based on charity. We don’t. The American economy is based on greed.

To ascribe such high contrast duality to our market-based economy — greed vs charity — seems a little…oversimple? It’s like saying there’s either promiscuity or abstinence; either you’re the Marquis de Sade or a eunuch.

That said, calling our economy greed-based is much too charitable in & of itself. The US economy is built on larceny; an in-your-face smash-n-grab casino crawling with gambling addicts suffering collectively from appetite unbridled; a bent for more for the sake of more. And if you’ve not got a stomach for all of that, well, then – good luck, loser.

But then, what’d ya expect? It’s America: the whole damn’d experiment is built upon an Indian burial ground.

Comments are getting exceedingly good, IMHO, especially bulfinch’s very comprehensive one in a few sentences.

Sorry for my mistrust at start.

Gold up 10 % in 4 months or so- from 2000 to 2200.

If that doesn’t end ideas of a FED rate cut in 2024, then maybe they are determined to have one regardless.

That gold move makes a GIC look lame, although RBC now offering almost 5% 1 yr.

Its interesting/concerning to me that gold keeps going up DESPITE positive real yields…

I just listened to an interview that observed that anything less than about 3% real yields have little effect on the gold price.

The real yield is somewhat paltry on the short end and it declines rapidly. Betting that it stays “positive”’ for a 20-30 year duration is a risky proposition!

Yeah this is my big signal too. Never been much into precious metals and I basically despise all this speculation with crypto and NFT’s. But their rise to me is a big indicator that people are losing patience and confidence in the US dollar, including Americans, otherwise there’s no reason that funny money like Bitcoins or Ethereum that wastes so much power for the magic “blockchain” should be worth so much. If the Fed did their job and shut down this inflation and loss of the dollar’s purchasing power, people would be less inclined to speculate in digital funny money like this. We really need a Paul Volcker and like now to impose some discipline, the longer we wait the worse the correction and reckoning will be.

Not to mention so much of this corporate profits is coming as Americans have higher delinquencies on credit cards and car loans so who knows where that’s going. It’s not at 2008 levels yet but going in that direction and it’s the worst delinquency rate since the GFC, while savings drain out, so that’s not looking like a sustainable business model. And then there’s the mess with buy now pay later and who knows how much the BNPL debt is.

Corporate profit rise, but consumers have been screwed

Personal interest payments now exceed wages for the first time, it seems that soon

Game over!

Consumers could stop spending …

I have voted no to all these profits by clamming up my wallet. Only necessary stuff.

I’m not sure the general American population has the Will power though.

95% of the things Costco and Amazon sells, you do not need. You can wait until they come down in price.

Bank that money for the nice 5% interest. Look for sales.

I vote no with my wallet and go out of my way to buy things from overseas and ship here (with DHL, too, if possible). Even vacations I try to go big overseas, but domestically just national parks with an annual pass that is pretty cheap. That included two cars overseas last year and currently looking at maybe having two more made for me in the next year or two (custom small shops) if I can get a slot when I want. Quality here in the US is abysmal by comparison and with higher prices lol.

Hah. Burnishing your appetite for the unnecessary with a humble brag about buying only bespoke from overseas isn’t voting with your wallet. Things are things. Utility (which does not preclude style) is what’s up. Outside of a cup for your coffee/beer, a decent hi-fi (doesn’t need to look like the control panel of a UAP), a library card and a good pair of boots, most everything else you own is the product of being tricked by slick marketers who created a goo-gah shaped hole in your life with which to fill in with their products.

Get the periscope up & peer through the frippet of marketing to the other side. If you’re healthy, then one needs shockingly little to become happy; so happy in fact that you might even feel guilty for it. That has been my experience, YMMV, etc.

*frippery

Another winner by bulfinch……Z33 has a HUGE and obviously unpatchable hole blown in him by the ad guys.

I was corrected strongly by Wolf off for calling advertising a “tax deduction” several times…Hell, he doesn’t advertise unless you want to count the mug as a little billboard (and I hope it has helped some) Maybe it was just another wrong term correction as he knows I am totally econ ignorant.

Anyway..it’s a VERY destructive set-up, especially when most media is busy dumbing down, confusing, or scaring people.

Most Americans do not have any spending discipline and they are a huge part of the problem.

Homes filled with junk, boats and RV’s parked in the driveways, enormous vehicles for the daily commute.

It’s almost like they need to buy a yacht to get away from all the junk they bought in their house. ;) haha

Well no it’s not game over. Hubris was shown to be a worthless emotion as America was stripped mined.

Big Question:

At what point do voters change their behavior and demand policies which reduce inflation?

I would like to get a good international perspective, especially UK.

We keep talking about consumers, but consumers just won’t change their behavior given availability of credit cards, etc.

This is likely going to need to come from a political realignment.

In the US in the 60s and 70s it took over 10 years.

Thoughts?

Well, one party doesn’t mind destroying the whole us system and ripping up the paper. And the other party cannot get anything done because they do not have the House of Representatives outright.

So at this point votes kind of do not matter unless the party of common sense could win everything with a strong mandate. Not looking likely. Just more of the same…

Party of Common Sense. Oh dear Lord …

Bond Vigilante Wannabe,

By electing whom? Both parties strongly support economic liberalism. On a political spectrum they are both center right and while voters argue their differences passionately, they are essentially identical. There could be a return with a workers type of party and much more activism but people forget that changes that are not permanent are quickly taken away or labor organizations destroyed. It will start in the global South first as things aren’t really bad in the US or Europe for any collective movement. South America is especially fascinating right now with so much swing(Columbia, Argentina, Brazil, etc.). Are we going into late stage capitalism? Time will tell but if we are it will be long and slow.

Sheesh Glen!

“Both parties strongly support economic liberalism.”

Was this a recycled comment from 15 years ago?! This is completely false.

“they are essentially identical”

This is probably true, but only in the sense that there is little substantive difference between fascism and communism. Both are authoritarian with different spins.

“Are we going into late stage capitalism?”

This, unfortunately, may be true. Is a return to violent authoritarianism in our future? Time will tell.

My definitions are correct as both parties support essentially free markets. I am continuously amazed that people can’t differentiate between fascism and communism but that means American propaganda has worked. To properly understand communism you need to read Marx and Engels, not continually recycle Stalin and Mao as evil as that is not only not accurate but a very reductionist view of complex periods. Even with that to view something from a Marxist perspective is to do a scientific analysis of material conditions and address appropriately to those. It is hard to argue that class as defined by Marx and surplus value extraction are not fundamental issues in the US.

People somehow want to outright reject that we have a flawed system and only if we elect this person or that person or only if we raise/lower rates or if we have a recession all will be fine. That is pure ignorance and contradicts all facts.

“My definitions are correct as both parties support essentially free markets.”

By that standard you could then say China’s system is an example of economic liberalism. The government interventions since the GFC are antithetical to economic liberalism, which both parties have supported in one way or another. The oversized influence of the FED on the economy is not economic liberalism.

“I am continuously amazed that people can’t differentiate between fascism and communism”

From an economic perspective, there is very little difference if the centralized control is in the form of a demagogue or a politburo. I understand there is an absolute difference in social philosophies and stated long term goals of class structure. My contention is that, in practice, there has been very little difference. Violent authoritarian control over the people is just that, and that is what really matters.

“To properly understand communism you need to read Marx and Engels”

I’ve read enough to appreciate the ideological goals of communism, but the problem with collectivism is that it ignores human nature. Human nature is the reason why all past attempts have resulted in an oppressive police state.

“People somehow want to outright reject that we have a flawed system”

I have never done that. The point is that history demonstrates that the communist cure is worse than the disease. I don’t buy the this time will be different argument.

Glen — excellent observations, and terrific comments. Thanks, actually

In the words of one of my favorite WS commenters, may we all fund a better pay

We just need to pull out the old Saber that’s sitting beside the presidents desk. Left there by FDR.

All these baby countries are getting a little too comfortable. I mean wtf are we letting Saudi Arabia buy pro golf?

That’s a no, saber saber time.

DAMN this is a good read! Glen and bulfinch are HOT tonite!!!!!!

Several others too. Today’s Dems are to the right of IKE, that’s my two cents on our political corporations.

Please look up the Barry Goldwater quote on religion, too, explains a LOT of political shit.

I also think dictators are harder to vote out than oligarchs!

Sorry, forgot ChS!!!!!!!!!!!

I gotta scrape up my yearly donation somewhere!

Betcha Wolf is pretty proud of himself right now, and SHOULD BE.

Glen “ both parties support essentially free markets.”

You have got to be kidding me.

Watch what they vote for not what they blather about.

Both parties support their preferred corporate oligopolists at the expense of actual free markets.

Free markets were slain when Judge Bork eviscerated antitrust enforcement with a bizarre ruling that al long as consumers appeared to have a couple of options everything was fine.

The free market corpse was buried with Citizens’ United deeming corporate legal fictions to be persons with rights.

The grave was filled in when FedGov colluded with corporate interests to shut down dissent and freedom of speech over COVID and Fox knows what all else these past 3 years.

There’s no free market without freedom of communication, and the deeper reading of the TikTok fiasco suggests that neither party thinks much about the public’s freedom to communicate when it goes against the interests of the “Property Party” (establishment wings of the two parties collude as one for corporate interests) …

Well, BVW, I question the proposition that voters even have a choice

Which over the hill gas bag to vote for, half betting on the likely longevity of either one dying in office which is more likely than not. At which time, the VP will assume the powers of the President of the United States.

Which draft dodger to pick, one has to be realistic and hear what the R’s have already alleged.

That the cause of the budget deficit is the most successful social insurance program in history, social security which is not even a component of the Federal budget. Except that Social Security invested it’s money by loaning to a dead beat that doesn’t want to pay Social Security back.

Interest rates should be the throttle on economic risk taking but someone keeps pumping pure oxygen through the A/C vents of the market casino.

Normally inflation is a supply/demand imbalance-too many dollars chasing to few available products. Now its just every good capitalist for himself.

Crypto,SPAC’s,billionares dying in ocean coffins,car companies IPOing on zero revenue, WFH everywere, zero dilligence before investing hundreds of millions of dollars in who knows what, unprofitable stocks going to the moon, boutique grocery delivery businesses. We need money!

Corporate Profits rise, but Consumers Are Screwed.

Personal interest payments now exceed salaries for the first time,

Nothing going to be fixed without a recession, QT for a while and then JP stopped,

Sometimes things must get worse before they get better.

“Personal interest payments now exceed salaries for the first time…”

That’s total BS. In Jan 2024, all seasonally adjusted annual rates, via the BEA:

Wages and Salaries: $12.6 trillion

Personal interest income: $1.8 trillion

Even if you add dividend income of $1.9 trillion: Total intr. & div. income = $3.7 trillion

Personal interest payments vs Average Hourly Earnings of Production and Nonsupervisory Employees, Total Private.

What is this BS???

Personal interest payments (as in interest paid) = $573 billion annual rate.

Average Hourly Earnings of Production and Nonsupervisory Employees, Total Private = $29.71 PER HOUR.

What kind of comparison are you trying to make???

Probably some people are curious to see if there’s future impacts to domestic banking, from CRE, but also potential cross boarder dynamics with international banking instability. Maybe it’s nothing, but worth watching.

“ Country Garden Holdings Co., one of China’s biggest property developers, warned it will miss a deadline for reporting annual results, further complicating plans to restructure its debt following a default last year”

Meanwhile, Vanke profits just fell 50 percent.

This is interesting as currency devaluations are occurring.

Did you miss the slow-motion collapse of China’s property sector that has been going on for two years, and suddenly it is news to you?

It seems to be speeding up a tad this week, but yeah, probably nothing

Nothing that a rate cute won’t solve, so get to it Jerome.

We desperately need rate cuts and Fed Powell is itching for rate cuts .

/s

Food for thought.

We just bought an SUV with zero interest for 48 months. This replaced a 10 yr old SUV for less money, especially including the interest on the older auto.

Cash is available, I’m just cautious, so am laddering CDs for the change.

I question how a car company can loan money when the new vehicle has many more bells and whistles than the old one.

Not attached to this comment so any jabs, new thinking, or spears are welcome.

There was a factory incentive on the vehicle, available in two forms, your choice: either $X,000 in rebate/discount or 0% financing. You chose the latter, and someone else might have chosen the $X,000 in lower price. The 0% financing was handled through the captive lender, which belongs to the automaker, and they worked out an internal deal. This has been standard practice for many decades.

Howdy Lone Wolf. YEP, ZIRPed again. Most Youngins never heard of Car Manufactures Discounts. Hope they have an app for that.

New technologies get cheaper over time. Your new SUV cost less to construct than your old one did, it’s that simple.

Wait till you get an intermittent short/open on your CAN bus, new tech fan…..or any of dozens of connections, chips, transducers, etc, etc.

Software is cheaper (to build) on vehicles than hardware, but MUCH MUCH MUCH HARDER to troubleshoot and/or fix.

Feel lucky? Got a CLOSE relative who runs a dealership?

It is hard to see how rate policies are even a recession really address anything. Prices might come down a little bit the government would be expected to mostly come in and help those in need with more deficit spending. And why would anyone root for a serious recession when those most at risk are the hardest hit? Reality is with a divided government and economic growth / profit being the fundamental measuring stick this is what we have. A rising tide does not lift all ships so perhaps a better set of measurements is needed. We need a set of balancing measures similar but obviously different as the New Deal. Billionaires basically duplicating what was done 60 years ago by the public sector with low orbit space flight might be a telltale sign of some imbalance!

I was curious, how are the profits in the energy sector? Is it not one of the largest pieces of any nations economy? Do we no longer recognize the energy sector? Old school, no green, which is all subsidies and tax breaks anyways!

Oil and gas extraction are part of mining and are included in the last category, the huge category of “Other nonfinancial.”

Old school? Like treat the planet like gramma treated those cookies you loved so much long ago?

Phil:

I saw a graphic of the 2023 profits of Saudi Aramco ($121B) vs. Meta + NVDA + Visa + Tesla + McDonald’s + Costco ($116B)

It’s nice to be a state- owned monopoly and global powerhouse with captive customers.

This is why we “allow” the Saudis to buy golf, build land and put billionaire playgrounds on it: The alternative is probably war.

They’re playing the capitalism game against us, by the house rules. More easily done than China with a huge land area and population.

Resource rich and in the driver’s seat.

Could you please post the total sales of each of the industry categories, and the total capitalization.

Would help in determining the ROI of each.

Thanks,

Do it yourself.

LOL, pure gold Wolf

Yeah Wolfman, the regional banks will recover within a couple of years with interest rates stabilizing (or lowering).

Been following also Vanguard Total Bond Market ETF and it also has steadied over the last 12 months.

Since residential rents are now set by the RealPage cartel, I expect something to break soon. You can’t bleed one third of households dry without side effects on the wider economy.

Will be interesting to see if current Washington DC AG lawsuit against Real Page for collusion will have any impact on the cartel. Not holding my breath but hopefully at least some incremental push back on illegal rent price setting will result. Agree don’t know how exorbitant rents and overall housing costs haven’t brought down larger economy yet.

USA price inflation running below wage inflation at the moment and has been for a while, so price inflation will pick up.

3.1% is going to be the low, then for the next few years then its going to ~5%. Not near 2%.

31.4 trillion at 0.05% / 150 million workers = 10,000 USD each debt servicing.

Scary stuff.

QT = $95 billion per month

Government overspending = $300 billion per month

See the problem?

But government deficit-spending is borrowed money, it comes from investors, and it’s going to help push up yields.

The problem is on the inflation side: the government borrows money from investors and then spends it in the economy, creating demand with borrowed money, which is inflationary.

The pandemic was three years ago, yet we are still waiting for heightened inflation to cease. Excess liquidity still remains in the system. Employment, asset prices, and wealth concentration sit at record levels. If the Fed wanted to tackle inflation aggressively, there is no better time.

It’s like jumping off a train that is picking up speed. You can jump off now and take some pain, or jump off a little later and take more pain. At some point, if you wait too long, you can’t jump off without risking it all.

Howdy Youngins and I am curious. Does your app show Profits as good or bad ?

I’m MORE curious what your definition of a “Youngin” is, you wise old WS sage.

Also I’m quite current on the Alzheimers drugs “apps” and none of them work. Once you get amyloid beta sheet plaques they work exactly like a prion….the self replicating proteins are off and running.

Higher for longer, seems likely to be higher for longer:

“ Using the two-month method to estimate Q1 real PCE growth, real PCE was increasing at a 2.7% annual rate in Q1 2024. (Using the mid-month method, real PCE was increasing at 2.7%). This suggests solid PCE growth in Q1.”

Redundant wrote: “Higher for longer, seems likely to be higher for longer…”

If quickly suppressing inflation is all you are concerned with, interest rates will have to be a lot higher, maybe back to 20% again (just my humble opinion).

But I suspect an interest rate high enough to quickly squelch inflation would send all the banks that bought long term bonds at QE/ZIRP rates into insolvency. …. and when they turn the lights off at the FED each night, the cartel of big banks that own the FED are all that the FED really cares about.

Maybe a long term FED goal of setting interest rates at the Inflation Rate + 2% would produce a softer landing. But financial innovations all seem to come with unexpected consequences.

One way or another, all of the assets purchased with credit (housing, stocks, etc. etc.) appear to be dangerously inflated compared to the means available for repaying said debts.

I think the Fed has tried too hard to achieve that soft landing, and now half the runway is behind us. It looks like Powell wants to pull up, circle the city again, and take that second pass as inflation runs hot. The passengers won’t be happy.

Even with a soft landing, you actually have to land the aircraft.

Not only was there never a landing, the craft has been gaining altitude. The decision to pause rates was yet another egregious act of dereliction by the FED. There needs to be some pain in order to restore health. They have tiptoed around every decision to make sure to coddle this everything mania. The entire FED board and J. Powell should be fired.

Regardless of whether you think rate decisions are right or wrong, what would firing Powell do? Decisions are made by 12 members of the board of governors, so leaving 11 of them alone won’t change things.

Too many names to remember, plus where their “dot” is. I am guilty of that myself.

In a world of excess, like now, there is no need for real pain because each increment of timid with drawl of the level in the reservoir of Federal Reserve cash has absolutely no effect on the absurdly low interest rate structure, who’s inversion since whenever the Fed raised the short term interest rates, has not been the harbinger of an economic downturn that it is famous for,

Disturbing article that reinforces the statistically impossible becoming possible. I think that profits after distribution to the shareholders goes to the Owner’s equity account, if I remember correctly. And therefore should be considered an asset. Which has been definitely been in the loving hands of a general asset bubble which seems to be the theme of the Fed since it’s inception.

Inflation is ignited first in asset price inflation. General inflation, like the pressure from the winds of a hurricane, are imposed on the economic market system to sustain a more expensive cost of living.

1. You should read the article. This is about pre-tax profits from “current production” of all businesses including small businesses.

2. What you call “Owner’s equity” is capital not assets on a balance sheet. So you have to redo the bottom two-thirds of your comment.

Big Tech, euphoric that they still can’t believe their good fortune that the schmucks gravitated to their apple computer projects of mass surveillance.

Like Soviet East Germany we approach a world where we are in competition with programmed machines that are authoritarian and admire Dick Cheney.

This is a very interesting site. I`ve learned a lot that, really I didn`t need to know, but it is fascinating to read Wolf`s writings and read some of the comments.

I was just looking up the difference between bunker fuel and diesel when I got here.

Thanks Wolf!

Hi Wolf, thank you for this insightful article! I didn’t realize corporate profits more than doubled since the pandemic, it makes the stock market behavior much more understandable. Strange small caps don’t seem to follow suit, I wonder if they didn’t get the same profit windfall as large caps.

Do you have similar data for other parts of the world, like Asia and Europe?

I could find profit data, but not excluding financials. And at least for the US, it seems to make a very large difference.

I have hard enough a time digging through the databases here in the US. I do a little on Europe, when I can find the data (inflation, house prices, ECB assets, that kind of stuff). Japan is down to just inflation and BOJ assets. Japan is a horrible challenge to get data out of. I can spend hours looking for the data and come up empty-handed. I do a little on Canada. Once you know your way around it, it’s easier — such as here in the US. So I mostly stick to the US. That’s also where most of my readers are.