The Fed has now shed 29% of Treasuries it had added during pandemic QE starting in March 2020.

By Wolf Richter for WOLF STREET.

The Fed’s Quantitative Tightening (QT) continues on track, and the unwinding of the March bank-panic measures took a leap forward as the FDIC paid off the rest of its loans from the Fed.

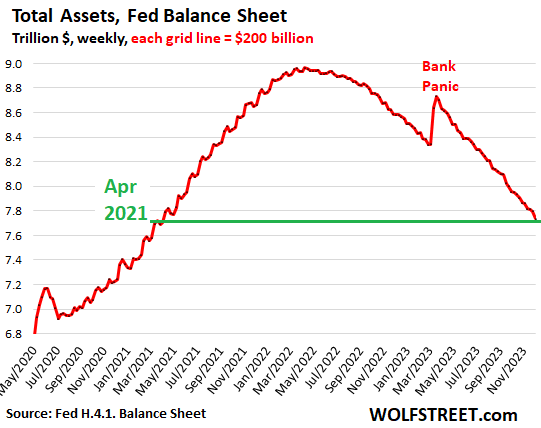

Total assets on the Fed’s balance sheet dropped by $129 billion in November, to $7.74 trillion, the lowest since April 2021, according to the Fed’s weekly balance sheet today. Since peak-QE in April 2022, the Fed has shed $1.228 trillion of its total assets. The closeup view:

From crisis to crisis to raging inflation:

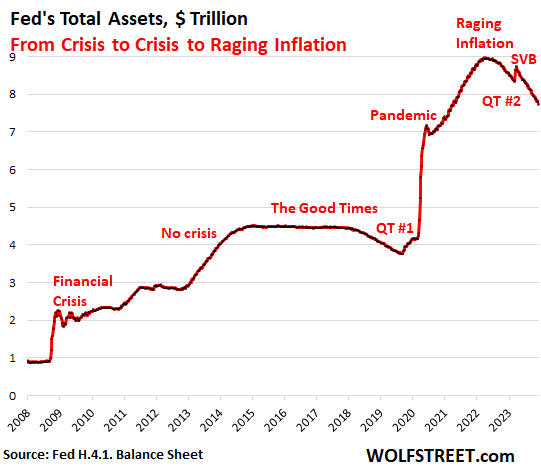

During QT #1 between November 2017 and August 2019, the Fed’s total assets dropped by $688 billion, but inflation was below or at the Fed’s target (1.8% core PCE in August 2019). At the time, the Fed was just trying to “normalize” its balance sheet.

Now inflation is still doing a lot of heavy breathing in services, though energy prices have plunged and durable goods prices have ticked down. Within the Fed’s favored PCE price index, core services inflation is still burning at a rate of 4.6%. Within CPI, core services inflation is still burning at 5.5%.

QT marches on.

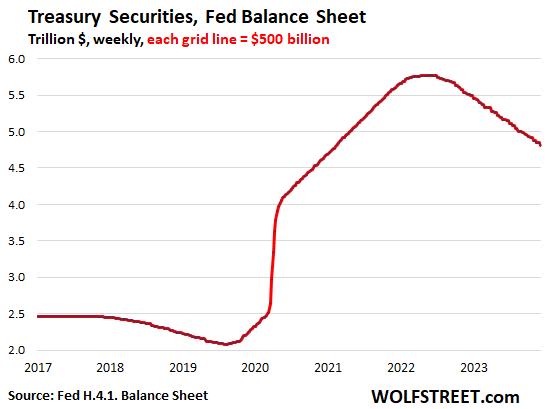

Treasury securities: -$60 billion in November, -$959 billion from peak in June 2022, to $4.81 trillion, the lowest since February 2021.

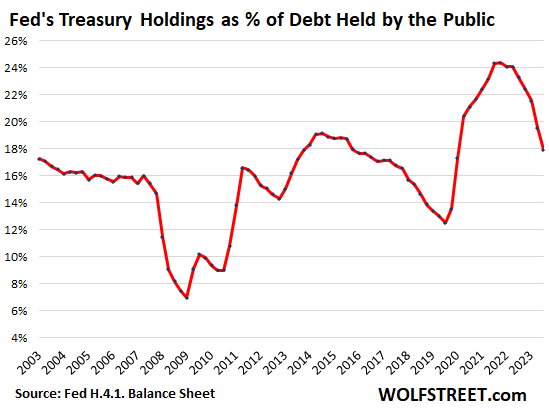

The Fed has shed 29.3% of the $3.27 trillion in Treasury securities that it had added since March 2020 as part of its pandemic QE.

Treasury notes (2- to 10-year securities) and bonds (20- & 30-year securities) “roll off” the balance sheet mid-month or at the end of the month when they mature and the Fed gets paid face value for them. The roll-off is capped at $60 billion per month, and about that much has been rolling off, minus the inflation protection the Fed earns on Treasury Inflation Protected Securities (TIPS) which is added to the principal of the TIPS.

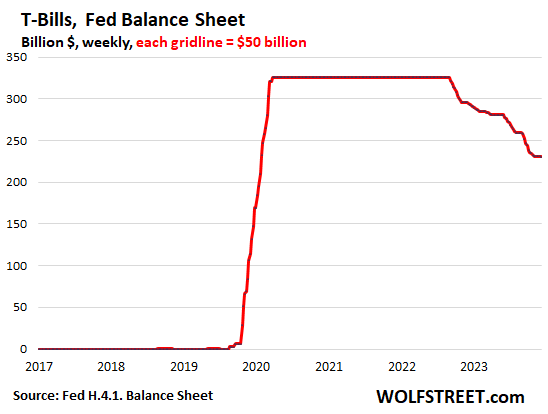

What Treasury bills do for QT. These short-term securities (1 month to 1 year) are included in the $4.81 trillion of Treasury securities on the Fed’s balance sheet. But they play a different role.

The Fed lets them roll off (mature without replacement) to fill in the gap when not enough longer-term Treasury securities mature and roll off to get to the $60-billion monthly cap. As long as the Fed has T-bills, the roll-off of Treasury securities will reach the cap of $60 billion every month.

But when the Fed runs out of T-bills to fill in any gap, the Treasury roll-off will fall below the $60 billion cap. So we keep an eye on these T-bills because as long as there is still a stash of T-bills, the Treasury roll-off can proceed at a constant pace of $60 billion a month.

From March 2020 through the ramp-up of QT, the Fed held $326 billion in T-bills that it constantly replaced as they matured by buying new T-bills at auctions (the flat line in the chart). In September 2022, T-bills first started rolling off as needed to get the Treasury roll offs to $60 billion a month.

T-bills are now down to $230 billion. No T-bills rolled off in November. Less than $1 billion rolled off in December (this week). In total, $96 billion in T-bills have rolled off.

The Fed’s shrinking weight in the bond market: The US national debt has ballooned to $33.8 trillion. This debt comes in two categories:

One: $26.8 trillion of Treasury securities are “held by the public”; they are traded and are held by investors of all kinds, including by the Fed. They’re the Treasury bond market.

Two: $7.0 trillion of Treasury securities are held by entities of the US government (“held internally”), such as by US government pension funds and the Social Security Trust Fund, and they’re not part of the bond market.

The Fed’s share of Treasury securities that are in the bond market has fallen to 17.9%, down from over 24% at the peak.

The Fed’s weight in the bond market, though still massive, has diminished due to two factors: QT reduced the Treasury securities on the Fed’s balance sheet; while the government deficit is ballooning the marketable securities (the data points in the chart are quarterly, except the current data point which reflects today’s data).

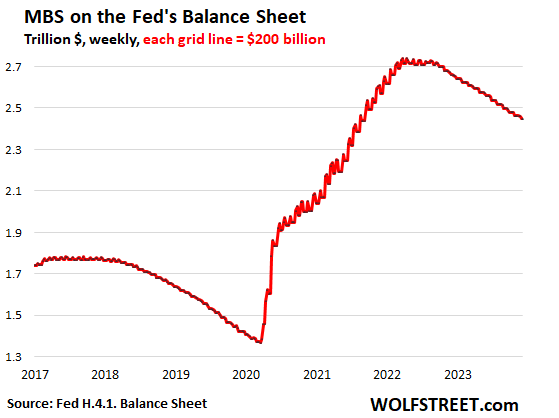

Mortgage-Backed Securities (MBS): -$16 billion in November, -$293 billion from the peak, to $2.45 trillion, the lowest since September 2021.

The Fed only holds government-backed MBS, and taxpayers carry the credit risk. MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made.

The higher mortgage rates have caused home sales to plunge and refis to collapse, which slowed the mortgage payoffs, and therefore the pass-through principal payments. The MBS run-off has been between $15 billion and $21 billion a month, far below the $35-billion cap.

Bank-panic measures unwind.

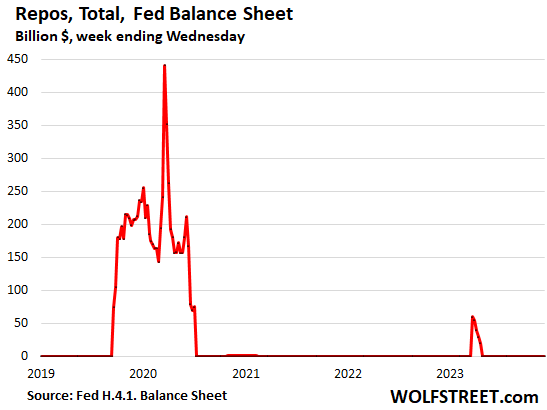

Repos: $0. Repos on the Fed’s balance sheet come in two flavors:

Repos with “foreign official” counterparties were paid off in April. At the peak in March 2023, they reached $60 billion, likely with the Swiss National Bank which was backstopping the take-under of Credit Suisse by UBS (the little jag in the chart below).

The repos with US counterparties faded out in July 2020, when the Fed made the terms less attractive. The Fed currently charges 5.5% on repos, as part of its policy rates, and there were no takers.

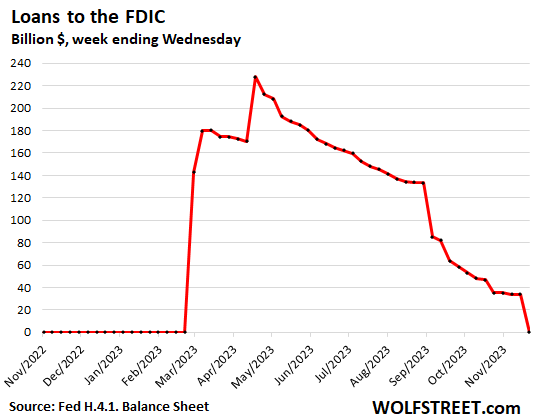

Loans to FDIC: -$47 billion in November to $0 as the FDIC paid off the remainder this week.

The FDIC has now sold enough of the assets it took on with the takedowns of Silicon Valley Bank, Signature Bank, and First Republic to pay off the loans from the Fed.

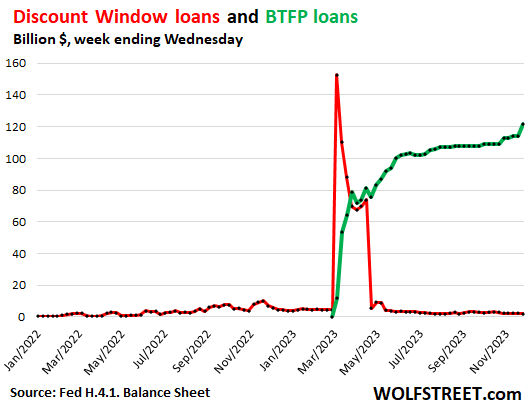

Discount Window: dipped to $1.9 billion, compared to $153 billion in bank-panic March (red line in the chart below).

Discount Window lending to banks is the Fed’s classic liquidity supply to banks. But the Fed currently charges banks 5.5%, and banks have to post collateral at “fair market value.” This is expensive money for banks, and they avoid it.

Bank Term Funding Program (BTFP): rose by $13 billion in November to $122 billion (green line in the chart below).

The BTFP, created during the bank panic, is a better deal for banks than the Discount Window. It’s more flexible; provides fixed-rate loans for up to one year; collateral is valued at purchase price rather than at market price; the rate is a little cheaper than at the Discount Window for new loans, and a lot cheaper for loans taken out in March and April when the Fed’s rates were lower. So this is a good deal for banks, and they’re using it.

But at $122 billion, this facility is small compared to the $22.8 trillion in commercial bank assets held by the 4,100 banks in the US.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

$1.23 T down and the market is still as bubbly as ever and housing market, especially in hot market barely cracked…who would’ve thought.

More “data dependent” evidence that the FED need to continue QT to before pre-pandemic level and maintain or increase rate hike. We definitely don’t need a rate cut by March as these market geniuses are predicting…

See my magic, who could have thought that despite so much QT bitcoin will jump to 43K, Nasdaq by 40%, 10 year treasury yields wil crash more than 1% below overnight rate, inflation will remain way over target and insane housing prices won’t budge despite mortgage rate rise making houses more unaffordable.

Only my QT can provide so much liquidity!

THE NASDAQ IS TODAY BELOW WERE IT WAS IN JUNE 2021, 2.5 YEARS AGO.

The NASDAQ 100 is down 3%. Bulls are screaming for all time highs soon. Appears they may get it.

…ath’s, but on a shifting baseline of devalued money…

may we all find a better day.

…and you could have put that money into bills and earned interest for the last 2.5 years, vs keeping that $$ in a declining index fund.

QQQ could trade sideways for the next decade, and the bulls would still find a way to rationalize that the next ath is right around the corner.

J. Pow,

You and your “benevolent” friends have screwed the bottom 50% and crushed their dreams of a good life like No one has done before.

You have destroyed the value of labor and rewarded speculation over productive work.

I was listening to Wolf on the Thoughtful Money podcast earlier today and he was talking about how hard it is for markets to thrive during QT. I completely agree, and yet here we are, with bulls back in control on Wall Street and the financial press laying narratives for more euphoria.

This tells me the Fed has a lot more QT still to do. This is going to be a multiyear process, and those of us who are praying for price discovery to be restored are just going to have to be patient.

THE NASDAQ IS TODAY BELOW WERE IT WAS IN JUNE 2021, 2.5 YEARS AGO.

Can you not look at a 3-year chart?

The last time this happened was during the Financial Crisis.

Yes, and this is despite a jack-jobbing mag 7 pump-fest, with an AI craze similar to Elvis.

True Wolf. Nasdaq is down. I see a peak about 16,218 Nov 2021. Today 14,415 is about 11% lower than the all time high.

And look at 5 years ago it was about 6,368. So today’s 14,415 is 126% higher than 5 years ago.

So if people want to compare to 2021, ok its a bit lower.

But I look at the long term, and +126% seems pretty bubbly to me. I’d like to know if this would have happened without the illegal fiat printing fake money system.

Also note Nov 2011 Nasdaq was 2700ish. Thats +433%! It’s gone up why? Are apple,google, apple, microsoft, facebook and netflix really providing that much more “value” today than they did in 2011?

Sure, the NASDAQ is a bit (about 10%) less insanely frothy than it was at the ATH. But 1) the DJIA is at all& time highs; 2) NASDAQ valuations remain very high by historical standards with a P:E ratio of about 54; and 3) the S&P 500 is up over 20% YTD.

Looking at the equities market and considering all of this in context, I do think it’s accurate to say overall market sentiment right now is bullish. One index being ~10% off its insanely-high ATH of 2.5 years ago does not negate this.

If one backs up even further from the 3 year chart (as does James Grant in his 11/10/23 feature GIRO article), then an even broader picture emerges that backs up shangtrOn’s sentiment:

“The H.4.1 dated Nov. 4, 1983 … showed total real assets of $191.2 billion, which corresponded to 5.3% of GDP….

Forty years on, the H.4.1 form… shows total assets of 7.9 trillion, which corresponds to28.6% of annualized third-quarter GDP.”

ShangtrOn’s conclusion that “the Fed has a lot more QT still to do” seems perfectly logical.

Moreover, an equally logical conclusion from looking at Wolf’s excellent chart entitle “From Crisis to Crisis…” is that a managed economy requires ever-grander (pun intended) interventions to keep the party going, and to respond to ever-more-serious crises.

The real pain will come when we pay for these growing interventions through even greater losses to purchasing power, and perhaps at the exact time that we suffer an economic downturn.

No, the real pain will come when the world goes back on a quasi-gold standard for trade between countries.

🤣

Mike R.-

Given our current financial predicament:

– massive government debt

– perpetual budget deficits

– inflation double the target (which should be 0%)

– various unintended asset bubbles

– commercial banks tethered to THEIR bank for survival

– a negative-capital bankers’s bank that has expanded its footprint by 400%+ over the lat 40 years

…what changes to the financial system (or what new system) do you advocate?

I’m not a proponent of the quasi-gold standard necessarily, but in a financial system that relies on the government bonds for employment and price management, increased production of bonds is assured.

A gold-based system should be in the solution set (as the gold certificates on the Fed’s balance sheet certainly suggest), and compared against other alternatives, such as any you might suggest.

Mike R

Could you define ‘ a quasi-gold standard’?

Which CBer will adapt it and Why? To whose benefit- politicians? Consumers?

QT tightening is defeated indirectly by keeping the required liquidity available to mkt participants via BTLP, repo, reverse repo and what NOT. Liquidity freeze is NOT allowed at any cost. So mkt is calling Mr. Powell bluff.

Wolf, please consider writing an article on this. Last FY the Gov. increased its treasury debt by ~$2.2T, ~8.2% of nGDP. Bc of past tax cuts Gov. revenue doesn’t go up much anymore. Meanwhile spending goes up faster bc of defense and social COLA’ed spending. Now my point. Ain’t no way in hell that this will get better w/o. Only worse, w/o a huge increase in taxes from the very wealthy. Get rid of CG, carried interest plus tax top ~3% about $1.5T. Then cut COLA’s by about 2%, say COI MINUS 2%.

Look at the Fred tax collection chart. Then look at govt. spending chart.

Yep, DC needs MORE.

Taxing it or borrowing it does the same long term. One removes money from consumption and investment routinely, the other crowds out private investment. They both drag down gdp. Govt Spending is the problem, not govt income vs. govt debt.

“Bc of past tax cuts Gov. revenue doesn’t go up much anymore. Meanwhile spending goes up faster bc of defense and social COLA’ed spending.”

I think that’s an incorrect premise. Tax revenues spiked almost vertically from a little over $3.5T to over $5T between Q2 2020 and Q2 2022. Government receipts, propelled in part by inflation, capital gains, and wage growth, spiked far above the pre-pandemic trend. Tax receipts have come down with the decline in the markets in 2022, though they are edging up again with the gains in 2023 and are still well above the pre-pandemic trend. Perhaps taxes should be raised on equity grounds, but the idea revenue doesn’t go up much anymore is not consistent with the data.

https://fred.stlouisfed.org/series/FGRECPT

Unfortunately, only thing going to correct housing is a spike in unemployment. With AIA index showing construction slowing, may finally get that spike. Does QT have anything to do with the drop in money supply M2?

That $1.2 Trillion they shed went directly into AI stocks and Bitcoin. We will all be rich by the time they’re done.

🤣

Do QE holdings ever get a mark to market appraisal?

I know FRB will hold to maturity, but does it also mean the effect of QE “totals” varies depending on the worth of the assets?

Ie, since their big splurge in spring 2020 at likely very low yields, and the current yields on gov debt, surely the “value” of those debts is a whole load lower?

So is it’s effect on the economy also lower?

No. They are simply letting the securities mature at par and not reinvesting. This is exactly how hold-to-maturity securities work at regular banks too so long as they are able to hold until maturity.

As bonds mature, their market value converges with their face value until they are equal at maturity. The Fed is doing QE by allowing bonds to mature and not replacing them.

QT

Oops. QT I mean. I wish there were an edit function.

Yes, unrealized losses mentioned in quarterly reports

Yes, there are some analysts who m2m the FED SOMA. Chris Whalen of the Institutional Risk Analyst does so. Due to m2m losses and the low coupons of purchased bonds, the Fed has flipped from providing net payments to the Treasury to providing the Treasury with a loss of around $100-$150bn per month, based on the rates they pay on collateral and deposits.

Bobby,

The Fed publicly discloses its mark-to-market losses (“unrealized” losses) on its balance sheet every quarter in its quarterly financial report. All anyone has to do is look at it.

Pages 10 and 17:

https://www.federalreserve.gov/aboutthefed/files/quarterly-report-20231117.pdf

For Q3, it disclosed $1.3 trillion in unrealized losses. After prior unrealized gains, the “cumulative” unrealized losses are $1.0 trillion.

But mark to market would have made QT look a LOT BIGGER. Its total assets on Sep 30 would have been $7.3 trillion at market value. In other words, the balance sheet would have dropped by $2 trillion under QT as of Sep 30, not by $1 trillion under QT.

The reverse is also true. Due to the rally in bonds in Q4 so far, the Fed will show huge quarterly unrealized GAINS on its SOMA holdings, which will reduce the unrealized losses by a whole bunch.

Bought reading your books now ….you are brillant analyst who uses facts and a cool author too. I read subscribe to all the top analysts Yardeni, Goldman , Real Money etc and no one has been able to explain why residential house prices dont weaken with QT. Yes understand long term Milenials out number boomers yes boomers stay in place ,yes inflation says hold bricks mortar, yes last place to get $500k tax deduction, yes home = status for Milenials , employment strong rental costs astronomical BUT all metrics

absolute price level % income , all expenses soaring + 20% prop tax prop insurance repairs upkeep heat electric and getting worse and mortgage rates doubled so cost of net disposible Y now 40% plus .

OPPORTUNITY COST is immense vs put money in 5% CDs. Age73 long term stock & real estate investor high end markets seen 3 crashes this has all the hall marks of bubble as you point out but it wont pop it gets stronger and with QE future what in the world will happen prices will fly again albeit you see flattening . Thoughts?

Look at the high inflation of the 70s, houses never declined.

People who locked in low mortgage rates won the lottery, their pay has increased while their monthly payments stays the same. I don’t expect houses to decline, actually here in SoCal I see all time high prices and houses selling quickly when smth comes in the market, inventory is too low.

Real estate reflects almost exactly the quantity of money in Fed’s balance sheet. Unless that money is withdrawn, (it won’t) house prices won’t come down.

Thanks Wolf,

QT hasn’t been talked about much with Powell during his talks or meetings. As we know they have been leaving interest rates unchanged. I’m leaning towards QT with the feds actions on inflation and not so much increases or pauses or rate changes. Cutting rates absolutely makes no sense with QT. Do you think anyone would ask JP about that!?

He did address this in a recent press conference.

He said it’s possible that non-recessionary rate cuts/adjustments could be accompanied by continued QT.

But as we all know, once rate cuts begin, Wall Street will demand QT be ended immediately.

My question would be, “ assuming with recent pauses are you relying more on QT with interest rates where they are, with no interest rate cuts until balance sheet is lower? Just to blow up the constant narrative of rate cuts.

So the Fed. basically, has AAPL, MSFT and AMZN on their balance sheet. That’s a market cap of about 7 trillion or so.

What made RRPs drop so much?

Did the Fed pull a string? It seems when this began, the stock and bond rally began.

I explained it here:

https://wolfstreet.com/2023/11/19/our-wall-street-crybabies-want-the-fed-to-stop-qt-and-they-wag-the-overnight-rrps-thatll-blow-up-the-banks-or-whatever/

So read it to get the answers. No the Fed didn’t “pull a string,” LOL, what BS, but money market funds are moving their funds from RRPs to T-bills, which pay a higher interest than RRPs.

The natural state of RRPs = $0. Only excess liquidity during QE inflates them and QT deflates them and they go back to $0, where they used to be, as the chart shows:

“Did the fed pull a string?”

That was a question, not a declaration.

As for RRP rates….5.3 is the offered rate, but which treasuries yield more so at to attract money from the RRP program?

Just asking.

“As for RRP rates….5.3 is the offered rate, but which treasuries yield more…”

Everything with a maturity of 6 months or less. As of today’s close:

1 M: 5.54%

2 M: 5.53%

3 M: 5.44%

4 M: 4.49%

6 M: 5.39%

Those are the dominant maturities that MM funds have to invest in; they’re not allowed to invest in anything over 1 year.

For example, Schwab’s Treasury money market fund SNSXX has an average maturity of 49.3 days, and it yields 5.09%. Just looked it up for you.

With the level of QE as a grand experiment along with ZIRP and MBS purchases driving down mtg rates and handing the non asset owners ie renters a real crisis on hand the Fed needs to stay the course . I don’t want a stock market crash nor a run on bonds and banks either . I still fear deflation. When was the last time USA had deflation ?

What exactly is wrong with a stock market crash? The vast majority of stocks are owned by the top 5%, and most of them bought most of their holdings at much lower price points.

Why did someone who had $3 million in the S&P in 2010 deserve to be handed a gift such that it’s worth $15 million today?

And you see the effect of this “wealth effect” in waiting lists for all kinds of luxury products. The latest I cam e across: waiting list for NetJets prepaid cards. A lot of millionaires were made multi-millionaires by the Fed. But I’m sure the PPP loans also helped quit a bit.

Some interesting stats

There are 24 millionaires in the US.

States with the most.

California

New York

Florida

Texas

Illinois

Pennsylvania

Arizona

New Jersey

Ohio

Massachusetts

ru 82,

Outside of the fact that there are about 24 millionaires on my block, so there must be more in the US overall, I would say that the top four states with the most millionaires on your list are also the most populous states, though not exactly in the order you depicted them.

Largest states by population:

1. CA

2. TX

3. FL

4. NY

What would be interesting would be the percentage of millionaires in each state. Maybe a tiny state like CT would be #1?

LOL, so I just googled that, and sure enough Statista ranks the top 25 states by the “Ratio of millionaire households per capita” this way for 2020:

NJ 9.76%

MD 9.72%

CT 9.44%

MA 9.38%

HI 9.20%

DC 9.12%

CA 8.51%

NH 8.47%

VA 8.31%

AK 8.18%

WA 7.85%

NY 7.52%

Texas is way down on Statista’s list of the 25 states, and Florida isn’t even on the list.

Exactly. And ultimately, that has a negative effect on society as a whole. An example is car manufacturers shifting all of their energy toward “high margin” luxury cars, on the basis that it makes more sense to sell one $150,000 car on a $20,000 margin than 10 $25,000 cars on a $2,000 margin each.

But the lack of affordable cars is bad for everyone.

The same principle is playing out in travel and numerous other goods and services.

This is called the “allocative effect” where the wealth of labor and the middle class is funneled upwards to the class of Oligarchs. Between the tax cuts, tax loopholes, and the chronic ‘boom and bust’ cycles we’ve created a legitimate class of Oligarchs. History shows that Oligarchs destroy democracies. You’re welcome.,

Wealth compounds. It’s math, not morality.

I’m with you. I’m done with the way the economy is handled in this country. I am growing more and more on Rand Paul’s side, always was on his side about the Fed but even moreso now. We need to audit the damn Fed (I’d prefer no Fed at all). And, yes, government spending definitely needs to be reined in as well. I’m beginning to agree with others on here the Fed is not serious. We know government is not serious on the fiscal side, and they don’t pretend to be. I’m so sick of this sht.

“And, yes, government spending definitely needs to be reined in as well. ”

This is the real crux of the issue. You can tax the crap out of the “rich” and still not fix things if the government doesn’t rein in spending.

You can be fed up with the way the economy is handled in this country, but Rand Paul is most certainly not the answer. He (and the fantasies he sells) are part of the problem.

Rand Paul…. LOL.

With a 10% historical return, wouldn’t you expect the $3 million to be worth about $12 million? Given the ebbs and flows of the market, I’m not sure your example is very far out norm.

First, the math I did came up to about $10 million, not $12 million. But in any case, that historical return was based on the economy growing and becoming more productive every year.

I don’t think that’s happened in the past 15-20 years.

I’m 100% for deflation. How can you fear deflation over what we have now? I know the arguments against deflation, but I don’t agree. I’ve had it. I also want a stonk market crash. I said it, that’s how I feel, and I wish it would happen.

The NASDAQ is 60% higher than its pre-pandemic levels, which were already lofty. That speculative gain could be corrected with only a 35% drop from current levels.

Why to fear deflation >

Lenders would be afraid to loan because they would lose value over time rather than gain. That isn’t what lenders are in business for. Who would lend if they didn’t even know how much of a loss they’d take lending you money. No gain, just loss! In fact, they couldn’t pay the salaries of the people who worked in lending.

Deflation isn’t disinflation. Deflation is when the value of the asset backing lending is decreasing vs inflation when it is increasing.

Sounds good, kind of, but when lending stops, so will much of our economic activity. And it isn’t like you can just wipe out trillions$ worth of debt and just start over. It would be chaos and maybe more like a world of Mad Max than Nirvana.

I don’t care. Like I said, I know all the arguments against deflation, including yours, and I am still for deflation. We are too excessive. No, it won’t be Mad Max. There was a time in this country of more austerity, and we survived just fine.

We can have deflation in asset prices without reduction in economic growth. The problem is, the Fed thinks asset prices and the economy are tied at the hip, via a wealth effect, so the Fed is very reluctant to let asset prices fall. Yet, the Fed has been more than happy to let asset prices rise undeservedly, despite increasing debts and financial fragility.

Next time asset prices fall, the Fed needs to stand aside and watch, if it wants to regain any credibility. We are witnessing now what happens when the Fed lacks credibility. The markets disregard whatever the Fed says.

Things won’t change until the Fed stops coddling asset prices.

Wait, what’s the basis for saying this? It would help lenders, it would only hurt borrowers. Lenders would be repaid in dollars that were worth more!

The only downside to lenders would be if they had to foreclose on collateral, the dollars they got from it would be lower.

“Lenders would be afraid to loan because they would lose value over time rather than gain.”

Over the last few years, lenders have been all too unafraid to lend. A little corrective move in the other direction would be a good thing–as it would with housing prices, rent, essential services, market exuberance, consumers’ willingness to “pay whatever,” and all of the other things that moved way too far, way too fast, in the wrong direction over the last few years.

“Deflation is when the value of the asset backing lending is decreasing”

People take out loans to buy cars (the definition of a depreciating asset) all the time.

People also take out loans not backed by any asset at all (credit cards, student loans etc).

Deflation is only bad if your investments are positioned to benefit from inflation. Mine are, so deflation would hurt my portfolio, but that doesn’t mean it would be bad for the rest of the country.

Deflation scares the FED. They will do everything they can to prevent deflation. Deflation feeds upon itself and goes into a downward spiral. This is one thing the FED learned from the 1930s and the basis for Bernanke helicopter money drop thesis. Keep this in mind always if you are an investor. The FED will step in at the appropriate time any time deflation appears to be rearing its ugly head. Don’t fight the FED. They can print at any moment at any time.

The FED would rather have high inflation than deflation.

Which is why the Fed should not exist. They are not accountable to anyone.

Bs ini-

“When was the last time USA had deflation?“

In terms of oil prices, March 2022 to present.

Inflation or Deflation always depends on your starting point. Not just a fact, but the game that they play.

Tell me how a bureaucrat can measure the Hedonics of the owners of the first black-and-white TV’s versus today’s Wall Sized TV?

And as near as I can see, there is no, or little, measurement of shrinkflation.

Price Discovery is so absurd that much of what I am offered is nothing more than fishing for fools.

Shrinkflation is designed to mislead consumers, not CPI. Shrinkflation is fully accounted for in all inflation measures because they track prices by weight ($ per ounce, pound, etc.) or volume ($ per quart, gallon, etc., or by specific piece (such as a specific vehicle model). Gasoline is tracked by $ per gallon not per tank; cereal is measured in $ per ounce, not box. Beer is tracked per ounce. All these measurements are on the products when you buy them. New vehicles are tracked by specific models. So Shrinkflation is fully reflected in CPI.

I fear that there *won’t* be deflation. I suspect that my fears will materialize and yours won’t.

Per the Treasury website, the 10Y will be auctioned on Monday. No mention of how much. The last time these notes were auctioned, the rate got to 5% then back to 4.2ish yesterday. That is a massive move for bonds. Given their high rate of spending, the govt will likely need to sell a lot of bonds. So I believe there will be another rate spike next week (up to 80 bp). Seems like simple logic, maybe too simple. What am I not seeing?

“the 10Y will be auctioned on Monday. No mention of how much.”

Just because you don’t know, doesn’t mean they don’t announce it:

They reopened the auction of a previously sold security (original auction on Nov 15), meaning they’ll sell more of the same security (same CUSIP). They sold $40 billion on Nov 15; and now they’re offering another $37 billion of the same CUSIP.

here is the announcement:

https://www.treasurydirect.gov/instit/annceresult/press/preanre/2023/A_20231207_5.pdf

To me it looks like that Treasury is doing an about-face after the drop in yields, which was in part caused by their announcement of selling fewer longer-term securities and selling more T-bills; and they’re now taking advantage of the lower yields they triggered and are selling a lot more longer-term securities at these lower yields, which is why they re-opened that auction to pile another $37 billion on top of it. To me this indicates that Treasury thinks longer term yields will rise again and now is good time to take advantage of those lower yields.

Always a day late and a dollar short!

My two cents would say it seems more like a pointed stick jabbing those calling for stopping QT. If they are so inclined they could purchase this security.

Me on the other hand is still picking up CDs, as of today at 5%.

Need several more and think this security just may not fill.

I can’t wait to see what happens when BTFP (QE) expires in March…wait for it…LOL! It of course is not going to expire. It will get extended and these supposed “loans” will never get paid back. Mr. Transitory’s continued bloated MBS support is so shameful given the prices of existing homes still going UP in most markets throughout 2023 (and no it is not just “seasonal”). “There is nothing more permanent than a temporary government program”. Forbear, forgive, & forget, and inflate is the plan. Existing Home prices will continue “higher for longer” in most markets given these ridiculous FED and government fiscal policies.

The difference between the Discount Window and the BTFP is essentially the costs for the banks in terms of interest and collateral. The BTFP is a better deal for the banks. The Fed has always offered banks liquidity through the Discount Window, that’s as old as the Fed itself. All the Fed needs to do is make the new terms of the BTFP less attractive, and banks will switch their borrowing to other sources, such as the Discount Window or selling 5.5% CDs to depositors.

The problem is that the “high quality collateral” being posted for BTFP should be at market value, not par value.

No way the Fed can get to Wolf’s prediction of a balance sheet under 6 trillion. The oligarchs won’t stand for that kind of competition or true price discovery in the global “market”.

Down a whole 1.2 trillion…. LOL! What is the deficit the government is running now? Does 1.2 trillion even get us through half the year?

Higher for much longer! In both rates and taxes!

“No way the Fed can get to Wolf’s prediction of a balance sheet under 6 trillion.”

1. There were bets here earlier this year that the Fed would never be able to get the balance sheet under $8 trillion, and look where we are. QT is going very smoothly. It was designed to go on for years in the background on autopilot, and it’s doing that. I’m just moving it into the foreground once a month.

2. What I actually said — in Sep 2022 — was that the Fed CANNOT go below $5.2 trillion; that that’s the absolute FLOOR below which the Fed cannot go, due the dynamics of its liabilities. That floor moves up over the years as the economy grows. That is not a prediction that it will go to $5.2 Trillion, but a prediction that it CANNOT GO BELOW $5.2 trillion. I said this because people kept saying that the Fed’s balance sheet should go back to its 2008 level, which it cannot do for the reasons spelled out here when I said it:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

Under 8 trillion is a long way from under 6 trillion. You are a data guy, I figured you would know that.

$1.2 trillion down, $2.5 trillion more to go? Not bad. QT was designed to run on autopilot in the background for years, and it’s doing that.

I understand why the Fed’s balance sheet cannot go below 5.2 trillion Wolf, never argued that, not sure why you brought it up. Anyway, I’ll bet you a Benjamin they don’t go below 6 trillion.

“…never argued that, not sure why you brought it up.”

I brought it up because you said “Wolf’s prediction of a balance sheet under 6 trillion.”

That’s NOT what I predicted. I predicted that it CANNOT GO BELOW $5.2 trillion. I did not predict that it WILL GO BELOW $6 trillion.

Do you see the difference?

I predicted a floor below which it cannot go for mechanical reasons, and my prediction is wrong if it goes below that floor, but is right if it stays above the floor.

I get prickly when people make up what “Wolf predicted”

Couldn’t the Fed reduce its balance sheet by removing cash for circulation, as it’s deposited, and by ending bank reserves (such that banks can’t hold money there)?

So almost 4 years after the beginning of the pandemic, and 3 years after the beginning of massive inflation, the Fed has sold off a small fraction of the assets it purchased beginning in March 2020. Congress needs to strictly limit this kind of garbage.

Congress loves it. Both parties spend like drunken sailors when they’re in power, whether it’s on social welfare or tax cuts, and QE keeps those interest rates low so they can borrow even more. The only thing keeping massive spending somewhat in check right now is divided government, and even then the federal budget is still $2 trillion in the hole.

That’s it. It’s the fox guarding the henhouse scenario. Congress needs to buy their votes.

Divided government is a beautiful thing. Keep it out of the way.

Without deficit spending, NO politician any stripe can promise the goodies to their vested interest groups., who put them there!

K-Street will be empty of all lobbyists

Happy1,

“Fed has sold off a small fraction of the assets it purchased beginning in March 2020.”

“Small fraction?”

1. The Fed shed 29% of the Treasuries that it had bought since March 2020. See article.

2. The Fed shed 21% of the MBS is bought since March 2020.

3. The Fed sold outright 100% of its corporate bonds and bond ETFs that it had bought since March 2020. It sold those before the end of 2021.

It’s like a house is on fire and the firefighters take almost 4 years to put out 29% of the fire.

It’s not like that at all.

I can’t comprehend how people do not understand that liquidity cannot be removed from the system as fast as it was injected.

The last 18 months the FED has done things to reduce liquidity in the system faster than they have ever done it. Ever.

Yes, there have been some pretty stupid FED policies for the past 25+ years (extremely loose money policy and multiple shots of QE). That is not going to be undone in a few years.

Congress? Congress was too busy packing all that printed money into cannonballs and aiming those millions of cash cannonballs right at the front doors of people who already had money.

“Congress needs to strictly limit this kind of garbage”

Congress was too busy packing all that printed money into cannonballs and aiming those millions of cash cannonballs right at the front doors of people who already had money.

If you happened to notice over the past few years that your boss upgraded his house, truck, AND car with the proceeds of his PPP “loan,” you can thank your saviors in Congress for that.

I know Wolf will address this in a later article today, but jobs report came in strong today (+199K NFP, U-3 3.9 -> 3.7%, AHE +0.4%) LOL rate cuts in March.

We all rejoice when asset prices like stocks rise, including the US government and many state governments. They are taxing us on the inflation they create. When markets crash there is less tax revenue. Social programs must be financed by borrowing, and our national debt grows ever larger.

Im liking this QT A lot!

I just wish this fed would double down, qe then qt all good.

Ive seen this before, where bad is good, and worse is better!

Ive often wondered why doesnt argentina use this model too it works so well here.

It’s because Argetina ran out of other people’s money. We have another 50 years to go. Well, 5-10 for sure.

Wolf: just finished with your interview with Adam Taggart. (that’s a few posts back, for those that haven’t listened to it yet).

That was some high quality material, and it reflects your highly developed, well-balanced emotional conditioning. Thorough, thoughtful, facts-based, wide-peripheral vision…and an astonishing capacity to integrate it, simplify it, and explain it so very clearly.

Just very, very good work. Keep it going, man. You’re tops.

And Adam is no slouch either. Very good interlocutor.

Not fast enough. See: speculators still cashed up and blowing massive bubbles all over the place.

It’s not even about being cashed up, it’s more that they’re confident that rates cuts are coming and that ZIRP and QE will be back in no time.

The Fed has done nothing to disabuse them of this notion.

I agree, but with no cash they are impotent. Drain the liquidity. Rinse them. Destroy them.

Drain liquidity? Let’s not hold our breath.

The Fed increased the money supply by $5T, then slowly took out only 25% of that after a 20% inflationary spike. That spike already increased the inflationary component of GDP (nominal less real) by over $5T. Thus, the excess liquidity is now embedded in GDP, which the Fed will protect at all costs.

We are approaching limits where QT can trigger serious deflationary threats, and we’ve seen how pathetically the Fed panics when such threats arise.

Until the Fed is able to withhold stimulus in the face of a run-of-the-mill recession and stock market drop, the Fed is as convincing as a drug addict who says he’ll enter drug rehab some day.

“it’s more that they’re confident that rates cuts are coming”

Let them make their trade then. If they really want to jump into long bonds, I’ll be glad to make money off their losses by shorting TLT.

MM

It is the perception of ‘rate cuts’ coming in the near future, the MM

investors are betting and got rich since indexes have gone up for the last 6 weeks. I respect the power of perception more than the reality, ever since our so called good ole Free Mkt Capitalism was put to ‘rest’ in the March of ’09. Since then only Casino rules apply.

It is an anomalous mkt in the last 200 yrs of US Mkt history. B/c Fed never bought the MBSs before. No suspension of mkt to mkt accounting standard. No QE/QT before Surreal mkt.

The two key takeaways from this pandemic balance sheet ordeal are as follows:

1) The Fed has a strong bias against deflation. Therefore, it will over-stimulate during times of perceived crisis, erring on the side of inflation. Additionally, it will add stimulus quickly, then withdraw it slowly, which tends to prolong excess inflation even after it is observed.

2) The Fed will not reverse excess inflation that results from over-stimulation. Therefore, the 2% average inflation target is really an unknown inflation target, after periodic bouts of emergency stimulus are factored in.

Until the Fed addresses this clear policy asymmetry, sentient observers are putting little faith in the Fed’s willingness to achieve its stated 2% average inflation target.

Wolf says 5.2 trillion is the limit for the feds balance sheet. There is a ways to go with QT. The Fed is reversing inflation. Not reversing inflation is rate cuts, or the narrative of rate cuts. The economy is strong, jobs good, unemployment down. Looking for a hike or an explanation for the pauses or relying on QT more than a hike. Treasury does have to issue more debt. They will pay regardless. I think jp needs to protect the dollar and hike. I’m waiting for it!

My point is the Fed waited too long to pull out the monetary stimulus. It’s now embedded in prices and GDP, so the Fed won’t get the balance down to $5.2T or anything close to that without triggering an asset price drop and recession. I’d say $7T is closer to the lower limit at this point, given the Fed’s overblown fear of recessions.

Who will be surprised if we enter a recession in 2024 and the Fed’s balance sheet is over $10T by 2025? I would love to be wrong about that, but as long as the Fed has QE in its toolbox, it’s like a bottle of whiskey in an alcoholic’s kitchen cabinet.

Well with all that balance sheet access they should hike, or does rates higher for longer means they don’t hike and balance sheet runs off? I would like to hear jp on their plan. Plain and simple, like, no more hikes or cuts and we are just running off the balance sheet for now. Enough of rate cut crap.

It’s asymmetric by design. It’s why Wall Street & big-spending progressives cheered when the Federal Reserve unveiled this policy framework in 2020.

In practice, the 2% inflation target has become a floor rather than a ceiling. And the inflation averaging at 2% only applies when “averaging out” below-target inflation with subsequent above-target inflation, not the other way around. 3-years of ~5% annualized inflation aren’t going to be “averaged out” with years of deflation to arrive at 2%.

Comments from Powell & other FOMC members have confirmed this policy bias. They waited until PCE inflation was almost 7% before raising rates in 2022, but said it might be too late to wait until L12M inflation reaches 2% to loosen policy, as by then they would have overshot their target, risking deflation. If they cared about American consumers, considering how pissed off people are about the last few years of price increases, they would say an an inflation rate slightly below 2% (eg the ~1.5-1.9% PCE for much of the 2010s, which the FOMC used to justify a decade’s worth of ZIRP & QE) would be acceptable as long as the broader economy weren’t in trouble.

But nope, 2% PCE (which is really ~2.5% CPI) is now the new floor, and rumors are the 2025 policy review will allow an even more flexible target on the upside.

Equally troubling is the desire to publicize an average inflation target without defining 1) the period over which the averaging is to occur, or 2) an error tolerance range. Absent these things, could inflation policy be any more useless or muddled?

Stay away from long bonds.

The 2% inflation target is itself a misnomer and should be ignored. Inflation for the most expensive items, housing, healthcare and education has always averaged significantly higher. Yes the price of eggs and airfare have dropped a few dollars, and your rent has doubled. Inflation targets have been met!

The FED is never ever going to reverse excess past inflation. Never. It would be insane for them to do so. It would be suicidal.

Repeatedly mentioning it just demonstrates you don’t have a very good grasp of macroeconomics. I don’t mean this to be insulting, I really don’t. Take a macroeconomics course online somewhere. It will help you better understand what to do going forward rather than continuing to get frustrated at something that you clearly do not understand.

Macroeconomics does not compel the Fed to have a 2% inflation target. Macroeconomics does not compel the Fed to not deflate a heavily inflated economy. By conjuring money, the yardstick by which even the Fed must measure it’s own Balance Sheet, the Fed has created losses.

That is the bailiwick of Politics.

And underlying the Federal Reserve is the Politics which instituted the Fed, which granted money and aggregate credit creation to politically connected New York Bankers.

Don’t assign to Macroeconomics the carcass that Politics hath wrought.

IMHO the pain of our economy is not felt by everyone. In fact, some seemvto be profiting from it.

Wolf excellent information as always. many of us are grateful that we have an alternative news source other than Bloomberg, CNBC just to name a few. Somehow compared to 60 years it was gotten so complicated with data and charts…I expect to graduate to a Masters degree level in understudying this due to your posts. at least trying. 👍

@Raging Texan You had asked the question “Also note Nov 2011 Nasdaq was 2700ish. Thats +433%! It’s gone up why? Are apple,google, apple, microsoft, facebook and netflix really providing that much more “value” today than they did in 2011?” I was curious so I looked it up.

12 months ending 12/31/2011 compared to 12 months ending 9/30/23 – earnings per share:

Apple: +387%

Google (Alphabet): +581%

Microsoft: +274%

Facebook (Meta): +2365%

Netflix: +1570%

Those are some pretty big earnings growth numbers…

I would have sold them already! Jeez

Good article and thanks for the unvarnished truth of your article. Of course, what it all means is open to interpretation. As is obvious by the differences of opinion expressed by the various folks who express an important point that everyone has a belly button.

Perhaps I’m misinterpreting, but you seem to be providing a seal of approval of the current operating equilibrium. Choosing to ignore the re-inflation of at least three asset bubbles, that exceed any other asset bubbles in American history.

Who is the Fed protecting by supporting asset prices ? All of it again, like the GFC which was precipitated by the collapse of a housing bubble.

Inflation, for longer, seems to be the message of a ridiculously dovish Fed, not wanting to influence the political outcome with a nasty old recession muddling peoples perception of the bleakness of their future.

” …you seem to be providing a seal of approval of the current operating equilibrium. Choosing to ignore the re-inflation…..”

What the F**K are you talking about???

This is QT, $1.2 trillion so far. I lambasted the Fed for years for doing QE, and now that it’s doing what QT in amounts that the QT deniers had predicted would never be possible, you want me to lambaste the Fed for doing QT? Are you out of your mind??? What is your effing problem?

Why don’t you scream at the pivot-mongers and QT deniers???

sorry, man if I provoked you. Didn’t mean too.

Dang forgot to take his medication today.

Hey Wolf:

I don’t think many would consider you to be snuggling up to the Fed.

But it is exasperating to see how quickly the Fed moves to help its friends. With instant billions at the speed of light. Yet small earners, businesses and workers die “the natural death” in the free market economy, as the anointed few profit from their losses.

Bailing out the wealthy depositors of SVB, First Republic, etc. was at least in part a political decision made by the White House (OMG, the donors are going to lose money) and the Treasury. The FDIC and the FED had to implement it. The FDIC was likely opposed to it. The Fed was likely in favor of it. That’s how I see it.

Asset inflation helps the Treasury and Congress. Higher asset prices means more tax revenue when assets trade hands in a taxable setting (obviously ways around it).

Looks like “Reserve balances with Federal Reserve Banks” is up to a YTD high after bottoming out at the beginning the year. Funny how that tracks equity markets pretty well as far as direction (not magnitude).

One trillion runoff in fed balance sheet via QT means effective interest rates are 25 basis points higher. This per Powell.

Fed has roughly 8 trillion on books.

QT max means Fed has capacity to “raise” interest rates by 2 percent with few recognizing it. Slow, frog in kettle raise through QT.

Opposite of the interest rate repression it has practiced.

On the other hand, I prefer to live like the financial industrial complex, like entertainment a complete fabrication based on the amount of substance A is required to neutralize an aqueous solution of substance B, equilibrium.

The markets claim to have the same kind of predictability since they realized, like a billion preachers before them, what they were really selling is hope.

My supposition is that the bigger the wad, the more willing is a man to pay more for a product that he alone has the God given right to purchase.

The Fed balance sheet, safely held as reserves for the banks that comprise the Federal Reserve system, who are being paid a subsidy of the FFR, so they won’t be tempted to juice the economy with liquidity.

The really logical person would say to themselves that somebody has so much cash that they are willing to pay more for that asset. Where does the cash come from ? Although the US treasury is the only USG authorized to print physical cash, the Fed can and has created an excess of cash that created the current inflation. I think that inflation is a wealth transfer ploy that makes the wealthy whole at the expense of the majority.

The Fed is a real life villain.

Dang !

Lesser beings aren’t supposed to understand how the financial pilfering works.

Woefully Inadequate.

I’m actually surprised the FDIC loans are all paid off. My skepticism on that has been vanquished.

Regarding the BTFP: The lending rate to banks is currently 5.1%. Interest paid on reserves is 5.4%.

I suppose one option available to the banks borrowing the $122 billion is to pay the 5.1% to put up their junk notes and bonds (paying sub-2% that have lost significant value) as collateral for the loans, then take the loans and stash them in their reserve account to collect 5.4%.

So they can make a thin but guaranteed margin of 5.4 – 5.1 = 0.3% while they try to sweat their way out of the balance sheet issues they find themselves in before the BTFP expires.

///

I don’t get it. Why does the FED believe it needs to intervene so heavily into the market? I’m not talking about interest rates or the QT (Wolf should get a T-Shirt “GO QT!” or “RUN QT, RUN!!!”), I’m talking about the rest of the c**p they pulled off. What was the idea? To become the biggest bond and stock holder in the world? Slowly QT-ing yourself out an liquidity glut, when the next big challenge is behind the corner? To buy out all failed economic ideas and subsidize them et infinitum? To trigger crisis after crisis, taking the opportunity to scavenge what resources are left, until the system stands no longer? They have completely lost their mind…

///