Higher for how much longer? “The extent of additional policy firming that may be appropriate….”

By Wolf Richter for WOLF STREET.

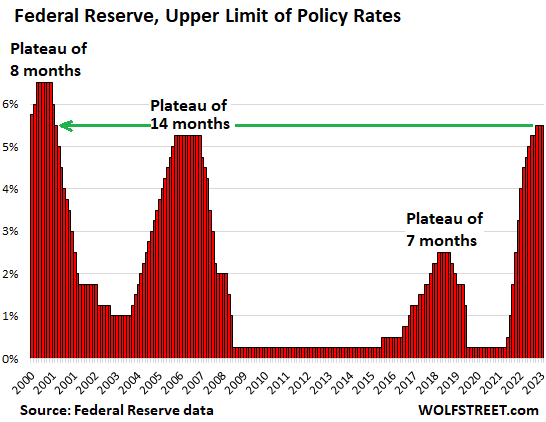

The FOMC voted unanimously to keep its five policy rates unchanged today, with the top of its policy rates at 5.50%, as had been broadly messaged in recent weeks in speeches by Fed governors. It was the second meeting in a row when the Fed kept rates unchanged, after the rate hike at its meeting in July. The Fed has hiked by 525 basis points so far in this cycle.

Today, the Fed kept its policy rates at:

- Federal funds rate target range between 5.25% and 5.5%.

- Interest it pays the banks on reserves: 5.4%.

- Interest it pays on overnight Reverse Repos (RRPs): 5.3%.

- Interest it charges on overnight Repos: 5.5%.

- Primary credit rate: 5.5% (what banks pay to borrow at the “Discount Window”).

Higher for how much longer?

The end of the rate hikes is typically followed by plateaus before rate cuts begin. The end of the rate hikes may not be here yet, and the Fed has already said a gazillion times for months that the plateau is going to be “higher for longer.”

More rate hikes? Today’s meeting was one of the four meetings a year when the Fed does not release a “Summary of Economic Projections” (SEP), which includes the infamous “dot plot” which shows how each FOMC member sees the development of future policy rates.

At the last meeting on September 20, the median projection in the “dot plot” kept another rate hike on the table for this year. There was nothing in today’s statement that changes that.

Today’s statement repeated the language of the prior statements, which leaves the door open for more rate hikes:

“In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

When will the rate cuts start? The Fed will release its next SEP and “dot plot” at the December meeting. In the SEP released in December 2022, the Fed shocked the world because it removed the projections of a rate cut in 2023. In the SEP released in September, the Fed moved the rate cuts further out into the second half of 2024, which was another shocker. So the next SEP in December will be interesting.

QT continues, with the Treasury roll-off capped at $60 billion per month, and the MBS roll-off capped at $35 billion a month, as per plan and on autopilot. The Fed has already shed over $1 trillion in assets in a little over a year, and this will continue.

Banking crisis copy-and-paste. Today’s statement repeats the same language about the banking crisis for the fourth meeting in a row: That the “tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation.” And it repeats that “the extent of these effects remains uncertain.”

I will publish my analysis of Powell’s preconference, and his own words, in a little while. Stay tuned.

My take on the Quarterly Refunding documents released today: The spike of the 10-year Treasury yield has apparently rattled the government’s nerves. Tsunami of Treasury Issuance Shifts from Longer-Term Debt to Short-Term T-Bills & 2-Year Notes amid Intense Navel-Gazing about Spiking 10-Year Yield

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Mr Richter if you were the Fed President would you be taking the same actions as Jerome Powell? Do you think the Fed is doing too little, too much or getting it just about right?

I think the Fed is close to where I’d be at this point. I want to see longer-term yields rise above 5.5%. Long-term yields are what actually impact the economy. So that’s what the Fed wanted to accomplish — push up borrowing costs, and most borrowing costs are linked to longer-term Treasury yields. So if this is happening, the Fed can let it develop and watch. We haven’t seen the economic effects of 5.5% long-term Treasury yields yet.

At the same time, if you get to 5.5% too quickly, without given markets time to adjust, all kinds of stuff can happen that I wouldn’t want to happen. It takes years to bring down inflation without killing the economy.

The HUGE mistakes the Fed made were in the years before it started hiking. Now it’s doing pretty good.

Thank you sir.

Good question, I’ve been wondering the same thing.

Is it “doing pretty good” at correcting the damage done over the past decade plus or is it “doing pretty good” at maintaining the status quo?

Yes

Yes and Yes

Was there ever any real questions about this today?

no.

MW: Fed points to ‘elevated’ inflation and expanding economy in leaving rates unchanged

A nice case of Chinese made beer, from mainland China, would help you stop worrying about it. Yummmm.

Howdy Lone Wolf. THANKS will wait for todays update……

I am more concerned about the slow pace of QT than the Fed’s failure to increase short-term rates again. At the current rate of QT (and allowing for a recession or financial crisis down the line), I think the Fed’s balance sheet will not return to pre-Covid levels for five to six years.

Pre covid levels? How about pre 2009 levels? The feds balance sheet has a lot of mortgage backed securities as well as treasuries don’t forget.

There has to be some kind of end game here. I highly doubt the USA plans on paying back $35 trillion in treasury notes/bonds. I’m sure the Fed has some kind of plan to backstop a debt default by the US government, because they own $6 or $7 trillion in treasuries. For that reason I doubt the feds balance sheet matters that much.

Now where did the fiscal policies part of that go? Cough cough members of congress and their own companies not having to pay back their covid paycheck protection plan loans. That’s inflationary right there.

LIFO and Tyler,

Why do I still have to read this unmitigated BS about the Fed’s balance sheet here?

The balance sheet runoff is SUPPOSED TO TAKE YEARS and run on autopilot in the background.

Read this. I wrote this over a year ago and it still holds:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

The longer they mess around, …you don’t want to find out…

Jpow: we’re not even thinking about rate cuts right now.

Hold again? Guess we’re hoping for the mythical lag effect to kick in from higher and longer, might turn out to be just as mythical as inflation is transitory…guess time will tell. Last I checked, inflation still not heading down and gaining some relative staying power…

Jpow: “The best thing we can do for the US is to restore price stability”

which means goodbye ZIRP, goodbye QE, hello interest rate normalization.

Say it with me folks:

HIGHER 👏 FOR 👏 LONGER

How about EVEN HIGHER 👏 FOR 👏 LONGER?

God, I hope so.

But my fav eggs are so costly!

I’m heading over to vanguard to open a bond ladder before I make huevos rancheros.

“Jpow: “The best thing we can do for the US is to restore price stability””

Why did you break it, Jerry?

Because he’s an idiot lawyer turned banker, not an economist.

Then again, the trollfaced Yellen does have a Ph.D (although for women, it’s not hard to get in).

Her husband did win a Nobel in economics.

That family might know how to balance a checkbook or 2.

Because the cost of NOT doing what they did was greater than the RISK of what has happened. There’s a reason why we call 2008 The Financial Crisis or The Great Recession rather than The Great Depression II.

Yes, the Fed could have done better. But give them credit for what they did accomplish instead of hating them for where things are today without a thought of where they could have been today had they acted differently.

They’re not corrupt or crooks. They’re smart humans doing the best they can with limited information, limited tools, and limited models. So don’t be so quick to judge with limited hindsight.

…once asked a dear and brilliant friend from seventh grade, now sadly passed, (who went on to acquire his MD and Ph.D in Biochemistry at the same time, to work at Salk, the HGP and UTx Dallas before starting his own successful company) what branch of medicine he would have chosen other than research. He answered: “Pathology, because it gives you the luxury of analyzing the errors of others without the risks of actual practice…”.

may we all find a better day.

The best policy now is not to pay attention. The game is endless; it will wear you out and mentally exhaust anybody. Production and physical work is healing.

They can play this game bc they have:

(1) infinite pool of credit seekers -all 3rd world countries plus USA

(2)wars which create profits and future credit seekers

(3)FinTech to instantly inject the addicts instantly anywhere

(4)Corrupt systems

(5)Ignorance of masses

Thanks Wolf

Please rate stability which means QT for longer vs shorter . The short term rate can vary based on conditions at the time

“Fed holds rates steady, hints at more hikes but markets see end of hiking cycle”

Got to love some of these headlines from MSM, guess market is about to undermine and play dare with Pow Pow again.. judging from where the market is now close to the end of the day…Pow Pow’s jawboning skills doesn’t work quite as well when it comes to tightening

Housing prices are skewed up by builders offering interest rate “buydowns”. In reality, these are declining prices that don’t show up in the data.

IMHO, these buyers should just pay the 8%, and negotiate the price down. It comes out in the wash but lowers the tax basis.

All the food I regularly buy is easily up over 20-30% from a year ago (I keep records – Topochico water 5.99 -> 6.99, Ribeye steak 10.00/lb -> 13.99/lb, etc). No idea what you’re buying. And this says nothing about shrinkflation or the degradation in food quality. Ultra-processed, chemical-laden hamburger buns that happen to cost the same as a year ago give the appearance of a slowdown in cpi.

You could reduce your personal rate of inflation by ditching that expensive mineral water.

40-packs of Poland Spring are $8 at the local Costco, if your tap water is really that undrinkable.

IMO T-Bills, I-Bonds, PM’s, Cash all sound good in this environment.

Bill Dudley, per Bloomberg today, sees four fatal flaws in the Fed holding FFR instead of continuing small quarter point increases. Of the four flaws, I find the third, that monetary policy changes have less lag today versus history, to be both most fascinating and concerning.

And thanks Wolf for two useful articles today. News I can use, versus say an NPR article about how birds in Canada and USA are getting renamed due to bird names deemed offensive or exclusionary (Anna’s Hummingbird did give me sad face)…LOL

Perhaps we should rename the Federal Reserve terms as I find find 5-7% inflation “offensive”…HA

Dudley is one of those that wants a quick recession so that the Fed can CUT rates again. They all want rate CUTS.

The beauty of going slowly is that there may not be any — or any significant — rate cuts for a long time. And that’s a nightmare for Wall Street, including Dudley.

Some people like to rip the band-aid off and move on. Others think it’s fun to pull it off one hair at a time, extending the pain and agony far beyond what is necessary. Jerome Powell falls into the second camp.

The longer they allow this inflation to run, the more it becomes entrenched. They know this. This is not an “inflation fight,” this is an “inflation entrenchment operation.”

Look Depth Charge, you’re going to be screaming the loudest when 0% and QE come back because the 8% policy rates you want asap blew up the global banking system, corporate debt, housing, CRE, and the Emerging Markets all at the same time.

We may get to 8% maybe if needed, but slowly please. This economy is immensely leveraged after 15 years of interest rate repression. This could go very wrong very quickly. But it can adjust over time.

Just be a little patient.

Bankruptcy laws are the proper solution to this mess, not lower rates. The capital and employment of businesses can remain intact during bankruptctcy. The investors are the only that get wiped out, which is exactly how risk/reward functions in actual Capitalism. Currently, what we have instead is Crony Capitalism, where donors… uh… investors are protected from all losses, no matter how irresponsible the investment is.

I love this site. I can’t say I agree with all the positions… but at least I understand them :)

Because I am a few days late, I’m not sure anyone will read my comments, but here goes…

It is easy to argue analytics and fundamentals. It is less easy to argue emotions and human expectations. I agree with @Depth Charge’s position from the perspective that it is one thing to unwind the economic drivers of inflation… and quite another to defuse inflationary expectations within an economy. Once an economy begins to bake inflation into their business models it is very difficult to unwind. Even today we hear of workers striking for higher wages (to address inflation) and state governments increasing minimum wages (to address inflation) and the Federal government increasing the COLA for fixed income recipients (to address inflation) – basically ensuring that inflation will not only not be suppressed – but will continue if not accelerate. I could go on, but you will get my drift. I read a comment above asking about whether the Fed thought that some deflation was in order – whether the asset bubbles they artificially created needed to be popped. Or whether, like a python swallowing a basketball, they were simply willing to accept the last three year’s inflationary “mistake” as water under the bridge – and were only looking forward. This appears to be the case. And finally – I agree with Mr. Wolf about higher and longer. But it raises the question of how long. My wife and I talk about how the Fed has frozen the residential retail market… and wonder how long it will last. The rates aren’t high enough to pop the real estate bubble they created. But they aren’t low enough to allow a healthy market to exist. In my day they called it stagflation. We will see…

Well, finally. The cyclical sticks can do better than the hyped p/e stocks (in a high interest environment before QE existed). People forget that historically this is the case

Policy mistakes on top of policy mistakes…par for the course with the FOMC.

For all those commenting that inflation is understated, correct. This is why we see so many mentions of ‘neutral policy rate might be higher than originally forecast’.

5.5% ain’t cutting it. Service inflation stuck. Long-term chart still trending up. More hikes coming.

“Policy mistakes on top of policy mistakes”

The policy mistakes were made in the years before the rate hikes, and those policy mistakes were catastrophic.

Now, the Fed is close to where I’d be at this point. I want to see longer-term yields rise above 5.5%. Long-term yields are what actually impact the economy. So that’s what the Fed wanted to accomplish — push up borrowing costs, and most borrowing costs are linked to longer-term Treasury yields. So if this is happening, the Fed can let it develop and watch. We haven’t seen the economic effects of 5.5% long-term Treasury yields yet.

At the same time, if you get to 5.5% too quickly, without given markets time to adjust, all kinds of stuff can happen that I wouldn’t want to happen. It takes years to bring down inflation without killing the economy.

I think we are at the top.

Just curious during a rate hiking period how many times has there been 2 pauses and then another hike . Sure wish they had hiked this time but probably no rush

There are no more rate hikes coming. Powell is a jawboning liar. In fact, there have been articles going back over a month that said “the FED is done tightening.” Somebody at the FED is probably leaking.

The Fed has no real intention of tightening further, but that is why long bonds yields are rising, so the Fed is soiling its own nest, likes doves do. Smart people are worried inflation will get out of control in the long term.

It will be the increase in long bond yields that finally puts a spineless Fed in the frying pan.

But notice when that one reporter tried to bait him with a question about rate cuts, he immediately swatted it away: “we’re not even thinking about rate cuts right now”

You need to back off a little, Depth Charge. Not everyone hates everything, and not everyone wants to blow up the entire economy and system, as you do.

I think the Fed is close to where I’d be at this point. I want to see longer-term yields rise above 5.5%. Long-term yields are what actually impact the economy. So that’s what the Fed wanted to accomplish — push up borrowing costs, and most borrowing costs are linked to longer-term Treasury yields. So if this is happening, the Fed can let it develop and watch. We haven’t seen the economic effects of 5.5% long-term Treasury yields yet.

At the same time, if you get to 5.5% too quickly, without given markets time to adjust, all kinds of stuff can happen that I wouldn’t want to happen (though you might want that to happen because you’re not happy unless the whole economy blows up). It takes years to bring down inflation without killing the economy.

The HUGE mistakes the Fed made were in the years before it started hiking. Now it’s doing pretty good.

“You need to back off a little, Depth Charge. Not everyone hates everything, and not everyone wants to blow up the entire economy and system, as you do.”

If I hated everything, then I wouldn’t like you, right? And I do like you, which is why I’m here. But I will admit, if hiking a piddly 25 basis points is “blowing up the entire economy and system,” then I guess I just want to blow everything up.

Where is the evidence that being at 6.25% instead of 5.50% would “blow up the entire economy?” Further, if the entire economy would blow up over a measly 75 basis points, then it’s a sham to begin with.

Notice how, in 2001, rates were at 6.5% and the entire economy didn’t blow up and crash into oblivion. And at that time the FED and .gov hadn’t dropped a more than $10 trillion monetary and fiscal zephyr over the entire lands, in conjunction with suspending “consumers'” requirement to pay their bills.

Also in 2001, the economy wasn’t grotesquely overheated as it is right now, STILL. Nope, not buying into the “hawkish hold” FEDspeak. Dereliction of duty by Jerome Powell and Co., still.

I agree. Depth Charge has it right. Wolf is wrong.

Depth charge has every right to be angry. The last few decades have been straight up malfeasance by the goverment and the Fed… still in progress by the government.

JeffD,

Agreed, he does have a right to be angry. What the Fed has done since 2008 until it started hiking rates in 2022 was catastrophically bad. But it’s on the right track now. And it’s important to see that. We can quibble over the details. But it’s on the right track. And god knows, I want it to stay on the right track. But to constantly deny that it’s on the right track is just emotional nonsense.

The government/Congress is not on the right track obviously and is going down further on the wrong track.

Wolf, do the math. If hiking another 75 basis points is enough to blow up the economy, than we don’t have much of an economy.

Lucca,

What’s your effing problem? Inflation is well below 5%. Wage growth and the SS COLA have outrun inflation this year. Wall Street is thoroughly pissed off at Powell and wants him to change course, cut rates, end QT, and restart QE. That’s what the rich want him to do. And they’re throwing all kinds of BS at him because of it. And you’re bitching about what exactly?

I think the Fed getting on track should entail the Fed sticking to it’s promise of 2% average inflation. With 20% inflation in three years, I’d say the Fed should be shooting for some deflation to achieve the target, assuming it’s words mean anything.

How can we trust the Fed to deliver average 2% inflation in the future when it just accepted 20% inflation in three years? Whether the Fed did this by accident or design doesn’t matter. All that matters is this Fed is OK with excess inflation above target.

Agree, J Powell has made some big mistakes, but he’s a hero compared to Bernanke, who is the architect of this whole mess that we are in now. Powell is finally moving in the right direction, but I wish he would move faster.

Like Wolf has stated and Druckenmiller has copied =)….consumers are spending like drunken sailors, per CNBC article today titled:

Stanley Druckenmiller says government needs to stop spending like ‘drunken sailors,’ cut entitlements

Yet Gundlach is saying rate cuts first thing 2024 during recession.

Basically, even the billionaires are clueless…just like the other 99.99999% of us.

Cut rates in 2024 = bad

Raise rates in 2024 = bad

Keep rates steady in 2024 = bad

Play with fire, get burnt. Yet “nobody could have seen this coming”, “of no fault of anyone”, yada, yada, yada…rinse and repeat patterns of human behavior throughout history…

Yort

I hope you are not comparing this clown to Wolf. Druckenmiller was on CNBC yesterday. I saw the interview. He was ranting about excessive government deficits and spending and then began proposing massive Defense spending increases, green energy spending increses, more foreign aid etc. He wants to cut SS payments COLAs and Medicare for current and future retirees to pay for this.

Billionaires love low rates and inflation, it just increases their wealth and widens the purchasing power gap between them and us minions beneath them.

Hi. Somehow the falling trajectory (rate of change) of economy and continued fiscal support and 2024 election points to the above events to be 2025 events and not 2024.

Wolf, any thoughts on the timeframe?

Thanks

Occasionally, while reading about the interest rates and RE roller-coaster, I come across some other details that make even some of those seem a bit trivial. I’m not sure if much has been written about or disclosed about what may be much more important, namely, that private equity has made one-fifth of the market effectively invisible over the last 25 years or so.

The article in the October “Atlantic” seems to bring up some facts that are very scary and too big to miss: “The Secretive Industry Devouring the U.S. Economy.”

It’s interesting, IMO, that while the article didn’t mention politics that much, focusing more on the economy, what wasn’t mentioned is that the issue can actually undermine capitalism and democracy.

Well this week is going well!

Corruption being tackled and stocks shooting higher. Let’s get thru the next 2 days and have a great weekend!

From my small statistical field of 1, me, and why I think the hiking cycle has topped.

I am finishing up a six month long lazy bicycle journey (mostly high country camping, not traveling too much).

I have never seen such empty McDonalds dining rooms, everywhere, 6 different McDs on this trip. Caused mostly by the menu price hikes I guess, more than doubled over the last few years and McDs has long catered to the lower end consumer which doesn’t eat there near as much now.

McDy appears ok because in the fastfood bugger segment they don’t have a lot of competition anymore. McDs spent a fortune on remodels and none of their competition has kept up. Further, they are making progress with getting/forcing their customers to place their own orders and use their app which lowers their labor costs.

So, lots of inflation at McDs that the lower end consumer can’t afford as well and is pulling back on.

I also hear from El-erain (and I think Powell) and numerous others that re-financing of loans and higher mortgage rates is and will continue to slow the economy.

So, I think the top is in and the bond and stock markets certainly agreed today.

I do like MacDonald’s, but I always feel like crap after eating there. So I don’t eat there much. Maybe other people feel the same?

I rarely eat at McD. Infact, I rarely eat out as I don’t like eating out :-) .

Although, just for experience, I did eat at a lot of high end restaurant to see what’s the appeal behind them. May be my I don’t have high taste.

I am vegetarian, so happy with simple home made meals.

Yeah, I have to watch the saturated fat and empty calories except when I am riding. Then I can eat anything and lots of it and still lose weight

Garbage in/garbage out.

I agree. Fast food at now sit-down prices. There’s no sticker shock like that of ordering a meal that sure seems to ring up at twice the cost a scant year or two ago. No thanks. I avoid McDonalds now. Sometimes I’ll get a sub sandwich. I can cut that in half and get two meals out of it.

I can see the top being in – only for short term rates.

Long term rates have a long way to climb. Bear steepening.

Future money must be worth more than current money.

Could be. Near term we will rally. Nice trading opportunity up and maybe back down…

panera is offering 20% discounts on their gift cards plus whatever cash back you can get from your credit card company. Also some free drink club.

Me thinks the fast food customer’s salary has not quite caught up with those of the fancy 7 course dinner crowd.

“Oh Pierre the foamed cucumber Pilaf’ was excellent!”

Perhaps this rate hold is good news; the longer it takes to address inflation, the bigger the ultimate financial disaster. Between Scylla and Charybdis; grab the popcorn🍿.

My friend bought a 1,500 SF ranch about 5 years ago for $167K in a suburban, rural part of NW ATL. He wants to burn a fire for the first time, so he had his chimney cleaned / inspected today. Imagine what the guy found? Masonry tiles are “displaced”, & repairs can be had for a low, low price of $8,500.

Services inflation, baby! Probably won’t be burning a fire anytime soon.

He could probably get a pellet stove and new (metal) chimney installed for a fraction of that price.

I paid ~3k for mine last year, and being in norther New England its helped me save on natty gas too.

Just tell him to watch some old this old houses with Nahm and Bahb. He’ll get fixed right up

Wolf – Will the “Tsunami of Debt Issuance” end up superseding the significance of Fed rates as far as real interest rates seen in the market are concerned?

Right now, the government and the Fed are pushing in opposite directions.

The Government is pursuing policies that pour fuel on inflation (huge deficit spending) and at the same time is trying to keep long-term rates from rising, so it’s shifting more to T-bill issuance.

The Fed is trying to remove fuel from the inflation fire (rate hikes and QT), and it’s trying to do so by pushing up long-term yields.

The Treasury’s TBAC announcement today had a big effect today, but over the next few quarters there is still a huge amount of new longer-term debt that has to be absorbed by the market, and yields will have to rise to do that. The Fed will get its higher long-term yields.

“Right now, the government and the Fed are pushing in opposite directions.”

Agreed. Judy Shelton pointed this out in a recent interview. As a result, the Fed can’t get the job done by just raising interest rates. This causes a crowding out of credit to small business owners which is not good for anyone. Nothing good can result from these policies.

Between FED and Govt ( aka Monetary Vs Fiscal Policy ), the Govt always win.

The government has to pay the interest, and it has to come up with the money to redeem the bonds when they mature, nothing is going to change that. If inflation is high, investors refuse to buy that paper unless yields are high. 1970s-1990s. And even after inflation dropped, yields stayed high because investors had gotten pissed off (Bond Vigilantes). It pissed the government off, but it was reality, and it had to deal with it.

Wolf:

The federal government doesn’t pay interest on the few national notes in circulation, some old gold and silver certificates, nor do they pay interest on any coinage in circulation, besides the initial cost of minting.

The trillion dollar coin is a bit of a meme talking point, but the closer we get to a singularity in interest payments on treasury securities, the more likely it is taken seriously. A similar event to dropping the us dollar off of the international gold standard, and also similarly, announced as only a temporary action.

During the 0%-era that started in 2008, the government paid nearly $0 on T-bills for much of that time. So we know how that works. In NIRP countries, investors that had to buy NIRP securities were forced to pay interest in order to lend to the government. So we also know how that works. The result is ultimately asset price inflation and consumer price inflation, and all kinds of other distortions that created the mess we’re in now. I mean, sure, governments can do anything, but do they want to, and can they, live with the consequences?

I personally think that additional rate hikes will not cool down inflation quite much. The rate (5.25-5.50) is already above the inflation (Core PCE:3 .7) and is restrictive.

The problem is the gigantic amount of liquidity circulating around (7.9T), which is fueling the inflation constantly. A determined QT (without any flip flops) that will reduce the FED balance sheet to prepandemic levels (~4T) is the action that will reduce the inflation under 2%, which is urgent because inflation has been running hot for years.

You will know when rates are sufficiently restrictive when the Federal government actually reins in spending. They’re spending at deficit equivalent of 5.7% of GDP, which will all turn to higher prices. Until then inflation will ebb and flow, but it will stay high and so will rates.

Misemeout – agree 100%. Rates & inflation will remain high as long as fiscal policy is to spend spend spend.

5.3% paid on overnight Reverse Repos feels a bit rich. Last I looked it was down to about $1T and falling. Does it make sense to bring it to, or below, the rates on T-Bills to help sop up some of the “Tsunami of Treasury Issuance” especially given the shifts in the Quarterly Refunding documents released today? Any reason that would be a bad idea?

Money market funds are moving cash from RRPs to T-bills at a pretty good pace, which is why RRP balances have plunged. They can go to $0, where they used to be before March 2021. That would mean another $1 trillion in T-bills can get picked up by MM funds from their current RRP balances.

First time watching the whole FOMC. You can hear the same questions being asked, “Dad, are we there, yet?” (Whining) “How much longer? I gotta go pee soon!” JP is one cool cat on a hot tin roof. Btw, his hair is perfect.

Just a note about rich folks saying the “drunken sailor” meme. You do not realize who can lurk here beyond the motley crew of folks trying to get a nut. There are 1% for sure floating around here. Staying power of what Wolf is teaching and preaching.

Over 500,000 people visit this site a month to read about drunken sailors. So that includes all kinds of people.

There are only a few hundred commenters though.

Wolf, appproximately how many people read the comments?

I never read them until wolf said

“The action is in the comments!”

I just had ptsd of trying to read the NYT’s comments. Where 1,000 mad New Yorkers yell at each other.

Swamp Creature,

Good question. I don’t know. My assumption is that many thousands of people a day read at least some of the comments. That is supported by data I got from the ads when I was still running ads in the comments. I know that people who DO read them spend a lot of time reading them.

I also know anecdotally that quite a few people ONLY read the comments.

I don’t have that kind of data-tracking set up on the site to nail this down. Maybe someday I’ll do it. Managing the comments takes up a huge amount of my time; I do it to provide comment readers an interesting and enjoyable experience so that they come back and read more comments, and I HOPE it is worthwhile, but hope is not a strategy.

If there is time, I usually read all of the comments as some are informative, and I enjoy Wolf’s comments on the comments.

Since I found this site I read everything from the title to the last comment.

Every time i have to re-read all the comments because there are always new ones added later.

What I like the most is the different opinions of people, but the most interesting is when the Wolf kicks someone who talks nonsense.

“hope is not a strategy.”

Yep, a famous general wrote a book titled “Hope is not a method”. I need to get a copy of that book.

Always look forward to your thoughts Wolf, thanks for sharing

What’s long and hard on Chairman Powell?

Lags of unknown length.

He talks about this problem at every meeting.

Odd as always, Mr market takes these comments as dovish and up go equities, anything is fodder for a relief rally

Ever since algos took over the market, I don’t put much stock (pun intended) into what happens on a day to day basis.

The market is not driven by investors, but by traders who buy things not intending to hold it for more than a few hours.

Likely not happening a lot in the reducing spending area. America has an addiction to imperialism which is part of the reason aid packages are being rushed through versus doing the business of keeping the lights on. Most of the world has no interest in the US suffering financially as it tends to be contagious so likely some nifty accounting tricks will just push all of this down the road. That is assuming we don’t end up adding trillions more via the Middle East. Post 9/11 wars have cost over 8 trillion dollars thus far. Seems like a lot more coming and of course the interest payments of what we have already.

Howdy Lone Wolf. Am I gonna have to watch Powells speech? Please do not make me do that. Did I miss your analysis on Powell today?

Thanks

With Quantitative Tightening continuing at a steady rate, that is enough to restrain inflation (while not increasing the Fed Funds rate, which is already at a 22 year high).

There is a new word that keeps popping up all over the financial news media. The word is “Clarity”. Right now we are living in the world where it is nearly impossible for the average person to find out what is going on. There is NO clarity! As an example, the TV networks are so full of Bull S$it with shills like Jim Cramer touting stock picks that are going up in order to get people to join the casino. Everything you hear is part of a con game, with the ultimate goal of separating you from your money, and for the benefit of the advertisers. That’s why this site is so valuble, including the comments section. They take time to read but the time is well worth it.

Wolf, in regards to your response to my earlier post:

My effing problem is we shouldn’t have to wait 20 years for income levels to catch up with inflated asset values. I’d rather see some deflation to bring asset prices down to our income levels. I know you’re going to respond telling me it’s not going to take 20 years, but you should get my point.

I get your point.