Bond Bloodbath, Housing Market in Deep-Freeze, as delusions fade.

By Wolf Richter for WOLF STREET.

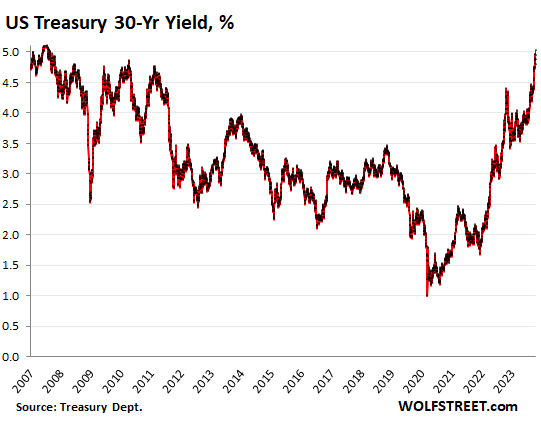

Today it’s the 30-year Treasury yield that pierced the 5% line. It currently trades at 5.02%, the highest since August 2007.

The first of the long-term yields to spike through the 5% line was the unloved 20-year Treasury yield on October 3; it currently trades at 5.25%.

These long-term yields above 5% are an indication that a form of normalcy is gradually being forced upon the bond market by the resurgence of inflation, and by the belated realization that this inflation isn’t just going away on its own somehow. This is a huge regime change, after years of the Fed’s QE and interest rate repression, and all prior assumptions are out the window.

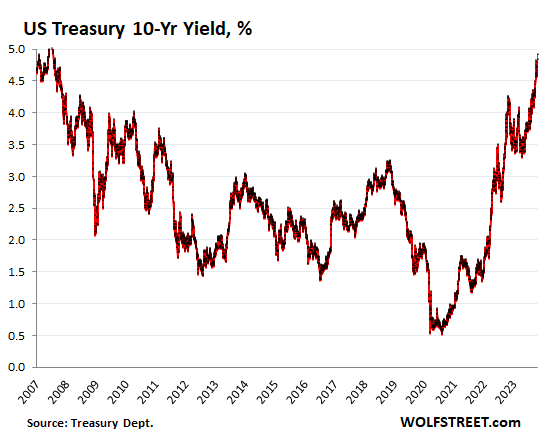

The 10-year yield jumped to 4.92% at the moment, the highest since July 2007, edging within easy reach of the magic 5% line.

Bond market delusions fade.

It seems, the long-term Treasury market is gradually coming out of its delusion about inflation and normalizing interest rates after having spent 18 months believing in the hype about a Fed pivot and rate cuts to something like 0% that would be forced on the Fed by a steep recession, with lots of forever-QE to follow, or whatever.

Instead, consumers are earning lots of money and are spending like drunken sailors. Businesses are spending and investing too. And the government is the biggest drunken sailor of all, further boosting the economy, and throwing more fuel on inflation.

And this deficit-spending by the government has to be funded by piling enormous amounts of Treasury securities on the market that need to find buyers. Yield solves all demand problems by rising until demand emerges. And that’s in part what we’re seeing now.

All of this is happening as the Fed is unloading its balance sheet at record pace, having already shed over $1 trillion in securities in a little over a year.

Bond bloodbath for investors that bought during QE and still hold this stuff.

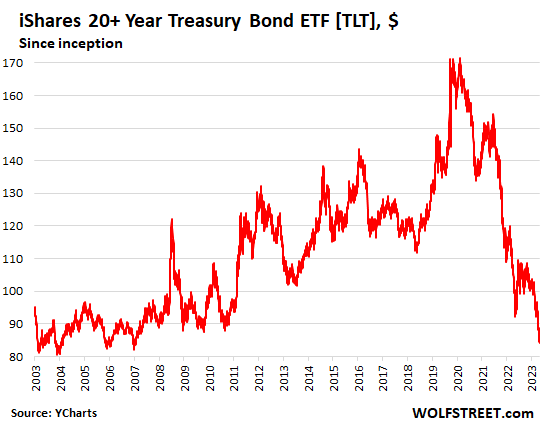

Higher yields mean lower prices. So this return to normalcy has been dishing out huge losses to investors who’d bought long-term bond funds or long-term bonds in the era of QE. Investors that own these way-under-water 30-year bonds outright can choose to hold the bonds to maturity at around 2050, when they will get face value back, and collect 1.5% or 1.8% coupon interest along the way.

Future bond buyers are looking at these juicy yields, and they’re licking their chops, hoping that yields will rise further to hit some magic number, at which point they’ll jump in, forming part of the demand for those bonds. There will always be enough buyers if the yield is high enough. And current bond buyers find those yields juicy enough, and a lot of demand emerges at 5%.

But investors that bought during QE are in a world of hurt. The iShares 20+ Year Treasury Bond ETF [TLT], which focuses on Treasury bonds with a remaining maturity of 20 years or more, fell another 1.6% today at the moment and has plunged by 51% from the peak in August 2020, which had marked the peak of the 40-year bond bull market that had turned into the biggest bond bubble ever (data via YCharts).

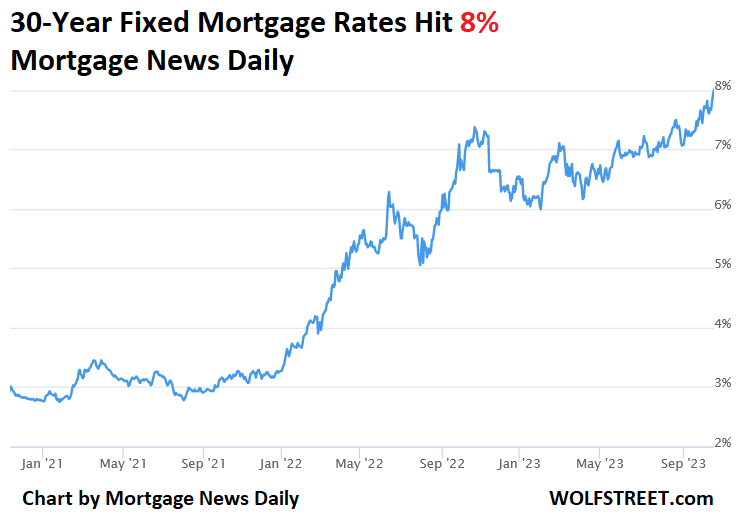

The 8% mortgage rates are here.

The average 30-year fixed mortgage rate kissed 8% today, according to the daily measure by Mortgage News Daily. If mortgage rates stay there to enter the weekly averages at that level, it would be the highest since 2000. Ah, the good old times are coming back?

Housing market in deep freeze.

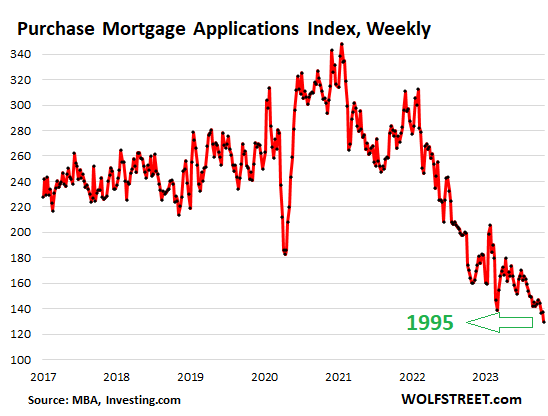

Mortgage applications to purchase a home have been on a steady collapse-track and in the last reporting week slid another 6% from the prior week to hit a new multi-decade low, and are 48% below the same week in 2019, according to data from the Mortgage Bankers Association today.

Mortgage applications to purchase a home are an indication of where home sales volume will be over the next few weeks. And home sales volume has already collapsed, and mortgage applications indicate that it will continue on this trend.

These 8% mortgage rates worked just fine back when prices were a lot lower. But prices have spiked in recent years, as the Fed repressed mortgage rates with QE and 0% short-term rates. And the resulting sky-high prices are impossible to make work with these mortgage rates.

In other words, the Fed-repressed mortgage rates have triggered a huge bout of home price inflation, and the surge in mortgage rates has now started to unwind it.

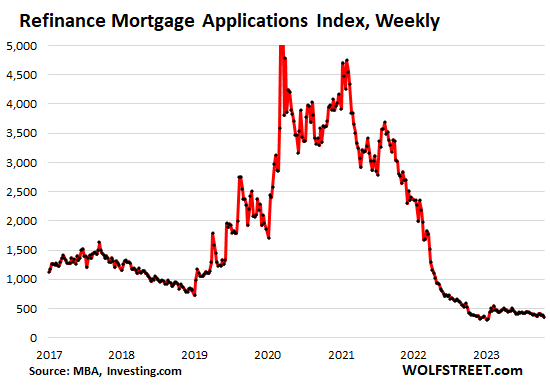

Mortgage applications to refinance a home plunged 10% for the week and were down by 87% from the same week in 2019, according to the MBA.

Most of the refis are cash-out refis, with non-cash-out refis having essentially vanished – they’re down about 97% from the same week in 2019, according to AEI Housing Center.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

THANK YOU, BOND VIGILANTES!!!

The bond markets are awash in US Treasuries while the buyers are drying up resulting in failed or failing auctions which means the prices of the bonds fall and yields (interest rates) rise. Get used to it.

Got it. It’s called, in part, the bind vigilantes doing what they do. And RRP money is being pulled out and put into treasuries.

I despise Bonds but there will come a time (no idea when) when they will become a gold mine of returns. It’s not any time soon that I know …

5% on the 30yr?

I remember 15%

the 30 something financial “experts” are wet behind the ears.

I have a question maybe someone could answer. I’m going to buy 10 yr bond, I will get interest payments every 6 mo for 10 years, will I get my first interest payment immediately? 4 week bill I get interest payment immediately and then get my initial investment returned in 4 weeks. Im believing on the 10 year they ill take my money immediately and I won’t get anything for 6 months. Hope you understand what I’m trying to say, thanks.

You will get interest every 6 months. Your principal is tied up for 10 years or until you sell. Call your broker to be sure. I am only interested in buying T-Bills < 6 months.

A guy I knew once bought 30-year yielding 14% I think (if I remember correctly). I could not even understand what he was talking about. That was around 2004. I think he held it for many years.

Andy

Yep. My father-in-law bought some at around 13% but it was in the early 80s. He also bought non-callable Chrysler bonds at over 13% after they got their govt bailout during that same era.

Your 4 week was a zero coupon bill, meaning the price is discounted initially and there are zero payments. Bonds pay every 6 mo instead.

No, the first interest coupon payment will be in 6 months. This is the case for all notes and bonds between 2 and 30 years. The final interest payment is paid with the principal when the bond matures. T-Bills of one year or less are sold at a discount so you pay less than the par value at purchase and receive the full par value at maturity, the difference being the interest.

Please note that if you are buying the 10-year at auction, the yield may be lower or higher than the interest coupon, in which case you will either pay a slight premium (interest coupon is higher than the yield) or get a slight discount (interest coupon is lower than the yield) to the par value of the bond. For example, if the current coupon is 4.75% and the yield is 4.9%, you will pay a slight discount to the par value representing the difference between the two interest rates.

Thanks for the answer rojo.

I am happy to see interest rates finely getting to a rate of return near the underlying inflation rate. Savers can almost break even after inflation. J Powell is not responsible for this, however. This is just a market reaction to supply and demand. I see interest rates going higher before the economy crashes and burns. Like the commander in Nam once said, and you Vietnam Vets who read this site know and remember:

” Sometimes you have to destroy the village in order to save it”

Just change “village to “economy” and get the true agenda that is underway as we speak, whether anybody likes it or not.

This is what happens after 20 years of irresponsible Federal spending and incompetent Fed Policies.

Look into Ireland’s bankingcartel keeping rates at 0,01% while inflation is (God knows how much really, with these CPLies) at least at 5%.

It’s not just me feeling sorry for myself, this is truly another level of corruption, greed and financial repression.

I have worked diligently at betting US LTB interest rates needed to raise higher. Jerry Powell is a big fat liar. Investors lost 1/2 their money invested in 30 Year Bonds. Your Welcome.

But seriously though, Wolf.

What happens if somehow we get the $1.082T in reverse repo monies down close to zero. This is where a fair amount of the retail demand for treasuries is coming from, correct?

When that dries up, this will put a major damper on demand for treasuries with significant implications for even higher yields?

RRPs are where money market funds stash their cash. They used to stash their cash at banks. RRPs started paying more interest than banks, and had zero risk, so MM funds shifted those funds from banks to RRPs. MM funds were flooded with cash from all sides, including retail investors, as excess liquidity was washing around. And they put some of this cash into RRPs.

RRPs were at $0 before April 2021, and they’ll revert to $0 just fine. They should be $0.

Investors are switching from money market funds to Treasury securities or CDs to lock in the 5.5% yields could be one reason RRPs are falling.

MM funds themselves are putting more of their cash into Treasury securities that now pay more than RRPs.

RRPs represent one aspect of excess liquidity in the system, as a result of QE. And QT is wringing out that excess liquidity.

In September 2022, I said that RRPs could go back to $0 where they’d been. This is what I said:

“In theory, they can drop to near-zero as liquidity is wrung from the system via QT. There is no reason for the Fed to maintain a minimum balance of RRPs. This is demand based, and as other interest rates rise and liquidity vanishes, RRPs could drop to very low levels four years from now. So for our theoretical minimum, let’s say this is near $0.”

So we’re 13 months into this prediction, and there’s still $1.1 trillion left to be wrung out of RRPs.

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

You need to keep your eyes on reserves. They cannot go to $0 and they were never at $0. When they drop too low, there will be problems in the banking system.

IOW, the Fed could easily accelerate QT without causing much turmoil, because any reduction in net Fed purchases of treasuries would be balanced by MM funds pulling money out of their RRPs and buying those treasuries.

This is why, IMO, we haven’t seen as much economic effect from QT as expected. Until RRPs (and bank excess reserves) come down to near zero, it’s just shifting treasury bonds from one Fed ledger to another. What’s the market effect if the Fed redeems a bond, uses the cash to retire a reverse repo (meaning they pay back the cash and get a bond back), while the MM does the reverse by taking that RRP cash they get back and buying a bond?

The Fed has the same net amount of treasuries on its balance sheet (considering the RRP as a negative balance since it’s basically treasuries that have been lent out). Sure, the balance sheet of the Treasury Dept. and the private market changes, but it’s only when the net balance in the Fed changes, that liquidity is actually destroyed (or created). And that only happens when RRPs are zero (or more accurately, when the balance doesn’t change as the Fed buys or redeems bonds).

“This is why, IMO, we haven’t seen as much economic effect from QT”

Long-term Treasury yields are at 5%-plus, mortgage rates at 8%, home sales have collapsed, asset prices are down across the board…. That’s a HUGE economic effect.

Wahoo; 8% rates. And to think posters here mocked me a year or so back when I predicted 20%. People said rates were going to go negative because the government had no other choice, yada yada yada.

But now we are more than a third of the way to 20%,

I’m skeptical of 20%. Way, way, way too many people have centered their finances around their mcmansions and real estate speculation. If mortgages go to 20% housing values will collapse so tremendously that it will cause a nationwide crisis as probably 30% or more of homes will be underwater. Once a slight recession hits and jobs start drying up and these high wages go away, it will just be a feedback loop. The Fed and gov’t will step in and we’ll be right back to square one.

My parents bought their house in 2010-2011 for 300k. They refinanced 240k at 2.9% if I recall correctly. That’s about a 1000 dollar monthly payment on the mortgage alone. During the past year they’ve gotten unsolicited cash offers for 750k. Let’s be generous and say they bought now for 600k @ 8%. That’s now 4400 a month. At 500k with 20% rates that 8300 dollars a month. Even if we jump back to 300k @ 20% that’s 5k a month.

They financed that 300k around 5% which would be 1600 monthly.

If rates went to 20% that same house that cost 300k over a decade ago and has now well doubled in “value,” it would have to go down to 100k dollars to make it the same 1600. Granted inflation is much higher but even if we say income has doubled in 10-15 years, you’re still taking a massive loss as you would need to be at about 200k to make a ~3200 dollar payment.

I can tell you that my parents and every other middle class person they know and I know are banking on their residence being a good 50% of their retirement. AKA “The nest egg.”

The younger generation are getting the shaft anyways. Screw them over a little more. They’re not going to obliterate the middle aged and older to soften the blow to the millennials and zoomers. At least that’s my observation and opinion.

The younger generation needs to stop chasing tech money and learn how to build actual things, like houses.

I’m in the trades and there’s a huge need for youthful labor, especially those with the mentality that they have to put their time in and learn how to work. The scant youth we do get think they are on par with old masters (the everyone gets a trophy mentality is coming home to roost).

Someone has to build new homes. Oh wait, the youth think they can just print them or build them with robots. Good luck!

Who was raising those kids and giving them all trophies?

You’ll be making due with the scab labor you were convinced you needed that in turn drove down wages for everyone.

Dude wants kids to work for him for minimum wage stapling together cardboard houses while they are forced to pay $2500/mo renting their 1bd/1ba poorly built apartment. Nope.

If the job doesn’t have a potential big payout, why work it? Low pay isn’t worth the effort.

Starting pay is in the 20s per hour with no knowledge and no experience. Not exactly poor to be an apprentice and pay goes up pretty quickly when you prove your worth. And if you really pay attention, you gain knowledge of how to build homes, manage people and run a business. We’re building homes that will last 100+ years that are more sturdy than my own 50 year old house.

But don’t worry poor attitudes are pervasive. You’d fit right in.

They are 3D printing homes in Austin Georgetown area in a master planned community . Still requires skilled labor to put everything together!

I just bought a newly built house in Texas this summer. I put a deposit on it when it was framed in May with the roof on. So all summer I went to the house and watched it being finished. Let me tell you that not one contractor who was working on my house had workers that were U.S. citizens. Not one worker spoke a word of English. But everyone worked hard and they loved being here and making the money. This is the New America.

This is not a 3D printed house; this is a conventionally built stick house with sheetrock walls and asphalt shingle roof. The total is 1,479 sq. feet in a brand new area. The cost was slightly less than $250K, landscaping, window blinds, garage door opener, and all appliances included. And it’s energy efficient with double pane windows, lots of insulation, radiant barrier in the attic, and a high SEER A/C system.

This is what young families are buying around here (Houston suburbs) and the builders are the big names (Lennar, Rousch Coleman, Dh Homes, Starlight, etc). And they are building thousands of these houses. According to what I just read earlier, there are 151 builders operating in Texas with several new communities by each.

In this development, the homes range from 1,200 – 2,600 square feet in size on postage stamp sized lots (a mix of one and two story homes). Young families can get into one of these pretty easily and these neighborhoods are kept up pretty nicely. Taxes are a bit high (~2% appraised value) but the HOA fee here is $200 per year (community grounds/open area maintenance). Of course, Texas has no state income tax (still).

I’m an old, tired, widowed retiree with a dog to keep me company, and on my street of about 15 houses, there are three other retired families. The balance is a mix of age groups. A nurse and her husband live next door to me. (I may need help from that nurse someday! LOL)

This is not Austin.

DD your not helping your case… Tradesmen here start at about the same… and without unions, the benefits are junk, pensions don’t exist, and while kids may be lured with promises of higher pay there’s no contracts, just a long line of worn out old guys telling them to wait their turn, take the abuse, and maybe just maybe someday they can be just like them. Trouble is, anyone smart enough to actually learn a trade today is probably also smart enough to look around at the drunk, worn-out, washups all around them and GTFO while they still can.

I’m not saying tradesmen aren’t necessary and valuable, what I am saying is that the economy doesn’t appropriately compensate or respect them in places where the unions are not still strong (pretty much everywhere these days). Don’t get me wrong, I put in almost 5 years commercial fishing, watched my father put in almost 5 decades as a union electrician… My father did REALLY well as a tradesman… but he will be the first to tell you that his job, and benefits, and respectful management DON’T EXIST anymore… even so, every time the union opens the rolls up 20x the number of guys they need drive in from out of state and sleep on the sidewalk over night just to apply.

So I’m sure a kid can get a job swinging a hammer for $40k tomorrow, just as I’m sure it won’t be much more than $50k 5yrs later when he falls off a ladder and they forget his name faster than the insurance company can say “your rates are might go up”… Or, that same kid can take $30k to sleep walk through a job at Chick-fil-A. You need people? Offer that apprentice $20/hr with a contract for $40 in 5yrs, a pension, and benefits he can raise a family on… Workers still exist, but its like my first coworker in high school once told me when I asked him why he was so damn lazy… “As long as they pay me $5/hr I’ll work at a $5/hr rate”… Kids ain’t all that bad… You’re just getting what you paid for.

What does non union home building pay per hour 15-20 per hour, 25, where can u live on that?

Digger,

At least in Illinois union trades don’t build residential, if your not a gc, it’s not a career, no healthcare, pension and unless you live in rural Wyoming , 25 per hour is not a career or.livable wage. That’s why in Ill, immigrant labor dominates housing construction

That’s the prob with every sport, craft, art, job and hobby.

No one wants to become a master. Only become an apprentice with a big megaphone.

I agree and tell the young that the trades are a good place for them to be in their careers. It’s gonna be a long time before laborers, journeymen, and contractors are replaced by robots. Not so much for office workers and electron pushers.

$20/hr is fast food pay in my state.

Someone stated “who can live on $25/hr” ?

My living expenses are about $20k annually (I rent). Going up yes. I live in a medium sized city.

But at $50k annual, one should have $15k to $20k in savings annually (taxes $10k to $15k).

Not bad.

I’m sympathetic towards workers working conditions. But pay ?

At $7.50 yes, $20 to $30 less so.

There undoubtedly is too much risk in many workers jobs, blue collar anyhow.

Where are the robots to assist movers, electricians, construction workers, tree cutters, etc ?

There is no shortage of compsci and AI (including robotics) graduates in the US and many other countries.

Of course if you believe you absolutely have to live in a very expensive city then $50k will leave you with less savings.

@AaRoW Independent tradespeople in northern rural New England definitely don’t fit your description. There are very few large outfits and work is job to job. No one’s getting a contract or promises about what’s going to happen down the line.

I don’t know, maybe Yankees are just tougher than the rest of the native born population. All of my acquaintances all work in various trades or mechanical jobs and no one is doing poorly.

You absolutely have to have an escape route as you get older. Offering an entry level job is the starting point. After a few years most go off on their own or subcontract their labor to bigger companies.

I’m all for unions but they’re not necessary in many places. Sure, if you want to keep up with the Joneses and live the urban/suburban lifestyle you need to make big money and have good benefits. But most of us up here burn our own wood for heat, fix our own cars and houses, grow or hunt a lot of our own food and have other hobbies that make life a lot less stressful. Builders are a lot smarter up here especially with the prices of homes – including a lift rental, staging and cranes for the tough tasks make the job sites a lot safer. The client pays for all those things. This is not people are expendable type of work. Crews are small and work efficiently.

I’m not a carpenter anymore but I have jumped on a few crews when they need a hand. I have taken on more technical things as I have gotten older – lighter lifting & more skilled knowledge equal better pay. I also own a few rental properties and plan on building a few more. I also have a Bachelor’s Degree (from a state school) – and I’m not the only one…one retired tradesman I am friendly with has a degree from MIT, although you would have never known it. I used my degree for one year and I haven’t had a job that needed it in 20+ years since then.

It is not just a job, it’s a stepping stone to a way of life that is far removed from keeping up with everyone else.

@tommy

Yes $20 an hour for the 1 worker the franchisee ok’s to hire.

meanwhile you sit at the drive thru 39 mins while he runs around getting your order ready and tik tokking.

LOL

My goodness. This is blowing up lol. You opened up a can of worms DD.

You want labor? Pay more!

I worked concrete and HVAC repair during my teenage summers ~15 years ago. Paid crap for it. Convinced me to get a good education and never do manual labor. Why break by back so you can sell my labor at 3-4x what you pay for it?

I now make $300k sitting in my pj’s coding, saving 75% of my income, with an endless stream of recruiters knocking at my door. Tech money will always be available as long as you keep using your gadgets and interacting with the Internet

Want the young kids to stop chasing tech money?? STOP using tech tools lol

for living wage:

An actual ”living wage” IMHO MUST be sufficient for one person to live without hunger or freezing or boiling in the heat DEPENDING on location!

Some places lived in last 50 years were at least 50% cheaper than others for the ”basics.”

Last time I was helping to calculate was 8 years ago in NorCal with a niece; it was $10K PER MONTH!!!

She was doing a sales gig and earning a bit more with her hard work….

Other where, including at that time and now, WE, the small family we, were and are living well with approximately $3K. And saving the balances, as almost all can and should do if they can figure out how to differentiate between ”needs” and wants.

@AaRoW, thank you for your counterpoint! Rants like DD’s about those lazy kids these days are growing tiresome and have been tiresome ever since they started being used, oh, say a thousand years ago.

@Digger Dave- why should a kid stop chasing tech money? If a tech company is willing to pay more for a kid’s services, why should he not take that? What makes building houses more worthy of his time than building software? It’s called a free market. If you want that kid’s labor, pay him for it, and pay him more than what others are offering. And realize you’ll also need to compensate him for the fact that his back will be thrown out in about 10 years compared to taking that cush office job .

Your examples reek of survivorship bias. You look at people who’ve survived 30 years in the trades and are doing well and assume *everyone* can survive 30 years and end up doing fine. But that’s not true. You don’t see the guys who get injured in a few years and drop out (either switching to a less physical job, or worse, doomed to a lifetime on a small disability check while battling chronic pain and diminished function). You don’t count the guys who *didn’t* advance to a significantly higher pay in 10 years (either because they weren’t skilled enough, or the union didn’t recruit more members, or maybe the economy crashed right when they had a few kids and needed more work) and so left the industry.

By your logic, every kid should go into tech because everyone who’s worked in Silicon Valley for 20 years is a multi-millionaire. Nevermind the hordes who never made it 20 years thanks to the rampant age discrimination where if you’re 40 and haven’t moved into management, you’re essentially forced out of the field.

I’m not saying trades is an awful choice. But this idea that any kid who chooses something else is lazy, stupid, or making a bad decision is nonsense. It’s usually a perfectly rational decision. And if not enough people are choosing the trades, then either pay more, or make the job more attractive (reduce chances for injury, increase chances of career advancement, make a better work environment, whatever). Every capitalist seems to become a flaming socialist when it comes to paying market rates for labor…

Hey Trucker Guy. There is nothing wrong with skepticism.

This blog site is over flowing with rabid gamblers who are speculating on housing and stocks. They actually seem to believe that if their “investments” go down in price that the FED or government will bail them out.

But the only group I see the FED being worried about are it’s member banks, which also happens to be the cartel that owns the Federal Reserve.

When the banking system under Baby Bush collapsed 2007/08 who did the government bail out? It wasn’t the homeowners. It was the banks that made all those bad loans.

If you are a small investor nobody is coming to bail you out if you get in trouble.

The very first thing the government did when Republic broke the buck was raise FDIC insurance from $100,000 to $250,000.

> If mortgages go to 20% housing values will collapse so tremendously that it will cause a nationwide crisis as probably 30% or more of homes will be underwater

If housing becomes really cheap the nation will collapse.

Just think how messed up your definition of wealth would have to be to think this is actually true.

During the last 20 years everyone got poorer. Young people have no home, no pension, they just exist to work another day.

That has to end, it’s cancer.

While I sort of see where Trucker guy is coming from, and the likely outcome being a Fed put/Gov bailouts if it all imploded.

I think your comment is more pertinent to the real issue with all this QE for decades nonsense.

Your last paragraph has a lot of truth to it, more than most people want to admit. Not trying to be ageist, or allocate blame, but my parents generation really doesn’t want to admit this aspect of the issue, or if they see it, try to brush it under the rug.

My concern is my own kids. If I cannot save enough to retire/buy a house etc then I will become a burden to them and force them into the same broken cycle(seems ~likely either way). This is a large part of what keeps me up at night…

You summed up the deliberate policies of financial repression, fraudulently low interestrates and reckless spending perfectly.

It is cancer and if you wonder about the chaos in the world, that’s partly because of anger, inequality and division.

For 14 years I’ve seen these corrupt monetary policies going from bad to utterly insane.

And now you’re seeing the societal impacts as clear as day.

Banks and corporations have record profits while everyone else is suffering. Then there’s the media with its lies&propaganda, telling you everything’s great.

It’s hard living in a reality that’s completely fraudulent and disfunctional and it’s only going to get worse.

I like your first paragraph a lot. Prob like it a little too much! ;)

20% should do it.

Zero real interest at 20% inflation.

The US needs 20% inflation for 5 years to bring its debt/GDP back into line (assuming zero annual deficits from here).

Or 10% inflation for 10 years with zero further deficits.

Maybe rates will get higher than 20% if government doesn’t stop overspending!

Hit my 8% MBS ETF buy trigger just now, so two more levels to go for for full investment. Need 9%, and then 10% before 2024 elections, cost averaging in heavy each step into housing chaos. Then we can see if the politico bureau of buying voters steps in or not by around mid 2024 before elections. Seeing team Red ahead 4 pts in CNBC poll makes me think team blue is going to have to “fix” the economy by having the Fed hit one of their easy buttons sometime in 2024 (which I think will be long term destructive, short term gain) If not, hello stop loses around 10.5% mortgage rates.

Maybe Wolf can print me a Bondegeddon Loser Mug, I’ll take two dozen…HA

Better than Vegas, right? Could anyone have imagined before ZIRP and QE that shelter, a basic human necessity, would have been turned into a speculators Vegas frenzy? Sad and crazy at the same time…

I’d still be wary of buying duration like that. Rates still have a lot of room to go higher imo…

I agree, duration is a risk so I’m risking the “house money”, as I got lucky buying a ultrashort treasury ETF back in Sept 2020, and sold it last week for 162% gain. I did hold one share, and see it is up now 176% today, so upward it goes, wow!

Also considering going long between 5-5.5% on on the inverse of my treasury short ETF, yet going to be more cautious as I think the Fed would be inclined to buy MBS first. My best guess is when housing folds into total carnage during an election year, the entire economy folds also as we have built our consumer debt construct around people using housing loans as ATM machines. Plus if team red wins, I’m confident the new Fed replacement will be a ZIRP worshiper, if history is any guide.

I’m betting that 10% mortgage rates will catch a lot of attention, as humans love rounded numbers, and that is a big going from 2.5% to 10.0%.

And I’m serious about those mugs, I’d pay $100 for any Bondeggeddon mug with Wolfs Fed cartoon printed on it. A tee-shirt would be even better! Could place a burning housing market in the background with the Fed cartoon head sticking out of a helicopter window, holding a fire hose which is spraying money on the houses on fire. As moor money always fixes everything, right???

And time is running short on those Fed images, as there is a good chance that the Fed gets fired “IF” team red wins in 2024. Better sell some merch now and hedge your bets…

Yort,

Very interesting thoughts. Your 10% mortgage rates are just about where Larry Summers said in early 2022 we would have to get to in order to conquer inflation.

I put MBB in a housing carnage watch list.

This whole economy is built on debt, this kind of greed is what you see in the last stages of an empire.

What does the 1995 arrow mean? 1995 numbers?

For some reason a lot of multimillion dollar homes are being scooped up here in Raleigh. Dunno the story behind that.

Lowest since 1995. I think that’s the beginning of the MBA’s data.

Bonds are cheap now. They’re on sale. everyone should load up the trucks, as the Fed will pivot soon. Actually, go all in on STONKS!

US Treasuries will be getting much cheaper in the days ahead!

True!

Einhal, that is not very nice, some newer readers might actually believe you.

Thank you. Wolf is very good, but I learn so much from the comments.

William Leaked…

As Yield goes up Prices go DOWN.

Therefore, prices get CHEAPER on bonds.

EG, “higher for longer” and the 10, 20, 30 are going down. Check 20 year TLT ETF for an example

Oh, I missed the first comment and saw SoCal Beach Dudes instead…

/Sarcasm Missed :O

My bad

This IS normalizing. When stock traders say “normal” they mean infinite free money for stock traders.

A few articles ago I commented that we’d have 8% mortgages by EOY, but I didn’t think we’d get there that quickly.

Patiently waiting for these rates to bring housing down. There’s no way my house is worth what my city claims it is.

Rates have brought housing down and that’s why transaction volume has tanked, no one wants to buy at these rates or at these prices. It’s just gonna take some time for the marginal sellers.to sell at the market price.

They’ve done our new assessments here.

I’m guessing those will get locked in before housing drops, then it’ll be several years before another mass assessment is done to give time for values to creep back up.

All good news but the home prices are not getting any break.

IN Southern CA, the asking prices and thus selling prices are still crazy high despite these high rates.

High prices with high rates is a double whammy for buyers.

recently, a colleague was basting how he has amassed 8 rentals though out USA in last 2 year.

We need some serious price correction if the prices are to be affordable.

Was i a new subdivision, 120 miles inland from So Cal beaches. The homes. The new homes are priced at 580K plus and most of the homes are sold out. The median income in this area is $45K.

Yup, there’s a certain amount of insanity, stupidity, FOMOism in SoCal that’s probably unmatched by most regions of the country…If you talk to someone from Irvine or South OC, they will probably tell you their house are made of gold if not better….. The price decline is not part of their vocab..sadly the market is still proving them right for the most part…

Well, like Wolf said the other day, real estate is regional.

I see a lot of softness in the market otherwise builders in socal won’t be offering 5.75 mortgage rate locked for 3p years.

The prices would go down for sure ..slowly but surely.

Not in Irvine, Ladera Ranch, Santa Monica or Culver City..them houses are made of gold…it will never go down…as folks around here like to believe :)

Has he seen the movie “The Big Short?” He’s the stripper who bought 3 houses, just so he knows.

Lol

The company I work at have American clients. We are the ones who help with advertising their products.

We’re busy in spite of the TikTok trend of long lines for job fairs. Lots of OT and so much work.

The American economy seems like it’s still booming for some reason. The Canadian companies tend to lay off staff in the thousands these days.

American economy is indeed booming looking at all the metrics.

People are still spending like drunken sailor along with Government.

Restaurants are packed, concert tickets are all time high with sold out, hotels/strs are full, airline tickets are high and crowded.

People are not scaling back on their spending YET.

The U.S. is booming because the federal government is borrowing and spending $2 trillion per year.

To be fair the government did save a ton on Medicare.

Airline tickets appear to be on a downward trend and are much cheaper than last year.

Has travel lost it’s Zeal?

Warren G. Harding,

Historically, September and February are the best months to buy an airline ticket (and Tuesday is the best day of the week).

I have planned a trip back to the USA for mid-March to mid-April next year.

I bought my round trip ticket on September 12th.

It helps that I have a CC that is running a promotion with 18 months no interest to pay it off.

IMHO, older folks have realised that health can go down hill very fast, and it’s better to run a bit short if you happen to make it to 80 with everything intact, then to be wishing you’d taken those opportunities while you still could. Looking at my parents, once you’re into your late 60s it’s crazy to put something you want to do off for a year for no good reason, when you’re still in good health.

For millennial, I think we’ve just realised that we spent 20 years grinding away believing things would get better and the deal of home ownership and financial stability would come back. It’s not coming back in our working lives. So millennial are just doing whatever they can now to try to build a life that doesn’t involved being a wage slave forever.

I can’t speak for the following generations. I think they probably see that the economic model is so bad that it’s not worth beating their head against a brick wall like the millennials did for 20 years. All power to them – I hope they just go live life, and keep opportunities open for us when we’re old so we can keep working in some capacity – I and most of the millennials I know have no expectation that the young will fund our retirement.

Wait, why would long lines be a tik Tok trend?

I can see eating 12 hamburgers or saran wrapping things. But forming a long line?

As Wolf says “return to normalcy”. Over the past 50 years the average Fed Funds Rate is about 5% and the average 30 year mortgage rate is a little over 7%, as I have been saying for too long. If you take out the ZIRP years, they are both much higher. Anyway, these averages are not too different from today’s. Housing is frozen not so much because of high mortgage rates, but because of ridiculously high prices, spawned by ZIRP. These prices will fall, but it is a slow process, like trying to turn the Titanic.

The market is frozen due to a combination of both, interest rates on loans and property prices.

Something has to give to get going again.

Why do things have to get going? 🤔

“These prices will fall, but it is a slow process, like trying to turn the Titanic.”

I wouldn’t be so sure that prices will fall much farther from here, maybe…maybe not. It’s reasonable that prices could also remain the same +/-10% for a long time. Long enough for the rest of inflation to catch up.

It’s reasonable that many people who own a house with a 2.x% mortgage will choose to rent their house out rather than sell it.

Yeah, well where are they going to live while renting their house? You homeowners crack me up sometimes.

You don’t always have to sell a house to buy a house. Use the proceeds from the overpriced rent you are charging to offset the overpriced mortgage you are paying on your new house. Sometimes you have to take a little risk to build wealth. It is a mistake to not try to take advantage of the cheap debt you have locked in.

I think he’s saying that they’ll buy another house but not sell their original one. The problem with that is there simply isn’t enough rental demand for people to all cover their costs that way. Not to mention being a landlord sucks.

I hear that a lot, and I don’t doubt that many people do exactly that. But is there Really no danger the lenders won’t start stepping in and stopping it? I’m damn sure it’s a violation of the mortgage terms in most cases, and isn’t somebody somewhere along the chain losing money from these violations?

Most mortgages require you to move in within 60 days and live there at least 12 months. After meeting those requirements, you can rent the house. Some mortgages may have additional stipulations, so your mileage may vary.

I did this during the great recession. I purchased another home, but did not want to sell my current home for a loss. I rented it for about three years until I was approaching capital gains. I was able to sell it to the renter without too much hassle. I used a property manager during the rental period and she took 10% of the rental income. It was really not a hassle at all. I was able to sell the property for a small profit.

“It’s reasonable that many people who own a house with a 2.x% mortgage will choose to rent their house out rather than sell it.”

No thanks, I’ll skip all that hassle and simply live in my home.

Utter nonsense. If buyers can’t buy, sellers can’t sell. Prices will fall, and they will fall a lot. Hasn’t quite started yet since there’s still money sloshing around, but it will.

It’s pretty simple: if people do not have the income to make monthly mortgage, property tax, insurance, hoa (?), fees, escrow payments, they ain’t buying houses.

Wolf’s charts in this post are pretty stunning. Purchase mortgage applications are on a 70-degree downward slope.

Home builders are shrewd operators and will cut back production at the first whiff of sales falling off, home shortages or not. And since homebuilding is a leading economic indicator, when those builders cut-back or shutter their operations, much of the economy shuts down with it. So, not enough income? no loan; no job, no nothing.

They do not ring a bell at the top. These charts are the next best thing.

You’d think that with mortgage rates at 8%+, investors would be smart enough to realize that if they don’t sell now, they could be stuck holding a literally illiquid asset a year from now if rates keep rising. I guess I just give too much credit to them understanding how their “asset” works.

Chs

Prices in most markets will fall by at least 20 percent from here and it’ll take 4 years

The Fed is not going to let inflation run that hot for that long. If there’s one goal they’re committed to, it’s getting inflation under control, and they’ve publicly stated that their target rate is 2-3% or less.

Even the politicians are in agreement about this. People don’t understand central banking economic theory, but they do see that the price of milk is going up and they get hopping mad about it.

IMHO, houses are easily 50% overpriced compared to people’s salaries. There’s no way the Fed will allow inflation to eat up that difference within the next few years.

Hopefully, the Fed pivots soon and drops mortgage rates back down to 2.8%, because people have a God-given right for their house value to go up by 10% a year.

Only a pinko commie would suggest otherwise.

haha…I am sure NAR and other housing industries are banking on this…hence why they sent a letter to Pow Pow urging him to look at interest rates and the “damage” it can do to the economy…

It’s funny how much these clowns are crying over spilled milk when the market is still price sky high in every metric…don’t cry about spilled milk when it hasn’t spilled yet…

Where was their letter when home prices spiked 20-30% in a matter of a year or two and crushed affordability even further for future potential buyers?

Yep, because America is now full of people who don’t care about anyone else as long as they have theirs, and those people are disproportionately in positions of influence.

“People who don’t care about anyone else as long as they have theirs.” That’s the entire country. It’s every man for himself and God against all.

Escierto, it wasn’t always this way.

Housing market deep freeze? Does it mean it will turn into an iceberg soon and sink the Titanic (aka slow turning housing market?) Sure doesn’t feel like that in SoCal…some people are still buying at nosebleed pricing sadly..

Oh well, small silver lining, at least parking money in treasury earn a decent return..

“Tops” always feel like they will last forever, especially to dopes.

The challenge faced by the U.S. real estate market today is that homeowners are not erecting for-sale signs on their front lawns. So, prices continue to move higher.

As long as inflation remains elevated, which is guaranteed because of high levels of govt spending on wars and domestic programs, home prices will continue to grind higher.

The national median price has been grinding lower.

Today, CAR reported LA County just hit an all time high. OC is either at or close to an all time high.

Yes, there was one major county in all of California that hit an all-time high, LA.

San Diego prices fell, Orange county prices were flat and below the peak of April 2022.

Overall median price in Southern California fell and was 3% below the peak in May 2022.

The median price in the SF Bay Area was 13% below the peak, San Francisco was 23% below the peak.

In all of California, the median price fell and was 6% below the peak in May 2022.

Glad you picked the one major county where prices hit an all-time high to make some kind of point, LOL

Here is all of California. Like I said, grinding lower:

LOL

As long as inflation remains elevated, which is guaranteed because of high levels of govt spending on wars and domestic programs, home prices will continue to grind lower because interest rates will remain high, thus preventing buyers from being able to purchase homes until the prices drop substantially.

There, Jim, I fixed that for you.

I can only speak for my small town in rural New England because I pay zero attention to pricing beyond its borders (besides what gets posted hear for national or city data). Inventory here is way way down but the people who are competing for this inventory are almost exclusively very wealthy (and not in need of a mortgages) or compensated very well, because the working class population gave up some time ago. In fact the working class largely gave up around 2018-2019 in this town, so this trend predates the covid stimulus bonanza.

And thus prices are still going higher and higher. The local only data confirms this. The pool of well-offs buyers is competing extra hard for access and it is absolutely insane.

One of my rental properties is in a HOA and the HOA has a list of every sales price for nearly 20 years. The prices of these homes have never eased off and are still setting new records as they sell, each new listing with a bolder and bolder asking price (and almost immediately snapped up).

I understand the metrics of median house prices and people being house-locked by low mortgage rates and unavailability of suitable listings, but if the Fed is trying hard, some slices of society are just not feeling it so the news on the ground in my locale is that they’re going to have to try much harder if they want to make headway in deflating asset prices.

Your mileage may vary and nothing I say extrapolates beyond this small town’s borders.

The discount will come to you too, you just need patience.

This market is slow and develops over years, not months.

So here’s a real-life example of a property I owned in Northern VA (about 10 miles from Washington DC) and how prices can rocket up and stagnate:

Purchased in August 1996 for $82k (and an 8% adjustable mortgage)

Sold in June 2004 for $260k (by me)

Sold again in June 2021 for $320k (near the last peak)

So in about 7 years, a 200%+ gain (1996 to 2004)

And in another 17 years, a 23% gain (2004 to 2021).

Inflation adjusted, the 320K in 2021 was worth 223k in 2004. So a net loss over 17 years in inflations adjusted terms.

What’s the point? That real estate can accelerate and then go flat or drop for a long period of time. And that these shifts can take years (as Wolf eloquently reminds us: Real Estate isn’t Crypto).

And that different areas move at different rates. So just because an area hasn’t seemingly dropped yet doesn’t mean it will not.

Where we are now is where we always are in any real-estate cycle: price run-up, then a frenzy and FOMO, then a flattening in prices with a meaningful drop in sales volume , and then (and ONLY then) a decline in prices.

Same as it ever was.

I love the ” mortgage rates and high prices don’t matter cause rich people don’t care,” argument. I heard the same thing from a friend of mine who sold boats in the Spring of 2001. He said Rich people always had money and would pay whatever for a boat because money did not matter when it came to toys.

I also heard it from the manager of a high end RV factory ($700,000 up) I sold parts to in 2007. He said Rich people bought these expensive RV’s with all of their sacks of cash and it did not matter if interest rates went up, the economy crashed or housing went bust because they would buy these RV’s because they “wanted them”. A few months later the sales of these RV’s ( and all others) dropped to nothing and the company was bankrupt.

People love the idea of rich people being stupid and paying to much for what they are selling. But it never works out that way in the end.

Yep it just takes a few months for greed to turn into panics, and bankruptcies soar. Manias go so high when they reverse its a waterfall straight down, and even the rich get washed. Suggestion if you’re rich. Place a beautiful Tulip on your nightstand by your bed. So beautiful. And ponder, someone traded their mansion for one of these.

@Digger Dave Does your HOA really show prices going up “every single year” from 2004 to 2014? I have not looked at every submarket in the US but I have not seen or heard or single submarket that was up “every single year” before during and after the 2008 financial crisis.

@Hubberts Curve you are correct that “rich people are not stupid”. It just seems like it when people see them “overpaying” for things (like $3K to take their granddaughters to see Taylor Swift), but once they don’t “need” to overpay few rich people will do it. I know many people that have helped their kids buy “overpriced” ~$3mm “starter homes” on the SF Peninsula since they want the kids and grandkids close “now” not after prices drop down the road (I don’t know a single rich person that does not think prices are headed down)…

The first HOA sale in this complex was in 2006 after the developer went bankrupt and the local market was flooded with these units. They have steadily risen since. There have been condition adjustments and a few foreclosures but there have no downward trends yet.

This local market did decline slightly during 2008-2012 but it never spiked as high pre-2007 as certain markets did.

This is not a region. This is one small town with a 4-figure population an hour away from any sizeable community. It used to be manufacturing and farming center now it’s just a giant retirement home.

I dont think the rich person is stupid (necessarily) to pay the $3k. I do wonder if the economic system is somewhat fundamentally flawed.

What did this person do to garner such wealth… did he (she) provide anyone besides himself (herself) any short or long term societal good ?

Some people are good teachers, good mechanics, inventors, janitors, plumbers, programmers, etc. They deserve to be nicely compensated.

But some people in the financial world… I believe… make large sums of money essentially only benefitting themselves. I dont consider my investing in mutual funds as benefitting society at large because it helps fund the companies. I feel that is a weak argument.

I feel pretty much the same way with respect to investors in real estate although I acknowledge if the investor maintains the rentals well and charges reasonably then okay.

Unfortunately that is often not the case with apartments. I base this on comments I have read with respect to apartments in the city I live.

It’s not an argument, it’s a statement of fact for one single small town. So the mania is at least still alive here… for now…but past performance does not predict future success.

Well said. The fact that people are cash buyers doesn’t mean they want to overpay with their cash for houses.

Anyone buying today is either willing to risk overpaying because they want what they want when they want it or they sincerely believe prices are going up.

But that’s what makes a market. People have different ideas of value, and govern their actions accordingly.

And there’s “overpay” and then there’s OVERPAY!!!!

Last house I bought I knowingly overpaid by about 10% of what I thought the fair price was (but 20% below the original asking price). So why did I overpay?

1) Spouse and I looked at probably 100 houses – each worse than the last

2) Had looked for 12+ months

3) Not getting any younger

4) House was better than anything we had seen and we were tired of looking

Had I pushed the seller, they probably wouldn’t have budged and I’d be looking at another 100 houses. And boy, my experience isn’t anything like on HGTV – I’ve seen more crappy, beat to death houses than I can remember (“Just like Leave it to Beaver!!” – IOW no work done since Eisenhower was president)

So there’s overpay to close the deal and get on with life (and knowing that you’re doing it) vs. OVERPAYING!! where the asking is double what you think it’s worth.

Fast Eddie, exactly. I’m 36. Many of my peers are not even bothering to look right now, and are continuing to rent, because they don’t want to pay $900k for a house they think can easily be worth $500k in a year or two. If it was only a matter of paying $550k, most of them probably wouldn’t be that concerned about it.

Geezus — half million dollar homes are now the standard acceptable price for first time home buyers?

I was 37 when I bought my first home in Austin 9 years ago. I made a solid 6 figure salary and paid $400K with a 15% down payment from my own cash savings and I still felt spooked by that price. I was really punching above my weight class, and I knew it, but I capitulated for probably the same reasons any other Desperate Dan might — including no longer wanting to be a source of passive income for the avaricious, work-shy twat-wad from whom I leased my little Crestview hovel.

I guess the perception of value has really been skewed by a decade of bubbalicious pricing.

I’ve been thinking about why the Boston metro market (and NE in general) has had such sticky prices.

I wonder if part of it is the lack of buildable land – most areas within commuting distance of Boston have already been developed because its such an old city.

But, I guess that logic wouldn’t apply to your rural town.

People live in their own echo chamber.

Everyone think that their city/locality is special and prices wont go down and have their own good reasons.

Some people thinks that their city has awesome weather that home prices can’t go down ever, some think that their city has many rich people who can just keep buying and buying paying insane prices.

Jon,

I *want* prices to fall in my area, and am disappointed that they have not fallen more.

My city says my 900sqft ranch on a 5th of an acre is worth almost 400k. There’s no way my tiny little property is worth that much. Ridiculous.

Yes, not only are they built out, but they are poorly built out if they were populated in the last 40 years. The older suburbs of Boston are compact and semi-urban. The exurbs have oversized lots and the best attempt that developers could do to jam in midwestern, southern and western sprawl in old agrarian communities (which are all now traffic nightmares). I hope the wages make up for the stuck in your car all day traffic of living in greater Boston. I’m staying in the sticks (signed, former M@asshole).

There’s plenty of land available where I live now but labor is the sticking point for new builds. It is absent and all housing that hits the market goes right to the wealthy. It’s not sustainable. And there’s no immigrant labor or low priced labor available plus the majority of the youth of the area want nothing to do with manual labor.

What you’re describing basically is the same way that Minneapolis area developed as well. Actually the analogy with Boston works on a number of levels, cultural too. Minneapolis is basically Boston West. Because of the way it developed, traffic was nightmarish even over a decade ago, and it’s far worse now. I moved to the sticks, and I’ve no desire to go back. It is one thing if you live in a city like Wolf does, where you can walk everywhere and not own a car. But that doesn’t work as well in flyover.

CHS,

I live in Minneapolis one mile west of the Mississippi river and one mile south of East Lake Street. To me, it’s the best location. From an affordability metric I could move/buy/build pretty much anywhere I wanted.

Downtown Minneapolis and St Paul are both just a few miles away, with a light-rail station a walking distance from my home. A nice single family neighborhood surrounds me. And what I do nearly everyday, ride my bicycle (wintertime also), is fantastic with the river to ride along and with many miles of good quality cycle-friendly roadway to cruise along.

Of course, there are issues with living in a city. But it feels like a small town in the neighborhood pocket where I live. Yet, the big city amenities like top-end and diverse restaurants, sports, theatre and music are right there.

“Your mileage may vary.”

Yeah, your mileage may vary.

Damn, there was another mob out on the streets blocking traffic and terrorizing the citizens yesterday afternoon just southwest of downtown Minneapolis.

One of these individuals, Zach Metzger, is on the ballot running for a seat on the City Council. The question is, will the Minneapolis Police Department go after him for his actions recorded and posted on X (Twitter), or will he be given a free pass? We shall see. . .

And nominated for the understatement of the week written by me:

“Of course, there are issues with living in a city.”

I reckon so.

MM,

I think the lack of open land is

probably a factor, but I think a lot

of it is that during the last housing

crash, the Boston market only had

prices drop by 15% or so over four

years. In the middle of an epic

nation-wide housing bubble

imploding, people around here

were about as well off buying at

the very top, and selling at the

very bottom than paying four years

of rent.

And so the Case-Schiller prices are

at all time highs.

J

Hm, it just occurred to me that nearly

all new construction you see around

in the near-Boston area is someone

tearing down a house and then putting

up a multistory condo building. This

doesn’t seem likely to help lower the

prices of the remaining houses, for

those that would like a freestanding

building.

J

J

It adds supply of condos, and thereby it adds supply of housing. Lots of people prefer to live in condos. A 1,500 sf condo is a lot easier to take care of than a 1,500 sf house. And condos come with lots of amenities and conveniences, such as a way to safely receive packages when you’re at work.

Wolf,

And it also means that the supply

of houses is shrinking at maybe

two or three percent every year.

Houses, of course, being the thing

measured by Case Schiller, and

the thing I have some interest in

having one. I’ve seen a house that

I had some interest in, get bought,

stripped down to studs, (I can’t

recall if they jacked it up, and

poured a new foundation/basement),

built back all “luxury”-like, sold for

double the previous price, and …

The new buyers razed it and built

a 6-9 unit condo building. A lot of

houses I’ve looked at have a second

MLS listing as a lot/land. I’ve seen at

least two, that were only listed as a

lot, even though there was a

occupied house on the lot.

J

This is what I see in NH. A generation started their careers during/after the financial crisis, was saddled with student debt and watched as housing marched up 25-30k a year before covid and then 75k a year during. Theyre in their mid 30s and are sick of dumping 25 grand a year into the rent hole with guaranteed 5-7% rent hikes since forever. If they finally go the job that can afford it they will buy the expensive house, because theyve only ever known it getting worse. “Just wait it out till your 40 the prices will go down” is not going to resonate with them. Meanwhile the humping and dog barking continues unabated in their neighboring units. That 4k mortgage looks sweeter every passing second.

Yea no way am I going to be screwed by the recession, then Covid, and then again by buying at the top of a market. I’m sure plenty will make that mistake as did boomers and xers in 2004-2007. I would rather burn 2200 in rent than 4000+ in mortgage with the equity lowered back to zero every year.

100%

There will always be bag holders. I was a bag holder in 2009 and I won’t make that mistake again. Rents in my city, which is one of the fastest growing in the US, are going down right now. I’m taking advantage.

I see the same price pattern, in nicer not to far away suburbs, from coast to coast. These suburbs are all near major US cities. No one wants to live in the city core any longer. People are paying up to live in the suburbs.

“No one wants to live in the city core any longer”; it’s too crowded, LOL

“Nobody goes there anymore. It’s too crowded.” – Yogi Berra.

The problem with the real estate shills is that their idiotic narratives aren’t even consistent with each other.

“Florida and Georgia are booming because everyone is fleeing New York.”

“Manhattan’s housing prices reached a record because NYC is booming and everyone wants to live there again.”

Which is it?

Easy answer. Work From Home is ending so people that kept their NY job while moving to Florida and Georgia are now returning to NY if they want to keep their job. This same pattern is playing out everywhere. That is the story.

High degree of flexibility is require to do the mental gymnastic needed to be a housing shills…I bet you SoCalJim can do Van Damm split like nobody’s business..

What do the non millionaire classes do in these wealthy pocket towns? Who works in the grocery stores, delivers your pizzas, snakes your clogged drains, collects your garbage and the bazillion other things that get done on a daily basis by the ordinary non-wealthy? Sooner or later these people move out of town. Then what’s left? Millionaires with piles of garbage in their lawn, clogged drains and a 5 year supply of Digiornos?

Doesn’t seem sustainable to me.

Some of the cities on the west coast of FL are currently addressing this very real issue by building affordable housing that will be owned privately and publicly and be committed to providing worker level rents and purchases.

Some are also committing to provide down payment help up to the $75K level which should be sufficient IMO; not sure of the terms everywhere, but some are grants.

Seems a lot of this subsidized housing is intended for first responder folks, teachers, and other GUVMINT employees who clearly cannot afford current rents or purchases at their present wages.

Sounds strangely socialist to me. In Florida? Surely there’s a law against this…or there will be soon.

Clearly this is an invented use of the term socialism! Ironic the US has had several socialist movements but education on the topic must be kept to the minimum! The red scare must continue! Real irony is most Americans are for it as long as you don’t use the word. All the collective bargaining seeking a piece of the pie the wealthy are gorging on is the early stages of labor recognizing their collective power.

I have a good friend in Venice Beach , who works as a part time real estate broker . Last week I asked her how the rising mortgage market has affected her sales . She said that none of her clients have used a mortgage since

2017.

Jcohn

It is interesting to know how many clients your acquaintance had during this period.

I mean, if they were under 10 for example, that’s not the main indicator.

@Brandon with the average home price over $1mm in most areas around Lake Tahoe “most” (over half) the “workers” are now living out of state in the Reno, NV area, Jackson, WY is the same with most “workers” coming from Driggs, ID out state. Vail and Aspen gets most workers from “in” state but they are driving from farther and farther away (now that the formerly “working class” cities around them are “million dollar” cities they have to drive even farther and are charging more).

100%. Zillow Home Price Index in Manchester, NH is now up 7.4% YOY. It just keeps going up. A friend of mine is a realtor in that area. It’s lots and lots and lots of 25-30 year-olds who are buying up the place (with help from mom & dad).

“A friend of mine”…always a sure presage to a slanted comment bereft of hard data/data analysis.

bul,

I spent 5 months working in the Manchester area in ~1986. The town was already becoming gentrified and was very appealing to Bostonians, who were buying there to escape the MA taxes, in spite of houses still being affordable in Boston. At the time, I had a relative living in Boston, in a city center 1BR duplex, which rented for under $200 a month, really cheap to a NYer.

The MA taxes are still what is supporting the NH economy and real estate market.

“The MA taxes are still what is supporting the NH economy and real estate market.”

Petunia – keep in mind, NH property taxes are much higher per sqft than in MA. This is the “cost” to not having income/sales tax.

There’s no free lunch.

Not sure I understand. I posted “Zillow Home Price Index in Manchester, NH is now up 7.4% YOY”. That’s reality, and another reality is that Millennials and Gen Z are the largest share of homebuyers right now, especially in that Southern NH market that’s very close to Boston.

The Fed is driving the 30 year up…and intentionally. Not as much for inflation but to hurt Russia and China.

The stuff people come up with is just funny.

An emoji says a thousand words???: 🥳

Yield curve has to flatten more. Its been inverted far too long. Main St. hating it though. R2K getting crushed.

This is an interesting point. Yields and interests have seen the highest points since several decades, but I think (most) investors do not care. S&P is up 13% YTD, NASDAQ is up 29% YTD, bitcoin is up 70% YTD, residential is up 6% YTD.

Either the economy is astonishingly fueled by reckless debt or there is a ginormous amount of liquidity revolving around thanks to the gargantuan money printing by FED or (most) investors strongly believe that FED will start printing again in 2024. Whatever the reason is, it seems that the investors seem like they became immune to rates and yields. May be because they saw that in March 2023, the FED showed its hand, which implied that the FED cannot let the even slightest risk of market collapse and is ready to recklessly print immediately (again). So, the investors are heavily emboldened.

“Whatever the reason is, it seems that the investors seem like they became immune to rates and yields.”

It may be because interest rates are closer to historically normal. Rates will likely need to increase significantly more to have a chilling effect.

Maybe. But I think differently. It used to be said the markets would not bear against 3%, then 4%, now it is 5%. Two years ago, nobody could believe FED policy rates could go above 3%.

How much the markets can hold more? I don’t know. With such a massive liquidity, may be the markets can even bear two digit yields.

Jason B,

“S&P is up 13% YTD, NASDAQ is up 29% YTD, bitcoin is up 70% YTD, residential is up 6% YTD.”

🤣 ❤

S&P is down 10.5% from Jan 3, 2022; NASDAQ is down 17.9% from Nov 2021; bitcoin is down 58% from Nov 2021, residential is down 1.6% from June 2022.

How easy it is to forget already?

Shifting baseline syndrome. It’s a thing.

Thanks for the comment Wolf.

You are right. They are lower when compared to the peak levels. But those peak levels were already exorbitant. The decrease from the peaks are very minor and they are still exorbitant, when considering the rate hikes. The current rates where unimaginable in Jan 2022. The asset price decline is very very minor when comparing the policy rate to now and then.

And starting in 2023 Q1 (I think due to money printing in March) most of the investors seem really in risk taking mode at the moment.

So, a lot of people who bought homes during the pandemic secured home loans for 3% or less. Why would these people sell a home with such a low interest rate just to buy a house at 8% – these people are locked into their homes, because of the low interest rates they secured over the past 4 years or so.

My first home, which I owned solely some 34 years ago, had a fixed interest rate of 10.5% on a 30 year loan. At the time, my mortgage broker told me it was a good rate with a good company. My retirement home, which I bought 6 years ago was financed at 3.99% for 15 years. I paid that loan off this past June, since I might be looking to cut back to working part-time in the near future. I won’t be eligible for SS benefits until the end of 2024, when I reach FRA. However, even a healthy SS check will not cover all my expenses, but it’ll greatly help. I’m a very lucky baby boomer and the great maker has been good to me. Time to sit on the backyard deck and watch the flowers bloom. Cheers.

Correct, they won’t buy a new house at 8%. So as Wolf has written, that means that they’re out of the market as a potential seller AND as a potential buyer.

I have joined a sports betting site, and the cash pot has grown 20% in the last year along. People are betting their last nickel to try to win the $1,000 pot. I wonder if this is a sign of desperation or just people have money to burn. I do it for the fun of it. I went around collecting the $10 entry fee, and found 50% of American’s don’t have the $10 to enter the pool. One dude, I felt sorry for him and bought him the ticket for the $10 entry fee. I hope he wins. I won last year and cashed in $800 right before Christmas.

How I wish Canadians had the ability to lock in their Mortgage interest rate for more than 10 years! Imaging having a 30 year rate locked in at 2%! There were some lucky people in the US who got around that rate not too long ago.

The USA mortgage market is distorted by government involvement. Your wish would require the Canadian government to also offer government backed security guarantees for mortgage debt.

As a Canadian mortgage borrower, that sounds great. As a Canadian taxpayer, do you still think it’s so great for you to subsidize borrowers?

Billions more for Israel……translated……billions more into the US economy to purchase stuff and then shipped to Israel

Just what we need….more stimulus

We are now way past the generation x peak, with the millennials now coming on strong, so anybody waiting for the pivot is going to be waiting and waiting and waiting….not to say we will not have a recession some day with relatively lower rates. Even a move to 3.5% on the ff rate will be a powerful stimulus.

A new first……in times of trouble, like Hamas, traditionally people buy treasuries……this time they are somewhat avoiding treasuries and buying gold. At least on the margin. Of course with the supply of treasuries being out the wazoo it’s more about having a truckload bring dumped on our front lawn.

Buying gold? Come on, are you being sarcastic? No one buys gold anymore.

Howdy Folks. They taught the youngins not to save $$$. I can promise you how to find some real FREEDOM. Become debt free as quick as you can.

Yes my wife and I have a favourite saying. We don’t have F. U money – we just live like we do. Mostly because we live in Rural Canada and have no debt.

Top Gnome, Same here except in the US. Fantastic rural home, 10 acres, woods, and a lake….. and NO DEBT. Debt Free Bubba said it,…..freedom is no debt. Daily stress is lowed to minimum too.

MW: Wall Street warns of ‘Black Monday’ repeat just in time for 36th anniversary!!!

The crash in 1987 was caused by negative gamma .

Today negative gamma is embedded within the structure of every ETF through the creation /destruction process . Will it happen again .

You bet .

When -let’s take a few circumstances

Closing of the Gulf of Hormuz

A naval encounter involving sinking of a ship between China /US

Russia taking over Odessa

8% mortgages are a return to historic normal, so 5.5% 30 year treasuries should be a return to normal. What next? The Treasury needs to refill their chequing account soon; old bonds need to be rolled over. Deficits of $1T+ need to be financed. China does not want to buy. Is the rate high enough for someone else to absorb them? This is the first wave of inflation. There will be more. Debt must be inflated away.

The US federal government deficit is now more than $2 trillion a year and is continuing to rise.

My theory is much higher long term yields and that we are paying 2 trillion a year in just interest payments within the next couple years.

This is a snowball effect happening. The higher yields go, the larger the deficit and the more concern the market has that the government will never bring it under control, so yields move even higher, based on lack of demand.

Do we have a tipping point, like the UK, where the government must step in and make changes to spending/taxes that restore some credibility?

Bond markets are really no different than the stock market in terms of people not wanting to hold an asset that is losing value, such as TLT. There will need to be a wash-out.

Leverage amplifies capital gains when the asset price growth is more than the cost of capital. That was certainly true in housing over the last 10-15 years with mortgages at 3-4% and price growth at 7%+.

Now the reverse process kicks in. Having a 30yr fixed rate will provide some cushion but ultimately with higher rates, assets will get repriced. Happened with mathematical precision in bonds (see TLT). Expect a few years of stagnation in all kinds of assets.

Doesn’t the 8% 30 year fixed rate mortgage mean that there are insufficient funds available for the mortgage market broadly to roll over the debt, and the homeowners are chasing insufficient funds higher? i.e. the yield has to keep going because its not possible for everyone to refinance.

I only ask this because 8% fixed for 30 years seems extremely high to me compared with returns elsewhere.

In this case there must be many people holding onto cash in anticipation of further asset price falls.

Mortgage rates simply are generally tied to the yield (interest rate) on 10 year US Treasuries plus around 3%. Simple as that now and the way it has always been.

Like the article says: there’s always a lender, IF the yield is high enough. There is no problem of “insufficient funds”. The problem is lenders can get 5% risk-free, effort-free from the USA gov’t.

If a private home-buyer wants that lender to give them that $ for a home purchase instead, they need to offer an extra 3% to compensate for the extra work & risk involved.

Thank God. Having lived in the late 70s and 80s with a much more reasonable housing market a 10% interest rate on mortgages should be the norm, 13 to 14% is good to cool off overheating. Praying every day mortgages hit double digits. President Reagan said that deficit spending drove up interest rates, so it is normal for rates for private citizens to climb as the Federal deficits are covered.

I’m surprised more money is not coming out of the stock market into treasuries. I recently bought 70K or so of 13 week 5.3% treasuries recognizing that they could shoot higher in December. I’m not taking a lot out of the market but certainly not putting more in.

Just curious, what kind of yield have you been getting in the stock market?

Don’t know exactly but bought in low in S&P index mostly when dropped going into pandemic. I tend to sell when I want to offset gains for tax purposes and don’t want to take massive capitals gains taxes here in CA by unloading much of it which is still up from that dip. Positioning now into managed bond markets and treasuries just because guessing upside is minimal in the market but honestly hard to predict anything. Now of course I will have more to pay in Federal taxes with interest but at least mostly protected from state. Down the road I hope to get out of CA to avoid the tax burden here.

S&P historically is over 7-8% a year. Good years and bad years but if you just leave it in an index tied to S&P that 7-8% is pretty good. Compounded it gets nice over a long haul.

If diversifying then yeah lots of safe bets now for that EZ 5.5%. But one has to think, if 5.5% is ez, then won’t most companies make 7.5% and up in their stock gains?

We shall see! :)

“S&P historically is over 7-8% a year.”

Seems a bit high for YIELD… maybe half that??? Total returns are much higher, closer to 10%,but doesn’t feel likely in the near term.

As ChS points out S&P total returns generally reported as approximately 10%. I read an article that claimed it was just under 12% from 1957 to mid 2023. As to yields, the last 20 years approximately 2% annually. Nasdaq less.

Internet quotes 1.57% as the current yield for S&P 500.