“Fed hikes till something breaks.” But honey, the biggest thing has already broken: price stability. The Fed is trying to fix it.

By Wolf Richter for WOLF STREET.

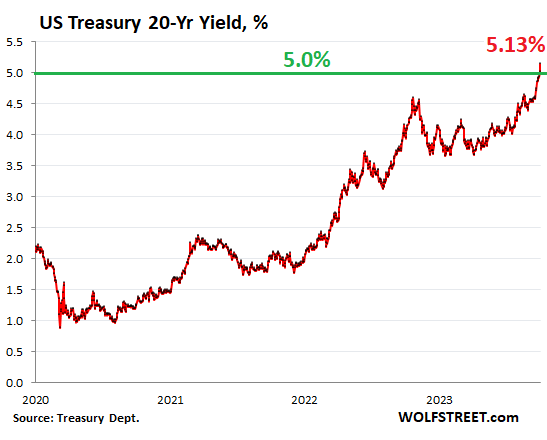

The unloved 20-year Treasury yield – “unloved” because it has been higher than the 30-year yield ever since the 20-year Treasury security was introduced in May 2020 – spiked 13 basis points today, after rising 8 basis points yesterday, to close at 5.13%, making it the first of the long-term yields to blow over the 5% line.

Over the past two weeks, the 20-year yield has spiked by 56 basis points. When bond yields rise, bond prices fall, and so this has been a bloodbath for existing bond holders. Future buyers are ogling the juicy 20-year yields and are licking their chops. But they don’t want to get caught up in the next bloodbath either. Because it has been one bloodbath after another, interrupted by sucker rallies.

The 20-year yield has now nearly caught up with the two-year yield, which rose to 5.15%, putting this portion of the yield curve within a hair – within just 2 basis points – of uninverting.

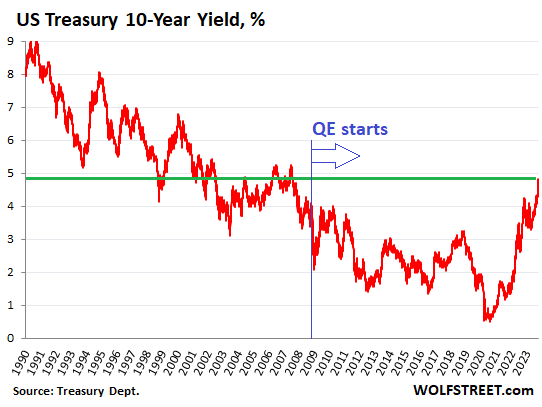

The 10-year Treasury yield jumped 12 basis points today to 4.81%, the highest since August 2007. Over the past two weeks, it has spiked by 49 basis points.

But wait… We’re just not used to these yields anymore. Back in the more normal times before QE, the 5% range was pretty common and low-ish even. For most of the 1990s, the 10-year yield was above 5%. So here is the long-term view of the 10-year yield:

The spread between the two-year yield and the 10-year yield has now narrowed to 34 basis points, the narrowest since October 27, 2022. This portion of the yield curve had inverted in July 2022, when the Fed aggressively pushed up the short-term rates with 75-basis-point hikes, while the long-term bond market was in total denial amid widespread pivot-mongering.

The inversion of the yield curve back then was another item, one of many items, that put us here at WOLF STREET on intense recession watch, and we’re still on recession watch, and there’s still no recession, far from it, the economy seems to have accelerated in Q3.

Markets are finally reading the Fed’s memo: higher for longer. That memo has been circulating for about a year, but folks have shuffled it around and buried it under stuff, and never got around to reading it. But the Fed governors, and Chair Powell himself, are now a constant ebb-and-flow of higher-for-longer.

And so markets dug up the memo and they’re reading it, and it says, rates are going higher, and they’re staying higher because inflation is turning out to be tricky and nasty, and it comes and goes, and moves between different categories of goods and services, and it dishes up head-fakes and drives people nuts.

And there is still all this QE liquidity sloshing around, doing all kinds of weird stuff to prices and fueling demand and inflation and the economy, despite the higher rates, and so the recession that should have come in late 2022 or at least in 2023 called in and canceled, and it said it might set a new date for later. Everyone is trying to figure this out.

“… Till something breaks.” But honey, the biggest thing has already broken: price stability. On Wall Street, the meme is that the Fed will hike “until something breaks,” but the biggest thing that the Fed is in charge of, price stability, has already broken into a million little pieces, and the Fed is now trying to glue it back together with rate hikes and by removing the QE liquidity from the markets. With its QT, it has already removed nearly $1 trillion in liquidity, but that’s just drop in bucket, so to speak.

And it’s not the economy that is sending stocks and bonds skidding – the economy is plugging right along and looks to have accelerated in Q3. What is sending stocks and bonds skidding is QT and these higher yields, but particularly QT. I discussed all this in my podcast on Sunday, THE WOLF STREET REPORT: Stocks, Bonds & CRE Face QT.

Fed heads talked, market listened: another rate hike this year. Amid the constant speeches by Fed governors, there are some disagreements about whether another hike, or even more rate hikes, plural, are needed now, or whether the Fed could wait a while, with more Fed heads making room for another hike. They’re all singing from the same page that the Fed can “proceed carefully” and that rates are going to stay higher for longer.

So it could be that we might get a rate hike with a couple of dissenters, that preferred no hike, which might signal that 5.75% at the top of the range — or a mid-point of 5.625% — might be it for a while.

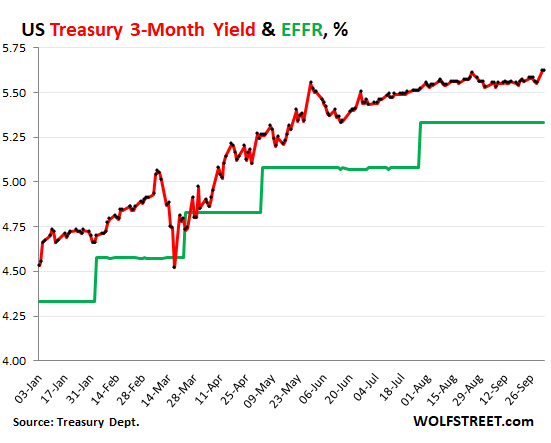

The three-month yield rose to 5.62% yesterday and stayed there today. At 5.62% the yield is now 29 basis points above the Effective Federal Funds Rate (5.33%), and is therefore now fully pricing in another 25-basis point rate hike by year-end.

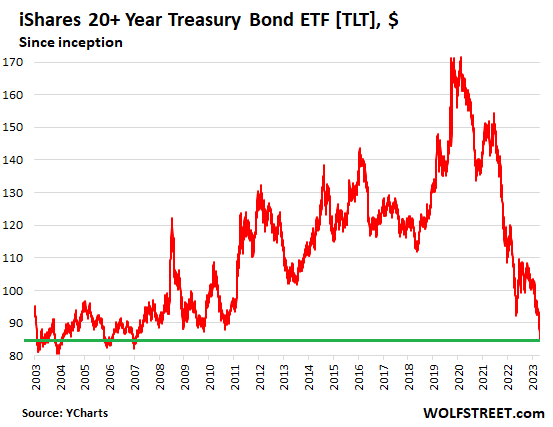

How big is the bloodbath at the long end of the curve? For example, the iShares 20+ Year Treasury Bond ETF [TLT], which focuses on Treasury bonds with a remaining maturity of 20 years or more, fell another 2.2% today. Over the past six months, it has plunged 20%. And from its high at the peak of the 40-year bond bubble in August 2020, it has now plunged by 50%, because in August 2020, the 20-year yield was 0.98%, and today, it’s 5.13%, and those that chased yield at the time got crushed, and those that tried to catch that falling knife since then got their fingers cut off.

Long-term bond funds are not conservative investments; they’re risky bets on the future direction of long-term yields. If you get it wrong, the losses can be catastrophic. Today, TLT closed at $85.06, the lowest since August 2007.

Future bond buyers are ogling this instrument. And they’re ogling those among them who tried to catch it over the past year and got their fingers cut off. If the Fed hikes one more time, and if the yield curve gradually uninverts, long-term yields would be headed over 6%, and that would produce another bloodbath.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Nature is healing

why I’m raising cash

almost time to go hunting again

For me ..stock prices havero go at least 50 percent down to start hunting.

Same for other assets classes

Patience would be rewarded.

gotta agr33 w Jon in this ”sit choo a tion”

gonna bee a bit or a ton more of the very badly needed ”’corrections”’ coming,,,

mostly, IMHO, due to the very clear avoidance of reality that was first introduced with the start of the FRB by the bankster elites and continues to this day to screw the workers…

Why this continues in USA is a very very grave question…

Almost as that ”they” want us to have to do/must do some kind of ”cleansing” that would not be needed if the FRB was not in our face every day, eh

Unloaded half my TBT today for 162% gain since Fed ZIRP trough madness. Using those funds to cost average into TLT,,,,,SLOWELY.

Will be totally screwed if we hit the TA of 12-13% that is hitting the media hype waves at CNBC, etc. Figure at those rates, it won’t matter as a majority of economics will be toast. Plus trillion dollar interest payments per year and 10% mortgage rates will get the govt and fed to panic again with more madness…for long enough to jump out of the trade on the way down.

And how about those 100 year Aussie bonds…240ish to 60ish in short order….WOW. The Aussies win the special kind of bond madness award, for now. Yet what-if Japan does it’s reversal magic and starts a global fed bond war? Pew, Pew, Pew…financial wars are just getting started.

Bonds are boring, said nobody anymore…

Perhaps. It seems to be one of Wolf’s reporting of the facts, without opinion. No matter how high the azimuth of human emotional response rises. No matter what, both the cause and the result, will be judged on a scale of love.

I suggest that, The failure of love is the most important reason that we are all here. The ability to forget.

I may be wrong

Yep. It is. After pushing rates to a 1,000 year low… I wonder what the “equal and opposite reaction” will be. We may get a bounce here…but there is a long way to go. And China is still divesting.

Wolf,

Some of us have a short memory, a QT start would help.

July 2022 phase-in. Sep 2022 full speed.

Like a turtle, not a hare.

DC

A turtle is one of the few water creatures to rise to the surface nose first. Seems to be what is now happening with interest rates.

Whereas a hare doesn’t often swim.

“Q3. What is sending stocks and bonds skidding is QT and these higher yields, but particularly QT.”

Totally agree. The QT is the major force that deflates the overinflated asset prices. Rates/yields may also have effect, but not as much as QT.

For this reason, we saw a rally in all types of assets (stocks, bonds, RE, cryptp) for about 4 months after FED rained $400 billion from the sky, after March 2023 banking crisis. This made the traders (falsely) believe that the QT is over. Now they are facing the reality (finally). In fact, if the FED is serious about reducing the inflation permanently to 2%, QT has much more way to go (possible 2T more reduction is needed). If that’s the case, we are in early phases of the QT.

Agree in August I started a small ladder with CD’s. Will slowly add each month for a little while.

Floating rate or chill with treasure bills for me until bull fever breaks bad

Debt is going to be inflated away. It’s too late to expect a pivot because wage inflation is here big time, and that means it’s going to take a very long time to snuff it out, unless something breaks. Working people realize this is their chance to get caught up in pay levels.

For the past two months, nominal rates have been driven by real rates. Why are real rates now above 2%? The major media politely refers to supply/demand imbalances of government securities. A less polite term is that the Treasury Department’s voracious appetite for cash to fund the federal deficit is crowding out the market. Late this Summer, Treasury announced a major issuance program and rates started to climb. Yes, QT compounds the problem but the deficits are twice as large as QT.

@Potter “Yes, QT compounds the problem but the deficits are twice as large as QT.”

And the O/N RRP facility funded half of that. And retail MMMFs funded half of the rest. And we’ve got another 800b left in the 4th qtr.

Now, the people that bought in Feb 2023 look real smart. They were able to get a 6%ish mortgage rate. This is the same pattern that played in the 1970s.

Alas, prices have dropped since then? So you got a 6% mortgage but you’re already underwater? Congrats. Now the market is just about frozen. The buyers left. So just quit looking on Zillow every day, make your 6% mortgage payments, and enjoy your house for the next decade because you don’t want to see the results.

That’s exactly what I told my daughter….(except I said enjoy it for the next 30 years).

How did you know? Are you eavesdropping p:)?

So much for taking a promotion or job opportunity in another state. Your house will be a millstone around yiur neck for at least a decade.

Ironically this may add to the wage inflation for experienced folks with skills in very high demand, unless some massive scale layoffs begin.

“You need my skills 4 states over and want me to move instead of WFH? That would cost you at least +60% to what I make now to make it worthwhile, mainly because of where RE market is now. Not ready to pay that much? Good luck with your search, call me if you change your mind”

Too bad WFH is not an option when recruiting workers.

lol wolf, this is a very rude awakening.

Be more lenient with those who want to buy a house. That way you’ll panic them more.

Cs

I, for one, have ZERO pity for anyone who goes underwater with their mortgage loan. Some of the “bubble level” residential RE prices paid in the past 36 months are absolutely ridiculous.

Too many buyers based their decision on FOMO and a firm belief that the RE tree will grow to the sky.

Intrinsic value and simply enjoying life is pretty sweet if you can afford the mortgage and don’t have to move, I wish more “speculators” lived that way.

Price didn’t really drop since Q1 2023, not in some markets. So yeah, 6% investment mortgage rate on a cash flow positive investment property sounds smart to me.

“cash flow positive”

Hahahah BS.

People who hype Real Estate can’t do math.

1. Renting is cheaper in almost all cases rn

2. In coastal markets RE is cash flow negative

I’ve only seen cash flow positive in some southern and midwest markets. If there is a recession that can quickly go bad.

People forget: taxes, insurance, maintenance, vacancy, eviction, ECT. It’s a huge hassle.

Dropped since February 2023?

Since June 2022, to be precise. Depending on the market.

LOL. You’re back? Must be real desperate for a sale at this point.

DC – SCJ’s been back for a couple of weeks, now…

may we all find a better day.

“Long-term bond funds are not conservative investments; they’re risky bets on the future direction of long-term yields. If you get it wrong, the losses can be catastrophic. Today, TLT closed at $85.06, the lowest since August 2007.”

Somebody should send this quote to Harry Dent.

I have a moderately sized chunk in a 401k bond fund that I haven’t paid much attention to (Metropolitan West Total Return Bond Plan) – should I just move that to something less leveraged? Performance isn’t “bad” lately, and has been rather good over time, but that don’t mean dick about the future.

Apologies if that’s a silly and/or obvious question, I love econ, data, etc. but have never had any interest in growing my money and never studied the process. It just keeps coming and I keep socking it away in seemingly safe places (like bond funds). Sounds like some of that might have been ill advised.

Thanks in advance for any input – ML

Bonds are definitely becoming believers that inflation can be tough to tame. I am building my list of all of the equities that I want to buy when interest rates peak. The extra-large dividends of many beaten up equities make buying peaks a less risky proposition.

It appears from these climbing yields that Volcker “possesses” the Federal Reserve building. With Jerome Powell’s low yield and Quantitative Easing (QE) dark magic incantations, that place must look like a Harry Potter movie.

Maybe the bloodbath will be equal to the years and years of getting NOTHING from zirp. You said it yourself wolf. That was its own bloodbath. Somehow, I doubt it however. It’s easy to take that which ostensibly cannot be counted, except by a clock. Then dear readers think about the word compounding.

The bonds have gotten religion. All the neophyte bond traders think that it’s as simple as the fed tightening and when they stop bonds will rally. Or recession and the long end will take off,maybe for a minute. In the old days coming out of the 70’s inflation ,bonds traded with a risk premium. As I said several weeks ago the curve would bear steepen. I believe the market is pricing in risk premiums and that the long end yields will trade considerably higher than the front end. Things are now different. A 40 year trend line has been taken out. Very simple. There is a complete disregard coming from the politicians and the Treasury and Fed regarding deficit spending. We know already what will come once the economy or markets hit the skids. The deficits around the world are out of control and will continue to explode. Japan the big experiment is trying to control rates and currency but you can never have both. Things are getting very dicey!

Old Bond Trader

Indeed. There is an entire “breed” of bond / financial traders that had 13 years of Fed manipulated , paint over the rust monetary policy. “The Fed will save us”.

For those who have seen the 70s and 80s…..a different view.

Curve getting back to where it should be…rates covering the published inflation rate…..

Still the Fed has about a 12% inflation overshoot from spring of 2021 to now. Will someone point that out to J Powell at one of these dog and pony shows ?

@ Old Bond Trader “A 40-year trend line has been taken out.”

Yes, the fundamentals have changed. Outsized Treasury deficits and the demand for money.

Which kind of institutions usually buy long dated treasuries?

Pension funds or commercial banks?

Would anyone know?

This looks like something that will blow a big hole in the asset liability equation for investors duped by Uncle Sam :)

Nope. Asset liability (AL) portfolios are designed to use either cash flow matching or duration matching. No problem with the rate moves.

“Which kind of institutions usually buy long dated treasuries?”

All of them. banks as we found out, pension funds, life insurance companies, bond funds, private investors, hedge funds with complex leveraged strategies, central banks, me when yields are high enough….

Life insurance companies hold bonds to maturity. They time the maturity to match their payout needs. They don’t have a problem with long duration bonds. Banks do when they have a run on the bank and are forced to sell long-date bonds to raise cash.

“Which kind of institutions usually buy long dated treasuries?”

SVB was a big investor in long term Treasuries. Look where that got them. The rest of these institutions that buy these securities are going to lose their shirts as well if they haven’t already. I don’t lose one night’s sleep over their stupid investments.

Wolf, as we all saw, SVB bought the long term bonds and then failed when they were forced to sell due to a bank run.

I’ve read that SVB did not hedge its risk at all to protect itself from exactly what happened.

My question is, how does a bank hedge itself against the risks of buying long term bonds purchased at near zero % yields?

For example, it can sell interest-rate swaps.

‘Banks do when they have a run on the bank and are forced to sell long-date bonds to raise cash’

Especially there is excessive leverage with that buy!

Both commercial banks and pension funds buy bonds. Yes it’s going to be a disaster. Especially the distortions the fed will make trying to bail everything out.

Gotta be about time for a bounce I’m bonds that’ll probably last through year end but I see the breakdown as three fold.

QT is eliminating a major supply vacuum

Government spending (partially due to higher interest rates lol) is higher then was expected. TLT really broke down right after the large offerings were announced

Oil prices are threatening to restart the inflation cycle. Diesel prices rising like they have been will filter into food and that’ll filter into wages. Oil looks ready for a pullback but next year looks like it’s ready to explode so should be fun for everyone… And during an election year yikes👀👀👀 too bad the spr never got filled back up

It should never have been drawn down to be honest Free markets my foot

Oil prices were merely driven up again by manic speculators and are now falling again just as sharply and quickly along with most commodities are demand evaporates for that stuff.

What good is 5% when the dollar collapses ie hyperinflation ?

Better than being added to Wolf’s list of imploded stocks.

The dollar is the cleanest dirty shirt out there. But there are plenty of currencies that have collapsed against the dollar. And inflation of 4-9% isn’t hyperinflation.

We’re not in hyperinflation, but we are in an inflationary spiral that is out of control. People in the Swamp are still buying houses at these ridiculous prices, which are so high that they cannot afford them. Lenders are making loans that cannot ever be paid back, and should not be made. The inflation mindset has taken over. This is worse than the late 70’s.

Not anywhere near as bad as the 1970’s.

Unemployment is very low, workers are getting raises.

Mortgage rates started and ended the decade of the 70’s at 7.5%.

No lines at the gas stations and no land war in Asia.

Price of homes is not a reliable indicator of inflation given they are almost exclusively financed with 30 year payments. Rents are more reliable. Owner equivalent rent is trash. Real rents. The two published indices I follow closely, ZORI and SFRI both peaked winter 21/ spring 22 and are showing rates of growth either at or below historic averages. These mortgage rates have basically shut the taps off to equity access, will eventually show in home prices, but not when 60-70% of homes simply cannot be sold due to the rate differential. High prices now reflect lack of supply, not inflation. Combine this with depletion of pandemic excess savings, record consumer debt, and resumption of student loan payments–I think in 18 months, we’ll be wishing for inflation if rates remain at these levels. I think we’ll have a hard time generating nominal GDP growth, let alone inflation.

C,

Here is the ZORI (red line), setting new record after new record, though it dipped a little late last year. The month-to-month growth rates have come down from the 1.2% range (15% annualized) in early 2022 to an average of 0.5% over the past five month (6.2% annualized). And big landlords have been saying for months that they’re getting about 6% increases on renewals and new lease signings.

So 6% rental inflation is where we’re headed in CPI rent data.

Arnols,

In the 70s

1. We didn’t have 35 Trillion in National Debt.

2. War in Asia was over.

3. We had Paul Volcker as Fed chief.

We now have all the bad from the 70s and none of the good.

Mr. Wolf,

“The dollar is the cleanest dirty shirt out there. ”

I kinda prefer the old adage……….”the prettiest turd in the septic tank”

MW: US dollar hits strongest level in nearly a year, heaping more pressure on stocks…

Correct, and as long as the majority of international trade is conducted in dollar, it will remain so.

Having said that, I see a big shift from I want a return on my investment to preservation of capital or simply return of capital…

Interesting times.

QT is going on right now. Cash deposits can get 5%. Aside from a 1973 oil crisis or crop failure, hyperinflation is not gonna happen.

Almost 99% of economies which experienced hyperinflation printed too much money to pay debts, deficits and stuff like that involves QE rather than QT.

The bulk of economies that experienced hyperinflation were the result of war — either civil wars or lost wars against neighbouring nations.

No, this is not true. Many economies face hyperinflation without a war. Take Venezuela, Lebanon, Turkey as an example.

And not all economies who had civil wars or lost wars with neighbors face hyperinflation.

Inflation has always the result of reckless issuing of money due to the simple math. This was true since the money was invented, even before the Romans.

Jason,

I don’t think Lebanon is an example of a nation facing hyperinflation without war. War on some level has been pretty constant in Lebanon since 1968. Though several conflicts dating back to the creation of Israel in 1948 also occurred. You’re correct hyperinflation results from the reckless issuance of money so war isn’t necessary, but war is often a catalyst.

“Juicy Yields Tempt, but Bloodbath May Not Be Over”

If your predictions come true about inflation going higher starting in October, then bloodbath won’t be over for a while.

Reading Wolf lately, I wonder which path the Fed will take now that the can kicking is finally coming to an end:

1. Let yields rise, but watch a selloff in the bond market as bond portfolios implode with bonds purchased in the easy money era which pay next to nothing.

2. Restart QE as panic spreads in the stock market, destroy all Fed credibility, and watch the dollar implode and let inflation destroy what is left of the economy.

Jay surely made his own bed, and also some congressmen who today were warning about our 33 trillion dollar debt and the spreading de-dollarization around the world.

P.S. If you have not done so already, watch Senator Kennedy from Louisiana grill Powell and the Fed’s balance sheet as being the main cause of inflation.

The stock market would still be overvalued if the djia, sp500, and NASDAQ fell 20% or more so there’s a long way to go until justified panic, and even then it would be wrong to further debase the dollar – it hurts the poor the most. I haven’t seen the senator questioning Powell thing but it sounds rigged. The Fed monetizing the debt is what allows Congress to carry out its bribery and vote buying. If Powell and the other leaders didn’t order it they’d be replaced but they still deserve condemnation because they agreed to do wrong. It’s only after they substantially debased the dollar that we get these so called criticisms. I don’t know that senators voting record but would not be surprised if he voted for at least some of the massive unnecessary governments deficit spending and may do so again.

Look folks, here’s the deal…Don’t listen to this Wolf in sheep’s clothing, man. Gimme a break. Trust in Bidenomics, it is the only game in town.

Even Wolf needs welfare, ahem, I mean credit and we are putting food on the table, folks. Plain and simple. Promises made, promises kept.

Good spiel Joe.

Just ordered a windshield for the Ford Edge and when the installer came he brought the wrong one. It seems even in the Midwest large companies are driving the small guys out. After a discussion the company agreed to order the correct one, found it, and will replace Monday.

During the process the company rep tried to inflate the bill by selling a set of wipers. I didn’t like the idea and mentioned to the installer. He related how this suggested sell had bit the company by installers quitting.

Not every new idea is a winner!

The Fed altered reality for a while…..as did the BOJ

The Fed NEVER had any business in the long end. The heralded “dual mandate” deals with two current issues…employment and prices.

Ah, but the forgotten third mandate….”Maintain moderate long term interest rates” ….abused and never mentioned. For moderate means “not extreme”, and the Fed’s pushing long rates to 4000 yr lows was hardly “moderate”.

Banking issues next for the headlines, and we have the inept and cardboard cut out Yellen to lead us through. Her ground breaking declaration to insure all deposits despite limits may have been the most dramatic unilateral dismissal of set law in financial history. The precedent has been set by the SVB and First Financial debacles.

@ Longstreet: “The Fed NEVER had any business in the long end.”

The trading desk has no business on the short-end either. The time horizon of the trading desk’s policy has been 24 hours rather than 24 months.

Great update…thanks!

Powell is said to prefer watching 3 month vs 18 month parts of the yield curve. This he said comes from some research by Fed economists. That to is close to un-inverting. It is now less than 15 basis points between them.

For the UK there is a 30 year gilt with a nominal coupon of 0.5% trading at 26p in the pound. Gilts follow treasury yields.

The losses from rising yields must be getting horrific.

Shouldn’t it be closer to 10p in the pound? 30 year gilts are at 5% right now.

UK is at serious risk of stagflation. Economy is very close to recession but inflation still raging (5% core), and if the Fed starts hiking again, BoE will have to follow to defend the pound. Things could get extremely nasty if the US doesn’t get on top of things.

It would be interesting to see a 5 year chart for a 20 year US Treasury Strip (or constant maturity, if such a thing exists…)

Cliff-like, I suspect!

I just rolled over my 100K CD for another year with my local credit union. I’m getting $4,000 interest for doing no work. I like this. I say to J Powell: “keep up the good work.”

your real return is more like zero. your interest income merely protects value of your money. ofc it’s better than other assets where losing money is more probable due to looming recession.

For me my yearly income more than doubled due to higher interest rates. The average worker only saw about a 5 percent increase in their yearly salary.

@ Swamp Creature: “keep up the good work”.

People somehow conflate high real rates of interest with a tight monetary policy instrument (as if they’re bad). Higher and firmer real rates of interest are a necessary condition for a healthy economy.

Is that pre-tax? 4% for 1 year is not good imo. Buy Tbills at that rate or a 1 year Tbond since I think you live in a state with income taxes. I’m still in MMF, which is 5%+ including state tax free ones like SNSXX/SUTXX. I expect more rate hikes so will be mid 5s for the state tax free ones.

DC

Currently have a passbook savings plan at 3.75%. Working on more CD’s. I think interest will do the same as the 80’s before Mr. Powell breaks inflation.

The next round of banks going down in 3…2…1….

How about the Austrian 100-year “medium term notes” L.M.A.O. E.g. 0.85% coupon issued June 24 2020 at 100, Maturity Jun 30, 2120.

Current price 32.4. Went as high as 130 at the end of 2020 and has been in a downward elevator since.

You can always hold them to maturity 🤣

100 year bonds now, perhaps 100 year mortgages presented by genius politicians as housing implodes sooner than later, and then 100 year old Presidential candidates to ensure our “long term” future…HA

100 is the new 30???

“You can always hold them to maturity”

That’s what I’m doing with my 10 year 1.9% CD, a constant reminder that I know nothing. Please don’t tell my wife.

earning 1.9% a year over 10 years is better than losing 50% or 90% over 10 years. It’s not the worst option.

Zero coupon bond etf had a high of 185 in 2020; now 68.53. “Only” 25 years duration.

The bond market is going to be toast for years. Dow 20k is once again in the future, LoL.

Frozen real estate markets, with perfect houses selling well, but the cost of fixing degraded or outdated properties is growing with inflation. Some of this boom is old boomers downsizing, and houses finally hitting the market. After all, proposition 13 froze so much real estate and raised prices for decades.

QT will hit international trade and finance much harder than here in the first stages, and they have only begun. Honestly, I expected this in 2014, but the Fed totally hit the panic button.

Take a look at the last 7 year US Bond Auction, 13 Week and 26 Week T-bills auctions and compare them to the previous Auction. The Federal Reserve needed to double to triple the amounts of SOMA needed due to the lack of real buyers at those auction. Investors walked away for US Governments. There more QT / QE than the Federal Reserve Reports.

Nonsense. Are you just making this BS up as you go, or are you reading this BS on some purveyor of toxic fiction?

At the last 7-year auction (Sep 28): $91 billion in buy orders for $37 billion in offered 7-year notes. That’s like 2.5 times oversubscribed. SOMA bought $0.

https://www.treasurydirect.gov/instit/annceresult/press/preanre/2023/R_20230928_3.pdf

In terms of T-bills, the Fed is replacing its maturing T-bills has they mature. That’s why you see SOMA is buying T-bills, but only small amounts.

For example, at the last 17-week T-bill auction (Sep 27): $162 billion buy orders for $50 billion in T-bills, so over 3x oversubscribed. SOMA bought just $448 million, which isn’t even a rounding error in the $50 billion.

https://www.treasurydirect.gov/instit/annceresult/press/preanre/2023/R_20230927_1.pdf

This I define as QE and minting $10 Billion short term money to shill the Treasury Auction yields result will create more Inflation (IMO). While Powell just left interest rates unchanged he lowered interest rates on the short term yields.

This week 13 Week $5.2 Billion SOMA issue size $71 Billion.

Previous week 13 Week $2.7 Billion SOMA issue size $69 Billion.

This week 26 Week $4.7 Billion SOMA issue size $64 Billion.

Previous 26 Week $2.4 Billion SOMA issue size $62 Billion.

182 Day T-Bill

https://www.treasurydirect.gov/instit/annceresult/press/preanre/2023/R_20231002_2.pdf

91 Day T-Bill

https://www.treasurydirect.gov/instit/annceresult/press/preanre/2023/R_20231002_1.pdf

The Seven Year Auction, I was wrong the Federal Reserve did not mint any SOMA to create QE or QT.

The Fed replaces all its maturing T-bills with new T-bills. That’s what you see the $4 billion in SOMA purchases.

The Fed still has $244 billion in T-bills. It uses them to fill the roll-off when the roll-off is less than $60 billion a month. So for example, the roll-off is $55 billion in one month, the Fed will also let $5 billion in T-bills roll off without replacement. Which is why the balance of T-bills is declining.

But when T-bills mature — which they do ALL THE TIME since they’re short-term — the Fed replaces them, which are the SOMA purchases.

Only ignorant morons call this “QE.” Adios. You’re done wasting my time.

Here are the Fed’s holdings of T-bills:

Correct. Stable prices are in fact the an official mandate of The Fed in order to maintain it’s charter. Why isn’t anyone in CONgress calling The Fed out?

Sounds like it is time to end the Fed’s Charter and return to the greenback or constitutional sounds money.

Good luck!

Even though QT and interest rates are ever upwards, the economy is perking along. Why, have a look at the money the government is borrowing and spending on the economy. Communism recycles money from the few to the multitude. The multitude is now generating huge demand, and they spend it immediately – they can not save it the way the old and upper classes do. Could this be a the start of something big, egalitarianism. American style!

“they can not save it the way the old and upper classes do”

Real wages are up, they CAN save, but choose not too. It’s too bad because if they did, they could at least get a little piece of the next bailout.

The most recent 52 week treasury bill went for 5.488%, somewhat better deal than most bank CD’s at this point.

Plus, no state income tax due on federal interest earnings. Makes a big difference for some of us in high tax states.

Monetarism has never been tried:

Lawrence K. Roos, Past President, Federal Reserve Bank of St. Louis & past member of the FOMC (the policy arm of the Fed) as cited in the WSJ April 10, 1986 “…I do not believe that the control of money growth ever became the primary priority of the Fed. I think that there was always & still is, a preoccupation with stabilization of interest rates”. Note: Volcker widened the Federal Funds brackets (policy rate) – didn’t eliminate them.

Keynes’s liquidity preference curve (demand for money) is a false doctrine. The money supply can never be managed by any attempt to control the cost of credit (i.e., thru pegging the interest rate on governments; or thru “floors”, “ceilings”, “corridors”, “brackets”, IOeR, etc).

Richard Fisher, November 2, 2006: – Fed

Déjà vu: “In retrospect [because of faulty data] the real funds rate turned out to be lower than what was deemed appropriate at the time and was held lower longer than it should have been. In this case, poor data led to policy action that amplified speculative activity in housing and other markets. The point is that we need to continue to develop and work with better data.”

I suspect the dissenters will go along with hiking the Fed Funds Rate to 6% before January because that keeps the Fed from doing so during a Presidential election year… a long-term mantra of the Fed. All of the action next year will be with whether or not they accelerate the pace of QT… and that just doesn’t attract all that much attention aside from the nerds who read WolfStreet.

Jim Rogers consistently tells young people to study history. I think that you have to stop listening to the CNBC and FBN talking heads and let history be your guide. If you add in all debt (corporate, consumer, state, social security off-balance-sheet future obligations, medicare off-balance-sheet future obligations, etc.) your debt to GDP is in excess of 300%. To lower that ratio substantially you need both (1) yield control and (2) to let inflation run hot (print money and let inflation rip). When your debt is denominated in the reserve currency and you are insolvent, which we are, then you have two choices: Outright default or inflate the debt away. In 100% of the time throughout history, option two (let inflation rip) has been the politically viable solution. You need (1) yield control, (2) let inflation rip, (3) let the term premium rip, and (4) rig the CPI so that it under-reports inflation. Under that scenario the Fed will lose control of the long end of the curve (markets take over from the Fed mandated command economy). This will be the death knell for long-term treasuries.

Insightful comment, Gvscfa. I hope you are wrong, but I worry you are right. Right now I am 80% in T-Bills because asset markets are still significantly overvalued. I am enjoying 5.5% interest free of state tax, and I am mostly sitting out the up and down gyrations of the stock market. BUT, if you are correct, and you may be, then one day an inflection point will come when I will have to abandon Treasuries and move back into stocks. Why? Because at least companies can raise prices to match intentional inflation that our government policymakers unleash in the face of unmanageable national debt.

I welcome challenges to my logic. My ego can take a hit if it leads to better insight. Thanks.

I too am invested in short duration bonds (inflation risk is near zero) and hard assets (commodities, precious metals, etc.) with little exposure to stocks and no exposure to long duration fixed income. Stocks and real estate should be a good inflation hedge but you may want to wait for a correction (per the Shiller PE stocks are way over-valued, we are currently seeing the correction in commercial real estate, and the bubble in residential real estate looks ready to pop) to jump in. Good luck!

GvsCfa

Real estate can be an expensive baggage unless Great Depression lessons fail me. County taxes cost many farmers their farm during the beginning.

Will this time be any different? Are our county tax assessors any more knowledgeable”

I agree with your analysis but precious metals have been getting slaughtered. You must believe that this is a short term problem for PMs?

80% in T bills, I assume of short duration of year or less.

This inflation popped up after 40 yrs of deflation. It won’t be that easy or in short time to produce disinflation. It could be another generation, unless we slide into D2!

Companies cannot raise prices if wages are NOT catching up inflation.

National debt, deficit will increase along uncapping debt ceiling until interest for T Bills will complete with SS! Until that day, the can will be kicked down, constantly.

Exactly. Lets look at a couple of points.

Inflation:

4% inflation over 5 years comes to a compounded rate 21%

5% inflation over 5 years is a compounded 27%.

A $500k house to build now with 4% inflation will cost $608k in 5 years

A $500k house to build now with 5% inflation will cost $638k in 5 years.

So from 1970 to 2010 there were 5 years where inflation was below 2%. The average rate comes to 4.76.

From 2010 to 2020, there were 6 years inflation below 2%.

The FED target inflation is 2%. Lets see how many years averaged below 2.5% going back to 1970. I think above 2.5% is closer to 3% and should not count.

-So between 1970 and 2010 there were 7 out of 30 years of rates below 2.5%. 23% of the time.

– From 2010 to 2020, 9 of the 10 years were below 2.5%. The average is 1.76%

So can the FED duplicate the 2010 to 2020 timeframe of 1.76% They were using a lot of financial engineering tools and the we also exported inflation via globalization. Or will things reverts to the 1979 to 2009 average of 4.67%.

I am guessing it will be very hard to get below 3% specifically with the current trajectory of the Government debt and looking back through history. I think anything below 3% will may be a reach.

But who knows. Maybe the 2010 to 2020 low inflation was because of productivity gains of China cheap labor and Web 2.0? Maybe 2020 through 2030 can see productivity gains via AI?

Grab the popcorn.

Very Interesting!

Based on this look back period it would seem that you need at least 5% yield just to preserve spending power.

So even after this historic(basis points per unit time) run up in rates, you would barely be preserving purchasing power at the long end around ~4.7%, assuming we end up somewhere in the same range as the years you looked at. If we end up with an elevated rate of inflation for several years to come, it will likely be higher than this.

My money is on the latter situation coming to fruition. Higher for longer indeed.

Thanks for the info.

Biorganic – You are headed in the right direction, but this is a gentle reminder to keep in mind the income tax we owe on interest earnings. Assuming the all-in (federal, state & local) marginal tax rates shown below, you would need to earn a pre-tax interest rate of more than 4.7% to end up with 4.7% in your bank account after taxes.

Pre-Tax All-In What After Tax

Interest Tax You Interest

Rate Rate Keep Rate

———– ——- —— ——-

5.5% 15% 85% 4.7%

6.3% 25% 75% 4.7%

7.2% 35% 65% 4.7%

Taxes are a major consideration when it comes to the question of whether you are maintaining your purchasing power in the face of inflation. Cheers.

Sorry about the jumbled up table headings below. The first column is “Pre-Tax Interest Rate”. The second column is “Tax Rate”. The third column is “What You Keep”. The fourth column is “After Tax Interest Rate”.

Should say “table above.”

D Thomas,

Thanks for running those numbers.

I am in a tax free state and most of the funds are in a Fidelity IRA, small percent in a Roth, and an even smaller in my companies 401k… New Job.

The options in the 401 aren’t great. There’s really only bond funds(no), some stable value funds that I don’t trust, or equities. So I know it’s crazy but I am using the company match to pad my losses and just DCA into SP500. I Just started that.

Maybe one day I’ll have enough funds outside the IRA to be lucky enough to worry about those taxed returns.

The Fed needs to hit high 2ish range before they will be able to rise goal to 3.0-3.5% range. This should be accomplished during a recession, barring a stagflation flare up.

I think one of the most bone headed moves by the Fed was to allow any homeowner a sub 3-4% mortgage rate, as now we have 80% of homeowners reusing to give up their low rates, which in essence locks up existing house sales. This mechanic is traitorous to the entire concept of free capitalism, as it removed the time value of money on a consumable product, houses.

So if inflation remains high, then new home construction is limited due to high construction costs, which drives up house prices even though existing sales fall. So basically we have house stagflation, with the bonus twist of locked up mortgage holders who are going to be emotionally scared as sub 3-4% rates are a financial abomination, and not likely to occur again anytime soon.

And this unnatural housing mechanic flows into labor markets as labor can’t move easily to the areas where needed as their houses are locked in low mortgages that are not portable. This is either Fed ignorance on full display manipulating markets without full understanding of human emotional factors, labor force effects, etc….or somehow by design to use inflation as a tool to deal with the future debt spiral???

I’m guessing the latter…

Why compare debt to gross income (GDP)?

Why not to assets such as is done on balance cheat sheets?

Didn’t I read somewhere that the recession starts not when the interest rates invert, but when they correct the inversion.

So right on time for October and Christmas as usual.

Yes more or less. When they un-invert and the Fed drops their benchmark rates a recession usually occurs a few months later.

1. The yield curve is supposed to predict a business cycle recession.

2. The last time the yield curve un-inverted was in April 2019, and there was no recession.

3. Then a year later, in March 2020, we got a pandemic and lockdown, totally unrelated to the business cycle, and the yield curve cannot predict and is not supposed to predict pandemics and lockdowns. And it didn’t predict it because it came a year after the un-invert.

4. So, the last time the yield curve inverted and un-inverted it predicted a business cycle recession that didn’t come.

5. Since the era of QE started, the yield curve has become useless as a predictor. It reflects what the Fed is doing: pushing up the short rates and still weighing on the long end with its gigantic balance sheet. And that’s all.

Well we will have to wait for the un-inversion to occur this time before we’ll know if you are right. ;)

I absolutely see no recession as of now.

Job Market is hot as evident from WR’s post.

real Estate is hot> Low inventory, very little price drop. I went to a new sun division in socal inland ( 100 miles away east from coast ). Almost all homes are sold. The home prices are 550K, median income is 45K there. Builders buying points for 30 yr mortgage, giving fixed 6% 30 year mortgage.

restaurants/ hotel rooms are full.

Concert tickers are stupidly high and are full.

People are still spending like crazy.

Where is the recession ?

Job market may be showing some cracks.

How on earth can people making a median 45K in income afford 550K houses? Something doesn’t compute here. Or is it just the high end income earners who can afford to buy these houses?

When Wolf says there is no recession he’s not lying, but it’s not totally accurate. There is *a* recession, as wealth inequality accelerates, more and more people are being crushed into paste for the benefit of the Line Going Up. But that is a recession in terms of living standards and life expectancy for the bottom 50%, not a recession in terms of GDP.

While that median income might be a pittance, remember that half of all incomes are above that. And remember that the median household income in the US is about 75k while the average is 105k as of 2022. There is a very long tail of high income earners. Those are the people running the economy right now, the top 25%. That’s me, my parents, and my parents’ family friends.

My friends are not so lucky. Many of them are barely scraping by, paycheck to paycheck, and most of them have accepted that short of massive generational wealth transfer from rich parents or a total rework of the way we do housing in this country, they will never own a home. I’m hopeful that this will start to change as asset prices return to reality, but we will need to make a lot of additional changes if we want to see the American dream of homeownership return.

Howdy Folks. This in here stuff is keeping this sober sailor high on spending. Waited a long time for some interest earned and just like govern ment. Spend Spend Spend. Unlike govern ment, will always save just a little bit…… A squirrels life is silly like that…..

“So just quit looking on Zillow every day, make your 6% mortgage payments, and enjoy your house for the next decade because you don’t want to see the results.”

This is why I read Wolf Street. No matter the topic, he’s a straight shooter– immune to hyperbole and wishful or catastrophic thinking.

‘Everyday I enjoy waking up and worrying if my house has lost value’

said no one ever.

I’ve never understood why folks care so much about the theoretical resale value of their home, if they’re not planning to sell. Its still the same roof over their head.

Nearly 5% across the board (1-month to 30-year). The markets have finally capitulated and quit fighting the Fed. I figure the 6-month will hit 6% soon. I hope so anyway because I ladder 6-month T-bills.

Forget stocks, real estate, and Treasuries over 1-year, unless you like taking losses.

Homeowners who are trying to sell are still holding out (greed), but they will give in eventually. Only cash-buyers can afford to be in the market and they are suckers if they buy now. I suspect most cash-buyers are on the sidelines. They are not stupid.

Next to crack: banks. Yellen should be sure she has a good supply of Geritol.

William Leaked,

“Forget stocks, real estate, and Treasuries over 1-year, unless you like taking losses.”

I do pretty well in stocks, long and short. Best year ever in 22, seriously short! I guess it is a matter of your expertise.

Its not really a gain until you close out your position and sell.

Wolf,

Thank you. Yields have a long way to rise yet, 10-year continues to be the laggard but it is good to see the curve slowly trying to dis-invert itself.

Yield curve inversion as an economic predictor went the way of the dodo once the Fed opened Pandora’s Box and unleashed QE.

BTW…anyone notice the drop in the ECB balance sheet last week? Now just over €7 T. Another €100 B in TLTRO loans matured at the end of September. If only the Fed could move at this pace on QT.

Dr. Copper has been shitting the bed this year. Perhaps it needs a colonoscopy. Often a good predicter of growth.

Copper is an outdated predictor of growth.

With this fake overall “market” conjured up since 08 you are right that what used to be decent indicators like copper or gold now mean dogcrap.