Availability rate in Q3 spiked to 36% in San Francisco. Sublease space nearly doubled YoY in Silicon Valley. Leasing activity collapsed. More landlords default.

By Wolf Richter for WOLF STREET.

The office nightmare brought on by working from home and Corporate America’s sudden epiphany that they will never need all this office space, keeps on giving: Despite all the hype and hoopla about AI, the office space on the market and available for lease in San Francisco in Q3 jumped to a stunning 36.3% of the total office space, another all-time record, up from 35.1% in Q2, according to Savills.

Including 9.4 million square feet (msf) of sublease space, 31.5 msf of office space is now on the market. Sublease space is where tenants have decided they don’t need this space and attempt to find a tenant for the space until the lease terminates.

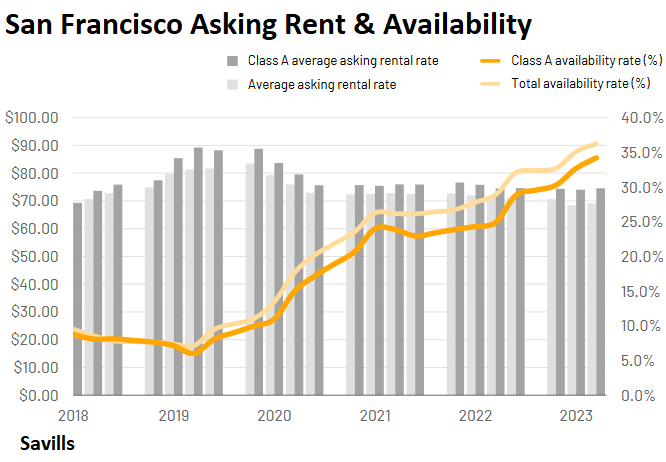

Asking rents have remained stubbornly enormous at $69.15 per square foot per year in Q3, despite the massive availability, though they have come down some from the highs in 2019 of over $80 per square foot per year. But asking rents are just that. Reality when leases are finally signed looks very different as landlords are desperate to make deals and are offering “record high concessions,” according to Savills (chart via Savills, gray columns, left scale = rents; orange line = Class A availability, yellow line = total availability, right scale):

And if landlords cannot bring in or keep tenants at rents that are high enough to meet the loan costs and operating costs, they default on the loan. Defaults on office buildings is now a constant drumbeat. In August, another three were reported whose mortgages were sent to special servicing, according to the SF Chronicle, citing DBRS Morningstar. Assignment to a special servicer indicates that a default is either imminent or has already occurred:

The landlord of 222 Kearny Street (148,000 sf), GEM Realty Capital in Chicago, missed a payment on the $24 million loan in August. The building is 27% vacant. Part of the remainder is leased to WeWork, which is teetering on the edge of a bankruptcy filing.

The landlord of 995 Market Street (91,000 sf), Bridgeton Holdings in New York, defaulted on a $45 million loan. The building is now 92% vacant. WeWork, which had leased 75% of the building, opted to terminate the lease early in August 2021 and was outa there. “The borrower has stated they will not be making any more payments,” the special servicer said in a note in August, cited by Morningstar, according to The Real Deal.

The $12.5-million mortgage on 1045 Bryant Street (35,000 sf) – a “high-end brick and timber building,” as the 1916 building, renovated in 2014, is now being pitched – was sent to a to a special servicer, indicating default or imminent default by the landlord, PBV VI. The building is vacant.

CMBS, of course. The mortgages tied to these three buildings, like most of the mortgage defaults on office properties that have come across our desk, are not held by banks, but had been securitized into Commercial Mortgage-Backed Securities (CMBS) and sold to investors. When these mortgages get into trouble, they’re sent to the special servicer that represents the CMBS holders.

Nationwide, defaults on office CMBS are now spiking at an astounding rate.

The market for sales of office building is beginning to unfreeze in San Francisco, but at discounts of 60% to 75% off from where they’d been valued a few years ago. We discussed the first two sales that took place in the new era here (75% off), and here (70% off), and there have been a few more sales since then in the 60% to 75% off range.

Office values massively repriced, office rents not yet. Part of the reason for rents remaining ridiculously high even for vacant space is that landlords must have a minimum amount of rent income or potential rent income to even have a chance to cover the interest expense and operating costs. They cannot cut their rents by a significant amount. Instead, they’ll default, take their loss on their equity, and let the lenders have the building and take the remaining losses.

The lender can then sell the building at a huge discount from its previous valuation, and at a huge loss on the loan, attract a new developer that, now with a lower cost basis, can fix up the building, and market the space at lower rents, which would push down overall rents and revitalize the totally overpriced market. Price can solve all kinds of problems.

That’s at least how it should happen – but that process is slow and hasn’t happened yet. And rents are still too damn high.

By sub-market, the availability rates ranged from 27.7% in the Union Square/Civic Center area to a catastrophic 57.9% in the Yerba Buena area, according to Savills. The Financial District North had an availability rate of 32.1%; the Financial District South 34.6%, both below the city average.

Leasing activity fell to just 0.8 msf in Q3, from 1.1 msf in Q2 and from the 2.5-msf range before the pandemic. Of the 10 largest leases signed:

- The top three were signed by, you guessed it, generative AI startups. But one of them, Hive AI, was just a relocation.

- Three were relocations: company vacates one office, moves to another office, not helping the overall office market; and if the move, as is now often the case, involves downsizing, it worsens the office market.

- One was a renewal.

- Six were new leases.

In Silicon Valley, the office availability rate remained that the record high seen since last year of 26.6%, with Class A availability rates over 30%, according to Savills.

Availability rates topped out at 35.9% in Downtown San Jose, 33.5% in Mountain View/Los Altos, 34.4% in Campbell/Los Gatos, and 29.7% in Santa Clara.

About 24 msf of office space was available for lease, including sublease space, which nearly doubled year-over-year to a record 7.6 msf.

Leasing activity plunged 60% year-over-year to just 652,000 sf, and was down from the 1.5 million to 2.8 million range in 2018 and 2019.

And yet despite the huge availability and the plunge in demand – oh, you knew this was coming – asking rents in Q3 rose 3.0% year-over-year to $5.22 per square foot per month ($62.64 psf per year), in part on a shift in mix, as “higher priced space is now available on the market both directly and for sublease,” according to Savills.

Of the top 10 leases signed:

- The top two were just renewals.

- One was a lease restructure.

- Seven were new locations

(Chart via Savills, gray columns, left scale = rents; orange line = Class A availability, yellow line = total availability, right scale):

![]()

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Bottom fishers will end up with some great CRE properties at a bargain price.

Question is as always…where the bottom?

Some RE has a negative value.

Not worth even if you got it for free.

rodolfo wrote:

> Question is as always…where the bottom?

I remember asking that question about 30 years ago and an old boss said “It is when Sam Zell starts buying” (unfortunately Sam passed away earlier this year).

Time for big contractors to look at CMBS to Apt/Condo conversions.

Not economically feasible for new buildings.

Cheaper and easier to tear it down.

Remember, every apartment needs water, sewer, a window, HVAC, etc.

The entire center of these office buildings cannot be used for residential.

Maybe universities or trade schools could use them, dorms on the outer perimeter, lecture halls/labs in the middle.

I know, I know, never happen. The broken window fallacy has become the basis of this economy.

Hong Kong some live in cages

Stayed in hotels in 70s bathroom down the hall

I have seen some creativity in the market addressing this. In one case, they actually left a void in the core of the building, building out residential around the outer perimeter. If the price is right, someone will come up with something. The exciting part of all this disruption. The pricey NYC lofts were once factories…

Which is perfect, because ti’s very difficult to find a building has including a decent coworking area or a study space. Imagine a coworking space or a study area on every residential floor, that is some residential urban paradise.

I lived in a converted office building and every problem you state was easily solved except for the deficiency of natural light, which was mitigated by an open floor plan and a large chandelier that I referred to as “the sun” which I had to keep on during the day.

Another issue: Where would these residents buy food? A lot of business districts do not have too many grocery stores.

Groceries? Food? I live in the country and I am getting most of what I need via Walmart and Amazon prime deliveries. Why? convenience. Going into town has become outright unpleasant. Yeah, deliveries are a sort of new thing for me, but I think it’s a permanent change. Druggies, crime, traffic, trash, smog…who needs it.

This a brain dead solution. Not that many can be rehabed. Who do you think is going to move into these apts? What services or amenities are available to attract people? How long a process? Here in Boston, the zoning and permitting takes several years. A better question is which buildings should be torn down?

What happens financially and legally to the landlords who default?

Whatever is iwriiten in the contract that can be civilly enforced.

But, typically, they get the asset (building) in a default.

Yes, commercial mortgages are often non-recourse, and all the lender gets is the building. In addition, properties are typically held in LLCs that don’t have anything else in them, and in a worst-case scenario, the lender gets whatever is in the LLC, which is the building.

The landlord loses the equity capital they put into the building.

The lenders lose the portion of the loan that cannot be covered by the proceeds from selling the building (after fees and expenses). So generally, the lender eats the bigger loss.

Thanks Wolf,

Who pays the property taxes? Do these just “go away”? Does a city/county take possession and try to lure new business into the space by offering a differed tax scenario?

Just curious, seems like an abandoned building of substantial size could be problematic for many other reasons.

Thanks.

One general point to make…if a lender required 35% equity in an office building deal initially, idiot overvaluations are not quite as catastrophic for the lender as they might otherwise be.

As with residential down payments, the “equity” in the deal provides a sort of “cushion” for the foreclosing lender…since the equity holders take the loss in its entirety before the lenders are out a dime (subject to how smart/experienced/patient the lender was initially).

So a $200 million purchase in 2019 might have been $70 million equity and $130 million debt.

If it turns out the building was overvalued by 100% ($200 million paid, $100 million true, current value) then the lender is only out $30 million, not $100 million (the other $70 million loss is taken by the initial equity getting completely wiped out.).

That is how traditional, conservative lending worked.

It is possible that during the ZIRP fuelled yield hysteria, cowboyish lenders (CMBS’ers perhaps) loosened that discipline in the name of getting deals and therefore have more exposure.

Each deal tends to be somewhat/fairly unique.

Valuations at securitizations — that’s what we’re looking at here — are based on appraisals that are made in order to sell the CMBS to investors. They ridiculously overstate the value, as we have found out time after time for the past 12 months. So at securitization, investors are told there is 40% equity, based on this appraisal, and then when the mortgage is sent to special servicing, the property is reappraised, and the valuation is cut by 60% or whatever. And then at the foreclosure sales, the proceeds are only a fraction of the re-appraised valuation. These appraisal at securitization are pure fiction to pull a bag over investors’ heads. Lots of times, there was never any actual equity in it to begin with. It just existed on paper due to the ridiculous appraisal.

WB: Unpaid property taxes do not just go away. But they may get so large that the accumulated unpaid property taxes are more than the property is worth. In several instances that I am familiar with, California counties agreed to wave their past due 1% Jarvis-Gann taxes so that public bond holders of assessment district or Mello-Roose bonds could be repaid and the projects refinanced and put back on the tax rolls.

Correct. My question is, will they still pay the property tax? If the Landlord is a LLC or a bank, can they just walk away? Then what? The taxes on these properties has got to be massive.

WB asks:

> My question is, will they still pay the property tax?

In CA the late fees on property tax bills are high so most lender REO departments will pay the taxes once they take title to a property. In CA the property tax bill is based on the “purchase price” so when a lender takes back a property bidding 30% less than it last sold for at a foreclosure sale they will pay more than 30% less in property tax.

ApartmentInvestor,

I thought that commercial real estate’s property tax liability tended to be tied to cashflow/actual returns rather than transaction prices…a fact that keeps big property tax consultancies like Ryan in business (choreographing financials/assessment appeals).

Obviously things can vary from jurisdiction to jurisdiction, but I thought big CRE owners had enough brains/bought political power to tie their tax liabilities to actual income (well…portrayed actual income…) rather than a transaction price agreed to during something close to a paint huffing orgy.

CAS wrote:

> I thought that commercial real estate’s property tax

> liability tended to be tied to cashflow/actual returns

> rather than transaction prices

In CA (every state is different so I am just talking CA here) 99.9% of commercial property is taxed just a like a home in CA at a little over 1% of the purchase price and can only increase by 2% a year. You can appeal to have your taxes lowered if something changes that lowers the value below your purchase price on both single family homes and commercial property, but this rarely happens. I had the assessed value lowered once when I bought an apartment building and “removed” the pool just after closing escrow, and Steve Jobs had it happen when he bought the multi-million dollar home next to him in Palo Alto and tore it down just after closing to “build” a pool. Only people that paid top dollar in recent years will be able to ask for a lower assessment due to vacancy or lower rents since the “current” value will need to drop below the “assessed” value.

Define “landlord”. Remember, you live in a country where “corporations (LLCs) are people”…

If the note holder is a bank, I suspect they will do what they in in 2008. Refuse any offers and just sit on the property until the taxpayer bails the system out, again. There certainly a few more steps and intricate details but the end result will be the same. The is no way these municipalities and central bank will actually allow deflation in those assets. Think of the lost tax revenue.

This ‘corporations are people’ seems to have been discovered by the general pop recently, even though the concept goes back to the 15 th century’s invention of the limited company in Holland. Ship building and ownership was an early use. Very difficult for one person to finance, it was done by a group, aka a company, which also in English means a group of people.

But does one guy own the mast, and another the rudder, while the big guy owns the hull? No, they will own shares in a ‘thing’ and the ‘thing’ owns the boat. If the boat incurs debt or damages, the thing owes the money. If it fails to pay, the creditor sues the thing.

Just like it was a human, so the simplest way to explain this in texts for centuries was to call the thing ‘a legal person’.

As well as the US, this is the practice in all countries with developed business law: eg., Europe, UK, Canada, Oz, etc.

All true. And I’d like to elaborate as best I can.

It also protected share holders from liability. The families of the crew/workers/shipbuilders couldn’t come after ANY of their assets if someone died or was injured.

I think that was the BIG one they avoid to this day. And also why they can pollute the shit out of everything….maybe the corp pays a fine, but they are tiring of that…eats into profits…so..they are working hard on corrupting and weakening the whole government, especially branches like EPA, OSHA, FTC, etc, etc. How can they possibly lose this game now is the question, it’s gone too far.

I’d say they effectively “rule” this country.

Incidentally, Bucky Fuller wrote a good essay on how corporations DO trace to SHIPS and the Age of Exploration, following a challenge to simplify it all, (and quickly) by that Rockefeller pal of his. A real polymath.

If taxpayers bail out a property, then it’s publicly owned and should be open to squatting. Same thing when a debtor gets shafted on a property, they should be able to store vehicles, or stuff there, in repayment. Laws are only as strong as their enforcement.

What happens when sheriffs refuse to evict squatters who are either breaking the law, or are covered by eviction moratoria?

Surprised We Work still rents space!!!!!!!! How?

It just made the CNBC “American Greed” series. (nothing else worth watching, although I do watch all drug related shows I bungle into) Didn’t say what the Venture Vultures made, but the guy who thought the scheme up cleared out with $700M+. Sleazy slick talker type, could sell anything (except to people like me).

(Think that Soft Bank idiot make have taken it in the shorts, though. Gotta make bean counting real simple (like Wolf usually does, or my mind wanders….especially if it’s video and I can’t re-read.)

Anyway, all perfectly legal. Amazing, Usually someone goes to jail on that show….it’s actually a VERY bad sign legal stuff makes that program.

The Corps have been buying law (actually unwinding 30s-40s-50’s regulatory law) for years now……about time for that flag with the top 50 corp’s logos instead of stars, and gilded age flop houses, or going back further “workhouses/poorhouses”. (vagrancy laws will FORCE the homeless out of sight and into them……the elite need their ambiance and law and ORDER)

Yeah, I know Wolf spotted and did stuff on this outfit a long time ago….maybe several.

As I dive South on US 101 from downtown San Francisco to SFO and beyond to San Jose, I am seeing new buildings popping up along both sides of the highway like mushrooms after a spring rain.

Any idea why?

Result of the long process of building a big building, from planning and permitting to financing and construction. Those take many years in California. The buildings you see going up now started that process years ago. They rarely get stopped unless something really bad happens.

The Oceanwide Center in San Francisco is one of those stopped projects. It had an original budget of $1.6 billion, but has been seized by creditors after construction was halted when it reached grade, years behind schedule, horribly over budget, and not economically feasible.

The developer, China Oceanwide Holdings in Beijing, has now also collapsed into bankruptcy. The mega project is now a huge eyesore in the middle of San Francisco right by the Salesforce Tower. This is a portion of the project, seen from street level (photo by Wolf Richter, May 24, 2021):

China is having a lot of bankruptcies caused by over spending in infrastructures. Plus the grifting is massive. There’s been a series of arrests of high ranking politicians for basically stealing from the state. That’s China. Here in the US high income theft comes from vulture equity funds that bury good companies with debt. Until they cannot even pay the interest on the debt. The money sucked out by the VE outfits. So it’s the private market where the stealing comes from in the US. I think JPowell made his ‘bones’ in this arena.

Unlike the US where lobbying is nothing more than bribes in disguise, the Chinese who are arrested for “stealing” “The People’s” money and other social deviance (the baby milk incident where the owners of the company were executed due to providing contaminated milk to babies who subsequently died comes to mind) may find themselves facing the death penalty and execution. Here we may place a few executives in jail for “knowingly allowing” ice cream contaminated with salmonella to be brought to the public and several people died. That owner whined and complained about his 20 year sentence being a death sentence because he was 63 at the time of being found guilty. He has little to no remorse and there are few consequences for those who maim and injure American citizens and they may flee to their respective homelands to avoid justice. Too bad our society don’t seem to care much about what the robber barons do to the average joe.

Reminds me of Japan after 1989 crash.

“huge eyesore in the middle of San Francisco ”

I wonder if there are some homeless tents popping up on this site?. That would take the term “eyesore” to a new level.

No, there is fence around it and security. When I was taking there taking pictures, I was confronted by a security guard (there was a fence between us). I gave him the name of my site and told him to look for the article.

The crane-bottom that you see in the background is now gone.

Get the right people in the Art world to go along and you have a SCULPTURE! And another SF sight for tourists to see.

(I’m starting to like this pic, and in an artistic way.

Take it to the De Young and see!)

Maybe this experience is dated, but for the employee, what about: 1) employment at will; 2) managers who want to micromanage or show they are “riding” the employees properly; 3) what about “out of sight, out of mind” for appraisals, raises, promotions, layoffs, training opportunities, networking, etc. even experienced when placed on “swing shift;” 4) what about “backstabbing” by the employees who returned to the office, and looking at some computer screen how is one to use the workplace “eyes” they grew on the back of their head?; 5) some workloads aren’t easily measured so management looks at your focus, efficiency, and interactions through the day; 6) finally how efficient can one be when they need to interact with another employee not instantly accessible or who you can look over a work file, documentation, hardware, etc. If it is a job like denying insurance claims, filling out “TPS reports” like the movie: “Office Space” then AI will be able to do that.

When I first saw Office Space I was sure they used the way my first boss in the corporate world talked as a model for Peter’s Boss (watching this one minute “TPS Report” clip gives me chills of that horrible year in a cubicle):

Yeah…if you could just go ahead and post that video? That would be great…

I never allow YouTube links. You can Google it.

Such a good movie!

My old boss was named “Lundberg”, but he was a nice guy.

I’ve seen it…was just making a joke.

(And good call on banning YT links.)

Just let all commercial properties be taken over by the State of California for non-payment of property taxes and forget about them.

Yes, let’s grow the gov even larger. They do such a brilliantly honest job now.

Like a backdoor version of Georgism, interesting…

But there’s no appetite to reform the taxation of land or capital among the rule makers . Land and capital are what empowers the rule makers.

Get as much of both as you can because it’s probably going to stay that way.

San Francisco is one of America’s most history-rich cities with magnificent architecture surrounded by natural splendor. It attracts interesting and/or beautiful people who love hills and serpentine lanes. It’s appeal is immense and will outlast any downturn, crimewave or other backlash.

I’m sure the jackals are already circling.

I’m sure they said the same thing about Detroit. It’s different this time, the tech bubble will last forever.

Potemkim Economy

How about QE for office building loans? The fed could take over those defaulted bank loans.

They’re not bank loans. They’re CMBS, and investors are on the hook, not banks.

My favorite SF building is the Millennium Tower, also known as the Leaning Tower of San Francisco. It has a 29 inch tilt and they can’t seem to straighten it. Apparently they can stop it from tilting more, but still, I would not want to be anywhere near where it might fall. Somebody is eating it on that one.

You cannot see a 29-inch tilt at the top of a 650-ft tall tower. I’ve tried many times. But there are all kinds of mechanical issues with the building, elevators, buckling sidewalks, breaking water pipes, etc. I heard that marbles will roll off the kitchen counter… maybe apocryphal.

You could drop a plumb bob on a longish line and maybe see it. I read where residents were having sewage problems. Yuck. I wonder who is going to pay for this mess. Somebody has to get sued.

Shitter’s full, Clark.

Not been there but try to line the corner of the building with another tall building then you will see how out of plumb it is .

Start a SF Galileo Festival. Would easily get wildly popular. Set dropped objects on fire….don’t have to just have 2, either.

Call it Burning Galileo. Burning man is too far away, out of space, and has been ruined by the wealthy, (like the rest of this planet) anyway.

I’ve seen video of a ball rolling on the floor in that tower. A large marble on a smooth surface like a counter is a very accurate detector of slope but u might have to overcome resting inertia to detect the real small ones

Trivia: the Pisa Tower is only standing because there was a 100 year pause before the top was added, giving the soil time to compact

…think the ‘Engineering Catastrophes’ series has the ‘marble roll’ across the floor demonstrated by some now, former, tenants…

may we all find a better day.

I would think that the hype for AI would increase demand for working computer space (server farms and colocation) and decrease demand for working human space (office space!)

Price can solve a lot of problems, but if there’s only demand for say 80% of the total existing square footage, then someone always can’t sell a lease at any price. I don’t see people wanting to work in offices because asking prices have fallen.

AI will stimulate demand for coal plants – in India. That’s also where the remaining jobs are going.

If it’s hype…..

Wolf,

What are your thoughts about the Prop 13 tax modifications (which may nor may not get passed next year) that could start to hit commercial real estate? Do you think that a lot of investors are increasingly concerned about the long term tax risks in California and that this could have a negative effect on the timing of a turnaround?

This obviously wouldn’t be the driver of decisions, but rather one of many potential risk factors to be considered (further technological disruption to work schedules, crime, cost of living, availability of workforce, etc.).

Not advocating the fairness or lack thereof of tax policy.

How big of a deal is this for long term real estate investors in the space?

re: “The office nightmare brought on by working from home,” some might think, would have the opposite affect on residential RE. Unless, for example, someone lives alone, has few pets, and plans to stay that way, wouldn’t they tend to prefer an extra office at home?

The first time I started a home business I had to use the dining room table. Within a few months, I felt compelled to move to a place with an extra bedroom. Since then, with or without a commercial office, I’ve alway felt the need to have a separate office at home. In fact, some relatives and friends that brought their work home when necessary, were stuck in the dining room while their wife cooked dinner.

Yes, there was some of that. People that moved from big cities, like SF, into the distant suburbs or into the ski areas, were looking for homes big enough to accommodate one office, and in many cases two offices (a his and hers). Builders are now pithing homes with offices.

Wouldn’t that include moving within the same city or rental complex? If someone had only 1 br, and felt the need to work from home, I’d assume they would want to find a similar place with 2+ br, either down the hall or across the street. No real need to move to the suburbs or head for the hills, unless they also wanted the wide open spaces.

During the years of high rates of covid, many people wanted as much space as possible between them and others.

Work from home, school from home needs more interior space. And going outside in a private yard was also preferable.

Going from a 2-BR to a 3-BR or a 4-BR gets very expensive in SF in a hurry. When you can work from home, why not live somewhere within an hour from a ski area and have a big house or condo and save a bunch of money? That’s what people actually did. Something like 50,000 people left SF and moved inland — though some are coming back now, it seems.

Thus far, the main beneficiaries of the AI hype train have been the “Mag Seven” stocks – MS, NVDA, AAPL, GOOG, etc.

These guys already have too much office space, and any incremental hires are probably remote eligible.

Color me unsurprised that AI is not going to save the office. If anything, it will tend to eliminate office jobs, for low skill or repetitive tasks.

“…landlords must have a minimum amount of rent income or potential rent income to even have a chance to cover the interest expense and operating costs. They cannot cut their rents by a significant amount. Instead, they’ll default, take their loss on their equity, and let the lenders have the building and take the remaining losses.”

Slightly off-topic, but wouldn’t this same logic apply to residential apartments & rents?

This is yet another reason why I feel residential rents can only fall so much.