Energy plunges, durable goods drop, food ticks up from sky-high levels, but meat re-surges, services are hot, rents accelerate, auto insurance spikes.

By Wolf Richter for WOLF STREET.

Energy prices plunged, durable goods prices (cars, electronics, furniture, etc.) dropped, food prices rose moderately, as some food prices dropped and meat prices jumped, according to the Consumer Price Index data released today by the Bureau of Labor Statistics.

But the action was in services, and has been for a long time. The CPI for Rent inflation – actual rents that tenants are paying – re-accelerated for the third month in a row, motor vehicle insurance spiked, lots of services jumped, but airline fares, rental cars, and some other services fell.

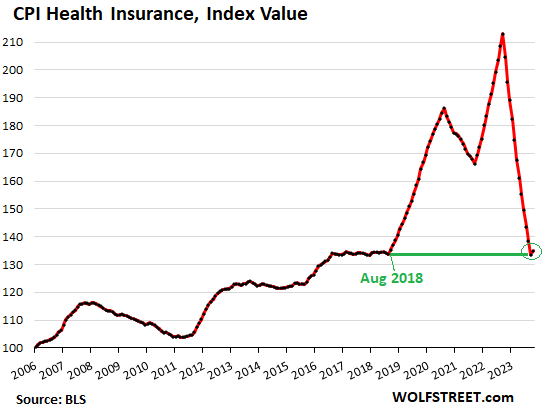

And the odious health insurance adjustment, which is part of services, reversed, as expected. It had caused the health insurance CPI to collapse by nearly 4% month-to-month every month for 12 months through September, and finally by 37% year-over-year, after the pandemic healthcare distortions had spectacularly blown up the model the BLS had used to estimate health insurance costs.

Now the health insurance CPI went the other way, as expected, and jumped month-to-month, and will jump month-to-month for the next six months under a newly tweaked system – and the jumps will get bigger. I just shredded the whole thing here: The Collapse of the Health Insurance CPI (How it Became Chickenshit).

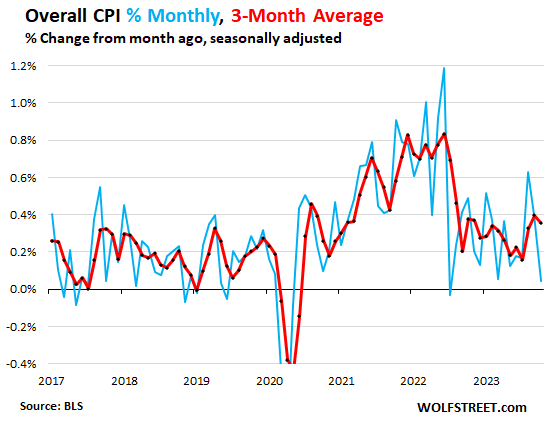

The Overall CPI, month-to-month, inched up by 0.04% in October, after having jumped by 0.40% in September, and by 0.63% in August. In October, it was pushed down by the 5.5% month-to-month plunge in energy and the drop in durable goods.

As you can see, this jumps up and down a lot: August had been the biggest month-to-month increase since June 2022; October was the smallest increase since July 2022 (blue line).

The three-month average, which irons out the month-to-month ups and downs, rose by 0.36%, or 4.4% annualized, with October and September values being the biggest increases since November 2022:

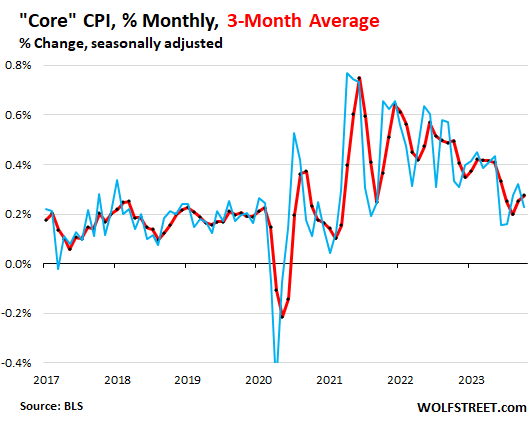

Core CPI, month-to-month rose by 0.23% in October from September, a slower increase than in the prior month, pushed down by the drop in durable goods, and helped by the moderate month-to-month rise in core services (blue line).

The three-month moving average rose by 0.28%, the biggest increase since June (red):

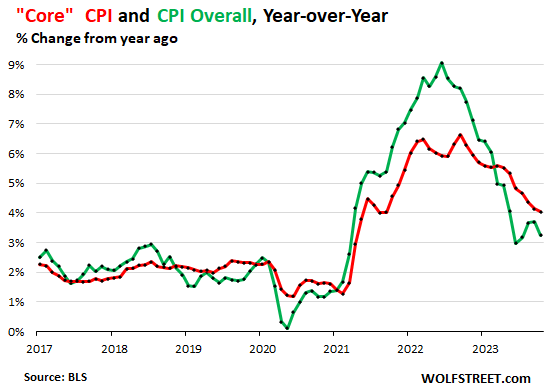

The year-over-year CPI decelerated to 3.2%, after three months in a row of re-acceleration, pushed down by the drop in energy prices and durable goods prices, and the 34% plunge in the health insurance CPI, and helped along by slower increases in food prices (green line).

The year-over-year “Core” CPI rose by 4.0% year-over-year, pushed down by the drop in durable goods, and the 34% plunge in the health insurance CPI (red line):

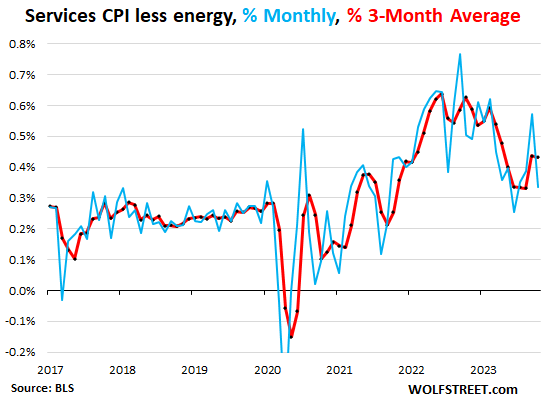

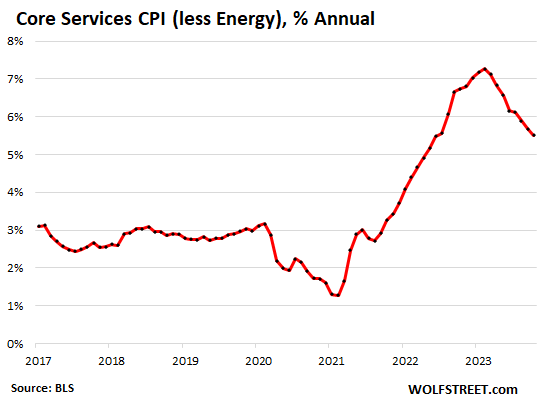

Core services still hot, rents smoke.

The CPI for core services (without energy services) on a month-to-month basis rose 0.34% in October from September, or 4.2% annualized, a lower rate, after three months of re-acceleration, including the 0.57% jump in the prior month (7.06% annualized), which had been the biggest increase since February (gray line).

The three-month moving average, which smoothens out these month-to-month ups and downs rose by 0.43% in October, roughly the same increase as in September, or 5.3% annualized (red line):

Year-over-year, the core services CPI rose by a still red-hot 5.5%, despite the 34% collapse of the year-over-year health insurance CPI within it:

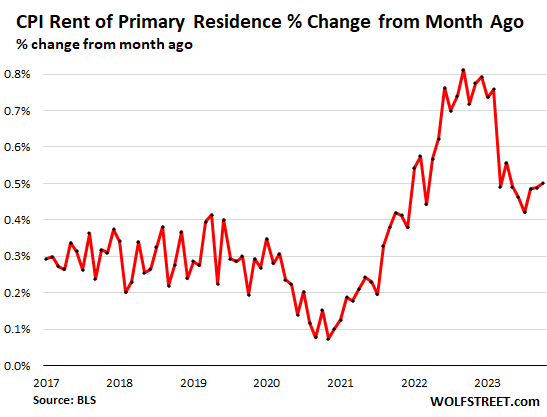

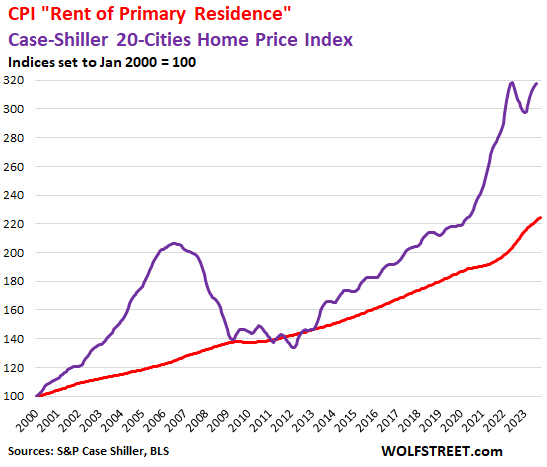

The “Rent of primary residence” CPI further accelerated to +0.50% in October (+6.2% annualized), the biggest increase since April.

The Rent CPI is based on actual rents that tenants actually paid. The survey follows the same large group of rental houses and apartments over time and tracks what tenants, who come and go, actually pay in these units.

The huge month-to-month spikes in rent in 2022 through February 2023 are behind us. But after cooling a lot in the first half of 2023, increases of actual rents have begun to accelerate again.

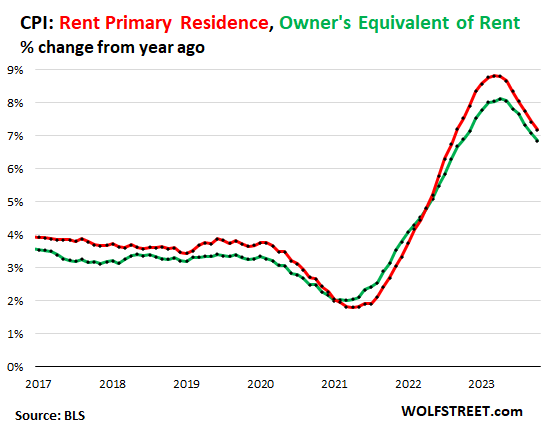

Year-over-year, the Rent CPI increased by 7.2% (red in the chart below). Over the past three months, the month-to-month rent CPI has run at an annualized rate of over 6%. This 6%-plus increase also roughly matches what the largest landlords have reported in their earnings calls. So it seems rent increases have gotten stuck at the 6%-plus rate.

The “Owners’ equivalent of rent” CPI rose by 0.41% in October from September (or 5.0% annualized), after 0.56% jump in the prior month, which had been the biggest increase since February.

The OER index is not based on actual rents, but on what a large group of homeowners estimates their home would rent for.

Year-over-year, the CPI for OER increased by 6.8% (green):

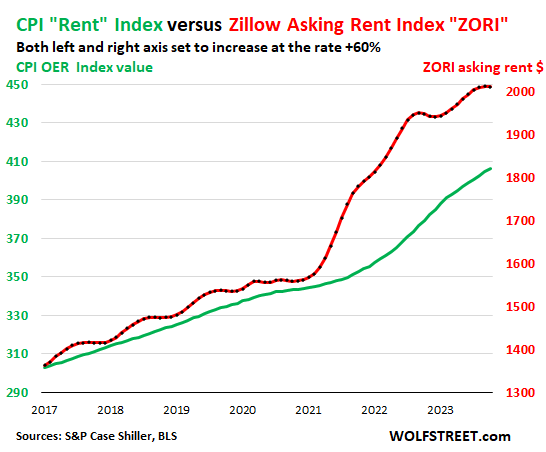

“Asking rents…” The Zillow Observed Rent Index (ZORI) and other private-sector rent indices track “asking rents,” which are advertised rents of vacant units on the market. Because rentals don’t turn over that much, the ZORI’s spike in 2021 through mid-2022 never fully made it into the CPI indices because not many people actually ended up paying those spiking asking rents.

In late 2022, asking rents in dollar-terms began to dip seasonally, but then began to rise again this year to new records in dollar-terms.

This time of the year, the ZORI typically dips a little. And in October it dipped by $1.91 from the prior month (-0.09%), to $2,011.22. The decline was smaller than in October last year (-$2.58 or -0.13%).

The chart shows the CPI Rent (green, left scale) as index values, not percent change; and the ZORI in dollars (red, right scale). The left and right axes are set so that they both increase each by 55% from January 2017, with the ZORI up by 47% and the CPI Rent up by 34%:

Rent inflation vs. home-price inflation: The red line represents the CPI for Rent of Primary Residence (tracking actual rents). The purple line represents the Case-Shiller Home Price 20-Cities Composite Index. Both lines are index values set to 100 for January 2000:

The collapse of the health insurance CPI. October was the first month without the monthly push-down adjustments to the health insurance CPI, which started with the October CPI in 2022 and went through September this year. I discussed the old and new versions earlier today, shredding the whole thing: The Collapse of the Health Insurance CPI (How it Became Chickenshit).

I’ll just say here that the health insurance CPI jumped by 1.1% in October from September, instead of plunging 4% month-to-month, as it had done in the prior months; and that the new version of this index is “smoothened” via a moving average, so the impact of the new positive values is slowed by the moving average, but should get picked up over the next months; it might rise by about 2% in November and by about 3% in December, my rough guess.

Here is the infamous chart of the Health Insurance CPI as index values, and that little hook at the bottom is the 1.1% increase that will increase over the next few months (this chart shows how the index has turned to chickenshit, technical term):

Services CPI by category.

The table is sorted by weight of each service category in the overall CPI. The CPI for medical services is the third largest item, with a weight of 6.3% in overall CPI, and over 10% in the services CPI. The year-over-year drop of 2.0% — though actual expenses medical care services have risen – was caused by 34% year-over-year collapse of the health insurance CPI within it. Note the spike in motor vehicle insurance.

| Major Services without Energy | Weight in CPI | MoM | YoY |

| Services without Energy | 61.7% | 0.3% | 5.5% |

| Owner’s equivalent of rent | 25.7% | 0.4% | 6.8% |

| Rent of primary residence | 7.6% | 0.5% | 7.2% |

| Medical care services & insurance | 6.3% | 0.3% | -2.0% |

| Food services (food away from home) | 4.8% | 0.4% | 5.4% |

| Education and communication services | 4.8% | 0.0% | 2.3% |

| Recreation services, admission, movies, concerts, sports events, club memberships | 3.1% | 0.1% | 5.7% |

| Motor vehicle insurance | 2.8% | 1.9% | 19.2% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.5% | 0.3% | 6.7% |

| Motor vehicle maintenance & repair | 1.1% | 0.2% | 9.6% |

| Water, sewer, trash collection services | 1.1% | 0.3% | 5.3% |

| Hotels, motels, etc. | 1.0% | -2.9% | 0.8% |

| Pet services, including veterinary | 0.6% | 0.6% | 7.3% |

| Airline fares | 0.5% | -0.9% | -13.2% |

| Tenants’ & Household insurance | 0.4% | 0.4% | 2.9% |

| Video and audio services, cable | 0.3% | 0.5% | -4.6% |

| Car and truck rental | 0.1% | -1.5% | -9.6% |

| Postage & delivery services | 0.1% | -0.9% | 0.8% |

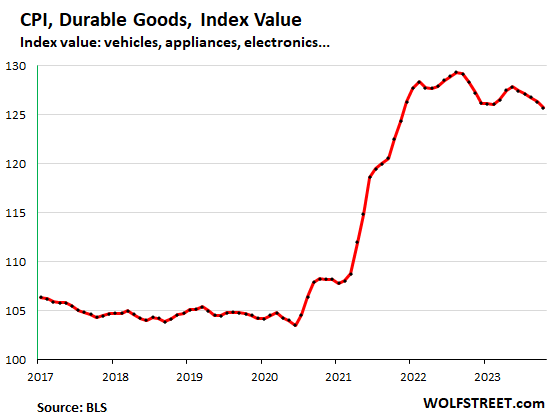

Durable goods prices continue to drop, after huge spike.

The CPI for durable goods, after blowing out during the period of shortages, has been falling for months. In October, it fell by 0.43% from September and by 2.2% year-over er-year.

The index is dominated by new and used vehicles, information technology products (computers, smartphones, home network equipment, etc.), appliances, furniture, etc.

This chart shows the price level of the index, not the percent change:

| Durable goods by category | MoM | YoY |

| Durable goods overall | -0.4% | -2.2% |

| New vehicles | -0.1% | 1.9% |

| Used vehicles | -0.8% | -7.1% |

| Information technology (computers, smartphones, etc.) | -1.4% | -7.6% |

| Sporting goods (bicycles, equipment, etc.) | 0.4% | -1.2% |

| Household furnishings (furniture, appliances, floor coverings, tools) | -0.2% | 0.7% |

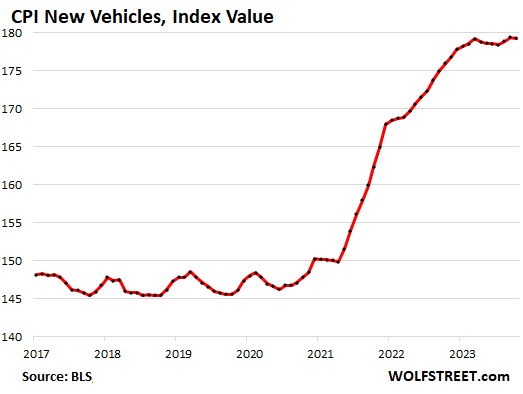

New vehicles CPI inched down by 0.1% in October from September, after rising two months in a row. Year-over-year, the index rose 1.9%.

For many years before the pandemic, the new vehicle CPI was essentially flat with some ups and downs, despite large increases of actual vehicle prices. This is the effect of “hedonic quality adjustments” applied to the CPIs for new and used vehicles and also other products (here’s my chart and detailed explanation of hedonic quality adjustments).

The pandemic price spike blew all this apart. Between February 2020 and April 2023, the CPI for new vehicles jumped by a total of 25%. Since then, it has remained roughly flat:

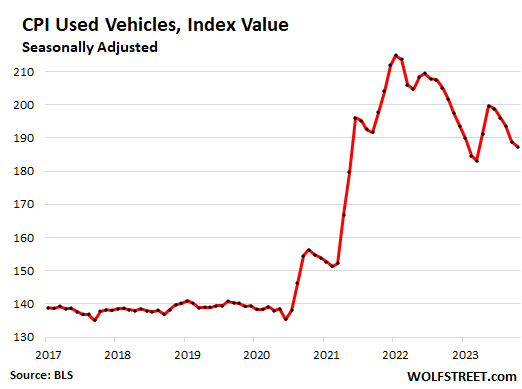

Used vehicle CPI fell by 0.8% in October and by 7.1% year-over-year.

From February 2020 through January 2022, the index spiked by 55%. Since that peak, it has dropped by nearly 13%. But it’s still up by 34% from February 2020.

Note the effects of the hedonic quality adjustments in keeping prices level in the years before the pandemic even as actual used vehicle prices rose:

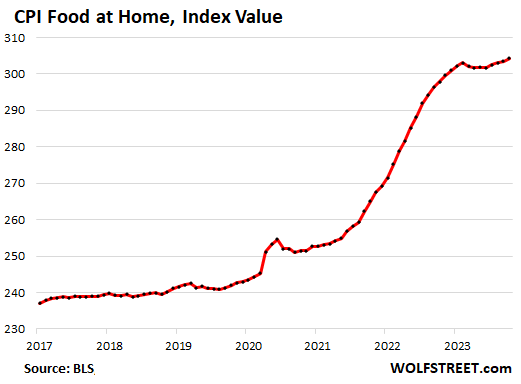

Food at home: prices ticking up again from very high levels.

The CPI for food bought at grocery stores and markets rose by 0.3% for the months and by 2.1% year-over-year. Those are relatively moderate price increases, but they are on top of very high prices, after the 24% spike during the pandemic through 2022.

Category by category, there are big differences, with meat prices now surging again, while prices in other categories are dropping. Baby formula is on the rise again as well.

| Food at home by category | MoM | YoY |

| Overall Food at home | 0.3% | 2.1% |

| Cereals and bakery products | 0.2% | 4.2% |

| Beef and veal | 1.2% | 8.9% |

| Pork | 1.3% | 0.3% |

| Poultry | 0.3% | 1.1% |

| Fish and seafood | -0.1% | -1.8% |

| Eggs | 0.1% | -22.2% |

| Dairy and related products | 0.3% | -0.4% |

| Fresh fruits | 0.5% | 1.8% |

| Fresh vegetables | -1.3% | -2.2% |

| Juices and nonalcoholic drinks | -0.1% | 3.3% |

| Coffee | -0.6% | 0.4% |

| Fats and oils | 2.3% | 2.8% |

| Baby food & formula | 1.0% | 8.3% |

| Alcoholic beverages at home | 0.2% | 2.7% |

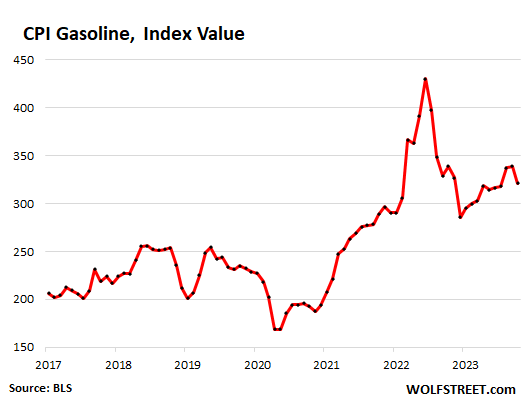

Energy prices plunged.

The CPI for energy plunged by 4.9% in October from September, and was down 6.2% year-over-year. Energy prices are very volatile, which is why they’re excluded from “core” inflation measures to see the underlying inflation.

These are energy products that consumers buy directly, such as motor fuel, natural gas piped to the home, heating oil, electricity services, firewood, etc.

Gasoline plunged 5.0% for the month after having risen all year. Year-over-year, it’s down 5.3%. But it’s down by 25% from the peak of the spike in June 2022. Gasoline accounts for about half of the total energy CPI.

Fuel prices – gasoline, diesel, jet fuel – eventually make their way into consumer products that are shipped by delivery van, truck, rail, or air as are nearly all consumer products. Jet fuel makes its way into services via air fares. These products and services are included in core CPI, which is how core CPI eventually reacts to energy costs, if the changes are big and persistent.

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | -4.9% | -6.2% |

| Gasoline | -5.0% | -5.3% |

| Utility natural gas to home | 1.2% | -15.8% |

| Electricity service | 0.3% | 2.4% |

| Heating oil, propane, kerosene, firewood | -3.4% | -17.1% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Rent and food are generally hard to find substitutes for these days. Store brand and mainstream brand prices are almost the same price.

Health insurance varies according to income level. I used to be told that Medicare and Medicaid funded low income people and seniors, but if one is a middle class person who needs lifetime cancer treatment, that is where the horror stories come about.

But I still believe that the drop in healthcare CPI was too overstated on the general inflation rate.

What’s surprising is that medical services and insurance are 6.3% of CPI weight. This is probably for employer provided insurance. If you’re on your own then you’re looking at 20%-25% (?). But you can keep your doctor if you like her.

That brings the question whether one is not poor enough to qualify for Medicaid or the ACA equivalent, that they have to pay a way higher premium.

I’m guessing this is where the lower middle class with blue collar jobs are stuck in, too rich to be low income, and not qualified for an employer group plan.

Gen – an astute, and key observation of a now long-running national conundrum. One, IMHO, that contributes to our apparently increasing demographic strife at the same time those efforts were instituted to relieve them. (…the programs implementing our best intentions often hurriedly/poorly-crafted and executed under the heavy fire of time and general human cussedness…).

may we all find a better day.

This is related, but I’m not sure how. I went into McDonalds in Ukiah Ca yesterday to get a cup of coffee, and there on the counter was this 2’x2′ sign. Had a couple burgers and some other smaller print, but in bright red 2″ tall letters that covered easily 2/3-3/4 of the whole sign it said,

ORDER.

EAT.

EARN.

ORDER.

I know I’m weird, but am I crazy or hallucinating?

NBay – was the sign pointing at the customer or employee? Both? Agree, kinda weird (not you), mebbe mgt. trying to get an idea across to new hires as to where the paycheck originates? Best.

may we all find a better day.

Very little of the total pie of healthcare spending is bad by the consumer, most is paid by companies and the government. This is a big part of the problem with healthcare, the ultimate consumer has no incentive to pick good value. Or take care of themselves, as they are paying for the cost. This market is not driven by economics/market, which is why it is so inefficient.

In two thirds of Canada by population rent plus utilities is equal to what a minimum wage earner earns after income tax for a one bedroom apartment. So they have to survive at the food banks and buy plenty of blankets and warm coats for the winter months. No wonder so many of these immigrants coming to Canada are making a U-turn and going back home.

Of course the best thing about life is that you can’t make this shit up.

The immaculate inflation print one year from the next presidential election, still under the sway of Ben Bernanke’s 25 year experiment with Milton Friedman’s unproven impulses.

I previously proposed a theory that general price inflation lags the cause, asset price inflation. I only mention that because inflation is only sleeping, waiting for the next opportunity too increase the price of goods.

The asset price bubbles in the stock, bond, and housing have been, mysteriously, reinflated. There exists, IMO, a dislocation between asset prices and spendable income of the middle and less fortunate classes. The wellspring of America.

Until there’s a real move towards negative job growth, this data is nothing more than the expected “cooling” off. We still have profuse federal deficits and many other reasons to think this “may well be” a classic ’74-76 head fake.

It’s funny how this one-month good news, after two months of worse than expected bad news, stirs up all kinds of exuberance, which is exactly what causes inflation to resurge.

Financial conditions loosed in a mega-leap today and over the past seven days or so. This is precisely why it’s so hard to get inflation back down for good, and Volcker finally lost patience and stepped on it with both feet, and triggered the awful double-dip recession, which did the job. But it took years to get there.

I would love to see Powell go full on Volcker. And, yes, I lived during those years. It was tough, but I survived. I don’t think there is anyone with the political will to do that at the moment, unfortunately.

But then again we want higher for longer, but the market is bringing down rates anyhow (along with Treasury and their little stunt last week). I have no clue what the answer is anymore. I don’t think in corrupt terms like our government and wall street, so I give up.

The CPI didn’t fall below 2% until 1986.

I made a fortune during those Volcker years.

Fed – an issue being, given the ‘Murican mindset, that those candidates with certain ‘political wills’ seem to lose elections…

may we all find a better day.

Yeah Pow Pow wants to be remember as Volcker, guess he is trying to copy his playbook to the T, even the part about relaxing too soon and having to come back with a fury to kill it once and for all…

If he failed to contain this, will Pow Pow be able to copy Volcker second act? I personally doubt it very much…time will tell especially depending on who will be in charge after 2024..

Pussy cat Powell wants nothing to do with Volcker like rate policy. He would prefer inflation destroy the economy before being implicated for causing one.

Volcker relaxed twice too soon. And 1984 became controversial as inflation reaccelerated (William Barnett and Milton Friedman had a disagreement).

If there’s no rate cuts in 24, we could be looking at $1.5T in interest expense. At some point, one has to wonder if JPowell is going to conjure up a few excuses just to keep the interest expense down. Volcker didn’t have the interest expense back in the early 80’s. We do and it’s a major issue, for now.

Fantastic article by you Wolf.

And UBS is now on record expecting the Fed to halve the FFR next year all the while saying there’s no chance of a GR 2.0. Those two statements seem very unsupportive of one another. It’s like “analysts” are making stuff up just to drive the markets higher, and then their algo’s are going to tell them when to sell out.

I generally agree with your synopsis which accurately portrays the economic agony of the currently grandparents whom experienced the with drawl of monetary stimulus when Volker had his change of opinion.

He accepted the wisdom that money is a commodity, designed too be spent. When there is marginally, too much money available then the normal people spend it.

When there is grossly, too much money, it loses it’s value. Abundantly available cash for an apparently undervalued assets like homes, stocks, and bonds. The one thing we never talk about is the corrupt structure of the FOMC.

The stock bubble immediately inflated and the overpriced houses held their asking price, suggesting that Powell emitted some kind of pherimone that excited the same old Wall Street propensity too take advantage of the dweebs.

Welcome Chairman Xi, owner of a labor mynopsony, a scab.

Now that Walmart is concentrating on countries other than China, it is okay for the corporate media to disparage manufacturing in China.

And Apple, searching for another desperate population to manufacture their product.

The crocodiles of American business, not a shred of doubt about whether they should have undercut the Union wage structure by manufacturing in China.

American labor cannot compete with Chinese Communist Party work force. Lower wage, less benefits, dispensable.

Totally not compatible with the young ones being able to afford a house. Something has too give which I think is likely to be the asset prices falling to once again, consummate the economic equilibrium that has been promised.

Just sat through a presentation regarding global employment statistics and the outlook of the next 15 years for talent acquisition. The amount of workers is 4 retirees to 1 employed. This presentation leads me to believe we will never have the mass layoffs we saw in 2008. Therefore, we are in uncharted waters.

LoL at thr market and msm reaction today…looks like they are ready to hang that Mission Accomplished banner on the aircraft carrier…inflation finally is transitory…

I noticed this too, I hold a bunch of stuff fairly passively and when something spikes or drops I have a look, nothing but “positive news” on the inflation front, markets green, USD falling. Whatever, we’ll see how “forward looking” Mr. Market really is, if it’s just a fake out I’m prepared as well, but the news cycle is definately very short sighted when it comes to pushing positivity, they take every chance . I suppose it’s their job given how they make money, I’m happy to have found this place.

It’s sickening. And yields plummeting, stonks rallying is beyond disgusting.

Also saw mortgage rate for 30 years fell quite a bit as well….already saw couple of articles predicting housing to rebound hard soon since you know 7% mortgage rate is such a bargain and all with the current average home price…

All the landlords in my area are putting their properties on at 10-20% above the prior realised rental from 1-2 years prior, which is already elevated from pre pandemic. They usually do no work on the place, so you’re getting “old” goods. Some try 25% and a few get caught out for their greed, but mostly these things go quickly.

We’ve personally always been a tiny bit behind the curve, the rules seem to keep changing dramatically a fraction before we get there. Current prices are utterly insane and make no rational sense, but they’ve felt that way for over a decade and yet they still go up. It’s hard not to get fatalistic and start thinking rents will just go to where house prices are rather than the other way around, but I’m also acutely conscious caving now could wreck our financial future.

One again robbing the retirees and savers.

I have found the last 10 days of, which is the NY Fed promising a floor under overpriced stock and housing as a nauseating spectacle of the Fed’s capitulation. The market has fought the feckless Fed and is winning.

The Fed appears as a lamb groomed for slaughter, pretending to be in charge while being told what too do

Watch the Fed ignore this BS.

No surprise the Nasdaq is up 2% on CPI day… just a suckers rally imo, and I took the opportunity to cost avg down my shorts.

Best performing sector today was real estate, same as the big spike up last week. Gift for short sellers as total junk companies that are probably months away from bankruptcy were up 10-15%. They will no doubt end up in Wolf’s list of imploded stocks.

Won’t the trajectory for Owner equivalent rent show softness which will lead to fall in core service CPI ex energy?

What’s your expectations for OER Increase for next 6 months

OER had a big jump in September. It came off that jump today.

So right now, as I said, the rent index seems to aspire to the 6%-plus rate, from the month-to-month data. So year-over-year numbers will easy until they reach that 6%-plus level we’re now seeing in the monthly Rent CPI. The days of 8% rent CPI are over, long live the days of 6%-plus rent CPI.

OER and Rent are rarely far apart.

So my house is going to double from here as rates go back to zero and money gushes from all trailer park mailboxes…sweet!

Another great analysis, Wolf.

Sometimes all the statistics get in the way, however, of the big picture, and to me the increase in the all urban CPI over just the last 3 years tells us a lot! From October, 2020 through October 2023 the CPI was up 18.2%.

That’s nearly a 20% increase in consumer prices in just three short years, and we all know how time flies….smile.

Some goods inflation has cooled way down along with a few services too. The catch is that the average person buys a laptop maybe once every few years. A plane ticket and rental car out of pocket maybe a couple of times if it’s a particularly exciting year. Gas edged down a little, but only until we’re drawn into the next middle-east conflict soon. Back here in the real world, my daily food costs went up 30% in a couple years even with cost conscious substitutions. I just renewed my homeowner’s insurance, up 15% in one year. Car insurance just renewed, up 13% in 6 months. Just went through open enrollment for health/dental/vision with premiums up 15% AND the deductible increased 25% + max out of pocket increased 33% in a year for a so-called “equivalent” plan.

Sure, consumer electronics have come back down a ways from peak insanity. But who cares when everything else that we actually buy every day is still seeing hot inflation? The walllets of the middle and lower classes are still being demolished where it counts: everyday purchases, especially services. Some CPI categories are a joke. The healthcare index is simply a bold-faced lie, flagrantly insulting the intelligence of the consumer. But hey, good news! The gov just told us inflation is within a percent of target! Mission almost accomplished! The BS, er uh, BLS can take their silly government-favored CPI metrics and aggressively shove them where the sun does not directly strike.

Is there a reason the Federal Reserve is being deliberately vague about the exact criteria needed to cut rates? (This is UNLIKE the very explicit criteria they provided in 2021 about what it would take for rates to lift off.)

The problem is without this communication, Wall Street keeps filling in the holes for them. And they’ve now priced in a 0.25% cut by March 2024. It’s not clear what would be the catalyst for the cut in only 4 months. Is it just lower inflation that’s still likely to be modestly above 2% (in the low 3%’s) by then? Or they’re betting on a sudden recession?

Failing to digest the fact that interest rates will be structurally higher for the next decade+ is my guess.

The high deficits will decrease tax receipts and crowd out real investment.

“It’s not clear what would be the catalyst for the cut in only 4 months.”

The date for the first cut moves all over the place. It’s wall street’s attempt to jawbone stocks higher and yields lower. The sooner the projected cuts, the bigger and longer the rally.

I’ve just received new proposal of new insurance plan for next year and price is up 8%. Of course it does not take into consideration that deductible when up and who knows what else changed since you need a a lawyer to figure out those plans. For example avarage insurance buyer needs to deal with Tier 1 , Tier1, deductibles, coinsurance, generic drugs.

If you read the most recent press conference notes from Chairman Powell on November 1, he’s actually not vague about what it might take to lower rates.

A few snippets:

Since early last year, the FOMC has significantly tightened the stance of monetary policy…..The stance of policy is restrictive, meaning that

tight policy is putting downward pressure on economic activity and inflation, and the full effects of our tightening have yet to be felt….Given how far we have come, along with the uncertainties and risks we face, the Committee is proceeding carefully. We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of

risks.

Further into the release:

We remain committed to bringing inflation back down to our 2 percent goal and to keeping longer-term inflation expectations well anchored. Reducing inflation is likely to require a period of below-potential growth and some softening of labor market conditions. Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run.

So look to what he says is necessary to discontinue rate increases and then add in time to anchor long-term expectations.

Once those are accomplished, then he’ll think about lowering rates. But absolutely not four months from now.

Fed futures trading yesterday and today indicate that “The Market” expects interest rates to drop by 50 to 100 basis points by the end of next year. How can this be true if the Fed is going to fight inflation until it reaches the 2.0% level? It can’t be true. I conclude that “The Market” is absolutely betting that the Fed will flinch and ultimately accept an ongoing inflation rate greater than 2.0%. It’s so disheartening. It makes successful investing depend more on understanding the Fed’s financial engineering whims than on analysis of business fundamentals. So depressing. Oh well.

So far, for nearly two years, futures trading has been predicting rate cuts within four to eight months every month. The imminent rate cuts just get moved every month by a month. I have no idea why anyone still pays attention to these bets.

I really appreciate the addition of the 3MMA graphs Wolf – much easier to see the signal thru the noise.

“I don’t know why they call this stuff Hamburger Helper, it does just fine by itself.” Cousin Eddie movie: “Vacation.” Looks like Jerome Powell is trying out for a movie sequel.

I am reading these last few articles as wait and see what happens over next few months. By mid January I will have some CDs and short term treasuries maturing and can see what things look like then. I am a person who tends overreact which isn’t a great idea in today’s media frenzy but old habits are hard to break! Only financial decision between now and end of year is tax minimization if possible but with markets up not likely.

Great article. Excellent in all manner.

Glen,

I have to fight against over reacting too financial news too. My better financial decisions have generally been those that I agonized over for a while.

El-erain’s prediction is for continuing sharp disinflation in headline inflation. He expects core inflation to stabilize around 3% over the next couple of years.

Howard Marks said he expects steady headline disinflation. He said he thought the fed funds rate was more likely to be in the 3-4% range than the 1-2% range over the next several years but he wouldn’t predict more than that.

So, not too much difference in their views.

My 4 large diversified mining stocks were up 5.66% in the last two days. That is a pretty big move for them. Over the last 2 months while the broader indexes have corrected they have often travelled inversely but haven’t lost half as much as the broad indexes.

I am not certain what is going on but mines are huge investments and a top in interest rates and hope for them to fall would seem beneficial to miners.

Also, the green movement and conflicts around the world are good for miners. It takes metal and minerals to build or rebuild almost anything.

These people don’t live in the real world. Anyone buying groceries, paying health insurance, booking flights, booking hotels, getting everyday supplies, going to the doctor, paying car insurance, all this on a budget, knows what the real inflation is. I don’t need charts, or stats, I can look at my previous paid prices, I can talk with family and friends, I can talk with strangers at the bar or in a Uber, and inflation is still out of control. And a raging stock market, lower mortgage rates, etc will just make it worse.

BS. That’s exactly how you fool yourself. You have no idea what my inflation is or that of 330 million Americans. You don’t even know what your own prices are, from what I can tell on your list. You can take flights and hotels off your list that went up this year, prices dropped, dude. This is just goofball stuff. In terms of our prices that dropped:

– My health insurance dropped in 2023 (both Medicare Part B & Advantage Plan)

– My broadband price collapsed by 65%

– Some groceries are more expensive, others are cheaper, eggs are a lot cheaper, and we’re now getting good deals on fish again (black cod at Costco for $8.x a pound, to-die-for fish)

– Found a wonderful craft IPA for $5.99 a six pack at Trader Joe’s a few months ago and have been buying it ever since, cheapest craft IPA in many years.

– Coffee came down in price, for example bought Peet’s 2-pound bags on sale at Costco.

– Our housing costs haven’t changed

– Gasoline is cheaper

– Our nonstop flights from San Francisco to Europe in Oct were the cheapest I have found in the 16 years we’ve lived in SF.

Etc. etc.

That’s why it’s total BS to pretend you know what inflation is for all Americans on average.

This is about perspective; the middle class continues degrading; the top 10% are doing peachy.

This is probably one of the most difficult things to grasp about inflation — one’s personal basket of goods is often unrelated to that used in the aggregated statistics.

You are right! Today’s game is all about being a smart consumer.

My UHC MA premiums going up 22.x % in 2024. And then we have the cumulative effect of the past three years that never should have happened and haven’t unwound or unwound enough. Insurance is through the roof. Car maintenance since before the pandemic through the roof and up appreciably every year since 2019. My oil change up again this year significantly. Everyone else’s home insurance and car insurance has gone through the roof. I’m glad the things you buy have gone down acceptably for you. I have not seen one thing I buy go down in price yet.

Okay maybe gasoline is down right now, for a brief moment, but that is up and down all over the place. We had huge spikes in the spring in AZ after being down, so I don’t expect gas prices being down today to last. Be nice if they do, but I’m not counting on it.

Wolf, while you are right that some things have dropped (like eggs and hotels), they’ve dropped from their 2022 high, but they’re still way above 2019, in my experience. The average person thinks “lessening inflation” to mean “deflation,” which the media takes advantage of.

“– My health insurance dropped in 2023 (both Medicare Part B & Advantage Plan)

– My broadband price collapsed by 65%”

Did providers dropped the prices themselves, or did you have to compare pricing and actually negotiate for better rates?

I’m guessing the latter.

Nissanfan,

Your question tells me that you may not fully understand what “inflation” is. So let me deal with that first. And then to your question.

Inflation is a broad increase in prices across broad products and vendors on average across a specific area, for example the country, or a big city. It’s measured over a specific period of time, such as price changes month to month, or year over year.

If one vendor raises the price but another vendor cuts the price on a similar product or service, that’s NOT inflation, that’s basic price competition. You get inflation when they raise their prices together, and when consumers pay those raised prices, instead of not buying or buying from a vendor with lower prices.

I discussed this early on in 2021, when I said that the “inflationary mindset” had taken off where consumers were paying whatever, and prices — used car prices in my example back then — were going up in leaps and bounds across the board, and people were paying them. That’s inflation. One dealer trying to rip me off, and I walk out and buy from another dealer for less is not inflation.

This is why inflation is very hard to track, and this anecdotal stuff is fine, but when people think that this anecdotal stuff is US inflation, they’re entering into BS-land.

I gave some counter-examples to demonstrate that you cannot figure inflation for the US from your personal anecdotal stuff. Saying that you know what US inflation is based on personal anecdotal stuff is just dumb BS. And I call it out when it exceeds my tolerance for BS.

To your questions:

1. Medicare Part B premium fell for ALL millions of Americans who have it, I didn’t change suppliers because you can’t. The Advantage plan premium was lowered by the same HMO, and I didn’t have to do anything, it went down for all people that have the plan. They were apparently losing some people and figured they want to stay competitive.

2. Broadband… The product is “gigabit broadband” and the vendor doesn’t matter, basic price competition, which is how you keep inflation from taking off. I switched vendors (I have three to choose from for gigabit broadband, and there is no difference, the service is the same, but the price plunged.

In 2021, when inflation took off, people stopped doing that, or couldn’t do that because everything went up together, and they just paid whatever. People are no longer paying whatever, which is why inflation has come down a lot.

No doubt there is deflation in certain items…however how many of these are discretionary versus essential. I would categorize the airline fares, hotels, cape cod as discretionary. Coffee, eggs, broadband are more essential. Your health insurance in all fairness can’t be compared when going from private pay to Medicare Part B/Advantage Plans.

“Did providers dropped the prices themselves, or did you have to compare pricing and actually negotiate for better rates? ”

Wolf addressed this in another article. Broadband? Change carriers. No “negotiation” required. Simply do some comparison shopping. Not rocket “surgery”.

My broadband dropped from $119 plus tax and stupid fees to $25 plus tax and fewer stupid fees for the same speed with better reliability. Took 15 minutes. There’s about $1,100 a year not wasted.

My Medicare Part B went up (you don’t negotiate with the government) $9.80. My Medigap Plan went down about $60 a month simply by changing policies with the same company (call a Medigap broker….. they’ll guide you – but you have to medically qualify). There’s another $720 a year, with the offset of the increased CMS cost, $600. That took about half an hour.

Went to Frys Foods (aka Kroger). Used their coupons and stuff to do a quick shopping trip. Saved 52% by using their “club card”. Again, not rocket surgery.

Gas in AZ? It’s because AZ (particularly Phoenix) uses CA blended gasoline – which cannot be supplied by refineries elsewhere (like TX or somewhere else). When their plants go down for maintenance, gas prices spike. I go to Costco. Last time I checked the Shell station around the corner from said Costco, the difference for regular was @ $1.00 a gallon higher at Shell – however, it’s still a $1 a gallon higher than when we moved here in 2017. Costco gas is “tier one” so there’s no risk of warranty denial.

Started shopping for a car as the technomobile needs a major maintenance. Like for like, the purchase of the new one had a $5K discount built in…. (of course, I know the dealer, but….) as they are starting to stack like cord wood (larger vehicle non-hybrid). Trade on existing still reasonable.

I find it amusing when I am getting 5.5% on my portfolio and some jackass says I am barely keeping up with inflation. Inflation is different for everybody, depending on what they consume and what their income is. I notice food prices really jumped, but they are only 6% of my annual income (I don’t skrimp on food). So it is not a big deal. The larger your income and the fewer your expenditures, the less inflation will impact you. And the more time you will spend watching Treasury rates.

El Katz, Medigap pricing is all over the place in California. For a given plan, by law the providers have to provide the same services. The annual costs for Plan F range from $2830 to $5212. It is pretty funny. In California, you can change providers once a year within a 60 day window after your birthday with no underwriting (i.e., no rejection possible for any reason). Outside of that window you can change a provider any time but the provider will ask a bunch of questions about your health and can reject you.

Ed Katz.

We all know how to shop. That wasn’t the point of my comments. My comments were simply pointing out that prices are still increasing on many items. That was the stated reason on Phoenix gas prices. I don’t agree with the stated reason, but you go right ahead.

Tony,

El-erain and Howard Marks do live in the real world very much more than almost all of us when it comes to understanding where financial conditions are heading. That is why I listen to them. The game in investing is buying before others and then handing it off to the them after it has already risen. Or as Buffet says, buying when others are fearful and selling when they are greedy.

Now is a time to buy equities if they are right and they generally are. It is not just them either. Lots of voices in the markets think the FED is done and that is generally one of the very best times in the economic cycle to buy.

I am a conservative investor. I like big old conservative companies that pay nice dividends. Further, my miners are held on the LSE (LONDON) because I do worry about inflated asset prices in the U.S. (housing too). I guess this is because the U.S. has evonomically out performed most of the world in recent decades.

Mohamed El-erain and Howard Marks understand real world economics better than almost anybody you could follow. As a retail investor I have to follow because I have access to little good data. Wolf is my best source for data. Everybody should support Wolf with donations.

Yeah, go buy NVDA, it’s on sale for 100x earnings right now, along with most other over valued company’s. Good luck listening to Mohamed El-erain who stated “The Federal Reserve will be forced to give up its aggressive monetary policy after Silicon Valley Bank’s meltdown, according to Mohamed El-Erian.” He wanted the Fed to pause long ago. Guy is wrong more than anyone I know.

Thomas, even if El-Arian is right that the Fed is done increasing rates, current equity valuations require a massive and rapid cut in rates for valuations to be sensible. I just don’t see that happening unless there’s a deep recession that also drops the “Earnings” part of the ratio.

There’s no way anyone could convince me that it’s a good time to buy equities that are priced to perfection (P/E of 25-30) when the risk free return is 5%

Gotta agree with Einhal on this one. And his point that the inflation that we’ve experienced in the last 3 years is baked in – we’re not going to see price reduction unless something economically drastic happens. No time to be buying, except generic peanut butter and jelly.

@Einhal: You said:

“There’s no way anyone could convince me that it’s a good time to buy equities that are priced to perfection (P/E of 25-30) when the risk free return is 5%.”

Yes, that makes absolute sense.

But, inflation allowing, what if the risk-free return is ratcheted down by the Fed in terms of interest rate cuts and brought down to near-zero or even zero?

This would force people back into equities. As a matter of fact, I think the Fed has systematically done this over the last 30 years to spike the economy and the stock market. I can’t think of any other logical reason to keep interest rates down since the Greenspan years and not provide a decent, risk-free return to savers.

Sean Shasta, exactly.

Rates have to return to 0-1% for current valuations to make sense.

The problem is that if the Fed drops rates that low, it means something major has broken, which will mean public earnings will tank. If earnings tank, the ratios will also get worse, leading to lower stock prices.

In my view, this is just pure mania/delusion.

You can’t put El-Arian in the same league as Marks. He changes his opinion every week.

Thomas Curtis,

“Lots of voices in the markets think the FED is done and that is generally one of the very best times in the economic cycle to buy.”

Historically, when the Fed stops raising eventually they cut rates as the economy heads into recession. I’m linking a graph of the Feds Funds rate going back to the 1950s. Look at when most of the plateaus after a cycle of rate increases led to cuts. Most recently, the Fed stopped raising and held rates steady after July 2000 and July 2006. The markets went down substantially in the subsequent recessions despite Fed rate cuts all the way down.

I have no idea what will happen this time, but I disagree that the Fed stopping a cycle of interest rate increases is generally one of the very best times in the economic cycle to buy. Maybe today plays out like the period after 1994, but often when the Fed stops raising bad things are happening, or are about to happen, in the economy and markets.

https://fred.stlouisfed.org/series/FEDFUNDS

Shawn Shasta, the “average” fed funds rate, since 1971 is 5.4%. The highest it reached was 20% in 1980 and the lowest was .25% in 2008. At the time of the dramatic response to the financial collapse in ’08, word was that the “Fed was out of ammo” – they had cut rates to the bone to stop an economic cardiac arrest. You may remember that. And the choice was to go negative on rates or do QE or some other extreme measure.

The Fed has effectively returned to a relatively normal rate and has replenished it’s “ammo”. In spite of the fact that the rate is in continuous flux, the stock market has advanced approx. 10.75% annually over the last 50 yrs., adjusted for inflation it’s 6.6%. So, depending on the risk-free rate, the market is probably gaining or losing ground but, in that 50 year span has had a good return vs. bonds.

It’s estimated that the market is currently overvalued which means that sizeable profit increases are anticipated for it to be fairly valued. I’m inclined to take the risk-free route with short term T’s and avoid the wall of worry. But the sky isn’t likely to fall unless there’s a black swan event. Just my opinion.

Some people are doom and gloom, like stopped clocks, and are right twice in 24 hours.

“Now is a time to buy equities if they are right and they generally are. ”

LOL 😆.

BTW I am invested aka long in the market but I totally believe this is the most overall market in the history and there is no value.

But this marker has support of the govt and fed and thus can sustain higher and higher.

A point in case.. inflation is quite high but government has been successful in showing to us that it is going down and down

In next few quarters fed would officially declare victory and start cutting rates.

I am making money in the market by being long but it does not mean market is fair valued.

This website has taught that dont apply logic to this.

Wr has been talking about impending jump in cpi due to health care adjustments and now we all know how it ended 😀.

I am long does not mean it is fair valued .

Mohammed el erian has been begging for pivot lest we get a disaster and also begging for fed to change its inflation target to 2%.

The way govt is manipulating the metric.. wed have 2 % inflation soon on paper and fed can declare victory.

No need to change inflation target to 3%.

It can be easily controlled by manipulated government metrics.

Don’t believe me ..just look at yesterday’s cpi.

“Wr has been talking about impending jump in cpi due to health care adjustments and now we all know how it ended”

RTGDFA

Health insurance jumped 1.1% for the month, instead of plunging 4%. That’s a 500 basis point swing.

And it will continue to jump every month for at least six month until the next adjustment comes, and those jumps will get bigger.

CPI fell because other prices plunged, including energy, durables goods, air fares, etc.

Without the 1.1% jump in health insurance, the month-to-month CPI would have been NEGATIVE.

This dumb shit has no place here.

RTGDFA above and this:

https://wolfstreet.com/2023/11/14/the-collapse-of-the-health-insurance-cpi-how-it-became-chickenshit/

“These people don’t live in the real world.”

Tony hit it out of the park today. I agree 100% with his assessment. I too look at what I’m paying for everything. I’m paying through the nose for everything. Now, I have to buy used car because some maniac hit & run driver totaled my historic Toyota Corolla ($15,000 damage). I got out OK, but Ms Swamp was on the passenger side where the impact occurred got injured and is out of work and we have to go around to multiple doctors.

The insurance company offered 5K for the totaled car. To get the same car with low mileage I checked is $12,000 from any reputable dealer. I told the insurance company to go f$ck off.

Swamp Creature,

You’re spouting off the same BS Tony did. I gave some counter-examples to demonstrate that you cannot figure inflation for the US from your personal anecdotal stuff. Saying that you know what “US inflation” is based on personal anecdotal stuff is just dumb BS. And it exceeds my tolerance for BS.

BTW, used car prices are down a bunch from the peak at the end of 2021 = DEFLATION, no? I get really tired of this BS

It boggles my mind how some people are chugging along just peachy, or at least saying they are, and others are scraping by.

Waiting in line to pick up the kids at school today, the homebody mom who’s never seen a day’s employment in her life dressed to the nines in luxury casual chic chatting on about the $90 LuLemon leggings she’s buying her 13 year old. Meanwhile our clothes are fill-a-bag-for-$5 at the local thrift store and I work my ass off FT+ at a middle class professional job (and solely keep up a home and family so yes, I’m familiar with the plight of working and stay at home moms–combined). Even shopping Aldi, and skipping my own meals isn’t enough to salvage my grocery budget. I’m pretty damn resourceful but if rent and food get worse I’ll be looking towards the food pantries once I’m done chipping through my long term food storage.

Anecdotal and its not a judgement or gripe by any means. But the wealth disparity is crazy, some have it, some are destitute, but feels like the rest of us are barely above water without a luxury lifestyle. A lot of my area is Keeping Up Appearances, I genuinely wonder how many of these folks are all talk and up to their ears in debt.

Lilvonshtupp, that’s what happens when you print $8 trillion and most of it ends up in the hands of the top 2-3%. You get crazy wealth disparity.

Just went shopping for a used car to replace my totaled Toyota Corolla. Noticed hardly any small cars in the used car market. Nothing but oversized crap loaded up with all kinds of tech and features nobody wants. I rented a Nissan Kicks for a week and don’t care for it. Too many buttons and lights screaming at you. The Insurance company for the s$ithead that totaled my car hasn’t paid a dime so far, one week and then some after the accident.

It’s funny how Wolf tries to tell us used car prices came down. Used car DEALER AUCTION prices came down. The dealers are not passing along those savings and the private seller market is just as high as the dealers. Wolf is like Biden telling us we’re not experiencing inflation.

Weeknd_Uncle,

That’s BS at all levels.

1. The used-vehicle CPI chart in this article is for RETAIL prices not wholesale prices. It shows that retail prices have dropped about 13% from the peak at the end of 2021.

2. All used-vehicle dealers are complaining about them not being able maintain their pricing. Prices are coming down, and per-vehicle grosses are coming down.

3. So do the math. Dealer buy at wholesale, and wholesale prices are down, so their costs are down. And yet, despite their costs being down, their per-vehicle gross profits are down. So because per-vehicle grosses dropped despite lower costs, it means that their retail prices dropped even more than wholesale prices. If retail prices drop the same as wholesale prices, their pre-vehicle gross would remain the same. But per-vehicle grosses are also down.

4. Read the quarterly report of the large used-vehicle dealers, such as CarMax, and you’ll see, instead of spouting off ignorant BS.

Consumer Price Index, CPI, is a funny thing when you start to look into how it is assembled and start to think about what it tell. I have come to that the CPI is a snapshot in one direction at a a certain time.

The CPI do tell how the prices of a selected set of consumer goods changed from the preivious month. The selection is what the average consumer buy, but no consumer may actually have a spending pattern like that.

Then, the CPI is reasonable good at tracking the month to mont change in prices. Year over year not quite as good as the selection of goods and weighting is revised at least once a year. Back to the snapshot picture, the field of view is changed some at least once a year.

Over the years what the CPI tracks have then changed considerable. Then there is hedonic adjustemts that could be argued that are questionable.

The CPI can not be used for any “what if” computing of cost. Any change in cost of something consumers buy would change the selection and weight of consumables in the CPI and then the CPI number itself.

Back to the CPI beeing based on a selection on goods given weights depending on consumers spending patterns, that probably give a cross coupling to the consumers purchasing power. If the consumers are well off they will use larger part of their purchasing power “non essensials”, not well of a larger part of will be spent on “essensials”. A shift in purchasing power will this way change the selection of goods, weights and probably the CPI number itself.

Sum up, CPI is a snapshot to tell how much last month was different. Stretch the timeframe and the picture get blurred.

An unrelated question please..

If I can hook up multiple bank accounts to Treasury Direct, and get automatic rolling over 4-week to 6 months t-bills with 5% or higher interert, and not pay state tax, then why open any bank CDs at all?

You could have multiple bank accounts but don’t need. I have lots of short term from 4 to 13 weeks, some with auto reinvest and some without. I did the 13 weeks back in early October as I wanted to not pay taxes for those until 2024 tax year. I have a 4 week reinvested a few times but maturing and redeposited back for paying property taxes. I’m in CA so big savings from a tax perspective. The money moves back and forth as needed via high interest savings account.

I have about half of my cash in 1 year CDs which I bought in January 2023 at the time 5% which I thought was really good deal. They will mature January 2024, so I have another year to figure out my taxes and sniff the air. This is money that I do not need, but can break with penalties.

The other half is Treasury Direct. So a blend of about 5+% or so and different tax buckets. Works for me.

I’m curious why you would use Treasury Direct, when you could use a brokerage account instead. Treasury Direct is so cumbersome to use, which seems like a risk to me.

Be extra careful to not forget your password to TreasuryDirect – unless you have 4-6 hours to wait on hold for an agent to reset it.

Bills and short term (<1yr) CDs seem to be pretty interchangeable instruments.

Biggest difference is bills are zero coupon and bought below par, whereas you buy the CDs at par and get the coupon at the end.

Why buy CD’s? I suppose that’s a bet that the Fed will drop their short term rate. Wall Street sell side is singing that chorus. Reasons given are 1) federal government can’t pay because of ginormous deficit, or 2) banking system can’t handle commercial real estate plunge, or 3) the federal reserve governors are jiving and 2024 is election year so money must be easy. I don’t know any better but four week bills are liquid enough to tack either way. My surmise is that the Fed will wear out the market bulls with “higher for longer.”

Admittedly Wall Street pricing in a cut means little. Seems like the Fed would have good reasons to keep or raise rates and other reasons for lowering them. Not sure which voice they will listen to or perhaps pick a happy middle ground.

This is pretty fascinating stuff to watch unfold.

Mr Richter are you surprised by the resilence of the stock market? The S and P 500 hit an all time high a little over 4800 with The Fed holding its interest rates at 0 to .25 percent and QE. The S and P 500 is now at 4500 with the Fed raising its interest rates to 5 to 5.25 percent with QT running for about 17 months. I am amazed at how the stock market goes up so fast when CPI misses expectations by a tenth of a point or job numbers come in slightly below expectations. Is Wall Street so excited about a recession and pivot that it could actually push the market to new all time highs on this hope? The whole system seems out of whack. Will we ever return to the stock market trading on fundamentals of the companies or is it just always going to be based on expectations of what The Fed will do from now on.

Idk what the algo’s ads doing. But I know all my coworkers are contributing to their 401k. If I were to extrapolate that to the very low unemployment numbers.. I’d guess most people in decent jobs are putting their money in the market.

I don’t think the 3% of paycheck 401Ks are enough to move the market. It’s the algos.

It’s a combination and the algos do calculate it in a big way. Institutional investors like insurance companies and 401K year target funds constantly hedge against their options all day long in order to balance their volatility risk. Volatility goes down, they have to buy to offset, which causes a rise in the market…and it keeps repeating. Boomers that are still contributing (and luckily there are many of them) are doing so at higher rates than those young’uns just starting out, plus based on their length of service, at a higher salary base (plus make-up contributions). When salaries go up, especially in an inflationary cycle, contribution dollars go up, (although capped by the latest yearly dollar limit -which itself goes up every year). The tide is expected to turn a bit as the same boomers start withdrawing instead of investing, but with people working longer, the effect is not yet drastic.

Einhal,

It accumulates to huge numbers that make a significant difference in pricing. I believe it makes the market more difficult to understand, as a large portion of these funds are invested in broad indexes. This simply raises the water level on equities as stocks are purchased to balance the index, not on the value of the companies. A dozen states have enacted legislation requiring companies to auto-enroll employees in these plans. Two big ones Cali and IL have more recently increased their requirements. Yearly escalation of contributions is included in some and proposed to become federal law in Secure Act 2.0. I would love to find a chart of whose money is invested in the broad markets and specific companies. Imagine when every US employee working for a company of 25 or more people is auto-enrolled in a 401K plan for 4% with that increasing by 1% every year to 10%. Will the employee or the market benefit more? How do we value companies with these blind funds in the market?

Steelers Fan, I don’t think we’ll ever return to fundamentals unless we have a deep recession, which includes a huge drop in asset prices, and the Fed backs off and doesn’t do anything.

As it is, S&P valuations are totally inappropriate unless you believe ZIRP is around the corner.

Perhaps none of it matters and that there is so much money from various sources(IRAs, QE, tax cuts, raises, etc.) that is has to go somewhere and the market has the best returns historically. After all, modern capitalism(massive wealth accumulation) is different from traditional capitalism( you use the profit you made to feed the next production cycle). People will see calamity coming perhaps and jump out and sideline money but only so they can jump in when it swings back up. I would think that would still result in higher yields for treasuries since a strong market obviously doesn’t help their cause.

Right, there’s a lot of continuation bias here (the market has had the best returns historically, so it will in the future).

The problem is that in the past, the economy was growing. It’s arguable whether that is true today. So it doesn’t necessarily stand to reason that stocks will continue to go up.

There’s still a surplus of savings over real investment outlets.

“Will we ever return to the stock market trading on fundamentals of the companies”

When was that? Maybe long before the internet, if ever. In 2000-2001, the stock indexes would routinely spike up on bad economic news in the “hope” that Greenspan would cut rates. It was pump and dump all the way down until the late-2002 bottom.

A difference from then is the greater volume of articles that swarm our screens. Twenty years ago, far fewer financial news sources existed, and nearly all were written by humans. Now, as soon as a CPI or other number comes out, our Apple News Feeds are flooded with clickbait, much of which is generated by AI. A source like Business Insider seems to generate dozens of contradictory articles every hour-this TA says the SPX will go to new highs in 4 months, and that guru says we’ll have a recession in 5. None of it is meaningful and all of it is intended to cause people to trade in fear to the benefit of those who own the AI that generates the articles.

Which is why finding thoughtful, detailed, and unbiased content generated by an experienced human is harder and harder to find, as well as being more and more valuable. So, thank you, Wolf.

But pump and dump schemes have been around since before the bucket shop days of Jesse Livermore, and probably as long as people have been bartering with sea shells and salt wheels.

I don’t believe we will in my lifetime. The government is creating a ponzi like scheme in the market. By introducing 4 to 10% mandatory 401k contributions to most US employees. That is very roughly 4 – 10% of 10 Million billion (total salaries) new dollars in the market each year. Please do check my math, because isn’t that equal to 4,000 – 10,000 trillion? It seems to me that as the escalates from 4 to 10% each year the market value will increase dramatically. Until the number of employees covered by these plans decreases through demographic or economic shifts. On the bright side, it should be up, up, and up for a while and only muted by market big brains scheming to extract those funds. SPACs?

I’ve seen a plan where if an employee doesn’t choose otherwise, the company will start putting 3% of their pay in a target date fund, so it’s not mandatory. You can choose at the onset to not contribute at all or at anytime after, you can sell the target date and get a money market or stable value fund. Forcing someone to buy hugely overvalued stocks that the index funds are overweight in would be theft, exploiting normal peoples unfamiliarity with valuations and their trust in their employer. Wouldn’t be surprised if some employers were somehow getting cut of these contributions, which they are if that company has stock and it’s in the index.

WS cheered! At least most Americans with their 401K, IRAs in the market breath with signs of relief. Now, the calling for lower rate is getting louder and louder. Wonder how long this exuberance will go on for before WS masters pull the rug.

This game started early this week with the unmoving market even in the face of an US debt downgrade which should have tanked everything by 2-3% but it did not.

Stock market is in the seasonally strong period as determined in its lifetime and the system is still full of huge QE suppression of interest rates that have not reset . However the stock market has not recovered from the 2021 high and has gone nowhere for 2 years and the bond market funds are 30 percent lower than the zirp period. Very similar to Wolf curve smoothing CPI still above 2 percent drunken sailors still spending and the Federal Government in an election year just passed their stop gap spending bill.

Hopefully the Fed will continue to keep rates high with no cuts. Job markets strong with peak baby boomers age just hitting 66 (1957 was the peak year for birth numbers at 10k a day new babies) . 66.5 is the age for maximum SS without a percentage reduction though many postpone til 70 to get the maximum possible based on health considerations.

Btm line is I don’t want an economic collapse but a great economy and opportunities for the future. I’m retired but I want prosperity for all. Inflation is an economic shock to me and others and the Fed is working on the excess after 15 plus years of QE.

Einhal,

“Thomas, even if El-Arian is right that the Fed is done increasing rates, current equity valuations require a massive and rapid cut in rates for valuations to be sensible.”

Note that producer prices fell heavily this morning. That is the sort of thing that people like El-erain and Marks have a pretty good idea of ahead of time from data within their own companies.

I mentioned that I am holding my miners on the LSE (London Stock Exchange) which on average is not as inflated as U.S. exchanges. Further my miners have an average P/E of about 9 and they are priced in the Pound which is a thoughly beaten down currency which is more likely to rise than fall over the medium to long term.

Dividends paid on the LSE to U.S citizens are not taxed by Great Britain. Also these are qualified dividends which are taxed at long term capital gains rates. If you don’t understand what that means study because the implications to overall long term returns are large.

In a general sense Buffett trys to buy things that he never sells because of capital gains taxes (there are different tax rates at different income levels). Again, study if you do not understand the implications. They are very important and not complicated.

Finally, I am an optimist. I think we will solve the warming eventually (though not in my remaining lifetime) and I do not think we will devolve into global war. Xi seems pretty stable as is the U.S. military. U.S. politics is a mess.

Xi is in San Francisco now for meetings with Biden. I see that as very very good. I think we can agree to more rules of fair competition. China is slowly climbing out of their hole which will be good for global growth

So, no global conflict and steady progress on green which means miners should have plenty of demand and they have a habit of sharing the profits. I think miners are in a modest to strong secular bull market.

That is my rational for this long term hold. My miners hit another new high this morning from when I bought them over the summer.

At least Wolf’s hometown SF got a make-over — all thanks to Xi.

No it didn’t. They just blocked everything, and you have trouble getting around, and the homeless people in that area were chased to other areas. The homeless are humans too, and you can’t just dump them into the middle of the Bay. They’re going to be somewhere. So now they’re somewhere else. The stupid BS on ZH is just stupid BS.

Gov N had all the homeless moved over to Oakland California. We get more news here in the Swamp about what is going on in SFO than we hear about local news here.

I’m not talking about foreign stocks or miners, but bubblicious tech or real estate companies. Let’s assume producer prices did really drop and won’t be revised upward next month.

So what? It took rates of 5.5% to bring that about, and the “markets” are pricing in cuts in March. The Fed cuts in March, and inflation explodes higher.

How many zombie companies will fail when the effects of higher rates really soak in?

Einhal,

I am 80% overseas so from that point of view we agree. My only NYSE holding is Tesla and that is a ‘flyer’ for me but Elon keeps hitting it out of the park and he is just now in his prime years.

I admire Elon and what he has done for the world and Ron Barron another real solid billionaire early Elon investor has lately been explaining a lot about Tesla/ELON (bringing it down to my level).

My real view on the markets right now is that they are climbing a wall of worry like they most often have throughout history.

I don’t like ETFs now, they seem too blunt of an instrument going forward. It seems we are again in stock picker markets like we were for most of history. So, pick your sectors and the companies you like within them or if you are a bond guy which I am not there are supposed to be great opportunities in high Yield bonds according to Howard Marks, one of the best.

I don’t see disaster on the horizon.

For some light reading about the Healthcare CPI “improvement” adjustments that Wolf is rightly riled up about:

https://www.bls.gov/cpi/factsheets/medical-care.htm

https://www.bls.gov/cpi/additional-resources/improvements-cpi-health-insurance-index.htm

https://www.bls.gov/cpi/additional-resources/improvements-cpi-health-insurance-index-appendix.htm

Make sure to follow all of the links if you want a true escape from reality.

I was in elementary school for most of Volker’s tenure. We were poor and I remember the adults complaining about that sombich Ford/Carter/Reagan, but that’s about it.

Question(s) – is there anything to be learned in comparing the political environment then vs now? Or is it really just a matter of leadership on the part of the FOMC?

Did the nascent financial press/political establishment celebrate every whif of good news and pressure Volker to relent?

Should we expect the committee to honor its unspoken commitment and keep rates flat in the presidential election year? By extension, is December 23 our last look until December 24?

Full disclosure, I think we’re close to neutral but would like to see another 25 bps just to make sure. Lag effects are real and compounding, hence the continued impact of QE after 18 months of QT.

The 2020s decade looks like it will overshoot the 2% inflation target by 20% to 25%, unless the Fed resorts to QE again, which could result in even higher inflation.

Long bonds at 4.5%? No thanks, I’m not your whipping boy

1) Annual Zori rent = 2K x 12 months = 24K.

2) Suppose the annual rent increases are : 7%.

3) In twelve years dividends (rent) accumulation is = 24K + 24Kx1.07 + 24Kx1.07×1.07 + 24Kx1.07×1.07×1.07…+24Kx1.7^10 + 24Kx1.07^11 =

24K x 18 = 432K rent accumulation.

4) The price of your hous is 500K.

5) The value of your house in twelve years should be : 500K + 432K =

932K.

6) If the expected price, in real terms, should be 700K, today prices

are too high. The intrinsic value of your house should be about 300K ==>

300K x 1.07^12 ==> 675K.

“Over the past three months, the month-to-month rent CPI has run at an annualized rate of over 6%. This 6%-plus increase also roughly matches what the largest landlords have reported in their earnings calls. So it seems rent increases have gotten stuck at the 6%-plus rate.”

Just reposting this for all the rent inflation deniers.

MM,

I am a landlord, in the Northern Illinois area. I can confirm rents are up and up in this area. Three contributing factors. Insurance has increased 22%, property taxes 11%, and Section 8 subsidies went up to $1325. The section 8 increase drives prices up, not only for those who receive it but in those properties where landlords want to avoid it. Many in-place tenants had to absorb the first two increases at renewal. Displaced tenants found a market where $1000+ rents became $1500+ overnight. Let’s see if we can convince Musk to create a truly democratic, free-market society on Mars where the government has no power over markets. We can then end the debates over economic utopian free market ideals.

TTB: my prop taxes went up ~11% last year too. Waiting to see how much my homeowners ins went up…

There are structural reasons rents must continue to rise – I was poking fun at some commenters who don’t think rents can continue going up.