Appraisers have not yet caught on to it either.

By Wolf Richter for WOLF STREET.

Homebuilders don’t have the luxury of outwaiting the market, or waiting for the Fed to slash rates, or whatever, they must build and sell homes, that’s their business, no matter what the conditions in the market.

And the market is struggling with 7%-plus 30-year fixed mortgage rates and sky-high prices, after a ridiculous free-money spike during the pandemic. Sales of existing homes have plunged by about 25% from the same period in 2018 and 2019, and by about 32% from the same period in 2021, because buyers have pulled back, and the people with 3% mortgages have left the housing market altogether, not putting their homes on the market and not buying homes either, not even looking at homes.

That plunge in sales might be OK with potential home sellers, thinking that this too shall pass, but it’s not OK with homebuilders, and they’ve been adjusting to this market by cutting prices, building at lower price points, buying down mortgage rates, and offering incentives, such as free upgrades.

The latter two – buying down mortgage rates and piling on incentives – don’t show up in the prices of the homes they sell. So the pricing data that we have from the Census Bureau about sales of new single-family houses do not include the costs of mortgage-rate buydowns and incentives.

With mortgage rate buydowns, the homebuilder subsidizes the mortgage payment.

The duration of the buydown can be for a few years, which effectively turns it into a teaser rate that can cause problems when the rate jumps to normal.

Or the rate-buydown can be for the entire term of the mortgage (“permanent”).

The big homebuilders have mortgage-lender subsidiaries that originate the mortgage for their customers and then sell the mortgage to Government Sponsored Enterprises, such as Fannie Mae, which will securitize the mortgages into MBS. For example, the mortgage-lender subsidiary of D.R. Horton is DHI Mortgage Company.

Having their own mortgage lender makes rate buydowns a lot simpler for homebuilders. This is similar to the “captive” auto lenders, such as Ford Credit offering 0% 36-month financing for F-150 XLTs at the moment.

The costs of the mortgage-rate buy-downs can be big, because the home prices are big, and buydowns effectively lower the sales price of the home.

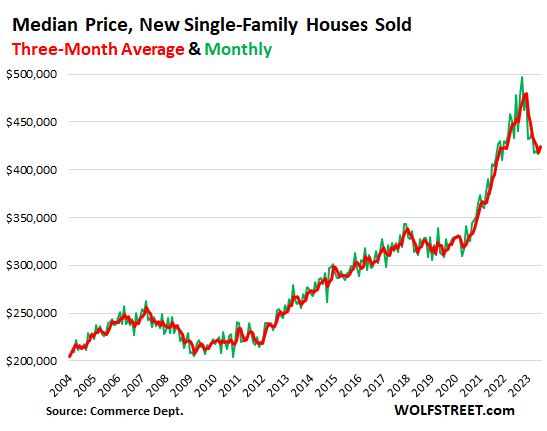

But the costs of buydowns don’t show up in the national median price of new houses sold. The numbers only show the contract prices. July’s median price (green) and the three-month-moving average of the median price (red) of signed contracts dropped by roughly 12% from the peak in late 2022, according to Census Bureau data. Now figure in the cost of rate buydowns, and the prices would have dropped a lot lower:

Concerning the mortgage-rate buydowns, John Burns Research and Consulting, which among other things regularly surveys homebuilders, came out with an interesting note about mortgage-rate buydowns by homebuilders in Florida, based on its regular surveys of homebuilders, phone calls, community visits, etc., plus this time, to supplement the data: “our survey team visited 13 home builders, three land brokers, and a regional developer in Jacksonville and Orlando.”

John Burns chose Jacksonville and Orlando because they’re “more rate sensitive than other Florida markets that attract a higher percentage of retirees who pay all cash and don’t need rate buydowns.”

In a prior note, John Burns said that 5.5% seems to be the “magic number” that makes home sales happen for homebuilders. This is what the survey found:

“Permanent buydown: Buying the 30-year fixed mortgage rate down permanently to 5.25% to 5.75% is making a positive difference in allowing home buyers to qualify for the home purchase.”

“Sub 5%: Builders will even buy the current rate down to 4.75% to 4.99% for inventory homes they want to sell quickly.

“Prepaying for even lower rates: Using a forward commitment, a builder’s mortgage company can originate FHA (Federal Housing Administration) or conforming mortgages at a below-market rate. Often, these buckets of money must be used within 60–90 days, so they work best when builders have nearly completed inventory.

“Temporary buydowns: A couple of Florida builders are using 2-1 temporary rate buydowns (a mortgage rate that is -2% lower in year one and -1% lower in year two) as part of a flex-cash program, allowing buyers to spend the dollars on closing costs, design center options, or a longer rate buydown. A move-up builder sees buyers accepting current elevated rates and planning to refinance when rates drop.

“Managing cancelation risk: One builder requires a 20% down payment from buyers receiving a 30-year rate buydown.

“Good to be big: Smaller production builders may struggle to compete for sales due to limited access or high costs of capital that curb their ability to provide inventory homes and rate buydowns.”

What about profit margins and appraisal issues?

“Builders did not express concerns regarding their margins, even though 30-year rate buydowns are expensive,” John Burns said.

“We have not heard of appraisal issues that could potentially stem from the heavy incentives offered but are monitoring for potential risk,” John Burns said.

And they’re hidden from the national house price data.

In the auto industry, rate buydowns are in lieu of cash incentives, such as rebates or dealer cash, and the customer chooses: either 0% financing or the cash incentives. The cash incentives translate into an explicit lower selling price that the customer sees in the sales contract and that then becomes part of the national data, such as the Average Transaction Price, new vehicle CPI, etc., and ultimately it percolates through to used vehicle values.

John Burns did not say, and I’m not aware of a similar pricing transparency among homebuilders where customers could choose, for example: on a $500,000 house, either a 5% 30-year fixed rate mortgage or, say a $50,000 discount on a deal funded with a 7.3% mortgage.

But the effective price difference due to the rate-buydown doesn’t show up in the numbers. And we don’t know just how far the effective prices of new houses have dropped; and appraisers – according to John Burns – have not yet caught on to it either.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“And they’re hidden from the national house price data”

Everything is fake – a gimmick. Everything. This is a PONZI eCONomy.

Old man yells at cloud, reliably

Project much? I’m probably younger than you.

PS – Have you ever thought of commenting on the article instead of following around commenters and trolling? Didn’t think so.

Excellent rebuttal. Some folks don’t seem to understand that comments are based on the individuals knowledge and life experiences (I have a Ph.D. in ECE&CS, learned much more than what the MBA classes taught me, really self-made, and perhaps my left handed personality makes me different from others). Hope folks understand that rather than using themselves as the gold standard

This,

”Hope folks understand that rather than using themselves as the gold standard”

IS good DEC!

Unfortunately for most, ”they” do not compare others with their ”actual” self, but, rather, with the fantasy/illusion of who they THINK they are.

Has to be one reason for the suicide rate these days, when reality catches up to the ”denial//illusion//fantasy” many have of self.

If youre going to “quote” Wolf, quote him accurately. He didnt say it’s hidden, he said its “not picked up by house price data”. Theres a BIG difference.

And is your personal characterization that everything is a Ponzi scheme (in tis case builders) a comment about the artcle?

I can tell you, I’ve referred buyers of my homes to morgatgage brokers who had buydown products. Some used them some didn’t.

The purpose was to help the buyer get into the house they wanted and get the house sold … nothing Ponzi about it. In the end, it’s THEIR choice and decision.

DC – I am trying to convince myself to stop caring about what a scam the economy is and just protect what I need to protect. I hate being so self-centered, but after trying to convince people that the government has really screwed things up, I find most people dont care/understand.

FYI – I noticed that Wall Street is pumping Tesla today on the potential for a ride-sharing network, right before sales growth falls apart. Classic pump and dump.

Cool! I’ve been wondering exactly what this “translational science” is, Mr Dr ECECS (you are young right?…..I never heard of that shit when I was in college)…but I’m real old.

Can you translate? PLEASE!!!!!!!

Like, what are you going to do with this recently discovered ventricular “kidney” shit? Gliph????ics or something? How about a CSF cleaning machine for Alzheimers?

Or do you follow other research like advanced flip-pop and latch research? (I will ignore you if you even mention quantum computing….that is just too far gone, “gold standard” stuff I guess.

Anyway, the rest of you all pulled together to give me a GREAT AM laugh…I see why DC is an institution here…..he lit a fuse of some kind…..a depth charge?

Can’t wait to see what other non-relevant shit is here in comments. Poor Wolf. Too bad companies can’t form the equivalent of spores during tough times, but maybe that’s coming, as the Hungarian guy said at his Senate dog and pony show, after he got even filthier rich shorting the whole GFC somehow.

Now WTF was THAT tripwire? Length? No names…..no nuthin……

I should have said “recently rediscovered”, sorry.

No reply? Sad.

Anyway, as an example there is a new interest in brain ventricles, and the “glymphatic system. His job (I’m pretty sure) is to explain the basic research to docs, generate professional agreement, etc, so they can explain to you and others up the chain why you are taking a certain medicine……sorta like a shell corp’s function, only this is “shell information or shell science”.

Anyway, BIG bucks go into Alzheimers research so look for meds related to new discoveries in this area. They gave up on breaking up existing beta plaques in cells, evidently. Need nano jackhammers or something. There is also potentially a big wonderful world of sleep meds here for strung out home buyers, and other societal problems

And the forming spores comment was about the home builders not being able to stop…not Wolf….I jump around too much, (coffee in old brain?) but there is a there there…..or at least an attempt at one.

“Old man yells at cloud…”

Sure, but it is a dangerous cloud.

The wiseacres (peanut gallery, DC pols) mock the lightning till it fries their *ss.

Seems to me there were plenty bloviating about “permanently high plateaus” in the pre-2008 housing market too.

Then they learned about *other* mortgage games that had been going on below their upturned noses.

I agree with you. Reminiscent of 2008 crisis – many people knew of irregularities in the housing market and the mortgage industry. It was not well-known to the average investor, however, that mortgages were being given to unqualified buyers, that homes were ridiculously overvalued,etc. the it all crashed.

Transparency and honesty are necessary – so I guess it is good Wolf is shining some light on some of the ways home builders are moving their product without cutting the published purchase price (and thereby propping up stats on housing prices.)

He did quote Wolf accurately — right there in bold black letters, (a lede to another paragraph: “And they’re hidden from the national house price data.”

This is so disrespectful and undignified comment. Try commenting on ideas rather than insulting other commenters.

“This is so disrespectful and undignified comment.”

It’s all they can come up with. They have no intellectual capacity to artfully comment on Wolf’s articles, so they resort to ad hominem personal attacks. They are nursing extremely fragile and bruised egos from something I said to them months ago – or in Mar Mar’s case, YEARS – and just cannot move past it. Can you imagine how thin one’s skin must be to carry that around in life, where an anonymous commenter on a blog is living in your head rent free like that? LOL.

Why is this western “capitalism” still called free market economy? When just about everything is subsidized by the state. This is exactly what the communists did. How long can they fake this? How long can they keep printing new currencies before the bubbles burst? Or causing hyper inflation. I don’t think this debt base economy can last forever. Many countries are already waking up and are in the process of dedollarizing. Who are we gonna sell our debt to then?!

Totally unproductive, irrelevant comment.

Mr. Random is randomly BS-ing!

John mentioned a good point.

We appraisers see it every day and it’s hotly debated. We were directed by FNMA in the last collapse to never make a dollar for dollar adjustment on concessions. Some make no adjustments, some do partial, and some do their job and do it based on the market response. I saw tons of these concessions locally, $20k, $14k on $350-600k homes and it was the norm last fall and early winter. It largely went away except for a few and is now back again. $14k on a DR Horton home I just did, value opinion was $560k. Only $6k down, VA loan.

There are 2 groups now, the haves and the have nots. The haves have locked in very low mortgage rate and are living a different world and the have nots are struggling with high asset/house prices, interest rates and very high rents (stuck between rock and hard place)……..

the people with low mtg rates r trapped value is the home price not the mtg rate

Why not both?

This article is actually about tools that can help the have nots become haves.

What’s wrong with helping buyers get into a new home by getting them into a lower rate mortgage at the same time? Suddenly they become haves, but the builder that helped them do it is somehow the bad guy???

Folks need to get the chips off their shoulders here. And btw, the world is ALWAYS going to be nade up of haves and have nots

“This article is actually about tools that can help the have nots become haves.

What’s wrong with helping buyers get into a new home by getting them into a lower rate mortgage at the same time? Suddenly they become haves, but the builder that helped them do it is somehow the bad guy???

Folks need to get the chips off their shoulders here. And btw, the world is ALWAYS going to be nade up of haves and have nots”

Potentially true, if the builders are willing to buy down the entire duration of the loan then you have a case in my view.

On the other hand, if builders buy down a mortgage for 2 or 3 years and then sell their buyers on the idea that interest is definately going to go down by the time that term ends, well they may be sending some buyers to the slaughterhouse.

Having said that, buying a house is a huge financial decision, people make their own decisions.

When I was living off grid, most everyone up there just called it “land poor”. But we had a few REAL rich guys…mostly Silicon Valley.

Pretty soon the so called haves will be underwater in their equity and stuck in place.

But at least they will be able to make their payments.

I call BS.

More like inheritance.

Much less successful brother-in-law just picked up 2nd house.

Must be nice to inherit a couple million from wife’s parents. (I’ll never know haha)

Marry a rich one!!!

Specifically I’m saying “haves” and “have-nots” are much more than interest rates.

Look at US inequality annd upward mobility over last 50 years.

Sounds like someone is envious of his “less successful brother in law”. All this talk about “greed” is fairly transparent when you look at subsequent commentary and realize that that person is “greedy” too….. but his greed is somehow more virtuous than that of another.

PS: Inequality can be directly tied to a several variables – many within your control and others not so much.

Equal opportunity and equal outcome seldom intersect.

Our lives are nothing more than a collection of all the decisions we’ve made along the way – both good and bad, but hopefully not fatal.

@El Katz,

Five in six people can’t afford a median priced home in California. Four in five in Indiana are priced out of median priced ownership. In California, people making $25/hr have been disqualified to rent due to insufficient income. This is not normal, and greed by those with their hands on the reins definitely has a part in it.

Unless ppl have saved for a

Down payment and can bring down the higher rate/monthly payment

“Our lives are nothing more than a collection of all the decisions we’ve made along the way – both good and bad, but hopefully not fatal.”

…but no; even a brief study of genotypes/phenotypes quickly reveals how specious this framing is. For starters, no-one lives in a deterministic vacuum. The finitude of control one wields over the outcome of their lives or even individual situations is not to be understated.

No single person gets to decide the layout of the playing field, how greased the rails are upon which the goal posts slide, or the degree of tilt in the tables. Not everyone’s born with the same opportunities or a map of where all the mines are buried. And for every tenacious soul that rises above the worst odds, a hundred others are blighted.

A life is much more than the sum of one’s decisions.

I disagree. If you’re paying attention to the layout of the playing field and anticipate the greased rails, moving goal posts, punji pits, molten lava, they don’t come as a major surprise to you as you venture into play. Sure, you might skin a knee or burn a finger, but you’ll usually live to fight another day if you’re paying more than a little attention, get up, dust yourself off, and carry on. You may even manage to prosper as TPTB aren’t as brilliant as they think merely because their arrogance eventually sinks them.

There’s way too much emphasis on what happens in Philadelphia or LA or DC that has little to zero impact on the daily lives of the average schmuck. I am fairly confident that the gardeners working in my neighbor’s yard don’t know nor care about the Davos crowd. Or Jay Powell. They go on in pursuit of a better life – no matter how futile your view would make it seem.

I believe what you’re describing is that of a fatalist who believe that no matter what one does, their destiny is predetermined by forces larger than they. While the influence/control one can exert may be minimal, you can often exacerbate poor outcomes by simply making repeated bad decisions – one of which is buying the BS fed to you by predators.

Those that are blighted (and the entire thesaurus of big words that you espouse) have opportunities to thrive or not – but their mileage may vary. Equal opportunity, but not equal outcome. If they chose not, it explains the middle class kids – some with college degrees or viable trades – that are laying on a sidewalk on Kensington Ave.. Were their rails “greased”? Tables “tilted”? Or did they simply make several bad decisions that compounded their negative outcome, despite the best efforts of others to save them?

We live in microcosms… like they say – real estate is local. So is your life. I don’t care about the smash and grabs in LA as they don’t affect me. My influence is only to not vote for the types that pass laws that encourage that behavior without consequence. Is it a good strategy? Maybe not… but I, for one, don’t believe in a hopeless existence. Otherwise, we should all simply drown ourselves.

No — I’m not not talking about fatalism; I’m saying that no-one lives in a vacuum where their path is forged purely by the decisions they make. It’s a profoundly myopic lens with which to view the world, and also one of the principal underpinnings in the neo-libertarian clap trap.

You make your bed, you sleep in it!

But sir, the beds on fire?

Pfft. You shoulda anticipated needing asbestos pajamas!

When I lose a loved one to a drunk driver on I-35, how then am I to reconcile how a series of decisions led her to her demise? Your stance is that anticipation and contingencies are the onus of the end user, and woe unto those who had the misfortune of not contriving the right plan B C and D or were born the wrong color in the wrong day/age, or had bad timing, bad luck or simply a lack of nepotistic leverage.

Hey — I wish things could be so neatly and dryly reduced down to binaries: Lassitude vs vitality; greed vs altruism; grit vs shit. Only the best would prevail given such a blueprint. But it doesn’t map out that way, and never has.

Bul, Katz called you a Calvinist……at least in one of his jumbled thoughts.

But I am enjoying this Ontology of everyone’s Epistemology. It’s all flailing, but then I have no solid answers, either.

Sure hope that self described “extra unique” guy (Dr ECECS) has the guts to answer me….but strongly doubt it…..just a drive-by.

I just measure haves and have nots by net worth……still think Wolf is too generous with his bottom 30%….I like bottom 50% better……but in the USA practically all of us are imperialistic pigs, (that screw each other excessively) always have been….maybe that’s his ref.

Binary thinking is usually bad.

What about the “Have somes”?

Obviously if I’m throwing in % it’s a continuum, not black/white.

But I WOULD draw a Constitutional Max Net Wealth Line at $10 or $15 M…and make the IRS a full part of the military, and consider it’s purpose “National Defense” against enemies foreign or domestic.

Then you have a playing field with BOUNDARIES and REFEREES with the final word…..but I’ve gone into that fantasy before.

Agreed! With mortgage rates above 7% again and the July median price of $436K being above the January price $432$, you know this is a house of cards.

I sincerely hope higher for longer persists what longer than people expect and anyone who jumped on FOMO train with short-term buy downs gets whack-a-moled, as they should.

Excellent, data powered article, as always. Even without considering all those incentives, 12% drop is quite remarkable. Bull media (which is nearly the entire media) is nonstop talking about housing recovery is going on full speed. But that’s certainly not the case. New home sales are good but prices are going down steadily. Existing (i.e used) home prices are still close to peak, but the sales are crashed.

It’s not surprising they’re talking about a “housing recovery.” Some areas have seen prices fall then rocket back up on fewer sales, so the skyrocketing prices are their idea of a “recovery.”

I have no doubt that Blackstone, Blackrock and the like can essentially own every asset on this planet with corrupt central banks and governments rigging the system for them. It looks like our future at this point.

BlackRock just owns stuff (not homes) on behalf of their clients (pensions, ETFs, etc). I don’t work there, and I don’t like Fink & Co, but I still hate seeing them associated with the hedge fund-like world that Blackstone lives in.

And Blackstone is a public PE entity as well that owns assets for the benefit of the shareholders . And I agree Gattopardo on Blackrock and I think Blackstone falls in the same category though different because the business model is very different . BK (PE) and BLK (Etf and other). I am not a big fan of the PE model but they navigate under the system we have and have leveraged up the assets in the country through all sorts of financial transactions. Some of which I think should have been handled with the SEC but they have managed to avoid most of the financial losses with their IPOs pushing the losses to the stock market holders.

BS ini-

Good distinction between BK and BLK.

Am I right to conclude that one BK funds itself via “illiquid” (i.e. non-marketable) funding vehicles, while the other funds it’s investments with market traded securities?

If so, Grant’s Interest Rate Observer penned an interesting piece some months ago that referenced the asset mix of several university endowments, and highlighted the enormous commitment to illiquid investments.

For example, the Harvard endowment has committed 79% of its 47 billion endowment to hedge fund + PE + real estate + Natural resources + potential capital calls. (Numbers quoted by Grant’s taken from analysis by Lawrence Siegel, dir. of research at Ford Foundation).

And some other big endowments had even higher allocation to illiquid investments!

It’s off subject to Wolf’s current article, but perhaps this would be a worthy subject for Wolf to pursue in a future article…

I agree. Blackrock invests in corporations, doesn’t buy houses. Blackstone on the other hand, outbids the young families to buy single family houses with all-cash exorbitant offers and charges those young families who were pushed out of the market with the rents they hardly afford.

Of course DC. Everything’s a Ponzi scheme of corruption and crime according to you. Engage your brain or do some research or both, and make some constructive comments instead of bitching and finger pinting all the time.

Home prices are going back up for the simple reason that there are still more buyers than sellers out there, (west coast excepted)

You seem deeply invested in this premise, but it observably fails within the present context.

Real Estate appraisers really do nothing much other than confirming market trends with ‘comparable listings’ and don’t look at important factors such as the age and the maintenance of a house (which is a depreciating asset) nor do they fully separate land value from structural value which is classified on property taxes as ‘improvements.’ Here in California most all of the value of a house in the market is LAND VALUE and that has been the case for the past 50 years and became wildly more so in the current market valuations now in 2023.

In Northern California there have been exciting developments in developers buying huge tracts of land around Travis AFB to Rio Vista to develop a new city. The solution to local towns and cities preventing new construction through zoning n California, at least the central valley, appears to be the formation of entirely new cities.

Even in San Francisco, developers manage to build 2,500 to 5,000 housing units every year. Currently, there are 6,667 housing units under construction. There are 72,177 housing units in the pipeline, most of which are in large areas of former naval bases (including Treasure Island), erstwhile industrial areas, a former ballpark, a former coal power plant, etc.

What those billionaires are doing in rural Solano county (in the flightpath of an air force base?) is something else, and is motivated by something else. And they’re replacing family famers with their project.

Yeah, that one was a real black box on local news. Plus it’s on the worst part of the death highway 12.

Local news seems done with it, as an eyeball catcher for now. And ambulance chasers, mattress, and drug companies want those SF eyeballs…mostly.

I bought the house I live in 20 years ago. I recall the real estate appraiser appraised the value of the house exactly, to the penny, at the then owner’s selling price. That’s when I realized that the appraiser is fully incentivized to appraise a property in the interests of the seller, real estate agent and mortgage broker, not its real market value. If you didn’t, who would give you business next time around?

It’s the same situation with the MBS ratings companies like Fitch. They’re really there to bedazzle the naïve customer with fairy dust while they get ripped off.

Appraisers won’t have any repeat business if they actually “appraised” a house – especially if the appraisal came in below the contract price and the buyer walked. Ditto home “inspectors”.

The last time I sold a house and the buyer had it “appraised”, no human showed up. It must have all been done online. We would know as there was no lock box on the house so, in order to gain access, they would have had to contact us directly.

I learned long ago, that the best comparable sale for a house is the sale of THAT house. It’s what a willing buyer and a willing seller agree to pay without duress for thay particular proprty. That is also a definition of market value.

An appraisers’ job is to confirm that the sale isn’t terribly out of line with the rest of the market. They’re also there to protect the lender’s interest.

The last house I refi’d, the appraiser was picked by the lender.

I just paid for the appraisal.

In this case, the appraisal is biased toward protecting the lender. However, the lender can’t be too harsh or they won’t get their fees before they sell the loan to Fannie or Freddie.

It was mostly based on comp sales which seemed to be spiraling up the last few years. The appraiser did show up for an hour to make sure the interior/exterior was in at least average condition.

By congressional edict, appraisers must be paid whether the appraisal blows up the sale or not.

As appraisers are drawn from a ‘pool’ they are selected based upon location distance to the subject property and their performance of ‘on time’ reporting and no value challenges that would cause the report to be revalued.

There are ‘drive-by’ appraisals where they actually drive by and take photos but do not contact the residents.

To the penny, every time. I was informed once, true or not, that appraisers in some other advanced countries are actually respected, and required to pass at least some tests and have some ethics.

First house was to the penny in 2005, second house to the penny in 2021. I’m still on the side that sees this working out differently this time, but the nature of appraisals hasn’t changed.

I’m not sure where you have found your appraiser. We have to test (and retest) every two years. And generally the people who priced the house in the first place (i.e. broker/agent) knew what the place [should] sell for. So it is not surprising that the appraisals support the selling price.

As much as it would be nice, R.E. appraising is not an exact science. It does function as sort of a governor so the RE engine doesn’t race out of control as fast as otherwise it could. And those appraisers that don’t have ethics tend not to last very long. You can see the OREA/BREA ‘perp sheet’ on line of those that get sanctioned.

An appraisal is a report on the market value of a house. The value is what the buyer is willing to pay for it, based on comps. The age and other things are all factored in all of this. It’s called a free market. Free markets are prone to wild swings and bubbles, like human emotions. The appraisal is not allowed to include his personal opinions, likes, or dislikes in the appraisal.

Much nicer (and cheaper) land elsewhere though. Too much money chasing what used to be much nicer areas.

As an appraiser, I and my peers always have looked at the age and maintenance of the house. (deferred maintenance) and we also had to estimate if not support land value in the cost approach.

Widespread mortgage rate buydowns would seem to be an area that would invite predatory lenders; especially when Federal Reserve officials are openly talking about high rates for longer term than originally envisioned.

These buydown loans might even reach the zone of “subprime” considering that a higher interest rate environment would put more people in that category.

If the rebate is coming from the builder directly, it would be interesting to know what the primary lender thought of that situation, especially the Federal agency backed mortgages.

Interesting article that definitely challenged several of my preconceived opinions on the status of the housing market.

The phrase that captures the risk for the feverish, young home buyer, from your article:

” The duration of the buydown can be for a few years, which effectively turns it into a teaser rate that can cause problems when the rate jumps to normal.”

Default on the teaser always end up as the cause. That is how the Fed has decided it’s going to go down.

Anyone thinking that the Fed isn’t the cash behind the housing bubble isn’t paying attention. They’re willing to commit the American people to pay the criminal banks 5.4%, to hold they’re balance sheet cash to make sure the bubble doesn’t burst, that they lay the loss on the people rather than the aristocratic asset holders.

It’s the payment stupid. All these folks had better hope their job lasts. Dear god I’m not buying shit from a moron who sold their soul for an imaginative future. I’ll live in a Quonset hut before that. Wait. I do. I love ya wolf, and this is the next key: subprime. It’s not about who can borrow what crazy amount to ‘afford’ whatever. It’s about who is trying to get who… into a monthly payment. You just outlined the new Subprime and where it’s coming from… these builders need to stay in business so well… how can we get someone to sign on the dotted line… buy it down…

Nothing wrong with a good Quonset.

Four square for home ownership, coming soon.

“John Burns did not say, and I’m not aware of a similar pricing transparency among homebuilders where customers could choose, for example: on a $500,000 house, either a 5.5% 30-year fixed rate mortgage or a $100,000 discount on a deal funded with a 7.3% mortgage.”

The danger of rate buydowns for a home buyer is that principal stays elevated. If SHTF after your 2-1 or 3-2-1 expires or you have to move, you now have to compete with builders offering those incentives while your realtor can’t.

Guy in my neighborhood is under marriage stress and they’re selling after 2 years. New truck and new EV after house and now the stress of payments is destroying the union. Tried to explain that currents rates will destroy them further if they each buy, but they seem oblivious. 6% on the sale and 7% on the new rate, and poof goes their equity. The average person is a financial idiot.

Great comment. I think you pointed out the risk, with a real world example.

“The average person is a financial idiot.” needs to be further examined, even though I suspect it’s reasonably accurate. Where would be without the risk takers ?

Would we even be able to destroy mankind ?

It’s always love that may save us once again.

I would argue that understanding/explaining compound interest, without googling it, would be the litmus to whether someone is a financial idiot or not. It’s a low bar, yet I bet half can’t.

I’m reminded of the old joke, why are divorces so expensive? Because they’re worth it.

If they’re miserable, the last thing they care about right now is staying together (or working on a mutually agreeable financial solution), and they’ll gladly spend extra $ not to see each other every day.

They’re both friendly people, and it’s a pity that it’s happening, but yeah, when misery reaches a breaking point both parties try to grasp at individual control regardless of cost.

Emotions don’t care about rates.

One guy in your neighborhood–>”the average person is a financial idiot”. Sounds like you found that one example you needed to confirm your world view.

It’s unfortunate that humans find it more enjoyable to revel in the misfortunes rather than the successes of others

I’d say the average person is probably more financially illiterate than idiot when it comes to affordability and interest rates. Recall the late 2000 era of using your house as an ATM and the resulting catastrophe.

Apparently, you do not recognize that the “success” of others is due to Fed policy errors, which punish the prudent. That success was simply handed to speculators, not earned, in many cases. Skyrocketing housing prices are the best example.

I consider myself “prudent” and have never blamed the Fed (nor anyone else) for my personal failures. It’s easy to be a victim, if that’s your preload, because it’s hard to admit you’re not the smartest guy in the room or you didn’t spend enough time to: “Stop Look Listen” (sage advice from a railroad crossing sign).

My preload is not that of a victim. My choice is to evaluate individual situations as presented and learn/adapt to thrive regardless of outside forces. I’m not a short term player. The “Wall Street Bets” mentality is not one I subscribe to just like I never play the tables/slots in Vegas as they don’t build those fancy buildings for free.

I am very prudent, never speculative. The Fed rewarded me as well. I think prudent people should take boring old man advice of buying and holding (investing in) assets.

It’s all smoke & mirrors, but you can’t win if you don’t play the game.

“The average person is a financial idiot.”

Financial literacy should be taught in high school. (If it is, it’s not done very well.)

Try a little thought experiment. Who benefits from having a poor education system?

I’ve thought about this a while and the first answer I came up with was “politicians” who benefit by being able to solicit votes based on emotion instead of facts and programs. (Yep, the same guys in charge of the education system.)

Now I’ve also begun to realize it is the PE 0.1% guys who are able raid companies by borrowing money to buy them and then putting the liability onto the books of the company they bought, with results as might be expected. Read “The Lords of Easy Money” by Christopher Leonard.

Don’t overlook Hanlon’s Razor in assessing the behavior of politicians.

They got rid of all that practical “old-fashioned nonsense” in high school decades ago. Things like “home economics”, budgeting, and the like is considered obsolete because it teaches traditional family values. Some of us bothered to educate our children in such mundane topics and now they’re among those that are perceived to be advantaged and not subject to “inequality” (which in many cases is just an excuse).

We’ve helped the adult children of other parents learn these things and they’re amazed at how it has worked to their advantage in just a short time. These aren’t children but 40 year old adults that never understood what a certificate of deposit was, how compound interest can be your friend or worse enemy, and the value of a budget. They just spent because they could “afford it” – until they couldn’t because some minor disaster hit that they were unprepared for.

As a 40 something, can speak to this. Our HS has Home Ec and Shop rooms that were closed off and unused by the late 80s/early 90s, the classes stopped being offered entirely.

Economics class was taught by a tenured teacher a sneeze away from retirement who was absent more than he was working, think they stopped teaching it when he finally retired. They rolled in the TV strapped to the cart and we watched a lot of How Its Made on the District’s fancy-turned-rapidly-obsolete LaserDisc investment. Our education as a whole, from Elementary to HS graduation was curated to meet the ever evolving requirements of state testing for funding, with little to no mind paid to real world application but the district sure loved announcing the colleges and universities we were off to (no mention of the student loans required to attend them).

Any sort of hands-on or career centered education was offered via BOCES where kids take a bus to the local community college for half a day. This program had poor attendence and was regarded as a drip pan for kids who had no shot at making it into college. Many parents refused to consent to let their kids attend it including my own, because optics and the push for college.

I do recall participation trophies being handed out at the end of sports, but even sports were woefully underfunded if not football or cheerleading.

And now at 40 something I’m learning what should have been taught long ago from the get-go, my peers often admonished by the same generations that wouldn’t teach us what they themselves had the opportunity to learn and to this day mock us for not knowing. Funny enough it was the same ones who insisted their kids (us) have the participation trophies they fancy to now slag us for. And the student loans thing.

Not a victim thing just funny how little has changed now my kids are in school. Education is 100% about meeting the state testing requirements that determine funding. One thing my kids are learning: to stay out of trouble and conform like their future depends on it, because with budgets dwindling kids are getting the friggin cops called on them, in freaking Elementary school, for simple playground spats or displays of attitude to justify security funding requests and district contracts with private vendors of various safety and security gizmos and programs.

Public school is a dumpster fire.

My son received a participation trophy for being the left fielder on the last place t-ball team in the league. This was circa 1986.

As we walked to the car after their last startling loss of the season, I took it from him, explained what it represented (he didn’t really get it at the time), and tossed it into a burn barrel – to his screams of protest and crocodile tears. His Mom wasn’t too thrilled with me either.

Today, at 42, he looks back at it and says it was among the best lessons he learned as a kid. Anything that’s “free” is worth exactly what you paid for it (monetarily or effort).

Funny, I read that and gather the mom had to do some major emotional clean up in aisle 3.

I think it’s DAMNED mean if true, but more likely a TOTAL LIE, anyway, especially him looking back at it as a “best lesson”…..sheesh……or is lying ok here? Beginning to think it is.

We were in the cellar (or close , I FORGOT) but I remember I was proud as hell of my orange Mendocino Van and Storage T-shirt.

@lili, I 100% agree with your statement. Going thru middle and part of high school in NC, I was in one of the last years they ever taught shop class and home economics. I took both, built a slot car, learned how to use tools and on the other end, learned how to use a sewing machine, make an oven mitt and bake/cook. I believe my mom still has that mitt to this very day, albeit being patched up a few times.

When we sucked at soccer, all the parents forced us to stay at the church after and the coach made us run drills while the parents chilled in the parking lot (chatting and drinking most likely). We learned to not suck after a few Friday evenings being spent running and kicking instead of video games and riding bikes with friends.

Just borrowed it from library. Thanks for the suggestion

“ The average person is a financial idiot.”

Yeah, all the cranks who financial sh*t post online, that’s where you find knowledge.

One can find knowledge anywhere one looks, even if you dismiss it as the ramblings of a fool. There’s always a tidbit somewhere you least expect it.

Epistemology in the style of the internet!

In days of old

When knights were bold

And toilets weren’t invented

They did a load

In the middle of the road

And went away con…

There was a young man from Kent…..

Anyway,

He stayed out of trouble

> “The average person is a financial idiot.”

In most closings, these “financial idiots” paid compulsory fees to a handful of professionals who supposedly have a fiduciary responsibility to put the borrower into a house that is within his/her financial reach, and to protect the lender and taxpayers from obvious default.

I dare say that the average person is an idiot, period.

Context, my man!

Drop that Aristotelian stupidity…….see Korzybsky for starters……

Also BIG difference between ignorance and stupidity…..see F Gump……

Subject to a close look at the details, I’d take a lower price and the higher rate. The math is tilted in your favor.

Well, of coarse, the devil is in the details which includes the so called lower price, and a higher rate. Which is actually an overpriced, in the money put.

The buyers are the marginal buyers who, for whatever reason, have to buy.

First timers don’t know that they are stepping into a buzz saw.

A new home by me is unattainable by the middle class because of property taxes. The tax rate for new home is 2.7%. So $10,800 per year for a $400k home. It’s counterproductive to supply the market with new inventory. What I think is the people in charge love inflation. It keeps the masses relying on the government.

In Texas, the property taxes you describe are a bargain. Here the taxes on a $400k house would be at least $12k a year along with another $4k for house insurance. Low tax Texas? In your dreams!

Escierto:

That’s because Texas doesn’t have an income tax…. so pick your poison.

Escierto- where do you live where property taxes are that high

I live 5 miles from downtown Austin Texas and my tax rate was 1.55% last year

Granted I built in a area between Westlake and Austin that was never annexed so is just Travis county (yet right in the middle of Austin),so I don’t pay city tax, but even then would be about 2% and this is an expensive city, glad we don’t pay income tax

Escierto’s right overall though, the lack of income tax in Texas in general is more than counter-balanced by the soaring property tax and insurance costs esp these days. The problem is trying to wear the mantle of being a “low tax state” when that claim is based on nothing more than a bit of creative accounting. It’s just shifting the costs and hit to savings of the income tax to the high costs from other taxes in Texas and then some.

Texas even does this with business taxes, on the surface there’s no corporate taxes but business taxes overall wind up higher than most other states like several studies recently showed– Texas businesses wound up paying around the 14th highest taxes relative to other states. So “low tax Texas” is just a slogan, nothing more than a ploy to sucker in the gullible with false advertising. Just like with Florida with the even worse homeowner’s insurance and real estate taxes there. It’s the same kind of thing like the claim that the US has less taxes than Europe but then just cherry picking the income tax at the federal level, not including the state, local or payroll taxes Americans pay and others don’t. My expat friends in general pay at most the same or usually even less taxes in Europe than they did back home regardless of the state, not to mention the healthcare premiums (and deductibles and co-pays), college tuition, childcare and other “de-facto taxes” they had to pay in America that left them with much less disposable after tax income or savings.

More than that…the global financial system now ‘needs’ inflation to stay alive.

His point is why to hate your government….unless you all pretty much do too, and so it just blew past you.

Escierto,.come to NY. Our property taxes are 12-18k in average, housing is absurdly priced still (although down 6% in some cases), pile on the interest rates plus utilities..it’s no wonder everyone’s trying to leave. And we have income tax (actually what ISNT taxed in NY)

Miller… Yes, of course he’s right – but not entirely for the reasons he stated. Property taxes aren’t higher simply because. The state needs revenue from somewhere and, if there’s no income tax, they get it from the property owner. I guess it’s fair logic that if someone can afford a $1M house in Austin, TX, they can afford the taxes on same.

Think TX is bad, try IL. My BIL’s taxes on a $550K market value house were $21,000. Plus high sales tax. Plus income tax. And they weren’t even in Crook County.

The 2/1 buydown mortgage rate has been all the rage in SoCal for the past 12 months or so which has kept buyers in the market and making purchases even with these insane crazy prices. So, as we go into next year most of those mortgages will start to reset to the higher rates as agreed in their contracts, which will no doubt be problematic for some people to deal with. I am sure everyone was convinced that mortgage rates would be heading down by now with the hope of refinancing to much lower rates.

Not happening…

You got that Right ! Powel has his Orders from Headquarters

He will keep Increasing Rates for as long as it

Takes Paul Volker all over Again.

These clients they opt for the rate buydown MUST qualifying worth the higher (current) rate. So when the “reset” happens, and if rate not refinanced, buyer still able to afford.

What happens in between with a person (job, health – etc) is not a lenders responsibility to keep an eye on buyers personal future plans.

*With higher rate

No. And pay attention to yields on 10-year US Treasuries which are what have always been the basis for mortgage rates which are based on those plus about 3% real interest.

New home builders have been making nice profits even with the buydowns.

New home builders can change the build quality to offset the “incentives”. The door and window packages go from Andersen to “Bob’s Windows and Stuff”, HVAC goes from Carrier to a lesser brand, the flooring allowance is reduced, the roofing shingles go from 30 year architectural to 20 year tab, plumbing fixtures from American Standard/Moen/Grohe to Aquaflow…..

Most of it is undetectable to many buyers who are enthralled with the 9 Chinese shower heads and the inferior dyed granite because *shiny*.

We recently purchased a new car and got to choose a rate buy down based on cash down. We negotiated a better trade in value and put down some cash. The cash got us a one point buy down and a lower term. Officially we paid sticker plus tags, etc, except we have about 25% equity. Same idea as the home builder offers.

This is pathetic in my opinion. No offense. :)

Petunia –

Except that your new car will be worthless in about 20 years.

A home builder offers an opportunity of a lifetime if values go up, unlike your rustbucket.

A twenty year depreciation schedule seems to be the rantings of a cockeyed optimist. One month after the moment that the ink is dry, the new car is worth 25% less than you paid for it. At least in the old days.

I have purchased many new, American vehicles and sold what was left after they’re useful lives which is about 12 years.

Petunia said, “Same idea as the home builder offers.” She wasn’t asking the car dudes’ opinion on the state of the American car.

My 14 year old car is doing just fine.

Jon,

Could you please add some alphanumeric symbols to “Jon” — another “Jon” is a frequent commenter here, including on this article, and this gets very confusing. I should have asked earlier. Thank you!

Thanks Jon,,, ditto here, with my 22 yo truck doing just fine, and my better half’s 14 yo car similar…

IMHO after owning dozens of cars and pick up trucks over the last 60 years and driving others for at least 10 years before that, the newer the vehicle the longer it will last IN GOOD drivable condition WITH ”’PROPER”’ maintenance.

Unless you bought a 4Runner

Bought new in 2019 and there are many identical ones selling for more than I paid over 4 years ago. No depreciation here.

What happened 14 and 22 years ago? You two win the lottery and become spendthrifts? Why not a 28 yr old car and 44 year old truck?

Ridiculous comments.

Somebody bought all of your used twelve year old “junk” and got a lot of miles out of it. And didn’t pay the depreciation that you did.

Never bought new, never will. I don’t think highly enough of my fellow drivers to drive anything other than heavy, used vehicles that win in a wreck.

I lost a house in Florida that I bought with a 40% down payment and lived in for 10 years. You may find out someday, maybe soon, that home equity is an illusion in the financial economy.

Home equity is real if you sell and don’t buy something else….

I am not convinced new houses aren’t more or less considered disposable by now. Nobody wants a house built 20 years ago. 100+ years ago, yes. But sticks and plywood held together by drywall for the last 20 years?!? And they are making them even crappier now. …didn’t know that was possible.

If you paid sticker, you never had a 25% equity. You have a perceived 25% equity from purchase price but, in fact, you were at/near a bust out (in other words, zero).

The “buy down” was likely because you shortened the term and the incentive rate from the captive finance company structured their offer that way.

The “better trade in value” was likely sourced from your decision to finance as the finance reserve can often be more profitable for the dealer than the vehicle sale. One dealer here only honors their online prices if you use their financing (it’s in the mouse print in the ad).

Your equity vanished as soon as you crossed the curb and the MSO was sent to the state. The dealer profit, all the below the line reimbursements sent back to the dealer (holdback, etc) by the manufacturer insured it – even if you took it home and parked it in the garage in a hermetically sealed vessel.

If you buy a 300K house with 60K down and closing cost of 15-20k, you are down the minute you get the keys, and you are just getting started spending money on that house. People always conveniently forget houses are money pits.

“Officially we paid sticker plus tags”

This drives me up a wall. You didn’t have to pay sticker. There are innumerable dealerships across the entire country which are selling for up to 8% under invoice, RIGHT NOW. All you had to do was some research.

In dealer math, sometimes it’s better to show skin in the game on a deal by raising the sale price and fiddling with the trade value to show “equity”. It’s an easier sell to the credit buyer when you’re doing a loan to equity ratio and allow them to fudge their software and get the deal in compliance with lending guidelines.

Hope you have gap insurance.

I don’t need gap insurance, my down payment with trade in was 25%.

Congratulations on your new ride! Dont let all the cranky commenters driving their old junkers ruin it. There’s nothing like the smell and feel of a new car!!!!

The new car is beautiful, lots of cool features, and we plan to pay it off quickly.

Our old car had 93K miles on it and needed a $2K catalytic converter to pass inspection. The old car was not worth keeping at that point, especially since it was worth 1/3 of its original price it its current condition. It was time to let go.

I remember this home builder incentive song and dance from the end of Housing Bubble 1 but what I don’t remember the exact timing of when I started reading about it.

What I mostly remember, from fuzzy recollection, is that one day they were offering incentives and the next day half of them starting going out of business.

I’m not suggesting home builders are about to go out of business, but my basic take-away was these home builders put themselves out of business before they drop list prices. They kept up appearances all the way to their funeral.

Homebuilder incentives may keep the new-home market alive a bit longer, but I think the existing home sales side of the market will remain frozen over until 30-year fixed rates drop back to 5.5% or so. Considering higher-for-longer seems to be the new paradigm, real estate on the aggregate will likely remain in a “bear market” so-to-speak for quite some time. This definitely is not the time to pursue a new career as a realtor.

Why? Historically, 7% interest rates on houses is a very fair and reasonably low mortgage interest rate.

Bought our first home w 18% first and purchase money second at same rate in 1978 Josh…

Rates were NOT an issue/challenge then or now:

PRICES and PAYMENTS were the only challenges then,,, and now IMHO…

(and just BTW, very same house has gone from $40K to over a MM…) and, again THAT, price, is the problem, NOT rates.

Not sure how WE,,, in this case the USA PEONs WE are getting out of this current housing situation, but suspect for various global AND local reasons it won’t be in any kind of kindly or friendly way this time.

“PRICES and PAYMENTS were the only challenges then,,, and now IMHO…”

That’s correct, but that’s why I think Josh is right. The majority of homeowners didn’t buy their properties at the very top of the RE bubble, they bought cheaper than that, and they also locked in a very low interest rate, so their payments relative to what is available to them on the market today are very low, so they’re not interested in selling and the existing home market is very slow and will likely remain that way.

If and when prices fall to where 7% interest is manageable to more people there will be more buyers but still it doesn’t mean existing home owners will sell. Likely for payments on a 7% mortgage to be comparable to what a lot of those people are paying now home prices have to fall quite a lot still, but then some of those homeowners might be looking at a loss on their current properties and still won’t want to sell. So IMO Josh is right about the existing home market, it’s not coming back very quickly.

It seems though builders have a big advantage by being able to offer these rate buy downs and things like this, so as long as they can be profitable that way then new homes will keep selling. It looks like people are able to make payments at those prices with those rates.

Interesting article. Since it applies to new homes I am curious if existing home statistics taken separately display a downturn clearly, or a more accurate view of the overall market.

I live in a tiny but locally desirable community where almost any existing house coming on the market in the last four years has been snapped up almost immediately. I’ve noticed recently they are not being snapped up quite as fast, though they would seem to be overpriced, and the sellers are a little slow to cut prices. Lot sales and new construction is also booming here.

I’m also two years into building my own house and plan to sell the one where I live now as soon as the new one is liveable. The new house has taken much longer to complete due to supply chain issues, inflation, and shortages of local skilled labor. Everyone is swamped with work in my area and they seem to slow their pipeline of jobs by quoting astronomical prices. Being the general contractor and architect on my own build has me appreciating how quickly the big guys can put something up- but a lot of what they put up is still crap. (OSB, 2×4 trusses, cheap windows and doors, etc.)

It would be nice if the housing market wasn’t as negatively exposed to increasing interest rates – in terms of their use by the Fed in controlling inflation, though I know first hand how badly inflation has affected my build. I don’t see prices going down significantly in single family existing homes unless we have a shot of substantially rising unemployment.

Tom

A buydown to 5% on a 30yr 7% mortgage has an NPV of about 25%, so it represents a 25% price cut. Significant.

This assumes that the mortgage is paid through the entire 30-year period. But the average 30-year-fixed mortgage is paid off in about 10 years either because of a refi or the sale of the home. So the calculation would have to be based on some average expected life of the mortgage, so it would be quite a bit lower.

Most buydowns aren’t for the life of the loan. They’re the 2-1’s you mention in the article. It’s in the range of a 5% discount off the sales price, which is often bumped up to compensate for the buydown.

The buydown isn’t so much about lowering the price as it is about helping the buyer qualify for the loan.

But the insidious part of this is you’re still paying prop tax based on the higher book value…

The two keywords in this article are “Government sponsored Enterprises” and “Federal housing Administration”.

Because that’s what “the American housing market” is all about.

Correct me if I’m wrong, but if you buy down a 7.5% mortgage to 5.5%, that’s the same as a ~18.75% reduction in the home price in order to make a similar reduction in monthly payment.

No wonder they’re trying to keep that cost hidden…

All a buydown represents is prepaid interest, but no impact on the principal. It also has absolutely no impact on the sale price. You still owe whatever you borrowed…. the only reduction is interest paid over the term of the buydown.

No wonder people get into trouble buying homes. 18.75% reduction in price, indeed. Do you think that when car interest rates were 0% they gave you the car for free?

Seth’s math is basically correct if the buy down is for the full 30-yr mortgage. Your car analogy doesn’t make mathematical sense.

Please correct my math, then. We are looking for what price reduction would result in the same monthly payment (what matters to most buyers) without the interest rate reduction.

The math is like this:

$300,000 x .075 = $22,500

$300,00 x .055 = $16,500

The $6,000 difference is the 2% buydown

$12,000 total for two years

Add $3,000 for 1% buydown in third year

Total buydown cost is $15,000

$15,000 is 5% of the sales price

I don’t Know much but it appears the Rent is still to damned high.

I know this is asking a lot bc I’m sure Wolf with have included if there was a way to calculate. But it would have been nice to see an estimate on the real world impact on house values. How much are they overpriced as a result? Besides, it seems like even existing house prices are still through the roof, presumably from investors or retirees with cash at least on the lower end.

Sellers want last years prices

Buyers want prices that are affected by 7.25% mortgage rates

Illiquid. Broken. By the Fed.

We would all be better off if 30 yr mortgages had stayed around 5% for the past 15 years….and the Fed had stayed out of the mortgage arena.

Great comment. Fed manipulated the housing market by buying mortgage BS like crazy. Now it refuses to sell. Total nonsense.

You got that Right !

And the people who saw their houses double in price feel ENTITLED to keep that “growth.” Most of America is filled with selfish parasites.

Just like the buyers who feel entitled…. knife cuts both ways.

Nonsense. Potential buyers feel entitled to a free market where the government isn’t putting its hands on the scale to keep them homeless.

Homeowners feel entitled to continued intervention in that market, as long as their ox isn’t being gored.

Do you really not see the difference?

I defy you to show me the muzzle print on the forehead of any home buyer that got “gored” by a seller. They’re two willing parties. One just has poor impulse control.

Do YOU not see the difference?

El Katz, people not buying and putting up with 8% yoy rent increases willingly forgoing one pain for another, but you cant escape rising housing cost unless you already own. The idea these trends dont hurt anyone operates under the false premise everyone already has a previous mortgage locked in.

Herpderp, exactly. It’s not a matter of an unwilling buyer and unwilling seller, but the fact that the Fed and Congress have badly distorted the market, and those for whom it benefits are fighting like mad to keep it that way.

I’m not “fighting like mad” to keep anything any particular way. Some things you just can’t fight and you make personal decisions that are best for you and yours. I don’t control the Fed, nor do I control the Federal agencies, nor government expenditures fueling inflation, nor stupid people with too much money. I never cared about interest rates because I used high rates to find an opportunity to negotiate a lower purchase price because what you pay is the most important aspect of the transaction. I learned to deal with these outside forces the best I can – up to and including doing nothing if it doesn’t make sense to pull the trigger.

Real estate is cyclical. Lower your expectations, prepare for an opportunity to present itself, and make a calculated decision. My kid’s first house in Bryan, TX was a hazmat site (figuratively). He worked 4 years, with his now wife, breathing copious amounts of drywall dust and scratching itchy skin from insulation in order to make it a desirable property. I did the siding, installed the windows, reconfigured the kitchen cabinets into a better arrangement, installed the flooring, hung doors, and did all the interior trim carpentry. They did the drywall, the tile work, interior and exterior painting – he and his firemen buddies even did the roofing. All with permits and inspections. He sold it shortly after completion, then laddered the proceeds into the house they have today in Austin. It’s how you start. Expecting the HGTV dream home out of the box is unrealistic and indicative of being a spoiled brat.

To expect someone to take a property that has a market value of X $ and not maximize their return just because *you* think they’re making too much money/are greedy is immature. The truth of the matter is that the person who expects that likely wants nothing more than to take that other person’s place and would likely choose to screw the next guy when it’s his turn to sell. They might even choose to flip it if there was enough daylight to make it pencil. Few are that altruistic to do otherwise.

I presently have a house on the market. The one across the street from it sold a year ago for $1.88M. This property (with arguably a better view, better floor plan, an additional bedroom, and pool) is currently listed at $1.35M – $100K below the comps estimate. It needs nothing. If someone offered me $1.1M for it on a clean deal, I’d take it in a heartbeat. You might consider that as an option. Listing price means nothing. It’s a starting point – we used to call it “if wishes were fishes” in the car biz. Put a phone book number on it and see what happens. Nothing is preventing you from shooting someone in the toes, but don’t try to both lowball them and be a weasel. If the house is bruised fruit, all the better.

Clean deal. Inspections contingency only. Financing arranged. Down money banked and available. Quick close. Put up more than a couple of grand in hand money because anything less makes you look like a flake not to be taken seriously.

Don’t worry about “insulting” the seller unless you allow yourself/or your spouse to fall in love with the property. There’s other fish in the pond.

I did that very thing in 1984. The house was listed at @$200K…. I offered $100K. He was “offended”. Told him I could buy it from him or the bank when they foreclosed – his choice. We found a happy medium ($125K) which was his mortgage balance. Negotiated with the realtor to lower their commish. He saved his credit rating (which matters in certain types of employment), unloaded the carrying costs (taxes, utilities, insurance, etc.,), the realtor sold a house they would not have otherwise sold, and I had an instant increase in equity for a few hours of phone work.

El Katz, a lot to unpack in your post, which I’ll respond to tomorrow, but I Just want to say you’ve totally misunderstood me.

I’m not saying any seller should sell for below whatever “market” is.

All I’m saying is that there is some very powerful howling against anything that will cause prices to correct. The people doing that howling are those who already have theirs.

Don’t forget to ask if kid thanked him yet again for throwing away his “I played ball” trophy. Has one hell of a memory, that kid.

1) Builders preempt a looming banking crisis #2.

2) In most divorce cases the queen of the house takes over the house,

which might become a falling knife, in a major setback for women lib.

3) Most commercial RE are frozen, b/c what used to be 3% mortgage

rates became 8%/12%. Teaser rates cannot save old vacant buildings.

A 30% discount might not be good enough for top tier buildings at a

7Y/10Y compounding rate.

4) In the major cities commercial RE might fail to pay interest and go bk,

like the ones in the flyover areas, devastated by the malls, decades ago.

5) Land value decay might last decades.

6) If we fail to feed 350 million people, what will happen to China

I would like to know what #6 means. No.. correction.. I NEED to know what #6 means. I really enjoy your comments for the riddle factor, but I don’t understand #6 at all ☹️

Means you might be way less worried about climate change than you SHOULD be.

Another way to keep ‘prices’ up on paper: We bought a condo from a somewhat stalled development. They waved two years of HOA fees during negotiations, which kept the sales price up over the ‘real’ price.

Can you tell us what 24 months of waved HOA fees would amount to as a % of purchase price? That would be interesting to know.

Yep new home price discovery is not clear which means that cash buyers may be see some losses quickly for a new home purchase much like the instant depreciation from driving a new car off the lot.

On a second note one of my children (36 years old) is bought into the SRT concept and just joined a group of SRT investors and closed on their first purchase (they pooled their down payment and capex money into an LLC) . They purchased a single family home by assuming 2 wholesale mtgs and owner financing at 5 percent for the balance. I have no idea what a wholesale Mtg lender is , why two loans , and owner finance for the rest told me the games are all about cash flow and liability but the sale price was not price discovery and was too high for a single family used home . Fortunately we have seen investor purchases drop significantly from the used home market. But those that do occur maybe at inflated valuations.

The problem is these builder’s haver their own appraisers that are hired and paid by them.

No one makes you use any particular appraiser. If their mortgage company wants to use a particular one, hire your own. Just like you never take the realtor’s recommendation for a home inspector. Hire your own. Best coupla hundred you could spend.

The government should limit the set of financial products available for retail.

This buydown isn’t innovation, it’s obfuscation.

Meanwhile in Canada banks are extending and pretending with negative amortization.

Both methods have the same aim: preventing price discovery.

How can the market work when key statistics like average house prices are basically a fiction?

The funny thing is this makes the moribund market look peachy, forcing the Fed to raise again. Weekend at Powells.

“This buydown isn’t innovation, it’s obfuscation.”

2004-2008 is on line 1.

The Fed/DC/the G is on line 2. (Over-valuation is a feature not a bug when you are trying to manipulate the “wealth effect”)

The interest rate buy down is not obfuscation. It’s a marketing tool. Cost of doing business.

Negative amortization doesn’t necessarily indicate that the owner is upside down in the loan. It simply means that they can’t afford the interest rate on the loan balance and it’s a tool to allow them to stay put. It’s nothing more than a type of reverse mortgage.

I’m re-learning the only thing you need to know about interest rates and buying a home: buy when interest rates are high and have severely impacted prices. Precise timing is not important – you’ll never get it right. High interest always drops far more than house prices over the long term.

2 years ago, we bought a property near the top at 3%. The mortgage comes due this year at who knows what rate but the property value is lower than when we bought. So we’ll be paying far more for a lower value asset – on top of inflation. Ughh!. Why did I not think this through before signing?

I have read many comments here and on many other sites regarding the real estate market. You are the first person to admit its mistake. Most people who have made a mistake are not acknowledged and even agitate others to make that mistake. Dying alone is hard. It’s easier when others die with you. It’s an honor for you!

People need to learn to do a pro-forma on any major purchase. It’s never just “interest rates” nor “price” nor “payment”. It’s the combination of all of them, plus the normal costs of ownership. Keep in mind that you can often appeal property taxes if you pay less for a house than the assessed value (we did that in Oregon and were successful).

You should also consider establishing a “sinking fund” for maintenance and repairs that you put aside on a monthly basis – just like your mortgage or property tax reserves. Put it in a money market (right now paying 5%) and watch it grow. It eventually gets to the point where it self-funds and you can devote that contribution to other things (but if you have any brains, you won’t).

You put it all down on paper and determine what your budget is and then don’t exceed that. It’s not a game… it’s real life with real consequences. There’s no reset button like on an X-box.

As an aside, we (as a new car manufacturer) would target new home buyers with enticing offers on new vehicles via direct mail. These folks just spent a king’s ransom on a house and, despite that, had a high propensity to purchase a new car as well. The “take rate” on those offers was impressive. Never ceased to amaze me.

But, if they got into trouble, I’m sure it was “The Fed’s” fault. Or some greedy seller. Never the one who made the bad decision.

You didn’t just post a tirade about personal responsibilitie, then admit to trying to fuck over people in the next sentence?

You never stopped being amazed by the fact that people that displayed they have money to buy things (a house), buy other things (a car)?

If you simply read the post, you’d see it was in the same vein as personal responsibility. It was just interesting to me that people would be willing to assume additional debt before having experience with the needs of the house.

It wasn’t **cking anyone. Keep in mind that Home Depot, Lowes, Ace, air conditioning companies, flooring outlets, pool contractors, and so on were all attempting to get their share of the pie.

It might surprise you to know that similar solicitations were sent to people who just had a baby, just got married, graduated college…. all this data is available for purchase because dufus americanus puts their entire life online.

El Katz The best time to buy a property is when the price is at the bottom even if the interest rates are high.

Interest rates are negotiable, property price is not.

You can also appeal your property taxes if you overpay for a house. My house’s assessment went up 70% the year after I bought while the rest of the neighborhood went up 35%. I got mine down to about 35%. And don’t forget the Homestead act or similar if your state has it.

(I admitted I overpaid for my house since out-of-towners with big money were driving up prices, and I got them to remove finished basement square footage that they falsely assumed existed based on listing pics they apparently scour. Pointed out every flaw I could think of).

As an aside, I could care less if I bought during the run up as long as I love my house, which I do. I never think of my house as merely a financial investment.

If its any consolation, I made the same mistake in 2007… It was an expensive lesson, but worth more then a college education.

@Johnny Poor,

“Why did I not think this through before signing?”

I’m guessing you might have been pressured by a significant other or family, maybe?

Tough break!

In live time Hurricane Lee may not only devastate home values but also the insurance and the insurance industries. We have created multiple bubbles within bubbles of risk carry forwards of totally artificial values. These value have levels of false protection that only secure the very smartest portion of investors. It will happen slowly and then all at once. Real estate is actually an illiquid investment with a funnel exit that few can use when Fire is shouted.

“We have created multiple bubbles within bubbles of risk carry forwards of totally artificial values.”

very well stated, couldn’t of said it better. One of the most concise descriptions of what’s going on with the rent seeking economy in the US and the housing bubble, and by extension in areas like healthcare and college too, with massive ballooning in prices but not having any actual increase in value

The mortgage buydown creates sticky buyers who will lose their benefit if they flip the house. Builders have lots of land to unload and don’t want future competition from current customers so they lock them in with a low mortgage rate and a high principal amount.

Under rated comment.

Buying dow the mortgage is illegal. It is a traansfer of cash outside the recorded sale. When the Eighties ended, a lot of people lost their homes to foreclosure. They had used all kinds of tricks to get themselves into a house they couldn’t afford. The courts did their homework and arrested the people for mortgage fraud, and a few did prison time. All that under-the-table and off-the-books stuff is illegal.

Howdy Roddy. Yep, there are lots of crooks out there. Wish they would catch the ones that brought US, The Community Reinvest Act, No money down home loans, No income verification loans, and ZIRP. Even if you catch those folks, they are given a prize instead of prison time…..

or elected to congress.

Corruption rules!

Mentioning the Community Reinvestment Act as a cause of the housing bubble is a sure sign that a person gets thier information from poor sources that take advantage of them. It is a sign that they consume sources of information that play to their biases and are even willing to lie to them instead of actually informing them.

For the record, the CRA had very little to do with the housing bubble. The areas where housing went up the highest and had the most froth were areas not covered by the CRA.

I wish more people would use sources of information that actually informed them rather than play up their bigotry.