The new era of “higher for much longer.” The 40-year bond & mortgage bull market died in late 2020.

By Wolf Richter for WOLF STREET.

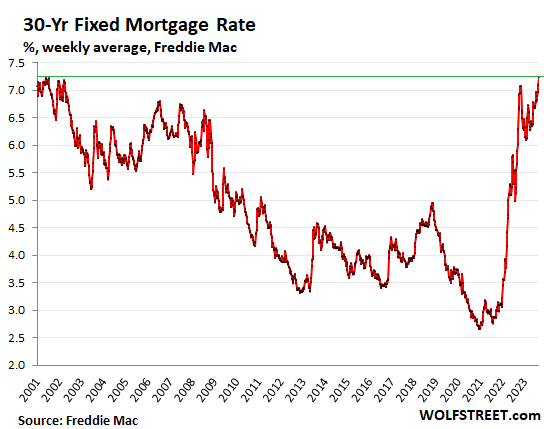

Today, Freddie Mac’s weekly measure of the average 30-year fixed mortgage rate hit a two-decade high of 7.23%. The next higher rate, 7.24%, occurred in June 2001. Beyond that single week in 2001, today’s average was the highest since 2000.

Various measures have already hit two-decade highs, including the Mortgage Bankers Association’s weekly measure, which rose to 7.31% yesterday; and the daily measure by Mortgage News Daily, which jumped to 7.49% on August 22, and currently sits at 7.37%. In response to these higher rates, applications for mortgages to purchase a home have plunged to multi-decade lows.

In terms of the housing market, 7% mortgage rates are not a problem – we’ve had them before, and much higher over the 30-year period in the 1970s through 1990s. The problem are home prices that spiked ridiculously in recent years during the Fed’s interest-rate repression; these prices are not sustainable, and we’re already seeing that in many markets.

The 40-year bond & mortgage bull markets died in 2020.

For a lot of people, these are pretty serious – as in dizzying – mortgage rates. But for people who bought homes in the 1970s through the 1990s, these rates appear to be about normal or low, compared to where rates were back then. In the 1990s, the economy worked fine with those rates.

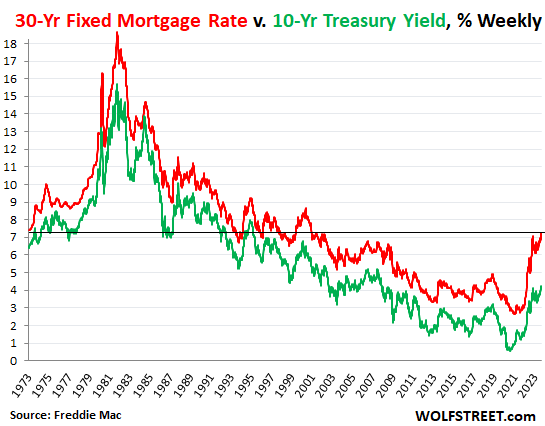

Mortgage rates roughly run in parallel with, but above, the 10-year Treasury yield, given that the average 30-year mortgage gets paid off in less than 10 years, such as when the home is sold or when the mortgage is refinanced.

The chart below shows Freddie Mac’s measure of mortgage rates in red and the 10-year Treasury yield in green going back to the 1970s. The spike in mortgage rates out-spiked with ease the spike in the Treasury yield (more about this in a moment).

The 40-year bond bull market (rising bond prices, falling yields) peaked in August 2020, when the 10-year yield dropped to the record of low 0.5%, on the misbegotten hype about negative yields at the time.

The 40-year mortgage bull market peaked at the end of 2020 with the weekly average of the 30-year mortgage rate at the historic low of 2.65%. This being the average rate, lots of borrowers got even lower rates.

After the 40-year bond & mortgage bull markets died in 2020, the world moved on to the new era of higher inflation and higher yields and rates. And in the world of fixed incomes, higher yields translate into lower prices, which is why the bond market has remained delusional for as long as it possibly can.

Long-term Treasury market still delusional, but edges out of it.

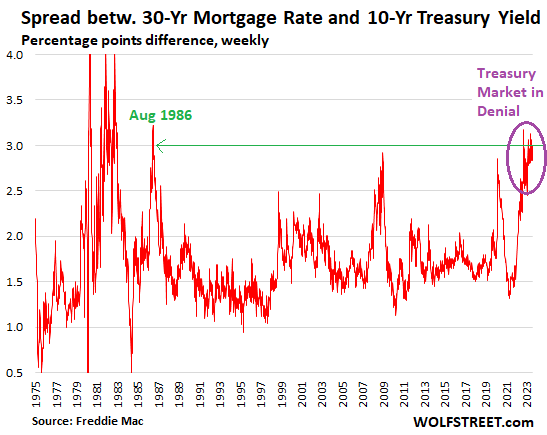

The difference (the spread) between today’s 10-year yield and today’s measure of the 30-year mortgage rate widened to 3.0 percentage points, which – other than a few weeks since March – is the widest since the brief episode in 1986. Most of the time, the spread is between 1 and 2 percentage points.

This wide spread shows that the long-term Treasury market hasn’t fully come to grips with the new reality yet:

The mortgage market has been more realistic about the “higher for longer” theme, and that theme may have turned into “higher for a lot longer.” Mortgage rates have risen to stay well above short-term Treasury yields, and to stay above inflation.

But the Treasury market has spent 18 months believing in the Fed-pivot hype that rate cuts would be forced on the Fed by a steep recession, with lots of forever-QE to follow, or whatever. The opposite has happened: The Fed has continued to hike and may hike again, QT marches on at record pace, the economy picked up speed in Q1 and Q2, and is now showing signs of heating up further in Q3, and inflation has entered into an upswing that will build in the second half.

Unlike the mortgage market, the Treasury market hasn’t figured this out yet, and longer-term yields remain well below short-term yields, and they remain below core CPI. But even the Treasury market is ever so gradually giving up on its pivot-any-moment doctrine and is coming to grips with this new era of higher for much longer. Given where the mortgage market is today, and where the short-term Treasury market is, and where core inflation is going, the 10-year yield would be right at home in the 5% to 6% range.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Staggering supply has clearly pressured Treasury prices. Treasury announced on July 31 plans to borrow over $1T just this quarter. The bond vigilantes are back.

The large treasury dumps likely finally got the market to realize the pivot spiel might just be nonsense. It has been amazing to me how long many people have been fighting the FED when Powell basically tells us what they plan to do ahead of time. It is like a man who tells you ahead of time that he is going to punch you and when he is going to, but each time you say, “nuh uh, that is not going to happen. You wouldn’t dare ” *WHAM* and this goes on for more than a year!

an 8% mortgage with 20% down doesn’t sound bad

or do I just take $$$ for next buy

have 7 homes 10 would be better

Watch it, Diddley, your story has many many pieces now. People will remember…….

The concentration of housing ownership is in the top 10%, this massive influx of low-cost credit led to the top 10% accumulating investment housing. Another is Corporate ownership in housing. So where does this leave us it’s not the bottom 90% that got houses with ultra low interest rates on overinflated priced houses. My prediction is the wealthy 10% are fixing to get bit in the ass. Get ready to get bit🤣😂

“Another is Corporate ownership in housing.”

Corporate ownership of single-family houses is ridiculously over-hyped:

There are 82 million single-family houses in the US.

Single-family investors with 100 houses or more own only 574,000 single-family homes. Less than 1% of the total.

Mom-and-pop investors and other small-scale investors dominate single-family rentals. They own 14.5 million single-family rentals, or 17.7%

ALL investors combined, dominated by mom-and-pop, own 15.1 million single-family rentals or 18.4%

5. This does not include the multifamily rental market (apartment towers and apartment complexes), which is twice as big with 31.5 million rental apartments. Mom and pop play a very small role in that. These are big and expensive properties owned by big landlords, including insurance companies, pension funds, and all kinds of private and public companies.

Data from Urban Institute.

Here is more for you:

https://wolfstreet.com/2021/06/22/no-blackstone-didnt-buy-17000-houses-out-from-under-desperate-homebuyers-and-blackrock-didnt-buy-a-whole-neighborhood-but-built-to-rent-is-a-h/

Can you blame them? Feds lost a lot of credibility over the years

Supply and demand. We’ve grown so used to Fed driving rates stories there’s a tendency to discount other major influences. It’s also hard to explain the surge in ten-twenty-thirty year yields in terms of Fed funds expectations alone … a speculative few months one way or the other isn’t much in the context of decades.

The Fed doesn’t control everything. I believe Wolf has touched on this before … that such heavy borrowing might only be fulfilled at higher rates. You could even make a case that Fed funds is being dragged higher than it otherwise might be by heavy borrowing on the short end … other borrowers have to compete with Treasury.

The supply of real capital is finite; the Fed’s main role here is that it’s keeping the supply of dollars similarly finite. So more borrowing demand needs higher rates to attract more lending supply.

Back in the nineties the phrase “bond vigilantes” colorfully described the tendency of higher deficits to be met with higher rates. We’ve had so much easy mooney since we’ve almost forgotten what real markets look like.

What makes you think our leaders want a “real” market, or must return to one? There are no natural laws in finance…only rules, which can be changed on a whim. Take from one group, give to another, any time you want.

The only untouchable is the wealth at the top.

Look a little farther afield for the correction to the concept you cite, “The supply of real capital is finite;” fin?

While it may be that the concept of capital, as first enunciated or actually practiced MAY have been finite, that is clearly NOT the case when cabals/cartels/gangs/brotherhoods of banksters can AND DO control absolutely, or close, their rules and regulations and enforcement policies and practices.

Until we have actual lawful educated democracy, ((you know, where ALL the voters have been able to prove at least a minimal understanding of their vote, eh) ,,, OR honest representational ”republic” there will continue to be THE drag of corruption on the backs of those who actually make and do stuff.

Dictatorships of any kind, etc., etc., can NEVER do this, so the trend TO democracy will continue until fair for all, and in spite of the obvious push back from the oligarchy who have been in charge for the last couple millennia.

@Bobber

“What makes you think our leaders want a “real” market, or must return to one?”

Where did I say they did? Wanting something and getting it are two different things. My point is that Treasury supply is pressuring prices and rates. For now. Things I did not say are not my errors.

@ VintageVNvet

Real capital is finite. Cartels, corruption, etcetera may move it around, but they don’t make it infinite. Bankers may create money and credit, but those are not the same thing as real capital.

I don’t think there is “finite” ANYTHING, and especially CAPITAL per Bobber comment. Man has been trying to measure things since civilization began.

Why?

So as to divvy it up according to the latest “rules”….again per Bobber.

Existing isn’t even finite….the question is in what form and when? We have all been parts of a rocks or the air or oceans somewhere over the eons of time. Assuming matter is finite.

Go look at the newest SI Units, they changed a few years ago.

EXCELLENT ANALOGY LL!!

Put me right back to at least ”junior high” school where that sort of warning was common by the bigger guys, (( most of whom dropped out during 8th grade when they turned 16, with NO ”social promotions”)) if not elementary school with besties, etc… my deer Woe Son(s)…

Try as I might, and have, I cannot understand the oblivion in which so many otherwise apparently wise traders continue to proceed; unless and until I get to the factor of the entirely illogical, non sensical, ill timed, (Etc., ad infinitum) GUVMINT INTERVENTIONS in markets.

Wonder if that intervention might be correlated, somehow, with ability of GUVIDIOTS to insider trade??

Just kidding about the wonder FYI.

Exactly. It’s like when Nvidia clearly told folks that there would be a short-term revenue surge as China bought chips before the ban is intensified, after which there would be a permanent loss of demand, and the idiots still bid Nvidia up (but only for a short while).

Treasury is borrowing now before rates go even higher?

Treasury will just borrow from self(called Fed)

MMT anyone

To assume that because rates were higher back in the 70’s is not a problem today, is to refute that living wages have kept pace with the rates today. That have not. Thus this is one of the reasons people are living in the lowest cost housing they can find.

Another reason people are living in rentals. And that they have to live in depressed areas is a result of housing management companies that keep pushing up rental rates to the point of unaffordability. Do we have homeless families living on the street or in unlivable tv’s?

“Given where the mortgage market is today, and where the short-term Treasury market is, and where core inflation is going, the 10-year yield would be right at home in the 5% to 6% range.”

I would love to see 8-9% 30YFRM before the end of 2023. That would be AWESOME!

And, the crazy part is there’s a good chance people would still keep buying houses, paying all cash and pushing up prices.

Let’s find out, JPowell!

Oh goodie! Home prices will keep going up and Up and UP!!!

AWESOME News for those of us who already own a home. A sickening shock to anyone in their 20s, 30s or 40s who do not. Those folks will be priced out of the market indefinitely if you get your wish.

But hey, no sweat, because I’m betting that YOU are not in that age group. Well, neither am I. The difference is, I’m hoping that home prices fall, and come back to sane levels. Because this old guy is never going to cheer and applaud while folks half my age are getting screwed. Even the wise acres who make cracks about my age, or call me “boomer”

I prefer “Bloomer”

so under 70

I am glad to read your sentiment on this page, Sammy. Because the majority here are the opposite – they actively root for folks to get screwed via real estate implosion even if they themselves will see no direct or even indirect benefit. Glad to see not everyone here is grumpy.

I think you misread Sammy’s comment. If the majority here want a real estate implosion, or at least for prices to go down to sane levels, I think Sammy is in agreement with that majority.

Nobody would be getting screwed. They’ll still own their homes, just not with 100% gains over 3 years.

Cheers Sammy. You are correct. Many boomers wonder why they don’t have grand kids…. well… family formation usually requires a home. One wonders about falling birthrates and wonders, what has contributed to this….

Sammy, I would accept a $1 profit on my house(after 25 years of owning) if it meant my kids could buy a house at a reasonable price.

You are not alone and I am, as my daughters like to jest, “as old as dirt” (58yo).

I actually hope the prices crash, but I do not think they will. At least not yet.

And thank you for bucking the trend of self interest over concern for the generations who follow us

Go Dave!

Let’s be clear. I want housing to crash at least 25%. My college educated kids are 27 (business / marketing) & 23 (applied computation mathematics), and they can’t afford a house.

Another post from yesterday made this clearer, but the guy who runs this website removed that post.

Is 25% even a crash?

If rates go from 3 to 7%+,

& every 1% is ~12% reduction in buying power (based on more of the monthly payment going to interest) aren’t we mathematically due for a 50% crash?

I own outright (traded fake money stonks for a house) so I shouldn’t be cheering for a crash, but I am for my kids & the next generations sake.

I’m with Cave.

We own, or at least rent only from local GUVMINT.

We would like our various and sundry family and other ”hood” helpers to be able to BUY local, say within walking distance, eh,,, and own ASAP because We think that is the very best basis for a stable society.

That WAS the case in a small city in SW FL in 1940s and 50s, and even ”professionals” could and did walk a couple miles to work, weather permitting.

This is the most rational thing I’ve ever heard a homeowner say about housing prices. The whole generation thing gets used to drive a wedge between us but we’re more alike than we are different.

Grey – …discussion here in Wolf’s most-excellent establishment consistently, and invaluably, illuminates the variance of our long-term ‘Murican demographic trends/attitudes over the last century…

may we all find a better day.

Yep! Let me add a trend, ok?…..Very many were on Valium for 15 years and before that on real speed (meth/Dex) for about as long, maybe longer. Kinda like a multi generational “Valley of the Dolls”, eh? Not sure how our Doc’s favorite drugs trend among many other trends affected things. I’d put links to both but everyone who doubts me can use Google and then Wikipedia. (Would LOVE to put drug ads up, though, great history clues)

Anyway, never leave out the time dimension….we live in it, ya know?

But damned BOOMERS still could have listened to Carter, dammit!

Agree. We should not ne taking advantage of the younger folks. Boomers had it too good for too long. Leaving the next gen with all Boomer government debt and overpriced assets.

The boomer “overpriced assets…”

In terms of high home prices, it’s not boomers that have driven them higher over the past 10 years because they’re no longer chasing homes; they’re done with that. And maybe you can say the same thing about stocks.

What has been driving up home prices over the past few years is younger people (the hugest generation ever) trampling all over each other to buy a home, and shoving each other aside, and outbidding each other. Younger people should gang up together on the social media and organize a total buyers’ strike of 4-5 years, and let the older people shuffle homes around between each other and their Maker, LOL.

Gen Xers and Boomers went on a buyers’ strike in 2005-2012, and it caused prices to crash by 50% or more in many markets. It worked.

The Fed is now trying to prod younger people into going on a buyers’ strike; so it’s raising rates. We went on a buyers’ strike that started out in 2005 with higher rates and continued through 2012 with very low rates. A buyers’ strike is a very powerful thing.

Oh, and $1.6 trillion of that government debt has funded student loans, that were supposed to be paid back, and now are being forgiven in huge numbers. Boomers have mostly paid off their student loans. These are loans to younger people, and many of them haven’t been paying them back and are waiting for loan forgiveness. If everyone paid off their student loans, the federal government debt would drop by $1.6 trillion.

Wolf,

What tells you that the mortgage market is right and the ten year is too low vs the bond market is right and mortgage rates are too high?

The mortgage market has been right! And the Treasury market has been wrong, month after month for 18 months! So we got that established. And the Treasury market is finally admitting to its errors and yields are coming up.

Be careful what you wish for benw. Are you another renter who missed the last 15 years of bull market in housing and hope to buy cheap when other folks lose their homes?

A lot of other sh*t is going to break before the housing market does. Commercial real estate already has. The auto industry, banks, airlines and any business, small or large, that can’t survive a 500% increase in debt service will be history.

Jobs will be the next to go. It’s already starting. This is going to get really ugly soon.

That’s a scary chart Wolf. It took rates over 20 years to drop the same amount the fed jacked them up in only 18 months.

I’m 56, own a home, and have 95% of my money in brokered CDs. So, I love a high FFR. Woohoo. Longer FOREVER, baby!

I’m a high school math teacher, so I’ve got a near recession proof job.

My kids are 27 & 23 and both are college educated but can’t afford a house.

Take this to the bank, CCCB, housing prices have to fall a lot. At least 25% for the long-term health of housing. We can’t have ever increasing prices with the Fed & Congress choosing winners & losers. That’s what we have markets for.

Last, the most important “possibility” when the recession finally arrives is whether or not Congress trots out rent & mortgage relief again. If they do like I fully expect them to, then we’re screwed. Market correcting foreclosures are a thing of the past, meaning higher home prices & more rental homes versus owned houses.

I’m a conservative who loves America and hates all of the woke agenda / crazy spending / open borders that are sending us over the financial & social stability cliff. And, I well know that UniParty Conservatives are every bit as culpable as Joe Biden.

And, I’m NOT a Trump guy. God Bless America.

BENW,

“My kids are 27 & 23 and both are college educated but can’t afford a house.”

LOL. When I was that age, I was college educated too, and by 25 I had an MA, and I couldn’t afford a house either, and that was in the late 1970s to early 1980s when houses were, as young people today would say, dirt cheap (they weren’t dirt cheap for us because we made a lot less money).

So asset prices shooting to the sky is great?

So massive amounts of money going to money losing companies (like Peloton) is fine?

So continued inflation at >5% is fine?

Actually 5% FFR is normal; 3% is abnormal. Some how CRE, airlines, banks, and the auto industry survived with >=5% rates for decades.

CRE and retail business have issues that have nothing to do with the FFR, such as the massive increase in WFH and e-commerce.

500% increase in debt service will be history.

or 0% debt service

I want higher rates 8 – 10% will be perfect. It is time to reward savers who have been deprived of a good riskless return for years…. If you hold overpriced assets then be warned.

8% to 10% rates are too low. We as savers got screwed for so many years so I would expect a 50% interest rate up front and 11% for the next 10 years minimum.

Financial prudence is a dirty word in our system.

I don’t buy unless I can get 30% ROI

my issue is NO HELP at $30 an hour

getting to point were I can’t handle more

so much opportunity out there

wish I could apprentice mil/genZ

WTF is this nonsense? Not every renter has “missed the last 15 years.” A lot of us came of age in that time, and weren’t in a position to buy a house. I don’t know why you think it’s acceptable for the Fed to manipulate the markets to reward people who already own houses and punish younger people who want them.

Cause he has a stake in it likely and exhibiting your healthy dose of NIMBYism. I mean he got in and saw his asset price like RE to the moon for no good fundamental reason…don’t try to take that away from him now…

A lot of the people in this country have an “I got mine, F— You” attitude. I’d also see that it’s not a new thing but it has been amplifying over the last 30 years.

Einhal, agree!

My daughters are 31 and 35 years old. I am pissed about what has happened to them secondary to the FED policies which have enriched the rich above all else.

This country has socialism already. Socialism for the rich and powerful via tax cuts, off shore accounts, asset inflation and bail outs for corporations and banks any time a whiff of financial impact for poor choices comes due.

For the average US taxpayer (whose money PAYS for this BS), disaster capitalism is par for the course.

“Renters who missed out on 15 years of bull market?” Hahaha.

It’s obviously their fault for being young. Should have been born sooner.

Better luck next life kid.

@Dave, I’d say the US closer to crony capitalism (“privatize the gains, socialize the losses” for the well connected) than socialism.

There is no buyer for your house anymore at Zilldo’s Zestimate. You missed the boat. You can stick a fork in that perceived equity, it’s GONZO.

and yet good listings go in 1-3 days

maybe your market is SHHHHHIT

Last year when FED barely started tightening, a lot of people thought the same that a lot of things would break at 5plus percent FED rates.

I think we really need higher for longer and America desperately needs home prices to correct desperately.

All these companies are making ton loads of money and most of them can survive with high rates and low home prices.

These rate hikes would take away mis allocation of money.

Home prices already went down 10 percent or more from peak , slowly climbing up now . This didn’t break anything.

Yeah that U6 at 6.7% really seems like jobs are going.. Oh and unemployment coming in below forecasts..

Bring it on! Only recessions and market crashes have managed to reverse some of the staggering wealth inequality. Hopefully this time the Fed won’t bend over for the Aristocrats with more bailouts.

> cheaper housing is bad

an absurd position that makes zero sense at any time in history.

> Are you another renter who missed the last 15 years of bull market in housing and hope to buy cheap when other folks lose their homes?

so when housing goes up and people gain on people who don’t own homes that’s ok, but the other way is bad?

again the logic here is very, very poor

The logic may not be poor, but rather self serving.

funny how my kiddies in mid 20’s now both bought houses and sit on 100% equity

but don’t care since they

1) need affordable place to live

2) raising kids isn’t cheap

3) bought right

both making LIVING wages of $25 an hour with lots OVER TIME

one is managing city of 5000 employees

just doesn’t know it(youngest financial manager)

raising kids 4 years old takes lots of FAMILY

My simplistic analysis. Pulling future consumption into the present via debt expecting to increase production to enhance the ability to pay off that debt has failed miserably. Gotta pay the piper.

They’re just printing now. That’s all they have. The government is out of control spending, and the FED is just debasing the currency, stealing the future of the young. Sickening. All of CONgress should be hauled off to the stockade.

They said government could reduce taxes and reduce deficits at the same time, by creating a virtuous growth cycle. The term trickle down theory sprung up.

Instead, what we saw was higher deficits, stock buybacks, and higher wealth concentration. Nothing trickled down.

It turns out, if you freely hand wealth to the top, they would rather hoard it than invest in an artificial economy on government life support.

It’s time to stop the welfare and money printing. People need something to invest in at reasonable, stable prices, with a return that is not dependent on continued massive artificial stimulus.

CCCB thank you for setting benw straight, when he clearly can’t see the bigger picture.

CCCB how many different names do you go by? You posted the same comment under a different name on the last housing thread.

Just one. Confirmed.

Typically, housing LEADS us into recession. So the fact that housing has cratered (i.e., prices) and is actually going back up now, is the main reason why there’s no recession.

The other 90% is the fact that we will run nearly a $2T deficit this FY which is an enormous amount of stimulus.

I’m glad to see that Wolf believes the bond market is coming to terms with all this. Hopefully, next they come to terms with is $33T in national debt growing by $2T a year that will translate into $1T+ in annualized interest expense by Q3 is reported.

Our fiscal house is insanity, and the bond vigilantes need to come out with vengeance & teach Congress a lesson and probably us too for voting for these !diots.

” So the fact that housing has NOT cratered”

Sorry

I’ll openly wish for 50% minimum downgrade in housing costs. Bring it.

It’s entirely about affordability, and the connective dots of income and debt.

The post-pandemic mindset that valuation and debt are inconsequential is about to be tested by higher rates and higher debt.

Technology to some degree has allowed the Titanic to dodge a few icebergs and extend the length of its unsinkable voyage — but either the ship will have to completely stop in its tracks now, or hit the inevitable destructive iceberg in its path.

There are two outcomes — bad or worse.

I wonder if a rotation out of stocks and into bonds has been putting a floor under the 10 year.

Here’s hoping that continued QT and the Treasury’s new issuance provides a tailwind for yields.

I have been mystified at why anyone would buy low-interest, long-term bonds or treasuries for years when inflation (actual not the underreported propaganda CPI by picking only specific items to include) was running so high for years, then increased, and is still fairly higher than the interest rates such securities pay. If interest rates go up, as after a geopolitical event, those securities will be valued far less by markets than new securities paying higher yields. Calling Silicon Valley Bank to explain…. Why getting long term, low interest paying securities can be bad. LOL

There CANNOT be a rotation out of stocks and there CANNOT be a rotation into bonds. For every share that you sell, there has to be someone with the exact same amount of money that buys your shares from you, and for every bond that you buy, there has to be someone that sells it to you. In the end, the number of shares doesn’t change, and the number of bonds doesn’t change, it’s just people selling each other the same stuff.

The only thing that changes is the selling PRESSURE and the buying PRESSURE, which is what determines prices.

Thanks WR for this nugget.

People always bring up the claim of money waiting on the sidelines and the above refutes this.

Sometimes I just want to upvote.

the simple “double entry” logic seems to elude most people.

one cannot sell if nobody buys.

the order book can have more sellers than buyers, as you say the “pressure” (liquidity) on each side determines the price direction.

The real swings come when people *have* to liquidate, rather than just a desire to close out.

For existing stock and bond holdings, yes. But if I change my new 401k contributions from 100% stocks to 50% stocks, that is a shift out of future stock purchases. I would think there is more of that occurring with saving/bond investments paying more.

Publius,

Changing your future allocations make no difference either. What Wolf says still applies: “In the end, the number of shares doesn’t change, and the number of bonds doesn’t change, it’s just people selling each other the same stuff.”

Changing your allocation may put upward pressure on bond prices and downward pressure on stock prices, but the pool of available bonds and stocks remains the same regardless of your change in allocation. You’ve just changed what you’re purchasing from the pool of available investments.

A rotation out of stocks could occur with institutional and retail investors selling their stakes and issuers (corporations) buying back shares, which would reduce the number of shares outstanding by the issuers.

Yes, share buybacks reduce the number of shares.

And cash acquisitions (but not via shares) also reduce the shares.

And share issuance (IPOs, follow-on offerings, share sales, etc.) increase the number of shares.

But that’s NOT what MM was talking about.

in the end, there is always a buyer and seller. doesn’t matter who or what they are. money exchanges for x. Also… really, make a list of who is doing buybacks…. sure… some… but market wide. please.

Corollary: There is no “money on the sidelines”, but there may be more DEBT, waiting to be created, on the sidelines.

I think I’m struggling to understand this.

Lets say I sell my broker 100 shares of xzy stock at $10/shr, and then use the funds from that sale to purchase a bond with a $1000 par value.

Sure, my broker is on the other side of the trade, and purchased xyz stock and sold a bond – but if they’re paying me the lower end of the bid-ask spread, wouldn’t that *not* put upwards pressure on the price?

“and the number of bonds doesn’t change”

But isn’t this not the case with all the new issuance coming from the Treasury?

Thanks for helping me understand.

…mebbe we’re all just cutting each other’s hair (though some have proper tools and others are using pinking shears…).

may we all find a better day.

This is only true is the money supply is relatively constant but if you printing extra money this extra money in system can be rotating from one investment type to another. And in the opposite situation where money is being destroy you end with opposite money “rotating” our of the system.

Finally some sense to the idea of money on sidelines ! It takes a buyers strike to really figure out price discovery

The comments about the psychology surrounding 7%+ mortgage rates are spot on. Buying my first place in 2000 at 7.3% was just – “Okay, sure….sounds good.”

It seemed completely reasonable. Of course, the condo in question was also priced reasonably.

7.3% sounds good and reasonable because rates were relatively stable at the time. 7.3% today sounds bad and unreasonable because they were half that 18 – 24 months ago. It’s all relative.

7.3% sounds reasonable when the average house is $200K.

It’s monumentally absurd when the average house is $500K.

House prices would have to fall by more than 50% just for the payment to be the same as when rates were sub 3%. All BBQd.

*All of the sheeple who loaded up on houses the past 3 years have just been BBQd.

I think this is going to be the biggest legacy of ZIRP or interest rate repression. Powell hoped for recession. Inflation isn’t cooperating. The labor market is actually reinforcing inflation at this point. There was no softening. And this is a biggie. Those who can work can job hop. Those who are not in the job market/fixed income… different story. They can’t keep up with inflation by hopping jobs. I think that 2% target is going to become history. In the same way decades ago interest rates were much higher. In effect. 2% is out the window for the next few years… look at it… how slow they move. We’re running so much higher than 2% and it’s rolling across the economy. And the labor market says ‘fyckyou’ that isn’t reality. Job seekers need 10% or more to jump ship. Jpow is moving like an iceberg because he knows to move faster detonates real estate…

Dick,

“I think that 2% target is going to become history.”

Just for you, hot off the press:

https://wolfstreet.com/2023/08/25/powell-smacks-down-calls-to-raise-2-inflation-target-2-is-and-will-remain-our-inflation-target/

But I agree with you that it’s going to be very touch to get to 2% core PCE, and I don’t see them getting there over the next few years.

Depth Charge… mortgage calculators abound on the internet. Try using one. The one I used put a $500k house @ 2.875% monthly payment at $2074.

A house of half that value at 7.3% has a monthly note of $1713… so NO… house prices do NOT “have to fall by more than 50% just for the payment to be the same as when rates were sub 3%.”

The same calculator shows that a house of $300,000 at 7.3% interest has a monthly payment of $2056… almost EXACTLY what the note was for a $500k home at 7.3%. So the right answer is for a home value drop of FOURTY PERCENT!!! Absolutely any house on the market has roughly the same mortgage payment at 7.3% if the price drops 40% as a house financed at 2.875% for the higher amount. It is just math.

But house prices will NOT drop by 40% in most cases. Inflation has also lifted the incomes of most home buyers. So they are paying the larger interest rate with cheaper dollars.

Which means that NOT “All of the sheeple who loaded up on houses the past 3 years have just been BBQd.” Perhaps those assets will go down in value somewhat but they are still paying the 2.3% interest rate payments with cheaper dollars of their own. WHICH IS THE CATBIRD SEAT in a period of higher inflation… a fixed mortgage at a cheap interest rate on an asset which you are not in a rush to sell.

In fact, if ANYONE is getting BBQd by this situation it is the banks that issued such cheap financing. They are losing so much money in interest that they could be making at the current rates that I won’t be surprised to read stories in the near future of your “friendly” bank offering to buy the houses from the 2.875% borrowers at the full rate to “help” them avoid losing money on the decline in that home’s value.

Our helpful mortgage calculator helps examine this problem as well. A three year old loan at $500K with a 2.875% mortgage generates $13,605 in interest for the bank… while a 7.3% interest on a $300K mortgage generates $21,805 in interest the first year for the bank. So even at a GINORMOUS 40% haircut on the property’s value, the bank is still losing 38% of the interest it could be making. If the property “only” declines 20% in value the bank is losing $29,073 annually ($15,468 relative to the 2.875% loan) or 114% of what it makes off the 2.875% loan at full value. The only thing saving the bank is if they commoditized the earlier loans in which case the investors are getting BBQd.

As it always is… at the start of any inflationary period… the people getting BBQd are the ones who LOANED the money in the immediate past… not the ones who secured those loans.

“SpencerG”

Yeah, no. I don’t reply to this idiot speculator.

Depth Charge…

There really is no response here… you were shooting from the hip. It is Plug-and-Chug math… anyone reading this can use a mortgage calculator for themselves to figure out which of us is right.

BINGO!

In June 2001, the inflation was barely counted, the spread was huge. Now, the rate is barely positive so if I was a realtor I would sucker prospective buyers by saying the loan/mortgage pays for itself.

Thanks Wolf!

I will be looking out for 6% after Xmas, even with one .25 rate hike. The down grades on the banks with the Fed window closing in March 2024 is a warning. It seems like higher for longer for sure, and lower for longer too, if you know what I mean.

There is a shortage of housing.

Shortage of affordable housing ?

The poor have never been able to afford a house, except for a few that are willing to have 3 generations live in the same house.

Rates are rising, but still low in a historical average during inflationary times.

Why would anyone buy bonds, when stocks outperform ?

An old fashion stock market crash would motivate a lot of people into bonds. Yes we might be in the BLOWOFF phase.

When you look at a long term chart of the Dow, S/P, or NASD. It looks very parabolic to me. History might not repeat, but it often rhymes.

With huge pay increases for labor…….Inflation is NOT going away.

Inflation is necessary for the Fed and Treasury. The Fed knows they have to inflate their way out of $34 Trillion of debt.

No way will the government reduce spending. Nor will the government default. IMO.

We have almost 15 million plus homes either vacant or in STR.

There is no shortage of housing but the inventory levels are low for sure.

The problem isn’t a “shortage.”

It’s a regime where every house gets “scooped up” by “investors” thinking that every house is a golden goose that spits out money for zero risk.

As long as that regime exists, every single house will be bid into the stratosphere without regard for fundamental valuation.

If spending will not be reduced & taxes not raised, then deficit continues. If no default & the Fed done buying with printed money (QT) then treasuries will flood the bond market resulting in even higher rates…..right?

The stock market would drop 80+ percent in mere seconds if the plunge protection team wasn’t there 24/7 365 days a year and 366 days a year in the leap years. The entire thing is nothing but a fraud ponzi run by the bankers with worse fundamentals than Bitcoin. It’s almost like looking back to the days of the dinosaur or the dodo bird when the stock market actually did predict the economy 6 to 8 months in the future.

Well the FRB was buying the bonds with QE 1,2,3 and have stopped . I buy bonds so I’m one of them as a retiree I need cash flow.

but but but Barbara Cochrane just told everyone to better buy now, with rate cut coming, home prices will only skyrocket another 15%…and mortgage rate cut to 5% is just around the corner. We should all listen to her since she is a well-respected Shark and totally not a shill at all.

Love seeing these higher yield…now even on the longer end…anything to put TINA environment behind us

Real estate agents I follow on Instagram have been posting that Barbara Cochrane video on repeat for the past month. They all have commission breath these days

I know a Realtor who says Barbara Cochran lives in NYC and is a bimbo selling her book.

Ah! See I didn’t know she had a book out- makes sense now.

“But the Treasury market has spent 18 months believing in the Fed-pivot hype that rate cuts would be forced on the Fed by a steep recession”. I’m not sure how you come to the conclusion this is incorrect. It takes 12-18 months for markets to react to Fed rate changes. And they are still hiking. Yes the Fed will pivot once we have the recession, which will begin next month with the wave of bank failures coming and massive job losses. Spring and Summer are seasonally good times for the markets (including the RE market). Fall and Winter are seasonally bad times for the markets. March and September is when markets have liquidity crunches, which is why we saw banks fail in March. We will again see a wave of banks fail in September.

As to a “strong market”, seriously? We have a supply shortage of labor, which is why labor appears strong, unlike the past when the strong labor market was because of a strong demand for labor. Unfortunately, the unemployment rates don’t tell anyone that. The stock markets have peaked and are rolling over. The DXY has broken out of a fallen wedge. PMIs are down around the world. Export and import numbers for China and other countries are falling of a cliff. But you think interest rates will stay high? Just because the government is having to issue way more treasuries than they thought they would which is causing the price of treasuries to go up (the yield)? Mmmkkk.

What’s the difference between “supply shortage” and “strong demand” when it comes to labor?

They seem to be two sides of the exact same coin. Both now and in the past labor is strong when demand exceeds the available supply. Or conversely, labor is strong when there is a shortage of labor relative to demand.

That’s the problem, the unemployment rate doesn’t tell you if the economy is strong or not. You can have “strong demand” with a growing economy because business is booming and businesses need more labor, because business is booming. On the flip side you can have “strong demand” in a weak economy because even though the economy is crumbling, the supply of laborers is far below demand. If you look at statistics though, labor supply is far below the mean, so we know the strong employment numbers have nothing to do with a booming economy, but a complete lack of people to work. Steven Van Metre or Eurodollar University on Youtube address the issue.

There are large and vocal camps of people debating whether rates will increase or decrease, both sides. They are probably both right. First they will go up. Then all hell breaks loose and rates will fall. It’s not an either-or question necessarily. The only question is timing and everyone will eventually be correct. I’m just going to munch on my popcorn.

I completely agree. Rates won’t fall until the recession hits, because at that point the Fed will drop interest rates to zero, causing short term interest rates to drop like a rock. The yield curve will then normalize. The Fed is very much to blame for the coming economic collapse. Banks have to borrow at the short end and lend at the long end of the interest rate curve, and the Federal Reserve completely effed that up.

They are trying to normalize the long side of the curve. When the recession hits. nope. Not going back to zero. That is over. God willing. Jpow has term till 2026 and doesn’t need reconfirmation. He can tell everyone to go fuck themselves and do what is right for people and country if he has the stomach. The whole point of this exercise is to get long term where it should be. Too many retards were at the helm for too long.

The Federal Reserve will not be decreasing the interest rates it sets at all in the months and years ahead, but rather will continue increasing them not that it matters much at all.

That’s quite a crystal ball you’ve got their.

Sees clearly the future. Wow.

My first mortgage was 9.75 and I was happy about it. Rates were going up.

My first mortgage was 17% and I didn’t think much about it. Too busy working and I learned to sail on the Bay during those two years. You could motor out of Sausalito in the morning on water that was like glass and return on a beat through Raccoon Strait with whitecaps and spray in the late afternoon. Wolf’s picture on deck brings back memories.

And your house price vs take home pay was? I bet your ratio was at least half of today’s.

about 0.26 I figure, no idea what it is now.

oops, I think I flipped those numbers, so it would be about 3.8

Wonder if the 10yr is a good proxy anymore since everyone is trapped at their 2.5-3% rates that might never come back…

Nobody is “trapped” at that rate. You can leave at any time you want. If anything it is the LENDER who is trapped there.

You can check-out anytime you like but you can never leave.

Not directly related to the mortgage rates, but a story came out today where Zillow is going to experiment in Arizona with offering mortgages with a 1% down payment to the buyer while Zillow fronts the other 2%.

Their house flipping business worked so well for them, I don’t see how this won’t. /s

I was reading comments about this story on other various sites and a lot of people make a good point that if someone can’t afford a 3% down payment on a house, more than likely they’re not in a good enough financial position to be able to afford the mortgage plus all the other ancillary costs of owning a home with just a 1% down payment.

Exactly. If someone can’t afford 3% down, they can’t afford to keep it maintained with all the other running costs. Same thing I told my friend before he got married…if you can’t afford the ring you can’t afford to get married as it gets way more expensive later.

Lemme guess — you work for De Beers…

Ha!

A gentlemen always knows that the ring should cost him a tasteful six months’ income. Anything else would be… downright gauche and uncouth.

LOL… twenty years ago I was in a pub listening in on a table of aircraft mechanics debating whether their colleague giving his fiance an $18,000 engagement ring was wise or not. Mind you that aircraft mechanics for a major airline make nearly as much as the pilots do. So they could afford it… but the debate was whether or not it was wise.

The female mechanics said they wouldn’t want to be responsible for wearing that much money on their finger every day. Most of the male mechanics were “he can afford it”… “not even three months salary”… etc.

But one mechanic shut down the entire discussion with “If I give my woman a $50 mood ring, it damn well better read HAPPY!!!”

If you’re really bent on trying to get your lady something ostentatiously expensive that she doesn’t even need, why not sign her up for elective spinal surgery or something where you’re at least supporting the craft of a true professional.

Cosmetic surgery of her choice. Or maybe that (or an extension) for YOU……..again, all HER choice.

“ if you can’t afford the ring you can’t afford to get married as it gets way more expensive later.”

This is poor logic sold to you by advertising.

Better to have no ring and get married.

Overall, paying for a home for 2 is cheaper than to pay for 2 separate homes.

Ring is compete waste of money. Use the ring money, invest and use the funds later to enhance your life.

Lenders frown immensely on borrowed down payment monies. Doesn’t pass the mortgage insurance test. Doubt if this is true.

Good luck with that. A FHA loan (3%) offer will get shot down. Especially in times, where Buyers are stupid enough to accept “AS-IS” demands from

Sellers.

Last thing seller want is another inspection, which FHA requires.

If ppl put 3% down they can easily walk away from that home without losing equity. Esp if their intention isnt to stay long term. They won’t be in a good position in this environment where the cost of everything has exploded. During the GFC the cost of everything was nowhere near what it is today. My husband and I were barely saving w 2 kids on a 65k salary then. But we got by. These times are exceptionally frightening. It’s not going to end well

Sincere apologies for totally agreeing with you,

My father always told me if you can’t afford to pay cash for something then you can’t afford it. He also said show me an honest man and I’ll show you a poor man.

When the 3rd quarter GDP figures are released, I hear that they will be 5% or more. The Fed will have no choice but to raise rates again at their next meeting. Look for the 10 year Treasury to top 5% and mortgage rates to break 8%.

ENJOY.

The stonks market is acting ballistic tonight. Going from red at 4pm to green as of 9:17pm.

Tomorrow is the big day, bagHODLers are waiting for any sign of a pivot, including any reduction in Jerome Powell’s blood sugar levels…that’s a sign of a pivot and #tothemoon! LOL.

Yesterday evening the market were up quite a lot.

We now know how did they close today ..big red.

Nvda was up almost 10 percent last night.

It closed up .14 percent today.

Don’t pay too much attendance to after hour data

Obviously, there will be no ‘pivot’ at all in the foreseeable future.

The FED ended the influence of the Bond Vigilantes and even the threat of foreign nations dumping their treasury holdings with the great inflation of 2008-2013.

Now that the FED is no longer a net purchaser of treasuries, and given the intense issuance coming from the Treasury over the next six months (and indefinitely), I think, at the margin, that Bond Vigilante influence can return.

I think that dawning realization is what we are beginning to see as the long term rates finally are starting to break loose.

Higher for longer? How about higher forever?

There may be something to it when compared to the 10-year yield of 0.5% in Aug 2020. I think that 0.5% has a good chance of not being seen again in my lifetime.

Don’t be so sure…stranger things have happened before. Let’s say the indicted one get elected, proceed to fire Pow Pow or threaten him again, Either Pow Pow cave or get someone else in there will do his bidding and bring QE and ZIRP…it’s a F up strange world we live, I probably wouldn’t want to bet the farm on not seeing 0.5% yield again.

The indicted one promised low rates not that long ago. Personally i think he even knows its unrealistic. Do you think this administration is on board with raising rates out of goodness of their hearts?

No. Even they learned that with interest free loans (lets be realistic), their spending binge doesn’t yield as much as results due to crazy inflation. They’d have to cut spending and look for budget cuts. No political power in this world wants to do it, because it makes them look bad the minute that is done and positive results of those actions aren’t seen for decades. Usually that is when their opponents are in power.

A president (from either party) firing a Fed Chairman for trying to control inflation… why would that LOWER the 10 year yield??? Presidents don’t set the interest rates… markets do. If anything doing that would send the 10 year yields to the moon.

A President of the US has no power to fire and cannot fire a Federal Reserve Chairman.

“There may be something to it when compared to the 10-year yield of 0.5% in Aug 2020. I think that 0.5% has a good chance of not being seen again in my lifetime.”

It should have never been seen in anyone’s lifetime, ever.

They should have never given free money to anyone and not lowered interest rates. They could get rid of inflation by making these lowlifes pay back all the money they should never have gotten in the first place.

Looking forward to the day when every other twitter post is NOT a late 20something RE Bro flexing his 15 leveraged investment properties or STRs or Storage Unit empire. In certain ways it’s so much like the early 2000’s

They’d have to get real jobs or real businesses. Not as trendy…

Howdy Folks. Higher for much longer??? YOU bet, and ZIRP better not return in my lifetime……They ruined the old school idea that saving some of your hard earned $$$ was a good thing.

I hope you’re right but unless I sink most of my money into long term bonds and or strip bonds of at least 20 years it will never happen.

5% mortgage rates causing a massive wave of buyers to enter the Real Estate market and bid up homes would be GREAT!!

Once the overzealous buy up their overpriced properties, largely using home equity funny money (either their own, or their parent’s), the market will be able to begin to heal. By heal, I mean that prices will moderate/decrease as rates remain in the 5-7% range long-term and home values slowly return to earth as much of the monopoly $$ in the hands of the middle class will have been spent. These lower home values will not cause existing 3% mortgage holders to walk away from their homes, rather they will ride out the price moderation/decreases over time using their low 3% mortgage payments until they are once again above water.

Moral of the story to Gen Z and Millennials: Do NOT buy until the hysteria subsides, which IT WILL. I’d say it will likely be late 2024-2025. 🤙

Who’s going to fund the interest payment though? According to CBO, Net interest outlay as percentage of GDP will be near to when HW Bush capitulated on “read my lips, no new taxes” while primary deficit is already at first year Reagan level. Bank credit is down so what floats the economuy must be either shadow banking or exogenous money. The other thing to watch would be the divergence between GDP and GDI.

Surging tax revenues (inflation also inflates tax revenues) and borrowing fund interest expense, as they do all other expenses (the drop in taxes in Q2 was due to capital gains taxes that plunged due to the shitty stock market, bond market, and crypto market in 2022. 2023 looks to be a better):

Today I noticed RE went down again in my area after stagnating for a while.

Most schools started already. Wait another 1-1.5 month and you should start seeing sharper drops. Its a seasonal trend.

Which is why higher wages are needed.

The Fed still owns 2.5 Trillion in MBSs….purchased at what can now be deemed bad prices.

Fully knowing that the Fed will not “lose” on this because they hold to maturity, this massive loss is a gain and benefit to many. It can only be considered in two ways..

*Was it an intentional spilling of money?

*Or was it just a flat out bad policy decision to delve into the the MBSs?

For decades and decades the Fed stayed out of the long end…then suddenly piled into it with both feet. We and the Fed now deal with this misguided move, well over $1 Trillion in unrealized losses in long maturities……as Bernanke polishes his Nobel. Is it the job of the Fed to implement policy that results in losses for the Fed? I suspect not.

I love when people say “It can only be considered in two ways…” the absolute hubris of that statement.

Here is a third way to consider it… the Fed buying MBSs from 2009 to 2014 was a GOOD POLICY designed to stabilize a tumbling housing market that had damn near destroyed the world’s economy. Like all successful policies it overstayed its welcome… hence the term “policy drift.” But it did what it was supposed to do when it was implemented.

Moreover the Fed NEVER intended to hold these to maturity. In fact they started letting MBSs roll off their Balance Sheet in 2017 to 2019. If we hadn’t had the COVID pandemic it is likely that the Fed would have resumed getting rid of them in 2020 and be done with that process by now. Fed governors haven’t been exactly shy about saying how much they want to be rid of them.

Wasn’t it just another futile attempt to rig the housing market demanded by the NAR?

“. In fact they started letting MBSs roll off their Balance Sheet in 2017 to 2019. ”

and what do you think holding to maturity looks like? They roll off when they mature.

The housing market didnt not collapse…..or “tumble”

“it did what it was supposed to do”

But, the Fed had NEVER done such a thing…and now they are STUCK.

It was not good policy. We would be better off right now if mortgage rates were at 5% for the period mentioned. 3% and under for 30 yr mortgages, created by BAD policy, or was it just spilling money ?

I love it when people say….

“Like all successful policies it overstayed its welcome”

Thus, at some point it became “bad policy” for its overstaying made it not applicable or needed at that point in time and going forward. Thus “bad”.

“Fully knowing that the Fed will not “lose” on this because they hold to maturity, this massive loss is a gain and benefit to many.”

That’s a fake theory. It’s not a “gain and benefit” to anyone. If the Fed isn’t selling, nothing changes for anyone.

But if it sells the MBS, it would have to sell a big discount, and someone would buy them at this discounted price and hold them until they get called (MBS don’t stay in the market until they mature, see my prior discussions on this), while collecting interest payments and principal payments at face value for years. That buyer would “gain and benefit” (could I have some of those please?), but only if the Fed sells, LOL. If the Fed doesn’t sell, no one gains.

BTW, the FDIC is selling some of the MBS every week that it picked up from the banks.

““gain and benefit””

Disagree.

The gain and benefit is out there in the asset appreciations.

Bernanke got his Nobel prize while Iceland locked up all the bankers.

Great piece Wolf! You set us off for sure. People are roused in their comments!

Fed speakers on Thursday (before Powell’s Friday speech) talked of higher for longer and the markets dove.

I guess the big money is adjusting and all of us little guys are trying to keep from getting trampled.

Who is holding the paper for all of these 3-5% residential mortgages? Are they bankrupting?

The Fed owns 2,5 Trillion. Packaged up in nice federally backed securities.

Just a reminder of what a Trillion is…

One billion seconds is 32 years.

One trillion seconds is 320 CENTURIES.

The difference between a billion dollars and a trillion dollars is a trillion dollars.

That is around 17% of all mortgage debt.

Crazy. Housing markets were totally distorted by the artificial low rates.

and some say it was good policy

The Fed owns all these garbage securities. They are all off 30 to 40% in market value. They are having a hard time getting rid of them, as a result. No one is selling or refinancing so these securities stay on their balance sheet losing more market value with each passing day. If they had to sell them they would lose billions.

From powell conclusion in today’s upcoming presentation, per Fed site.

“ Restoring price stability is essential to achieving both sides of our dual mandate. We will need price stability to achieve a sustained period of strong labor market conditions that benefit all.

We will keep at it until the job is done.”

Stability = Affordability

After listening to the Jackson Hole speech…..

The pillsbury dough boy is now Patton.

He is a tough mean inflation fighting cowboy determined to kill inflation down to 2% no matter what…….

This is going to get interesting when unemployment finally moves….

rates definitely headed up up up

Powell at Jackson Hole: “the process has a long way to go.” Labor market is tight. Core PCE has not moved much. GDP is crazy high. Higher, much longer.

MW: 2-year Treasury yield heads for highest level in 17 years after Powell’s Jackson Hole speech

DM: Fed Chair Jerome Powell warns there could be MORE interest rate hikes if economy’s surprising resilience keeps inflation above 2% target

Federal Reserve Chair Jerome Powell has warned that the continued resilience of the US economy could require further interest rate increases, speaking in a closely watched speech that also highlighted the uncertain nature of the economic outlook. Powell noted in his speech on Friday in Jackson Hole, Wyoming that the economy has been growing faster than expected and that consumers have kept spending briskly – trends that could keep inflation pressures high. He also reiterated the Fed’s determination to keep its key rate elevated until price increases are reduced to the central bank’s 2 percent target.