Core services inflation at 6.1% year-over-year; Core CPI at 4.7%. Three factors make it rough for CPI the rest of the year.

By Wolf Richter for WOLF STREET.

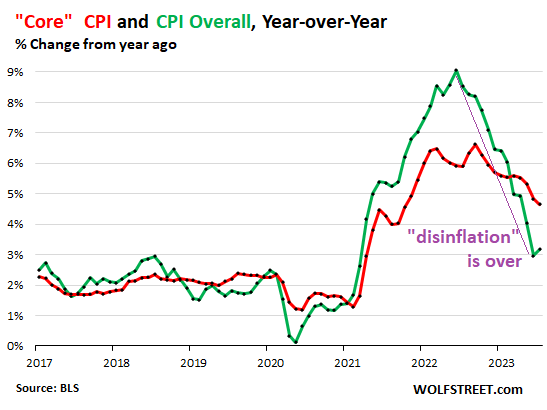

Overall Consumer Price Index rose by 3.2% in July compared to a year ago, the first year-over-year acceleration since June 2022, marking the end of the period of “disinflation” when the year-over-year inflation rate cooled. There are three reasons that we already know (more in a moment) that will cause the year-over-year CPI rate to increase further in the second half of 2023 because the disinflation honeymoon (purple in the chart below) is now over.

The “Core” CPI rose by a still hot 4.7% in July, compared to a year ago, an increase that was a hair smaller than in June (+4.8%), according to data by the Bureau of Labor Statistics today. July was the smallest increase since October 2021. Core CPI is a measure of underlying inflation that excludes the prices of food and energy products, which gyrate wildly in both directions.

The chart shows core CPI (red) and overall CPI (green). The year-over-year plunge in energy prices (still -12.5% in July despite the recent month-to-month increases!) pushed the overall CPI increases below those of core CPI. When energy prices stop plunging on a year-over-year basis, overall CPI will once again be above core CPI.

The tougher second half has started. We already know this, no forecasting required:

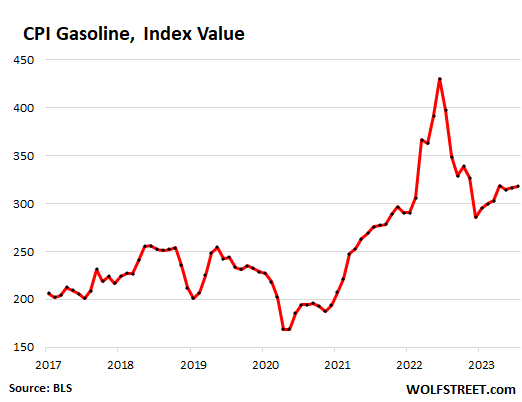

- Energy prices don’t plunge forever. Gasoline CPI has risen 11% since December, but is still down 19.9% year-over-year. Gasoline prices collapsed in the second half of 2022, and it’s against these much lower prices that year-over-year CPI changes will be measured for the rest of the year.

- The “base effect” is starting to fade. The “base” for today’s year-over-year calculation is July 2022, which was the month the surge of the CPI started cooling sharply, driven by plunging energy prices. Those lower values in the second half of 2022 will be the base for the year-over-year calculations going forward, leading to bigger year-over-year increases.

- The odious ridiculous “health insurance adjustment” ends with September and will swing the other way. I discussed this earlier today here. It pushed down the year-over-year CPI for health insurance by 29.5%, to January 2019 levels, which pushed down medical care services CPI into the negative, despite maddening price increases. But starting in October, it will swing the other way.

On a month-to-month basis, held down by the huge odious and ridiculous health insurance adjustment, core CPI increased by 0.2% in July, same increase as in June (red in the chart below). The three-month moving average of core CPI rose by 0.25% (blue).

Core Services inflation accelerated.

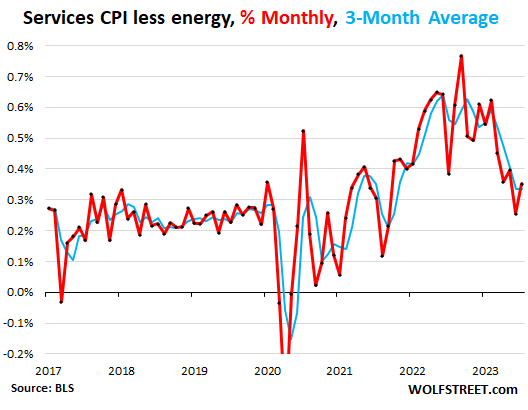

The index for core services (without energy services) increased by 0.35% in July from June, a sharp acceleration from June (+0.25%).

This increase comes despite the odious, ridiculous, and massive adjustment to the CPI for health insurance that caused CPI for health insurance to plunge by 4.1% in July from June (my details here), which pushed the CPI for medical care services into the negative.

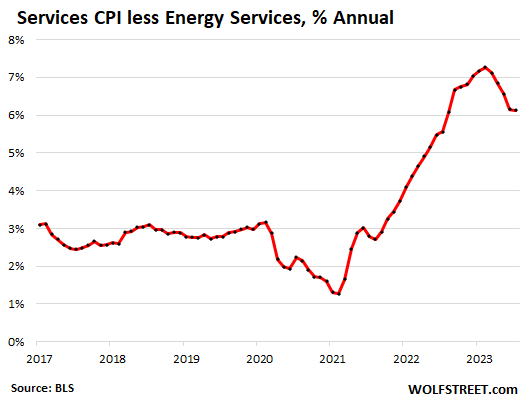

Year-over-year, the core services CPI rose by a still red-hot 6.1%, compared to 6.2% in July. Unrounded, the difference was minuscule, as the chart shows, 6.124% v. 6.159%.

Without the health insurance adjustment, core services CPI would have also accelerated on a year-over-year basis and would have been higher to begin with.

Note that the Medical Services CPI has turned negative, pushed down by the health insurance mega-adjustment.

| Major Services without Energy | Weight in CPI | Change MoM | Change YoY |

| Services without Energy | 62.4% | 0.4% | 6.1% |

| Airline fares | 0.6% | -8.1% | -18.6% |

| Motor vehicle insurance | 2.6% | 2.0% | 17.8% |

| Motor vehicle maintenance & repair | 1.1% | 1.0% | 12.7% |

| Pet services, including veterinary | 0.6% | 0.7% | 9.8% |

| Food services (food away from home) | 4.8% | 0.2% | 7.1% |

| Rent of primary residence | 7.6% | 0.4% | 8.0% |

| Owner’s equivalent of rent | 25.5% | 0.5% | 7.7% |

| Postage & delivery services | 0.1% | -0.1% | 5.1% |

| Hotels, motels, etc. | 1.1% | -0.5% | 6.6% |

| Recreation services, admission, movies, concerts, sports events | 3.1% | 0.8% | 6.2% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.4% | -0.5% | 6.5% |

| Video and audio services, cable | 1.0% | -1.3% | -4.6% |

| Water, sewer, trash collection services | 1.1% | 0.5% | 5.8% |

| Medical care services & insurance | 6.5% | -0.4% | -1.5% |

| Education and communication services | 4.9% | 0.3% | 2.7% |

| Tenants’ & Household insurance | 0.4% | 0.1% | 1.1% |

| Car and truck rental | 0.1% | -0.3% | -7.2% |

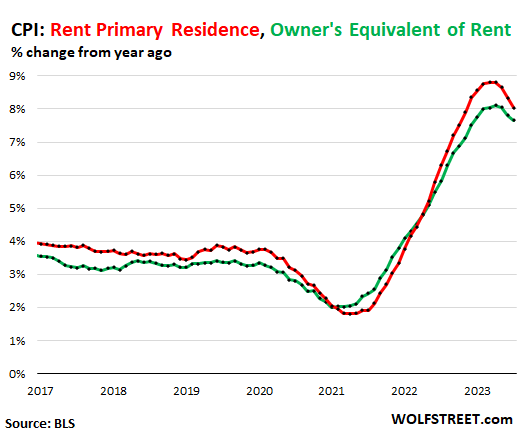

The two CPIs for housing as a service (“shelter”).

“Rent of primary residence”: +0.41% for July, +8.0% year-over-year (red in the chart below). The July rate of 0.41% amounts to annualized growth rate of 5.0%.

The survey follows the same large group of rental houses and apartments over time and tracks what tenants, who come and go, are actually paying in these units.

Owners’ equivalent rent: +0.49% for July, +7.7% year-over-year (green). This is based on what a large group of homeowners estimates their home would rent for.

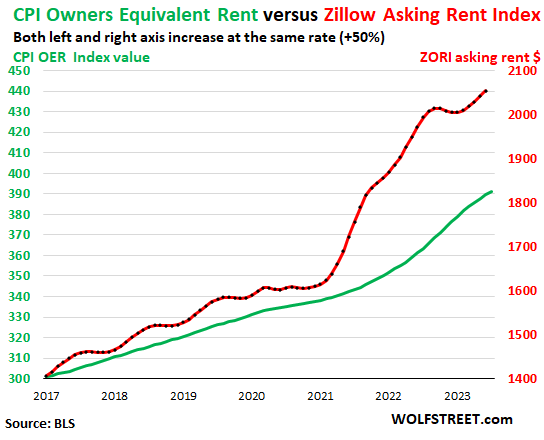

But “asking rents…” The Zillow Observed Rent Index (ZORI) and other private-sector rent indices track “asking rents,” which are advertised rents of vacant units on the market. The ZORI’s huge spike in 2021 through mid-2022 never fully made it into the CPI indices because rentals don’t turn over that much, and not many people actually ended up paying those spiking asking rents.

In late 2022, asking rents in dollar-terms began to dip. But this year, the ZORI rose again and has been hitting new records in dollar-terms.

The chart below shows the OER (green, left scale) through July as index values, not percent change; and the ZORI (red, right scale) through June, as index in dollars. Zillow has not yet released the July data.

The left and right axes are set so that they increase each by 50%, with the ZORI up by 45% since 2017 and the OER up by 30%:

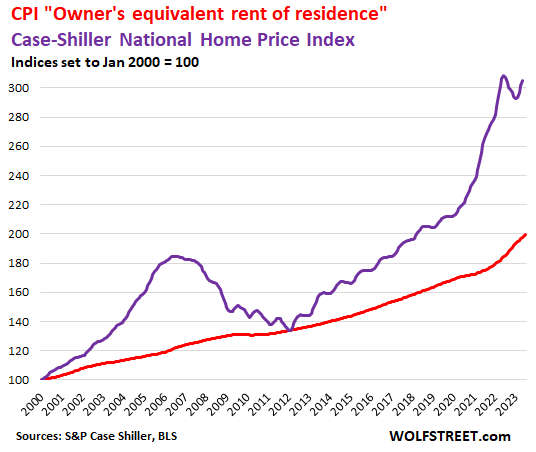

Rent inflation vs. home-price inflation: The red line represents the OER. The purple line represents the Case-Shiller Home Price Index. Both lines are index values set to 100 for January 2000:

Durable goods prices stabilize at nosebleed levels.

The CPI for durable goods – the index value, not percent-change – has moved up and down at nosebleed levels, with a slight downward trend, since early 2022, following the spike from mid-2020 into early 2022.

In July, the index dipped by 0.3% from June, and by 1.4% from a year ago. It seems to be normalizing at those nosebleed levels with the same slight downtrend that it had before the pandemic for many years due to “hedonic quality adjustments” to the CPIs for new and used vehicles, consumer electronics, and other products (here’s my explanation of hedonic quality adjustments).

| Durable goods by category | MoM | YoY |

| Durable goods overall | -0.3% | -1.4% |

| Used vehicles | -1.3% | -5.6% |

| New vehicles | -0.1% | 3.5% |

| Information technology (computers, smartphones, etc.) | -1.4% | -8.5% |

| Sporting goods (bicycles, equipment, etc.) | 0.1% | -0.5% |

| Household furnishings (furniture, appliances, floor coverings, tools) | -0.4% | 2.2% |

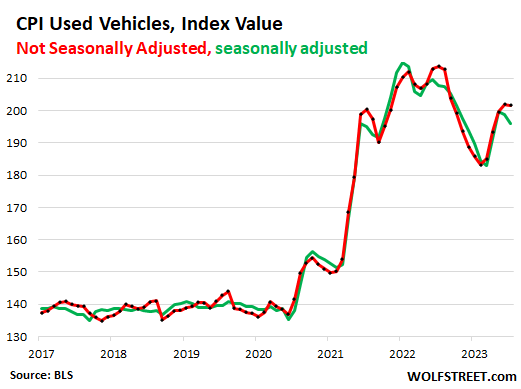

Used vehicles CPI fell by 1.3% for the month, seasonally adjusted (green), and by 5.2% year-over-year, following the 52% spike from mid-2020 through mid-2022. Not seasonally adjusted (red), it edged down 0.2% in July from June.

The chart of the index value – not seasonally adjusted in red, seasonally adjusted in green – is an illustration of the wild pricing turmoil that persists to this day:

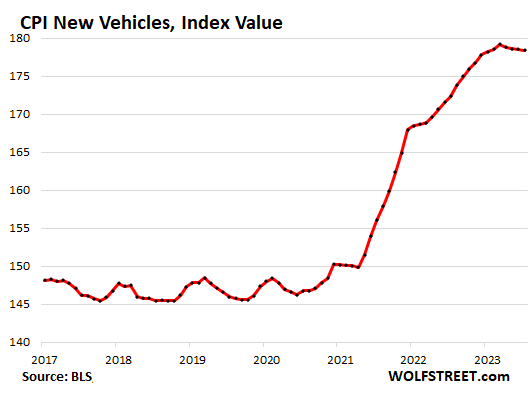

New vehicle CPI dipped by 0.1% for the month, the fourth month in a row of slight month-to-month dips, amid big price cuts by Tesla and other EV makers. But year-over-year, the index was still up 3.5%.

This leveling off follows a stunning price spike over the past two years. Very little of that spike has been reversed over the past four months, as this chart of the index value shows. Here too, prices appear to be normalizing at nosebleed levels with a slight downward trend:

Nondurable goods.

The energy prices have begun to rise again month-to-month, with the CPI for gasoline rising all year. But year-over-year, energy prices are still way down.

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | 0.1% | -12.5% |

| Gasoline | 0.2% | -19.9% |

| Utility natural gas to home | 2.0% | -13.7% |

| Electricity service | -0.7% | 3.0% |

| Heating oil, propane, kerosene, firewood | 3.7% | -21.2% |

Gasoline accounts for about half of the total energy CPI. It has been rising for seven months, and over the next few months will turn positive on a year-over-year basis, measured against the plunging prices in the second half of 2022. This will further push up overall CPI. You can see this dynamic in the CPI for gasoline as index value; the low-point was December:

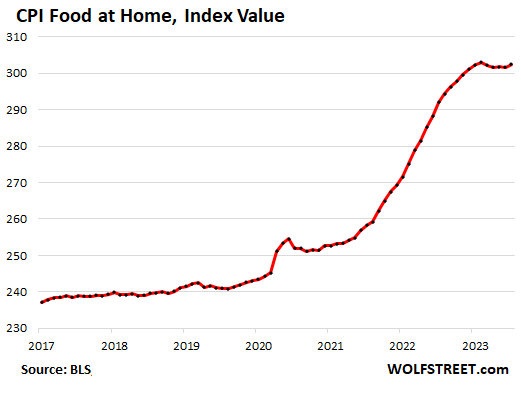

Food prices have begun to inch up again on a month-to-month basis, after a slight dip, following the devastating 24% spike during the pandemic.

The CPI for “food at home” – food bought at stores and markets – rose by 0.3% in July from June, driven by increases in beef, poultry, fish and seafood, fresh fruits, and fresh vegetables. So the inflation game of whack-a-mole is returning to store shelves? Year-over-year, prices rose 3.6%.

| Food at home by category | MoM | YoY |

| Overall Food at home | 0.0% | 4.7% |

| Cereals and cereal products | 0.1% | 8.8% |

| Beef and veal | 0.4% | 2.7% |

| Pork | -1.9% | -3.8% |

| Poultry | 0.8% | 1.4% |

| Fish and seafood | 0.8% | -0.9% |

| Eggs | -7.3% | -7.9% |

| Dairy and related products | -0.3% | 2.7% |

| Fresh fruits | 1.0% | 0.3% |

| Fresh vegetables | 0.7% | 2.1% |

| Juices and nonalcoholic drinks | -0.2% | 8.6% |

| Coffee | -0.6% | 3.3% |

| Fats and oils | -0.5% | 8.7% |

| Baby food & formula | -1.3% | 7.5% |

| Alcoholic beverages at home | -0.2% | 3.2% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

Bill Gross made an observation about treasury yields and the potential stagflation scenario.

He said that the interest rate on 20 year zeros would provide the best guide for long term interest rates for the short to intermediate term.

Specifically, he is looking at the 1 year to 20 year zero spread (currently about -80 basis points).

He is looking at the 20 year zeros because central banks tend not to buy those and there is less manipulation of them.

He is expecting this spread to narrow to plus or minus 25 basis points at some point, probably by the end of the year.

How do you think about this yield curve/stagflation scenario, and do you think it is likely to play out this way?

Bill Gross is an old, washed-up bond man. He couldn’t even live with his neighbor next door and had to take him to court. I wouldn’t pay attention to him. He needs to learn how to paint or do something like that in his retirement. Seriously

Unhelpful and silly.

Well, taking ownership of bond for twenty years seems like a risky proposition. A bond which currently pays less than the rate of inflation, which is as likely to be 7 % as 4 %. I think the the 20 yr is a sure loser.

Correct.

The issue is asset valuations.

The 10 year coupon can be artificially held down which makes things look better than they are.

The 20 year zero doesn’t have those dynamics.

So the 20 year zero is a better forward indicator.

How to fix inflation:

Step 1 – remove the main inflationary items from measurements (food & energy) and change name from CPI to Core Inflation. (Knocks off 1.5%)

Step 2 – Change Core Inflation name to PCE and change measurement tactics again (knocks of 1.2%)

Step 3 – Add huge nonexistant negative adjustment for health care to calculation and dont tell anyone (knocks off 2%)

Step 4 (coming soon) – Remove housing/rent from inflation calculation and rename index (knocks off .75%)

Step 5 (last step before implosion) remove services from inflation and rename index again (knocks off 2.5%)

And there you have it. Were back at 2.0% for our new inflation guage – ISN (Inflation Stripped Naked) !!!! /s

There’s a large contingency of investors who thinks a return to ultra low rates is inevitable and that what we’re seeing now is a momentary blip. Their argument is essentially that Uncle Sam has no choice but to inflate its way out of debt, and can’t afford to operate beyond the short term borrowing money at current rates.

I don’t agree with these people, but for those who do, locking in today’s rates for 20 years looks like a sure win. If they’re right, they’ll able to flip those bonds for profit when rates drop again, regardless of how those rates match up to inflation.

How do you see credit spreads playing out?

I thought they would have opened up by now.

Investors who expect a return to ZIRP should be avoiding junk bonds like the plague because the economic conditions which cause this should hurt them bad (unless they are thinking there will be a bailout, which seems a high risk bet).

If they are wrong, and long rates move up just a percent, they’ll eat huge losses on the value of the bond. Long bonds are a risky play in this age when Fed policy has been excessively dovish for 15 years, asset prices have shot up 300% in a decade, deficits have blown out, and inflation is running hot.

ST bonds are the better play.

These pivot-monger idiots just never stop. They’re broken records on auto-play by now. The “inflate your way out of debt” trick doesn’t work anymore, certainly not in the US economy and system where more inflation also just means higher government costs for allocations and payments. So we’d get the worst of the both worlds, higher costs of living and higher government deficits, there’s no snapping fingers and moving out of a debt burden like this by “letting inflation run hot”. Not to mention this would demolish whatever’s left of the US dollar credibility as a storehouse of value when it’s already rapidly losing it’s appeal globally, and even among Americans (the basic reason for all this crypto and NFT idiocy). That means a rapid goodbye of whatever’s left of USD reserve currency status and a sharp collapse in demand for US debt in general. The “go 20 yr” crowd here really needs a hard lesson from the school of Paul Volcker on all this.

“The “go 20 yr” crowd here really needs a hard lesson from the school of Paul Volcker on all this.”

Gee you mean like another 14.5 % increase on the Fed Funds Rate ?

Volcker’s Fed Funds Rate was 20% in 1982. Prime rate was 21% or so …..

Miller,

There’s the obvious course of action leaders should take, which is not necessarily the course of action they will take. The pivot mongers observed the Fed’s spinelessness for 15 years now, as they stubbornly did the wrong thing.

They believed they could bloat asset prices, debts, and money supply, while maintaining financial stability. With that kind of thinking at the helm, mistakes will only continue.

Would you ride in the back of a bus, on a cliff, if the bus driver doesn’t understand speed, momentum, and braking physics? That’s the equivalent of modern Fed policy, which attempts to solve a debt problem with more debt. People are reasonable in believing today’s tightening is likely another blip in the Fed’s dovish path.

We’ll find out for sure next time asset prices drop 30%. If the Fed has any sense, they will not panic. They will let the fire burn out the dead wood, until asset prices and debts reach healthy sustainable levels.

Since 08, I’ve been a deflationist. I didn’t think they would go to these lengths to keep growing debt. But that is just what they do, apparently. So it feels like we’ll get at least one more bout of panic cutting and some degree of bailouts, as the Fed bounces between an inflationary spiral and a deflationary depression and just chooses the opposite of whatever’s not smacking them in the face at the moment.

But Miller is right, I hear people say inflate your way out, but how does that work when debt is always growing faster? They use the analogue of the post-WWII period, but that was a period of extreme high Real growth. And no huge outstanding govt liabilities as noted. Not remotely comparable, in my estimation.

“…inflate your way out, but how does that work when debt is always growing faster?”

The math is this, very oversimplified: 7% nominal GDP growth at 5% inflation (= 2% real GDP growth) causes tax receipts to rise by 7%. If the deficit is 6% or less, the total burden will shrink over time. If it rises by more than 7% the burden will increase.

The problem we now have is that interest rates have also risen a lot, so that’s an additional factor.

So if going forward for 20 years Treasury yields are stable at 5%, in the same scenario with inflation at 5% and nominal GDP growth at 7% (2% real GDP growth), then after 7 years or so the majority of Treasuries will be at 5%, and at that point, you will see the burden of interest expense as percent of tax revenues shrink.

Obviously, in reality, nothing is stable for 20 years, and an overleveraged government and economy will be thrown one curveball after another.

Bobber, Miller, etc.

Not even Pivot Mongers tbh.

Kathy Jones at Schwab and a lot of other analysts suggest buying junk.

Morningstar recommended buying 5-10 year “belly of the bond market.” I can’t even remember them all.

Kathy Jones quote (from memory):

“Even if spreads widen by 100 bps, we think high yield is compelling and losses would be mitigated in a year or two.”

Sooo…

Step 1: Buy garbage

Step 2: Lose money

Step 3: Coupon pays for said loss in (1-3 yrs)

Step 4: Inflation

Step 5: Oh crap, this doesn’t make sense.

FOMO and don’t “market time” even if you’re buying flaming poo.

Thank you Wolf, I skip all the headlines and appreciate the value of your deep takes.

The shelter inflation for rent will continue until services inflation comes down. Try being a landlord and have the gas valve replaced on your rental’s furnace, have the garbage disposer fixed, have the dishwasher fixed, etc. God help you if the problem is electrical. If you have landscaping service that has gone up a lot too.

Another thing is that the SPR has been drained long enough so gas prices are reflecting that as the Saudis continue with their output cuts.

The “markets” have had a great time so far with the disinflation narrative. I hope it will hit them over the head like a 2×4.

Not to mention property taxes.

Condo in Atlanta – property taxes this year went up from $5,756.94 /yr to $7,614.25 /yr. That’s a 32% increase in one year.

In podunk Omaha 1 year valuation increase 50 k

Amazing stat on property taxes is there a cap for the homeowner annually like in Texas . The Texas prop tax resets on a sale of a property that takes decades to complete the resale process. However with the explosive home valuation increases in Texas the state is seeing a large surplus in their budgets which I think may continue to increase over the next few decades as homes sell. Higher taxes more spending more inflation

Texas property taxes reset every year. Each year, every property is appraised. Homestead exemptions slows the pace of the increase to 10% a year, but that is a compounding 10%.

…you ain’t seen nothing yet.

The flip side of that is if the tenant’s income doesn’t keep up with the rent, it’ll wind up vacant and a money pit all the same.

We’ve heard all about the monumental bond yield curve inversion.

We’re about to see a monumental housing rental yield curve inversion.

Rent prices have nothing to do with the landlord’s costs. Sucks to be a landlord when your costs are rising but you can’t squeeze anything else out of tenants. Really sucks when the cash tied up in the rental could be making 5% risk free.

In Manchester/Nashua NH there’s a new wave of first time investors buying up 2-4 families paying 50-60% more than they were worth in early 2020. They then raise tenant rents from say $1300 to $1900 in order to cash flow on their mortgages. If tenant can’t afford it they start the eviction process. It’s a tough time out there.

This is why I would not rent from an individual. Market rate is market rate, no matter what some dope thinks the rate should be based on his costs or whatever. Apartments[dot]com says Manchester, NH average rent is up 3.8% YOY, and it looks to me like there are some really nice looking places for rent for a reasonable price. Rent on a property doesn’t spike up 40% just because some new idiot is trying to make some money off the property.

Sorry for the double comment, forgot to add:

There are also plenty of equity groups out there who are scouring for multifamily units that are renting below market, scooping them up, doing such great updates like painting front doors (eyeroll), and then jacking up rent to what the software says it should rent based on area income, location, condition of the units, etc. Small time and new investors don’t stand a chance against these guys, whatever they are buying is the absolute crap bottom of the barrel.

Manchester & Nashua have historiclly been affordable vs cities/burbs closer to Boston, which have had bloated rents for the last decade. Meanwhile home prices remain subbornly high.

That said those investors buying now are fools, the Boston/southern NH market has to cool down eventally.

crazytown, I’ve had the opposite experience.

While individuals have often given me below market (or zero) increases to “keep a good tenant,” the corporate ones seem to not care, as they can fill the spots easier. Not to mention that the bigger ones often have ridiculous fees like “sewage” and “valet garbage.” Screw that.

From my experience, being a landlord is a role that disassuades one of the premise that human beings are endowed with a sense of decency.

Agreed. I’ll take my 5% treasuries. Powell at least pays the rent. lol :)

From my experience, being a renter provides exactly the same insight.

A landlord has too many senior partners – governments, agents, lawyers – telling you what you can and cannot do and how much money you can keep. I got rid of everything after a “must rent to” burned down the kitchen. Property values eventually rose again and I lost that increase but who knows how much would have actually gone in my pocket compared to alternate use of the capital. Be honest, what does a small landlord actually pocket if you price your time accurately and include the time doing tasks demanded by the government. Keeping track of all that is mind numbing and mostly unnecessary.

No sympathy for landlords. Mom and Pop landlords are the worst. California has statewide rent control now. Annual increase limited to 5 percent plus cpi to a maximum of 10 percent. Some cities are stricter. There are a lot more voters who are renters than landlords.

The real world disagrees with you, as asking rents are down YoY. Supply is outpacing demand.

Not sure where you are, but rents and leasing fees are definitely up where I am. Especially in my rentals.

Certainly true in Jacksonville FL. Needed a 6 month rental while undergoing treatment at Mayo Clinic. We used furnished finders site for search. Lots of AirBnB owners are on furnished finders to get the leads. Many were reaching out to me agreeing to cut their rates for the longer term. But even with their discounts, the apartments were offering great incentives of discounts and first month free, even on a short term rental. We got a 2BR 2.5 bath apartment with a garage for what most 2BR 2Baths were asking plus first month free.

I wasn’t surprised as I counted a dozen new apartment buildings being built within a 10 mile radius of Mayo Clinic. I think the supply of apartments in Jacksonville out pacing the demand is just starting.

@john

I agree – being a landlord, those things add up big time. I just had an electrician quote me $1000 for the same exact job he did for $600 on another one of my houses 2 1/2 years ago. I also had a quote a year ago for 600 to do a small concrete walkway. It is no $950.

I am also hearing from other people who have had quotes to replace a wooden deck. 4 years ago quotes were about $12k. Now they are coming in over 25k to 30k for the same project. Replacing a deck does not increase the value of the property. You have to increase rent as otherwise your cash flow gets crushed.

While China’s economy has been imploding for a while, its real, Lehman-like moment is fast approaching, which may indirectly reduce world demand, inflation, and (since the US bankers invested in the CCP’s Ponzi, Chinese companies through insane loans to cronies) crash also the US and EU banking systems.

The CCP’s trust, insurance, finance, and LGFV companies (and the CCP’s banks in the middle of this) are collapsing. Their trust companies and banks are refusing withdrawals! The CCP government wants to keep arming their PLA to invade most of their neighbors, so it will not help them.

That is the ticking, CCP, time bomb that will tame US inflation —partially.

The CRB commodity index is rising:

https://tradingeconomics.com/commodity/crb

This is a leading indicator.

PPI up .8% y-o-y

Month to month, the services PPI spiked by 0.5%, which is 6.2% annualized, which confirms what we have known all along that inflation has solidly moved from goods to services at all levels.

This MoM spike in services PPI caused the overall PPI to rise by 0.3% MoM.

Gas, where I live, just popped 10% from yesterday!! (40 cents)

Where is Wolf’s “Gas Station from Hell”?? Haven’t seen it in a while. I’m waiting for mine to hit $5/gallon. Right now it is $4.79.99

The algos certainly had themselves a day today at the expense of the headlines, didn’t they?

The propaganda’s thick out there today:

“Don’t be fooled by the uptick in inflation, says economists. Prices are falling, and the Fed now has the ammo to pause its rate hikes.” Lolol.

You can’t make this crap up. Do they think we are that stupid.

Yes…Yes they do think we are that stupid.

Yes, because there are a lot of educated idiots in the USA with an economic IQ of just over 50.

People like that are ones that state “Because the media said so”…

Yes, they know we are stupid. So the 1.5 B of lotto money was invested which may have caused the “retail” market to rise until that allocation was satisfied.

The “market” is like a one octave over tuned string on a string instrument. Likely to snap at anytime

fantastic word pretzel.

when the gov puts out numbers like the health insurance cpi adjustment, with a straight face – you can’t believe any of this.

These economists must not know the difference between disinflation and deflation. They should read Wolf Street.

The Wall Street Journal of all places really embraced the Kool-Aid on this esp ever since Murdoch and his crew of idiots took over. WSJ has been all over this disinflation narrative and “Fed has a chance to pause” trash even when Powell himself has said no way. Not to mention that prices need to come down in a lot of sectors for cost of living to be barely affordable to the majority of Americans, esp healthcare, housing and education. (Shock, shock, deflation! There’s nothing wrong with temporary deflation when it happens on the heels of big inflation and in certain sectors, there’s still overall annualized inflation and it’s a corrective)

Crazy how folks completely ignore the source over the narrative.

Well, maybe it isn’t so crazy.

Reminds me of building a decision support system to collect basic data inputs and roll it up to a status summary dashboard for decision makers. The big argument was over whether the decision makers could edit the factual data input by low level workers.

The sensible people said no, you can’t edit the facts.

The decision makers said it was absolutely necessary [to goal seek] ahem; correct the inputs of ignorant workers.

Obviously you know what happened.

Note that the doctrine of “Collateral Estoppel” means that if only ONE of the cases brought against any defendant was lost (i.e., resulted in a final judgement) by that defendant, e.g., Purdue or a Sackler family member, the findings against that defendant in that case (after appeals) would be binding against that defendant in ALL pending and later cases. They would thereby lose those cases as to liability but not the amount of damages or punitive damages.

That is the true reason for the tobacco purveyors also making a similar, mass settlement— to save their rear ends. Will the Supremes rescue their masters or bite their hand?

Prices might be rising less-fast, but certainly not declining. Looks we are stuck at this new high price level. People need to think about money is a smart way. The people I know complain, but then go and impulse buy all sorts of stuff. My darling spouse spent $200 on groceries but we only had 2 meals. I guess we had to have every variety of salad dressing on hand. Ugh

The cavernous gap between house prices and owner’s equivalent of rent is stunning. Nothing good can be happening as it reverts to the mean.

The answer to this question is the ONLY thing that matters, when the recession arrives: Does Congress trot out rent & mortgage relief?

No gives your “nothing good” prediction a chance.

Yes, translates into housing doesn’t take a hit and that gap remains cavernous and widens as the Fed lowers the FFR.

We should all step back and ask ourselves how far down the MMT rabbit hole have we fallen? My guess is all the way to the bottom and there’s no turning back.

There’s almost 33 trillion reasons to support this premise that has wrought upon us a $970B annual interest expense and climbing.

Inflation isn’t dead. A 6% terminal FFR is likely at this point and possibly higher. Bullard last December predicted 7%.

I’m not convinced that a recession is the likely outcome, especially if the overpriced asset markets retreat 40 to 70 pct. There is huge money on the side lines when, as you cited, the world spins again.

We have to remember that the asset valuation market has been a pawn of “our” Federal Reserve Bank, which in turn has distinguished itself as a useful tool of the swashbuckling bankers.

Well. now their cowardice has created the reality that we face.

Money on the sidelines is always a bit confusing to me when the fed is taking the money they receive from their bond maturities and don’t reinvest (QT) . Also when a stock sells the money from the sidelines so to speak goes into stocks but the sale proceeds becomes new money on the sidelines making the money on the sidelines a wash . New money creation (QE) is money on the sidelines.

One area of monetary theory I don’t understand fully is assets and money. Probably why deflation is such a worry to monetary policy. Can easily wipe out banks and corporations and lead to massive unemployment.

I’m not saying one is coming in the next 6 months. In fact, my post says nothing about its timing, but we all know there will be more recessions.

AGAIN, for housing and the economy, in general, the ONLY thing that matters is if Elizabeth Warren gets her way and pushes though rent & mortgage relief. Such a move will prop up housing and not let the normal foreclosure process ensure deflation happens in housing.

Housing costs are zonkers. If they continue to tick up by 5-10% over the next 12 months like that very well may do, then a 30% drop is needed. And that means two things: A very big recession without E. Warren getting her way.

But, if she does, then housing costs will continue to rise and result in our financial reckoning being much worse that it needs to be. And that’s the big one where that historians label it a depression.

I really don’t understand the Warrens of the world. While I see why a populist might want to say “Families should be able to stay in their homes,” what about families that want homes and can’t afford them?

“Money on sidelines” 🤣🤣

It will be the height of hypocrisy if the right endorses mortgage relief (she’s a Dem, so the right would have to cooperate) when they’ve been yapping endlessly about the unfairness of Warren’s attempts to orchestrate student loan relief. Which means there’s a good shot of it happening. /sarc

The response, “yeah, I’d like someone to pay off my mortgage,” said by people against student debt relief, is almost a cliché now.

IMO renr relief is much more likely. Without a significant increase in unemployment, I don’t envision a lot of mortgage delinquencies and forced selling happening (the former still being at historic lows).

But rents are still way too low vis a vi home prices, and eventually will correct up imo. When tennants start getting squeezed, congress will likely be pressured to act.

I’d also wager that a higher % of Warren’s voters are renters in cities rather than homeowners.

CONgress is one of the main problems

Right, and if Congress does grant rent and mortgage relief then this ensures housing doesn’t take a hit like it needs to.

BTW, if they do rent relief, then they’ll have to do mortgage relief. It’s not mutually exclusive (OR). It’s an intersection (AND) event.

I’ve been pointing this out too – the mean reversion will be some combination of home price declines and rent increases.

That said, its also worth pointing out that BOTH are trending up..

Prices Normalize at Nosebleed

And thats just where they’re gonna stay until JPow or our profligate congress get serious.

What landing??

Bill Ackman is expecting 3% to become the new 2% inflation target.

So, he’s shorting the long end of the yield curve and expects the 30 year rate to increase to the neighborhood of 5.5% from it’s current 4.25%.

Such a flattening out of the yield curve would be welcomed with open arms by individual long term bond investors, but banks would not be very happy.

3%? Try at least 3.5%, Ackman!

Powell has stated numerous times that their goal is 2%. The reason why, I do not know, but I would expect them to stick with 2% but extend how long the “long term inflation goal average” actually means. So if the long term means over a decade then maybe they consider a long average for 2% which would allow them to run at 3% like that guy predicts while still claiming that the goal is 2%.

Personally, the FFR should be approaching 9 % too halt this obviously anchored core inflation. Statistically, the measured rate of inflation is just as likely to be accelerating as decelerating.

The idea that a rational FOMC, given the resumption of the 15 plus years of the Fed sponsored keggar since they paused, would pause 25 bpt increases seems absurd.

You still believe in a rational FOMC?

After 15 years of ridiculous asset, debt, and money supply pumping, it might be easier to make a case for Santa Claus.

Giving in to 3% inflation means the instant end of the US dollar as a storehouse of value around the world, partly because of course such a surrender just means that the actual concession would be far higher than that. Investors and buyers have so many options to store their savings they’re not going to be storing it in a currency that’s rapidly losing it’s value because the country’s leaders can’t get their act together and manage their finances. JPow knows this, it’s just not happening.

They can’t *admit* they’re raising the inflation target, but they can let it run higher without saying its official policy to do so.

Imagine a ‘goldilox’ scenario of inflation around 4-5%, 10Y 6-8%, and mortgages 9-11%. These mortgage rates aren’t crazy high from a historical perspective, investors can still earn a real yield on their bonds, and the gov’t can pay back their debt with devalued dollars.

Laughably false and utterly nonsensical assertions.

You in particular seem to be stuck in this delusion that the USD has a kind of “guaranteed reserve currency” status etched in some sort of stone, you’ve been debunked by dozens of commenters here and by Wolf himself yet you stick to it. You’ve made sensible posts elsewhere but you have a severe blind spot here. Keeping it real simple–a reserve currency gets that status and holds it because the currency serves as a reliable storehouse of value that reliably maintains the value over time. That’s the whole point of a reserve currency, that’s what it means, it’s the only reason people care about it. If that currency and the finances of the country behind it are poorly managed, especially if inflation is allowed to run hot in a futile attempt to “inflate away debt”, then people lose interest in holding that currency because it fails the most basic test of a reserve currency, ie. does the currency (more or less) retain it’s value over time? With poorly controlled inflation, the answer is no.

Bleating on about “there is no alternative” or like arguments miss the point, it’s not just “one other currency” that rivals dollar asset holdings, it’s all kinds of alternative assets, both other currencies and other forms of asset classes from commodities to equities to property and even (as dumb as it should be) crypto and NFT’s. No reserve currency has suddenly lost the status overnight, it’s bled away gradually in a “death by a thousand cuts” as people find more reliable ways to store their money when the managers of that currency fail to do their job of preserving the currency’s value. And investors and savers have a bigger menu of options now than ever before. You seem to be of the complacent fantasy that Congress, the Fed and US financial leaders can recklessly mismanage the US Treasury and assets, push the national debt higher for dumb misinvestments and allow inflation to run wild and the world will just sit by and happily, stupidly keep buying up dollar assets without pushing yields higher and higher. Sorry, but not happening. The recent Fitch downgrade alone is yet another indicator of that. Investors and savers aren’t dumb, they’re well aware of the lazy temptation of incompetent, ineffectual financial officials to try (again, and fail) to “inflate away debt” and they’re not going to support a currency who’s buying power is being chopped to pieces due to such mismanagement.

“Laughably false and utterly nonsensical assertions.”

— Yeah, like plate tectonics…

Just because you cannot see it moving, doesn’t mean it isn’t happening, Dude. LOL!!!!

Miller

” stupidly keep buying up dollar assets without pushing yields higher and higher. Sorry, but not happening”

Since ’71, in spite of loss of purchasing power every year, Treasuries, notes, bills and bonds are being bought by the rest of the World or by Fed itself since they can keep on printing.

TINA

No other currency out there can complete with the ‘least dirty shirt’ for the next decade or two. Brick currency is an hallucination considering what happened/happening to Euro.

There is no currency backed by gold unless willing to exchange for Gld 24/7.

There may be ‘trading’ currencies between sub set of Countries for products. The foreign currency exchange cannot do without US$. Emerging and even Euro Countries have to free themselves from the existing liability of millions/Billions loans outstanding there. rest hogwash and wishful thinking and praying.

synny129, the “the least dirty shirt” only work as long as shirt’s are the favoured garment…

There may not be an alternative to the US dollar as a reserve currency, but what if the concept of reserve currency is left?

Miller,

I generally agree with all of that but here’s a counter-argument:

Higher inflation (whether officially recognized or not) will inevitably result in higher rates, which will make treasuries that much more appealing. No other country (that I’m aware of) is paying >5% on a 6-month bill right now,

IMO the real issue is unanchored inflation causing a selloff in bonds and yields to spike. Then the question becomes whether or not the Fed will be able to manage it without resorting to QE. Imagine they’d try something like what the BoE did during the glit selloff last year.

If the Fed does actually go back to QE at some point (unlikely imo) then I can see a flght from the dollar, but I think Jpow & co have learned their lesson, and seem to realize how important it is to defend the currency right now.

Lag effect: So much for the lag effect deflection and false future; the Federal Reserve paused mid June and inflation reaccelerates in mid August. The time delay only seems to be that of the time interval of the reporting period. If inflation is reaccelerating then the interest rate increases were not sufficient to stop inflationary pressures and have already done all they are going to. The Federal Reserve officials’ public relations aren’t talking this inflation down anymore than President Ford or President Carter managed to do.

It’s idiotic for the Fed to focus on one month’s data as if somehow monthly data create an irreversible trend. During the Great Inflation, the data bounced around a lot. The Fed must kill inflation once and for all before considering whether it’s time to reverse course.

every Mainstream Media outlet Screaming what a great report this was – time to stop raising rates and get back to the zero rate gravy train asap ! cognitive dissonance on steroids !

Yeah, all over I heard talking heads saying “rate cuts could come in 2023 with this report”. Give them back their free money spiked punchbowl!

Perhaps it is cognitive or fear of ending up homeless if these bubbles pop.

Which seems more than an unlikely event.

Mainstream regular media that I watch called this report “rising inflation” and that was all they said. I do not consider CNBC, Fox Business or Bloomberg mainstream media. As I watched mainstream media(CNN) and my local news channel I flipped to CNBC to see the DOW up 400 points plus I thought, what am I missing here?

Blue line is missing from the core cpi monthly percent change chart. I like the light blue. I still think you should plot it as a centered moving average. Just move your blue line one unit to the left.

Your cpi write-ups are the best I have seen. Thanks. With gas prices taking off again, next month’s cpi should be entertaining. Gas prices filter into some components of the core cpi as transportation costs, so even core cpi will be affected.

This looks good for stocks, especially AI. Inflation has been excellent for the global economy, relax, it’s transitory.

it’s being widely reported that inflation rose for the first time in 12 months…for instance:

Inflation rises for first time in 12 months – CNBC

Politico: U.S. inflation rises for the first time in a year to 3.2% rate

CBS Moneywatch: Inflation rose 3.2% in July, marking the first increase after a year of falling prices

Progress on inflation stalled in July as prices nudged up – Washington Post

and that illustrates why i don’t like focusing on, or even reporting CPI as a year over year metric…the underlying reason we’re seeing an uptick now is that July 2022 CPI was unchanged…so here we are in July 2023, essentially reporting on what happened a year ago as if were current…

Inflation report from some kids at Fed, a few days ago:

Where Is Shelter Inflation Headed?

“ Monetary policy famously operates with “long and variable lags,” and our forecasts imply that this guidance is relevant when looking at housing markets and shelter inflation. In particular, our forecasts suggest that the rapid rise in interest rates since early 2022 is likely to have had a significant effect on slowing housing markets, and this slowdown is likely to continue going forward (Liu and Pepper 2023, Gorea et al. 2023).”

Perhaps. On the other hand, the long and variable lag is not good for over priced assets, which have a tendency to fall precipitously, all of a sudden. We shall see if the sellers holding out to sell at the market top are successful, which the data indicate there is an insufficient number of buyers willing to accept their burden.

If forecasts depend on “long and variable lags of unknown lengths” (a phrase often used by Powell), the forecasts are worthless.

My electricity bill is $90 higher this month than same time last year. The KW usage is near identical, both peak and off peak. $410 last year and $490 this year. So I am not sure energy prices are cooling off. Phoenix APS provider.

That’s insane.

Omaha $124 with a pool

$490/mth for electricity?

Hard to believe.

My heating costs in northern Canada during winter when gets down to -40F is only $200/mth (4000sf detached)

My last apartment had a high ceiling and (what I assume was) an inefficient AC unit. During peak summer months the electric bill got up to around $450 ish if I remember correctly. This was summer 2020, back before the crazy energy spike. I had a roommate and we split the bills evenly.

I imagine you don’t have electric heat to be paying that little to heat 4k sqft. In every place I’ve lived that had nat gas heat, the electric was highest in the summer due to AC use.

Sounds like the market is disincentivizing people from living in the middle of the fucking desert

Sort of a conundrum right. Nat gas is at 30 year lows. No inflation.

Renewables are supposed to be even cheaper than fossil fuels. Why is electrical utility price going up?

KWH prices should have dropped this year in theory.

1. No, natural gas is not at a 30-year low in the US. 30-year low is around $1.60 per million Btu (in 2020). Now, NG is at around $2.80.

2. All power generators buy their natural gas or coal with long-term contracts, and they hedge. So when the price of natural gas exploded by 350% from $2 to $9 in 2021-2022, it wasn’t passed on via exploding per kwh charges; your kwh charges didn’t explode by 350% over that time period; they just went up much more gradually. Now NG has come off that spike, and kwh charges kept going up gradually as a national average. In Texas there is an alternative system, and during high-demand heat waves, electricity rates can spike by a lot for short periods, and then fall back to low levels.

…because one of them is a storable commodity.

Marvelous article on the current inflation measurements that avoided pointing out the grim opinions embedded in the so called, “data”.

In my opinion, the data showed that, on average, inflation has become anchored at an average rate of increase in prices at an average of 5.2 pct with a range between 4 and 7 percent as statistically, equally likely.

Also, as an aside. The last thing the WW2 veterans, who raised me, would have said that what they fought for was to save the financial business.

I’ll bet, they would say they did it to preserve the culture, scrapped together like a mosaic, from their point of view, as survivors of WW1, the Great Depression, the Dust Bowl, the flu epidemic and WW2. And what came after.

Get used to getting screwed. The left leaning, socialist policies of UN and other climate change, environment pushers worldwide like the Democrats in your country in the good old US will make inflation today look like a drop in the bucket. You are going to see massive inflation and restrictive life costs, expenses, living costs that will make you wet your pants. Double, triple everything etc. coming down the pike people by 2030.

Another fool blaming the left for the sins of the right.

As if both parties weren’t in on this mess…

Exactly.

Once again blaming one Party over another Party for this Mess. When Both Parties are complicit and controlled.

First time responding long time reader.

People are lost in the trees; can’t see the forest. Media put dope in their canteens, so now they wander around, believing in talking wolves and fairies.

What kind of self respecting troll says “will make you wet your pants” for his verbal crescendo? Very religious probably.

Concentrate and start again kid.

My electric bill doubled from last year.

It’s a bad time to be a plebe or a sheeple in America and it will get worse.

Ours went down.

I’m in northern California like you Wolf and my electricity went up 10%. At first I thought it was the heat wave but nope, PG&E said it was the raise in rates.

Zenman said: “My electric bill doubled from last year.”

That’s what I replied to.

There is a difference between a “bill” and the “rate.” That was my point.

Our electricity “bill” is minimal because we have no A/C and use gas for all heating. What uses most of the electricity is my computer equipment. If we go hiking for a few days, which we did in June, I shut down all computers and turn off the LEDs, and our bill goes down by $4 which lowers the bill by something like 10%.

Inflation is not that you pay more; it’s that you pay more for the same product, in this case Kwh.

Your Kwh rate sure didn’t. Those only go up. Only your usage went down.

Short term interest rates will go up to 7% at least. It’s probably time for another “emergency”.

That is an assertion without foundation, and an unlikely one at that.

Anyone that matriculates in society is betting that the feckless Fed will take at least 3 years of grunting and sweating, even with a continuous stream of 25 bpt increases, to reach 7%.

Bullshit smells, like all shit.

At least one homeowner has gotten the message from home builders that prices must be cut to sell. Here’s a price cut on a SFR after being on the market for less than a week:

For about a month now, the depletion of the strategic oil reserves has stopped. And coincidentally or not, I’m seeing a rise at the pump.

Now, while gasoline isn’t part of core inflation, shipping costs might be. So, higher fuel and the loss of Yellow trucking might drive a bit of inflation going forward.

The burning of gasoline is likely to become a memory of an early time, like steam engines. Burning fossil fuels for energy, probably should not be considered much of an advancement from the wood fire. Just more refined.

The likely fossil fuel that will be in demand is natural gas.

During a heat wave in California last year, the government told EV owners not to charge their EVs. Imagine the drain on the grid if all cars were EVs.

Took 50-60 years for steam engines to disappear.

Steam reciprocating engines mostly have, not steam turbines.

Complete BS for a number of reasons. First, the energy density and potability of six carbon and longer hydrocarbons cannot be beat. Moreover, a number of government and private organizations are having significant success in using engineered algae to produce these fats (that’s all diesel fuel really is folks) at respectable yields and fairly quickly. The issue with all gases (propane, methane, hydrogen) is, and will always be storage.

I believe burning plentiful and potable one carbon farts and inorganic potato chip shells is much better than your torturing poor little innocent algae and then imprisoning them scheme…..And yes, I knew, I save lot of money frying my eggs in diesel.

also seems I saw that Bio-tidbit in an Exxon commercial……

“We really want to stop making money, honest! We will pound our drill rigs into algae jails.”

Even if the algae cannot be used as fuel, if they can be produced cheaply enough they can be sequestered as a carbon sink…

The Canadian housing bear who sounds like Justin Bieber… He had to remove a post today

Because even though he explained that a Vancouver realtor was almost misleading university students to buy a C$565,000 (US$425,000) 1-bedroom condo, one dated metric from a third party almost got him into legal trouble.

The Realtor did a YouTube video and explained that though the mortgage will be C$3,000 a month, they can AirBnB the condo during the summer for $20,000 and magically pay only C$1,300 a month for the condo for the entire mortgage period of about 25 years.

Leave it too the Canadian’s to find the sunny side of the shit sandwitch.

The Canadian’s have allowed the price of housing to spiral out of control and are now faced with their fuck up, they are considering whether to honestly confront their fuck up or to paste a band aid over the impending collapse of asset values.

The Canadian’s are not automatically, nice people.

It’s not sustainable. Wolf talks about wage spirals in the US job market, while here in Canada, union jobs are replaced with staffing agency, which then hires newcomers, and more recently ‘international students’ for minimum wage.

The sick joke in Canada is that the median wage for entry level fields in non-unionized professional jobs is minimum wage.

And you don’t really find 15-year-old burger flippers earning $20/hr either, because the fast food industry hires newcomers, temporary foreign workers and international students for minimum wage.

At one fast food franchise, while I was at the counter, this middle-aged guy in the background kept looking at me as if he wanted help. Canada wants wage serfs. They don’t pay for talent.

And where does a student earn 1300 a month while full time in school? Was that discussed in the realtor analysis? Then after graduation for the next 25 years I’m assuming the student has moved into a home for themselves how does the student pay for double rent? These folks are amazing . Been going on for decades that same idea was present in 1976 when I was in college but there was no summer AirBNB cash flow because the homes and condos in the summer near a campus were empty .

“International students” are huge cash cows in Canada. Do not be surprised if the Canadian government would welcome corrupt oil dictators and their families to “study” in Canada, as long as they bought real estate. There was a huge protest in Canada, because an alleged war criminal who fled during a genocide in the 1990s was living a good life in Canada.

A lot of the foreign students from China pay cash. The rest of the foreign students are priced out of the market.

Off topic:

Wolf in you earlier article you wrote about projected TGA balance upto $750B but it’s moving in opposite direction. TGA has gone from $550B to $430B while treasury debt is increasing. Curious to hear your thoughts. Regards.

Yes, and I said it would do that. Estimated quarterly tax payments cause the TGA to balloon, and then the next three months, it all drains out again plus some (deficit). That’s why it’s not easy to get to $750 billion, from $550 billion, because that $550 billion was after quarterly tax payments had come in.

I wonder what the CPI would be if not for the health ins adjustment.

We’ll find out later this year.

According to my estimates, if would change core CPI for example from 0.3% month-to-month to 0.4%. Annualized from 3.66% to 4.91%.

Every month, for 12 months.

Thanks Wolf. Looks like you did a lot of work for us.

…you always do, Wolf (…and, fortunately for many of us, you still usually seem to enjoy it!). Many thanks.

may we all find a better day.

The food-at-home chart seems to sum it all up for me. A 24% average rise in prices since the beginning of the pandemic, leveling off and holding the increase in current prices. The Dollar Tree got it right, from $1 to $1.25 overall raise in prices. Same with utilities and insurance (not health insurance) it’s all averaging about 25%+ higher in 3 years.

Even if core inflation were back down to 2%, it’s on top of these permanently inflated costs. Good luck out there.

Dollar tree is a joke can of green beans,1.25 wal-mart 64 cents also most everything is Chinese junk

The foam ‘poster board’ is versatile(the paper peals off). Top 10 of my DIY materials!

As if Walmart is any different? There are 35,000 “Dollar Stores” in the US, up about 5000 from 2017. When you have NPR clutching pearls against them, then you know that it is a home run for consumers. Nobody can answer against that “it is cheaper than anywhere else”,

not if kale or quinoa is available.

Good Judgment’s professional Superforecasters see a 72% probability that the Federal Reserve’s target range for the federal funds rate will be the same at COB on 20 September as it was on 26 July. They also see a 38% probability it will be higher. Whether inflation continues to be “sticky” is one of the key drivers of this forecast.

CME @ 86% prob of no change

The Wolfcast seems to imply a bit more stickiness, but higher for longer range still suggests no rate cuts until recession in 2024, and polarizing hysteria with election cycle, rate cuts, tax cuts, wage cuts, benefit cuts, rating downgrades, earnings revisions, government statistics revisions, etc

Seeing gas prices going up the last few weeks, I decided to see what was going on with SPR drawdowns. I’m hearing they have stopped doing so, and I’ve assumed over the last year the drop in prices was the result of the administration dumping oil into the market. Sure enough, in late July they began ‘refilling it’ after draining it by ~40% in the last 2 years. That’s about 250M barrels @ today’s price of $83/barrel to refill.

There were mltiple refills announced, then the biden admin cancelled/delayed at least some of those due to the price not being in the 70’s range.

Can’t make this up.

Our products would fall into vehicles and durable goods. I can’t speak for everyone, but I can tell you why our prices are stuck at nosebleed levels.

I have been watching our margins daily since 2023, where it used to be weekly or monthly. In the inflation storm of 2021, our monthly gross margins bottomed out around 9%, and have been slowly climbing from there as aggressive price increases have been realized, and steel prices have fallen. There were maybe 6 months in 2021 where we bled cash like a stuck pig.

Margins are now stubbornly below pre-stimulus average of 28%, at 25%, despite relief on raw materials. Other inputs like wages and insurance keep rising and eating up all the relief elsewhere in the factory. I am just talking “revenue less cost of goods sold”, not bottom line profit after SG&A.

Starting the year, I was almost certain we’d be seeing prices fall in the last half of the year. Instead, the backlog is already booked through year-end at record high prices and 2024 is shaping up to require another 3-5% price increase just to keep margins on target.

It makes sense why they say prices rise like a rocket and fall like a feather. As long as the orders keep coming in, I have zero incentive to drop them.

Not only are today’s margins still a few points below average, we have a giant smoking crater in our balance sheet from 2021, and I’d like to ship above average profitability for a while to make up for that loss. BUT if the orders dry up, that attitude will change almost overnight.

Thanks for sharing. Very nice to hear from trenches rather than armchairs. It makes me wonder if any industries, and which, are seeing slowing demand. Seems like people are still on a buying rampage, even if it increasingly financed.

The People’s Republic of China is now in full deflation and that is intensifying across all sectors of their huge economy.

LOL. They had one little dip of the YoY CPI to -0.3% due to the base effect and plunging energy prices, and both are now fading. And CPI will get a plus-sign going forward. So don’t lose your hair over it.

The entire property sector in the PRC is in huge collapse and this has been ongoing for several years and is massively worsening with the bond collapse of Country Garden. The ENTIRE economy of the PRC is slowing dramatically this year and that has been ongoing for months. As to numbers reported that is always pretty much a bunch of nonsense and has little bearing to reality as you will discover very dramatically over the coming months.

Is it showing in actual property prices? If not, it’s not a bust.

Sure, they’ve got a real estate problem over there and a debt problem, and the construction boom that they built their huge economic growth on for decades is kaput. But CPI doesn’t measure that. It measures the monetary phenomenon of consumer price inflation.

You can have a shitty economy and lots of inflation, no problem. See Argentina and Venezuela.

Take a look at a long term chart of rental rates. They basically only go up, even in bad times.

The strikes and the settlements following the strikes really put wind under the inflation wings.

More strikes to come

There ought to be a “stable prices mandate” on the Fed so we don’t get into these predicaments /s

…but, but, if prices are stable how will anyone make a killing speculating???

may we all find a better day.

There is no such thing as ‘disinflation.’ Prices either rise or fall. If they rise the word is ‘inflation’ and if they fall the word is ‘deflation.’ In most case, prices rising is mostly due to greedflation or price gouging or taxation and when they fall it is due to normal market forces. Prices overall in the US economy are now headed into massive deflation and that is happening on many products and services this year.

“There is no such thing as ‘disinflation.’”

🤣. You really need to get out a little more. Or at least buy a dictionary. Or at least look stuff up on the internet… it’s free. Disinflation is a common English noun that has been in documented use (in writing) since at least 1880. It means a period of slowing inflation. The adjective form is disinflationary.

Which products and services do you predict will be deflating?

More evidence that the FED is still way behind the curve, and that the “pause” two meetings ago was just another failure in an extremely long list of failures. “Higher for even longer.”

“Higher for even longer.”

Should be changed to

“Higher until the economy collapses”

I really don’t understand the ignorance of these ivy league economists that talk about inflation/stagflation today and compare it to the 70’s/80’s, and then I realize they are paid shills (Krugman) and are blatantly lying and playing semantic games. At least we have Wolf to shine the light into this cockroach kitchen. What was our debt/GDP ratio in the 70’s/80’s? What were interest rates again? I think my first car loan was at 18%. Yeah, take the FFR to 18 % Powell, I triple dog dare you. We have indeed fallen a long way as a country. There are, in fact, things that every person needs in order to simply survive. The availability of these things, in a world of 8 billion is the real issue they are trying to paper-over, while at the same time stealing as much for themselves and their own. Accept the truth and simply do as the “elite” do and move on. You will live longer an be happier.

Speaking of disinflation, Jeff Snider, greatest economist of all time, touted as the king of understanding money, has been talking incessantly about disinflation, for about two decades — and he’s especially, very hyper amplified by the current economic environment.

It’s very strange, to walk along the information highway, in this Madmax world of polarized thinking, about the choices, between immaculate disinflation, no landings, hard landings, helicopter touchdowns and a wide spectrum between euphoric AI explosive growth, versus dystopian dysfunction and then the firm stance of those in the middle, who don’t care, have no opinion or realize that we’re in a period, perfectly represented by Schrödinger Cat uncertainties — where the unknowns have to be accounted for as being totally uncertain.

“Economists” do not understand how economics works. If they did, they would be wealthy and living like Bezos, and not trying to explain the inexplicable. I take no forecast seriously, although some are more amusing than others. My time frame is about three or four months and my projection, if you asked me to make one, is pretty much based on what is happening right now. That’s my simple model. It is not some complex multivariate time series models, which clearly are of no value, or some hairbrained economic theory, or some guy’s interpretation of what happened in the past.

The best cure for inflation is inflation. Inflation is really starting to bite and this train wreck is preceding. I just got a call from my old detailer of 3 years ago looking for work. He was always too busy. I offered him 66% of what I’m currently paying and he said yes. My paint shops and mechanic shops are struggling and taking in my work with better deals now and getting it done quick and telling me they need the money to pay their employees. They’re hurting for cash flow in spite of the higher prices they have been charging. I see many small businesses on the edge. My business volume is down by 50 to 70% by call volume. Whats keeping it going and prices up is a SHORTAGE of good low mile older vehicles! Shortages might keep inflation up longer but I say we have stagflation, then the recession So the inflation in the train wreck is firmly in motion and has been and I can confirm this next little wave of inflation because I have been getting sales now at still high prices even with the volume down(thats stagflaion). This is what I see now: since inflation is just another word for wealth transfer, the rich are getting richer and everybody else is dropping one box car at a time in this train wreck. The forces of the rich bringing up inflation are being countered by the forces of the rest being wiped out from inflation. We have a rolling train wreck one box car at a time while the rich bring up whack-a-mole. Probably this second half the effects of the FED will overwhelm all/most of the inflationary forces of the rich. Id look for a stock downturn. This has been supporting house prices imho. The best cure for inflation is inflation and it’s biting hard on more and more each month and you can see it feel it taste it as many are just struggling barely hanging on. Some people live in communities of only rich, so reality is tough to see. I’ll finish with this – (almost)every major bubble and mania in history when you look at it’s upside graph, had an equal or worse downside graph to its equilibrium. Look at the housing bubble 1 graph peak to trough, and look at housing bubble 2 graph. Predict objectively.

The fundamental problem with your assertions is the number of people/corporations that are dependent on government spending (directly as a government employee or indirectly as a government contractor like Lockheed etc.). This is not the 70’s/80’s…

So we need a lot more tax revenue then? Lets try the 1960 schedule, OK? Beef that Gov’t up!

Come on, be a sport……

but they will stop your algae torturing sick fun.

Not that it matters, but just watched a Forward Guidance with Jack Farley, interviewing Jim Bianco and someone else.

Long story short, much was theorized about two more Fed hikes next year, in addition to the one next month. They were suggesting continuation of immaculate no-landing, where inflation gooses the economy and no one cares about the well telegraphed ongoing Fed nothing-burger.

They obviously see yield’s going higher, which dampens excess bullishness in equities. The perfect Goldilocks calm sea’s outlook, versus the reality of all the headwinds culminating in a perfect epic storm…

I enjoy that show, because there’s a nice mix of smart bulls and bears

How we stopped inflation without a recession (hint: by not stopping inflation)

Do we really have no hangover after the largest economic orgy in history – more than $10 trillion in fiscal and monetary stimulus in 2020 and 2021? The charts below suggest we’re still just drunk.

The inflation crisis is over.

Or is it?

This morning a reader sent along an interesting analysis of Thursday’s supposedly positive inflation report showing that prices in July rose 3.2 percent annually – and an even more interesting chart.

First a little background. That 3.2 percent number is “headline” or overall inflation. That headline annual figure peaked at 9.1 percent in June 2022 and has since fallen sharply. Thus the growing consensus that inflation is back in check.

But the “core” inflation rate tells a less optimistic story than the headline number. Unlike overall inflation, the core inflation rate excludes changes in food and energy prices, which can move quickly. It is less volatile than the overall inflation rate. This chart (not the one from the reader, wait for that) shows core inflation since 2018

Wolf has a huge hard on for this “inflation is here to stay” nonsense. Let’s look at reality shall we? The inflation rate was nearly 10% last year and now it’s 3% and the Fed just recently popped the funds rate over 5%. Hmmm? China is in a deflationary tail spin and so will the US follow. Simply put the baby boomers (the ones with the money) are deflationary by nature and will force a massive downward pressure on prices. Not even $6T (with a T) in printing helicopter money could keep inflation rising. Not to mention the soon to be coming market collapse and recession. Inflation has no chance over the next 5 years. Now in 2028, then all bets are off with GenY and Z making up a massive population even larger than the boomers. And guess what, young people with money ARE inflationary!

I hafa admit, this is one of the silliest comments I’ve read all day. Kudos.

I particularly love this one: “Simply put the baby boomers (the ones with the money) are deflationary by nature and will force a massive downward pressure on prices.”

Boomers who are now retired have stopped working and started to spend income from their assets, and spend down their assets, thus converting assets into consumption — that’s what retirees do. They might SELL stocks or bonds to pay for trips, eat at restaurants, go to shows, redo the kitchen, etc. YOLO. Not working and spending their wealth of assets on consumer goods and services is very INFLATIONARY. They’re just taking money and throwing it at consumer goods and services.

Conversely, the segment of your sentence, “…will force a massive downward pressure on prices,” is true in terms of asset prices, LOL. (But asset prices are not part of CPI).

Pure wisdom served up fresh daily. Wolf Richter, thank you again for all your hard work, eloquent writing and great humor.

+1000!

may we all find a better day.

I think you’re confusing wolves and sheep Wolf. The three main components to CPI is housing, transportation and food. Boomers are spending less on all 😉! In 5 years that’ll all change with the younger generation taking over.

Not all boomers are poor. As you heard in the popular media, boomers have a lot of wealth, lots of boomers have lots of wealth, and those are the ones that move the economic needle – not the homeless boomers.

So now let’s go through the items, including a biggie you didn’t list, #3, medical care, where older people spend a fortune.

#1 largest component: Rent and OER = 33.1%. Housing is for everyone, including boomers. They’re not downsizing because they’re locked into their 3% mortgages. And those that rent, they’ll pay more, just like everyone else.

#2 largest component: Food at home = 8.6%. Boomers, like everyone else, are going to eat.

#3 largest component: Medical care: 7.9%, consisting of medical care commodities (1.5%) and medical care services (6.4%), including dental. Boomers are HUGE consumers of medical care and that balloons as they get older.

#4 largest component: Transportation commodities (new and used motor vehicles): 7.8%

Boomers with money – and there are lot of them — are spending a lot. They’re travelling a lot. They’re buying nice vehicles (Harleys! Young people don’t buy them!), they’re eating out, they’re buying stuff on line. And they’re spending large amounts on medical care, including dental.

What else are they going to do with all their money for the rest of their lives other than spend it, and let heirs have whatever is left over?

Sure, in terms of sheer numbers, the millennials outnumber the boomers, and some of them are already spending their inheritance (assets) from their boomer parents, thereby throwing more fuel on the inflation fire.

Incredible how everything has been repriced at these levels and will never go back down. A can of soda now cost 2 bucks, but people buy it anyway, soooo who cares 🤷♂️🤷♂️🤷♂️. There is no end in sight to this glut and people truly don’t care, they’re still drinking their overpriced margs and traveling on max credit. You think these companies gonna bring prices back down when they know they can get away with passing costs to the consumer. But then again this is a tale as old as time. Remember the old adage: “Your gonna pay more and you’re gonna like it!”