Incentives jump but still below normal. Average Transaction Price and Average Listing Price stuck at ridiculous levels.

By Wolf Richter for WOLF STREET.

Automakers have now reported deliveries for June and/or for Q2. They were up by a lot. The inventory shortages that dogged the industry in 2021 and 2022 are abating for most brands, and some brands are overstocked. Automakers are once again piling on incentives and offering special financing rates. Adios odious addendum stickers. Dealers are making deals, and so Americans are piling into dealerships once again. Sales compared to the same period a year ago:

- General Motors, Q2: +19%

- Ford, Q2: +11%

- Toyota, June +14.9%

- FCA (part of Stellantis), Q2: +6%

- Hyundai, Q2: +14%

- Honda, Q2: +45%

- Kia, June: + 8.3%; first half: +18%.

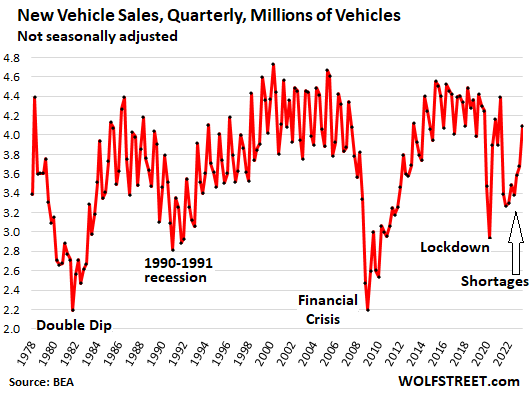

Total sales of new cars, SUVs, vans, and pickup trucks in Q2 by all automakers jumped by 17.5% year-over-year, to 4.10 million vehicles, the highest since Q2 2021. These are deliveries to end users, either by dealers to their customers, or by automakers directly to large fleets, such as rental fleets.

New vehicle inventories begin to normalize: overstocked here, out-of-stock there.

Starting in early 2021, chip shortages and large-scale production cuts were triggering new-vehicle inventory shortages across the industry that crushed sales. Those shortages have been abating, and dealers are restocking, and customers are flocking to them to buy once again.

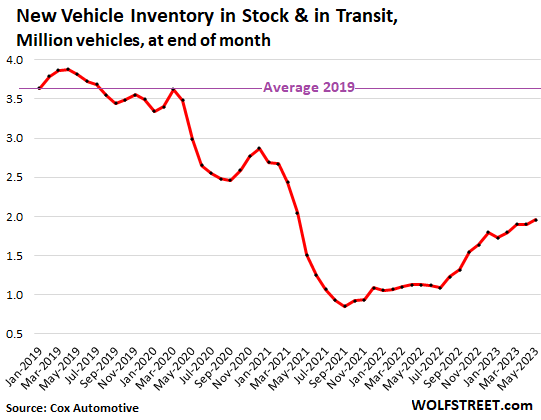

Inventories of new vehicles on dealer lots or in transit rose to 1.96 million vehicles by the beginning of June, up by 73% year-over-year, the highest since April 2021, and double compared to the out-of-stock period in mid and late 2021, according to data from Cox Automotive.

By comparison, in 2019, new vehicle inventory averaged 3.66 million vehicles. But dealers were overstocked back then:

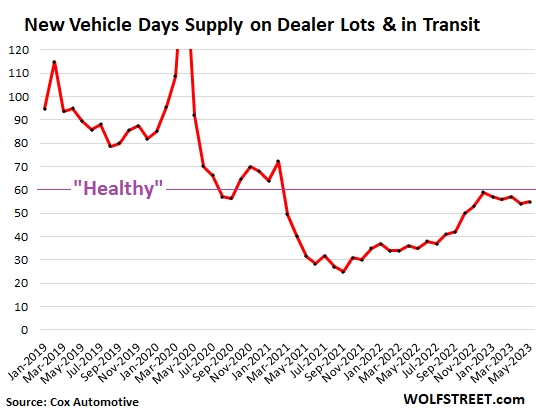

Days’ supply almost back to “healthy.” At the beginning of June, supply rose to 55 days. Over the past six months, supply has hovered in the 54-59-day range, while 60 days is considered “healthy.” By comparison, in 2019, supply averaged 90 days, when the industry was overstocked (which was a good time to buy a vehicle amid huge incentives and discounts).

Some brands have vehicles coming out of their ears: Jeep started June with over 150 days’ supply, followed by Infiniti (119 days). Ram, Jaguar, Chrysler, Buick, and Lincoln all had over 100 days’ supply, according to Cox Automotive. Mini and Dodge had over 90 days’ supply.

A bunch of brands had normal supply at the beginning of June including Ford with about 70 days, GMC with 60 days, Nissan with 58 days, Chevrolet with 50 days.

But supply was still very tight for a few brands. Toyota, Honda, Lexus, and Kia had 30 days’ supply or less. Toyota’s Corolla and Highlander and Honda’s Civic had the lowest supply of just 21 days, which are essentially out-of-stock levels.

Incentives up, prices stuck.

Incentives are coming back. The average incentive spending by automakers per vehicle rose to $1,798 in June, nearly double the amount a year ago, with leases having relatively lower incentives, according to J.D. Power.

Incentive spending as a percent of MSRP rose to 3.9% in June. But back in 2019, when the industry was overstocked, incentive spending reached 10% of MSRP.

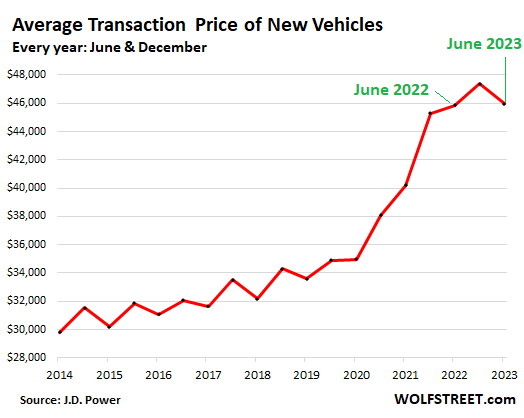

The average transaction price (ATP) was roughly unchanged year-over-year at nearly $46,000 in June. The chart below shows Decembers (the seasonal highs) and Junes.

Part of the absurd increases of the ATP in 2021 and 2022 was caused by automakers’ prioritization of higher-end models and trim packages to make up in dollar sales (revenues) what they were losing in volume (number of vehicles) due to the shortages. This shift in mix is now reverting, which lowers the ATP. In addition, the bigger incentive spend also lowers the ATP.

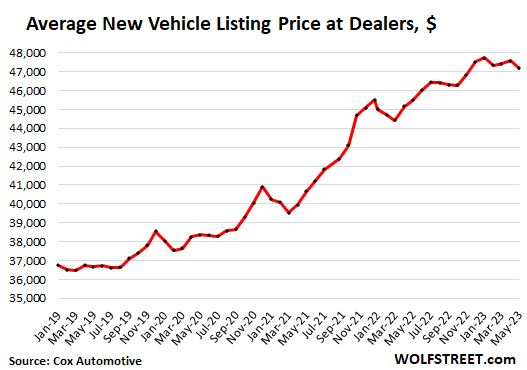

The average new vehicle listing price in May, at $47,172, was up 4% year-over-year, with a slight down-trend in recent months (the dip early this year was seasonal).

Pent-up demand may put a damper on those recession hopes.

Over the seven quarters that the chip shortages hit vehicle inventories and sales (from Q2 2021 through Q1 2023), automakers sold 24.1 million vehicles. But over the equivalent seven-quarter period just before the pandemic, automakers sold 30.1 million vehicles.

So retail customers and fleets (especially rental fleets!) bought 6 million fewer vehicles over this seven-quarter period than over the equivalent period before the pandemic. Instead of buying a new vehicle, they kept what they had for a while longer. And this creates pent-up demand in future years. We see this after every deep downturn in the auto industry. It’s a slow process, but it happens.

Many people and companies have waited for a long time to buy a new vehicle. Frustrated by the rip-off addendum stickers, out-of-stock dealers, and long waiting lists, consumers and businesses went on buyers’ strike. They had the money, and rates were low, but they didn’t buy because there was either nothing to buy, or it was a rip-off.

The situation is now normalizing, and buyers are coming out of the woodwork. This will be the first time that the US economy is widely hoped-for to enter a recession – we’ve been watching and waiting for it for over a year – while pent-up demand for new vehicles is fueling sales, and that is another factor that contradicts the recession scenario and might put a damper on those recession hopes.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What is the cost of a vehicle to manufacturer (parts and labor and I guess transportation) relative to its MSRP, on average. Is this information available anywhere for a specific model? What’s the average mark-up and is this available for a specific model anywhere? Manufacturers can say their MSRP is anything. They can hike the MSRP, and then lower the price, and say the vehicle is on sale, like they do with food in supermarket sales.

There’s a lot more to the difference between suggested retail price (MSRP) and manufacturing cost than just factory cost to retail. As an example, there’s things like royalties (for use of the brand trademark… common when a brand is sold by a distributor such as TMS or SE Toyota) payable to one sub corporation to another (R&D, plant corporation separate from the mother ship), warranty reserves, legal reserves for product liability lawsuits, currency fluctuations have to be considered, SGA, tooling amortization, engineering (many manufacturers have R&D corporations that stand separate from the mother ship, just like their plants)… the list is long. It’s a well guarded secret. Where I once haunted the halls, there were few people in operations that new all the details. The information was sequestered so only the top brass new the total picture.

So, to answer your question… it’s a black box. The “invoice” a dealer shows you or appears on the interwebz does not show the encoded “holdback”, which is percentage of MSRP rebated to the dealer, fuel allowances, floor plan assistance, marketing allowances, etc., which all vary by MSRP of the vehicle.

It’s all levers, mirrors, and blue smoke.

You want to have some real fun, go to the parts catalog and start to order all the parts it would take to assemble a vehicle. Probably cost you $150K to roll your own Camry.

Cue up Johnny Cash, ‘One Piece at a Time.’

Old Henry could have written it on a napkin at his table in the Dearborn Inn, back in the day.

yep. The replacement parts rip off. Both of my big diesel pickups need complete engine replacements due to manufacturing defects, but they are just out of warranty. New, they cost +- $80,000. The dealer wants $38,000 to just rebuild the engine. yep, gotta do it but not at that price. Right now, I am without transportation looking for a better deal.

(I had my older diesel tractor rebuilt last summer for $5000 so I have a clue.)

This is the rock and a hard spot!

I believe food stores have sales because warehouses are full ,need to be depleted so manufacturers can keep plants running. Cereal could be a example been buying for $1.29-$1.99 regularly

There’s going to be a shit-pot of slightly-used vehicles for sale in the very near future…

That would be welcome. But right now, there is a shortage of used vehicles because rental fleets couldn’t buy the supply of vehicles they wanted in 2021 and 2022, and they kept what they had, and so there are fewer rental units feeding into the used vehicle market. Rental fleets normally buy 2-3 million new vehicles a year, and a year or two later, they flow into the used vehicle market. This has been curtailed for two years. Used vehicle inventory is close to 1 million vehicles below normal — and prices have shot higher over the past three months, which is not good.

not sure if rental companies have same inventory with Uber being dominant now.

Uber and car rental companies aren’t really competitors.

Uber isn’t competing with rentals. It’s competing with taxis and car-ownership in big cities. Uber allows people in SF and other big cities to not even have a car. Very common. Cars are a huge hassle in big cities and expensive (parking). If you just need a car a few times a week, you’re better off Ubering. And car sales to retail customers might show that. But the rental business is booming.

I sure hope so. 220,000+ miles on my 2003 Nissan pickup. I’m not your typical American… I’m afraid to spend money!

I haven’t decided that I need anything

’03 f150 with 300,000

works fine, use it for work

definitely not as nice as the 2015 F150 4×4 sport I used to have with 85,000 miles on it

—-

but I couldn’t resist the $30,000 value and used it as down payment on house

People are under no pressure to sell these vehicles. Vehicles are better engineered than ever and the silly spending bonanza indicates no one is fearing losing employment. Until those dynamics change, vehicle inflation is here to stay.

Hopefully car prices will keep on rising.

Why would you hope for that?

He either forgot the /s or he is selling cars.

maybe he’s hoping the high prices will finally put you off buying

Chinese cars: No Chinese cars are sold in the United States. There are YouTube videos of very challenging laboratory crash tests that the cars did excellent, the videos had 5 stars but didn’t break it down into vehicle areas.

There is no reason for these monopoly level car prices. Before the 1980s Japanese vehicle entry, the domestic cars were expensive and troublesome; who doesn’t remember on a cold day opening the air cleaner and shoving a metal coat hanger to open the throttle plate as a makeshift manual choke.

Bring these Chinese cars in ASAP and the prices will drop. As Jerome Powell said in reference to housing: “The solution to high prices is high prices.” The Chinese cars will fix the supply part of the demand equation and not stress a white hot labor market; a win – win.

“No Chinese cars are sold in the United States.”

LOL. The China-made cars sold in the US include the Buick Envision, the Volvo XC60 (Volvo is owned by Chinese company Geely), all Polestars (owned by Geely), and maybe a few others.

Lotus makes their sports cars, such as the the Emira, in Norfolk, England. But Lotus is 51% owned by Geely and 49% owned by Etika Automotive of Malaysia.

The Emira is powered by a supercharged V6 Toyota or a I4 turbocharged AMG/Mercedes engine. It is probably the last of the ICE cars Lotus will make, and has gotten very favorable reviews from what I’ve seen. Steering feel and feedback is supposed to be unmatched by anything else. Price is just over $100k, but there’s a long waiting list to get one.

A perfect “Mid-life crisis machine!”

Using USA cars from the 1950’s to 1980’s, I’ve never had the cold weather issue. Oh and opening the throttle plate is the reverse of choking. Maybe you were opening a stuck choke plate which was flooding the car in cold weather. In any case, yes, cars from Japan had better quality, but US cars from those years weren’t that bad in basic ability to get you where you needed to go. Now British cars on the other hand…..

The crash tests have variants… offset barrier crashes being one of the most “challenging”. Some of the smaller vehicles are not suitable for U.S. highways. In case you didn’t know, many of the Asian brand cars sold in the U.S. are North America only products – designed, engineered, and produced only for the North American market and few are exported. Auto manufacturers have an issue with investing in Chinese production… patents to the Chinese are merely a nuisance, not a deterrent. The Chinese government also has the nasty habit of seizing corporate assets.

Original imports from Japan were subject to “import restrictions” back in the 1980’s when the U.S. auto industry was struggling because, as usual, they misread the market. That’s how you ended up with so many factory “transplants” (Honda being the first in Marysville, OH) dotting the U.S.. Then there was the “chicken tax” on complete pickups. That’s why companies like Nissan and Toyota shipped the cab / chassis and the beds separately and then installed them in their port operations before shipping to the dealers.

Early Japanese cars had many issues too. The key one being rust. Japan doesn’t use road salt and the concept of fender liners, galvanizing, special alloys, and sealing body cavities was foreign to them. In the 1980’s, it was not uncommon to see bulging hoods where the strut towers rotted out and the hood was the only thing keeping the front suspension from collapsing. To their credit, the vehicles were *bought back* and replaced with limited financial impact to the customer. The difference was that, while there were problems, the Japanese imports acted in a customer friendly manner: It’s not that you fail, it’s how you recover that matters. Of course, that was before the frat boy MBA’s arrived on the scene.

This just brought back a random memory: I bought an MGB back in the early 80’s. It was among the first attempts the Brits made to Federalize vehicles for emissions. On a cold start, the cat would get so hot that it turn bright orange and burn the paint off the hood until the choke opened. I learned to lift the “bonnet” before starting it cold. Might be why everyone thought it was always broken.

Here in central Florida a few miles from Disney, 3+ million dollar homes are selling in days while the drone of Lamborghini engines in the distance is a constant. A rolls Royce, Ferrari, or other exotic is common in what 20 years ago were just upper middle class homes. Themeparks and stores are packed…no signs of recession.

At the same time, As of January 2021, 37.9 million Americans lived in poverty, accounting for 11.6% of the total population, according to the latest report from the United States Census Bureau. That’s despite the fact that America ranks first as the richest nation in the world in terms of GDP.

I am also seeing far more homeless and drug problems than the 20 years ago timeframe that you mentioned. Not all boats have been lifted by the rise in the asset prices.

Which is down from 15% in 2010 and 22% in 1960. So while all boats aren’t lifted equally, I would say all boats have been lifted.

Some of these boats resemble submarines with screen doors.

Poverty in America is relative

Off topic, just to remind you that when the Berlin Wall fell, NATO and America in particular convinced Ukraine to get rid of its nuclear weapons by guaranteeing its security.

Somehow it couldn’t be right now that the west had abandoned her

Juliab, the Russians also made many concessions in the German reunification treaty signed in 1990 after the Berlin Wall fell. NATO routinely promised Russian that they wouldn’t expand one more inch toward Russia, then proceeded to spend the next 20 plus years expanding ever closer to Russia. So, it is no surprise that NATO has routinely broken promises to both Ukraine and Russia simultaneously over the last 20 years, they’ve only exorbated the problem with Ukraine and Russia, they have not made it better.

Well said, CB!

CB,

Imagine if I walked into your house and claimed that your kitchen now belongs to me.

Each sovereign state has the right to determine its own policy and priorities

The FED just couldn’t bring themselves to do the right thing, so they “paused” their rate hikes. In turn, inflation will rage even harder.

I feel the same. Today’s ADP report should light a fire under their asses.

Nah. They’re busy crafting a narrative about how they need to wait to see how the past rate hikes will affect the economy going forward. “Let it run hot” is alive and well. Never before in history has shelter and transportation been stolen from the masses so quickly. “You will own nothing and be happy.”

The rates aren’t the problem, their obscene balance sheet is. On the positive front however, the balance sheet declined $42 billion in the past week. It’s now below the low in March prior to the SVB nonsense.

Baby steps.

Be careful ,probably more bank failures around the corner

Ah, the Call of the Mild. I’m surprised you can even hear the Lambo roars over all the shrieks of awe & delight they no doubt induce amongst all within earshot.

I’ve (unfortunately) been through central FLA over the years. Lots of pretend goin on there. That area rather invites it. I don’t recall witnessing all their moldy, mildewed driveways bedazzled in glitzy supercars as you report, but maybe I’m just blinded by the sun on their streets of gold

I agree with your assessment. Any how many of those visitors to the theme parks are foreign visitors?

True,lots of poverty in Central FL.Average salary is 15-20$ an hour and the prices are more than in Brooklyn,NY.And good areas of Brooklyn are not cheap.Even crime infested East NY in Brooklyn is not cheap. I find Brooklyn is much more affordable than Miami and quality of life is better.Jan and Feb has no more snow.

The new car lots of the dealers I go past everyday look about half full on average. Is this still a hangover from the virus and it’s secondary effects like the shipping and chip shortages of over a year ago? Or have they intensionally reduced inventories?

Ford, GM, Toyota, Honda, Kia…loaded dealers parking lots, but they might rot.

If you read the article, Toyota, Kia, and Honda dealers have <30 day's supply. Hardly "loaded" lots. 30 day's supply is hardly functional in a "I want it now" marketplace.

45 days on ground was considered ideal. 60 days was tolerable. Much above that, prepare to fire the incentive cannon because of inventory in the pipeline (production and factory orders). Again, most people don't realize this but factory production is planned annually and modified quarterly (or at least it was where I lurked). Dealers place their orders (allocations) well in advance of production and shipping (about a 60 day window). Inventories are watched closely as components are already ordered and you can't shove a diesel V10 in a compact car nor a CVT in a dually pickup. Certainly, the manufacturer can cut orders from suppliers, but that's how they lose "their place in line" and can end up with future component shortages when suppliers shift production to less fickle customers. Factories don't make any money when they sit idle and you can't layoff your line workers and then rehire replacements as assembly is no longer done exclusively with a "dugga dugga" (aka an impact wrench), a crowbar, a 2×4 "door adjuster", and a 5 pound hammer.

It is pretty obvious from the list of autos that have low inventories that people are looking for cheaper cars. Once the inventories of those cars rises, we will see average prices fall alot more.

Some of the domestic car companies are in a real bad spot. They killed off the cheaper cars that customers want and on the high end customers are flocking to Tesla for the tax credit. No wonder those inventory numbers are shooting higher for Buick, GM, Ford, Jeep, etc.

There are tax rebates of 7500 on BEV cars and Tesla is increasing production. I imagine this brings the average price up at least a little, even though it costs the buyer less when you look at the net.

I personally think the demand surge peters out after 2-3 quarters. Work from home is really changing the need for vehicles. Alot of couples that work from home could do with a single car, or just keep one older car for the rare times that two cars are needed. My wife daughter and myself are using the Tesla for almost all our driving and just keeping older ICE cars for when we need them.

My wife and I have the same cars in our stable as you do. And as does your family, we use our Model 3 most of the time. It seems the ICE car drivers are getting more surely on the road. Seeing the end approaching, I think. BEV prices are coming down, but they need to get lower for the market to turn.

…perhaps that longer-term, ‘this time it’s different’ always seems to fall victim to constantly-erratic ‘timing’?…

may we all find a better day.

This reminds me of the real estate market everyone expected to crash too, but low inventory means no lower prices.

No recession = no crash anywhere. Not cars, not homes, not services, not travel…

Real estate moves painfully slow.

Just wait for a year or two.

It sure didn’t move painfully slow on the day up. 40% increases in some markets.

Prices dropped only 10% in NYC(not Manhattan) other districts from 2008 -2012.RE prices would not drop a lot in good,safe areas.

Not stocks. Who needs 0%?

I’m seeing all kinds of drops on really nice houses.

Jobs data strong and more folks back to work in office more demand for cars

1) New vehicles supply. Four years ago, in Mar 2019, we have been on the

cusp of recession. Three years ago, when the econ was comatose, supply

reached the moon. The 2019 and the 2020 aberration are coming back.

2) A new normal inventory with abnormal sticker prices.

3) Slightly used F150 and Silverado are stuck in the parking lots.

4) In the recession Tesla will be doomed. Toyota Corolla will sell in turtle pace.

People are in no mood for a recession, maybe because Jerome Powell printed $6 trillion so the government could do a helicopter drop.

It created a permanent inflationary price step of 20%, so far. The Fed appears to want another 10% or so, given the pause in it’s inflation fight.

What the Fed says and what the Fed does are drastically different. The results are in.

5% inflation and the Fed pauses rate hikes and slow walks asset sales. Such consternation, after a quick 20% inflationary step up? What more evidence do we need to conclude the Fed willingly accepts high inflation?

Your mistake is believing that the Fed didn’t want significant general price inflation. That is what they said/say, but they lie through their teeth. The ONLY way the US can eliminate some of the monstrous debt is via inflation.

Why do you think the US government gave away several trillions in free money directly to the people? The excuse was the COVID shutdown which by the way, didn’t need to happen. “Never let a good crisis go to waste”.

I’m tired of people not understanding this and railing against the Fed for not doing more to control inflation. They wanted it, they got it. Get over it.

I’m hoping for a real eye-popping, blowout inflation number that “nobody coulda seen coming” to smear egg all over the face of Jerome Powell and his fraudster buddies.

You say don’t rail on the Fed after it creates 30% inflation?

Don’t be a lap dog or shill for the Fed. It’s sickening.

Think of it as the Fed sponsoring a 30% debt jubilee while at the same time powerfully juicing the economy with monetized deficit spending in the trillions. Even those taking the 30% haircut (e.g., bond investors) are getting more interest income, so every player gets something. What could go wrong? An external shock seems to be the only thing that could derail the current party, and even then the Fed put will try to prolong the festivities.

It’s pretty obvious that government spending more than offset any monetary tightening short term. Long term the trend will continue, but with uneven results. Government is crowding out the private sector due to infinite credit especially small businesses who can no longer access credit at any price. Government will pick winners and losers from their corporate friends. Everyone else will be left to rot with inflation and credit drought.

Eventually the Fed will have to monetize the debt, if they don’t Congress will take them over.

Crony capitalism, or for us older generation, it was the classic definition of fascism, when the public sector is controlled by the private sector.

CNBC: 30 Year US Mortgage rate soars to 7.22% after strong economic data

If you can’t buy a home, buy a car $FOMO. If you can’t see Taylor Swift or Beyoncé in concert since tickets are sold out go to Disney World. $YOLO fevor still running hot in US. Jobs are plentiful and incomes are rising. The extra 5% of interest income on money market and CD’s is a nice cherry on top. The Yoomers and Boomers are fueling the economy, there is perfect competition for that spot sleeping on the airport floor. The average folks now have to wait until the are 38-40 years to have a down payment on a home. EV’s are the luxury car faster, stronger, and earth friendly.

Canaduh is seeing 90 year mortgage loans. Fantastic. What’s next, 25 year auto loans? Bankers are the scvm of the earth.

That is a little deceptive. They have fixed payment variable interest rate mortgages. Meaning to keep your payment fixed, if interest rates go up then the payback time has to extend. It isn’t that you go in and get a 60 or 70 year or more mortgage up front. You have people who have what was a 25 year mortgage at very low interest with that interest pegged to a Prime rate. That Prime rate has gone way up so the mortgages length in payback times has to go up too.

Never let the facts get in the way of a good story.

I’m part of this issue. My business bought a new Platinum F-150 in May and a new Limited F-150 last week, which helps skew the average transaction price in the future. FWIW, the Platinum came in 90 days, and the Limited came in 60 days.

The salesman said I got lucky on the Limited because nothing comes in 60 days. He also said he no longer believes anything Ford says regarding constraints and delivery times. I’m a corp check buyer, but he said interest rates are killing their business.

What a hoot. I looked at Ford’s website. The Platinum rig you bought has a monthly payment of $933 per month for 84 months with $6,699 down (10% of MSRP)… excluding tax, license, dealer fees, etc..

7 years. I remember our leadership peeps sh*tting a brick when we first proposed a 60 month term. Long term financing crushes future sales because the customer is traditionally underwater in the vehicle for the first several years. Rolling negative equity into the new loan (which is how it was handled) only exacerbates the situation.

I found Mazda YOY sales but not MOM sales. YOY is huge.

Look at Mazda’s corporate public relations section on their corporate website (not the sales site, but the investor relations/corporate site). Most manufacturers publish their sales press releases in that category.

Mazda’s YOY sales are huge because they are following the money like everyone else, CUV’s, CUV’s, and more CUV’s in the lineup.

This is nothing but a gut feeling here. Seems prices of anything spike with inflation, drop just a little when price shock dampens demand, then settle, as you pointed out “at rediculous levels”. Remaining so until it becomes the new normal. Wash, rinse, repeat. Fixed incomers just have to stand and take it, buying less and prioritizing.

We look at zombie companies and say “they shouldn’t have gotten so used to ZIRP and should have been stabilizing their balance sheets and pushing to profitability faster”–all factually accurate. The household/consumer never gets the same attention, except with the crowd that reads WS. I about threw up in 2016 when we hit hat trick auto financing numbers–first time the average price was over $30k, average monthly payment was over $500/month AND the average term was over 5 years. Financing more, for longer, what can go wrong? Yet here we are today, with almost 1/5 new auto loans being taken out with a payment over a grand per month. Nothing goes to heck in a straight line, but when something starts to go to heck we’re going to learn a lot about how resilient the consumer is based on debt service and lack of household liquidity

Banks are signing people up for defaults. I thought we regulated this? Next bank bailout is going to be expensive. Can’t wait.

Many of those car loans are with the captive finance companies (Ford Motor Credit, Toyota Motors Credit Company, etc.). Those were bundled and sold as investment grade paper. There in someone’s pension or 401K.

El Katz, look at Wolf charts.

1) The 2019 and the 2020 overextended supply is coming back.

2) The new normal inventory has a shocking sticker price.

3) Terms are stretched. Interest rates doubled.

4) Toyota, Kia, Honda have vehicles people want.

5) If the next recession will be deep mfg will ask : where are the new orders.

6) Tesla might have the same fate that Ilan Buffalo NY solar panel factory had.

Overextended supply is coming back in product lines that eat $6 a gallon gasoline with wild abandon….. always has been that way. Gas gets expensive and Jeeps and the like stack up like cord wood on a New England farm.

Manufacturers often spin up the factory volume and invoicing to make a good quarter to juice the stock or ADR’s. They also play with month end cutoffs to juice retail sales. I used to laugh and say “pretty soon we’ll have 10 month years if they keep this cr@p up”.

Sticker price is adjusted through incentives. Key operating word on the “sticker” is “Suggested”, which is the “S” in MSRP. There’s bunches of ways to move the needle that the average non-auto industry person can’t fathom. I know first hand. I did it for decades at the manufacturer level.

Terms are stretched. No kidding. Once upon a time, 36 months was the norm. Now it’s 84 months. That’s done so they can advertise an “affordable” price point. Many consumers are math challenged and never figure out the actual spend for 84 months x’s $1000 for a $68K vehicle. Hope they have “gap” insurance (contract value vs. book value) if it gets totaled.

Not all Toyota’s Honda’s and Kia’s are what people want. Some of the product lines are slower moving but these manufacturers didn’t shoot their passenger car lines in the head and, as a result, have options if their assembly plants are flexible. Truck only companies can only make trucks. Ford may have gotten the memo and is, allegedly, bringing back the Taurus because the frat boys effed up.

Where are the new orders? Fleets, returning lease customers, “pull aheads” (you pay the customer to return his lease vehicle because the car is worth more than the residual) and you can roll them in a new car for similar monthlies. Ain’t rocket surgery.

Don’t count Tesla out. They’re a technology company that happens to put their product on wheels. Many legacy car companies can’t make an entertainment system that works if their life depended on it. That’s the number one killer of “initial quality and reliability” rankings.

20% of new car payments are over $1,000 per month.

None of these people can afford their loans.

Banks are signing people up for defaults.

I thought we regulated this?

1000$ post taxes for the vast majority. Meaning 1300-1800 gross. Per month. For a car. Insane.

Nice to see auto sales normalizing, yet I do not see us hitting pre pandemic levels for some time. You now have to content with double sticker shock – on the price of the car and financing. Per the chart, the ATP is fifty percent higher than it was in 2014/2015. Many people shopping new vehicles last bought around that time frame.

Also, the transition to electric vehicles is a cost and inventory nightmare for legacy car makers. Suffice it to say that that Tesla has a huge advantage on those trying to strike a balance between EV’s and ICE vehicles. I’ll save that take for another time when you address electric vehicles.

I’m also saving my take on the hangover that is building for the drunken spenders.

Thanks for the thoughtful blog.

I’ll also add that Honda, who is the only pure ICE manufacturer (for now), had far and away the best comps at a whopping 45%.

Take a look at last year’s sales for Honda… they were on their lips due to canceling chip orders and losing their place in the queue. The thing with percentages is that if you sell 150,000, to get a 45% bump is difficult. If you sold 6, it’s not so hard.

Just read that 17.1% of consumers that financed a car are paying over $1,000 per month. Pre pandemic it was about 4.2%.

I’m old enough to have had a lower mortgage payment.

Put your lower mortgage payment into the inflation calculator and get back to me.

My original $311 per month payment on our first house would now be $1,911 per month. $311 a month included PITI so it would likely be higher.

If you want to understand automobile prices, chew on these stats about production cuts (worldwide) 2020-2023:

2020: 8mm

2021: 11mm

2022: 7mm

2023: 2.8mm (estimate)

I’ve seen slight variations in this data, but the gist is this: between 2020 – 2023, close to **30 million** vehicles were cut from production.

That’s a *lot* of vehicles that won’t magically appear in any inventory, ever.

TL;DR: Like interest rates, barring a massive economic downturn, we’re likely to see elevated vehicle prices for the foreseeable future.

As a world traveler I hate Japan. But Lexus made in Japan is the only car I would now buy. The best and most reliable by far.

50-70k for a car is just silly and reflects the COVID era liquidity dumps and interest rate gimmicks. There is still a bit of free money as well as pent up demand sloshing around in the system in 2023. Both will be exhausted, along with the labor shortage, by 2024 as the layoffs and bank failures mount.

Repos are climbing quickly and fleet sales are making up for some lost lost retail sales now. I guarantee manufacturers will be increasing incentives above the 7% mark by 2025, retail sales are slowing and some manufacturers have over a 2 year market day supply, such as jeep, ram, Chrysler and combine this with the average new vehicle interest rate at 9% and trust me the dam is about to break. Automakers became arrogant and cocky during the plannedemic and supposed supply shortages but will be humbled soon. Vehicles increased 40% during the plannedemic and wages for most did not increase equivalent so they are all still exorbitantly priced today. I personally cannot wait until the automakers are in a bind.