“Higher for longer be damned”: consumers and businesses.

By Wolf Richter for WOLF STREET.

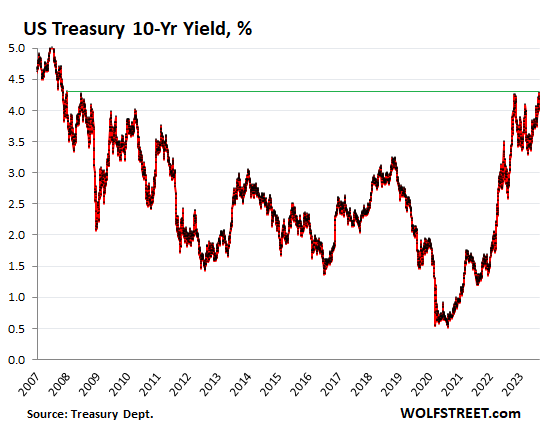

The 10-year yield closed at 4.28% today, according to Treasury Department data, the highest since, well, let’s look here, November 14, 2007, so about 15 years ago, having edged past November 2022 and June 2008 by a hair. 2007 is notable in that it was the last year before the arrival of QE.

What is hilarious in a twisted way is that the 10-year yield had dropped to 0.5% in August 2020, and everyone and their dog were preaching to the world that longer-term yields would drop into the negative in the US, as they’d already done in Europe, because of course the 40-year Great Bond Bull Market – Great Bong Bull Market? – would have to continue for evermore, with yields falling deeper and deeper into the negative. I have a term for this: Consensual Hallucination.

The entire sucker-rally from November last year through May this year has now been mopped up.

So it has been quite a trip, from the all-time low in August 2020 via raging inflation to the 15-year high. And every step along the way, the longer end of the Treasury market has been in denial.

But gradually the market is grappling with the notion of coming out of denial. The thing is, in normal times a 10-year Treasury yield of 4.28% would be low, when short-term yields are 5.5%, with inflation and the uncertainty of inflation bouncing all over the place. Eventually investors would want to be compensated for inflation, no?

Mortgage rates today rose to 7.34% for the average fixed-rate 30-year mortgage, according to the daily Measure by Mortgage News Daily. This morning, the Mortgage Banker’s Association reported that the average rate during the reporting week was 7.16%. And the housing market is not exactly jubilating.

Higher rates mean lower asset prices. This goes in lockstep with yield producing assets, such as bonds and real estate investments. It doesn’t go in lockstep with other assets, such as stocks, but it goes. Just like lower rates meant higher asset prices all around for the past 15 years of interest rate repression.

Inflation, once it reaches this magnitude, tends to dish up nasty surprises, and we just got another one from the UK where services inflation spiked to a 40-year high, and we got one from the Eurozone where services inflation spiked to a new high, and we’re going to get some “surprises” in the US in the second half for reasons we’ve spelled out here.

Bond market has to grapple with a wild mess.

1. “Higher for longer” inflation, yup, still a huge thing, and still making the Fed very nervous, and not just the Fed.

2. “Higher for longer” Fed rates to tamp down on higher-for-longer inflation. Looks like one or two more are coming this year. Who knows, rates are already a lot higher than we had imagined in March 2022, when the rate hikes finally started.

3. “Higher for longer be damned.” The economy is not slowing down. Consumers are doing fine. Wages are rising. Businesses are hiring. The housing market hasn’t collapsed. Inflation has shifted to services. The federal government is deficit-spending its way to happiness. And rates may have to go higher still.

4. A tsunami of longer-term Treasury securities. The Treasury Dept. detailed it in early August, which we sorted out here. The tsunami of issuance is needed to fund the ballooning government deficits and to increase the balance in the Treasury Department’s checking account (TGA). The first ripples have already arrived via ramped-up auctions of notes and bonds in August, including 10-year notes and 30-year bonds last week.

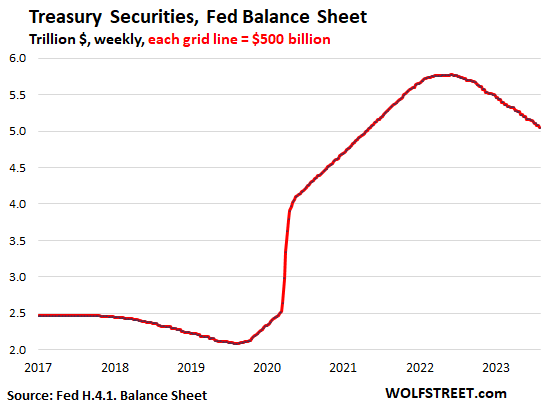

5. While the Fed is unloading Treasuries. So far, the Fed has reduced its holdings of Treasury securities by $723 billion from the peak in June 2022. It reduces its holdings by not replacing maturing securities. At $5.05 trillion, its holdings are now the lowest since May 2021. It has shed 22.3% of the Treasury securities it had bought under its pandemic QE ($3.25 trillion).

Future investors lick their chops, but are edgy about inflation. Obviously, a 4.28% yield on 10-year money with no credit risk is a lot more attractive to future buyers than 3% was, or 0.5% LOL.

But a 5% yield will be even more attractive, and lots of investors are holding out for that 5%, because the unknown is inflation over the longer term, and it can spook investors that want to commit funds for 10 years or longer.

Inflation bludgeoned bond investors year after year in the 1970s and early 1980s. The survivors formed the bond vigilantes, and they refused to buy, and for years, Treasury yields remained high, even as inflation was falling. But thankfully, the crowd in the market today has no idea what that was like, and they’re still expecting inflation and yields to be a lot lower in a year or two rather than, God forbid, higher.

And when inflation gets bad enough, and keeps dishing up nasty surprises as it did in the 1970s and early 1980s, well then 5% may not be enough either to entice enough buyers to absorb the tsunami of new issuance. Ironically, looking back over the long term, that 5% to 6% range wasn’t a bad place to be for the economy, such as in the 1990s (circled in the chart below), but asset prices were relatively speaking a lot lower.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I could use 7% money market rates to go with

my 3% percent mortgage .

Right?!?! Let me know when 7 hits and where!

3 month bill is at 5.4%

Wells fargo savings account is at 0.1%

No wonder money fleeing banks. Stupid greed and the stupidity of buying the 10 year at 0.5%

It’s not my fault the banks like SVB don’t have a risk manager are are suicidaly idiotic.

P.S. wolf street is my #2 favorite web site! Who beat you out? Sadly, it’s zerohedge. Your good wolf, one day you will beat them too! Keep up the good reporting

“Wells fargo savings account is at 0.1%”

Wells Fargo is offering a bunch of CDs, 5-months and 11-months, between 4.4% and 4.76%, minimum $5,000. Just google it.

The Delta Community Credit Union in Atlanta is offering a 12 month CD at 4.741% with a $1,000 minimum.

One of the WF savings accounts is paying 1% also.

In regards to “But a 5% yield will be even more attractive, and lots of investors are holding out for that 5%”….

Yes 5% “should” happen, yet I’m currently started cost averaging into a position now as 5% isn’t going to happen if something breaks in the financial system between now and 5%, especially before the Nov 2024 elections.

I’ll need to double down at “5%” if that is “allowed” to happen. Also buying up MBS at these mid 7.5% rates and will double down at 8-8.5% if that is “allowed” to happen.

Of course all of it is ETF with low fees so can dump instantly if necessary. Investing is gambling, yet the Fed and Govt make it much more predictable nowadays. Could they “walk away” and let capitalism happen? Sure, yet unlikely our Santa Fed or vote buying Govt will let “the system” fall apart in an election year of 2024.

So place your bets gamblers…um, I mean investors…HA

Check out Raisin, gives list of 5 star banks/credit unions with over 5+% rates on savings and CD’s. I refer to Raisin daily for updated institutions and rates.

local CU has 12 month at 5.24%

Meanwhile, Fidelity is currently paying 5% on any spare cash you leave sitting in your brokerage.

Wife and I are trying to keep a 20k balance for emergencies, but every time we hit 5k above that, we’ve been throwing $5,000 increments out of our credit union into Treasury Direct 1-month bonds, rolling them over every month at 10-day increments. Every ten days if we need $5k back, we stop the rollover. I want to say they are earning near 5%, but I haven’t looked this week.

The point is there are OPTIONS now. We don’t have to tolerate BS low rates on our money any more.

Hey Sacramento:

Like Wolf said Wells does have good rates on CD’s, I have a 15 month at 5% that I got in Feb 2023.

Purchased a Wells Fargo CD through my Schwab account this morning maturing in June 2024 and yielding 5.3%. Non-callable. Chase is offering callable CD’s at a slightly higher rate.

Brokered CD’s are the way to go…

Agree 💯

Plus the US Treasury isn’t known for secretly opening new accounts under your name to hit idiotic sales quotas.

Why do you think asset prices – stocks and real estate are staying high?

Stocks – because companies are able to pass on inflation? Inflation good for companies?

Real Estate – gravity needs to work sometime. Even with the marginal buyer and seller?

True question is – when will the highly levered part of the corporate sector throw in the towel? Why has spreads not reflected that? When will the credit event take place that crashes the party?

Stocks are already down from their peak at the end of 2021. Many of them a whole bunch. Slow process though.

The national median home price is also down a little. In some places, housing is down a lot. An even slower process.

I’m waiting for the Magnificent Seven to crack. Very close now. Still holding key levels. Nvidia Aug 23 report should be interesting – AI hype on steroids. Once these seven stumble, the traders will short the s*** out of it. Pardon my French.

Shorts create a floor on prices more often than causing stocks to fall. Any stock *without* shorts, look out below!

Exactly this. If all you look at is the indexes, you’d think the rising tide has raised all ships, but it hasn’t. The return to previous highs (a week ago, bounced off those highs pretty hard) are almost entirely on the backs of 7 hype tech stocks.

Real great indicator for economic health, there. Let’s hope the technology that is supposed to put people out of jobs pays off so we no longer have customers for our generated goods and services!

I recall the late 70s and1980s when my passbook savings account paid 5% interest. I bought a 3 year certificate that paid me 13%. I don’t get very excited about these so called high interest rates being paid to savers in this modern era. Paul Volcker was the good guy to the working class in the 1980s and a thorn in the side of the financial oligarchy. My perspective of financial doings comes from the working class or rank and file and not the corporate elite or their press or management’s point of view.

Interest rates were capped a few decades ago, we will never see high interest rates being paid to savers. Interest rates have been climbing since last year but interest rates paid to savers has lagged behind. This tells me the banks are being stingy to savers but are raking people over the coals if they borrow.

I parked most of my retirement nest egg into short term 5% CDs and i-bonds to try to cut my losses in this inflationary world.

There is an inverted curve on interest rates with the best being short term. Are the banks being cautious to a recession like the fearful have been floating around??

monk – your last paragraph is a true jewel in the lotus…

may we all find a better day.

traders have already put down their bets. hedge funds have heavily shorted long term Treasury rates and some stocks. this mess is going to get much worse.

speculation in real estate will be the biggest problem. there are people who are buying homes in places like southern california right now at prices higher than the past peak. i see 50% downside as a minimum for many home prices. there needs to be real pain in the economy for distressed inventory to put downward pressure on stocks.

Agree on Nvidia…man, those slicksters eased from the quiet-but-actual-moneymaker (chips for AltCoin mining computers) into the AI-vapo-hype without a blink of an eye.

That’s the corner that insane PE stocks paint themselves into – there “always” has to be some “revolutionary” product just around the perpetual corner in order to justify the fever-dream growth rates implied by PEs greater than 25/30/45/100+…so they gotta go on CNBC to hyperventilate…and pay media shills to hyperventilate on their behalf.

Slotsve, your memory of Volcker as a friend of the working class is faulty — he is reputed to have kept a slip of paper in his wallet reminding him to crush labor.

How about commercial real estate? Will this be an economic downturn that may assist long term rates (mortgages/10 yr treasury)?

Real Estate prices will not drop significantly unless the average person’s economic situation changes and more private sellers feel pressure to sell. For now there’s too little inventory and present homeowners historically low fixed mortgage rates are still tainting the well water.

I think you’re absolutely right. The Fed also has itself to blame for this “locked in” effect with 2-3% mortgages- especially with what it did with MBS purchases 2020 once COVID hit.

I know a lot of people complain about the locked in effect. But if you were able to get a 2-3% rate, you should be very happy. Once in a lifetime rate IMHO.

Refinanced my 30-year 5% mortgage (that I had put 11 years into) to a 2.375% back when I worked for a mortgage company as an MLO, but we’ve been paying the OLD payment – $1550 on a $1100 monthly bill – so as to pay down early and recoup the 11 years lost.

$1100/month on a colonial with finished basement, updated kitchen and baths, on 1/5th acre in the Baltimore suburbs? I’d be INSANE to sell/buy into current rates. I’m also very happy to live here for a long time, though, so not your typical homeowner.

I thought the same in 2008 2009.

The current price levels are absolutely not sustainable

Something has to give in

Lets wait for few quarters and see.

The recession has not even started and may not start for next few quarters but its coming unless normal economic cycles are canceled

Even when adjusted for inflation, housing prices continued to rise from 1976 to 1980, a period when interest rates were only going up. After that they only dropped about 9% over 6 years (in real terms) and only because a mortgage was 17% in the early 80s

Stocks are off ATH because earning were essentially pulled WAAAY ahead in 2020 and derivatives are driving price action.

Sovereign debt doesn’t matter to governments. They aren’t setup for anything but short term vote grabbing which means austerity is not even considered.

Yields are headed up because of the extraordinary pressure on U.S. labor. Germany is literally a cold winter from complete deindustrialization. They do not have enough LNG capacity to support their energy needs nor do they have enough storage capacity to make the billions in renewables they have invested in while shutting down their nuclear plants viable 100% of the time. Germany is the economic engine of the EU.

Go further: China likely has 50% youth unemployment of recent college grads and their debt situation is worse than Greece with their real estate situation.

So you have reshoring and near shoring pressure on the US which already has no real available labor. This will re-accelerate inflation in the states as wage prices rise.

This is really fascinating to watch tbh. It’s an unstoppable object running into an immovable force. It’s just taken the bond.and equity markets over a year to sober up from drunken QE stupor for reality to hit. And the pullback is going to strong enough to shake out the weak hands so the big boys can start driving things higher again.

All with inflation likely going back up over 4% again before year end, if not higher.

Messy headwinds 1-5 in Wolf’s article make TIPS interesting as a port in whatever storm develops — but what rates and what maturity? 1.9% (over unknown inflation) on the 10 year is near 10 year peak…

Any thoughts?

TIPS are indexed to CPI-U. Don’t expect that to be very high in the near term.

TIPS? I do not like them Sam I Am. For starters, they only pay off relative to ordinary Treasuries to the extent CPI increases exceed expectations. Expected CPI is already priced in … much lower base yield. Next the entity doing the paying gets to determine how much; the pressure to suppress the CPI is enormous. They’re also more correlated to stocks than ordinary UST, undermining their diversification value.

Most people are better off using a mix of ordinary UST and global stocks … stocks for inflation protection and Treasuries for nominal ballast. Throw in a little commodities for more inflation protection.

Thanks Finster. I do appreciate the Dr Seuss reference!

“10-year yield closed at 4.28% today” beautiful 😁😉

Don’t sell out for pennies. Inflation is set to run in the 4-8% range as far as the eye can see. The Fed is going to fund government deficits. There really is no other viable option, given the room full of whiners and crybabies who run the show.

This is really good news. Having lived through a variety of times and inflation it does seem that we are a little low on the mortgage interest. Definitely should be at 10% like the end of 1980s early 1990 when inflation was cooling; however, it doesn’t seem like we will need Volcker’s 13 to 14% mortgage rates. Definitely should make sure “creative finance” is outlawed this time around.

So, we may well be at the ‘holding one’s breath’ point in time.

As some of us have been doing since the repo crisis of, i don’t know, 4 years ago…?

The housing bubble popping…getting so close now…

It’s the suspense that get me! – BB

The suspense is terrible. I hope it will last! – WW

“Mortgage rates today rose to 7.34% for the average fixed-rate 30-year mortgage, according to the daily”

There is still massive Consensual Hallucination among used house sellers.

Michael Bordenaro (YouTube) visited a guy in SoCal who is trying to sell his house for $3.75 million. You can sort of see the ocean far away from the porch, but it is not on the beach. Been on the market for months, and seller refuses to drop the price.

Seller bought it in 1987 for $237,000.

The entitlement of used house owners is at epidemic levels. The ideology of endless house appreciation is deep seated and has created something similar to market collusion amongst house owners. You have to wonder when and how that will pop.

Saw that video and I totally agree about the entitlement part. It’s all about passing the bucks to the younger generation and they cash out. I have no sympathy for these people if they end up losing everything. Be realistic and cash out at $2M or $2.5 which he already said has gotten offer before but nope, be just a little less greedy apparently is like asking them to chop off their legs…

My father likes to say “Your first offer is usually your best offer.”

By that he doesn’t mean that you won’t necessarily get a higher offer… but that it may take a lot LONGER than you think for it to arrive. And you lose the chance to seize a lot of opportunities in that time.

In the car business, we used a similar term:

“Your first loss is your best loss.”

Yeah he says that too. Same idea. Don’t dwell on a perfect solution that may never come. Move quick and move on.

Know several people who recently bought the second house with proceeds from the first house. But the first house is not sold yet.

That will not end well…

If the first house was not sold, then there couldn’t have been any proceeds right?

Unless those “proceeds” were a variable rate HELOC…

Well put & good example! I too wonder when the teflon bubble will finally pop, in all of it’s rigidly stubborn toxicity.

Kashkari said “housing has bottomed and is now recovering” just Tuesday. The emperor has no clothes.

Buffett bought home builders

Haha so did he openly admitted to MSM his dear leader Pow Pow has failed at fighting inflation? Because you know they are gunnning for the wealth effect to bring down inflation and if housing already bottomed then they absolutely freaking failed…

What a tool…wouldn’t expect any less from him though

Why would housing have bottomed? It’s 100% higher than 2018.

In a normal cycle it would never have gone up this much. And inflation is responsible for some of the increase but the rest of the increase is due to rampant speculation.

Like wolf just said “Assets fall in this environment” or something to that effect.

Don’t cry if your house loses $150,000 in equity. It never was real.

“Kashkari said “housing has bottomed and is now recovering” just Tuesday.”

These people are a cancer upon society. We need a totally new model, because this one is broken. These people are crooks who are intentionally destroying the standard of living of the masses.

He’s the one that wants to keep hiking rates, LOL. For him, that’s more rate-hike ammo.

Then what was the point of his statement?

Homebuilders are one of the best sectors of the stock market this year.

There is no inventory. People still need houses.

Poor Private Equity titans. Hard days ahead for them! (Of course, they’ve taken to siphoning off insurance premiums into their deals…and that looks to grow).

There are rumors about heavier QT as rates get cut a bit…..which only strikes me as funny b/c Fed rate hikes coincided with a lot of fiscal stimulus. A lot of “yes but no” “brake and accelerator”……

The great bong bull market will never end, too many stoners!

This joint is rough on us stoner investors. Have a heart, we stoners like TIPS now and also look forward to a 5% 10-year.

Currently struggling with the mortgage rates going up and assets refusing to go down. Partner and I make decent coastal money in the Midwest. Have our eyes on what could easily be a forever home, but the price vs 7+% pushes monthly payment, and lifetime interest, higher than I like. Even if we can afford it, I’d feel so bad if we miss-timed.

But on the other hand, even worst case scenario we still afford it. Real tough to make that decision, cause no guarantee the price drops, or who else is watching the house, or it doesn’t just get pulled off the market.

Patience.

I would advise you to grab it while you can. Forever lasts for a long time… inflation does not.

-You can always adjust the mortgage payments by refinancing once inflation subsides. Moreover your INCOME is likely to rise with inflation.

-You can NOT always find a “perfect” house

-You CAN always drive past that house after someone else buys it thinking to yourself “We could have bought that house back in 2023 for just XXXXXX dollars.” I have been in the car with my dad for decades as he plays that game of regrets. It is excruciating… and “forever” lasts a long time.

-You CAN always sell it if it doesn’t work out.

Are you a Realtor? Even been under water on a mortgage? You CANT always “just sell it”.

“You CANT always just sell it”.

Sounds like you have some personal experiences with this.

If you pay, let’s say $600, more today for that house you want and “can afford” today….buy it. That $600 additional amount is not forever. So let’s say you pay a year worth higher mortgage ($7200 a year total)…that’s peanuts when you compare and take into consideration what you already know. Do it! No regrets if affordability is not an issue. Or maybe just give back the lease car payment (some have).

No I am not a Realtor… but my mother was for 25 years. Does that count?

And of course you can “just sell it”… you may not be able to sell it for a PROFIT… but in a functioning market there is always a price at which a home will sell. The only three times in my 58 years when that has not proven true was the 2007-2009 Great Recession, the S&L meltdown in 1989-1991, and the oil patch meltdown in 1985-1986. All were short-lived and for the most part local in nature.

If you are willing to ride out those brief times in history because you have TWO “coastal incomes” while living in the Midwest… then you will probably come out fine by seizing the day and buying your “forever” dream home. Just keep making the mortgage payments until the crisis passes.

SpencerG,

Your advice violates a fundamental tenet of finance. Time value of money.

Riding it out and breaking even after 15 years is a total disaster from a financial perspective. During that time, others have doubled their wealth, so your piece of the pie has shrunk considerably.

A home is a person’s largest investment in most cases. Why would you choose to disregard purchase price?

Bobber…

First off, Time Value of Money is an economics principle… not a Life principle. It has no Value when Time has no meaning. The original poster said this was to be her “forever home” which means that unlike what you (and my mother) say… it is not an investment but a sanctuary against a maddening world. A place of Happiness. Like a woman’s wedding ring it will NEVER have monetary value because she never intends to get rid of it.

Secondly, where did you pull fifteen years from? It is hard to find a time in American history when housing prices declined for fifteen MONTHS never mind years. Sure, if such a nightmare scenario happened then perhaps she will regret buying her dream/forever home. But it is unlikely to be the case and if so not for very long.

Lastly, IF the housing market did decline for fifteen years then NOBODY would be doubling their wealth in that time frame. If keeping up with the Jones’s is that important to you… don’t worry about it… you will be shoulder-to-shoulder with them.

In short, a “forever” home is not an investment… like the wedding ring it is something you spend money on to add to your Happiness. And if you are not willing to seize such moments when they come along then you are likely to live an unhappy life.

“once inflation subsides”

I wouldn’t be so sure this happens… I’m currently on the other side of this trade, fwiw.

Unless it’s really different this time, or you have a ship load of money, hiztory predicts patience is in order.

Everyone wants to compare this inflationary period with what Volcker faces in 1980… they need to compare it instead to what Greenspan faced in 1990. We may not get back down to 2% but getting back down to 3% to 4% is pretty much a given. The only question is how long…

Monkee, I hear you. If it helps, we are having a melt up. i.e. people are slowly but surely getting used to high rates and they are going to start paying these prices for homes which may even drive prices higher over the next couple of years, giving the “building as fast as we can” developers time to completely reach the status of being overbuilt…until we have one of those recessions that you don’t just hear about, but you can feel. It cycles down then. Quite a long time to wait for it to bottom. Tough call, but you can buy the forever home now if you can afford it, sock away money if you can afford it at the same time, buy a rental/investment property at the bottom, sell near the next peak (residential cycle is a loong one) for a small fortune in profit, and pay off the majority if not all of your forever home mortgage. (during that 15 to 20 years, maybe rates came down and you refi’d) Easy, right? ;-)

Additionally, if you don’t want to be a landlord, pay forever home mortgage down rapidly until you can refi at an easy to make pmt.

I was watching a Berkshire Hathaway annual meeting video a while back… Charlie Munger was asked “When is the best time to buy a house.” And his answer was something like, “The best time to buy a house is when you need a house.” Buffet’s answer was pretty similar so long as you are able to comfortably afford it.

It really comes down to how comfortable you are with the payment and how long you plan to stay in it. People who bought their “forever home” at the height of the last housing bubble, but kept their jobs and where able support the payment through the GFC were largely fine by 2014-2016 l, great from 2016 to 2020, and are in spectacular shape now.

We do all kinds of things in the U.S. on large scales. We buy big things, we grow huge amounts of food, we’re still a giant manufacturer… But where we really go big is money printing, one way or another. Look at the graph of our money supply over the decades. It only grows, and the value of the dollar only drops. There is no decade post-WWII in which house prices didn’t multiply. The median price nearly tripled in the 70s and then doubled again in the 80s despite double digit mortgage rates. So we will continue to print over time, because it’s all we know. Asset prices follow.

If it truly is your “forever home” (by that, I mean you plan on living there for a decade or more), AND you can afford it at current rates, then buy it. If rates stay high, fine. If they go down at some point, then great! Refi at a lower rate then.

The best time to buy a house was 2013.

A perfect house is a “Forever Home” and it does not matter if you are underwater while owning it as long as you have planned ahead and can afford it. Historically, keeping the house for 10-15 years has ALWAYS shown a profit.

If you buy your forever home now and can afford it:

1) You have a guaranteed fixed housing payment for 15 or 30 years. Historically, you will not have this guarantee if you rent. The opposite is almost guaranteed.

2) If rates go down, refi to a lower rate. You win.

3) If rates go up, be very grateful for your locked in rate. You win.

4) After you buy, stop reading housing blogs and housing prices and just enjoy your home. Prices do not matter anymore because you are in your forever home and I guarantee you will be above water within half the time of a 30 year mortgage.

Absolutely do not buy a house now as an investment with the intention of moving in 2-3 years. That is when you will likely lose financially.

The other way to massively lose financially is to foreclose. I had several friends who did in 2010 and they are still trying to recover. Have a nest egg to prevent losing the house.

Howdy Folks, aint this fun??? Really is for this old timer… What a mess to unwind before our very eyes. But wait, this will take years to unfold……

Yeah, it is better than the last time around when I had just graduated from high school in the 70s and didn’t have a clue.

At least I have a clue now and fiscal policy is keeping young people working unlike the 70s era and when we had 4 recessions and inflation was a way of life… This is better than that…

Looking forward to tomorrow’s 4-week T-Bill auction to see if the short term T-bill yields follow suit.

The term spreads are friggn incredible, like the us10y-us2y. It seriously is frightening how these types of spread ranges are behaving now, and how long this is dragging out. I’ve recently been watching the 30y more lately, because of the stress banks are under, as these prices drop. The current price on a 30 doesn’t get this low very often, so we’re in a pretty complex when yields to maturity are higher than face values. The last time this stuff was this twisted was at the epicenter of the GFC — or back to the 90s.

Oh but wait, even during those heightened crazy stress blowups, the budget deficit was microscopic and we didn’t have all the excess fiscal and monetary distortions. The Fed BTFP is basically taking temporary pressure off banks and the FDIC, because literally everything is screwed up. That bailout program is becoming far more popular with lots of banks, as these yields drift higher.

My ridiculous, uneducated, wild assumption is, we’re about to see major mergers and consolidation of lots of banks, in addition to significant earnings revisions and more ratings downgrades.

As all these yields higher, this literally cannot continue very much longer imho, but maybe this time is different and that infinite amount of cash being spent by consumers will save the crashing economy?

“we’re in a pretty complex when yields to maturity are higher than face values.”

For institutional Investors, you have to take into account the hedging costs. Look at CDS, with more downgrades of US debt right around the corner.

For international Investors you have to take into account hedging the FX risk. Even with these extremes, they are still losing Money in US debt and are exposed to a nasty surprise in the Dollar. These sqeezes can get really ugly fast.

The only thing keeping this House of cards from collapsing is that US debt is still Tier-1 as collateral. So is Gold, but without any FX risk and much less volatility than US debt (look at the MOVE. This is crazy).

One of these days someone will do the math.

As long as enough people share the hopium bong, the hallucinations will continue..

Beg4mercy,

“The current price on a 30 doesn’t get this low very often” —-

In the Voelker era my father’s friend went big into the long bond when Voelker had the fed funds rate up near 20%.

This retired judge bragged on that for the remainder of his life.

bragged…

And rightfully so even if it hard on the rest of us.

Something similar for me. In my home town Schwab had one of those electric signs in front of their store flashing the rates. Saw those 20% rates every lunch hour. “No brainer” says I to myself. But I was a poor young adult and couldn’t afford to do anything about it.

I feel like I’m about to be given a second chance. Maybe they won’t get up to 20%. But 15% or even 10% would make me feel giddie!

RedRaider

I feel the same about the opportunities (and risks) at this juncture. I think having lived thru the 70s gives an edge.

I am more of an equity guy but I would would be paying a lot of attention to long bonds yielding >10%.

RedR and Thomas Curtis,

The circumstances that would bring about 10% long yields would make you think twice (thrice…and, well, lots more times) about buying. It’s not like the 10s/30s would just spring up to that level with fundamentals that resemble today…

Atlanta is predicting Q3 GDP growth at an annualized rate of 5.8%. This is a monster forecast that may or may not last as new economic data comes in. But analysts have also been revising their projections upward, from 0% in June to 2% now. In any case it’s clear the economy is still extremely strong.

Ain’t inflation great? Everything goes up! Higher for longer!

GDP growth rates are adjusted for inflation

Good thing that debt ceiling limit was suspended so they can deficit spend their way to positive GDP

Not adjusted for .gov spending though…

The ATL FED overstates GDP 80% of the time. It is a totally worthless indicator.

I googled on its accuracy and it seemed about as accurate as most professionals.

Where is your data?

As accurate as most professionals does not give off a lot of confidence. It actually helps to make my point. Go on their website and compare their estimates throughout the quarter to their final estimate. Their track record is horrendous.

Their 5.8 is probably based on a report or two that no doubt will be revised downward. If GDP was based on just those reports then it could be 5.8. Point is, we are not growing at 5.8. Larger point is that people quote the 5.8 as if it is realistic. It is not.

TheTenYear,

“As accurate as most professionals does not give off a lot of confidence.”

It is all we have. Every statement of GDP is an estimate. If 3rd GDP only comes in at 4% it is still a strongly bullish indicator.

So far I haven’t seen data supporting your statement that GDPnow is worthless. I would bet that is because you have none and any you could find won’t support your assertion.

Thomas Curtis,

I told you exactly where to go to find the data to support my conclusion. If you can’t find the data you have not looked.

“Go on their website and compare their estimates throughout the quarter to their final estimate”

GDP NOW says 5.8% growth. I say it won’t be half that. You say 4%. Let’s see who is closer, me, you or “the experts”.

Yeah the ATL Fed numbers have been off by embarrassing amounts year to year and quarter to quarter (and checking on some of their own updates we didn’t see a number like that anyway), as in multiple percent revised down. We struggled to get around 1-2% growth in Q1 and Q2 (after it dropped in Q1 and Q2 2022), propped up only by still heavy government spending stimulus from COVID and the spending bills and a tail of consumer spending. Which includes healthcare bills so that’s not really a good thing either. And the spending was still high but already showing slow-down in May and June, withdrawal of more pandemic stimulus and high debt levels, more than $1 trillion in credit card debt and esp auto loan levels going bonkers. But anyway not seeing these ridiculous claims anyway, most of the indicators are saying as expected, 1-2%. Unless ex. early surge in student loan re-payments as they come due, CRE crash, big drain from the Treasury auctions, bigger hit from the pandemic stimulus withdrawal or just the delayed (but now starting to hit) effects of the rising yields even bring it into slightly negative territory with hits in August and September.

Keep them rates nice and high Pow Pow for very long, I sure do enjoy my money in Tbill paying my rent now. Sure I won’t get that high from seeing my home value still up on Zillow like my friends and family like to brag about but then again I am ok with not paying half a mil in down payment and still pay 2-3K more compared to rent. The math sure is hilarious though, especially when you see non-RE people telling you buying is still cheaper and better..lol

Cherry on top would be to see home prices and overvalued asset come down then again this inflation has prove to be sticky and wealth effect still well and alive and everyone still a drunken sailor so I am not holding out my breath.

You’re right, the math has completely flipped.

Even if you paid $400K in cash for a house, you’d still owe $500 / month at a minimum in property taxes and insurance.

With 5.4% T-bill yield on $400K and the $500 / month you save, you can rent a luxury apartment or townhome for $2,300 / month.

$400K down payment? Cue the bronx cheer. Pretty paltry stuff…better keep saving!

But on a serious note — it’s these kinds of ez-kum/ez-go gambling winnings still waiting on the sides that will need to jump in and get flushed from the system for any kind of organic price discovery in used housing to occur. Years to go in most markets, I suspect.

Luxury apartment for $2,300? Where would this apartment be?

Luxury as in luxury vinyl flooring.

Barstow, CA

Western North Dakota and eastern montana what we call “sleeping rooms” which are studio apartments which are rented by oil workers. These apts rent for over $2000/ month. RVers or campers are not allowed. Towing services are in Billings which is over 200 miles from the Bakken Oilfield. The oil boom is over. The drillers, derrick hands, and motormen are all gone now but the rents haven’t gone down.

We were somewhere around Barstow, on the edge of the desert, when the drugs began to take hold.

― Hunter S. Thompson

Oh Arnold you beautiful quoting bastard!

The Bats Man!!

Vietnam?

@Bill Slotsve

Yeah that’s the worst part about this, these outrageous inflated prices are brought in for rents and homes in the Boomtowns but then when the boom goes bust, these crooks try everything to force prices to stay high. Including like you said trying to ban RVs or vans or even just cheaper housing from going up. The son of an old family friend did the North Dakota oil-drilling thing for a while and saw what you saw. Was a blast while he was doing it, physical and long hours but good work and great pay for a good while if you had the body to withstand the stresses. Interesting entertainment options with the traveling shows coming into town, great women to meet and date and build a nest-egg for it. But once the boom is gone it’s gone.

What these idiot landlords demanding such high rents don’t realize is that without the lure of the huge pay from the oil patch nobody’s going to pay even half that amount of rent to stay there. It’s like paying LA or Manhattan rent without the beach or Broadway nearby. And being fair it’s not like LA or NYC can afford that kind of rent either, jobs in general aren’t secure and just don’t pay enough for it. Debt levels were already increasing like crazy for revolving credit (more than $1 trillion for credit cards) and esp auto loans, but now yields are going way up. Another factor that hasn’t gotten mentioned is that those writers and actors strikes are really starting to bite across the country, another hit that wasn’t factor in before August. And very soon student loans coming due. Rents and home prices just have to come down to have any kind of realistic relation to what Americans can actually pay without going even deeper into debt.

Depends where you are.

I rented a 2br 2ba penthouse unit with a buddy for $2600/mo in Lowell MA, back in 2020-2021.

That said, the same apartment in Boston would easily have cost $4k+ and likely more now.

Gotta pay the price to live that big city life.

In my area a $2.3k gets you a tiny apartment in a crumbling building in a low income neighborhood.

But then 400k gets you a tiny house on a bad neighborhood all the same…

Geezus. Where (in general) are you, Nick?

I see a lot of For Rent signs around here, but they just sit there like mushrooms after a rainstorm. No-one biting.

Has to be manhattan right? Right?

Lol

Hey Nick:

In my area (SE Denver Metro) I am renting a 3 bd, 3 ba 2200 sq ft townhouse for $2,750/month with community swimming pool and all the yard work taken care of. No way I am buying a house now at these rates. I will park my retirement money in T bills at 5%.

Why do you people want to see house prices crash?

Envy?

Economic stupidity?

Houses are now a dual purpose entity. They are an essential good for the average person as well as an asset.

If you destroy both the ulility of the good to provide the essential service – being able for the average person to acquire a good that provide long term housing and at the same time reduce the ability to acquire some equity or wealth over time you destroy the basis of the majority of the people or the middle class.

Combined with an inflationary environment that destroys wealth and increases costs for ordinary people not able to use or access the tools available to the upper socioeconomic levels you are going to end up with a situation like in Germany between the war years.

And by the way the yield on those government bonds after taxes is paid is still not keeping up with inflation.

You are losing purchasing power evey day you hold them.

Destroying the utility of a house as an asset would change nothing about the utility of the house as a living space; in fact, it would make that utility more accessible to those who need it the most.

Houses do not appreciate in value. That is physically impossible. Houses always depreciate due to rot, materials falling apart, weathering, etc. Houses require constant maintenance so as to not develop gaping holes in the roof or to become a haven for rats, raccoons, and insects. Houses have inescapable expenses associated with them such as taxes and insurance. They are the definition of a money pit.

Sure, the materials and labor can track inflation so that, inflation is high enough, the nominal price could go up over time. But on a real basis, the house declines in value.

Sure, the hunk of dirt it sits on is technically scarce, but only in a very small portion of areas does the hunk of dirt carry a majority of the total house price.

We know that house prices have ballooned far beyond inflation for 10+ years, and it is not due to the utility of housing increasing, but purely due to an almost religious cult ideology of “houses always go up in value.”

Houses do not create wealth in any way or form. Once they are built, they just sit there. They do not create products. They do not create value-added services; they can only be rented out for a fee, like renting out a tractor.

Thus, when houses become an “asset” in the way they are treated today, they become a purely speculative play, like physical silver or Bitcoin. This enables all sorts of get-rich-quick schemes, and prices are driven out of reach for people who simply want to use the houses for shelter.

If we crash the housing market hard enough, and enough speculators feel the pain, then perhaps we can strip away housing as a speculative play for good and restore sanity to this essential human need, instead of rewarding the scalpers that currently infest the entire space.

Stripping houses as an “asset” would have nothing but positive benefits for society, as more people would have access to the most important function, which is shelter.

It would be the most direct, nondestructive, and wholesome form of social justice available – affordable housing for all, while wrecking the parasites of society in the process.

Carlos — thank you for your meter and shrewdness with your response here. Excellent.

“perhaps we can strip away housing as a speculative play for good and restore sanity to this essential human need, instead of rewarding the scalpers that currently infest the entire space”

I like that.

Unfortunately, even a hard crash would just bring new scalpers to the game at a lower basis level.

AGREE totally Carlos:

‘Purchased’ first house w help from family, worked very hard to fix and rehab, etc., and then sold for approx. 2.5 times ”buy price”…

Same house now ”priced” at 25 times first price.

CRAZY is as CRAZY does.

Without some serious ”legislation” to get ALL the bloodsuckers OUT of housing,,, ALL housing,,,

USA is going to continue on the long slippery slope to civil or, more likely, uncivil war similar to SO many other countries/nations/societies over the last couple thousand years.

Because we have been thru one spectacular bubble already. This bubble is almost 2x bigger than that one.

It’s not that anyone wants it to crash, they expect it to. Because logical people are realistic.

Some of us would like to see our children be able to afford a home. And pay less property taxes. Unless you are moving somewhere cheaper, increased home prices really don’t help much.

“Some of us would like to see our children be able to afford a home.”

Yep, hopefully without having to move 3 states away.

“Why do you people want to see house prices crash?

Envy?

Economic stupidity?

Houses are now a dual purpose entity. They are an essential good for the average person as well as an asset.”

You are no historian, but a crackpot economist maybe….

This is a fine addition to think about as yields drift higher:

“ The second trillion worth of balance sheet reduction is likely to have more of an impact. The first trillion occurred against the backdrop of the federal funds rate moving rapidly higher, and the second trillion matters more because it’s coming against the backdrop of a quicker increase in the pace of Treasury supply.”- The Rates Strategy Group at J.P. Morgan

Translation, from Wolf:

“ then 5% may not be enough either to entice enough buyers to absorb the tsunami of new issuance”

I remember when everyone and their dog were telling people that Bitcorn and dogcoin were hedges to inflation at US$50,000 and US$0.65-0.70 respectively.

Bitcorn is now at a decline at give or take US$28,000 and dog coin is at 6 cents.

Even still, Bitcoin at $28,000 is nuts since you are buying a bunch of 1’s and 0’s on a computer you don’t own.

Bitcoin is technically a hedge against inflation because it is intrinsically deflationary in nature: It has a fixed supply of 21M coins but some portion gets lost (literally) every year.

Most of the price, however, is due to speculation which means it varies wildly and trends with the amount of idle money people set aside for such “investments”.

you’re only talking about supply of bitcoin. But there is no need for it. Demand is purely speculative, to get rich quick. This kind of demand vanishes overnight, and already has. Bitcoin is down 55% against the USD, so that’s like the shittiest hedge against inflation ever LOL

To be fair, if you compare it against the US dollar since its inception, it has massively outperformed. That being said, BitCON and all crypto has zero intrinsic value. It is a gambling widget for suckers and con men.

Please tell it to those who bought it at US$60,000 in late 2021. What a great hedge against inflation at its current value US$27,500.

Tell them… That most of the price is due to speculation? That is, after all, what I already said.

A great many assets have valuations based completely apart from any intrinsic value. Original artwork, for example, isn’t worth anything intrinsically but people pay huge amounts for them. It’s certainly not because they’re nice to look at because you can buy a reproduction indistinguishable to most people for only a few dollars.

Bitcoin, despite being just 1s and 0s, cannot be duplicated/forged like artwork. Sure, anybody can create other digital tokens but they’re distinct just like creating a new fiat currency does not make it equivalent to a US dollar.

I don’t claim that BTC is a smart investment (it’s not) or that you should buy some (you shouldn’t). I’m merely providing some facts.

Wow you almost lost a new Tesla.

That blows.

In Europe in the 1700’s Tulip speculation was a thing.

Bitcoin is the same just no neat flowers!

Hahaha

Why did Bitcorn decline from US$27,500 to US$26,200 in a matter of hours?

What happened to the “muh hedge against inflation”?

Glad that I bought a tiny fraction for lotto money at C$70,000 in 2021 and sold for C$73,000. After the app did it’s Fx conversion and fees, I lost only $10!

When everyone and their dog tell you something is certain, run the other way fast. People say and do a lot of stupid S$$$

Just look at Vinfast IPO, even after today’s drop we are still at peak stupidity.

The reviews on the few cars they have sold in the U.S. are terrible, too. On another note, the first Fisker EV was sold this week for $309,000 to a sucker in California. It only took how many years to build a saleable car…10? (I said saleable, not profitable)

Here’s an angry man hoping the world ends so that he can break even on that bond ETF.

Investors put nearly a 90% chance on the prospect that the central bank would leave rates unchanged at its upcoming Sept. 19-20 meeting. Lots of I could have, should have, would have post COVID investors watched the opportunity of a lifetime go bye bye. The agony of having wealth in assets you have not sold, may be far greater opportunity cost if cash or capital is left not deployed. America economy is more resilient today, just as its people. I now believe anything is possible, one man single handily took over and entire political party back in 2016 and has not given it back to the plutocrats.

Hey Ohio.

Spoiler Alert: He is a plutocrat.

OSA-

“America economy is more resilient today, just as its people.”

Do these connote resilience?

– $30++ Trillion in debt and growing rapidly

– A brittle banking system that continues to be reliant on regular money infusions whenever cracks appear

– Rising rates as Fed attempts to stifle inflation

– Violent racial, political, socio-economic and ideological disputes

– Geopolitical fissures, including growing trade frictions

Please pass the kool-aid…

(Or was I oblivious to sarcasm?)

OSA…hey, look! They’re throwing free rolls of paper towels!…

may we all find a better day.

Everything is relative:

EU is better?

Japan?

China?

Russia?

Just because you are bad, being the least bad is a massive advantage.

Japan is much better in many respects and you actually have freedom of expression too.

Who would have thought that people in Japan would be able to express themselves better, more freely and without being cancelled compared to the US….

Freedom of expression in Japan?

Pm Abe sez Huh?

Great! Distributions matter,

Great article. A trip down the elusive Memory Lane, that happens to connect our current location of Oz, all the way back to Kansas, and with just a few clicks.

The housing market is stalled imo (not finished) because actions that discourage credit expansion i.e. mortgage loans, are a principal policy lever of the Fed. Given that the US money supply is shrinking now, at some point prices will have adjusted to the higher quantity of money in circulation, whether thats accompanied by a recession or not.

Crucially at this point, interest rates will be relieved in an environment where wages that underpin mortgage affordability are permanently up i.e. house prices -might snap back up more dramatically-.

I see skittish sellers in a rising market the same as skittish buyers in a falling market, but as long as the seller can come some way to meet what are going to be temporary affordability constraints, then why not consider now a good time to buy? At peak credit repression.

My guess is that lots of persons in their 30s and rising 40s are seeing reasonable wages and job security for the first time. Like you I suspect/worry that it won’t take much cut in mortgage rates for a lot of them to go househunting. I may be biased toward anxiety about this since I want to buy, too (but not with the current “frozen” state of the used home market).

Why would the fed ever lower rates again?

We’re in this inflation problem due to low rates.

They do not to throw low rates on the fire.

gponym,

More important than interest rates is price. Rates go up and down and when down you can refinance.

But if you overpay for your particular housing market it can be a costly mistake.

Who knows, rates are already a lot higher than we had imagined in March 2022, when the rate hikes finally started.

Uh no… I have been expecting the Fed to take the Fed Funds Rate up to 6 percent (to 6.5%) this whole time unless inflation got seriously out of control in which case they would have to do a Volcker and go MUCH higher. It doesn’t look like inflation will explode at the moment so the Fed will still inch higher this year but will let Quantitative Tightening keep the pressure on the economy going forward (after rates reach that level).

If banks were wobbly with a 3.5% Ten Year….what now?

Seems we are on the brink of bank downgrades and worse.

I will say it again,

Yellen’s decree to cover ALL deposits was the most important and far reaching move by one person in the history of American finance.

Limits on insurance for deposits IS a form of market discipline, and she, having no concept of free markets and the like, dismantled the concept.

This is a step, whether intentional or not, toward a Nationalized Banking System. And with the bailouts coming, MORE inflation.

“Yellen’s decree to cover ALL deposits was the most important and far reaching move by one person in the history of American finance.”

“We will never have another financial crisis in our lifetime”

Janet Yellen

…I vaguely remember similar statements being made around the time of Glass-Steagel’s repeal…

may we all find a better day.

…of course, those who said that may have expired shortly thereafter…

may we all find a better day.

Ol’ Yellen’s got a penchant for magic mushrooms…who knows where her mind was/is whenever she made such expansive declarations.

But the shareholders still get wiped out if a bank collapses

Yes, that’s the way common stock works. It should be a known risk to the buyers going in.

The Fed may not need to raise rates….as the flood of Treasuries for auction and the QT will likely serve the purpose…the old and forgotten “supply and demand” concept.

Hopefully, this will put a positive nature to the yield curve and absolutely destroy the Fed’s “Force” investors to the markets with suppressed long rates idiocy.

Since the end of WWII structural inflation has always come in three waves and lasted about 10 years. The first wave of inflation is coming to an end now, but the second wave of inflation is worse than the first wave.

1940 -1952 and 1967 – 1983

https://www.longtermtrends.net/real-interest-rate/

Don’t care about the cause and effect, WWII, OPEC, QE, SPR, $1T deficits, demographics, etc.

The bill is coming due and it will be paid through much higher prices for things we all need and I’m not talking about an Apple phone.

BlackRock says full employment-stagflation for the next year and then probably increasing growth especially once China gets back on a firmer footing.

Larry Summers says he sees the 10 year yield averaging 4.75% for the next decade because of government deficit spending.

GDPNow predicted 5.8% growth for the third quarter the other day.

I think this is the time to own things that will increase in value with inflation. For me that is A Rated companies that produce things the world needs.

This reminds me of the seventies except we have deficit spending now (industrial policy) which is keeping us out of recession. I think we are going to inflate our debt away.

We also have a shrinking labor force which is inflationary.

“inflate our debt away” by taking on more debt and also at higher yields? That’s now how that works…that’s a debt spiral and won’t end well.

Labor force is not shrinking…more people are working. 167m people. https://wolfstreet.com/2023/08/04/powells-nightmare-wage-growth-after-signs-of-losing-altitude-re-accelerates/

Z33,

Yes we will be inflating much of our debt away if the 10 year yield averages 4.75% for the next decade as Larry Summers predicts. Most of our debt was borrowed at much lower interest rates so we will retiring it with inflated dollars.

The labor force will be smaller over the medium and long term because boomers are retiring and dying and this is inflationary. The labor cohorts following the boomers are not as large.

Finally, with deficit spending on industrial policy we are bringing home more and better jobs so we will have more taxes collected and fewer recessions on average going forward.

Bet on inflation and good companies that make stuff the world needs and have the associated pricing power to beat inflation not money markets or bonds.

China just stopped releasing youth unemployment rates. That’s how good things are going in China.

re: “GDPNow predicted 5.8% growth for the third quarter the other day.”

It’s a blowoff.

Summers? Really? 😂

Yes Summers. I have made a lot of money by listening to Summers since 2021 😛.

What earnings multiple are these companies’s stocks trading at?

IMO the issue with your thesis is the stock values can still go down, even if the companies themselves are solid. I don’t see Apple or Exxon or JNJ going out of business anytime soon, but wouldn’t buy their stock right now.

I too think inflation (and interest rates) will be higher for longer, but my trade is to short long bonds.

The real story is going to be with the 30 year bond. And it is starting to reflect world dissatisfaction with the US and its cronies.

This stance is negated by the DXY trend and the fact that the EU is committing energy suicide (at least the economic engines of the EU), JPY is about to tap out, and China is a disaster.

TINA applies to entire countries too.

Remember this, back in 2020:

“ the Board has reduced reserve requirement ratios to zero percent effective on March 26, the beginning of the next reserve maintenance period. This action eliminates reserve requirements for thousands of depository institutions and will help to support lending to households and businesses.”

Heard an interesting interview yesterday about how there’s an indirect price we’re all paying , he calls it an inflation tax. Apparently, these bank reserves are not taxed, much like the cash in your pocket.

I’m still scratching my head on this, but the topic is fairly critical, because these nice higher yields, connected to the deficit, point to to the reality that our country will have increased difficulty servicing our debt. Some may recall the recent sovereign downgrade — which connects to all the pandemic fun and current bank downgrades.

This is complex and serious stuff.

Here’s the dude talking about this issue, seems a bit tinfoil hat like, but an interesting rabbit hole:

University of Texas at Austin’s Director of the Center for Politics, Economics, and History, Charles Calomiris about his recently published paper “Fiscal Dominance and the Return of Zero-Interest Bank Reserve Requirements.”

In response to your good comment b4m, I can only repeat the words of wisdom from Wolf, OR more likely one of WE, in this case WE the commentariat on Wolf’s Wonder that I hope all on here support with donations at least as much as I do:::

Just saying the following comes from commentariat because Wolf is, usually, more circumspect w. re liability, etc.

“The FEDERAL RESERVE BANK of USA” was initiated and has been maintained for ONE REASON, and one reason only: DEFEND the banks that own it.

Any other propaganda that suggests otherwise ”SHOULD AND MUST” be considered just more of the bull pucky.

Good luck and may the Great Spirits help you find your way,,,

I appreciate your comment and hope that I’m not drifting into anything perceived as divisive, rude, stupid or pointless.

I just found that dude’s paper, published at the

St. Louis Fed site,, therefore I assume the underlying seriousness of his concerns are legitimate and worthy of consideration.

I posted that, because I think there are consequences relating to government debt, and as much as I’m thrilled to get a few extra bucks from my money market, there is legitimate reason as to why the USA has been downgraded by two ratings agencies.

The paper in question is complex, as is the plumbing of the Fed and Treasury and their interconnected obligations to our nation.

The entire topic probably is not something for this venue, so my apologies to Wolf or anyone that feels that’s inappropriate.

Beg4mercy,

I think you misunderstand what reserves are.

Reserves have nothing to do with taxes. They’re not income. For banks, they’re an asset. For the Fed, they’re a liability.

Reserves are the banks’ cash that they put on deposit at the Fed, and the collect interest from the Fed on these deposits. The Fed calls these deposits “reserves.” The banks on their own balance sheets call them “interest-earning cash” or similar.

Reserves are instantly liquid. And as long as a bank has enough reserves (= cash on deposit at the Fed), it can withstand a “run on the bank.” If the bank runs out of reserves (cash) amid a run, then it has to find cash somewhere else, either by selling securities, such as Treasury securities, or by borrowing.

The reserve requirement was 10% before it was lifted. That meant that banks needed to keep 10% of the money they owe their customers (their customers’ deposits) at the Fed, so that they would have enough liquidity to pay their customers when they start yanking their money out via large-scale withdrawals.

A reserve requirement to 20% would have likely prevented the collapse of SVB.

Reserves at the Fed amount to $3.22 trillion at the moment. That’s a lot, a lot more than a 10% reserve requirement would produce.

The problem is that some banks have few reserves and others have a lot, and it’s those with few reserves that are at risk if there is a run.

A 20% reserve requirement would amount to something a little over $3 trillion, about the same as now, but EACH bank would have 20% of their despots stashed at the Fed for instant liquidity, which would make for a much more stable banking system. But banks rebel against it because it can cost them revenues.

What your source meant: Lifting the reserve requirement made banks more unstable, and more subject to runs, and therefore more subject to public bailouts. So it’s going to be public money (taxpayer money) that may bailout the banks because the reserve requirement was lifted. And in that sense, lifting the reserve requirements imposes a risk on the public, and if there is a bailout, it would be a form of a tax on the public.

Wolf, you are correct that 5-6% rates in the nineties were not bad because asset prices were relatively cheap. I would add, 5-6% was cheap relative to rates in the 70s and 80S.

Today, we have the exact opposite story. Markets are at all time high relative to interest rates. And rates are extremely expensive relative to the 2010s.

As you mentioned, the ten year hit 0.5% in August 2020, an all time low. Coincidentally, the markets soared as interest rates approached that all time low. It also took an all time low in the ten year to lift us out of the 2000 and 2008 bear markets.

Based on 2000, 2008, and 2020, it hard to envision sustainable new highs with interest rates at 15 year highs. History tells us that current market levels are not sustainable.

Markets are looking beyond the next recession and assuming the Fed will always do whatever it takes to keep asset prices high and debts serviceable. This interventionist Fed told markets time and time again that asset prices are on a path upward, with only brief blips along the way.

It’s a short sighted Fed, with zero sense of responsibility for the wealth concentration and generational theft it creates.

The Fed’s buying of MBS, and allowing home owners to lock in 30 year financing at 2.7% was extremely negligent. The Fed has done clear long term damage to younger generations.

No. MBS instruments only apply to low-end fully conforming loans and those rates were due to the very low yields on 10 year US Treasuries and not due to anything the Federal Reserve did or didn’t do. The Federal Reserve only even owns a small amount of MBS instruments and it doesn’t matter who owned those securities as respects the huge housing markets.

1. “The Federal Reserve only even owns a small amount of MBS…”

The Fed still holds about 21% of agency MBS (it was 25% at the peak). Total agency MBS ca. $12 trillion. Fed holds $2.5 trillion. That’s not a “small amount.” The Fed is by far the largest holder of MBS.

2. “it doesn’t matter who owned those securities as respects the huge housing markets.”

The Fed purchased MBS with money it created. It was a way of creating $2.75 trillion in new money and throwing it at the market by buying up MBS. This buying with newly created money pushed up asset prices all around and therefore pushed down yields, and lower yields on MBS translated into lower mortgage rates. That’s how the 2.7% 30-year fixed rate mortgage came about.

Good points 1 and 2, Wolf.

Would it also be accurate to point out that the Fed, by buying those MBS in a stressful financial period, “bailed out” the previous owner from whom they purchased the securities (perhaps a previously aggressive Broker/Dealer or bank)?

This adds the sin of “picking winners and losers” to the sin of manipulating market prices on such a large scale.

The roles and goals of the Fed should be re-examined — hopefully soon.

John H., I always considered the Fed’s actions of buying MBS to bail out the owners of the MBS and then keep buying them to not have them take on more risk. So an indirect form of bailing out banks…

The Federal Reserve has WARNED many times about overinflated asset prices and unsustainable US federal government debt.

It was not short sightedness on Fed’s part. It was all intentional.

DM: US Mortgage rates could soon hit EIGHT PERCENT – the highest level in two decades – as Fed considers further interest rate hikes

Economists have predicted mortgage rates could go above 8 percent if the economy continues to show signs of strength and the US Federal Reserve decides to raise interest rates again.

DM: Number of US millionaires drops for the first time since 2008 – as 1.8 million lose their status thanks to volatile markets

According to UBS and Credit Suisse’s annual global wealth report, almost 1.8 million Americans lost their millionaire status in 2022, leaving 22.7 million remaining.

What is the point of rising 10Y when there are very little notes issuance by treasury? Who are selling their existing notes at a loss, and what are they doing with resulting cash?

US Treasury issuance is now at record high levels as the US federal government is running around a $2 trillion annual deficit and needs to refinance around $15 trillion of debt on an annual basis.

Okay, Thanks.

Rates have been so low for so long I’ve found the younger guys you talk to over at Vanguard have never heard of the rule of 72.

I’ve never heard it in the casino market the last 20 years either.

With rates rising and the possibility of no frills, boring, pragmatic, sane, treasury / CD investing reemerging, perhaps this term will as well??

MW: This latest Fed GDP forecast has the U.S. growing 5.8% in the third quarter. No, really.

WAY WAY too early in the quarter for this to mean anything. We haven’t even gotten July consumer spending, which is 64% of the economy. It’ll move all over the place for another six weeks.

I guess I might have to shed a tear today for Glenn Kelman /s

I have been saying the last few months that the Fed Funds Rate today is about normal (5%), and the 30 year mortgage rate is about normal (7%), looking at averages 1971 to 2022 (there is much variation). Wolf also notes the 10 year Treasury is not particularly high. So it is no surprise to me that the economy keeps humming along. If the Fed really wants to get to 2% inflation (which I kind of doubt now, I think they will be happy with 2.5% to 3%), we are looking at rates much higher, much longer. Stuff is going to break. The Fed has already taken extreme measures to keep the banks afloat (apparently no limit on deposit insurance and BTFP). CRE is already broken. Stock market is starting to break, but it can be easily manipulated by the big players, for a time. “May you live in interesting times”, an old curse, perhaps Chinese.

“May you live in interesting times”, from WL,

not only a curse, though widely acknowledged as such in non local media, but even MORE likely ”a” or THE challenge from elders.

Fairly simple to figure out, and, so far, fairly simple to figure out that left branch of humanity now getting back together with east branch challenged far damn shore in spite of recent clarity due to increased genetics understandings of last couple decades.

Lots of fun to watch for those of us who embrace interesting times and spend lots of time studying similar situations past.

MW: Dow falls 300 points, Nasdaq loses 1.2% in final hour of trade as rising bond yields weighing on tech stocks

“4. A tsunami of longer-term Treasury securities.”

Yes, Treasury department is trying to front run the US10y rates. Very clever, meaning we will see over 6% yield soon, and then government will look clever, they will be able to spend more and borrow less? Well, it does not make sense. Eventually, they will be caught up and forced into austerity.

This inflation will go nowhere, unless fiscal responsibility ensues. Both fiscal and monetary restrains are needed to force services inflation to dissipate.

8% montages will slow things down I think. My son and his wife bought a 345K house north of Atlanta back in Feb. And got a 6.25% mortgage. They could not afford 8%. They are fairly typical as to income for their age and education. I think it will take 8% to “break” things which I think Powell secretly wants.

Big Short guru Michael Burry bets on market crash

” In late June, Burry’s Scion Asset Management fund purchased $866 million in put options against a fund that tracks the S&P 500, and $739 million in put options against a fund that tracks the Nasdaq 100. YTD, the S&P 500 and Nasdaq 100 are up 16% and 38%, respectively, reports CNN, and those put options will see him profit if the market sinks.”

who cares? he’s been right with his calls one time.

The financial media outlets are trying to ignore the situation, but their financial propaganda isn’t working. It’s going to get very interesting with respect to who will be buying all the upcoming treasuries for sale and at what price. Eventually, the Fed will probably have to increase the duration of the new treasury issuance. That’s when it’s going to get really interesting.

Hard to know if this thread is dead, but perfect place to describe my morning tea leaf experience at FRED.

I ran across a recent Bloomberg interview with Bill Gross, legendary for being wrong as often as right, and his hair still looks ridiculous.

Anyway, he suggest the spread between Effective Fed Rate and 10 year is too high, relative to historical norms. That’s really earthshaking news, considering the way rates have reason in a year.

Nonetheless, using FRED, that spread is about 1.2%, which Bill suggested that normal spread is about 132 bps, so, like, that seems irrelevant — but in context, the spread range we are in now, hasn’t been this extreme for decades.

Furthermore, the 10y-3m spread is inverted greater than any time since 1990 — and obviously the Fed Funds Rate is as high as GFC.

Meanwhile, the spread between 30y-2y is inverted back to 1990 lows and on it goes, take your pick of any spread, it’s showing recession like activity.

However, to another comment from Bill Gross, stocks and bonds are both overvalued — but relative to what?

I strongly agree that certain ranges of treasuries are priced high, as people pay too much chasing future yields, but the fascinating thing is how low in price the 30y is. The obvious disconnect there, is that nobody wants it — but guess who owns a tsunami boat load of 30y treasuries — banks! Banks are watching the value of those crumbling into sawdust, as they prop up their balance sheets with the Fed BTFP, or maybe a freebie from FHLB … which technically is probably as insolvent as the banks and our government.

The only solution here is to buy high and sell really higher and be thankful the world is filled with suckers and moronic imbeciles that are very willing to buy anything that doesn’t hold value.

The current 30 year treasury price doesn’t seem to reflect the Fed’s position and the market seems to be pricing in significant interest rate cuts in the near future. Are the market manipulators trying to force a Fed put? The 30 year treasury seems to be too low.

From our friends at the Peterson Foundation

“ More recently, average maturity has risen to the highest duration over the last 20 years, reaching 75 months in May 2023, as some of the short-term borrowing was replaced by longer-term maturities. The share of total outstanding marketable Treasury securities represented by bills declined from 25 percent in July 2020 to 18 percent in June 2023, while the share represented by notes increased from 52 percent to 55 percent. The current average maturity of 73 months is 10 months longer than the 20-year historical average”

Seems like that indicates higher yields relative to supply and demand, but who cares?

Absurd that the Future Pits and Daily posts by the Federal Reserve control Treasury Prices while they continue to generate inflation by minting Quantitative Easing and Tightening depending on the time factor of each Debt instrument. The NY Federal Reserve sounds like a Bond Day Trader working the Pits reading his 2 part interview posted by the NYT. What happened to Free Market? Bonds are totally manipulated by the Federal Reserve. And Golly, with $31.5 Trillion plus another $2 Trillion of New Debt Adds coming after the Debt ceiling was lifted. US Bonds are in a Fantasy World that will take 30 years to pay off at $1 Trillion / Year. I call Bull Shit!

I think the fed could reduce inflation by raising the reserve requirement of banks. This would reduce the money multiplier without causing existing loans to readjust at higher interest-rates