Inflation is just going to stick around for a while, it seems.

By Wolf Richter for WOLF STREET.

Powell, in his press conferences, keeps pointing at wage growth as a factor in services inflation, which is still raging at 6.2%. So we’ll start with wage growth. Because this is interesting: Average hourly earnings of “production and non-supervisory employees” – the bulk of total employment – rose by 0.45% in July from June, the highest since November, based on surveys of establishments by the Bureau of Labor Statistics.

It translates into an annual rate of 5.5%, nearly double of where the Fed wants to see it to get inflation down to 2%. These “production and non-supervisory employees” include working supervisors and all employees in nonsupervisory roles, including engineers, designers, doctors and nurses, teachers, office workers, sales people, bartenders, technicians, drivers, retail workers, wait staff, construction workers, plumbers, etc.

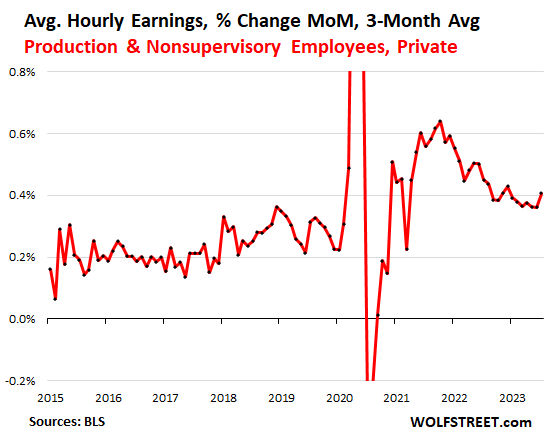

The three-month moving average, which irons out the month-to-month zigzags, jumped to 0.41%, the highest since December:

Wages that increase at an annual rate of 5.5% are great for workers. And it looks like it might keep going, amid demands of huge wage increases that unions are now putting on the table across the country.

But on the inflation front, that annual rate of 5.5% in wage growth is kind of a shocker. This is Fed Chair Jerome Powell’s reaction, as captured by cartoonist Marco Ricolli for WOLF STREET:

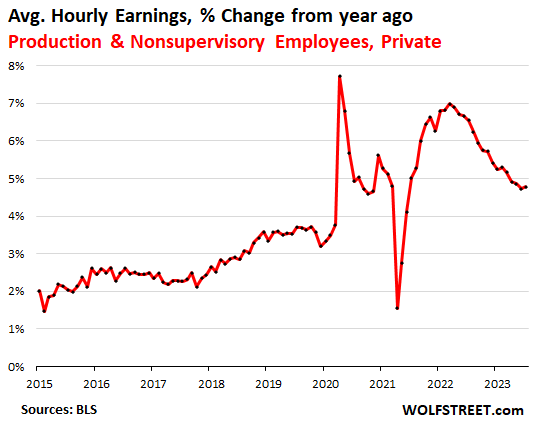

Year-over-year, average hourly earnings of “production and non-supervisory employees” rose by 4.8% in July, an acceleration from June (4.7%).

By comparison, the Consumer Price Index for all items increased by 3.0% year-over-year. So pay increases are easily outpacing overall CPI inflation. But overall CPI inflation was brought down by the year-over-year plunge in energy prices that is now beginning to reverse, and price declines in some goods. But the CPI for core services is still red-hot at 6.2%. And it’s in this context of services inflation that wages keep coming up:

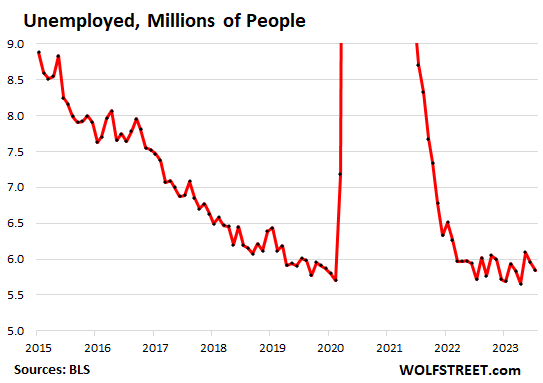

Unemployment still near historic lows. The number of unemployed people who are actively looking for a job dipped for the second month in a row, to 5.84 million in July, and remains near historic lows.

We have seen this phenomenon in other data: Layoffs and discharges, after ticking up for a year from the historic lows in 2022 and early 2023 amid waves of tech layoffs, fell in recent months again and are back in the historically low range. And claims for continued unemployment insurance, after rising from mid-2022 into early 2023, have also declined in recent months as even tech companies with huge layoffs, such as Google, have continued to hire, and hired each other’s laid-off workers.

And this is one of the reasons why wages are re-accelerating.

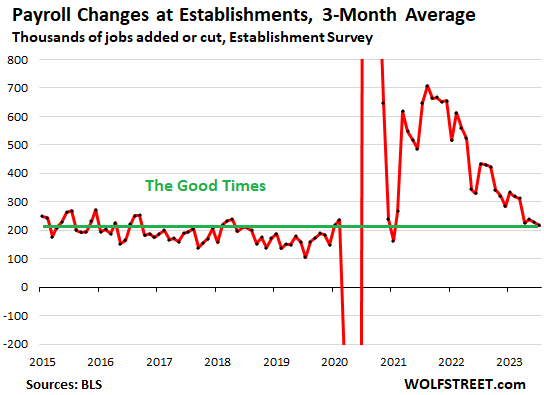

Employers continue to hire at a solid pace, adding 187,000 payroll-type jobs in July, according to the survey of establishments. Over the past three months, employers added 653,000 jobs, for an average of 218,000 per month, slower than during the heady days of 2022 and earlier in 2023 but right in the range of the Good Times before the pandemic.

This chart shows the three-month moving average, which irons out some of the ups-and-downs:

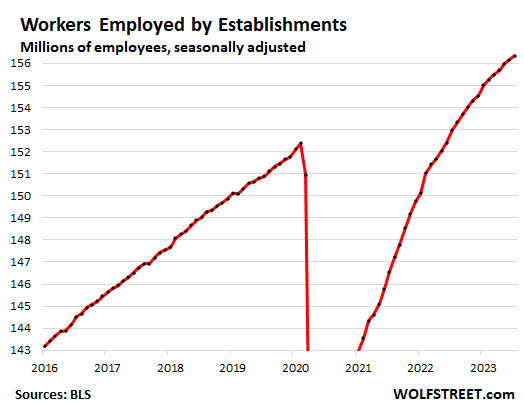

The total number of employees at establishments rose to 156.3 million.

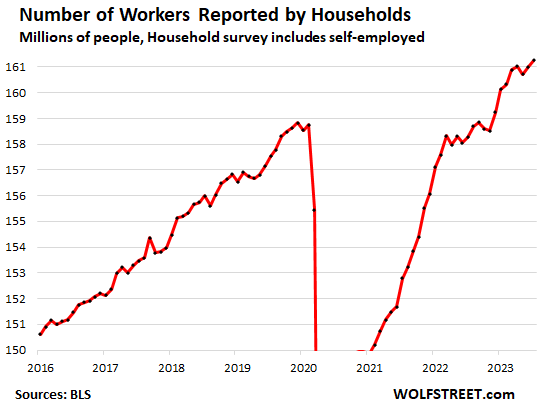

The total number of workers, including self-employed, rose by 268,000 in July, to 161.3 million, according to the survey of households, which tracks all kinds of workers, including the self-employed that are not tracked by the survey of establishments.

Over the past three months, the number of workers rose by 231,000 – increases in June and July, and a decline in May. This data is notoriously volatile on a month-to-month basis.

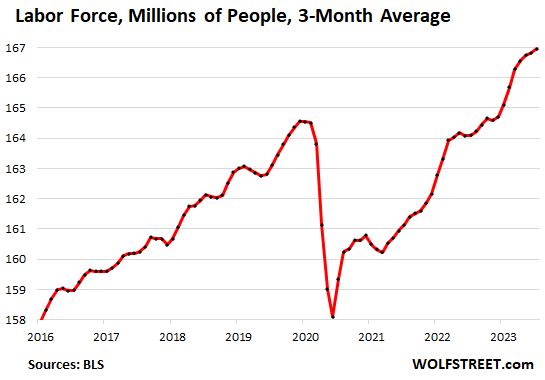

The labor force rose by 152,000 people in June, to a total labor force of 167.1 million. These are people who are either working or actively looking for work. Over the past three months, the labor force rose by 415,000 people. This chart shows the three-month moving average:

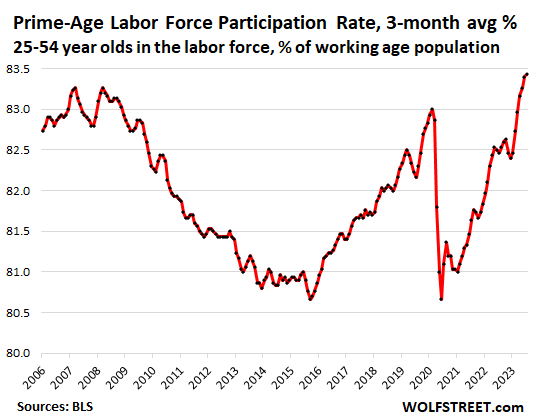

The prime-age labor participation rate ticked down a hair to 83.4% in July from 83.5% in June, which had been the highest since 2002 when the labor market came out of the Dotcom-Bubble period.

The three-month average rose to 83.4%, which is what the chart shows.

These are people aged 24 through 54 who are either working or actively looking for work. People in their prime working age are now participating in the labor market at a rate not seen in 20 years. The prime-age data largely removes the issues of the large wave of retirements over the past few years.

The narrowest measure of the unemployment rate dipped to 3.5%, second month in a row of declines, and just one tick above the 3.4% in April, which had been a historic low. The rate has hovered in the range between 3.4% and 3.8% since February 2022.

The employment-to-population ratio ticked up to 60.4%, a hair above May and June (both 60.3%) and same as in April. All of them are the highest since before the pandemic.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yes, finally some honest data behind what every business owner already knows. Good people are getting harder to find, so it is worth the investment to pay them, especially if your market is getting increasingly more competitive. Regarding unemployment, it seems like the unmotivated are not actively looking for work, could this be skewing the data?

If they are not looking for work, they are not counted as unemployed.

C’mon A:

Every one of the dozen or so folks I’ve known, as employee and employer, who have been employed to help the unemployeeed get their paid for dole have known all the tricks and strategies to ”look for work all legal and proper” and have no intention of working except to ”renew” their dole by working as little as legally required.

IMHO A, ya gotta keep in mind that the #1 main purpose of any bureaucracy is to maintain the bureaucracy; next main purpose is to please the boss; then, IF we are lucky comes the client/customer, eh

What dole? Some states make you complete an obstacle course to just get unemployment.

Just from your post I could take a pretty good guess at the sources you use for information.

All I can say is that you need to get better sources of information. Your current ones are not informing you. They are taking advantage of you.

Amen.

Workers are important constituents of companies – every bit as important as investors, customers, and vendors. All of whom have more to do with long term value than the employees in the c-suite, IMO.

After decades of wage decline and zero negotiating power workers are enjoying a moment of appreciation. It drives Powell and Dimon et al absolutely crazy.

They cheer a recession so they can report some losses, refi their masses of debt, and reset their comp hurdles for their stock options. And, of course, turn wage earners back into disposable commodities.

In the old days a 5 percent unemployment rate was considered full employment. Seems we will be at full employment for awhile.

I remember that as well.

I suspect the 3.5 was snuck in to keep an excuse for accomodative Fed policy and low rates

Wage growth will continue until people can afford a place to live. It will not only take proper interest rates and shedding MBS, but at this point we are going to need some new regulation to get rents under control. Enough is enough.

“Wage growth will continue until people can afford a place to live.”

Don’t be absurd. People can afford to live in shacks without wage growth, although shacks have gotten expensive too.

Agreed, people will live together in shacks, if they have to.

But employers have a difficult time expanding their workforces (beyond locals) because of housing costs. I turned down a job I really wanted in San Luis Obispo due to pay vs housing, I was thinking they were going to pay more than Florida. I was wrong.

Its a hard problem to solve, how does a company convince young & middle age workers to relocate to an expensive area?…you pay them more.

But what about the existing workers, they won’t stand for the new guy getting paid more than them (even if the new guys COL is higher due to housing).

Good point

Rent controls? Has that worked before? Only corporate landlords will survive, and their properties will slide into Sovbloc-style decay. A great many people rent from individuals under special circumstances that would fall outside of a government mandate. Elder care, security in numbers, maintenance, and just having company are all considerations that don’t fit a neat little bureaucratic quantification. And how long would rent controls hold out without the flip side becoming “necessary”? Wage and price controls. And the black markets in goods and services thrive alongside the official market. Not like it hasn’t been tried before . Landlords don’t have it easy unless they have hundreds of units, then it’s just another business and scales to profit traditionally. And they pay people to manage and fix the headaches, and count their money. The last thing that the little guy needs is more government regulation.

How many rentals you got ricky?

Rent controls help impose thresholds on the avarice of corporate slumlords & good ol’ fashion’d mom-n-pop landlords alike.

We need it. What’s more, I would count on it being an inevitability in coming decades. There’s no law saying you have to like it.

Well said. I have had a couple of rentals in a low income neighborhood that I feel as if all I do is subsidize the renter. After 17 years, I am down 50k cash flow after my gross rent versus all the expenses it come with the renters trashing the unit or normal wear and tear. I would say 30% of the renters I have had treat the rental as their home and the other 70% treat it as trash. The good renters leave the house in good shape and eventually buy a house. The bad renters look surprised when I do not renew their lease after they have broken multiple appliances or cabinets or doors. Or I have to pay to get rid of mice or cockroaches because they do not clean anything or take care of the yard.

On the positive side, the house has appreciated about 90k over this time so I am up a little. Once I sell and have pay captial gains…not much profit there. Hindsight.. I would not have purchased this rental. It was not worth the aggravation to average about $1000 a year of wealth.

Wait, what about a good old-fashioned recession? That would correct rent & housing prices without government intervention. Do you have E Warren on speed dial?

And, what exactly are “proper” interest rates?

The Fed is running off MBS, but they’re not going to sell them. That would push up mortgage rates.

Proper interest rates would be a rate set higher than inflation. No QE style shenanigans either.

Fed printed its way out of the last recession. All workers got was a small raise & massive inflation.

LOL. Bloomberg front page:

Fed Officials Tout Job-Market Slowdown, Seek to Pivot from Hikes

The two “doves” — Bostic and Goolsbee — that have been clamoring for an end to the hikes for months, LOL. Nothing new here. Bostic doesn’t even have a voting slot this year. Neither one will have a voting slot next year.

Example; We recently searched for and hired a research director. Considerably fewer applications than other equivalent searches, but exceptional candidates. We interviewed every single candidate. First time in 25 years I have every seen that happen.

Hence, no recession in sight. Should be a dynamic 4 qrt. Retail sales!

We are here at day 413 of the Wolfstreet recession watch.

Unemployment needs to go up to get a recession.

Got a bit to go for that.

I doubt we’ll see anything like a meaningful recession for years in the US. I regard the 2020’s as The Windfall Decade, as, anecdotally, I no of know other time in my life where so many hyper-average slobs were rocketed from the hairy edges of near penury to the deep black lap of solvency and beyond. I do suspect, though, that the easier the winnings, the more cavalierly they are allocated/lost.

If you get lucky — hold on to it! Or like DeNiro said in Good Fellas: “don’t buy anything for a while.”

12 months ago everyone was convinced there would be a recession in 2023.

Seems like every CEO announced layoffs to get ahead of the coming recession that was predicted by every economist.

There is something a lot like a recession in China. Can they have one without dragging us down?

I bought the mainstream narrative that there would be a relatively direct transmission of increased rates to reduced investment and business activity leading to increased unemployment resulting in a recession.

I don’t know why I bought it given the sorry record of the orthodoxy, but I did. Now I’m learning some things about the interest income channel and how fiscal policy overrides monetary policy. Good times!

I’m interested to see how the Student Loan Moratorium affects things.

People have to start paying in October (right before Black Friday and Christmas).

A tick down in consumer spending???

That with a Sept rate hike could be a doozy for frothy markets.

People with student loans who stopped paying while hoping for a government bailout are short-term thinkers and unethical to boot. The two usually go hand in hand. An ethical person repays their debts.

The resumption of student loan payments will definitely shift “consumer demand” to other areas—debt service.

Don’t know if we have any data to support it, but I doubt any but a very small percentage (if that) continued paying down principle or, if prohibited, saved the equivalent of those payments as if they never had to pause them.

Anyone who saved them in a personal “escrow” account was not contributing to the run-up in spending anyway.

The people who spent their loan payments will now redirect their spending back to loan payments. Those who refuse will go into default.

I expect consumer spending to decline and defaults to rise simultaneously. There will be a cluster of people who feel entitled to that loan forgiveness and who have grown accustomed to spending even further beyond their means.

Corporate revenues will be in decline by the year’s end. Then layoffs may start.

I’ve literally never heard such garbage come from someone’s mouth. It would be idiotic to pay someone who isn’t asking for their money back when instead of investing it during that time

Wolf, im happy you understand inflation because very few others do

Everybody……and I mean everybody was screaming a couple years ago to hike rates because if inflation started to roll it would be hard to stop.

but no

now they think he’ll pause because employment might…..might be slowing……maybe.

When they know that inflation in the later part of the year is already baked in higher short of a total meltdown and wages are rolling.

OK….what’s next…..the Chinese take NY and we claim its Chicago they really want.

Do your GD job….and stop trying to be a genius. You’re not. Not even close.

but we do know you’re crooked……

Do we like or want higher rates….no…..but inflation is a dangerous thing to play with when you have debts out of the wazoo and congress is in the hands of kids who still think they are in high school.

Most of those “kids” are well over 65 years of age.

Powell has says this is not looking like a wage-inflation spiral.

It sure is strange after so much banging on about how inflation is out pacing wage growth, and that’s hurting workers, once wage growth starts to outpace price increases, suddenly that’s the new whack-a-mole that needs to be hit.

Definitely not a new whack-a-mole, he was very up front a year ago, while workers were quitting for massive wage increases at new companies, that controlling wage growth was a priority. The “out of control” wage growth absolutely terrified all of them.

Nobody wins in the wage tug of war between employers and employees. Everybody trying to take advantage of the inflation situation.

But those who are not involved (fixed income) get obliterated.

In “my area” there was a steep minimum wage increase passed years ago, pre pandemic. Predictably, the price of everything skyrocketed. You can’t have huge pay increases for entry level/low skill jobs without absolutely “guaranteeing” more inflation. Sorry.

Your conclusion is faulty. The Federal minimum is $7.25. It has not changed since 2009.

There are 22 states that do not have a higher minimum wage. Inflation is not any lower in those states.

Not sure if I was clear. “My area” had inflation (rent, food, energy) BEFORE the rest of the country. And now it’s even worse. Nobody is benefitting.

The federal minimum is irrelevant in many cities and states. In my area it is almost $17/hr. Have you ever heard of what is happening in other parts of the country? It is illegal to pay anyone less than that. It has been substantially higher than the federal minimum wage long before the pandemic.

You commented that minimum wage increases is causing inflation. I pointed out that 22 states have a minimum wage that has not changed since 2009.

Your conclusion that increases in minimum wage are causing inflation is incorrect since inflation is also affecting those 22 states.

Inflation is hitting Texas and Louisiana the hardest right now. Minimum wage is $7.25 in those two states.

Minimum wage is irrelevant today because when even starting McDonald’s salaries are $15/hour, nobody is getting $7.25.

They could raise it to $12/hour and it would make almost zero difference.

Your reading comprehension is what’s faulty. Read it again. That’s now what he said.

I saw MacDonald’s jobs posted at drive thrus over a year ago all over Houston – Freeport area for $15-20.

McDs down the street from me advertises $17/hr for starting pay. This is in NH which has the same state min wage as federal ($7.25/hr).

The true min wage ($17 or whatever/hr) is being enforced by the market rather than the state.

Dah,,,,,and productivity growth doesn’t account for anything in your equation?

Not sure that productivity has increased much over the last several years. Looked at a BLS chart of Labor Productivity and it actually didn’t show growth especially the last couple years (I will happily accept my beating if this is wrong).

Why can’t anyone blame asset inflation? I had to listen to Gruber trying to explain a wage price spiral to people the other day, but no one wants to talk about how assets almost doubled in value and people have to pay rents/mortgages.

Rent has averaged 5% inflation for 10 years. Theres only so long these things stay tenable.

Wages need to catch up to housing inflation, forget about consumer inflation. People need shelter just as much as food.

That won’t catch up anytime soon as there’s not enough inventory to help drive housing prices down. Wages can keep increasing but if the amount of available homes/rentals doesn’t, those increases will be offset by supply & demand issues. Super low rates and free money put us here and the road to recovery is going to be a long bumpy ride.

Dietric you obviously are not a regular on this site. The “low inventory” BS doesn’t fly here. It remains a lie no matter how many RE shills show up here and try to pimp it. And boy do they.

@CSH,

There may be plenty of inventory, but it is being hoarded. There is no “available inventory”, and that is the problem. Phase out investor tax breaks for home ownership and the problem goes away. Owner-occupiers get none of those tax breaks for owning, and investors shouldn’t get them either.

There are no buyers either. Entire Housing Market, Buyers and Sellers, May Have Shrunk by 20% to 25% because of the 3% Mortgages. They’re not listing their homes because they’re not moving out because they’re not buying a home to move into because they don’t want to give up their 3% gift from God.

https://wolfstreet.com/2023/07/21/entire-housing-market-buyers-and-sellers-may-have-shrunk-by-20-25-because-of-the-3-mortgages/

Replying to Dietric..

Higher mortgage rate would solve high home prices.

We do have lot of shadow inventories… short term rentals and empty homes..

Let the rate increase high enough for investors to sell their homes .

Was looking abnb per day price plummet ..

wolf has been calling the inflation story all along very accurately

but I miss the “rug pull” calls – if for no other reason than they were hilarious.

Now Wolf, don’t get mad at me but my question is only tangentially related to the article.

Why is it that we don’t hear so much about the corporate profits/inflation spiral?

It’s all over the news. It’s hyped in all earnings reports, it’s hyped in all the financial publications, it’s hyped everywhere, all the time, it’s just not called “corporate profits/inflation spiral.”

It’s just that it’s possible wage growth is following inflation, not driving it? I’m confused.

‘Rapid wage growth has not been an important driver of inflation, according to a new analysis published by the Federal Reserve Bank of San Francisco.

The recent run-up in the employment cost index, a measure of wages favored among economists and policymakers, “explains only about 0.1 percentage point” of the three percentage-point increase in consumer price inflation excluding food and energy, San Francisco Fed economist Adam Shapiro said in an article published Tuesday on the bank’s website.’

Yeah, everyone has their own idea about what causes inflation. It’s funny because we really don’t fully understand inflation.

Wage growth is definitely linked to inflation. It’s just not always clear which direction.

So if you actually read the SF Fed article, you will see that they admit that wage growth IS linked to inflation, but via rents. People who earn more money can pay higher rents, and landlords too have figured this out, so higher wages are driving rent inflation. So this is inflation driven by the income side. That’s their view, in the article.

Powell’s view is that higher wages cause costs of services providers to go up, and so they raise their prices. So this is inflation from the cost side.

I can see both happening right now. It’s not either or.

Im confused. Everywhere I go it feels like there are less and less employess, as employers seem to have realized customers will put up with worse and worse or nonexistent service.

I would think unemployment would be way up unless everyone is working from home

Julie brk just reported 36 Billion in a quarter

American economy just keeps bulldozing through recession predictions, so inflation will not come down for a while, interest rates will go up more, and at least some US labour sees their wages roughly follow that trajectory. I’m not sure what our wages are doing overall in Canada but I’m not meeting a lot of people experiencing “wage growth” lately, inflation may be lower here but there’s no way we can quash it before US does, I think we trade 70% maybe more just with the USA alone. What I am starting to see though is people looking to sell properties because some are on variable rates, we don’t have those fancy 30yr fixed rate mortgages up here.

Basically a long winded way to say I’m jealous of my southern neighbours, even if some of them think the sky is falling on them 😂

Quit electing Trudeau might help solve your problem

Sure. Just find us someone obviously better and we’ll get right on that. He hasn’t (yet) turned into “blind” Harper (“Who needs science research?”) or King Jean (“Were going to have a long discussion on climate change and then you’ll vote the way I tell you.”) so I can live with him as PM for the moment.

I thought both Harper and Chrétien were good when they started but the power corrupted them.

Imagine thinking that whatever figurehead is in office controls this shindig.

Right? Just elect this one special person and they’ll solve all your problems! 😆😂🤣

Though it’s about time for Justin to go, the main function of elections to me is to clean house and for me he’s had enough time in there.

The Canadian media are salivating after job losses. They think the BoC will stop raising rates, as though they can independently keep rates lower than the Fed.

The Bank of Canada is far more aggressive with QT; therefore it should tame overall inflation sooner than the US.

Seems other financial sites are stressing about full-time jobs down and part-time are up. That can’t be good for the economy.

WSJ: Heard on the street

A Goldilocks Job Market Is in Sight

Employment data showed America’s job market is cooling. It isn’t cool enough for the Fed just yet, but it is getting there.

s/ LOL

Bloomberg: Fed Officials Tout Job-Market Slowdown, Seek Pivot From Hikes

The two “doves” — Bostic and Goolsbee — that have been clamoring for an end to the hikes for months, LOL. Nothing new here. Bostic doesn’t even have a voting slot this year. Neither one will have a voting slot next year.

Looks like the stink market (stock market) read Wolf’s article. The Dow dropped almost 500 points from its high.

I notice Buffet said a few days ago he was buying $10 billion of 3 month T-bills. I hope he does not crowd me out.

“I notice Buffet said a few days ago he was buying $10 billion of 3 month T-bills. I hope he does not crowd me out.”

Not just Buffet, Elon Musk is saying that T-Bills are a no brainer.

You can do your part. Buy more government debt. No shortage of opportunity in sight.

The horse, Exterminator, helped promote buying government bonds after WWI and during WWII.

An exterminator would come in handy right now.

Sh*t, Musk, too? Now t-bills MUST be a scam. I’m out!

Exactly

Zirp policy has caused many distortions. I have a widow friend who is 77 and always kept a heavily stock market portfolio in her IRA because she had a small pension plus social security. We ran some tax planning software and she is screwed as far as taxes go. Asset price appreciation has pushed her into the 35% Federal tax bracket on RMDs.

It makes me wonder if government prefers zirp because they get to borrow for free and generate a lot of taxes off the capital appreciation. Anyway I think the US as gotten more like CA in that taxes are getting too procyclical where tax revenue is too boom and bust depending on assets.

Nick “Nickileaks” Timiraos is already claiming that today’s data makes a second rate hike less likely. And the 30 year mortgage rate is down a full 17 basis points today after spiking yesterday.

It seems like the only two absolutely unkillable things on planet Earth in 2023 are the American economy and the “pivot incoming” narrative.

If I hear the word “pivot” one more time, I think I will puke.

I know the 10 year dropped hard today down to almost 4.0 from 4.2 instead of moving the opposite direction

I’m so damn sick of it. Pisses me off with the 10 year. It was beautifully high and then this crap. Every time the 10 year gets over 4, the data miraculously misses. Happens every few weeks.

Ackman should just STFU.

After he said he shorted the 30 year, everyone bet against him on Friday. Never fails.

Like winter, a pivot _is_ coming. As long as you don’t state when, you’ll be correct eventually.

@from today’s article:

“The prime-age data largely removes the issues of the large wave of retirements over the past few years.”

Not all jobs are the same though. I am thinking that for jobs that require significant skills, the wave of retirements will cause issues.

Couple of items that seem pertinent:

1. What progress has been made in eliminating the job openings to cool labor demand; that item doesn’t seem to be reported anymore.

2. In general, these work from home jobs make no sense. If a job can be done remotely, then why not outsource it to a less expensive country’s labor market? Everything, remote can probably be done somewhere else.

“What progress has been made in eliminating the job openings to cool labor demand; that item doesn’t seem to be reported anymore.”

Hardly any progress over the past five months (last five dots in the the circle). The decline in openings over the past year is mostly or totally because a lot fewer people are quitting (they got scared from all the layoff announcements), and therefore fewer jobs open up because people stay put, which cut down on the the churn. That’s really all that has improved.

“Everything, remote can probably be done somewhere else.”

That’s obviously not the case, or companies would save the costs and boost profits. It’s safe to assume that when a company allows remote work, it is in the best interest of the company to do so.

Remoting is about more than just cheap wages.

My company has tried many times to hire people in India and it never works out well due to the timezones, cultural differences etc

Gary, you are the problem not the solution, every job that go overseas or down south is a job that an American is losing. Let people keep their jobs from home, going back only means we’ve been going to the office for nothing all these years when we could have spent more time with our families or doing things we want, not in the car stuck in traffic. CRE speculation, zero interest rates, human greed, your way of thinking are the real problem.

Why not outsource a job that can be done remotely to a less expensive country’s labour market? Yes everything don remote can probably be done somewhere else, but can it be done cheaper somewhere else?

It may be that the USA insome instanses is the cheapest labour market.

Anyone know the latest breakdown on debt growth? I think private debt is contracting and government debt is blowing out so that total debt growth is still pretty robust. Last number for 2022 I saw was $93.5 T growing at 5 – 6%. Got to slow that number I think to slow economy.

Household debt is not contracting. Bank lending is down a little. Corporate bond issuance is down a bunch, but corporations – including Amazon, Apple, and a bunch of other giants plus a gazillion other companies — issued a huge amount of bonds when rates were low and they’re now flush with cash mostly, and they’re not inclined to borrow at these high rates unless they have to.

Which is interesting, because the value of these bonds are now impaired, so not only are the holders taking default risks when the issuers were crappy credit risks, but they’re also getting a rate much below what they could get for AAA rated debt now.

I remember reading Berkshire’s report a few years ago and BNSF was issuing long term debt really cheap. I think about 3%. That looks really smart for BNSF and not so much for the debt holder currently.

Tanger REIT reported. Its a pretty interesting read because they go after certain type of discount shopper. I don’t own it, but watch it. Like many businesses they are able to post nominal increases in profits, but kind of flat in real terms. Opening a giant new mall in Nashville in a month or two.

I am presuming that since the GFC, the rating companies have become irrelevant. And sovereign currencies are subject to exchange-rate fluxuations.

@oldschool

Now BSNF can take the cash from those 3% bond sales and buy 5% treasuries and this will help boost Net Income. LOL

In Hindsight, I sort of wonder if I should have refinanced my paid off rentals at 3% and now I could be putting the cash into 5% Treasuries.

Global debt just hit $305 Trillion. I think the last time I looked several months ago it had just crossed $300 trillion. I am pretty sure in less than a year it went up $5 Trillion.

Central Banks QT may not be able to mute this debt expansion?

It’s confusing as to why stocks faltered today and didn’t ignore this news about more burger flippers adding to GDP growth, it’s as if the market understands this will be revised with all the other data. Nonetheless, odd that stocks are skittish, very weird!

If more people than ever are working making more money than ever, why are government tax receipts down?

Capital gains taxes plunged because 2022 was a super-shitty year all around with stocks, bonds, cryptos, etc. getting whacked, and investors “harvested losses” in late 2022 – selling their losers to lock in the tax benefits from those losses. When people paid their taxes in April 2023, for 2022, those capital gains tax receipts were down massively.

Employment taxes are way up.

Probably a little late to ask this but does that mean capital gains make up a larger portion of tax receipts for the US government than employment?

Capital gains tax as % of total individual income tax revenues maxed out at 14% in 2021 and 2022, and it’s over. A per the CBO — interesting stats, QE performed wonders on capital gains and capital gains tax revenues.

Receipts from capital gains as percent of total individual income tax revenue:

Before 2008: 9% on average.

2010: 5%

“Since then, the share of receipts from capital gains has increased steadily” [QE, LOL]

2021 and 2022: over 14% “…much higher than is typically observed. That strength helps explain why individual income taxes measured as a share of GDP reached a historical high in fiscal year 2022.”

In CBO’s projections, they’ll revert to normal by 2033, of 7.3%

Hi Wolf – just a shout out of appreciation for your data driven articles, and always thoughtful answers.

Keep on rocking!

Thursday Buffett buys the 3 month bill.

Friday the 4 week bill beats the 3 month yield.

Next news nugget…

Yo – yo economics.

Meme Bonds are next?

Thx Wolf and all y’all!

I like looking to see how many shares Berkshire bought in during the quarter as he knows capital allocation and you can look at brk stock price and estimate at where he thinks fair value is.

Berkshire is still biggest holder of actual plant and equipment in US so its still a way to play real economy if you can get it at the right price.

Thank you for this and your many relevant and concise comments of here old school…

Appreciate so much that you are willing and able to bring to Wolfs Wonder the local focus needed from all on here to help him at least try to bring us not only relevant but reality oriented information for our efforts to keep up.

Thanks again,

mAyBe tHe FeD sHoUlD pAwWwWwWsE tO gIvE mOoOoRe tIme bEfOrE hIkiNg aGaIn /derp

Currently, 87.5% of market participants expect the Fed to keep rates as is at the next meeting, according to the CME’s Fed Watch Tool.

Excellent time for Powell to hike again…

Thank you, Wolf! Another great article!

I’m not a conspiracist, but could this be part of a soft landing?

Inflation has been high the last 3 years. It makes sense that wages will follow. If they don’t, won’t there be a hard landing caused by the housing bubble?

ie

If someone purchased a house in 2019(or before) for 700K and watched the value grow 40% to a peak of 1M in 2021, they are doing fine. They won’t walk away like millions did in 2008. As long as the prices stay above 600K-700K, they will be above water. It would have to be a 40-50% drop for them to be underwater.

If someone purchased a similar house in 2021 for 1M, they may have seen a 6% drop in value (940K) but likely only owe 800K on their mortgage with a 20% down payment. They are still above water.

Inflation has been raging since 2019 to today. From a CPI online inflation calculator, the 700K house in 2019 should be worth 850K today if it tracked CPI inflation. If wages also track CPI, even the person who purchased at the peak in 2021, is seeing some relief and is still not underwater.

Housing prices should track inflation if speculation is removed. Inflation is helping current homeowners especially if wages are tracking inflation.

Housing prices could still fall 10-15% and everyone will still be above water in inflation adjusted dollars.

The Fed is threading the needle and preventing any housing drops more than 15%. Inflation is raising the floor if everyone is receiving wage increases.

For a soft landing, the Fed has to:

1) Prevent massive job losses that will prevent people from paying their mortgage and rent.

2) Prevent a housing drop of more than 15% which could cause mass foreclosures.

3) Keep inflation high to raise the floor on housing prices rather than have the housing bubble deflate rapidly. The longer wage inflation is high, the less likelihood of mass foreclosures like in 2008.

So far, so good. I think.

Soft landing = inflation landing at 2% without the economy crashing. If inflation isn’t landing, it’s not a landing.

Wolf, I am going to argue with your definition of a soft landing.

I think the soft landing has more to do with wage inflation versus non-wage inflation (i.e. commodities, goods, assets, etc.). The more inflation is restricted to wages (versus non wages), the softer the landing (crash) feels for most of America who work (i.e. receive wages) for a living.

As for the actual level of overall inflation, I think it is a given that inflation is going to have to run higher than 2% for awhile (the federal deficit demands it). Sure, the FED is saying 2% as a target, but absolutely no one believes that, not even the FED. Instead, I think they are willing to accept higher inflation as long as it doesn’t get out of control.

The more that controlled inflation can be pushed towards wages, the softer the landing to most Americans.

Wolf, you are absolutely correct.

We have not landed. We are circling the runway and slowly descending into a massive thunderstorm.

The results could be:

1) A deep, sudden recession if we crash. Foreclosures, stock market crashes, job losses. Despair, calamity, and political turnover will ensue.

Or

2) The biblical? “Great Reset” where everyone makes 20-30% more in their jobs and can still pay their rent/mortgage which has been flat for 3-4 years due to higher rates and AirBnB speculation. Housing speculators will wake up finally and realize that making 3% in rent is worse than making 5% in a Treasury or dividend and slowly return inventory to the market. Wealth disparity will lessen since speculation with cheap money will be eliminated. Cheap money will be eliminated.

They say I’m a dreamer. Maybe I’m just giving the underhanded Fed too much credit.

If someone bought a home for 700k in 2019 with 20% down (140k) and a rate around 4%, they have, ballpark, a 550k remaining mortgage balance with a monthly around $2200. A buyer of similar means today would look to afford around 15% more monthly, make it more, say $2600 to keep the numbers round. At 7% that borrows only about 370k. Assume they can also manage a down payment around 15% more, say 170k to be generous. 170k + 370k is only 540k. Ergo, the home cannot be sold to a buyer of similar means even at the 2019 price. After selling costs, 200k _negative_ equity.

Market prices have not yet fallen to reflect this for reasons such as:

– so few owners are willing to give up their low-rate mortgages, there’s little inventory for people who feel they must buy,

– many buyers feel sure they’ll be able to refinance in a year or two at 4% or less,

– some sellers are buying down the rates to close the deal, for example by 2% the 1st year, 1% the 2nd (especially new home builders),

– some buyers have made tons of money from the PPL and ETC giveaways,

– some buyers have made tons of money in stocks.

The current market is stunted and won’t return to normal for a long time, because as the example above shows, all that equity is purely an illusion.

As long as there’s a WAR on….inflation will stick around! The hikes are geopolitical.

BS. This inflation started over a year BEFORE Russia invaded Ukraine. By February 2021, CPI was going straight up. And I’ve been publicly screaming about it since early 2021. By June 2021, nine months before the invasion, CPI was 5.2%. By Dec 2021, two months before the invasion, it was 7.2%.

Well, historically wars are inflationary, and geopolitical fracture that adds more friction to trade presumably is also? Add in oligopolists with their thumb on the oil scale, and I think you have a recipe of more inflation for longer.

MW: Stocks close lower, S&P and Dow post first weekly loss in 3 weeks after historic U.S. credit/debt ratings downgrade

When jobs report dropped my first thought was boom stagflation.

Little surprised markets rallied at all on it but seems they were just trapping some poor souls.

Should be a fun next couple weeks!

‘Average hourly earnings of “production and non-supervisory employees” – the bulk of total employment – rose by 0.45% in July from June . . . an annual rate of 5.5%, nearly double of where the Fed wants to see it to get inflation down to 2%.’

Which is to say, to bring down inflation workers have to suffer. Wages have to be suppressed and unemployment has to rise. Workers can’t be allowed wage increases greater than the rate of inflation any more than they can have savings accounts paying more than the rate of inflation. That would be contrary to policy.

CPI understates cost the of living by excluding increases in medical care, housing, and college, all of which have skyrocketed and increasingly unaffordable to a larger share of the population. Wage pressures do not account for these increases but that’s where the official blame falls: prices go up even in the absence of any wage pressure. Meanwhile corporations have posted record profits, having piled on the price increases during The Plague. Inflation is largely the result of corporate greed, not because workers are paid too much.

Those who have power in the world want it to be this way, but it will change.

It will get worse. It’s been getting worse since financialization got going in the 1980s.

“CPI understates cost the of living by excluding increases in medical care, housing, and college”

No, CPI does not exclude them. In fact:

1. housing = 33% of CPI

2. Medical care services = 6.4% of CPI; medical care commodities = 1.5%; combined = 7.9%

3. College tuition = 1.2% of CPI

Don’t you ever read ANY of my CPI articles? I mean, not a single one? And then you feel compelled to comment here?

And before you argue back with another uninformed line: rent CPI jumped 8%!

Cost of carry per month on housing doesn’t tell the full inflationary impact of housing.

If you own your own home, inflation of shelter is near 0% because the price of your home doesn’t go up and the mortgage payment doesn’t go up. Only property tax goes up.

Insurance and utilities are separate items in CPI.

And if you don’t own a home Wolf, is rent inflation your only inflation rate?

If say your 30, your rent is up 5% and the cost of buying *exactly the same home* is up 30%. Long term you are going to buy a home, is the inflation rate 5% because that’s your cost right now?

This is how we had “twenty years of inflation below 30%” when in the UK house price inflation averaged 11% per anum over that period.

typos:

your / you’re

and :

This is how we had “twenty years of inflation below 2%” when in the UK house price inflation averaged 11% per anum over that period.

TRUE that ”property taxes go up” but only generally,,, and not always TOO MUCH in FL and CA where there ARE limits…

This old boy who has owned properties in CA and FL and several other USA states over the last 60 years cannot understand why the VAST majority of USA citizens do not INSIST that property taxes MUST NOT increase without limit,,,

And once agreed to by owners, especially o

”owners” of Single Family ”HOMES” who do NOT insist upon those taxes to BE LIMITED so that folks, in this case folks who are NOT part of any and all incredible and clearly speculative BUBBLE can continue to live in their homes without GUV MINT TAXES???

Clearly a MAJOR SCAM,,, by and for GUV MINTs.

The BLS updates its profit-related calculations once a year, in October.

“CPI understates cost the of living by excluding increases in medical care,…”

As noted by Wolf, it is health insurance that is the curious metric.

Health insurance CPI will show negative through September 2023 because of the way the BLS measures. There may be minor monthly fluctuations based on other inputs, like the cost of hospital services, prescription drugs, medical equipment and supplies, home health care and nursing homes, but the BLS calculation is based on insurance company profits. Seems like a weird way to measure when there seems to be better hard data out there. Reminds me of the survey of owner equivalent rent for housing. Why not available hard data?

I applied for a 25% cost of living adjustment today. 🤞

So you are asking almost 5x the rate of inflation? Good luck with that.

I was out shopping for some food items today. Looks like the engrediants to make morning coffee have gone up 20% in one year.

Bottled water – up 20%

Coffee – up 20%

Half & half – up 25%

All non-food items like paper napkins, towels, cups are up 25% or more. This inflation in food and support items is way more than the figures reported by the government.

Wait a sec, why are you using bottled water for coffee? Tap is fine nearly everywhere, and at worst, you can use a Brita.

Einhal

They put Chlorine in the tap water around here. Coffee made from tap water tastes like crap.

Pro tip. Put the tap water in a bottle a day early. Chlorine is gone in 24 hours. Put $ in pocket.

They put chlorine in tap water everywhere. It kills the bacteria in the water that comes from the water source: rivers, lakes, wellfields. Sometimes they’ll put in more than other times when certain readings get too high. During those times, you can actually taste it. It’s called “chlorine dosing”. Most of the time it is at low enough levels that you won’t notice. It was put in your bottled water too. But it bleeds off into the atmosphere at some point.

Dougzero

So your tip used to correct…

My municipality used “chloramine” and it apparently doesn’t evaporate?

Regardless, they leave chlorate or chlorite in water.

That said, I just drink tap water. You’re probably tasting minerals tbh.

The worst is super hard water. Wrecks all your appliances.

You could prob buy a water filtration system cheaper than bottled.

May I add, not only does the Chlorine ruin the taste of the water for coffee, but many times the water has a muddy brown tint to it. If you want to drink that crap be my guest. I’ll drink my bottled water, even if it costs a few bucks more than free tap water.

Obviously you haven’t tasted Texas tap water! Bottled water is a necessary evil there.

Vancouver Canada has pure water that flows through all the taps. It tastes a lot like bottled water. No one buys bottled water there.

You can install a reverse osmosis filter in your house for much cheaper overall cost. I live in Texas and a Brita (activated charcoal) with generic filter kills the chlorine taste. Hell a sand/rock filter and sunlight gets rid off almost everything bad or unpalatable about water. If you are buy bottled water and not using 5 gallon jugs…I don’t know what to say might as well burn cash for heat.

When I was living in Wichita Falls, TX, back then, we toughed it out just fine. Bottled water was rare and expensive back then (Perrier?). You can flavor the water (make iced tea or put a slice of lemon in the pitcher and keep it in the fridge. Works great to drink. But you can’t do that with coffee. So when it comes to coffee, everyone has their own method. Back then, coffee was generally lousy, so it didn’t matter.

Beg4mercy, our Texas tap water is just fine. I’ve been drinking it for decades. Bottled water is a waste of money, and bad for the environment as well.

Uh, which part of Texas. Where I live in DFW, the water tastes amazing. Bottled water tastes like garbage to me.

Beg to differ, Real Tony! No one in Vancouver *should* buy bottled water, but you should see the 20 *pallets* of it down at Costco that all the entitled morons are buying.

Vancouver: not only are we nearly #1 in the world for overpriced real estate, but also we’re #1 for number of entitled people!

Let the chlorine in tap water exfiltrate for a day or two, then run through a Berkey.(black filters only).

It requires a a tinfoil hat to block all of the government mind control beams that comes from the Jewish space lasers to see the truth that the government is underreporting inflation in food and food adjacent items.

The lowest priced items around a dollar or less all doubled in price.

Agreed food is up.

But as well as cornflakes and coffee my weekly shop also includes a smart watch.

My food total is up $50 but my smart watch is down $40, leaving me close to flat.

Anyhow I have to go for my lobotomy now, they say that after it I won’t question the statistics behind any government data. Can’t wait.

funny g;

Glad to see, as some of us on here have been worrying about u.

Not too much as some of your former posts have been also funny enough for us to hope you can get through the trauma of reaching the point in your understanding of the challenges of dealing with an oligarchy that now has clear control of the message…

Thanks for your many comments, some of which have been educational to at least me, if not all on here.

ah I had no idea my absence would be noted.

all well, got a front row seat for the great canadian collapse (if the Fed keep rates high).

Wolf: we *need* another “splendid Canadian housing bubble” article.

The chunky soup cans appear somewhat less chunky nowadays…I’d estimate about 25 % less chunky

Services inflation is increasing at 20%. Got my insurance premium for my home and its up 20%. Housing prices are starting to go up again even with 7 .39% mortgage rates. I think Powell needs to go back to the drawing board. Everything he’s done so far is not working to bring down inflation. The 2.2 trillion annual budget deficits are not helping either, and is making the Fed’s job much more difficult if not impossible.

Services inflation is NOT increasing at 20%. That is you cherry picking one item (which may have other causes depending upon where you live) and applying it to all services.

That isn’t how it works.

JimL

Instead of posting that BS why don’t you ask the dudes in Florida who just had their homeowners insurance premium go up 25% or better yet, had their policies cancelled altogether.

Swamp Creature

People make the mistake of taking one item that went up a lot and assume that all items went up by the same. You said in the past that you own your home. So rent inflation (=33% of CPI) for you is near 0%. That’s part of services.

Everyone has their own inflation rate.

“People make the mistake of taking one item that went up a lot and assume that all items went up by the same”

Well, property taxes went up over 10%. Health ins premiums went up 10%. My appliance repair ins went up 15%. Gave my lawn man a well deserved 10% raise to keep him. Nearly every service I buy is going up double digits or more. We just got a 20% increase in our Appraisal fees so I’m cashin in on the services inflation at the same time I’m complaining about it. If you believe those service inflation numbers the government puts out, I’ve got a bridge over the East River in NYC I can sell ya.

” My appliance repair ins went up 15%.”

OK now this triggered my BS alarm. Do you have the same appliance repaired every year for the same problem???? Do you even have appliances repaired these days??? How do you know it went up compared to a year ago? Fantasy numbers.

That’s where I stopped reading. One item is BS, all items are BS.

” My appliance repair ins went up 15%.” Yep.

Went from $49/month to $58. That’s not BS. I’ve got the receipts. This insures all my old appliances. Some are over 30 to 40 years old. My refrigerator broke and they gave me a new one for free. They are not the best technicians I’ve ever seen but they have provided useful information to help me keep my appliances in working order. Why should I waste my time trying to find technicians when I’ve got better things to do.

LOL. That’s not cost of a repair. That’s insurance. You’re citing insurance premiums, not appliance repair costs.

I would like to add that most of these service inflation items are NOT discretionary. They are necessities. The cost comes out of disposable income and is in after tax dollars. What are you suppose to do. Not pay property taxes, and have the county put a lean on your property? Or drop Health insurance premiums and go bankrupt when you have a major illness?

Services inflation on necessities is killing the middle class.

Are property tax hikes counted in inflation data somehow? Of corse they fund services but I can’t see how that would fit into any of the CPI categories.

SC,

I agree with you about the unfairness of property tax increases – I can tighten my belt in other areas, but I can’t purchase fewer city services. Also its a tax on unrealized gains.

That said, I’m having a hard time seeing how paying for appliance repair insurance makes economical sense. Remember, your insurance company is a middleman that needs to make a profit – why not cut out the middleman aka self insure?

MM

For $58/month for this cheap appliance ins package, it’s the cost of one night out for dinner in some crummy restaurant. I’ll take the appliance ins package over some crummy restaurant food.

SC,

True, but you could also put that $58/mo into T-bills. After a year you’d have nearly $700 + interest.

The idea of self-insuring is you fund your own repairs, and have $$ left over from not paying the insurance middleman.

NB: none of the audio gear I rent out is formally insured, I self-insure by putting cash aside from each rental into a repair fund.

Putin raised interest rates ten percent in one day and that seemed to work. Rate hikes in America seem to be too small and drawn out over too long a timeframe.

Who takes economic advice from Putin?

Just payoff the mortgage and ditch the home insurance. I’ve never insured any homes even vacation homes.

“ditch the home insurance”

That’s the dumbest comment I have ever read on Wolf Street. I just filed claim for 30K on my home, for a major sewer backup issue. I’m glad I had insurance, even though they screwed up the claim. They finally paid up. I ditched the ins company but not the insurance.

How much in premiums have you paid for home ins in your lifetime (and if you kept invested in short-term bonds to grow it) vs what you are getting in return from them? It can make financial sense to be self-insured depending on your rates and how infrequent you file a claim.

I see in an earlier post you have an appliance repair insurance policy, too. I know people that have those and insurance on their cell phones, high end watches, etc. I don’t on any of that stuff…you may be the type that likes to insure everything. I rather just keep my money and not destroy stuff and fix/replace it out of pocket.

The last time we had inflation from a similar cause was 1946. It stuck around for about 3 years before the excess cash was used up, production was ramped up, and the demand was satisfied. At that time nobody expected the central bank to solve inflation. Rent controls helped to some extent, but Congress obstructed the administration’s attempt to keep rent controls.

No one expected the central bank to solve inflation, because in 1946, the central bank hadn’t intentionally caused it!

Financing nearly 50 percent of WWII’s deficit through the creation of new money laid the basis for the chronic inflation this country has experienced since 1945. Interest rates, especially long-term, would have average much higher had investors foreseen this inflation.

The Fed’s contribution was $22.5 billion in “high powered money” – interbank demand deposits, the reserves of the commercial banks.

It should have come as no surprise that we did not have a “primary” post-war depression; our problem was excessive demand and inflation. During WWII we had official stability and “black market” inflation. This was reflected in the price indices as soon as price controls were removed.

The central banks caused it but not intentionally. It’s a byproduct of what they did to (successfully) protect the economy from the Financial Crisis and the Pandemic.

Whether the cost is worth that success or if a more moderate response would have been better is subject to debate but nobody can really say where the economy would be today had they acted differently.

I think there is multiple aspects to this. After the 2008 collapse, Bernanke went with this “unconventional monetary policy”, ie “quantitative easing” in order to avoid a 1930s style depression. At the time, I thought the effort was noble.

However, a few years subsequent to that, the Fed was beginning to unwind QE, only to be met with the “taper tantrum” of 2013. And when policy became an explicit backstop to stock market declines, I think moral hazard set in.

Also, with QE, a free market in our largest market, the debt market ended with yield control. Yield control meant that the Federal government would run huge deficits without regard to what that would do to interest rates. So, federal expenditures no longer needed to correspond to revenues, which was more moral hazard.

The Trump tax cuts, along with his endless tweets for the Fed to step up QE was more moral hazard, as the tax cuts would never pay for themselves. QE was to pay for it. Similarly, Biden wanted to forgo $400 billion in money owed the treasury (loan forgiveness) without regard to how the money would be replaced is more moral hazard.

There is a huge moral hazard aspect to the way that this QE carried on for as long as it has. It comes in for good reasons, but it doesn’t hang around for as long as it does for good reasons.

Printing money has caused inflation for millennia. There’s no way you can say it wasn’t intentional. And printing doesn’t protect anything. All it does is kicks the cand own the road and steals from others.

They didn’t “protect” anything but the wealth of the already obscenely wealthy. And they didn’t just “protect” it, they grew it in an absolutely grotesque fashion. This is the biggest wealth transfer in history, from the middle class and poor to the people who least need it. It’s a disgusting economic model. “Protect the economy” my asz.

DF, thank you for the excellent and well reasoned response.

E, QE isn’t exactly money-printing because it’s balanced by a debt that will be cause it (in theory) to be reclaimed via QT. I don’t think the Fed expected QE to be as long or as big as it became, but let it continue when there was no core inflation happening. I agree with you that they should have seen it coming in the future and known it would race to catch up. Hindsight is perfect and they were trying something new, but I still think they should have forseen it.

DC: They absolutely did protect the economy and turn what could have been a second great depression into only a great recession. Wealth transfer was an unfortunate (and unintended, IMO) consequence.

I think GDPNow is now showing 3.9% for GDP in the current quarter, no big surprises here. Granted it’s not perfect, but it’s clear that the economy is anything but weak.

The formula for GDP includes government expenditures. Federal, State, and Local government expenditures are over $10T a year per FRED and have been growing at a fast rate. GDP is more of a marker of government spending at this point imo so I don’t put much thought into it any longer. In fact I would be surprised if it ever goes negative again given government spending growth.

The problem with high wage growth is that precisely this that causes the recession because wage growth has momentum.

So wages grow because the money supply has grown. However, money supply in the US is now shrinking.

A soft landing is low wage growth as wages match money supply.

A recession is when the momentum of wages soars past the money supply and there is -suddenly- an insufficient quantity of money to service the wages (or the economy generally), then viable businesses go bust and its terrible hard landing.

This is the trick imo, how to “land” wages appropriately on the expanded money supply .

Money supply shrinking with high nominal wage growth is actually a recession indicator, -not- an inflation indicator imo.

Wages are still chasing the inflation rate which is always substantially understated.

Money supply, if you’re referring to M2SL, has actually been growing since April when it bottomed. We’ll see if the trend to up continues and with $2T in Federal deficit spending I think it will go up…

The participation rates are unnaturally high. Extend any of those employment ratios back to the 1950s participation was much lower and more stable. Some adult has to run the household. More people should be out of the “covered” work force and in the open or grey economy. It could be done without the social inequities of the 1950s. Everyone working for “the man” is disgusting and unsustainable.

I really bristle when I see the YOY metric.

This all started around June of 2021, and prices are up roughly 20% over THAT time period.

Fed’s goal of 2% per year, without compounding, would bring a 6% rise..

So the OVERSHOOT is roughly 14%…..even if inflation returns to 2%.

What of the 14%? Doesnt matter?

We need some deflation to get back on the self authored inflation trajectory of the Fed…..but where is that discussion?

There is still about $4 Trillion too much sloshing around out there and the QT’s pace just isnt fast enough to resolve the issue, IMO.

Very quick to PUMP, Very slow to correct the problem. This suggests perhaps the goal of monetary policy by the Fed is not what we perceive, or expect.

And that’s the problem with the “goal.” Overshoots will never be corrected for, but undershoots will.

It’s more evidence the Fed wanted a nice 20% inflationary step-up to devalue existing debts. Inflation overshot by 14% in three years. If the Fed thought that was a problem, they would be targeting a period of price deflation to remove that excess inflation from the system.

Instead, the Fed is slow-walking QT, allowing the 14% inflation step-up to become embedded in the system, while piling on additional inflation of 4-6% per year. As people factor in the inflationary step-up, they overpay for goods and services, including houses. They take on excessive debts to fund the purchase of excessively priced assets. In a short period of time, say a year or two, the inflationary bump becomes a permanent feature of the economy that cannot be removed without destabilizing everything.

Shame on the Fed for its lack of transparency. I don’t recall the Fed ever saying the range of inflationary overshoot could be 14% in a three year period. The Fed said balance sheet expansions were temporary.

Right. Working and fixed income class should be rioting in the streets demanding deflation of that three years instead of hoping for a return to the 2% target. A giant hoodwink that just flew over our head :)

10,000 baby boomers retire each day.

About 6000 baby boomers die per day fyi

I just checked to see. In 2022, 3.2 million people of any age died in the US. So that’s about 8,800 per day of any age. Makes sense that the older generations would make up larger portion of this, LOL.

There’s a website with death clocks for each gen and for boomers they put it as a total of 85.358 million ever with already 27.540m dead and one dying every 15.4 seconds and 5,617 dead today. Pretty dark. It has 188 millennials dying just today by comparison…

Price inflation may have been 20%, but not wages – did your wages after tax go up by 20% since June 2021? Wage-inflation hahahaha what wage inflation? Deflation, you mean

Average hourly wages of nonsupervisory workers went up 12.5% since June 2021. My wife’s wages went up more than that.

CPI went up 11.8% since June 2021.

Fees for Appraisers working for the VA went from $525 to $625 last year. They still can’t find people to do the work. The reason: crime is out of control in Washington DC. There is murder every day, sometimes two. Homelessness is rampant. Maniac drivers are all over the place.

LOL

You really need to find better information sources, ones that actually inform you rather than play to your fears and take advantage of you.

Turn off Fox. They literally are willing to lie to you to keep you as a viewer. Be better informed. Or not and continue to live in ignorance. Your call.

Jim,

Dumb comment – Swamp actually works as an appraiser, in DC.

JimL

I missed the part where swamp was misinformed. Can you clarify or demonstrate?

In Tech, my coworkers and I saw a 2% raise last year. However, RSUs paid over 3 years increased. Thank goodness for the AI bubble or we’d all be leaving.

“I will gladly pay you Tuesday for a hamburger today.”

Slightly off topic Canada must be taking in too many immigrants as the unemployment rate ticked up a tenth of a percent in July. Too many people looking for jobs with the increase in the population.

In the larger macro picture, this increase in wages is a serious threat, because it helps amplify the hangover conditions of Zirp.

I just ran across a Fed blog post from last November, graphically explaining the disconnect between mortgages and hose equity. Here’s an interesting thought:

“ It may be that houses were accessible only—or mostly—to people who took out a mortgage, but now they can be owned by people who have enough equity to bypass external financing.”

With that background, consider what’s been going on for a lot of people, during a decade-plus of Zirp — let’s say, the s&p 500 has gone up about 300% +/- going into the pandemic — then, the god-given stimulus jackpot hits, with a tsunami of cash everywhere, and your real estate doubles, stocks continue their trip to the dark side of the moon — and this pesky issue of minuscule inflation pops up, causing your income flow to decrease by a an insignificant amount, that’s barely noticeable. Yes, ice cream doubled in price, but the money market has that covered.

My point is, there’s so many people who are fabulously wealthy now, and we’ve had years of everyone ignoring prices.

Currently, there are people overpaying for stocks, bonds, housing, food, etc, and ignoring the underlying cancer of cash burn — as their casual and comfortable discussion about if a recession isn’t going to happen, lingers on.

Ultimately, the cash burn, is like cancer, easy to ignore, until gradually and progressively, something changes. I think there’s a collective disconnect for people not coming to terms with reality.

Back to Fred, people who were able to leverage stock gains into buying multiple homes for Airbnb, may want to reconsider how much longer their winnings streak can continue.

If rent has gone up 40% but you received a 20% raise last week, it is more like a “Hair of the dog” cure for the hangover.

You have hope that with more raises, the headache will eventually go away.

If your rent went up 40% and your wages go up 20% while your rent goes down 15%, you will be magically cured. The masses will feel no pain.

It will be a soft landing. Or some may call it a Great Reset.

““Disability claims [are] soaring,” economist Peter St. Onge recently tweeted.

Bullshit. I’m so sick of morons abusing my site to spread bullshit and lies designed by morons for morons. I have no idea why you have so much fun spreading these GDF lies.

Here are actual disability claims, which in 2022 dropped to the lowest in two decades, despite increase in population:

Here are working people “with a disability” who are now WORKING thanks to working from home. And this GDF idiot “Peter St. Onge” you picked out of the Twitter shitpile confused people “with a disability” (e.g. leg missing) who are working and earning a living with “disability claims.” And you’re abusing my site to spread this despicable braindead shit.

LOL. I always come back to your site for your comments, I enjoy reading you slap people around

I just HATE it when these lies that go viral on the internet get dragged into here. The stupidest stuff is what people click on the most, and it’s this stupidest stuff that goes viral.

The internet is a strange place.

Winston,

You made me do it:

https://wolfstreet.com/2023/08/05/ill-just-crush-the-stupid-stuff-in-the-social-media-about-disability-claims-in-reality-claims-dropped-to-20-year-low-while-people-with-a-disability-are-employed-in-record-numbers/

The stock market has been telling us for months inflation was reaccelerating. That’s one of the first places it shows up. Truly tight money doesn’t kite stock prices, and it’s no accident softening final inflation followed bearish action last year. Consumer inflation won’t be licked without another leg down.

There also seems to be a weird relationship between labor force participation rate and CPI-stuff.

That relationship has been totally haywire, especially with pandemic oddities.

That may even fit with my prior curiosity about wealth accumulation since GFC and the possibility that there’s people dropping out of labor force, because they can — and $7 ice cream doesn’t phase them.

My dad pointed out:

As an ounce of gold can essentially always buy a fine suit,

Minimum wage is the price of a burger.

You can’t mix and match though! In my town I joked 20 years ago: The land of the $10 burger, and nobody will get out of bed for less than $10/hr.

Now it’s $20! Still climbing too.

Wage growth is good actually.

Yes, and Powell said that too. But he also said that when wages growth suddenly spikes, without corresponding productivity gains, it turns into a real problem for inflation.

And what do we call productivity gains without matching wage growth? Didn’t hear any fed officials worry about that. Looking back forty odd years of that I’d say if there is any validity to this line of reasoning then it shouldn’t come up for another three decades. That is unless we choose to produce reasoning strictly as a rhetorical device.

This is somewhat interesting, from a fairly recent Fed paper on inflation predictions:

“ In the previous sections, I showed that money supply/government debt ratio has been a useful predictor of U.S. inflation since the early 1990s. In this section, I investigate the money supply/government debt ratio as a force behind the U.S. inflation dynamics since the early 1960s. Figure 1 depicts the relationship between inflation (four-quarter CPI inflation, bold line, left scale) and money supply/government debt ratio (M2/Market Value of Gross Federal Debt, dash line, right scale) in the U.S. since 1959Q1 to the present. However, since this ratio is derived from the money supply/output and government debt/output ratios, therefore, I also investigate the behavior of money supply and government debt as percentage of gross domestic product (M2/GDP and government debt/GDP) showed in figure 2.”

The following is the intro in that paper:

“ The purpose of this study is to provide empirical evidence that, at least since the early 1990s, monetary aggregate such as M2 has been a useful predictor of U.S. inflation combining with the government debt. The reason for this is that government bonds (and other assets in a broad sense) also require money for transaction, and therefore, the predictive power of monetary aggregate can be improved by addressing this issue. To derive inflation forecasting model, I modify the quantity theory of money using an argument that is in line with the concept of ―price gap‖ proposed by Hallman, Porter and Small (1991). However, while the use of Hallman, Porter and Small’s (1991) P-star model requires estimation of long-run equilibrium money velocity and potential output, in this study, I argue that inflation can be forecast simply by using money supply/government debt ratio as a predictor.”

and Jay Powell, right before the “transitory” inflation began to spike

“We must unlearn what we know about M2”

This is the dreaded wage-price spiral.