Will CPI inflation back off as used-vehicle prices partially unwind? Ha, here come the massive CPI measures for rent that have begun to soar. Inflation Whac-A-Mole.

By Wolf Richter for WOLF STREET.

This has been developing in the used vehicle market since November: After prices spiked into the stratosphere, more potential buyers became reluctant to overpay ridiculous amounts for a used vehicle, and sales began to dip, and the underlying dynamics in the wholesale market began to weaken in November and weakened further in December, and then in January wholesale prices were flat for the first time since August seasonally adjusted. And not seasonally adjusted, prices fell.

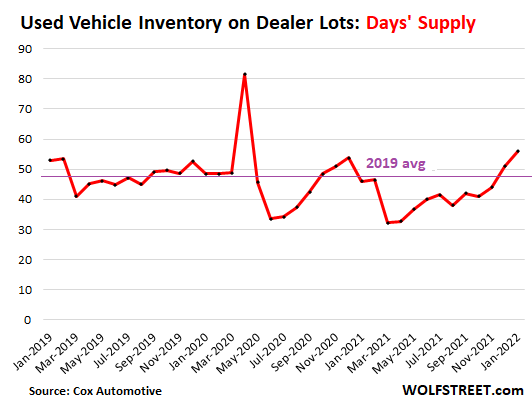

By the beginning of February, supply was above average. And over the first two weeks in February, prices have begun to dip even on a seasonally adjusted basis. So here we go, charting the turning point of a market gone nuts.

Used vehicle supply on dealer lots at the beginning of February rose to 56 days, up from the 40-day range over the summer, the third month in a row of increases, including sharp increases over the past two months, according to data from Cox Automotive released last Thursday. This was well above the average supply of 48 days in 2019. So given the current rate of retail sales, there is plenty of supply on dealer lots, and this supply is growing rapidly:

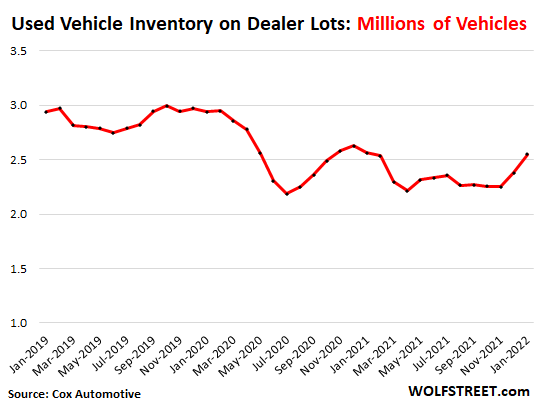

The number of used vehicles in inventory on dealer lots at the beginning of February rose to 2.55 million vehicles, the highest since December 2020 (2.56 million), according to Cox Automotive data, and the second month in a row of sharp month-to-month increases.

As you can see from the charts above, though used vehicle inventories were tight last year, there was no shortage in inventories to rationalize the ridiculous price spikes – 40.5% year over year, according to the CPI for used cars and trucks.

These price spikes happened, starting a year ago, because consumers were suddenly eager to pay those prices, and dealers were eager to charge them, and then when dealers saw that they could sell at those prices, they began bidding up wholesale prices. This is the inflationary mindset that took over, and prices spiked despite plenty of supply.

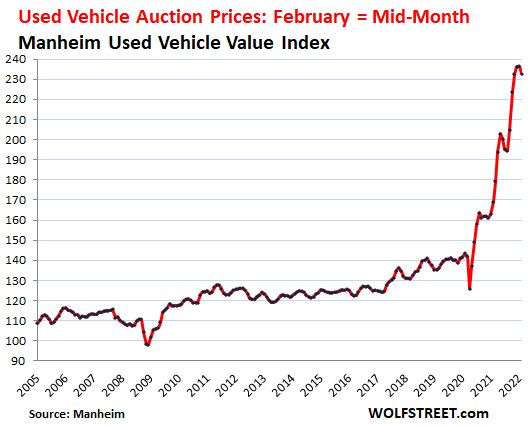

Now there’s the first dip in wholesale prices.

In the first two weeks of February, wholesale prices at the auctions around the US fell by 1.5% seasonally adjusted, the first dip since last summer, after having already flattened in January, according to Manheim, the largest auto auction house in the US and a unit of Cox automotive. This whittled down the year-over-year price spike to 38%, from the peak of 47% in December, and it whittled down the two-year spike to 62%, from 67% in December. Even if those prices drop quite a bit further, they will still be ridiculous.

Based on the underlying auction dynamics that deteriorated further over the first two weeks in February, Manheim said that used-vehicle prices would “likely see further declines in the second half of the month.”

I don’t expect prices of used vehicles to plunge anywhere near 2019 levels, because prices of consumer goods are downward sticky, but there is now growing resistance by potential buyers to these still ridiculous used vehicle prices.

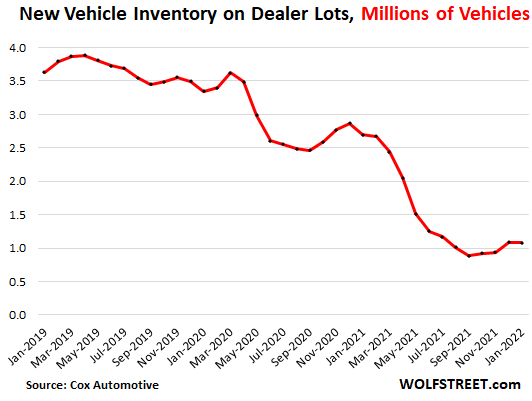

But new-vehicle shortages still rule.

Inventory of new vehicles on dealer lots at the beginning of February dipped to 1.08 million vehicles. While that is up a tad from the lows during the fall, it’s up not nearly enough to make a dent: they’ve collapsed by 68% from two years ago, when there were 3.35 million vehicles in inventory:

New vehicle days’ supply, given the depressed sales volume due to the shortage of product, ticked up to 37 days, still woefully low, when 60 days is considered healthy. By comparison, in 2019, average supply was nearly 90 days, which was problematic in the other direction.

CPI and the unwinding used-vehicle price spike.

It takes about two months for wholesale prices to translate into retail prices captured by the CPI for used vehicles. So the flat wholesale prices in January and the declines in February will start to filter into CPI in a month or two. And then the CPI for used vehicles will start to decline. Does this mean overall CPI inflation will back off?

Used vehicle CPI weighs about 4% in overall CPI. The two housing measures in CPI, which are both based on rents, weigh a combined 32% of overall CPI. These housing measures have started to surge. As the spiking “asking rents” – rents listed by landlords in their ads – become actual rents for enough tenants to move the needle, they will filter into CPI.

But this process takes time. The asking rent spikes we have already seen through January will filter into the CPI over the next two years (I discuss this phenomenon of asking rents versus CPI here). And given their weight (32% of overall CPI), these rent inflation measures will easily blow away any declines in used vehicle prices.

This is the game of inflation Whac-A-Mole: One price gets hammered down while prices begin to spike elsewhere as inflation spirals through the economy.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I think the title of this article should be:

Buyers Pause: Used-Vehicle Supply Increases, First Dip in Crazy Prices. But New-Vehicle Shortages Persist

There will be plenty of buyers if prices drop far enough. Price solves those kinds of issues.

Corporations are playing a game of how much can we get out of the brainwashed morons. They will push prices as high as they can. They will push it till people quit buying. Inflation is running at a good 25%. Lets use the 1980 way of calculating inflation. They couldnt get inflation down back then so had to manipulate the headline numbers. Now with our Moron government sanctioning Russia we will feel more inflation pain. The lunatics are running the asylum. Sanctions will bite us in the a$$. Oil has already jumped, $5 gas or higher at the pump soon. Oil is the life blood. As Oil goes so dont everything else food, fertilizer, transportation. Its a domino effect. Yep those sanctions will hurt Russia they just made $20 more on a barrel of oil overnight. It just amazes me how ignorant people get into a position of power and make all the wrong moves. A Fed that is so far behind the curve it insane. A goverment with mostly senile old farts wearing diapers running the country. The lunatics are in charge of the insane asylum and we are all Fu#*ed.

“Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies”

Groucho Marx

Just anecdotal evidence.

I have been traveling quite a bit the last month.

Every CarMax and used car dealership I drive by are packed with inventory.

and they are 1/2 empty here

Nah Wolf got it right. Thanks for another great article. Time to re-up my subscription.

Hey, let’s air drop all those used Toyotas into the Ukraine…that outta solve our trade deficits on paper at least!

Deficit is $1T, You’ll need to drop at least 50 million cars. It is more than Ukranian population.

Silly wabbit…Central bankers can bribe, er hire, appraisers to set values at any level they want. Car dealers couldn’t give a sh*t as long as they get their price paid. As soon as we drop 190K autos on Putin’s troops, we declare a win-win for the trade balance and military. Next up solution, invasion of Canada to liberate the breakaway republics tired of rediculous rents-“Forget it Jake, it’s Chinatown”.

They could be like the U.S. then with several cars per driver! Then lots of new businesses will need to be started to support the cars and the gasoline sales. Soon after that they would need their own central bank! Think jobs!

Great deals on Chrysler 300 models, fantastic ride, love them.

I have a 2011 300C — probably the best car I’ve ever owned. Bought it used in 2014 — you can’t beat the depreciation of Detroit iron when you’re buying used.

Description of Weimar notgeld (unofficial currency issued by many institutions and municipal governments of the time):

”

With notgeld, artists were free to convey the existential crisis of the moment. “There’s this sort of insane frenzy [to the art] because the denomination is increasing so rapidly,” Maynes explains. “But there’s also this kind of despair and chaos.”

”

The decentralized issuance of currency is crypto. “Frenzy, despair, and chaos” rings true today.

“notgeld” – learn something everyday!

This (and WTF charts!) is why I visit this site!

Notgeld literal translate to emergency-money. As stated it was issued by local governments and such. It is we can’t get banknotes from the central bank so we print our own temporarally and we will change them to real banknotes at a later day. They can’t be further from crypto except maybe the Venezuelan state one or that one from facebook.

My AWD/backup vehicle is a 2008 Escape with 140K on it. It runs fine, but the transmissions are notorious for crapping out around 150K. Most people wouldn’t put a rebuilt tranny in an old Escape, but with used car prices what they are, and the 3.0L V-6 in it being a solid engine, I’d have to consider it.

As long as it isn’t rusty probably a good move.

I have a 2009 Escape with 215k miles on it. A handful of sensor issues but really no big deal. Had a mechanic look at the codes and it’s not the part “tire sensor error” the tires are fine but the sensor is toast at $400 to replace I don’t care. Hope the car passes smog in May!!

If it’s the TPMS (Tire Pressure Monitoring System), odds are it’s not “$400 to replace”. The batteries in the valve stems are likely dead and the cost to do those is minimal. Take it to a *real* tire place and get a quote.

Note to self: When you replace your tires, buy the kit. It’s like $19 (that’s what Costco charged me a year ago). They replace the 4 batteries when the tires are broken down for replacement.

Check the date codes on your tires that are “fine”. If they’re over 6-7 years old, they’re not as safe as you think they are, despite the “good tread”.

Depends on the particular sensors in the Ford. Some have replaceable batteries, others are sealed units and you have to replace the entire sensor when the battery dies.

$100/wheel is about average to dismount the tire, replace the TPMS sensor and remount/balance the tire.

Just be careful: In the case of my Infiniti, the TPMS receiver was flakey, and even with brand new sensors on all wheels still threw random errors until I replaced the receiver.

Autozone checks this free,check out utube can probably fix yourself

Wait, I see the future: Bob-“Dyslexa, ignore the idiot lights and concentrate on making the motor work.” Dyslexa-“Okay Bob, I’ll order a whore for video nights and put juice concentrates in the motor works. Would you like some relaxing music now?”. Bob starts to puke when the Beethoven begins to play.

So when the stock market starts crashing hard, likely before year end, there will be plenty of used and new car inventory.

And when (not if) we see $150 per barrel oil, that inventory will consist of a crap ton of very large suvs, and very heavy pick up trucks, that were all bought at very elevated prices,

Americans still have not realized that fracking (so called miracle) was all about the feds super easy, debt financed as far as the eye could see, and something that won’t ever occur in our lifetimes here again in America as far as the volume pumped out of the earth on mainland US.

Unlike 2008, there will not be a price peak in oil and then a crash of the price, but rather a runaway price scenario where oil simply cannot be found or extracted fast enough to meet world demand, and the price of oil hitting $200, then $300 per barrel will basically lead to the certain collapse of our oil based economy. The gasoline is really the waste or byproduct of the real need for the rest of the barrel of oil, refined for most everything produced that we eat, and consume, or need to use to live on in terms of all kinds of products.

If oil (and other commodity prices) remain so high (or higher), you would expect at some point that instead of promoting a weaker currency (like in the past decade), countries are going to want a stronger currency.

It surprises me that this hasn’t happened yet. Perhaps we first need to see one or more of the developed world currencies weaken relative to their peers. Nobody is really looking at this now yet, but once an event like that happens, many hedge funds will start looking for blood, and then it is game on.

It really doesn’t make sense to keep thrashing your own currency at this point in history (it never made sense to me anyway, but once it starts to prevent wealth from trickling up in some countries…)

“And when (not if) we see $150 per barrel oil, that inventory will consist of a crap ton of very large suvs, and very heavy pick up trucks”

Not to mention trying to heat their companion McMansion they overpaid for. I can see many huddled in one room with the doors closed and drapes on the windows. Stock up on candles !

Hope Carter is still around to at least mumble, “I told you idiots so”.

I would argue that gasoline is the product and the rest of the barrel is waste. In 1901 you may have been correct but back then they didn’t have plastic. A big reason why oil is so high is that EVs are getting to be the standard car and they don’t use gasoline. And most new oil projects take so long to develop that they will come on stream when EV will seriously eat into oil demand so there is a serious reluctance to invest in new projects

My kid is graduating college and with good grades on a well paying degree, so was promised a new car. RAV4 hybrid was requested so I started looking around. One dealer is asking – and said they’re getting – 4K over MSRP for hybrids, as gas goes over $5 in CA. Note that just with MSRP differences that hybrids are $3K more than gas equivalent models, so the spread is now $7k.

A spreadsheet calculation shows a RAV4 hybrid saving $700 a year versus its gas cousin at $5.50 gas, 12K miles a year, so just shows people are stupid. So I told my kid no hybrid.

For gas cars I am seeing the usual haggling around MSRP, and you can get below on many models. Note “internet shopping” sites haven’t fixed car shopping at all. Buying a new car is still a horrible, horrible experience.

agree totally on the horror of the process of buying new car(s) whateva!

Just sold outright the ’19 RAM for over 50% MORE than offers just over a year ago, and after trying and failing to buy a hybrid, new, settled on a cherry 20 year old from private seller, very reasonably priced IMHO..

dealer wanted MSRP plus$2K ”dealer” charges and would NOT give fair ”trade in ” value for the 19 with 11K miles (barely broken in IOWs)

ironically, the corporate office of the dealer bought the ’19 for cash at the price I wanted, which I found strange, but fitting well into the crazy times, eh

Agreed on your comments, but maintenance on a hybrid is lower then I.C.E.. I have a 2016 Malibu, 100,000 before first brake job, very comman says my mechanic. Oil changes, filters, plugs, all last longer. Actually the Malibu is a fine sedan no longer produced because of no customer demand, that’s beyond me. The m.p.g. hasn’t changed at all, even in the cold midwest 36 m.p.g. is normal, 40+ on the highway most of the year.

Hybrids never pencil.

It’s like solar panels. You don’t do it to save money, you do it for the environment.

Cue Sally Strothers here…..

Our hybrid — biggest car I ever owned — gets 40 mpg urban driving, which is where it’s being used. Bought used two years ago. Runs great. Compared to my G-35 which got 18 mpg, maybe. That’s 22 mpg difference. At 15,000 miles per year, we’re now buying 375 gallons of gasoline per year, instead of 833 gallons as we used to for the G-35. OK, different car, much less hp. So it’s more than just the hybrid tech. But it does make a difference: at $4.80 a gallon, we’re saving $2,200 a year.

When gasoline hits $8 a gallon, we’ll be eating steak again from all the money we’re saving with the hybrid :-]

Our Beloved Wolf-

Like fresh Parisian baguettes and croissants, please enjoy steak in moderation. You are irreplaceable.

Wealth increases the necessity to circumscribe our passions.

Wolf what hybrid do you own?

Fusion. Since I travel quite a bit, I rent quite a few cars. One time, they gave us a Fusion and we drove it for a week. I was very impressed, and since we were in the market for a car, we bought one a few months later from a rental company.

Whoever made the decision at Ford to kill the Fusion is verifiability braindead.

According to motortrend dot com, 2020 Ford Fusions are going for about 24K, 1K over MSRP.

Humility precedes honor.

Yes, I should sell it and make a bundle, hahaha. I could make several thousand bucks on a vehicle I bought used two years ago. This is totally nuts. But then I’d have to pay an even crazier amount to buy something else :-]

I’m glad someone else thought to mention that this is more than a pure economics issue, what with the externalities not being factored in.

Nothing environmentally friendly in making solar panels. It’s energy intensive, uses lots of nasty chemicals and generates lots of nasty wastes. Also, the mining of silicon, arsenic, antimony, boron is an environmental nightmare.

And the dealer doesn’t ask over MSRP for the non hybrid?

Also the resale value is important.

High used car price is incentive to trade it for new. It reduces pain when you see price of new cars, also reduces sales tax.

Yes, I can still drive old car, but I might never again get such deal for selling it.

But check out new car prices! How much over sticker would you like to pay?

If you’re willing to drive to 4 to 5 dealers and aren’t looking for the most in demand vehicles, I’m sure there are deals to be had at or below MSRP. The car market’s legs will begin to bow to rate hike pressures before year’s end.

2022 is the recession signal year for cars that will precede a turn in the housing industry in 2023. It really starts to fall apart when the FED gets to about $500B in unwinding its balance sheet, most of which they may have to roll off or sell at a loss.

And people’s wealth outlook will continue to tank as we’re looking at a sustained 18 months of dropping market asset / crypto prices that started in early 2022. Everything will drop another 20-30% over this period, greatly affecting people’s willingness to spend money one all sorts of things.

The question is does the higher rates, and no QE translate into a much slower rebound than what we say throughout the last 9 months of 2020? My opinion says absolutely yes.

This mania of selling vehicles above MSRP is now so widespread that Ford has started to crack down on it, apparently telling dealers that if they continue doing it, they’ll get their allocation cut further, which is a powerful weapon, given that dealers have already been having mega-troubles getting their orders filled because of the shortage of vehicles due to the production cuts due to the semiconductor shortage.

So glad I moved to a place with great public transit. I like driving and have a ten year old car, but it is a luxury to drive, not a need.

Mc Mullen food in council bluffs is advertising selling new cars under msrp

Iowa

“This mania of selling vehicles above MSRP is now so widespread that Ford has started to crack down on it, apparently telling dealers that if they continue doing it, they’ll get their allocation cut further”

According to the Ford CEO earlier this month, only about 10% of their dealer network is charging above MSRP. What is happening is that most used, in-demand cars like the Bronco are being sold for very high prices due to the new shortages.

Ford is making a big deal about nothing. They’re NOT going to significantly reduce the number of cars they send dealers. Telling and doing are absolutely two different things. This all bluster, trying to make Ford look like the good guy. Now, if Ford actually comes out and starts widespread allocation reductions, then I’ll certainly eat crow, once you’ve written the article about it.

But, the ugly reality is that we’re looking at $120 oil by mid-June at the latest. Housing & rents are going to keep going up throughout 2022, and I believe you’re on record stating that these price increases are going to start to shine in CPI this year. Sustained food price & wage spiral increases are on tap for the remainder of 2022.

The only thing that’s going to stop this inflation is a recession, which is anyone’s guess as to when that will occur.

Chinese are buying up the Toyotas and Lexus SUVs and reselling them for profit. Why do they always bubble up everything?

C$16,000 for a 1993 Toyota Land Cruiser when it was sold for C$12,000 a few months ago? To 666 with that!

It eems to me from France that auto price and supply insanity in the U.S. is due to the proliferation of m.b.a ‘s from prestigious business schools and the total mismanagement of the supply chains.

Vehicles here seem to be abundant at reasonable prices,

Just purchased Peugeot 2008 EV, for less than ice equivalent.

Both their new and used auto lots were full.

Not directly related to car inflation but related to crazy price spikes that will come down…

I read that in Europe they are going to change the way the CPI is calculated starting from ~2024 or so, to include house price inflation better.

It is obvious what the play is here: by that time there is likely to be a long bear market in housing, coming down from the crazy prices we see today. This will then give them cover to keep interest rates (too) low citing “deflation”, despite soaring consumer prices.

YuShan-

“ they are going to change the way the CPI is calculated starting from ~2024…”

The manipulation of “data” by statisticians is a potent and ever-present tool used by policy-makers to persuade and deceive their subjects. And not just in economics….

Can’t remember who said it, but the quip about “torturing the data till it says what you want” comes to mind.

the statistics professor at CAL started his first lecture by saying he would show us how to ”prove” anything we wanted to prove with statistics, and proceeded to do exactly that

the first book assigned was, “Lies, Damn Lies, and Statistics.”

folks who don’t understand the total flexibility of statistics are completely subjected to the vast and continuing propaganda currently controlling most of WE the PEONs, especially those of us who watch TV or nowadays most of social media

– “The manipulation of “data” by statisticians…”

Disagree.

The data are manipulated by non-statisticians.

The so-called manipulation is basically an attributing of meaning that the selected statistcs never had in the first place.

You can prove anything with statistics to people who don’t understand statistics.

Statistics only apply to groups, not individuals. What does it mean to say there’s a 60% chance of rain today? It will rain 60% of the time? It will rain over 60% of the area in question? Look it up. The methodology is absurd and will confirm your long-standing suspicion that weather forecasts are worthless. If you want to know whether a specific day will be sunny, the answer is “it either will or it won’t”. 80% chance of rain means nothing.

I like Granny Clampett’s rain prediction technique. If the ants are covering their ant hills its going to rain.

You can’t apply statistics to individual independent events. If you toss heads 10 times in a row, what are the odds of heads on the next flip? 50-50.

If a procedure works 75% of the time, what are the chances it will work for you? Patients ask this all the time. The problem is that we might have good evidence that it works 75% of the time but that’s for a group of patients studied. Patient #74 might have done well but #75 was a failure. Are you going to be like 74 or 75?

There’s no way of knowing. All that can be truthfully said is that 75% get better.

I have to explain this all the time to supposedly numerate friends (mostly engineers) that life expectancy averages aren’t terribly helpful in the way of predictions for any one individual in the way they are for life insurance companies. For an individual it’s kind of like the “law of large numbers” in reverse.

You seem to not understand there is distinct difference between statistics and probabilities and they are not the same. Once you get your grip around that, your picture of making conclusions should become clearer. Probabilities can use statistics, but they are not statistics.

Shouldn’t the stimulus payments be about dried up in the economy at this point, along with people borrowing against their over-valued homes be reaching their peak? Either many are already underwater on their homes and vehicles or they’re going to be very soon.

There are growing numbers of 2018-20 pickups on the lots valued at $40 to $50k. Used vehicles at these prices? If I’m dropping this kind of dough on a riding-in-style pickup that everyone can see me show off, I want that new car smell.

Buy a new car scented air freshener for $3.99 at your local car wash.

Oh don’t worry, with stocks and housing inflated beyond any amount the stimulus payments doled out, people can sell and home eq their way to keep the economy humming.

A Ford dealer website displayed over 100 new vehicles. I checked and most of them are on order, not on the lot. A salesperson told me they have the vehicles that were photographed on their lot. The vehicles without the dealership in the photo background are on order. There is a $69,000 Bronco in inventory. The gas economy vehicles sold out. Brent oil futures are nearly $98/barrel this morning.

went to my local RAM dealer to see my buddy there, and saw a nice looking pick up in the show room with a SOLD sign on the windshield

buddy said buyer paid $116,000.00 CASH

WOWZA!!!

A shill? Was it really a bona fide sale or mere window dressing?

If not dealer bait, then “Holy High Price Ram Sticker, Batman!”

Hopefully he is planning on using it to tow something heavy!

repossessed cars…maybe?

I dropped by the ford dealer on Friday to pick up some screws for the Fusion undercover splash shield. We have a hybrid with almost 110k miles on it. The only maintenance we have needed is a new battery (trunk), and splash shield. Still on original breaks. In any case the parts supply guy said that Ford would regret discontinuing their cars. 2013 Fusion Hybrid SE Life time MPG 42.4. Best car we have ever owned.

In 1979 oil was $130 dollars adjusting for inflation.

In 2008 oil was around $160 adjusting for inflation.

We have a long way to go.

I usually buy an off lease or lightly used BMW every 4 years. I buy cars when I don’t need them so I don’t get crushed on pricing. Might hold off now for a bit longer. If more people did this prices would dump heavier. Most people I know just love newer cars, but could easily drive there current cars a bit longer.

This (….”could easily drive there current cars a bit longer”) is a point made often by Wolf. New car purchases are frequently optional, discretionary. (it’s “their”, btw)

When interests rise to a certain height, and the monthly payment rises to a certain amount, this whole escalation will deflate.

My Dad used to sell cars, many years ago. He was always amazed to report that most buyers cared little re the price, interest rate or length of loan, only what the monthly nut would be…

Bought a new dodge Dakota in 2000 drove till 2018 great vehicle except for ball joints ran great but got rusty ,cab mounts fell off cars are worst investments ever ,be like stock market buy and hold, this pickup new was $10;500

Get used to inflation. As prices rise, volume will drop. Hence we will get stagflation until wages rise. Lather, rinse, repeat.

Thus the lesson of the 70s doth return.

So until the fed makes money expensive and scarce, we live the whac a mole. And given how moronic the populace is about politics and inflation, this might take a long while. Like ten flipping years.

As for fixed income, plop. Stocks also will look like crap.

Someday this war’s gonna end…

Starting point is far worse than entering the 70’s.

Median income and net worth have flatlined since late 90’s, even with an unprecedented asset mania, a fake economy, and the loosest credit conditions ever.

Country produces a lot less useful stuff hence the huge trade deficit. Longer term, USD should lose a lot of value versus the currencies making it which will also impact living standards.

1982-2020 was a period of rising asset prices and mostly moderate inflation. When the mania ends, look for the opposite. Deflation in asset prices and higher inflation in consumer goods, especially the items people need most to survive.

The majority of Americans are destined to become poorer or a lot poorer.

Deflation for car prices? All I see at my friend’s job is young men in their early 20s to 30s buying used cars for over C$15,000 while they pay C$500 a month in car insurance and gas prices are rising.

Partly true. Real income has been increasing for the past 5 or 6 years vs inflation. This year no. But according to Doug Shorts analysis, median real income dropped from mid 90s to 2014 and then it has been rising. Actually we are back to where it was in the 90s.

Thus, you are correct that it basically has been flat but that is good. It means that income has kept up with inflation.

Of course, he gets his data from the FED…etc. So we know inflation has been under reported.

You guys ever see commercial,free,free,free explains our economy free money free housing free food = helicopter money

The US population has never been less prepared to handle economic adversity than it is now, both financially and psychologically.

An irresponsible sense of self-entitlement and societal lack of accountability. In the public sphere, no one is accountable for anything, except the taxpayer.

Amen

US Baby Boomers are remembering. Most of my friends who remember the years 1974- 1983 are cutting back. The population lost in space are early Gen X cohort and their offspring. They have never seen a hard economy in their lives. They are hitting their early to mid 50’s with kids in college and prime layoff age. In my upper income community they have no idea to save or cut back. They do not know how to cut their grass, pick up a pain brush or clean their homes. I was deeply troubled by an X stay at home wife who FB asked for someone to remove the dead fish dropped by a bird on her driveway. Single income families will be in trouble.

A couple of years ago, I saw a blurb from someone high up the Home Depot food chain. She said that they were making instructional videos, since many younger people had no idea how to use their products.

One of them was how to use a tape measure!

Gen x lived through the dot com boom and the GFC, as well as bore the brunt of offshoring to destroy skilled labor and uncontrolled immigration to destroy unskilled labor.

On REI’s website there are classes on how to ride a bike.

The majority of the US Population were not old enough or invested enough to feel the direct sting of the last housing collapse/stock market crash/recession. Let alone the dot.com crash, the 90’s recession, the 90’s RE market devaluation, Black Monday, the S&L Crisis, etc. They have virtually no perspective. They will be educated soon enough.

Been watching several world travelers ride motorcycles around the world in rural areas. The key is to drive a simple small displacement motorcycle with minimal electronics because you can get them repaired anywhere kind of like the small Toyota pickup which is sold all over the world.

Great idea until Bambi runs out in front of you or grandma turns in front of you.

Last year, I bought my wife a new 50cc Honda Metropolitan (because she thought it was cute) to ride around our neighborhood. While I tagged it and insured it for liability purposes, I told her it was my sincere wish she didn’t leave the hood.

Very true. I will say this. I used to bicycle all the time on streets and rural roads when I was younger and riding 30 mph is safer than riding 12 mph. Keep her in the hood if you can.

NYT:

“Why It’s Unusual for Drivers to Be Charged in Cyclist Deaths”

Only 7% (!!!) of NYC drivers who killed cyclists (bikes & motorbikes & EV bikes) end up in the court room.My guess is – only those who bothered to stop and look at the gory twitching body in Spandex, instead of keepin’ on driving.

Even more funny is the reaction of particular NYPD precinct where this accident occurred.Cops start ticketing bikers for everything they can think of 😀.

Harassment lasts about 1 months,interest wanes, then it is business as usual.

Motorbikes are good for city streets, but for rural roads that is a death wish. Hitting a herd of cows at 40mph, getting hit or sideswiped by speeding minibuses or trucks= instant disaster

On a foggy day in Wisconsin, back in the 80s, a co-worker of mine hit a cow in Wisconsin. Luckily he wasn’t going very fast. The cow took off. My buddy was not seriously hurt.

Prime NY strips at my local gourmet grocery annual meat “sale” a few weekends ago: $68/lb. No thanks. Buyer’s strikes will be spreading across a range of products.

Does anybody have comfort the rent inflation is computed properly?

If owners equivalent rent is based on a poll, do they publish the detailed polling statistics and polling methodology? Has the data compilation been audited by an outside group? Has the methodology and approach been audited by an outside group?

Without assurances, it seems possible that a huge part of the CPI could be easily manipulated behind the scenes.

These are basic questions any transparent government should address.

House value. Let’s say $300k. Desired ROI. Let’s say 5%. $15,000 per year. Subtract Taxes, Insurance, & maintenance. Let’s say $3000. Leaves $12,000 per year or rent at $1000 per month. OER is $1,000.

Sorry. Add Taxes, Ins & Maintenance. $18,000 per year. OER should be $1500 per month.

Wolf-

It seems you’ve covered energy, auto and housing inflation pretty thoroughly. It would be interesting to see some of your excellent analysis in areas of healthcare inflation and continual rise in education costs.

Info on how they fit into CPI, and some detail on their trajectory and what level of importance you place on them might be helpful.

(I’m relatively new to this site… perhaps you could point me in the right direction if covered recently)

There aren’t different kinds of broad inflation. But we are definitely headed for peak oil. Broad inflation, contrary to Charles Evans, always results from monetary policy blunders, a rate-of-change in monetary flows, volume times transactions’ velocity, greater than the roc in real output.

Contrary to Powell’s transitory remarks in April 2021, nothing has changed in > 100 years. The distributed lag effect of money flows has been a mathematical constant for > 100 years. And that was the case after the last stimulus payment in March. Powell should have known what was coming.

1) SPX is down, but S&P futures are UP > Mon close.

2) If Mirkel had mini she wouldn’t need Putin., but she panic…

3) Germany is running on NG. The German might start a fusion, a reaction.

4) If Japan kept the core running, Fukushima generators wouldn’t not shut down.

5) NG in bed with ESG. Together they destroy the coal and nuke industries by selling NG below cost.

6) Used cars and XLE are losing their steam.

As far as #3, a company called Fraunhofer tracks the stats for German electrical production mix. For 2021 (full year), they show natgas at 10.4% of Germany’s production, in 4th place.

Wind 23.1%

Lignite (brown coal) 20.2%

Nuclear 13.3%

NG 10.4%

Solar 9.9%

Hard coal 9.4%

Biomass 8.8%

Hydro 4.0%

Other (presumably oil) 0.9%

They don’t have to be dependent on gas if they don’t choose to be. But they are trying to replace nuclear and coal with renewables already. Add in a third thing that needs to be replaced, and they are going to have to prioritize something.

Just like House prices, Used Car prices is very much boosted by the $6 Trillion $USD printed by Federal Reserve.

The only way to end these asset price madness, is Guillotine Movement for all members of Fed Reserve.

It’s barbarian, no doubt, but it’s probably the only way to rein in the runaway Inflation. Make the beheading WRITTEN into the textbook for future generation, and to ingrain FEAR to the bankers.

In the name of Helping the poor, Fed is actually screwing the POOR and hard-working savers, while helping immensely the Rich.

Was doing my taxes and noticed the IRS cut back the mileage deduction from 57.5 cents/mile to 56 cents/mile in 2021. This is in the face of a 40% increase in the cost of ownership of your business vehicle. WTF is going on?????

Isn’t part of the mileage deduction for vehicle depreciation, which there wasn’t any last year? I don’t know because I haven’t deducted mileage in over a decade now the corporation owns the vehicles.

I have (let’s say, acquaintance) who just bought a Nissan Armada for about $60,000 to save from having to spend about $5,500 on a tranny for his 2009 CRV. I bought the CRV for $1,200, spent less than $1,500 and a few days fixing the transmission.

I now have a sixth car and I don’t know why.

The CRV is perfect, but I don’t need it.

My ’97 Expedition is jealous, as well as my ’37 Cord and ’79 Corvette. My ’99 GMC doesn’t seem to care and the silly ’02 525I BMW needs to be driven. BTW, the 1965 Mustang is flawless.

Maybe I need a Nissan Armada too to keep from spending a few thousand on repairs every couple of years.