If the homeownership component in CPI mirrors the Case-Shiller Home Price Index, CPI would jump 5.1%! Not to speak of new & used vehicle prices, which I nevertheless speak of.

By Wolf Richter for WOLF STREET.

The Consumer Price Index jumped 0.6% in March compared to February, the sharpest month-to-month jump since 2009, according to the Bureau of Labor Statistics today, and was up 2.6% from a year earlier, after the 1.7% rise in February.

The infamous Base Effect, which I discussed last week in anticipation of what is now coming, was responsible for part of it: CPI had dipped in March last year, which created a lower base for today’s year-over-year comparison. Over the 13 months since February last year, which eliminates the Base Effect, CPI rose 2.3%.

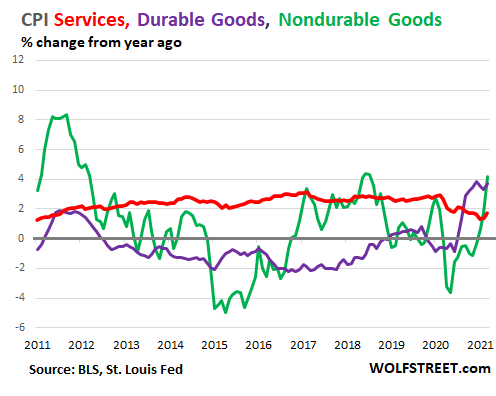

- Prices of durable goods continued their upward surge, rising 3.7% from a year ago (purple line);

- Prices of nondurable goods, which are largely food and energy, including gasoline, jumped 4.2% (green line);

- Prices of services rose 1.8%. This is the biggie, accounting for two-thirds of overall CPI. It is dominated by a measure for homeownership costs, which ludicrously, as home prices are exploding, merely ticked up 2.0% from a year ago. More on that in a moment.

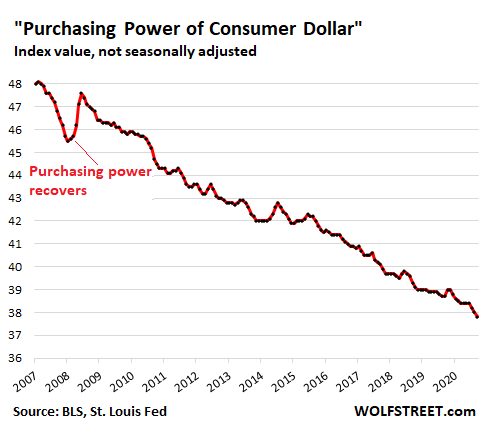

Consumer price inflation means loss of purchasing power of the consumer dollar, and thereby the loss of the purchasing power of labor denominated in dollars. And the purchasing power thus measured dropped 0.5% in March from February to a new record low, according to the BLS data. Given the insistence by the Fed on perma-inflation, the dollar’s purchasing power keeps dropping from record low to record low:

But wait, it’s a lot worse…

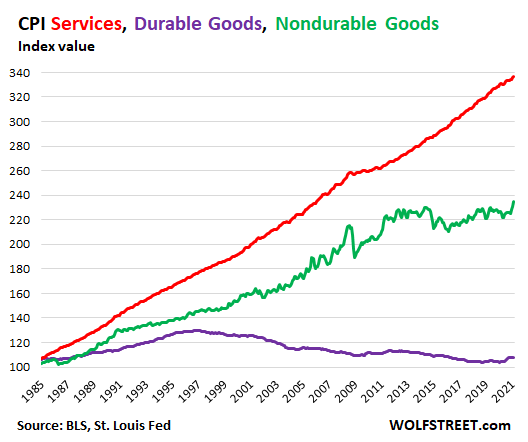

The three major Consumer Price Indices – CPIs for durable goods, nondurable goods, and services – over the long term, give a fascinating picture of what is going on with the CPI itself. These indices, shown below as index value, not year-over-year percentage change, were set to a value of 100 in 1982-1984. Since then:

- Services CPI has risen steadily (red line below).

- Nondurable goods CPI rose until about 2012 and has then wobbled along in the same range, but now appears to be breaking out of that range (green line below).

- Durable goods CPI peaked in 1996 and has trended down ever since, even as actual prices of most durable goods, particularly big-ticket items such as vehicles, have surged. The recent increase in the durable goods CPI barely registers in the long-term decline (purple):

CPI for services held down by homeownership costs, which exploded in real life.

Housing costs – rent and homeownership costs combined – weigh about one-third of the overall CPI and about one-half of the services CPI. Rents of primary residence (accounting for 7.8% of overall CPI) ticked up just 1.7% in March compared to a year ago. In reality, rents have surged in many markets and plunged in the most expensive markets. So national rent increases of 1.7% might be close.

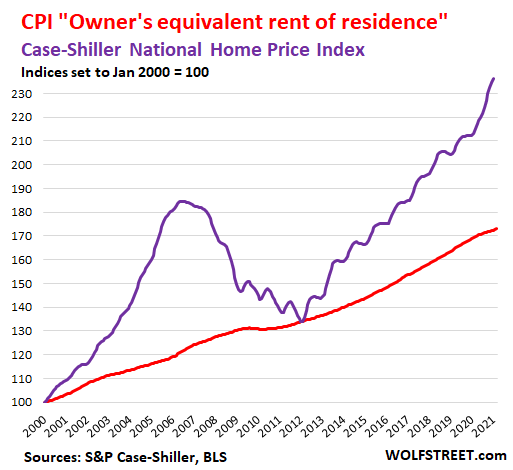

The problem in the CPI is the homeownership component, the “Owners’ equivalent rent of residence,” which accounts for 24% of overall CPI. It is based on surveys of homeowners’ estimates of how much their home would rent for. And this CPI for “Owners’ equivalent rent of residence” in March rose just 2.0% year-over-year (red line).

But the Case-Shiller Home Price Index, which is based on the sales-pairs method and has a better handle on housing bubble reality, soared 11.2% year-over year (purple line).

Had the homeownership component of CPI risen in line with the Case-Shiller index, the overall CPI would have jumped by 5.1% year-over-year – nearly double the published rate of 2.6%!

And just when you thought it couldn’t get worse…

The long-term decline of the CPI for durable goods is of course a mirage in terms of actual prices paid for durable goods – everyone who has ever paid for durable goods knows that.

This is due to the increasingly aggressive use of “hedonic quality adjustments.” As a product is improved and the price goes up, that price increase is then ascribed to the added costs of the quality improvements, and is therefore excluded from CPI, as CPI is supposed to track the loss of the purchasing power of the dollar, and not the costs of the improvement of products.

The theory is that you’re paying more because the product is better. This is true for consumer electronics and motor vehicles, which have vastly improved in all aspects over the past 20 years. But the aggressive application of hedonic quality adjustments leads to bizarre outcomes, including the long-term declining CPI for durable goods that has been weighing down the overall CPI.

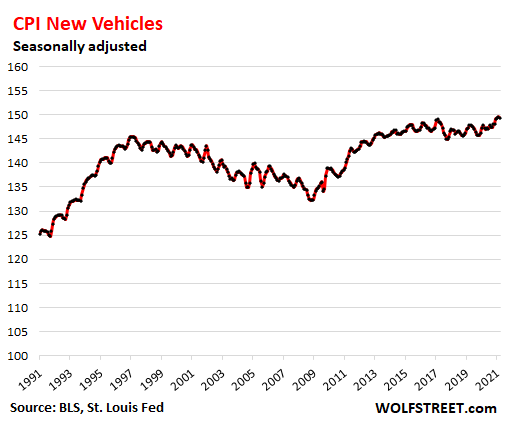

The CPI for new vehicles – even as the largest dealer group in the US is bragging to Wall Street about the record prices and profit margins it’s getting – hasn’t moved at all over the past two months and was up only 1.5% from March last year, and has barely inched up the since the mid-1990s:

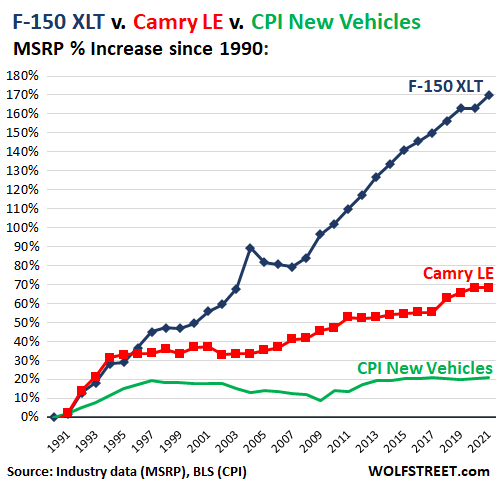

For a reality check, and for your amusement, here is my annual F-150 and Camry Price Index, representing the MSRPs of the best-selling truck and the best-selling car in the US from the 2021 model year back to the 1989 model year. The green line denotes the annual CPI for new vehicles:

The used vehicle price shocker and hedonics.

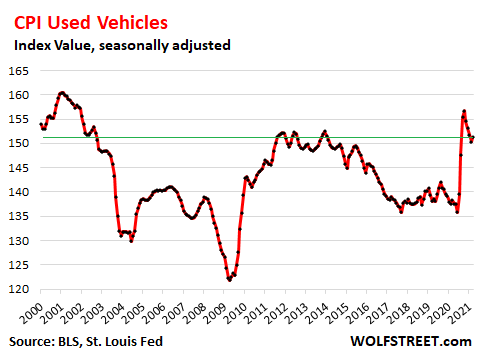

The CPI for used vehicles is also subject to aggressive hedonic quality adjustments, but there are times when prices skyrocket so far so fast that they even outran the hedonic quality adjustments – and that took some doing.

The CPI for used vehicles ticked up 0.5% in March from February, after four months in a row of month-to-month declines. Those declines were likely due to hedonic quality adjustments finally catching up with prices that went haywire starting in July last year and spiked in a historic manner in the vast and liquid wholesale market as well as in the retail market.

Compared to March last year, the CPI for used vehicles was still up 9.4%, after double-digit price gains late last year. The chart shows this spike that peaked in October last year and has since backed off giving up a portion of the prior gains. But this recent decline has not been borne out by actual prices in the market, which remain red-hot.

Also note that despite the spike, the used vehicle CPI remained below the levels 20 years ago, even as actual used vehicle prices have surged. The index for March 2021 was 5.4% below the index value in March 2001. This is the power of aggressive hedonic quality adjustments:

And there are more inflation pressures further up in the pipeline, as companies are reporting surging costs, and that they’re able to pass on those surging costs to their customers. Read… Producer Prices Blow Out

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Hegemony is expensive, Wolf.

One ugly question to ask…does DC have a longstanding deal with intl trade partners/allies that in exchange for those for nations continuing to accept dilutional US dollars in exchange for their real asset exports (and not engage in their own 100% offsetting FX manipulation) the US will essentially bear the brunt/large cost of basically any military defense of said countries?

1) You have to wonder why foreign exporting nations continue to send (for decades) real asset exports to the US for dilutional US dollars and *not* largely offsetting US exports (of which the US has long been woefully short).

2) You have to wonder why the US has mostly silently tolerated foreign military “partners” spending half or less than the US (in GDP percent terms) then the US does.

Hell, Germany, the UK, and Italy all have fewer than 300-400 main battle tanks each…quite likely less than needed for territorial defense, let alone power projection.

The US has nearly 7000 main battle tanks and the ships to haul them all over the planet.

So we have two very weird international relationships and you have to wonder if they aren’t related in the deep, deep background of politics

“real asset exports to the US for dilutional US dollars ”

What if China sent us items that end up in dumpsters in ten years, but take the diluted dollars from those exports and buy hard assets, assets that rise in value over time? Who wins?

Trade deficits do matter, despite what the academics tell us.

come come now – it’s only been 50 years since merica went full FIAT

at 1st they threw inflation to wind for 8 years – basically made $10 worth $5 or less

then steady decline – massive vote buys – medicare, medicare drugs, then just SPENDTHRIFT spending by our corrupt congress

they promise benefits to moon

then decide moon ain’t worth anything

take time for fiat to explode so be patient

our congress has time table – tic toc

Especially matters when they are buying up our prime farmland,ranches,water access,food processers,tech co.s.

You answered your own question. The rest of the world sells stuff to the US for dollars BECAUSE the US has 7000 battle tanks and lots of depleted uranium shells to go with them.

It’s more complicated than that. Most of Europe is very happy we have those tanks! Their societal organization benefits from our lopsided defense spending.

On the other hand, much of the rest of the world is afraid of our navy, Air Force, and shells.

To EdYooper

I am European, live in Europe, and I am absolutely unhappy with the US meddling in Europe’s affairs. I wish the US became weak enough so that it could not afford this anymore and stayed home. My anger/frustration/disgust is not against the common people of course, but it is not the common people either that own/manage those tanks. Just wanted to point out that not everybody here is grateful for those tanks.

Joe, without those tanks, European countries would have to spend money on their own defense, and wouldn’t have that money to provide “free” health care and university that they constantly gloat about.

re: “… the US has 7000 battle tanks and lots of depleted uranium shells to go with them”

Close, but no cigar. Only the A-10 ‘Warthog’ CAS (Close Air Support) aircraft’s GAU-8/A Avenger 30mm cannon uses depleted uranium projectiles. It’s a tank killer (and a good one).

Joe, there are choices, for sure. Maybe your EU countries would rather have the Russians or Chinese as your close, and maybe protective, allies?

Hey Ed, it’s not some sort of charity scheme.

Since WW2 the deal between the US and and most of Western Europe is that the European parties stop going all militaristic yet again, that the US provides military muscle, and in return Western Europe backs US foreign policy and supports US global hegemony. It’s a deal that for a while broadly suited all parties.

Now it’s beginning to sort of dissolve, both due to the decreasing ability and domestic desire for the US to fund such a massive military force, and due to the decreasing overall threat of foreign hostile military incursions (as such actions mostly no longer represent attractive prospects for would be invaders…), as well as a divergence of trade interests as more and more countries begins to refocus towards protecting their domestic stability in a world of a shrinking pie size.

Sorry I do not want to hijack the discussions and bring politics to this page. I am trying to be short but it usually does not work for me. Anyway.

RightNYer,

When mafia A protects a restaurant from mafia B, word in mafia A is that the restaurant is lucky. This is not necessarily true. There are mechanisms by which the US controls Europe (civil world, monetary system, financial institutions, companies, the defense “strategy” we’re discussing now etc.), Europe is a richly held province. The reason this works at all is partly because Europe does not spend on defense, and I have to say I am convinced that it cannot freely spend on defense either. Imagine if Germany announced to become a nuclear power in the world. They cannot even build a stupid pipeline to Russia.

> and wouldn’t have that money to provide “free” health care and university that they constantly gloat about.

I believe this is wrong. Poor countries like Romania or Bulgaria even during the communism used to have free education and healthcare. Rich countries like the UK do not have free education and healthcare. The NHS public healthcare in the UK is a joke, without private insurance you won’t get far. Lots of examples of poor countries having free public education and healthcare. I also heard that in Cuba the healthcare is beating the US healthcare in quality in some areas, and it is public and free. The reason there is no public healthcare in the US is politics, mindset and the likes IMO.

Anthony A.,

> Maybe your EU countries would rather have the Russians or Chinese as your close, and maybe protective, allies?

The first problem is that we do not have the choice, it was decided in WW2. I also have to say that until around the 1990s the US led empire was the best empire to be part of. Things have changed since then and right now things are insane. The US is getting unbelievably crazy, it is depressing to see that. Not only financially, but in every other aspect as well. Culturally, politically, in diligence, in skills of the leaders, everything is terrible ATM. Not saying that Europe does not have all these issues, but being in this situation that we have a similarly crazy friend who has the pistol in our back at the same time, this situation is not ideal to say the least.

Right now I would not pick the US over Russia or China. In my head it is a 50-50 today, and the trend does not seem good. Were getting into the 49-51 situation very soon IMO. You might find it crazy, but I am more worried that the Biden-Harris (and before that Trump) gang pushes the nuclear button than either of the eastern empire’s leaders.

I wish things were a bit more balanced in the world.

If you view Bretton Woods as war spoils…

You have to wonder about that. It’s strange the world accepts dollars when the US will be printing $2-4T or more every year for the foreseeable future.

Anybody who thinks inflation will be transitory is assuming the government stimulus will end. That isn’t going to happen. It’s more likely the government stimulus will increase and silently morph into some form of guaranteed income for the bottom 50%. When that becomes clear, the USD will tank, unless the foreign governments do the same thing.

The stimulus wouldn’t cause the USD to tank if we raise taxes elsewhere to pay for it. But we all know we won’t, so the only way to raise that money is to print it.

RightNYer,

DC is too terrified to raise taxes to the level necessary to pay for DC’s habitual spending (and probably rightly so).

DC knows that it is held in very low regard by the general public (DC might not be able to accomplish much…but they can read the hell out of polls).

So DC will go to great, dangerous lengths to avoid poking the bulldog (majority opinion, already highly cynical about DC honesty/competence).

So money printing (the silent cancer) is strongly preferred by DC…its negative effects can be obscured (asset inflation) or it can be pinned on patsies (speculators! Landlords! Etc!).

Ditto for the asymmetric application of taxes.

So long as higher tax rates are borne only by a safe minority of citizens, DC can game democracy (because the untaxed/less taxed majority won’t give a sh*t).

And the exact same logic applies for DC’s perpetual desire to avoid close scrutiny…if a majority were included in higher tax rates, that majority would scream for crawling up DC’s *ss with a microscope.

And DC’s *ss can’t bear much scrutiny.

So, the silent cancer it is.

Cas

You’re getting into the big stuff.

A country with big production of bombs, tanks and bullets is not going to do well in a world that wants tourism, flash global consumer goods, cheap tvs and cars etc. is it?

Yep. Use that cash before it’s worth less than yesterday.

I continue to save every dollar I can. I’m not going to be one of the sheeple borrowing and spending everything I have.

Thank you for contributing unspent dollars to the pool of dollars being devalued.

DC

Inflation is a tax on liquidity. The closer your assets are to cash, the more you will lose. Land historically is about the furthest you can get from cash and I would ague that is what drives the price of housing. The clapboard crap you put on the surface is just a load of depreciating junk like your car.

That’s exactly what they push you do: spend on some crap, any crap. After that, you have to work, any work. Spin the wheel, mouse.

US Department of Gerbil Manipulation.

Notice the U.S. rarely has mass street protests. The last few years have been out if the ordinary and even the last couple years U.S. protests were very small compared to what happens in France, Spain, Italy with some regularity.

The gerbil wheel here is running hard.

The Europeans are unarmed and protesting is their only show of force. Americans are armed and ready. You should be very afraid of the silence.

“You should be very afraid of the silence.”

Woman you got me smiling again because YES.. i feel the “silence” too, even though i’m in one of the smuggest places in the land.

x

Go long wheelbarrows.

Cas

Nice one Cas.

A little story that brings together everything we’ve been talking about here for weeks.

Covid lock-down has seen UK residents spending time in their gardens. This has seen a rise in the demand for GARDEN GNOMES. Suppliers are saying they are totally unobtainable and they are blaming the big ship in the Suez canal. Which, incidentally, Egypt is making an 800m$ third party insurance claim for loss of reputation on. Ship is impounded because insurers won’t pay. Used gnome prices are soaring on Gumtree and folks are having to lock up their gnomes to avoid getting them nicked in the night. Too late to go long gnomes, but I reckon any financial forecaster who went long gnomes last year should be nominated investor of the year.

I’m in the process of shifting all my cash into precious metals. Then save for emergency savings. The rest of my paychecks will be going into the casino stock market. I am not going to hold worthless $ anymore.

#payMeInBitcoin

Zr

Earnings from essentials like bread, milk and beans.etc have traditionally been resilient to inflation because folks have to buy them at any price long after they’ve given up Netflix subs etc. Not glamorous but very few basic things are.

After Biden was elected, that was the mantra of the economically savvy Trumpsters at the end of last year.

“Buy absolutely everything you will need for the next four years to deny your spending to his economy and help discredit him and the other one”.

Looking at these price increases, I’d say that was a very thrifty choice what to do with their money.

They assume energy utilities are part of Owner Equivalent Rent (OER), their fake housing number. When energy prices rise, OER is adjusted down since the fictitious rent provides the ‘renter’ with a subsidy against higher utility prices.

Is this not similar to the 2007-2008 crisis? Because it sure seems like it. Will seemingly irrational investments, like bitcoin and Tesla and everything else suck down the markets toppling over everything or is it that everybody is a genius with 20 bucks and a robinhood profile?

Bitcoin, and all crypto, is the biggest scam the planet has ever seen. Imagine the folly of everybody in the world trading all their labor for some digits on a screen in the name of getting rich. We have no leadership, because if we did this garbage would have been shut down immediately. It 100% speculative gambling.

Crypto is so much more than a simple explanation. It represents something globally that is extraterritorial in nature. Crypto market cap is rising for a reason and much if not most of the influences are a direct result of global financial instability. I say it again……we are in a new world and like it or not this is part of what will be our future.

C

pets.com was beyond a simple explanation. They even had a sock puppet.

I have few bitcoins and I have absolutely no faith in it

I am in it for money although btc itself has no value

Btw.. use binance.us not coinbase.

You are spouting the crypto marketing line.

The reality:

Crypto 0.5 was about crime: drugs initially but cyber crime has been turbocharged by cryptocurrencies.

Crypto 1.0 was about Chinese and South Koreas evading capital controls.

Crypto 1.5 was scam the retail consumer (2017). I have access to consumer behavior on several platforms – it is amazing how the 2017 crash led huge percentages of retail customers on these platforms to stop logging in or doing anything else with crypto – until the price started going up mid/late 2020.

Crypto 2.0 – going on right now – is the valuation of cryptocurrencies as “nerd art” – i.e. collectibles in the order of Monets or Ferraris.

Notice none of these include the “currency”, “efficient transactions”, etc nonsense.

I read this from another site- Wall Street Journal (Alexander Osipovich and David Benoit): “Investors are borrowing huge sums of money to buy stocks… As of late February, investors had borrowed a record $814 billion against their portfolios, according to data from the Financial Industry Regulatory Authority, Wall Street’s self-regulatory arm. That was up 49% from one year earlier, the fastest annual increase since 2007, during the frothy period before the 2008 financial crisis.”

It doesn’t matter if it is not NINJA loans or borrowing from Countrywide for ones HELOC. If people are borrowing from their equity or purchasing inflated real estate based on comps that are from prices established by over asking/appraisal prices, then this is a serious problem, no? And if people are buying second homes from equity that is truly “transient” or bitcoin for Gods sake… this can be terrible. Warren Buffet thinks bitcoin is garbage. I think he may have some insider knowledge, no?

The only question is will the federal government let these speculators eat it this time? I think they might as long as they are not to big to fail.

There was an article on CNBC with the headline:

“Investors have put more money into stocks in the last 5 months than the previous 12 years combined”

The Hwang fail will fix that. I think Hwang personally was responsible for $80B of borrowing, so the collapse of that leveraged mountain itself will change the overall industry’s margin numbers.

The banksters that got burned (all of them to various degrees) are certainly reviewing their customer books for another potential Hwang bust as we speak.

Buffet hates bitcoin because he drinks directly from the Fed money spigot. He’s made a huge part of his fortune investing in commercial banks which are allowed to create money out of thin air. Bitcoin is an assault on the global money cartel which has created a monopoly on money counterfitting. He doesn’t have insider information, it’s a massive threat to his business model.

“is the biggest scam the planet has ever seen”

#2: Crypto

#1: Multi decade dilution of US dollar.

Can you see how #2 is related to #1?

I know how this ends, I just don’t know what the fed is going to do. They know how it ends and they have a plan. I wish I knew what that plan was. I knew what would happen with COVID but I didn’t expect the federal government to screw everything up so badly.

I don’t know what kind of whiplash game they have planned for the next few months once this thing goes down… everyone seems scared except the the kids in robinhood land.

Nope, not related at all. Crypto is 100% pure speculation.

Nope. The US went off gold/Bretton Woods in the 1970s.

Rather than the dollar sinking – it became a central bank reserve currency. Or in other words: what used to be a liability (dollars owed) became an asset (dollars held by central banks).

Clearly dilution means something very different than what you think it does.

“Clearly dilution means something very different than what you think it does.”

I never even mentioned dilution, you did. Not only did you just create a strawman argument, you are conflating things. Crypto has nothing to do with the “multi-decade dilution of the US dollar.” Crypto wasn’t even around when that started, and it wasn’t “invented” because of it. You’ve created a fallacy.

I’m sorry, c1ue, I thought you were cas127 responding to me. Please ignore my post. I need to pay better attention to names that share similar characters.

Depth,

1) You were right on quote attribution the first time…the quote you cited did not come from me…

2) Next up…

“it wasn’t “invented” because of it.”

Hmm…Bitcoin was designed/launched in the 2008/2009 timeframe…dollar dilution was *very* much on the mind of the markets during this time…that was why there were huge commodity price spikes…people wanted to get the hell out of USD (which they anticipated being printed, given the crisis and the US huge accumulated debt problems) and into real assets.

(For more opaque reasons, people got seduced back into US dollars and Commodity/real asset prices fell, over a number of following yrs)

So I think dollar dilution was very, very much in the mind of early Bitcoin designers/propagators.

Otherwise…there was no particular reason to make the ultimate Bitcoin supply finite…they could have played the same dilutional fiat fraud games that DC does.

The reason to make Bitcoin supply finite was to make Bitcoin a superior store of value relative to the dollar.

@Depth

No worries. The tertiary responses don’t get “reply” buttons – my bad for not specifying who I was replying to. Which was cas – as you correctly understood.

@cas127

I think it is far more likely that a US intel agency created bitcoin to enable currency smuggling in closed financial economies like China, as well as to funnel illegal funding to foreign puppets (see Navalny) than some mysterious person slapped together a fantastically coherent compu-nerd art setup and has chosen to ignore the generational wealth created.

Equally, the notion that cryptocurrencies are anti-dilution is ludicrous: as Wolf has mentioned many times, the 4500+ cryptocurrencies show that there is nothing unique whatsoever about any of them, individually or collectively.

The ongoing point and market manipulate antics of the Leon Sumk and cohorts reinforces the pump and dump nature of the entire sector.

It is a scam if you believe our government represents YOUR interests. What if cryptos were created solely for capital flight purposes? What seemed like a joke 10 years ago is now getting an IPO for Coinbase and also has futures contracts trading in Chicago. Treasury and the Fed have had ample opportunities to de-legitimize but have not – that should tell you something.

I think the old stories about power still exist – our government will only restrict if politically necessary.

Bitcoin is purely a wealth reallocation mechanism. For every buyer, there is a seller, so there is no actual CASH going in or out of it. It’s value depends on the imaginations of its holders, not any type of cash flow potential.

Currently, yes, although you can buy a Tesla with it, some other stuff. People will only use the dollar if it remains a store of value. It appears there’s one almost-currency looking great and the world’s reserve currency taking a bath relative to everything but all the other sovereign junk.

It’s a scam if you think corporations represent YOUR interests.

“If” crypto is for capital flight purposes? There is a dearth of suitable investments, and crypto is a nice relief valve which allows the Fed to overpump the money supply. The end game is to adopt the rogue currency and control the flows. Should the Fed shrink the MB, the problem will take care of itself. They will indemnify the hedge funds for their losses. The Fed backstops all (institutional) speculators. If the US wants to sell fighter jets to UAE, (while they conduct a war against Yemen to which the USG is opposed) not the same as you giving a few dollars to your favorite Imam in Sana’a. Those weapons sales represent private jobs and income, and are not political at all, and someone just figured out there is more money to be made lifting sanctions on Iran, than keeping them in place. If we put more sanctions are Russia it’s probably because they nothing to sell, other than natural gas to Europe, and we have building an LNG market for years, and would like to push them aside, just as we did in Iraq, and the French too) in 2003. Now China is pushing the US aside, in the Basra oil fields. The corruption was too big for US oil giants like Exxon. They would love to use crypto and make deals. No doubt the digital Yuan is a great enhancement in China’s foreign investment. after the mess in Darfur. US crypto would be politically expedient, only if our institutions have it, and then of course the transparency would negate it’s usefulness.

The secondary market stuff like CBOE or whatever is meaningless.

In Japan, they created an index to represent the value of golf club real estate during their go-go period.

As for the rest: Tor was created by US Naval Intelligence to enable foreign operatives to report back. The criminal and pedophile users are great because it is harder to pinpoint the spies among the criminal elements.

So why is it so outlandish that Bitcoin was created by a different US institution to simultaneously funnel cash to its puppets abroad and to weaken the financial controls imposed by other countries, particularly China, to keep capital from escaping?

China learned a lot from Russia’s “democracy and free market” experience where literally hundreds of billions were funneled out of the country to money laundering havens like the Cayman islands.

Agreed but how is this different than Unicorn stock shares?

Or “Modern” art?

Viewing these things through a Veblen “conspicuous consumption” lens is useful

I just read that 78% of the dollars in the world were made in the last 12 months. This will not end well.

Jerome Weimar Boy Powell assures us that there’s plenty more dollars where that came from. He sees no inflation and stands at the ready to unleash a tsunami of liquidity. Cue BTO’s “You Ain’t Seen Nothin’ Yet.”

Lashings are in order for Jerome whipping boy Powell for this irresponsible behavior.

Physical dollars, maybe.

Actual dollars in existence? No way.

Physical dollar turnover is irrelevant. The US Treasury/Mint does switchovers regularly to inconvenience the forgers. They don’t want anyone infringing on their monopoly.

Chip shortages are shutting down truck production. There is a theory the Chinese were worried about sanctions cutting off their chip supply and they stockpiled. They are planning to build their own chip foundries after the Huawei ban.

Those $1400 stimulus credits that appeared in checking accounts might contribute to the inflation fiasco.

Indeed it is part of the larger “Made in China 2025” initiative to domesticate high tech manufacturing. For better or for worse, the rift in trade between the US and China is beginning to materialize on a large scale level. On the bright side, Intel did announce that they will eventually return to in house chip fabrication.

Intel already makes their CPUs in house. The problem is they are way behind on tech due to blunders over the last few years. The transistors of their main CPUs are currently 14 nanometer. They have some 10nm chips out but not many. AMD (made by TSMC) is all on 7nm. Apple (M1 chip – made by TSMC) is on the cutting edge 5nm. Smaller is better and intel is way behind. They do have the best brand recognition (AMD makes a better chip but they don’t have the brand power and don’t have the supply as they have to rely on TSMC), they have deep pockets, and a new CEO who is an engineer instead of bean counter.

I need to add that them recommitting to making their chips in house is great. Wall Street wanted them to give it up and have TSMC do it and become a fabless chip company.

Taiwan Semiconductor Manufacturing accounts for half of the worlds chip supply. They are building a $10 Billion plant in Phoenix, AZ. Is there a greater geopolitical risk with China ramping up its aggressive saber rattling on Taiwan?

Oh and those CPI crushed dollars earn NOTHING in savings accounts. Good luck if your Wall Street casino 401k gets cut in half about the time you retire.

Doesn’t anybody ever ask if chip performance overkill (for 95% of applications) is the utterly wrong focus relative to improved production efficiency/cost for the n-1 generation of “cutting edge” chips?

cas127: It’s not just about chip performance, it’s about efficiency. Performance / watt is lower for the newest generation of chips. That’s why Apple is pursuing them so aggressively, it means phones and computers that run cooler and last longer on each battery charge.

MarMar,

Fair points and thanks for you insights.

On the other hand, I still think that the incremental performance/power consumption/heat profile improvements are pretty small from yr to yr, relative to the attention/capital spending poured into them.

But I’m also amazed that Apple somehow gets people on a 2 yr upgrade cycle (at $500+ a pop) instead of a 4/5/6 yr upgrade cycle.

I agree but the $1400 checks will actually be rapidly taken by the landlords, credit card companies, and other rentiers who are owed vast sums by most Americans. Those payments are not the cause of the rising inflation; the ultra rich and banksters’ (privately owned through its district banks but deceptively named) “Federal” Reserve is the cause and effectively, the enemy of the poorer 90% of Americans.

Of course, the CCP’s subsidies of the ultra rich’s investments in China (with CCP partners admittedly, via ultra low interest rate loans), free land, quasi-slave labor, removal of all regulations, etc., has enabled both the CCP and the ultra rich to reap huge profits and get more powerful. Now, comes the most worrisome stage for the world.

That said, the middle class in America is currently being destroyed by the inflation and asset bubbles created by the banksters’ “Federal” Reserve. The ultra rich have huge investments in China, so they are fine with most Americans being deprived of any opportunities or futures by the massive transfer of jobs to China, since they have milked them dry now. See “China Has One Powerful Friend Left in the U.S.: Wall Street” in the billionaires’ Wall Street Journal.

How will this play out when the billionaires control most politicians now? I fear that either the ultra rich will be brought down and actually pay taxes at reasonable rates again, or America will be on the road to collapse. IF so, better learn Mandarin.

Those $1,400 “stimmie” checks appeared a month ago for many people and have already been spent. As soon as next month we should start seeing large drops in consumption.

The stimulus is one time, but the federal unemployment bonus goes until September. That’s a $300/week add-on to state unemployment – which in turn have been extended to 76 weeks?

Now add in some “black market” labor – and there are significant numbers of people who never had it so good.

Agree with this.

How can it be spent when I never got mine.

With all due respect, you are not representative of the entire population as a whole. Somewhere in the neighborhood of 135 million $1,400 stimulus payments have already been sent out.

Depth, yes, and most Americans spend their money the moment it comes in.

They must have read my posts on Wolf Street. Didn’t like what they saw and held up my stimulus payment.

A lot of shortages stem from the container shortage and container allocation chaos (e.g. containers with medical equipment goes from country X to country Y and then those containers are left there because country Y just doesn’t have anything to ship to country X). Containers are the backbone of global trade. International shipping cost has more than tripled, according to articles I read.

DH

Taiwan Semiconductor is the largest and most advanced chip producer in the world, I believe they recently had a plant fire losing production at an already crucial time. Chip factories are extremely specialised and highly capital intensive requiring vast investment which cannot be quickly juggled around. The Chinese know this because they are smart people. Some people in other places prefer to spend their money on share buybacks and huge Ceo remuneration .

Barry Ritholtz, a serious man, commented that the dollar’s value is not diminished in light of the price of dollar based assets. He noted the famous quote that the dollar has lost 98% of it’s purchasing power in 100 years. Well ,maybe if you sat on a dollar since then. The Dow was 1088.82 in March of 1921. Today it closed at 33,667. I got a C in cost accounting so I became a Poli Sci major (D’s in Calc and Trig too), but what is that a 30,000% increase? Now I call BS partly because the vast majority to do have the money to invest, but even small savings add up. Am I wrong? Probably as the .01% reap far too much of the wealth and the minimum wage adjusted for inflation at it’s highest point ever, under LBJ is now less than $11/hr. 40% of Americans work for less than that, hedonistic adjustments be damned.

The almighty buck has lost 98% of its value since 1971 when measured against something that used to matter, but that last 2 % is going to be tough.

a 2992% increase I think …but hey, who cares?

“Well ,maybe if you sat on a dollar since then”

Why should anyone have to hazard great risk, volatility, and loss (equities) simply to *preserve* the value of the money he labored for…just so DC (master forger of the world) can run an ersatz global empire predicated upon dilutional dollar deceit and systemic fraud.

There is a Takings Clause right there in the Constitution.

You are conflating many things.

Stock market index averages are meaningless since the actual components of it change all the time.

Similarly: there are pretty much no people alive today who invested in the stock market in 1921. For that matter, how many of the DJI components in 1921 are in the DJI today?

And let’s not forget the DJI hit 150 in 1939…

As c1ue mentions, it’s apples and oranges in respect of the Dow. Today it doesn’t contain any of the companies it included in 1921.

As companies rise they get included, and as they drop off they get excluded. It’s basically an index of whoever is broadly doing quite well and getting big over the course of a few years, so the Dow is sort of one of those survivorship bias tales.

I am wondering how this impacts the larger stock market. Right now whether you look at Shiller PE or other measures, stocks are very overpriced. The rationale given for the high PE ratios is that interest rates on bonds are super low and that investors have nowhere to go, which is true. But if inflation starts eating the purchasing power of the dollar more aggressively, those bond holders are going to wake up to the reality that their 10 or 20 year bond maturities will leave them with a negative rate of return. The result should be a demand for higher yields on bonds which should then give investors a choice beside stocks to invest in again. For me the big question is, will that be enough to deflate stocks? And secondarily, how will this impact company profitability since most companies took on large amounts of debt that would also be deflating (assuming price increases can occur without collapsing demand)

Judging by the market’s reaction today, they don’t seem too concern about it. Why would they be when they know the almighty FED got your back and telling the whole world inflation is totally under control, we got your back bro! If you’re home, bitcoin, stock owners why would you bother to argue, best time to be alive, ultra low interest rate, your own asset price going through the roof and FED is throwing the kitchen/bath tub at every turn.

“demand for higher yield on bonds”

So long as the Fed can print dollars and artificially manipulate bond demand downward…it doesn’t matter what private bond buyers want/demand.

They are continuously undercut by the Forger to the Gods (DC/Fed)

(To sum up…interest rates are the intersection of demand for lendable funds and the supply of lendable funds…interest rates are literally the demand/supply driven “price” of borrowed funds.

But the Fed can print money/lendable funds at near term will…driving the supply of money/lendable funds way up, and therefore driving interest rates way down. The Fed is the honey badger in the fiction driven US economy…and honey badger don’t give a sh*t what private savers want/demand).

No, because the Fed will buy bonds to keep them low with or without investors. If that just blows out the money supply all the faster, I doubt they care. Money velocity is already at unfathomably low levels and keeps dropping like a rock as cash continues to pile up in overseas bank accounts. It’s a one way street from the Fed to the govt to the crowd to companies to the money coffin. After some recirculation, much of it accumulates in tax haven accounts to be squatted on until the day it is unleashed and actually causes the inflation everyone is waiting for. Imo, if they aren’t spending it then at least it isn’t causing more inflation and it can stay there for all I care.

Fear the zombie money coming back to life.

Not necessarily.

Government Bond yields that are close to zero can also be viewed as an indication that the currency they are denominated in is practically worthless.

Case in point, Venezuela.

2,447% annual inflation (official figure – low balled)

10.68% 10-year Government Bond yield.

Anton

If you’re not buying reliable earnings, you are buying dreams. Granted some of them may come true but which ones is a gamble.

The interest rate is the key aspect of money. It is the cost of money ie low interest means supply greater than demand.(ie easy margin & house loans with adverts and pushy salesmen) It is also the time value of money ie a $ today is worth more than a $ tomorrow. You’ll wait longer for a future dollar at 2% than you will at 10% hence the higher price multiple of all the stocks that promise future earnings rather than current earnings. P/E tries to give an idea of this but it is a comparitor of various companies at the current prevailing interest rate and not an indicator of how different stocks would perform at different rates. Higher rates would devalue future earnings relative to current earnings and kill their valuation in the market.

Govt needs to keep rates low,(hence supply high) to fund their massive debts. They are caught with Hobson’s choice. To fund their debts they have to keep rates low which increases value of future earnings.

Round and round the circus goes, where it stops no one knows.

The Fed is going to make a millionaire out of me yet. How come I don’t feel like one?

Because a wheelbarrow to carry the cash costs $900,000.

“5.1% year-over-year – nearly double the published rate of 2.6%!”

5% “feels” more like what most people have been experiencing for the last 20 years for healthcare, college, and a few housing hot spots in America. Now all the other product and services get to play catch-up, with the most destructive to global society being more “Egypt Spring” food shortages across the globe, at the same moment in time…

Curious discovery that the “Asking Rents” versus “Effective Rents” have a large divergence recently (although for a short period only so far). There are a lot of theories to why, and I suspect Landlords getting “zero” in rent, due to limited evictions, is mucking up the rental data flows. Texas courts recently overturned the CDC “no eviction” ruling, so keep an eye out to how this affects the state of Texas to see if this trend reverses…

“Asking Rents” versus “Effective Rents” per, amusingly enough, “Inflation_Guy”:

https://pbs.twimg.com/media/Ey2uZe6XEAIE-nI?format=jpg&name=small

A lot of griping here but the path to prosperity is clear: just get out in front of Nancy Pelosi’s husband with your options trades, and everything should be a home run.

I think this really highlights the severity of the problem and as long as Puss boy Weimar Jerome refuse to acknowledge it and continue to go on 60mins touting everything is going as planned and holding interest rate, regular joe will continue to suffer from the effect of real tangible inflation. Welcome to the next decade/century of forever price out from the housing market or any real hard asset not part of the CPI

“If the homeownership component in CPI mirrors the Case-Shiller Home Price Index, CPI would jump 5.1%! Not to speak of new & used vehicle prices, which I nevertheless speak of.”

Jerome P was on 60 minutes and said that if wages went up more than inflation, companies would outsource their jobs to foreign countries. He said that it was part of the Fed’s plan to let inflation run above 2% for an extended period while keeping wages suppressed, and was good thing. This was all part of the globalization of labor master plan that he supports. I saw the entire interview.

He truly is a douchebag of a different caliber, not to say any of his predecessors were better but at least they were that bold in telling the non 1% to eat sawdust while the rich are busy choking on their cake.

It’s too bad that the “redistribution”/”confiscation” model is so embraced by everybody from the average Joe to the “elite/experts” (like the Fed).

Taxing rich, corporations, etc., to redistribute to the poor is not a sustainable economic structure. Regulations have to exist ( direct tariffs, etc.) which will cause action/behavior changes by businesses. This is especially important for trade deficits.

Jobs (real, productive) and capital investment (plant and equipment) would return. That is sustainable.

“companies would outsource their jobs to foreign countries” – very insulting. companies have been outsourcing for decades. what are the American people supposed to do? Keep working for less? he may as well say “hey working-class people, go to hell”.

If only, if only guys like chairman pin-head could have HIS job outsourced.

If Americans celebrated a “Give me a raise” holiday every year, what in other countries is called a “general strike”, things would be very different in America. But the descendants of the heroes of the conquest of the West have been sucked-in into the mythology of work ethics, personal responsibility and equal opportunity, so… Take the pill. Swallow whole.

Seeeee…..” personal responsibility AND strong work ethic ” have downsides.

Everyone reading this has lived through at least part of the last 52 years. I’m referring to the last 52 years where our lovely Federal Government has lost money (deficit spending) in 48 of them. Did you really expect any different result? If I had a business and lost money in 48 of the last 52 years, would you or any bank keep lending me money to stay in operation? We are all fools for letting this go on for this long. 2% inflation my rear. Prepare for a lower standard of living folks.

Repeat after me…..Government is NOT a business……nor should it behave like one.

What I also find interesting about this data is that, although not surprising is the lack of outrage from the general public. Inflation such at this on housing and cars have real impact to the quality of life. FED is more than happy to unleash this kind of damage to the non 1% especially on the bottom 50% of society, yet they can completely get away with it scot-free goes to show the effectiveness of keeping people ignorant of things that truly matter to them and for politicians to misdirect piblic anger on things that are irrelevant by comparison.

Furthermore, indoctrinate the entire society to be forever in debt mentality, I guess it’s way more effective than having a physical chain to control them. Can’t afford things because inflation is getting out of whack? No problem, take on more debt! Just read today Nissan is incentivizing dealers to offer 84 and 96 months loans over standard loans. Maybe I will live long enough to see 15 or 30 years mortgage being taken out on new car purchase sometime in the near future.

$814 billion has been borrowed by people investing in the stock market, borrowed against their portfolios. That’s a 49 percent increase over last year. And that’s not counting the largest banks are not actually reporting all margin debt that is fueling the sharp rise in stock prices.

Debtpushers love them some sheep…like addicts for drug pushers

Instant fix before the crash…

“keeping the people ignorant”

ZIRP has been in effect for 20 years.

How much air time has CNN dedicated to it over those 20 years?

Meanwhile, Avenatti lived in Cuomo the Younger’s colon for a straight month worth of airtime.

“Just read today Nissan is incentivizing dealers to offer 84 and 96 months loans over standard loans.”

And there will probably be a lot of takers.

That being said, Nissan has been struggling the past few years.

They ought to be struggling. My last car a Nissan Sentra, manufactured in Mexico, was a tin can, and self destructed after multiple repairs that exceeded the value of the car. I subsequently donated the car to a charity for zero tax deduction, as I lost my charitable deduction under the 2017 Tax Cut & Jobs act.

They are struggling and many of OEM management level folks have left..

Agreed, lost their way starting in about 04 when they stopped the pathfinder, a bullet proof vehicle which competed with the highlander. Turned their flagship q 50 into a luxury piece of cr-p. Ah and we come to their CVT, a marvel of a short life transmission. Now rated by CR as one of the lowest brands.

SC

Japan and UK Nissans used to be bombproof. I think globalisation has hammered these Japanese brands more than any others.

Imagine the great Toshiba being ‘in play’ for private equity for God sake. It’s another world to the one I knew. OK nuclear was a bad bet for everybody, but I mean.

“Owners’ equivalent rent of residence,” which accounts for 24% of overall CPI. It is based on surveys of homeowners’ estimates of how much their home would rent for.

This a very poor way to determine such an important component of the CPI. This rental data is available on-line to any real estate professional with a user id and password, who paid the annual subscription fee to access this information. Its less than $500/year. Why would anyone with half a brain use a flawed data collection process and not pay $495 for the accurate rental data that is on-line? Can’t the government afford $495/yr. That’s because they don’t want the accurate data. This flawed procedure allows the government to under report actual housing costs and trick the public into thinking the CPI was much lower than it really is.

Who was it that said “There are lies, damb lies, and then there are statistics”

“Who was it that said “There are lies, damb lies, and then there are statistics.”

Mark Twain

Time to retire the penny. In this time of inflation, it ain’t worth a cent.

They cost almost twice the face value to produce and need to go away, but like a bad penny, refuse to.

Pennies disappeared in Canada years ago!

Save your nickels, then. Current metal value: .054 cents. A $2 roll of nickels = $2.16.

Tell your bank to stock your savings account in nickels. :-)

I will inconvenience you with a story about India. USA was born 1776. The nation of India was born on 1947. As soon as 1980s India retired those pennies (1 paise equivalent of 0.01 rupees the lowest denomination). Kids these days do not even know what is a paisa means. Around 1995 dimes 10 paise went out of circulation. Around 2000, quarters 25 paise went of circulation. Now 2021 even 5 rupees, Indian equivalent of $5 is the lowest of all. US after ~250 years got pennies in circulation. Pennies are the 0.01 of the dollar. Now, tell me. Do you want the pennies out of circulation? Men will grow up never seeing the dollar bill in strippers thongs soon…

I understand your point. Pennies are worthless. They must be in circulation to show the people that the lowest denomination of the currency is not worthy. Something is going on…

Pennies are nearly all zinc in composition with just a teeny bit of copper on the outside, and the zinc industry has a vested interest in keeping them alive.

Nice thing about the older US and Canadian pennies, is they were made mostly of copper. So the copper makes the old pennies worth more than a cent!

Yes, pennies are around for SALES TAX.

CP,

Your comment that R5 is the lowest denomination is interesting to me, because when I grocery shop, I estimate the bill in $5 increments. Two boxes of pasta with sauce $5, each packet of deli meat $5, two boxes of soda or water, etc. Five dollars is the lowest practical increment, in a supermarket, to do a fast calculation.

Statistics don’t lie. It’s just that you can prove anything with statistics but only to people who don’t understand statistics, which is most of the planet.

Didn’t Kyle Bass buy a boatload of nickels a few years ago because the metal content was worth more than 5 cents? IIRC he flipped it for profit to Mexico where it was melted down. I think he made $200K on $1 MM of nickels.

Even the lowly zinc penny costs more than a penny to make.

Melting down US coins is illegal.

Petunia,

Melting down US coins may be illegal in the US, but almost certainly isn’t in Mexico…

The copper value of UK 1p and 2p coins of pre-1992 vintage (97% copper) was higher than the actual denomination of the coin itself a while back (and may still be) as copper prices rose. I’ve just found a whole load of articles online from 2006 discussing it and the legal implications of melting them down; the Royal Mint even warned that it was an offence for a member of the public “to melt down a coin of the realm”

Petunia, I believe that statement is only partially true. It’s currently illegal to melt U.S. pennies and nickles, but perfectly legal to melt silver and gold coins to recover metal value. This legality issue has changed a few times over the years.

I believe in Canada it’s illegal to melt down any coinage.

A few years back, I sold a sack of silver half dollars to a U.S. metals recovery company for melting, assaying and payment to me when silver prices were high. Perfectly legal and above board.

“Not to speak of new & used vehicle prices”…remember a few years ago when $40,000 was a lot of money…

Per Edmunds:

–> the average cost of a used car or truck now tops $20,000.

—> the average cost of a new vehicle surpassed $40,000 for the first time.

Wolf,

Yes inflation is here. They can say some is demand pull and some is demand push, like climate change and cleaning up the air we breath. A lot of commodities will be needed for those batteries with a weak dollar, with all those dollars. So will they ever fix the cpi?

The dollar lost 5% against BTC in the last 24 hours. Just saying.

BTC is the biggest scam in history.

You sure? I thought it’s the US economy …..

Next time BTC loses 10% in a few hours against the USD, I’ll remind you :-]

I notice that the crypto crowd loves to cherry pick.

Haha

Good one ?

Would someone please tell me what asset or what entity stands behind Bitcoin??? All I can smell is Tulip Bulbs from an era when the definition of Financial Asset Mania was constructed. However, what I see going on around this purported “asset” would require a new annex at the Asylum. I am going to import black beach sand to sell for $65,000 per gram; I bet buyers will be lining up for blocks just like in the Cabbage Patch Doll days.

It’s nothing more than a speculative scam that soaked up hundreds of billions of the FED’s latest QE.

Beanie Babies and Olympic pins are the next mock currency.

DWY

I’m so old I reckon I can skip out of being concerned about Bitcoin. Max K must be a squillionaire!

However, I still have remnants of a brain so I’ve tried to suss this BTC thing as it’s gone along. It is truly beautiful maths and the best utopian philosophy of exchange ever. Basically it solves the ‘problem’ of exchange of value between individuals at a distance without a trusted intermediary (eg banks, etc). Theoretically rendering all financial intermediaries redundant. What I personally find utterly mind blowing is that it creates an immutable record of every transaction the coin ever makes. Imagine if a 10$ bill came with a ledger that showed every transaction it had ever made in it’s life. Could be embarrassing for some. Apparently there can only ever be 21 million of them ever and that is the stat that gives the hedge against inflation value to it. The math also makes mining effort asymptotic to the ultimate 21m which means it gets more and more expensive to produce the more there are.

Of course there are practicalities for all beautiful theories. The first being this is all predicated on computing power. Imagine the processor capacity required to encrypt and store every detail of every transaction ever made by each coin. That’s what miners do and get paid for their effort by new coins (beautiful concept) but they’ve already impacted the availability of Nvidia gaming chips(fastest) and they are only coding a tiny percentage of world transactions. Where the hell is the processing power going to come from for all the worlds transactions? Energy is not an issue because they are making use of non-peak energy from renewables. The faithful say that computing power will match the demand for it but I think we are talking ultimate boundaries here. It also relies on tech equipment. Will your mobile phone work if you need to buy water in a desert? The guy will probably take a dollar.

As I say I’m too old to care, I’m stuck with paper. If I was 15 I’d be in it to my neck.

Something wicked this way comes.

Alas Babylon.

Look at right hand (but avoid – at all costs!, of what my left hand is doing ..to screw you.

The lying .gov bureau of lascivious statistics et al. Sinners to the end!

1) If u kept a dollar bill from the seventies, u have 98% unrealized losses to claim on Apr 15. The dollar fell from 48 in 2007/08 to 38 in 2020, or about 20%.

2) WTI was $150 in 2008, but now it’s $60 x0.80 = $48.

3) Sugar was 60 cents in the sixties, but now it’s 6 cent x 0.02 = 0.12 cents.

4) In the seventies, a 3BR ranch in an upper middle class CA suburb cost $100K. Today it’s worth $1,200,000 X 0.02 = $24,000.

5) Toyota Camry 1984 cost $12,000, today it’s $25,000 x 0.05 = $1,250.

6) Air condition cost $400 in the 80’s, now it cost $300 x 0.05 = $15.

7) A year ago TY made a new all time high, because the whole world

trust the dollar.

In addition to hedonic adjustments, the BLS needs to introduce kleptonic adjustments . . . increases due to price gouging,

Funny! But true…

My son came from a local lumber supply house, an area where you can’t even get a house built because of the backlog…a sheet of 4×8 exterior 3/4″ plywood was listed at $99.

Let the groaning begin.

If the lumber costs keep going up, in the future, homes will be framed and roofed with plastic materials (polystyrene, polyethylene, etc.), or concrete via “3D printing.

A lot of house decks are being built with synthetic polymer materials. Costly, but longer lasting than wood and less maintenance.

AA

Today I read that some of your US clever guys have invented a paint so white it can reflect 98% of light and hence sun energy hitting it.

This means that global warming is potentially solved because it is predicated on white polar ice melting to blue sea and failing to reflect away enough sunlight during the day, If all roofs and vehicle, etc tops are mandated to be painted with this paint throughout the World you can go back to driving a 5litre Chevy V8 and give Greta Thunberg a lift to school in it.

I heard they closed all the Walgreens pharmacies in Wolf’s home town of SF. Apparently, according to the report there was a lot of theft going on. Prices are getting so high people don’t want to pay for anything so they just help themselves. There is no punishment for any crime under $1,000. I think I’ve got things right but some native of the area may want to correct me. You can’t always believe what you hear on the fake news. Remember, what happens in SF happens in the rest of the country with a few months lag. So get ready.

many of them but not all….The DA is a Woke idiot who’s parents killed a cop, believes in criminals not victims…..

this town will be Detroit in 20 years

actually cd, i’ve heard that it ISN’T the DA, Chesa Boudin’s doing, like i’d also assumed; apparently it’s WALGREEN’s policy not to chase or interfere with theft.

they now have a bored security guard AND police officer at the 24th/potrero location (that’s why i now dance there– because they can keep an eye on me).

i ask if the stealing’s stopped yet, and the security guard said nope/ kids came in and went behind the counter to steal batteries and he said (Brother to Brother), “come on, man, that ain’t right,”

but the kid just went ahead and took more and walked out.

entire shelves are empty in front and you have to order anything to have it delivered there in a single shipping box (if they can find it when you go back 2-3 times to pick it up).

it makes no sense BUT to me, but i think it’s because when obama care started those years back, Walgreen’s got the contract to dispense everyone on SF’s Healthy San Francisco’s health care drugs (there were a few indie pharms on the list of options, as i wanted indie, but now all gone), and they probably make bank dispensing drugs to everyone in town, and can take the hit on everything else and don’t wanna spook the newer, low-end clientele.

someone went to the bathroom right in the path of the electric door on the mat, and feces were tracked in around the store as a poor employee followed the prints around with a roll of paper towels but neglected the originating pile, people pass out in front of the store, and i’ve seen folks come in and get mad and either just take stuff off the shelves or clear them in rage.

the staff are absolute saints but it’s doing a number on their humanity and morale. / they don’t care. they CAN’T.

i sat waiting for my refill one month, and the homeless woman waiting next to me’s big dream was saving up $1000 for a trailer to live in since her last one was repossessed even though it was janky and moldy.

i was more terrified that she was telling me this stuff like passing on a tip that she figured i’d NEED sooner than later.

it’s already turning into detroit here. or something else. because detroit seemed contained. this is systemic.

yup/for better or worse california leads the country here.

x

Kitten, I worked in Detroit for 4 years right outside of downtown (southeast along the river) in the late 1970’s. I ran a manufacturing plant with a 98% black workforce. I don’t recall Detroit then as bad as you say SF is now. Back then, the only issues were drug related and those were factions killing each other for the sales territory.

The local population where I worked at Fort Street and Summit Ave were respectful even though the whole area was poor, very poor. The guys and gals in the plant were fine people and good citizens. Many had been there for 30 years.

However, when I look at google maps of the area, everything is gone now …..my plant, the neighboring Chrysler assembly plant, the GM Cadillac plant, all the old tenement houses, the bars…everything. All that’s left is the Detroit Harbor Terminal buildings.

This may be happening to SF someday if this nonsense continues. What the heck is going on in this country? This stuff has to stop.

Dear Mr Anthony,

Gentrification in San Francisco is already OVER. i’d been praying for this but what is taking its place is worse, now that no one even cares about the gentrifiers anymore. it’s like corporations… it’s like they know, sense, smell that they’re also about to be old broken down strippers on their last good weeks (or as Petunia said: “drug addicts who think they’re still in charge.”).

years ago when Walgreen’s got us all as a captive audience, their stock soared and things got crappier and crappier. and while their entire chain of stores seem to have become loss leaders, the health system in san francisco has also been phasing out all their actual doctors and using nurse practitioners to reschedule us into other billable clinics and specialties and the care has gotten sloppy and bloody in a couple of my own cases.

and even if you got x-rays six months ago, they’ll try and reschedule you for another round. they are tired and i got blood drawn and had a swollen arm for 3 months.

they got rid of the doctors and the nurse removing my IUD broke a tool inside me and made a bloody mess and said if i wouldn’t stop crying she wouldn’t take it out.

i later complained, they closed ranks, and i was deemed a problem and had to have a series of talks with management. it was creepy and weird.

i used to trust the medical industry, now i’d rather try my luck with a swiss army knife and a lighter.

they were even outsourcing their own health care clinics to an independent set of clinics because they made more money diverting clients outside their own clinic system.

clinics where the staff were making close to minimum wage.

so whereas Detroit and Flint could be said to be the earliest casualties of offshoring, business in america is now nothing but the government contract or “investing in distressed properties” and the private equity hump and dump scheme.

and what pitchforks? what revolution or rage??? where???

America is having its very own American Cultural Revolution, but without having our violins and books yanked from us. we willingly give them over.

and you don’t have to take away who we are or what made us as a country because we can’t remember ten minutes ago, and so yeah…

R-E-S-P-E-C-T? have you seen how people date by showing up on all fours with their pants around their ankles while texting on their phones?

that’s us being sweet, because all day we will have been calling our own country men and women “nazis” “racists” or whatever all morning.

Mr Anthony i was very wrong to use Detroit as an example because this is something else entirely detached from even short term financial common sense.

i’m not gonna end on faux California Joy, but there IS a freedom in realizing it’s all Over. you kind of ..laugh. a gallows laugh, but at least it’s a start.

(wink)

x

Kitten, thanks for the reply. I’m sorry to hear it’s been that bad for you and everyone else in the SF area. That healthcare situation sounds downright criminal.

I have family in Santa Clara and north of Oakland. I haven’t been out that way in three years.

And I haven’t been back to Detroit in 20 years, so my knowledge is old (like I am!). But I have to believe Detroit is still somewhat dead from a manufacturing standpoint, with the exception of what’s left of the auto business.

Like you said..”and what pitchforks? what revolution or rage??? where???” Yeah, that’s not happening and probably won’t as the Big Money/Politicians is figured out how to keep us fighting among ourselves and not be paying attention on what they are doing to the country.

Hang in there, be safe and keep your head up.

Tony

Thank you, Mr Tony.

the longer i’m around, the more blessed i feel in all ways regarding time being born, good health, and i’ve always been awash in love. my life=no more complaints. everything “bad” was so i could have empathy.

i’m good and i will share best i can.

thank you.

x

Swamp Creature,

Nope, we’re surrounded by Walgreens, and by CVS stores. I have no idea why there are so many. I would close more of them. This is brick-and-mortar meltdown. Who needs all those Walgreens? We get all our prescription drugs from our provider’s online pharmacy.

But if you get your info about San Francisco from Zero Hedge, you will be purposefully misinformed and misled.

Current locations of Walgreens in my part of town, per Google map. To give you a sense of distance, it takes me about 30 minutes to walk from the Walgreens at the top of the map to the Walgreens at the bottom:

I think I heard it on the local radio station here WMAL. They said it was due to a crime wave. Losing more due to theft than they were making in sales. With everything so screwed up here why the hell are they worried about what is going on 3,000 miles away. You can’t even get good accurate local news here from our local radio stations. I use Walgreens and CVS a lot here. CVS is always crowded, not so with Walgreens after they took over Rite Aid. I wouldn’t be surprised if some of them closed. Who cares.

The report I saw was that the old neighborhood/”mom & pop” stores were closing up because of the usual retail issues + the theft problem. I imagine chain drug stores would be very profitable based on their core business.

This kind of problem has been going on for a while for various reasons. In some outlying suburbs, the city went bankrupt (~2008), so police wouldn’t show up for things like shoplifting and burglaries.

The property theft rate in SF is among the highest in the US, mostly driven by vehicle break ins, from what I saw. Ms. Alioto (famous San Franciscan/daughter of former mayor), said it was just part of the cost of living there.

English pennies still exist, though I can’t remember using one for years, even cash has almost dissapeared, thanks to the COVID excuse, those almost unused, uncirculated pennies, are steel blanks, copper coated, you can pick them up with a magnet, and even then they still cost 4p to make.

Additionally thanks to “decimilisation” in the seventies the value of English currency was more than halved, pre suddenly only having 100 pennies to pound by government edict in the seventies there used to be 240 pennies to a pound, 20 shillings, 12 pence per shilling, as massive and stealth reduction in purchasing power and almost no one noticed, all because apparently it was too difficult to have 240 pennies to a pound, us dummies needed just 100, they govmint must have been crying with laughter on the quiet.

Maybe in the US…

Deff not in plenty of other countries, USD is only strengthening…

Last few days USD dived against some major currencies (GBP, EUR, CNY, etc.). I’m hoping this does not continue.

The dollar has gone up 5% against the Thai baht (THB) in the last three months.

And I’m hoping that it goes up another 5%, to where it was when I established expat residence in Thailand three years ago.

Then I can happily convert another tranche of my USD wealth to THB, and earn 2.75% my Thai wife’s credit union account (which will hopefully beat Thai inflation).

To give an idea of living costs – we’re renting a comfortable holiday apartment on a tropical island in southern Thailand for $200 a month. Clean air, friendly people, lots of cuisine variety in the downtown night food market (ex: can get large tasty chicken shawarma burrito loaded with veggies for $3).

Wish it were possible to move to Thailand, but like most folks in their 50’s, I have too many family ties. Wouldn’t feel right to leave them to fend for themselves.

zagonostra,

Get a place with two guest rooms and invite your family members to stay… they’ll love it, and you’ll love it.

And if they’re not showing up, you can rent them out to other people you know or tourists in general and make some money on the side.

‘Then I can happily convert another tranche of my USD wealth to THB, and earn 2.75% my Thai wife’s credit union account (which will hopefully beat Thai inflation).’

If this is sarc, I don’t get it. Just enjoy the US $ bonus but don’t put wealth in the baht. The Asian Financial Crisis (aka Thai Crisis) began with the baht which lost 50% against US $ in a week.

If the USA experiences another bout of civil unrest in multiple cities, suburban house prices will jump again, with or witout inflation. People will spend to keep their wife and kids safe.

Really. You mean house prices go higher?

Home prices are going up like crazy even without the civil unrest

Think of it like this … if the politicians allowed the police to enforce the laws, more areas would be safe for family life, and house price increases would drastically slow since people would stop trying to relocate to low crime areas.

Socaljim,

Please go watch the movie Mildred Pierce up to opening scene near the very beginning when the police officer sees Mildred contemplating jumping off a sea walk into the ocean rocks below.

What would a Minneapolis cop have done?

1). “Ma’m, please stop so I can help you over that rail.”

2). Shoot her to her from jumping. She was going to jump anyway.

3). Yell “taser!” then shoot her with a bullet.

Enforcement isn’t the problem. It’s what the police are being trained on not trained on, and the growing realization our govt favors some and screws the broad majority.

Was watching the G Floyd trial in Minn on Court TV. Looks like the guy’s going to get convicted of at least manslaughter. I haven’t seen anything that changes this slam dunk verdict. This whole trial is a complete waste of time. This thing should have been settled out of court. It seems like a slam dunk case, but you can never tell with juries. If he gets off it will be time to get out of dodge if you live in a major city.

S C,

I would disagree that this trial, for D Chauvin – not G Floyd, has been a waste of time. “Settled out of court?” What would, and could, the State offer that defendant would accept in a plea bargain?

I never had any direct dealing with Mr. Chauvin, but he frequently worked security at Target Field, where I brokered tickets on the street for ten years. And I live in the 3rd Precinct where he worked. Seen him many times over the years in his squad car in my ‘hood, and around the stadium before Twins games.

You are right, “… you never can tell with juries.”

Now the question is what is ex-officer’s Kimberly Potter’s next move as I would assume manslaughter charges will be brought against her soon?

Dan Romig

Wouldn’t it be better to settle this out of court and avoid riots across the country? The cop was obviously guilty of manslaughter. I’m not a lawyer but I know the law. You have to, to survive in the Swamp. I don’t trust juries. All it takes is one to hang the jury and have a mistrial. The Defense is hoping for that.

This is all just my opinion.

But Swamp, that’s Dan’s point. The cop likely knows he has little chance of being convicted of murder, so manslaughter is all he’s facing. So the only way he would have taken a plea, realistically, is if the state offered something like negligent homicide (assuming Minnesota has such a statute) or reckless endangerment. Allowing him to plead to that would have caused a fury in the community.

So it’s in both parties’ interests to roll the dice. Chauvin knows he only needs one holdout, and the state knows that, even if he’s acquitted, they can say they tried.

RightNYer

I don;’t give a rat’s a$s about this f$ckin cop or both party’s interest. I want justice. And that means convicting him for the crime he has committed. Its an obvious case of manslaughter. Apparently none of you have been in court or if you have, you have forgotten what takes place in there. There is no justice in court anymore. If you think there is you’re dreaming. I’ve been in litigation with Real Estate companies over half dozen times. Never won a single case. Its about who has the best lawyer and who is on the jury. Its a crap shoot. The defense in this case looks pathetic. They have not scored a single point in favor of the bad cop. My point is that this should have never been allowed to go there because if he is acquitted then cities will burn. You want that???

Swamp Creature,

Every morning that I wake up alone, I remember what happened in the Anoka County District Court on 22 January 2010. My wife, Elizabeth Hawes, was an accessory after the fact to the murder of her older brother Edwin by her younger brother Andrew on 29 October 2008.

She was tried and convicted of a crime she did not commit: Aiding and abetting 1st degree murder. Her conviction was appealed in the Minnesota State Supreme Court and the United States 8th Circuit Court of Appeals. Both of these were denied. As a result, Elizabeth is to remain incarcerated until death. Mandatory life without parole.

At the opening of her trial, the State offered her a plea of 2nd degree murder, and had she accepted it, she would be released on 1 November 2028.

“I did not plead guilty to a crime I did not commit, but if I did, I would be released from prison on November 1st, 2028. Even now, knowing how things turned out in court, I would not plead guilty to 2nd degree murder because it isn’t true. I cannot sign off on something I did not do.”

My wife was convicted, as the Supreme Court’s Opinion confirms, on motive and circumstantial evidence. From page 23 of A10-1225: “In sum, it is reasonable to infer from the circumstances proved that Hawes aided and abetted Edwin’s murder.”

“… you can never tell with juries.” “There is no justice in court anymore.” So true Swamp Creature, so true.

Swamp, I’m not taking a position on the trial or anything else. I’m just presenting my theory as to why it didn’t settle prior to trial.

SC, the questin is how does all of this affect urban/suburban house and equity priices … That is the bottom line.

SocalJim