OK, let’s look at the Tesla magic briefly.

By Wolf Richter for WOLF STREET.

Tesla’s profit was all about Tesla’s pollution credits, or “regulatory credits,” as it calls them. These are tax credits that Tesla gets from governments and sells to other companies. There is no cost associated with them; they’re booked as revenues and flow through to profit. Tesla reported this evening that these regulatory credits jumped 40% in Q4 compared to the same period a year earlier, to $133 million.

Despite the surge in regulatory credits, net income fell 25% to $105 million. Without those credits Tesla would have lost $28 million.

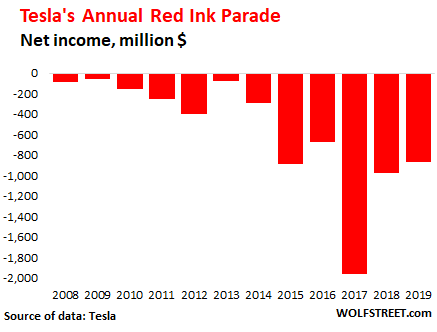

For the year 2019, Tesla reported a net loss of $862 million. This includes $594 million in regulatory credits. Without those credits, Tesla would have lost $1.5 billion. Tesla has been producing vast quantities of red ink since it started disclosing its financials in preparation for its IPO in 2010. From 2008 through 2019, Tesla lost money every single year with relentless insistence, and those net losses over those 12 years combined now amount to $6.7 billion:

And Tesla has a revenue problem.

Revenues inched up 2.2% to $7.38 billion in Q4. Automotive revenues alone edged up just 0.7% to $6.37 billion. And gross profit fell 3.6% to $1.39 billion. This is not the hallmark of a growth company. This is the hallmark of stagnation.

But here is why this is happening: Tesla is going downscale, going from luxury to high-end mass-market, while everyone else in the industry is trying to do the opposite, go upscale.

Global deliveries in Q4 of its less expensive Model 3 have surged 47% year-over-year to 62,620 vehicles. But deliveries of its high-dollar models (which sell for twice as much or more than the Model 3) have collapsed by 29% to 19,475 vehicles.

In other words, just to stay even, Tesla has to sell three $35,000-Model 3s for each $105,000-Model S or X that it doesn’t sell.

After waves of layoffs, operating expenses under control

In 2019, Tesla went through waves of layoffs, particularly in the US, and it has scaled back in other areas. The result is that operating expenses have remained flat in Q4 at $1.03 billion.

Constant need to raise cash: $4.3 billion in 2019

In May 2019, Tesla raised $2.7 billion in a sale of shares and convertible bonds.

In addition, in December 2019, it entered into a loan agreement with a consortium of state-owned Chinese lenders for loans totaling $1.63 billion to fund the construction of its factory in Shanghai, the purchase and installation of equipment in the factory, and working capital to run the factory and pay the workers. Part of this loan package replaced a bridge-loan from those state-owned lenders that Tesla had obtained earlier in 2019.

This $4.3 billion in new cash came in handy on its balance sheet where its cash balance rose by $2.5 billion over the 12-month period to $6.2 billion. So it won’t run short on cash for a while.

Tesla’s debt has now swollen to $13.4 billion ($11.6 billion long-term and $1.8 billion short-term debt)

How much should Tesla be worth, if it ever makes a big profit?

In terms of earnings per share, Tesla’s annual net loss translates into EPS of -$4.92. So if Tesla is ever able to make an annual net income of $862 million – a swing of $1.7 billion – it would have EPS of about +$4.92. Now, this assumes that Tesla doesn’t sell any shares or hand out any shares to executives in their compensation packages, which would dilute EPS. So let’s assume the share-count stays the same for once.

In that glorious future year where Tesla makes $4.92 a share, instead of losing $4.92 a share, what would it be worth, as an automaker in a stagnant saturated industry? At a PE ratio of 20 (giving Tesla the benefit of all doubts), its shares on that glorious day in the future when it finally has an annual EPS of $4.92, the stock would still be richly priced at 20 x $4.92, giving it a share price of $98.40.

Just to point out how crazy this has gotten: This evening – upon the announcement of 2% revenue growth and a 25% plunge in quarterly net income despite $133 million in regulatory credits, and of an annual loss of $862 million – Tesla’s shares spiked nearly 12% to $648.

Tesla’s stock makes it the second most valuable automaker in the world. But how about Tesla’s size? Read… Tesla’s Global Deliveries Compared to the Top 10: Volkswagen, Toyota, GM, Ford, Honda, FCA, Mercedes… Here’s the Chart

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The market hasn’t been based on fundamentals in over ten years. This is the new game in town. Find out which companies have been chosen the winners by the Fed and Wall Street and bet on those. That’s it. Very simple. If you are not willing to do that, then don’t play in the casino.

@Reality: The truest, and most lamentable words I have ever read about the joke which is the stock market.

It’s not a joke, it’s a game, in which rules can be rewritten. It’s as if a bunch of folks playing Monopoly decide that each player starts with 10 millions dollars and that the “Go to jail” card now means “Golden Parachute — you receive 1M$ in bonus”.

It has always been a game but now, it’s more blatant, extreme, absurd.

Yahoo headline today:

“Fed to pare back ‘Volcker rule’ to expand bank investment in venture capital, securitized loans”

… excerpt

“The Volcker rule was part of the Dodd-Frank financial regulatory package enacted into law in 2010. The regulation was named after former Fed Chairman Paul Volcker, who wanted to discourage banks from taking on excessive risk for profit-taking that did not ultimately benefit their customers.

The regulation prohibited U.S. banks from engaging in short-term proprietary trading of securities, derivatives, and commodities. The rule also limited banks from owning “covered funds” that in many cases involve pooled investment vehicles.”

So the 2010 attempt to partially cure the 1998 rescinding of the Glass-Steagall Act of 1933 (that fuelled the 1999 bubble madness) has now been negated. Oh well, our savings never belonged to us anyway.

“Oh well, our savings never belonged to us anyway.”

….

“All Your Dollar Are Ourn…”

—Federal Reserve (Not Email Scammers)

“All your base are belong to us.” -Zero Wing

These jackass are really not content until they run our economy into the ground and give a the great depression the reboot..

Perhaps Musk is a truly a genius? The Einstein of Economics?

He is quite close to proving Financial Escape Velocity and/or Critical Mass Hysteria exist and must be included in any meaningful future Economic models.

Wolf, thanks for that. Completely different than the mainstream media who are singing Tesla’s praises tonight. If he can make Tesla a profit surely he can put a man on Venus. Sure there will be lots who disagree with your take. It used to be “how much money did this company make?. That is the past would indicate the future. But now its about projected sales, free cash flow, forward operating margins, etc…Anything exceot whether the company is making money or not. Which I think says something about the company…its all about keeping stock values higher, not the bottom line….that is the one after everything…..including BS et al

Thanks for sorting out the numbers Wolf. As others have pointed out, not something you hear from mainstream media. Everyone is singing Tesla praise like the second coming of Christ. Truly insane time we live in for sure.

On a seperate note, care to do your analysis on GE? They seem to be benefitting from the savor CEO complex lately. Any stock on the hype train rebound?

I second a review by Wolf of GE!

Yes, GE. TBTF because jet engines? What about the rest? How deep are they still into financial derivatives? What are there real environmental liabilities from PCBs in various rivers next to their former mfg plants, etc. ? Retiree liabilities?

You want to talk about how crazy this melt up is? TSLA, GE and the extend of how much those stock went up in such short time is definitely a sign of our time now. Although TSLA is truly in a class of its own when it comes up melting up. Here’s another one for you Wolf, how about some analysis on DB? Stock is up close to 5% today after earnings and as far as I can tell from general headline, overall result is pretty piss poor, yet up we go.

https://finance.yahoo.com/news/deutsche-bank-db-posts-q4-133201074.html

Wah, my first real stock market crash is coming…

Aw, don’t cry! Uncle Jay will fix it by giving all your money to the 1%.

Meh.

That’s nothing.

Boeing reported an epic $4 Billion revenue miss, announces $18.6BN in 737 MAX costs, cuts 787 production…

And the stock goes up 2%.

Maybe the new way of investing is picking the stock losing money and buy buy buy.

and MacDonalds beat the street by 1 cent…

and is closing stores in China…

Stock up $6….and up 16 for the month.

Because of ccorona?

If not, which i assume, than they will loose turnover.

Next on the menu: coronaburgers.

It is not a bad report actually. It does not make sense to only emphasize annual net income (loss) rather than Q-to-Q improvements.

Of course, the report alone can not justify the craziness of the stock price. However this is the new norm in our stock market, isn’t?

Is it a “a bad report?” I don’t know. I know it’s the report of company with stagnating revenues and big losses.

I emphasized year-over-year revenues in Q4: +2% stagnation with automotive revenues +0.7%. I emphasized that Q4 net income plunged 25% YOY, and that it plunged despite the surge in regulatory credits. YOY is how to look at quarters, and how analysts look at quarters. When you look at quarters sequentially, you get trapped in seasonal swings.

As Tesla moves to China….

Are they getting any “help” from the Chinese govt?

Will their technology be stolen, and face Chinese competition?

And what of all the credits Musk got in the US? No obligation to keep production domestic? If not, ridiculous croney capitalism under Obama.

“Are they getting any “help” from the Chinese govt?”

Yes. The one thing we know is that Tesla got $1.63 billion in loans from Chinese state-owned lenders.

The regulatory credits are from all countries, not just the US.

China too still has EV subsidies in place, though they have been reduced recently.

EU, Fiat bought a lot of rights from them. IMHO a death company in Europe even after their merger with Peugeot. Though they have at least some EV knowledge.

Wolf,

I agree with you on the fundamental insanity of Tesla’s valuation – but let’s step back and think about what may be really going on…and what may finally stick the blade into the valuation.

For me, I think that Tesla has (in the broader public’s mind) become synonymous with the bright shiny future of green, non-fossil fuel (boo, hiss…despite running the transportation world for the last 100 yrs – including yesterday).

The actual company (because it is a high PR symbol more than just a company) is almost irrelevant – if you are fairly naive, have a few thou to take a flyer with, want to chat Green at the next superficial cocktail party – you think Tesla (because actual research probably really isn’t your thing).

Tesla is sorta the perfect SV hanger-on, hipster doofus stock.

But even among that specific shareholder class there is a danger – the *next* hip Green stock with an ultra high profile hustler CEO (maybe an ex politician…)

Once that happens in a significant way, the hipster doofus mkt gets split – and on and on.

So long as Tesla is a symbol, standing alone – the idiocy will likely continue – almost irregardless of the numbers.

Tesla is known for manipulating its sales numbers in Q4 to report nicer number for the quarter (who cares that this would translate in much wider loss in Q1 next year, right?).

Q4 is often the quarter after which rules change. Tesla sales is very dependent on those rules. I would not claim those numbers are manipulated for stock reasons.

are those credits linked to actual vehicles sold? do they have to be paid off at some point, or are they a free subsidy for a phantom company? meanwhile too much money too few stocks.

If Tesla had a huge income it could use those credits to reduce its tax liabilities. Since it doesn’t have taxable income, it can sell those tax credits. They’re granted by various governments (US, EU,etc.), and thus they’re indirectly a reduction in tax receipts by those governments, and are thus indirectly a taxpayer-funded subsidy.

I need to get me some of those pollution credits and sell them so I can buy a private jet and prance around the world like a idiot.

I am sure once I cash in on my credits I will attract all sorts of tattooed trashy women, take dancing pills, drop acid and put myself to sleep with Ambien and red wine.

Finally I know the SECRET!

Where do I apply for these credits? Do you just say I am running an EV company and I get them? Do I need to plant a few trees?

How hard can it be – Elon has been doing it for years – and look at this fool.

Al Gore.

The carbon trading scheme would have foamed the runway for carbon extraction industries and could have gone to a larger market system where you got some credits for moving to an electric car, insulating your house, putting in efficient appliances and lighting, etc. The goal is freedom from capitalism, though, for some, and the full force of price seeking for the majority.

And he got the sweatheart deal from gov Cuomo in NY…for the solar panel factory…

What is the govt phone number for these deals? I’d like to make a call….

If Tesla is selling these credit I guess you could buy them? If they become profitable they keep the subsidy and gain a tax credit which is nil in this political environment. Seems like a negative trade-off. Banks prefer QE to lending money. What happens when the real economy picks up and liquidity for financially engineered profits has to be plowed into capex, where the ROI is a lot lower?

“too much money too few stocks.”

Checked the other day and I think the top

6 stocks of the SP *500* accounted for over 20 pct of the mkt cap of the entire index…which itself is over 80 pct of the value of all public companies.

So 6 companies make up about 16 pct of the mkt cap of over 4000 publicly traded companies. Or well over 100 times their equal weighted share.

It is sorta like the early 70s “Nifty Fifty” period on steroids – before each of the Fifty got taken out and shot one by one.

‘In other words, just to stay even, Tesla has to sell three $35,000-Model 3s for each $105,000-Model S or X that it doesn’t sell.’

Revenue wise, yes. 105 divided by 35.

Profit wise, it might have to sell 10 3s to equal one S. That is IF it makes a profit at all on a 3. If not then no amount of 3 sales gives the profit of 1 S sale.

The world’s most profitable car company per unit is Porsche. It has no desire to put one in every driveway.

Cousin VW does that and is doing an EV. Does anyone think that VW’s EV will use different tech than Tesla?

Of course not, BUT there won’t be all these defects in door handles, body panels etc. VW has always been in ‘manufacturing hell’. But while Elon was finding this out he was blowing his ‘early adapter’ lead.

The profit of a Porsche or the latest i- phone is largely because of its ‘cool’ or class or exclusive factor. You can’t have that and be a mass product at the same time.

The 3 will sink would could have been a profitable niche automaker.

Now you mention Porsche:

This Porsche is expected to be sold for about the same price as a model S.

If i had the money, choosing between this Porsche and the Tesla would be a no brainer. Porsche any day. Even without all Tesla’s tech-gismo’s. I want to drive this car, not be driven by it.

OK, I could upgrade the SUV in my fleet from a 2013 Lexus RX450h to a Porsche ‘Mission E Cross Turismo’.

Damn quick at zero to 100 kph in 3.5 seconds! Plus, it has “An 800-volt charging architecture that’ll put 200-plus miles of juice on the car in just 15 to 20 minutes.”

Yes, between Porsche and Tesla – Porsche any day!

according to car and driver:

tesla model s $81k – $101k

porsche taycan $105k – $186 k

Well Nick Kelly.

I have a 39 year old vw in slightly worn but excellent condition. I’m 64 this year, and shooting for driving a 50 year old Westie. Then, my grand daughter gets it.

Do you think anyone will be driving a 39 year old Tesla, ever? 50 + years?

Take that shiny T off the front hood that shows the World how rich and important the cutting edge Tesla owner is, and watch the car’s value drop by 30%. Delorean spelled with a T.

Vehicles that depend on high tech electronics and computing have to hamster race to stay in the game.

How many miles on that VW?

There are plenty of Tesla’s now with 300,000+ miles on them.

Of course there will be someone driving a 39-year-old Tesla. Some old curmudgeon who likes bragging about the “new condition” of his old garbage will surely keep one locked in a garage just to preserve it for the future. Please tell us you’re joking about giving your granddaughter a 39-year-old death trap to drive.

tesla really doesn’t have a choice but to bet on the model 3 model y. if they stuck to building only high end vehicles, they would end up being absorbed into a large conglomerate. tesla needs to get those lower priced models out the door before they run out of cash.

The stock is up because of guidance. 500K in 2020 and Model Y moved up to March.

GM is going to sell 7.5 million+ vehicles in 2020 v. Tesla’s 500K (if Tesla gets there .. Musk’s legacy is one of broken promises).

I think if the next Tesla product would be a pitchfork it may make the stock go even higher

The stock is up because of a short squeeze followed by momentum-chasing speculators piling on.

It went up after the truck. Stock market logic. If something happens and the stock moves, then that must be the cause. Ergo the truck is making the stock go up. Everybody wants those futuristic curves.

Ask any five year old about the Musk truck.

That is why.

Thanks for sifting through the financial information so I didn’t have to. I wouldn’t touch this mess, long or short, so I don’t need to know but I still like watching from the cheap seats.

This mania. repeating so soon after the last two manias. is shocking. We have a central bank openly manipulating markets, our leader taking credit for the gargantuan bubble and insane people chasing after near insolvent momentum stocks. How will this end?

“How will this end?”

Waves of suicides.

Followed by cannibalism.

Followed by films about waves of suicides and cannibalism.

I think we’re like ants looking up a jets and not having a clue. It’s not about profit. The value, the core business is the burn rate. Get it?

supply chain issues will cause some pressure on markets soon…..

cat is out of bag….and it has a corona

Tesla will tank when the rest of the market tanks. Until then it’s a deserving darling – and it should be the first stock you pick up after the crash.

It’s the future of transportation and energy.

Tesla is going to have massive competition in about 2 to 3 years from companies like Volvo. Volvo was last seen tying up years of supply of batteries for its newly planned electric vehicles/hybrids.

As usual, GM, Ford and Chrysler will be the last to meaningfully commit to EVs, and therefore won’t have the patent portfolio to be competitive. In fact, if I was younger and could be more of a speculative investor, I would bet on GM’s bankruptcy (again) before I would bet on a Tesla bankruptcy.

Just the usual… 2 weeks ago I opened the hood of my friend’s 2015 Chevrolet and spotted 3 design errors before even starting to fix the problem. GM truly is general misery, a company the compelled me to buy Japanese cars starting in the mid-1970s… one the best decisions I made in life.

S,

What, you don’t like cars that require pulling the engine to change plugs? Or my friend’s jeep, where the front drive shaft goes through the oil pan?

I used to drive a Tercel and once changed the pop can sized starter in ten minutes….from the top, no less. Wonderful vehicle. I think the starter cost $40, new.

There are no critical or even important patents in the drive train. This is why Musk has told anyone to help themselves to his. One of the reasons all the legacy makers are jumping into EV is how easy it is.

Yes, but they drag their feet because unlike ICE drivetrains, none of them make their own major components: motors and batteries. So… ? Little profit.

The transmissions and electric motors in electric cars are really pretty simple compared to a combustion based engine. Overall an electric car is simpler engineering when it comes to the guts of making it move. The real technology behind them is the batteries that power them. As far as what brand of car someone would prefer to drive, I think it’ll mostly come down to price, safety, looks, features, and reliability, same as now but in a narrower scope. Teslas have struggled with reliability issues, which can slowly be ironed out by improving design and manufacturing processes. However, other car companies have already developed significant expertise in manufacturing and making sure simple things like the door handles falling off doesn’t happen. It would not be hard for them to rehash their matured designs and just rearrange the guts of the car for an electric motor and batteries.

I think what this will come down to ultimately in some regards aside from tangible design isn’t so different than with gas based vehicles. The main issue will be the price (and perhaps it will be more central if electric vehicles on the whole are more reliable, which it seems they will be), and therefore manufacturing efficiency will decide who wins this race relatively speaking. Other established car companies are biding their time to enter the electric vehicle market (again, it’s not that difficult of a technology to implement). Unless Tesla is aggressively and consistently improving their manufacturing operations so that they are on par by the time other manufacturers decide to enter the market, then they may fall away.

Well… I usually like what you write but you can’t knock a true innovator. They can often see far beyond a financial analyst. You’re reading the short game, he’s playing the long game.

As an entrepreneur myself that went from rags to riches with a starting point of $200 I saved up… I can tell you now that what I built really could not be quantified by any analyst until it had already come into fruition.

Now, is the stock overvalued? I’m sure. I got in at $180 so I’m cool with whatever. I’ll sell out in the near future and buy back in for the next 40 years ideally.

GM/Ford/etc. are going to be obliterated by Tesla.

GM/Ford are too big to fail.

They were too big to fail when the global financial markets were frozen. They’re not too big to go bankrupt if markets are operating normally and there are buyers. Not that I think this will happen.

What are the barriers to entry? Every major carmaker is churning out EVs now.

“GM/Ford/etc. are going to be obliterated by Tesla.”

Personally, I think this is wishful thinking that isn’t rooted anywhere near reality. Ford’s first attempt at an EV is not far off from Tesla’s Model Y specs, and according to polling, has more people willing to buy it by 2% or so.

Ford alone have 40+ full EV & hybrids coming out by 2023. GM is not far behind. Ford is profitable, sitting on about 43 billion dollars, and GM not far off.

New !!:Tesla Tulips grown in Holland

“Tesla Tulips grown in Holland”

By…AI…robots…underground…in Holland colony…on Mars.

Tesla feels very dot-com bubbly to me right now

1) people literally sign up for the Robinhood app just to buy TSLA shares – like Bitcoin mania

2) a Hawthorne effect where no matter what the stimulus is the market just reacts by going up. Like it knows it’s supposed to go up so it just goes up on any news.

3) as wolf notes, a seemingly complete disconnect from the fundamentals of profit.

This is the closest stock to what we saw in 1999 in 20 years. I’d love to short it but man will it rip your face off if you get the timing wrong.

I commented on the other post today… thank goodness I was too busy to short the thing going into earnings. Sure only 10 shares, but it would have been close to $100 per share of loss.

Ouch.

One time being busy helped.

That $35K Tesla is a myth. They actually start at 40K and the variant you should really buy is just under $50K. At 50K it’s not really a mass-market vehicle. It’s nearly twice the fair market price of Wolf’s favorite :) comparison vehicle (a new 2020 Toyota Camry).

Some quick back-of-the-envelope calculation:

If you figure the Tesla is going to save you say $650 per year in fuel cost and you’re going to own the car for say 8 years then 8×600 = $5,200 then let’s say another $800 in oil changes then we’ll make it an even $6,000.

The fair value of a brand new nicely loaded Camry is about 28K, plus that $6K = $34K. Compare that with the nicely loaded Tesla at 49K… The Tesla costs more almost 50% more (and remember, that’s accounting for the savings in gas).

Basically EVs still have a long way to go to reach price parity with ICE vehicles. Until that happens Tesla will remain a niche player. It’s only governments that are keeping its head above water (with purchase credits or tradable tax credits like the ones mentioned in the article).

The gist of what the Tesla fanbois are missing is that yes, Tesla has a technological advantage today by the time that price parity arrives, the competitive marketplace could look a lot different than what it looks like today.

What about the comparison between Tesla and a Japanese hybrid? There has to be some cost savings for the Honda Civic compared to a Tesla car.

For me, all this simply proves that it is hard to enter the auto industry if your cheapest car is at least $50k. This is even before you consider the other bad press the company gets. This includes the infamous video where a mechanic pounds a ton of rocks and dirt out of a car’s fenders, and the introduction of their truck. The government can do better by funding 130 episodes of Sesame Street per year for the next 50 years instead of giving “Regulatory Credits” to Elon Musk.

Hybrids are expensive to buy but cheap to run.

I switched over the company cars to Toyota’s in 2016 and apart for my employees’ tendency to bump into immovable objects at speed despite parking cameras and other bells and whistles (“But I was going very slowly boss!”) they are ridiculously cheap to run: we have a five-years unlimited mileage maintenance plan with Toyota and we’ve only had two warranty issues so far, intriguingly both on the same car (a blown shock absorber and a broken rear door handle).

I have been thinking about replacing the small Honda hack with a hybrid Yaris but… even with a big discount €14,500+VAT are a bit too much to stomach right now.

The new bigger hybrids (Corolla, Camry etc) are all pretty expensive, the Prius looks cheap next to them.

Honda has a new small electric car coming on the European market but it’s really small and really pricey: I’ve been quoted €28,800+VAT (incentives are pending because there’s no sure release date yet). It’s basically a joke and doesn’t even come with Panasonic batteries like Tesla or Toyota.

Nissan has a very nice small electric delivery van but, again, the price is a deal killer: €30,000+VAT. You can literally buy two of the same vans with gasoline engines for that money and still have something left over.

Then there’s the Toyota Mirai, which is basically all that’s left of Japan Incorporated’s promises to deliver a “hydrogen economy”. It costs a truly enormous sum (around €68,000+VAT) and it comes with an old fashioned reinforced fiberglass hydrogen tank made by a Mitsubishi subsidiary. Fuel cells… right.

I keep on hearing people saying the costs of manufacturing EV drivetrains and batteries “keep on going down”. If that is the case it means the cost of everything else is shooting into the stratosphere: that Nissan van I mentioned above has done up in price 15% since 2017. The only things that changed are the battery and the firmware governing it… make of this what you want.

These things are still completely reliant on big direct incentives (over 10% of list price minus VAT) to sell, meaning the technology itself may be mature but it’s still not financially viable outside of a tiny market.

@mc01 “Hybrids are expensive to buy but cheap to run.”

this is a key point. the fact that toyota is staying out of the full electric game is telling. it’s not clear that the current dream of battery powered autonomous electric vehicles becoming the norm is viable. toyota seems to be more interested in plug in hybrids and to a lesser extant hydrogen fuel cell cars than full battery powered electric vehicles

Japan Incorporated seems to be sitting on the fence on this one.

They bring out lots of concepts and prototypes but very little in the way of commercially available electric vehicles.

Honda has just introduced an electric delivery scooter in Japan. Very clever idea but, again, it’s also very pricey without big incentives.

I suspect these folks know how much image damage has been done by EV fanboys (they sound more like cultists from a 70’s penny dreadful than motoring enthusiasts) and by small time/fly by night manufacturers with 24oz steak appetites and Big Mac budgets and want the waters to calm down before getting serious.

I’ll keep on repeating it here: the first serious company to manufacture an affordable electric delivery van that doesn’t need big incentives will make a fortune, not one manufacturing luxury cars and status symbols: that’s the stuff we are waiting for.

My Toyota (Lexus) hybrid is great for city driving, which is most of what I do. It’s very easy to change oil & filter and the thing is just convenient to operate and maintain.

Is it as fun to drive as my SC400? No. But when I want to go somewhere in town, I take my RX450h.

EV is the future for most applications, and as Wolf reminds us, “… the flat torque curve of an electric motor … makes it ideal for performance driving and towing.”

Interesting discussions. The one thing is that Tesla is way more expensive than any hybrid that Japan produces. Factor in all costs in the long run, and it is clear that Tesla is the most expensive. At least, they are trying to offer something new, unlike 23andMe which is on the downstring because they only offered a single use product.

@dan romig as Wolf reminds us, “… the flat torque curve of an electric motor … makes it ideal for performance driving and towing.”

both performance driving and towing dramatically reduce range. i’m curious how tesla will handle customers pulling rv’s with their cybertrucks stopping at superchargers every 50 miles for a fresh charge.

@MC01 i agree that an electric delivery van makes the most sense. i’m surprised that hasn’t already happened. i think japan is smart to wait and see. diesel seemed like a good move when the germans jumped on it but now in hindsight, it was a disaster. there are a lot of pieces that have to come in place for widespread use of ev’s to make sense:

improved battery technology both in range and hazardous materials

faster charging times

widespread and standardized charging infrastructure

building a more robust power grid to handle the electrical demand

You’re sounding like a Musk Fanboi.

Forgot the Honda Clarity, which have FCV/PHEV/BEV Drive Options.

TM and HMC Subsidize H2 Fuel for 3 Years, so Leasing the FCVs for 3 years costs you the Lease and Ins.

TM are Rolling Out FCV Demonstrations City-wide for the 2020 Tokyo Olympics, 2nd Gen FCVs, and a H2 Based “R&D City”.

H2 are available from the Industrial Mfg Processes – that’s why JPN are pressing on. DEU and CHN are working on them as well. Beats burning Gasoline and Smogging Up the Cities.

Refueling Infra may be a tad more expensive; but Enviromentally safer than dealing with Gasoline/Diesel Fuel Spills.

Granted, for a Industriously Hollowed Out Country like the USA, building out H2 Infra for Vehicles may be too big of a Task. However, One can Drive from San Diego to Northern Cal – possibly to Seattle – with present H2 Infra. I’m surprised that TM+HMC haven’t focused on the East Coast of the USA; but it looks like they’re going to wait for the 2ndGen FCVs to Push for the Infra Chain.

I used to live near Torrance where NSANY, TM, and HMC all had their NA-USA_HQ within miles of each other. I spoke the language (moved there in 2000 from NJ since my Mother is Japanese – most Ethnic Goods Sold/Serviced there) with the IT/Fin/Defense/Aerospace Exp; but was only called up for an occasional IT Interview so far off – since they were too cheap for USA Contractor Rates and outsourced stupidly.

As you may be aware, they pretty much relocated or hollowed out their SoCal Footprint.

It was kind of funny seeing a RDSA H2 Station that was built across the street from TM’s HQ Years Ago. Rarely spotted someone refueling there; and that was before the Mirai Rollout.

“and a Japanese hybrid? ”

Exactly…where have the Prius-gasms been since the late 90s intro?

Doubling MPG is too real world Green to count?

You are assuming oil will stay cheap, and electricity will stay expensive….and also that battery efficiency will not increase (battery efficiency is increasing by 3-5% per year), not to forget battery price decreases. ICE vehicles are at the end of the road technologically. Ten years from now, battery powered cars will have double the range and cost a fraction.

No, I am NOT making the assumptions you’re describing.

On the contrary. I think electric vehicles will have a bright future.

Those who ARE making assumptions are the Tesla fanbois who are, for some inexplicable reason, assuming that every other car maker is just going to sit idly by and not improve their own EV offerings while Tesla continues to offer a product which is technically superior.

At the end of the day what’s going to matter is what will the competitive EV landscape will look like at the moment that price parity point arrives – which would truly allow these vehicles to actually become mainstream. Anyone intending to hold Tesla stock for the long term should ask themselves this question as well.

Keep in mind that Tesla is like the Chinese Government – they LIE about everything.

Notice my post on the earlier thread about how multiple users including a journalist found that their Tesla batteries lost roughly half their capacity in cold weather?

Tesla disputes that. Trust Tesla on that?

As for batteries improvements are hard to come by — see this Wired article:

Better batteries mean better products. They give us longer-lasting smartphones, anxiety-free electric transport, and potentially, more efficient energy storage for large-scale buildings like data centers. But battery tech is frustratingly slow to advance, due to both the chemical processes involved and the challenges that exist around commercializing new battery designs.

https://www.wired.com/story/building-a-better-battery/

It remains incredibly tough for even the most promising battery experiments to find their way out of research labs and into the devices we carry.

Tesla also says the batteries can be recycled – that is a LIE:

https://www.stuff.co.nz/motoring/111367821/what-happens-to-all-those-ev-batteries

That $35K Tesla is a myth. They actually start at 40K and the variant you should really buy is just under $50K. At 50K it’s not really a mass-market vehicle. It’s nearly twice the fair market price of Wolf’s favorite :) comparison vehicle (a new 2020 Toyota Camry).

___

You’re comparing apples to oranges. Your $25K Camry is a base model with a 4 cylinder engine. The variant you would really buy is a $40K well equipped V6.

Years ago I would have agreed with you but the 4-cylinders of today are much improved over the 4-cyl of old.

Just Some Random Guy,

Minor quibble: The Camry Price Index is my second favorite one; My number one favorite one is the Pickup Truck Price Index (PTPI?)

https://wolfstreet.com/2019/12/15/my-pickup-truck-price-index-crushes-cpi-for-new-vehicles/

FWIW the average price of a new vehicle in the US is about $35,000. This average price keeps skewing upwards due to people buying $50,000 pickups on 72+ month loans.

Demand is not a problem for the Model 3, even at its $50,000 real-world price.

There is only one problem with that thinking. The Model 3 is a luxury car and a super expensive EV one at that. (Given that it is labeled a luxury car by Google.) There are some cars that are more expensive, but save money in the long run. That is given the $35,000 price tag. Most people are going to opt for something cheaper like a gas guzzler or hybrid from Japan.

The Model 3 basically competes in the BMW 3-series class, among a subset of potential buyers who don’t regularly go on long trips and have at least one other car with an ICE. For reference, BMW sold about 48,000 3 and 4-series cars in the US in 2019.

I’m not sure what you mean by more expensive cars saving money in the long run. Fuel and maintenance are clearly cheaper with an electric vehicle. Depreciation is a bit of an unknown, but I doubt it will be too far off a 3-series, assuming battery pack life is addressed.

Regarding the vehicular choice of “most people,” they’re buying SUV’s and pickups, not sedans, let alone electric ones, so we’re not talking about the general public.

If you want to make a fair comparison you’d need to compare the average price of a sedan to the Model 3 rather than comparing the average cost of all cars to the Model 3.

Demand for the Model 3 is skewed by years of back-log Tesla has to go through. I am not so sure marginal demand now that the Tesla has worked through the preorders is that high.

The fairest comparison is the average price of a BMW 3-series to a Model 3. We’ll see on the demand piece, but I don’t see supply catching up anytime soon, especially once lower-priced versions become available in greater numbers.

1) Tesla financial coronavirus will change investors expectations.

2) Tesla pay options. Tesla stock price in a bull run. In half a year, up from 175 in June 2019 to 500 in Jan 2020.

3) Tesla share prices formed a bubble.

4) Tesla option expenses will hit a bubble.

5) If Tesla workers exercise options, cash in, Tesla payroll cost will spike.

6) NIPA accounting calculate employees stock options when stock

options are exercise. Ilan payroll will reach the moon.

7) Facebook share price up from 123 in Dec 2018 to 224 this week.

8) Zuk will tumble from a cliff.

9) GOOGL up from 1000 to 1500 within a year.

10) The flu season is extremely severe this year. The tech sector is extremely fragile at bubble peak, when options value at peak.

11) GAAP will soften the damage, because it spread cost through

several years.

Options given today to employees will have zero value in the next few years.

Thus, in recession, a combination of layoffs and a sharp reduction

in options cost, help co at the bottom, moderate financial pain at the bottom.

Income in SF and silicon valley will go south in the next few years.

Employees will be let go, or leave on their own, because options

will disappear, but rent will not, until their lease expiration day.

There’s a lot of “paper millionaires” out there who think they own a million dollars of illiquid options but as Wework showed – might be worth little to nothing.

2 weeks ago I saw one of my connections on LinkedIn grumble a company he had options in exited for $100 million but the employee shares got $0.

I wonder how much this is going to happen and what the macro effects are of people doing things like buying houses based off of how much they imagine their options might be worth – and what happens when they find out they’re actually worth less or even $0.

I’ve been hearing these tales of doom and gloom for a solid decade. Any day now….

Are these regulatory “credits” a permanent feature?

I also take it short-term debt is that with a maturity of less than 2 years?

Surely Tesla hours to market and tries to raise $5 billion after Elon gets his bonus for the valuation?

These regulatory credits are a result of government policy in the US, the EU, and other countries. If governments decide to change their policies, they can.

1) Buyback lift market cap.

2) A corp spend less than 50M/Y on 1B buyback loan at 3%-5%.

3) Market cap can grow by the billions. The buyback is a lever that lift prices along with options value.

4) At peak, corp expenses cannibalise themselves.

5) Share value fall, the buyback campaign is gone, dividends send to the freezer, and old options have zero value. At nadir profit stabilized, or start to rise. 6) During the dark days, when there is no more hope, co that grudgingly fall, or rising slightly, is a signal that investors are

interest in them and they are ready for a liftoff.

To think Gm just up and literally dumped their

electric car program back in the day.Small minds

Easy to think petrochemical availability was going to last when I drove into the city of angels in 1970 to find gas was $0.10 per gallon,,, big gas war going on to get rid of the stuff as fast as possible, eh?

kinda sorta like the flaring of nat gas today,,, same level of cost benefit, etc….

of course it’s going to end some when and under some circumstances!!! and don’t we all wish we could know either,,, but in spite of the volume of rhetoric, nobody does, not even, or perhaps especially not the musk guy

Hmmm… just a couple days ago GM announced that they will be investing $2.2 billion in an existing plant to convert it for producing all-electric vehicles.

Hmmmmm….GM converting existing ICE plant to produce EV !

GM exited Indian market totally 2 years ago.

Great Wall of China bought GM’s last idling plant in India last month & going to build EV’s & launching soon in India.

The internets say Boeing reported it’s worse earnings in history. I checked Boeing stock price now, it’s $322. That’s higher than I remember it being about a week or so ago when I last looked ($320).

Fed Chairman Powell said yesterday stock prices are somewhat elevated. I checked the stock market now it’s 28,525 / 9,057 / 3,251. That’s much higher than 18-24 months or so ago when and I think I remember it being about 23,000 and Powell said the Fed was targeting asset prices.

I think what Powell is really saying by his actions, is that he does care at all in the very least about inflated asset prices, and wants to inflate asset priced more and more, but says to us he is not doing this while he does do it.

The Fed pretty much does the opposite of what it says.

Here’s what they’ve said:

-QE is temporary

-Assets on the Fed balance sheet will be reduced

-QT will be like watching paint dry

-We’ll normalize interest rates

-Stock price increases are a transitory effect of policy

-The Fed does not target asset prices as part of its mandate

…..yeah, right.

The Federal Reserve has either been very deceptive, or very ignorant, or both.

Perhaps the Fed should have thought a bit more before they blew the biggest asset price bubble in history.

It’s called deja poo – the same shit all over again.

Not a Tesla fan boy and don’t own one yet. But Tesla has a “HW/SW platform” opportunity similar to MSFT in the 90’s. They build their own quite advanced silicon hardware (HW3) and their own software stack on top of it. They also have over the air upgrades pretty much perfected. If their gamble on “neural nets” pays off they will be quite ahead of other car assemblers that outsource all the hard stuff (SW).

** Off Topic **

Since IOER was upped to 1.6% yesterday by the Fed, the Repo rate today went up from 1.55% to 1.6%.

Meantime the rest of the Treasury rates are FALLING.

It’s crazy. Time to buy a Tesla Y?

Iamafan,

Powell said yesterday that they would start raising the repo offering rate. I didn’t think it would apply to NOW. I thought it would apply to, you know, someday “during the second quarter.”

Looks like the Fed is trying to move away from being the lender-of-first-resort in the repo market to being the lender-of-last-resort. This should bring repo balances down further.

I still think Elon is dealing with the Communist Chinese Devil by borrowing his money, and building TSLA’s manufacturing future within his realm. Also easily within his grasp.

I wonder how many of those credits he sold as no cost revenue, came from the Chinese. I think they are like a boa constrictor, in the process of curling themselves around this ninny and getting ready to put the death squeeze on him to extract his blood, factories, technology, and anything else they want for their own industry’s use.

Stockholders? Ha! Historically, look where they land in any bankruptcy.

Does this concern seem all that outlandish to anyone here?

I thought I should point out that Tesla, Musk and it’s finance staff are taking big risks “managing” earnings and other stats. When I first started working (I am an accountant) this was common practice, even expected, and largely legal provided you didn’t go beyond reasonable to deceit. Now everything is driven by regulations with lawyers, external auditors providing opinions that allow you to skirt the truth using the rules. That is to engage in deceit. The problem is when you have a financial failure or debacle like Enron, in come the Feds, the State Authorities looking to cover up their lack of oversight with lots of bodies hung high. Add in some publicity seeking DA, and angry ex-investors and you have a full scale mob with rope. All those legal opinions will be deemed garbage, rebranded as evidence of fraud, those same regulations will be mined for crimes with years attached, throw in a few gratuitous emails and texts, frightened employees singing like birds, and the scaffold takes shape. Musk and those who have participated in these financial acrobatics better have been very careful, but we all know Elon is anything but. The adoring crowd will turn to mob when they lose their money, despite the fact that any half wit should have recognized this whale of a scam called Tesla.

The idea that you can save the planet by spending more is a telltale sign of a Kafka world. There is a multiplier effect to spending money, so even if you spend the money on solar, the recipients of the money will go and spend it on all kinds of things. The total money spent is roughly equivalent to the toll you’re exacting on the planet. Besides the multiplier effect, I believe there is an even more important reason why spending more will destroy the world: Nearly all spending is driven by the desire to prove that you’re a little bit better than your neighbor, so by spending a large amount on planet-saving technologies, Mr. Jones is setting the bar high for all the poor fellows in developing countries to keep up with him. The children in those countries grow up trying to emulate him. A quality used car can be purchased for under $1000 today. Various parts will break over time, but if you pick a common model, there is an endless supply of used replacement parts lying around in salvage yards across the entire nation. It’s more work, but those parts have already been manufactured and you’re not creating much additional strain on the environment by reusing them.

TSLA shorts taking it in the shorts again today. Oh the humanity.

If they only squeaked out $1.25 per share profit, their current PE would be 522:1

Someone made a killing in the past few weeks on the ‘greater fool’ theory. I wonder who got in at $260 and out at $620?

Anyone here?

While a PE of 20 is fair, it’s far from the standard anymore. Amazon’s is 92, which is much lower than it used to be.

There are just some stocks, fair or not, that will always have a ridiculous PE ratio. Tesla could just keep having a PE ratio of 150-200 because that’s what people are used to for this stock.

In other words, fundamentals aren’t nearly as important as perception and psychology. That’s why we love/hate the market and letting the market determine who wins and loses is a bunch of BS!

“letting the market determine who wins and loses is a bunch of BS!”

In the short term, the mkt is a voting machine.

In the long term, it is a weighing machine.

Tesla sales dropped from 12.00 to 36 this month in Holland. No more freebies on taxes and poof, no more sales.

must be 12000

more likely 1200,,, 1,200 or, per most Europeans 1.200

AKA one thousand two hundred,,, or twelve hundred,,, eh??

I hope everyone is aware that Tesla had $20b in revenue in 2018, roughly $25b in 2019 and the forecasts are for $30b in revenue this year.

When it comes to a market share and mind share juggernaut, Tesla is up there with the very best that ever existed…. thus the market cap we see today.

People who drive the car and own the stock, let me tell ya those guys ain’t dumb. Peter Lynch knows what i am talking about.

Sorry to offend the 75 year old silver haired guys reading this who drive to their local Borders books and Barnes and Noble in their cherished Oldsmobiles and Pontiacs.

akiddy111,

“When it comes to a market share and mind share juggernaut, Tesla is up there with the very best that ever existed….”

“mind share” maybe — however that may be counted or quantified (how long people are “thinking” about Tesla?).

But “market share”? Tesla’s market share in 2019 in the US = 1.3%. In China = 0.001%. GM’s market share in the US = 16.9%.

In terms of market share in the US, Tesla was below Mazda in 2019.

Here is how Tesla’s global deliveries stack up against the big automakers. I marked Tesla in red so you don’t have to pull out your magnifying glass. Note that even if Tesla DOUBLES its global deliveries, it’s still a tiny outfit:

I didn’t know you could get drunk on kool-aid. Are you following your messiah and mixing in acid and smoking whacky?

Either that or you are a paid troll.

Tesla is a garbage mobile.

1) Tesla popped up and made an all time high, on large hot air bubble.

2) The daily volume was very, it produced a tiny bar that didn’t move.

3) There was a battle between investors in pursuit of Tesla

power, and those who sold and took profit at high level.

4) Tesla Jan 2020 daily chart : high frequency of large volume pulses, large effort by market makers, to keep momentum up.

5) Tesla weekly : an anomaly : the smallest vol. in the last 4 weeks, but the largest candle in the last two months.

5) The weekly input (volume) is trending down, but price accumulation is up.

8) Tesla EPS = (-) 4.81 // P/E = (-) 133.11 // options YES // no div.

9) Tomorrow on Fri Jan 31 BA earning report, might stall Tesla

engine.

Since Suzuki is the market leader in India (Indian sales contributes a lot to Suzuki’s total sales)

(50% market share & Hyundai-Kia is 30% -all the rest 20%).

so out of curiosity ,checked stats in global suzuki dot com page.

Suzuki Japan is the 11th biggest automaker by production worldwide !(not in top 10)

Global production =3,055,860 units in calender year 2019 (3.1 million only /down for the 1st time in 3 years)

TTBTF

Well, it’s interesting to compare the cash burn chart for Tesla in this article vs. the one for Netflix, posted in Wolf’s earlier article about the bankruptcy of Movie Pass

Netflix’s cash burn rate in 2019 was FOUR TIMES higher than Tesla’s, and has been on an accelerating trend since 2014, whereas Tesla’s cash burn rate has clearly improved and decreased since 2017.

Now, both companies’s stock are obviously grossly overvalued, as is Apple’s, for reasons I explained in Wolf’s previous article/rant about Tesla.

And yet Tesla gets the vast bulk of the vitriol directed against it here on Wolfstreet, with multiple articles that have appeared arguing just how big of a financial house of cards it is.

Way back in February 2019, when Non Wolfstreet that this would be Peak Netflix. Pretty close. I’ve been ranting against Apple for a long time as well.

Wolf finally acknowledged Netflix’s precarious state and quasi-legal financial engineering in his Movie Pass article.

Strangely, Wolf NEVER says anything about how grossly overvalued Apple stock is.

Wolf, whether Tesla lives or dies or becomes the next Apple or Amazon, you are clearly a charter member of the TSLAQ Club.

Being obsessively biased against Netflix, I hereby announce that I am forming the NFLXQ Club. Wolf, you are hereby invited to join as Official Member #2

ugh, computer glitch –

Way back in February 2019, when Netflix’s Unseen- By-Anybody movie “Roma” won THREE Oscars, I posted here on Wolfstreet that this would be Peak Netflix

“Wolf finally acknowledged Netflix’s precarious state and quasi-legal financial engineering…”

Come on, Gandalf, just because you didn’t read it doesn’t mean I didn’t write it:

For your fun and edification, this in October:

https://wolfstreet.com/2019/10/21/cash-flow-zombie-netflix-borrows-another-2-billion-heres-how-it-tricks-up-its-income/

And I picked out a few more, in no particular order:

https://wolfstreet.com/2018/04/23/junk-rated-netflix-borrows-1-9-bn-most-ever-in-drive-by-bond-issue-to-burn-3-4-bn-in-2018-and-report-a-loss-to-the-irs-as-debt-soars-to-8-4-billion/

https://wolfstreet.com/2018/01/22/junk-rated-netflix-expects-tax-loss-will-burn-3-4-bn-in-2018-after-burning-2-bn-in-2017-debt-piles-up/

https://wolfstreet.com/2017/10/24/what-junk-rated-netflix-just-said-about-the-bond-market/

Ok,Wolf you get to be charter member #1 of the NFLXQ Club.

I’ve often wished your site had a search function so it would be possible for your readers to search for past topics, comments, comments by specific poster, etc

Yes, if you’re on a smartphone, the search function is practically impossible to find. But on PC/laptop, it’s easier. It’s the box in the right sidebar under my book ads. It works reasonably well. But if I want to find something more complex on my site, I Google it :-]

Netflix is a purveyor of garbage (says the guy without a TV). We do have this trash in a rental property because people do enjoy their garbage, but of me, there is next to nothing worth watching on Netflix.

And yes, it’s another cash burning monstrosity that should not exist.

Need to keep the sheeple entertained so they don’t see that they are being herded towards the slaughterhouse.

I really enjoy reading news @ wolfstreet, but I strongly disagree with your Tesla articles. From the business only perspective, Tesla’s value makes no sense. However, Tesla’s technology, products and team are at least 5-7 years ahead of any other company and it seems like the gap is only widening. Not a single company has autopilot, which they sell for $7K, imagine in 5 years, 5 million vehicles sold with $7K autopilot add on which is almost free for Tesla. They could also licence it to other car manufacturers and not just the autopilot, but all of their patents and technology.

I’d say we’re 15-20 years from when EV’s become mainstream. They’re too expensive and the infrastructure isn’t in place to service them yet. Right now the only EV company with decent sales and decent resale value is Tesla. None of the other EV’s in the market are doing well. As you point out, even Tesla is having a hard time growing.

Honda is holding off EV’s for now and moving toward hybrids for their car lines. This seems like a good middle ground. It’s enough to satisfy the new EU ICE car regulations and doesn’t require infrastructure changes.

My next car will probably be a hybrid. While they seem more complicated than an ICE car, you lose the starter and alternator which are the most failure prone parts of most ICE engines.

Tesla is doing well?

In spite of massive subsidies they continue to manage to lose billions every year.

I suppose if your measure of doing well equates to a rising share price in spite of losing billions for nearly two decades then yes they are doing extremely well.

Tesla is without a doubt the most amazing corporation in the history of the world.

They put Apple and other companies that are profitable to shame.

Wolf, I think after today’s massive short covering , we deserve a follow up commentary. TSLA puts KKD to shame :)

Last Friday, I told commenter “David in Texas” in an email as part of our ongoing TSLA marveling: “The way people have turned this automaker into some kind of supernatural phenomenon is just amazing.” That’s my story and I’m sticking to it :-]

Supernatural sounds about right..20% up at the end of closing. Just wow and not in a good way…

It’s a ponzi-scheme for investors

What do you think about this ?

https://markets.businessinsider.com/news/stocks/ron-baron-tesla-hit-trillion-revenue-stock-investor-bull-forecast-2020-2-1028872367