Quantitative Tightening has removed 40% of Treasury securities and 28% of MBS that pandemic QE added.

By Wolf Richter for WOLF STREET.

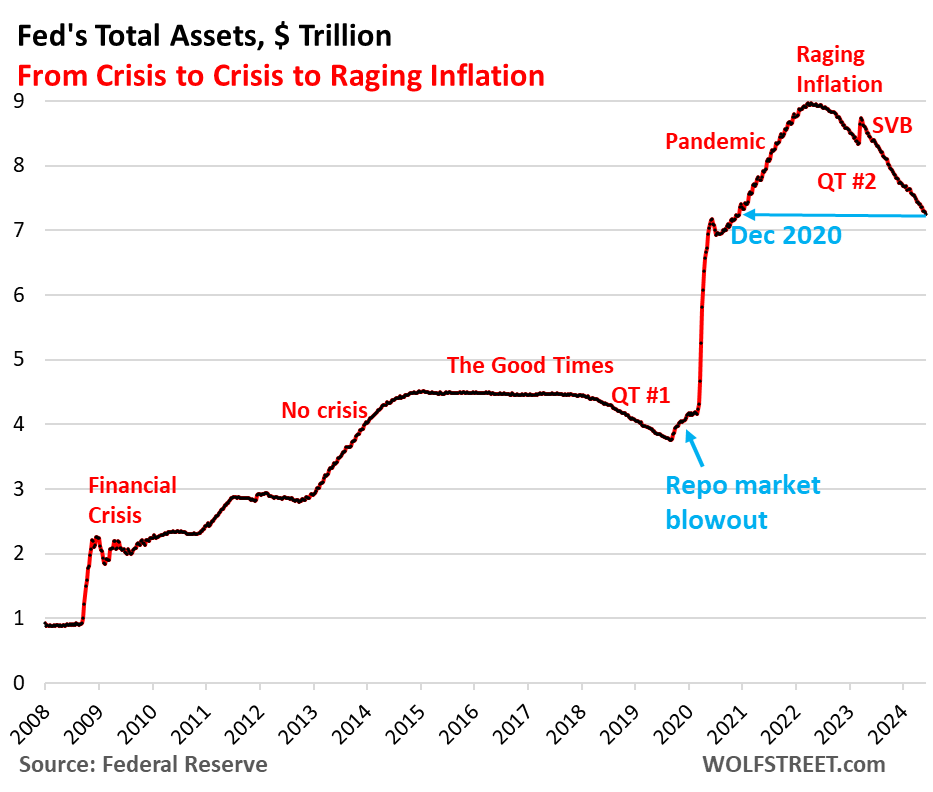

Total assets on the Fed’s balance sheet dropped by $107 billion in May, to $7.26 trillion, the lowest since December 2020, according to the Fed’s weekly balance sheet today. Since the end of QE in April 2022, the Fed has shed $1.71 trillion.

At its last FOMC meeting, the Fed outlined how it will slow QT in order to get the balance sheet down as far as possible without blowing anything up. The idea is to slowly approach the unknown level below which liquidity is too low, to avoid another debacle, such as the repo market blowout in September 2019 that caused the Fed to undo a big part of QT-1. That’s to be avoided this time.

May was the last month at the old pace of QT. Starting in June, the cap for the Treasury runoff will $25 billion, instead of $60 billion. But the cap for the MBS runoff has effectively been removed: whatever MBS come off, will just come off, and goodbye; any amount over $35 billion will be reinvested in Treasury securities, not in MBS, in line with the plan to get rid of MBS entirely over the “longer term.”

Why the Fed’s balance sheet rose even before 2008.

Sometimes folks say that the Fed should bring the balance sheet back down to $900 billion where it had been in 2008 before QE, and anything less is chickenshit.

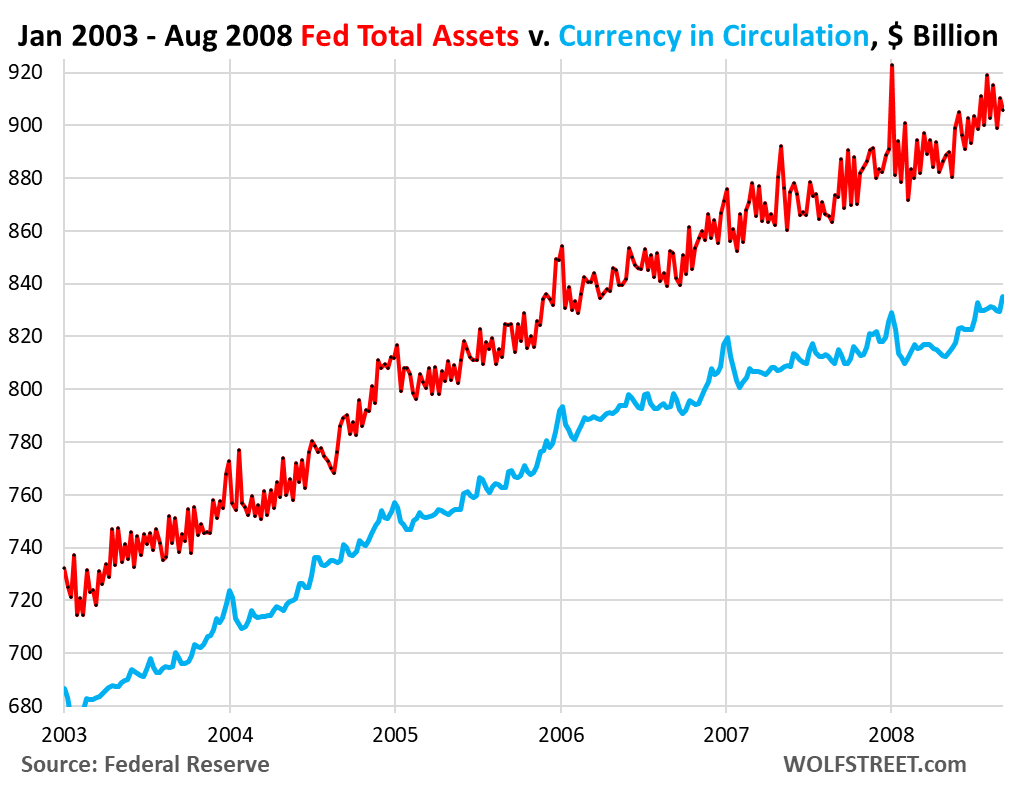

But wait… currency in circulation. From the first day of its existence, the Fed’s assets have risen roughly in parallel with what was its largest liability: currency in circulation (paper dollars, AKA “Federal Reserve Notes”). The amount of currency in circulation is entirely demand based: When you try to withdraw $100 from the ATM, you expect the ATM to have the $100. Currency in circulation has quadrupled from $600 billion in 2003 to $2.35 trillion today. And assets must rise with that liability.

Between 2003 and August 2008 (just before QE started), the Fed’s total assets rose by 26%, from $720 billion at the beginning of 2003, to $910 billion in August 2008 (total assets in red, currency in circulation in blue).

Total assets are so jagged because the Fed used overnight repos on a daily basis to provide liquidity to, or drain liquidity from the banking system via its Standing Repo Facility. Those repos were on top of a more or less steadily growing base of Treasury securities. The red line also includes the Fed’s other assets such as gold and the Special Drawing Rights (SDRs).

In addition: During the Financial Crisis, the government moved its checking accounts from private banks (JPMorgan primarily) to the Federal Reserve Bank of New York, out of fear that the banking system would collapse and wipe out its checking account or whatever. This Treasury General Account (TGA) has a balance of $703 billion currently, which is a liability for the Fed (money that the Fed owes the government). So this was added to the balance sheet in 2009. With the $2.35 trillion in currency in circulation, that’s already over $3 trillion.

In addition, the Fed has other liabilities — primarily reserves and ON RRPs — which are now shrinking under QT (all in our most recent update of the Fed’s balance sheet liabilities).

QT by category.

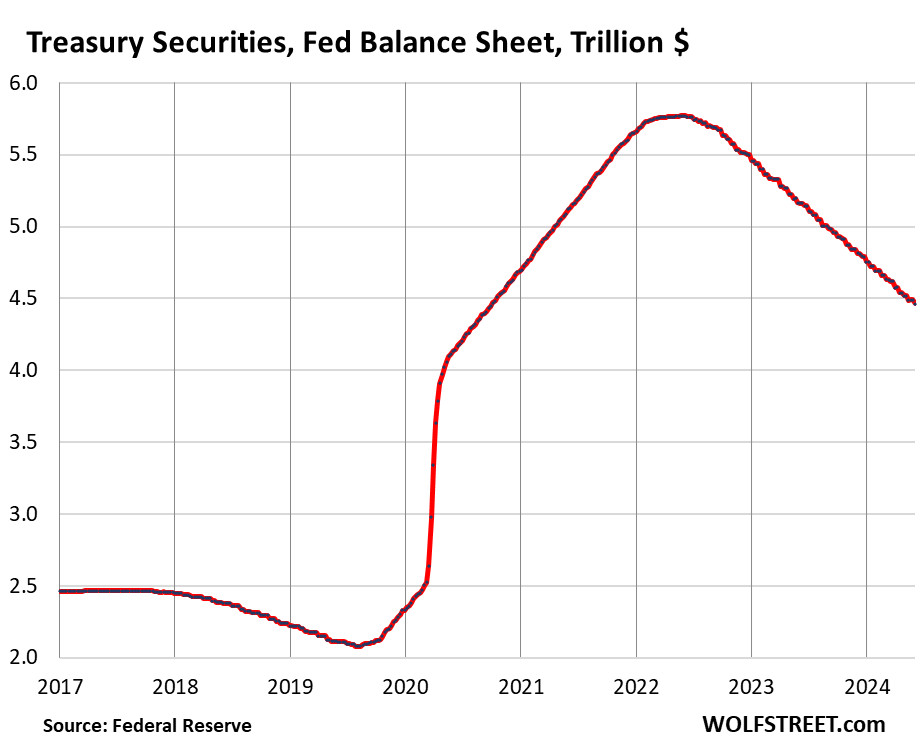

Treasury securities: -$57 billion in May, -$1.31 trillion from peak in June 2022, to $4.46 trillion, the lowest since September 2020.

The Fed has now shed 40% of the $3.27 trillion in Treasury securities that it had added during pandemic QE.

Treasury notes (2- to 10-year) and Treasury bonds (20- & 30-year) “roll off” the balance sheet mid-month and at the end of the month when they mature and the Fed gets paid face value. The roll-off was capped at $60 billion per month through May, and about that much has been rolling off, minus the inflation protection the Fed earns on Treasury Inflation Protected Securities (TIPS) which is added to the principal of the TIPS.

Starting in June, the roll-off will be capped at $25 billion, minus inflation protection from the TIPS.

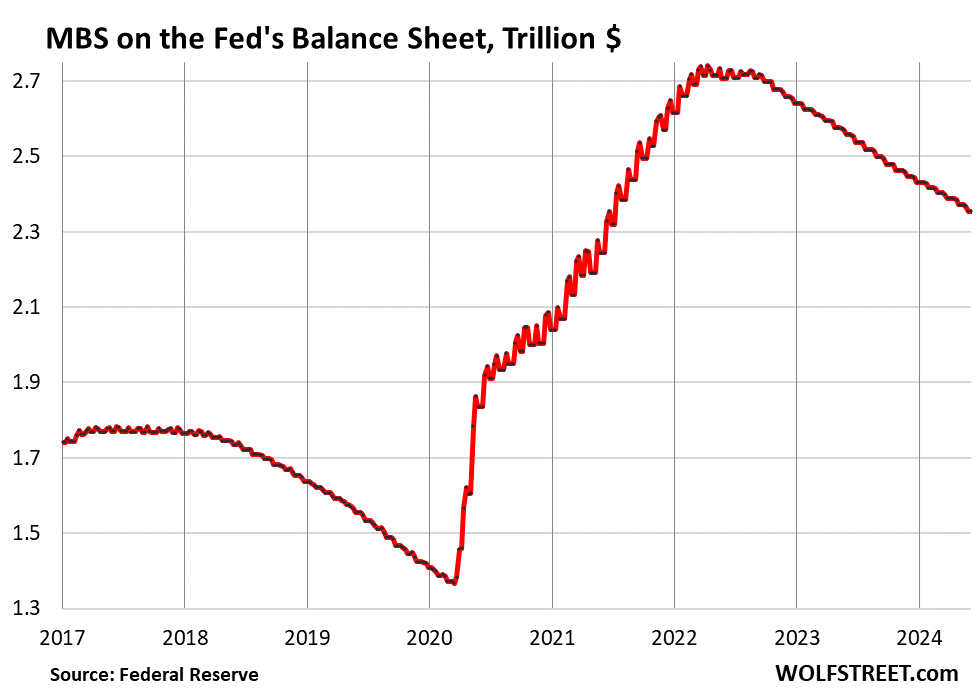

Mortgage-Backed Securities (MBS): -$17 billion in May, -$386 billion from the peak, to $2.35 trillion, the lowest since July 2021. The Fed has shed 28% of the MBS it had added during pandemic QE.

MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made. But sales of existing homes have plunged, and mortgage refinancing has collapsed, and so fewer mortgages got paid off, and passthrough principal payments to MBS holders, such as the Fed, have been reduced to a trickle. So the MBS have come off the balance sheet at a pace that’s far below the $35-billion cap.

Under the new version of QT, the cap for MBS has effectively been removed. If over $35 billion in MBS come off, they’ll just come off, and goodbye, but the amount over $35 billion will be replaced by Treasury securities.

Bank liquidity facilities.

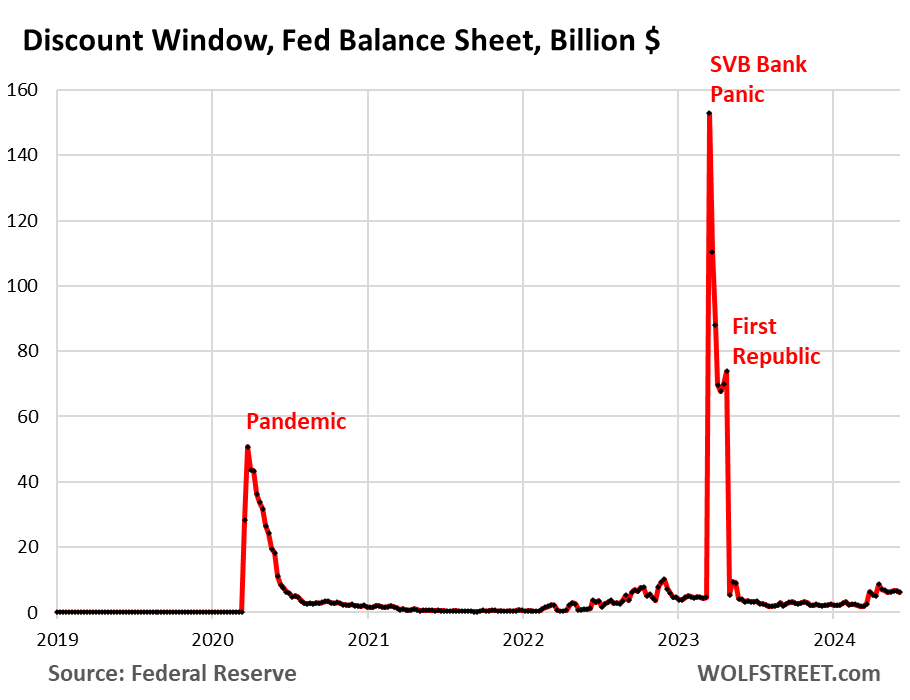

Discount Window: -$600 million in May, to $6.2 billion. During the bank panic in March 2023, loans had spiked to $153 billion.

The Discount Window is the Fed’s classic liquidity supply to banks. The Fed currently charges banks 5.5% in interest on these loans – one of its five policy rates – and demands collateral at market value, which is expensive money for banks, and there’s a stigma attached to borrowing at the Discount Window, and so banks don’t use this facility unless they need to, though the Fed has been exhorting them to make more regular use of this facility.

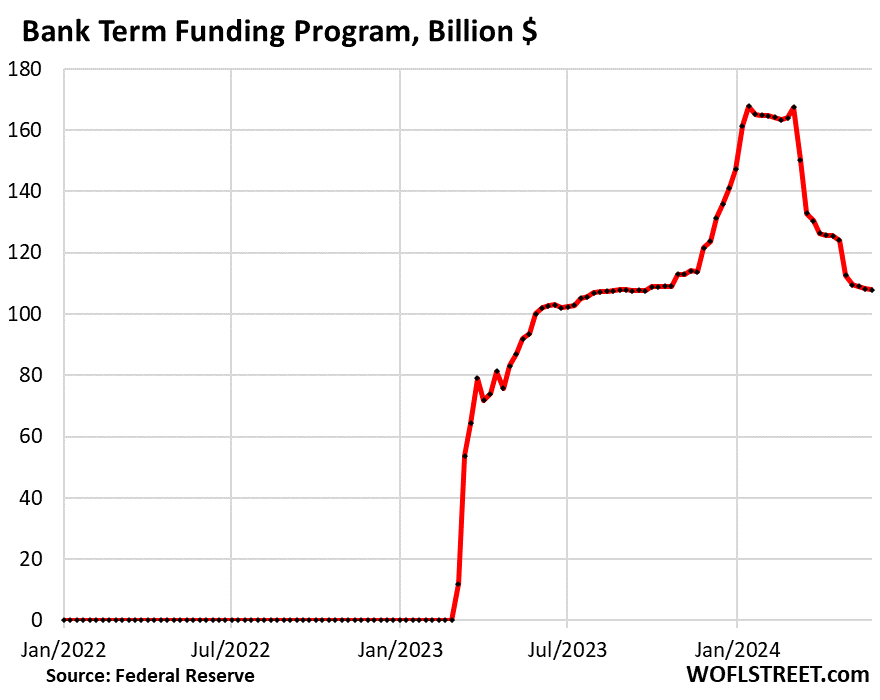

Bank Term Funding Program (BTFP): -$16.2 billion in May, to $108 billion.

Cobbled together over a panicky weekend in March 2023 after SVB had failed, the BTFP had a fatal flaw: Its rate was based on a market rate. When Rate-Cut Mania kicked off in November 2023, market rates plunged even as the Fed held its policy rates steady, including the 5.4% it pays banks on reserves. Some smaller banks then used the BTFP for arbitrage profits, borrowing at the BTFP at a lower market rate and then leaving the cash in their reserve account at the Fed to earn 5.4%. This arbitrage caused the BTFP balances to spike to $168 billion. The Fed shut down the arbitrage in January by changing the rate. It also let the BTFP expire on March 11, 2024. Loans that were taken out before that date can still be carried for a year from when they were taken out. By March 11, 2025, the BTFP will be zero.

So over the next 10 months, the BTFP, on its way to zero, will remove another $108 billion, or about $11 billion per month on average, from the balance sheet, on top of regular QT.

All other bank-panic facilities from March 2023 have already been zeroed out.

Why assets dropped by $108 billion in May, though QT was capped at $95 billion:

Here are the biggies, accounting for $105 billion of the $108 billion decline in May:

- Treasury securities: -$57 billion

- MBS: -$17 billion

- BTFP: -$16 billion

- Unamortized Premiums and Discounts: -$4 billion

- Other assets (accrued interest, etc.): -$10 billion

- Discount Window plus remnants of 2020-era SPVs: -$1 billion.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What does this mean for the future is the big question.

I don’t know the future, but in the past 15 years, fed reinforced this one thing continuously: cash is trash.

Trash that pays 5.4% in interest.

Yes, that much Wolf and I agree on. No person or fund is going to loan Uncle Sam money for anything less than 5%. UNFORTUNATELY central banks will still buy bonds, AND all the bought-and-paid for criminals in CONgress cannot afford 5+% rates, THEREFORE, I stand by my prediction that the Fed will not get it’s balance sheet below 7 trillion! The very fact that the Fed was allowed to increase it’s balance sheet this much in and of itself is reason enough to END THEIR CHARTER.

5.4%, but 30% of that is lost due to tax. It’s still a negative real interest rate. M2 on the rise again.

Andrew,

1. So the gains on other assets are not taxed, LOL???? If you buy and sell stocks or PMs or cryptos and make money, the gain is taxed federally and by states. So why should that be different with T-bill interest?

2. Oh it is different: Treasury interest is NOT taxed by states, unlike stock market gains.

3. M-2 is a useless figure. I told you already. It’s is a bad metric that doesn’t measure money supply. For example, M-2 includes CDs of less than $100k, but excludes CDs of over $100k. So if someone has a CD of $120k that matures, and the cash goes into a bank account, or into to two $60k CDs, then money supply increases. There are other problems with M-2, including how ON RRPs are handled. M-2 is meaningless, which is why I don’t cover it, and why the Fed no longer mentions it.

5.4% *now*.

What was the average 1 year T Bill from 2002 to 2020?

After averaging 5.5% in the 90’s (and higher in the 80’s),

T-Bills averaged just 3% from 2000 through 2010 (and the higher rates were enough to implode Phony Boom #1),

then a mighty .7% from 2010 through 2020.

Those are the rates that ginned up the absurdly inflated asset values the Fed is now trying to make slightly less absurd.

(Amazing what a printed-fiat-fueled 85% reduction in Treasury rates – from 5.5% to .7% – will do to asset “values” under a mindless application of discounted cash flow calculations).

5.4% less Uncle Sam’s tax clawbacks… at least for holders who have to pay taxes.

For those in higher federal tax brackets, interest-after-taxes is around 3.5%, about the same as inflation.

For lower-income people, inflation often bites harder into paychecks, so even 5.4% is maybe not enough encouragement to save.

And for higher-income people, the tax friction means there’s still no real incentive to save.

But hey, at least banks can get 5% from the Fed while still paying 0% interest on most checking and savings accounts!

Income is taxable. Why is T-bill interest income different from income in the stock market? They’re both taxed. It’s a fake distinction.

But T-bills are NOT taxes by states, and stock market gains are, so that’s a real distinction.

Wolf: from my stash of trash, I just slipped a Jackson & Lincoln into an envelope—destination, Wolfstreet. In California today that $25 will barely buy 4 cheeseburgers at McDonald’s with no fries.

Back in the mid 60s, I can remember for years, a cheeseburger at the McDonald’s cost 15 cents at the location where I lived in Colorado Springs. I was early in high school & that was good Eatin. Too bad what the Government—Fed, whatever has done to the currency value. Now what used to cost dimes & nickels is now—check your wallet at the door or, pull out the plastic. Heck, the stamp for mailing now cost more than 4 cheeseburgers were then!

Thank you!! But I think I will invest the trash in real fruit, vegetables, grains, legumes, and meat at the grocery store. It goes a lot further there than at McDonalds, it tastes a lot better too, and is a lot healthier. But yes, it goes a less far than it did a few years ago.

Back in the 1980s was the last time I ate at McDonalds. Their hamburger was nearly indigestible. Not sure what substances they put in them. Not meat.

I always found myself amazed how Americans trash talk their own currency. They watch too many Gold Bugs and BTC Gurus

I wouldn’t be surprised if some of the free toasters the banks were giving away 50 years ago to open a CD were still working.

You keep making a big deal about how you hate M2. Fine, then what IS a useful metric for ordinary people to watch money supply?

Money supply is just useless as a concept. People should focus on asset prices and on what the Fed does. And on consumer price inflation, which has many causes, including mass psychology, and money supply may have little or nothing to do with it.

So this is how I look at it. What’s called “money supply” rises as collateral values rise that are being financed with new loans which immediately become deposits, part of which add to money supply. That per se is not inflationary. What is inflationary is a surge in asset prices (and that’s driven by the markets). And then those higher asset prices = higher collateral values, which allow for bigger loans to be made backed by those higher collateral values, which instantly turn into deposits, part of which add to money supply. And what’s also inflationary is the Fed pushing up asset prices via QE and interest rate repression.

Cash is trash until the 🐔💩 hits the fan. Then those of us with cash exploit those who held none.

You’re going to toss a chicken into a fan?!? Mean!

Actually, that is an intelligent comment. The future is not something that is predictable usually. Unless one was an insider in the short term that QE was in force.

What is truly remarkable is the Voodoo math behind all the asset appreciation, as money printing is credited singlehandedly by the mainstream for both inflation and soaring asset prices.

Taking it in perspective: the amount of money printed since the COVID crash rose to about $4.6 Trillion, and now it’s been pared down to $3 Trillion.

Sure, that extra money sloshing around the system juices house prices during the time it’s still in circulation, but how does it *sustain* at 40% on top of the existing 2019 real estate bubble, turning it into a 2024 real estate superbubble?

Sure, the economy has grown, which would steadily increase the stock market fundamentals, but how does that explain 28-35PEs for the total stock market, and 70+ PE for tech?

Sure, crypto exists….why does crypto exist again?

If printing money caused all this “growth,” wouldn’t un-printing money reverse it?

What is this financial wizardry where you can print $4.6 Trillion, bless the country’s wealthy with $60-100 Trillion of asset growth, then you can un-print $1.6 trillion, and the asset growth remains?

It’s amazing! It’s a miracle! It’s money printer black magic!

or… just maybe….it’s a $50 Trillion Asset Bubble, the greatest ever witnessed in world history

I would love to get Wolf’s take on this…

Why are asset values still going up with the continued QT…

Government spending plus FOMO accounts for some of it, increased productivity a small amount of it…

What is the rest?

My assumption would be a highly leveraged country. Moved on from leveraging up private side, now we’re leveraging up the public side. Don’t know exactly why countries fall, but when govt. asks it’s people to fight and they own none of the land that they are suppose to be fighting for, not much battle going to be shown.

Supply shortages are keeping assets like homes up. Unless some fiscal policy incentives building or people are forced to sell their homes, that will remain true.

Some assets like vehicles and appliances are seeing depreciation.

Labor shortages are driving services inflation. The ratio of workers to non-workers is changing with baby boomer retirements.

There’s a big movement to onshore manufacturing. That’s going to raise some goods; particularly goods like building materials.

Still, some goods are depreciating. Like electronics.

This is possible despite QT because money velocity is on the rise.

Right on.

Too many are hyper focused on the Fed, when there are many forces that affect the markets in both supply and demand. Baby boomer retirements put many more than usual in a position of change. It happened at time many more than usual had an unexpectedly high market balance in both stocks and real estate. Many more than usual had locked in low mortage rates and feel stuckish, but not mired in. Other life events continue pushing and pulling people to move, despite prices or rates.

In true American style when fat with cash you buy a more expensive house. Either with cash or equity that supports a down payment to move you up.

Government spending, without QE, doesn’t create net new money, because the treasuries issued to raise the money drain it from the economy in the first place. It just moves who is holding the money: generally from investment institutions to businesses producing products the government wants, or programs required by Congress: military, border control, AFDC,…

“but how does it *sustain* at 40% on top of the existing 2019 real estate bubble”

There is at least some ratchet effect.

“What is the rest?”

On June 6, 2023, the overnight reverse-repo balance was $2.1 trillion.

On June 6, 2024, the balance had fallen to $0.378 trillion.

That represents $1.7 trillion that had previously been “sterilized,” kept out of circulation and essentially on deposit at the FED earning ~5.3%, that has now left the FED’s accounts and escaped into circulation somewhere in the economy.

Where do you think that money went?

Where would you put it if you decided you wanted to earn more than a no-risk 5.3%?

Some of that $1.7 trillion went straight to reserves, which is why reserves shot up when ON RRPs went down. The rest of the money went into T-bills, repos, etc. the stuff money markets invest in, because that’s whose money this is.

A lot of money went into capital investments which take time and resources and labor to implement. How about that manufacturing boom? Now we have to hire people to make the things. The machines have to be maintained. They have to live somewhere. They have to eat. Someone has to make the food.

The QT and increasing rates makes it more expensive to invest now and spur all that subsequent economic activity, since ostensibly we have too much economic activity causing too much inflation from people bidding up all those things and services they have to buy because of that prior capital investment.

Who decides what PE is the correct PE for a given stock? The price of a stock at any given time is determined entirely by who shows up to trade at that moment.

Is there hard data that shows US manufacturing output is actually increasing? The data I’ve seen shows basically a flatline to slight downtrend from end of 2022 to today.

https://wolfstreet.com/2024/06/03/eyepopping-factory-construction-boom-in-the-us-semiconductors-auto-industry-and-everyone-else/

Yes Carlos I do not understand any of this either. The stock market keeps climbing even with all of this tightening. People keep making the same bets over and over on AI and the rumor of a rate cut. It is amazing to watch. I guess people are confident when the music stops the Fed will just find another DJ and the party will continue forever. Mr Richter isnt in the prediction business but I would love to hear his thoughts on the realm of possible outcomes.

“Printing” didn’t cause all the growth. Look at Wolf’s first chart. It shows continued growth of the money supply before QE. Understand how that money got created and you’ll get the keys to the universe.

Cash + TGA ~= $3T, sounds good. That means the Fed needs to bleed off another $4.3T with QT of $60B a month. 72 months. Like a car loan.

If nothing else Powell could say that – they intend to stick with QT for a long, long time, in the background on autopilot. They’ve got enough slack in rates now that a normal recession can be handled by dropping to 1.5% or whatever. These next four to six years are going to be interesting.

“Cash + TGA ~= $3T, sounds good.”

You have to add “reserves” to that. Reserves are cash that banks keep in their accounts at the Fed to pay each other during the day. Huge amounts flow through these reserve accounts every day. The reserves are the center of the payments system. When you buy a house from someone else, the money goes from your bank (incl. lender) to the seller’s bank (incl. lender). Those banks pay each other through their reserve accounts at the Fed. A minimum of reserve balances is required just for the banks to be able to process the daily transactions amongst themselves. The question is what is that minimum and how far above that minimum should reserves be to avoid a payments crisis. That question has not been answered. My guess is that it’ll be somewhat above $2 trillion. So that’ll put the absolute minimum balance sheet above $5 trillion.

Asset values are overpriced by 30-40% across the board, and reserves are now higher to support those lofty asset price levels. If the goal is long term economic health, reserves should be reduced to a level that supports sustainable asset price levels, not the bubble price levels. Will the Fed reduce reserves that far? I don’t think so. I think they’ll back off tightening at the first sign of potential trouble. They already did that in December by introducing talk of rate cuts. They’ll keep it up.

Wolf,

I get the general gist of what you are saying here regarding payment system/reserves/etc…but then how did everything function perfectly well (and much economically healthier) in the 1950’s and 1960’s when such reserves were a teeny, tiny fraction of the print-engorged reserves/Fed balance sheet levels of today.

I kinda wonder if the huge-bank-reserves/Fed bank sheet-are-required-to-handle-SFH-payment-system argument isn’t just saying that empty inflation is required to sustain empty asset inflation (housing division).

Again, macroeconomically the US was significantly healthier in the 1950’s/1960’s when operating on a small fraction of the paper money flying around.

cas127,

Before the reserves were big, the Fed used repos from its Standing Repo Facility to supply cash to the banking system from day to day as needed. See the 2nd chart above plus explanation.

The Fed killed the SRF in 2009 after QE started. In Sep 2019, when the repo market blew out, it needed the SRF, but didn’t have it. So in 2021, before QT started, it revived the SRF, and it’s now adding approved counterparties to the system all the time so that in the future, the Fed can switch back to the old system of using the SRF to supply liquidity to the banks on a daily basis as needed, instead of higher levels of reserves.

The BOE has already announced a plan to do so:

https://wolfstreet.com/2024/05/25/bank-of-england-to-sell-all-remaining-bonds-and-use-repos-instead-to-manage-liquidity-financial-stability/

Is real estate in a bubble?

Additional data I hear constantly in real estate circles:

-Low housing stock: Current stock is still below pre-Covid values, and no one wants to sell and give up their historic rates

-Low construction: It will take the construction industry 11 years at current rates to build enough houses to meet demand

-Rising demand: Millennials are the biggest generation since boomers, and they are now reaching peak household formation age

If you’re waiting for real estate to crash, don’t hold your breath. A correction maybe, but no crash in sight.

Your first two points are RE propaganda:

Unsold inventory of new houses in all stages of construction:

how is population growth accounted for in these charts? There is about 50 million more people in the USA now then in 2002. Do you have a housing starts per capita chart available?

Peter

Yes, if supply was as tight as advertised. Then builders wouldn’t be offering so many incentives. Market fixes take time to work their way through the system and create inequities in price.

The real fix is to stop fixing.

Truly amazing and it’s all scripted…

Operationalized by printed fiat – so it is scrip’ed.

IMO Carlos, your last sentence, ” just maybe….it’s a $50 Trillion Asset Bubble, the greatest ever witnessed in world history…”

IS the case.

Sooner and later, these very ”chickens” WILL come home to roost, including especially what is rumoured to be approximately

$600 TRILLIONs ( an old figure ) of so called derivatives and other financial shenanigans masquerading as who knows what, but clearly influencing tremendously these days the rest of the global economy and financial system…

Prepare accordingly.

IT IS CRIMINAL PURE AND SIMPLE. Budgets should be DEBATED and justified and paid for with tax revenue, period. This is the hallmark of a democratic republic. You really want to “save democracy”, END THE FED.

Excess cash is a hot potato that nobody wants to hold. They’ll buy anything at any price to get rid of it.

Aren’t markets rising because the Fed seems to have lost inflation fighting credibility? The responsible folks hope they will tighten appropriately and refrain from QE and rate repression in the future to enforce some market discipline, but they used these tools in the past, even before the pandemic arose. Why? They obviously knew it would create inflationary pressure. Why did they use them in the first place and what prevents them from doing it again?

We can say the inflation picture has changed and inflation is more visible, so we hope they will be more careful, but when the threat of deflation arises (say, via a stock market or RE drop), will they continue to be careful or will they open the monetary spigots, again?

I predict they will print. It seems the full employment goal is more important to them than defending against inflation, at least until long rates blow out upward and remove their options. I think the markets agree, so they continue to move up.

“Aren’t markets rising because the Fed seems to have lost inflation fighting credibility?”

With long rates still low, I’m not sure we’re there yet.

Money created by the Fed has to be owned by someone till it is retired via QT.

While a particular investor can get rid of it by trading cash for a security, the cash now is held by the seller. So collectively all investors cannot get rid of the cash. It remains somewhere.

Depending on where it ends up will determine what it does. My theory is the following

1. During the pandemic, Treasury sold bonds which Fed monetized I.e. created new money

2. This money was sent out to people who spent it causing inflation

3. The spending cause money to be concentrated with the rich because they are asset owners where people spend their money. Some of it comes back in the form of wages but not all

4. So asset owners end up with even more money than before the pandemic

5. They can’t eat two dinners so they now invest….which causes this increase in asset prices

Granted that the Fed is draining this slowly. But the amount of money in the hands of the capitalist is still higher than it was in 2020, 2021, 2022 and 2023. It slowly moved from bank accounts of people to bank accounts of corporations.

So in a circular way this is similar to QE 1 introduced by Bernanke with a lag. Bernanke gave money to banks and it remained trapped there. QE-JPow ended up achieving the same thing with a delayed affect.

Would love to hear theories by other smart folks as well. If I am wrong, please be polite. Note that I introduce my views as a theory and not a fact :)

I think you are saying something parallel to what I’ve been thinking:

QE round 2 was so reckless and massive that wealthy people are still coming to grips with just how much money they now have. QT to this point just hasn’t made a dent.

Let me assure you, it is not the mathematics that are in question. It the same hope that instigates the purchase of a lottery ticket.

What too say at a podium to give some kind of testimony about my brother who lived the same kind of environment I did. The first thing, were I to be honest I would describe him as an educated cretin.

Born with the gift of gab, he was a family man.

The “Enron-ization” of The United States of America.

Makes me wanna watch that old ’70s movie: Americathon.

Fair enough.

Take a moment out of your busy day and share with us your favorite dictator….

I’ll take Idi Amin for $300 please.

That movie from 1979 was a look at the future 20 years out, so in 1998, and it predicted that by then (1998), the US had run out of oil, USD cash was worthless, people got around on foot, everyone had to pay with gold, etc. Sure it was a silly hoot, but the opposite happened, as US frackers created the biggest oil glut ever, LOL

Congress needs to ban QE and while they are at it ditch the second mandate and while their at it set the inflation target to zero.

Pointless if they don’t quit constantly ramping up their own spending at the same time. (This includes stuff like student loan forgiveness.) Good luck with that, neither party’s gonna help you there.

The last thing Congress is likely to do is oppose anything frowned upon by the big money donors which the so called Supreme Court of the United States of America licensed money, aristocracy, as a legitimate claim against traditional democratic freedoms.

The stock market ‘value’ of a single one of the 7,000 or so stocks, Nvidia, is now more than $3 trillion alone. Where is any money coming from to support stock transactions, real estate, and bank balances if all the Federal Reserve has is a mere puny miniscule $7 trillion?

The price of the stock is set by the small number of shares that actually trade. The bulk of the $3 trillion worth of Nvidia was bought at a much lower price, by those who are still holding it.

There is in fact not enough liquidity for all the stock in the stock market to be sold at the current prices. This is reasonable, because the stock represents capital, but money is for buying and selling non-capital goods for consumption.

During my long years there is one thing that I painfully learned was that the stock market is always overvalued until it crashes.

Can someone explain why M2 money supply is going up slightly despite all this QT?

Yes. Money supply (such as M-2) is a bad metric that doesn’t measure money supply. For example, M-2 includes CDs of less than $100k, but excludes CDs of over $100k. So if someone has a CD of $120k that matures, and the cash goes into a bank account, or into to two $60k CDs, then money supply increases. There are other problems with M-2, including how ON RRPs are handled. M-2 is meaningless, which is why I don’t cover it, and why the Fed no longer mentions it.

I believe Lacy Hunt uses ODL, or other deposit liabilitiies as a measure of the money supply.

That’s even worse as a metric for money supply. It’s even narrower than M-2.

Sounds like the people generating the M2 metric failed basic math in elementary school.

Our troubles will be soon be over. Looking into my greasy tool box it occured to me that we haven’t tried the liquidity wrench to get a good turn on the nut. Since the total asset wrench was stripping the nut, let’s lock the MBS wrench on the nut and see what we get. Either well brake the bolt, which is fine, or we get the nut off.

Sounds like hard work. Hands might get dirty. I think the white collar “mechanics” will take a break, relax, and put off work till tomorrow.

The difference being that the white collar mechanic is spending the money earned by the blue collar mechanic. No?

The Federal Reserve still has $2.35 trillion in mortgage backed securities, with only $15-20 billion rolling off each month.

At this rate they won’t even be below $2 trillion when the next downturn hits, and suddenly they’ll be “forced” to buy another $2 trillion in MBS to stabilize housing prices & every other asset class.

2 years ago, FOMC officials were talking about selling MBS outright to speed up the pace. Whatever happened to that? 🤔

“Whatever happened to that?”

Three regional banks blew up because yields rose and they had too much exposure to interest rate risk and then experienced overnight clean-out runs on the bank. That made the Fed skittish about pushing yields even higher. They didn’t want to be accused of blowing up their own banks?

QT is a risky thing.

so don’t do QE in the first place, but the geniuses at the Fed are the smartest people right??? Oh they had to do QE because of an earlier mistake the Fed did? So they go from one error to another? Get real Mr. Richter, the Fed is destroying our country. It is a tool of the rich and banksters to fleece the middle and lower classes and the govt itself.

Everything is a tool of the rich, including and maybe primarily the tax code.

‘Everything is a tool of the rich, including and maybe primarily the tax code.’

Wisdom dispensed daily….

Any lever than can be pressed in their favor is fair game.

Just a little love song from the Fed…

“Keep on pushing, babe

Like I’ve never known before

You know you drive me crazy, child

An’ I just wanna see you on the floor

I want a superstitious public

Who’s got a superstitious mind”

Actually borrowed from Whitesnake, but I believe the “Fed” meaning both our Federal goverment and reserve love their supserticious chickens.

I’m not sure how much of an effect this would have, but could the Fed sell off the MBS into the open market to get rid of it? Would anyone even want to purchase them at face value given many of them have interest rates below what you could get on treasuries and CDs?

Theoretically, the market value of MBS at lower rates would be well below those issued recently at highe rates.

I’ve always wondered what the hypothetical mark2market value of my 2.7% mortgage is.

Cole,

The Fed could sell them at market value. The Fed has been performing “small value exercises” for years, selling (and also buying) MBS at market value to make sure its system works. The amounts are small, such as $20 million, and I don’t report on it. Those small-value exercises are announced in advance and I get them in my email. So it could sell larger amounts at market value, no problem. But it might drive their prices down a little further, and if another bank collapses because of a run on the bank triggered by unrealized losses, the Fed might get hit with part of the blame, and so I think that’s why this is off the table. The Fed is now in the camp of easy does it.

While I’d like to think that the MBS rolloff will rail at $35B immediately, maybe a more realistic path will be an average rolloff of $25B for the duration. Back of the envelope calculation puts the final Fed MBS retirements somewhere around Spring 2031. That’s pretty “easy does it” to conclude an emergency housing values support program that started in 2009.

The point is that they will come off, all of them, and that the cap has been lifted, so if mortgage rates drop and refis kick off again, they’ll come off quickly, and if rates don’t drop, they’ll come off slowly, but they will come off.

“But it might drive their prices down a little further, and if another bank collapses because of a run on the bank triggered by unrealized losses”

Aren’t these MBS held by Fannie Mae and Freddie Mac etc?

No, the MBS are “issued” (sold) by Fannie Mae, etc., and “held” (bought) by investors, such as a bond fund, a pension fund, or the Fed.

The first impediment to the implementation of your recommendation is the Fed obviously thinks that is a dumb idea suggested by an ignorant citizen

Wolf,

“…Currency in circulation has quadrupled from $600 billion in 2003 to $2.35 trillion today. And assets must rise with that liability….”

Please forgive my ignorance, but what assets are backing our Federal Reserve Notes? Under the gold standard, it was ounces of gold. But now we have fiat currency.

Thanks in advance for explaining!

Treasury securities at the time.

Will the FED replace treasuries that mature in excess of the new cap with the same treasuries that mature or T bills, as with MBS?

Thanks

That may be in the future, as suggested by the Fed’s Waller in a speech. For now, they’ll be replaced with securities of similar tenor.

I have a question regarding the slow motion QT and the reverse repo facility: Mrs. Logan said in her speech -i believe in January- it is necessarily to slowdown QT because the RRP facility has fallen significantely.

What will happen when the RRP is at zero? Zero QT or new QE?

No.

1. Logan said to slow down QT when ON RRPs get low and approach zero. As of the beginning of June, ON RRPs are down by 80% ($378 billion today). So the Fed is now starting to slow QT.

2. Logan said that slowing down QT after this excess liquidity in ON RRPs is gone will avoid a blowup and a premature end of QT, and will allow the Fed to take QT further than it would otherwise (lesson learned from September 2019). Everyone since her speech has said the same thing essentially, including the official announcement at the last meeting.

3. The goal is to get RESERVES down to “ample” from “abundant.” That process has barely started. That’s also in the official announcement. And “ample” is a good distance off.

4. When ON RRPs are at zero, they’re finally back to normal. And then QT will lower reserves, which is the goal.

Many thanks. Do you think QT will continue after the RRP is at zero, and maybe again at a higher speed? Or is this more highly unlikely?

QT will continue at the pace announced at the last Fed meeting. Doesn’t matter what ON RRPs are doing. What matters are the reserves.

People talk about the lock-in effect that’s resulted from current mortgage rates having shot up so high and fast from sub 3% to 7+%, where homeowners sitting on a low rate mortgage are reluctant to sell or refinance because of the payment shock of what they’d face in a new loan.

If mortgage rates come down low enough to overcome that lock-in effect, without the Fed becoming a buyer of MBS again, then the MBS on their balance sheet will come down much more quickly than the current rate due to payoffs of the old loans from new sales and refis.

With mortgage rates having dropped from peaks a year ago already and for-sale listing inventories ticking up, it could be coming sooner than we think.

Yes, higher home sales will speed up passthrough principal payments to MBS holders, including the Fed, and those MBS will come off faster. The thing that can unleash a torrent of passthrough principal payments to MBS holders is a boom in refis, if and when rates drop far enough – though they may not drop far enough to trigger this boom in refis.

I don’t understand why the Fed started buying MBS during the Pandemic?.

“Never let a crisis go to waste,” quote source unknown and common. Buying MBS gave the Federal Reserve the chance to inflate the price of housing and kick off a higher level of inflation to achieve their 2% stated goal or perhaps any number they really want. The Federal Reserve also wanted to get paid the inflation in arrears that the population owes them by having lived too well in low inflation times.

Kitchen sink mentality. We threw EVERYTHING at the economy: stimulus checks, rent and mortgage moratoria, PPP loans, you name it.

It was clear housing didn’t need the government’s help by early/mid 2021 though. All financial assets really. I’m not sure what the Fed was looking at instead at the time, and I guess we’re never gonna get an answer.

What are you suggesting ? That there is a sympathetic response by the organs of our democracy that ensure the rich win ?

Is there a way to reduce the amount of paper cash in circulation?

I understand that there are a bunch of $100 USD federal reserve notes circulating overseas. If some way could be found to make those notes “expire” off of the Fed’s sheets, or return to the Fed, then the currency in circulation could be lowered, and the Fed’s balance sheet lowered as well.

My first guess would be to add an expiration date to the currency, and a holder would have to turn it in for a new note before that date. For US holders, it’s not a big deal to look at the dates, and turn the soon-to-be-expired notes to a bank for a new one.

And if it could be done, would doing so be a good idea?

Seems like a good way to reduce demand for dollars worldwide. Probably not something D.C. is going to be in favor of, since that demand is what lets them continue to spend staggering amounts of the stuff.

“If some way could be found to make those notes “expire””

That sounds counter-productive to the Fed’s goal of supporting foreign demand for dollars and treasuries.

I once read that most of the paper $100 bills are held overseas. Russia, Africa, the middle east. Untraceable and portable.

The world, the BRICS seem to be de-dollarizing on their own. In time these bills will leak back into the banking system and the amount of notes outstanding and the Treasuries held by the Fed to “back” them will reduce. The last fifteen year may have been peak Benjamin so to speak. I guess we’ll see.

The USD would lose its status as a reserve currency overnight. If USD can be canceled at anytime, and Euro and Swiss francs can’t, why hold USD… ever? That may in fact be the *fastest* way to create an economic collapse, if that were your goal.

That’s something Third World countries often do with their currencies though. But there’s a reason they’re still in the Third World.

50 year old Swiss banknotes are demonetized.

As in they’re worthless as legal tender?

I guess some European countries did this when they switched over to the euro. Although my understanding is every country gave you several years’ advance warning, and in Germany in particular old Deutschemark notes can be exchanged forever.

Having Treasuries pay a reasonable amount of interest would likely pull some of that currency in, I would think. It’ll take time, but I wouldn’t be surprised to see currency growth slow.

Why do you want to reduce the amount of paper currency in circulation? What is the point?

40 percent of current homeowners with a mortgage at 3 percent WOULDN’T qualify based on income for a 7 percent mortgage…this will keep the housing bubble in place for a long time as builders will not increase supply and keep prices elevated…

@Gd: As Wolf has mentioned several times, builders will have to build and offer incentives because they need to keep their businesses going. They will not increase supply by a tremendous amount but if they don’t show some growth, their share prices will crater.

This is going to be a tug-of-war in multiple directions but overall the trend in housing prices will be downwards for the foreseeable future.

Lower housing prices?

Did you see the weird double peak on the housing value charts? that could be a stubborn…I’m not going anywhere for the foreseeable future.

But up or down, doesn’t really matter, got to always be flexible. But I would prefer lower house prices, much lower…but if that happens I think everything will come tumbling down along with.

And if I die tomorrow….burry me on the lone prairie.

The fed is finally rewarding savers by default and those off risk assets..it’s about a gd time…these credins are truly the creatures from jekyll Island and more like MR. HYDE….111 years of bubbles…democracy…clown show…plutocracy…and pluto is back after 248 years…

I dont understand with high interest rates and TQ why are they saying the financial conditions are loose?

Meant QT not TQ. Lol

@Milo: Cos there has been an excessive amount of stimulus – via QE, Zirp, and fiscal policy since 2008 – only a small part has been tightened via higher interest rates and QT.

This is confirmed by statements from Goldman Sachs and other investment banks that there is so much money still on the sidelines waiting to be invested back into the stock market.

So a lot more tightening has to happen before the economy gets to equilibrium and inflation comes down.

Hope this clarifies your confusion.

Financial conditions are loose only in the public markets (bonds, junk bonds, leveraged loans, etc. that are traded). Banks have tightened credit. CRE bank credit has tightened drastically. Try to get a loan for an apartment building! So it’s split.

Isn’t multi-family residential still pretty easy to borrow for? Interest rates are high, but so are rents, and rents are high because people still pay them despite complaining. They cashflow.

So we’re talking big buildings here, towers, not fourplexes. Lots of projects are stalled because they cannot get funding. They were planned with 3% mortgages and they don’t pencil out with 7% mortgages. For a big multifamily project to get a bank loan, the rents when occupied at a stable high-enough rate need to cover the mortgage payments, maintenance, taxes, insurance, operating expenses, etc. The biggest expense is interest expense, and it more than doubled. So lots of projects are on hold until rates come down far enough. If they don’t, something else will have to change to make them pencil out, such as rents soaring, or a combination such as somewhat lower rates and much higher rents. But many of the big markets have been overbuilt, and soaring rents are may not be in the cards there.

Nearly all multifamily that has been built and planned over the past 15 years are higher end — because that’s where the money is. So these are higher-end expensive projects. They need to get high rents to make those work.

There is an article on Bloomberg yesterday that companies that got into apartment rehabbing and flipping are in serious trouble because of the higher interest rates and falling values. Due to falling values, banks are not willing to lend to these flippers, so these flipping projects are failing big time.

Further, individual investors were allowed to get on in the action and they are losing their shirts. Very interesting read.

I appreciate the explanation, Wolf (can’t reply directly to your response, we’re nested too deep).

I’ve been traveling around the inland West a good bit in the last few months. Colorado mountains, Salt Lake, Spokane, Boise, Bozeman. Basically all the places Californians are supposedly moving to. Walking around neighborhoods. I’m seeing a LOT of MFR and condo construction, completed in the last couple years as well as current shovels-turning construction. It’s overwhelmingly lower-middle end, especially when also considering the SFRs and townhomes getting built in the next development over. Which is what these areas need, but I have to believe they don’t get finished unless the cash flow’s there. Perhaps most of these projects were planned in the 3% era, but there’s no small amount of building still going on.

Another conspicuous phenomenon is the RV/vandweller “communities” right on the edges of these new developments. They seem never to be in the older parts of town.

It has been awhile since I have been involved with one.

Starts being completed.

Anything on paper has been put on hold.

Yes, CRE folks are in a world of hurt and complaining even more loudly about the Fed that it has maintained higher interest rates for far too long. Starwood has tightened withdrawals for their REIT just a day or two back. I think more shoes are likely to fall in the near future.

In other words, money is cheap if you are rich already or have access to financial markets. For John Doe, credit is not available.

The world will never change :)

Companies I research are snatching up less capitalized competitors while FTC sleeps. More corporate profits in the future and less competition and we are a nation of renters.

Unless the host dies, the parasitic capitalists will not stop

Well, they are not saying that financial conditions are loose. What they are saying is that financial conditions are restrictive for expansion of the business structure.

Why has currency in circulation gone up 400% in 20 years? More cash under the mattress because if distrust in the system? Rise in number of illegal immigrants, who operate in a cash economy?

I don’t know if the Fed has commented on this.

Over half of USD cash is overseas, for a variety of reasons, nefarious or not, including that some economies are dollarized or essentially dollarized and the USD is in circulation there. The Fed has released reports on this every few years.

How would the Fed know where the cash sits? It’s not reported anywhere, so they would be guessing.

My guess is it’s due to the huge rise in undocumented immigration. Let’s say 10 million undocumented people entered the country. If each had $2000 in cash savings, either here or sent abroad, that would be $2T hard cash needed to support these hard working folks.

Have you ever spent any time in a Third World country? I don’t think you have or else you would be aware of how the USD in cash works in these countries. In many cases the value of the local currency has been annihilated by the strength of the dollar these past few years. For example the Colombian peso has lost 50% of its value since 2013. No one who has any money keeps their savings in the local currency. That’s where the dollar currency is.

Bobber

USD cash flows into foreign countries largely through the US banking system. Foreign banks must ask their US correspondent banks to send them dollars when their customers ask for dollars. So that part of the flow is documented.

USD cash is in common everyday circulation in a bunch of countries.

It’s the official currency in:

• East Timor

• Ecuador

• El Salvador

• Liberia

• Panama

It’s heavily used informally in other countries including:

• Argentina

• Cambodia

• Venezuela

• Zimbabwe

USD cash is used as a savings product in many countries where the local currency does nothing but crash constantly. People there don’t keep local currency. They convert it into USD and store it at home.

Each undocumented immigrant arriving with $2,000 in cash??? You gotta be kidding. Most of these people arrive with nearly nothing. Most of the people are from poor countries where $2,000 is a fortune. These homemade BS theories don’t belong here.

Hmmm. Your math needs work.

10M x 2000 = $20B

You’d need 500M of your cash rich illegals to get to a trillion bucks.

Right, the digits are off. The increased cash must be attributable to other sources, like cash under foreign mattresses, foreign central banks, etc.

My guess is that you use too many poor information sources and they take advantage of you. Why do you do that?

JimL, the comment came from my own brain, not sources. I fumbled on the 10-key, nothing more, and I admitted it. This is a comment board, not a peer reviewed research site.

I guess we are going to be stuck at “lowest since 2020” for a while?

🤣 yes, I’m afraid so. That was a looooong year.

I’m generally lost as an egg in April when it comes to this stuff, but it is hard to believe those “Junk” MBS’s are paying down at 10% + a year.

those ““Junk” MBS’s” are government guaranteed. There is zero credit risk for the holders. The taxpayer carries the credit risk.

The Fed may be reducing liquidity gradually, but that doesn’t mean asset prices will deflate gradually or orderly. History suggests the opposite.

Assuming history repeats, will the Fed be able to to refrain from use of QE and rate repression in the future? It’s a reasonable question. Some would say the Fed cannot do anything about increasing asset prices, unless it is prepared to accept the pain and unemployment that would accompany a price reversion to sustainable levels.

I know Wolf likely discussed this in more detail in an earlier balance sheet article, yet I am curious as to how the currency liability grew from $600 billion to $2.3 trillion over the past 20 years?

Factors such as inflation and worldwide demand for currency would explain some of this, though we’re MUCH more cashless as a society than in 2003. Surely the need for paper currency has become much more obsolete than 20 years ago, and would seem to serve as a huge dampening factor for currency demand. What gives?

See my response to Bobber above. If you lived in a country (like say Colombia) where the local currency has lost 50% of its value since 2013, where would you be parking your savings? In the local currency or under your mattress in a pile of Ben Franklins?

Yes, and they have to get those dollars somehow. Where do they get them? A lot of these countries have exchange controls that don’t allow conversion to USD, so I assume a lot of laws are being violated.

In my earlier work, I recall a lot of Latin American executives trying to get paid by a US parent company in dollars rather than local currency.

Would it be crazy to think the FED is working as fast as possible to make room on the BS for an inevitable round of QE ?

You’ve made the point that Treasury can sell all the debt they wish as long as yields are high enough, but we are told the Fed is under pressure to cut rates.

Would they be able to announce a “cut” and yet still enable Treasury to sell all the debt they need to without allowing higher yields ?

Seems like in the end, the FED will be forced to grow the BS again as the only real way to “control” interest rates.

How big can the BS grow ?

I know everything is wonderful, but why am I seeing a family of 5, with a family income of $75k forced out of their home to live in a camper. His wages are higher, but not high enough. He has a job but may not be able to afford to keep it. Anecdotal, I know, but in the end all of our lives are anecdotes, just like in the long term, we are all dead.

All very strange and we won’t even talk about the geopolitical risks which of course will never effect us.

“Would it be crazy to think the FED is working as fast as possible to make room on the BS for an inevitable round of QE ?”

Yes, crazy, but dumb might be a better word.

The Fed’s main policy instrument is interest rate policy, and now it can cut because they’re at 5.5%, and it has LOTS OF ROOM TO CUT before it runs out of space to cut to stimulate the economy.

And liquidity issues will no longer be handled via QE — that was the Bernanke method, and it was put back in storage. In March 2023, the Fed already showed how it would handle liquidity issues: with short-term liquidity measures that than vanish. You can forget about QE. The Fed is going back to how it used to do it, including by having revived its Standing Repo Facility. So higher rates for longer, then is there is a recession, some rate cuts, and maybe a few more rate cuts followed by rate hikes. If something blows up, it’ll use repos and other short-term liquidity methods that then dry up when the blowup has settled down.

If Wall Street actually believed the Fed would not use QE in the future to resolve market turmoil, like it did in the Great Recession and Pandemic Crisis, I think stock and RE markets would be much lower than they are today. It would mean a “Fed put” does not exist.

We won’t really know what the Fed will do until they are tested, and they seem to be accepting “higher for longer” inflation in order to avoid any kind of test. In my view, it’s hard to say whether the Fed’s actions are targeting 2% inflation or 3-4% inflation for the next five years. I hear what they are verbalizing, but I put emphasis on the results.

“In my view, it’s hard to say whether the Fed’s actions are targeting 2% inflation or 3-4% inflation for the next five years.”

Is 3% inflation really so bad with a 5.25% risk-free rate?

That is fine for now, but it’s guaranteed for only 3 months. Who knows where the next corner leads us when we are on a dovish monetary path that has allowed inflation to run about 15% above target in four years.

Conservative investors have been raped and pillaged the past two decades, and they deserve a 7% long rate, to recoup the earnings lost to past inflation.

If the Fed does what Wolf recommends, which is to stay out of the QE game, and they publicly state it, risk asset prices would reset tomorrow and inflation wouldn’t be such a continuing uncertainty.

I feel that in 2020 the fed was preparing for a Boss Fight.

Anyone who knows, knows. ;) 🎮

Summer is asserting it’s predictable arrogance, all is well. Without a care for what may come next.

The Fed balance sheet is what it is as well documented in your article.

The facts are what they are. The interpretation of what the facts are indicative of is the crux of the controversy. In my view, the Fed balance sheet is obese and the source of the excess liquidity that is supporting the irrational asset bubbles. Unless it is another political decision that the best thing for the less thans is to cover Dimon’s gambling losses.

Will the stock market settlement period change in June influence any liquidity calculations i suspect not because both still have the delay and digitally they could be the same day . Moving from 2 days to 1 in June .