After years of brick-and-mortar meltdown, the Pandemic. Desperate measures are now required.

By Wolf Richter for WOLF STREET.

Simon Property Group and Brookfield Property Partners obtained approval from bankruptcy court this week to buy the retail and operating assets of J.C. Penney, which had filed for bankruptcy in May. Simon is the largest mall REIT [SPG] in the US. Brookfield Property Partners is an entity of Brookfield Asset Management, a huge complex Canadian asset manager and PE firm with numerous entities. Brookfield Properties became a huge mall landlord after it acquired in 2018 the mall REIT GGP, the second-largest mall landlord in the US. In 2010, after General Growth Properties, as it was known, had filed for bankruptcy, Brookfield provided funding in return for an equity stake. In 2018, when GGP was wobbling back toward bankruptcy, Brookfield bought the remainder of the REIT for $15 billion.

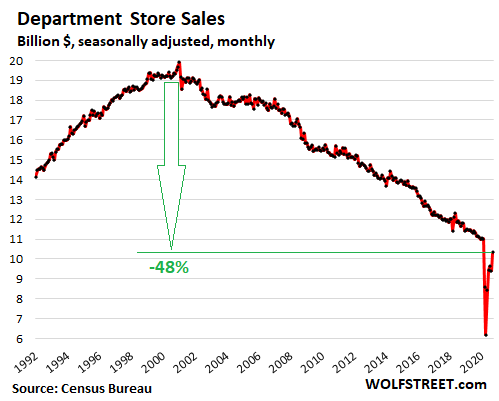

But shopping for the type of merchandise sold at malls has massively shifted to online platforms, including the online platforms of the mall retailers, such as Macy’s, one of the top 10 ecommerce sites in the US. No group has been hit harder than brick-and-mortar department stores, which form the essential anchors at malls. This started 20 years ago, when department store sales peaked. From December 2000, sales dropped 45% by February 2020, after a series of department store bankruptcies that included #1 department store chain Sears Holding. By September 2020, sales were down 48% from that peak:

So now, Simon and Brookfield, as well as other mall REITs, are buying retailers out of bankruptcy court to keep the stores open so that they can pay rent and fill the otherwise vacant space, and create some foot traffic and attract a few shoppers for the other stores, so that they too can keep paying rent, and keep the mall from turning into another zombie mall.

If Simon and Brookfield hadn’t stepped in, J.C. Penney might have been liquidated. This would have caused the loss of the 60,000 or so remaining jobs and the closure of about 650 remaining stores – down from about 90,000 jobs and 800 stores before it filed for bankruptcy.

Simon’s malls have about 60 of those J.C. Penney stores, and Brookfield also has a slew of J.C. Penney stores in its malls. These are anchor stores. If those stores close, new tenants willing to pay what department stores are paying will be hard to find. Anchor stores are the magnets that attract foot traffic.

Without anchor stores, there won’t be enough foot traffic to keep the other stores open, and one after they other they’ll close. This has happened many times before the Pandemic, and the Pandemic is speeding up the process. Each one of these J.C. Penney stores needs to stay open and attract shoppers to keep the mall alive.

Sparc, a joint venture between Simon and Authentic Brands – in which PE firm BlackRock became the largest investor last year – has already acquired other collapsed retailers, including Brooks Brothers, Forever 21, and Lucky Brand. Authentic Brands has a portfolio of over 50 brands. November last year, it bought some pieces of Barneys New York out of bankruptcy.

The idea now is to get some of those brands into some of the stores, including J.C. Penney – and people will come, or whatever.

Simon is focused on A malls in the best locations, and has weathered the multi-year pre-Pandemic brick-and-mortar meltdown better than other mall landlords. Some mall landlords have already filed for bankruptcy, including two mall REITs last Sunday: CBL & Associates Properties and Pennsylvania Real Estate Investment Trust. And things are getting tough even for Simon.

On Vaccine Monday, SPG’s beaten-down shares surged 27.9%. But then Simon reported quarterly results, which were rough. Revenues had plunged 25% in the third quarter, and occupancy had dropped to 91.4% on September 30, down from 94.7% a year earlier, and the lowest in many years. By Wednesday, SPG had given up nearly half of the Vaccine Monday gains.

Buying your own collapsed tenants out of bankruptcy, when their entire business model has been under withering attack for two decades – even ignoring the Pandemic for a moment – has the aura of desperation to keep the stores open that would otherwise close and empty out the mall.

In a way, short term, that’s a good thing: Retain some of the jobs, keep occupancy rates from spiraling down, and keep the malls from turning into zombies.

But even Simon cannot get Americans to abandon ecommerce. This is a structural shift of how Americans shop. Mall retailers are the bull’s eye of what ecommerce is targeting. The damage started years ago. I have been documenting the brick-and-mortar meltdown at least since 2016. This structural shift isn’t a new development, though mall landlords have publicly pooh-poohed that phenomenon every step along the way.

Simon has already shed some malls, including sending jingle mail to creditors. For example, Simon walked away from the mortgage of a 1-million-square-foot super-regional mall in a suburb of Kansas City, MO, the Independence Center. When the mall was sold in a foreclosure sale in April 2019, it generated a loss of $150 million for commercial mortgage-backed securities investors. Trepp, which tracks CMBS, called it “the largest loss ever incurred by a retail CMBS loan.” This was just part of the regular brick-and-mortar meltdown and preceded the Pandemic by a year. And now the process – including jingle mail – has accelerated.

At the time of securitization into CMBS a few years ago, inflated collateral values led to soothingly low loan-to-value ratios. Then trouble hit. Read… Jingle Mail Haunts Commercial Mortgage-Backed Securities as Property Values Get Slashed Below Loan Amounts

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

TJX Cos., which also owns Marshalls, HomeGoods and TJ Maxx is an exception bucking the trend.

Minimal online sales and their stores are doing well in Covid times.

Even opening new stores.

“But shopping for this type of merchandise has massively shifted to online platforms…”

The TJX companies are one step up from the dollar stores, which are also doing well. The mall anchoring department stores were at another level.

For the most part, TJX stores aren’t in traditional malls. They’re mostly in strip centers, where you can go in and out without making a day of it. Probably pay less rent as well.

“The TJX companies are one step up from the dollar stores, which are also doing well. The mall anchoring department stores were at another level.”

Thats because dollar stores are for lower class people. Malls were aimed at the still existent middle class in the 80’s. Those people have been sucked dry via credit and crappy jobs, don’t need em anymore. I don’t buy that all that retail biz has gone online. I think people have become less wealthy.

Frugal people shop at TJ Max and dollar stores also.

The TJX’s of the world are leveraging their strengths as a hedge against off-premise sales. Inventory varies on a store-by-store basis, and they do not publish their inventory online. This forces customers to come into the stores for a “treasure hunt” customer journey, giving shoppers a rewarding experience that sticks. And since they purchase their inventory at a deep discount, their gross margins are healthier compared to the average B&M operator. And let’s be honest, who can touch their price points??

$$$ stores might actually be better named as small local department/general stores that compete favorably pricewise with the huge wally world miles away from most localities…

many $$$ are located near schools so that it’s convenient to stop there before or after picking up the kids, others just at intersections of county roads, etc., etc.

ones that friends have worked at have insisted on not enough hours for benefits, etc.; and also insisted on irregular schedules so employees could not work another regular job; and the salaried ”key holders” end up making less than minimum wage frequently, by virtue of the unpaid overtime required to do their job right,,,

(sounds kinda like the small grocery store I started at in the 1950s era, eh)

One problem in the department store business has been consolidation. In the not so distant past, department stores were based in a particular city or region, so they had a lot of local knowledge and could tailor their products, hours and service locally. As the department store chains grew, they became increasingly homogeneous and less and less likely to have what locals wanted.

I used to shop in department stores fairly often. Malls were useful because if I couldn’t find what I wanted at one store, I could just go to another. At some point, the department stores started merging their identities. It was as if they all read the same Modern Mall magazine and adjusted their stock accordingly. It was harder and harder to find what I wanted. Specialty sections, and their knowledgeable staff, vanished.

Now I mainly shop online or when I am in one of those transitional neighborhoods where new stores are opening, but before the big rent squeeze forces out the more imaginative.

Absolutely true. When Macy’s bought all of those regional chains, something was lost. In the southeast, Dillard’s and Belk are hanging on, but they may be the last holdouts.

So… where is the money in this? Scamming investors? Making money out of defaulting loans and letting creditors keep useless malls?

I wonder where they are getting the capital. Without violating any NDAs, I can say that gigantic fortunes exist, but I had not heard of these two companies among the ones owned by the ultra rich.

Keep in mind that after the pandemic our remaining economic activity and national wealth will be concentrated even more in companies with access to such fortunes or to bailouts from the “Federal” Reserve or if the US Congress ever agrees, from the government. That will play well with the angriest members of both parties. Taxes will have to be raised on them, since the ultra rich will have a huge majority of US income. :-)

“I wonder where they are getting the capital”

Good question.

I wonder if the malls (probably owed quite a bit of rent in arrears from JcP) basically used a “credit bid”…using that already owed money as a substantial part of what they were “paying” for JcP.

Not a bad strategy, but credit bids don’t do much for non-bidding creditors, since little to no new cash flows in.

Ironically, somewhat of the same result can be obtained by the LL agreeing to a percentage-of-sales lease (sort of making the LL a de facto partner of the lessee.

But waiting for the BK gives the LL a lot more leverage, control, and ownership.

As far as I know it’s all on borrowed money with low interest rates. If you can get money cheap enough you can try to make a go at it. The top guys are getting paid several million a year to try to make a viable business. If they fail, they have still pocketed the salary and maybe missed a bonus.

M

You guys are all too logical.

Here’s my analysis:

Simon Property Group and Brookfield Property Partners have been bleeding money like the guy who fell into the meat grinder.

However, some new junior MBA has done a model (god, I love models – 99.9999% are pure bovine excrement) that says Simon & Brookfield are not losing money fast enough, and buying JCP ought to just about take care of that.

They’re also paying $15B (billion) to buy up every other losing REIT pile of crap on the planet. This should definitely put them across the finish line.

To be totally fair, once this pandemic ceases, and the recent, nearly-miraculous news that there is a vaccine that will soon be approved that is actually 90% effective is the kind of holiday gift that we can really love, I would love to go shopping in a mall again (albeit only for stuff that is minor and cannot be purchased much more cheaply online.) They sell the experience of mall shopping, not really just the goods.

Many teenagers just go there to meet each other and watch movies on gigantic screens, even though we now often have screens that are almost as large, in terms of degrees of visual field covered, in our living rooms. If it is true the pandemic will be over soon, e.g., by September 2021 when all Americans can get vaccinated regularly, then those who own stores in exclusive mall properties will be in a good place to profit when mall-based businesses are desirable again. I suspect most Americans will want to rush back to living the normal lives that we all have sorely missed.

I am not saying that the whole economy will recover rapidly. The dominoes are still likely to fall due to economics, over-leveraged companies, and simple math. I doubt that the ultra rich will temporarily show some foresight and cease acting solely on the basis of extreme greed, so they will terminate many viable companies in the coming months.

They have the power to do that. (Keep in mind that if we divide US income between that attributable to labor and that attributable to owning property (“capital” as the commies call it) by far the most US income and thereby economic power is concentrated in the hands of the ultra rich, property owners. McKinsey & Company’s “A new look at the declining labor share of income in the United States”, which indicates that the share of income from capital is only about half of all income probably does not consider the vast, foreign-source income of US and EU billionaires and millionaires, held in non-dividend paying, foreign corporations which income has not brought back to the US to avoid US taxation.)

Exclusive, pleasant, mall-based businesses will again be desirable investments after the pandemic, albeit they will have to focus on profiting either from very exclusive items for the rich who do not care so much about saving money in a distressed economy or on items that customers will prefer not to buy online. While I still think that the growing lack of economic balance and equity in the US is a ticking time bomb, as in France during the 1760s, which will need enormous, FDR-like wisdom among both parties to defuse, it will be good to again party for a while before the inevitable.

The US dollar will not always be the world’s reserve currency and US liabilities and debt will soon be untenable. The pandemic just hastened that time. We will just have to enjoy the post-pandemic economy in late 2021 while we think of ways to prepare for the oncoming economic “deluge” — to borrow a term from Louis XV.

I really don’t get it either. Why buy a sinking ship and keep it afloat? Do they really expect customers to come back to JCP? That store was killed a few years ago when the new CEO scrounged up from Apple tried to make it into something it wasn’t. Boom! Dead!

Maybe these new owners expect a big Xmas season…..then what? Keeping part time workers employed doesn’t seem like a valid reason to engage this strategy.

My guess is that some or most of the small tenants have co-tenancy provisions, which allow them to cancel their leases if the anchors go dark. This at least holds that domino effect off for a while.

Agree. I’ve seen outright cash subsidies of anchor tenants to avoid a cotenancy cascade.

JCP was in deep doo-doo when they hired Johnson. He was hired for what he did for Target, not his experience at Apple. He built up the “shabby chic” image that benefits Target.

Nobody could have fixed Penney. They had over 4.5 billion in debt to service and an old, expensive supply chain. They lost money on all the products that Macy’s , Kohl’s, Walmart, Nordstrom, etc turned a profit with. They only made money on store brands and Sephora. In retail you have to sell a product for more than it costs. They couldn’t do that.

What else can they do? Without the anchors, the music stops. This keeps the mall executives in the game until they finally go bust, which could be two decades from now.

News flash to Simon Property Group and Brookfield Property Partners: the music has stopped.

Hundreds of millions of consumers would rather eat a dead rat than shop at JCP in a mall.

All of these hedge funds are funded, ultimately, by our pension savings. They “invest” more of our pension savings in the dead, milk it until they can’t, and then head out of town leaving us holding the empty bag. Couple that with inflation…

That flys right over most.

I really do not like returning things.

Let the pandemic be over so I can shop

at a store care free again.

When you return you pay shipping both ways.

Not true for Amazon or maybe just Prime members.

Prime is addiction.

That is the biz model at Amazon.

People who cough up the annual fee (mostly for magic beans benefits…) feel “obligated” to “use” the fee by shopping more at Amazon.

Not noticing that Amazon’s price advantages are very, very quickly disappearing.

Studies have shown that Prime members spend a lot more at Amaz than civilians.

Cas127, yes. Amazon often is not the cheapest, or even close to it, for many things, and it certainly isn’t for groceries or household supplies. As it is, I only buy from Amazon for things that really are hard to get elsewhere.

RE: Amazon price advantage. I was shopping the other day for something in my gargantuan size (both tall and fat!). Kingsize had the item, but Amazon had the same item for 30% less, with free shipping and return if I needed it.

The problem with hating Amazon is that they are very, very good at what they do. Pricing is reasonable, service is outstanding, and prime is (currently) worth it.

Yeah, the problem is that all of that comes at the expense of the manufacturer. Amazon pushes the costs of its “easy” returns onto the manufacturers, who take the hit for returns.

I’m super annoyed at how Amazon has crippled their search engine to only show me items that are most profitable to Amazon, regardless of what I am looking for.

Clete,

Well, in the battle of the anecdotes, I can only say that I have seen a 25% to 50% price hike in the cost of used books on Amazon, over the last three or four years.

On the macro scale, Amazon’s marginally improving marginal profitability is coming from someplace…I think worse consumer pricing is a fair place to look…although the Prime model/hustle lends stability to the whole enterprise.

Harrold,

I agree, Amazon’s “search engine” has been intentionally crappy (to avoid pure price competition) for…essentially forever.

There are ways around it but none particularly great.

And with Amaz making bundles off pdt placement advertisements now, the situation will get worse…sellers don’t pay for ads that can be undone by price based search results.

Unfortunately, the biasing of search results is becoming more and more common…Walmart does it too, in a semi sneaky way.

The days of large players online being consumer oriented is coming to an end.

Shopping around has returned as a necessity.

I am a Prime member. Recently I ordered two items I saw on Amazon directly from the vendors’ websites at 30% cheaper (shipping included). They both arrived in a week.

Same here. I particularly was looking for underwear and t-shirts, and I found going directly to the Fruit of the Loom and Hanes websites was cheaper than both Amazon and Walmart.

Amazon will always be able to provide “economy of scope” in terms of single stop convenience…but the price competitiveness seems to be going the way of the Dodo.

Google, which has only made tiny strides in this kind of retail, could really clean Amazon’s clock by providing a “virtual” portal of thousands of manufacturers’ direct order sites/pdt catalogs with a centralized pmt mechanism.

Amazon has that huge overhead warehouse system for next day delivery…but my guess is that 80% of customers will wait an extra couple days to save an extra 20%+.

Shipping costs are really where Amazon has the advantage online. If you have shipped selling goods on Ebay lately, for instance, you will see the total costs are almost prohibitive. A website for your own business is next to impossible.

The closest Ikea is 500 miles away. Ikea ships me stuff for $5 per shipment (I had a total of 8 small items) or I think it’s $49 for large items. And a one year no questions asked return policy.

Decent quality and way cheaper than Amazon with free shipping.

I didn’t realize there was ANYWHERE in the continental U.S. that was 500 miles from an Ikea, but looking at their map, I see that you’re right. Crazy!

https://www.ikea.com/us/en/stores/

On the other hand there’s no sales tax with eBay.

soon to change….

shipping costs have increased across all platforms this 4th quarter. Amazon may have an advantage, but it has the overhead too! What is the true cost to “free shipping”? That is one reason FedEx cut ties a few years ago. Amazon is always looking for a third party to pay,whether USPS or seller. Amazon has over 100 million prime customers times yearly rate , that is a lot of shipping, and yet they are grappling to make it work, as folks now sit at home and click to buy, but not all at once!!! My neighbors have tons of Amazon boxes, what a waste, if only they could have been combined.

Yes, even the cost of shipping my beer mugs has jumped by 7% (thank you FedEx). They’re all doing it.

Throwing good money after bad. It’s the law.

“Forget, it Jake. It’s Fedtown”

I hear the lunch is better over at the Albacore Club. All you need is a membership, but don’t expect any almond cookies after the meal.

Nice, but man, I had to Google that one.

It’s often called a perfect script for many reasons. But they miss this symbolism..everyone is just a fish on the hook of the most powerful guy in the game, and he controls the club. Fits this economy fairly well. And yes, soon we’ll all be singing “I’m Just a Googl-o!”. Like 52 pick up with 3×5 cards…the way of the new wierld.

Who can’t see how noncongruent this is? Might we utilize the psychological term of ‘Double Denial?’ [ If you pretend you don’t know, and I pretend I don’t know ] then we’ll both get along just fine! Just to be completely clear: You pretend you’re not losing money even though you’re in bankruptcy, and I’ll pretend I’m not losing money by continuing to support your 20-year monetary losing streak, then Everything will be hunky-dory! WOW!

You have just described a perfect marriage.

Pretend and extend.

What future trend will make all of this zombieism viable? Could it be a dramatic increase in consumers via a massive amount of immigration? Or will there be a Fed led income program like UBI?

I think maybe they are taking a page from the China economic playbook with an infrastructure first then consumer backfill. Sounds nuts in know, but it sure doesn’t resemble free enterprise as we have known it.

lol, there is still some opportunity for mutual development/transformation along the way.

so maybe pretend and extend until JCP starts using their retail floor space as a distribution center? and/or, until the REIT can build condos above the mall and a grocery store on the main level?

This is all about harm mitigation.

Behind Door #1: Chaos. JCP decides which stores to close, and when. Foot traffic drops at those malls, like, whenever. SPG reacts to each event, one-by-one, in the order they occur, never being able to tell new prospective tenants what other JCP locations will come available, and when. The period of time that there is no rent and no foot traffic varies at each location.

Behind Door #2: Managed decline. Keeping the JCP stores open, for now, keeps foot traffic coming to the malls, for now. New tenants can be lined-up before the stores close, so the period of time that the JCP stores are closed (and the period of time that foot traffic to that mall is depressed) can be kept to an absolute minimum.

Making the best of a very bad situation.

#2 extended: continued capital/debt to manage the decline is allocated to these failing companies (and prop up the investors that one these) that could otherwise be allocated other entrepreneurs industries with better future outlook: cheaper money for zombies more expensive money for upstarts.

You are looking at it from the store point of view. Not the mall. The better capitalize, better run malls can do this and kill the zombie malls quicker

I’m looking at it from a societal resource allocation point of view… are malls something something that one should be doubling down on now after being in decline for over a decade?

the investors who are under water and would like to recoup as much as possible über alles would say yes… the banks with large CMBS exposure would say yes über alles…

Your assumption is that there will be no malls. Mine is that a most malls will go under but not all. And if i was a owner of a lot of premium malls i would expect that my malls would survive.

SPG has no problem walking away from a dying mall and letting creditors eat it. See the last paragraph of the article. It’s not the landlords that are ultimately on the hook. It’s inventors in CMBS and banks and insurance companies with mall loans.

My assumption is closer to that the purpose malls serve today is closer to that of what any given horse’s purpose for transportation. Buying HY defaulted trash for pennies on the dollar doesn’t start making anything close to previous par value again. The few “premium” malls that survive will be utterly insignificant.

Jingle mall is a problem when you also own one of the renters.

Failure Management is the new growth opportunity in America. The Fed will be quick to assist. Extend and Pretend will be the incubator for this enterprise. Perfect fit for the PE vultures connected to easy money.

Dr. Doom:

Ever since the advent and shaping the narrative that “junk bonds” are profitable all this becomes possible. We don’t have to sell anything profitable; we just have to wait it out until companies go broke then sell the debt….and if that doesn’t work another “financial sausage” will be created. Ain’t capitalism great????

They should have waited at least 2 more years to buy.

Blood is not yet in the streets, now is not the time to buy. They are buying with the expectation that economic recovery is right around

the corner. The dollar store decade is here.Marshalls, HomeGoods, TJ Maxx are the new mall anchors and they sell trash.

After the worst Xmas season ever experienced, then what?

When Government lackeys start asking “who moved my cheese”? Then it will be time to buy but we are not even close to that sort of capitulation.

This Christmas season is not going to be anything near what MSM talks about as they continue beating the drum about getting back to normal. We have entered a new turning and “normal” has been changed forever. Wolf refers to the “good times”. They are gone for awhile!!

Good old days are gone forever. Climate change will settle in before the economy can turn the corner.

I don’t agree that Marshalls, HomeGoods and TJ Maxx sell trash. They actually have a lot of nice stuff, often the same brands that the other stores are selling. The problem is that their business model is predicated on buying overstock from manufacturers. This only works because the manufacturers, by dumping their overstock cheaply, are trying to at best, break even, or at worst, recoup some of their costs.

This can’t work unless they can sell the majority of their clothes in non-discount stores at non-discount prices. Otherwise, producing everything to sell in a discount store is a losing preposition. In other words, the discount stores’ model requires a healthy retail environment elsewhere. Without that, the manufacturers won’t bother.

They also buy unsold merchandise from the major retailers, which is why you will see some items 1 year out of style and in strange/wrong tagged sizes.

JcP went tits up now, not in 2 years And in their malls, not somebody else. And 2 years without an anchor store and your mall is more death than zombie.

This is “I wouldn’t start from here advise.”

The Primark shopper only buys at them for price because they are for other goods the perfect Prime shopper. They are bad as anchor stores

Severance denied benefit eligible.. what about me?

Eventually the Tooth Fairy must die. For only so long can collective insanity prevail.

Over here the mighty John Lewis chain has received planning permission to convert half of its immense flagship store on London’s Oxford Street into offices.

The City of London has been presented a planning application to demolish an eighteen year old, ten storey office/retail complex with a thirty two storey office tower.

The end must come. Delay will make it worse.

These latter day buggy whip manufacturers are in a state of total denial.

What’s the plan for those new offices?

Who’s moving into offices on Oxford Street? What kind of offices?

All those WFH’ers who are desperate to return to the sociability and creativity found only in the office. Some indeed, are yearning to enjoy again the delights of commuting and overpriced coffee and lunches.

No!! It’s over. London’s future looks bleak.

I don’t really know the sector that well. I own the big outlet REIT which is a little bit of an odd category. It gushed cash in 2019 with roughly 200 mil cash flow on 500 mil revenue paying 140 mil in dividends. It’s a slightly declining business and you have to estimate the decline to see what a proper price to pay for the stock is. Its the same discount model as any stock but you have to build in a negative growth rate. Every stock has in common that you are estimating the future and if you are too optimistic you will lose money.

I learned a couple of things about at least this REIT that is probably true of most. They just roll the debt over and for this REIT the current interest is 3.6%. Depreciation is the gift that keeps on giving as it more than covers the interest.

The goal is to keep a vibrant place that people want to come to. It is imperative that occupancy is very high with the brands people want. Who wants to go to a place with a lot of empty stores as it kind of has a feeling of failure and decline? Also no one wants to go to a place they don’t feel safe.

Also the wildcard is covid. What are the long term affects on people’s behaviour?

Thinking of JCPenney as just a physical store misses part of the point. Penneys has always done a strong “online” business, first by snail mail and phone, and later by email and iPhone. I’ve been buying clothes and bedding from Penneys since 1970, by mail and email. They still do a good job of selling online.

Yes, exactly. But the online business isn’t helping brick-and-mortar stores; it’s killing them. And it’s killing the malls. As I said, Macy’s website is among the top 10 ecommerce sites in the US. And yet, its stores are failing and are getting shuttered, one after the other, a process that started years ago.

It’s interesting when someone like DLTH tries to go the other way and go from on-line to brick and mortar as well. They stumbled quite badly and then covid hit. I haven’t followed it but stock is way up since virus hit.

Old School,

The miracle of ecommerce. So I just looked up their last quarterly report (ended Aug 2):

Online sales soared by 59% to $47 million, accounting for 34% of total sales: powered by an “…increase in existing customers shifting from buying in-store to buying online.”

Store sales fell 1.8% to $89 million.

I’m not justifying their stock price, just pointing out the HUGE shift to online.

Hi Wolf,

Can you provide a source for Macy’s being in the top 10 ecommerce sites in the USA? I would really love to believe that is true as I hold a lot of $M calls and short $M puts. But this claim has me being a bit skeptical.

Google eMarketer top 10

Wolf,

Yes Wolf I saw that move on SPG. What does that, machines, or computers?, programmed to buy, on covid news? I see more trading than ever, with the Vix up. Seems like the story changes everyday for that reason. No one wants to hold, or constant rotation. There are no more fees on trading at brokers. How are they making money? How are they making money? Whatt are they selling and to whom? Thanks.

Psst! This is not about building business. This is about making it through the next quarter while I collect my executive salary and pound every personally disposable dime into stocks that only go up. Any bonuses are pure gravy.

Oh, and does anyone here know of a textbook in print that explains how to default on multi-million dollar mortgages with one hand while taking on massive insolvent debt with another hand? Apparently I missed that lecture in my business classes. I would say ROTFL, but I think Rolling On The Floor Laughing In Piles Of Money (credit) is more apropos.

Lisa, that sums it all up perfectly for me. The business of America is private equity firms.

Talking about malls and shopping, I wonder what the ‘shopping’ siutation is like in Japan now?

I haven’t heard of many big retail outfits closing up shop recentlly. Of course bars, restaurants, and hotels are going bust.

And Japan hasn’t lockdown their economy like other countries either, but they are still suffering as people limit activity.

Of all the places I’ve lived, I liked the shopping and dining there best.

Oh, and by the way, speaking of shopping, the mail between Japan and Australia started up again on the 10th as far as regular airmail is concerned. Letter and small airmail packets can now be sent to Australia from Japan. Now we can buy things from there again.

Mail has been shut down from Japan to Australia since March of this year – 8 months!!!

1) The momo Brookfield Mr Flatt is very optimistic like the Reichmann Bros. before they filed BK. Mr Flatt preserve your cash for better 20%-25% ROC. Those opportunities will come if you will be patient.

2) SPX daily : Nov 9 2020 high is EW 5 from 2009.

3) 2009 low is wave 4 from 1974.

4) SPX might drop all the way to 1998 backbone near 2009 low.

5) The locust FANGs feast on the globe, but the big banks are flat flat in their 1998 backbone.

6) Major cities RE will see blockades

The regular media is even posting stories on smaller banks choking on CRE loans. Probably be one of those “at first slowly, then suddenly all at once”

Rosengren:

““I am especially worried about a second shoe dropping that will particularly affect small and medium-sized banks, which provide a large share of commercial real estate loans and small-business loans,” Rosengren said in a September speech. “A curtailment of credit resulting from such problems has caused serious head winds to recoveries in the past and may be a serious problem going forward.”

Genius! Pay rent you are owed with your own money! How long does this death spiral last? As long as they can still get financing.

Perhaps someone wants to be legally in-place to accept future government bailouts (for zombie entities)? Perhaps the next phase of the business cycle is to help those that can’t help themselves.

Look, women still LOVE to “go shopping “. If Simon can buy these big brands for pennies on the dollar, capture their online sales and pay themselves the rent…brilliant! Blackrock agrees with their strategy. They are going to make Billions!

You mean, women over 60? Even they discovered online shopping during the Pandemic. Younger women (and men) have come of age with the internet and see no reason to mess with a mall and all the limitations on merchandise, when you have every product, in every size and color, of the entire world at your fingertips. Which is why sales at brick-and-mortar department stores are down 48% from the peak in 2000. Look at the chart in the article.

True enough, but:

I have been researching electric ranges for several days, gathering prices and reviews from online vendors.

Now, back in the house with a tea break awaiting a call back from a local furniture store for their price on the make and model we have selected. Planning to buy from the brick and mortar retailer, even if it costs more.

Why? Online will charge delivery fee for such a big item anyway, and basically just act as a middleman from factory to purchaser. If there is a problem or warranty issue then such a big item will be a nightmare to return or seek service from an online vendor. This is also a fairly major purchase and we want to get it right. Plus, I don’t do Amazon as a firm rule. I have signed up with Prime for free shipping option in the past, then canceled right away, but… The store owner and employees are local residents and deserve support, imho.

Sometimes appliances break down despite how good the reviews are. If that happens I want to be able to give the store a call and talk to a person who is actually in residence and knows the product.

I never upgrade an appliance for style, because what you purchase probably isn’t as good as what you have except for efficiency. My parents oven which is mounted in wall and no longer a standard unit is 66 years old and has only had elements and thermostat replace. Their freezer (deep freeze) is about the same age and never has been serviced.

HEADLINE TODAY: “Consumer prices unchanged in October.”

What a joke!

Unchanged from September. But up 1.2% from a year ago, which was pushed down by the year-over-year 9% drop in energy prices.

“But up 1.2% from a year ago,”

Oh,ha, ha,…….Oh,ha, ha,……..Oh

If you remember JC Penny, not PennEy you are not alone. Look into the thousands of what are called ‘Mandela Effects.’ Do this yourself with an honest desire for truth. How about ChevErolet? Mirror mirror

I distinctly remember Lord Nelson Mandela went down with the ship in 1966 at the Battle of Hastings after printing copies of the Magna Carta on a Guttenburg press. We all waived memorial pennants at Jets stadium in San Fernando by the bay. No false memories here!

Was it over when the Germans attacked us at Pearl Harbor?

Not sure. Dean Wormer ordered Sir Marks-a-Lot, head of the history department, to redact all that from the rest of the transcript. But I do believe they finally crossed the Rhine on a slip-and-slide using pogo sticks while hula hooping. Called it Operation Limbo Rock.

1) The next shoe will drop when consumers will return to god.

2) My old data showed that online shopping is spiking after midnight, when America is lonely.

3) Wave 4 will send consumers into the arms of god. Online shopping along with malls, and high street spending will drop like a rock,

OMG !!

4) China will hit by 10 plagues, while Americans will be lost in a desert .

5) Brookfield might raise JCP rent, to squeeze their Xmas cash out of them, to show a positive cash flow, pay JCP 60K employees by piling JCP debt and ==> pay SPG & Brookfield executives bonuses.

We’re in a new era, where corporate profits are meaningless, essentially, because regulation is meaningless. Within that framework, we see more wealthy people extracting wealth from thin air, thus causing real growth to decline and future value to fall lower. As bond yields head lower, fewer people will invest in growth and whatever profit is left will be shared amongst pirates

We still have some good manufacturing in our small county. I am actually amazed with what is still around. A modern cotton mill, a large pool equipment manufacturer, a large cosmetics plant, a Pfizer plant and a Caterpillar skid steer plant plus a few others. Don’t think any pay that wl except Pfizer.

Where’s Marty Byrde from the TV show “Ozark” when you need him. I bet these down and out department stores would provide great money laundering opportunities.

Interesting article Wolf and well explained however I’ll be damned if I understand what they are doing. Unless of course they smell a bailout acomin in which case best be in up to your neck.

I recently heard a presentation about how the dying malls could be used to grow food. Let’s get thinking outside the box.

It amazes me that malls have not already caved. They have been dead for over ten years,

Their heyday was the 1970’s, somwhere between wide collars/leisure suits/neck chains/pumps/8-track and later fads of big hair/roller disco/cassettes/beta max/laser disc. They’ve been graveyards of the walking dead ever since.

Did my morning walk. Walked by what was our hot shopping center 30 years ago. On one end was Belks department store and on the other was Roses what used to be called a dime store. About ten empty stores in between. Less than _40 cars in a lot that could hold close to 1000.

Absolute madness.

If you have a bankrupt tenant you don’t subsidize them – you evict them!

Poor decision by Simon & Brookfield

This is the entire crux of the situation:

“So now, Simon and Brookfield, as well as other mall REITs, are buying retailers out of bankruptcy court to keep the stores open so that they can pay rent and fill the otherwise vacant space, and create some foot traffic and attract a few shoppers for the other stores, so that they too can keep paying rent, and keep the mall from turning into another zombie mall.”

Just another bleed out scheme to drain whatever cash is left in these retail dinosaurs and insure that it goes to rent as long as possible.