Quantitative Tightening has removed 37% of Treasury securities and 27% of MBS that pandemic QE had added.

By Wolf Richter for WOLF STREET.

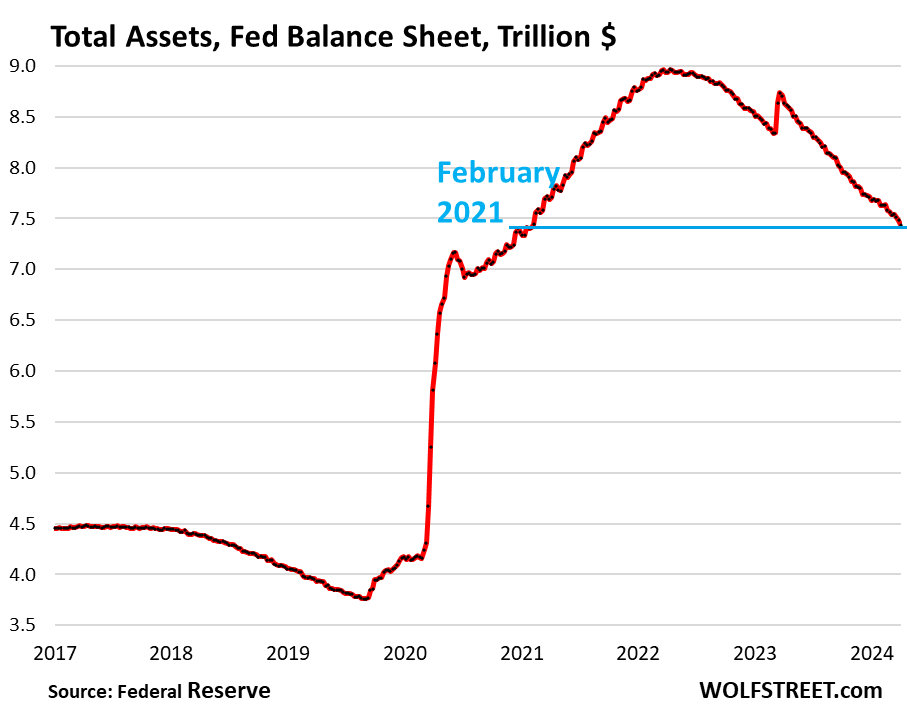

Total assets on the Fed’s balance sheet fell by $99 billion in March, to $7.44 trillion, the lowest since February 2021, according to the Fed’s weekly balance sheet today. Since the end of QE in April 2022, the Fed has shed $1.53 trillion.

There have been discussions at the Fed about how and when to slow down the pace of QT, the idea being that slowing the liquidity withdrawal will give liquidity time to move to where it’s needed from where it’s in excess, to avoid blowing up something which would then require the Fed to end QT “prematurely,” as they said. “By going slower, you can get farther,” Powell explained during the FOMC press conference.

They’re trying to get the balance sheet down as far as possible, and easy will do it, that’s going to be the program. But not yet.

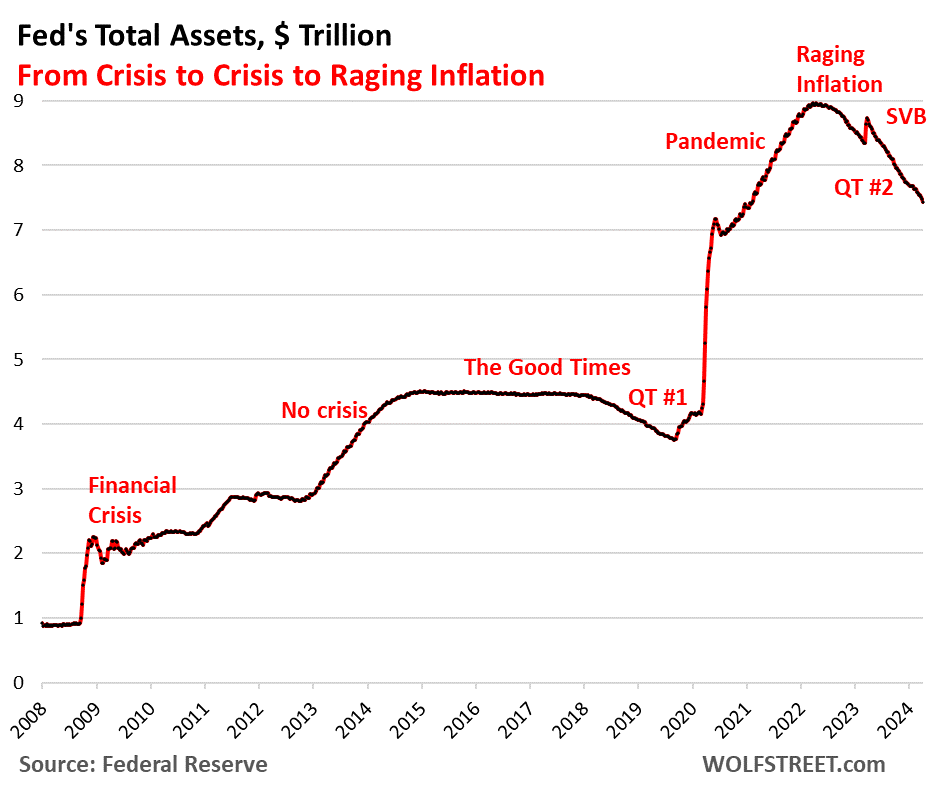

During QT #1 between November 2017 and August 2019, the Fed’s assets dropped by $688 billion, while inflation was below or at the Fed’s target (1.8% core PCE in August 2019), and the Fed was just trying to “normalize” its balance sheet.

Now inflation is above the Fed’s target, though it came down a lot in 2023, and it has started to re-accelerate in a nasty way. Here’s the long view of the Fed’s balance sheet:

QT by category.

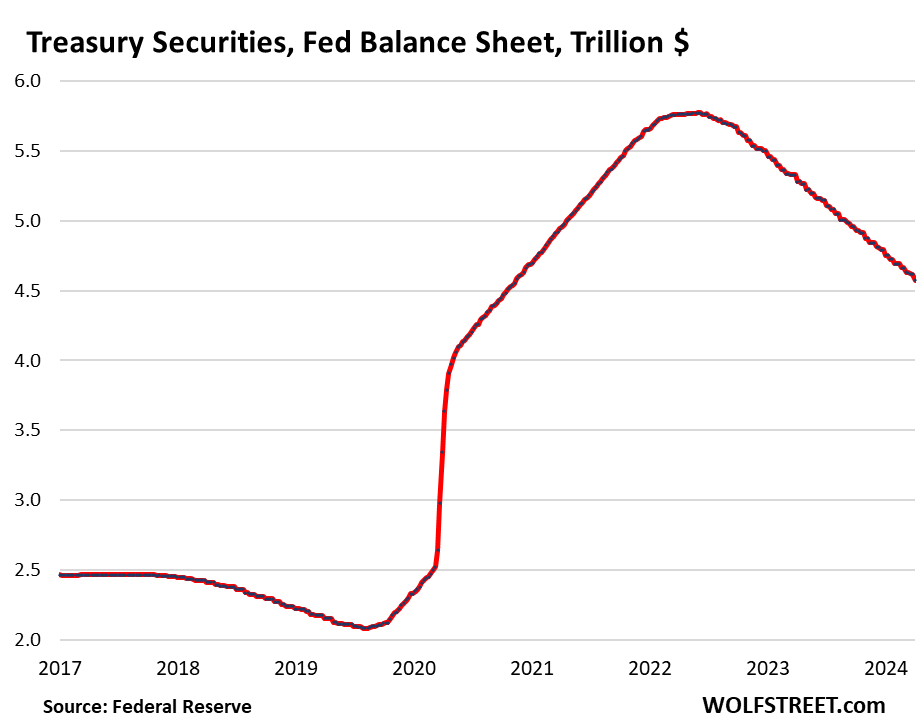

Treasury securities: -$57 billion in March, -$1.20 trillion from peak in June 2022, to $4.58 trillion, the lowest since November 2020.

The Fed has now shed 37% of the $3.27 trillion in Treasury securities that it had added during pandemic QE.

Treasury notes (2- to 10-year securities) and Treasury bonds (20- & 30-year securities) “roll off” the balance sheet mid-month and at the end of the month when they mature and the Fed gets paid face value. The roll-off is capped at $60 billion per month, and about that much has been rolling off, minus the inflation protection the Fed earns on Treasury Inflation Protected Securities (TIPS) which is added to the principal of the TIPS.

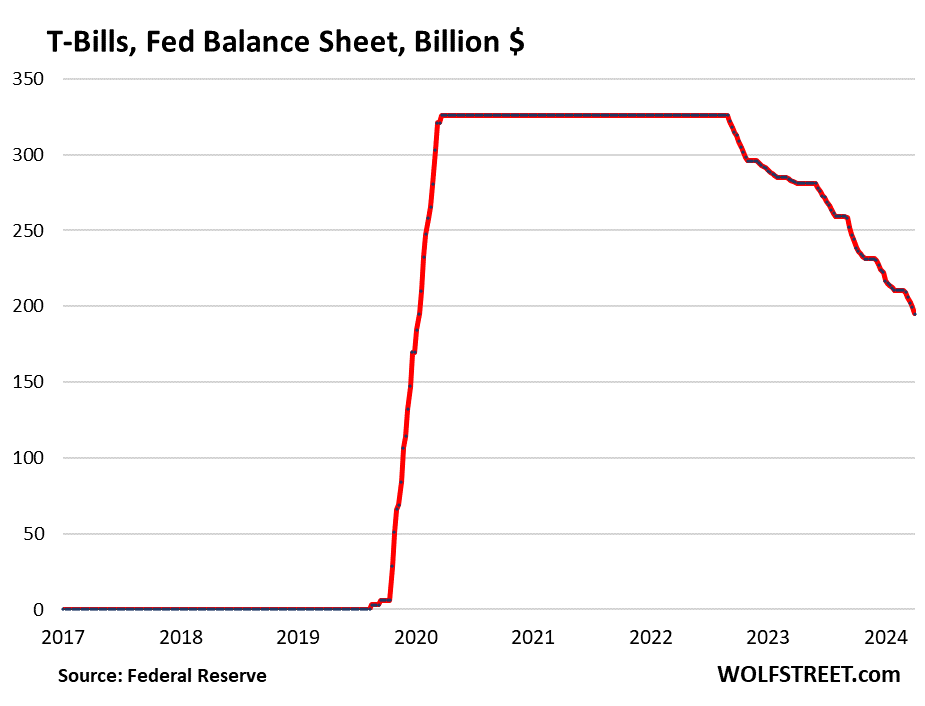

Treasury bills and QT. These short-term securities (1 month to 1 year), now at $195 billion, are included in the $4.58 trillion of Treasury securities on the Fed’s balance sheet.

The Fed lets them roll off (doesn’t replace them when they mature) only if not enough longer-term Treasury securities mature to get to the $60-billion monthly cap. This means that as long as the Fed has T-bills, the roll-off of Treasury securities can reach the cap of $60 billion every month. Here’s the maturity schedule of securities on the balance sheet and for how long T-bills can top off the roll-off before they run out.

From March 2020 through the ramp-up of QT, the Fed held $326 billion in T-bills that it constantly replaced as they matured (flat line in the chart). T-bills started rolling off with QT in September 2022 to bring the Treasury roll-offs to $60 billion a month. They’re now down to $195 billion:

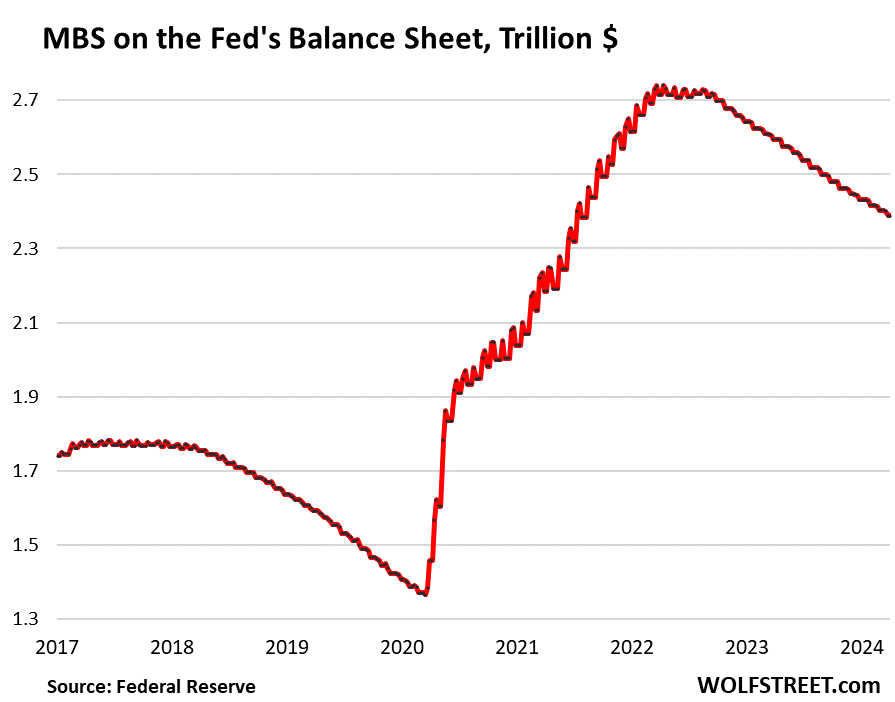

Mortgage-Backed Securities (MBS): -$15 billion in March, -$352 billion from the peak, to $2.39 trillion, the lowest since July 2021. The Fed has shed 26% of the MBS it had added during pandemic QE.

The Fed only holds government-backed MBS, and taxpayers carry the credit risk. MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made.

But sales of existing homes have plunged, and mortgage refinancing has collapsed, and so fewer mortgages got paid off, and passthrough principal payments to MBS holders, such as the Fed, have been reduced to just a trickle, and so the MBS are coming off the balance sheet at a pace that’s far below the $35-billion cap.

Bank liquidity facilities.

Above we talked about the main elements of QE and QT: Buying and shedding securities for monetary policy purposes. QE and QT are relatively new things in central banking.

Below we’ll talk about liquidity provisions to the banking sector, which is a classic function of the Fed as a lender-of-last-resort to the banks. The Fed has had this function from day one. These measures are not part of QE/QT, but since they have similar effects on the markets, and since they’re on the asset side of the Fed’s balance sheet, we must add them to the discussion.

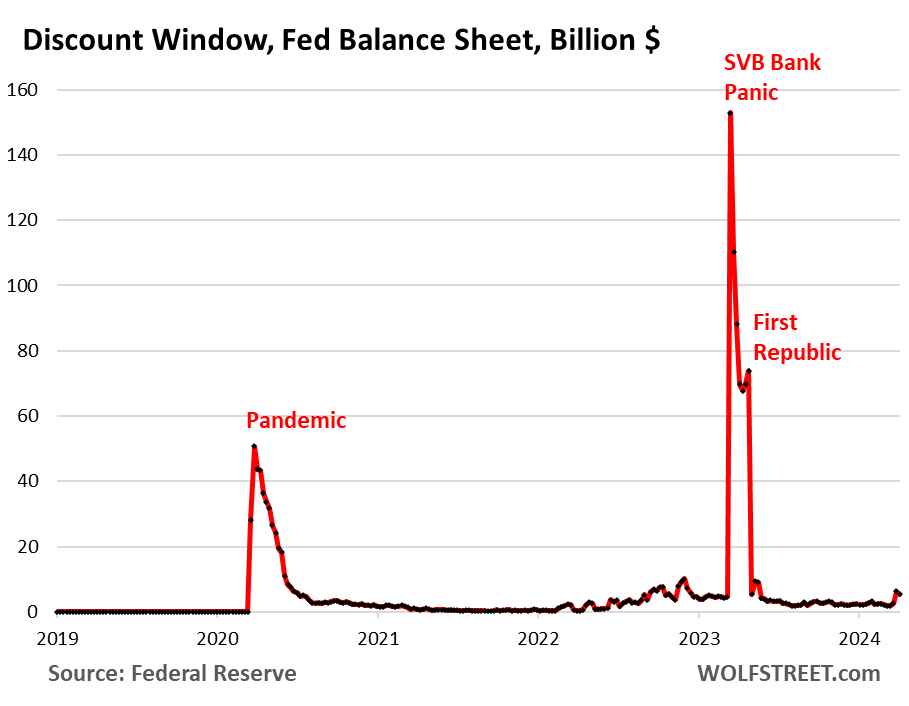

Discount Window: +$3.6 billion in March, to $5.5 billion, but down from $153 billion during the bank panic in March 2023.

The Discount Window is the Fed’s classic liquidity supply to banks. The Fed currently charges banks 5.5% in interest on these loans, and demands collateral at market value, which is expensive money for banks, and so they don’t use this facility unless they need to. The Discount Window rate is one of the five policy rates that the FOMC decides during its policy meetings.

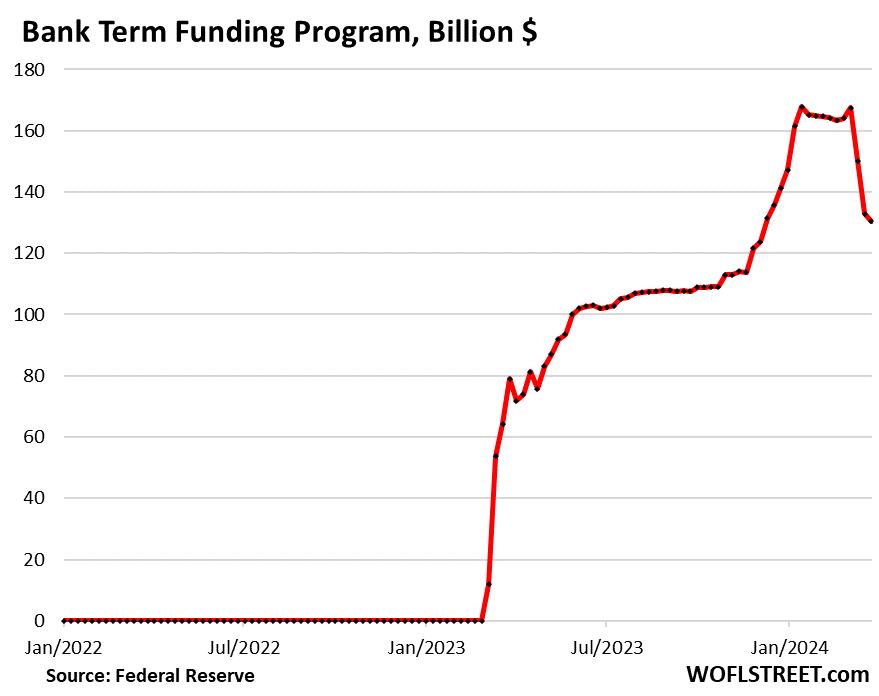

Bank Term Funding Program (BTFP): -$34 billion in March, to $130 billion, and down from the peak of $168 billion.

This thing was cobbled together over the panicky weekend in March 2023 after SVB had failed. It had a fatal flaw that no one thought about at the time. But when rate-cut mania set in November 2023, the fatal flaw became apparent, and some banks used it for arbitrage profits, borrowing at the BTFP at a lower market rate and then leaving the cash at the reserve account at the Fed to earn the higher 5.4% that the Fed is paying on reserves. This arbitrage caused the BTFP balances to spike.

This rankled the Fed to no end, and it shut down the arbitrage opportunity in January by changing the rate, and it let the BTFP expire on March 11. Loans that were taken out before then can still be carried until March 11, 2025, by which time the BTFP will be zero.

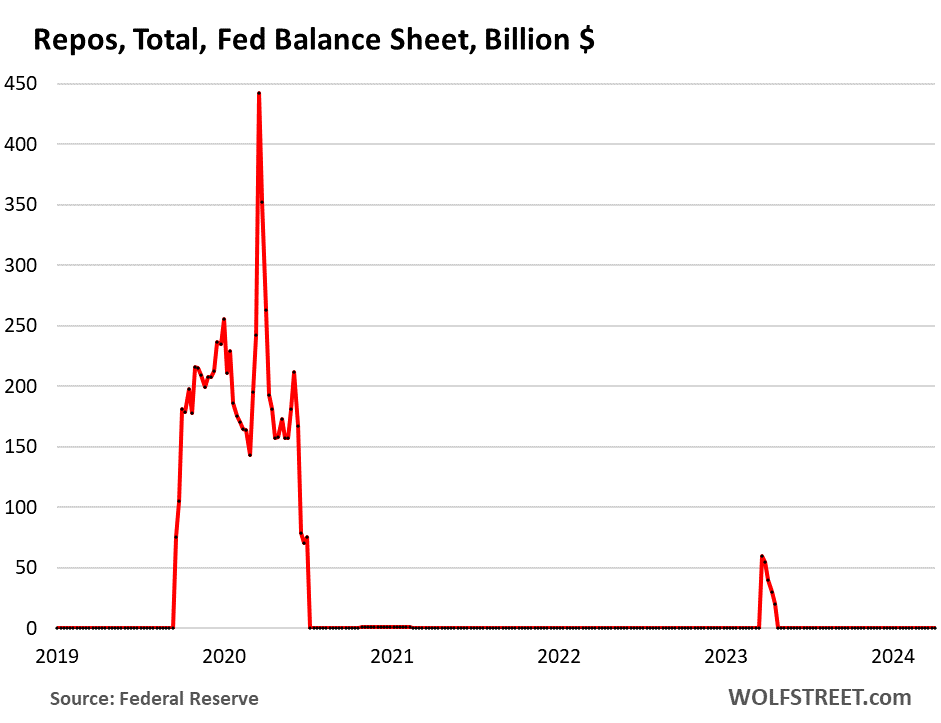

Repos: $0. The Fed currently charges counterparties 5.5% on repos, as part of its five policy rates. The Fed’s repos come in two flavors:

- Repos with “foreign official” counterparties were paid off in April 2023.

- The repos with US counterparties faded out in July 2020 and have remained at around zero.

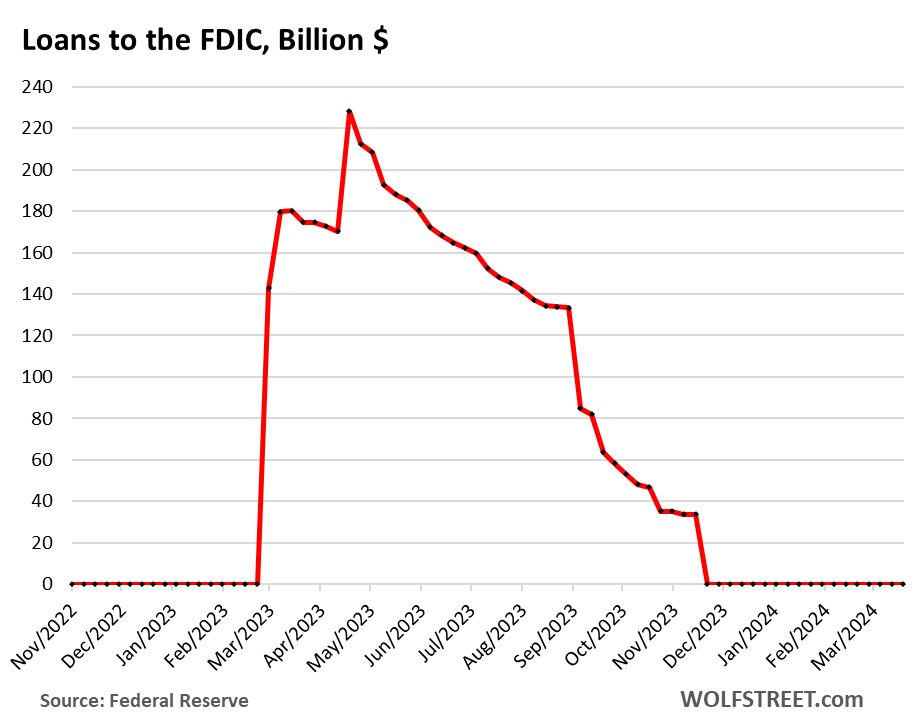

Loans to FDIC: $0. This facility was put together over the bank-panic weekend in March 2023. The funding allowed the FDIC to quickly make whole all depositors – not just the insured depositors – of the failed banks, before it could sell the failed banks’ assets. The FDIC paid off the remainder in November 2023. This is the last time we’ll post the chart here, it has been one year, and it’s over and gone. Good riddance:

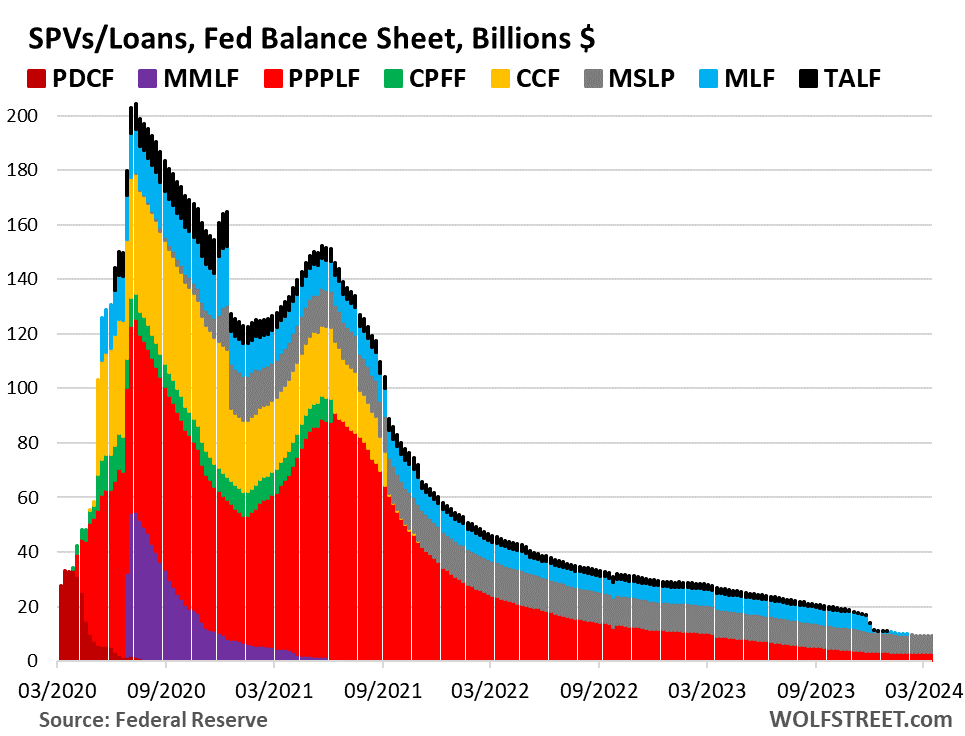

One final word about the pandemic SPVs.

Remember the SPVs, the alphabet soup of seven Special Purpose Vehicles that the Fed had set up during early weeks of the pandemic? We used to have a lot of fun with that stuff here back then. But we haven’t talked about them for a couple of years, so it’s time, one final time.

The purpose was to be able to buy assets that the Fed would not be allowed to buy otherwise. The dodge is simple: it would set up the SPV, lend to the SPV, and it even got the Treasury Department to provide the equity capital, and then the SPV would buy the forbidden assets. In the early months of the pandemic, the Fed then bought those forbidden assets that ranged from junk-bond ETFs to PPP loans.

The first one became active in late March 2020, while the WSJ, Bloomberg, CNBC, et al. ran ridiculous hype-and-hoopla stories of just how many trillions in securities the Fed could buy with these instruments. And it caused markets to rocket higher, knowing that the Fed would buy trillions of dollars of stuff, from junk bonds to old bicycles.

Alas, from get-go it was more of a propaganda coup than anything else. The Fed never bought much. The balances peaked in July 2020 at $205 billion all combined, and then it began unwinding them.

It totally unwound five of the seven SPVs so far, and they’re gone:

- By June 2021, its Commercial Paper Funding Facility (CPFF).

- By July 2021, its Money Market Liquidity Facility (MMLF).

- By November 2021, its Corporate Credit Facility (CCF) which held corporate bonds and bond ETFs, including junk-rated stuff, and it made money on them.

- By January 2024, its Municipal Liquidity Facility (MLF).

- By January 2024, its Term Asset-Backed Securities Loan Facility (TALF).

Only two stragglers are left, with minimal balances: The Paycheck Protection Program Liquidity Facility (PPPLF) now down to $3 billion from the peak of $91 billion in June 2021; and the Main Street Lending Program (MLF), now down to $6 billion, from the peak of $17 billion in January 2021.

So combined, what’s left of the $204 billion in SPVs is a combined $9 billion. Good riddance.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks for putting this together. I’ll be interested to see the liabilities in the next update with them.

Me thinks they need to jettison all they can now, in order to clear the decks for the next round of QE-finity. Sick bastards.

Maybe you have a sick imagination?

“T-bills started rolling off with QT in September 2022 to bring the Treasury roll-offs to $60 billion a month. They’re now down to $195 billion.”

Just wondering. It’s been 17 months since 9/2022. Why aren’t all of the T-Bills matured & rolled off, if the Fed hasn’t been replacing them?

RTGDFA. It explains it.

You people need to read the articles not just the comments to understand the balance sheet, for crying out loud.

This reply makes me wish there was a voting facility on these posts.

So we are back in 2020 land. “Keptin ets abut tu git choppey”

They’ve gone from $3.75T in 2019 to $9T in 2022 to $7.5T in2024. Would love to see what fiscal side has done in that time frame. All this Gvt money, waiting for fed to start talking new 3% inflation target as pundits are hoping.

“By going slower, you can get further,” this article quoted Jerome Powell. LMAO. How about for QT that; “Size doesn’t matter.”

The reduction in liquid assets, is not impressive from the POV of someone that is awaiting the collapse in asset prices by 50 pct so they can afford to purchase a modest home in which a family can grow up in.

100%, the Fed needs to return the purchasing power they “Borrowed” from savers.

Doesn’t appear that this will happen without a major recession. And if that does happen, QE will come back with a vengeance now that the reigns are free. And we all know Congress will extreme defecit-spend until the cows come home. So any dip will be brief and then we’ll be right back to here. Normal business cycles don’t apply anymore. Privatize the profits and socialize the risk is the new American way.

This is the simple truth and you have laid it out succinctly.

Maybe the new era can be called “Managed Capitalism”. Wonder if I will even live to see when this breaks, as it feels like it will be a while.

If banks had to shoulder just 5% of the loan loss on securitized debt, new bank lending would dry up, quick.

QE will come back within the next five years, regardless of outcomes. The debt-to-GDP ratio will demand it. Congress has gone wild. We are in a lull now, because we are still burning off $10 trillion in liquidity injected by the pandemic response, but that soon will pass.

That will never happen. They will devalue the dollar just to keep that from happening. You need more money to buy a home? Better find a better paying job.

Yeah, here in Raleigh you can have a shack, which was freshly painted grey, for $580,000.

Tempting huh? 😆

Old bicycles? Never heard about that one.

I think the housing market is going to loosen up a bit and that MBS roll off will finally hit the $35B limit. People weren’t really going to be locked into their houses forever just due to a decent mortgage rate. Life still goes on. People sell and move.

I like these monthly QT updates but I have to remind myself that this small reduction isn’t going to matter because the Fed will have QE’d up another five or eight trillion during the “blahdy-blah” crisis or pandemic of 2025-29 and the balance sheet will be at $12T or more by the elections in 2032.

Does painting the interior walls light gray, putting in some white tile or laminate flooring, and putting in stainless steel appliances make a home worth $100-$200k more?

Browsing current listings would certainly have you believe so.

My sister-in-law tried to get me to move near her in Cary, NC shortly after my wife died in late 2022. So I went there for a visit to look for a small house (under 2,000 sq. ft.) and one level. You are right! All the new houses and old shacks fixed up of that size were over $500 K!

So, I went back to Texas and bought a NEW small (1459 sq. ft.) shack and paid less than $250 K. And the house was built by the SAME BUILDER as the ones in NC.

Exactly,

Wolf this is what a millennial want for their family , an affordable housing. High price and high mortgage, why they bother to buy a house? and we are not taking setious about this kind of stories of Germany/ Canada/ … price reductions , because reality is when you see you pre qualification letter, with unaffordable monthly payments, lol the rest is BS

How much buying power are you going to lose while waiting?

Also, as someone who thinks financial decisions are often life or death, I realized that buying a home doesn’t have to mean getting the absolute best price.

Buying a home is not an investment. It is an expense on how and why you are going to live.if my recent home purchase is breakeven after 15 years I am ok with that because it is not an investment decision, it is a lifestyle expense decision.

The “GREAT PONZI” programs survived again! I wonder how many times Treasury can “pull the rabbit out of the hat” before the rabbit dies? The rabbit has eaten $34+ trillion so far.

Thanks Wolf for timely updates.

Hope FED goes to 7T (at least) before slowing down QT.

ON RRP has 450B. So they should be able to do so very easily.

Powell last Press Conference “Fairly Soon” on QT slowdown update was very confusing.

That last chart looks like a

psychedelic shoe, impressive.

Psychedelic Shoe® size 11.5

That’s the new “Air Jerome”, available for a limited time only.

Well at least he isn’t selling bibles.

No it is a chelsea boot

Perhaps more appropriately, a court jester’s shoe?

…evabuddy wants to be in shoebiz…

may we all find a better day.

That was really a great article. I can’t believe how big the balance sheet has grown since 2008. Just passing the buck from Crisis to Crisis. Theoretically since the US Dollar is a fiat currency, it can increase until the world ends right?

My guess is that at the end of the world that canned peaches are worth more than money. I’ve seen the apocalypse movies and money loses its value.

When those peaches become valuable, so do the little pointy bits of lead and brass.

…Or the sun burns out, whichever happens first.

We will all be dead and gone before MBS get down around 1.3 again.

Some of us maybe, but not all, knock on wood.

“Knock on wood”: It derives from the pagan belief that malevolent spirits inhabited wood, and that if you expressed a hope for the future you should touch, or knock on, wood to prevent the spirits from hearing and presumably preventing your hopes from coming true. (from somewhere on the Web…)

Similar to saying, “God bless you” when you sneeze. Belief was that when you sneeze, you leave your body momentarily and a demon can jump in. Getting blessed might prevent the possession.

How – if I’d only known that before, I woulda exended more effort knocking on all of the lumber existent, removed, and added to this hippies-with-hammers-rural palace I’ve managed to live in over two decades…(Best!).

may we all find a better day.

Actually I am surprised at how much the level of MBS on the balance sheet has dropped.

Given that an extremely large portion of mortgages that make up those mortgage backed securities, I would have guessed most are at mortgages with a rate at less than 5%. Given that they should barely drop. That they have dropped as much as they haved is great progress.

Thank you Wolf. I’m thinking about the short term treasuries rolling off in about three months, and the Fed rolling off longer duration bonds they purchased. Seems rates would be higher especially getting to the longer duration bonds.

Wolf the more I think about it, I’m thinking correction or pull back and an un inverted yield curve.

We have a bear steepener in our future.

Former Kansas City Fed president, Thomas Hoenig, expects a recession near mid 2025 (but not until mid-2025), followed by elevated inflation. This matches what Jeff Gundlach has been saying for at least half a year, but Gundlach didn’t attatch a time frame. I’m on board with this assesment. It’s become my baseline.

How many old bicycles are left on the Fed’s balance sheet?

Good question. I’ll check on that.

If the employment report holds any water…….just what the h is the incompetent/crooked fed going to do next…..

Inflation is accelerating.

Oil is climbing

Employment is hot

Demographics are hot

Commodities are jumping

Gold is hot

and they are sitting on their dumb asses to protect their buddies that made bad bets and a bunch of bankers that were so busy having golf dates that they did not have time to run the bank.

Get moving you dolts.

Just a quarter point will knock the speculation out of the markets, drop real estate prices, and get employers and employees thinking about who might have to go if things slow.

It’s all about confidence…….and right now the markets are confident the fed could care less about inflation.

and cut out the stupid speech making….in fact fed governors should be barred from opening their mouths outside of the meeting aside from the chair.

I agree, especially considering that they know full well that their response to the Great Financial Fraud (it wasn’t a “crisis” and we all know it) was 100% wrong.

Yes, CONgress was complicit, but the Fed also knows CONgress is fully owned (by Fed member banks).

Fred: Your statements are why I feel it will be one and done or zero rate cuts this year. One ( in Aug.) simply because it is an election year. If things stay the same it probably should be one or more increases for proper shock and awe.

I did notice one Fed governor who actually mentioned “increase”.

Headline on CNBC: “Fed Governor Bowman says additional rate hike could be needed if inflation stays high”.

The word is getting out.

And another “On Thursday, Minneapolis Fed Bank President Neel Kashkari said rate cuts won’t be required this year if inflation stalls. Kashkari said he forecasted two rate cuts by 2024 in the latest Fed dot plot. “The Fed needs to keep interest rates higher in the range of 5.25%-5.50% if inflation remains stronger than hoped,” Kashkari warned. He added that if that still did not work, further rate increases are not off the table,”.

One wonders if Wall Street has gotten the message.

You have to balance this against all the five year corporate debt that was issued at essentially zero percent interest in 2020. There will be hell to pay if interst rates don’t start coming down, inflation be damned. It’s long term good for the economy if all the zombie corporations go belly up, but not all at once.

One of the first WolfStreet reports I listened to in 2020 was about Boeing borrowing $30B at zero rates. I’ve been waiting for the piper to demand his due on the easy money. It feels like that day is always next year.

Many problems arising in the financial “plumbing” and we still haven’t gotten this “balance sheet” below 7 TRILLION!

But I digress, this whole thing should be offensive to everyone. The Fed NEVER should have intervened in the first place, especially with respect to BULLSHIT “financial products” like MBS.

We became no better than the Soviets when we allowed Hank Paulson to hold CONgress hostage. Time to reap what has been sown.

Hedge accordingly.

“still haven’t gotten this “balance sheet” below 7 TRILLION!”

It was almost $9 trillion. What is your problem???????

His problem is with a balance sheet over $7 trillion, as is mine and a lot of other peoples’. The FED destroyed pricing in the economy.

But a lot of that comes from the Fed’s expanded roll in managing the global rates & dollar complex. E.g. the FIMA repo pool, where foreign CBs can get dollar loans against treasuries. But this has nothing to do with domestic money expansion.

Domestic banks also borrow from the Fed instead of each other now. Its actually ironic that the Fed Funds is the ‘key policy rate’ yet the Fed Funds market itself is basically dead.

You should drive looking through your front windshield rather than drive looking in the rear view mirror.

You will get better results.

Apparently, Hank Paulson will be the next treasury secretary if 45 becomes 47.

I agree that the FED should have never bought MBS securities. No doubt.

The fact they did is history. For better or worse they did and that action is in the past.

I think rather than imsit here and whine about it, the more important question is what to do about it. Do you disagree?

Every time I see Wolf’s chart on MBS at the Fed my blood boils. A bunch of unless paper-pushing f&%kers “create” some financial “product” that makes them wealth beyond their wildest dreams while blowing up the financial system. All of these people/corporations should be bankrupt and in prison. Instead we bailed them out and let them change the laws so they cannot be prosecuted? WTF?

If Mortgage Backed Securities buying makes your blood boil, what does cryptocurrency do? Light up a city?

Wolf-

Are the mechanics that allow SPV’s still in effect, or are they (hopefully) re-formed out of existence?

Thanks

Congress limited by statute what the Fed can do. So the Fed must get the approval and participation of the US Treasury Department to do this SPVs, which it did.

Congress has always been fully onboard with money-printing of whatever kind. And you can already see Congressional resistance to these 5.5% rates and QT. Congress is THE WORST at managing a monetary system and a currency. And the White House too. Trump railed on a daily basis against QT and the 2.5% rates Powell put in place at the time, LOL. Trump keelhauled Powell on a daily basis publicly over those rates and QT and threatened to fire him over them, and Powell eventually buckled.

SPV is close a close relation to SPIV. A spiv being British slang for a person who makes a living from underhand dealings or swindling.

What is the difference between the US Congress and the Argentinian Parliament? The US Congress has a reserve currency to use (until???).

I remember Trump speaking approvingly of Europe’s negative interest rates.

I’m confused.

My impression from the article was that the Fed “broke the rules” set by congress, or at least that they betrayed the confidence of Congress by perpetrating the SPV dodge.

If so, haven’t they effectively created a dangerous precedent available for future emergencies be to potentially even worse effect?

Seems like a door that should be nailed shut.

The Fed used SPVs during the Financial Crisis as well, with government approval. The ECB doesn’t need SPVs, it just does all this stuff outright. In that respect, the Fed is more limited than other central banks.

No effective limit to paper issuance almost seems like a return to the “real bills doctrine” debate of the 18th, 19th and 20th century. Essentially, we (consumers/savers) are at the mercy of the technocratic elite and their perception of the lesser of two evils (depression v. inflation) during each exigency or perceived emergency.

Where are the Thorntons, Hawtreys, Hepburns and Laughlins in todays economics discussion? Even John Law sought (but failed) to put a limit on issuance.

You said QE and QT are relatively new phenomenon in the US economy, and well the global economy. This feels to me like a permanent fix to prevent any major asset price drops again. Particularly the change that they made with SVB and others to cover “all” depositors rather than just the ones that were FDIC insured. I mean, no wonder the markets have just been going crazy and seem to go nowhere but up. If asset prices will never go down, then why not? This seems to be the status quo going forward. And if Tr*mp gets elected, it’s to the moon on inflation, and all other asset prices. This is all bad news for the prudent investors. But this is great news for the grifters, and the gamblers, which is basically what our economy has become. Too bad…

In terms of QE, I think central banks are now quietly learning the lesson that years of QE let the inflation cat out of the bag for the first time in 40 years, and so it seems, central banks have lost their appetite for QE. It looks to me like they’ll switch to temporary liquidity measures, rather than QE, the way they used to do it before 2008. The Fed is now fully set up to handle things – such as markets being shut down after 9-11 – the classic way, now that it revived the Standing Repo Facility (SRF).

@ Wolf –

whether it’s “QE or temporary liquidity measures”, it all reduces the value of your past labor (represented by saved dollars), supports asset values and bails out favored parties ……….

manipulation and corruption in favor of the banker/financial class

Whatever. Temporary liquidity measures come off the balance sheet after a relatively short period of time — such as during 9/11 (they lasted a few weeks, in the middle of the dotcom bust, which then continued), or the bank panic measures in March 2023. But QE bond purchases stick to the balance sheet for years or forever.

Thank You, Wolf!

I hope they have learned their lesson. Cynically, I doubt it. I think that at any sign of trouble, QE will resume (similar to 2019 and the pandemic). The Fed implements QE infinitely faster than QT.

“I think central banks are now quietly learning the lesson that years of QE let the inflation cat out of the bag for the first time in 40 years, and so it seems, central banks have lost their appetite for QE. ”

Did you ever let a cat out of a bag? That is the easy part. Trying to get a cat back into the bag is infinitely harder and much damage should be expected to the economy. I don’t think the Fed has that much fortitude to get the cat back in.

I’m optimistic (naive) and think that the Fed has seen the result of the excessive rescue efforts and the moral hazard they produced. It appears (e.g. the rapid rate hikes to quell inflation) they want to put the cat back in and will not rescue the stock market if it caves. In fact, I imagine that they’re waiting for the opportunity to not rescue the market if there’s a major reset.

I heard the blood boiling already.

Every central bank has a plan until they get punched in the mouth…

They got punched in the mouth by inflation.

I tend to agree with you regarding Mr. T. How much immediate inflation will be created if he keeps his pledge to institute a 60% tariff on China and 10% on everyone and “everything” else?

It really does not make sense to put a tariff on raw imported goods such as copper or rare earths as that just gives every other country better pricing on their finished goods.

I have some annual reports from Anaconda and Kennecott in the 60s. As the US controlled the world market the domestic price of copper was 30 cents and the world price was 70 to 80 cents, which made the US the low cost producer in anything using copper. Now, thanks to Wall Street merger mania Anaconda no longer exists, Kennecott is foreign-owned and the US may soon be the one with the higher cost of raw materials.

Makes this old geezer happy he is 75 instead of 5. May our grandkids all have a better day.

Unfortunately, I agree with you.

Once the SVB bailout to investors happened then markets roared back to life. People started to think that the government will always step in and make things keep going up. And I have a hard time disagreeing with them. Covid pandemic we saw massive money printing and Powell sat there and said they have no desire to raise rates and everything is fine.

Why would anyone play it safe at this point? The last 16 years has shown that being irresponsible pays off.

I don’t think you realized how much investors lost when SVB went bankrupt.

Five years ago, if my goal was to quietly default on debts via inflation, with least public outcry, I would have done exactly what the Fed has done. Inflate by “accident” in response to an emergency.

To set the stage for more inflation in the future, I’d do exactly what the Fed is doing now. Walk back a portion of QE slowly, to provide political cover and allow the bulk of QE to embed in GDP. Wait for another surprise “crisis” to fire up the money printer, with everyone’s approval.

The key is to inflate while keeping a lid on inflation expectations. This requires periodic “emergency” stimulus. There doesn’t seem to be another way to accomplish it successfully.

Monetary management is more art than science at this point. Acting and sales skills are a definite plus.

This is pretty fanciful fiction. Nobel Prize for literature?

Some people cannot help themselves but see a conspiracy behind every rock.

To them, the sun literally rose because the government was trying to spy through their East facing windows.

Nutters going to nut.

I’m sorry Wolf as I know that you will disagree, but this percentage-wise small amount of run-off just shows how totally reckless and obscene the Federal Reserve have been. They should all be sacked for their actions in this. I know it will be said they were just trying to cover the pandemic loses but this was ridiculous and has caused huge pain for the middle class and the poor

They printed $5 trillion to make up for a $1.5 trillion loss in economic activity.

Inflation was inevitable.

What is stopping the Fed from stating the obvious, which is that inflation is the direct result of ongoing large fiscal deficits? Why isn’t this the central talking point regarding inflation?

In my view inflation was caused by a variety of factors, being initiated by the pandemic via supply shortages and then accelerated by ZIRP and pouring billions in pandemic relief across the board. This was also combined with corporations taking advantage of raising prices. I don’t see large fiscal deficits being an issue as a driver but a longer term issue, and of course when times are good the deficits should disappear, which obviously isnt happening. It was mostly self created by those we elect to faithfully look after current and future generations so perhaps it is our fault?

Hi Wolf,

Will there be an ecb article soon?

ECB and Bank of Canada are coming sometime between today and Sunday. Both had big drops.

yes, let’s blame the victims …………

Glen – your final sentence is the one that we, the citizenry, is one we seem to most-frequently disregard, if not ignore completely (perhaps in a belief that effective self-governance is easy, or that one is a closet royalist…).

may we all find a better day.

91B20 1stCav (AUS),

Actually my last sentence was pure sarcasm with perhaps a hint of hoping some people might be introspective with it!

The rationalization that we are a country trying to live up to it’s lofty ideals is humorous to me given the hypocrisy of it all. But without the ability to bring about real change it is sometimes better to balance caring and compassion with dark humor.

Glen – can’t disagree (was certainly, and widely-present in Soviet society, among many others), and I often laugh that way to keep from crying, but won’t give up…best.

may we all find a better day.

Its taboo for the Fed to comment on fiscal policy.

This is false. Prior Fed chairs regularly spoke out about fiscal policy.

Bobber, I guess it us up to me to say out loud what the FED can’t.

The obvious thing to do would be to tax back some of the pandemic spending. But the US middle class (and the poor) are already paying an impressive number of regressive taxes (sales tax, wheel tax, a water tax to fund the local fire dept, taxes on phone service to fund the police, cable, gasoline tax, and the FICA tax falls heavily on the working poor). I skipped over a few like the Real Estate tax. I probably missed a few as well.

A tax increase on the high earners ($400,000 and up) would be the Keynesian solution. But the wealthiest among us control the people who could raise these taxes. So instead we are more likely to see new tax cuts for Billionaires.

Then for grins, you can throw in an economy where people see that more money can be made by shuffling around little pieces of paper, and speculating, rather than manufacturing things.

Just my 2 cents here.

You have hit the thing that amazes me the most.

It amazes me how many people are incentivized to vote against their own best interests.

They are somehow convinced that if we just somehow give billionaires another tax cut that we will hit economic utopia.

They think it is the billionaires that create jobs despite the fact that jobs are already plentiful. Historically so.

They are programmed to vote against any tax hike that would make the tax system a mote equitably fair system.

They are programmed to hate immigrants and taxes. They don’t understand why. They just naturally respond.

Pretty sizable difference between people earning 400K (mostly dual income types in costly metro areas) and billionaires. You and many others have picked up this very political idea that if we just tax people who make a little more money than average, all will be well. The truth of the matter is that there is not enough revenue from taxing the billionaires, and people making 400K in Manhattan or CA are already paying 30% or so Federal and another 8 or 10 ish state, and they don’t have sufficient numbers to pay down the deficit.

So the only way out is restraining spending. Or taxing the middle class which is a non starter.

Or, as is already happening, the Fed will allow enough inflation to inflate away the value of the debt, and crush the middle and working classes with an unconstitutional and immoral inflation tax.

So Steve Hanke says the money supply is contracting and Michael Howell says global liquidity is rising. What’s your take on the future of asset valuations in the face of the never materializing recession and the continuing ponzi boom?

Recession is certainly hitting much of the rest of the world. For some reason, there is a certain segment of the population that will not be happy until it hits the U.S.

They want their fellow citizens to suffer.

Sick people.

To which fellow citizens do your refer? Those who can’t afford to buy a house? Those who watch inflation roar as their incomes stay stagnant? Oh no, you are talking about the speculators in the stock market who might have to look at a lower number figure on their brokerage statement. Who is the sick one?

Thanks again Wolf.

ECB with another massive drop in assets last week. End of quarter and it looks like Є247.7 B in TLTRO III loans matured.

Total assets down Є263.6 B for the week. Now at Є6.6 T.

One wonders how low the ECB can go with QT?

The FED never did enough when it came to QT and raising rates. The economy remains grossly overheated and they are just resting on their laurels as if they have actually accomplished the task at hand. They have not, and they will not.

It is painfully obvious to everybody that their default is to always err on the side of inflation. They even advertised that they were going to “let it run hot” and then peddled the “transitory” lie. They told the world what their intentions were. And now here we are.

The population as a whole is sick to death of inflation. They don’t just want disinflation, they want DEFLATION. They want the old prices back. This is the disconnect between politicians, the FED and bureaucrats and the electorate who put them in office.

Prices at the gas pump are going berserk the past month+, and most other necessities which people cannot live without are rocketing higher. There is simply way too much money sloshing around the system and they don’t want to do anything about it. They have engineered the most massive speculative hyperbubble in world history, and it continues unabated.

Wolf’s response to your call for deflation will be that the people who want the old prices back don’t want their old salaries back. And that’s true, to a large degree.

But it’s my position that the middle class is worse off, regardless of what the official numbers show in terms of real wage gains.

The actual pay amount means nothing. It comes down to the erosion of the standard of living. If you make $10 per hour but a studio apartment is $300 per month, you are much better off than $20 per hour when the studio apartment is $1,800.

They have absolutely destroyed the standard of living of the masses. The FED’s precious “wealth effect” is a goddamned lie. And they won’t even sell the MBS on their balance sheet. These aszholes are a cancer upon society.

Agreed on this. While McDonalds workers are making double what they were, their costs have exploded such that they are worse off, in my opinion.

The problem with the “wealth effect” is that it’s so unevenly distributed.

That’s why you have Bezos buying a third mansion on an island near Miami while millions can barely afford a studio.

All the subsidies to make homes and healthcare “more affordable” are just making problems worse. But everyone in Congress already knows that. At this point, it is Ponzi, by design. FHFA conforming loan limit: “The new ceiling loan limit in high-cost markets will be $1,149,825, which is 150% of $766,550.” If the FHFA had simply frozen the limits at 2019 levels ($484,350), houses would be affordable right now. One simple regulation changed the entire housing economy.

PS This FHFA limit is also at the root of shelter inflation in the CPI. It was increased 5.56% in 2024 due to a chicken-and-egg price spiral based on the CPI shelter component. The FHFA could easily freeze it for a few years to “calm down” the animal spirits in the housing market, but it won’t (cf Ponzi scheme in previous comment).

But Wolf will remind you that some inflation is defeated and the CRE is down majorly. So, I’m just going to finish this lunch here, and then go out and buy a couple office towers, and perhaps an industrial park for good measure.

Along the way, you can pick up a single-family house in San Francisco with your strengthened dollars, to where you need 20% fewer dollars to buy the same house than a couple of years ago. Your dollars have also become worth more with regards to houses in Austin and lots of other cities.

The whole discussion came up because certain people here insisted on mixing consumer price inflation with asset price inflation (such as housing), and I used this as an example of why you do NOT want to mix consumer price inflation and asset price inflation. But no one ever reads a whole paragraph here.

I don’t disagree but with recent wage gains it is unlikely we will see price deductions returning to anything close to pre-pandemic. Even if money continues to come out of the system we are likely just at a new normal. Bellwether stock DNUT broke out today which is an ominous sign.

Ummmm….. deflation??? Do you really want your paycheck to go back to it’s 2019 level?

I do!

Most people would gladly have their 2019 purchasing power back.

Also you underestimate the # of people whose paycheck *actually still is* at its 2019 level.

And people whose income, while higher than 2019 levels, have not kept up with price increases, especially in necessities like housing, insurance, child care, and so forth.

I would gladly take my 2019 salary and 2019 prices again.

At least I could afford a house and food back then.

Absolutely. I want a complete roll back to 2019 prices in everything, which by the way was still a massive bubble.

Depth Charge-

Taking into account that interest rates are the price merely the price of money, I find your desire of “a complete rollback to 2019 prices” concerning.

You don’t want to go back to sub-3% interest rates (egregiously manipulated by the Fed during 2010 to 2020) do you?

Let’s roll back to a significantly earlier year than 2019, as long as we’re wishing.

Sympathetically

Seriously? How many people are paid 30% more than in 2019? Every single person I know would make that trade. Every retired person especially.

Your “obvious” conclusions are based more on your desires than any rational reading of the facts.

You only have your biases and weaknesses to blame. If you did better your results would be better.

fredf – not an expert, here, but how much does decline in the 16 years baseline-value of those dollars figure in your percentage calculations (as part of the inflation game we’re all playing in…). Best-

may we all find a better day.

Looks like most of yesterday’s losses will be reversed.

It now seems that asset prices will never drop, even in the short term, because every market participant, including the algos that run things, see every new high price as a “baseline” upon which prices should never drop. Therefore, any dip is a buying opportunity, and as such, a self-fulfilling prophecy.

Congratulations on discovering the logical fallacy called anchoring.

Well……I am in no way at the level of Wolfe…..but assuming the cpi jumped about 35% over those years you could make the little under a trillion base adjust to about 1.3 trillion and go from there.

Obviously there are more goods and services available now compared to 2008 but…….no where near the monetary growth.

Bottom line……they know all this…..this is not a surprise……or unknown to them……they are deliberately stealing from the middle class and transferring to their donors. It’s not a healthy growth…..it’s a booming boom creating all kinds of misallocation of funds.

OK, I hereby make a formal prediction that the Fed Balance sheet tightening will be wholly-paused before it drops beneath the “mini-peak” of $7.165T of June 10, 2020.

I strongly suspect this will be concomitant with Overnight Reverse Repo Agreements diminishing to near the $200B level. Wolf has proven to my satisfaction that ORRA are *not* shadow-QE – but all four people I’ve talked to finance with real skin in the game have given me the same message: diminishing ORRA gives them the heebie-jeebies.

I suspect the timing of that full-pause will be sometime in July or early August.

I suspect (with some confidence) that QTs slowing will be announced on May 1st.

The only thing I see affecting this timing would be an Oil Shock arising from the Middle East dramatics.

If I’m wrong – I owe Wolf a beer!

Make sure you save the link of this comment (hyperlink under the date of your comment) so that you can hit me over the head with the comment when I post an article with this headline: “Fed Balance Sheet QT: -$2 Trillion from Peak, to $6.99 trillion.”

We’ve already had lots of predictions of this type here over the past 2.5 years:

1. Late 2021, when the Fed started tapering QE: “The Fed will never end QE”

2. And after it ended QE: “The Fed will never do QT.”

3. And after it started QT: “The Fed already ended QT because…”

4. And after QT got bigger: “The Fed will end QT next month because…”

5. Then: “The Fed will never go below $8 trillion because…”

You see, it’s just a long series.

Wolf,

I went ahead and bookmarked it.

Mind you, I’d actually be relieved to be proven wrong to the benefit of your reputation and the detriment of my own (however anonymous!).

But nevertheless I’ll repeat my bet that the balance sheet floor (at least in the near-term) is not lower than $7.165T and that will closely coincide with ORRA of around $200B.

We should know by August.

Repos take liquidity out of the system. The Fed is /borrowing/ reserves against collateral (treasuries) that it provides.

The argument you should be making is that the SRF and discount window are stealth QE. With these the Fed is /loaning/ reserves against collateral.

But I disagree with that too because not everything that provides liquidity is QE. Central banks are supposed to be lenders of last resort.

Err, meant to write reverse repos.

No worries – I knew what you meant.

My concern about ORRA comes from the interpretation given here (article is from November, 2021).

https://www.nasdaq.com/articles/reverse-repos%3A-what-they-are-and-why-they-matter-2021-11-04

“A sustained rise in reverse repos such as we have seen this year tells the Fed that banks don’t need their help anymore and that they can reduce liquidity adding measures, which were originally intended to be a short-term response to a crisis, without disrupting either the economy or financial markets.”

So rapidly-falling ORRA *could* be interpreted as a signal by the Fed that they have drained the pool too quickly.

BigAl,

The article you linked is BS for several reasons, I’ll list a few of them here:

1. about your quote: No, ON RRPs are not where banks put their cash; banks put their cash into reserves at the Fed, which pay more (5.40%) than ON RRPs (5.35%). MONEY MARKETS and other nonbanks that don’t have access to reserves put their extra cash into ON RRPs. Repeat after me: MONEY MARKETS and other nonbanks that don’t have access to reserves put their extra cash into ON RRPs.

2. “So rapidly-falling ORRA *could* be interpreted as a signal by the Fed that they have drained the pool too quickly.” I assume you mean “ON RRPs. No, ON RRPs are normally ZERO. It’s only toward the end of QE and at the beginning of QT, when there’s way too much cash flowing into MONEY MARKETS that ON RRPs start having big balances. See chart below. The Fed is EXPECTING ON RRPs to go to zero. ON RRPs represent “liquidity that money markets don’t want” is how the Fed’s Waller called them.

3. The Fed is looking at reserves as the limit to how far they can go with QT, not ON RRPs. ON RRPs will go to zero or close to zero this year.

4. The article was published on Nov 4, 2021 and predicted a jump in stocks to due tapering going on at the time. But Nov 2021, was the very peak of the Nasdaq and then it plunged by 35% and the S&P 500 plunged by 20% . Even after the generational rally in 2023 and so far in 2024, the Nasdaq composite in only flat with its ATH in Nov 2021.

There is however the fact that ON RRPs represent non-bank excess cash. So when QT draws down ON RRPs, it removes liquidity that isn’t needed, so QT has a lesser impact on the rest of the markets as long as the drawdown comes from ON RRPs and not from reserves.

I think the supply coming out of the ONRR (temporary deep storage) are acting to suppress Treasury rates.

My guess is that a large portion of the ONRR is being used to buy Treasuries. As the FED’s demand has diminished, it has been replaced at least in part by the ONRR cash.

If so, the Treasury market hasn’t yet fully felt the full strength of the QT signal. The ONRR are acting as a buffer and introducing a time delay.

The FED may be bracing for impact as they see how the mid-to-long-term rates react (violently?) to a rather sudden drop in demand when ONRR go to zero.

If the rates react violently, then what will the stock market do?

The committee members are probably holding their breath for this one.

I’d love to see Wolf’s take on this comment above. Its a bit over my head, but seems important (if true).

Pancho,

Three of my four friends that I mention in my friendly wager with Wolf (see above) cited ONRR as blunting the edges of QT. I don’t claim to have much knowledge about it, though.

“some banks used it for arbitrage profits, borrowing at the BTFP at a lower market rate and then leaving the cash at the reserve account at the Fed to earn the higher 5.4% that the Fed is paying on reserves.”

There appear to be some flaws in this theory. One, it would be against the law for the Fed to loan cash. Two, bank reserves held at the Fed are not cash, they are qualifying assets, treasuries, Agency MBSs, and SDRs. Three, the small banks that utilized the BTFB do not have reserve accounts with the Fed, if they did, then they could’ve parked their treasuries there to garner the higher interest rate.