Germany is an example of what interest-rate repression and QE do to home prices, and what happens when raging inflation causes those policies to be reversed.

By Wolf Richter for WOLF STREET.

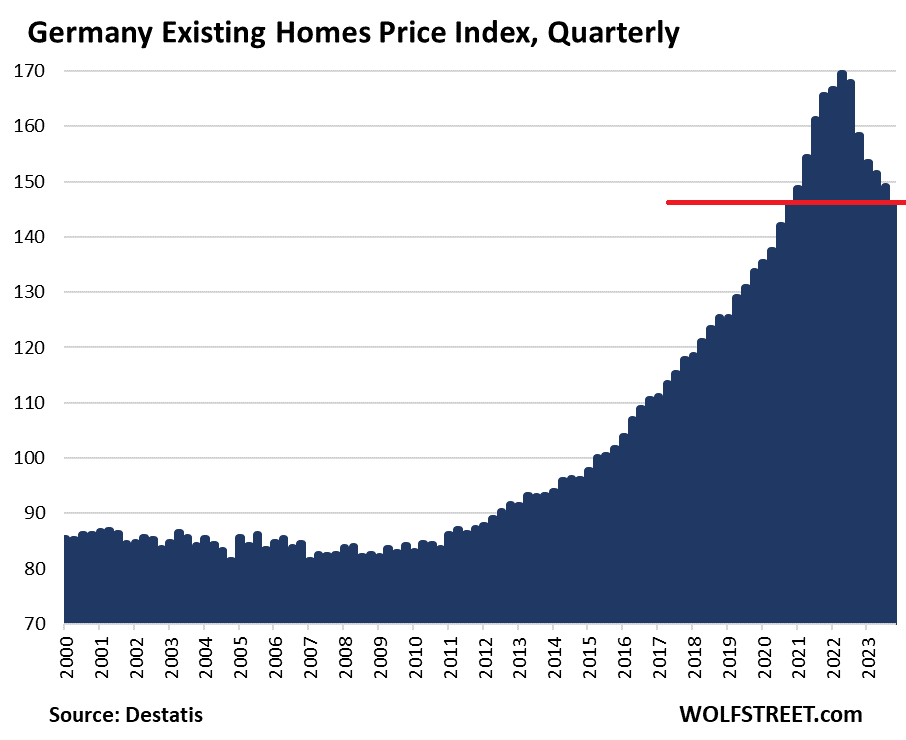

Prices of existing homes in Germany – used single-family houses, duplexes, and condos – that were sold in Q4 have now dropped by 14% from the peak in Q2 2022, according to data from the German statistical agency Destatis today. The index has now unwound all the gains since Q4 2020. These are the biggest drops in the data going back to 2000.

Quarter to quarter, prices dropped by another 2.1%, the sixth quarter in a row of declines. Year-over-year, priced are down 7.8%.

Germany’s housing bubble – inflated by the ECBs absurd negative interest rate policies and crazed mega-QE – has turned into a housing bust after raging inflation forced the ECB to reverse course. The ECB has by now shed €2 trillion of its QE assets. It also has hiked its deposit rate to 4.0% (up from -0.5% through mid-2022) and its main refinancing rate to 4.5%. Inflation in the Eurozone has come down a lot, as energy prices have plunged, and some goods prices have dropped, but it remains high in services where it started showing the first signs of rebounding.

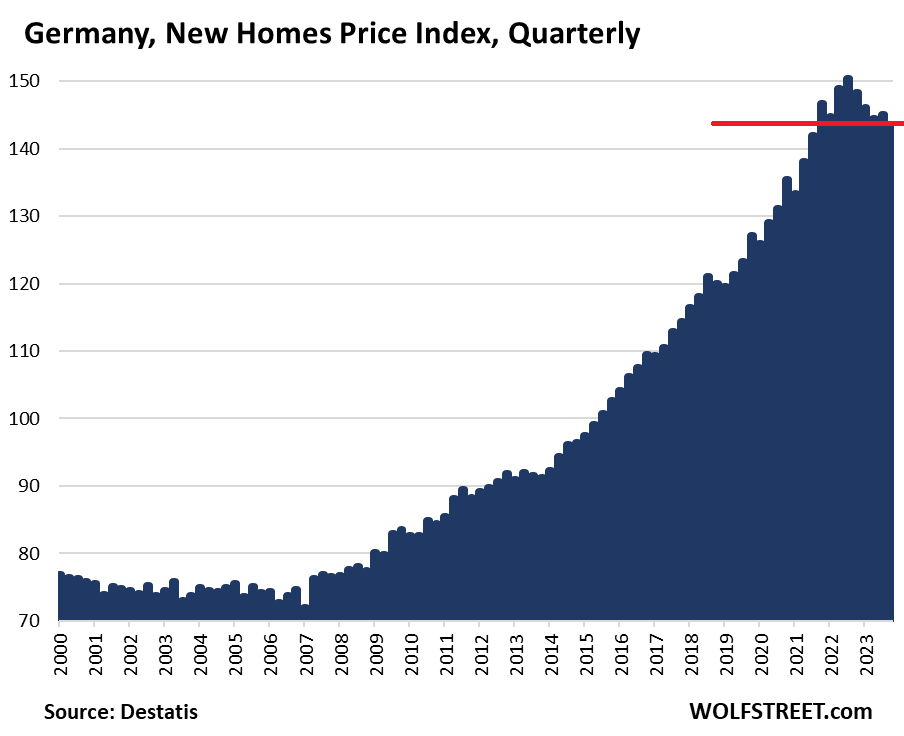

Prices of new homes – new single-family houses, duplexes, and condos – dropped by 1.0% in the quarter, for an annual decline of 3.2%, and are down by 4.5% from the peak in Q3 2022.

The index has now unwound the gains since Q4 2021. Between 2010 and the peak in 2022, prices had spiked by 80%.

Note that sales of new homes is a much smaller market than sales of existing homes.

Prices of single-family houses and duplexes have drop more than condo prices in 2023:

Prices within cities overall:

- Single-family houses and duplexes: -11.0% YoY, and -2.7% QoQ

- Condos: -7.1% YoY, and -1.9% QoQ

Prices in the seven big metros (Berlin, Hamburg, Munich, Cologne, Frankfurt, Stuttgart, and Dusseldorf):

- Single-family houses and duplexes: -9.1% YoY, and -1.5% QoQ

- Condos: -5.8% YoY, and -1.7% QoQ.

Prices in thinly populated and rural areas:

- Single-family houses and duplexes: -6.9% YoY, and -2.1% QoQ

- Condos: -2.8% YoY, and -3.1% QoQ.

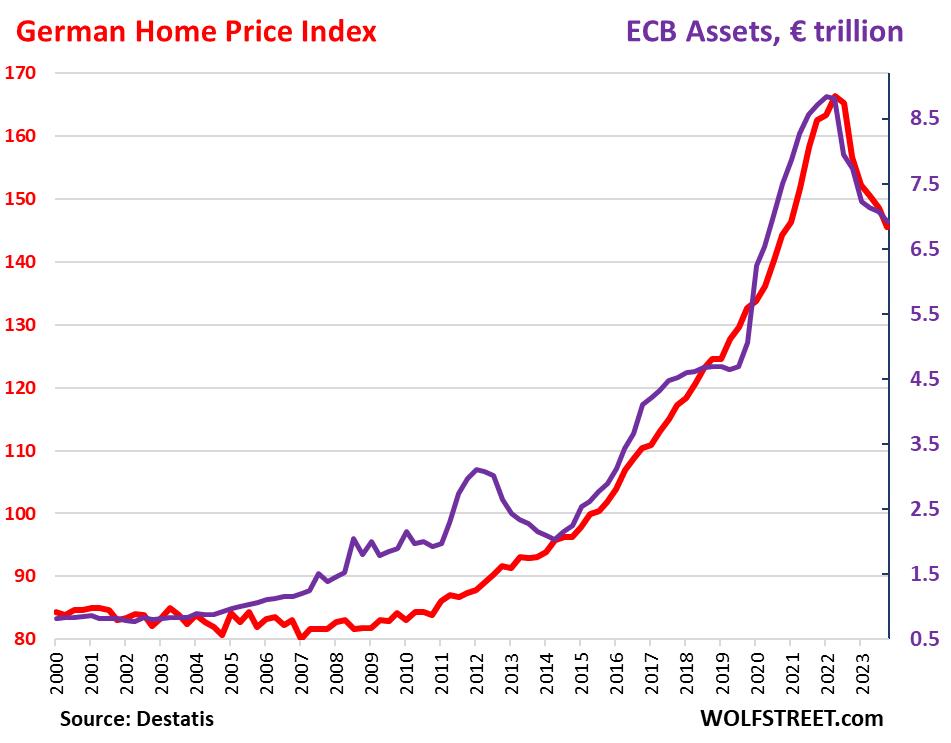

Home prices and the ECB’s balance sheet.

The overall home price index, which combines new and used single-family houses, duplexes, and condos, fell by 2.0% in Q4 from Q3, and is down by 12.6% from its peak in Q2 2022.

We compare this overall home price index to the ECB’s balance sheet.

On the way up from 2008 to the peak in 2022, the home price index soared by 100%. But the ECB’s balance sheet ballooned by 309% over the same period.

On the way down, the home price index has dropped by 12.6% from the peak, while the ECB’s balance sheet has dropped by 21.7% (by €2.0 trillion) from the peak.

This shows that the movements are not proportional, but they’re both big movements, and they’re going in the same direction. In creating the chart, we have put both in the same space but on different scales: the home price index in red (left scale), and the ECB’s total assets in trillions of euros in purple (right scale), with their bottoms and tops roughly aligned.

It shows the reality of QE: Interest rate repression through policy rates and through QE causes raging home price inflation. Similarly, higher short-term rates accompanied by QT wring some of the home price inflation back out of the housing market.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Germany is an example of what interest-rate repression and QE do to home prices, and what happens when raging inflation causes those policies to be reversed.”

I really hope the key word here is ‘example’. Which ultimately means a forerunner, prediction, or coming soon to a USA near you.

Here is Canada:

https://wolfstreet.com/2024/03/18/the-most-splendid-housing-bubbles-in-canada-national-house-prices-flat-in-feb-16-from-peak-condos-drop-further-on-bank-of-canadas-5-massive-qt/

And here’s the USA:

https://wolfstreet.com/2024/03/21/amid-weak-demand-for-existing-homes-active-listings-price-reductions-jump-listing-prices-weaken/

And San Francisco:

https://wolfstreet.com/2024/02/27/the-most-splendid-housing-bubbles-in-america-feb-2024-update-20-city-index-drops-for-2nd-month-from-double-top-biggest-price-drops-from-2022-peak-san-francisco-seattle-portland-denver-phoenix/

Let’s hope it keeps falling. Home prices are still too high.

They are ridiculous unless you have gotten a 300% raise in the last 3 years.

Yes, way way too high. Even in Texas that used to be affordable for most of the housing, both mortgages and rents have got so outrageous that even the top paid professionals can barely stay ahead, and then the property tax.. Texas despite all the state marketing has never been a low-tax state, the property and business taxes are some of the worst in the country. And then the worst bubbly markets and not just on the coasts, Boise Idaho and Bozeman Montana of had some of the worst bubbles in the US so it’s “fly-over country” too. Housing needs to fall around 60 percent in a lot of the USA to be affordable. The United States now has record homelessness already and just get’s worse every month.

Result of all this is family formation has crashed and burned all through the US, the rent seek economy from the housing bubble and Everything Bubble is sucking all the funds out of the real economy, even well paid Americans can’t afford kids. And then there’s childcare and healthcare adding on to the housing cost misery. I know China gets lot of flak for its real estate sector but it popped its own housing bubble deliberately last year, so young couples could afford homes again and start families. Housing should be shelter, not an investment to rent seek from. (or at least not in most of it–China’s copying Singapore here with the two tiered thing).

We need to make that choice in the US, either we can have homes as shelter, or let housing keep soaring to complete unaffordability and have a few aristocrats surrounded by millions of homeless. That’s where stupid ZIRP and QE led to, all these asset bubbles with something as basic as housing now rising to bankrupting inflation and cost of living levels. And history’s shown if it continues, the wannabe aristocrats holding the assets don’t have long before the guillotines come out for them.

Miller, excellent post. I’ve said it many times before, that the problem with printing money to create the “wealth effect” is that you force yourself against a wall. You either have to keep printing to maintain it or finally let the bubble pop, after which you have the “anti-wealth effect,” which means all you’ve really done is pulled demand forward.

Additionally, once you print money, you lose control over where that money goes and what goods and services it chases.

The foolish central bankers thought they could print money indefinitely and have all of the money do nothing but chase stonks, crypto and bonds. Well, eventually the money started chasing housing (which is why housing has gotten so out of control, even in parts of America that used to be low cost of living) and it started chasing goods and services.

The wealth in America that resulted from this deranged printing ended up in the hands of the top 5-10%, which is why providers of goods and services have started targeting that demographic, and ONLY that demographic. That’s why many car manufacturers would rather make a $15,000 profit on a $90,000 luxury car or truck than a $1,500 profit on 10 cars.

That’s why prices on “experiences” like hotels, them parks (I’m thinking particularly of Disney), and sports events have skyrocketed so much. The wealth in this country is so concentrated that they don’t need to make their goods and services affordable to the average man. They can make all of their profits on selling to the top 5-10%.

As you said, that never ends well for a society.

Miller, I couldn’t have put it better myself. Neoliberalism has comprehensively failed as an experiment where the well-being of the citizenry is concerned. And what can’t continue, won’t continue …

Looks like the move in the US could be to an even higher bubble peak. QT and rate hikes ain’t workin’.

Give it some time. The Nasdaq is just a hair above its former all-time high in November 2021, instead of being 50% above it. We had a huge gigantic rally that will burn itself out. Home prices overall haven’t gone anywhere in two years. So you can see some of the effects. There is just a huge amount of liquidity still out there, so it will take time.

Possibly, injecting 1trillion every 100 days into the veins of this wild beast will help tranquilize it.

Forget Germany or Canada!

Here is for Los Angeles!

S&P CoreLogic Case-Shiller CA-Los Angeles Home Price Index

https://wolfstreet.com/2024/03/26/the-most-splendid-housing-bubbles-in-america-march-2024-update-biggest-price-drops-from-2022-peak-san-francisco-seattle-portland-denver-phoenix-dallas-las-vegas/

Burn baby burn

The central bankers think they’re deities, and can fix any problem. Their “cures” are almost always worse than the disease.

Sounds like chemotherapy

It is really unbelievable how these people are so unabashedly evil.

Politicians are innocent souls, they are natural creatures, they are humans also. Yes, it’s a sweet truth… 🖊 ❤.

“Not in my neighborhood (insert any areas in SoCal) and my country…it’s different this time over here…”

Looks like other countries without 15/30 years fixed is falling quite fast, maybe our savior will be all the fixed mortgages and how it will keep existing supply low..etc as they will all say…

I almost regret paying off my 30 year early as could be making money on it now. That said, nice to have it paid off and just taxes and maintenance.

Agreed. It’s a huge stress relief. You can live like a king on $2k a month if you have every material thing you want already and no debt. I’ve also noticed that people with paid off mortgages appear to age slower as well.

Take one more now, for the fresh taste,… ❤

In unrelated news but will be fascinating to watch is the DWAC SPAC going public. Think I might keep that out of my portfolio but I thought it was nuts when FB went public so what do I know!

Interest rates are not the problem prices are. People need to stop the fomo and prices will fall dramatically

Tank? What happened to Plunge? You’re messing with my drinking game ;-)

Hallo Gefangene….Affe siehe Affe tun

Will it work?? I doubt it. Entire world did the same things. Good Luck….

It’s interesting how the same phenomena are repeated in country after country around the world. In this case, a housing boom that lasts a persistent amount of time.

It’s truly proof that we’re living in a global society, with the same restaurants and the same macroeconomic trends.

And it is increasingly difficult where I live to find a restaurant that offers American menus….

What’s an “American menu?” Cooking brought by colonizers, slaves, and immigrants? Or cooking as practiced by native Americans? Or by Mexicans? A big part of the US used to belong to Mexico, so is Mexican food not an “American menu?”

I don’t want to quibble. I’ll just relish the awesome fusion of it all.

A bag of onions

A handful of celery

A handful of kale

A few carrots

A can of sardines

Daily menu

Howdy Curiouscat. Fast Food is American. Maybe you just do not like veggies???

Do you want to supersize that?

Says the one stared hardworking McDonald’s employee that will earn five stars one day…

My friend (American) and his family were visiting Rotterdam a while back and asked a local to recommend a restaurant. They were told there was a Scottish place just around the corner…ended up being a McDonald’s. They took it with good humor!

The original fast food was invented possibly thousands of years ago maybe in Asia or the Middle East (today street food).

What Americans invented was the corporatization of fast food — making franchises that all sell the same stuff.

Howdy Fast Food Gunkies. I loved sitting at Steak and Shake with my mon and dad, tray on the window, glass Steak and Shake glasses, sitting and watching the rat rods go round and round in a circle while eating. My Fast Food Pure American Experience.

McDonalds is the fast food place founded by a couple Irish Americans, MacDonalds would be the name of the Scottish fast food place. There’s an old joke where in Heaven the cooks are French, the policemen are Irish and the mechanics are German In Hell the cooks are Irish, the policemen are German, the mechanics are French. I have had Irish & Scottish relatives argue over not only who had the worst food, but who is the most thrifty (in the end it seems like the Irish have the worst food and the Scottish are the most thrifty). I tale after both sides of the family since I am a thrifty bad cook…

@Wolf. Any chance we can get a commenter BLOCK feature for your site? Sure seems like DebtFreeBubba is in violation of your commenting policies and, frankly, adds nothing to the conversation.

Thanks for your consideration.

Apt.Inv – the one I recall is that the main driver in the founding/expansion of the British Empire was a constant search for a decent restaurant…

PostT- Wolf’s job, here, has become massive (imho) for a one-man band. At least, you can see D-F-B’s handle and skip over his posts (as in the days of newspapers where one’s self-filtering of non-relevant ads, sections, articles and columnists were de rigeur…), unless you think the influence of his words are so powerful than they require a response…(heck, I have NO doubt I’m ignored meself more often than not!).

Best to you.

I believe the comparison was more like this:

In Heaven:

The British are the policemen

The Germans are the mechanics

The Swiss are the bankers

The French are the cooks

The Italians are the lovers

In Hell:

The British are the cooks

The Germans are the policemen

The Swiss are the lovers

Italians are the bankers

The French are the mechanics

I thought the Big Mac is everywhere, and is used to gauge local currency purchasing power.

With the “minimum” wage in CA fast food restaurants going to $20/hr ($40K+/year) next week the price of the Big Mac should be going up in the state.

I was looking around on the information highway, trying to figure out the interest rate for public debt, because that seems to connect to financial repression. The Treasury isn’t exactly making this easy

“ As of February 2024, the United States government has a monthly interest rate of 3.2 percent on its debt, continuing an upward trend in interest rates that began at the beginning of 2022. In February 2024, U.S. debt reached 34.47 trillion U.S. dollars.

Rising rates on Treasuries helped propel the average interest rate on the debt to 2.97% for fiscal year 2023, up from 2.07% the year before and 1.61% in fiscal year 2021, Dwyer said.

The spike in payments was evident in October, the first month of fiscal year 2024, though experts caution against drawing too many conclusions from a single month. The government paid $76 billion last month, up 77% from the $43 billion tab in October 2022.

The Congressional Budget Office’s long-term projections provide a glimpse into how much larger net interest payments could grow. They are expected to hit $1.4 trillion by fiscal year 2033 and $5.4 trillion by fiscal year 2053, according to an agency report issued in July.”

How about rents? DIW Berlin says they increased by 3% in 2023 in comparison to 2022 (averaged over 150 cities) caused by population growth (euphemism for forced migration) and slowing down of building acitivity. They also say house prices decreased by only 2% in that period which is less than the DeStatis number. Presumably depends on which cities are included.

Related although not directly to Germany, more to US rates which affect all rates. There is a long complicated piece over at Zoo H by Simon White, Bloomberg Strategist Thursday 21. His stuff is one of the reasons I run gravel thru the sluice over there.

I can barely understand it but I can read his conclusion: US policy is already very loose and although the Fed would like to throw a bone to those clamoring for cuts this year, it would be ‘unwise’ to have any.

Bostic just now slashed his visions for rate cuts in 2024 down to 1. And he said it would be later in the year. Bostic is a dove. He saw 3 cuts for 2024 late last year. If we get a few more bad inflation readings, there won’t be any cuts at all.

Wall St. hallucinated 7 rate cuts this year, then ran the markets up to uncharted territories. Then when FED officials like Bostic signal a single rate cut, the markets just stay at the highs – or go higher. There’s too much f***ing liquidity. DUH. QT is WAY too slow, and they should have hike another 100 basis points beyond where they stopped.

Yes!

I think sentiment matters too. In 2022, QT was just getting started and the balance sheet was much bigger but stock went down and came close to crashing. We need some significant events or news to deliver the fatal blow to the hallucinated market. It could be as simple as a few more bad inflation reading and Fed decides not cutting like Wolf mentioned. And coupled with a string of earning miss from the mag 7, it could turn into a crash of epic proportion.

Here is a controversial thought for you DC,

Is hiking short-term rates any further right now really going to have the impact you’re hoping for (@DC)? With there still being excess liquidity out there from QE, won’t higher short-term rates just mean that this excess liquidity will earn more money and contribute to more spending (this excess liquidity is sitting in bank reserves at the Fed and RRPs)?

I know the higher short-term rates will increase certain borrowing costs as well, but with there being excessive liquidity out there, higher borrowing costs don’t bite as hard as when liquidity is tight. I imagine the higher short-term rates won’t really start hurting (CRE aside) until the excess liquidity from QE is drained down, and the remaining liquidity has to start being more judiciously distributed across the economy (which will of course force longer term rates up).

I am such a fan of Depth Charge. I would definitely recommend him/her to run for a school PTA chair if s/he isn’t already one.

Nick,

I’ve been infatuated with yield spreads for a long time, so this current cycle is very unique.

I watched/listened to a YouTube, with a good analyst named Vincent Deluard yesterday.

He wonders if the inverted spreads are actually acting in an inverse way, where short term rates are stimulating economic growth.

I’ve got a weird old chart I watch, called Dr X Bubble detector and there’s a ungodly disconnect between equity valuation and inverted yields.

It’s as if, the short term yields are helping fuel p/e expansion — and obviously, the AI bubble is benefitting from short term yields being higher for longer.

Housing market seems both insulated and resilient and able to ignore rates, but that’s never made sense with typical incomes and wages.

Maybe those short term yields are part of a generational transfer of wealth, and thus the wealth effect is being supercharged by short term yields and stocks, and excess cash is being diverted into some demographic black hole?

Anyway, Vincent doesn’t see a recession anytime soon, but sees more problems if the 10 year heads towards 5%.

Sorry to ramble…

It must be tough to be trying to regulate monetary policy with fiscal policy aka spending/deficits at these levels.

A funny thing in the UK: the opposition and maybe journos have asked: why does the BoC always give the gov exactly the money it asks for. The BoC is supposed to be independent of gov.

The imaginary parallel in the US would be the Fed refusing to create the money to cover the deficit, lol. Before Germany got into the euro and the ECB, I think it was something like this.

I was trying to find the piece again today: if anyone wants to read it here is the title:

Did You Spot The Gorilla In The Fed’s Meeting Room?

The Capitalist way is “boom and bust;” the Socialist way is planning with steady growth and improvement.

It is apparently a matter of personal taste for the government of each type of society.

Gary-

Is it the “personal taste of the government,” or the personal taste of “the governed” that determines the form of government?

See Happy1 question below…

While most people think McCarthyism is over it is alive and well. Besides of course the history as well as tearing down organizations they continue to monitor. If you simply have a podcast or YouTube channel you will likely get a personal visit and have a thick file, which theoretically you can request legally but they won’t share with you because of ‘national security’s. Given I frequent those channels, podcasts and subscribe to Jacobin I am likely noted somewhere but not considered a ‘threat’. Communism is not a dangerous idea except that is a threat to capitalism. We have communism to thank for defeating the fascists. I can easily point to historical US instances such as putting Pinochet in power and supporting death squads and thousands of other imperialistic actions but the point is to comprehend Marxism outside of the red scare propaganda. Most people that criticize it haven’t read any Marx or Engels.

To be clear. There are not any communist countries on earth today. What we refer to as communist are just dictatorships and nothing else.

There are socialist countries today such as we see in Scandanavia and the folks there like it and are happy.

There aren’t any democracies on earth today either. Only Corporatocracies exist where there are not dictatorships and in many cases, it’s hard to tell the difference.

Louie,

You are making up your own definitions and likely based on a lifetime of propaganda which of course I was subject to.

There are indeed no communist countries but countries that have communist parties with the country in the stage between capitalism and communism.

The Scandinavian countries are not true left countries but of course provide a better standard of living and equity, which is one of the main goals of Marxism. With an understanding of history it is easy to see why they have made those concessions to labor but of course concessions can always be taken away.

A single party doesn’t imply dictatorship but provides democracy while having a solid ability to do long term planning which leads to stability. There is if course no utopia but Chinas record of eliminating extreme poverty and industrializing rapidly speaks for itself. Even the recognition that the cultural revolution of eliminating western influence was flawed and Deng Xiaoping recognizing that material conditions required embracing it was crucial, starting with countryside education for all regardless of class. China is a fascinating study but of course it is important that Marx developed his theories assuming a country was already industrialized. Achieving his noble goals in a country as wealthy as ours would be simple, and at one point it was successful here and in Europe until defeated by those who controlled the wealth. Olaf Palmer of Sweden was a good example of this. There are numerous well researched books on all these subjects.

For me its the feudalist/monarchist way. Slowly cultivating rich multigenerational familial histories and funding public places of worship that take centuries to complete while riding around on horses.

I would be king of course so this system is clearly ideal.

Howdy Comrades Best way to be Free is NO Personal Debt. Hold Real Estate in an LLC if you really want a home. Mortgage it to the max and walk away if trouble arrises. My experience with a high level Tea Party Organization was eye opening about Govern ments. My real name is not Bubba for instance. I really like the Lone Wolf but somebody else could be watching too. HEE HEE Find your Freedom where ever you live. It is out there.

Well, “debt free budda” then. Thought that might be you sitting next to me here at the sunshine mental home. Any thoughts on the German housing market.

Howdy Home Toad While actually sitting up in the mountains out west, my German Crystal Ball shows the same as the US. My post earlier was monkey see monkey do. Again in case some missed it, the entire world, locked down their economies, Zirped to stupidty, QEed, printed and spent. I don t think they will end up any different than US……

Don’t you have it backwards?

Central planning creates bubbles because there is no price discovery to match supply with demand. Gaps form that suddenly close all at once via boom/bust or societal upheaval. It is common sense, really.

Market-Based economies will suffer the same fate if monopolies/oligopolies aren’t limited and money is allowed to pervade politics. Also, special consideration must be given to minorities because they don’t have sufficient votes to defend themselves. One minority class getting screwed right now is the renter group. Monetary policy has repressed that group with extreme asset inflation and CPI inflation.

Bobber – recall my 12th-grade Poli-sci class back in the ’60’s, a major component being questions about the Constitution’s ‘job’ of balancing ‘the will of the majority’ and ‘the rights of a minority’. By course end, we generally agreed the job was noble, but the execution problematic-and ongoing (…much like the Founders…).

may we all find a better day.

Debt free bubba

“At least here you an talk and type like a comrade” yes.

Ha ha “steady growth and improvement”, do you mean like Cuba and Venezuela or like the former Soviet Union?

It seems like he forgot to complete the sentence.

“the Socialist way is planning with steady growth and improvement….”

…of the money supply, followed by rapid growth of the money supply due to the scheme collapsing, followed quickly by the collapse of the entire economy.

Germany became dependent upon russian fuel, and they are learning a hard lesson.

Germany and the rest of Europe has always depended on off-continent oil and gas to fill the. energy needs that coal didn’t. Shell, ENI, Total were worldwide energy exploration companies decades ago. And West Germany did plenty of business with the Soviet Union. That saying, something to the effect that if goods don’t cross borders, armies will, is true. If you are making a profit dealing with a militarily comparable country and if the scale doesn’t tip radically one way or the other for political or technological reasons, it doesn’t matter what they espouse as dogma. Berlin may not prudently trust Moscow, but they would be ill-advised to trust Brussels or Washington DC either. None of the above has their back.

Every house I ever lived in in the United States as a kid has worn out and been demolished for more money than it cost to build. Every house I lived in as an adolescent in Germany is still there, largely unchanged. They are usually of masonry construction, built solidly and feel like it. Watch a stick-built 1950’s ranch style house in North Dallas go under the trackhoe and into the dump truck in thirty minutes. And they were well built for the time.

if I was “investing” in a house I’d look at Erfurt or Jena or Leipzig, the east is a better deal. Don’t know how anyone can afford anything around Munich these days

That chart at the end of the article was very well done.

In terms of your dissing wood buildings: German buildings where the structural parts are brick or stone would collapse in an earthquake of the types we have in many parts of the US. Wood is an excellent construction material, far stronger than brick or stone. Only steel is stronger. Brick is the worst (brick buildings in earthquake zones are either retrofitted with wood and steel or the brick is just a facade to look pretty and the structural parts are wood and/or steel.

BTW, last October I went back to my old neighborhood in Nuremberg where I lived when I was a kid, first trip back in decades. I looked at the grade school I’d gone to and walked around the area. The whole area had completely changed. All the old houses that still existed at the time had been torn down and had been replaced by multi-story apartment buildings. The old multi-story apartment buildings that existed when I was there still stood. But all the low stuff was gone. It’s called urban renewal.

wee correction, and thanks for the wood comment, Wolf.

“Wood is very strong. A comparison with steel and concrete shows that structural timber has a strength to weight ratio 20 per cent higher than structural steel and four to five times higher than non reinforced concrete in compression.”

Each material has its best best uses, but wood can now used in buildings to 12 stories….in Canada.

I have carpenter friends who spent 2 + years in Kobe rebuilding housing after the 95 quake. Used Canadian designs as wood flexes in shaking.

I do a lot of timber frame work using yellow cedar (cyprus) which is known as temple wood in Japan. They buy up the best stuff we cut and mill here on Vancouver Island. Coincidentally, just picked up some 18 footers yesterday from my buddy who has a mill. Working on another project.

Didn’t the Germans invent fachwerk buildings centuries ago to overcome the structural limitations of brick and loam?

The oldest continually inhabited buildings in the world are wooden. They are in Japan.

…with respect to former Axis powers, given the amount of incendiary bombing they ultimately became subject to, it speaks well of the wooden structures that survived (in non-bombed areas, of course)…

may we all find a better day.

It’s done.

In our press it is written that the fall in housing prices in Germany is only 8 percent.

That’s why I read ”Wolfstreet”

That’s year-over-year, not from peak. The decline started nearly two years ago. Destatis releases the actual data and everyone can download it; but in the press release, it doesn’t do the “from-the-peak” % change math. It spoon-feeds reporters the YoY and QoQ percent changes. The rest you have to figure yourself by downloading the data and figuring the from-peak percent changes. It’s not rocket science, to be honest. But reporters, with their degrees in journalism, are completely overwhelmed by basic math. That’s a problem everywhere. That’s why financial reporting can be so crappy.

“overwhelmed by basic math” LOL — the case for most liberal arts majors (and many medics!). The last time they used more than two of the four basic arithmetic operations was probably in high school.

In my experience numerical illiteracy is widespread — ask a random average person to do a percentage change or a rule-of three calculation. They will fail spectacularly in the majority of cases.

I understand all that

I meant that the media is deliberately presenting the information in such a way as to downplay the facts and keep FOMO in the masses

Yes, that too, always everywhere when it comes to real estate.

Could you make an analysis for Portugal? Prices are up 60% in the last 5 years

I’m also interested in a similar Portugal analysis.

Maybe I should do a series on the “Most Splendid Housing Bubbles in the EU” to complement my US and Canada “Most Splendid” series. Eurostat has country-level data I could use, but not city-level data as far as I can tell. Obviously, I cannot do all EU countries, there are way too many. But I could do the biggest 15 or so. If enough people read it, I might do it.

The Nordic countries were a clear bubble – Finland wasn’t that much affected, but Stockholm and Copenhagen was priced almost as high as Oslo, no matter how many new apartments they kept building.

In Portugal everybody blamed American expats for gigantic house prices – now the political left that attracted them with golden visas is gone, but the affluent Americans are hardly in a hurry to sell their newly acquired villas.

In Spain only the Northern part of the country (primarily Barcelona) is affected, otherwise the Spanish housing market crashed so big in 2008 that there was no trust in the system for a new nationwide bubble to form.

Swiss housing market is mainly an asset-dump for the rich: if you’ve earned a few million in commodity trading or other business that is run through typically a Swiss shell entity your investment advisor will likely recommend you to put your francs into real estate as Swiss banking privacy is just not that good anymore. Some parts of Geneva and Zürich approach the cost level of Monaco because of this, but otherwise the situation is not that horrible for the typical budget-flats that the Swiss prefer (besides, mortgages are a thing that the Swiss do so much better than the US right after private healthcare and firearms licenses).

Even Eastern European countries such as Poland, Romania or Czechia have a major real estate affordability issue relative to local wealth levels – they’ve been hit much harder by inflation, so home prices there kept climbing even in past years, while real incomes remained flat.

The British Isles is also another wild story, the Irish got pretty mad about it, but their situation could be easing.

Germany you already covered pretty well – all I’d add is that S&P has a construction PMI and the sentiment for new residential projects is much worse than manufacturing PMI at the beginning of the pandemic. Okay – any business questionnaire about Germany should be taken with a grain of salt as the Germans are known to be extremely pessimistic and negative about anything and that doomer bias should be accounted for, but the first wave of bankruptcies are hitting the sector already from small tradesmen to construction giants.

Now the ECB is in a bit of a trap though: if they’d adjust the interest rate too early some Southern European countries that are performing fine even at high interest rates wouldn’t really like it and could see inflation returning. And the risk in that is not just another real estate craze, but that those countries will turn increasingly Euroskeptical and could (in theory) return to monetary independence by reinstating the lira, drachma or peso.

Wolf, please do it, it will be super interesting!

Prof. Emeritus,

Will add Bulgaria.

In the capital Sofia there are about 700k units of which 240k are empty, neither for rent nor for sale.

Property taxes are extremely low and this allows people to “collect” properties.

At the same time, construction is booming, every square meter is being built.

The population of the capital decreased by 20 thousand people. In the next 2-3 years, 5 million square meters are to come on the market.

The prices are ridiculous, on average around 1,800 euros per m2, but there are also offers for 7,000 euros per m2.

The minimum salary is 450 euros/monthly. The average salary, which is a highly distorted concept, is 1,500 euros before taxes. The most common salary is 800-900 euros before taxes.

There is no immigration in Bulgaria, the Afghans and Syrians hide in the trucks where they often die of suffocation, but they don’t want to stay here. Their final destination is Western Europe

However, the deals started to decrease and this is already the second year.

The media keeps scaring people that prices will continue to rise.

If in the USA and Canada prices have risen by 50-60 percent in the last 2-3 years, here they have risen from 100 to 300 percent in the same period.

Wolf, I’d read it. I look in the windows at all the real estate places in countries I’ve visited (6 so far this year). And I look online. I’m seriously thinking about a place in the EU as a second home.

My experience with Portugal is that it did get expensive, but while there was a good representation of Americans the main property buyers where Chinese and British, both of who had very different reasons for tapering off over the past couple years.

Southern Spain is almost the same, along the coast, but inland in both of those countries is a lot like rural Italy, where nobody lives because there’s no jobs. You can buy a place, but getting anything done is a major fight with the local gov’t , lack of skilled labor, and a general disinterest in helping anyone who isn’t of the same nationality. A lack of language skills on the part of many wanna be expats doesn’t help.

I’m in no rush, my job pays for my current residence, and if I retire I don’t care too much for the tourist trade; so that provides options.

Long time reader from the EU here, please include Poland.

What about adding HH income to the charts? In Canada the disconnect between HH incomes in those metro areas and RE prices is absolutely staggering.

Historical affordability is 2x-4x HH income. Vancouver and TO are at 9x+. Lunacy.

And still people are buying (though at lower highs and lower lows for the last two years).

As always, love your work W.

KFC – it is always helpful to be aware of the ‘fng’ attitudes and effects you’ll surely encounter whenever, and wherever, you up-stakes to move …

may we all find a better day.

K_G_C – apologies, auto-whatever strikes again. (…now, off to re-explain our common spring hydraulics to my neighbor whose tank feed appears to have been broken by a falling oak branch in our last big storm…).

may we all find a better day.

DM: Inside Austin’s housing boom and bust: Texan city was the poster child for America’s thriving Sunbelt during the ‘pandemic’ – but as average prices tumble $150K, experts warn properties are now 35% OVERVALUED

Its sunny climate, expansive state parks and relative affordability attracted an influx of buyers during the pandemic. But after two years of rapid price growth, it appears Austin’s housing bubble is finally about to burst. Properties in the Texan city are typically selling for $525,750 now having declined almost $150,000 from their peak in May 2022, according to figures from Redfin. It marks an astonishing u-turn in demand across Austin which was seen as the epitome of the Sunbelt’s pandemic real estate boom. The region proved especially popular with well-paid tech workers, who were left unshackled from their San Francisco offices by lockdown. But a sudden slowdown in jobs and population growth – preceded by a period of overbuilding – have caused both prices and rents to plummet.

“…it appears Austin’s housing bubble is finally about to burst…”

About to burst? That’s like sh$tting your pants and then saying you might need to use the restroom.

My sister lived in Austin for a while. Austin is basically Exhibit A as to what happens when you have uncontrolled development with absolutely zero consideration for infrastructure.

In a lot of ways, it’s now as bad as LA, in terms of traffic, crime, homeless, and so forth.

I have a completely different view. I have visited Austin frequently over the last 12 years. Though it has grown quickly and the real estate prices are out of whack and there is a homeless population, it is still a nice small city where traffic is manageable and crime is not a huge issue. Yes, there are some shootings in the downtown bar areas late nights but those are par for the course where drinking and guns are part of the mix.

Howdy Real Estate Enthusiasts. We have such a long way to go still. Disco was not born over night either. Took years of crazy for that to happen too.

Bubba, you are on a roll! LOL!!

Howdy Anthony A. Learning can be fun. Wish I had figured that out in High School because that is as far as I got. What the FED does this time is really important to me. Learning here is a blast. Other posters comment personal experiences, YEP, lets have a little fun?????

Great to see all your comments DFB. I love the agitation some others get from seeing you ‘post too much’ HEE HEE

Late in the game but I understood real communism was based on giving all you can and taking only what you need. Good luck with that now. Just watch the apes in the zoo. Or is it the cages that cause such behavior? Greatest “blog” on the web Wolf. Thanks

@Mike Smith: So you’re saying that human beings have not significantly evolved more than apes. I think you’re right.

Sean, a Tom Waits quote: “We are all just monkeys with money and guns.” Sadly, I must concur!

Dear Wolf,

it will be great if you can make some research on the housing bubble in Eastern Europe and Bulgaria, for example. That country is in currency peg with the euro, but the ECB interest rates has no effect on the commercial banks mortgage loan interest rates in Bulgaria. In fact, the mortgage interest rates in Bulgaria are the lowest in Europe – 2,00% – 2,5%, despite the fact, that Bulgaria is the poorest country in the EU and therefore the risk is the highest.

The most ridiculous thing is that the country itself – Bulgaria finance itself on 5%-5,5% (when it issues government bonds) from the international market, but the commercial bulgarian banks give mortgage loans on “the regular Joe” from Bulgaria on 2-2,5% interest rate.

How and when does this idiocy ends?

These interest rates you are talking about are without GPR.

With APR, the lowest interest rate is 2.9 percent, and this does not include the mandatory life insurance.

Together with it, the lowest interest rate is over 3 pr.

However, this is a “floating” monthly rate that can change every month.

A property is paid off for 10, 20, 30 years.

In my opinion, the poor financial education of the people in Bulgaria combined with the risk of buying a property with a “floating” interest on the mortgage and without any buffer set aside in the bank is something of the kind of gambling on Bitcoin.

We had the film “Debasememt” in 2009.

The sequel is highly anticipated, apparently a new twist, but we’re still watching the adverts and eating our popcorn.

What will they pull out of the bag this time?

They won’t do the same thing again. By definition the majority have to lose, not win.

I watch land prices in the US more than house prices, because the bubble is in the land, not the actual structure. The land speculation continues as I am watching building lots disappear, and still at prices 8x-10x what is normal.

The fact of the matter is that raging inflation is still prompting people to buy hard assets. And the new narrative is that the FED’s target is no longer 2%, but something much higher. They must be fine with this psychology, because they do nothing to stop it.

Howdy Depth Charge. Yes, exactly the plan or the psycho logy. The next Bubble will be New Residential Real Estate Construction.

FWIW Leipzig (625K) has almost the same population as Stuttgart (632K) and should be included in any “biggest metros” list.

You’re talking about cities. This is about metropolitan areas.

Lucky ECB sound monetary policy and 2% Core inflation they will be able to lower interest rates June. USA High Inflation $34 Trillion Debt. If The Federal Reserve Lowers interest rates the US Dollar will turn into a Peso. Due to our higher inflation US prices will remain high. All my most not so humble opinion.

Services inflation in the Eurozone remains very high, hasn’t dropped in about five months, and on a monthly basis started ticking up further.

So the ECB’s rate cuts maybe one-and-done.

Hard assets…yep.

Even if I can’t afford land, I can buy high quality tools, firearms and liquor. At least they have utility! Farm animals would probably also qualify, but you need land for them.

Donating to 501.c.3 is also meaningful.

That was supposed to be a comment to DC above…

Just here in the UK the prices are going nowhere down despite the highest interest rate