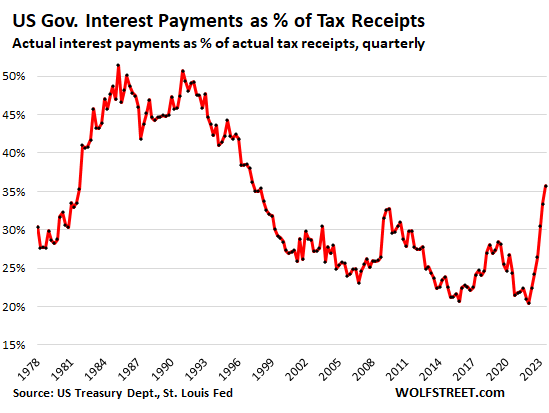

Interest payments threatening to eat up half the tax receipts may be the only disciplinary force left to deal with Congress.

By Wolf Richter for WOLF STREET.

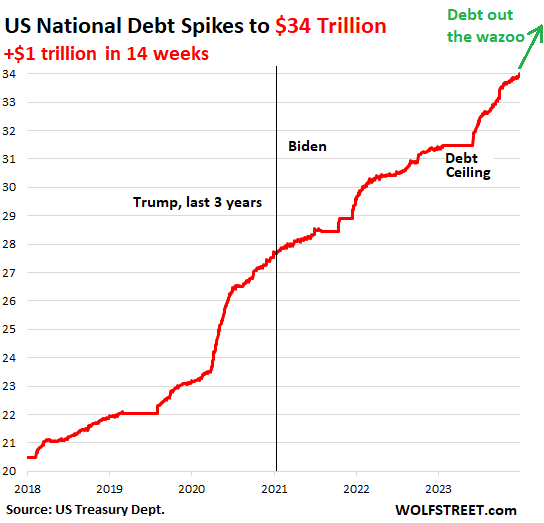

The total US national debt spiked by $1.0 trillion in 15 weeks since September 15, to $34.0 trillion, according to the Treasury Department’s figures this afternoon. In the seven months since the debt ceiling was lifted, the national debt spiked by $2.5 trillion.

These are huge gigantic numbers that are piling up as a result of the incredible hard-to-fathom daredevil reckless shake-your-head deficit spending by Congress. Congratulations, America! We made it, $34 trillion!

Since the beginning of 2016, the total debt has spiked by $15 trillion, or by 80%! This stuff is just breathtaking.

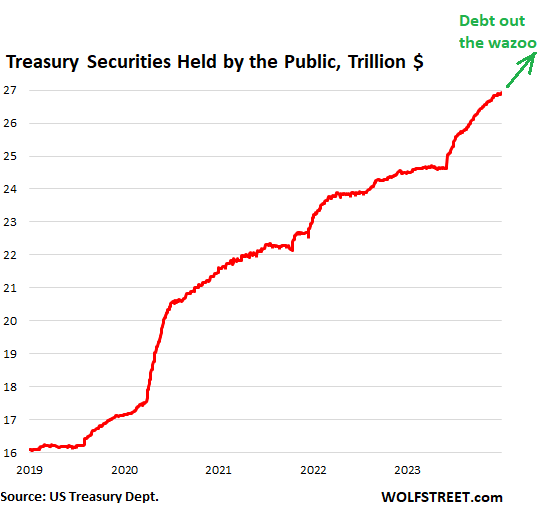

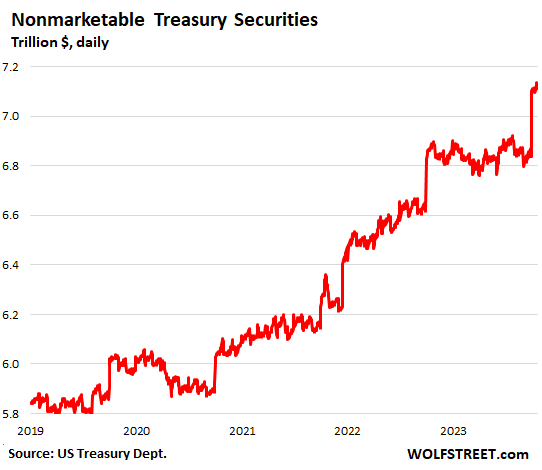

The total debt of $34 trillion is composed of two types of securities: $26.9 trillion in marketable securities that are traded in the Treasury market and held by investors around the world; and $7.1 trillion of nonmarketable securities that are held by US government pension funds, the Social Security Trust Fund (my discussion of the Trust Fund, income, outgo, and deficit in fiscal 2023), and individual investors with “I bonds” and “EE savings bonds.”

Marketable securities: $26.9 trillion, up by $2.24 trillion in the seven months since the debt ceiling. They’re held and traded by the global public, from regular folks diving into T-bills to money market funds, bond funds, banks – oh lordy – insurance companies, other financial and nonfinancial outfits, including Apple and central banks.

The Fed’s holdings of Treasury securities are now down to $4.8 trillion, after having unloaded about $1 trillion of them under QT.

Foreign investors are holding on to what they have had in dollar-terms, about $7.6 trillion. But the mix of countries is changing, with China and a few others unloading, while the big financial centers and a few other countries are loading up. But their share of the incredibly ballooning debt has plunged from over 32% in 2015 to just 22% now.

Nonmarketable Treasury securities: $7.1 trillion, up by $300 billion in the seven months since the debt ceiling. They’re not traded in the market; they’re held by US government pension funds, the Social Security Trust Fund, etc. A portion of these nonmarketable securities are the I-bonds and EE savings bonds that are held by American individual investors.

Interest payments as percent of tax receipts is the crucial metric that depicts the burden of this debt. In other words, to what extent do interest payments eat up tax receipts, and what’s left to pay for other stuff?

The measure of tax receipts used in the metric is total tax receipts minus contributions to social insurance and some other factors. It’s what’s available to pay for regular government expenditures, including interest expense. The ratio of interest payments to tax receipts spiked to 35.7% in Q3.

History shows that when interest payments eat up close to half of the tax receipts, the rest of the world gets very nervous about the US debt, and then finally Congress gets more serious about dealing with this issue, but not until then.

Ultimately, interest payments threatening to eat up everything else appear to be the only disciplinary force left that is able to pressure Congress to do something beyond grandstanding, but obviously not yet.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I will cut rates to 0% soon. If you need confirmation, ask any real estate agent you come across.

He will tell you that the spring season will be a blast with 10% gains as I will reduce rates to 0% and mortgage rates will fall to 3%.

So no need to worry about interest rates.

J Pow for President!!!

If the US ever got into trouble, the Fed can always introduce another scheme to bail the country out, something like America Term Funding Program (ATFP). No worries whatsoever. And if the Fed gets into trouble? Then Congress can authorize the Fed Term Funding Program (FTFP).

Ponzi scheme you said? Nah, I call that clever financial engineering.

I know that was sarcastic, but there is truth in what you said, to a point. It’s not really a Ponzi scheme if interest payments as a % of tax receipts remains below 33% or so.

However, we are reaching that inflection point when the FED can no longer bail out Congress, and that’s a real concern.

With higher wages we get higher tax revenue, but we get more inflation and then higher interest rates.

With a recession, we can lower interest rates, but then we have less tax revenue.

We gonna be fresh out of chicanery…

The party ends when it becomes absolutely obvious inflation won’t be anywhere near 2% in the future, which causes momentum to reverse course. Lots of market participants know the end game is ahead, but they want to see the last gasp of the bull market before selling. Nobody in the investment industry wants to be an outlier.

the cause of “inflation” is not higher wages.

They’ll also tell you every 4 walls Is worth a $ million.

Real estate agents aren’t mathmeticians, easy license, any high school graduate or GED holder can be one

As a matter of fact, in a lot of places 4 walls are worth more than a million dollars.

Your solution is to keep renting, I suppose and just watch those walls get further and further away from being owned by you.

Not because those walls are any better than they were in the 80s when they were put up, but because your dollars are being devalued rapidly by trillions of debt. Eventually either the dollars become worthless or explosive asset deflation bankrupts many. It has happened in many places at many times and this is no different.

You really own nothing in the end…

It’s all rented…

If you know of a way to take it with you when you go…

Let us know.

It’s called irrational exuberance, happens every real estate cycle. Thanks for participating, as those in 2007 did.

Nothing goes up forever. Especially when the $$ printing press stops.

40% increase in the money supply artificially blows up all asset prices, leverage increases it further….

What to do when those 4 walls collapse? Can’t eat em, and taxes & insurance never deflate

owning the 4 walls is highly overrated. especially older ones – the maintenance costs alone.

History reveals that during inflationary times two things monetize: real estate and stocks. So being invested in those two areas makes sense. As for Realtors– the barriers to entry in that business are minor. Go online; accumulate your hours; take the state and federal tests. Then there is no apprenticeship time period to actually learn the business. It is comical that people will trust the purchase or sale of arguably their highest value asset to a rookie; someone with no experience. My advice to people who are going to enter into a real estate transaction is to interview those you might work with; check references; do your due diligence. This advice comes from a 17 year REALTOR in Arizona. Good luck.

I’m not sure history reveals stocks are always a good investment during inflationary times. Stocks did pretty poorly in the 1970s and bottomed in 1982, just as inflation was getting under control. The stock bull market came after inflation came down. I have no idea what the future holds for stocks or inflation, but the idea stocks are an inflation hedge is at least uncertain.

EXACTLY correct c peace!

Have had many RE transactions over the last 50 years or so, and after interviews with both ”buyer’s agents” and ”seller’s agents” have gone with the more experienced.

AT LEAST 5 years actually working full time is my suggestion to anyone who does not have an ongoing relationship already.

Have also made it known when buying that I would list with the buyer’s agent IF and only IF they did what I wanted.

IMHO, as in every representative biz, there are good folks and incompetent folks in RE biz,,, so be aware and pay attention to every clue.

There are no educational requirements of any kind for a real estate license in most states. And they want to call it a “Profession”?

No need to use a realtor. My last few real-estate transactions dealt with individuals directly (attorney & title company).

Yeah go for it….these debt numbers are so large it kind of become meaningless…it’s like saying how far Milky Way is or telling me the Millennium Falcon can do in Kassel run in 12 parsecs…

If more debt equals to homeowners continue to get a hard on seeing their houses rocket up more in value in Zillow or their stock/crypto to go up, I am sure they are all going to say go for it…34T to 40T is only couple of digits away..

34T to 40T is only 17% increase which is nothing in a strange way, this means that if they can cut back to only increasing the debt by 1T a year nobody will even notice since that would be less than 3% year. At this point they grew the debt so fast and so large and mostly survived a Trillion here or there wont make a difference, it is meaningless. Once day it might when population growth stops or some other factor not considered comes along.

rising tide raises all boats, doesn’t it? real estate paper equity vs. selling it and cashing out.. where else you going to buy

And, it will be $35T by the end of March. No end in sight. Oh, and we reached $34T five years early compared to what the CBO predicted around 2020.

No one in Washington seems to care.

Excellent! My commodities portfolio will love it!

Thanks Jay, you shcmuck!

“no need to worry about interest rates” UNLESS you are one of the responsible people that saved all their lives in anticipation of getting

interest on their savings for retirement. The responsible savers have been screwed by the Fed for the last 15 years (exclusive of the last 18 months)

Do away with the FED like the new president of Argentina is doing to his central bank and let there be a unmanipulated balance between savers and spenders relating to interest rates.

Time will tell if he actually does away with the central bank, which in Argentina is part of the Ministry of Finance, or if he will create an “independent” central bank or if he will succeed in dollarizing the country (which would effectively do away with the central bank). He’s got to get the National Congreso to go along with this stuff, and he doesn’t have a majority there. For a screwed-up situation like Argentina, any cure is going to be very tough.

Great idea! We get to vote later this year and we’ll have a choice between Tweedle Dum who sez “print” and Tweedle Dee who sez “print and print and print some more.” Stonks and housing will enjoy huge and edifying increases as we tilt the table away from younger people.

Not for sure bd!

This may turn out to be the election, finally, in which an actual legitimate ”3rd party” candidate will prevail.

Looking very possible at this point in time IMO.

As an always voter and always registered NPA since 1968 election, I will absolutely vote independent of duopoly if given the chance, and I suspect many many folks will also.

“Machines” DO break down sometimes, eh?

There is ZERO possibility of a 3rd party candidate winning the 2024 presidential election. Or are you assuming that Biden and Trump will both be dead before November??

Lier, lier pants on fire.

“ask any real estate agent you come across”

Just today I heard that int rates & insurance will becoming down soon from a RE agent in FL!

Now is a great time to buy! /s

Après moi, le déluge.

– US Congress

Le loi, c’est moi.

-White House

all I have seen for decades is SPEND SPEND SPEND

with absolutely NO INTENTION on paying back

and FED will due CONgress bidding by making fiat $dollar

WORTHLESS

IMHO – this is called conspiracy to defraud

Really? Precious metals and crypto tanked today on the strength of the almighty US dollar. So much for the death of fiat!

Federal debt equal to 100% of GDP doesn’t seem too onerous on its own. On average, it’s a year’s worth of salary (or profits for a business owner). When you add in mortgage debt, student loans, corporate debt, unfunded pension liabilities, and unfunded Medicare and Social Security, things start looking hopeless, particularly for people who are getting mortgages equal to 5x their income. All that debt has to be serviced by today’s citizens and in some cases repaid.

Not today’s citizens. The debt can will be kicked down the road and our children and grand children will get stuck with it.

As boasted by the economist Keynes

Even Keynes said back off stimulus when not needed.

We’re stuck with the debt Reagan created. Look at Wolf’s last chart. Reagan put is in a far higher interest payment to receipts situation than we are today. And many would argue that created an economic miracle.

BS. Congress writes the budget, not the President. Congress was run by democrats the entire time Reagan was in office.

Reagan was a spendaholic. Who could forget the Star Wars defense?

“We’re stuck with the debt Reagan created.”

We’re also stuck with the debt FDR created.

Stockman explained it all when he quit because he couldn’t actually starve the beast after the tax cuts.

Reagan “created” maybe ~$2T in debt over 8 years (actually congress created it). We are stuck with that debt, but it doesn’t even equate to a 15th of our current $34T national debt which was created by lots of different (D)s and (R)s over the years.

Congress farts out a trillion dollars of debt in 15 weeks these days, so the bit that Reagan “created” is only going to become an ever-shrinking blip compared to the whole. We have devalued our currency and we will continue to because that’s the usual arc of an empire. There is a 0% chance we will ever pay back that $34T, so there’s a 100% chance we will continue to devalue the dollar. Example: WW2 bloated our deficit to 258 billion. That’s chump change here in 2024 – there are individual people worth more than that now! But that’s how inflation works to “pay back” debt, as if by magic. Our dollar will be worth less next year and less the year after that regardless of who is President.

Ancient history. If all the morons after Reagan hadn’t spent taxpayers money on endless wars, free handouts, and their “special projects” all this could have been paid off

But both parties love to rob from Peter to pay Paul.

George W Bush signed a one trillion dollar budget deficit bill from the Democrat controlled House in his last year. To me that was the beginning.

I believe the House comes up with a budget, but so does the President. They then “hash it out”.

But lets not forget the money supply….

which, measured by M2, was 7.5 Trillion in 2007, then 21.5 in 2021….nearly tripling. In 2018 14 Trillion, in 2021 21 Trillion. So in 3 years, the money supply increased by what was once the entire float in 2007.

Speaking as one of the “children,” we’re not paying back this debt. The debt is uncollectible

Stockman explained it all when he quit because he couldn’t actually starve the beast after the tax cuts.

Russia paid off the last of the USSR legacy foreign debt by 2006 about 26 years after the collapse. Surely the very prosperous USSA could do the same, if similarly motivated. Its only $100,000 per person that’s pocket lint in todays dollars.

Nothing like a good war to clear the debt load.

Winner takes all and pays nothing back.

Not disagreeing with any of your points, but to be exact, the St. Louis FED website put debt to GDP at 120% at the end of Q3, but holding steady over the last couple years. The peak was 133% in Q2 2020, but I’m guessing there were GDP distortions during the lockdowns.

Look at the percentage of riders vs. horses in the GDP and think again.

Government is DeadWeight – produces nothing, only consumes tax dollars and debt. The U.S. maybe has 11% manufacturing and of that a lot is assembly of parts from China and Mexico.

Past performance is no guarantee of future survival.

Notice that when the boomers emerged into their heavy spending and earning years 1992 thru 2008 the ratio dropped substantially.

The millennials are just about to do the same. They are the largest generation in history.

Also the peak of social security applications is right about now. Peak boomers were born in 1960……64 years ago. So each year hence fewer SS applications and the front edge (born in 46) starts to die like flies in about another 5 years……..as an older boomer……bzzzzzz…… the issue is immigration because our folks don’t like to have children. We need more immigration……legally.

A trillion here, a trillion there. Pretty soon we’re talking real money.

One would expect US Congress and US President to act fiscally responsible and rein in the spending. But that seems like fantasy or dream. The country which create the currency in which debt is issued, they can print that currency and repay. I know it may not be that simple or straightforward. But concept is same. FED has authority to create money. But isn’t that what FED has been doing for last 10-15 years?

If FED drops the rate again to 0% then those interest expenses will come down and Us Govt is back in Business. We can act as if all under control.

We know this time Inflation is very high and FED will not be able to drop the rates again without sacrificing inflation mandate. Question is will this FED have spine and stand up to US Congress? That’s $34T question to me.

As long as there are suckers who are buying long term US treasuries at such low rates, US will keep issuing debts. Isn’t it? When will all those Countries and Investors will become wise and ask for higher rates?

“FED has authority to create money. But isn’t that what FED has been doing for last 10-15 years?”. Until March 19, 1968, the Fed was required to hold a 25% gold backing for the currency it created. Good ole LBJ cancelled that to fund the Vietnam War and the Great Society. From there. it was off to the races.

Real interest solves all problems. Thanks, Jay!

inflation is the answer

Biden passed the Inflation Reduction Act… come on man!

Inflation pumping is monetary prostitution. The Fed is the pimp on probation. Speculators are the Johns. I guess that would make Wolf the snitch (Huggy Bear?).

That’s a Starskey and Hutch reference for youngens out there

The Bernanke system : raid bank accounts for deflating IOU to suppress

the long duration. That’s what the BOJ has been doing for decades.

The front end and RRP might decay. The long duration will be underneath them . US10Y might drop to zero, or below. Inflation might drop to minus

(-)2%, or worse. The EFFR might lag behind the falling 3M, trying to contain

them. Rates might drop below the inflation rate. The negative rates between 2008 and JP hikes might resume in 2024.

Wolf,

Could you please fact-check the claim that the BoJ has been raiding bank accounts for decades?

I think by ‘raiding bank accounts’ he means ‘interest rate suppression’ i.e. close to zero interest rates, which means any saving you have in the bank (a quaint historical practice) depreceates in real terms, especially when inflation picks up.

The banksters and the politicians have now got the tiger by the tail.

If the FED does nothing and holds steady, then the politicians get caught in a death spiral of trying to issue more debt to outrun the interest payment, all in the name of getting out of office before they have to start goring oxen.

If the FED tries to reduce Treasury interest payments by reducing interest paid on reserves to 0.25% to manipulate the short end, and engaging in QE to manipulate the long end, then they’ll definitely get an inflation resurgence.

At which point, it will be back to the first option.

We may have finally broken loose of the FED’s ideal Goldilocks scenario of the last 15 years: endless QE and federal government debt expansion without consequence.

If so, then the showdown between the banksters and the politicians will begin soon enough.

That seems logical, but they just monetized $8T of debt since 2009 and pushed inflation to 9% for a bit, and long rates are still around 4%. If they can get away with that, what else can they get away with? I’m sure that’s the question keeping Fed leaders up at night.

$34.x Trillion: Debt

$22.1 Trillion: The grand total for the Department of Defense budgets from 1945 to 2024, adjusted to constant 2024 dollars.

Source: Google Bard

What price freedom?

BS comment. You cannot compare an actual figure of debt ($34 trillion) to an inflation-adjusted spending figure expressed in 2024 dollars. Either both are adjusted or none are adjusted for inflation.

AI = artificial idiocy.

Also garbage in, garbage out.

Perhaps “our drunken sailors “ that defy convention with their spending are in reality in Washington DC.

And government spending is the reason the economy has surprised and defied the traditional warning signs from the Inverted Yield Curve, Leading Indicators, etc, etc.

$34 trillion is only $103,000 in debt for every one of the 330 million living humans in the US

Or a little over $4k/year in interest payments.

Kent-

Depending on the interest rate you assume.

CCCB,

It’s about $215,000 per household. That’s the better measure because toddlers don’t like to pay their debts.

But no problem. The median student loan debt is about $18,800, and student loans have to be forgiven because they’re too burdensome?

A lot of those humans don’t pay taxes for a variety of reasons. So how about per tax payer? Or per person making over poverty levels. Does that number exist?

About half of those humans filed a tax return and about half of the half of the humans paid federal income taxes.

Who earns the income? You can’t talk about tax burdens without also analyzing income levels, otherwise the info is skewed. Also, tax sheltered income such as unrealized gains is highly relevant as well.

Top 1% made about 22% of the income and paid about 42% of the taxes. Top 10% made about 50% of the income and paid about 74% of the taxes. The top 50% made about 90% of the income and paid about 98% of the taxes.

ChS,

How are you defining “income”? If you aren’t including unrealized gains, your figures offer a narrow picture.

For example, if Elon Musk and I each have $100k salary income, we’ll pay the same tax. The tax law doesn’t currently include his unrealized gains of $80 billion in his taxable income. When analyzing tax burdens, however, it’s clear Elon pays a drastically lower tax rate on his total income, if unrealized gains are included.

The tax law doesn’t do a great job tracking and taxing income in a broad sense. There are lots of well placed loopholes for the wealthy class, but people earning wage income are locked down tight with W-2 reporting.

It’s Federal Income Tax as defined by the IRS and which is theoretically the revenue available to the Federal Government to pay down the $215,000 per household.

Taxing unrealized capital gains doesn’t work unless you also provide tax credits for unrealized capital losses. That would mess and would be harmful to the economy. The gains are unrealized because they are being used in other parts of the economy, such as supporting jobs and innovation. Someone who experiences an unrealized capital gain doesn’t really posses the gain until they sell the asset. That gain could be gone tomorrow if the asset value crashes.

Wealth is already taxed in the US through property taxes, sales taxes, and capital gains. You may disagree with the rates of those various taxes, or which level of government collects them, but wealth is being taxed.

By the way, one of the ways that unrealized capital gains can be reduced is by ending double taxation of dividends. Generally, dividends are taxed both at the corporate level and by individuals receiving the dividends. This encourages corporations to retain earnings, which get taxed as capital gains when stock is sold.

If corporations were not taxed on earnings distributed as dividends, more dividends would be distributed and individuals who own stock would receive more taxable income annually that is subject to federal income tax, at progressive income tax rates.

Don’t worry, we will not have to pay it back based on the past 100 years. LOL

CBO says the debt will hit $54 Trillion in 2033. But they are usually off by 10% when looking out 10 years. So it will be probably be at or above 60 trillion most likely.

Thus if this ends happening, be prepared for hard assets like houses real estate and land costing much more because it will take more devalued currency to buy the same thing in the future. The utilitarian value of your house stays the same. A place to live but it just takes more greenbacks to purchase the same value.

The time honored technique by governments in this situation is to inflate the debt away. My guess is that we will mostly see that but combined with some reduction in expenses and increase in taxes.

Unlikely that an economy that usually has a growth rate of around 2.5% p.a can naturally outgrow this level of debt.

The University of Pennsylvania Wharton Business School penned a brief in October regarding the Federal debt.

There will come a point “after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt whether explicitly or implicitly”.

Implicit default…easy to imagine it now.

Correct, and when goods and services stop crossing borders, troops will. Same as it ever was, eventually people need to get back to actually making and producing real things to exchange. We cannot all be retired, no matter how productive we once were. Physics and thermodynamics are a real b%#ch like that.

I remember reading that back in 1984 when Gramm-Rudman-Hollings was being debated.

Ture. At some point under the current budget projections, some economist I have followed have said we will reach a point where the Federal Reserve will just have to buy the excess government debt the public does not buy.

The government will not default on the debt. It has 220 trillion in assets.

/s They may have to sell Alaska to pay the debt at some point.

No defaulting of US debt by the govt. They will mint a $1T platinum coin at the Treasury and use it to pay debts. Just more devaluation of the dollar so those holding the debt get paid back in dollars that aren’t worth what they thought it would be when they bought the debt. Congress has legal authority to do that.

More than 100% seems normal now, here in the UK it is similarly pushing past 120% and rising, Japan is unmentionable. Stock markets collapsing, house prices falling, cars not selling, major job losses? Maybe a short blip at the most, particularly seeing it is election year for many.

The enabler behind this frightful growth in federal debt: the Fed.

“The power to issue money was essential for the finance of the government – not in order to give us good money, but to give to government access to the tap where it can draw the money it needs by manufacturing it.”

— F. A. Hayek (A Free Market Monetary System, lecture Nov. 11, 1977)

An unfortunate reality: if a power has the ability to produce money at will — it will. (Apologies to Murray Rothbard for the paraphrase)

I agree. The idiot Janet Yellen (one of the most disgusting and detestable women in America today) said we should “go big” during the stimulus bills because rates were low.

Well, why were rates low? Because of interest rate suppression. The Fed and Congress created a vicious cycle.

Is misogyny really necessary here?

Where’s the misogyny? He’s not wrong. Same could be said for men in similar position. Offense where none is warranted is not necessary either.

It sounded misogynous to me too, but then text can be tone deaf.

I do doubt Einhal would say the mirror about the biggest male idiots in America today.

Really? We are talking about a total collapse of our economy either all at once or gradually and you are worried about misogyny?

The cause is rampant corruption tolerated by the distracted and stoned masses.

Dear John H.

Love your article references to F.A Hayek.

If it isn’t too much trouble, could you recommend a few must read books on the works of Hayek?

Isn’t crypto an attempt to create private money? Granted that it is not useful for transactions given the latency and cost…but if that limitation was overcome and there was wider acceptance then wouldn’t it be private money?

His most famous work is The Road to Serfdom but the one I liked most was The Constitution of Liberty

“National and governmental affairs are, it is true, more important than all other practical questions of human conduct, since the social order furnishes the foundation for everything else, and it is possible for each individual to prosper in the pursuit of his ends only in a society propitious for their attainment.”

From ‘Liberalism In The Classical Tradition’ by Ludwig von Mises

Economic stability is a good thing to keep, I reckon.

Aman-

1. My favorite short piece of his is his Nobel prize acceptance speech entitled “Pretense of Knowledge,” and is brilliant and humble — two traits not always combined in the same individual. (Google Hayek + Nobel)

2. If your really wanting to dig into Hayek, start nibbling away at the Routledge Collection, starting with “Socialism and War,” “Good Money part 1,” and “Good Money part 2”

3. Bruce Caldwell, a professor at Duke, (who edited Socialism and War mentioned above) wrote a book about Hayek that I’m guessing is excellent, but I have not read it yet…

4. Of course, the unabridged “Road To Serfdom” is popular and worth reading (as Leonardo recommended)

5. Check out the website “Free To Choose” which has many lengthy interviews with a multitude of great economists (sometimes an oxymoron?). Several are with Hayek who was then pretty old, but extremely a sharp and able communicator. They are a real treat!

There you go.

Thank you so much for your response.

I find this site so useful. Believe it or not but 13 months ago I had zero understanding of money and banking and economics.

But through the posts of others and book recommendations (reading book a day….and after several books) I am now able to make a lot of sense and consider myself sufficiently knowledgable.

Truly grateful for the generosity.

Aman-

I would classify Bitcoin, as an example, as a “money experiment.” Market participants are voicing dissatisfactions with our current money system. Much of the dissatisfaction revolves around the ability of the banking system, headed by the Fed, to create or destroy currency at will, and thereby manipulate the public’s behaviors.

I’m definitely unqualified to say whether other crypto’s are money, but I’m pretty sure that there will be other experiments, and perhaps some that eclipse Bitcoin. That belief keeps me on the sidelines of the Bitcoin fracas.

Meh. All of the Austrians despised democracy, having lived through the nationalist revolutions which destroyed their precious AustroHungarian Empire after WWI. I would trust them as I would adders fanged …

A good start for getting a window on their thinking is Quinn Slobodian’s “Globalists”

eg-

“Austrians despised democracy…”

Apparently so much so that most of them, most notably Mises and Hayek, migrated to the U.S. in the mid-twentieth century.

Don’t worry. Everything will be just fine. I will always find some investors to buy my infinitely growing debt. In the worst case, uncle Jay will print another gazillion to buy my debt. It is not just me. Look at Japan, UK, EU (except Germany).

Fiscal discipline is a relic of past. Now is the time of infinite printing and spending. You just enjoy the party. Somebody else (your children) will pay the bill.

Well, in the simplest terms you have stuff and claims of ownership on stuff. Through the miracle of rehypothecation, we have built a game of musical chairs. The hope is you pretend to own it but never unilaterally liquidate it.

What people forget is all this is built on a rule base that is as flexible as water. What would you really do if the Uniparty actually converted all your “assets’ to government IOUs?

“That IOU is for a car. I’d hold onto that one.”

If your debt level is continually increasing, I think that this implies that you are using new debt to pay-off older debt – not really healthy.

Then you have the federal government, via the FED, buys it’s own debt – lends itself money.

Then you have the federal government, via the FED, sets the interest rate on the debt – by creating artificial (auto-) demand for the debt.

Then you have the federal government, via the FED, lending money for the purchase of government debt.

Then you have an economic system which is paying for goods in currency which must be used for the purchase of government debt. This flood of currency then dominates other markets/currencies.

It seems to me a danger signal when it is no longer desirable to invest in tangible assets, but rather in intangible items of which value is unlimited because it cannot be defined.

It seems to me that increasingly what holds the system together is faith in the system as it becomes increasingly intangible.

I am not sure I have it all and not sure I have it completely right – trying to get my head around this. Where is the limit?

The limit is real resources, including labor.

It’s not about the spreadsheets, it’s about the molecules …

Nice one. Yes, people forget clouds are made of molecules and not just bits.

So who will buy this excess of debt once all the reserve repo funds are gone?

This is scheduled for february-march.

Yield solves ALL demand problems. If there is no demand for a 10-year note being sold at auction at 4%, well then there will be lots of demand at 4.2%, and then a month later at the next sale, it might take 4.3% or 4.5%, etc. And as we have seen, demand explodes once the 10-year yield hits 5%:

https://wolfstreet.com/2023/10/23/spectacle-ensues-after-10-year-treasury-yield-pierces-5-huge-demand-piles-in-yield-plunges-19-basis-points-in-hours/

I was thinking short term yields,the ones that are fixed by the FED..

I suppose there would be pressure on these rates too,even if the country was in recession.

Can you imagine JP saying:well we need to raise rates despite the recession?

This is the problem with crazy government spending at this level;it creates recession AND inflation which is a vicious circle.

FED will need to find a way next february to absorb the new debt without rates skyrocketing.

June 1994 – Moody’s Investors Service lowers its rating on Canada’s foreign currency debt to Aa1 from Aaa, citing the government’s large and growing public debt.

January 1995 – A biting editorial in the Wall Street Journal headlined “Bankrupt Canada” calls Canada “an honorary member of the Third World,” lumping it in with Mexico and suggesting the International Monetary Fund might have to come to its aid.

( Canada’s debt to GDP in ’95 was about 60%… 😂)

In 1995, Quebec voters got to vote on the province’s separation from the rest of Canada. They voted against separation but only by a very small majority.

The longer things remain crazy the more normal they start to feel.

Pre 2000, high debts were considered very risky. But interest rate repression eliminated its ills and 24 years later no one really cares that much.

Perhaps society swings from one extreme to another often biased by recent past.

Aman – “…when the going gets weird, the weird turn pro…” -Hunter S. Thompson

Doesn’t seem to bother any sell side analyst on Wall Street. They all think the stonk mocket is going higher… “As long as you have a 5 year time horizon… stock always go up… price target higher… blah blah blah..”

The ballooning debt should be one of the biggest dangers to the market that almost nobody is talking about. Until maybe Moody’s or S&P downgrades it again…

It is the red swan that nobody will notice until it is too late.

I read alot of these comments and it is odd to me that no one seems truly, sincerely concerned where we are not only at but where we are HEADED. I read a post by “an economist” yesterday that stated we can just keep printing money.

Really? No side effects to that? Wow.

On today’s (1/3/24) “Morning Edition” on National Public Radio, the American public broadcaster, Senator Bernie Sanders’ economic advisor was interviewed and she said that we have nothing to worry about regarding the $34 trillion US National Debt because the US prints its own money and the government’s debt is denominated in US $.

It’s actually true what she said, in terms of a “default.” The US will not and cannot default on its debt, no matter what. Her idea was that the Fed can print money to buy that debt to avert a debt repayment crisis (default), and that is true, the Fed can.

But eventually INFLATION sets in, which eventually always happens. And now we have inflation. And the Fed’s buying more debt would stimulate inflation even further, and the US would follow Argentina, with 160% inflation, to where the local currency can no longer be used to borrow or price goods and services, and the economy gets into real long-term trouble.

It’s important to distinguish the two: There cannot be a debt default where the US cannot service it debts; but there can be horribly destructive inflation.

Wolf, what’s the likely end game?

1. Argentina/Weimar hyperinflation

2. Japanese style deflation

3. Just muddle through with moderately high inflation for long periods

This is why I should read all of the comments first – especially Wolf’s – before I comment myself (down the thread).

I believe we are going “Argentina,” or some such. Inflation is their chosen path, even hyperinflation. They have shown us.

And each of the two scenarios has a different set of victims with the damage from inflation being more widespread but a lot easier to deflect away by a multitude of excuses just as we have witnessed during the last 2 years.

Elites are more dependent than the rest of us. They need easy access to borrowed money to inflate their asset values. They need even more people to take care of them and their estate because they never learned any useful skills. They dislike hyperinflation as much as the rest of us. Just plain inflation suits them fine.

Dennis,

How can there be deflation like Japan? Japan has very high savings rate. Japan uses negative rate to avoid deflation.

US has very low savings rate US relies on other countries to siphon away the excessive money printing. Now other countries do not want to take the printed money. Fed has to take it. This creates a vicious cycle of hyperinflation.

Talking heads on TV don’t believe US dollar will lose its reserve currency status, hence money printing can last for foreseeable future. However, British pound was also reserve currency until it wasn’t. The rest of the world doesn’t need excessive dollar to facilitate trade. Alternative will be found.

Dr. Milton Friedman’s “reckless government spending causes inflation” theory coming to light about 40 years later.

Dr. Milton Friedman additionally argued that large government deficits are a contributor to inflation.

“Inflation started in Congress” a signboard from “The Freedom to Choose” once showed…

maybe a reverse split would help.

1) China is buying 90% of Iranian oil at a discount. The Hooties spiked

and China is paying the price.

2) China’s economic troubles are growing. The cost of shipping through

Cape of Good Hope is rising. Europe and the US evaluate the Chinese exports.

3) China’s proxies obey her 4 years after the Suleimani “event”. That is good news for the west.

4) Turkey is Europe and the ME industrial hub. The ASEAN nations export to the US is rising. US industrial hubs are growing. China is facing competition all over the world. Overcapacity will cure inflation.

ME

Much like oil. High prices cure high prices, just as low prices cures low prices.

Gluts on both sides and ends!

I’m about ready for the axe handles and hammer handles. I heard about during the Depression.

“Interest payments threatening to eat up half the tax receipts may be the only disciplinary force left to deal with Congress.”

Something needs to happen because congress won’t voluntarily rein in spending. It’s going to take something major for them to do their jobs.

We can throw some bones around and utter some incantations in the hope the bond vigilantes will come back from the dead.

This metric can be simply adjusted by raising taxes rather than paying down the debt.

I’m all for raising taxes …on other people. I think 110% would be about right.

The bottom line is that all of this $34 trillion in federal debt will need to be refinanced for the foreseeable future and will face increasingly higher interest rates as it becomes more difficult to attract money to finance it, not to mention that most all of is is being issued on a short term basis with terms of 10 years or much less and will need to be refinanced soon with more issuance of US Treasuries while it keep expanding.

Between now and the end of 2026, a grand total of $60 billion in bonds will mature, so effectively 0% in the grand scheme of things. Over the next year, cumulative interest payments on notes will likely go up a tad, while the fall in interest rates on bills over that period will likely offset the gains in interest payments. In other words, the most likely scenario points to interest payments on the national debt to stay roughly where they are currently at, over the next year, and likely over the next two years. The pressure from corporate interest rates are more likely to push up the overall rates, and thus treasury rates/payments, more than any funding problems on the national debt itself. My two cents.

“Between now and the end of 2026, a grand total of $60 billion in bonds will mature, so effectively 0% in the grand scheme of things.”

Are you talking about Apple’s bonds? If you’re talking about Treasury securities, you’re seriously off. Something like $8 TRILLION will mature between now and the end of 2026 and will have to be refinanced.

Or perhaps he read an article that differentiated between Bills, Notes and Bonds??

Either way, the implication that only 60 billion in US Treasuries mature is waaaay off…

Thanks for calling “BS” when you see it, Wolf!

In the 1990s, borrowing by the US government slowed so much (close to a balanced budget) that issuance of 30-year bonds was much reduced. In 1993, they reduced the 30-year auctions to just twice a year (from quarterly). In 1999, 30-year auctions were reduced to once a year. In 2002, they were discontinued entirely. So bonds that mature between now and 2026 were issued between 1993 and 1996, which is when already few 30-year bonds were issued. They were re-introduced in 2006 with the growing deficits. But those won’t mature until 2036 or later.

So yes, he could have read a headline that discussed the maturities of those 1990s-series 30-year bonds, and not knowing what he was looking at, thought that this was total maturities that had to be refinanced.

What’s maturing now are trillions of notes and bills every year that have to be refinanced.

Sorry. I was looking at the “Monthly Statement of Public Debt” from Dec 31, 2023. That shows the maturity date and amount of every Treasury CUSIP. The details of the rolloff dates and amounts are good stuff. Also, non-marketable EE and I bond holdings total around $100 billion, so less than 2% of non-marketable debt holdings.

My comment addressed the maturity of all bills notes and bonds over the next two years. I’ve seen a lot of comments flying around that interest payments are going to keep increasing dramatically due to rolling over Treasury debt. I was just giving my two cents that looking at actual maturity schedules and what’s likely to happen with rates, interest payments have probably plateaued, more or less, unless future corporate bond problems spook the market, pushing up overall rates.

If Congress cannot pass spending bills for FY 2024 by Jan 19th (and Feb. 2nd, for other cabinet agencies) and has to go to yet anotha CR, then the sequestration word will become a popular one again.

That’s because of the debt ceiling deal last year, which features automatic across-the-board cuts if Congress cannot pass spending bills by April.

The other out is an omnibus, but the House GOP is on record saying no more bloated omnibuses. You know, the kind that is loaded up with “goodies” for the military-industrial complex.

It’s an election year, so one would think Congress will find a way to avoid sequestration, but you never know. The House looks to be unstable and I can certainly see House Freedom Caucus refusing to pass another omnibus and forcing a long term CR.

More popcorn, please.

“That’s because of the debt ceiling deal last year, which features automatic across-the-board cuts if Congress cannot pass spending bills by April.”

That may be best outcome we can get…

Wolf, perhaps an analysis of the impact of ongoing tax cuts over the past several decades on the overall budget deficit would be enlightening. My sense is this is not simply an overspending situation but, rather, one that involves both income and outgo.

Federal Budgets:

Clinton presidency $1.6-$1.9T

Bush presidency $2.0-$3.5T

Obama presidency $3.6T-$4.2T

Trump presidency $4.1T-$6.8T

Biden presidency $6.3-$6.7T

Spending problem IMHO.

You are correct, Tom V. Debts and deficits are accounting residuals of spending (which comes first, since the US Federal government only ever spends one way — by issuance of brand new dollars which are NEVER “recycled” through the Treasury/Federal Reserve) and taxation (which comes second and represents “destruction” of dollars — they are never “warehoused” anywhere) over some defined time period.

Any distinction between spending increases and tax cuts is mathematically meaningless — they both have precisely the same result where the size of deficits and debts are concerned.

Compared with other nations in the Organization for Economic Cooperation and Development , the United States ranks 32nd out of 38 in (tax) revenue as a percentage of GDP. According to some research, the combined Bush and Trump tax cuts account for about 38% of the debt held by the public as a percentage of gross domestic product.

So, yes, tax cuts with no plan to cover the costs of already committed programs has an impact on the deficit. The Austrian School is based on thought experiments, but we’ve seen the empirical results over the past 30 years, which were a failure. Wealth is a pool, not a flow. It does not trickle down, it accumulates.

Looking at that last chart made me wonder how the the interest payments as % of tax revenue would evolve in different scenarios.

e.g. What if rates held steady around 5%? From what I (google) can tell, the US gov currently pays about 3% interest rate on average, and the weighted average term (duration) of the debt is about 5 years. So given that rates only starting rising a couple of years ago, there is probably still a fair chunk of debt to roll over at higher rates. Changing the effective rate from 3% to 5% would be enough on its own to get the interest as % of tax receipts metric to Wolf’s 50% threshold.

Then add in the government running a deficit of 7% of GDP, heading into an election year, and the election potentially being won by Trump, and potentially things could escalate fairly quickly.

Seems like a lot depends on the path of inflation. If it stays down, rates can stay/go down, and the ‘party’, such as it is, can continue. But if it doesn’t, Fed/politicians may face some difficult decisions.

Can inflation stay down when unemployment is already at very low levels and government deficits are very large? I guess we will find out, but I think for this to be true, commodity prices, especially oil, would need to be stable / falling and the USD would have to stay strong.

Only one thing is for sure, and that is that it will be nice to have Wolf tracking and charting it all for us as it plays out…

Isn’t inflation the governments best way out of the debt mess? Then GDP and tax receipts increase relative to the debt. With that incentive, I have to wonder if the fed and our politicians really care about bringing inflation back to 2% or if it’s mainly just talk?

That can obviously lead to inflation and of course inflation leads to increased costs which could help the debt but also everything costs more even for the government. Ultimately spending has to be addressed at some point but that requires full control of Congress and executive branches by the GOP and that hardly would result in cuts that would be positive for most Americans. On the other side tax cuts on corporations and wealthy would be the likely path and hard to see that as well. The saying that Wall Street likes a split government is apt.

The last graph is telling: there has never been another time in recent history when interest as a % of taxes had six consecutive increases.

Sure looks like that graph is violating Wolf’s rule and going to heck in a straight line.

Well, on the positive side tax cuts for individuals expire end of 2025 and corporate ones are permanent.

I am 100% convinced that CONgress and the FED are actively and intentionally destroying the US for their own personal financial interests.

I do not believe there will ever be an honest attempt to rein in spending. I am also convinced that QE is a permanent tool and feature of the FED, and that it remains in their arsenal at the ready.

All of these people – the FED and CONgresscritters – are going to destroy the currency and the standard of living of the masses to satiate their own rapacious greed.

I don’t tend to subscribe that it is intentional. It is a natural result of a system that concentrates wealth and benefits the few over the needs of the many. It isn’t default human nature or any such flawed arguments but a choice of political and economic system choice. The US will likely bring some manufacturing home, then get inflation, then determine how to best exploit labor and resources elsewhere to lower prices. Same you know what, different day.

“It is a natural result of a system that concentrates wealth and benefits the few over the needs of the many.”

Which is every system ever employed by humans. Previous attempts to correct it have only made it worse. You may not believe it’s not human nature and can be corrected by political choices, but there is not one example successfully put in practice, not one.

You made my point. Capitalism destroys every threat.

Not really. It also destroyed monarchies, feudalism, dictatorships… yada yada yada

Whether you have a politburo or AI driven by analytics, it’s still created by human inputs that are subject to the inherent corruption of power. AND it falls apart without violent authoritarianism.

Sorry, but utopian communes are a fantasy.

I agree there is no utopia and while the concepts of utopian socialism exist in concept they have nothing to do with dialectical materialism. Even reforms are good as any improvement for the working class is beneficial but anything not permanent is easily taken away. I’m simply suggesting we have a system that isn’t healthy for the bulk of the world and could it be changed to make things materially better. I believe it is possible.

Incremental improvements are always possible, Glenn. The “there is no alternative” crowd are expressing a political preference, not an empirical observation.

I don’t think anyone is opposed to reforms, I personally believe there are opportunities for many. However, transitioning to some form of Marxism is not a reform, it’s a complete transformation. Further, it’s a transformation that has been attempted several times in the past and which have only exacerbated the very things it claims to correct.

To blame the failings of Marxism on Capitalism is a copout at best, and intellectually disingenuous. Also, if you hold that view, you cannot also believe that “reforms” are possible because any such reforms would be destined to fail due to the destructive forces of Capitalism.

The only reason any of this matters is you are giving impressionable young minds the wrong ideas. There is a not so insignificant number of people in the US that believe we should transform into some form of communism. If that were to occur, the scale of human suffering it would cause is alarming.

The answer is that it can be fixed, but won’t be fixed, due to the nature of power structures in organizations.

Howdy Folks. Good thing the FED got inflation under control. Congress will cut spending soon also. Been listening to all my disco music again. Fun Times this time for me………..

I have watching my old DVDs of the “Forsyte Saga”, the original BBC series first televised in 1967. Around 1890, one could hire a maid in London for 6 pence an hour and all the tea she could drink. What you have to pay these days? 8 pounds an hour? A custom built home on a large lot on the outskirts of London cost Soames Forsyte 12,000 pounds (including cost overruns). Today, the house and land would probably go for at least 5 million pounds. As bad as US inflation has been since 1890, my guess is that British inflation has been a lot worse. In 1890, one could get about $4.80 US for a pound. These days, you would only get about $1.25 US.

Why do you suppose that the nominal “value” is what matters? That’s a category error. What matters is how much of the total sum of “stuff” (molecules, joules and labour) over which you exercise ownership or control — the numbers are just a distraction.

Quite right old chap:

First time in Galway, a pint,,, that is an Imperial Pint of Guinness was ONE SHILLING, approximately 12 cents US at that time, 1970.

As instructed by local GF, I traced my initials in the topping, and, sure enough, it was still there when pint was otherwise completely gone,,, and just for entertainment purposes, after 5, my usual and frequent dose, I stood up and fell flat on the floor,,, though was able to get up after the surprise,,, and go to the loo…

Last I looked, definitely NOT in person, due to similar expense of almost everything in the Emerald Isle,,, same Pint of same product was 2.5 ”pounds” or Euro equivalent ???

Crazy bad for every Irish folks, that’s far damn shore.

Trump I’m set up to $28 billion and you don’t say a word. Biden adds 5 billion and all you can say is Biden Biden Biden

Huh?

He’s stuck in the partisanship stupor, just where the politicians want him.

But I mean the numbers. What kind of numbers are these. “5 billion.” When it comes to the debt, no one writes about “5 billion” anymore. It’s all about trillions now. And then 28 v. 5. I just have no idea what this is.

Howdy Tony. The numbers are not divided or added by different sides. There is only one party not two. The UNIparty Federal Govern ment spent US into 34 trillion in debt. We are gonna pay with inflation. Learn your history and listen and read closely when The Lone Wolf comments on the early years. 70s 80s in particular………

People are focused on spending, but the TCJA took a chunk of revenue off the table as well. It will be interesting to read what all these “we need to address the debt” folks write when there is an opportunity to increase revenue and decrease spending.

The Congressional Research Service already has some publications out on the costs of keeping the TCJA vs reverting to prepare legislators for what will be entertaingly stupid debates. Not that anyone in Congress can read…

This will eventually run into a wall of energy or rather the lack of energy. Shale production is currently forecast to peak around 2028 and the come down will not be pretty. Based on data from various government agencies, there’s not enough metal (for storage) in the world to fully transition to a green economy, so hyperinflation is baked in no matter what, and not just in the US. Bacon at 50 dollars a slice, that’s the true American Dream.

Nearly everything you said it nonsense. “Peak oil,” whether conventional or fracking, has been predicted for decades, and yet US production keeps surging from record to record. All that will happen is that oil will get more expensive, but that has been predicted too for decades, and it hasn’t happened yet.

Nearly everything you said is nonsense. “Peak oil,” whether conventional or fracking, has been predicted for decades, and yet US production keeps surging from record to record. All that will happen is that oil will get more expensive, but that has been predicted too for decades, and it hasn’t happened yet.

In addition, more EVs in the national fleet will reduce demand for oil. Gasoline demand is already down. As EVs become a bigger factor in the national fleet, gasoline consumption will decline further. The petrochemical industry, which is HUGE in the US, will still consume oil and demand growth might come from that direction, and there will be plenty of oil for it to consume.

Your metals comment is similarly nonsense.

Your conclusion that this will cause hyperinflation is like totally nuts. If we get hyperinflation at all (chances are minuscule), it won’t be triggered by energy, metals, and EVs. What kind of BS have you been reading?

I believe is is referring to the amount of rare earth metals that would be required to convert all the transportation and home energy storage needs to fully electric. He is correct in this regard with respect to elements such as lithium. There is a reason that they are call “rare” earth metals…

DUH.

Jeeeeesus. Rare earth metals are NOT rare. They’re everywhere, including in the US. Lithium is everywhere too, including in the US and even in California, DUH.

In the US, the lithium production being planned is from brine coming up deep from the earth. In CA, this brine is already coming up for geothermal power generation, and lithium can be extracted from it. Exxon is working on a big lithium project in Arkansas, drilling down deep and pumping up the brine. Oil drillers already know how to drill deep and get liquids to come up. That’s where the tech is going in the US.

Rare earths, while very common, are messy to extract, so companies in China, which face fewer environmental issues, jumped all over them some years back. The classic lithium mining is messy too, and so we left it to other countries to do the dirty work.

The price of lithium collapsed amid overproduction, despite the boom in EV sales, LOL.

The Salton Sea is already an environmental catastrophy out in the middle of nowhere. They could mine their lithium from there with no net effect.

The dread inspired by the “big scary debt number” is a zombie economic idea that simply Will. Not. Die.

Wolf correctly notes upthread that the US Federal government does NOT face a solvency constraint. The constraint is real resource availability, including labor, and inflation is the consequence of exceeding that constraint, NOT insolvency.

I despair that the distinction will ever be widely understood, and my suspicion is that there are those for whom confusion concerning the distinction is both profitable and politically useful.

The thing to be concerned about is NOT how much is being spent, but WHAT it is being spent upon — given real resource (including labor) constraints, decisions about what is being produced via those resources is what actually matters to the wellbeing of the citizenry and its descendants.

Stop worrying about the spreadsheet and start paying attention to the molecules.

I concur, which is why we should be investing in our citizenry and starving the military industrial complex – stop vaporizing our productivity.

Defense spending is not the problem. And spending on social programs and subsidies for green energy aren’t “investments”, they are boondoggles that are bankrupting all of us.

I concur that ultimately physical reality will assert it’s dominance over economic affairs.

Where I have difficulty is your implication that debts don’t matter. Maybe not to the US, which at least relative to other developed nations, doesn’t have an outsize debt problem. But wasn’t debt invented to break out of the physical constraints of resource and labour? By taking on a debt you promise to repay the debt in the future, thereby allowing the consumption of future resources now. The outsize result of never really taking away the intoxicating punch bowl of debt is why debt matters.

As Wolf states in the article, with interest payments on the debt eating up close to half of the tax receipts, that’s only half at many resources at the disposal of the government compared with zero debt. I.e. half of what you ‘earn’ is ‘lost’ to historical consumption.

But the more fundamental physical debt we should be spending more of our resources on addressing is the carbon dioxide debt we’ve pumped into our only atmosphere. Paying down this debt should be a top priority for our resource allocation if we want to keep civilization in any way civilized. Those molecules can’t be defaulted upon in a spreadsheet.

What do Interest payments as percent of tax receipts look like in the USA over the last 100% years? What do they look like in other advanced economies?