The educational-industrial complex is laughing all the way to the bank.

By Wolf Richter for WOLF STREET.

One person’s loan is another person’s asset. If the loan is canceled, the asset is destroyed. That’s how it is.

No one is making payments on government-backed student loans anymore, after two years of forever-forbearance, countless campaign promises of forgiveness, various targeted forgiveness programs already in effect, and now the biggie, the general forgiveness program being hashed out.

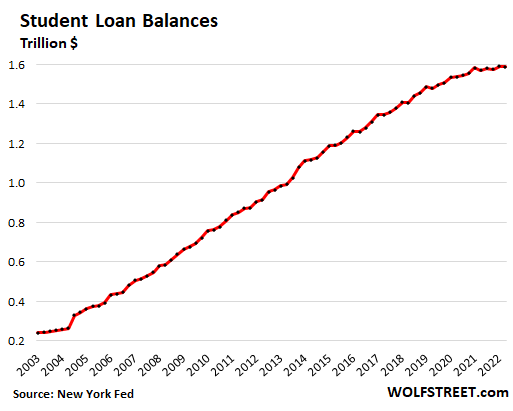

Total student loans outstanding, assuming they’re even still “loans,” remained at $1.59 trillion in Q2 compared to Q1, according to the New York Fed’s Household Debt and Credit Report. They have been relatively stable since the Q1 2020, as new loans were being added, while practically no one made payments, and as the numerous forgiveness programs are whittling down the tally from the other side.

Federal student loans.

Federal student loans account for about $1.3 trillion of this $1.59 trillion in total student loans, according to a separate report from the New York Fed. The remainder are Family Federal Education Loans (FFEL) owned by commercial banks, and private loans.

It’s the $1.3 trillion in federal loans that were all moved into forever-forbearance in the spring of 2020, and that are now up for forgiveness.

The median balance of federal student loans is $18,773 – meaning half of the federal student loans balances are lower than $18,773, and half are higher.

The outliers everyone is talking about, the $150,000 and $200,000 loan balances, were accrued by a small percentage of borrowers going to law school, medical school, etc., most of whom are now in high-paying careers and don’t need loan-forgiveness at all.

Forever-forbearance “solved” delinquencies.

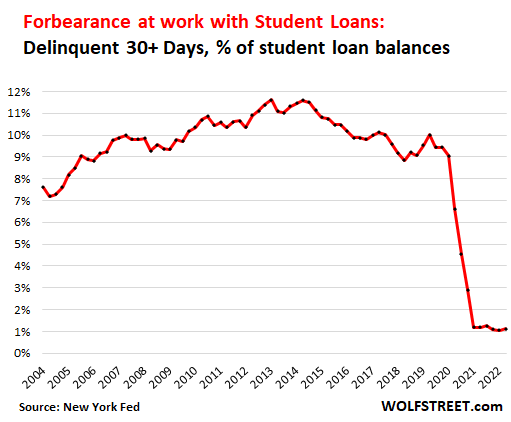

The amount of student loans that were 30 days or more delinquent plunged from the official 9.4% of total balances before the pandemic to just 1%.

For federal student loans, the delinquency rate is 0%. All of them were automatically enrolled in forbearance programs in the spring of 2020, which have been renewed over and over again and are still in effect. When a loan is moved into forbearance, it is reclassified as “current,” not “delinquent,” regardless of payment status.

FEEL and private student loans, which were not enrolled in forbearance programs, accounted for all the delinquent loans.

Student-loan forgiveness and cancellation.

In addition to the list of existing student loan forgiveness programs – Public Service Loan Forgiveness, Teacher Loan Forgiveness, Closed School Discharge, and others – there is now the forgiveness when students feel that the educational-industrial complex screwed them.

So just on Thursday, a federal judge granted preliminary approval of a settlement that would cancel $6 billion in student loans of over 200,000 students who claimed they were defrauded at 153 mostly for-profit colleges.

Few of those schools have been held to account. So it’s the taxpayers that will pay the $6 billion, not the educational-industrial complex that got the $6 billion over the years, laughing all the way to the bank.

And the biggie, a general forgiveness program is currently being hashed out by the administration. The proposal started out with $10,000 in forgiveness per borrower. But this stinginess of the taxpayers is leaving a lot of voters deeply frustrated, and the anger is boiling over, putting politicians under pressure to buy more votes, or re-buy the same votes, by raising the forgiveness amount to $50,000, maybe with income caps.

Next, auto-loan forgiveness… Just kidding, kind of.

The average transaction price of new vehicles is nearly $46,000, and the average advertised price of used vehicles is $28,000.

By comparison the median government-backed student loan is $18,773. Just another consumer loan. It’s not the end of the world having to make a $200 payment every month for 10 years – and wage increases and inflation over 10 years will reduce that burden.

And if people cannot even make a $200-payment, they cannot make a $400-payment or $800-payment on an auto loan either. So when are we going to buy votes with promises of auto-loan forgiveness?

It’s unfair that people who bought a car because they need to drive to work would be forced to pay off those loans. We need to have general auto-loan forgiveness. The government could just buy up all the auto loans outstanding and then forgive them, up to $50,000 each, maybe with some income caps, such as $250,000 per individual and $500,000 per married couple filing jointly.

Think of it this way: It would be a huge boost for the economy because, instead of making car payments, those folks could then blow their money on other stuff.

It’s not fair, but fairness has nothing to do with it.

The government (taxpayers) funded these student loans by borrowing in the Treasury bond market. It then handed this borrowed money to the educational-industrial complex via the students, expecting to get paid back most of the money, plus interest, by the borrowers after they start working. Their payments would have helped the government service the debts that it incurred to fund the student loans. But that’s over. Going forward, the taxpayer pays off the loan of the borrower.

In other words, the waiter that would have liked to go to college but couldn’t afford to now has to pay off the student loans of software engineers that did go to college. It’s not fair, but fairness has nothing to do with it. This is about vote buying. And they’re hoping the waiter cannot figure this out.

Allow bankruptcy courts to decide what gets discharged and how much borrowers have to pay every month.

Borrowers currently cannot get their student loans discharged in the bankruptcy court system. But they found something much more appealing in order to get rid of their debts: Politicians eager to buy votes with other people’s money, namely with taxpayer money.

But that doesn’t need to be that way. These same politicians could change the law to allow student loans to be discharged in bankruptcy courts.

So it would be a judge that decides how much that coder with a degree from Stanford can pay every month for the next 10 years, and how much that teacher with a degree from OSU can pay every month. And the judge can then discharge the rest that cannot be paid. Personal bankruptcy has worked that way since the Bankruptcy Reform Act of 2005. In personal bankruptcy filings, people cannot just walk away from all their debts.

Student-loan borrowers would then think about whether to tough it out and make the payments; or file for bankruptcy, get the blemish on the credit report, get part of the student loans forgiven, if any, and make payments under a court order for many years.

This system is already in place for personal bankruptcies. It’s not perfect, but it’s functional. And it would provide relief to borrowers who really cannot pay. And it would be a lot fairer to everyone around, including the waiter that couldn’t afford to go to college and doesn’t really want to pay off the student loans that other people had incurred getting their degrees.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I agree that Wolf’s waymakes a lot more sense… but the same politicians who authorized this student loan debacle in the first place don’t want to force student borrowers to take responsibility in Bankruptcy court.

It didn’t have to be this way. Twelve years ago the Obama Administration promised that taxpayers would SAVE $68 billion over the next decade by having the government hand out student loans rather than having banks and other third-party lenders do it. “Cut out the middle man” and the government could pocket the interest (and savings) and thus borrowing would be cheaper. Cynics warned at the time that the government is GREAT at handing out money… not so great at collecting it when the bill comes due.

Now the nation is being gaslighted into paying the piper. This isn’t the average taxpayer’s fault… it is the fault of politicians who knew EXACTLY what kind of monster they were creating.

I doubt that blanket forgiving of student loans was even in the imagination of the most nanny-state politicians 12 years ago.

I agree with Wolf – the blanket forgiving of student loads is bare-faced buying of votes by shameless politicians. This is done by all major parties. The nanny-staters are all wheeeee, what a great opportunity!

Any blanket forgiving over median loan, like other gross disgusting vote-buying issues, loses my vote for all non-objecting candidates in the party responsible, probably for many years.

“the blanket forgiving of student loads is bare-faced buying of votes by shameless politicians”

So what’s new?

“The main thing that every political campaign in the United States demonstrates is that the politicians of all parties, despite their superficial enmities, are really members of one great brotherhood. Their principal, and indeed their sole, object is to collar public office, with all the privileges and profits that go therewith. They achieve this collaring by buying votes with other people’s money. No professional politician is ever actually in favor of public economy. It is his implacable enemy, and he knows it.” – H. L. Mencken

So, whenever pols graciously promise to cut your taxes or provide you with more “free” services or provide “relief” handouts, they’re effectively buying your vote with your own money or with new debt effectively put on YOUR tab.

Didn’t Wolf not point out that most mortgages today are backed by government aka tax payers. So when Fed raises rates and house prices correct and people handover their houses in no-recourse states, what choices will fed/government have? See what I did there.

Mortgage balances are way higher than other loans. Ready for MMT!

SS,

HUGE difference.

Student loans are “unsecured” loans.

Mortgages are “secured” by collateral, the house. If you default on the loan, you lose the property, even with a non-recourse mortgage.

The lender with a non-recourse mortgage still gets the collateral (the house) if you default, and gets to sell it in a foreclosure sale, but if the sales proceeds are smaller than the loan value, the lender cannot get a deficiency judgment and go after your other assets and income.

With a recourse mortgage, the lender gets the house, PLUS they can go after your other assets and income for the deficiency.

But in both cases do you lose the house.

SS:

But the key difference is that there is a physical asset in your example of the mortgage. A house can be sold and some financial recovery made.

You can’t repossess an education. Well you can, but it’s rather gory.

TIME TO END ALL STUDENT LOANS

see solved it

and for those we’ll forgive – make sure IRS(got 87,000 new employees)

gives 1099-C cancelled debt = INCOME to receipient

Going to McDonalds and buying food there with a credit card is non-recourse and non-collateralized too, unless Jamie Dimon wants to pump out my septic tank the next day.

In the scenario where house prices correct or even go sideways, the house ceases to be an asset. Will you really like a zero liquidity collateral that requires you to pay utilities bill, trim grass, repair roof, monitor and fix plumbing, provide security……

If house was really an asset, why did govt need to bailout so many lenders in 2008.

I would be willing to bet money that alot of these people who cannot afford to repay their student loans have very nice $1000 iphones that they buy every 2-3 years.

Government largesse that distorts market dynamics is the largest problem in the United States. Housing prices too high for first time buyers? Blame the government. The government has put the taxpayer at risk for default on home loans and driven interest rates to lows that would have never existed if banks retained the exposure for home loans. Home prices would be a fraction of what they are today if not for the governemnt. Cost of college too high? Blame the government. Piles of free money has allowed colleges to raise prices massively with absolutely no pushback from the population. And this has created a higher education system that is affordable only for the rich and the poor (via need-based scholarship). It has also bred a whole industry of for-profit education that provides little value to the students. Healthcare costs out of whack? The government has refused to crack down on a healthcare industry that is basically a complete fraud. Hospital bills are a cruel joke, driving many people into bankruptcy. And then there is the military-industrial complex, where the revolving door of top military brass into the private sector after retiring is a gravy train that perpetuates a lack of accountablity in pricing for military systems. Financiers that combine companies until there is no competition and ship jobs oversees, while rewarding CEOs at a rate that is absurd, compared to the average salary of an employee. Zero government enforcement of insider trading, anti-trust laws, etc. A legal system that is designed to generate fees for lawyers, not justice or efficiency for the people.

Our private companies are NOT the problem. We have many of the best companies in the world. But our lack of effective government is rotting away the core of this free enterprise, competitive system that has produced great companies.

Our government has become a massive leech. When do people realize that the core of this problem comes down to BOTH the republican and democratic parties?

If you are a died-in-the-wool advocate of either party, you are delusional and YOU ARE THE PROBLEM. Both parties are dominated by special interest parties and are virtually indistiguishable in terms of the money the accept from these special interests.

Now do Katie Porter.

SS:

The house is still an asset… even if underwater. Even if it’s a smoking hole in the ground, the land still has some value.

IMHO, the student loans should be repaid via payroll deduction. Once the ex student debtor attains a certain level of income, it comes off the top. Hard stop.

That’s the purpose of pursuing an education – to improve your lot in life and improve your chances of earning a higher than average income. Why should they be able to dump the loans for the education that worked to their advantage on others?

The very first thing Obama went after when first elected was federalizing student loans.

It did save a lot in fees. If he hadn’t, the discussion would now be how to forgive the student loans while bailing out those private investors that are holding those student loans and got rich off fees and interest.

hmmmm….no matter how one cuts it – it all reads like burden shifting to me. As someone who actually paid for his kid’s college education – the insult only intensifies the anger. This, in the end, is no different from all the federal enticements used to snare illegal aliens.

Wolf makes a good point here. The only thing worse than an inefficient government bureaucracy is when governments try to fund private enterprise and completely distort the normal economics of truly free markets. That leads to massive profits for a small group of people. Businesses know that the most profitable customers is the US government.

Government’s primary role in private enterprise, and our economy, should be to establish laws and enforce them. Anti-monopoly laws, tax policies that reward production of value, rule of law, enforcement of contracts, etc.

Government should do alot less, but do it well.

I probably benefitted by those student loan changes, and the first thing I did was pay off my loans.

If people make different decisions, thry should be held to them. That isn’t to day an absolute judgment should be made given systemic factors and personal circumstances, but I’m not a fan of doing forgiveness and the unintended or unknown consequences of doing so.

“the blanket forgiving of student loads is bare-faced buying of votes by shameless politicians. This is done by all major parties.”

What Republican is advocating the forgiveness of student loans?

None I know of, but you missed the point. The Repubs have their own set of votes they buy.

Finally, finally, finally! Someone admits that this fiasco was created in 2005 when Bush removed student loans from the bankruptcy code. Student loans exist in an illegal credit market – a sort of debtor’s prison – that benefits banks, higher education, and all economic functions in between.

That being said, the government will never allow these loans back into the bankruptcy code, nor will they be forgiven. A massive college town bubble is reliant on this forced, and unending slavery of the youth. Think about the towns, cities, regions and people that benefit from student loans – professors, shop owners, apparel manufacturers, construction companies….it goes on and on. All on the back of America’s “future.”

Rising rates will cool it all down. Not sure what the lenders expected charging 6% rates to people while a 5 year bond was at <2%. How many recent grads want to make minimum payments and see the balance due creep up because of that usury?

I was one of those people who got my mechanical engineering degree and got out of college in 2013 to a competitive labor market. Eventually got a job and saved up to pay off my loans before buying a car. Would be nice if I got a thank you check from the Federal govt for being responsible if they go ahead and forgive $10,000 for everybody. Would go a long way towards a downpayment on one of these overpriced houses around here.

Bush?

The Senator that proposed these changes is now President.

Trying to rewrite history to favour your political party?

I think there is a much better solution to all this – cut the interest rate to ZERO!

This way we don’t have to bail them out but they do get a break from the government. It’s really a crime anyway that corporate borrowing is at a quarter percent and mortgages were 3 and yet student loans that the government makes money from are 6-8% (I’ve heard,not sure exactly).

I don’t see why student loans should be something the government makes money in, why aren’t they just set st the fed funds rate?!

Americans were hell-bent on preventing borrowers from declaring bankruptcy to discharge their student loans. Biden even wrote that change to bankruptcy law.

This crushed ordinary people who’d run into real misfortune, like loss of employment for health reasons. It was a dumb and cruel policy.

“Personal responsibility” bro.

Now nobody is paying anything and Americans are on the hook for ALL of the loans, including the ones that were otherwise good.

This is a nation of people too pissed off to even think straight.

IMHO, the change to the bankruptcy law was using the same paint brush on all borrowers. IIRC, the reason was that high income earners (doctors, lawyers, etc.) that had extreme loan balances would BK, get them discharged, and then go about their business earning their high income.

Sadly, the student who got a degree in education got splattered in the process.

but the history and psyc majors all got jobs as baristas

Construction company in my area filed bankruptcy 3 times needless to say ,he’s well off .Biggest scam in the world

That wasn’t a personal bankruptcy. His COMPANY filed for bankruptcy. The bankruptcies discussed here are personal bankruptcies.

Actually, the ability to file for bankruptcy is an important part of our system. It allows people to recover from mistakes. If you have no bankruptcies, you will create a risk-adverse business climate and lock productive people into a business or job where their skills are not well utilized.

The ability to take chances and then try again at something else is very important. Anyone who loans money out understands the risks and it is part of the equation in lending institutions. If people are still lending to this guy, that is their problem.

Perhaps the answer is for students to incorporate and then the student loans made to the new corporation.

Creditors would rather get something than nothing, particularly if a firm is otherwise solvent but is overburdened with debt. You can’t be reductionist with bankruptcy or treat it as a purely moral issue.

The loans (especially for those whose education did not result in appropriate employment) should be paid in part by the lucrative institutions from where the students graduated. Many universities/colleges sit on properties worth hundreds of millions, and have endowments in billions, yet pay no taxes, and offer degrees in non employable areas of study. The other culprit is employers who require educational levels far in excess of job needs, just because they can. Lastly, “on-going education” requirements in many occupations is yet another education racket.

Women are the biggest victims of licensing and excessive education requirements. In Louisiana you need 1500 hours of instruction to braid hair. This particular regulation hurts black women there the most. They could make a good living if the govt just left them alone.

Also, I was an applied math major. I would gladly have volunteered to teach kids the math skills they badly need in American schools. To do this, I need the equivalent to an MA in education. This is just nuts.

NYS now requires BSN in 10. Can barely afford to live here as an RN, but yeah cool make em pay for 3 1/2 more years of school (an ADN really takes about 3 years worth of classes including summers contrary to popular belief) while working a stressful job many women take for the shift work around childcare.

Many employers cover a fraction of the tuition, but others don’t, science credits ‘expire’ and schools get conveniently selective what credits transfer. Empire wanted me to take 3 semesters worth of crap gen eds despite having over 115 credits under my belt due to selective transfer credit acceptance. No.

The job market is crap if you don’t pay through the nose to stockpile letters after your name that you then have to keep paying in license fees, mandatory courses and CEUs to maintain credentials. Plenty of other professions out there with less cost and liability. And good luck getting your loans forgiven, so many employers are for profit and the ones that aren’t are in higher stress/liability environments. I checked out Biden’s revised PSLF program, over 15 years in healthcare and I might have 2 years that count toward PSLF. Gee whiz. Its all a joke. I’m still deciding on my next career but until ‘they’ straighten out the obscene cost and piss poor value of education, I am done paying for more college.

The student loan program was destined to fail from the start. Loan amounts and subsidized vs unsubsidized are usually based on the parent’s income despite the fact the student is obligated to pay these back. Subsidized vs unsubsidized makes a huge difference in the loan balance upon graduation and the parent’s income threshold for determination isn’t all that high. Also, the risks assumed by the lender(s) is erroneous at best, there is NO bank or financial entity that would ever lend this kind of money to an 18 yr old with NO credit, NO income, NO collateral and therefore NO guaranteed repayment! Furthermore, there’s no guarantee the student will finish college or be able to secure employment with an income to support repayment. The entire program is a debt scam and the anger should be directed at those responsible for implementing such a disastrous program, not towards the borrower, most of whom were 18 yrs old at the time of borrowing and likely had a very limited understanding of the commitment. Perhaps a class educating students on exactly how the program works should be required before loans are issued considering the extreme risks for the lender (tax payer) with this type of borrower. Ideally, they should put an end to the program!

Yes! Aside from cutting the rate to zero or the fed funds rate I do think it would be great if the institutions were somehow on the hook a little bit. Their salaries and endowments are absurd just like the tuition.

Truly I wish the government would make very good state schools with only good, functional classrooms, that’s it! Then they can pay great teachers good salaries and the private ones can compete w that!

It was the myth of freshly-minted doctors declaring bankruptcy to escape their loans that pro-lender politicians used to sell the idea of making student loans non-dischargeable in bankruptcy.

Not all people who graduate from law school / med school, etc. get high-paying jobs. Many law school graduates in particular find that the dream of a high-paying job runs into the rocks of the current job market.

Suggestion: more public funding for public junior colleges, colleges and universities. This way, tuition stays low, college administrators would no longer get multi-million dollar salaries – and students won’t need to take out excessive loans to learn the skills needed in today’s workplaces.

If they want to pay. for a high-tuition school, they can – but they’re no longer forced to do so from a lack of under-supported public schools.

Higher taxes is your answer?

More gov’t control over an already corrupt public education system that is responsible for declining metrics in many key categories?

Abolish college sports beyond tiddly-winks competition. No stadium that is more than some wood bleachers and a lawn. When you have college coaches making a million bucks, something is perverted.

Just drive through Texas just once. There’s high school stadiums that rival some colleges. It’s just stupid. “I can’t add nor read, but I can chase a ball…. if only I could remember what kind it is.”

For every loan I’ve ever received, I’ve had to demonstrate the ability to pay it back. That provision doesn’t exist in Student Loans.

“Loans” move money from one account to another, like from your mother’s purse to your wallet.

“Credits” create money in an account without removing any money from another account. Creating such money is an advantage of fiat currency.

Under “fractional reserve”, some fraction of the value of a credit has to be assigned or “committed” from the creditor’s assets. This requirement puts an asset-based limit on how much crediting a creditor can do.

If only 5% of a credit is backed by creditor assets (typical for a non-systemic bank), and a nominal interest rate of 3% is charged:

— 95% of the capital paid by the creditee is a gift to the

creditor, 5% releases the committment on the creditor’s

asset; and

— 20 times 5% i.e. 100% of the committed amount is the

true interest rate.

Federal-backed student “loans” are credits. As the article suggests, the system is a gift from poor students to people who have assets.

Nonsense. A loan requires that the principal — the amount owed — is paid back, not just the interest that is supposed to compensate the lender for risk and inflation.

At the beginning of the pandemic, I had a small sudent loan balance of $2,500. I decided to keep on paying $100 a month towards it, even though it was in forebearance, and now it is paid off.

I know a coworker of mine who has a student loan, and she stopped making payments on it during the pandemic because that would be stupid, since Uncle Sam would probably just forgive it anyway. Even though she could not “afford” paying her student loan, she could still afford taking airline trips down to Florida to go to Universal Studios and Disney World. No worries–just send the bill to the taxpayers, I suppose.

I would rather see my tax money go to your coworker’s vacation than go to a hedge fund manager as a tax cut. Just saying.

I would rather not have either!

haha very good!

Wolf, stuff like this is what leads me to believe you’ve really lost the script.

Next you’re going to be asking “is federal debt really debt?”

There’s obviously a difference between a private loan (like a car) and a public “loan” (like the Covid PPP) and there always has been. It’s not like the government needed any revenue to go about printing the money in the first place, and they only need the taxes to make the currency scarce. In the case of federally backed loans, they might as well have been a grant with a perpetual tax penalty attached to them. You can even look back through the history of these things to realize the people negotiating these legislative programs were always moralizing about how poor kids from poor families might not deserve to go to an expensive school, and that there needs to be program of debt peonage to discipline them, lest it all goes running amok. So then naturally, as the only way America knows how, they outsourced everything to privatized companies, with little accountability, to skim off the top of every student trying to pay what was owed to the state.

It doesn’t take an intellectual to check how other countries handle this stuff. Clearly many of the other first world countries have figured out how to treat this stuff like a public service and infrastructure project. Even in Germany where upper education is already heavily subsidized, and they have a federal credit program for students, with the stipulation that half the loan can be expunged upon completion of the degree.

In a world where the economy either runs on debt or taxes, Americans choose debt every time.

The is a lot of financial aid for students in the US that is based on “grants” (among other financial aid, such as tuition and housing programs). Grants don’t have to be paid back. And the amounts are huge. Grants come from various sources, including federal. Why do people always confuse grants and loans?

I normally love your analysis, but I think you are missing the bigger picture. Which is about the interest rates being charged. Those Federal loan interest rates are typically 6%. Forgiveness or no forgiveness, I hope those politicians buy votes by reducing the interest rates lower, as it IS in ‘Murica’s interest to educate its population.

Why aren’t those loans interest rates tied to the CPI?

No financial leech should profit on an inherently government function.

“Why aren’t those loans interest rates tied to the CPI?”

CPI = 9.1% now. Let’s sock it to them just when they can least afford it because inflation is already eating their lunch?

6% is pretty good for an unsecured loan, such as as student loan. And student loans have the worst default rates of all loans, and interest should reflect the risk at least to some extent.

HEAL loans for medical school 1982 to 1986 were 18%.

I got away with 3% – 4% on my loans, but that was during preak ZIRP.

In ‘78-81 I borrowed $18k to go to law school. Wachovia serviced the loan. I paid off every cent @ I dunno 6% and Uncle Sam has made a fortune in taxes. I reckon I’m a dinosaur.

While this article makes excellent points about student loan debt and who’s actually paying for them, it ignores the larger problem of, why is secondary education in the US so expensive? We went from a public funded state and federal secondary school program where you could literally pay for school while going to it off of a part time job to requiring kids who know very little about themselves to intelligently mortgage their future so they can go learn a skill or trade? The corruption in these schools directly feeds athletics, a multi billion dollar a year industry is supported by students who are supported by government debt which is paid for by taxpayers. There’s your problem, not the kids being given a decision between working crap jobs or mortgaging their future to hopefully make a better life.

College athletics are the de facto minor leagues for professional sports, especially football and basketball. College administration has grown and grown with no end in site. Colleges can charge what ever the market will bear (and more) because they have no skin in the loan game. Many colleges will let a warm body attend if it has an approved loan. No longer is a good SAT score needed, just 98.6.

I agree. Cost is ridiculous. 600 kids in an Econ 101 class each paying 2800 for 4 credit hours is 1.68 million dollars. Having paid my student loans and saved and invested to put 2 kids through college, I will be making my position on this heard by my politicians. I love the bankruptcy idea. Is it even legal for the federal government to forgive these loans?

To attend Univ of Chicago Law School, you will need to pay $108,063 for the 22-23 school year.

Good point, we all hear about student loan forgiveness, but if you’re doing it to right some sort of wrong (and coincidentally buy votes), then you had better have a plan to prevent the same problem from recurring. I see no solutions proposed as loudly as forgiveness. Can’t even make a dent in the usurious interest rates. And even if rates could be lowered, the schools would just raise their tuitions accordingly. It’s so typical American grift.

Solution.

No more government backed student loans.

Universities can now make those loans. Maybe out of their billions in endowments.

And they can be discharged in bankruptcy.

And, almost overnight, affordable universities…

Government isn’t the solution. It’s the problem.

Typical libertarian BS, blaming any problem on the government. The reality is Congress can outspend any industry, any private economy, anytime it wants. That’s why when libertarian ideologies crater the economy Congress has to bail the miscreants out. I think it’s time to stop bailing them out. Let the ‘free market’ fund itself for a while. For a change.

Harvard is a nonprofit and pays no taxes. Harvard’s endowment is $53 billion.

Harvard has become a hedge fund that pretends to be a school.

Hint.

Government backed student loans.

These were rare when college was affordable.

And COULD be written off in bankruptcy.

“it ignores the larger problem of, why is secondary education in the US so expensive?”

No, the article calls it out very specifically: “educational-industrial complex.”

Free college should come with drab classrooms and lab buildings, no “campuses” but just big buildings in an urban area, no fancy student housing, etc. They do that in Europe. Universities are not fancy there. Here, university campuses are enormous and constantly growing industrial enterprises with huge sports stadiums and arenas and pools, pumping up entire industries, such as the construction industry, the sports industry (including media), electronics suppliers, such as Apple, textbook suppliers (don’t even get me started about THAT scam), etc.

There is a way to make public college free – but first you have to dismantle the gigantic educational-industrial complex that got rich and fat off these student loans.

No way in hell should the taxpayer pay for students to live in luxury housing, go to fancy campuses with gorgeous buildings, huge stadiums, and huge park-like areas in the middle of expensive cities. If you talk about low-cost education, follow the European model of what a university looks like.

Or paying a politician that teaches part time $400K+…… and then that very same politician rails on about “affordability”.

Someone should also call out the private sector. Why would anyone need an MBA to run a carwash or taco stand?

I once worked for a bookstore chain, that had 4-16 employees (very season). Guess what. The company wanted the store manager to have an MBA. Insane.

Many universities are including the costs of required texts into the costs of the course, preventing students from purchasing texts elsewhere. What a scam!

Sounds like the community college I went to in Chicago. Nothing fancy, just a big building next to the red line. It wasn’t free, but I could afford it working temp jobs.

I remember walking past some college or university in Naples, Italy. The place was a dump. Made me think about the American colleges with Olympic-size swimming pools, huge gyms, etc.

My campus had free massage chairs you could book for half an hour at a time. Those were nice.

Don’t forget the luxurious student housing being built with 5 star amenities for junior and little missy. Architects and Builders are making hand over fist along with as the investors in the public private partnerships that fund many of these projects. Didn’t you show some chart a while ago which correlated the increase in education costs with a neatly tracked chart in the construction industry?

Can convert all those empty corporate office buildings to colleges and dormitories

CrazyDoc,

“Can convert all those empty corporate office buildings to colleges…”

Yes, that would work, if they wanted to, and it would save a huge amount of money, and they could sell their huge fancy campuses. And cut tuition down to near-nothing.

In addition, they could hold many classes remotely, with hundreds of thousands of students listening to the same lecture globally, and that should be free. But they don’t want to do that either.

Lots of things could be done, but the educational-industrial complex would wither, and that’s not allowed to happen.

One of the reasons it’s so expensive is because of all the support from lotteries. It’s built it money, creating secondary education inflation.

I’m fine with allowing a portion of college debt to be discharged through bankruptcy, but I don’t think it should be 100%. This indefinite suspension is for the birds and is adding to inflation.

I don’t think it should be more than 50%.

Hello, college in the US inexpensive BECAUSE the Federal government pays the loans no questions asked with no inquiry credit worthiness, ability repay, or the quality or earning potential of the educational program. It’s nuts.

is expensive, not inexpensive…

If I were a legislator I’d dig my heels in to reform public schools as part of this. You ought to be able to “work your way through school” attending a public uni, as prior generations did, with little/no debt. But unis have become real estate tycoons, building plush dorms with lazy rivers and rock climbing walls in their rec centers. They’ve hired fifteen tiers of management. I’m not averse to some debt cancellation, unlike Wolf, and despite having paid off my $70k+ (including grad school). But we can’t keep subsidizing bad behavior from these schools. Then the problem will just never go away.

I hear on the radio that enrollments are down at all but the top-tier “elite” schools. Maybe market forces will help, but the market is 18 year olds who have (largely, I know I didn’t in HS) never taken a personal finance course. They don’t know any better. They’re basically just easy marks for the “education-industrial complex.”

The education industrial complex is the base of the Democratic Party. Has anyone else noticed that they no longer talk about high costs of education only the price to consumers? Any sense of cost control, especially in the bloated administration and construction has gone completely out the window.

How is the Federal government implement “cost control” at private universities or state run college or university systems?

Republicans, in general, would scream bloody murder at any attempt to regulate for profit private systems. Regulation might have put a large dent in the lucrative profits of all the Trump style universities that have been out there.

The only way to implement “cost control” is to signal people they are responsible for their decisions in getting educational loans. Then demand for crap education will decrease, which would lower costs. Looks like that is not going to happen. The opposite will probably happen.

You implement cost control by cutting schools with low student loan payback metrics out of the federal student loan program.

For profit schools are a miniscule part of the problem and you are pointing your finger at the wrong political party. Higher Ed is a massive Democratic constituency and the problems are problems of government removing market control and incentives. Loans should be drastically curtailed and not provided for programs that fail to meet graduate financial metrics.

I got my student loans starting in the 90s from the feds, and paid it back to them. Only in the aughts did the servicer change from federal to third party, and then the stupidity started. Payments were frequently misapplied or not applied at all to my balances. Can you believe that the feds, with no profit motives, actually processed these loans better?

It was Bush’ bankruptcy reform in 2005 that made student loans non-dischargeable in bankruptcy courts. That’s the part that made no sense. Debt is debt. This has partially led to the ridiculous situation today, by not allowing legitimate cases of usury and fraud to be discharged.

Wolf’s point that it was the lender for most of these loans should not go unnoticed. If they had reasonable limits and standards for loans the educational administrative cartel would be held in check. Instead there were just blank checks for whatever marginally passed for education at inflationary rates for the past two decades that were not tied to real GDP or any other reasonable metric. Higher ED was allowed to expand on the debt fueled mania with much administrative and construction bloat.

I was able to work “part-time” (30 hrs/wk) and get my degree from the closest public college in five years with all of my portion of the costs covered by my earnings and with less than $20k in federal loans, which I paid off in about 10 years without feeling burdened by those $200 or so monthly payments. When I entered school that seemed reasonable. It should have stayed that way.

Digger Dave,

The 2005 BAPCPA was signed into law by President Bush II. But guess who’s fingerprints are all over the Act?

A Democratic Senator, on the Judiciary Committee, from Delaware was pushing for this Bill, and he voted against three amendments in it to ease bankruptcy requirements for some citizens. One was to help seniors keep their homes. One was to help military service members and widows of service members killed in action. And another was to help women whose financial trouble stemmed from “deadbeat husbands’ failure to pay child support or alimony.”

Plus, another detail the Delaware Senator voted against in this Bill would have allowed debtors to continue to pay their union dues during bankruptcy proceedings.

D D, the Act was predominately a Republican supported piece of legislation that catered to the banking and credit card industry, but it had bipartisan support as well, and the biggest supporter from the Left side of the aisle on Capital Hill now has a new address: The White House.

By the way, Delaware is the preferred domestic address, because of State tax laws, for corporations such as large banks and credit card companies. As their Senator, our now-President worked hard to take care of them.

Chapter 7 or Chapter 13?

Good points Dan, and glad to see some other folks seeing what made me SOOOO glad to have gotten OUT of that entire racquet by paying off my ”student” loans long ago.

And the guy I paid off the last $3,000.00 with a paper check, promptly pulled out a $3,000.00 bottle of some antique booze that he and I drank ALL of while, for the first time for me at least, he told me of his WW2.

He was drafted into USAMC the day he completed medical school, sent directly to front line MASH, but only until PTB realized he had spent his jr HS year as exchange student in Germany and was ”completely fluent.”

So, OSS with two ”drops” into Germany, barely getting out each time,,, and then, ”Public Health Officer” for that country.

GREAT guy,,, miss him a ton…

And, to be shore,,, WE, in this case the USA WE, WILL have folks like him again…

As Nimitz of one of his equals said, ” NO, it is NOT ”extraordinary people,” IT IS ”regular people” RISING to extraordinary heights to respond to extraordinary events.

WE the PEONs can only hope this continues to be true, not just for America, but for all peons everywhere…

1) Student loans reached puberty.

2) Student loans can be divided into several tranches.

3) Most student loans are between 1K and 10K. They cannot and should not compete with the rich in the upper tranches

4) Very few loans above 150K – for lawyers, dentist, doctors, high tech – distort the median balance. The skew up the total balance, in a fake positively biased.

5) The upper two tranches are the symptoms of the vertical rise since 2003.

6)

7) The cause : in 2003 the gov sent teenagers to the dorms instead of rioting in the streets.

If you have student loans above $50,000 pay only up to that limit of 50K because a loan forgiveness program is expected.

Also mostly, women goes to college and take up majority of the student loans (61% women and 51% men accept student loans for the college bachelor degrees). Colleges encourage student loans because, student loans give more tuition and fees to the colleges. Rob peter to pay paul. My two dollars…

1. Ask colleges to reduce tuition. Why they need to build a new stadium and fancy buildings for the students?

2. Vague college degrees such as “gender studies” are often not necessary. They should be get away with. Humanities should not have high enrollment.

3. Colleges are sitting on billion dollar endowments. They are hungry for more and even more while the students have to borrow money from taxpayers.

4. Forgive student loans for students entering government sector and working there for five years or more.

5. If allowed to bankrupt, a doctor will bankrupt and start a practice. How to milk him?

Fancy new stadiums and buildings are for the alumni. They put their name on the outside.

A large portion of the lower valued loan balances are ex-students who didn’t even graduate. This pushes the median down. While the median balance may only be $18k and change, there are many students who went to private colleges and earned degrees in art history with balances from $50k-$100k. They are the ones in the worst spot working at Starbucks, but will continue to reliably vote Democrat hoping that will change their situations.

I love the cause sent teenagers to dorms! Wolf statement that the waiter and other service industry hourly employee will end up paying for the loan forgiveness won’t be discussed in any election debate . I just wonder if anyone listens to elections anymore. Rolling on the ground about the proposal for auto loan forgiveness.

Any way to calculate the shadow money creation from the rent, eviction and mtg payment delays that were instituted in 2020?

1) The majority of the lower trenches are young black and Latino voters.

2) They are drifting away from the ruling party.

3) Since BK is not an option, writing off the lower tranche might be politically rewarded.

4) US treasury will dump those loan in a secret vault.

5) The reconstruction plan will give Zoomers and millennial an economic booster in 2024.

6) So, vote for the ruling party, because the other side will not give it to u.

7) But wait, they clicked cash, PPP loans, grants, EIDL loans, when US economy was comatose.

Yes, the auto loan forgiveness was howl worthy. Now, lets watch someone somewhere pick it up as a real suggestion?

It’ll be only for electric cars.

Wolf mentions OSU. My daughter in law went to grad school there and is a dentist for several years now working on a native american nation health center. She has huge loans to pay back. I think bankruptcy could be her way out. It was Biden as a senator who made these loans so tough to get out from under.

The government always here to help!

Thesis > Reaction > Antithesis

– Georg Wilhelm Freidrich Hegel

Taught in second year high school ~ 1974

Ugh. We just paid for 4 years undergrad and now 1st semester of grad, for our Daughter. We scrimped, saved and planned. I don’t feel so good.

I worked 7 days a week to help my daughters graduate and stay out of debt. If it weren’t for the people making sacrifices to be accountable, this Banana Republic Express would have derailed into Weimar by now. The crazy thing is the median student loan is about $17K. At the very most…..why not forgive the interest and term the loan out for 25 years @ $56/month? There is no good reason to forgive the principle other than to loot the responsible folks to buy votes. We have no choice, we have to vote with our feet now!

Hey …my neighbor has three kids with student loans..

and my neighbor just put 100K into his kitchen and is off to Greece for a month.

He votes a certain party in hopes of forgiveness. If forgiven, he just got a free new kitchen and a nice vacation. Those who paid their children’s tuition, who went without, lose. Fair?

DeToqueville noted in his “Democracy in America” that democracies don’t last, because eventually people will vote for those who pull from the Treasury and disperse the money for political power.

To wit.

I guess we will see soon enough if the Fed will save the dollar republic with higher interest rates. “Democracy in America” has become what your country can do for you and the “most reckless Fed” has exacerbated this behavior with super low interest rates for the past 20 years especially. The M1 money supply chart looks like a sting operation…..flood the world with cocaine and then increase the price on the Street 5X and then see what happens with capitalism Vs socialism? The hunger games are on!

A lot, if not most, of the inequities cited here are there because the wealthy benefit the most from them. They are the creditor class. The ones who own munis and Treasuries and corporate debt. as well as stocks and various derivatives beyond counting, much less auditing i.e., the financial system as a whole. The ones who own minerals and land and forests and all the rest of what initially belonged to the public. The Oligarchs, in other words. The same Oligarchs who exist in every nation in every corner of the world. Democracy, fascist, communist, name your poison. Income inequality is the engine that fuels this class. Everyone else is just too ignorant, or hopelessly compromised, to reform the structure down. Bitch all you want about Biden but raising taxes and giving Medicare negotiating power, are two levers that are required for reform.

So what is the policy moving forward? Take out up to $10,000 (or whatever payoff is decided) in loans even if you don’t really need to, because taxpayers will cover it? No way it’s a one-time deal, have to buy off future voters, I mean college students.

Exactly, Publius! I have plenty of problems with this plan on it’s own, but the bigger issue is, “what now?”. Is college free? What about the new class entering college this year? Do they go hog wild on loans because their parents realize that it’s free money (eventually) and better than shelling out their own money? This plan is catastrophically disruptive because it breaks the relationship between debt and accountability. The ultimate moral hazard.

What about the people who skipped college to enter the family business and took out loans to bolster their operation? Restaurants, landscapers, construction, etc. Why not loan forgiveness for them? Oh right. Because it’s not federal debt. What a total mess it is to create two classes of people based solely on who their lender is.

Marcus 1. Debt is the ‘ultimate moral’ hazard. But not in the way you believe. Debt is the way the rich became rich, in case you haven’t noticed. Debt centric financial systems are created for the rich, by the rich. So Help me God.

It’s more buying off the votes of The Higher Ed Industrial Complex. The students/parents are merely a vehicle in the process.

Typical lol.

This article has the tone of attacking the debtors, with no responsibility shouldered to the entity underwriting these predatory loans.

There was a lot of misleading advice and misinformation propagated from every institution under the sun about the usefulness of a college degree.

This propaganda conned both parents and their unsuspecting children, putting pressure on everybody involved that these worthless pieces of paper were the only way to a good career and middle class life.

Furthermore, the author paints a black and white picture. Not every student went to a Ivy League school. Some went to lower tiered colleges in good faith that their hard work would payoff, only for society to break its social contract.

Students were responsible for the debt, but there was no career and middle class life.

And I don’t want to hear about how “well maybe they should have gotten a STEM degree”.

STEM degrees don’t guarantee you anything in a globalized job market. Experience and network is all that matters.

Furthermore, I am an avid reader.

There are so many financial articles I’ve read, and a number of authors, who are working in the big boy institutions, will sometimes divulge that they received a degree in English or some other liberal art, but are working in finance.

Degrees mean nothing in the large majority of cases. Competent people are competent. I am a tradesman, and know journey workers that will run circles around people with engineering degrees.

I’m a tax payer, and I support write downs.

Student loans are sinister, and debtors need relief.

“Degrees mean nothing in the large majority of cases.”

That was not my experience in applying for jobs at various points in 50 years of working.

d

You are talking about the past.

TBS is talking about the present.

Without a four year degree, many doors that lead to a better life never open. I witness that on a daily basis. An advanced degree isn’t for everyone but I always encourage young people to consider it.

Well, my experience was different. My economics degree did not give me any leg up in the job market whatsoever. None.

All I was told is that I lacked experience the majority of the time. Jobs were extremely difficult to come by without the experience or right network.

And even the white collar jobs I held I competed with others in the same role that had no degree at all.

I was under the assumption that meritocracy existed, which was part of a false consciousness I was forced to break out of.

I realized that these white collar jobs were saturated, and I had no place in that arena, so I moved on to blue collar work, which was a blessing in disguise, since I make way more now than I would have ever in a meaningless cubicle Job begging for promotions.

50 years in the work force? You sound like a boomer, which means you really don’t understand the current dynamics of the job market for younger peoples trying to make their way.

Even receptionist jobs require college degrees now.

Lol. Yeah no, with the ease of financing school and the big scam sold that college is an absolute necessity, everyone and their dog has a college degree now. It’s the new high school. I knew a lot of kids when I went to college that were forced there by their parents and they had no business even graduating high school.

College degrees are the absolute bare minimum now. From what I’m seeing, if you’re under 30, a high school degree gets you a life in a miserable job or a life in and out of jail. A college degree gets you a job stocking shelves at Walmart with all the other worker bees.

I don’t have a college degree, I went into the “lucrative” world of trucking. I work 14 hour days, driving all night, burning up 50-60 hour work weeks to barely cut my teeth on 60k/yr. In a medium cost of living area. And I am absolute killing it compared to all the other people I know from my age group. There is one guy who got a GED and works in the pipe fitters union who makes slightly more than me but works out of town 70hrs a week. One girl got an MBA and makes 65k in a high cost of living area. The rest are just warm bodies in retail or service industry milling about like zombies for 14.50/hr struggling to makes ends meet and taking anti depressants.

Also, piss on this bullshit idea of loan forgiveness. At 18 you’re legally an adult. You aren’t mentally but hey, that’s how the law has been for decades. If you sign up for a student loan that’s on you. The middle class is and has been getting destroyed for a long time. There isn’t some quick easy ticket into it. I knew when I was a teenager that the terms for student loans were financial suicide and that college wouldn’t be the golden ticket magic carpet ride to success like everyone passes it off as. People used their pen to sign on the dotted line, they shouldn’t get a free pass carte blanche. Where’s my free ride? I bet you they wouldn’t retroactively reimburse my CDL school that would have costed 5k if I would have needed to attend it. Like others have said, what if I say I want out of trucking and a life of manual labor, is college free now? (aka nearly worthless) Can I get a degree in computer science on the deferred dime of the tax payers and pay nothing but the opportunity cost of lost wages while I’m in school?

What an absolute mess. I don’t know how likely the “forgiveness” is to actually happen but seems like Pandora’s box to me.

The middle class has not been destroyed, just equalized around the world through globalization. Globalization has been reversed in the past, and can be reversed again. So was class inequality. There’s hope, but takes a lot of pain to get there.

I have a friend.

He lost his job 2 years back.

The govt paid for his rent and living expenses for 2 years roughly $4k in total per month or so.

He went on vacation to Europe for 3 weeks spent thousands.

He has 70k in student debt.

He looks forward getting it forgiven.

I am a taxpayer and am angry at this .

sick story. another crab in the bucket

A few things get overlooked with the “Shoulda gotten a STEM degree”:

1. Most of the STEM opportunities are concentrated in computers and healthcare. After that, it’s other engineering disciplines.

2. Engineering programs aggressively weed out people, which means that many of the non-STEM majors are really ex-STEM majors.

3. ISTR that the major with the highest underemployment rate is actually business.

Big Show, not one thing you wrote justifies taxpayers picking up the bill for that debt relief.

Find someone else to pick up the tab for that forgiveness. We are not here to indemnify everyone against everything.

The bottom line is that people want what is best for their bottom line, like the banks and other oligarchies 14 years ago when student loans were still being paid.

Unless your rich, you probably hope for loan forgiveness. Generally, It is not about morality.

It is easy to say what is right and wrong from a position of wealth. However, most people would steal to stay alive. The politicians and government figured out what they “needed” to get away with then, and they know what they can get away with now.

More poor people probably still believe that bank forgiveness was a good idea versus the number of wealthy people that think student loan forgiveness is a good idea. The two sides of forgiveness.

No. The working class will not take this well. There will be hell to pay with the blue collar electorate and with all of us who paid our loans and children’s tuition. This is both bad policy and bad politics. Terrible policy actually.

I agree, but these are the cards that are dealt. It is difficult to not play the hand using the cards that are dealt to you unless you go off the grid

“But that doesn’t need to be that way. These same politicians could change the law to allow student loans to be discharged in bankruptcy courts.”

Or, act like the civilized world and just have the government directly fund college educations, or at least provide it with extreme subsidies.

The purpose of college loans is to teach people that one gets ahead by taking on debt, not by looking to the government for any kind of help. It is an instrument of moral instruction.

Absolutely. Education is a public utility, and should be heavily subsidized. Right along with healthcare.

These costs should be kept low, so labor has more purchasing power within the productive economy.

Unfortunately, we live in a world where rentiers, privatizers, and other parasites rule and are protected by their union, the federal government.

Kent,

Going to college or University is no longer affordable in the USA to the vast majority of students. That is not a good system IMO.

I was born in a day when that was not the way it was. I paid my way through a Bachelor’s degree at the U of MN. But full year tuition for my first year, 1980/1981, was a grand total of $1,150.50 for the three trimesters ($383.50 per trimester — now on a semester schedule).

It’s a tad bit more these days.

Yep, my college tuition is now about 25000 times more than it was in the early70’s.

Inflation nation started early with college tuitions. Makes RE inflation look somewhat tame.

The US system is set up to hugely benefit the “educational-industrial complex” — so called in the article.

There is a way to make public college free – but first you have to dismantle the gigantic educational-industrial complex that got rich and fat off these student loans.

Free public college should come with drab classrooms and lab buildings, no “campuses” but just big buildings in an urban area, no fancy student housing, etc. They do that in Europe. Universities are not fancy there. Here, university campuses are enormous and constantly growing industrial enterprises with huge sports stadiums and arenas and pools, pumping up entire industries, such as the construction industry, the sports industry (including media), electronics suppliers, such as Apple, textbook suppliers (don’t even get me started about THAT scam), etc.

No way in hell should the taxpayer pay for students to live in luxury housing, go to fancy campuses with gorgeous buildings, huge stadiums, and huge park-like areas in the middle of expensive cities. If you talk about low-cost education, follow the European model of what a university looks like.

Here in UK, colleges and universities are happily getting on with the latest educational-industrial hype craze. In my small market town on the outskirts of London, they just built a brand new spanking university (with all the modcons gabbins and leisure facilities you Yanks seem to get everywhere), the cost of which is about 10x per sqm what it would cost to build a multistorey office block or resi block. There is a private villas village built in Bahamas off this one for sure. The courses they offer are the ones that are guaranteed not to be needed in two years, let alone in twenty. Given the profiles of the “students”, I’d rather not name the courses lest I be branded as ***phoby this and ***phoby that.

So, the business plan of corruption and parasitising off the tax-payer host is happily spreading from west atlantic to east atlantic and so on.

The old adage of: just get more customers and the plan will grow, here holds firm.

As I understand it, the complex was born after WWII with the GI bill and then the war on poverty programs in the 60s?

Thanks Wolf for moderating my comments.

I don’t allow MMT promos.

When a class of loan fails or falters in any way the first action is to halt new issuance. Is anyone suggesting that? No. Why not? It’s a sacred cow.

Agreed. The government wants to keep feeding the educational-industrial complex.

I suggest something that involves the following in some form..

Colleges with a certain size endowment must …..

cosign the student loan, or….

be lender themselves for the entire tuition or a lion’s share

and why not?

We have an arrangement now where the federal govt provides the credit for the purchase of a service from a “business”. (schools are big business, don’t kid yourself)

This in itself pushes tuition costs up.

If a person wants to buy a Ford, he deals with Ford credit. Not the federal car loan dept. What would the price of Fords be if federal credit was involved?

If you want to go ABC University, deal with ABC University Credit Dept.

If these steps, in some form, were implemented, two things would happen…

Tuition costs would cease their dramatic rise

Worthless degrees would disappear

Both, because the school would suddenly have an interest in repayment of loan.

Free school education, what a great idea! Years ago only those who had enough or submitted to the whims of the elected had the opportunity. Now, the youth doesn’t have to vote or pay allegance to any politician.

Free public education should be in drab buildings without campus, stadiums, pools, fancy student housing, etc. Europe does it that way, and it’s not free either.

Old K-Mart and Sears properties will do nicely.

One question on the numbers – is $18k the total balance, or the principal balance? i.e. excluding interest and late fees

Total balance owed.

Seems to me if the government wants to “help” the people, maybe they should consider paying off health care debts. This actually might help people in need.

It burns that the ethical are boned and the moochers are rewarded. After Katrina, SBA loans were forgiven and forgotten. Your taxes covered it. The unscrupulous made hay in the Deepwater Horizon spill, I was in Venice LA at the time and saw.

It wasn’t all BP’s money.Student loans will be the next gimme. “Car mortgage” forgiveness not far off. Gotta have somewhere to sleep. All this makes those who pay their taxes and subsidize the unproductive feel like gullible fools. And those who can do so undetected will not pay all their taxes going forward. Salarymen are trapped but lots of us aren’t. When the only interest government took in individual’s lives was getting their share of the money that those people earned, it was much more intimidating to get a we’re-hungry-pay-us notice from the irs. Today they have involved themselves in so much that many are noticing the cracks and fissures in the structure as they exceed their competency at governing like it’s nursing care. Highways and armies, leave all else to the states. There’s less wealth to steal now from those that the government can easily scare into compliance, and more and more that they cannot find and confiscate cost-effectively. Black markets in labor flourished in northern Europe and Scandinavia with East Europeans working under the table. The Soviet Union existed for longer than a straight collective should have, and it’s extensive black markets in materials and commodities was part of the reason. In the sixties, US people started little businesses to lose money which could be offset against gains to lower their tax burden. As tax cheating becomes a practical necessity again, the feds will crank up enforcement. They cannot win all the time. The mouse runs for his life, the cat runs for dinner. If a thousand mice decide that they’re tired of running and bow up on the cat instead, he’s gonna be contemplating a change of venue. There’s hundreds of thousands of houses in this country that a irs agent would be ill-advised to walk up to. They’re government proles regulating you at your expense, not righteous workers. And they know that if they don’t do anything they can’t do anything wrong, and want to keep their pensions. Government always becomes top heavy, and falls on the governed.

Already $7500 credit to buy the right car. If enough don’t buy, I bet it goes higher. People going to drive their old beaters to 300k.

The way I understand with superficial reading: the law limits where EVs and components (battery) have to be manufactured, almost no EV today qualifies for it, and it will be years before automakers can set up US production for this stuff to get their EVs to qualify. Ford and GM have lambasted the limits.

Free higher education would be a fairer and more straightforward system. If taxpayers will pay the bill eventually.

Ask the tough question…

WHY is education so expensive?

Did Plato charge this much?

So many static courses…..math, language, history, art, physics, accounting…

A few lectures a week that could be videoed and “canned” for repeat use…and teaching assistants (TAs) that get tuition breaks for their teaching the smaller classes. Where is the great expense?

The cost is other than the actual delivery of education.

The trajectory of college tuition has been in lockstep with the trajectory of the budget of the Dept of Education.

From zero in 1979 to $63 Billion a year!!!

For the simplicity of math, lets assume that each State received $1 Billion a year to spend on education in their State as they see fit. This would leave $13 Billion for a trimmed down dept in Washington.

This suggestion strips bare how the federal leviathan operates…they take and then give back after taking their cut. Maybe the money never should have left the State in the first place?

Only 38% of Pell Grant recipients complete degrees in eight years, which is as long as federal data track. That means some two-thirds of Mr. Biden’s $229 billion could go down the drain. WSJ 3/30/2022

Why should taxpayer pay if it’s free education? Who will be chosen to be educated?

Why are taxpayers paying for secondary education?

Free higher education sounds great.

Will the teachers work for free? Is that the idea?

Because if it worked the other way …

who sets the pay scale?

what of grad students?

what of more than four yrs for a BS?

what of those who just paid in full….refund?

what about trade schools?

debt forgiven for two home families with the boat and european vacations, country clubs? (upper bracket famalies are huge percentage of those owing college debt)

Unlimited free university courses, room and board would be a waste of taxpayers’ money. There are so many complaints about people going to college and not getting good jobs, they may cancel the student loan program, or only extend it to the brightest applicants. Some of these diploma mills do not provide adequate training, only easy A’s to keep the cash flowing.

I had a college loan that was difficult to pay back. I got the bank to restructure it to make the payments smaller. I paid it off and have no long term debt.

There is a lot of distortion in the comments, so far, in this post. One of the biggest problems in the student debt issue is the for-profit colleges. They actively recruit students – every way imaginable, e.g. recruiting homeless people living under bridges – to get their education using student loans with no money down. And their recruiting is directed primarily at poor students, promising a great job and easy, quick coursework. The attempts by Democrats to stop this fleecing was shut down by the GOP who were beholden to the contributions from the for-profit lobbyists, as recently as the Obama Admin.

The GOP and the Dems are protecting other industries, too, as we all know: pharma, big oil, etc. So this shouldn’t be characterized as something that the Democrats are guilty of. That’s BS. “Another Scot”, you might want to reckon with some truth and recognize the widespread corruption within the GOP.

Bernie Sanders and others have advocated free college education, for one and all, like a few countries in Northern Europe. Here are two serious issues with that thinking: 1) if students do not have any “skin in the game” – paying or in some way sacrificing to get a program completed, so they can quit at any time, drag-out their instruction for years, play around with different majors, etc., they’ll be pissing away taxpayer supported higher ed. Not so if students are paying for it. The community college system pays good salaries to teachers with very, very modest workloads who are teaching 6th grade skills: arithmetic, remedial reading and writing, ESL. Look at any Comm. Coll. schedule of classes: tons of remediation. The audience is mostly students who didn’t give a sh*t while in middle and high school. They’re “catching up”. So, aside from student loans, there needs to be more stringency about what constitutes K – 12 competence. Throwing money at the idea that people have a “right” to higher education is just inflating the time it takes to learn the three R’s.

Yes, Dems are bleeding hearts and want to give a leg-up on the massive number of people in the lower echelons of our country. But free higher ed is stupidisimo.

Students know what loans are about, even at the age of 17 or 18. And they typically have parents who are aware of the obligations. Pretending that they “didn’t know the gun was loaded” is nonsense. These loans should not be “written off”. It’s the same moral hazard of the FED rescuing banks who caused the ’08 financial crisis. We ALL know that. The same applies to student loans.

And the idea of “buying votes” is crap. Americans forget political actions a day after they learn about it, so, thinking they’ll feel some loyalty to Biden for erasing their debt is science fiction.

I am fine with a free education system for degrees that are actually needed for job openings (those that are not needed should cost as they would be considered for personal development).

Shorten degrees to two years or less and make them more specialized (lots of subjects in a degree are useless filler and not needed for an individuals job afterwards) and pair the student to an internship for a year straight after at a company that is willing to help out with cost-sharing the education. in that way it may resemble a trade. The government gets to fill jobs that are actually needed in the economy, companies get workers with the skills they need and students get a useful degree that doesn’t bleed them.

Then move the colleges and dormitories to all the vacant office buildings, starve the bloated universities of their waste and maybe there will be lots more prime land for residential housing.

Free education in European countries is not free, there’s limited availability and you have to qualify to get it. It’s nuts to talk about ‘free’ education. Those countries also control what and how many spots are needed, they won’t pay for your art history major.

Life long democrats will become republicans if student loans are forgiven. Well, for sure at least one I know will.

Sure just add another $2T on debt stack. Print away!!!

Actually no. It’s already added to the pile. That $1.6 trillion in student loan debt was cash that the government handed to students, and it borrowed that cash as it went as part of its Treasury issuance. So that $1.6 trillion is already included in the government’s debt. What’s different is that after forgiveness, the taxpayers has to pay it off instead of the former students with student loans.

Money has turned in to confetti,these political hacks of my generation have stolen the future of America.Hope they make it through judgement day

with the gov. involved in everything it’s no wonder everything from health care to education is so expensive. Saw a chart showing productivity gains and the amount shared by labor and capital. Just what? Capital over the last 30 years or so has outpaced labor by a wide margin. If they had shared the gains average wages in this country would be 3 times what they are and then maybe folks could afford 400k houses and 50k cars. But they still would not be able to afford our ridiculous health care and education.

Health care became super expensive-o-rama without government involvement.

When was “health care” without Government involvement?

I put that in quotes because of the confused conflation between actual health care and so-called health insurance. When I was a kid, we went to a family doctor and paid in cash. The doctor was not required to fill out federal forms for the diagnosis/treatment. Every state has a bureaucracy for regulating insurance. They agree on costs of treatments/medication. The federal government, obviously, has a huge bureaucracy for regulating “health care.” None of the explosion in costs to the individual occurred without government assistance/encouragement. We probably pay over a million dollars in salaries to ensure that someone does not cheat and deduct the cost of unnecessary cosmetic surgery that would reduce their adjusted gross income by no more than $100k. (Mind you that is their AGI , not their taxes.)

I contend that more government is not the answer.

According to my ex-doctor, the rise in his operating costs (he is a single practitioner in a concierge practice) was the result of government reporting requirements. He had to increase his staff 100% from 3 – a nurse, a receptionist, and billing / office manager (aka his wife) to 6 to comply with the red tape. In order to make a living, he would have had to resort to “assembly line medicine” (in his words) and he said that wasn’t the reason he went to med school. His choice was to go concierge or join some corporate practice as a drone.

If you look at the costs in a medical practice, I’m fairly sure that the bulk of the “growth” in employment is administration – not the people that provide care.

The cartels/oligarchies exist by oppressing competition thru their ‘ lobbying efforts and price fixing. They disdain competition. It makes one feel safe to work there.

Monopolies everywhere now. What was once considered a monopoly, aint any more.

If you want to have a business, you better have lawyers and accountants on the pay roll if your in the one of the Cartel/Oligarchy/Monopoly industries:

Banks/Finance, Military, Health, Telecommunications/Media, Defense/Offense, Education etc… just the ones I think of right away.

It could be “lichened” to the largest organism in the world-a myceliated fungus with huge connected reach and power feeding off of each other, and on the masses.

haha funguy It will not change in my lifetime.

.

A history professor? So this whole system of employer-based health insurance happened without .gov involvement?