The three account for 50% of retail sales. People blowing their disposable income that outran inflation by a wide margin this year.

By Wolf Richter for WOLF STREET.

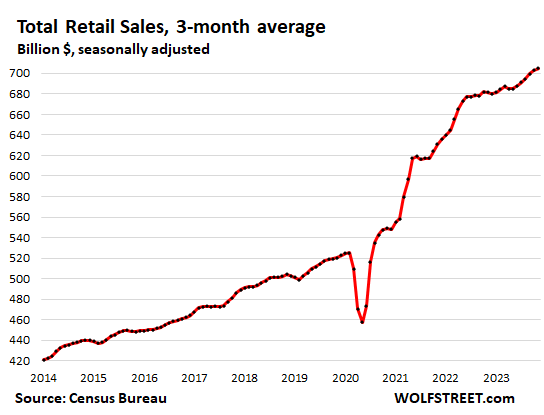

Total retail sales rose by 0.3% in November from October, seasonally adjusted, even amid dropping prices of durable goods and gasoline that retailers sell, as inflation has now totally moved into services that retailers don’t sell. So adjusted for inflation, retail sales would have increased even more.

Compared to a year ago, retail sales rose 4.1%, despite the price declines in durable goods and gasoline.

The three-month moving average, which tamps down on the artificial drama of the monthly squiggles that can obscure the trends, rose by 0.3% and was up by 3.4% from the same period a year ago. All charts here show the three-month moving average:

But only some categories of retailers benefitted, particularly the big three that between them account for 50% of total retail sales: Ecommerce operations, bars and restaurants, and at auto dealers.

Other types of brick-and-mortar retailers are in permanent decline, such as department stores and electronics and appliance stores, because their sales are wandering off to ecommerce including their own ecommerce operations, and their brick-and-mortar stores lost out again. Sales at gas stations plunged because the price of gasoline plunged. And we’ll get to all those in a moment, each with their own chart.

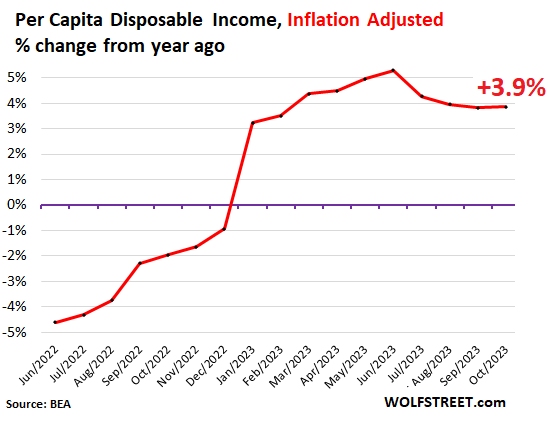

Where does this money come from? It’s not a secret.

Per-capita disposable income, adjusted for inflation (total income from all sources minus taxes, adjusted for inflation), jumped by 0.3% in October and by 3.9% year-over-year, in other words, outrunning inflation by 3.9% year-over-year, after having falling behind inflation in the prior two years.

This is what consumers had left to spend on goods and services, and to save. And our drunken sailors, as we’ve come to call them lovingly and facetiously because they just refuse to stop drinking from the punchbowl, saved some of their disposable income and blew the rest.

This is what fuels the spending binge we’re seeing:

Retail sales by major segment of retailers.

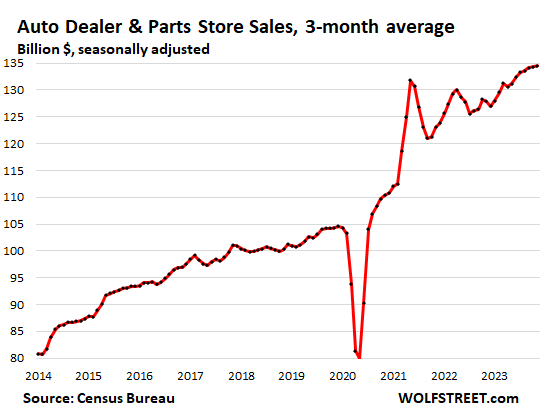

New and Used Vehicle and Parts Dealers (22% of total retail sales):

- Sales: $135 billion

- From prior month: +0.5%

- From prior month, 3mma: +0.2%

- Year-over-year, 3mma: +5.2%

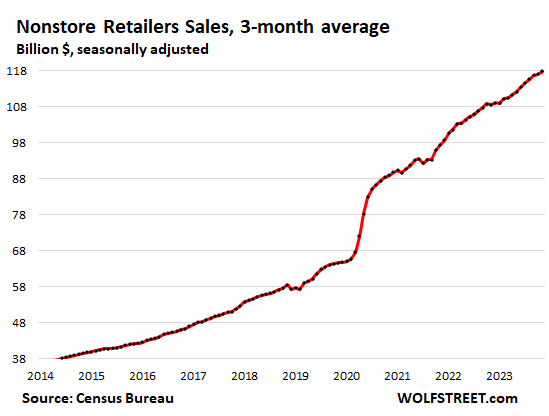

Ecommerce and other “nonstore retailers” (16% of total retail sales), ecommerce retailers, ecommerce operations of brick-and-mortar retailers, and stalls and markets:

- Sales: $119 billion

- From prior month: +1.0%

- From prior month, 3mma: +0.7%

- Year-over-year, 3mma: +8.6%

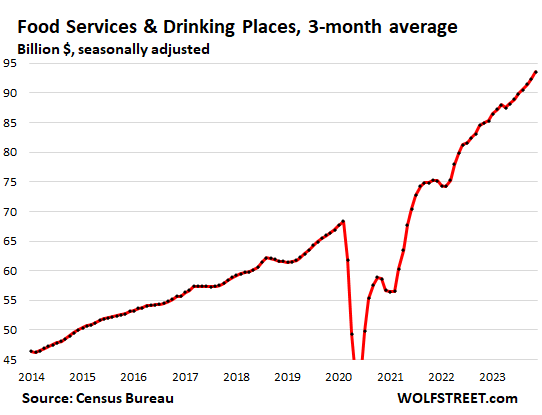

Bars & restaurants (“Food services and drinking places,” 13% of total retail). Our drunken sailors are going wild eating and drinking out, with double-digit year-over-year spending growth, spending a lot more at those places than at food & beverage stores, under the motto, YOLO?

- Sales: $95 billion

- From prior month: +1.6%

- From prior month, 3mma: +1.3%

- Year-over-year, 3mma: +10.0%

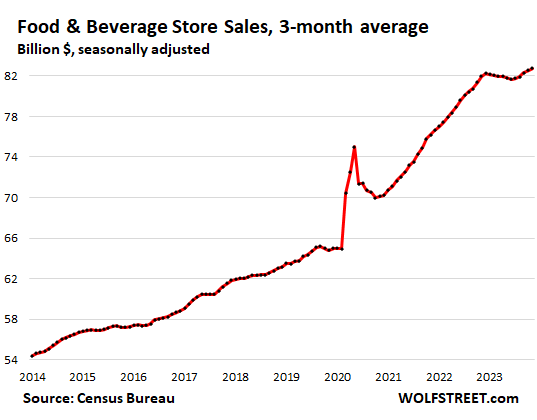

Food and Beverage Stores (12% of total retail):

- Sales: $83 billion

- From prior month: +0.2%

- From prior month, 3mma: +0.2%

- Year-over-year, 3mma: +0.9%

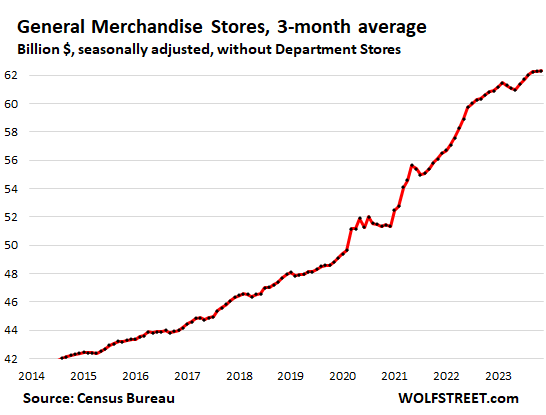

General merchandise stores, without department stores (10% of total retail):

- Sales: $62 billion

- From prior month: +0.2%

- From prior month, 3mma: +0.0%

- Year-over-year, 3mma: +2.4%

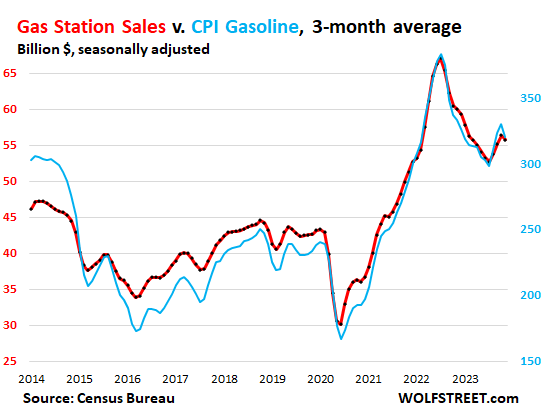

Gas stations got a boost from price increases (8% of total retail sales). Sales at gas stations move in near-lockstep with the price of gasoline:

- Sales: $54 billion

- From prior month: -2.9%

- From prior month, 3mma: -1.0%

- Year-over-year, 3mma: -7.0%

This chart shows the three-month moving average of the CPI for gasoline (blue, right axis) and sales in billions of dollars at gas stations, including other merchandise that gas stations sell (red, left axis):

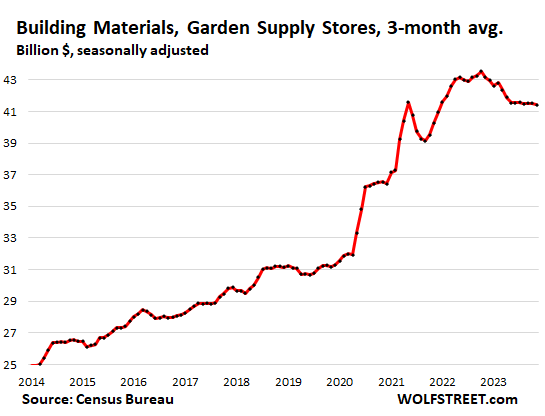

Building materials, garden supply and equipment stores (6% of total retail). Pandemic bubble bye-bye:

- Sales: $41 billion

- From prior month: -0.4%

- From prior month, 3mma: +0.3%

- Year-over-year, 3mma: -4.0%

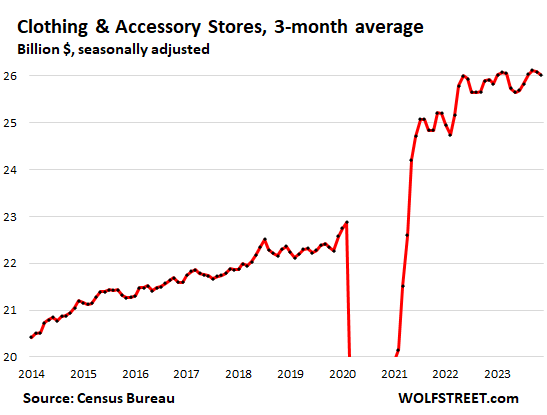

Clothing and accessory stores (3.7% of retail):

- Sales: $26 billion

- From prior month: +0.6%

- From prior month, 3mma: -0.3%

- Year-over-year, 3mma: +0.4%

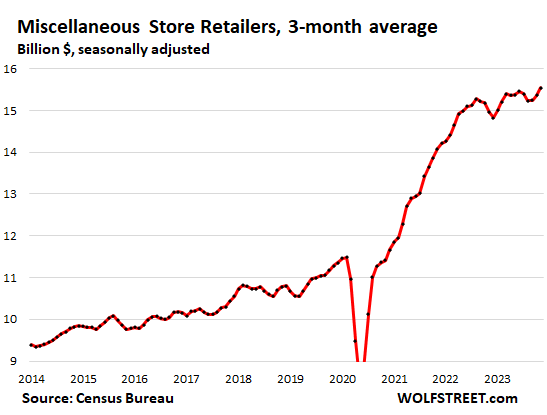

Miscellaneous store retailers (2.2% of total retail): Specialty stores, including cannabis stores.

- Sales: $15.4 billion

- Month over month: -2.0%

- Month over month 3mma: +1.1%

- Year-over-year, 3mma: +3.9%

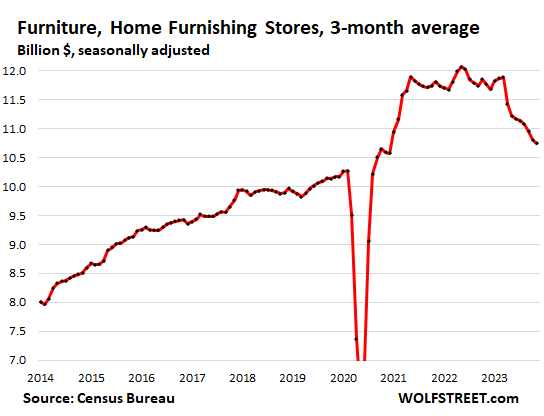

Furniture and home furnishing stores (1.6% of total retail). A big portion of furniture and furnishing sales have wandered off to ecommerce, with huge online retailers dominating the scene. This is what’s left over at brick-and-mortar retailers that specialize in furniture and furnishings:

- Sales: $10.7 billion

- From prior month: +0.9%

- From prior month, 3mma: -0.5%

- Year-over-year, 3mma: -8.6%

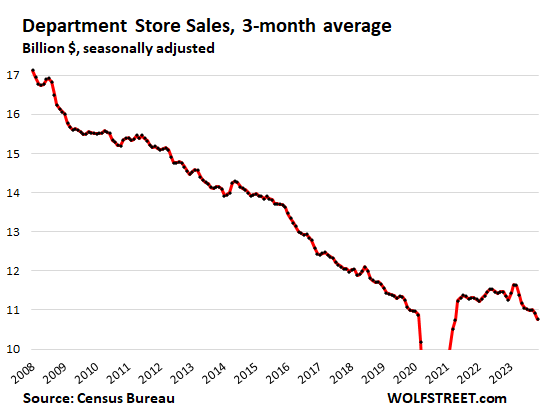

Department stores (now down to just 1.5% of total retail sales, from around 10% in the 1990s). Ecommerce sales by department store chains are not included here, but are included in ecommerce retail sales above.

- Sales: $10.5 billion

- From prior month: -2.5%

- From prior month, 3mma: -1.6%

- Year-over-year, 3mma: -5.3%

- From peak in 2001: -40% despite 22 years of inflation.

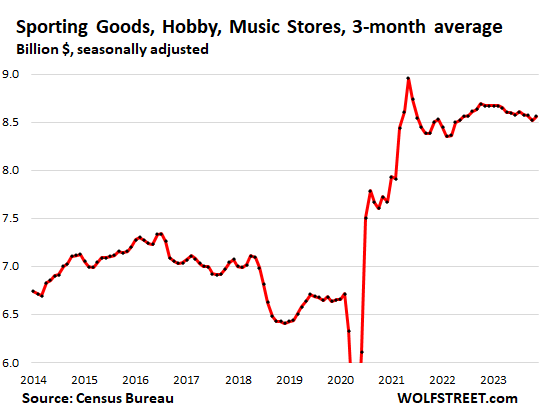

Sporting goods, hobby, book and music stores (1.2% of total retail):

- Sales: $8.6 billion

- Month over month: +1.3%

- Month over month, 3mma: 0.5%

- Year-over-year, 3mma: -1.3%.

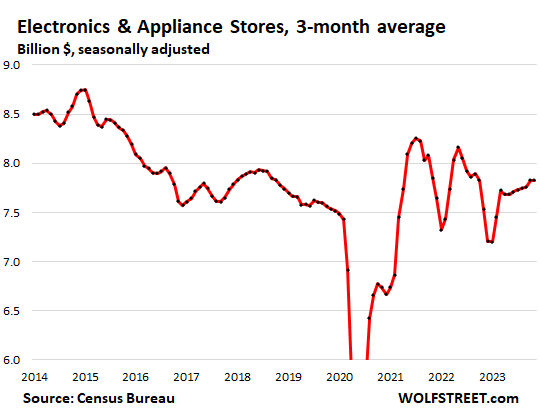

Electronics & appliance stores (1.1% of total retail):

- Sales: $7.8 billion

- Month over month: -1.1%

- Month over month, 3mma: 0%

- Year-over-year, 3mma: +3.9%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

…and Jerome holds rates steady while signaling three cuts in 2024.

What an F’ing joke. I hope you are correct Wolf and those three cuts get pushed into 2025, otherwise it’s time to starting dumping dollars and this time around commodities will be competing with treasuries. Everyone will be spending more, a lot more, if he starts cutting according to those dot plots.

time to buy assets like stocks, bonds (assuming fed actually cuts >=3 times next year), and bitcoin :)

10 year at 3.94%, core CPI at 4%. Enjoy my positive rates and thank me.

so I bought BREAKFAST this morning for daughters college graduation

10(baby, 5, 8 and 10 year old + 6 adults)

$200

scanned bill – coffee $3.95, latte $7.95, most bfast on menu $16++

left 10% tip

don’t tip for drinks

Bad boy! bad boy! Don’t believe your lying eyes.

Look at these numbers over here!

Now go FOMO into some stonks and finance a house you won’t be able to pay.

I just spent $60 on 3 dishes of Vietnamese TO GO! Delish, but dam! And notice how the tip “suggestions” have inflated so that 20% is often the default, and 25% is there for the drunken sailors.

Fed Pivot Definition:

“A Fed pivot is when the Federal Reserve reverses its existing monetary policy stance. This can be a change from contractionary to expansionary policy or vice versa. As the U.S. central bank, the Fed is responsible for setting and implementing the country’s monetary policy.”

So The Fed had this information yesterday when they met but decided to plot out an extra rate cut anyway. Unemployment below expectations as well today which the Fed knew already. Better make sure we are ready for a recession that might never come though. Better make sure we are ready to cut rates the second inflation gets anywhere near two percent. Cant be too careful. 😂

All measured in inflated dollars

figure my high price property for sale now will get new interest

still looking to raise some cash for other purchases

made my money here – time to seek out greener pastures

Watch out for when they say “It’s premature to talk about QE”. Or “We’re not even thinking about thinking of restarting QE”. Cause that’s when they start QE. Lol

and the Fed wants to do what….. 3 rate cut… May be there is a new logic, crazy sending will not increase inflation….

Best of Luck to all of us……

It’s just amazing that The Fed will move heaven and earth to save asset prices. They will climb Mount Everest on steps made out of MBS to prop up a housing market that didn’t need help. They will make premature statements about rate cutting before inflation is defeated but drag their feet when inflation is ramping up. They use extreme caution to bring down inflation that they helped create but have no qualms about keeping rates at zero to stop a very mild recession. Maybe they know something we don’t but I doubt it. It’s just like when the politicians tell you they need to spend more money to lower the deficit. It has never worked but they keep telling the lie.

Maybe they are just working for the banks. So they kept rate at 0% for 12 years (for no good reason since after 2012) to let banks recover and build a moat. Can’t help some banks (SVB, First Republic), but they try to keep other regionals afloat.

Might as well spend now. Youll never save fast enough for a house and youll never save fast enough for retirement. Live it up, and when the bill comes due move to a country with legal euthanasia.

Yolo!

That’s not even a joke. LOL

My local city is helping with affordability by giving out big property tax rebates to low income or seniors over 65.

Low income starts at $62k for a single person to qualify and goes up to $102k depending on how big the family. The $102k was for a family of 8.

subsidizing existing homeowners so inflated prices persist for current renters. interesting welfare mechanic. but expected.

Wolf … so a 3.9% increase in disposable income translates into 30-50% more total retail sales compared to pre-covid!?

I know those are estimates there but I am shocked to see that and have always wondered where so much extra money would come from. Doesn’t seem to add up but maybe that 3.9% is that big a number to affect the overall retail spend $ by that much!? Just seems crazy we are buying 50% more stuff than before the pandemic even with inflation of both wages and prices.

To compare, both over four years, since Nov 2019, and neither adjusted for inflation:

Four-year retail sales growth (+35%) v. four-year non-inflation adjusted disposable income growth (+25%).

Annual retail spending in 2023 (about $8 trillion) looks to be about 42% of total consumer spending ($19 trillion).

“Four-year retail sales growth (+35%) v. four-year non-inflation adjusted disposable income growth (+25%).”

So, overspent 10%.

10% of retail spending times 4 years = $3.2T — All the pandemic free money! Unless that free money got included in the income. Convoluted accounting so elites can keep running the peasants around circles like one new entrant to Repub party president nomination does.

Wolf, thank you for all the data, and graphs, and explanations, and answering questions, and a dose of reality every day. Can’t find a site like yours anywhere on internet.

Great question. I would also like to know this.

The 3.9% in disposable income is inflation adjusted. I don’t believe the total retail sales numbers are.

Oh drunken sailors, why go sober when you can stay drunk and suffer no consequences now and down the road…drunk is the new norm and lol to inflation is transitory, our sailors will make sure it’s not…

Drunken sailors is too tame to describe the spending habit, how about Yayo addicts instead? They are looking for the next fix, I think calling them that even tough in cheek is more appropriate

I look at it like going out and spending money at restaurants is helping people stay employed. I could pull back and save for a rainy day but that would be creating a rainy day for somebody today. As they say, a rainy day tomorrow is always better than one today.

Howdy Folks and Lone Wolf. Ya ll are welcome.

Signed. Retired sober sailor enjoying life more good, since ZIRP died.

Looks like with the exception of housing related sales, everything is back on anout the same trajectory as before covid. Only real estate is suffering at this point.

This makes total sense. Theres been no recession. Employment and wages are still strong and banks are paying a lot more on savings accounts.

Yup and with housing, you already know what the MSM and RE industry is already hyping up as the next great rush into buying since we’ll have rate cuts, 30yrs will be at 5% and everyone will be rushing back in overbidding and jizzing all over what little inventory left, that’s the narrative being served now ahead of next Spring season…I got a good laugh from a RE agent spam below…who knows people fall for this kind of crap, then perhaps housing demand will see a spike back up..

The Fed Is Predicted To Reduce Interest Rates 6 Times in 2024

What’s Happening? The Federal Reserve, often referred to as the “Fed,” is expected to lower interest rates in 2024. This decision is aimed at addressing concerns about a slowdown in the economy.

Why is the Fed Doing This? The Fed is taking this step to help boost economic growth. By reducing interest rates, they hope to encourage borrowing and spending, which can stimulate businesses and create jobs.

What Does It Mean for You? This would lead to lower interest rates on things like mortgages, car loans, and credit cards. It’s good news if you’re looking to buy a home or make a big purchase.

Impact on the Housing Market:

Lower interest rates typically mean lower mortgage rates. Thus, we may see more affordable borrowing costs for home buyers. This could make home ownership more accessible and potentially lead to increased demand for homes.

Existing homeowners might consider refinancing their mortgages to take advantage of lower rates.

Lower rates could also result in more housing inventory by incentivizing current homeowners with low interest rates to sell and buy a replacement home.

On the flip side, a surge in demand for homes, driven by lower rates, might lead to increased competition among buyers. This competition could potentially drive up home prices in some markets.

Never have seen Nebraska furniture mart offer 50 month financing . What’s that tell you

Lennar just had a earnings call. They had a great quarter even though the average house price they sold dropped -11% from $500k to $444k. They made it via volume. Probably less quality finishing too? LOL

-Revenue of $10.97B (+7.9% Y/Y) beats by $680M.

-New orders increased 32% to 17,366 homes; new orders dollar value increased 32% to $7.3 billion

-Backlog of 14,892 homes with a dollar value of $6.6 billion

-Deliveries increased 19% to 23,795 homes.

-Repurchased 3 million shares of Lennar common stock for $337 million.

Crazy. They have a great backlog and that was before the current drop in mortgage rates. Of course, maybe the rate drop is not that important as they were doing rate buy-downs.

We have discussed this for months: lower prices, smaller houses, fewer and cheaper amenities, and massive mortgage-rate buydowns have been very effective in getting home buyers to switch from buying an existing home to buying a new home. So existing home sales have collapsed, and new home sales have hung in there.

Most recently here:

https://wolfstreet.com/2023/11/27/prices-of-new-houses-drop-further-18-year-over-year-sales-drop-high-inventories-rise-further-supply-jumps/

Pray for home furniture stores. That’s got to bite. Potentially also the impact of less people moving house?

Buying furniture online is a huge relief. I remember going from furniture store to furniture store every weekend for weeks to see what they had, and they had some showroom stuff and the rest was in the catalogue, and it was really hard and frustrating to find things we liked and prices we found acceptable.

Now we spend 2-3 hours on the internet, looking at thousands of pieces, quickly discarding 99.9% of them, and ranking our top 10 choices, and then we order and are done. We’ve bought lots of big stuff that way, a whole living room, a huge armoire for the bedroom, cabinets, smaller pieces… minor assembly required (make sure you have a power screwdriver and a hammer and a good saw in case something doesn’t quite fit).

So yes, pray for the furniture stores. Because we aren’t ever going through that pain again.

We were looking for a simple dresser to put our clothes in. Went to some of the furniture stores and it was all particle board junk with laminate veneer that made them look like they were real wood but no not quite. And of course, $300? Who buys this stuph? We are die hard garage sale goers and just were patient and found a really nice dresser at a rummage sale for a church that someone was trying to move to a new home. Lovely dovetail drawers and simple pulls, maybe a few scratches here and there but nothing major. A little wax on the rails and the drawers were fine. $35. They tried to talk us into taking along the two huge metal file cabinets but thankfully I was able to say no. I realize this isn’t for everyone, and if you’re looking to put together an entire wardrobe set in one style it’s not going to work, but a little patience and you can find some really cool stuff second hand.

Lifehack: develop a taste for 20th century (but not mid-century modern) dark brown furniture. You can get screaming deals on this stuff in nice condition if you look around on Craigslist because nobody seems to want it.

It, uh, helps if you can get the other adults in your household to share that taste….

“Showroom only” retailers can/will be easily be replaced by digital showrooms. What’s the point of a physical storefront if you’re just going to ship the product from a warehouse (vs your customer driving away w it)?

One difference is seeing a really cool set of pictures and reading a few dozen fake reviews and then receiving a particle board POS vs. Seeing and touching IRL and getting exactly what you hoped.

Granted I suck at online shopping, not everyone will have these experiences.

Unemployment claims drop big time

Retail sales explode

Wolf writes a column regarding the expansion of new factories

So………Powell decides to fantasize about cutting rates

It’s either he is crooked or…….after thinking about it…….the dumbest fed chair ever……and that is saying something.

My vote is on crooked…….his Cayman accounts are probably closing in on Buffett money. At least he is doing the old fashioned American way…..steal it. Work ethic….what a myth.

Where do Walmart sales fit into these categories? Maybe General Merchandise, but it also sells a lot of Food, and Clothing, and other stuff.

Walmart has better online experience than Amazon now. And shows you best deals first. You can beat Amazon prices half of the time and by a lot. Delivery (at least in my local) is better than Amazon. Showed this to my GF she was surprised; saved like 30%.

Just like more young people today are eating more than they should an increasing number of young people are spending more than they should (and it is easier to spend today when you can press a button and have a hamburger on the way from DoorDash or almost anything else from Amazon). P.S. I won’t be investing in any Retail RE REITS since the local O’Reilly Auto Parts charges $39.99 for same exact 5 quart bottle of Synthetic motor oil that Amazon or Walmart will deliver to my door (usually the next day) for $24.99.

Those are good savings. You can also get oil pump for changing oil thru oil measuring stick outlet. Then just change the oil filter. Don’t even have to go under car in most cases. That’ll save $200 if you drive a German car.

But your local O’Reilly lets you bring your used motor oil back. Does Amazon accept used oil?

I’m guilty of getting my oil from Costco (only $39.99 for 2x 5qt jugs of 5w-30!) but try to buy everything else from the local autozone that I’m always bringing my used oil to.

Yes.

This is data about retailers and their revenues, not consumer spending. It views consumer spending from the recipients’ side.

This is by store location. So a Walmart store (classified by NAICS code as General Merchandise Retailer) gets the survey and fills in the revenue data for all their merchandise, including food.

Thanks. So the Food data are distorted. Walmart is the largest grocer in America. Yet, if I understand you correctly, it’s food sales are grouped under General Merchandise, which is thus also distorted. I learn a lot from your site.

There is nothing about “food sales” in this article. Please make an effort to understand this. Clear your mind of your preconceived misconceptions. Press Ctrl ALt Del

But there is a retailer category in this article, called “Food and beverage stores,” and there is another retailer category called “gasoline stations,” and there is another retailer category called “General merchandise stores,” and there is another retailer category called “Nonstore Retailers” (“Ecommerce and other “nonstore retailers”), and there is another retailer category called “Food services and drinking places,” and they all can have food sales, even gasoline stations, which are often convenience stores.

Some of us might think that Food is included in Food and Beverage Sales. /sarc

Thanks Wolf,

We need a strong dollar. Powell has abandoned it. I don’t care about the balance sheet or QT. All this is bad in my opinion. Insanity is doing the same thing over and over again looking for different results. Just making our currency worth less and less.

There are a lot of people who have to take RMD’s now. That money

is going out into the economy instead of being invested for those

that would inherit it.Lots of older drunken sailors.

And if decent sized, which wouldn’t be most, is you want to pull as much out tax efficiently as possible. Inherited IRA tax laws have changed a lot and require them to complete in 10 years. Law makes complete sense but more planning for some.

I have both regular and inherited IRAs. Their RMDs are figured differently. When looking into IRA regulations, I sometimes wonder what sort of perverted lunatics(s) come up with these convoluted rules. This applies to the entire tax code.

It would be revealing to have spending figures that were somehow sorted by ability to pay (say credit score) so as to indicate if the spenders are spending within their means or are overextended. I see a lot of boomers in restaurants, many of whom I assume are pretty well of. As noted in an earlier post, the upper half of Americans are well off. Maybe most if not all of this spending is by them? There has been gloom and doom regarding overspending of one form or another for years now. If folks could not cover this spending, they would all be bankrupt, even allowing for the gov handouts.

Poor people never spend much and therefore never move the economic needle much. That’s about the lower 20%. Most of the low-income people either have no credit cards because they cannot get them (they have to make do with debit cards) or they have very low credit limits. Many don’t even have bank accounts (the “unbanked”). So debt isn’t their problem – low income is. They cannot buy it if they cannot pay for it.

You have to make more money to borrow money. The more money you make, the more you can borrow. Subprime doesn’t mean poor, it means bad credit, the high-income young dentist that got in over his head is subprime.

The rich spend money on stuff that isn’t sold by retailers in this list, such as yachts, corporate jets, Rolexes, paintings, antiques, classic cars, etc. And this type of spending is not included here.

This list here is just normal retailers.

In terms of consumers being overextended, nope:

https://wolfstreet.com/2023/11/09/credit-cards-the-big-payment-method-balances-burden-delinquencies-available-credit-how-are-our-drunken-sailors-holding-up/

Sigh. Prices for everything are going to stay high, aren’t they?

If you read the article, you will see that prices of durable goods have been falling and the price of gasoline has plunged. This is the stuff these retailers sell, but you hafta RTGDFA to see it.

Of course. I remember when gas was 19 cents a gallon. I feel safe in saying gas will never go to 19 cents a gallon again in America. We occasionally have profound and prolonged deflation in some markets, like housing, but for most commodity prices, once they are up, they stay up. The best we can hope for is that the rate of increase in prices, i.e. inflation, slows. Powell is happy with a 2 percent increase a year, but that’s not 0 percent.

I remember when the Chipotle Steak burrito was $7.50 in 2019 and now it is $12.50. LOL That is a 66% increase.

Thankfully, I don’t eat there, so that’s a 0% increase.

Fast food prices have gone up but I have noticed the last 2 times at the grocery store my bill was much lower than it’s been for a while. It has been consistently over $100 the last year or so and last 2 times it’s been around $80 buying the usual stuff I tend to buy. So some things dropping some things not so much

Wolf

I recently read that ‘ Buy Now, Pay Later’ (BNPL) credit data is NOT reflected in the credit reports of 3 agencies. Also NOT in general Consumer Credit stat. Is it b/c BNPL is offered directly to consumer by the individual merchant/company? Thanks.

1. Wrong. It’s reflected in credit reports. Here is Equifax:

https://www.equifax.com/newsroom/all-news/-/story/-buy-now-pay-later-credit-reporting/

2. It’s reflected in the green line, “Other Loans,” which include personal loans, computer loans, payday loans, etc. BNPL is about $50 billion, the rest are other loans

If it weren’t for the irrational stock market reaction after the Fed meeting, I don’t think people would really care about an additional .25% interest rate reduction sometime next year. It’s immaterial.

The salient issue is what happens with QE/QT. I think the bloated size of the Fed’s balance sheet and money supply encourages stock market speculation.

It’s anybody’s guess whether the Fed will continue QT to the point of asset price declines, but I don’t think current Fed leadership will push it that far. I believe they want to maintain high asset prices to avoid a reverse wealth effect that could snowball into a recession. There are lots of fairness issues associated with continued support of high asset prices, but the Fed has never worried much about wealth concentration, moral hazards, or related issues caused by its policies.

That said, asset prices are so high now, they could fall under their own weight despite the Fed’s most dovish efforts to keep them propped up.

Yes it did cause speculation it also caused regionals buying bonds with very low yields, this is all QE. We need higher rates to protect the dollar. IMO.

Im going to assume you know what the two fed mandates are … what they AREN’T are fairness issues, asset prices or wealth concentration.

So far they seem to be doing a decent job at reducing inflation and not killing employment. This is confirmed by increased disposable income and savings and higher retail sales data

Perhaps you should direct your question to Bernanke, Yellen, and Powell. If the mandates have nothing to do with asset prices, why did the Fed intentionally seek to raise asset prices in order to create a wealth effect? It’s on record.

I suspect many people have “living-in-fear-of” fatigue and are trying like hell to let go & just enjoy their lives. It’s not really working (look at suicide rates YoY) but I salute the crickets for trying.

@bulfinch,

I wager most of us lost more loved ones than usual over the past few years, with an aging population that’s likely a compounding problem. Likewise, we all had to contemplate death with the Pandemic. Let’s take the time while we and those we love still have it.

Agreed. Wholeheartedly. I’m just too worrisome and kranky myself to live it. Getting closet all the time

Following WWl & the Spanish Flu; an eat, drink & be merry mentality took hold. The 1918 – 19 body count left everyone shell shocked. So they spent their way out of it. Bought cars & refrigerators & washing machines & telephones & radios. Aggressive consumption. Life expectancy increased through the twenties. 2020’s look more & more like the 1920’s. The most critical question is – what will happen to life expectancy this time round ?

I think the 1920’s may be a good comparison. WWI and the Spanish Flu killed millions. The survivors likely had a different outlook on life. That led to the Roaring 20’s and excess. Think about the excesses of The Great Gatsby.

The party ended in the late 20’s with the stock market crash and a long Depression. Nationalistic despots were able to gain control of much of Europe which didn’t end well.

Could history repeat itself? If it does, we likely have a few more years to party before it all comes crashing down.

Let’s think positively; the 1937 – 1938 recession was caused by monetary contraction and Treasury policies including stimulus reduction. In this recession there is a photo of two men walking down a street in Los Angeles a walking billboards. One placard saying “I voted for ham and eggs,” (was a 1930s old age pension movement and in 1937 Era the Social Security tax had begun). The second saying “I believed the banks,” (a timeless message of those who want to believe and have cognitive dissonance of the stonewalling banker right before their eyes;” hence they believe Powell and the oligarch banker’s corporate media, spending their rainy day funds right into their economic doom while the rich plump and bloat off “the fool and his money is quickly gone.”

I’m done Wolf, there is no spin or reason or rhyme of what JPowell did yesterday.

I’m beginning to think that our beloved and honored host suffers from Stockholm Syndrome.

Wolf seems to take a lot of heat because he only reports on the past and present and refuses to speculate. It seems to be those who disagree with what the present data shows and trendline leading up, that throw the most pepper his way.

Pea Sea,

People are so upset they can’t even think anymore.

There were dozens of comments here calling for bloodshed and revolutions and other stuff because the Fed added “any” to the statement and added a rate hike to the dot plot for 2024. Or maybe really because stocks jumped and yields plunged.

These people were sick to their stomach and threw up all over the comments, and I had to go in behind them last night and mop up the mess. I deleted dozens of comments to that effect, people were going nuts on me. Today is a little better, but there’s still lots of vomiting.

And then I come across your vomit. but I already put my mop away for the day.

Photoshopping cigarettes from photos doesn’t make the room smell any better. Might could be you wind up undermining the value of a comments section by over-tuning things. The Fed’s actions & what it’s effectuated in the markets inflamed your readership. There’s some value in a record of that sentiment, no matter how dubious or bilious. I’m guessing the nastiest stuff never makes it out of moderation.

People gross me out in the comments all the time…but that’s what’s out there, and it’s maybe important to know.

Globally, equities have averaged beating inflation by 5.2 percent from 1900 to 2019. Cash breaks even, bonds beat it by about 2 percent. I don’t know why people keep expecting holding cash to make them money and get flaming upset when yields go down. It doesn’t even matter if yields go down or up or stay even..you’ll never beat inflation holding cash.

Sam-

“..you’ll never beat inflation holding cash.”

Not true, at least historically:

Per 2011 Andex chart:

Comp. Ann’l Grth Rate, by decade:

——-30 day TBills—Inflation

1930’s: 0.6%. -2.0%

1960’s: 3.9%. 2.5%

1980’s: 8.9%. 5.1%

1990’s: 4.9%. 2.9%

2000’s: 2.8%. 2.5%

Stocks, Bonds and commodities also have some decade periods of underperforming inflation…

Just sayin’.

“And then I come across your vomit. but I already put my mop away for the day.”

😆😂.. my day is now made, see you all next article lol

Absolutely right, WOLF. Found this on you tube today. John williams, President of NY FED.

https://youtu.be/NRvDg4H7ReU?si=uYR3VNYrNrjugn13

Ross Da Boss,

Thanks.

For everyone: this YouTube link is the CNBC interview of Williams brushing off the rate-cut expectations. 8 minutes, worth watching.

Wolf seems to be a member of the upper class, so there is probably some level of bias in his views just like there is for everyone else, although he certainly tries to be unbiased.

The upper class has been killing it for the last 15 years, it probably seems bizarre to many of them that members of other classes may not see such a rosy picture.

If I had the text version of Peter Turchin’s “End Times” I would copy the anonymized story of the decamillionaire he uses in chapter 3? when he is trying to offer examples of his various classes of system actors. Unfortunately, I have it on audio and I won’t be transcribing that.

The FOMC and Chairman Jerome Powell did nothing yesterday.

I should post the transcript, and then you could actually read what he said. But there are copyright issues, so I cannot do it.

While the public are spending like drunken sailors the US government is doing the same going deeper into debt around 33trillion at last count. Interest repayment on this debt alone is approaching the 1 trillion dollar/annum mark. Tax collections are insufficient to balance the budget and deficit spending remains the order of the day.

The military spend alone is greater than the next 6 countries’ military spend combined and it persists in spending on wars that are ideological and no threat to the US itself, the latest being Ukraine and Israel.

Is this sustainable and who is going to pay for this?

What better time to signal rate cuts than now? LOL

Never.

A very merry Christmas

And a happy New Year

Let’s hope it’s a good one

Without any fear

Inflation will not subside until wages stop growing. People need to slow their spending is the bottom line, and they won’t do that if they don’t have to.

All we have to do on Fri is to send AAPL to $200, to $3.1T.

Bought testing Apple put today. Let’s see if it shows any green. Small caps outperformed QQQ in the last few days, same as they did before the last time things unraveled.

Admittedly the future can change but the signaling was strong enough yesterday to indicate equity markets still going to trend upward consistently for long term investors. 2024 might be a little slow but sensing it heats up after that. That’s my take anyway. Keeping some money fairly liquid for opportunity shopping since returns for that money still not bad.

I think we are entering an economic and investment boom period like we haven’t seen since the mid 80s and on thru the 90s.

Personally, I have been looking at off-grid-outback land for several years. Pricing is frayed. I think it may be time to buy and have a shell put up before everyone realizes that things aren’t that bad and especially before everyone realizes that things are pretty good.

This market is broadening in a big way and that is very bullish. Jim Cramer is probably ecstatic this evening!

Glen, get a broker that lets you short. You only rarely need it but when you need it nothing else suffices.

TC – but interest rates *peaked* in the early 80s. Right now its the exact opposite, interest rates recently *bottomed*.

How did the stock mkt do in the 50s & 60s?

depending on opinion, interest rates just *peaked* for this “cycle”

When I think of interest rate cycles, I think of generational bond bear/bull markets.

I.e. the bond bear mkt from ~1945 thru 1981, and the bull mkt from 1981 thru 2020.

If rates bottomed in 2020, we have a long ways to go before the next bond bull mkt.

I find this sentiment baffling, and I have seen it multiple places in the last couple of weeks.

Setting aside the fact that we haven’t had a rough economy in awhile(and I was under the impression that one of the features of capitalism was its cyclical nature), the global geopolitical situation is the worst it has been since at least the Cold War.

Judging from your comment you seem to be Australian. You guys know that when the moronic US government stumbles its way into a war in the South China Sea, you guys are going to be neck deep too, right?

China strikes back : Huawei new phone competes with AAPL and their

new chip competes with NVDA

Now we get need those products competing here to drive consumer prices down! Admittedly prices have fallen but a decent phone is still a decent price tag. Waiting for iPhone 13 to drop significantly in price for my son as I am happy with inexpensive Samsung.

Micheal,

One of these days I will upgrade my eleven year old Panasonic plasma with a 55″ 4K OLED. Sharp has just introduced one with a Roku streaming feature built in, and since I use Roku, that is of interest to me. It won’t be too long before more and more sporting events are streamed in 4k, and on a variety of services, but right now it’s just a few events and a few streaming services. So, I’ll wait a while before spending like a drunken sailor for a new TV set.

But I mention this as Sharp has entered into a partnership with Foxconn now as their “parent company”, and their new TV sets are made in Mexico, I believe. Foxconn makes the Apple iPhones, no?

It seems to be a good deal & a good product — from researching online anyway: for $1,200, a 55″ 4K OLED Sharp can be ordered “ecommerce” in the USA. But only from two different retailers as far as I can find.

So, a Japanese company that’s owned by a Taiwanese company making TV sets in Mexico to be sold in the USA. Yeah, that’s par for the course these days, I reckon.

Europe is almost in recession and they have not talked about cutting rates yet, however JP speaking in advance about cutting them by 2024, with an economy on fire, a job market on fire, retails sales on fire, even BTC LOL, the only thing that justifies such a decision is an election year , maybe he already spoken with the administration in charge, both have led us to this disaster, the number of credit card delinquencies is worrying, let’s wait for the next report for Q4 2023, hard to survive, and yes, inflation is going down but people continue to suffer, enjoy this Christmas party, next year it will be different “game over”

“… the number of credit card delinquencies is worrying,…”

not really

The number of credit card delinquencies is barely a blip on the radar. The American consumer is doing just fine–indeed, that’s the key takeway from TGDFA (and other recent articles here re: consumer credit and spending). If you notice them going up, it’s because they’re going up from an aberrant pandemic number, from a magical time when suddenly everyone was a great credit risk.

DM: Manhattan rents DROP for the first time in two years to $4K a month – as costs to lease a home across the country plummet by largest amount since 2020

The median rent in Manhattan, which is the most expensive place to lease an apartment in the US, fell 2 percent year-on-year in November to $4,000.

“Asking rents.” Not actual rents that people are actually paying on current leases and at renewal.

First rule in Real Estate, location, location, location. That explains the highest price in Manhattan, but also explains that Manhattan does not indicate the rate for anywhere else in the country. Rents are still climbing in Illinois due to recent legislation needing to be absorbed by the market.

Wolf, do these numbers include gift card sales?

This might sound tangental but hear me out:

At my company, gift cards don’t count towards our sales, its only when the gift card is used that it goes towards our numbers. Otherwise we’d be counting the sale twice (once when the gift card was bought, and again at redemption, even though only one actual purchase happened). I’d assume other retailers do the same.

This year gift cards seem even more popular than last, and I wonder how much spending ($$ going from credit cards => retailer bank accts) isn’t being captured by this data (or is it?)

No, gift cards are not counted twice. And yes, your company seems to be doing it correctly.

Gift card purchases — when I walk in and pay money for a gift card — are recorded as “deferred revenue,” a liability on the balance sheet (money the retailer collected but owes the customer something for it). Because no goods have been exchanged, it cannot be recognized as “revenue” on the income statement. Later, when you walk in with the gift card I gave you for your birthday, and you buy something with it, it is recognized as revenue on the income statement, and therefore as sale, and the liability account “deferred revenue” is relieved of that amount.

A portion of gift cards are never redeemed, and the company gets to keep the cash without have to provide the goods or services. This “breakage” portion can be estimated by the company based on historic breakage data and be taken straight to revenues, followed up by a periodic reconciliation of the estimated breakage to the actual breakage.

This is an accounting rule, and all companies should be doing it this way. Your company seems to be doing it as well. This also assures that they’re not counted twice.

Thanks Wolf – I wasn’t farmiliar with the specific accounting terminology here.

On our little corner of the internet, I’d guestimate gift card sales are making up nearly half of gross CC revenue this holiday season so far. They’re wildly popular especially with these bonus value promotions going on.

So this is consumer spending that has yet to show up in the data.

It’s fascinating to me that wages have outpaced inflation most of the year, and people are spending and having a jolly good time and yet all these polls say consumers are pessimistic about the economy. It doesn’t add up.

It adds up. Powell was asked about that too. People HATE inflation, and they HATE the high prices, even if they have come down a little on some products, but are still high. And they’re grouchy about that. But they like their higher wages and the interest they’re earning, etc., and they’ve got their finances kind of in order, and they’re feeling pretty chipper about the rest, and they’re traveling all over the place (can confirm anecdotally from our recent trip to Europe, packed planes, airports, and trains), and they’re going out and they’re eating out (can confirm anecdotally, had to wait one hour during the week to get into one of our favorite not-cheap restaurants here to do a little bit of drunken sailoring, and it was packed with young drunken sailors having a great time and paying quite a bit of money to eat out.

The independent Federal Reserve will cut rates next year.

Plan accordingly.

IWM

Eyeballing it here but only about $100 billion over trend on retail sales… Recession right around the corner😂

If disposable income is so strong based on the YoY data, how does this data tally with the record credit card delinquencies data on the other hand?

“the record credit card delinquencies data”

Your brain got polluted somewhere?

https://wolfstreet.com/2023/11/09/credit-cards-the-big-payment-method-balances-burden-delinquencies-available-credit-how-are-our-drunken-sailors-holding-up/

I noticed everyone around here is betting on sports. It’s gone crazy. Even housewives are joining in. Lots of this money is never reported. It’s an all cash business. I’m joining in with the rest of the drunkin sailors. A lot of this and other spending is “Off the books”.

You can now bet on where the college players will transfer to using the ‘portal’. Not even a sporting ‘event’. Crazy.

Swamp ‘n Doug – it’s getting harder for me to believe that point-shaving, etc., isn’t going on, the variants now available and provided by our digital age, let alone sanctioned by the likes of sports ‘governing bodies’, massively-enriching that target environment…(…sorry, just another Capt. Reynaud moment…).

may we all find a better day.

You provide some of the best economic commentary and analysis in the field. You are a light in the crumbling dark tunnel that is “macroeconomic analysis”.

I really appreciate your blog, as our societal changes make traditional economic theory increasingly irrelevant, and as our society blew right by behavioral economic theory into the realm of behavioral corrosion.

-A fellow dissenter

Why haven’t we seen a (recession) reduction in the exchange of goods and services yet? Because employment is strong. Why is employment strong? Because demand for goods and services is strong and people have to provide them. Why is demand for goods and services strong? Because employment is good. Why is employment good? Because there is a lot of demand for goods and services. Why is there so much demand for goods and services? Because employment is strong and people have the income to spend…so there is plenty of demand.

I know it gets FAR more complicated than that once you start to dissect the factors influencing demand and employment but this loop keeps playing in my head for the last three years as the overly-simplistic explanation for our economy. Someday that loop will play out differently but I’ve given up trying to predict when. My finance education was, at the very least, incomplete. Still trying to learn and stay informed, so that’s why I come here.

@Random Guy 62,

I have witnessed what may be causing some of the confusion. We replaced 7 highly experienced people due to retirement. Their replacements came in higher on the salary curve for years of experience, but did not make what the previous employee was paid.

Happy workers, they all made more than their past job.

Happy company, now paying less for the team.

Manager sad to leave after so many years. Burned out carrying the experience slack.

Happy retirees (me included) as the stock market and treasuries just keep producing.

Best advice I have heard for the future. Expect less.

It will take some time for this baby boomer demographic shift to settle throughout our economy.

Our nation, which contrary to the propaganda, could, even in pandemics or recessions or depressions, stand on it’s own with free markets, is being saddled with enormous amounts of debt to support the oligarchic wealth transfer system, such as the government buying mortgage backed securities, that they put in place by buying off our government representatives. I believe the “landing” will only get harder the longer we don’t start putting our house in order. The alarming loss of the dollar’s value is a big red flag to get our attention as citizens to stop stealing from our future generations and wasting our resources that it would help us to have for hard times that inevitably come.

I think it’s all tied to housing, and those who bought rental properties over the last 10-15 years are flush because they can pass through the mortgages costs to renters, and therefore the owners still have considerable disposable income to spend. Renters on the other hand are paying through the nose and wracking up their credit cards …tale of two cities!

When the housing market breaks, everything else will follow!

I think it’s hilarious that as people are complaining about the price of haircuts, they go blowing their money at the tavern. Something that’s essentially going to wind up getting flushed down the toilet an hour later. People just baffle me.

They’re not paying for the nutrients when they go to nice restaurants or taverns or whatever; they’re paying for the experience: to have fun, enjoy life, enjoy the tastes, enjoy the company, see lots of strangers around, be seen, flirt, eat something they cannot eat at home, etc.

Going out is different, it’s good for your soul.

It is hard to “Eat, Drink and Be Merry” when you are having to do all of it at home.

Going to a sports bar, having a beer, and doing high 5s with total strangers when your team wins is good for your soul and good for the community.

Curious if any of the rise in discretional spending could be mapped to changes in birth rates, especially for higher socio economic groups as well as change sin age and design to ultimately have children. Seems that the trend of people forgoing marriage, and/or having kids or if they do doing so later in life would contribute to singles and DINKS (dual income no kids) reaching primetime earnings ages without having to spend on kids.. I live in Boston- two kids in daycare is a lot of discretionary spending.

If all the spending that is in cash and “off the books” were counted, then retail spending would be even higher than reported. I for one must spend a good 30% of my disposeable income this way. i.e. landscapers, home hair salons, sports betting, holiday cash gifts etc. No one is accounting for this spending on services.

Unless your landscaper or hairstylist is parking that “off the books” cash under a mattress somewhere it ends up “on the books” eventually.

think all consider, wolfstreet, now lexicon?