Something darkly humorous about these central-bank engineered easy-money spikes that then go POOF.

By Wolf Richter for WOLF STREET.

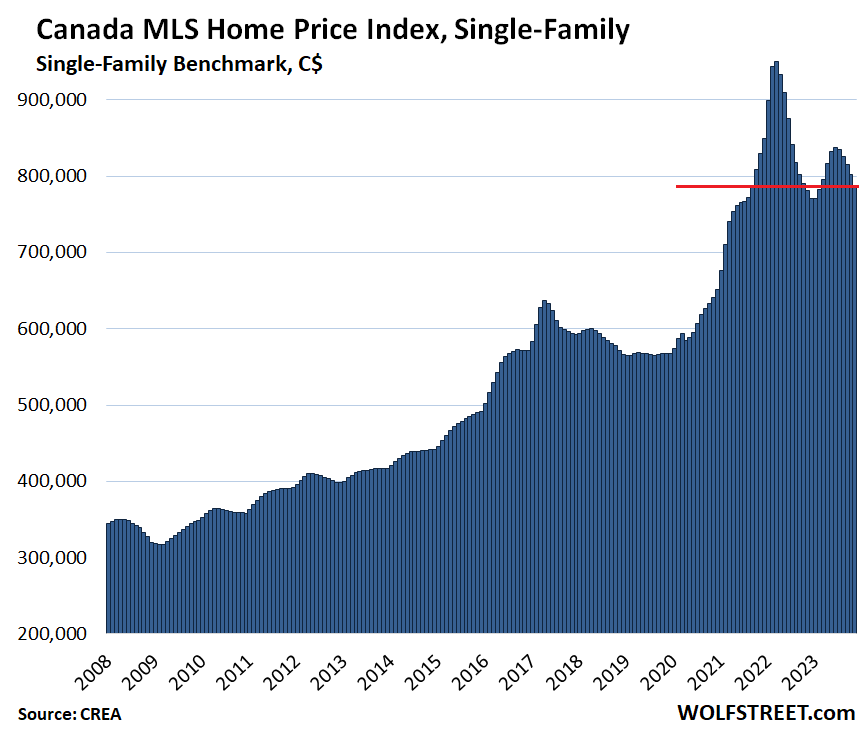

Home prices in Canada dropped 1.7% in November from October, after having dropped by 1.6% in October from September, the fifth month in a row of month-to-month declines, according to the Home Price Benchmark Index for single family houses by the Canadian Real Estate Association (CREA) today. These drops whittled down the year-over-year gain to just 0.9%.

Since peak-frenzy in March 2022, the benchmark price has fallen by 17.2%, or by $162,000 (all prices in Canadian dollars), to $788,200 – a level first reached on the way up in September 2021.

Substantial losses spread across other markets, but not all: Prices in Calgary rose to a new record. We’ll get to them in a moment.

Home sales dipped by 0.9% seasonally adjusted in November from the already low levels in October, the fourth month in a row of declines – prices are still too damn high – and supply of homes for sale inched up to 4.2 months at the current pace of sales, compared to 3.1 months in May.

The easy money is over, the Bank of Canada hiked its overnight rate to 5.0% in July and has kept them there. Home prices reached such a level of craziness that they were regularly pointed to by the BoC in its pronouncements for the past two years.

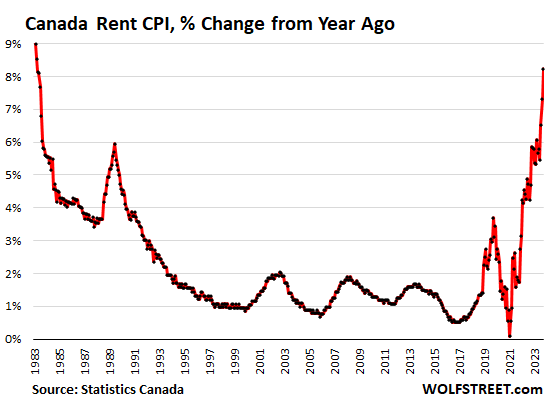

And now, the BoC has to grapple with another housing issue, the worst rent inflation since 1983.

Single-family House Prices by Market.

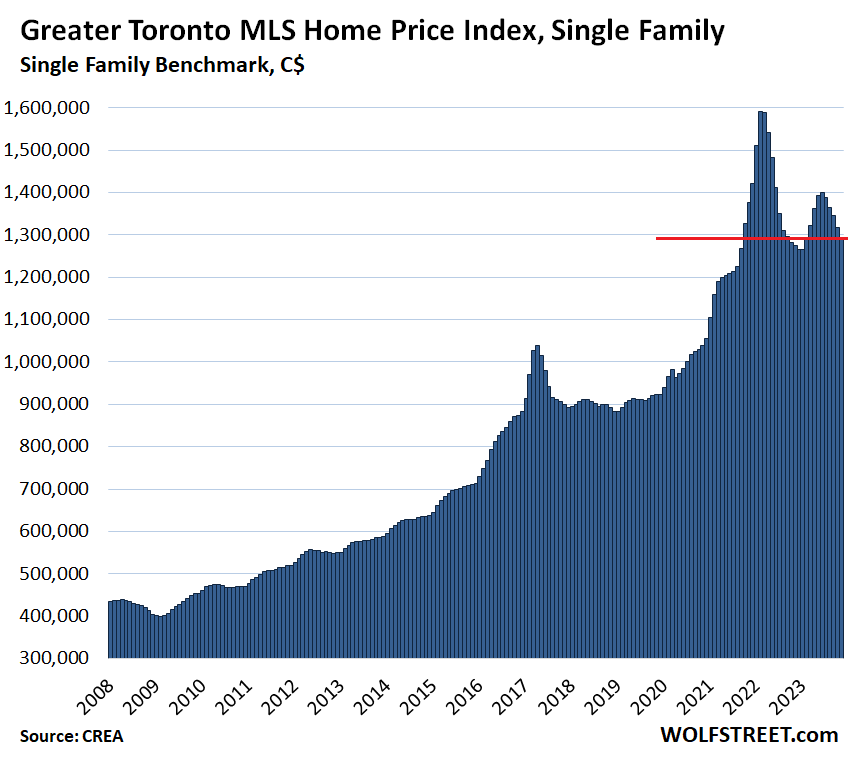

Greater Toronto Area (GTA): The MLS Home Price Benchmark Index for single-family houses fell by 2.0% in November from October, after the 2.1% drop in October from September, to $1.291 million, the fifth month in a row of declines. The November drop whittled down the year-over-year gain to 1.3%.

The benchmark price has plunged by 18.9%, or by $300,000, since the peak in February 2022 and is now back where it had first been in September 2021 on the way up.

There is something darkly humorous about these central-bank engineered easy-money spikes that then go POOF.

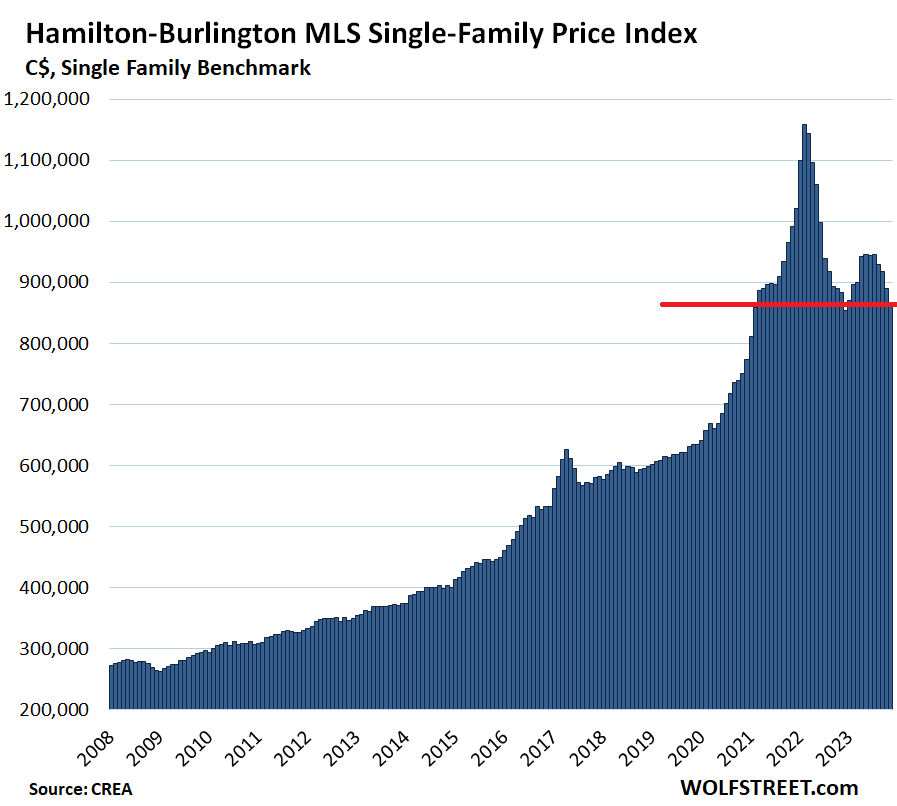

In the Hamilton-Burlington metro (part of the “Greater Toronto and Hamilton Area”), the single-family benchmark price fell by 3.0% in November from October, to $864,200.

- From peak in February 2022: -25.4%, or -$294,700

- Year-over-year: -2.2%.

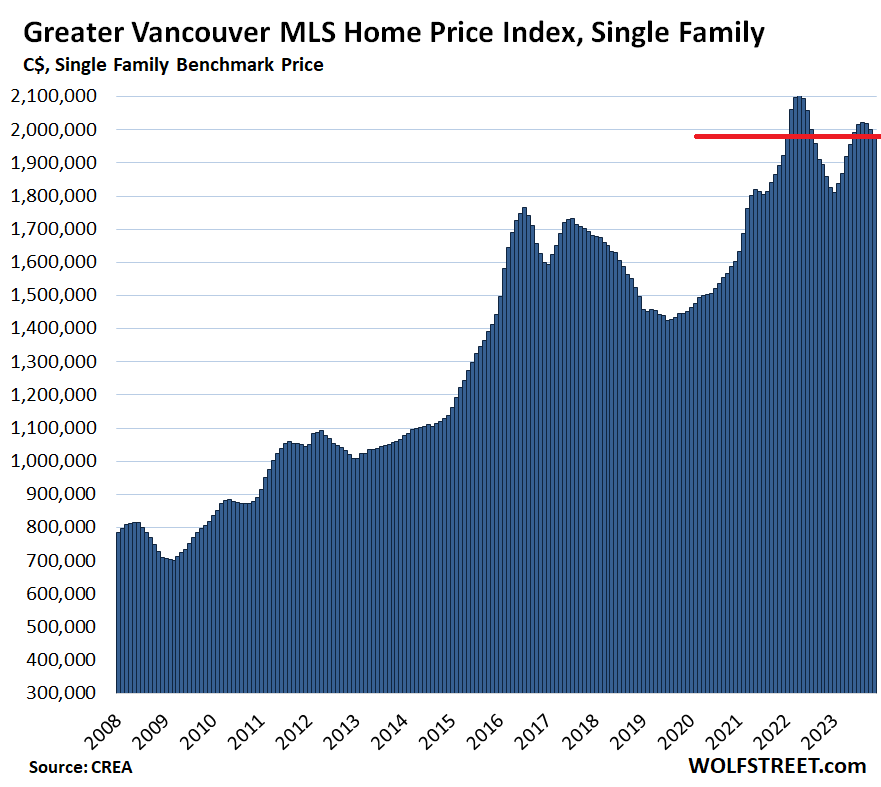

Greater Vancouver: The benchmark price for single-family houses fell 0.8% for the month, to $1.985 million:

- From peak in April 2022: -5.6% or -$117,400

- Year-over-year: +6.7%

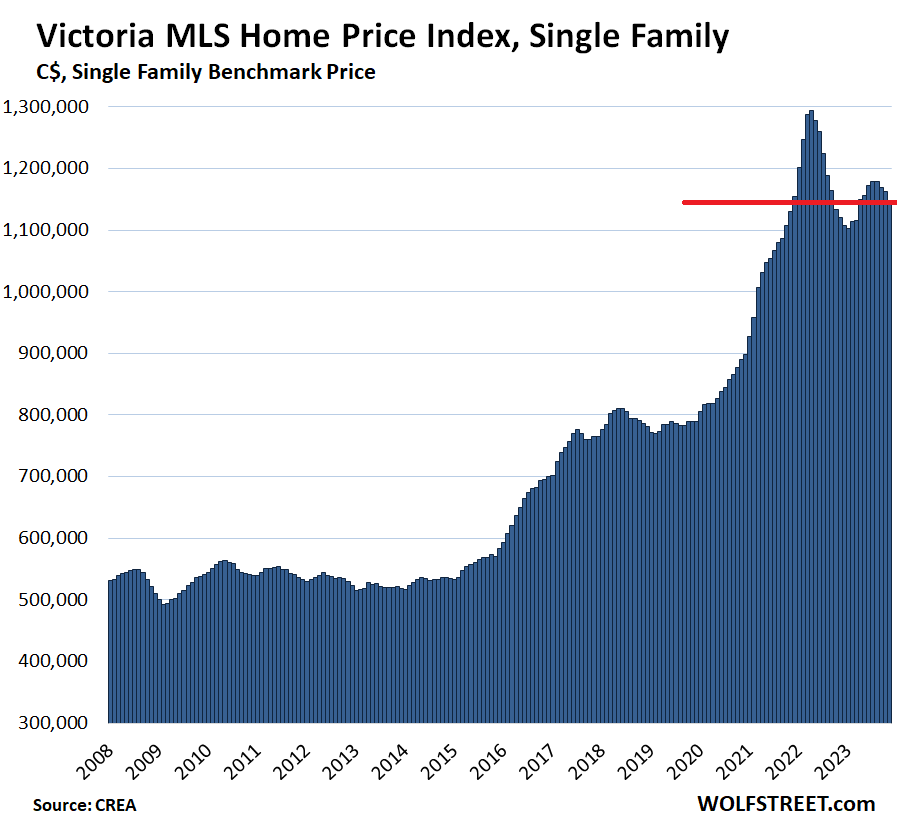

Victoria: The single-family benchmark price fell 1.2% for the month to $1.148 million:

- From peak in April 2022: -11.3% or -$146,700

- Year-over-year: +2.5%

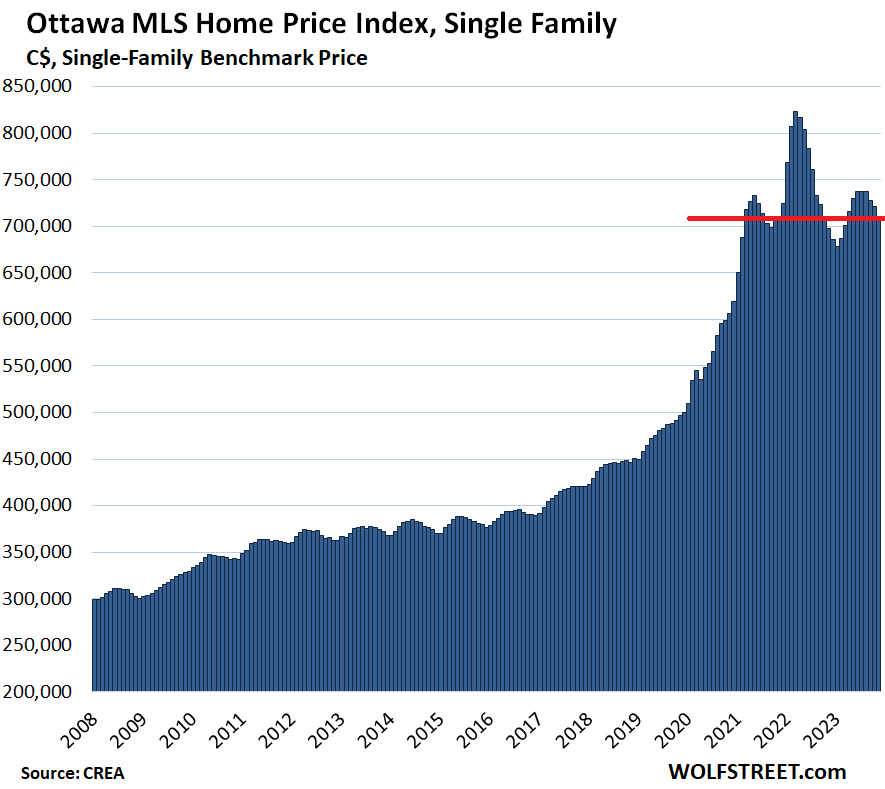

Ottawa: The benchmark price of single-family houses fell by 1.8% for the month, to $708,900, where they’d first been in March 2021:

- From peak in March 2022: -13.9% or -$114,300

- Year-over-year: +1.6%.

Funny head-and-shoulders chart of a housing market had been relatively sane until the BoC went on its money-printing binge and 0% in March 2020.

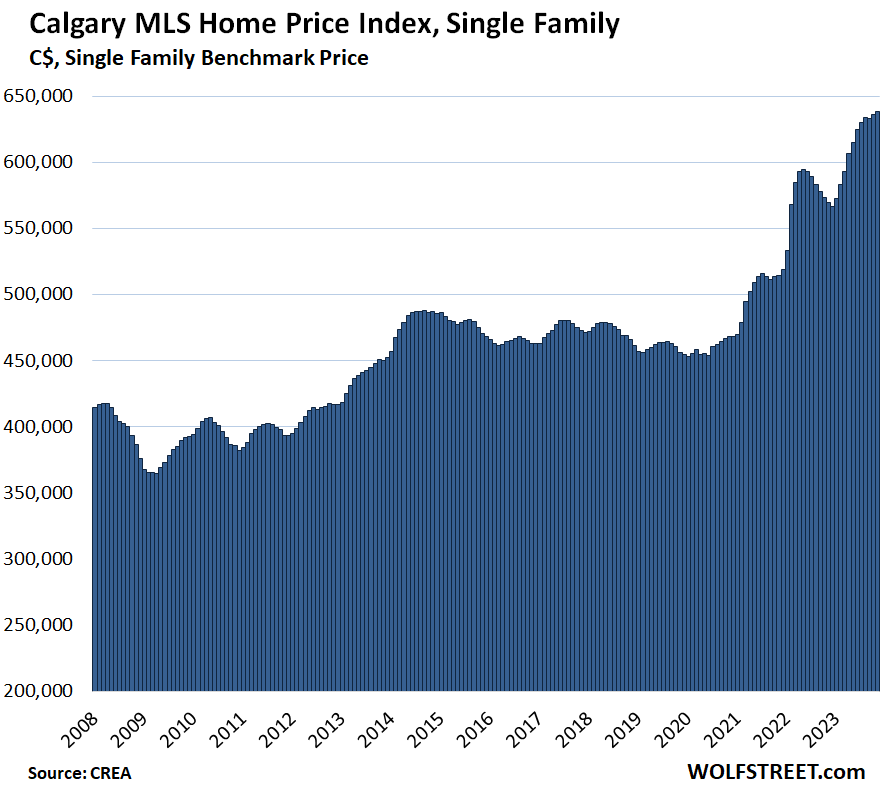

Calgary: The single-family benchmark price rose 0.4% to a record of $638,600, and was up by 12.1% year-over-year, a spike after years of going nowhere.

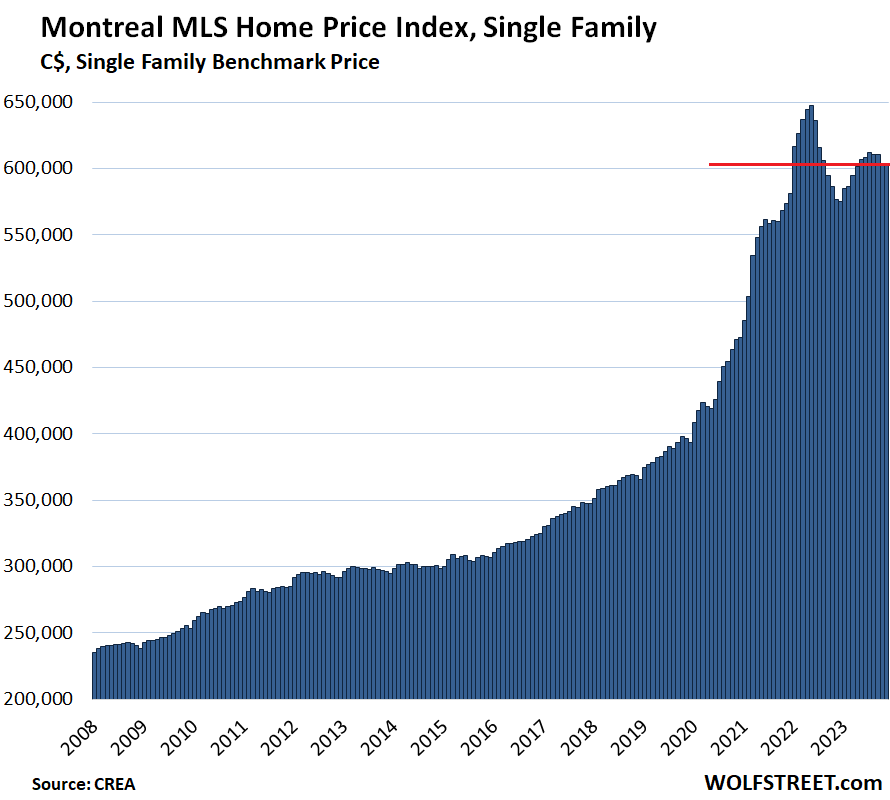

Montreal: The single-family benchmark price ticked up by 0.3%% for the month, to $604,200:

- From peak in May 2022: -6.7% or -$43,400

- Year-over-year: +4.7%

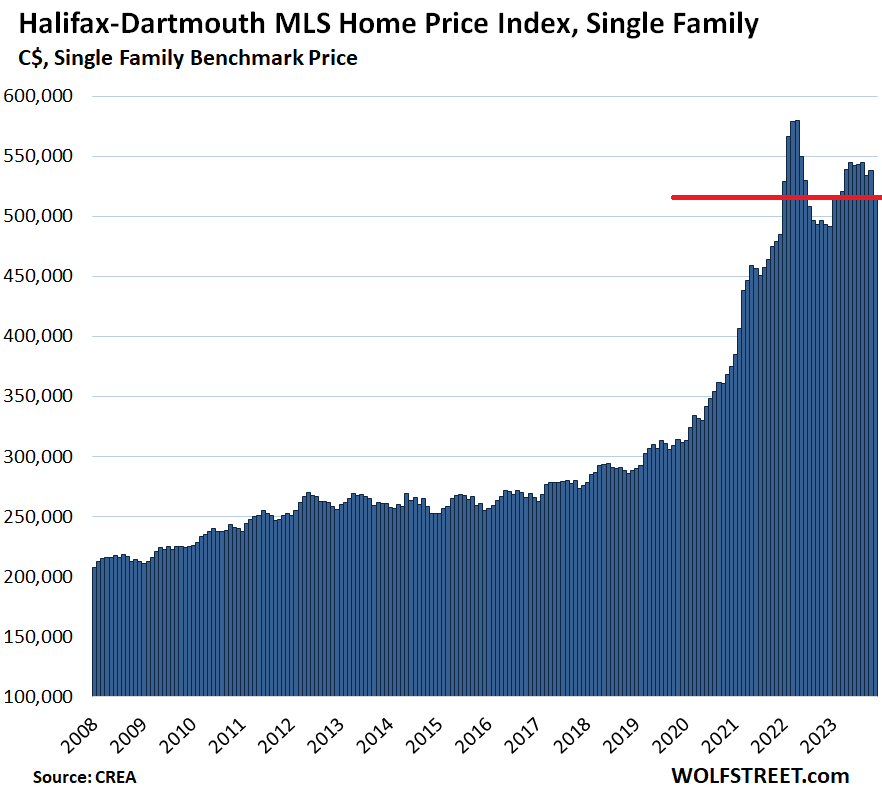

Halifax-Dartmouth: The single-family benchmark price plunged by 3.9% for the month, to $517,100:

- From peak in April 2022: -10.8% or -$62,400

- Year-over-year: +4.8%.

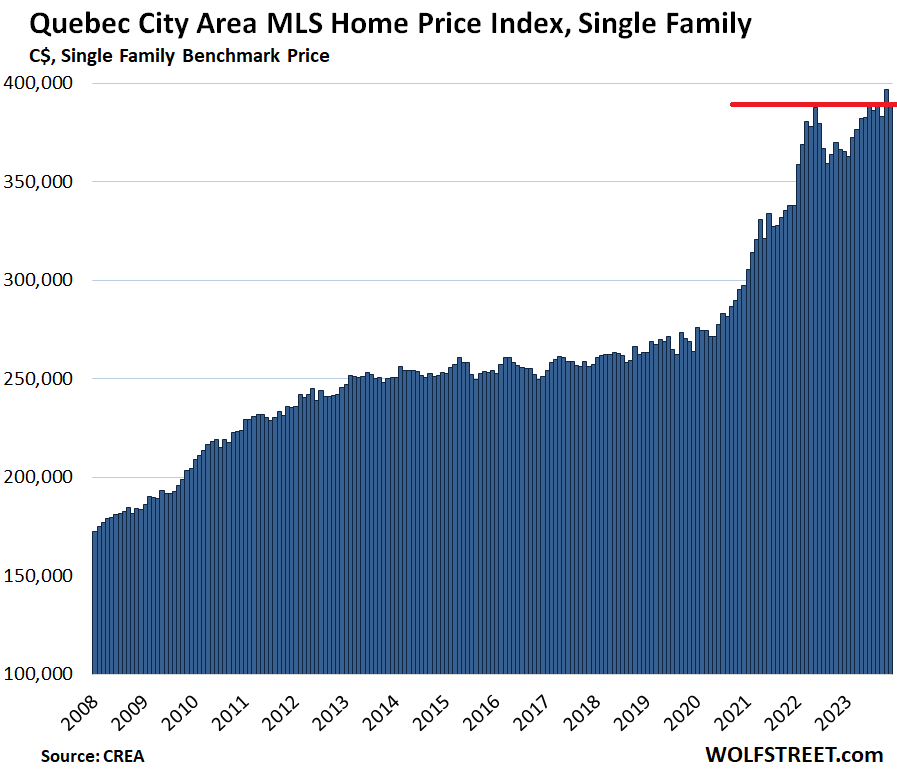

Quebec City Area: The single-family benchmark price dropped by 1.9% from the record in October, to $389,600, and was up by 6.3% year-over-year:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Something darkly humorous about these central-bank engineered easy-money spikes that then go POOF”

I find it exceedingly grotesque, especially when we’re talking about shelter. Turning housing into a get-rich-quick scheme for cashed up speculators while taking it away from workers who need a roof over their heads is despicable. There’s a special place in hell for all these central bankers and politicians.

That special place would right next to the Usurers.

Down the hall from the sub-prime car loan originators.

The problem is at least 30 years old when governments, their brains having been eaten by neoliberalism, got out of the business of building low income housing. The delusion that “the market” was ever going to build low income housing has been ruthlessly exposed and it’s going to take at least a decade before any improvement will be felt — and then only after the government admits the error and reverses course. I’m not holding my breath — we’re governed by and for rentiers.

eg: I recently read an article about the “most livable city in the world” for 8/10 years. In Vienna: 60% of people live in government funded affordable housing.

I have a mortgage on my “affordable housing” in a ski town. It’s a strange program (for a capitalist culture), that is the only way I got off the rent elevator.

Hard to take away the punch bowl.

Which ski town and congrats. My single nephew in Claremore ok one of the lowest housing areas in the nation (Tulsa suburbs) just moved out of his 1 br apartment as rents rose more than his min wage cooks job. He is a no skill hard working 45 year old ex con but has been drug free for a decade. Wish he would get more skills than short order cook .

Bs ini:

Telluride. Where a short order cook can make more than a guy with an engineering degree. I am in building maintenance and engineering here (obviously no engineering firms).

Total hospitality industry, and services inflation is hot. My niece who is 15 years younger and no college is making $40/hr as a server.

I should have been a server???

I’d prefer the government simply stop printing money which drives up housing costs, retirement costs, medical, education, and everything else.

“The Fed Finally Surrenders; Inflation Wins”

Today’s headline …… Somebody tell Wolf the Fed just pivoted…

Big Time

Don’t expect Wolf to admit he was wrong

““The Fed Finally Surrenders; Inflation Wins” .. Today’s headline”

This is the kind of manipulative clickbait self-contradictory BS headline designed to be consumed and spread by morons that makes me laugh. If inflation resurges, the Fed will not only take the rate cuts off the table but will also put rate hikes back on the table.

Right now, the Fed is expecting inflation to come down further, which is why it moved more dot-plot rate cuts into 2024. But if that’s not the case, if inflation resurges, as your idiotic headline suggests, those dot-plot rate cuts in 2024 will vanish and rate hikes will start showing up again.

If you actually listened to Powell, you would have realized that it’s all about inflation: lower inflation = lower rates; higher inflation = higher rates.

Your stupid headline promises higher inflation and lower rates, which is total bullshit, and you wallowed in it exuberantly.

Mr. R:

Sometimes I wish you would say what you really think and not hold back../sarc.

Thank you for the reality.

Jerome is pimpin’ stocks, Wolf. You know it.

Depth Charge,

That’s BS, and deep down you know it. The people that were pimping stocks were the reporters, trying to put all kinds of crap into Powell’s mouth. They badgered him about “rate cuts” five times, they were the ones that said “rate cuts,” they were trying to get him to say something that could be misconstrued as “rate cuts,” and he never even once said “cate cut.” The reporters were like a pack of dogs trying to get their pound of flesh. It was a feeding frenzy for their hedge fund cronies.

Get the transcript and read it.

The Federal Reserve under Jerome Powell is not an inflation fighter; by their own admission Powell’s target rate is 2% inflation that is still robbing the workers. For a 20 Trillion dollar economy, 2% is still $400 billion dollars robbed from all of us. It doesn’t even make any sense in the same English sentence to proclaim inflation fighting and say 2% inflation; much like saying someone isn’t a thief because they only steal 2% of the inventory every year.

Gary,

What matters for workers is growth of “real” incomes (income growth adjusted for inflation).

If inflation is 2% and wages increase 3%, workers come out ahead. That’s what matters.

If there is 0% inflation, and 0% wage increases, workers don’t come out ahead.

Where workers get “robbed,” as you put it, is when 4% inflation meets 2% wage increases.

“If inflation is 2% and wages increase 3%, workers come out ahead. That’s what matters.”

No, that’s not “stable prices.” What matters is stable prices, the FED’s mandate. Inflation is bullsh!t, and they’re pushing it. Scrap the FED. Get rid of these parasites for good.

Wolf, it is not entirely BS. Powell could come out and say “Bubble asset prices cause inflation, and we will keep raising rates and withdrawing liquidity until the S&P is back at its pre-pandemic high. But he doesn’t. Why?

Einhal,

Is that a serious question? Can you imagine what would happen if the Fed set a price target on the S&P to the downside? Just as the Fed never should have engaged in QE to inflate asset prices (though it didn’t set explicit targets), it would be equally absurd to set price targets in the other direction. If, as you say, bubble asset prices cause inflation, then inflation will persist and the Fed won’t be cutting rates any time soon.

Your comment indicates consumer inflation is not really your concern, asset prices are. If so, I can see why you’re perpetually disappointed. What you want is outside the Fed’s purview. I suspect asset prices will eventually come down as a result of the Fed’s inflation fight, but I also understand that’s not an explicit concern of the Fed.

Inflation has come down significantly. If inflation stays elevated or starts to rise again and the Fed cuts rates anyway, then you’ll have reasonable grounds for calling the Fed out. Until then, Wolf’s right it’s BS.

The point is, that asset inflation IS inflation. Discounting it as inflation leads to a situation where houses are unaffordable to the average person in an area. That isn’t acceptable.

But in any case, asset inflation ultimately leads to CPI inflation. It always does.

If the Fed cared about inflation, why is it mouthing off about cutting rates? It shouldn’t be thinking about thinking cutting rates.

That was its retarded mantra in the other direction, no?

Einhal,

I’m sympathetic to your viewpoint generally, but I accept the system works a certain way. The Fed is focused on consumer price inflation and that’s just the way it is. If asset inflation “always” leads to consumer price inflation, then eventually the Fed will need to address it.

As for cutting rates, the dot plot estimates include 8 nonvoting members of the 19 member FOMC. We have no idea who changed their estimates to suggest a third cut in 2024. The person or people may not even have an actual vote. It doesn’t matter as long as the Fed reacts to inflation and not what Wall St. wants. If the Fed cuts in the face of high or rising inflation, then I’ll be screaming with you. Until then, I’ll watch how this plays out.

rojogrande-

“…I accept the system works a certain way.”

I’d argue that that you should have said: “the system DOESN’T work a certain way.”

The problem with central management of the economy revolves around “intervention.” Toward its mandate of maintaining an acceptable employment level the Fed intervenes in the interest rate markets with the immediate goal of making credit more available, thus supporting employment. The intervention is imagined to be transitory, and as soon as the need for the intervention has passed, it is imagined that the Fed will restrict or remove the support.

The problem is that the stimulative “support” phase is pleasant, while the “restrictive” phase is painful. Human being human, all instinct and politics points to interventional asymmetry. The history of the Fed, especially since the employment legislations of 1946 and 1978, is a progressive history of interventional asymmetry. Longer periods of intervention interspersed with short bursts of restriction.

Here are some of the results of asymmetrical intervention in central banking:

– Bigger and broader booms and busts

– Inflationary blowoffs

– When restrictions kick in, deflationary bouts

– An inflating central banking institution

– Asymmetric deficits, and an exploding level of government debt

– Institutionalized consumer inflation as evidenced by a positive “inflation target.”

– A Banking/Academia/CB “complex” complete with revolving doors between the three that perpetuate “the system.”

(A legitimate observation is that some of this is just the nature of cycles and will happen with or without CB intervention…)

I, like you, believe that we are sort of stuck with the central banking system. I’m skeptical that there can be an Alexander Hamilton moment. And the FRS can serve some useful regulatory and operational functions. But being charged with maintaining full employment, stable prices and moderate interest rates (the bastardized mandate usually kept in the closet) is NOT working. Reform of some sort is needed. Congress could start by revisiting the mandates.

IMHO

Exhibits defending my assertion that Central Banking, as currently conducted, is NOT working:

A. The magnitude of the current fiscal deficit, in a non-recessionary environment.

B. The soon to be $35 trillion U.S. debt outstanding.

So what is “lower inflation, lower rates”.

Well, total house prices (land prices) aren’t included in inflation stats, only the cost of carry on the debt.

So when rates are cut, housing will go up, and wages will stay the same.

Working families will be forced to either rent forever or borrow more total $$ to get security of tenure.

Then at some point rates will go up, squeezing all these people.

The Fed’s constant flirtation with rates as low as possible creates all these risks, all for the useless “wealth effect” of housing.

It’s an intellectually bankrupt view, IMHO.

John H.,

I believe I stated it correctly for the point I was trying to make to Einhal regarding a downside target on the S&P.

If I’m reading your comment correctly, you’re saying the system does NOT work because of the outcomes of the system: high government debts, high deficits, booms, busts, etc. I agree that many of the outcomes from the current system are harmful for society as a whole. However, the outcomes are not the system, they are products of the system. We can perhaps change the system and thereby change the outcomes, but for now we have to work, plan, and invest in the system we have. In the current system, the Fed will never set an explicit downside target for financial assets.

I agree the current system leads to some very bad outcomes and incentivizes excessive intervention by the Fed. I also agree reform is needed, but I have no power to reform the system. I’m just trying to understand how the current system works, warts and all, so I’m not completely run over by it. It’s what keeps me coming back to Wolf Street. ;-)

rojogrande, correct. The Fed will try to keep its bubbles intact forever. Any hint of housing prices dropping leads to stupid comments about cutting rates, so as to reinflate the bubble.

These people are a malignant combination of stupid and evil.

rojogrande-

Yeah, I see your point: “what is, is,” I suppose, and work with the system we have.

I remain naively hopeful that enough people recognize that the Fed’s triple mandate is the problem, and that debt issuance and monetization will destroy our currency’s purchasing power.

Fed mandate reform and scope limitations are needed to avoid currency degradation.

Respectfully

Few (including many financial analysts) seem to understand the wisdom of what you have said. With the amount of public and private debt here and internationally (not to mention instability in the Middle East and eastern Europe), the demand for funds is likely to keep rates relatively high for the foreseeable future. Even if rates come down by 100 basis points in the next 12 months, borrowers will be paying substantially more than they have in the past 5 years, likely resulting in defaults which will impact the stability of financial institutions, requiring propping up by the government with resulting inflationary pressures….Not a pretty picture for the years ahead.

The Federal Reserve did not ‘pivot’ at all, but rather kept their Federal Funds Rate completely unchanged.

I watched Powell live. He was very clear that until we get to 2.0%, rates will stay up or go up more.

In fact he responded very directly to a reporter who implied he had said rate increases were done and cuts were coming soon. He said if conditions change (ie. inflation rises again, employment and/or wages rise again) the fed will RAISE rates more.

He was clear about only lowering rates if inflation continued to drop, so as to not push the economy into a recession.

Watch his speech, if you havent. If you did and didnt hear what he said, watch it again and pay attention.

Most of the comments here have sounded like people watched a different speech.

The main problem with his speech is that why would he even mention that they are having a discussion of rate cut. That is baffling and ridiculous. Even Bank of Canada governor said today that they are not thinking about any rate cut.

Kevin,

The reporters kept mentioning it!!!

Like a pack of dogs, kept coming at him from all angles.

CCCB,

“Most of the comments here have sounded like people watched a different speech.”

LOL, that’s the impression I get after every Powell presser. I’m thinking what the hell were they watching?

Admission, I didn’t watch the speech. I live in a country where rates were also left unchanged. I rely on you guys for the inside skinny p:). My problem is the smoke billowing up my backside by the manipulation of inflation figures. The rate of inflation may be dropping, but prices are still headed up overall, and in more insidious and stealthy ways. Not to mention, who’s in charge of manipulating those figures? Hmm..

The problem is the unprofessional government in Canada. Show me at least one project they have done successfully, on time, and withing the budget planned. There is none. Same goes here: they were printing money like crazy “stimulating” economy where there was no need to. Now they increasing the interest rate when there is no need to. Simply put, the less they intervine the better it would be for the country. Too bad we could not get them all on a rocket and launch it in space. Canada would be much better without the incompetent liberal government.

Agreed.

This is a deliberate and coordinated policy throughout the West.

They purposefully desired a two-tier society where you’re either a landlord or a renter.

No wonder everything is on fire, everyone is fuming with anger and inequality was never greater.

Of course, even the unaware masses are starting to realize that something isn’t making sense. Governments are deliberately letting in millions of people while not creating additional housing.

And right now, they’re doubling down on anyone connecting the dots and saying that this reality is divisive, unfair and unsustainable.

The Pavlovian reaction of calling anyone critical of these policies ‘far right’ is exactly what you would expect from these authoritarian failures.

Social cohesion and equality is everything…trying to force it with policies of fear, punishment and ideological fantasies isn’t going to work.

The social contract is broken. When those in power can’t even accomplish the very basic principle of adequate shelter for everyone, you know it’s time for change. One way or another.

Yup. Feds for the last 40 years could have de-commoditized residential real estate as a continuation of tax reform for principal residences in 1981. Too easy to get rich quick for that generation so further reforms were thrown out. I have no sympathy for landlords that have recent capital losses or negative cash flow – unless you’re renting a space that you currently live in.

I dunno… I think the rich have secured a sweet spot in heaven.

The article is a meticulous report on the current values of the parameters the royal we have deemed as importance. The values themselves, stir the primordial juices, which we all eventually learn, are not the most reliable optimum solution to the problem with the status quo. A sideshow for all but the most dedicated.

What I see, is the potential for a significant decline in the price of housing which if, is allowed to fail chaotically, will be like a Richter 8 financial earthquake.

It is my perception, that the asset markets are unique in the sense that the quoted price of the last share, increases the value of all the other shares who mourn the loss in value of the last speculative share. There is a financial inertia underlying our society. IMO, the 18pct loss is trivial and indicates that the monetary conditions maybe still, too lax. Then, I consider the misery that unemployment has cost us, and I think they probably are correct in the pace of snuffing out the excesses.

Seems like higher rates could actually amplify rent inflation in Canada, since Canadian mortgages aren’t a fixed rate.

That makes the BoC’s inflation fight that much more difficult.

Nah, the rates don’t really impact rents much, rents are impacted by population change and housing stock change (ie. supply and demand).

Absolutely .

I challenge that assertion that mortgage rates don’t impact rents.

Currently, when the juju was flowing and the asset prices were destined too exceed all previous episodes in human history, the land lords raised rents in an economically linear manner.

Only someone who financed their property at a subsidized ZIRP rate would be so smug. Currently, the speculative rent is at a maximum with a steeply rising vacancy rate. Seems like the small boy, whistling past the grave yard.

Correct, landowners who bought beyond their means are passing on the rising costs to renters.

Rents fall when interest rates rise and rents rise when interest rates fall. Home prices will probably rise 10 percent in 2024 and another 15 percent in 2025 as interest rates plunge. As home prices rise rents rise. Rents will go into the stratosphere in 2024 and 2025, double digit increases in both years. In order to keep the immigrants coming to Canada a massive increase in the minimum wage has to follow.

When I see these charts I think…..there are a lot of rich people in these Canadian Cities. I could never afford to live there.

In Canadian dollars (1 CAD = 0.75 USD). But still.

Isn’t a 20-25% pullback in any market, just a normal correction?

I’m not sure why, since 2008, every strong market is defined as a bubble and as such, is required to explode and wreak havoc on the world.

Drug addicts etc are looking for an excuse for their failures so these journalists make up these silly stories. Everyone knows you buy a house and hold it long-term to avoid be subject to massive rise in cost. Renting is always cheaper so irresponsible people forget to save for rainy day.

Tyui, almost by definition renting is going to be more expensive than owning a house, because if it weren’t, the landlord would just sell the house rather than renting it out.

There are some exceptions; if the landlord is speculating on large price increases then he may be willing to take a loss on rent since he’d be holding the house regardless, and better to have a bit of cashflow rather than zero (and better to have somebody who’ll notice quickly if the pipes burst). Or if the landlord is planning a teardown he might be indefinitely deferring maintenance, so he and his tenant together are gradually extracting the equity out of the building.

So the supply dynamics suggest that, under typical conditions, renting would be a little more expensive than owning.

Then on the demand side, there are various benefits to renting rather than owning: you can move within a year (or within a month, sometimes) with no transaction costs and no need to wait for a sale; you don’t need to worry about maintenance costs; if the building catches fire or floods you can just walk away from it; etc. Financially, renting has lower credit requirements and avoids the need to lock up a down payment or any other equity. There’s also the fact that very small properties, such as studio apartments, are very hard to purchase so you’re forced to rent if you want such a space. So you would expect “renters of choice”, in Wolf’s words, to be willing to pay a premium over owning.

Canadians are, on average, wealthier than Americans.

Canada also has one of the highest proportions of high net worth individuals in the world. It’s a safe haven.

Canada — making the world safe for oligopoly since 1867.

It was the engineered housing bubble that created the artificial wealth.

Just curious, do you live in Canada? Or are you making assumptions? If “Canadians are, on average, wealthier than Americans,” then why was my wife’s first country of choice, when she defected from Romania, America. Canada, where she ended up, was, and always will be, the consolation prize. If Canada is so great, and you are American, then please move here for the higher standard of living.

nicko2 has been commenting here for a long time, and we had some discussions. From memory here, I think he is a Canadian expat living in a developing country. He talked about it, but I don’t remember the details.

nicko2, if you see this, please chime in.

He said the average Canadian was wealthier then the average American.

Cities in the US with similar population to Canadian cities, won’t see the same average housing costs.

The path your wife took has nothing to do with his statement.

Where did you get the data. Are you one of those typical Canadians and Europeans who envy America for its technological achievements

They don’t have the same level of restriction the US has on foreign real estate investment, which is why some call Vancouver “the nicest Chinese City in the world.” Australia has similar problems in a lot of their metro areas.

They also both share she fact that outside of the major cities, they’re largely uninhabited and everybody tends to live close to the border. Yes, an Ocean is still a border.

Most people in Canada can’t afford the home they live in.

That’s the entire point of why Canada is in such a mess.

Nothing here makes any sense whatsoever.

It’s a really low quality of life here.

It’s all paper wealth in housing that the Chinese created. The people who already own homes in the provinces of Ontario and British Columbia have been the benefactors since 2015 when all the rich Chinese came to Canada.

It’s all over. Rate cuts next year. Bond yields falling, TLT up bigly, mortgage rate will fall. It’s all over. Forget housing crash until 10 years from now?

Rates will go down and there will again be bidding wars on homes… gitty-up!!!

Part of the issue with housing in Canada is that the government there has decided to bring in 1 million+ newcomers per year – for a country of just over 40 million. The funny/sad part is that the government is still “considering” if immigration is affecting the housing market.

You dont want to live here. Miserable weather, expensive houses, high cost of everything, high taxes. Fake people. Its a prison.

Yes it is a terrible place to live. Do not come here. I mean do not go there.

top gnome says: “Yes it is a terrible place to live. Do not come here. I mean do not go there.” My friends that have moved from CA to ID often say the same thing (before adding that it snows about 9 months a year)…

The cost of living is sky-high and everything is done for the poor especially poor people with children at the expense of the rich.

Grad of Trump U?

One diff, it’s not always election season. Elections for EVERYTHING. And the wacky quasi-monarchy. Who in Canada or the UK or Oz scatters pardons around like paper napkins?

Every year the UN has a ‘quality of life’ index for countries. They have to be rich to rate at the top. The same five or six change top positions each year. They are all Constitutional Monarchies: Denmark, Sweden, Holland, etc. The best the US has ever done is 14.

Not too many mass killings either, been a couple of years. Don’t need to pack a piece. In my younger days I did a lot of hunting, owned a variety of long guns. Never held a hand gun.

If you gave me a house in Texas, I wouldn’t move there. In fact I won’t set foot there.

Nick,

FYI: George posted from Canada, from your neck of the woods. Maybe you know each other in real life?

Guess I was sarced

It’s ok — Texas isn’t too flapped by the absence of your foot.

I have lived in Texas for more than 30 years. When I first came here, it was a great place to live with a high quality of life. It has gone steadily downhill. You never used to see a homeless person and everyone could afford a house. The infrastructure was good. Now it’s a dystopian nightmare, an example of a society literally disintegrating.

Escierto, that’s a function of leftist politics and mass immigration. America has gone downhill in general, not just Texas.

A few other differences: (And Nick lives about a 2.5 hour drive from me and surprise surprise I don’t know him. But I like and respect his comments for over the past 10 years, anyway)

Today the Cdn senate voted to confirm and make into law Bill C-21. Illegal to now own an assault style weapon in Canada. There will be a buyback for those still out there. Illegal to now purchase a handgun. Domestic Red Flag alert, guns seized by police, all guns if there is domestic violence in your house….. If you currently have a restricted gun license RCMP can search vehicle on any traffic stop. Awesome, as far as I’m concerned. And I’m a gun owner, for hunting. Never once thought I should worry about firearm violence. Ever. It never crosses my mind. We don’t even lock our doors, my shop is never locked, it just doesn’t register.

Abortion is a right. No book bannings. Election every 4 years and every minority Govt has to work as a coalition or be voted out of existence. Elections last 30 days only, plus illegal to campaign on election day. Illegal for Fed Govt employees to spout party politics. No gerrymandering, as all electoral boundaries decided by a non partisan panel with local input and public hearings to avoid controversy or rigging.

I have never once received a medical bill or had to co-pay except for the shingles vaccination, and why that isn’t covered I have no idea. I just had minor day surgery at local hospital, no charge. Years ago a Texas grad student was working in our area surveying fish. She broke her arm and had to pay to have it set at hospital, plus pay for the X Rays. She told me it was cheaper than her co-pay private insurance in Texas for the same injury. We do not pay medical insurance premiums. Our meds are a fraction of US costs.

Problems in paradise? Of course. But by and large citizens try and look out for each other. Do the connected have undue influence and effect? Of course, but at least our Govt reps don’t stock trade with insider knowledge. Schools are funded at the same per pupil amount regardless of the postal code. No local school funding. Teachers have autonomy and are well paid.

I was born in the States. My sister still lives there and we are actually quite nervous about crossing the border to visit her. My two older brothers formally renounced their US citizenship. One lives near me in BC, the other moved to France. I moved here at age 12 when my parents left the Bay Area in ’68….both veterans by the way. It was finally the riots in Hunters Point that tipped the scale. My Dad started to keep a handgun in the house and my mom didn’t go along with it. I will never forget their ‘private conversation’ about selling out and moving. I was about 10 at the time and snuck down the hallway. It took about 2 years to sell out and leave as my dad had a business. We were instructed to say we were moving to Seattle, as at that time the FBI was investigating ‘dissenters’ and passing on names to the IRS.

Canada. Terrible place to live. Just terrible.

Oh yeah, my 40 year old kids have homes soon to be paid for, and I retired at 57…a blue collar worker my entire life. Yes, housing is way too expensive, but firm plans are in the works to bring it down. As for my contribution to the younger generation, I am a landlord and rent a cottage to a young couple for $600 dollars per month, or about 1/2 of what I could gouge someone for. It is 5 years old and I built it myself. We plan to buy another house soon, and will rent that out at a reasonable rate as well. Why do we do this? Because we have gained in the appreciation of the property. I have to sleep at night and we try and do right for our community.

The birth rate has gone nearly to zero. Only the Chinese are having kids and fewer and fewer of them. The Pakistani’s and the Punjabs had children up until about eight years ago now they’re having none and I mean none.

…I understand that declining birthrate is a phenomenon common to most ‘first world’ countries. (…might be viewed as resulting in ‘demographic vacuums’ and attendant immigration issues. An old situation, often referred to as ‘barbarian invasions’ in centuries past, when population overload on a location’s resource base and a native technology’s failing ability to deal with that overload generating the flow. Rome certainly dealt with this. (Hard to keep ’em down on a busted farm once they think they’ve seen Paree…)).

may we all find a better day.

#Facts

I will say though that the Indian families who have bought the homes right and left of my parents have only been in Canada for a few years. Four adults in each – all working and all pooling their resources for the betterment of the family make it possible for these immigrants to do what many born and raised Canadians will never do – own their own homes.

But still, the immigration policy is bonkers. It shouldn’t take four people to do what a couple could do 30 years ago.

20-23% of the housing stock is owned by investors. Selling the top to immigrants is the exit strategy.

acouple could do thirty years ago…..that couple is likely still paying, the others who share the home in the beginning are all living mortgage free. Yes prices have gone up but so have wages. Most young people would not get out of bed fir what we made at the end if of our careers. The whining generation is not used to working saving and waiting. Instant gratification is the norm so they get themselves into big homes with big mortgages.

Like when the Japanese bought Rockefeller Center…

You know, if people considered Western nations anything more than operational economic zones, somebody might try to argue that the Canadian government has a duty to its own citizens far ahead of immigrants, regardless of how economically beneficial they are and how their spendthrift fiscal responsibility helps them pay for ridiculously overpriced houses. Also, I think you’ll find that, if you look under the hood, these Indian families have a lot of economic incentives the Canadian government has given them that aren’t available to the native population. I know in America we certainly do.

@Grant: Wow, that doesn’t make sense. Would you care to elaborate on the economic incentives provided to immigrant families and not to the native population?

@Sean Shasta

In the US, Southeast Asians (that includes Indians) are included in the quota-not-quota system of affirmative action for universities. The SBA also carves out generous small business and entrepreneurial loans for immigrants, and these are largely used by Indians. Think hotels and gas stations. This is often used in conjunction with visas and then it’s handed off to the next person for their visa. There’s a ton more, but those are the big two sticking in my head. The system’s ripe for grifting if you’re aware of the opportunities. I don’t think America has a dearth of people qualified to own and operate a gas station, so I don’t think it’s a stretch to say extending unfair advantages to non-citizens in order to operate this business is a detriment to their citizens who could be doing it. I can’t imagine the situation is much different in Canada, whose government seems to specialize in handwringing and active antipathy for the native-born population.

This is exactly the problem.

Canada is not a real country.

It’s an economic zone.

You can live in one of 5 gulags.

You can see fields if you drive 10 minutes or less from the middle of the gulag to outwards.

You cannot build on the fields.

You must buy within the gulag limits.

Taxes are 50% of your salary.

On your net wage sales taxes are at least 15%.

The government won’t build infra out into the fields from the gulag.

Gulag population levels will increase by 4% per year.

The Daily Gulag newspaper will say it’s 2% per year.

You will sit in traffic jams at all hours of the day.

The entire population will look at you funny if you mention any of this.

Anyhow, back to the gulag citizen 824201399.

They do the same thing in India.

The funny thing is that people from other countries see this but we are looked at as racist and cruel if we say anything. 1M new people a year is not sustainable without infrastructure, proper healthcare, and jobs. We are literally bringing in students, refugees, and immigrants and putting them and our own citizens on the streets.

Cay – looking at this from the ‘Murican side, the rejoinder has been ‘…but the immigrants are willing to do work that ‘Muricans won’t…’. Our self-inflicted, can-kicked problem by folding to business interests and never implementing an effective card-check policy that would have raised compensation and working conditions to a point where ‘Muricans WOULD do that work (…cost of U.S. living higher as a result, no doubt, but those revenues going towards ‘ making work pay’, AND maintaining honor in it-at least until those jobs were automated (or exported-oh, yeah, we did that already) out of existence…).

may we all find a better day.

Hi Wolf,

Do a bit on the condo prices in Toronto and the number of assignment sales

Condo: -13% from the peak, -1.2% for the month, -1% yoy, at $803k back to Nov 2021

That’ll do a 360 soon and there’ll be bidding wars on the assignment properties. Properties are now sold with open bidding like an auction instead of blind bidding.

This is exactly correct. Raising interest rates will hit corporations who have financed the construction and purchase of multi-unit residential properties – which forces them to raise rents. It might be that it is a better strategy in Canada than raising rates past 5 or 6%.

Lots of Chinese moving money away from mainland

Lots of chinese money is laundered through gulag 1, gulag 2 and gulag 3.

Cigarette for drug swaps on gulag reservations 1 and 2.

Long live the economic zone!

We own in Calgary; prices just won’t stop rising. About ~10% increase this year.

Everything thrown to the sky sooner or later falls to the ground. From higher it falls, the damage is greater.

It is like filling up an ice cube tray, the Toronto and Vancouver cubes got full and started spilling over to Calgary…

Looks like the fact that Canada does mortgages differently than the US has managed to arrest, albeit not deflate their housing bubble. Here in the Eastern part of the USA the housing bubble continues unabated.

Does Canadian government operate a mortgage subsidization arm of the government (similar to the Fannie and Freddie, owned by FHFA, I think)? Are Canadian mortgages actually originated and owned by banks? Is there a securitization industry there?

Federal mortgage subsidization surely plays a huge role in US housing disasters of last 50 years, and I’m wondering if it’s similar north of the border.

Apologies if this is a repeat question…

High loan to value ratio mortgages (<20% down payments) require the purchaser to buy mortgage insurance from either the federal government (CMHC) or a private mortgage insurer. This has created a massive moral hazard as the banks originate the mortgages, which carry zero risk in theses cases, and then securitize them and sell them to investors looking for returns that are guaranteed by the federal government.

There are stress tests required for mortgage qualification, but I personally think these stress tests allow for debt loads way beyond what people are actually capable of carrying – the max is something like 42% of your pre-tax income in debt payments. Also Canadian mortgages are either fully variable (they change month to month based on the BoC rates) or they’re fixed for typically 3 or 5 years, after which the mortgage holder has to renew for another period at whatever the rate is at that time. Many people who got rates of less than 2% will be renewing in the next 2-3 years likely at much higher rates.

Fully agree with this comment. CMHC has removed mortgage risk away from the banks so banks which has resulted in ‘Moral hazard’. In other words, the Citizens of Canada ultimately carry this risk.

I think it was under PM Paul Martin’s tenure that CMHC shifted away from building affordable housing to guaranteeing high risk mortgages. IMHO, this was the start of the housing travesty that followed.

The stress test is gone.

Not quite. IMO

Every single AI model is programmed to be a liar as should be obvious by the word programmed.

Any model “trained” to rank the mathematically proven independent variable as the dependent variable, it seems to me, violates the basis of our understanding of right and wrong.

Yes, the state backs mortgages.

We also have just a few big banks that are too big to fail.

The govt mainly backs housing by inhibiting building then setting immigration rates far above the known build rate.

Then they come out and say “hey we didn’t know and are you racist maybe?”.

Then loads of Canadians who own housing and fully understand the point being made join in on the name calling and then HELOC the gains.

Georgia t, Ivan and Awkward Potato-

Thanks for insights.

Between housing agencies and CB, the central planners have done a great job, heh, heh.

This classic post tech-wreck quote sums up the delusional thinking of the planners:

“To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment…. Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.”

Paul Krugman, N.Y. Times, Op-ed, August 8, 2002

It seems this interventionary call to action reverberates, amplified, after each crisis.

“Georgist”

Damnable spell-check!

Auto-Correct can burn in Hello!

Also google “Understanding Canada’s State-Backed Real Estate Crisis”.

Article written this week, they preempted your desire.

What is the percent of the residential housing stock financed by mortgages?

60%

I’ve read that over 70% of mortgages are held and taxpayer/government backed through Fannie, Freddie, FHA, and VA. Mine is held by Fannie even though my loan servicer is a bank. My bank, like the Fed, may also be holding MBS’s issued by Fannie/Freddie at lower than 4% interest rate.

Unlike 2008, the Fed led private banks are off the hook this time. If needed, it will be a bailout using tax dollars (or forebearance/forgiveness).

I’m sure the banks care if housing crashes the entire economy so the Fed will likely step in before that.

Morning Wolf

US release ?

Dec 26. Merry Christmas!

Fed’s John Williams says the central bank isn’t ‘really talking about rate cuts right now’ – CNBC

=======================

Isn’t this what Powell should have said last Wednesday? What a bumbling, incompetent, and ineffective fool he is…!!!

Now they have trot out Williams to do damage control.

These guys have to learn the basics of central banking from ECB’s Lagarde and the BOE.

The ECB learned from the wild and woolly reaction of the markets, media, and social media to Powell’s presser the day before. They knew what was coming and were ready for it. That’s the benefit when you let the Fed go first.

Wolf: But, with all due respect, the Fed has seen the marketing ratcheting up for the last several weeks.

Since they are “experts”, shouldn’t they have known that nothing but an outright “no discussion of interest rate cuts…” should be their position.

They claim to be “experts” and top-notch economists – and get the big bucks and awesome amount of power to move markets. They did a pretty shoddy job. I’m sure most commenters here on Wolfstreet.com would have done a better job than Powell did on Thursday.

*market ratcheting up

Seems to me people hear what they want to hear every time the Fed speaks. Been even worse thru pandemic. Endless selfish bs dressed up as concern for the little guy. Notes to clients read more like Dear Santa letters. Informed predictions or desperate wishes? HIGHER HIGHER HIGHER RATES. For LONGER LONGER LONGER. If u are suffering at 5%+ the problem is you not rates. Hard for people to realize how broke they really are. OPPORTUNITIES ARISE FROM OTHERS FAILURE. Let people fail already!!!!!

One might compare this to the statements that get made by the current Pontiff that seem to soften or abrogate Roman Catholic doctrine and send the Magisterium on a week-long tour per comment saying “nothing’s changed. He worded it badly, but he meant to uphold current orthodoxy.” Yeah, but at some point it’s impossible to argue that the guy didn’t know on some level that certain groups would take his comments and run as far as they could with them. At least this seems to be the first one for Powell. “Foot-in-mouth Francis” has had over a decade to figure out not to give ammunition for speculation.

Sean, yes. Powell is a bumbling moron. I’ve never seen a worse public speaker from someone in his position.

That’s one area where both Clinton and Obama excelled. They could get in front of any crowd and speak about any topic and do so with grace.

But….well….with lots….of…… pauses.

Despite being a teleprompter there. How they said things was better but better oration doesn’t improve bad content.

Glen – in public or private arenas, one’s ability to maintain a straight face is one to be cultivated…

may we all find a better day.

Perhaps their failure is choreographed. Meant to make you and me accept that we are helpless American citizens, unable to replace this bumbling, incompetent, Trump appointed, aristocrat, reassuring the squillionaire’s that he did what he was told.

Which could be mistaken as a normal guy, aligned with yeah, but still, has a dog.

dang – methinks the choreography of that failure has come from several different directions in efforts to incline the citizenry to re-accept a type of ‘monarchy’ since the Brits surrendered at Yorktown. Franklin warned of this (…my apologies, Wolf, as usual I’m too-historic, here, but to stay somewhat on-piste, many early ‘Muricans did move to Canada, being just fine with the way things were antebellum…).

may we all find a better day.

MW: Federal Reserve’s Williams says the Fed isn’t ‘really talking about cutting interest rates right now’

MW: Traders brace for chaotic ‘triple witching’ Friday as $5 trillion in expiring options collides with index-rebalancing mania

And as usual, it was a big nothing with stocks again unchanged like usually are on these quad/triple “witching” non-sense days.

With O/N RRP under $700bb and continuing to drop, hopefully liquidity keeps coming out of the system and home prices in US drop some at least (here in FL).

The problem with modern America is that the “elite” of both political sides are much closer to each other than they are to the average American.

From an article on The Hill:

“A year ago economists thought there was a 100 percent chance of a recession and now the Fed is signaling we are going to have three rate cuts, possibly next year, and that’s on the back of a strong GDP report and strong employment numbers,” said Brendan Duke, the senior director for economic policy at the liberal Center for American Progress.

“When it comes to how Americans feel about the economy, these rate cuts have been sort of the missing piece,” Duke added. “They are going to unlock a rising stock market and lower mortgage rates.”

This is a very liberal advocacy group, and he’s spouting off about how a “rising stock market” is going to change how Americans feel about the economy and how they are personally doing.

These people just don’t get it. The vast majority of people have no substantive exposure to stocks.

Someone’s $80k 401K going to $105k is not going to move the needle.

“These people just don’t get it. The vast majority of people have no substantive exposure to stocks”

Have read this ‘harsh’ truth in any of major financial media publications?

They ALL are in a bubble with top 10-20% where every thing is more than merry and think the rest of the society is like them. Top 10% own over 90% of Wall St wealth and the rest less 7%.

I tend to see it from a more granular perspective than the average or the mean which is an abused statistic. I prefer the median as a much more descriptive statistic.

The inequality is much more obvious as is the decline in living standards and other common comparisons.

Wealth is admired but, rarely, the source of a life well lived.

Thursday was a risk on day but that’s all being unraveled today! BTC is back down to $41,899.20. Precious metals gave up their gains from yesterday too. Idiots!

Escierto

What unraveled today? S&P nudged down a fraction (but NOT DJA and Nasdaq) Tech groups related to AI, cybersecurity, blue chip growth ETFs and coal all went up.

Scanning of my own well and highly diversified portfolio (Tech heavy tilted towards AI, Cybersecurity, Robotics +Blue chips+) about midday where 20:1 (Red v Green arrows) ratio of down vs up, stock groups, ‘roughly’ indicating where the ‘new’ money being directed. I pick among them and invest additional in some of those shares stocks/ETFs. It also suggests me which stock sectors are being favored. This info is also available on various sites online but I rely my own. Works most of the time but NOT all the time.

I follow on a DOWN day only. NOT a UP day when everything is being pulled up. Just my own idiosyncratic strategy, TO each his own.

Hi Wolf, thanks for the article. Could you post the condo chart for Calgary please?

Merry Christmas!

Next month maybe.

Say what you will about US single family real estate, but with the rally in the 10 year, mtge rates have nowhere to go but down. Since listings are historically low, it will be an exciting 2024.

Since the 10-year has plunged so hard, it has no where to go but up, LOL.

Inflation and Animal Spirits

“It’s the idea that Wednesday’s unexpectedly dovish pivot by policymakers, who penciled in three quarter-point rate cuts for 2024, may end up undermining their inflation battle and create a new set of problems. The reason is that it’s reawakening the market psychology forces known as “animal spirits” — giving investors greater confidence and easing financial conditions in a way that might make it harder to control inflation.”

-MarketWatch

This so called ‘Animal spirits’ encouraging speculative bets will keep on going until a spike in inflation rate in the next 2-3 months. FOMO adds more volatility.

Speculation can imperceptibly turn to fear, which I think is underway.

The potential for loss exceeds the potential for capital gain in the new year as the coordinated bid dissipates, liquidity declines, and the financial employees begin to act strange. A formula that I have lost more than I have gained, using.

20 percent below the peak is a huge move down and clearly the housing bubble is being addressed . I don’t want a stock market crash and as far as stock investors go the markets are barely back to 2022 levels . Manufacturing is coming back to USA which will really help our economic picture . We had raging inflation in the 1970s and 1980s because of energy price shocks. Low energy prices around the globe helped tame inflation until 2001 then the global GFC and j now shale oil and NG. Lower fuel prices are reducing inflation even core as costs are dropping . Lower interest rates would be needed before a recession hits . Don’t fight the Fed

Right on ! The only thing is that asset prices are at record highs, while the actuarial interest rate went from zero to 5.5 pct for the risk free security. How can a risky asset such as a stock or a house not be worth less on a discounted cash flow analysis.

Good evening Wolf,

I’ll add a bit of context to what you’ve already presented.

Currently there’s 57% of all existing mortgages with our big banks have had amitorization extensions (over 30 years). The big banks have roughly 70% to 75% of market share I believe.

At current rates, mortgage renewals are expected to increase monthly costs around 30% (quite the bite out of disposable income). The federal government and BOC are still continuing the narrative of a “housing shortage”. This is while the BOC and CMHC’s own housing affordability index has current levels at the most unaffordable levels since 1982. Just over 60% of mortgages are up for renewal in 2024 and 2025. A toxic combination of really low interest rates, FOMO, stampeding speculators, and a federal government/OSFI that sat on their hands. The mortgage charter that was recently presented in the fall economic update was a repeat of what was in the annual budget in spring and amounts to the government asking lenders to be gentle – none of it has been passed into regulation/law, perhaps it was more for optical purposes.

Thanks for staying unbiased and sticking to the facts Wolf.

Everything is crazy expensive in Canada. In liveable areas, it’s 400k for a junker or 600k for a decent habitation.

I just bought a house in BC because I’m moving provinces for work and it took us nearly 4 months to find a suitable house

– still nosebleed price territory though. Prices are coming down, but not far enough or fast enough – lots of stubborn sellers and fantasy pricing out there still.

Prices will go nowhere but up as mortgage rates continue to fall. Places in the 400 to 600 thousand range have no jobs or you freeze in the winter as it gets down to fifty degrees below zero.

Living standards in Canada are far behind the USA.

The price of food here, particularly fish and meat, is huge.

Supermarkets have no competition, each brand locates in one area with nothing much close to it.

Selecting fish, for example, there is no manned counter. There is one choice of either salmon or trout, on my recent trip not both. The trout was very expensive.

It’s just like that all the time. I have a job paying 6 times median wage, I pay nearly 50% tax.

Housing is a fortune.

Lots of horror stories from friends who’ve had to take kids to ER, waiting hours and hours.

Nearly every single person at my work has been replaced with a Chinese or Indian developer on a work permit, who will all be on it for years and will have their already low wages suppressed.

Roads in the city are the worst I’ve seen in any western country. My car requires regular work on the shocks etc, yet another cost.

Teachers are on strike for an indeterminate period.

Nurses are on strike.

I have no permanent doctor.

Any trip to the supermarket is guaranteed to touch $100.

The working class people (like everywhere) are great, that’s the one bright spot.

Thanks to Pierre Trudeau there’s not much of anything as in no selection and higher prices because everything has to be in both English and French at the same time. To make matters worse the French race of people has virtually died out in Canada and the legacy of Pierre Trudeau haunts everyone to this day.

Power outage *again* in an expensive Montreal suburb.

Perfectly clear, tranquil weather.

Happens all the time.

Could be hours before it’s back on.

That’ll be 50% tax, please.

Love, Canada.

You don’t live in Canada — you live in Quebec

;-D

“Something darkly humorous about these central-bank engineered easy-money spikes that then go POOF.”

If I were a lot younger (I’m 75) I would be making a lot of money riding the wave up and cashing out before the peak. I did that in the Eighties. Actually, I knew when to cash out back then, but all my property was jointly owned with a wife who had a different agenda. Now I know.

Now is the time to be hoarding cash and enjoying a modest life. No need for asceticism. When everything slides downhill like it did in the Nineties, it is time to start buying again. I’m looking to do the same thing here in China. Maybe go halfsies with a relative on the down payment on a choice new construction home. Just have to wait for a good price drop.

I was born and raised in Italy and I lived in Australia, UK, Canada and finally the US so I do not have a “home country” bias when evaluating Canada vs. the US (I have citizenship in both countries in addition to Italy obviously).

In my opinion and in the opinion of a lot of Canadian expats that voted and keep voting with their own feet, there is simply no comparison between Canada and the US for a reasonably hard working professional.

The US offers a vast superior experience when it comes to choices (career, geographical locations, consumer goods) and overall a lower cost of living and higher salaries. I just came back from a weekend in Vancouver to visit few friends “trapped” up there (living in a 1M+ condo), they would love to move to the US if they could. A huge chunk of people earnings in Canada gets chewed up by out of this world RE prices. Often they show me some of the most ridiculous listings, we call it “The Great Canadian RE comedy show” (or Horror Show if you are trapped in Vancouver and in the market for a property). If I understand correctly, during the runup in the interest rates the Canadian government negotiated with the banks for a lengthening of terms for many mortgage holders with duration extended up to 75 years!! Maybe 50 years mortgages are around the corner.

I just bought a beautiful vacation (and eventual retirement) house in a gated community in Tampa Florida and I cannot even imagine what would be the price for the same house in Vancouver and before someone says it, no it is not in a flood zone, it ranks “1” (minimal flood risk) on the FEMA scale exactly like my West Seattle home.

Canada has the same hire and fire business culture as the US with close to European salaries…frankly, I rather go for more money. I’m sure that the vast majority of immigrants, if given the choice between the US and Canada, they would go for the former. Like someone already said it, Canada has always been the “consolation prize”.