The Home Price Benchmark Index is down 13% from peak in March 2022. The Canadian housing market is in a category of its own, in terms of craziness.

By Wolf Richter for WOLF STREET.

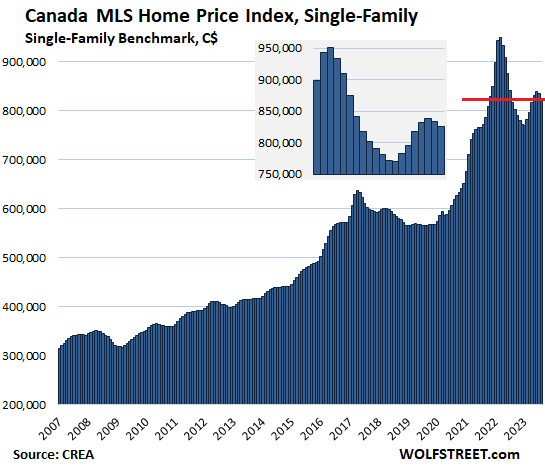

The Canada Home Price Benchmark Index for single family houses fell by 1.1% in August from July, after having already fallen by 0.5% in July, to $825,700 (all prices in Canadian dollars), ending a rambunctious spring selling season that had been further fueled by Bank of Canada rate-cut hopes, which then turned into two additional rate hikes so far.

From the peak in March 2022, the benchmark price has dropped by 13.1%, or by $124,900, according to data from the Canadian Real Estate Association (CREA) today. Year-over-year, given the stunning price plunge last year that forms the base for this year, the benchmark price ticked up 1.0%.

But not all markets are the same. In the Greater Toronto Area, prices dropped more sharply, and were down 14% from the peak in February 2022, while prices in Calgary rose to a new record. More in a moment.

Sales dropped, supply rose. Home sales fell 4.1% in August from July. New listings rose 0.8%. Since March, new listings have surged by 25%. Active listings increased by 1.9% in August, the third month in a row of increases. Supply rose to 3.4 months, double the level of the pandemic low.

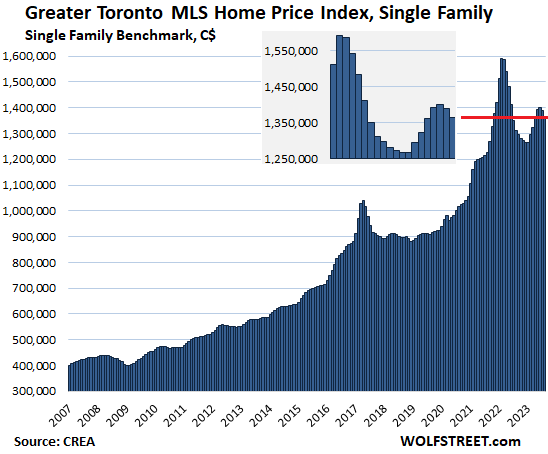

Greater Toronto Area (GTA): The MLS Home Price Benchmark Index for single-family houses fell by 1.7% in August, after having fallen by 0.8% in July from June, to $1.365 million.

From peak in February 2022, the index is down 14.2% or -$225,800. Given the massive plunges last year in the June-August time frame, which form the base for the year-over-year comparison, and the effects of the rambunctious spring selling season, the benchmark price was up 4.1% compared to August last year:

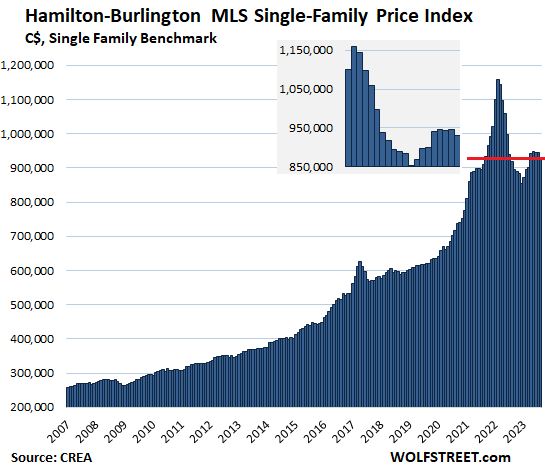

In the Hamilton-Burlington metro, which is part of the “Greater Toronto and Hamilton Area” (GTHA), the single-family benchmark price fell by 1.6% in August from July, to $930,300, after having been essentially flat in the prior four months.

From peak in February 2022, the price has dropped by 19.8%, or by $228,900. Given the stunning plunge last year at this time that had followed the stunning spike, the price in August was up 1.3% year-over-year.

These kinds of free-money-spike-and-plunge charts would be hilarious, like something you’d see in a satirical magazine, if they weren’t so serious.

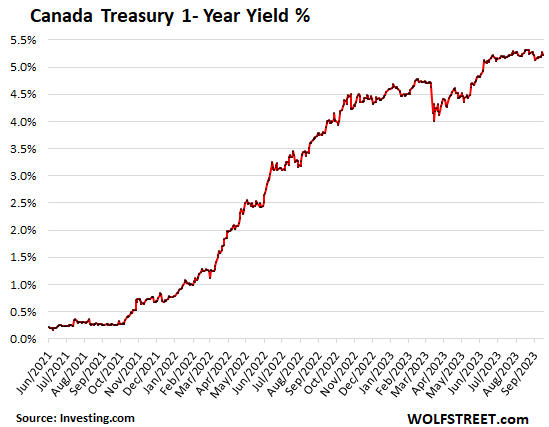

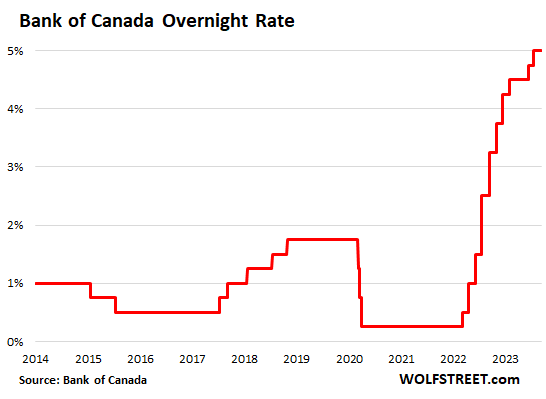

The Bank of Canada has tightened policy with a rate hike in June and another in July, to 5.0%, after announcing in January that it would “pause” its rate hikes at 4.5%, which had ushered in dreams of rate cuts, the result of which was a drop in short-term interest rates, with the 1-year Treasury yield dropping 75 basis points, from 4.75% in January to 4.0% in mid-March, the result of which was the rambunctious spring selling season.

At its September meeting, amid re-accelerating inflation, the BoC paused its rate hikes at 5.0% with a bias to tighten further.

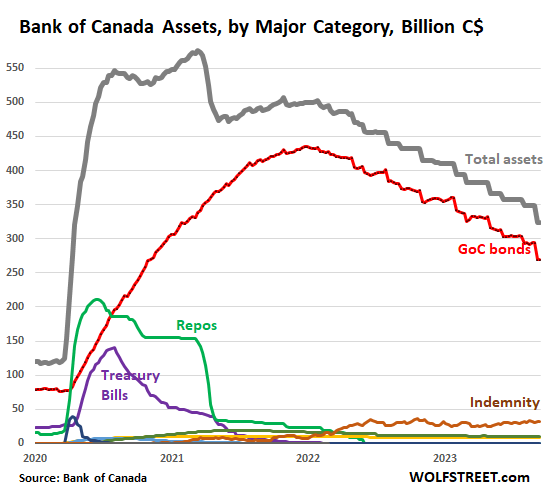

QT would continue, the BoC also said. It has already shed 55% of its $455 billion in QE assets that it had added during the pandemic, including 46% of its Government of Canada (GoC) bonds and all of its repos and short-term Treasury bills. There is still aways to go to get rid of the crazy liquidity thrown at the markets during the pandemic, but the BoC has made quite a bit of progress so far:

Canada’s housing market reacts to shorter-term interest rates, in addition to other factors, such as hype and hoopla. It’s shorter-term rates that move the Canadian market because of the types of mortgages used. Lending typically is via variable-rate mortgages, whose rates are changed based on shorter-term interest rates; or via fixed-rate mortgages with rates that are fixed only for short periods, such as five years (for details, see our Introduction to Canadian Mortgages and Mortgage Insurance).

Today, the 1-year yield is at 5.22%, and it has been in this range since early July, up from 4.0% in mid-March; it’s that sudden drop to 4.0% in March that triggered the spring frenzy.

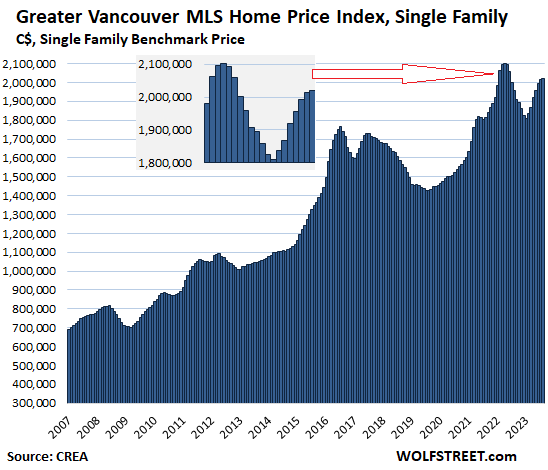

Greater Vancouver: The MLS Home Price Benchmark Price for single-family houses inched up by 0.3% in August, to $2.02 million:

- From peak in April 2022: -3.9% or -$81,600

- Year-over-year: +3.2%

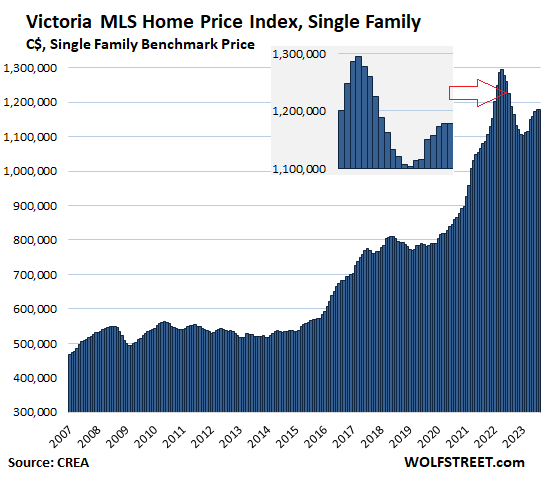

Victoria: The single-family benchmark price was unchanged in August, at $1.178 million:

- From peak in April 2022: -9.0% or -$116,000

- Year-over-year: -0.8%

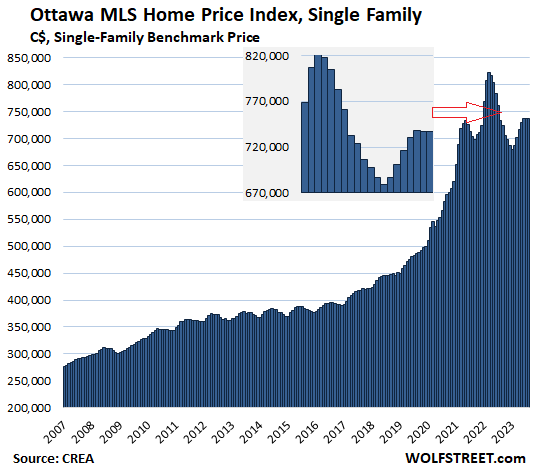

Ottawa: The benchmark price of single-family houses edged down just a hair in August, after dipping 0.1% in July, to $736,900:

- From peak in March 2022: -10.5% or -$86,300

- Year-over-year: +0.6%.

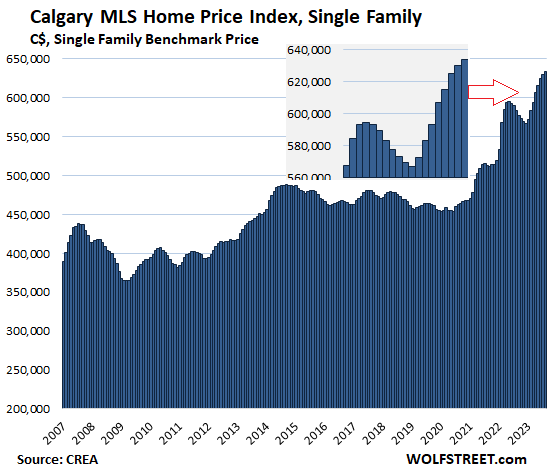

Calgary: The single-family benchmark price rose 0.7% for the month, and by 8.7% year-over-year, to a new record of $634,000:

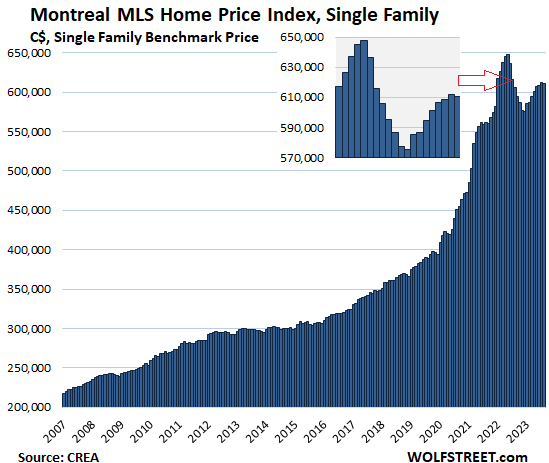

Montreal: The single-family benchmark price dipped by 0.2% for the month to $610,800:

- From peak in May 2022: -5.7% or -$36,800

- Year-over-year: +0.8%

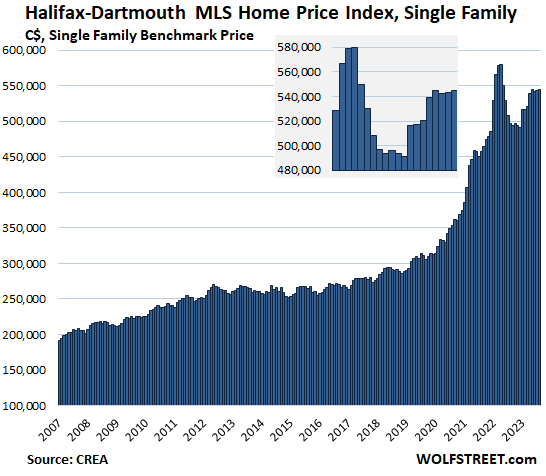

Halifax-Dartmouth: The single-family benchmark price inched up by 0.2%, to $544,600, having been essentially flat for four months:

- From peak in April 2022: -6.0% or -$34,900

- Year-over-year: +9.6%.

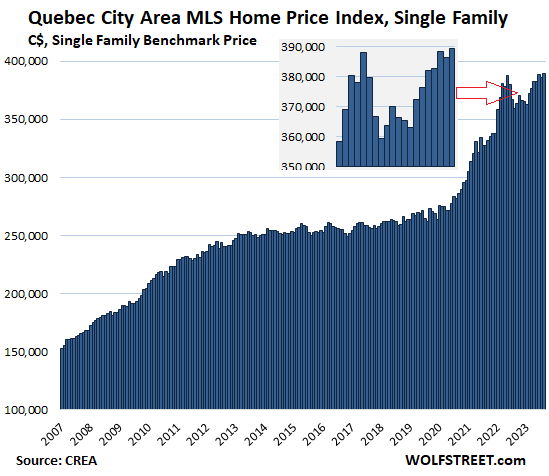

Quebec City Area: The single-family benchmark price rose 0.8% to eke out a record of $389,300, and was up by 8.3% year-over-year:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thank you again for an excellent article.

Sobering.

It does seem, however, a lot more difficult to find similarly presented data for the UK retail housing market.

The China money dried up ages ago and there’s a good chance that these investors will add to the number of listings as they look to get liquid to deal with the problems they face as China deals with its own economic reality. KO

Which may be coming to a place near you (you plural) Wasn’t there that partially built office building in San Fransisco and isn’t there a substantial amount of property owned by Chinese citizens in Vancouver and other Canadian cities? Who knows the amount in the UK. Oh, and, Australia….?

That said, what’s emigration from China (running from Chinese financial/political crackdowns as fast as possible) over the past few years been like for those with overseas property assets?

How are Canadians in Vancouver able to purchase a home for $2,000,000CAD?

Isn’t it obvious the money is coming from outside Vancouver? The West Coast is driven by international money, particularly from China.

Housing bubbles are a pyramid scheme in that those that owned before the bubble was fueled, can continue to fuel it for some time as they leverage up the paper wealth gained on their pre-bubble owned home, and used it to trade up and/or leverage up to buy investment property(ies).

It’s all good until it isn’t.

Then there’s no chance to cash out as the market dries up as soon as enough of these “risk takers” get pressed as far as cash flow goes, and others get freaked out and just can’t bear the risk and sleepless nights that falling home prices are having on them.

Amen. That also describes the US real estate market. Search for what W. Buffet said recently on this.

The China money dried up ages ago and there’s a good chance that these investors will add to the number of listings as they look to get liquid to deal with the problems they face as China deals with its own economic reality.

Also, the banks are the ultimate risk bearers because of anti deficiency judgment laws and as to commercial real estate, because they foolishly made loans to cronies’ subsidiary entities formed to specifically run specific malls, etc., so those subsidiaries can walk away from loans and properties and get safely put into bankruptcy. (Safely for the wealthy owners of the companies.)

No personal guarantees were ever made as to most, real estate companies or the assets of personal guarantors are hidden in foreign trusts and unreachable to banks. Get ready for GFC v.2! LOL The legally insolvent banks and Wall Street will soon demand more free bailouts from us.

Government fueled the bubble, with the help of the central bank, major banks, and “regulators”.

The global south’s success in regards to bringing the developed world’s hegemony, exorbitant privilege, and control of the global financial system to an end, has resulted in “stubbornly high” inflation as the developing world is developed enough to trade amongst itself instead of being forced to accept sustenance prices for their exports as the developed world was the only game in town for their exports.

As a result of this reality, and the inflation being experienced in aging developed-world countries, the governments of these countries (“independent” central banks) have no option but to raise interest rates. Otherwise the bubble would continue to speed up, and this would lead to inflation becoming completely unanchored, and the value of the developed world currencies would fall even faster than they should.

And the reality is, a strong currency is a very good thing (as long as you can buy imports with it).

What’s better than being able to import goods and pay for them in a currency that you, and you alone can print, at zero cost.

Yes, eventually, there will be inflation higher than targeted, but with a little bit of financial repression where governments choose to pay interest rates below the rate of inflation, the pain is felt massively more by foreigners that hold previously issued IOUs than the pain felt domestically.

The pain felt domestically is unavoidable as it results from the “loss” of exorbitant privilege, something people just accepted as a birthright without fully appreciating what made it so, and what could bring it to an end.

This is a great post. The issue is very simple. The only way a society collectively can consume more than it produces is if another society collectively produces more than it consumes.

For the last few decades, the third world has been willing to subsidize the developed world by selling their goods and services for the developed world’s (largely the West’s) printed currency.

You are right that the pain is felt more by foreigners, but it also changes what the foreigners are willing to tolerate in the future. That’s, in my opinion, part of why we’re seeing a lot of inflation, and why there’s a push to “dedollarize” even if it’s at its infancy right now.

This argument ignores SERVICES. Services account for about 65% of consumption.

These are Canadian dollars. So, not real dollars.

Even at current exchange rates, two million Canadian dollars is still $1,477,814 US. The average wage is $73,705 (Canadian) and the unemployment rate is 5.8%. Not nearly enough to support these prices.

Because they own a house that’s now worth $$1.9mm.

> but what if you don’t own a home already?

then you are going to die in the Canadian gutter

One does not die so easily. If you lose the house for 1.9 million on paper you go to rent, it’s simple.

Canadian reading comprehension? Look again

georgist

I understood very well what you wrote. And I have read many of your comments. What I don’t understand is why you insist that everyone should own a home. There are plenty of people around the world and in Canada who pay rent and haven’t died in the ditch. I myself am a naturalized Canadian and always paid rent when I lived there. I’m still alive hahahaha.

I lived in Vancouver until 2004 and even back then it was all anyone ever seemed to talk about. Had many friends in university who lived in large detached houses by themselves because their parents lived in HK or Taipei or elsewhere for most of the year. Why would you ever let an asset like that leave the family?

Canadians in Vancouver either lived there for decades, inherited property, or if they can’t afford it, live in Hastings Lane among the unhoused. Housing bear Garth Turner already mentioned that it would have to take two surgeons with no medical school debt, two pilots, even two millionaires to afford a mortgage in Vancouver using the 30% affordability threshold.

Affordability in Canada now means that a 10th percentile earner can’t own a 50th percentile home.

You sure about that stat? Even if accurate, income does not equal wealth and the savings necessary to buy a house. Lots of young people earn high incomes and haven’t had enough years to save yet, or don’t bother to save enough. Look at the savings rate. At 5%, it’s still a lonnnnnng road to a solid 20% down. And it always has been.

Search “dollarwise How Much Income Do You Need to Afford a Home in Canada?”

> The average home in Canada costs $754,700.

> The minimum income required to purchase the average Canadian home is $180,075

> Even the top 10% of earners (estimated average income of $174 – $176k) in Canada do NOT qualify for a mortgage to purchase the AVERAGE Canadian home.

> In the last month alone, the increase in minimum income to qualify for a mortgage has risen by $3,798 in ON and $2,854 in BC.

Povince Avg Home Avg Mortg Income Reqd

Quebec $467,500 $374,000 $118,445

Average income in Quebec is around 65k, household income 85k.

If you earn more most of it goes in tax, the top marginal rate is 53%.

Canada is essentially over as a capitalist country.

The banks have stopped repossessions.

Most people cannot build equity.

A regular visit to the supermarket to buy basic products, no meat, ingredients not ready meals will set you back way, way over $100.

Every good you can possibly think of costs more than the USA.

The border is heavily policed on the Canadian side for “sneaking in” goods not taxed in Canada, punishment up to and including being turned back from the border in future.

You can see land *everywhere*, open, unused. You can’t build there, you have to pay for a condo next to a huge field with ongoing service charges.

Georgist,

No, you’re missing a key piece. Again, just because they don’t qualify income-wise means little. You’re assuming all these 90%ers have only the minimum in downpayment. It’s likely that the higher the income, the more cash they have to reduce the principal. Take it to the extreme. Someone with $50k of income and $1m in cash could buy a median home with all cash or 75% cash and qualify. This is a significant chunk of buyers in all markets. I live in an expensive area, with plenty of recent buyers, and most of the people I know can’t “afford” their homes at 10% or 20% down. But they rolled equity from another property with a large gain or had plenty of cash to make the mortgage a lot smaller.

How can you possibly not extrapolate that twenty years forward and think that it’s going to work out ok?

Prices *cannot* stay detached from wages. That’s just math.

Canada has not invented a perpetual motion machine.

It is a bubble, it will deflate.

How are Vancouverites doing it? Inheritance and/or leverage. Keep in mind that the bubble has exploded incredibly fast, as a result there are still humble school teachers living in 1.8M houses that they bought for say 300K some years ago, someone like that has a lot of equity to play with, often times they simply stay there and then retire in Kelowna or something (as a result feeding those smaller city bubbles). Sometimes though they’ll be leveraging to buy more properties. An example would be my previous RE agent who just a few yrs ago owned about 20 properties in the suburbs with his wife(they’re not Chinese lol) that they rent out to tenants, they started years ago. Some don’t play the property game themselves but they will help their kids purchase property, some of those kids keep living at mom and dad’s while renting their property out, many homes BTW come with ready to rent suites right from the developer with seperate entrances and everything so you can live there on upper floors and rent 2 seperate suites on your lower floor if you wish. Any Vancouverite without these advantages is not buying 2M houses, they’re renting, buying condos in the suburbs or moving away entirely.

An important note is that Vancouver attracts very wealthy people from around the world, business people, actors/directors, athletes and musicians, the houses they buy are sometimes in the 10M and 20M range. Metro Vancouver and the lower mainland do not have a lot of space for development compared to other cities, it’s boxed in by ocean, mountains and the US border, about 20% of the lower mainland if I remember correctly is agricultural, on top of that there’s quite a bit of NIMBYism, in a lot of the expensive neighborhoods there aren’t a lot of existing or new high rise condos/apartments, sometimes there are none at all and other times when a development is greenlit the “tower” they put up is laughably short. Currently there’s a lot of talk about lack of industrial space that’s said to be hurting the regional economy. So Van has a lot of unique demand pressures on top of the crazy “Free money era” cash floating in the market, but the cheap money is the main culprit IMO, some people are leveraged up to their titts with properties which drove the appreciation which attracts the infamous “foreign investors”.

They can’t. They rent or move to a cheaper part of Canada, while rich outsiders from China and other countries buy up the real estate.

I think there is a ban on foreign home ownership in Canada

Canadian Politicians have forced working Canadians out of the Cities, through Foreign Ownership of Canadian Housing. Of course, extremely few native Canadians can pay $2 million plus for shelter.

Dirty Money from Offshore continues to flow and Canadian Politicians continue to Profit. Think of Canada as just as controlled as the USA by the DC WEF crowd.

This Canadian from Vancouver moved to the US 15years ago. And won’t be going back.

We don’t.

First time buyers can only do it with help from family. Others are upgrading, having been in the housing market for years.

Dad and mom that bought there house for

200k in the 60’s and are sitting on the biggest windfall that OLG can’t compare too

Wolf, thanks for zooming in to the graph to help make your point that the bubble is bursting. lol

You don’t need the zoom for that, you can see that from three miles away. What you need the zoom for is to see what happened over the past three or four months.

See?

It does bring to mind a Big Dipper Roller Coaster.

Slow crank higher and higher, then , over the next few years, ‘Weeee…..’ all the way down…

Housing has begun to dominate the discourse in Canada, especially near me in Ontario. People here have to renegotiate their mortgages every 5 years or so, and many are struggling with the new rates.

Supply near me has jumped in recent weeks. Interesting times.

That’s why I tell people not to get mortgages with teaser rates. Once they reset, the higher rate will cost you an ARM and a leg.

It’s not a teaser rate, the mortgage has to be renegotiated every 5 years, that’s the longest you can get in Canada in a normal product.

I had no trouble getting a 10-year rate at Scotiabank. I just had to ask….

Sure ask away. Right now 10 year fixed is 1% more than 5 year fixed.

You can get anything, for a price.

The vast majority have variable or 5 year fixed, most stats don’t even include it, so it’s not a factor in what will play out.

“That’s the longest you can get in Canada in a normal product”.

Someone provides facts that destroys your argument.

“You can get anything, for a price.”

LOL. The number of people on this forum who talk about things they know nothing about is stunning.

JD…The original comment is quite valid. The standard longest mortgage term on offer is 5 years. If one individual inquired about a10 year term it does not change the actuality of what is.

Georgist and Captive are simply describing how the banksters operate here.

People who type lol are not impressive

Excellent article and data. Terrific. Everything is just so unaffordable where I live on Vancouver Island, and some smaller markets away from the larger centers are still increasing in price because those larger locations are even higher in price! It is like a contagion. After a summer of fires so many have headed west for vacations with plans to stay and relocate….putting even more pressure on markets. 75% of the cars and trucks on the highway have kayaks or quads strapped down. Many are from out-of province.

And this situation is poison for renters and for hopeful first time buyers.

A snapshot anecdote. Son rented out his property (near me) to relocate to town as his wife works shift as a nurse thus making the commute too dangerous in the winter. Renter is a young couple from Ottawa. They want to buy the place as soon as their home back east sells. Meanwhile, their parents have also relocated here and indicate other relatives are planning to do the same. They try and pin me down about son’s plans and I just say if you don’t buy it by spring it will just officially go on the market if the prices are still acceptable. I also told them to go through a winter here before locking in. Winter here is more than mild temperatures….many cannot stand days and days of overcast and rain.

Good folks, but it is still one less home a local will buy or be able to afford.

One other thing, a friend runs a local lumber supply company. I have dealt with them for decades. (Carpenter) Business is now very slow as new construction is slowing. They cite interest rates and lot prices as the main factors. There is talk of layoffs. A good building lot can go for $900K, certainly $600K. It is plainly unaffordable except for those newbies who have sold out elsewhere and have a wad of cash. One bedroom apartments are $2,000 per month in a city of 40K.

Our Federal Govt is dysfunctional and barely hanging on in a minority position. The anger about housing and food prices is everywhere. They retain power by pandering to another party who wants universal dental coverage and $10 per day daycare. All great ideas, but meanwhile folks cannot afford decent groceries and housing, and are pretty sick of the inflation rate and don’t feel open to higher taxes or more Govt deficits. I think the pendulum will swing a hard right before too much longer. It has before.

Thanks for a great article about our housing market and problems.

Regards

The United States ran a big experiment where we allowed people more freedom and responsibility for their own economic prosperity and it worked fabulously.

But politicians only gain power by throttling freedom and individual productivity, so of course, as they grow government, they destroy the successful experiment.

Tucker had an interesting video on Argentina recently. I am curious to learn more about the economic lessons from that country’s failures.

Tucker, the guy that got fired for telling so many lies and now broadcasts from his utility shed? Why would anyone waste time listening to that guy?

Rachel is your man?

I don’t know what you are talking about but suspect the trans Atlantic slave trade lead to economic gains that in real terms eclipse any era since, but that didn’t have much to do with freedom and responsibility. Your mileage may vary.

As soon as you mention the word Tucker you cease to have any credibility whatsoever and you are only speaking to other members of your cult.

Some people are still driving far-right teslas. Talking about cult, am I rigtht?

Yours and Arnold’s comment have nothing to do with Argentina or gametv’s comment. Some people here always have to inject their personal politics.

Would be interested to know how they glossed over the fact that Argentina’s implosion sources MAGA-esc populism. Worth noting that Peron’s cult remains in power right now, in 2023…

Canadians think that if they give poor people $500 of dental a year it’s fine that the middle class take $30k a year in free housing gains (which is taken ultimately from non-asset owning poor), then it’s all good.

The answer to everything is crumbs for the poor via the state, while the state lines up everything for asset holders.

Nobody understands macro here at all, ask anyone and they will tell you housing will continue to rise above wages, forever. What does that even look like? Lawyers living under bridges? Canada is a mad house.

Why blame the government when it is pure speculative demand in the market driving housing prices higher? Now they’ve fallen 13% and will likely continue to fall. That’s what supply and demand does.

It’s very clear the government have a huge hand in this.

To say otherwise is false. We don’t live in a completely free market of supply and demand.

because they caused the speculation!!!!

After the banking crisis they dropped rates to nothing for what ???? 15 years!!!

Borrow 1$ pay 1% make 9%

Of course ita the government fault and now we pay for there mistakes

I appreciate this perspective, but I have to point out there’s a lot of conjecture and speculation here, and maybe a little bit of histrionics (no offence intended). VIREB stats show a pretty substantial drop in all markets since Peak Fool (early 2022) and declines are kicking in again after the unfortunate conjunction of Spring Market Disease and Pivot Madness earlier this year. Listings are way up, too.

The only market up significantly in August was the Cowichan Valley at 3.58% year-over-year compared to August 2022. Overall for the island (minus Victoria) the year-over-year decline was -2.33%, thanks to (are you ready for this?) a -32.32% year-over-year decline in Port Alberni and a -1.65% decline in Nanaimo (second largest market on the island after Victoria). Carnage starts like this, from the hinterlands and then into the cores. Note these are comparisons to August 2022, when prices were fully in free fall compared to Peak Fool in early 2022.

I don’t have any sense of people moving here to escape fires, or that kayaks on cars are indications of anything. My kayaks are on my car sometimes and I was born here. I’d certainly not move here to escape fires – it’s pretty smokey today. We’ll see what the 2022-2023 immigration numbers are like when they are released, but immigration/inflow for 2021-2022 was a touch above 80k. That’s about double the long term average but more or less directly correlated to the doubling of immigration targets.

Housing has been an issue here for far longer than any recent “driver” might fairly be blamed. OECD estimates 8.7% percent of houses in Canada are empty/unoccupied, and we don’t seem to think it is important to track how many more have been lost to AirBnB (it’s probably a lot). Low interest rates meeting wealth disparity forms the main issue here. If I resort to anecdote, all the Boomers I know have multiple houses, obtained with low rates and leveraged equity. Most people in younger demographics have one or zero houses. This is not generational quibbling, just observation. There’s a lot of offshore money here, too, but it’s something we don’t seem to want to track very accurately, so who knows? I’ll just say it’s awfully weird to see a Ferrari parked in the Nanaimo Costco parking lot.

Anyways, going to get interesting here with all the mortgage renewals coming up…

TEMPLE

TEMPLE: “Low interest rates meeting wealth disparity forms the main issue here.”

Very well said. Just a few years ago I was reading about the wealth gap for the millenial generation in Canada, authors claimed it was the widest gap of any generation. If I was to speculate how that came to be I’d say not all of the “boomers” are hoarding wealth from RE, some are passing it down to their kids.

It is going to get interesting indeed, I know some on variable rates (on the mainland) that are under strain already and looking to downsize, everything is just starting.

P.s. enjoy Island life, just came back from Port Hardy after doing some work up there and drove to Nanaimo where our boss likes to fly us in/out from for some reason, it was a fantastic drive and I’m glad he likes to waste money lol. I did indeed see quite a bit of out of province and even out of country plates, however I think some of those will disappear once the whale watching tour boats and stuff shut down for the season 😆

In America, kayaking is a code word used by the lesbian community. It is a method of flag-waving to identify each other, like lavender scarves, Carhartt coats, and Subarus. I know a lesbian couple who have kayak racks on their Subaru and a vanity plate “KAYAK”.

In my corner of America, kayaking is code for sweaty elites menaced by bass boats. Not sure whose side I’m on.

What the hell? Really?!? I kayak sometimes. I’m a dude. Do people think I’m a lesbian?!

Pretty funny Lake Tyler Rx Park has kayaks for rent so no need for racks and I have no idea who rents them nor do I care about the 1-3 percent of those mentioned above and good luck to anyone and everyone in Canada

People actually like kayaking, we do too (not the crazy stuff). It’s a popular sport. You can rent kayaks so you don’t have to put them on the roof of your car and don’t have to worry about getting back to your car after you’re finished with your river run. It’s also an Olympic sport.

…can’t resist this old one, doubtless soon to vanish, here.

Two novices decide to make a kayak trip very late in the season. After making their way far out into a very large lake, an incoming cold front drops the temperature precipitously. Shivering, they light their camp stove to try and provide a little warmth, but fumble it and set the craft and its cargo on fire, sinking it.

Thus demonstrating that you can’t have your kayak and heat it, too…

may we all find a better day.

I’m a 50 year old man. I have both a Subaru and a kayak. I fish with it all the time. I guess I’m a lesbian trapped in a man’s body.

Yes, there are lots older people with multiple houses. I know many snow birds who maintain two residences, each one getting about six months of use.

With big rises in RE taxes, auto costs, utilities, and other maintenance, this retirement setup is going to get very expensive from here. Duplicate expenses are not fun, especially when they are rising fast.

The prospect of home price drops adding cost to the equation. Plus, the prospect of a big stock price decline along with continuing high inflation makes the picture wholly unattractive from a financial perspective.

From a pure financial perspective, it’s much better to pick one location and live there full-time. The best time to sell the extra properties is now, while prices are still not far from record levels. It’s so easy to put the money in ST bonds to earn 5%-6%.

Earn 5-6% means your only losing 5% to inflation

Adda boy

Politics will most definitely swing right in the next federal election, but conservative policies won’t be the answer either.

That will give a massive mandate to Freeland as she leads the Liberals to the largest landslide victory in federal Canadian politics.

With the end of globalization as we’ve known it (under rules written by the West, for the benefit of the West), and the exorbitant privilege we’ve enjoyed, especially for the last 40+ years, we are going to see governments in every developed world country get more involved in their country’s economy.

This will be true regardless of which party is in power.

And it will be the right thing to do.

The economy will continue to be pragmatically managed as a mixed economy, with government and the private sector both continuing to do what they do best.

“That will give a massive mandate to Freeland as she leads the Liberals to the largest landslide victory in federal Canadian politics.”

Nice rumour. Whereas I heard Freeland was getting a new home built in Florida, next door to her European buddy.

Freeland is not smart.

First up: she used to write for the FT and the Globe and Mail.

Have you read articles in these newspapers? Blogs like this exist for a reason: the paying public cannot, on average, understand complex topics so the press doesn’t cater for them.

Freeland recently came out and said she would force BoC to lower rates.

If your country is suffering from inflation, in large part due to imported goods, how smart is it to come out and state that you’re going to strong-arm your central bank? 5 year went up the day she said this, having the opposite effect.

Freeland might get in, but she’s not smart.

Canada claims to be one of the most educated populations in the world, but educated to what standard? “Degree”? What if most of the universities aren’t very good?

41 percent of Canadians believe the government sets interest rates.

Is that what a high proportion of tertiary education buys you? Can we get a refund?

Earn 5-6% means your only losing 5% to inflation

Adda boy

Paul…. It’s nice to hear from you. I wondered what happened to you as I don’t remember seeing you since the lockdowns

You have to thank Trudeau for the housing bubble, fueled by the most reckless immigration policy in the history of Canada. A mind-boggling 1.5 million import a year including those on work permits and student visas. Many expensive houses in Vancouver are still being purchased by cash from newly arrived immigrants from Asia.

This is so typical of politicians and bureaucrats and economists that think they can manipulate their way to a great economy.

At the core of an economy is the ability to manufacture/create value and if you dont have that, all other attempts to create wealth out of thin air is a scam that will eventually fail.

You have to thank the moronic speculative buyers for that.

What about the governments that provide the suppressed interest rates, the loan guarantees, and bailouts??

It’s going to be alright.

Developed world countries are governed pragmatically based on the political economy realities in play globally. ,

This is true regardless of which party is in power.

Canada doesn’t care how you got your cash, so long as you buy a Canadian home and push working Canadians to the curb.

Also in Canada we pay > 40% tax, that tax is used to build roads, services, infra all around cities. That infra imbues value on the land.

People laundering money from overseas into Canadian real estate didn’t pay > 40% income tax, yet they are riding the wave of our taxes.

So you don’t believe in free markets then?

I had thought I read that alot of Canadian mortgage holders who could not afford higher payments were being switched into mortgages that amortize over greater than 30 years so that the payments didnt spike too high. Is this not the case?

Next thing the bankers will try is force people into reverse amortization loans, or interest only loans so that the homeowners cant get out of debt – ever!

Debt is the new slavery.

I did hear about some negative amortization loans in Canada. At what point is it functional slavery?

Twenty percent of active canadian mortgages are in negative amortization.

We basically have a huge banking crisis brewing, the losses are being held in the banks to prevent mass sales and (OMG!!!) price discovery.

What does price discovery look like at 6% rates where the median household income is ~$85k?

It’s going to be a big shift. That’s why Trudeau has been busy ramping up immigration to astronomical levels this last year.

What is happening here is so extreme, so insane, it is hard to comprehend.

If we get a fall in prices like we did in 91/92, then that would take us back to circa 2017. Which would still be extremely elevated relative to incomes and rental rates.

Going forward every month we are going to see increases in listings, and declines in sales.

I have a feeling that it’s going to be a long drawn out process.

Well, first slowly and then all at once, as they say.

Suites in single-family homes have allowed massive mortgages to be serviced, up to now.

But with more homeowners likely looking to this option as a source of additional disposal income (in these times of significant inflation), that very well could have a deflationary impact on rent costs, which makes it even harder for many highly leveraged home owners and highly leveraged investment property owners (condo and single family homes).

Over the last decade, many people have bought investment properties, including people, who bought a more expensive home and kept their first home as an investment property.

I believe we are also going to see an increase in people who are in their 20s and 30s possibly moving home to save money, and maybe even with the hope of saving enough for a down payment as they to see home prices continue to fall.

The pool of people who were able to buy into the market because their parents were able to gift their children a hundred thousand dollars to a few hundred thousand dollars to put towards a down payment has run dry.

There is no next pool of buyers until house prices fall significantly.

And a few months of falling house prices and rising number of listings will be more than enough to stop the few buyers there are from jumping in to catch a falling knife.

And before someone else says:

> immigrants will buy them!

well the average immigrant comes with $22k of savings.

So they won’t.

They will not this year but maybe in the next year or two they will after they work for a year and have income.

A friend of mine in Florida said 3 immigrant families pitched together (13 or 14 people all to together) and just bought a 3 bedroom house on his street. The street looks like a used car lot now. LOL

This is completely incorrect.

House prices in Canada have detached from wages.

Therefore most immigrants will not be able to pay the prices.

That’s just maths.

What difference does it make whether prices go lower or higher?

Dad and mom that bought there house for

200k in the 60’s and are sitting on the biggest windfall that OLG can’t compare too

Canada must follow the same economic laws as the US. All that housing equity is available for the demand side of the limited goods & services; like Jerome Powell and other economists say. In order to stop inflation that excess real estate equity needs to be removed from the system. President Clinton had an idea of imputed income based on what the homeowner would have to pay to rent his property, the difference between that and the mortgage would be taxable income. Seems like this would work great in Canada with the all cash purchases. Certainly would help any Canadian government deficits or even pay down their nation debt; might be worth revisiting here in the USA. Jamie Dimon says that we have almost exhausted that excessive pandemic era savings that has been causing so much trouble in inflation; so re-engineering equity may have a great positive impact.

Why not just confiscate people’s homes and skip all intermediate steps. Or you could just move to Venezuela.

What President Clinton was proposing would be sort of like a national property tax. In financial circles there has been nothing but praise for ZIRP, central banks buying residential MBS, etc. that has provided untold equity and wealth to the population. It is well known that in most areas property tax rises when the housing market booms, and it is a small price to pay for all the wealth given by the government or quasi government (central banks) to the population. Local and state governments are flush with cash needed for operation thanks to the housing boom government policies (including local zoning); no sense to run federal deficits when only a small part of the equity given by the government/quasi government programs is asked back (President Clinton) in return. Even inflation is a gift to equity and gives even more wealth to the population in equities of all kinds.

Don’t laugh. One can buy a very nice 2 bedroom apt in Cuba right now for $5500 USD..

I’m serious.

+ comparable health care at a fraction of the cost. I bet EV charging stations are rare though…

I’d love to take your home(s)

Gary

Yes. A true Socialist. Government prints and inflates House Prices, and one of their Zealots wants to tax the working poor by taxing “imputed Rent.” on the fake, inflated nominal price.

Try this. Cut Government, the biggest Parasite on the Working Poor.

“President Clinton had an idea of imputed income based on what the homeowner would have to pay to rent his property, the difference between that and the mortgage would be taxable income.”

But this specifically punishes folks who bought a house to live in.

…kinda like the idea that the nation’s mundane manufacturing base would no longer be THAT important when it’s solvable pollution and expensive short-term social costs could be exported while making a few bucks for those who figured out the new game…(sic transit etc.).

may we all find a new and better day…

> There is still aways to go to get rid of the crazy liquidity thrown at the markets during the pandemic, but the BoC has made quite a bit of progress so far.

I’m not sure I’d agree with this fully.

Surely the *real* source of crazy liquidity in Canada is the housing market.

And the money for that comes from the banks, produced out of thin air, with the house as collateral. But the collateral is only “worth” the loan because every Canadian bank has been issuing CAD like confetti.

Prices have *completely* detached from wages. Housing is now entirely priced in other houses.

There are two types of Canadians:

1. working forever, don’t own a house

2. own a house bought before the extreme bubble, disposable income

You could earn 250k and be on the breadline if you are in group 1.

You could earn 100k and have money to spend if you are in group 2.

Because of this productivity has plummeted. Our GDP is flat despite massive immigration.

This place is *really* messed up.

Imagine you are at a party where most people are 35-45. Most of them would have a mortgage, right? Let’s say there are 30 people and conservatively 2/3rds have a mortgage, so 20 people. 4 of those people are paying their full mortgage like before, but instead the total going down, it’s going up!

And the % in negative amortization is also going to go up. Hiring is drying up big time, so virtually nobody is getting a raise, yet every 12 months 20% of fixed rate 5 year mortgages must be renewed onto the new, higher rate.

Meanwhile anger at Trudeau is through the roof, along with grocery bills.

This feels like a hot mess that is going to play out fast.

So, then just elect a quasi-intelligent PM instead of Justin Trudeau.

just like in the state eh?

I’m Generation Zee, and my peers are shocked that when they were 10, their parents paid $1,000 for a two-bedroom apartment.

Today, a bachelor’s apartment is about $ 1.800 or more a month. Rent prices hit record highs in Canada.

When will the prices stagnate?

You guys are getting Housing Bubble 1 and Housing Bubble 2 all at once. Tottaly normal. Plus global warming. So milder climate – closer to North Dakota than Alaska. No surprise rents are going up.

Vancouver wasn’t mild for the past few summers. Reached 50C with the humidity. Toronto was baking too with 42C heatwaves a few weeks ago.

Hotter summers, milder winters, but intense rain and snowfall if it happens.

And northern Ontario is getting more tornadoes.

During the fiscal year ending 6/30/22, Canada took in almost 500,000 immigrants. That broke the record previously set back in 1913, when about 400,000 immigrants came (including a grandfather and an uncle, in my case). My guess if that when the numbers are released for the year ended 6/30/23, they will beat the total of the prior year. All of the immigrants need a place to live and many bring significant savings with them, or have generous relatives still living abroad.

The old Toronto house that I grew up in recently went up for sale. It and the house next door came into the family in 1929 for the princely sum of $2,500 for the two, according to Toronto housing records. My old house and was sold by the family in 1979 for about $79,000. It is now on the market for over $1.7 million but has been totally modernized. I did not recognize the interior (as shown in photos on real estate web sites).

Gentrification creates winners and losers.

Correction: My guess IS not IF in the first paragraph.

Any estimate of what they spent to “totally modernize” the house? I can’t imagine that it was cheap considering the basic structure is probably 100+ years old and any expansion/major modification would require it to be brought up to current code and structural standards. Add 44 years of inflation to the equation as well.

The exercise might not be as financially juicy as you think.

Population increase through Q2, 2023 is available from StatCan, I think it was around 1.2 million, literally off the charts…

> many bring significant savings with them

That’s why they’re all working at tim Horton and best buy?

They bring on avg 22k.

Why would someone with 800k come to Canada, with such high costs and so many issues compared to other western countries?

“when they were 10, their parents paid $1,000 for a two-bedroom apartment.”

What is the price of that very same apartment in the very same location with the very same amenities? What was their parents’ income at that time? What would the increase be if solely based on inflation?

There’s a lot more to it than just simple back-of-bar-napkin math.

I went and looked online for the first apartment we rented in Clarendon Hills, IL. Back then it was $235 a month. Same apartment today (not unit, but exact same building and apartment size) is $1,578. I made $9,100 per year at that time which would be $56,700 in today’s inflated U.S. bongo bucks. So, the rent is about +$100/mo out of sorts, based purely on inflation only – hedonistic upgrades not considered.

I have done the exact same exercise EK,,,

Paid $50 per month rent on a large ”studio” apt w large bath, walk in closet and small kitchen in 1970,,,

Last I looked, it was $2500 per month, and NOT changed.

Meanwhile, I could earn at least $5/hour as a student worker in ’70, and I have found similar pay these days is $20/hour for the same level of skills.

”’NOT FAIR”’ for youngsters,,, is just the beginning….

”WISH” I could help, but, as mom always reminded me,

“IF wishes were horses, every beggar would ride.”

I’m in my early 20s. Did we get 10% yearly inflation for apartment prices to double? The time value of money doesn’t get that significant in a few years unless there was high inflation year over year. The 2010s were generally low inflation.

Gen Z:

It’s not overall inflation that hits housing (or rentals). It’s inflation in the categories that feed it. A rise in hamburger won’t impact rents… but an increase in the cost of appliances, HVAC equipment, lumber, plastic bits (plumbing), copper wire, paint, etc. will. Some of the increases were temporaryish, but others haven’t bled out. Taking paint, for example: a gallon of Benjamin Moore Regal paint was @ $50 in 2017. It’s poking $80 last time I looked. Aura, which was @ $65 in 2017 is now @ $100 per gallon. Then you have to look at the cost of services that are ballooning. All that has to squeeze out somewhere.

In a nutshell, don’t look at published inflation rates and think those are the holy grail.

Justin’s is keeping immigration super high to to save the assets of the 3/4 MP’s that make 150k+ and have many multiple homes for rent from losing there Many assets.

At least you don’t have to go far to discuss this issue with your MP ….. he’s probably your landlord

Now that we have a finer understanding of the nosebleed costs of Canadian residential real estate, perhaps we can proceed to a cogent analysis of the manipulation of said markets to drive those costs higher for fun and profit by the rentier-profit class. We have the ‘what’. The ‘why’ should be obvious. Now we need the ‘how’.

All you have to do is read the stuff here. Here are some answers:

2020-2022 spike in prices: Bank of Canada interest rate repression and money printing. For the money-printing part, please see the chart in the article:

Interest rate repression:

https://wolfstreet.com/2023/09/06/amid-accelerating-inflation-in-a-slowing-economy-bank-of-canada-holds-rate-at-5-0-with-bias-to-tighten-further-qt-continues/

In addition, up to 2019, before the pandemic-spike in prices:

https://wolfstreet.com/2019/05/10/money-laundering-provided-1-in-20-dollars-for-real-estate-in-b-c-canada/

Thanks! I’m finding several other partial explanations, all of which just happen to enable the financial industry to victimize home buyers. Surprise surprise.

Money laundering is one I hadn’t thought of but should have because it’s big business everywhere. My roadmap for tracking financial predation in CA isn’t what it could be.

BMO is now at 22% of mortgages in negative amortization.

Today BMO announced they are withdrawing from the auto lending market.

Oh Canada.

BMO recently took over Bank of the West, which operated hundreds of branches in the US and was formerly owned by a large French bank.

Banks have notoriously run from the auto financing business like a scalded dog at the first sign of stress in the market. Next, they’ll pull the dealer floor plan commitments. To outsiders, this seems like a seismic move. To auto industry peeps, it’s just another day in paradise.

That’s why manufacturers have their own finance arms.

“That’s why manufacturers have their own finance arms.”

Back in the 90s, one of the first things I noticed while studying the balance sheets of the Big Three US automakers for the first time is that they’re primarily financial institutions. Actual mfg is just a side line. Financialization of industry in general precedes Jack Welch but seems to have taken off since then, so that now strategic financial extraction is the new normal.

Financial predators seem to have better tools these days. Weapons are tools.

Auto manufacturers need a consistent source of retail paper and retail leasing to keep the dealers merchandise moving so the factories can keep running. Banks are not reliable sources as they mostly want the customers that don’t need the loan and are not big players in retail leasing as they don’t have a seamless way to dispose of the off lease vehicles. There’s quite an operation in place to get rid of off lease vehicles on the factory side and manufacturers have honed their operations to have multiple outlets – the last choice is the wholesale auction due to all the crazy costs associated with them beyond the auction fees.

The manufacturer also needs dealers with open lines of credit (aka floor plans) as the manufacturers cash draft vehicles as they ship them to the dealers (it’s on a *clock* from the date they leave the yard) and having a bank decide to not pay those drafts on a whim is quite disruptive. And expensive.

The finance arms are separate corporations…. i.e., TMCC is independent of TMS. Sure, it’s the same sandbox but they are firewalled. Lots of Federal laws you can trip over if funds improperly float between subsidiary corporations.

‘No soft landing in sight for housing bubble’

Headline: Globe and Mail biz section Sept 13

Highlights:

Canadian mortgage debt is 140 % of disposable income. total debt is 170 % which is 50 % more than US prior to the GFC.

Several major banks report that about one fifth of mortgages have negative amortization…..forcing lenders to increase the principle and extend term. About one quarter now have terms greater than 30 years…previously rare.

Moving on to my take: these are emergency measures that can’t be extended much further. They buy time, perhaps in the hope that rates will decline as fast as they rose. This may be connected to the widespread illusion that Canada has an independent interest rate policy.

As though the BoC just happened to drastically raise rates at the same time as the Fed!

That was causation not an incidental correlation. If Canadian bond rates were much lower than US rates, all money would flow south. If much higher the C$ would rise and hurt exports. These facts make some of the BoC’s musings in the Globe about future action a bit comical.

A BoC ‘pause’ actually means: wait to see what the Fed does. Which at this point looks like a hike.

As to the future, the overextension of all these borrowers is not going to go on forever or even for very long. The banks will look to their own interests first and will want to recapture the equity to cover their…exposure, before the equity slips too low to cover the mortgage.

The problem with the idea that owners can go ‘on strike’ and refuse to sell, is that there are always a few sales that MUST happen due to individual circumstances. But the appraisers have to use recent comparable sales, so these few forced sales will lower the appraisal of the surrounding properties, and thus the banks estimate of their equity.

The banks will not want to see this drain slowly away, increasing their exposure.

Played poker other nite with a realtor in the game. In the interests of a cordial game I didn’t argue with his optimistic outlook, and ‘how stupid people have been to wait for lower prices’. But he did complain that some of this buyers were being required to qualify ‘at over the posted rates’.

Oil is blasting to $100 a barrel; no Canadian crash in sight.

The question as always is when will people abandon or stop paying for homes that they owe more money than they are supposedly worth?