They spent a record amount more at bars & restaurants than at food & beverage stores, which tells us something about our drunken sailors.

By Wolf Richter for WOLF STREET.

We’ve long expected that consumers would shift their spending from goods that retailers sell, after the drunken binge during the pandemic, to services that retailers don’t sell, and they did.

But our drunken sailors just cannot give up on shopping, and retail sales have continued to surge despite the shift to services, and retail sales surged again in August, including at auto dealers, at restaurants, at food and beverage stores, at clothing stores (+0.9%, annualized +11%, oh dearie), and at general merchandise stores, despite a drop in prices of many goods that these retailers sell, including new and used vehicles, the largest category.

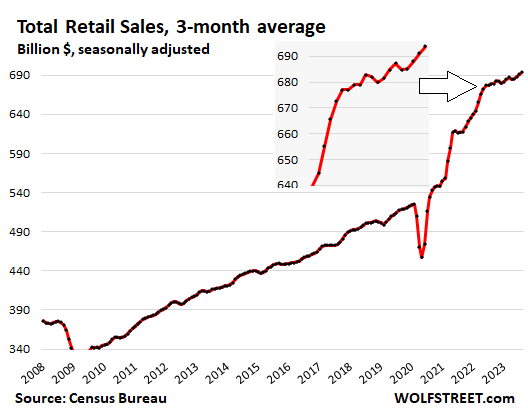

Total retail sales, including at food services and drinking places, jumped 0.6% in August from July, after the 0.5% jump in June. Compared to a year ago, retail sales rose 2.5%, seasonally adjusted. Not seasonally adjusted, retail sales rose 2.9% year-over-year to $719 billion. The chart shows the three-month moving average to tamp down on the artificial drama of the monthly ups and downs that can obscure the trends.

Inflation and retail sales.

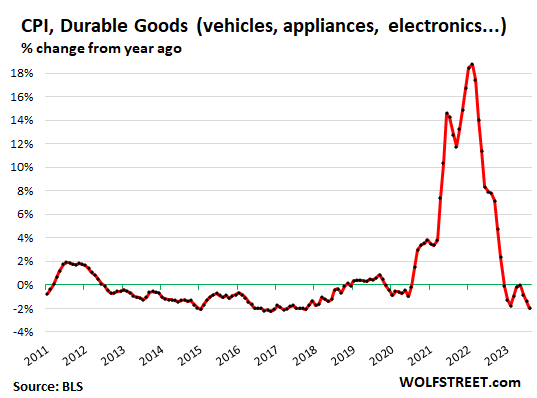

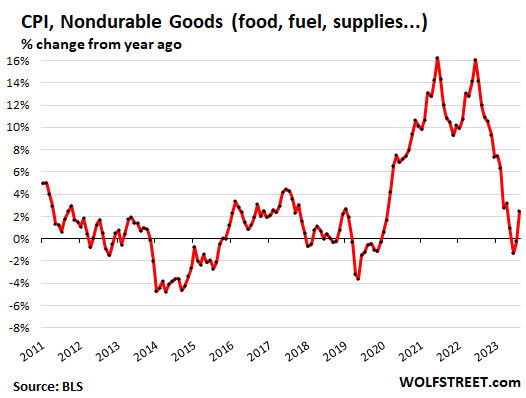

Retailers sell mostly goods, and many goods prices, after spiking in 2020 and 2021, have flattened out or dropped from the peaks, including the biggie, motor vehicles. When holding retail sales against inflation, you cannot hold it against the overall CPI, which is dominated by services, which retailers don’t sell, and in services is where inflation is now raging. You have to compare the goods retailers sell to the CPIs for those goods.

Just for a feel, here are the CPIs for durable goods and nondurable goods that roughly cover what retailers sell.

The CPI for durable goods — which dominated by new and used vehicles, furniture, equipment, electronics, etc. — fell by 0.3% in August from July, and fell by 2.0% year-over-year:

The CPI for nondurable goods — dominated by gasoline, food, clothing, and supplies — jumped by 1.8% in August from July, and was 2.5% year-over-year:

More evidence they’re still partying.

Our drunken sailors love “experiences,” and they are now spending a lot more eating out and drinking out (red in the chart below) than they’re spending at food and beverage stores (green).

The gap hit a new record of $8.4 billion in August (three month moving average), which tells you something about our drunken sailors.

In 2019, for the first time, Americans spent more eating and drinking out than they spent at food and beverage stores. While this trend briefly reversed during the pandemic, when many restaurants and cafeterias were shut down, it has come back with a vengeance:

But sales at gas stations got a boost from big price increases.

Sales at gas stations move in lockstep with the price of gasoline. But sales at gas stations account for only 8% of total retail sales. Sales jumped 5.3% in August from July. But year-over-year, sales were still down 10.3%.

This chart shows the CPI for gasoline (green, right axis) and sales in billions of dollars at gas stations, including other merchandise that gas stations sell (red, left axis). Clearly, changes in sales move in lockstep with price changes:

There were some losers.

But some retailers were left holding the bag, so to speak, as the splendid pandemic boom they’d been through continues to unwind.

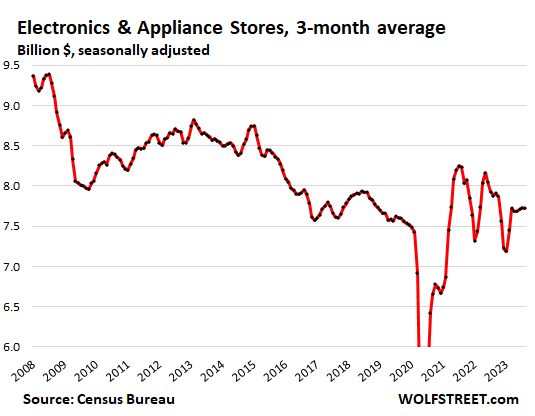

Other categories of brick-and-mortar retailers, such as department stores and electronics and appliance stores, have been getting wiped out systematically by ecommerce, as you can see in the charts below, and I have reported on their countless bankruptcies, liquidations, and store closings since 2016 under the leitmotif of Brick-and-Mortar Meltdown.

What they have in common is that they’re relatively small categories or retailers, way down the list that don’t move the needle much.

Retail sales are not a measure of “consumer spending.”

Consumer spending is far broader than retail sales. Consumer spending, while it includes spending on goods at retailers, is dominated by spending on services that retailers don’t sell, and we track this overall spending by our drunken sailors separately.

Retail sales by major category of retailers.

All dollar amounts are seasonally adjusted. All charts show the three-month moving average to reduce the month-to-month ups and downs that can obscure the trends.

New and Used Vehicle and Parts Dealers (19% of total retail sales):

- Sales: $134 billion

- From prior month: +0.3%

- From prior month, 3mma: +0.1%

- Year-over-year, 3mma: +5.8%

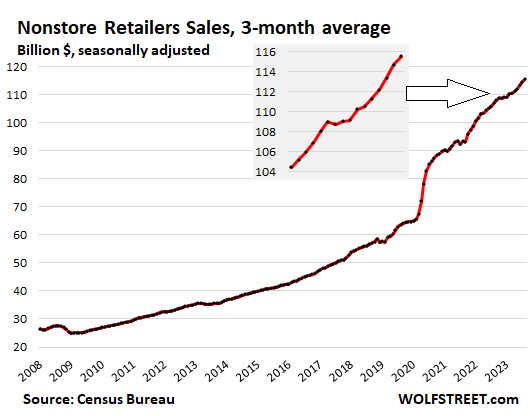

Ecommerce and other “nonstore retailers” (16% of total retail sales), ecommerce retailers, ecommerce operations of brick-and-mortar retailers, and stalls and markets:

- Sales: $116 billion

- From prior month: +0%

- From prior month, 3mma: +0.8%

- Year-over-year, 3mma: +8.1%

Food services and drinking places (13% of total retail), includes restaurants, cafeterias, bars, etc. Our drunken sailors are spending more eating out than at grocery & beverage stores; see the two-tone chart further up:

- Sales: $91 billion

- From prior month: +0.3%

- From prior month, 3mma: +0.6%

- Year-over-year: +9.6%

Food and Beverage Stores (12% of total retail). Sales leveled off in prior months as food prices, after spiking, dipped. Now food prices are ticking up again:

- Sales: $82 billion

- From prior month: +0.4%

- From prior month, 3mma: +0.2%

- Year-over-year, 3mma: +1.9%

General merchandise stores, without department stores (9% of total retail):

- Sales: $62 billion

- From prior month: +0.3%

- From prior month, 3mma: +0.4%

- Year-over-year, 3mma: +2.7%

Building materials, garden supply and equipment stores (6% of total retail). Pandemic bubble bye-bye:

- Sales: $42 billion

- From prior month: +0.1%

- From prior month, 3mma: -0.3%

- Year-over-year, 3mma: -4.0%

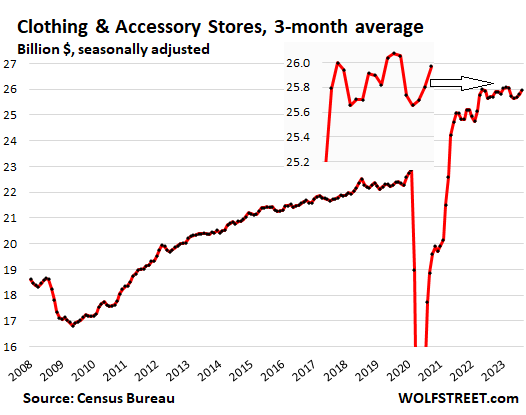

Clothing and accessory stores (3.7% of retail):

- Sales: $26 billion

- From prior month: +0.9%

- From prior month, 3mma: +0.7%

- Year-over-year, 3mma: +1.0%

Miscellaneous store retailers, includes cannabis stores (2.2% of total retail): Specialty stores, from art-supply stores to wine-making supply stores.

- Sales: $15.4 billion

- Month over month: -1.3%

- Month over month 3mma: -0.3%

- Year-over-year, 3mma: +0.8%

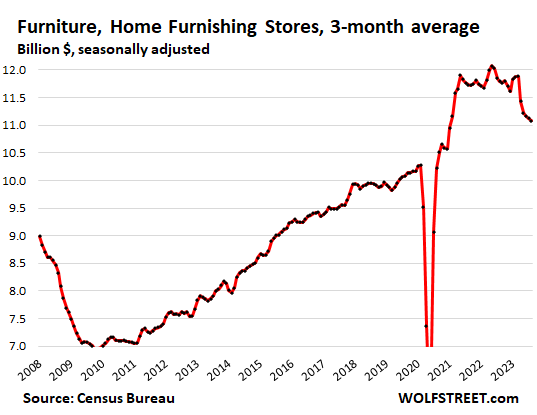

Furniture and home furnishing stores (1.6% of total retail). Another pandemic bubble goes kaput.

- Sales: $11.1 billion

- From prior month: -1.0%

- From prior month, 3mma: -0.5%

- Year-over-year, 3mma: -6.1%

Department stores (1.6% of total retail sales, down from around 10% in the 1990s). Online sales by department store chains are not included here, but are included in ecommerce retail sales above.

- Sales: $11.0 billion

- From prior month: +0.3%

- From prior month, 3mma: +0.3%

- Year-over-year, 3mma: -3.8%

- From peak in 2001: -40% despite 22 years of inflation.

Sporting goods, hobby, book and music stores (1.2% of total retail):

- Sales: $8.6 billion

- Month over month: -1.6%

- Month over month, 3mma: -0.2%

- Year-over-year, 3mma: -0.2%.

Electronics & appliance stores (1.1% of total retail):

- Sales: $7.7 billion

- Month over month: +0.7%

- Month over month, 3mma: 0%

- Year-over-year, 3mma: -1.9%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Howdy Mr Lone Wolf. This old sober sailor is guilty as charged. The wicked witch ZIRP is dead… Just about timing now to where the yellow brick road ends and how much to spend…..

Wolf, you are an amazing analyst for defining the details of each tree, but I feel you sometimes forget the forest. “More evidence they’re still partying” – have you also studied history? This is what people do. Don’t ever expect them to … buckle down. So, we need the electronic tether, right -?

Just for this sailor analogy purposes, say there are two kinds of drunken sailors…(all returning dead broke)….and many degrees in between. Young, healthy, and/or higher skilled sailors is the analogy yardstick, net worth/skill set/connections is the real life one.

Military; safe in a guaranteed shelter and with a guaranteed 3 squares and an exceptional overall guarantee things will stay that way. (Even the brig is nice, if the SP brought them back)

And those who are on their own…..Merchant Marine with uncertain futures……and of course none or a useless Union (since Reagan)……essentially contract sailors, more everyday.

(Assuming these “sailors” are just a comparison to the current American population, correct?)

Which kind is likely to spend the most?

Which is likely to end up sleeping outside somewhere and looking for a another ship…..or sick, dead or in prison.

Howdy Nbay The hard working debt free folks always win as far as I am concerned. That is just me….

Howdy!

I’ve heard “NOT hard working” second, third, etc, hand hundreds of times, but never first hand…..and I have had one HELL of a lot of different jobs…..guess I never really wanted a “career”…..because I didn’t have one.

Don’t have that “yellow brick road ending” spending problem, (for me it’s saving, which is non-stop anyway, so no problem) though……or debt.

Damned lucky to have this 500 sq ft over 62 low income hotel style apt, though….happy as hell.

Oh, and because I have worked with hundreds (thousands?) of people I KNOW I am extra hard working….and enjoyed it! (well….most of it)

I think it’s less about the sailor, and more about what the bar has been serving them, for free. The past couple decades, it’s been nonstop tequila shots, courtesy of the house.

Yeah, that’s another aspect to the mess.

Somebody should have a good long hard talk with the bar owners and set them straight on what they have been doing to the sailors…….AND the ship, for the last 60 years.

Maybe jail a bunch of them, too.

The Glen Campbell excuse:

“I was over-served.”

I was at uncle’s place 10 mi (by road) N of Newcastle Coin 72 or so. Went to GlenWood Spr un office. Sent me to Aspen for ritzy restaurant job. Some ski-bums in line told me Campbell was a local a-hole.

Hope he went to jail on DUI.

“CO in”……spell check is damned AI gone rogue…….and it WAITS for you to move on before FN things up on ya, too…..guess it “learns” that by looking for corrections?

Evil.

We need a proper “Bar Rescue” to sober things out.

As a former drunken sailor myself, I am happy to see the bars doing well today. I was in my local pub the other day to place a bet on a football game and couldn’t even get in the door, as it was so crowded. No problem, they had set up outside dining because of the pandemic and kept it open even after the pandemic ended.

EXCELLENT!!!

Let’s get drunk!!!

I wonder how these people are paying for all that, besides racking up debt.

I loved going out or just be lazy and DoorDash everything. But you cannot go out to a dinner for two without hitting $100+ and to DoorDash something like Jack In The Box is at least $30 with tip… and this is like 1 combo meal.

Overall, that is just my experience. It is getting expensive being lazy, so I have been cutting back on the junk food and trying to cook at home more. Which is a win-win for my wallet and health.

Lots of people are making lots of money, and they’re getting the biggest pay increases in their lives, and they’re still finding better jobs that pay more, and record number of people are working, and the bottom 90% households have over $40 trillion in net worth (assets minus debts). They’ve got $5 trillion in money markets, they’ve got $10 trillion in savings products at banks, they’ve got stocks and bonds and equity in real estate, etc. And they’re still making more than they’re spending, and they’re still adding to their wealth.

“…and the bottom 90% have over $40 trillion in net worth (assets minus debts)”

What’s that number with home “equity” subtracted out?

not much DC, if you divide the $40T by 330x.9,,,

so average about $135K per person if calculator don’t lie,

seems like it’s just part of the fun and games, AKA bread and circus, etc.,

as always to distract the workers from the plunderers behind the scenes

seems theoretically impossible to have actual fairness, equity, even equal opportunity without complete transparency, eh? equally clear we’re far away from that,

though I certainly do think the overall trend is up towards the goals suggested by the Declaration of Independence in spite of the second and subsequent derivatives frequently being negative, and WE, in this case all/average we be better now than 50 or so years ago

VintageVNvet,

Not quite. So the bottom 90% of households (not individuals) = 115 million households have $40 trillion in net worth = $344,000 per household.

$23 trillion is real estate equity for the bottom 90% = $198,000 in RE equity per household.

The concerning part for me is the bottom 50% only have about $3.5 trillion of the $40 trillion held by the bottom 90%. I think that demarcation is worth noting.

Good comment/insight. This is where things will fall apart.

Even for the 90%, $550K in equity is really not very much in the overall scheme of things.

Mike R,

That’s true, and given the leverage and risks, it can vanish in no time. But then that happened to us during the dotcom bust, so it’s not new.

rojogrande,

Yes, the horrible wealth disparity here is always worth noting. The homeless and poor are worth noting. This society is horrible about taking care of people, including poor people, people with addiction problems, and people with debilitating mental health issues.

But all this is irrelevant when talking about overall demand and spending. For the overall economy, it doesn’t matter WHO spends, as long as money gets spent.

We see the same happen with wildlife, including lions, chimps, wolves, and wild dogs. When there is a kill, the dominant male feasts first while others watch. The eating follows a power based pecking order. Some are lucky if they get a hoof to gnaw on.

The devil is in the details. And the reason why the Top 10% of that bottom 90% is gonna have hell to pay is because they are not rich enough to live on an island. They are gonna be prey for the bottom 10% within that 90bottom

There is no such thing as “real estate equity”. As long as your mortgage isn’t paid off, a house is not an income-producing asset but a liability. And the income-producing assets certainly are not owned by the bottom 90% but by the top 5%.

A house should be seen as a “home” and not as an asset. It’s not a “liability” (= something you owe), but it has costs associated with it.

But if prices rise, as they have for the past many years, the selling price exceeds the amount that you owe, and that’s your “equity.” You can cash out that equity by selling the home and invest that cash in T-bills and earn 5.5%. You can also draw cash out by borrowing against that equity, such as with a HELOC, or doing a cash-out refi (but don’t refi at today’s rates, LOL), and then you can do something else with that cash, such as losing it in some get-rich quick scheme, such as meme stocks or cryptos.

“You can cash out that equity by selling the home and invest that cash in T-bills and earn 5.5%.”

And buy a tent and a mattress. And a warm coat for winter. Or rather several of’em, which is No Problem with your 5.5% interest.

Franz Beckenbauer,

You can do that, of course. Or you can travel around the world. Or you can rent. Or you can buy another home, using the equity from the sold home as down-payment. If you downsize, such as many empty nesters are doing, you can use the equity of your sold home to buy a condo, maybe in a lower-cost area, and not even have a mortgage. I know people who did that last year. You have all kinds of options.

and as soon as you ‘cash’ out of your house to buy said T-bills, etc.

you now get to pay RENT

that’s fine since you’ll be renting from me or one of my million(top 10%) friends

besides October is VIG month – ie time to pay major grifters called local govt

rent is due on those properties we ‘own’

Hi Wolf, it seems that you are confusing large increases in spending with the plebs having lots of spare cash, but it is just extreme inflation. I know it is hard to believe, but it will become clearer as inflation further destroys society. Your charts will continue to show a notable bias to the upper right corner

The lower end of the pay scale has gotten the biggest pay raises.

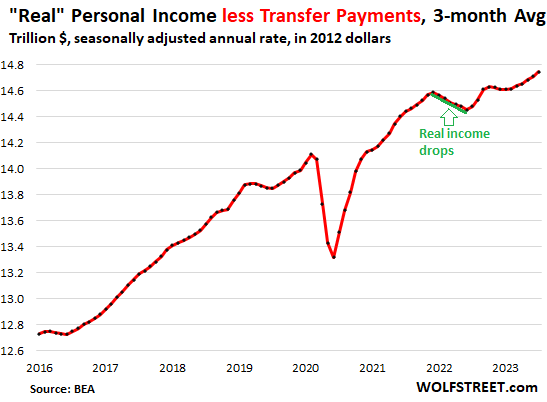

Here is “real” income, adjusted for inflation, without transfer payments (Social Security benefits, unemployment benefits, welfare, etc.)

When is minimum wage going to be raised to $15 per hour? Most fast food places still don’t pay very much. The middle earners $15-$25 per hour have gotten big pay increases though, I agree.

Also, please note inflation is now less than 4%, hardly extreme.

Just looking at these charts there clearly is lots of spending ongoing on both services and goods. The jump in 2020 from the pandemic handout is hard for me to fathom but the numbers are there with government checks for everyone and the party started. Inflation hit and the numbers keep rising based on inflation amd gdp growth.

Another great article. Thanks, Wolf!

It’s all personal and anecdotal. We’ve saved SO much working from home the last 3 years, I think I need to retire because I’m now becoming a grumpy old man.

This Return to office is hurting.

Gas/vehicle servicing: I used to put 20K/year miles on my car going to the office and customers. At the current IRS mileage rate of 65.5 cent per mile, I am now spending 13K/year on gas and vehicle servicing. That is 10% of my after-tax income.

Clothing: I need to wear clothes now. another 5% of my income at these inflated prices.

Food services: If I am going to drive 1-2 hours into the office, Happy hour and lunch are required. Another 10% of my income with $20 lunches and the requisite Happy Hour to network(commiserate) with my co-workers. Another 10%.

So far, I am counting about 25% of my income going to stuff I used to feel comfortable with but now am spoiled and angry. I must be a saver.

Thank you for your efforts to stimulate the economy. LOL, yes there’s a lot of that going around. Thank god my Wolf Street media mogul empire’s headquarters is right here in the former master bedroom.

I’d be happy to visit you if I am in the area.

What is your clothing budget? What’s in the fridge?

My clothing budget: 2 pairs of blue jeans every two years. 1 pair of black dress jeans every 10 years. Bulk purchases of assorted sweatshirts, T-shirts, socks, underwear, etc. every five years. A black leather jacket every 20 years. Everything bought online at the lowest possible price.

I look best in jeans and sweatshirt, outright hot with a black leather jacket on top 😎🤣

I still have a lifetime supply of dress shirts, suits, sports jackets, and funky ties, along with cuffed slacks that are so old-fashioned they’re cool, in a world of skinny pants. I should have kept my double-breasted suits that I finally threw out 20 years ago.

However, the wife is a different story. She has to go to the office every day. Talk about standing helplessly in front of crammed huge closets and stammering, “I have nothing to wear.”

Awesome!

Mrs. R is truly the best wife in the world. I’m giving up the master bedroom when the good lord takes me.

10-4 P,,, absolute soulmate quality!!

ya can have pretty much any of the rest of the place, but don’t even think about the MB!!!

Petunia,

🤣

The lay of the land is a little different here. The master bedroom used to be our guestroom because we didn’t want it. The bay window goes out on a busy loud four-lane street and a traffic light, with a view of the buildings on the other side of the street and up Russian Hill. What separates the building from the street is a 5-ft. wide sidewalk. Even though we’re a few floors above the street, it’s like we’re right next to the street.

Our chosen and actual bedroom goes out the back, where it’s much quieter, and it has panoramic Bay view. We adore the view:

I really liked the personal tid-bid. It’s a little fun to know more about you, besides being one of the best financial bloggers out there. :)

…the Balclutha AND the Jeremiah! Very nice!

may we all find a better day.

Tell you what Wolf that’s some mighty fine real estate you got there with that view.

Location location location!

… and a prime view of Alcatraz Island!

Wolf,

We get each other in this way.

Oil back above $90 today. Consumer continues chugging along.

Yet you wouldn’t be able to tell if you listened to CNBC talking heads: they’re all in on the end of the tightening cycle & rate cuts in first half 2024.

Oil is not really included in rate talks if it’s not included in core cpi. It’s considered volatile and outside of the main items the fed considers when raising or lowering rates.

The link to cnbc and the fed raising or lowering rates and oil prices is illogical.

Each family also has an additional $80,000 government debt hanging over their head, just from the pandemic debt increase.

Somebody has to pay for all that pandemic waste and fraud.

Prob saved a ton from the political combatants who died of Covid rather than wear protection.

(Govt woulda had to pay the gabillions they paid in! But They gorked so we all get to keep it)

That’s so American

Can you really call them drunken sailors when it seems like being drunk is the new norm…might need to come up with another description. This good time will probably never end so drunken spending is the normal spending period..

The biggest drunken sailors are the members of Congress. They will never sober up.

If you never stop drinking, you never get a hangover, right?

Alcohol poisoning only applicable to real life and not Congress and consumer binges, also not applicable if you’re Rasputin apparently…

“If you never stop drinking, you never get a hangover, right?”

My concern is that the tap will run out for our drunken sailors, and then there will be one heck of a hangover.

Rick

Yes, and then they will whine and cry they have nothing and expect a bailout.

Congress is what the Recovery movement calls Dual Diagnosis. Mental illness combined with alcoholism.

And their donors intend to keep them that way….and if they could read speeches on it, they would have them on Thorazine.

I had the ex (who was a psych tech at Sonoma St Hosp) steal me one Among other things…Ritalin was nice). I now TOTALLY get the phrase, “Chemical straight jacket”. And it’s not pleasant to not worry or want to do NOTHING, either. Couldn’t wait for it to wear off……but wasn’t a bit upset about it, either, Hard to describe.

Dunno if it will pass but there is a credit card processing bill in the works.

Gonna decrease processing fees to almost NIL.

Also will kill all the CC rewards programs as an effect of the lowered fees.

That would be a good thing overall since merchants pass on the fees to the customers, and things might get a little cheaper if they don’t have to pay those fees. But some people will complain about losing their kickbacks.

I’m not helping the situation. I bought a $17K piece of lab equipment today for my business that’s the size of a big juicer/blender.

Then, this afternoon I went to the Powersports store and bought my wife a lithium Ez Go golf cart.

Business was good the first half of this year and it’s taking off like a rocket the second half of this year. It helps that my global competitors got too aggressive with price increases and haven’t stopped.

Needless to say, I’m not financing anything. If I can’t write one of those old-fashioned checks, I don’t need it.

Howdy Nemo Thanks for the feel good story….. I am from the old earth and love small business stories….

Enjoy the golf cart!

I used to work for EZ-GO’s parent company Textron.

What kind of lab equipment did you buy?

“Partied at Eating & Drinking Places”

Wolf, I wonder how much of this increase is because people are going out and celebrating vs. the huge increases in costs? If a cocktail was $10 last year and is now $15, how do you account for that since data shows total spending has increased due to inflation vs. people actually spending more money willingly because of pay raises?

I say this because some times I break into a cold sweat when I see the bill. Service charges and gratuity are often included as well which makes matters even worse.

No, opposite. Inflation at the grocery store was much much worse than at restaurants. The CPI for “food at home” (stuff bought at the store) had horribly spiked in 2020-2022, with double-digit rates, at double the rate of the CPI for food away from home. By now, this all calmed down. In August, the month-to-month CPI for “food at home” was +0.2%, and the month-to-month for food away from home was +0.3%.

So if you adjust the past three years of that two-tone chart for the CPI of each category, the difference would be even huger.

Seems to me the inflation of food and cocktails is location specific Wolf.

Certain pasta dish we love has gone from $29 to $40, and then back to $33 in the last three years at one of our faves…

Other places certain steaks have gone from around $40 to around $80, and not backed off a bit, at least so far.

Going to have to test the latter soon, just to keep up to date on their pricing, eh?

Where it’s most noticeable is fast food. I’m floored to see that places like McDonald’s now have $11 Big Mac value meals.

Who would pay that? I guess a lot of people…

It may be even more complicated. There is a neighborhood Italian place here, owned by an Italian guy that jabbers away in Italian with his Italian diners. He took the classic pasta dishes from $18 before the pandemic to $25 during the lockdown (39% inflation), and OK, outside seating, trouble finding staff, not a lot of places open etc., and we paid.

But then the city opened up fully, and with lots of choices by 2021, we stopped going because it was too expensive compared to other places.

Prices are still the same today, so 0% inflation since 2021. But we only started going back when they started to offer 30%-off specials, sent out via text message on certain days (“30% off on all pasta dishes tonight,” that kind of thing), which brings prices back down to the original.

This is why inflation is so tough to calculate.

There are something like 7,000 restaurants in SF, and competition is fierce.

There are other ways where they get you, for example, now they have these handheld electronic checkout machines where you can choose a pre-calculated tip (usually 18%, 20%, and 25%), but it’s off the final amount after taxes, instead of the amount of food and drinks only. So you’re tipping on taxes and fees.

Is fast food included in ‘Food services and drinking places’?

That dang stuff is high-priced. Really not worth the price.

Yes, fast food is included.

Wolf, that’s emblematic of everything. No one wants to reduce prices, so they keep prices the same and offer more specials. I’ve seen landlords do that during recessions. Don’t reduce the monthly rent, but give 15 months for the price of 12.

I guess people fall for this game?

“checkout machines where you can choose a pre-calculated tip (usually 18%, 20%, and 25%”

Modern tablet checkout registers are infuriating. They’ve really turned me off from eating out. In many cases you’re paying and tipping first at the register before you even know what the quality of the service is going to be. Worse yet, they seem to be spreading into EVERY effing transaction these days. Don’t want to tip for fast food or even some retail purchases? Well good luck spending the next 2 minutes digging through menus on a micro-screen looking for the hidden “no-tip” button while a cashier angrily stares you down.

I feel like such a millenial for saying this (because I am), but the more automated checkout kiosks, the better. I’m just getting so damn tired of being forced into an awkward effing wage negotiation every time somebody spends 15 seconds packing a poorly assembled sandwich into a bag for me. I hated American tipping culture before the pandemic, but it has become far worse post-pandemic.

VintageVNvet – Invest in a sous vide and you’ll never eat steak in a restaurant again. Just have to plan 2 hours in advance but by the time you drive to the restaurant…

Those checkout machines can be avoided in most cases quite easily by paying in cash. I know you give up card rewards but often it is just easier and less confusing to do so.

I’m in a slow boil over NFL games.

NFL divides the schedule into Sunday, Monday, Thursday games – and occasional Sat games. Each day is then sold to different network providers. So, one must buy into a separate package for each day depending upon the provider with the overarching contract (CBS, FOX, ESPN, NFL Network)….they all have subscription services. Very costly just to track a single team’s 17 game schedule – worse if one does not live in the home team local market.

The NFL gets sweet money from all the providers. The networks are taking a nice cut. The fans get gored.

When/if there is a substantial economic calamity or inflation seriously eats into discretionary income…I believe the NFL will suffer for its greed.

Doug, and then you get to deal with braindead cashiers who have a hard time counting out your change.

No thanks.

@Einhal,

I am amazed at how many times I have given a cashier an extra dollar to have them look dumbfounded, not knowing what to do with it. Just two weeks ago, a cashier gave the “extra” dollar back with four ones and then figured it out for herself that I might have wanted a five back. That almost never happens. Young people don’t seem to “get” how cash works.

Sure but I can count change so who cares. Non-issue.

NotSure

When I travel in the States, I pay in cash as if I am in a third world country. Not because people hate the CC fees or don’t take CCs, but then there is no tip screen. Just the jar, which I’m used to ignoring.

I’m with you, though. It’s easier just to avoid those places. Screw them.

I think the stock market demands growth. Even just a smidgen of growth.

I feel like all companies are in a holding pattern to produce just a bit of growth against the head winds of consumer cooling.

Even if they have to ‘ShrinkFlate’ products to trick the consumer into giving them more profit.

The good news is the groceries are lighter on each subsequent trip. Ha

These Drunken Sailors are partying like is 1999…. :)

nah, unlike 1999, there’s a no hangover on the horizon like 2000s aftermath. Pow Pow did it and give us no landing, only good times ahead and spending will continue to be strong…all the worries about higher rates…turns out to be nothing burger.

Yep, we’ve done a great job as a society defying the laws of gravity and physics. We can print and borrow unlimited money, and everyone’s happy and rich!

The future is so bright I had to buy a $200 pair of sunglasses.

Did you finance it, though?

Use the Chase “pay later” feature! ;)

Maybe like 1929! The last decade plus was like the Roaring Twenties!

agree qt:

Eat, Drink, and BE Merry, for tomorrow we dine might be the current motto as it was in the late 1920s according to my dad and grand dad.

CPI, PPI, Oil, Retail Sales. What did we learn this week?

Inflation will roar and The Fed has accomplished nothing.

Bureaucrats will cook the books, like Healthcare CPI, and tell you everything is awesome.

Get that side hustle going so you can pay your rent and taxes.

I’m just bracing for my health insurance to go up this year by a lot.

In my state (and at my job) the best is the kind you can buy yourself. Well not the best of the best, you would have to work for particular companies, but pretty good health insurance.

Anywho, all this Health CPI talk has me worried a $100 a month increase might be on the horizon. since the pandemic the increases haven’t been very much, so far.

Does this pace of spending get affected with the resumption of student loan payments in October. Is there enough principal and interest due to affect consumer spending?

This is probably not relevant, but as the punch bowl slides off the table, the drunken sailors may finally wake up.

From a week ago:

“ U.S.-based employers announced 75,151 cuts in August, a 217% increase from the 23,697 cuts announced one month prior. It is 267% higher than the 20,485 cuts announced in the same month in 2022, according to a report released Thursday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.”

LOL, That’s the good ol’ Challenger Report. You forgot to mention what the job cuts were in the “month prior.” Here is the headline from that “month prior,” which was July 2023:

“Job Cuts Fall to Lowest Point in 11 Months in July 2023…” And it goes on: “U.S.-based employers announced 23,697 cuts in July a 42% decrease from the 40,709 cuts announced one month prior. It is 8% lower than the 25,810 cuts announced in the same month last year,…”

Look, those are GLOBAL layoff announcements by US companies, with only a portion of the layoffs in the US, and they jump up and down hugely by month, because a global announcement by one company (10,000 OMG) is a big number, so they’re always there, sometimes 40,000 in a month, sometimes 20,000 in a month, sometimes 120,000 in a month, year after year, and so you get these funky comparisons of +200% or whatever that the recession mongers drag out, but then layoff announcements collapse the next month by 80% and recession-mongers then fail to mentions them. Isn’t that funny?

Here is the chart of the Challenger report for tech jobs global layoff announcements by US companies. You can see the big wave of layoff announcements that started mid-2022, and we discussed this a gazillion times here, but it has now TOTALLY CALMED DOWN, which you also forgot to mention, isn’t that also funny? Recession mongering gets silly after a while:

I wonder how much of this spending is due to…

Inflation mindset, “dollars will be worth less tomorrow, might as well spend them today”

Lack of appreciation for the value of saving money (perhaps thanks to ZIRP and no one earning interest for the last 15 years)

Or just a general lack of ability/desire to plan for the future…

I wonder the same thing.

Many people paying 6x gross income for homes.

Eating out at restaurants now the norm for many people, rather than the exception.

Spending $800/mo. for auto payments.

Dropping $5-$10k on vacations

There definitely is a change in behavior the past 20 years, probably because the government and Fed have never tried to put the reigns on anything. The deficits keep growing. Recessions are avoided at all costs via money printing money.

There’s a reason forest rangers say – “don’t feed the wildlife”. When fed regularly, animals forget how to find food on their own. Perhaps the Fed’s leaders should be required to attend some forestry training.

Good analogy. The other forestry analogy that comes to mind involves wildfires. Prevent the small ones from occurring naturally and you end up with one big monster fire that consumes all.

Kind of like the Fed eliminating recessions until they can’t.

Perhaps these spenders were trained by the drunken master.

The drunken master says no to:

No saving!

No dollars left in checking!

No owning property until your 80s!

No Missing Out!

Lol

Nine for me spend only what I have to . I also am deferring SS to 70 in case I live longer than planned. Get lots of criticism for this choice because I should take the cash and spend .

I’m also planning to wait, as a sort of insurance policy. My wife thinks I’m crazy and will claim much sooner.

Excellent work went into these charts and the wealth of the “little people” (Leona Helmsley). This harkens back to the President Carter and Ronald Reagan presidential debate topic of President Carter’s statement that “the people living too well;” the second installment of President Ford’s whip inflation now (WIN) campaign. Both Ford and Carter relied on the Federal Reserve chairman to make sure inflation stopped any excessive lifestyle of living too well; just like President Biden is relying on through the slow motion inflation reduction (high flatline now rising) of Jerome Powell. All of this excessive spending will be replaced again with the generic grocery store section white or yellow cans with black letters: “food,” “drink,” maybe this time Jerome Powell’s picture will be proudly on the can.

Some of those cans may be labeled Soylent Green.

What’s the secret in America that people are spending money on restaurants? The wages are higher too. 14-year-olds are still earning US$20/hr to flip burgers in Portland or Seattle!

The Toronto Star and Reddit mentioned today that Canadians are cutting back on restaurant visits.

America is a whole different world when it comes to the economy for some reason.

America is hypercapitalization mindset and extreme FOMO. Everything here is done on steroids, bigger, better, more. It’s how everyone thinks since a child. And when you are in it, you have to play the game. Our level of consumption is unlike anything the world has ever seen.

No one has mentioned investments of “red necks”.

Jeff Foxworthy:

“You know what rednecks like to buy? Shiny stuff. We are attracted to shiny objects. UFOs, beer cans, fixing lures…”

“fishing lures…” (had to “fix” that)

Howdy HowNow Being a lifetime Redneck myself, number one item is guns with ammo.

If – somehow – I end up being in the U.S. the first thing on my list is a shiny, classic-re-issued 1911A1 and a box of .45ACP, thank you very much.

Rudy – for your sake, hopefully your anticipated encounters occur at close range (and you’ve worked on your upper body…).

may we all find a better day.

In a Hunter S. Thompson esque voice:

“Reddit cannot be trusted!”

Haha

The real median wage has been falling for 3 years now, so all this exuberance is irrational. Of course noone wants to crash the party so a crisis becomes inevitable.

That was during the high inflation times through 2022. In 2023, wages have outgrown CPI.

Are there stats on median wage growth in 2023? There’s stats on average but I never see median.

Howdy Tudor Not sure if old folks spending, makes it into the Lone Wolf charts. The lifetime savers will start spending nearer to the end. You cannot take it with you and I like that song about never saw a hearse with a trailer hitch.

I hope your wife is going to be fine after the traffic collision and that the driver that hit the back of your car had sufficient liability coverage. What kind of car was she driving?

Thanks.

Ford Fusion Hybrid. RIP

Let’s day a drunken tech sailor makes $250k in Seattle. That’s $200k after tax. He annually spends $15k on that fancy car and gas, $36k on that fancy apartment, $20k on restaurants and bars, $15k on fine vacations, $5k on skinny pants and shoes, and there’s a ton left over for savings and whatever else. Party on!

Ok, what did it take for this drunker tech sailor to get hired at FAANG/MAMMA/fintech bro?

Very high grades in high school with APs and high test scores for entrance to an great CS/CE/Math/etc program, maybe a double major math/cs. Then, probably a masters also. With internships throughout. So let use a school like MIT, CMU, UW, Caltech, UCLA, etc. Then, hard grinding to meet deadlines, getting promotions, stock grants, bonuses, and buying some skinny jeans (seriously wtf).

So, what percentage of the population could even do something like this? Why do companies pay for such talent?

Don’t forget the stock grants, stock options, bonuses, full benefits, 401k match, etc. My favorite is when Musk kicked out all the dead weight from Twitter (X) and kept all of the uber nerds. I love that picture of him surrounded by these guys. Brings back the old days.

I was a tech bro back in the day and I was well compensated back then which kept me well fed to this day. This is every day for me, not some weird one-off existence.

Try 50K on the apartment

After tax is ALOT less, just fyi.

Remember FICA!

tbh it’s hard to save right not even in this income bracket, unless you own property before the pandemic. Then it’s your little beautiful piggy bank.

Viva drunken sailors! I wish them the best because after all, deck work is tough so they deserve it.

“A smooth sea never made a skillful mariner.”

English proverb

Very confused by all of this. It wasn’t long ago that I would hear that people were a pay check away from living on the streets, now everyone has more money than they know what to do with? I would think inflation would make life harder for the middle class. Are these good times or bad? Sounds like I’m missing out on something.

“Very confused by all of this…. I would hear that people were a pay check away from living on the streets,”

What your “heard” was clickbait BS in the headlines that keeps getting regurgitated because people click on it.

Here is the actual data on that paying for an emergency repair and having money set aside for bad times. Read this and it will un-confuse you:

“54% have three months of expenses set aside in their account. But 13% can’t pay for a $400 emergency expense.”

https://wolfstreet.com/2023/05/27/americans-ability-to-pay-for-emergency-expenses-or-three-month-job-loss-with-cash-or-cash-equivalent-by-selling-assets-by-borrowing-or-not-at-all/

Also, the bottom 90% households have over $40 trillion in net worth = $344,000 per household of the bottom 90%. we walked through this in the comments above:

https://wolfstreet.com/2023/09/14/our-drunken-sailors-splurged-at-stores-auto-dealers-amid-lower-prices-of-durable-goods-partied-at-eating-drinking-places-and-paid-an-arm-and-a-leg-at-gas-stations/#comment-542475

https://wolfstreet.com/2023/09/14/our-drunken-sailors-splurged-at-stores-auto-dealers-amid-lower-prices-of-durable-goods-partied-at-eating-drinking-places-and-paid-an-arm-and-a-leg-at-gas-stations/#comment-542434

Sounds like an advertisement for more QE and stimulus. I guess the FED and .gov found the magic money tree after all.

It sounds like an advertisement for more QT and higher rates, no?

“It sounds like an advertisement for more QT and higher rates, no?”

Absolutely not. What you are describing is some economic utopia. Why would they do QT and raise rates when everything is so hunky-dory and everybody is wealthy and spending like drunken sailors? They found the magic money tree. Just print prosperity. Why stop?

You are highlighting how wages are easily outpacing inflation and everything is just fanfuggingtastic. Where’s the problem? Per your data and commentary, I am at a loss as to why the FED wouldn’t just pivot and keep pumping this thing into oblivion.

“Why would they do QT and raise rates when everything is so…”

INFLATION.

Just to change the subject but there appears dodgy dealings with this weeks Nvidia price spikes. Things are not what they seem…

“I’m shocked! Shocked to find that dodgy dealings are going on in this market.” — Captain Renault in Casablanca (sorta).

Here’s lookin’ at you kid.

Spitzer did a number on a few of the crooks on wallstreet in the early 2000s . Don’t underestimate the wallstreet wizards and when the can devise a scheme . Take a look at Vinfast for example VFS symbol. Company sells less than 200 EV in USA and gets a 250 billion market cap due to liquidity. Float is 1 percent of the stock . Trades like cryptocurrency in the old days. Btm line there easily could be a game played with Nvidia stock don’t forget dot.com 1929 or 1987 20 percent 1 day event down

Yep!…..tough times!

Yesterday at the local store…..two older women were arguing over the price increase for caviar.

It’s time to tighten our belts……for the good of the country……so……try to limit how much champagne you drink before most meals.

Is this euphoria……..no idea…….but the pain Powell has placed on us is just too much to handle. What a monster. Let up Jerome!….or at least let’s delay any move that might slow the party down. Inflation….let them eat cake.

Spending money like there’s no tomorrow, given the realization that one way or another, collectively or alone, all too soon there will not be one.

Lots of FOMO and YOLO going on. I myself plan to leave this world deeply in debt, and yet with the knowledge that so many will mournfully regret that I was not born twins.

Sailors have traditionally been grossly underpaid or they wouldn’t sign up for more grueling months at sea.

Cartoon of an executive looking out the expansive boardroom window at the world ablaze: “Somehow we need to monetize this – and quickly fast.”

Can’t tell you how nice it is to be reading your comments once again. Haven’t seen a thing from Kitten Lopez since forever. And Wisdom Seeker.

That’s very kind of you. Thank you. Let’s hope Ms. Lopez and Mr. Seeker are well.

Ms. Lopez is well. Her companion, James, is very ill. She asked everyone to send him “good juju.”

Debt = pulling future consumption into the present. It seems that this cannot go on forever. At some point we have to stop or decrease our present consumption in order to pay for the future we’ve already consumed. Maybe our productivity can ramp up? That seems doubtful to me.

Gomp,

Your model is of a zero-sum game.

But sometimes, clearly, the economy works as a positive sum game: more productivity (technology, work inputs, etc.) creates more pizza pie for all: win-win, so to speak.

This at least runs uphill against the debt trend. The government printing more “pizza tickets” (money or credit) blurs the picture, yes, maybe endangers it, but does not necessarily always cancel it. The USA at the end of WW2 had roughly the debt level (to GDP) it does now, and look, we grew out of it, into something of a “golden age.” So yeah, maybe. I’m more worried about hitting an ecological resource wall than a debt one. (Thank you, UC Santa Cruz.)

I might be more optimistic if debt starts to decrease but that’s not happening. Also, post WW2 when the military returned to work private sector, had lots of kids, more mfg, etc. That doesn’t seem to be a plausible possibility for me. Hitting a resource wall be also be a debt wall. When I see the total amount of increasing debt, I’ve never read or heard a believable specific solution for a good outcome.

Sorry, my response seems to be missing a few words.

Phleep, I agree with both of you to an extent, but there is a huge distinction to be made between WWII spending and our management of pandemic money printing.

A lot of WWII debt was quite productive. That debt built vast manufacturing capacity and went to the development of all kinds of new technologies. We came out of that period industrially unscathed while the infrastructure of nearly all of our potential production competitors had been bombed to bits. Huge postwar developments continued… A large part of the motivation for building our interstate system had nothing to do with civilian mobility, as that money was going toward growing our ability to quickly move military equipment around. A giant added bonus was a tremendous ability to move consumer goods and people around. And we had the productive output to run surpluses and dig ourselves out of that debt (at least for a while).

Conversely, recent spending hasn’t gone anywhere productive. Much has gone straight to inflation or smoke-&-mirrors financial products. Our roads and bridges aren’t much better for it. Very little industrial expansion has occured for the huge price tag. Our population isn’t expanding at a rate anywhere near the the baby boom. And we have multi-trillion dollar deficits ahead as far as the eye can see. Our education system is largely broken. The average kid is barely functionally literate, can’t perform basic arithmetic, and many have a hard time grasping the most basic biological principles. Poor mental health and mass hysteria are off the charts, and our large cities each have thousands of drug zombies walking the streets. We’re in pretty bad shape in a lot ways that aren’t accounted for simply by comparing our national debt vs GDP. The scale of the debt may have been bad after WWII, but our ability to produce our way out of it was a totally different animal.

Not – ‘…yeah, but we’re looking good for next quarter…’ (/s).

Well said.

may we all find a better day.

Not Sure,

Great post. Thank you.

Phleep,

“ecological resource wall” — Yep, we have to manage a biosphere and we can hardly manage ourselves…

My personal ESG investing centers on mining until Elon can park an asteroid in orbit. I hope I live long enough to see that. It is just the sort of thing he would love to do!!!

It’s gonna take an awful lot of metal and minerals to build: EVs, Solar, Wind, and Transmission not to mention the build out of the 2nd and third worlds.

Demand yields price appreciation.

Economies built on debt expansion can go on for a long time if you hoodwink the public into thinking everything is normal. When inflation runs hot, you can say it’s temporary, rig the stats, and say you are attacking it, but don’t follow through.

The Fed just monetized $5T of debt, with barely a notice. Words like disinflation sound so nice, when spoken by bought and paid for media talking heads. I have a feeling you could sizzle their rears with a branding iron, mid sentence, and they’d still be spouting the propaganda.

Indeed, Bobber. And what I find a bit misleading in all of Wolf’s detailed analyses here is his implicit assumption that the CPI and other statistics issued by the BL(B)S bear any real relationship to reality, when all those of us in the not-top-10% know that they are in fact heavily manipulated to the downside, and have been so for decades now.

(From Bloomberg Friday Morning) — Mohamed El-Erian is warning that a swath of corporations will be hurt by higher interest rates when they have to refinance next year.

“If you look at high yield, if you look at commercial real estate, there’s massive refinancing needs next year. Massive,” he said on Bloomberg Television Friday. “So that’s the point of pain which starts to happen.”

“There are things that have to be refinanced in this economy that cannot be refinanced in an orderly fashion at these rates,” according to the chief economic adviser at Allianz SE and Bloomberg Opinion columnist.

I also heard him say the FED will have to cause a recession in order to get the inflation to 2%. He guessed the FED would choose higher inflation for longer over a recession.

This reminds me so much of the 70s when the mantra was to ‘own things that will rise with inflation’s.

“…that a swath of corporations will be hurt by higher interest rates when they have to refinance next year.”

For most companies, it will just squeeze their profit margins a little. So what?

And the zombie companies, that have borrowed huge amounts despite losing money year after year, well, they should have restructured or been liquidated in bankruptcy court years ago, and so maybe now finally that’s going to happen, which will clear out some of the deadwood. That would be a good thing.

Wolf,

“For most companies, it will just squeeze their profit margins a little. So what?” —

The ‘what’ in my post is not that most companies will be seriously harmed it is that their growth will be slower for longer and inflation will be higher for longer. This is near the edge of stagflation.

As individuals our investments need to account for this and that is why I said owing ‘things’ is important in inflationary periods.

Things include stocks from sectors that have historically performed well during inflationary periods and sectors that look good for these coming years and decades.

Interest earned from money markets is taxed as income. Qualified dividends (mostly this means you have held the dividend paying stock longer than 3 months but read the rules…) from stocks are taxed as longterm capital gains which are lower for most people.

For retired people that are not buying houses or paying for college educations and don’t have to show a lot of income qualified dividends from good companies and share price appreciation make a lot sense.

ZIRP and Fed balance sheet growth combined with stock buybacks have accounted for a large portion of the dividend growth. Maybe this business model was created by ever increasing Fed QE. Borrowing into hr future and financial leverage. Just a word of caution.

BS in,

I am not using U.S. miners. I am using global miner from Great Briton, Australia, and Brazil,…like BHP Billiton and Rio Tinto, Vale, Anglo American.

Share prices in general on foreign exchanges are not nearly as inflated as U.S. share prices.

There are a number of foreign exchanges that do not tax dividends paid on shares held by U.S. citizens including London (LSE) and Brazil.

The U.S. dollar is at the high end of its long term average and will likely fall as the world normalizes which will require more dollars to buy the same amount of foreign shares.

Mostly though, I like the big miners because we are going to need ever more metal and minerals and they have a history of paying large dividends and have been around a long time, many are over 100 years old. As Warren Buffett would say, “They have a big mote”.

Saying “higher for longer” as inflation runs twice target is just debt monetization. If rates are higher for longer, it means inflation is higher for longer.

I would prefer the Fed sell it’s MBS portfolio and say “inflation is now 2%, people can now invest without the uncertainty of runaway inflation.”

Higher for longer will include debt monetization (reduce the governments debt). It will also help reduce the risk of recession.

When it comes to economics and markets what I prefer doesn’t matter. Adapting to what is, is all that matters.

I think El-Ehrain is correct on his guess for the future. I think avoiding recession and improving price stability are more important than getting to 2% inflation quickly.

So, I am putting my money and retirement to work built up on these views.

Medicare actually saved a ton of cash the last few years. Something like $3.9 trillion.

And that’s with all the unnecessary surgeries they’ll do on poor unsuspecting people nowadays too!

This must have been what 1924 -1929 felt like.

Wolf, in what ways does income/wealth inequality affect the level of spending in the economy? I always thought higher wealth inequality leads to lower consumption, but it does not seem to be the case in this economy (or the effect is lower than imagined). Is it because of debt? Or higher spending by the top ten percent?

Yes, there is a huge wealth inequality in the US, but the people in the middle also have relatively high incomes and some assets. There are lot of people that are making good money, and they have assets, and they’re consuming just fine, but the difference between them and the top 1% is huge because the 1% have so much. In the US it’s not the case that the middle layer is poor and doesn’t have anything they’re doing just fine — but it’s that the top has so so so much more.

in San Francisco, the median household income is $127,000. That’s a fairly big and diverse city, and that’s the median (50% make more, 50% make less).

In California, the median household income is $84,000.

This notion that most Americans are poor is total BS.

“This notion that most Americans are poor is total BS.”

I agree, but averaging wealth in America also obfuscates the truth. That was the point of my earlier comment.

Why assert: “Also, the bottom 90% households have over $40 trillion in net worth = $344,000 per household of the bottom 90%,” when the household net worth of the bottom 50%, over half of the bottom 90%, is less than $55,000. Even in the bottom 90% the wealth is essentially all at the top of the cohort. In a society as unequal as ours, using averages hides the truth. I’m a proponent of calling things like they are.

Wait a minute. The median income figures I cited are “median” NOT “average.”

As I said, the $127k in median income means: half of the households make more than $127k and half make less than $127k.

Those 50% that make less than $127k include those making $125k, $120k, $119K, etc.

Minimum wage in SF is $18.07/hr. So that’s $37,600 a year. In a two-earner household, both on minimum wage, that’s $75,000 a year. That’s minimum wage.

The Census figures for incomes are “median,” not “average,” including the $84k for California.

So you need to shoot down your argument yourself. If you would like, you can borrow my trusty old double-barrel 10-gauge goose gun for reaching those highflyers.

Is that 127k in SF eligible for food stamps at that low of an income?

Wolf, is it not rather disingenuous to be talking about the median income in the notoriously unrepresentative San Francisco area, or in California in general, and implying that this has ANY bearing on the average or median income across the USA?

I am disappointed that you would even try to use such a rhetorical subterfuge.

Alan,

“…rhetorical subterfuge.”

You’re full of BS.

1. These were examples.

2. California is the largest state in the US, with about 12% of the US population. So that’s a good example, rather than, say, Oklahoma, with a tiny population.

3. There are other big states with decent incomes, for example in NY State, the median household income = $75,200

4. Even in the US overall, the median household income is $69,021 — meaning half of households make over $69,021, and half make less. Of those that make less, some make $69,015, and others make $68,995, etc.

So don’t give me this braindead crap that all Americans are poor.

YOLO is the new battle cry from younger Americans. They will absolutely spend themselves into poverty if given a chance. And why not given what lies ahead with climate change, the death of social security and Medicare, irreconcilable political differences, etc. With that said, there is only so much they can spend until they run out of spending power. I reasonably believe that day is coming and will show up in the next couple of months.

Well they could be locked into the spenders prison.

You get used to spending at say 10k a year. Miscalculations lead to your spending spilling over onto credit cards. Then the credit cards get filled up.

Now you do not make enough to overcome the debt plus interest.

And the prison is to keep handing an extra 10% of your income to credit card companies (Banks) for the next 10 years.

It’s almost like a hazing a lot of us go thru here in America.