Month-to-month CPI spikes, core CPI and core services CPI accelerate, despite ongoing massive health insurance adjustment.

By Wolf Richter for WOLF STREET.

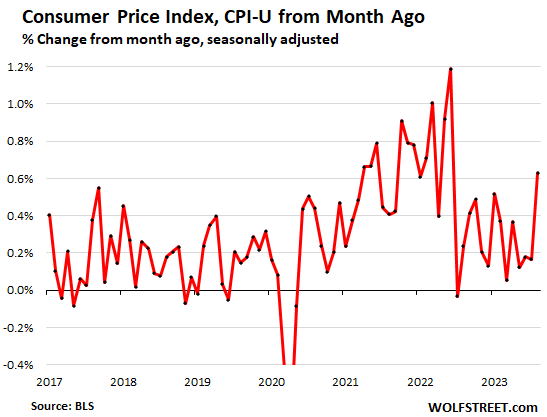

The Consumer Price Index (CPI) jumped by 0.63% in August from July, the biggest month-to-month increase since June 2022. Annualized, this amounts to a red-hot 7.8%.

This jump comes despite the still ongoing ridiculous monthly adjustment to the health insurance CPI that caused it to collapse by 33.6% year-over-year. The September CPI, to be released in October, will be the last month with that adjustment; with the October CPI, to be released in November, it will flip, which will add upward momentum to the CPI readings. CPI, core CPI, and core services CPI have been understated significantly since October last year, when the monthly health insurance adjustment started, one of the biggest data distortions coming out of the pandemic (more in a moment).

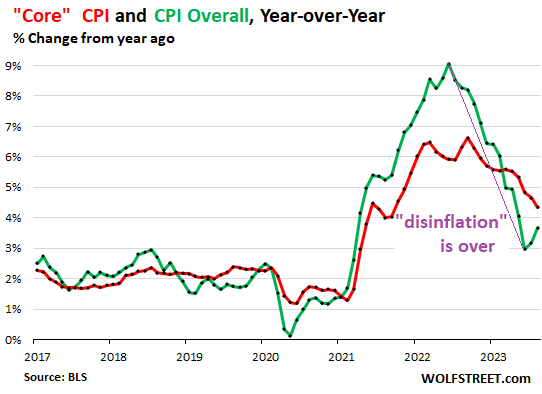

With this month-to-month spike, the year-over-year CPI rate accelerated to 3.7%, the second year-over-year acceleration since June 2022, according to the Bureau of Labor Statistics today (green in the chart below). July had already marked the end of the period of “disinflation” when the year-over-year inflation rate accelerated for the first time since June 2022.

The “Core” CPI, which attempts to track underlying inflation by excluding the volatile food and energy products, rose by a still hot 4.3% in August, compared to a year ago (red in the chart).

Given the narrower focus of core CPI, and the therefore proportionally bigger weight of health insurance in it, core CPI was even more distorted than overall CPI by the 33.6% collapse of the health insurance CPI.

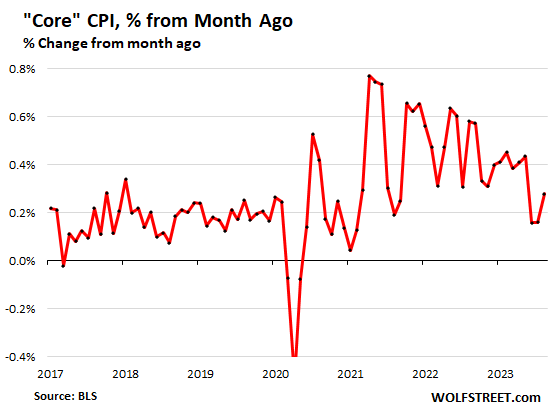

Core CPI, month-to-month, was held down by the collapse of the health insurance CPI, and yet, it still accelerated to 0.28% in August from July.

Fuel prices will push CPI up further, even core CPI.

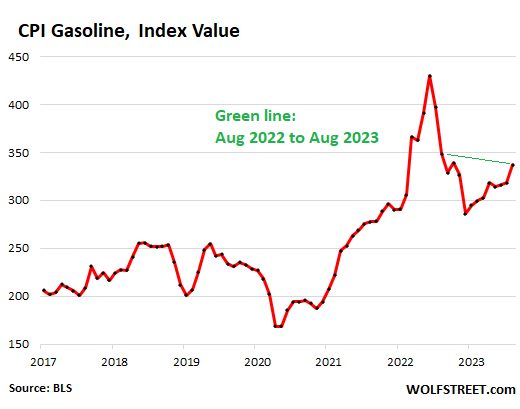

Starting with April, the year-over-year plunge in energy prices at the time, particularly gasoline, pushed the overall CPI increases below those of core CPI.

But on a month-to-month basis, gasoline prices have been surging all year – they jumped 10.6% in August from July – thereby whittling away at the year-over-year plunge as we went. In August, gasoline CPI was still down by 3.3% from August 2022.

Given how the gasoline CPI plunged in late 2022, we know that on a year-over-year basis, gasoline CPI will turn sharply positive later this year. The green line in the chart connects August 2023 and August 2022:

Gasoline accounts for about half of the total energy CPI. Note that gasoline, and energy overall, are still negative year-over-year, despite the sharp month-to-month increases. They will flip to positive, and become bigger drivers of CPI inflation over the coming months:

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | 5.6% | -3.6% |

| Gasoline | 10.6% | -3.3% |

| Utility natural gas to home | 0.1% | -16.5% |

| Electricity service | 0.2% | 2.1% |

| Heating oil, propane, kerosene, firewood | -12.4% | 8.4% |

How fuel prices filter into “core” CPI.

Diesel has also been surging this year on a month-to-month basis. The price of diesel over time filters into the prices of consumer products that are shipped by truck and rail, as are nearly all consumer products. Jet fuel has been surging similarly, and that filters into products that are shipped by air, and into services via air fares. These products and services are reflected in core CPI, which is how core CPI reacts indirectly to rising energy costs.

The tougher second half has started.

We’ve been warning here about this for months while the media was touting the story that inflation was “vanquished” or whatever. We knew CPI would worsen dramatically in the second half for at least three reasons:

- Energy prices won’t plunge forever, and in fact gasoline prices began surging again.

- The “base effect,” which pushed down year-over-year CPI in the first half, is finished.

- The ridiculous “health insurance adjustment” that started with October 2022, will swing the other way, starting with the October CPI, to be released in November. More in a moment.

The collapse of the health insurance CPI.

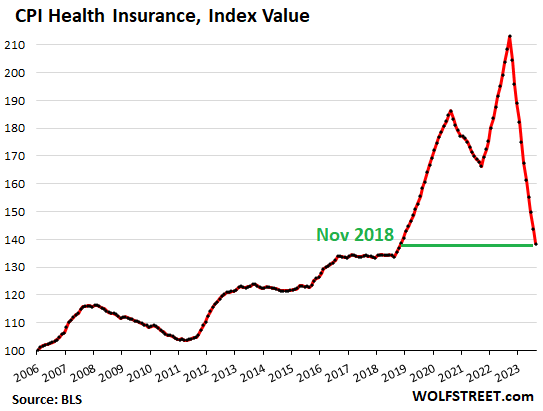

The monthly adjustments to the health insurance CPI, which started with the October CPI last year, will swing the other way with the October CPI this year, to be released in November (I discussed the details a month ago here).

The adjustment pushed down the health insurance CPI every month on a month-to-month basis by 3.4%-4.3%, which has now caused the year-to-year health insurance CPI to collapse by 33.6%, despite maddening price increases of health insurance in the real world. I’ve called these monthly adjustments “odious” and “ridiculous” because that’s what they are. They’re one of the worst data distortions that came out of the pandemic.

A 4% month-to-month plunge, as opposed to a 1% month-to-month rise, as would be the case, represents a month-to-month swing of 5 percentage points!

The 33.6% year-over-year collapse, as opposed to something like a 12% increase, as would be the case, represents a swing of 45.6%.

The deeper we go into CPI and the narrower the metric – overall CPI, core CPI, services CPI, core services CPI – the worse this adjustment distorts the figures.

The health insurance CPI as a price index itself (not percent change) in August collapsed to the price level of November 2018, despite massive health insurance increases since then. This is why I have been so furious about this metric from day one: it renders core CPI and even more core services CPI essentially useless as an indicator of where underlying inflation is going. This is just effing nuts:

Core Services CPI accelerated, despite collapse of health insurance CPI.

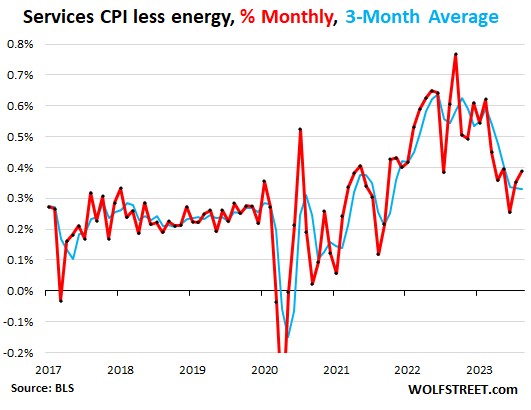

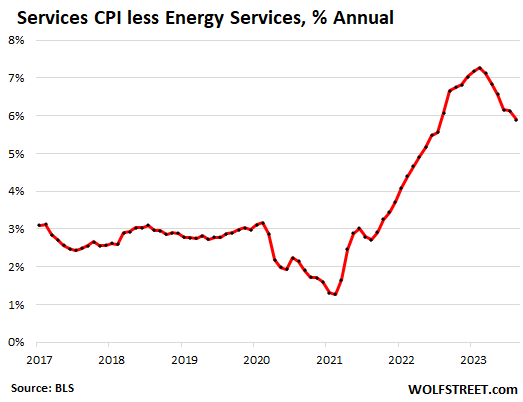

The index for core services (without energy services) accelerated to 0.39% in August from July, the second month in a row of acceleration, despite the adjustment to the CPI for health insurance of -3.6% in August from July.

Year-over-year, the core services CPI rose by a still red-hot 5.9%, despite the 33.6% collapse of the health insurance CPI within it.

What happens when the health insurance adjustment flips?

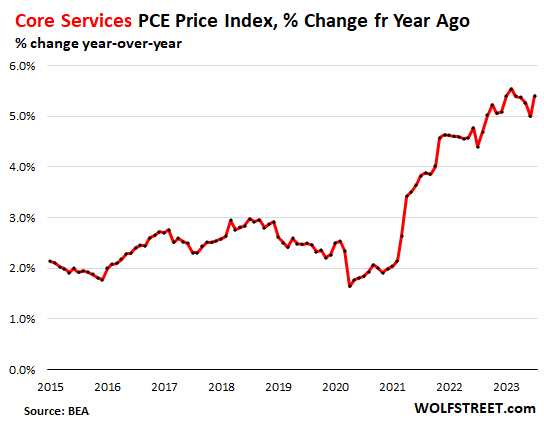

Our other major inflation index, the PCE price index, which the Fed favors, uses different methods to track health insurance. It has its own flaws, but it is not distorted by this ridiculous health insurance adjustment. In the most recent release, the core services PCE price index spiked to the second worst level since 1985, an indication of what awaits core services CPI after the health insurance adjustment flips:

Services CPI by category.

You can see in the table how hot many price increases are. The table is sorted by weight of each service category in the overall CPI. The CPI for medical services is the third largest item, with a weight of 6.4% in overall CPI. Its weight in the services CPI is over 10%, and it has been repressed by the collapse of the health insurance CPI within it, and turned negative year-over-year.

| Major Services without Energy | Weight in CPI | MoM | YoY |

| Services without Energy | 62.4% | 0.4% | 5.9% |

| Owner’s equivalent of rent | 25.6% | 0.4% | 7.3% |

| Rent of primary residence | 7.6% | 0.5% | 7.8% |

| Medical care services & insurance | 6.4% | 0.1% | -2.1% |

| Education and communication services | 4.9% | 0.1% | 2.6% |

| Food services (food away from home) | 4.8% | 0.3% | 6.5% |

| Recreation services, admission, movies, concerts, sports events | 3.1% | -0.1% | 6.1% |

| Motor vehicle insurance | 2.6% | 2.4% | 19.1% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.4% | 0.7% | 6.4% |

| Motor vehicle maintenance & repair | 1.1% | 1.1% | 12.0% |

| Hotels, motels, etc. | 1.1% | -3.6% | 3.0% |

| Water, sewer, trash collection services | 1.1% | 0.5% | 5.8% |

| Video and audio services, cable | 1.0% | 0.6% | 5.9% |

| Airline fares | 0.6% | 4.9% | -13.3% |

| Pet services, including veterinary | 0.6% | -0.6% | 8.5% |

| Tenants’ & Household insurance | 0.4% | 0.3% | 1.5% |

| Car and truck rental | 0.1% | 1.3% | -6.8% |

| Postage & delivery services | 0.1% | 0.0% | 4.7% |

The two CPIs for housing as a service (“shelter”).

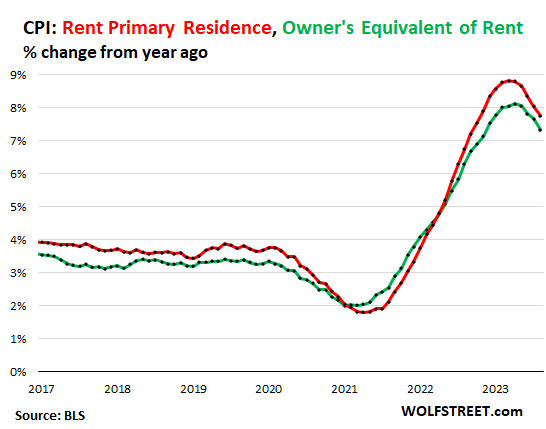

“Rent of primary residence” re-accelerated to +0.48% for August. Year-over-year, +7.8% (red in the chart below). The August rate of 0.48% amounts to an annualized growth rate of 5.9%.

The survey follows the same large group of rental houses and apartments over time and tracks what tenants, who come and go, are actually paying in these units.

Owners’ equivalent rent: +0.38% for August, +7.3% year-over-year (green). This is based on what a large group of homeowners estimates their home would rent for.

The chart shows the year-over-year percentage change of both:

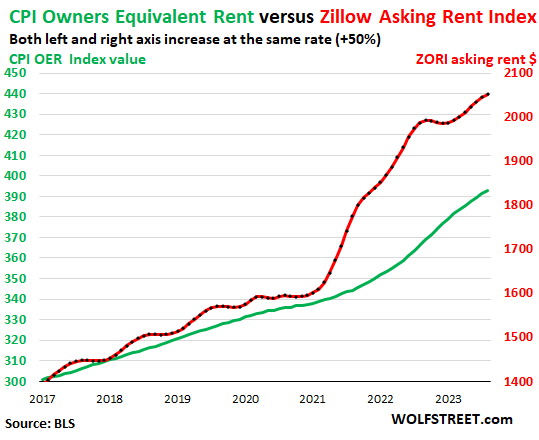

“Asking rents…” The Zillow Observed Rent Index (ZORI) and other private-sector rent indices track “asking rents,” which are advertised rents of vacant units on the market. The ZORI’s spike in 2021 through mid-2022 never fully made it into the CPI indices because rentals don’t turn over that much, and not many people actually ended up paying those spiking asking rents.

In late 2022, asking rents in dollar-terms began to dip, but quickly began to rise again this year, and started hitting new records in dollar-terms months ago. On a month-to-month basis, asking rents have been rising in a range of 0.33% to 0.62% (annualized 4.0% to 7.7%) over the past six months with some seasonality in it. So asking rents continue to increase at a fairly sharp clip, but not as fast as in 2021 and early 2022.

The chart shows the OER (green, left scale) as index values, not percent change; and the ZORI (red, right scale). The left and right axes are set so that they increase each by 50%, with the ZORI up by 47.3% since the beginning of 2017 and the OER up by 30.5%:

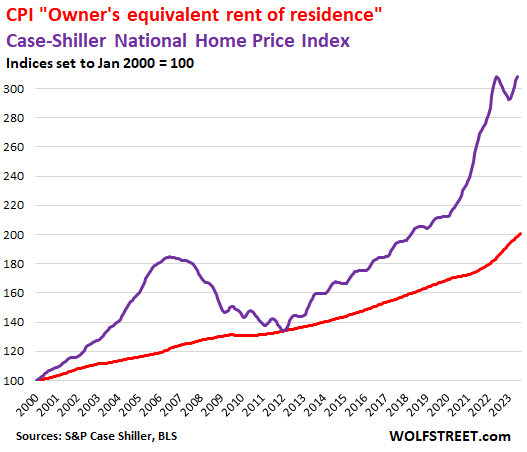

Rent inflation vs. home-price inflation: The red line represents the OER. The purple line represents the Case-Shiller Home Price Index. Both lines are index values set to 100 for January 2000:

Durable goods prices stabilize at nosebleed levels.

The CPI for durable goods, after blasting into the astronomical zone, has been slowly meandering lower, but remains in the astronomical zone.

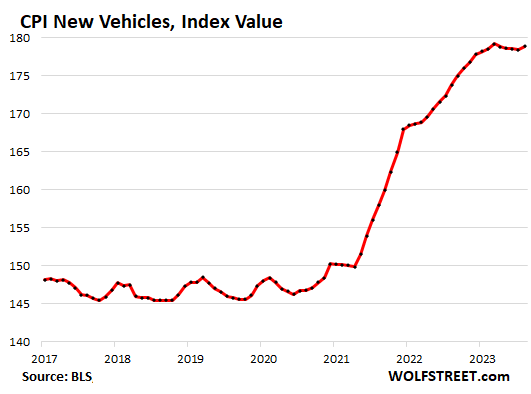

New vehicles CPI, after easing just a bit, rose again in August from July, and the price index is now just a hair away from setting a new high. Year-over-year, it’s up by 2.9%.

Thankfully, there are now changes underway. Tesla is massively cutting prices, while gaining market share at a blinding speed (it’s already #2 in California, and at this pace will surpass Toyota as #1 in 2024). And so now Tesla’s price cuts, followed by some other automakers, are whacking the industry’s oligopolistic pricing behavior.

For many years before the pandemic, the new vehicle CPI was essentially flat with some ups and downs, despite large increases of actual vehicle prices. This is the effect of “hedonic quality adjustments” to the CPIs for new and used vehicles, consumer electronics, and other products (here’s my infamous chart and detailed explanation of hedonic quality adjustments).

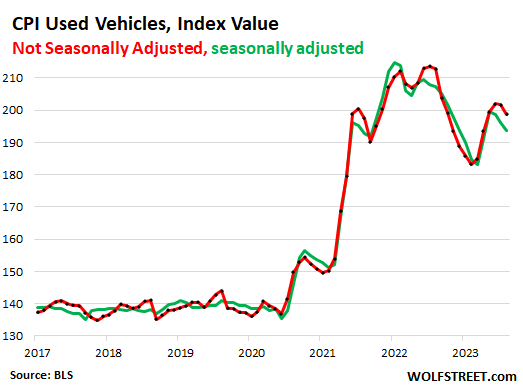

Used vehicle CPI has gone through some major gyrations after the historic 53% spike in used vehicle prices that started in 2020 and peaked at the end of 2021. In August, the used vehicle CPI fell by 1.2% seasonally adjusted from July and was down by 6.6% from a year ago. From the peak, it has now fallen by 10%.

The chart shows the seasonally adjusted (green) and not seasonally adjusted (red) index values. The past three years were wild pricing turmoil. You can also see the effects of the hedonic quality adjustments in the years before the pandemic.

| Durable goods by category | MoM | YoY |

| Durable goods overall | -0.3% | -2.0% |

| New vehicles | 0.3% | 2.9% |

| Used vehicles | -1.2% | -6.6% |

| Information technology (computers, smartphones, etc.) | -0.8% | -8.7% |

| Sporting goods (bicycles, equipment, etc.) | 0.2% | -1.2% |

| Household furnishings (furniture, appliances, floor coverings, tools) | 0.3% | 1.7% |

Food at home.

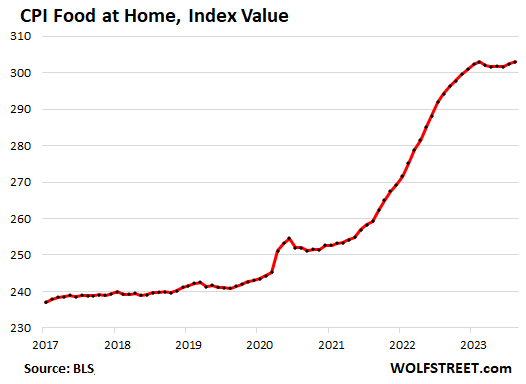

Food prices at grocery stores and markets have calmed down at astronomical levels, following the 24% spike during the pandemic. Instead of plunging to bring them back into line, food prices dipped just a little for a few months and now started rising again at roughly the pace before the pandemic, but on top of these nosebleed levels!

The CPI for “food at home” rose by 0.2% in August from July. The 3.0% year-over-year increase was the smallest in two years.

| Food at home by category | MoM | YoY |

| Overall Food at home | 0.2% | 3.0% |

| Cereals and cereal products | -0.3% | 4.3% |

| Beef and veal | 1.2% | 6.3% |

| Pork | 2.2% | -1.9% |

| Poultry | 1.0% | -0.1% |

| Fish and seafood | 0.1% | -0.8% |

| Eggs | -2.5% | -18.2% |

| Dairy and related products | -0.4% | 0.3% |

| Fresh fruits | -0.3% | 0.6% |

| Fresh vegetables | -0.1% | 1.0% |

| Juices and nonalcoholic drinks | 0.3% | 5.8% |

| Coffee | -0.7% | 0.9% |

| Fats and oils | 0.2% | 4.7% |

| Baby food & formula | 0.4% | 8.4% |

| Alcoholic beverages at home | 0.1% | 2.4% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I saw a chart on CNBC….salad dressing is up 12%. Ouch ;)

How can it be that inflation rises after “massive” QT and the rate hikes by the most responsible fed ever.

Why no rate hike this meeting? Also wallstreet not worried of the higher inflation report forcing rate hikes.

Looks like inflation will remain higher for longer as real rates (subtract hpusing inflation instead of rent equivalent) remain lower for longer

“How can it be…”

People are still amazed at just how much money they made during all the QE. Still coming to grips with how rich they are now.

The best Fed ever?? They are pussies!! What we need is a Paul Volker to really sock-it-to this ruinous inflation that won’t go away !!!

How can this happen despite “massive” QT and big rate hikes bu “the most responsibility fed ever”?

Also, why no rate hikes expected in this week’s Fed meeting? How did it work put so well for wallstreet?

Seems like inflation will remain “Higher for longer” as real rates (after subtracting housing inflation instead of rent equivalent BS) remains negative.

Government spending remains sky high. QT without cutting Government spending in Welfare like Medicaid won’t reduce inflation rate as much.

You think that’s the problem. The problem is corporate welfare and tax cuts for billionaires. Medicaid is 9% of the federal budget.

“The problem is corporate welfare and tax cuts for billionaires. Medicaid is 9% of the federal budget.”

Those have absolutely ZERO to do with inflation.

info..

gov’t DEFICIT spending remains sky high.. thats the money being spent that the gov’t doesnt have already incoming from tax reciepts.

medicaid is a joint federal-state program.. its a support program for underprivilaged/underserved people. the spending on it has not increased tremendously over the past few years.

the gov’t has given more federal dollars unilaterally to ukraine in the past year plus than it has allocated to the medicaid program. so your ‘target’ of ire is absolutely misplaced.

escierto..

those two things you mention are INDEED problems. but they are not directly bearing on the inflation problem.

the fed cannot overcome massive and continuing federal deficit spending with mere interest rate hikes alone. id even argue that more aggressive QT would have a marginal impact also. they dont have any other options. the fed exists at the mercy of the legislature, and is merely a tool when it comes down to it. im not going to give the fed a pass for its misguided actions/inactions over the past 15 or so years..

but congress is ultimately to blame for all of this. they passed the bills giving out the money to everybody. they cannot balance the budget. they continue to show the utmost irresponsibility in every aspect of fiscal policy, and THAT is the problem.

@ n0b0dy

2021 Federal spending on Medicaid was 513 Billion , and State Spending on Medicaid was another 235 Billion, both of which dwarf total spending on the Ukraine to date (75 Billion).

So we could have 10 more wars the size of Ukraine that never ends and it would be roughly what we spend in total on Medicaid.

Hence the urgency to address entitlement reform.

Happy1,

Where is the Medicare money coming from???????? It’s health insurance that is paid for by future beneficiaries and by current beneficiaries (no, Medicare is NOT free once you’re on Medicare). Like the government can shut down paying for Medicare, but still collect the contributions to Medicare? DUH. Spread this manure somewhere else.

Oh yeah Ukraine. Aside from that. Entitlement spending makes up a greater % of budget than Military.

LOL, SS is self-funded by the beneficiaries and has racked up a $2.7 trillion surplus over the past 20 years. These attacks on “entitlement spending” are beyond silly.

There is an old saying that inflation is a tax on the consumer

= Why inflation leads to a weaker economy

Add in:

a) a contraction in the money supply

b) A dramatic increase in interest rates over the last 12 months

c) banks tightening lending standards.

= The probability of a recession starting soon are very, very high.

Wake me up when the money changers cut the $2.5T MBS in half 😉

Wake me up when the Fed liquidates all illegally purchased MBS, the balance sheet starts to shrink meaningfully, and the banks are allowed to fail instead of illegal emergency measures like BTFP. Deflation is good for the masses, especially good for assets 😉😁

Melody,

During the first year of QT, the Fed has shed about 25% of the Treasury securities and about 15% of the MBS it had added during the pandemic. By November, the balance sheet will be down by $1 trillion. That’s a start, no?

Let’s stop trying to predict the recession, YouTube doomsters been calling it since 2021. It will happen one day, the business cycle is still alive.

Info81,

LOL, yes. But Kenneth M Luskin adores and prays to the YouTube doomsters and recession mongers. He has been stuffing my inbox with this stuff for a long time. Meanwhile, we’re still on recession watch here. Feels like Waiting for Godot.

All of the doomsters failed math. When you print that much money and introduce that much stimulus, it leads to almost unimaginable distortions in economic activity to the upside. Recession? Bahahaha, that’s the exact opposite of what’s happening.

If you are NOT interested in what is happening in the economy and the leading indicators for the economy then you probably should not be reading this blog…..

The conference Board is my source for the leading indicators of the economy

= I do NOT “adore and pray to Youtube doomsters and recession mongers”

I face reality to understand how the economy works, and how it will continue to work based on hard facts and human emotions….

= If you want to walk around with rose colored glasses in a state of perpetual delusion, then you will always be caught off guard when bad things happen.

the recession is amount left over after paying for things we need

been proverbial drought this year for savings

and now I get to pay(oct) property taxes – only 10% higher

I think I’m gonna take next few months off of buying

oops – buying back my old f250 – 2001 diesel, dependable and right price – but i need dependable work truck(was for 10 years and I’ll get another 10 out of it)

there goes balance year – it’ll take couple months income

It’s way cheaper to make your own

I don’t eat at home but I would have thought fast food would have went up more than 6.5% year over year. These past few months I’ve been getting slaughtered at fast food places. My costs for food have went from 400-500/month at mostly McDonald’s and subway to 700 or more.

And I’ve been losing weight. Can’t seem to buy any days meal for less than 20 bucks now.

I should go back over the road, rent is up 10% this year and I also have to pay for heating and Internet now so effectively a 15% jump. Verizon has upped my bill every month a few dollars, in 6 months it’s 30 dollars more expensive.

Dude, try an number of the mvno’s for your cell service. It probably will cut your cell phone in half, give or take.

To save others from having to google it.

mvno = mobile virtual network operator

Doolittle reminds me of the company I work at. Some co-workers came up with an acronym /buzz word cheat sheet. We would use the cheat sheet to decode all of the buzz words and acronyms used by management during town hall meetings. :-)

here’s simple on ROFL

TG, that +6.5% sure isn’t from hedonic adjustments for higher quality.

I don’t eat FF but I observe the prices, and what I see is probably +25% over the last 2 years or so.

The presentation of the data, battling the natural tendency for bias, good article. It certainly demonstrated by way of an unbiased presentation of the data. An important aspect.

I think you presented the unvarnished truth about inflation, as I’m struggling to understand it. But the data suggest that, statistically, inflation is moving from the lower region of the normal distribution to the higher estimate of the normal distribution around the mean.

More importantly for us citizens is that the excess liquidity available from the Fed’s balance sheet has temporarily stabilized a run-away inflation at whatever one believes is actually, statistically, as good a guess as anyone whose guess was between the lower 1.96 standard deviations below the mean and the greater 96 pct certainty limit.

Currently, like 4.3, 5.2 m, 7.

I commend you as your restrained description of the doggy poop nature of the reliability of the measurements that are aggregated in a cavalier manner that then are reported as what’s happening now.

The current inflation is an engineered product, designed too lull the fools into an acceptance mode. The boiling frog.

Hey the Fed has this one. Forget their past gross incompetence since they were established a hundred years ago or so.

Unless they have fulfilled exactly what they were installed to do. Utilize the control of the machinery of the growth of the money supply too impose the will of the banking interests on the people.

The Fed is paying 5.5 % too hold a lid on the inflation that the golden days during a hard inflation, convinces one that all is well.

You are so right. It seems like the price of a meal at McDonalds has damn near doubled in the last year or year and a half. I don’t even get a soda; I drink water with my meal. I avoid eating out.

I gained 12 pounds eating, one mac chicken sand off the value menu for lunch. No fries or sugar soda, just water.

It was like 9 months.

Assuming you are a trucker. Difficult job with regards to eating, but try something other than fast food. Cooler filled with supermarket veggies and a protein. Or a wrap or something you can read at least read the ingredients on. Worst cause I guess the salads as McD’s but mind dressing.

If you think FF is $$$, the long term health costof a diet consisting mostly of it will be shocking.

I usually go for gas station sushi. A little riskier, but not as processed as McDonald’s.

What happens when you’re in the car and the bad sushi hits… :/

About 40 years ago when I was driving a truck from the Midwest to the west coast I would pack a cooler with sandwiches I made myself along with some fresh fruit. The goal was to avoid eating in restaurants, save money, and eat a bit healthier food.

That is an awesome option.

50+ years back long haul Truckers used to buy fresh fruit (apples, bananas, oranges, etc) at the super market to take with them in the cab. Today I would add a 6 or 12 pack of water for the cab.

For what it is worth, I think breaking up some of the bigger and more monopolist corps would do wonders for reducing inflation.

Or, the gov’t could tax the mega rich, and reduce the deficit that way. But since the wealthy have been able to buy the government, that does not seem likely to happen.

Exactly! Keto (e.g. “wheat belly”) is a good option as well when on the road.

Amen, brother. It is hard to travel in the States in regards to eating decent. Almost everything here is the same processed garbage from the same gross companies (Sysco, US Foods, etc. ). Choke’n’Pukes (casual chain dining) are hardly a step up from FF.

All you have to do is check the Star/City health inspection records for all restaurants and you’ll never eat out again

Paying $20 for a fast food meal is absurd!

Go put in some effort and learn how to make your food. It’s not that hard to make a weeks worth of all different kinds of lunches for about $20 (that’s 5 lunches for $20 just to be clear) and it would be much better food for you. You know that eating McDonalds every day will literally kill you right? You’re definitely throwing away your income unnecessarily and hurting your health at the same time.

There’s a documentary where a guy did it for a month and almost didn’t make it… just sayin … there’s better, smarter ways to do things Trucker and I’m not trying to be a jerk here or anything, it’s just crazy to do what you’re doing and should really try something different for your own good.

So pessimistic, think about it, the sooner you die from congestive heart failure, the sooner you retire from working!

Shoulda been a salesman.

In SF, when inflation hit post pandemic we stopped buying food from Lucky’s, Safeway or Whole Foods and got everything from Costco. Saved a boatload of money.

I went on a long road trip with my kids last month. I bought a small portable air fryer ($40) because I can’t eat most restaurant food. I made steak in my hotel room. Yea, not fancy, but the steak was good and healthy and affordable.

My kids love Panda Express and Pizza. Panda Express prices seem to be similar to what they’ve always been. They can enjoy that while they are young.

Buy a cheapie rice cooker from Amazon. 6 cups to 8+ cups depending on how many servings you need. $20-30. You can cook ramen, rice, mac n’ cheese, soups, beef stew, canned veggies, hotdogs, etc without the need of microwave. You can even cook at the rest stops if there is an outlet (my mom used to cook everything with a rice cooker to save money when we went on trips).

Good memories when I was a kid and we didn’t have much money. I still bring one if we do road tripping. Good times.

Short honeymoon.

I was talking to my insurance claim agent after making a claim for hail damage.

He said they have been swamped this year with claims. Get ready for future rising home insurance next year. Fires, Hail Damage, Flooding. They cannot keep up with all the claims. Not only are there more insurance claims, construction materials and labor up so insurance payouts are more. Insurance companies will look to recoup the payouts.

This means rent it going to go up in the future as it will be passed through from the landlord.

My auto insurance renewal went up thirty something percent over last year. Provider said more claims and higher cost per claim to blame for this area. Checked around and other providers weren’t any better or actually worse.

Higher cost per claim. No doubt, when new cars cost the same as a small condominium did not that long ago…

Our small townhouse cost $47K in 2011.

We just had an insurance claim due to a leak in the kitchen. Replaced tile in about 1/2 of the house and bottom kitchen cabinets, moving and storage of things, 2 months in a hotel kitchenet. $38K. Of course, our insurance premium doubled.

Insurance just playing catch up

with super high costs of materials and labor

I don’t work for less than $40 an hour

with fuel surcharges, charging minute I leave to minute I get back

try hiring plumber after 5pm

$500 min. + $185 an hour(min 2 hours)

+++ if they have more to do it’s all at nice high rate

they don’t mind as they take your cc

we had sewer line(about 10′) redone – was cast iron

had to hand dig under house

simple bill – labor $2,700 + 1 unit material: $1,000 = $3,700

for about 6 hours work

Our auto insurance hasn’t budged for years and I can only assume it’s because our cars are 2013, 2002 and 1995. Only the 2013 has collision and comp coverage, others are liability only. So the increased cost to repair doesn’t matter since there’s hardly any value remaining to cover. There are options.

Insurance for condo asociations in Miami where I own rentals are up 40%+. Some associations are up 100% – 200% and more!

These costs result in higher condo maintenance fees, and you are right. I am passing it on through higher rental rates.

Thats how the business works. You have to cover your expenses and make a return on investment.

Actually, that’s not how it works. There’s no God-given right to cover your expenses, especially if your mortgage or other loan is based on bubble prices paid in 2021 or 2022 (not saying that’s your circumstance, but it is for a lot of people). Your expenses are what they are. Rental rates are based on the market, and have nothing to do with the landlord’s costs.

Sure they do.

Home owner’s insurance in Florida now averages $6k/year. I live 10 miles from the coast. My insurance company tried to double my rate to $4k. I increased my deductible to $25k, meaning I’ll cover any problems with the house outside of it burning to the ground. It’s still $1k for that.

A home I wanted to by in Cook Cty 2 yrs ago but over 15k in prop taxes, is back on the market for 70k higher with a 2k prop tax increase. Yikes. Seeing huge prop tax increases that make it out of reach

Got that right… USAA has bumped us up 10% over the last year because of exactly what you brought up. Services inflation in action!

Property insurance rate increases have already hit Gulf Coast states and California, hurricanes and wildfires, and they are crippling.

Prices have stayed low partially due to reinsurers chasing yield, now they can get 5% in “risk free” treasuries, plus windstorm and fire claims spiked over the past 3 years.

Should this trend spread nationally, and I believe it will, homeowners/tenants household insurance at 0.376 of CPI will require a major revision.

Imagine a homeowner with a $2,000 mortgage payment suddenly paying $2,200.

Question: though inflationary in CPI, are insurance premiums ultimately deflationary as they take cash out of the consumer economy?

Its almost like climate change is real.

That was like reading the book of revelations. When do the trumpets start blaring in the sky? Great write-up

Should we expect an interest rate increase this upcoming fed meeting?

I think a lot of people are going to be surprised. I think this will be the meeting the Fed does what it needs to, but not what everyone is expecting.

They can’t afford to let this get away from them.

@djreef I hope you’re right, but I fear they’re going to sit on their hands once again and… let this get away from them.

Hey, don’t worry about it, the Fed is an American institution, whose first instinct when a Fed person, is the well being of the median American person. Sarc

The Fed is a gutless concubine of Wall Street. They’re not going to do squat at they’re September ceremony other than utter nonsense about how inflation is well contained.

I think that Wolf’s data indicate that inflation is out of control and the FOMC should increase the rate of decrease of their paid for liquidity by 15% and increase the rate by 25 bpt.

The bastards let it get away from them when they digitized a lot of new money into existence. The treasury has done it’s part as well.

If the healthcare CPI kicks in hard later this year as expected, how can the FED not raise at least 0.25 basis pts in December?

Yet I would not be shocked if markets somehow melt up slowly through the rest of the year, until early next year when the motto might be “Inflation Secured”.

Just wait until the Zombie companies are finally forced to refinance at higher rates, along with corporate real estate, etc. Even the Fed didn’t count on having rates higher this long, so the odds of some financial carnage is getting higher each and every day rates stay “relatively” higher than the short sighted, experimental days of ZIRP and helicopter money printing policies.

That will never happen. The Fed or Treasury will come out with some fancily-named program that will help preserve the environment or keep ‘murican jobs or some other popular thing, but in reality provide backdoor access to liquidity at low rates to zombie companies. They will never, ever be allowed to die.

Pause then hike by 0.25% amounts to an 0.125% increase, so that is the current direction. Still need one more month for confirmation of inflation increase and still waiting for labor market weakness. The rates will move 3 or 4 tenths higher if core inflation moves higher than 0.2% in sep, in my estimation.

Good comment. I disagree with your suggestion that the Fed needs another month. Inflation is well anchored and out of control.

The Fed is so far from they’re mandate, relying on the foolish and naive nationalism of the people to sell they’re radical agenda.

They have been less than compliant with the average persons conception of American equality. Taught to me by my WW2 veteran Father and Union member.

I am expecting another pause with all sorts of “hawkish” blather about data dependent this and that, blah, blah, blah, and “lag effects.” The truth is that the FED wants this inflation, and so does the gov.

Depth Charge, can you explain?

Though I don’t disagree, your second graph and the comment on it seems counter to one of your prevailing sayings, which you’ve placed on a mug. In your defense that line was “going away from heck”. I won’t hold it against you ;)

Love your CPI articles, they are beyond excellent. I think it’s the only place inputs to various measures are clearly laid out. Thanks

Cool, Pow Pow better stick to higher for longer…perhaps even telegraph couple more hikes will definitely be a thing to squash any remaining pivot hopium…

I sure can use more ROI on my T-bill, loving it so far since I don’t get the joy of seeing my house value go up in Zillow, 6 and hopefully 7% return will suffice

No matter the interest rate, the Government won’t pay you more on interests from what it borrows than what it gets through inflation. Not even the same, in fact it will be a lot less.

Your accruing-interest T-bill denominated dollars are still losing value, granted at a lower pace than under the mattress.

One would think that the commoners realize that the people in control of the “printing press” have leverage over the rest of us.

Oh they realize it. They just think they deserve it because they’re the “makers” not the “takers”.

Nice call on CPI, Wolf. Question: The .6 percent increase in CPI for August is driven by a 10.6% increase in gasoline (all types) price. This compares to a .74 percent gasoline price increase in August per GasBuddy (3.77 to 3.80). For the prior month, July, the CPI increase for gasoline (all types) was .2 percent compared to a 7.96 percent increase per GasBuddy (3.51 to 3.77). For some reason the CPI number is one month delayed in the CPI report to actual prices. Maybe someone knows why? Anyway, since I drive an electric car the .6 increase in COLA, and for my TIPS inflation premium, is good news even if a month late.

The EIA has a mid-July to mid-August increase of 8.7%. Much of the data here is collected during the month, and around the mid-month period, and not on the last day of the month, but with the same month-to-month distance.

I don’t pay attention to GasBuddy, but it likely has a similar increase for the period of mid-July to mid-August.

Next Monday, when the EIA’s weekly gasoline price is released, you can kind of figure what the gasoline CPI will do in for the September CPI.

Thanks for including some index charts and not just month over month or y-o-y percentage change. I feel they give a truer picture of costs, visually, at least.

Inflation is dropping, yes. But overall costs for most items are still historically high and rising.

The value of a dollar (as well as that of other currencies) seems to have fallen by some 20 – 25% since 2020…

Gas Buddy has recently become extremely unreliable here in Central Texas. Is anyone else noticing the same change?

Thanks wolf,

So hike now before healthcare included or wait for it in November reading and fed meeting? Wouldn’t waiting be like cutting rates? Reminds me of inflation is transitory.

The Fed is looking at the PCE price index, and it doesn’t do that kind of stuff. See the chart I included from the PCE price index for core services? That’s what the Fed is looking at.

Thanks wolf,

Interesting, CPI is taking up urban expenditures while PCE is taking up urban an rural and also third party payers like healthcare. The PCE index on the chart looks is about 5.25-5.50 at the feds fund rate.

I was hoping for an early retirement but with this persistent and unpredictable inflation, I’ve decided that planning to work part-time during my 60s is the rational thing to do. I’m self employed and enjoy the consulting work I do which helps.

Retirees who have to navigate through this inflationary mess must be concerned.

Howdy OutWest. This retiree is living the dream now that ZIRP is dead. Inflation has interest rates higher and this squirrel is loving it. Now all I have to do is lock in when rates have peaked. Maybe they never will peak?

Debt-Free,

During ZIRP, inflation was ~1%. You got 0% yield. -1% real/year.

Now, inflation is say 5%. You get 5.50%, which is 3.5% after tax. -1,5% real/year. You (we) are worse off.

I’ll take legit 0% inflation and 0% yield!

Howdy Gattopardo This Old squirrel does not spend the savings or invest in the stock market. I know everybody says you are losing $ against inflation. Don t care, time to spend till I dead….

Gatto,

You’re making a lot of questionable assumptions in the statement: “Now, inflation is say 5%. You get 5.50%, which is 3.5% after tax. -1,5% real/year. You (we) are worse off.”

1. You’re picking an inflation rate out of the air that’s higher than any reported rate of inflation.

2. You’re assuming the taxpayer is in the highest marginal bracket of 37% in order to reduce interest income from 5.5% to 3.5%. As a percentage, very few taxpayers reach this bracket.

3. Lots of interest is earned in tax-deferred accounts and the taxpayer can withdraw from those accounts in the future when they are presumably in a lower tax bracket.

Everyone’s situation is different, but very few people fall into the group you seem are describing. I would also accept 0% inflation and 0% yield, but the current situation is much better than 9% inflation and 1.5% interest from June 2022.

@Rojogrande,

1) That 5% is legit. I think we all know CPI is adjusted, via hedonic and other goodies like the health insurance tweak, to a number that doesn’t square up with real world, on the ground spending. Wolf’s F-150 (or was it Camry?) example is perfect. Regardless of the adjustment for quality, which pulls the index down, you still have to pay that higher price for it. 5% is likely low.

2) I’m not assuming 37% (even though a LOT of people pay that), I’m assuming ~25% AND a state tax of around 10%, which many, many, many of us pay. Yes, I know t-bills are state exempt, but other fixed income/CDs, etc., are not.

3) True re: tax-deferred accounts. That’s surely a minority. But whatever, those people then are doing a little better than inflation, many are doing worse than inflation.

AGREED, the 9% CPI and 1.5% interest was worse!

Gatto,

In 2018, only 1.2% of married taxpayers were subject to the 37% rate.

With regard to you assuming state taxes, why would anyone who is subject to state income taxes get a CD that doesn’t compensate for those taxes relative to T-bills paying 5.5%? That’s a choice.

You’re original comment was about what a bad deal interest rates are given taxes and inflation. I was trying to point out that you were taking the most extreme example that simply doesn’t apply to most people. Taxes and inflation are somewhat lower than your assumptions.

Rojo,

You’re partly right, of course. I *am* taking an example toward the upper end, but definitely not the most extreme (25% Fed rate). I left out the ACA/Obamacare 3.8% tax, because I assumed incomes <$200k single/$250k married.

On the inflation side, we all know the stated index is lower than what most people experience.

As for why people invest in CDs rather than t-bills in states with income tax…I dunno! But they do, and they don't get compensated for it. That ain't me.

stocks and housing like inflation. So hopefully your investments will keep up with the current inflation rate.

Stocks and housing does not do good with high rates which correlates with high inflation.

Housing especially is vulnerable to 30year mortgage rates.

WR has posted many articles showing how housing has been hit because of high rates.

Median US Housing prices just reached new highs not that long ago. That’s with mortgage rates at 7-8%. So far hikes only killed the volume.

Stock market, well SPY just recently had few red days and that seemed like a shocker to many…

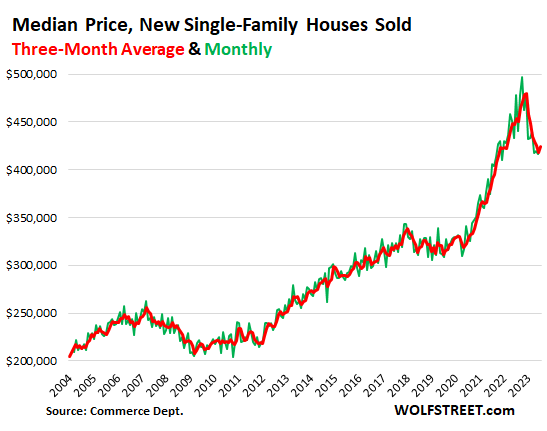

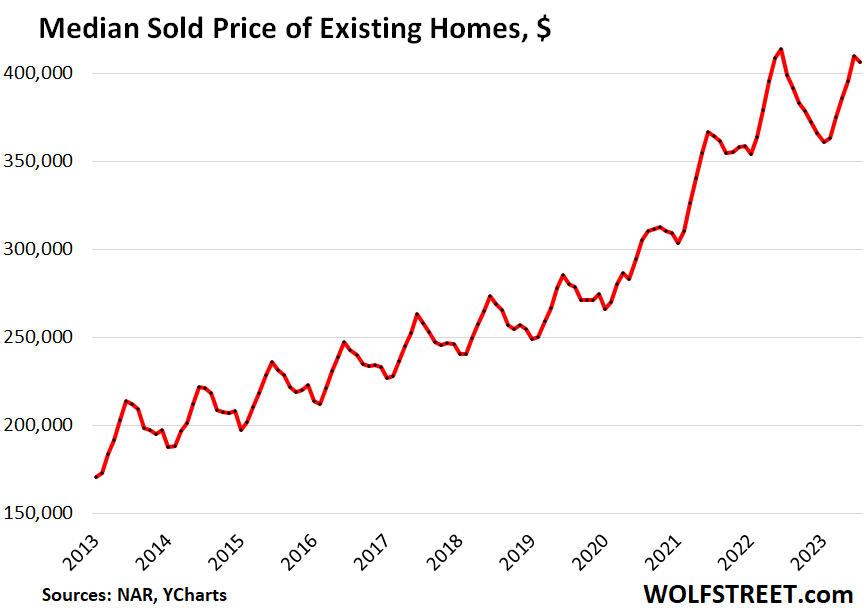

Medan new House price, peaked in Dec 2022:

Median existing home price peaked in June 2022:

@Wolf Richter I probably got a head of the data, but once we see July data reported, I would say it will get ahead of July 2022.

Both of the data sets shown here (NAR for existing homes and Census for new houses) are through July. Next week, we’ll get the August data for both. And I will post articles with updated charts on both data sets.

That is certainly the line pitched by people selling stocks and houses.

And yet, closed sales volumes way off for RE at least. Funny how inflation/increased interest rates actually undercut heavily leveraged transaction volume (and ultimately prices)

These higher interest rates are making retirees wealthy.

Some yes but not the majority. Majority of retirees are on small pensions and social security . Just take a look at the RV parks etc. Full of rich retirees I don’t think so. I wish I’m one of the not rich retiree. I have friends that are 85 still working at Home Depot .

You see a whole lot of Class A RVs at RV parks, which are in the $300K range and depreciate about 20% every year.

Owners of Class A are either rich or financial idiots.

Yes, both.

Not everyone thinks in terms of an RV as a financial investment. Maybe they just like the idea of not having to pay property taxes, home insurance, association fees, move wherever they want when they want, and they’re willing to spend the money on the RV in pursuit of their dream. It’s no different than taking a world cruise or any other recreational pursuit.

I wouldn’t want one, as I think they’re a lot of work…. but I respect another’s right to have one and spend their money any way they seem fit.

Don’t be a hater.

Define wealthy.

Howdy wcl. I would like to? OK? No debt, live within your means, save some of your $$ always, live as free as you can.

Been doin’ that for many years.

I’m gonna go with DFB in general on this question!

Have worked with folks with lots of money many times in my 50+ year career in the construction and remodeling industry, and I can testify that many, maybe most were not wealthy at all except for $$$…

And to the other point, many of the folks my age I have talked to at HD and Lowes and even WM have told me that after they had started retirement a while, their spouse came to them and said, “Honey, I married you for better or worse, but not for lunch. Get your a** out there and find something to do other than micromanage me.”

VintageVNvet

Yeah, I’ve also heard stories of couples seeing too much of each other in retirement and straining a marriage.

Grandchildren.

Thoughtful thread….

My experience from having spent several decades in the fin’l services industry led me to conclude that almost all people define wealth as: “anyone with more assets or income than me.”

That sentiment was uttered by my:

Pizza deliverer kid

Grocery store checker

Barber

Teacher

Plumber

Banker

CPA

Broker

Attorney

Doctor

Auto dealership owner

Local magnate

Most of them thought people who made more than themselves should pay more taxes.

“Wealth” is an extremely mushy word, and when conversed upon, usually includes the concepts of “fairness” and “redistribution.”

Wealthy = lethargic contentment, or as the screen name implies, a full belly and an empty mind.

No shortcuts though, getting my mind right was way harder than anything I ever did for all those filthy dollarbucks. Lots to unlearn

full – Nan-in and ‘A Cup of Tea’ ?

may we all find a better day.

^^^This guy gets it – drain that cup and the rest is easy

“These higher interest rates are making retirees wealthy.”

It’s impossible to get wealthy from 5.5% t-bills for a year now. C’mon, man. As I’ve noted above, you’re barely pacing inflation after tax with that.

Howdy Again Gattopardo. It comes down to how you define wealth as an individual. Other peoples idea of wealth is fine but does not matter to other individuals. Some poorer folk to you may feel wealthy and richer in life than others. Life is good but only if you live it your way…..

Actually, it depends on your current wealth. If you have a pension of $55K, SS of 42K, interest income of 33K from the T bills and you only spend 100K to live (no mortgage left), you increase your net worth 30K YOY. That only requires 600K in T-bills. I think there are actually quite a few boomers in this type of situation. They are also the ones fueling the services spending.

“barely pacing inflation”.

When you look at inflation numbers, you have to assume that every person is participating in every category of goods. That’s BS.

We don’t spend much more than we did when we moved into this barn 6 years ago. So getting 5.5% vs .5% on funds sitting dormant is pretty sweet to us. Allows me to gift the max to each kid every year and have plenty left to p*ss away on Don Julio Anejo tequila.

If you run your life like a business you find all kinds of opportunity to thrive.

Is that a bad thing even though it is completely wrong. Inflation only enriches the owners of assets. Most retirees are not living the free and easy financial existence. Some are and they flaunt it, without awareness of how ridiculous they are.

Remember, it is only 11% of the population who are financially independent

I am concerned! Inflation was always my number one concern when I retired at 60 I’m 66 and the early year inflation hit at the worst times

Work is the best hedge against inflation.

Wolf this has been a terrible tactic for the last 20 years.

source: worker

the only benefit of working is that at some point I’ll be skilled, should working ever be a better option than being a rentier. But for the last twenty years it absolutely has not.

Minimalism is better.

I second you 10000%.

I have no desires for the worldly objects of the world so I feel very very liberated.

I lived a life full of luxuries and now I have no desires for them so I live very minimally. Now I just eat rice and lentils with lots of greens and some cheese.

My nirvana would be living in a 1 room hut with my bicycle.

jon?

whats stopping you from your ‘nirvana’, exactly…?

please, do tell..

you used the phrase “would be”, which is a bit strange.. because any adult person could easily do what you are talking about with immediate effect.

while i agree with brad’s statement, there are varying degrees of ‘minimalism’.. i for one, have an affinity for running water, and indoor toilets…

Very wise words.

Perhaps. Most bodies seem to wear out making work physical work difficult and intellectual work challenging, fending off the young bulls.

I have lived where I am at for years and walk alot around here. I live near several retirement communities and I am seeing people in their late 70’s and one almost 80 yr old working now in the stores i have frequented for years. So sad….

Howdy Folks and Mr. Lone Wolf. Not many out there tell the truth like you or have a crystal ball such as yours. So, You are my rebel with a cause.

THANKS

Nice to hear Wolf talk about the impact of energy prices on core CPI, something not often discussed, although I mentioned it a week or two ago. The Fed will not get to its 2% target with federal funds rate just above normal and 30 year fixed mortgage rate just a little below normal (I define normal as average 1971 to 2022). The labor market is tight. Nominal wages are rising almost everywhere. There is not much of a slow down in the economy. I am guessing the Fed needs to go to around 7% and mortgages to around 9 or 10% to start to have any real impact. I doubt if Powell (Mr. lags of unknown length and variability) has the balls to do it and has probably been told not to by his handlers. He is no Paul Volcker. Perhaps Powell is hoping for a Black Swan event to bail him out.

As for me, I am laddering 6 month T-bills. I have as little money as possible in banks, and not just because they have lower rates. The COLA and ensuing increases help my I-bonds of which I have a lot, social security, and pension because all rise more-or-less by COLA. I got a $50,000 income increase this past year, thanks to rising T-bill yields. My wants and costs are relatively low, so my increase in income swamps the negative effects of inflation. I don’t spend like a drunken sailor, but I do buy whatever I want.

Powell is a clown on a wall steet payroll. Rest of the fed bunch not much better. All about mambo jumbo nonsense talk and no real action.

Correct. Energy and FOOD are becoming a problem for the lower middle class. I know several people in property management (500+ units, not small potatoes like me with my two duplexes), and they are seeing an increase in missed rent payments again. The problem is the eviction courts are still backed up and a single eviction in our are can cost as much as $10,000 and take 6-8 months.

Yes, rates need to go up, but Powell is no Volcker, and this is definitely NOT the 70’s. What was the Debt/GDP in 1979 again…?

Hedge accordingly…

My credit union is offering 6% on 4 month CD’s. I’m going to move 30K into them and sit back and relax. Why take a risk in the casino when you can get that return with no risk.

“Why take a risk in the casino when you can get that return with no risk.”

And yet the PE ratio of the SP500 is still at least 1.6 times historical norms (at these approx interest rates).

Given those facts it is hard not to picture Wiley Coyote holding an Acme anvil in midair when thinking about the equity mkts.

He can stay suspended forever if he doesn’t look down…

Fidelity has a nice rate comparison calculator that shows the relative return with inputs for your income, tax rate and rates of return. Depending on your tax bracket and other variables, you might be better off at 5.3-5.5% in T-bills than at 6% CD. if you live in a state with no income taxes that would even things out.

It seems everyone I talk with is on the same path. T-bills free of state taxes are a no-brainer. I don’t go as long as 6 months in a rising rate environment and find that right now 17 weeks seems to be the sweet spot for me. That allows me to rollover more often as the rates continue their elevating journey.

Here’s hoping for another .50! I can dream can’t I?

I ladder six month tbills. This means every month some mature and for now I immediately buy more. It’s paperwork, but timing is important. When rates appear to be peaking I’ll shift to longer term cds. I have to stay on my toes, but it is mainly fun.

I use schwab, but I do not use their auto rollover option. I have the new tbill settle on the exact day the old tbill matures. Also i try to keep as much money out of the cash account as possible, because it pays a lousy yield.

I use Treasury direct as it is much easier to use and especially for auto rollovers which can be edited as desired. I tried Schwab once to see how they do it and found that to add rollover is not easy (could be me) and they like to hold your money and use it for many days before letting you have access to it. Plus when they sweep it into your account it only gets .45% interest. Yeah no more of that, thanks.

TD is easy and just returns to your account of choice.

I’m laddering 4-week T-Bills with auto reinvesting through Treasury Direct … for the slightly lower rate than the longer term bills, I have the option each week to cancel a reinvest if I ever need more cash than I have available in my credit union.

Doug, that is why I do not use auto rollover at schwab. I keep one dollar in the “cash” account. With TD, if you need to sell before maturity, you need to move the tbill to a broker. I have not needed to yet, but if there is a dramatic drop in rates, i want to lock in rates at CDs fast. You can buy CDs at a broker, not at TD. TD is clunky but I guess it works. I use it to buy Ibonds, as there is no other choice.

And by the way the Fed rate hike probability this September has fallen after today’s CPI release, who would have guessed. Insiders know that the so called inflation fighting Fed is on their side.

Those rate hike probabilities have been a joke for 18 months. Take them only for your amusement.

But it is possible that the Fed will skip a hike this meeting. They know what’s coming: much higher inflation numbers later this year, and they can use those numbers to politically defend their rate hikes. If they hike at the next meeting, they have to defend them with technical explanations that Sen. Warren will have trouble understanding, such as “core services inflation,” etc. Instead of listening, she will scream: Why did the Fed hike to 5.75% when CPI is 3.7%? Later this year, it will be easy for the Fed to explain and for all to see why they hiked to 5.75%.

Howdy Mr. Lone Wolf. Hope you have security and body guards . Too much truth makes most people crazy. Be careful Sir. We need you.

HEE HEE

Fed doesn’t work for the government or congress or senate. Their mandates are clear – low inflation and high employment. We are in high employment and high inflation for years now so clearly Feds priority should be to kill inflation. And when inflation is way above target already and rising again, raising interest rates and reducing money supply further are the solution. Any rational person would think so. And if Fed is not willing to raise rates to combat rising inflation which is already way above its target then they are clearly not doing their job. It’s really black and white.

Now the reality is that Fed is puppet and does what its masters ask to do. Their real agenda is to enrich the rich and the Wall Street and fool to general public and the rest of the world. And they are doing an awesome job.

“Fed doesn’t work for the government or congress or senate.”

incorrect.

the fed was CREATED by congress, it is a (quasi) gov’t agency. so yes, it ‘works’ for the gov’t. it does have some independence in what actions it can take. but to presume that politics or the entities which created it have NO BEARING on its decisions, is.. illogical.

now on another level, you bring up the suggestion that the fed is a ‘puppet’, and merely does what its ‘masters’ want it to do..

so what, you think its just them? you dont think its the same state of affairs with the house, senate, judiciary, presidency? for that matter?

the fed is not beyond reproach. but you fail to see the bigger picture in total. if anything, they are merely the junior partner in the scheme you insinuate.

but really, when you boil it all down..

the PEOPLE in this country are ultimately responsible for the state of affairs.. some to a greater or lesser degree.

whether thru their own actions/inactions, general indifference, passive acceptance/acquiescence, etc.

that reality is the entire basis for a democracy/republic. regardless of how you look at the political power structure.. capitalism allows the ultimate ‘power to the people’ in allowing each person to ‘vote’ with their dollars.

nobody NEEDS a brand new $1200 iphone.

nobody NEEDS a brand new $80000 pickup truck.

people who complain about inflation, but then go spend ridiculous amounts on things anyway are PART OF the problem.

im not suggesting you are that type of person, however.

n0 – a good pickup of that 7-10 split…

may we all find a better day.

Fantastic analysis on the reasoning for the pause. As you say the Fed has been in this political big business environment for along time and are in place for those reasons. As a product of big companies in the private sector going against the grain early generally has bad outcomes even if proved right later.

I agree with you, but to echo what the other poster said, the Fed shouldn’t be caving to political considerations at all, whether it’s Trump screaming for lower rates so he can have higher stock prices, or whether it’s Warren screaming for lower rates so unemployment stays artificially low.

This same reasoning is why the Fed is not selling MBS but rather just letting them run off. Selling would drive up mortgage rates further and invite scrutiny of their “interference” in the mortgage market. Just letting MBS payments roll in without replacing the principal is much harder for ignorant and malevolent politicians to attack.

In my opinion, the Fed is not trying hard to tackle inflation. They need to reduce the money supply, which means selling assets at a quicker pace. The Fed won’t do this because it appears their #1 goal is to protect asset prices. Inflation is secondary.

Agree 200%. When asset prices skyrocket, they sit on their couches and watch with a drink. When they are inching down a bit, they start printing money.

I dunno… I can see this perspective; at the same time, Jpow has implied he wants to see housing come down at FOMC pressers…

I think Jpow & co are digesting the bigger picture: they need to be serious about defending the currency.

They’ve already taken down those asset classes by a bunch, and it continues. Look at three-year charts. This is a slow process. Just because not everything plunged as fast as cryptos doesn’t mean asset prices havened dropped. They’ve dropped across the board.

What? really?

Cryptos are still up 200% from pre pandemic levels.

Sorry for your recent 60% losses. But as you said, no big deal because on a long enough a timeline, everything is still up?

Hahahaha

Sorry, I’ve nothing intelligent to add but this comment absolutely killed me 😆😂🤣

Most of my assets were acquired before pandemic including some crypto and a ton of real estate. So I am asset holder. And therefore I know that Fed works for me and thanks to them that after a worldwide pandemic, my new worth (in net equity minus debt) has tripled in last 4 years. Wow. My rent net profit has doubled (with some remodeling). Inflation is great for me. All this while non asset holders are screwed.

Recent dip in crypto or stocks or real estate doesn’t bother me.

Crypto: 500% up and 60% decline, okay I’ll take it.

Real estate: 50% up and 5% down, okay I’ll take it.

Stocks: 80% up and 15% down, okay I’ll take it.

Do you see a pattern. Do you see that Fed is working for me.

Cash is trash at any interest rate. Fixed income are losers. Renters are losers. Poor are losers. Non asset holders are losers. That’s the hard truth.

Bobber – faster QT makes a lot of sense in theory, but it doesn’t seem to be working in the UK.

Don’t have the exact #s in front of me right now but BOE has been tightening at ~2x our pace while taking rates up more slowly. Last I saw they had total CPI>6% and core ~7%.

However, one could make an argument based on this observation that there is room to double US QT rate without inflicting severe damage, and I strongly support this thesis

Thank you for the detailed report Wolf.

Howcome? I read the main stream news media today. They were essentially saying (!): “We are all fine. It was just a brief spike. And we just remembered a thing called ‘Core CPI’ though, and tt is heading down. Everything is going to be great. ” And the markets rallied, because CPI was BETTER THAN EXPECTATIONS (!) – The same gimmick every time!

Let’s get back to the real world. Last year has shown that interest rate hikes have limited effect on inflation. It trimmed the summit, but cannot bring it even close to 2%. Why? People are still spending, hoarding, getting into debt more and more, instead of saving. Why are they doing that? They think they can refinance their debts whenever rates go down. Nobody wants to caught with cash for FED’s next QE. Everybody wants to have as much debt as possible. And they all believe that next QE is close.

Solution: Aggressive tightening of liquidity. Unless you squeeze the money supply, inflation will continue to rise. Actually FED was going somewhat well for this (though terribly late), March 2023 pivot (I know Wolf doesn’t like this phrase) slowed the course heavily. Worse, it showed that QT is vulnerable. Fed need to kill the “pivot” story by aggressive tightening.

As we all know that fed does not have the ability to sell treasuries (because the yields will rocket and govt cannot service the debt), the only thing fed can do to reduce the inflation is 1) sell mortgage BS 2) shutdown BTFP. I agree that this may risk a recession. But there is no other way to return to 2%. As Wolf said, headline CPI will go even higher, possibly passing 4%. But I am pretty sure that mainstream media will sugarcoat that as well.

There is one more thing Powell can do. He can grow a pair and tell Congress the Fed cannot be effective at tackling inflation while huge government deficits continue. But that would require leadership.

I think nobody have guts to tell that. Shutting up and printing money is much easier and less risky. Inflation doesn’t hurt the rich. Middle class is doing ok (if they are not paying rent). Who cares about the poor? Do they even have time to go to the ballot?

Jason and Bobber,

Inflation, when it gets over certain low limit, can be very disruptive to businesses and the economy and consumers. And the wealthy hate it because inflation eats their wealth, and they will send their wealth to somewhere else, which is even more disruptive. See Argentina.

There are a lot of primitive misconceptions about inflation and the wealthy floating around out there in the blogosphere.

If the Fed were as you described, they would have never hiked their rates from 0.25% to 5.5%. See how easy it is to shoot down this stuff?

Jason:

“CPI was BETTER THAN EXPECTATIONS (!)”

No, overall CPI was worse than expected. Core CPI was worse than expected.

Inflation doesn’t hurt the rich? Yes it can. Those with conservative holdings, like lots of Tbills or cash or whatever that doesn’t track inflation get nailed.

When nine in ten young workers can’t buy a house, or even pay rent, then inflation matters. We are already at five in six Californians and four in five Indianans not being able to afford median priced homes. Lowering rates by a quarter or half point would just push up home prices and rent, further exacerbating the society crushing problem of unaffordable housing. The Fed can’t fix this problem at this point. It will require tax policy and regulatory changes.

Wolf Richter: “And the wealthy hate it because inflation eats their wealth…”

There is a difference between the “wealthy”, as might be commonly perceived, and those with privileged access to the freshly-printed money. The latter are in a different category altogether. They’re the ones that created the printing presses in the first place, and wage the wars that maintain their particular brand of money as money. The disruptions to business and the economy that their privilege creates are not their concern so long as their privilege is preserved. That’s their only concern about “inflation.”

Sam L. – ref. longstanding discussions here in Wolf’s most-excellent establishment re: ‘punchbowl ‘…

may we all find a better day.

Actually they recently found out Medicare is saving 3.9 trillion or something like that in savings that were unexpected.

The Medicare costs were projected to be much higher than they have been. It’s been a giant windfall for the government.

Wolf, thanks for the reply. I agree 300% with you that high inflation hurts businesses and economy and also many things. For the wealthy, they may not like high inflation either. The question is how much do the wealthy care about it? Do they care about the high inflation more than potential decrease in asset prices? I don’t believe so. Vast majority of the wealth of the rich are tied to assets. As long as the asset prices increase or hold well, they don’t care about the inflation much. But if the asset prices go down rapidly, then they start to get upset quickly, even if the inflation is going down.

I am not saying fed doesn’t care about inflation at all. They certainly do. But if they were really serious about it, I think they would not be so loose and slow for QT. Remember, before Summer 2022, fed told they would allow MBS rolloff with a cap starting in the summer, but it didn’t. Instead, fed bought new MBS to replace those rolled of during the summer, when CPI broke the 9% level.

In March 2023, there was a serious financial problem and they invented BTFP. I understand the emergency, but it became a backdoor (although not all the banks exploit the mechanism to protect their trustworthyness).

I am fully onboard with your analyses. For the cause and effect association, without a much more faster QT, I feel like the rate hikes are not sufficient and even further rate hikes may not reduce the inflation to 2%, because there is too much liquidity in the system. Rate hikes have limited effect on that. May be I am wrong. We will see in time. I will gladly admit my mistake if the time shows so.

““CPI was BETTER THAN EXPECTATIONS (!)”

No, overall CPI was worse than expected. Core CPI was worse than expected.”

Of course it is worse. I was trying to say that mainstream media has always something to sugarcoat the statistics. It doesn’t have to be true. And I actually read this today.

Average SS check $1500. One million old people die of corona. Saves government 18 billion annually. Medicare savings is on top of that because the dead don’t need health care.

I’m not sure what else everyone is reading but to fall asleep on my work trip I throw on some cable TV in the hotel (I don’t have cable at home lol) and lately have had Bloomberg BNN on or whatever it’s called till I wake up at 2am and shut it off. Anyway, there’s not been a single analyst that was on yesterday that has had positive things to say about current inflation picture, some were talking about the rise in gasoline as well bringing those inflation mumbers higher in the near future, almost everyone was saying “higher for longer”. Not what I expected from “mainstream” financial news, especially cable TV

There was a a few odd and annoying comments like “Asia weakness” which I’m not so sure about. Also, those people on that channel seem to be hyper focused on sensationalizing small intraday moves in the market and trying to tie these little swings to major long term indicators and fundamentals when really it seems like it’s just pure noise. Still, on the inflation front they didn’t seem that far out of step from what Wolf is talking about here, just with a lot less detail and data points.

Seba – …perhaps they’re still hoping to dash in-and-out to snatch the remaining pennies in the path of the steamroller?

may we all find a better day.

And here I thought this group made fun of Zerohedge, yet Zerohedge has been pounding the table about hotter CPI for a while.

Higher oil prices are putting a massive strain on the economy. Walmart just lowered starting wages. Summer is just coming to an end (spring and summer are when the most economic activity occurs). Bank lending has flattened and been flat for months (how much inflation can there be if there aren’t new loans?). We just had two negative quarters of GDI.

How long do you really think CPI will remain hot once the recession gets rolling within the next few months? We have student loan payments resuming. Summer vacation is over. Pandemic savings is almost gone. People are having to pay rent/mortgage payments again. A pretty large percentage of people are carrying revolving high interest credit card balances. I highly doubt this article will age well. A one month print isn’t anything to get excited about.

Actually consumer price index can continue to rise even in a recession. Less purchasing power may as well result in less consumption than lower prices. The consumers spend their money on less stuff costing more.

I don’t see how, when there are no customers to purchase your products or services.

With no customers there is no CPI at all as it is transactional data that make up the CPI. It actually happened during the pandemic, some items where not traded and as a result there where no input to the CPI.

But as long as there is some transactions there is something to compile the CPI from. It do not matter if the vehicle CPI measure the price of a million or a thousand cars new cars sold. The vehicle CPI measure if the price of each new sold car is up or down. Same with other consumables.

Are you Jerome Powell?

Howdy Liberty. I will bet you 50 cents the article does age well. Very well in fact and I usually never make such bets or take chances. Bet me? HEE HEE

The US dollar isn’t going away. But a lot of Foreign held dollars may be coming home. That, too, increases inflation.

There’s a shortage of dollars, so I don’t see how they could possibly come home. The DXY is going up, not down.

The Liberty Advocate, DXY is only going up against other currencies. The dollar has done terrible in terms of what it can actually buy.

E.g., the dollar can get you more euros today than it could three years ago. But what you can get for those euros is lower if you travel abroad.

I would love to know how inflation will remain sticky with M2 dropping and banks balance sheets remaining sticky. Feel free to let me know.

Looks like M2 like YC have been rendered useless.

Howdy Liberty, Govern ment just grows and grows. Limited Govern ment is Fiction. Hope that helps….

I don’t know how this plays out, but a drop in M2 can be offset by an increase in the velocity of money. Velocity plunged as the Fed poured liquidity into the system under QE and has started to increase recently.

https://fred.stlouisfed.org/series/M2V

Also, lots of lending is now done outside the traditional banking system. Total debt is leveling off, but not decreasing at least according to the St. Louis Fed.

https://fred.stlouisfed.org/series/TCMDO

I won’t be surprised by a recession in the near-term, but I also won’t be surprised if it’s a year or more off.

rojogrande

Good points. I’m not sure about the total debt graph, but banks lending standards have tightened significantly and their commercial loans have flattened out. I’m not sure that total debt represents an expansion of credit so much as people and entities lending their savings. Most other central banks can “print” money, so that may be part of what is going on there.

“Howdy Liberty, Govern ment just grows and grows. Limited Govern ment is Fiction. Hope that helps….”

For clarification, I’m an anarcho-libertarian. I know limited government is a fiction.

As to government continuing to spend, they always spend, until they can’t anymore. Without a growing economy, it is impossible for the government to continue. Just look at the Soviet Union.

It’s not about the Federal Reserve buying US treasuries. It’s about businesses and consumers not being able to get loans. No business or consumer loans, that’s deflation. Commercial loans rolled over in January and have been going down. Deflation. Prices have no hope of staying high much longer.

Howdy Liberty Great, we agree Govern ment spent too much and inflation is raging.

You may grow some grey hair waiting for this ‚recession’, pal.

Ah, you forgot about the $2T of deficit spending that. The party continues, the beer kegs keep rolling in.

Funny how stocks and Bitcoin topped out in July and are rolling over, and the DXY is going up with all this deficit spending…

“…how stocks and Bitcoin topped out in July”

Bitcoin topped out in Nov 2021 and has since then collapsed by 60%.

The Nasdaq topped out in Nov 2021 and is down 15%.

The S&P 500 topped out in Jan 2022 and is down 7%.

Wolf Richter

I’m not sure what the point is you are making Wolf. Yes we had a dead cat bounce. And the Fed started aggressively raising interest rates in February I believe of last year and it takes 12-18 months for the effects of those rate increases to be felt (or maybe you disagree?).

Unlike the Covid panic though, where the government drained their reserves by handing out money directly to people, this time they used it to fund the expenses during the debt ceiling standoff.

You talk about stock prices and Bitcoin as though they are economic indicators. Most people in the know tend to look at things like unemployment rates, GDP growth (estimated this quarter at 6%, Atlanta Fed).

Your are groping to find some rationale for a Fed pivot, but it’s not there.

Judging by the recent increases in gasoline, natty gas, and wood pellet prices, I’ll take the other side of that trade and bet on inflation re-accelerating.

Also,

“A pretty large percentage of people are carrying revolving high interest credit card balances.”

Most of these balances don’t accrue interest, as has been discussed here previously.

Personally I pay everything I can on my CC, and have the full balance set to autopay every month. I’ve never paid a dime in interest, despite having a consistently large cc bal. I’m sure lots of others do the same.

I don’t remember the exact number, but it is something like 20% don’t pay off their card every month. It might be 40%. I can’t remember. They aren’t delinquent, yet, but there are a lot of people carrying balances.

Howdy Liberty. You type thoughts of someone I may know here. Keep up the good work……

Stock market actually went up today 📈

Wall Street investors doesn’t care about inflation – they care about interest rates. And since the Federal Reserve is close to the end of its tightening cycle (whether they raise by another .25 or .50% before reaching peak rates is immaterial to valuations), markets are unlikely to sell off unless this second wave of inflation becomes significant enough to warrant substantial further tightening.

“John Bull can stand many things, but he cannot stand interest of 2%.”

– Walter Bagehot

Let’s wait and see what 5% does.

Up, but not a higher high. It’s the trend that matters. Intraday moves are usually pretty irrelevant. The stock market topped out in July and I doubt we will ever see it that high again. Globalization is over.

In the dot com bubble Nasdaq also recovered almost all losses of the first leg down. Today that recovery went into handful of stocks.

In the summer of 2000, which was 5 months into the dotcom bust, a bunch of telecom stocks and other tech stocks, including Intel, hit new highs. Intel never got back to its high of August 2000 and is now down about 50% from there, but it’s still up from where it had been in the 1990s. So no problem.

Wolf, I think you mean “in the summer of 2000” not “2022”. I remember it well.

Yes, thanks. Fixed.

Markets have finally priced out rate cuts this year (though with only 3 months remaining, it’s not much of a bold call anymore.)

At least that’s something. One of the few times in recent history that FOMC projections led the market, instead of the other way around.

Howdy Jackson. Follow the dots. I think a new one comes out soon.

Morons everywhere shouting from the rooftops about disinflation. Even the major financial press is falling victim to this narrative. Spitting out nonsense in the name of high value financial journalism.

Howdy Rob. Wells Fargo folks say lower rates march 2024. 225 Basis points. Banksters HEE HEE

You must be a Zerohedge reader.

You’ve obviously missed how much transportation costs have dropped, how much fewer homes are selling, how commercial bank lending has flattened out for months, how the M2 money supply has dropped, how Walmart dropped their hiring wage, etc., etc.

Look at the median new and used home prices graphs above. The damage has been done over time. What you describe is a decrease in the RATE of damage.

No, I haven’t missed that. But services inflation, like haircuts, dental cleanings, medical services, car and home insurance, rent are not dropping, and are continuing to increase at a high rate.

The CPI y/y was down from 9.1% to 3% nonstop, without a counter trend.

It bounced back up from 3% to 3.7%. It’s the first stopping action after

a year : 0.7/6 = 10%.

The downtrend is strong. The CPI might cont down below the 3%.