Durable goods prices fall. Fed favored “core” PCE price index re-accelerates.

By Wolf Richter for WOLF STREET.

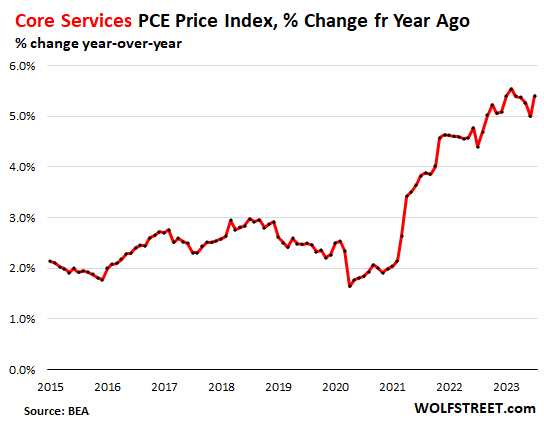

Services inflation is at it again. Year-over-year, the “core services” PCE price index accelerated to 5.4%, the second worst since 1985, according to data by the Bureau of Economic Analysis today, sharing that spot with January 2023. February had been the worst.

The Fed’s job is far from done. Powell has been fretting about core services inflation for a year, and today he got what he worried about he’d get: an acceleration of core services inflation, especially in the red-hot “non-housing services”:

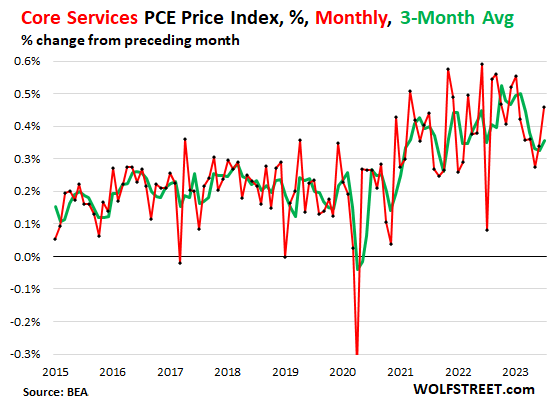

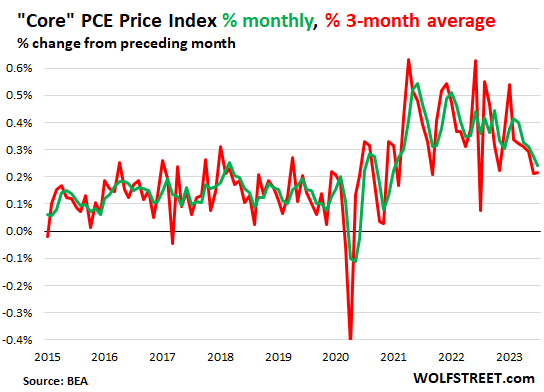

Month-to-month, the “core” services PCE price index – services minus energy services – jumped by 0.46% in July from June (5.7% annualized), the second month in a row of acceleration, according to the BEA today (red line in the chart below). The three-month moving average (green line) accelerated to 0.36%.

In core services is where inflation has gotten entrenched. Durable goods prices fell on falling prices of motor vehicles, electronics, home furnishings, etc. But inflation in services is where it’s at, and where it is very hard and frustrating to eradicate from.

Note the massive increases in some of the non-housing services listed here (finance and insurance, transportation, recreation), which is precisely what Powell has been fretting about. The biggest month-to-month increases were in:

- Housing: +0.42% (5.2% annualized)

- Transportation services: +1.03% (13.1% annualized)

- Recreation services: +0.79% (9.9% annualized)

- Financial services and insurance: +1.64% (21.6% annualized), which people have already figured out from their new insurance premiums.

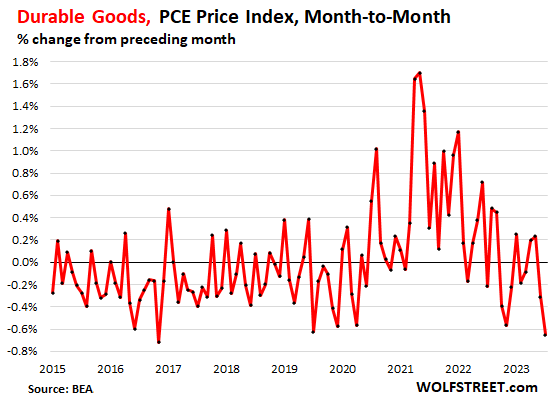

But the durable goods PCE price index plunged by 0.65% in July from June, the steepest drop since 2017, after having declined by 0.31% in June, with all four major categories declining, as some of the ridiculous price spikes, particularly for motor vehicles, have been partially unwinding since mid-2022.

- Motor vehicles, which dominate the index: -0.65%

- Furnishings and durable household goods: -0.23%

- Recreational goods and vehicles: -1.11%.

- “Other” durable goods: -0.37%

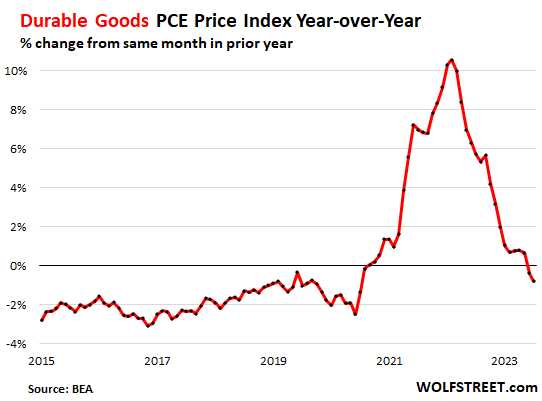

Year-over-year, the PCE price index for durable goods fell by 0.8%. The index was negative in the years before the pandemic as a result of manufacturing efficiencies, offshoring, competition, and the infamous hedonic quality adjustments that remove the costs of improvements from the cost base, on the principle that consumer price inflation is the change in dollars to buy the same product over time, and cost increases due to improvements are not inflation. Here is my explanation of hedonic quality adjustments, including my chart of prices of the F-150 XLT, the Camry LE, against the new vehicle CPI, to demonstrate the perverse effects of these adjustments.

The durable goods PCE price index is now normalizing. Absolute prices of durable goods remain high but are giving up some of the ridiculous price spikes of 2021 that had been caused when an overstimulated consumer ran into supply disruptions and was willing to pay whatever:

The core PCE price index, which excludes food and energy products, was revised higher for June month-to-month (was 0.17%, now is 0.21%) and accelerated from there in July to 0.22%, on the mix of the surge of the core services index (+0.46%) and the plunge in the durable goods index (-0.65%):

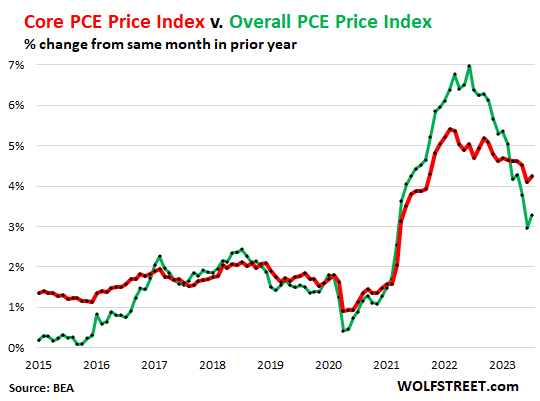

Year-over-year, the “core” PCE price index, the inflation measure favored by the Fed, accelerated to 4.2%, from 4.1% in June, over double the Fed’s target of 2%, and going in the wrong direction (red line).

The overall PCE price index accelerated to 3.3% year-over-year, pulled down by the 22% year-over-year plunge in energy prices (now abating), which caused the overall PCE price index (green) to remain below the core PCE price index (red) for the fifth month in a row. And both are going in the wrong direction.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, this is being interpreted on Wall St. as a good enough report for the Fed to end its tightening campaign do you agree?

Did you read the article even??? It will answer your question. At least read the headline, LOL

RTGDFA

Inflation is here to stay forever unless we get human population under control. We have more babies coming onboard everyday means more consumers everyday sqeezing out ever dwindling everything. 50 % reduction honestly will be a good start.

Get lost with your depopulation agenda, Klaus Schwab.

Elon musk? Ramming rears will fix that buddy

ummm…

no.

the number of people isnt the driver.

population could double, but inflation would remain the same if all those ‘extras’ dont have any money to spend.

its the AMOUNT of dollars in ALREADY existing people’s hands, getting spent all over the place.

its the AMOUNT of (negative) dollars the USgov’t creates with its profligate deficit spending quarter after quarter.

It’s not that simple. In fact, one could argue that less workers in ratio to the total population size results in higher price inflation. Lots of work to do, but not as many people available to deliver the needed products and services. When supply can’t meet demand, prices increase.

The Ant and the Grasshopper.

JD – increasing, rather than decreasing the value of the average human unit? Interesting concept…

may we all find a better day.

Birth rates are DOWN in almost every country in the world. PRC is shrinking; Italy has a lower birth rate. Nigeria is growing, but they will stabilize as well. The OECD countries are all shrinking. The US Congress and President need to put windows in their stomachs so they can see. The US NEEDS immigrants, especially skilled ones, who are flocking to Canada. We must control out border and allow in-migration to avoid Ja[an’s fate-to-be, where they have sold more adult diapers than baby diapers for more than ten years…

R u on crack?

I have a question. I am in the federal government retirement system currently invested in the G Fund which is tied to long term treasury yields. When I see PCE come in higher I expect the treasury yields to go up but that doesnt always happen. Is there something that I am not understanding?

“Is there something that I am not understanding?”

Yes:

1. the market. Treasury yields are the result of bets in the market, and currently short-term T-bills pay 5.5% and the 10-year yield is 4.1%, … the market.

2. Incessant pivot mongering for the past 18 months has kept the month-to-month hope alive that “soon” Core PCE will plunge to 2% and the Fed will cut rates to 2%, and then the 10-year at 4.1% would look OK.

Spot on

If you can, I would highly recommend switching out of the G fund and into a shorter term bond/money market fund, which will provide you with:

a) better protection against inflation, and less potential for a drawdown in value if long term rates rise more.

b) a higher current interest return

3 month bank CD’s paying 4 to5 % interest right now.

G fund cannot suffer “drawdown” based on rates. It’s a fake investment.

Howdy Steelers Fan. Congrats on saving some of your hard earned $. If investing into the G fund is through the TSP? Good for you. NO income tax and can move the $ between funds. Win Win

Best bond fund in the world, Bubba, unless you are one of those sick freaks that lives life to squeeze every penny possible out of it. And most of it, especially in the USA, is very FAR from “hard earned”….so why does everyone say that? Kinda like a social convention, like “hello”, etc?

Advertising folks are really good (and constantly improving) at putting a big ring in your nose at an early age, and hooking you up to whoever pays them the most.

Go to the TSP website and read the .pdf about the G Fund. It is NOT “tied” to long-term treasuries. It is based upon non-public issues only for the G Fund. Although not publicly traded, the G Fund runs closely with 90 day T-Bills.

The G fund is invested in special nonmarketable short term treasuries.

“Fed’s Job Far from Done”

Agreed! I’m hoping for at least two more 25-basis point rate hikes. And, I also would like to see a recession, so in my book the Fed’s work isn’t done until the later comes to pass sooner than later.

Cheers!

What would 2 measly 25 basis point rate hikes do when 550 basis points have failed to deliver? The FED needs to AGGRESSIVELY sell off its entire balance sheet until it reaches pre-COVID levels, then continue back to pre-GFC levels.

Just what would that do to have any affect on ‘inflation’ at all?

Well, let’s give it a try and see, no?

Selling its long-term bonds will increase long-term interest rates and put downward pressure on the prices of stocks, bonds, and real estate. Decreased house prices should put downward pressure on rents and, hence, inflation.

Volker clearly thought so and turned out right that time…

Misread that – aggressively raise interest rates till inflation crashes is what I had in mind…

To answer your question, I refer you to the concept of tipping points.

A) While I agree that the Fed printed an obscene amount of money since the GFC, at some point soon the combination of higher rates and a smaller Fed balance sheet will cause a financial market crash.

B) The Fed will never be able to get its balance sheet back to pre GFC levels without causing a depression.

=================

Bottom line:

When financial markets start to crash, the over indebted sectors will collapse on themselves, and that will cause a meltdown in the banking sector, which will cause a dramatic shrinkage in loans, which will rapidly shrink the effective money supply…

Because so many people use stocks as savings accounts, and so much money is created by borrowing on real estate collateral, when these 2 mega asset classes collapse, the amount of credit will collapse, which shrinks the effective money supply.

=====================

If the Fed tried to shrink its balance sheet at the same time as Govt borrowings are going thru the roof, and the banking sector is in crisis… Well that is a recipe for a depression meltdown.

Yeah baby! It’s what we all deserve for letting government corruption to flourish.

What I am looking forward to is the $1.6T monies in reverse repo’s getting drawn down to zero. I would imagine that a lot of this money is being diverted into treasuries. Once that money gets soaked up, the demand for treasuries will start to dry up. This is a really big deal. This would affect the demand for treasuries dramatically which would push yields up further.

The problem is that it will take at least 2 years to drain this out of the system. Within that timeframe, we’re probably going to have some sort of recession that will cause the Fed to spin up QE which is the primary source of the RRPO funds. Then it will just start going up again. Basically, what is happening is the Fed prints all of this QE which sits in the system waiting to be used to finance deficit spending. The Fed is literally perpetuating funding the deficit spending through QE.

Doolittle,

The psychiatrists at the Russian troll farms discovered well placed prepositions can create practically instant agreement. I don’t know where you learned it, but don’t waste it on a two-bit media empire, OK?

I take that back. I’m looking at a Waldorf Astoria Maldives ad.

Absolutely agree with Depth Charge. From my personal observations, I see that nobody cares about the rates. Most people around me are still rushing to buy a house and upgrade their cars like crazy. Especially hourly wages almost doubled since pandemic. People are switching jobs like changing their socks. Fed MUST sell bonds and reduce its balance very fast. Otherwise, 2% inflation will be a dream.

“Especially hourly wages almost doubled since pandemic.”

Not in this poor southern state. A lot more people are having to scrape. Renting has turned into a terrible situation for most. Landlords are pouring it on. Food prices are a hell of a lot higher than 3 years ago along with everything else. I think at least the bottom 50% will have to grub out a living now.

My wages havent doubled. Since I’m union we’re locked in at a contractual rate, and I think this year was a 3% raise. Doesn’t help when inflation is raging ridiculous in NY and the cost of everything is way more than my meager 3% could afford. Heck even my companies medical went up more than 3%, so my entire raise is lost in that and then some.

“when 550 basis points have failed to deliver?”

How do you know this? Because inflation hasn’t dropped as much as we’d like? It’s highly likely, although equally unprovable, that inflation would have continued to rise and would be well north of 10% without those 550bps.

But I’m with you, dump the QE portfolio a hell of a lot faster than they are. The longer inflation lasts, the more it costs us. It has to be worth something to incur some pain from a more rapid QT.

I don’t think we’ve begun to see the tremendous carnage that will take place in CRE, and unlike Helicopter Ben, who should be in leg irons, there WILL be contagion. Hundreds of billions haven’t re-adjusted to current rates…

I think it’s been 525. We started @ 25, right?

What part of “at least” did you not get? I don’t see the Fed pushing the FFR much past 6%. Just to get to 6% is going to require 10x more FUD from the gurus calling for the pivot.

Either way, 2 more MAY create sufficient downward pressure on equities. I’d like to start there with at least a 10-15% sell off. We need downward pressure on the wealth effect.

I agree with the Fed balance sheet selloff, but this isn’t going to happen.

Won’t happen, you’ll be lucky we get another .25 basis point hike….once again I am really I hoping I’ll be wrong so let’see.

Correct. The Fed is terrified of “overtightening” despite ample real-time data showing that the tightening so far has been insufficient. So we’ll be lucky to get one last 25 bp raise; and an increased rate of balance sheet reduction simply will not happen, no matter how necessary it may be.

I hope you are both wrong. Powell seems to be in this fight for the long haul, but I certainly understand being skeptical given the Fed’s track record, especially since the Bernank. Well, Greenspan too most definitely.

There’s another problem brewing that is going to become a direct problem for the Fed in the next year or two.

Wolf’s last article has a graph of the government’s interest expense as a percent of tax revenues. It’s showing a darn near straight line up, easily the steepest sustained period in Wolf’s numbers. And there’s nothing happening right now to even slow it down. It will climb aggressively while record low-interest gov debt matures and is rolled into new higher interest debt as the gov continues on its orgy of debt issuance with no end in sight.

At this rate, by the start of 2024 we’ll cross the line where the gov collects $1 in tax and immediately spends over $0.50 on interest alone. The gov danced around 25 cents on the dollar for the last couple of decades. Where will we be toward the end of 2024? 75% of tax revenue going straight to interest on debt? Either we see a blend of massive spending cuts with massive tax increases (politically impossible) or the Fed breaks under political pressure as they typically have for at least a couple of decades.

The Fed and Congress are in a game of chicken and Congress doesn’t have enough political will or even enough cumulative brain function left to flinch. We can’t be spending 70%, 80%, 90% of our tax revenue on interest, so we WILL print it and skew future interest expenses in the gov’s favor by breaking lower on interest rates. Not sure exactly when, but it’s seems almost inevitable. Welcome to the debt spiral.

“interest expense as a percent of tax revenues… will climb aggressively while record low-interest gov debt matures and is rolled into new higher interest debt”

This graph concerns me as well. Not only that, but if we start to have an actual recession (combo of stocks falling and/or job losses), then tax reciepts will fall as well.

The Fed will lose the chicken race.

Remarkably (cough), The Wall Street Journal and CNBC looked at the same data and are currently spinning it as good news.

Agreed. A lot of financial media was downplaying this; they were saying how the PCE data came in line with expectation while monthly inflation cooled. But MarketWatch was pretty honest in its reporting today – the PCE ticked up and leaves Fed with more work to do.

These young reporters with their recent degrees in journalism don’t look at the actual data. They wouldn’t even know what to look at. And they don’t have enough time to even download it and look at it. All they do is look at the top part of the press release from the BEA and make a story out of it. And in many cases, that story needs to be in line with the narrative of the paper. That’s what journalism majors learn how to do.

It sounds like those “journalists” could easily be replace by generative AI (unlike WolfStreet :) )

Yes, and they are being replaced. Major papers have been publishing AI-written (and maybe human-edited) stories for years. And they’re getting better.

I will defend my little human-to-human corner for as long as humans read my stuff…

Gotta keep the Bidenomics lie alive as those media establishments went all in on supporting and grossly lie about everything concerned with him.

Why stop now?

You liked last guy’s lie “establishments” and lies much better then, I take it?

I guess we all have our favorite lies.

They would Spin neutron bombs dropping on all Major US cities as “good news” because for some non-seqitur reason it would cause the Fed to “Pivot”.

So, the current USA human condition then becomes, “Who’s lies does one like to read and repeat the best”?

There are probably a few “reasons behind our choices, which are likely some kind of media lies also, yes?

That’s as good a definition of this so called “critical thinking” (or lack thereof) as I have heard.

MW: The U.S. dollar strikes back: What’s next after August’s rally

But CNBC is telling pivot coming

No, they most certainly are not, but IDIOTS have been saying that this entire year and into last year.

A 21.6% increase in financial services and INSURANCE? That’s highway robbery.

The problem with insurance is that so much of it is mandatory, legislated by law. Whenever someone is cornered by the marketplace, price gouging is soon to follow. Pair this with the fact that we live in an “oligopoly world” where only a few major companies compete for all the business there is to be had, and you’ve got the makings of a perfect storm of pricing.

Those insurance companies have exposure to USA gov bonds and don’t have access to the same facility setup to save banks from having to mark their bonds to market.

Many states allow you to put up a surety bond to forego having insurance for auto or home (if mortgaged) but that money sits there doing nothing.

Insurance companies take in your money and THEY get to put it into “the safest asset in the world”.

You zig, you zag – it don’t matter because it’s all stacked against you.

Most states allow you to post something like a $10,000 bond for car insurance. You don’t require home owners insurance if you pay it off. You don’t require insurance on paid off rental homes. You don’t require health or life insurance…

Not saying it’s wise to drop insurance, but the requirements primarily exist to protect the financial interests of those that hold your VOLUNTARY debt.

If you can afford to lose it, don’t insure it. If you don’t want to pay it, don’t take on debt that requires it.

It’s hardly mandatory.

Agreed. And in my view, the minimum amounts states require for car insurance are WAY too low.

Low limits are perfect if you’re a working class driver. It’s almost unheard of for any single accident settlement to be more than the policy limits. It’s not worth it for anyone involved to go after someone that’s a wage slave given there’s not much to bleed. Having a high limit actually increases your chance of getting sucked into a drawn out settlement, full of discovery and the slow walk through the legal system while your insurer protects it’s piece of the high limit you are carrying and the other insurer smells blood.

But I’m all for premium adjustments where they are truly merited – people driving assault vehicles that are oversized, have a poor field of vision and cause excessive damage and destruction in accidents, with extra high increases for modified vehicles and also those motorcycle riders that go helmetless so they turn broken bone injuries into 7-figure brain damage injuries that society covers the tab for. That’s the real problem with auto insurance – it doesn’t come close to covering the real costs associated with anti-social decision making that our unlimited freedom consumption economy encourages.

It’s not mandatory that I cease to exist in the long (usually painful) USELESS drawn out manner that enables you hustlers to buy and fly airplanes, either….

Ohhh…those pivot folks are going to be disappointed….they got a major hard on yesterday when job opening data looked slightly weaker and rallied up the market, guess they are still in denial today as the market just barely down…

That’s some strong hopium there…junkies need their next fix soon…

The pivot is coming soon.

It just depends on how you define “soon”. It’s 2025 for me. And beware the pivot. Falling rates after a huge runup is almost always coincident with recession. Same goes for yield curve uninverting after being inverted.

Either way, the only thing that will get our world and economy back closer to on track is a good ol fashioned nasty recession. My guess is this time it will start from the top down….and wipe out a whole bunch of stupid money at the top of the heap.

I went into a store last night to buy groceries, and it’s truly insane to not take into consideration that food is a luxury item. It’s as if every product is a cog in the price gouging wheel.

Meanwhile, housing costs for buyers or renters seems to be connected to that same mentality, of testing the waters, to see how high or far things can be pushed — looking for a breaking point.

The pandemic resilience mentality is all about tunnel vision and tuning out everything about the past, as we embrace the dawn of a better AI world.

Additionally, nothing is going to break, because this time is different, primarily because people have unlimited incomes, backed up by a Teflon market that can adjust to ever expanding delusion.

I watch coupons. Pork and chicken has dropped to Pre-Pandemic levels on sale or with coupons. Eggs have plummeted but not quite to that level yet.

Even “luxury items” like soda have dropped. $3.99 for a 12 pack at Kroger this week with a coupon. I haven’t seen that price since 2018.

Most people are buying prepackaged food items. I see few people in my local store buying ingredients. The spice aisle is the loneliest spot in the store.

The spice aisle should be lonely, go over to the bulk food bins and buy your spices there for 1/10 the price!

I see that at my local grocery… ballpark 60% of the store is prepackaged food including deli and bakery, 25% dry goods and supplies and the other 15% ingredients (I include canned goods in that…)

Chicken dropped? B.S. unless maybe you live on a poultry ranch?

Whole Foods breasts went from 3.99 about 6 months ago to 4.99 and now 8.49 this week. Same pattern at Trader Joe’s, just take $1.50 off it. 4 rolls were 2.99 last week, 5.00 this week. I could go on and on.

Chicken hasn’t dropped for me, but has barely gone up in price for like 10 years. I buy Costco’s boneless skinless chicken breasts (like 12 breasts split into 6 plastic sections refrigerated). Anyway, it was $2.99/lb (about $20-30 a pack on avg) for as long as I could remember. Then it went to $3.49/lb earlier this year and it caught my eye. 17% price rise over prob 10 years at least (and same price in 4 different states I’ve lived in over that time). Eggs have gone up…lowest price was 90 count for like $5 back in mid 2010s, but then they switched to cage free and price went up then avian flu or something happened and went up again. Now it’s like $10-11 for 60 count. Bananas were always $1.39/lb for as long as I can remember and then up to $1.49/lb recently so my personal food inflation not much…

I went to eat at a resort hotel i am staying at. 9% tax and they expect you to tip a minimum of 18% but the good tip button but if you had great sevirce 22% and WOw service is 25%

You have to be prepared to add 30% to any meal these days.

I wish we would just get ride of the tip and pay service people a normal wage as in Europe.

Don’t act like it bothers you. (OK to bitch here)

You will lose “obviously quite wealthy” points with the other players there.

Too little too late.

According to Wolf, core services prices and labor have increased.

Nobody poor should be going out to fast food for a $10 Happy Meal or a $12 Big Mac deal. It is much much cheaper to eat healthy at home. Eggs, pork, chicken, rice and beans have gone down.

I agree that even healthy food has gone up but it is far cheaper than fast food or processed food.

Leave the fast food for the middle and upper middle class who have not started watching their budgets yet due to wage increases and PPP.

Poor people pay rent too. And buy used cars to get to their jobs. And have medical bills. I wish inflation was limited to mcnuggets.

How can you so callously say that poor people don’t need to eat fast food, and so this type of inflation is okay.

Higher for longer Fed has some early sept CPI but I say 80 percent chance of hike in Sept . Higher for longer . I was hoping things were cooling off more but not in the forecast and is staying sticky .

Meanwhile in Canada, this politician wants the Canadian dollar to become a peso or what?

Dirk Meissner, The Canadian Press

Published Thursday, August 31, 2023 2:37PM EDT

VICTORIA – British Columbia Premier David Eby is calling on the Bank of Canada to halt further interest rate hikes.

In a letter Thursday to Bank of Canada governor Tiff Macklem, Eby urged him to consider the “human impact” of rate hikes.

The Bank of Canada is set to make an interest rate decision next Wednesday.

> Three major Canadian banks have disclosed that about 20 per cent of their residential mortgage borrowers – representing nearly $130-billion in loans – are seeing their balances grow as their monthly payments no longer cover all the interest they owe.

Close to the end game for Canada now.

Soft default or hard recession?

Canada GDP stalled last month, signalling a recession.

The 5% GIC rates don’t mean anything if the CAD is devalued by another 25%

it was worse than stalled. It was flat nominal but our population went way up. Per capita GDP fell 3%.

And of course even that is a huge lie as inflation on stuff people actually buy on a weekly basis is worse than the figures suggest.

Get ready for the winter:

– falling CAD

– healthcare teetering and covid / flu / loads of old people

– recession now that every homeowner doesn’t get 30k tax free every year

This monetary system has been Made to create free Money.That’s what it does. That “s its function. And it’s impossible to control where it’s going (other than some pipe-dream of a “digital currency” that didn’t even Work in communist China). Trying to keep this monetary system from creating free money is like trying to make a bycicle Drive Backwards. the most brutal rate-hike cycle in monetary History didn’t even make this monetary system flinch. It just shrugged it off and went on doing what it does -create free money.

The Fed is completely useless.

DC could top that in his sleep.

MW: October WTI oil gains $2, or nearly 2.5%, to settle at $83.63/bbl on Nymex

Rice, beans, green beans, tomatoes/salsa, and apples/oranges provide all the nutrients required for a healthy diet, and have not increased that much in price relative to rents….While being relatively affordable for even poor people who can boil water to cook the rice and beans.

———————

If the U.S. govt spent a tiny fraction of their budget building affordable rental housing , they could earn a very nice financial return, while greatly benefiting everyone in society…

Unaffordable housing stresses everyone including wealthy people, who suffer from crime, which is caused by overly expensive housing.

The Federal, state, and local govt own a lot of land that could be turned into very low cost rental housing. You can buy a nice tiny house for $50,000, and if you rent that home out for $500/month, or $6,000 a year, that is a return of over 10%.

———————

But, the bankers only want to see their collateral rise in value…

= Why our govt prints and spends too much money, while failing to increase the supply of affordable housing.

———————–

“Money is the root of all evil”

And guess who controls the money?

The corrupt lying cheating bankers on Wall St., who essentially control the Fed and our entire govt.

= The system is rigged….

Why do people believe the govt would be able take taxpayer money and invest it into rental housing and make a profit? Doesn’t anyone remember the “affordable” housing built in the ’60s and ’70s in the big cities that is now slums? To quote a(n) (in)famous American, “C’mon man.”

No, we don’t need more govt ownership of private property. We need less.

I think most slum properties are owned by the private sector.

You did not even read the analysis I provided, because your ideology blinds you to reality.

The affordable housing that was built for many decades provided low cost shelter, which kept people from being homeless….

The founder of Starbucks grew up in govt built housing… Would he have been better homeless?

You are clearly and totally removed from the reality that poor people face.

Please leave the analysis of reality to people who actually care about solving real problems affecting people who need some basic help.

The monthly rise in Core PCE is the most interesting figure to me. The Fed will not reduce inflation by moving to a pretty much normal Fed Funds Rate (around 5%). Okay, admittedly they got there fast, but they also had a decade of ZIRP. Nobody knows where they have to go to get to their goal of 2%, but higher for longer seems pretty much assured.

I agree with many on this board, that .25% increments are not going to do much. The economy will adapt, as it has. I realize Powell does not want to upset the stock market, but maybe some sort of “intervention” or shock therapy is needed to get the pivot junkies back to some semblance of reality. But we have to realize Powell and his board and members of Congress probably own a lot of stock and don’t want to take a big hit. Death by a thousand cuts, or the slowly boiling frog.

It is interesting that everyone blames the Fed for inflation. I am not saying the criticism is not warranted but what would also help is for the government to reduce their deficit to zero.

Bingo. Let the damn government shut down at midnight September 30. No kicking the can with continuing resolutions either.

riiiiight.. because that has a non-zero chance of happening..

you might as well have suggested that people just stop buying things altogether. that would help too, ehh?

It is the madate of FED to inflation at 2 percent.

Does the government has such mandate ?

The Fed has a 2% mandate?

Surely you all meant to say use 60’s tax schedules plus a real nasty estate tax schedule.

I know you all can think better than that.

The Fed is the drug dealer. The government is the junkie.

Your comments suggests we should shift blame from the drug dealer to the junkie. That’s the wrong answer. Absent the drug dealer, there would not be any junkies.

Bloomberg reported “Core price index posts smallest back-to-back gains since 2020”. They then gush from there how great things are looking. When I saw that I immediately came here to get the whole context.

It’s amazing how they can find one little speck of truth and extrapolate it to paint a narrative The core price index is a blend of goods (falling) and services (rising). The year over year increase in that index is still over 4% as Wolf mentions.

Thank you again Wolf for giving us the entire picture.

Bloomberg uses AI for some of its articles. So maybe that was the problem.

Of course inflation is rising again. Powell is trying to fight inflation while maintaining sky high asset prices at the same time (by slow-walking QT). It’s another game of kick-the-can.

Sell the darn MBS!! Asset prices will drop 10-20% and inflation will halt instantly.

Powell can’t sell the MBS ever. The Federal Reserve would have to discount the securities to reflect the higher interest rate environment, resulting in taking a loss. The Federal Reserve doesn’t produce any goods or services, nor do they have taxation authority: therefore, the Federal Reserve can only fund their experiments with inflation.

The Fed creates money and can therefore never go bankrupt. So it doesn’t care one iota about making losses. It’s already making hefty losses. It doesn’t matter if it makes more losses. It can sell the MBS just fine, and a few Fed governors have suggested that the Fed should sell some of them. But that discussion died down in March 2023 when the banks collapsed because the price of the securities (including MBS) had plunged.

Right now the FDIC is selling those MBS at a rate of about $4 billion a week, and until those are gone, the Fed won’t even discuss it.

And as long as all three branches of government continue to spend trillions like they were millions, dumping loads of cash into the economy, interest rate hikes and QT will do nothing to slow inflation.

Surely delaying selling MBS delays the removal of those $$ from the economy? Or is it just a wash as the MBS could be used as collateral?

The Federal Reserve has $2.5 trillion dollars of MBS on its books. If the Feds think $4 billion a week is a maximum then it will take $2.5 trillion ÷ $4 billion/ week = 625 weeks or 12 years for the Feds to end their holdings.

1. This is BS. MBS come off the balance sheet via pass-through principal payments because homes are sold or mortgages are refi’d and as regular mortgage payments are made. They also come off when the MBS are called after a few years when the mortgage pool shrank a lot.

2. MBS don’t live to maturity.

3. Selling MBS would simply speed up the process.

4. The FDIC sits on $100 billion in securities and loans. Selling $4 billion a week seems about right. The FDIC is not the Fed.

5. Don’t you ever read any of my articles on the Fed’s QT???? But you feel compelled to comment on this stuff?

Hey….nothing that radical right now.

I want the inflation during the Soc Sec months real real HIGH….what are they, Sept, Oct, Nov?

I’m just greedy, sorry…..

1) Kings were fat. In Asia people lived on rice for thousands of years.

The Irish ate potatoes for hundreds of years. Okinawa yams.

We are overweight, because we eat like kings. Obesity became global.

2) Dr Nathan Bryan : in the bezel of our blood pipeline, in the Endothelial cells, we produce Nitric Oxide, a gas, that lives only 1/4 of a second. NO dilate our capillaries when we run and keep them healthy.

3 ) As we grow we lose 85% of Endothelial NO production.

4) Oral NO production : when we chew dark leafy green vegetables : Kale, Swiss, collard, broccoli, beets…bacteria in our tongue, saliva and few

drops of balsamic vinegar produce NO.

5) Avoid mouthwash and brushing with toothpaste with flourine.

6) It doesn’t cost much to improve your health, to avoid the doctors, the dentist and pharma

Not bad….there is kinda sorta true stuff in there. Better than I could have done with charting, that’s for sure. That out of Nature or Science on the NO stuff and (sorta) translated?

There is a certification for bio-sciences journalists, kinda like ASE in car repair. In fact for all journalists….helps with hiring.

I aced the 10 question practice test, 70 is passing.

Thank you!

PS; Dentist is ok guy, and use baking soda, LOTS of it…..and pack/push it in, don’t brush much…worn out flattened brush is best. You are chemically trashing their houses before it becomes plaque.

Wolf– About a year ago we had a disagreement about inflation. Your view that the price rises had virtually 100% to do with inflation that we were stuck with probably forever. My position was that we could not be sure that at least SOME of the price rises was do to goods shortage–as Economics 101 would expect.

I thought of an interesting test -using FUTURE data on Durable Goods price CHANGES that you showed have now gone down to zero. I’m glad you now agree that supply disruptions COULD have been at least PART of the cause:

..” an overstimulated consumer ran into supply disruptions and was willing to pay whatever:”

So we agree now. But– since your graph is for price CHANGES — and the CHANGES are now down to zero– the graph confirms that durable goods have now jumped up from 2021 to now.

IF this graph in the future for durables blips down BELOW ZERO for a short time that WILL NOT mean inflation has gone down. It will just suggest that PART of the cause for durable goods price rise was due to supply disruption rather than permanent inflation.

So will durable goods prices soon take a short, temporary blip BELOW zero– or not! If it does, that suggest that supply constraints were at least PART of the cause. If not– I’d have to say you were likely right, they are now stuck higher–there was no price effect on durables due to lack of supply.

LOL.

I went back to your comments (not hard to do for me since you haven’t posted that many comments).

You said inflation was caused by temporary shortages, and not by the Fed, and once the shortages were over, inflation would go away.

So that was cute.

I said that inflation was caused by a variety of factors including that consumers went on a buying binge and paid whatever because the Fed had thrown trillions of dollars out there, and the inflationary mindset had set in, which is what I’ve been saying for two years.

And now the inflation is entirely in services, and there are no more shortages. I told you then that you don’t get it. Inflation is a much broader phenomenon than just some shortages.

Sounds like a misunderstanding between us. Anyway, whatever happened then, I’m definitely a believer now that inflation is happening in services. A lot of service workers were getting under $15/ hour then. How they could survive on that with rents what they are I have no clue. So I’m not too unhappy that they are doing a little better.

Wolf,

What is your opinion of the labor unrest in Japan (mild unrest by US standards, but still happening)?

Do you think we are going to start seeing enough political pushback in Japan that it will start affecting policy?

Yeah, like their diets were healthy, ever.

This doesn’t seem to bad. People can do without a lot of those services and will when they have to. Durable goods are more important and they are coming down. In total this is ok. The economy is strong.

What was much more worrying to me today was the sales ban on AI-chips to some Middle Eastern countries. Cold War Two intensifies and is a drag in so many ways…

Yeah, but why should they have to so that the Fed can protect the banksters?

Thomas Curtis,

“People can do without a lot of those services and will when they have to.”

Jeeesus. What obliterating nonsense. You’re talking about being homeless.

Services include housing, healthcare, insurance, education, communication services (so you can post silly comments here), etc.

“People can do without a lot of those services and will when they have to.”

Yep, cut back and save money.

1. skip paying your property taxes and have the state put a lien on your house.

2. skip paying your local income taxes and get fined interest and penalties.

3. Drop your homeowners ins and pay out of pocked for a new $800K house in case of fire or natural disaster, or when someone breaks in and robs you, or someone gets injured on your property and sues you.

4. Drop your health insurance and then go bankrupt when you have a major illness.

5. Skip paying your electric bill, and have your power cut off to your house. Same with your water and gas bill.

6. Get rid of your high speed Internet, and go back to dial up internet with telephone (RS11 lines) or couriers to deliver important documents.

Most services that people buy are necessities. They are going up at near double digit rates of inflation already and will be accelerating more in the very near future.

small price to pay for the benefit of 1%

As always, a lot of interesting comments, feedback, input, etc. about the inflation rate to which I would offer two thoughts:

– First, service inflation can be more problematic to people than product/goods inflation as various services (e.g., auto/home insurance, healthcare services, doctors/dentist visits, haircuts, etc.) are generally viewed as “must” haves rather than “nice” to have. Goods and durable goods purchases can often be delayed/deferred if money is tight but certain services are absolutely essential. What I’m wondering is if we’re seeing the consumer having to trade between essential services and nice to have goods purchases.

– Second, everyone is focused on interest rate increases which Wolf has already documented appear to be a net zero sum game (i.e., some people paying more but others are earning more). What I believe the Fed needs to do is accelerate its QT program given the absolutely huge increase in its balance sheet over the past decade plus. If the Fed wants to get serious and begin to inflict some pain and deflate asset prices, a more aggressive QT runoff is going to be needed.

In any case, I agree with Wolf as clearly the Feds job is not done and actually has a long way to go. I suspect that in one fashion or another (barring an economic collapse and depression), the inflation fight is going to take years to finish and will need to be waged at both the monetary and fiscal levels (as government spending and deficits are out of control). The only question is, who wants to be the “fall person” for doing what’s necessary and instilling renewed financial discipline in the economy and markets. Certainly not the spineless politicians that have not displayed any backbone for the past two plus decades.

Man you guys are ripping on this poor guy but there’s some truth here. You can cut back some on some services. It’s possible to learn to fix your own house wiring, do your own plumbing, chop down your own trees, mow your own lawn. You may need to buy the car but you don’t necessarily need to pay someone to change the oil. I believe when times get tough and labor prices get high, people do cut back on services and will find a way to go without several. Yes, some services are impossible to eliminate. When times are good it’s easy to pay others to do things for you because you a)don’t have the time because you’re so busy working and making that $$$ and b) you made all that $$$ so you might as well spend it paying others to do the things you don’t feel like, which falls under services

its POSSIBLE to do alot of things..

but do you get out much??

80% of people have their phones do nearly everything for them.. its becoming worse and worse. this is not the 1920s, where most people had a natural sense of ‘self-sufficiency’.

society today COULD NOT handle a repeat of the great depression. it would become total chaos. that much is absolutely obvious. i say this as a younger person, who is working out there around the public on a regular basis.

comfort and convenience have become the norm to a degree unprecedented in history, to the detriment of society as a whole. i am not advocating for a return to the stone age, either..

True but the bottom line is that on some level if the public cannot afford all the services it demands, then it cannot have all of them.

Some trade offs can be made, despite dependency issues.

The choice of who to punish is clear. Either the fiscally irresponsible with a lot of debt or those who are debt free, plenty of cash and cash equivalent investments who have managed their finances well for many years. The first group includes our government and the Fed. The second group is old people trying to live on 0.01% interest savings.

Exactly. Back when NYC and other jurisdictions imposed rules requiring calorie counts to be posted, the stated reason was because the poor were obese because they didn’t know what they were eeating.

Well, as it turns out, only fit, upper middle class people even LOOK at the calorie counted posted on the board. The poor largely don’t care.

The poor also disproportionately smoke cigarettes and do other things that are bad for their health.

In my view, poverty doesn’t cause poor health. They’re both symptoms of the same disease, that disease being a lack of ability to forgo in the present things that will make things much better in the long run.

In my opinion, the main problem with poor people is that they never took the time to learn how to inherit great wealth.

Prejudge much?

You judge all poor people as if they are a different type animal.

I judge you based upon your prejudice to to be an uniformed bigot!

ob Stokes: Social mood governs the actions of investors and central banks

The image of the Federal Reserve has been much like the Wizard of Oz behind the curtain — pulling just the right levers in the right way to keep the economy humming and the stock market climbing.

However, this is a misconception. As Robert Prechter states in his “must read” book, The Socionomic Theory of Finance:

I studied the Fed’s historical actions and realized that the Fed does not act; it reacts. Social mood pushes the economy around, and it also pushes the Fed around. I realized if you know the trend of social mood you can predict what the Fed will do, but the Fed’s behavior tells you nothing about what financial markets will do.

Nonetheless, investors far and wide still pay close attention to Fed announcements, wanting to glean what’s next for rates, the economy and stocks.

For example, consider this news item from May 19 (CNBC):

Federal Reserve Chair Jerome Powell said Friday that stresses in the banking sector could mean that “our policy rate may not need to rise as much as it would have otherwise to achieve our goals.”

However, the bond market will do what it wants to do, no matter what the Fed says.

On Aug. 21, there was this Bloomberg headline:

Treasury Yields Hit Highest Since 2007 on Elevated Rate Fears

In other words, the mood of investors drives the trend of bond yields (and interest rates), and the Fed reacts.

Actually, all you have to do to know what the fed will do next, besides pay attention to what they tell us in advance, is follow market interest rates. The fed always FOLLOWS the market. They never lead.

Nope. Both of you are confusing cause and effect. Easy to do.

The Fed TELLS the markets well in advance and even in writing (Dot plot, etc.) what it will do over the next few months and further out, and I explain it to the market in my articles when the Fed says this, and then a month or two later, and further out, the Fed does what it said it would do, and what I said it would do months earlier, and eventually the market followed the direction and prices in what the Fed said it would do. That’s how that works.

My advice: unsubscribe from EWI marketing emails :)

I just bought 2 new tires. They cost the same as the 2 bought last year but the Replacement insurance and the installation charge doubled.

There are many dynamics inside the inflation story, but in the current context, I think the Fed plays a pivotal role in contributing to the current chaos. Some blame goes to congress and politicians, but one way to look at this, is to think about bird feeder.

If consumers, private equity and Wall Street are given easy economic conditions, where gorging is encouraged, then the normal economic environment is disturbed.

The Fed has stuffed the economic bird feeder with nonstop seeds, to a point where the birds are overly dependent on an easy nonstop stream of birdseed.

The birds are so addicted to gorging that they’ve forgotten how to forge for food. The spilled grains on the ground are unimportant, because the feeder is constantly refilled.

Nobody understands scarcity, nobody understands sacrifice or the concept of cutting back — everything is based on the illusion that everyone can have anything, because failure doesn’t happen and everyone knows the bird feeders will be refilled.

Inflation has rotted my brain

The US government alone has spent something like $25 TRILLION since the beginning of the COVID drunken sailor mania, over 3 years.

That’s like a 3rd of GDP conjured out of thin air.

That means for every 2 units of value you created through blood, sweat, and tears – bureaucrats at the top magically willed 1 unit of value into being.

Of course that would rot any normal person’s brain.

Tell me about it! My hummingbirds are sugar-water addicts.

Put a bit of vodka in. It’s funny as hell, honest! Guy in NM showed me trick. Had 5+ feeders (out on 40 acres), went through 5 lb sugar in a week or two. Wear safety glasses if those long beaks bother you, but my friend didn’t….they don’t think if them as a weapon he said, but it sure bothered me…too fast, even drunk.

With Federal spending completely out of control, the Fed has no choice but to jack up interest rates and trigger a major recession or depression. I wish this were not true but it is. These crooked brain dead politicians will not get the message until this is done. Currently, I see not even the beginning of a recession here. Every place I go is packed with people spending like drunken sailors. They are using credit cards like it’s real money. Traffic jams are worse than pre-pandemic.

Credit cards are real money when they are paid off in full – which is exactly what most credit card users do – when they are due each month.

Also function as a 30 day no interest loan.

Swamper, I see no slowdown at all either. Probably because there isn’t one. You’ve seen GDP, you’ve seen consumer spending. All solid growth.

I’d go so far as to say places like $6 cappuccino shops are busier than ever. And two homes in my watch area just sold at shocking record per sq ft prices above $6 mil. I couldn’t believe it.

Problem with the Fed cracking the economy, Congress will just raise spending even more as stimulus. How to take the Congressional credit card away?

Ten years ago I remember the Fed fretting that they were doing all the heavy lifting to support the economy, and desired more help on the fiscal side. Be careful what you wish for.

It’s amusing how the same (older) folks who were gloating and bragging about how much their house and stock portfolios had “appreciated” are now starting to complain incessantly about how high property taxes, insurance, HOA fees, vacation and travel expenses, hair and nail salon fees have soared – and act like we now should feel sorry for them because they live on “fixed incomes” or whatever.

Like, for real…you thought that Gen Z and Millennials, the young people who were unable to benefit from lower house and stock prices because they weren’t born in the right time period, were just going to toughen up and take a financial reaming in the hindquarters, but that somehow you would be spared a similar fate?

“It’s amusing how the same (older) folks who were gloating and bragging…now starting to complain incessantly”

Where did you get that from? Did you imagine all these people, or do you know tons of “older” folks who really did brag and now complain? I know of no such people. Jeez, man.

Touch some grass and talk to real people off the Internet. The gloating about house values (and the associated complaining about property taxes and insurance prices) is literally everywhere.

If you lack free time or social skills, however, look up Michael Bordanero on YouTube. He just released a video today diving into this subject in detail titled “These 2 Expenses Are BANKRUPTING HOMEOWNERS.”

Electric rates Texas just checked current rates online. I have a 11 cent/kwhr rate in Jan for 3 years that was 50 percent higher than my previous rate . The latest quotes are 13 cents/kwhr for 3 years which is 10 percent higher . Please we need higher for longer rates and get services inflation under control!

Is electricity really something people can cut back on in Texas?

That’s 1/4 the rate in So Cal. How is that even possible?

Electric Co Ops.

In San Diego on peak max rate is 84c per kwh.

Then oops, 7x. Shouldn’t So Cal be the cheapest with all the solar around??

Gatto – the utilities don’t own that much of the solar plant. That which is grid-tied is ‘net-metered’, generating a lot of value-strife between that which the utilities pay solar-producing homeowners for their output vs. the cost to the utilities for construction/maintenance of the distribution grid and utility stock value…

may we all find a better day.

The emerging trend seems to be disinflation or outright deflation in durable goods, but stubborn inflation in services and a likely rise in non-durable goods inflation later this year.

Call it the “we have too much stuff” effect or something.

Hear Hear!

Lol. Don’t worry Carlos. You have not missed the next big run in house prices. 15 years from now you will think todays prices were a bargain when the government debt is at 50 trillion and the fed is printing and buying 1 trillion a year of treasuries.

That is the path we are on

Federal government debt has nothing to do with housing prices.

“Federal government debt has nothing to do with housing prices.”

Fed debt and money printing go hand in hand.

money printing increases money supply.

increasing money supply lowers the value of dollar which raises price of real estate.

ru82, you really think the Federal debt will be only $50T in 15 years? That’s basically our current deficit x 15. I’ll take the “over” on that one.

Gattopardo. I think it will be over too. I was trying to be optimistic.

LOL. Right now the CBO projects 46 trillion in 10 years by 2033. They have been underestimating by 5% to 10% for the past 15 years. I think we hit 50 trillion in 10 years….not 15.

In 2021, they projected the 10 year future budget in 2031 budget to be 36 trillion. Now in 2023 they say the 2031 debt will be 40 trillion. So in 2 years they already upped their estimate by 10% from 36 trillion to 40 trillion.

Goldman Sachs say the Inflation adjustment act will go over budget too. The CBO has not even have that in their projections.

So be prepared for more inflation caused by the government. They probably combat this inflation with another inflation reduction act. Haha. All they know how to do is spend.

> Three major Canadian banks have disclosed that about 20 per cent of their residential mortgage borrowers – representing nearly $130-billion in loans – are seeing their balances grow as their monthly payments no longer cover all the interest they owe.

Fed continuing to raise. Goodnight Canada.

Please place your bets:

1. depression or

2. soft default via depreciation

3. insane ramp up in immigration

4. Canadians agree to do actual work

Fed engineered the inflationary impulse during and coming out of COVID. Fed is full aware that inflation will continue as wages gains catch up with earlier price increases.

Fed wrings it hands and expresses its concern….all for theatre. And everyone falls for it.

Interest rates will stay pretty much where they are. No big changes. Rates will stay here for at least another 6 months to a year.

Lots of demand destruction occurring in the weeds. Mr. Curtis comment about cutting back was spot on and everyone jumped his sh*t. Of course people aren’t goin to stop paying power bill, but they will start using less. Same with everything else to pay “have to” bills.

Mike R.,

Thanks Mike.

Of course people will cut back when prices get too high and there are many services that can be cut out without impacting lives in a large way.

I find the hike in services inflation not a big deal. People have money to spend on the extra-frills so the economy is ok and no recession soon.

I didn’t notice any comments about my bigger worry from yesterday, the restriction on the sale of AI chips to at least some Middle Eastern Countries, a further dividing in the world.

Don’t sweat it. I doubt if God or Allah know what AI is, or even care. They are bigger Luddites than me.

Unless it goes into life-size sex toys…..then there will be hell to pay!

(dumb pun intended)

Inflation certainly looks sticky, and it also looks like lots of banks are still sucking off the Fed BTFP Teat. A lot of those emergency loans that banks are reliant on, are reminiscent of biotech companies burning cash, pretending to be solvent. Inflation is definitely helping to expose the zombies, but it’s still a game of whack o mole, waiting to see what accounting gimmicks are used to buy time.

Inflation recalibrates imbalances and helps burn excess stupid money. The shorelines will soon be awash with a tsunami of zombies — very ugly, but necessary.

Feeling more and more confident in stagflation for a long time.

Inflation numbers in September here should be interesting. August CPI could come in around .8 MOM.

GDP growth is supposedly picking up so here comes more entrenched inflation.

Yield curve flattens rates keep ticking up and assets watch out below. This is more when not if imo.

Gonna be rough out there

Good article as usual Wolf. On looking at your Japan section, I see the last article was 7/19 and it was really about the US National Debt, not Japan. Given that:

– you have some keen insights into Japan

– Goldman says the yen will test 155

– Ueda is now on the job and his honeymoon is ending and will now have to deal with it hitting the fan

– Japan is buying less US debt (per your stats)

– if YCC ends, the diminishing carry trade will have worldwide implications

– another rate increase by the Fed will add to the turmoil

– Japan’s proposed record size defense budget ($53B !)

I’m really looking forward to your next article on the yen or the Japanese economy in general.

Cheers!

Homeowner’s insurance premiums are out of control. Typically a premium period is one year…just like an apartment lease. So does this mean that only 1/12th of these increases are in the current PCE and will flow thru with a lag just like rents?

The typical consumer with a mortgage will not feel this cash flow hit until his escrow payment is adjusted. In the past it was yearly but I suspect the mortgage servicers can’t wait this long any more. More evidence that many consumers are liquid, but insolvent.

The water temperatures in the gulf are 3 Deg above normal. This is the fuel for future hurricanes. Insurance companies hire meteorologists to assess risk. I see premiums doubling in the next year from the already inflated levels. If you live on the Gulf Coast, I wish you luck. Mine went up 25% and I don’t even live anywhere near the gulf or the ocean.

I live in central Texas; 350 miles away from the coast. Misery loves company…mine also went up 25% this last renewal after a previous renewal increase of like 18%. It might be these homeowner’s insurance escrow increases that breaks housing more so than interest rate increases. Even homeowners with a 3-3.5% mortgage don’t escape this pain.

I heard residents of Florida can expect on average $6,000/yr for homeowners insurance. Big insurance companies are pulling out of Florida. If you live there, expect nothing but shiester insurance companies left. They will collect exhorbitant premiums and then file for bankruptcy when they have to pay for a large natural disaster.

I’m reminded of the scene from Planes, Trains, and Automobiles.

Δ P = Δ M + Δ V – Δ Y where P is aggregate price, M is money supply level, V is velocity M, and Y is GNP. Y is decreasing, V is increasing and M is hidden. This formula is derived from P =(M * V) / Y which shows growing GNP reduces inflation as more goods and services are produced. Government Spending crowds out Private Investment (i.e. Capital Spending).