Detroit automakers hugely overstocked, ready for a strike.

By Wolf Richter for WOLF STREET.

The average transaction price (ATP) for Tesla models in the US fell by 19.5% year over year in August, according to Cox Automotive. Most EV makers had been aiming for the higher end because that’s where they thought the easy money would be. But under Tesla’s attack on prices, the higher end is ratcheting down.

The ATP for all EVs fell nearly 18% year-over-year, from over $65,000 in August last year to $53,376 this August. These are massive price drops, and they’re starting to have an impact on the overall market.

Other automakers have also implemented effective price cuts via increased incentive spending, and the ATP for all brands at $48,451, was roughly flat year-over-year, according to Cox Automotive today.

For first eight months of the year 2023, the ATP for all brands fell 2.4%, or by $1,212, the largest decrease in the data going back to 2012.

The table below shows the ATP by automaker. Four of them show year-over-year declines of the ATP. Chinese automaker Geely owns Volvo and controls Polestar. Indian automaker Tata owns Jaguar Land Rover. Volkswagen Group of America includes Volkswagen, Audi, Bentley, Bugatti, and Lamborghini.

| Year-over-year % Change of ATP | |

| Tesla | -19.5% |

| Nissan-Mitsubishi | -4.9% |

| Geely | -4.0% |

| Honda | -2.9% |

| Mazda | 0.1% |

| Toyota | 0.1% |

| GM | 0.6% |

| Subaru | 1.5% |

| Hyundai | 2.9% |

| Ford | 4.4% |

| Stellantis | 4.7% |

| BMW Group | 6.2% |

| Tata | 7.8% |

| Mercedes-Benz | 12.4% |

| Volkswagen Group | 13.9% |

Consumers are starved for price cuts, triggering a surge in sales.

Tesla only discloses global deliveries, which soared by 83% year-over-year in Q2. Guesstimates peg Tesla’s year-over-year US-only increase at about 40%. In California, registrations of new Teslas jumped by 37% year-over-year in Q2, according to the CNCDA.

The share of EVs reached 21% of total registrations in California. Tesla’s Model Y and Model 3 have become the #1 and #2 bestsellers last year, and this year, they widened their lead.

Tesla has become the #2 automaker in California thanks to the price cuts, with a share of 13.6%, behind Toyota with a share of 14.7%. The #3 automaker is Honda, with a share of 9.3%. At this pace, Tesla will be #1 in 2024.

Turns out, lower prices are just what the doctors ordered, a bitter medicine for the legacy automakers with their oligopolistic pricing methods. Consumers love lower prices.

Total auto deliveries by all brands in the US jumped by 17% year-over-year in August, according to data from the Bureau of Economic Analysis.

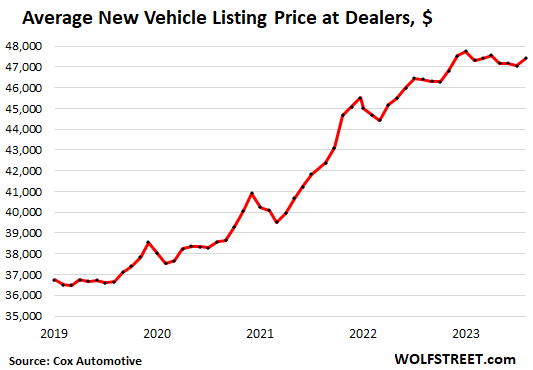

Another measure, the average listing price in August is down a hair so far in 2023.

But between the end of 2019 through 2022, in three years, the average listing price has spiked by 30%, after having already surged in prior years. These massive price increases are just toxic.

So here we go, after years of toxic price increases:

Below $20,000, hardly anything left. The lowest-priced vehicles in the US are the Mitsubishi Mirage and Kia Rio, both starting in the $17,000-range. Most other automakers have abandoned this segment.

Below $30,000 is thinning out. There were only three segments left with ATPs below $30,000 in August: compact cars, subcompact cars, and subcompact SUVs. The Bolt and the Bolt EUV, are in this category.

Lower-end models of other segments, such as Ford’s compact pickup truck, the Maverick, start in the below $30,000 range. But in terms of the ATP for entire segments, only compact cars, subcompact cars, and subcompact SUVs remain below $30,000.

The ATP of non-luxury vehicles edged up 0.7% from a year ago to $44,827, according to Cox.

The three best-selling segments that accounted for 45% of total sales in August had much higher ATPs:

- Compact SUVs: $35,688

- Midsize SUVs: $46,381

- Full-size pickups: $65,567.

The ATP of luxury vehicles fell 3.3% year-over-year to $64,107. Tesla’s price cuts dominated. Other brands in this segment where ATPs fell included Buick, Infiniti, Jaguar, and Volvo. But the ATP for Audi and Mercedes-Benz jumped by 10% year-over-year, BMW by 6%, and ATPs also rose for Cadillac, Land Rover, Lexus, and Lincoln.

Tesla has been building factories, and it has been expanding production at existing factories, and it’s pushing sales with brutal price cuts in an industry that loves price hikes.

Tesla can afford the price cuts because it had the fattest profit margins among major automakers before the price cuts. And its price cuts, which were followed by a number of other EV makers, is starting to have a cleansing effect on all automakers, whose oligopolistic pricing behavior has led to toxic price increases over many years.

These automakers set themselves up for a shakeup by newcomers, and they’re now getting shaken up, and that’s a good thing. New vehicle prices need to return to earth. And we’re going to keep our eyes on it to see how that’s going.

Putting a spark back into the below-$30,000 segment.

What the market now needs is a flood of non-luxury EV models to put pricing pressures on the lower end of ICE vehicles. Even the Model 3 is in the “near-luxury” segment, competing directly with the BMW 3 series, and not the Toyota Corolla.

GM’s Bolt starts well below $30,000, but the model run ends by the end of this year. GM has teased a new Bolt based on GM’s new Ultium platform, also in the below $30,000 range. Tesla is rumored to come out with a Mexico-built sub-$30,000 model. And other automakers will surely jump into the fray. So eventually, but not now, there’s going to be some real action in this below $30,000 price category that ICE vehicles have been abandoning one after the other.

And maybe some Chinese EV makers can figure out how to instigate a battle in the US over the below-$20,000 segment?

Incentive spending by automakers is rising.

Domestic automakers, now overstocked in many of their models (more in a moment), have piled on incentives – their way of cutting prices without changing the MSRP during the model year. Incentive spending jumped to $2,365 per vehicle on average in August, or about 4.9% of the average transaction price (ATP). But incentive spending still has a long ways to go before it reaches the 10% of ATP that was needed in 2019 to move the inventory.

But incentives on some models are far higher, reaching over 10% of ATP in the high-end luxury car segment, 8% on luxury cars, 7.3% on entry level cars, and 6.1% on full-size pickup trucks.

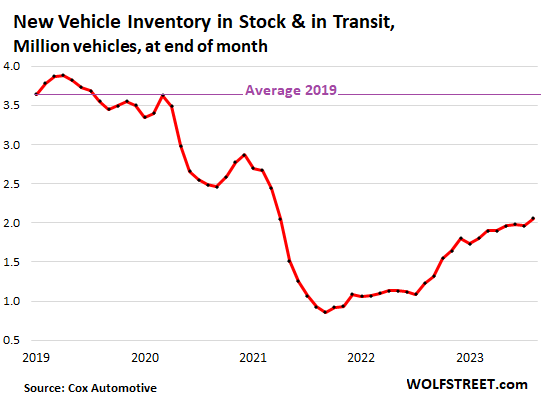

Inventories recovered, Detroit brands overstocked, ready for a strike.

Inventories at dealers and in transit increased to 2.06 million vehicles, the highest since March 2021. Supply inched up to 58 days, with 60 days’ supply being considered healthy. But it’s very unevenly distributed with some brands having low inventories, and others being overstocked.

Inventory in 2019 was very high, above 3.5 million vehicles for most of the year, with supply being between 80 and 95 days.

But EV inventories of pure EV makers are not included. There has been a lot of confusion about EV inventories. The pure EV makers – Tesla, Rivian, Polestar, etc. – don’t have dealers; they sell direct to consumers, and they don’t disclose their own inventories. Cox Automotive does not know and does not include any of their inventory data in its metrics.

So if you read anything about EV inventories or supply of EVs, it’s about the legacy automakers – Ford’s EVs, GM’s EVs, Kia’s EVs, etc. – which are just a small-ish corner of the EV market that is still totally dominated by Tesla.

Of the EVs by legacy automakers, the Chevy Bolt – one of the non-Tesla bestsellers – had less than 30 days’ supply, which means that many dealers are essentially out of stock.

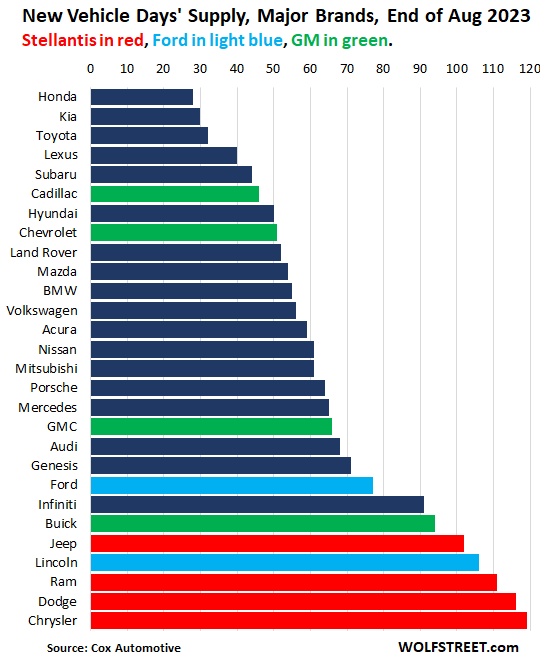

Inventory by brand ranges across the spectrum from being nearly out of stock at Honda, Kia, and Toyota dealers, to being woefully overstocked at the brands of Stellantis (red).

The Stellantis brands, drowning in inventories, could handle a UAW strike for a while before a drawdown of inventories would eventually hit sales. At GM and Ford, the situation is more mixed, and a strike could hit sales of some models fairly quickly.

Tesla and other EV brands that don’t have dealers are not included here:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What defines a luxury vs non-luxury vehicle in the context of these stats?

Price.

Hence the reason the very basic model 3 was considered the best-selling “luxury” car.

So it gets complicated in a hurry.

1. The Model Y and Model 3 are #1 and #2 bestsellers in California of any and all models. They far outsell anything else out there.

2. The industry divides the entire new vehicle market into two segments: luxury and nonluxury. Within these these two segments in some market, the Model 3 might be the best-seller in the luxury segment, as defined by cutting the market in two.

3. The industry also divides the market in numerous other categories, see list below. They’re combination of price and type of vehicle. In bold is the subcategory of “near-luxury car,” which is the official label of the Model 3, the BMW 3 series, BMW i4, the Lexus ES, Mercedes C class, etc.

Compact Car

Subcompact Car

Mid-size Car

Minivan

Full-size SUV

Luxury Full-size SUV

Compact SUV

Subcompact SUV

Hybrid

Mid-size Pickup Truck

Van

Luxury Mid-size SUV

Mid-size SUV

Luxury Subcompact SUV

Entry-level Luxury Car or near-luxury car

Luxury Compact SUV

Sports Car

Luxury Car

Full-size Pickup Truck

High-end Luxury Car

Full-size Car

Excellent analysis, as always. If the strike lasts long, it will put upward pressure on the new car prices, which will affect used car prices and pushing the inflation up.

It is out of the context, but I am wondering how the bull (which is nearly the entire) media will sugarcoat the expected CPI spike tomorrow. I can read the headlines from now: “Although the CPI spiked up (may be 3.6?). because of base effect and energy prices, the stocks markets rallied as the CPI came lower than expected (3.8). Moreover, core CPI headed down (or remained steady), eliminating the worries for the future. Everything is great in this Barbie Land. We are all rich and happy to until forever. Go buy some suncreen!!”

I’m buying back my ’01 f250 from my son

dependable, has only 275k miles on it(diesel)

and no DEF epa bs

sub-$10k

good for another 10 years

I’ll take it in and have it serviced well – can afford couple $K

I spend way to much time looking for a 7.3 in that 97-01 year range.

Kick em when they’re up

Kick em when they’re down

Kick em when they’re up

Kick em all around. – D. Henley

Ford and GM.

Cut prices if you want to sell cars.

And your unions wants a 40% raise or they go on strike.

Yes, that’s going to be an incentive for GM and Ford to shift more production to Mexico.

Shifting production to Mexico means NOT qualifying EV credits….

= The shift to EVs will continue as the average selling prices are continually reduced, and in about 2 years, EVs will be cheaper than ICE…

If the big 3 allow the myopic bean counters to make decisions, they will repeat their past mistakes…. and go bk again.

Meanwhile foreign owned companies are building more EV plants in the U.S. so they qualify for EV credits.

Geely owned Volvo is the only Chinese company building autos in the U.S.,… but, I expect others to follow.

The big 3 (and all other companies) should follow the labor profit sharing blueprint of Nucor, which has grown to become the biggest steel producer in the U.S.

Tesla profit margins will continue to shrink, and the stock will crash and burn, but the company will survive.

Elon Musk is a jerk… but he is a brilliant engineer.

AI fluff is luring fools to huge losses.

If I were forced to choose, I would rather take investment advice from the Jonas Brothers (boy band) than from Morgan Stanley’s Adam Jonas

“Shifting production to Mexico means NOT qualifying EV credits….”

Nope. US, Canada, and Mexico are the original countries included for final assembly. And that list has now expanded.

yep and this is the true price of the US economy being based so much on rent seeking with inflated prices for things like healthcare, college education and housing–it forces higher wages for workers to deal with rising cost of living but without actual increased buying power, just affording the same things like before that got needlessly more expensive. And that then makes the products needlessly more expensive too that then makes American businesses less competitive. Our prof pointed this out when teaching the lessons of the classic economists since 1700’s, it’s why rent seeking is so dangerous to any real productive economy, it forces up prices for actual goods and services without increasing their value and allows competitors to jump in. When GM and Chrysler collapsed in the GFC in 2008, it wasn’t the car manufacturing costs themselves making them bankrupted, it was ballooning healthcare costs for their workers (and also college and housing costs requiring higher wages to cover). But rather than heeding that warning and making healthcare, college and housing less expensive since then, they’ve gotten even worse in the US and accelerated even more than overall (high) inflation. With ZIRP and QE adding even more fuel to the fire.

Even though the car price reductions for Tesla and other companies are in the right direction, they’re still over $50K which is too much for American’s incomes esp if EV are supposed to become basic all-road vehicles. At the same time manufacturers in Europe whatever their issues, don’t even have to worry about ballooning healthcare and college costs for their workers (most don’t go to college unless they qualify and it’s usually tuition free). And now on top there’s EV price competition from BYD in most countries, and in that case the healthcare and university costs are even lower where the manufacturing is done so that allows them to sell their cars for even lower. Even if all the other common-sense reasons to reduce too-expensive US healthcare, college and housing costs haven’t worked, then maybe driving American companies out of business would be the last straw to force the issue. But even then probably not, with Citizen’s United it’s just too easy for those industries to keep bribing politicians to keep the mess going until the rest of the economy is starved out.

I never have understood why corporations are in favor of paying the healthcare costs for its employees.

“Even if all the other common-sense reasons to reduce too-expensive US healthcare, college and housing costs haven’t worked, then maybe driving American companies out of business would be the last straw to force the issue.”

I have also wondered where this is heading. In addition to the options of working for more money and working for less money, the option to not work at all exists. I’m dealing with this in the construction industry. I’ve raised my prices in response to higher insurance costs, higher parts costs, and my cost of living. My prices are going up, and a decent construction worker won’t work for less than $35/hr around here. And you can only find one or two, the rest are happily employed or making $100/hr+ as independent contractors. How long until businesses (other than one-man-shows) start going out of business?

@Arnold

me neither, would seem like American business would be pleased to not have to deal with providing health coverage, and company execs would be the loudest voices against this over-expensive healthcare and education system and asset bubbles we have in the USA. This rent seeking hurts them the most. In one of our business trips to Europe years ago around Housing Bubble 1, back when we still had blinders on about those things, we assumed the EU branches would all be complaining about red tape and how much easier it was to do business in the United States. Instead the companies in Europe were all so much happier they didn’t have to worry about worker’s healthcare costs and administration, childcare and that those and housing and university costs were lower for their people.

It meant costs of doing business and hassle were lower for the European branches generally, and salaries didn’t have to be so high to afford equal buying power compared to workers at their US branches. (And taxes in reality are around the same in both areas, with pay-roll state and other US taxes figured in) In that kind of sense the nominal American GDP is inflated due to the higher costs of things like healthcare and college, probably why for ex. China has a much higher GDP than the US by the PPP numbers, they can buy a lot more with less. That meant cheaper products and a more competitive business environment overseas but US companies stay quiet like lambs on this even though our higher cost of living and healthcare admin is hurting them. GM and Chrysler in GFC are a painful example but in fact I gotta wonder if this is a big reason America has lost so many of our key companies in past few years and decades at least for corporate staffing. Budweiser now owned by Inbev, the Dutch own Giant, the Swiss own a lot of our pharmaceuticals now Aldi a lot of our grocery stores. It just costs less to staff and deal with all the overhead and costs of living over there.

Corporations aren’t in favor of providing health insurance. Their employees demand it as it’s now an entitlement. Heck, at our company, even retirees screamed like a stuck pig when the retiree health insurance program sunset and was replaced with a monthly stipend – which doesn’t increase and buys less and less every year.

The Amercan solution to everything is debt. If you cant afford it, just finance it.

And when payments get too high, make the term of the loan longer…. 6 year car loans? Insane.

The simple solution is if you cant afford it, dont buy it. Live within your means.

@ El Katz….employees “demand it” as part of their compensation package, as it is a form of compensation since it is directly valued in $. The gall of these plebs!

FWIW – I’d prefer to see a single payer option and private if you have the $ to do so (and dislike your public option)

Arnold,

I think historically healthcare benefits were introduced to attact talent when wages were frozen during WW2. And here we are. Nothing is more permanent than temporary.

@ Arnold

Corporations don’t want to pay healthcare costs and are furiously offloading those costs to their employees with higher deductible plans and larger employee contribution costs.

Look at how top heavy these companies are, incentives to underpayment workers and the huge upcharge on regular vehicle items.

Dirty Laundry

I’ve put 40k miles on my used car and it’s still priced at the total I’ve got in it. About 30% of that went to mechanics and stayed local. Guess all the above is why…

I see full lots of Teslas at dealers around Houston. It fells that the Tesla cuts happen because of inventory.

TESLA DOESN’T HAVE DEALERS.

RTGDFA

You’re looking at used Teslas at some dealers.

As a business traveler and with many friends who are travelers…

What you don’t want to hear at the car rental counter…

We only have EVs left.

1. They should cut their rental rates. EVs should be cheaper to buy and cheaper to rent than an ICE vehicle because they’re cheaper to build, as Tesla is demonstrating, and they’re cheaper to operate. But these morons — including the idiots at Ford, Hertz, et al — still think that an EV should have a high-end price.

2. You have to LEARN how to drive an EV. Everything is different. You have to learn how to deal with the screen, etc. You have to learn how to find charging stations instead of gas stations. That’s not a problem if you already have an EV, but if you drive a 10-year-old ICE vehicle and then rent an EV, there’s an uncomfortable learning curve right there at the airport rental parking lot. It always takes a while to figure out where what is with a rental car these days, but EVs push this to an entirely new level.

@ #1 – But EV’s are not cheaper to build or buy, so they aren’t cheaper to rent. They may be cheaper to own due to fuel costs, but rental car companies don’t care about that, in fact they can charge slightly more as you’ll save some during the rental.

EV to IE cost parity is getting closer but batteries are expensive. There is a reason why Honda will sell you a Civic for $24k, Toyota will sell a Corolla at $22k. Tesla doesn’t have anything there. The electric competitor in that price range is a Bolt, which is significantly smaller and less practical than a Civic, not to mention slightly more expensive.

Your math is outdated. Look at Model 3 price ($36,000 before federal tax credits) v. BMW 3-series base price ($44,500). They’re direct competitors, “near-luxury real-wheel drive sports sedans.” The cheapest Model 3 runs circles around the cheapest BMW 3-series, and yet is $7,000 cheaper (before tax credits), and the Model 3 has high profit margins.

Tesla has been in a price war in China. It’s now all about cutting production costs to win this game (the low-cost producer wins, the high-cost producer loses).

I take a Tesla anytime… Other EV……Nope.

I hear ya wolf, and agree in the price segment Tesla competes at they perform better and are cheaper. Also the current MSRP of a base 3 is $40,240, not $36k

Anyway ICE’s are still ultimately cheaper to make (for now) which is why there is no Tesla (or other) competitor for a Civic…at the moment.

Also, BMWs and Teslas are both premium rental products and last I checked Teslas did rent for less than a BMW with Hertz.

Non of this is anti EV. I like EV’s. But the figures above on msrp are facts and EV’s still have a way to go to hit MSRP’s at the lower end of the market.

Gaston,

Nope, $36,220 (before tax credit) from Tesla’s website. You’re looking at the price before the last price cut.

May be used, I have heared about “no dealers”, that’s why I noted it. Appeared in several areas.

Will stop next time and ask. But from highways they look like any other dealer, just huge T on the roof and big parking lot with only teslas, no empty space.

In Texas it’s illegal for Tesla to sell cars to the public. It is considered much too dangerous for Texans to purchase an automobile without the paid assistance of a car salesman.

The most import factor in Tesla’s “no dealership” is that when Tesla sells a car for $40k, they get $40k. Ford/GM/Stellantis has to give the dealership their cut. Texas guarantees the dealership their cut of every sale.

IvanA – Likely a service center, I used to drive past one in Blue Ash OH (NE suburbs of Cincinnati) on occasion. I haven’t been up that way in 2-3 years and can’t comment on current “inventory”, but back then there were always 10-20 units in the (rather small) lot.

My son bought a used Model 3 a few years ago and picked it up there. Not sure if it was purchased directly from Tesla, but it was an off lease unit so Tesla-direct is likely the case (he did not finance). Our families are vacationing together this week so I can find out details tomorrow if there is interest.

PS – He and I drove from NKY to Indian Rocks FL in a rented Rivian, and aside from the charging and re-gen I found the “driving” part to be largely indistinguishable from internal combustion w/auto transmission. And I’m a confirmed luddite

Huge T on the roof and the parking lot? That’s the new “gigafactory”.

@Apple,

I thought Texas was a “my freedom to do buy anything shall not be restricted” state. No direct car sales to the public? Smells awfully like regulation.

Digger Dave, that’s a common misconception. The state of Texas wants the freedom to do anything it wants without interference from the federal government. When they talk about freedom, they don’t mean for the people themselves.

There are lots with Tesla’s parked in them near their office in Scottsdale. They’re likely off lease vehicles that went to term and Tesla has them listed on their website as used. The vehicles on the used portion of their site are located all over the country (it’s in the listing and often shows a cost to ship a specific vehicle if you want it that isn’t close to you).

Tesla does have retail stores. There is one in Renton WA. They sell direct and have a service center. There are cars for sale on the lot, and you can go test drive there also.

Sure, Tesla has its own stores and service operations. But it does NOT have dealers.

There is a Tesla distribution and repair shop not far from me. They took over an existing car dealership property a few years back. People go there to pick up their vehicles or take them in for maintenance.

I do see a LOT of cars in the lot, all parked according to color. Maybe pre-orders that people decided against purchasing?

This is great news, really…actually it’s fantastic. Elon might be kinda nuts, but he has pulled off something special with Tesla (Cybertruck notwithstanding). Or maybe in spite of himself- whatever.

I can’t think of another company that is crushing competition by lowering pricing AND doing volume. There probably are some, but I don’t know of them.

I’d love to get a new car (especially electric) but my commute sucks and your just one afternoon away from getting clipped by a 98 Corolla with no muffler and spoiler where I live so, crappy econo daily driver it is for for me still. One day though, I’ll get to replace it with a hand-me-down Model 3 at a decent price.

Uber has some program for Tesla leases. At least that is what several Uber drivers (with Teslas) in the Bay area told me. Not sure how they deal with high mileage later on. You can probably get one of those for under $30K in a year or two. Good luck.

Tesla has several used Model 3’s for sale on its website for under $30k. Interestingly, they are all white.

White (non-pearl) is a popular color for the manufacturer to produce due to lower emissions from the paint booths. The heavy metallic paints are deadly…. which explains why some colors are in short supply – despite their popularity.

That narrative that Tesla is crushing competition by lowering pricing is BS. Tesla built factories with a very large amount of production capacity, which has recently come on line and is continuing to edge higher. So they adjust prices based on the demand versus the supply. They want to keep factories running.

Declining prices means that the production increases at Tesla are not being met by demand at the current price points.

My guess is that Tesla is close to reaching the point where they will have a hard time cutting prices, because their margins are getting down to the range of traditional car companies. So if they cant cut prices further, they will start to idle factory capacity. And the narrative of endless growth will disappear.

China is the canary in the coal mine for Tesla. There is alot of new competition, at lower prices, for the Model Y and Model 3 from Chinese companies coming up and this might lead to declining demand for Tesla. In North America, the guy (troy teslike) who tracks Tesla production and deliveries sees a slow-down in Texas production from 50K a quarter to 30K a quarter. This could mean that Tesla demand in the US is also faltering.

The latest analyst pump and dump with Tesla is to push the idea that Tesla’s valuation should be increased due to their future autonomous robo-taxi network. Like that idea is worth 500 billion today – sure!

gametv,

You got this completely backwards. You assume that the folks at Tesla are idiots, that they don’t know what they’re doing, that they have no strategy, that they’ve never had a strategy, that they don’t have a plan — though Musk outlined the plan for Tesla to become the largest automaker in the world — that they build factories willy-nilly, and that they reluctantly cut prices to keep the factories that they’re still building and already expanding and starting to build busy. You need to rethink your hubris.

The folks at Tesla have run circled around everyone in the industry.

Yes, folks at Tesla are genius with a plan. Musk is our modern Napoleon on his way to conquer the world. And their amazing business strategy allows them to cut prices and run circled around everyone in the industry.

Nothing to do with the MASSIVE subsidies that Tesla receives.

“Tesla to get US$41 billion in government subsidies over made-in-US EVs and batteries”

https://www.notebookcheck.net/Tesla-to-get-US-41-billion-in-government-subsidies-over-made-in-US-EVs-and-batteries.723968.0.html

Not to mention the free advertising (AND bashing of the competition at the same time, double whammy) 24×7 in ALL mass media with the Global Warming, Green Energy, Save the Planet, Buy an EV or you Will Die, and so on. In fact, it is a LOT more than advertising, it is the culture (universities, arts, etc.). Whether you think human beings affect the weather of the planet in any significant way is beyond the point.

Yeah, those guys at Tesla running circled around everyone in the industry is a feat of pure genius!

They should be at NASA sending men to Mars… oh, wait! Isn’t Musk on that now? Let’s see how that goes.

SS,

ALL EV makers that have qualifying vehicles and batteries get the subsidies. But Tesla sells 60% of all EVs in the US, ALL of which are manufactured in the US (California and Texas), rather than imported, and it has battery plants (along with Panasonic) in the US that make the battery cells and battery packs for its vehicles.

So what are you bitching about?

The subsidies in general? Yes, agreed, bitch about them, they’re odious. ANY subsidies, including the $50 billion that the chip makers are getting.

Or that Tesla has a 60% market share in the US??? And therefore gets 60% of the subsidies??? Is that your real complaint? You need to bitch about the idiots that run Ford, GM, Stellantis, Toyota, et al, who spent a decade poohpoohing and ridiculing EVs and Musk and Tesla and now are so far behind and so stupid that they cannot get their shit together and keep screwing up with their EVs so that they cannot catch up, and now these idiots have such low volumes of production that they only get a small portion of the subsidies.

Tesla built a US brand that is demolishing the import prestige brands in the US. If anyone had suggested to me 10 years ago that a US brand would be the #1 luxury brand in the US I would have spit my drink all over them. I’m not a huge EV fan bad credit must be given here. It will be very hard for anyone to catch Tesla’s market share lead in the US.

I’m finally starting to notice a noticeable number of new EV models from Mercedes, Polestar, VW, Cadillac, Audi, and such. Definitely most EV’s I see are Tesla, but until recently the only non-Tesla EV I saw routinely was the Bolt.

BMW had electric car i3 since 2013. Tesla 3 came out in 2017.

Tesla has a roadster in 2008-2012 and the model S came out in 2012.

The BMW first electric car 1602 Elektro-Antrieb was first unveiled at the 1972 Olympic Games in Munich.

Dr. Ferdinand Porsche built an electric car and it won a 25-mile in Berlin on September 28, 1899.

The point I am making is that Tesla is the only company that can be credited with pushing EV’s mainstream and was the first to do so. All the other products failed and were sold in minuscule numbers. Even today – in 2022 Tesla sold more than 2x all other BEV’s from other makes combined (US market).

Took Porsche the whole 12 years after Tesla invented the electric motor.

That’s why Elon is such a genius. /s

Tesla did not invent the electric motor. It was demonstrated by the Englsh physicist, Peter Barlow, in 1822.

I see 30 Tesla to every one other EV in Colorado. The legacy brands are not going to get it done.

Here in Toronto, you need a car to go to work. However, the cost of insurance is about C$400 a month for a regular driver, and about C$800-$1,000 a month for a new and young driver (like myself).

I’ve noticed that Canadians like to brag about paying C$50,000 for a dealer SUV, yet complain that they have no retirement savings, and are broke.

In America, while a car is a necessity in my cousin’s state of Georgia anywhere outside of the ATL, I don’t see people bragging about overpaying for new cars.

It’s my subjective experience when it comes to car ownership. I’d rather buy used, and invest in the depreciation. But used cars are crazy here too.

C$20,000 for a 1993 Toyota Land Cruiser!

Wished they had an edit feature.

In Toronto, many employers are demanding that one owns a car to travel anywhere outside of the downtown core.

There is a lack of reliable transit in the Greater Toronto Area. Demanding that one must have a car to work for C$20/hr seems to be outlandish to me.

My brother has lived in Toronto for the past 20 years. Not only does he not own a vehicle, I don’t think he even knows how to drive. He has always used the mass transit systems there which are far and away better than anything in the US. In Houston and other Texas cities there is little to no mass transit.

Did you read my comment? I said that Toronto employers want their employees to own cars. And where did I mention Texas? I mentioned the state of Georgia, and Atlanta with about 500,000 people have better local rail networks than Toronto with 3 million people.

Gen Z, are you channeling your inner Wolf Richter?

I’m stunned that you think Toronto is more car-dependent than Atlanta. Have you ever been there?

The MARTA network have more lines and stops than the TTC, with a lower population.

I’m just telling people that GTA employers demand that employees own a car, and that’s becoming common these days.

You do nothing but whinge about how tough it us living in Canada….why don’t you move already? Seriously, not being flippant, but life is too short to be so miserable…..

So I’ll complain about New York or LA transit? And what did I complain about?

It’s like people can’t criticize Canada or what?

How is insurance so expensive? is it full coverage?

I paid that yearly….

I’ve been in Toronto for 20 years. My wife and I pay $230 a month for two cars with a combined value of $50K. Transit is not as bad as people say, and it is pretty great if you live in Toronto proper.

That being said, If guy lives in Brampton which is a suburb an hour from downtown. It’s also the insurance scam center of Canada so the insurance costs are higher. You might need a car for a job, but that would be true for many cities and is not unique to Toronto.

The 1993 Land Bruiser is a cult car…. people buy them for big $ and then dump big $ to restore them.

Canadians are all living in a hyper-bubble caused by terrible government policies that have propped up property values. That distorts every economic equation.

If that property bubble finally busts, Canada is toast.

HUH?

Your Toronto insurance prices are way off base.

I pay 125/mth and my son in mid 20’s pays $225.

What are you driving a Lambo?

Putting the whole lithium vs. gasoline debate aside for a second, what I’m mainly reading here is that a non-union automaker (Tesla) is absolutely mopping the floor with UAW automakers. Additionally, the vertically integrated Apple-store model that Tesla employs to sell its cars like devices appears to be leaving the increasingly antiquated car stealership model in the dust as well. Worse still, the unions are poised to strike rather than finding a reasonable middle-ground with their employers to keep jobs in the states.

A good parasite doesn’t kill its host, nor does it chase its host across a border. The UAW with its empire in decline almost certainly won’t take a hint from what happened to unionized British industry in the 70s when its host empire was gasping its last breaths. Seems like we could again be hearing that giant sucking sound that Ross Perot was talking about back when I was a kid.

I don’t see “nonunion” high in the ingredient list to teslas secret sauce. It’s on the label, but probably near the bottom, IMO.

There is a stigma around union shops that I think is outdated – That their workers are slow loafers who hardly do any work. There is some truth to that, but manufacturers have neutered unions with a combination of outsourcing and automation.

The Ford Rouge line I toured moved at a set pace to engineer loafing potential out of the assembly process. That isn’t a rare idea. Caterpillar’s flagship assembly lines use the same approach. They also outsource a ton of their components to low-cost global suppliers, often nonunion.

The giant sucking sound is a complex problem, and it can’t be laid exclusively at the feet of unions. That conversation starts with high housing and healthcare costs in the USA.

Unions should fight for better wages for their workers. It might drive jobs south. But what is the alternative? Accept an increasingly lower standard of living because there is always someone more desperate somewhere else?

Ultimately that is the problem for workers in the US. Capital and jobs flows out, goods and people flow in in a very unrestricted manner. Means the average small buisness who can’t ship work to a cheap country or the average worker with replaceable skills can’t negotiate or compete as efficiently. And so their wealth declines.

Ross Perot pointed this out 30 years ago.

True. Just like helping people pay for school tuition does not fix the problem of high school costs. It actually worsens it.

Only fighting for pay increases does nothing to fix the high costs of housing and insurance. It tacitly tells these markets it is ok to keep jacking up prices. Eventually US employees will be making so much money per hour just to pay for the excessive housing and insurance costs that companies will be forced to move elsewhere.

Why not have unions instead work on lowering the costs of housing and insurance for its members? If it can lower these costs by 20% it is the same as a 20% pay raise, and no additional cost to the purchasers…

Bring back the company town! /s

This may be true, but average wages for Tesla assembly workers are 70% of average UAW wages, and that’s before the 20-30% increase UAW and legacy automakers are fighting over. It doesn’t take much imagination to see Tesla permanently undercutting the legacy car makers on price and wiping the floor with them.

“Most EV makers had been aiming for the higher end because that’s where they thought the easy money would be.”

“Below $20,000, hardly anything left.”

“Below $30,000 is thinning out.”

Wolf, you really should sign on as a consultant for our friends at the most recent, rapidly imploding, EV SPAC listing. Just make sure the check clears before sending them the link to this report.

If the average transaction price of a Tesla is down almost 20%, I would hazard a guess that there is no net profit (the only real profit) left. Oh well, Musk can make it up on volume.

Tesla’s profit margin is still higher than that of Ford and GM. It’s just not as high as it used to be.

Tesla doesn’t have dealers. That cuts out the entire layer of costs for Tesla, and it gets to keep all dealer profits. It also doesn’t get screwed by its dealers on warranty work.

Automakers spent billions a year on advertising. Tesla spends $0 on advertising. This alone is huge.

Tesla is running circles around these legacy morons. I’m furious with Ford and GM. Their incompetency completely blew it. They just let Tesla take charge, and they’re not even trying to catch up. I thought by now, there’d be some serious competition, but no, they’re just dabbling and screwing up and blowing it. I would love to wring Farley’s neck.

What’s your take on the Kia/Hyundai push into EVs? They seem to be very aggressive and pumping out new models in what seems like record time.

Yes, it seems they got the memo, and I see a lot of their EVs. But they too have lots of issues ramping up production. All the companies are years behind Tesla, and they’re now having similar problems that dogged Tesla years ago.

The Kia/Hyundai EV’s are good cars, but priced a bit high. The Kia EV6 / Hyundai Ionic5 pair both start at $50k and hit $60k+ instantly once you get beyond the base model. That’s going to be a hard sell against a $47K Tesla Model Y. (Made worse by the Tesla’s eligibility for Federal Tax Credits against that $47K price.)

And it may be a struggle to find a dealer willing to sell/service the EV’s. When I visited my local Hyundai dealer, they informed me that they had never seen a Hyundai Kona EV and were not ordering any. They had a half-dozen Ionic5/6’s on the lot, with prices well north of the $35k Kona.

With you on Ford and GM, but that’s decades of similar decisions.

Tesla seems to benefit from a singular purpose. Nobody is close to them. Interesting to see what opening their charger network does for revenue too. There are higher charge rates plus a monthly subscription available to lower them…seems like easy money on the back of their existing infrastructure.

Think about this….

Every Model 3 on the road today in the USA was built in a old car factory in California that Toyota and GM gave up on. Built and sold with high enough margins that they are killing the competition with price cuts, and still making money.

Good engineering keeps reducing the production costs of the vehicles, and Tesla (aka Musk) keeps passing on the savings. The cost advantages of the structural castings used in the Model Y are amazing, and that’s only one example….GM might as well be making Chevy Citations.

Tesla is a “closed loop” company. They share none of their profits outside their closed network. You’d likely be surprised by how low the actual cost to produce a motor vehicle (forgetting variable costs like legal, etc.) really is.

A good portion of profits for a manufacturer come from the “spare parts” side of the business. As the old story goes…. see how much you spend buying the individual parts to build your own $35,000 Toyota. It’s probably far north of $250K, assembly not included.

Poor Nissan. They were once among the best cars out there. Mitsubishi and Nissan SUVs from the 90s and early 00s were indestructible. Now you’re lucky if the transmission lasts 75k

In a sane world this would mean that the price of used EVs should drop like a stone. What is the situation here ?

They dropped like a stone, LOL.

A couple of years ago, people were flipping new Teslas for a profit. They got wiped out too with the first price cut. I love price cuts!!!

“The Big 3” priced out their customers. Now it’s their turn to twist in the wind. They are probably hoping for a strike to clear out some of the rotting inventory, but that does nothing for their long term financial health. I’d like to see them all disappear at this point.

Was truck browsing casually yesterday. The prices of trucks (yes we USE them here) are still about $20k too high for me to set foot back in the market. There is still a shortage of mass market models, and I can’t help but see this as a conscious decision by GM. It’s like they came to realize they don’t have to work so hard to make money. Just sell luxury and screw the hassle of high-volume, low-margin business.

Personally am partial to GMC trucks. I browsed online at the same dealer where I bought 5 years ago in the Saint Louis area. They have a mountain of new Denalis on the lot, a few SLTs, and no SLE or work trucks. Everything outrageous, but discounts are reappearing.

I have been on a buyers strike for a year or two. Looks like another year or two coming.

Right. A casual gander at new inventory of full size trucks shows pretty much everything in the $70k-$100k range. This is, by no means, affordable to the average person.

Tesla has been cutting their prices while the big 3 have been jacking them up to levels almost inconceivable. It truly is greedflation.

Wolf has often said “nobody needs to buy a new vehicle” and he’s mostly right. I’ve essentially realized that I am no longer interested in buying a new vehicle. My “buyer’s strike” may be permanent. Not only have the prices of the vehicles gone full clown show, but so have DMV registration fees, insurance and everything else. The math makes no sense.

I could not agree more but We have a 2008 sienna that is rusting and is starting to cost more in repairs so we looked for a used car. The price of a used car is insane. A 2017 mazda cx-5 with 60000 km is $25000 and brand new 2024 is $34000 What am I missing I guess for the extra 9k I want the easy 6 years. We ended up ordering the new one that should be here in November. I did notice that getting the low end trim off a dealer lot is very difficult. The last time I bought a new car it was easy to negotiate a price decrease and no one payed sticker. now we are paying sticker price and after reading several sites are lucky there is no upcharge. We live rural and looked hard at hybrids Hybrid toyotas are a long wait and honda prices are insane for what you get. and what is up with a cvt transmission my shopsmith had that from the 1950s it was noisy and not that great even as a lathe

Here is an area where people get bamboozled to pay high prices and gladly do so…and using the words need to and have to….Interesting.

Plus they don’t make high quality vehicles. Toyota so much more reliable. You couldn’t pay me to buy a big 3 vehicle.

“Consumers love lower prices.”

Love hearing it, Wolf! Almost positive that the purpose of getting a Ph.D in economics is to spend four years trying to obliterate that simple truth from the grad students before they go to work for the FED.

Keep the good analysis coming.

Wolf, is there any transparency from Tesla how sales of expensive extras like their “Full Self-Driving” package impact average sticker price over time? Customer satisfaction with Tesla cars themselves is still very high, but even if you read Tesla fan sites (e.g. electrek, teslarati), the consensus seems to be that FSD will try to kill the owner on a regular basis, with each software upgrade finding creative new ways to do so. So this is a feature that adds 12 – 15k to the sticker price at zero additional unit cost of production. I’m just wondering whether A) FSD popularity sales rate are lower than a year ago, given that it now has a poor reputation B) are there enough of these 15k packages sold that it has an impact on the overall average price and margins.

A good portion of the upcharge is likely more for liability reserves as the self-driving claim is a magnet for tort lawyers.

Wolf, you mention competition from China. Why don’t we see China EV models here? I know that they are selling at increasing rates in Europe, to the extent that the EU is looking into legislative action. Is it tariffs? Safety or other criteria? I’m not looking to buy one, just curious at their absence here when they are easily found in Europe.

Polestar vehicles are China-made EVs. There are probably some other small-volume China-made vehicles around here. We now now have several Vietnam-made EVs cruising around, LOL.

But BYD, Geely (Volvo), and others may be preparing to enter the US. The US state franchise laws make that complicated though, because in theory they will have to set up a network of franchised dealers to sell the vehicles, and they may not want to do that. So they’re trying to figure out how to get around that.

Low-cost China-made EVs are already making inroads in the EU, to where the EU competition regulators are now getting nervous.

Read today’s WSJ

LOL. I read the WSJ every day and shoot down some of its nonsense, including recently its BS about wetsuit shaming (Google the phrase and you’ll see); and idiocies about hotels in San Francisco. So in terms of vagueness, your comment makes today’s #1 spot.

Well, I’m pretty sure the WSJ knows that companies with fifteen competitors do not have an oligopoly.

Ted T.

🤣 Not sure if the WSJ knows anything at all. There are only FOUR automakers in the US that make full-size pickups (Ford, Stellantis, GM, Toyota), which is why pickup prices are ridiculous. Pickups generate the highest profit margins for these automakers, it’s that protected cash cow. That’s how you see the effects of oligopolistic pricing. Does the WSJ have a chart like this? Nope. WOLF STREET only, to open your eyes:

What are the total government subsidies given to EV car buyers in CA, ie federal and state? Also, what do you believe will happen to EV sales if these subsidies are reduced or eliminated due to a continued deterioration in government finances and or a change in administrations in just over a year from now?

Subsidies go by qualifying vehicle. Not all vehicles qualify. So you have to pick a vehicle and see what it qualifies for.

Tesla and GM ran out of the federal subsidies a few years ago, and that had no impact on sales. Tesla’s sales continued to soar. Some of Tesla’s vehicles now qualify again for the new federal subsidies, others don’t.

The main thing that subsidies do is fatten automaker profits.

Yes, subsidies should be eliminated. It’s stupid policy to subsidize something that is already in hot demand.

Wolf,

The tax rules changed. Tesla and GM tax credits were reinstated under far different rules. The phase out for 200,000 sales disappeared. Most Tesla models get the $7,500 for 2023. Battery/material rules change rules again in 2024. Too confusing for those of us in the tax industry let alone normal consumers.

Yes, read my comment more carefully, all of it.

Meanwhile in France…

I do not know how important Chinese automobiles are in the USA at this moment, but in Europe in general and France specifically, they are coming on strong. Just look at some figures:

France (dernière mise à jour : août 2023):

Tesla Model Y : 19 372 immatriculations

Dacia Spring : 17 210 immatriculations

Fiat 500e : 13 536 immatriculations

Peugeot e-208 : 13 235 immatriculations

Renault Megane e-Tech : 10 486 immatriculations

MG 4 : 8 656 immatriculations

Source : Avere-France, CCFA

So we see the Chinese-manufactured MG4 at 6th place already. Another brand not in these figures but currently entering France like a tsunami is the Chinese-made BYD. They offer cars at price points that are very hard to beat and thus a problem for the established European makers.

A funny thing is that EV’s in France are heavily subsidized by the government, up to a maximum price of 47000 euros you can obtain a bonus of up to 7000 under certain conditions. Now Stellantis for example have difficulties offering their most popular vehicles like the Peugeot E-308 under this price. This car was originally offered at 47040, so 40 euros above the bonus limit. Hilarity ensued. They then reluctantly reduced the price to 46999 euros.

Now all kinds of government officials have their knickers in a twist because these new Chinese competitors seem to have no problems offering quite nice EV’s at price points under this bonus limit. So you could say that these bonuses offered by the government do help Chinese manufacturers in killing off the European competition like Stellantis, home of Peugeot, Citroen, Opel/Vauxhall, Fiat, Abarth, Alfa Romeo, Lancia, Maserati and others.

At this moment bureaucrats everywhere are running around like headless chickens, trying to figure out how they can continue to push European EV’s with bonuses without people gratefully pocketing those bonuses to buy very competitive Chinese EV’s.

It’s really a sight to behold.

I see that here in Germany also, and BYD was very visible on the roads in Portugal when I was there last week. Frankly the Chinese cars I’ve seen are more attractive than anything the Big 3 and Tesla are pushing.

I’m waiting for a 2 door sports car design like the old Toyota 2000 or Alfa Spyder. To me that would be a no brainer to lighten the car and God knows Mazda has sold millions of Miata’s so there’s a market no one is currently aiming at. I’m single, and haven’t bought a 4 door vehicle in 30 years. Unfortunately BMW and Porsche have priced themselves out of the market as far as I’m concerned, and I have one of each.

EV competition in China is red hot, they will have well honed vehicles in other markets if and where they are allowed.

So what’s going on with Honda and Toyota?

Toyota reduced production during the covid-19 lockdowns and did not get back to full production until basically this year as they did not meet their full production goals last year. They have also reduced incentives. I do not know about Honda.

Last week their hard drives filled up and Toyota had to halt all production.

Crushing the minivan market.

They make reliable vehicles that people actually want to buy.

So VW’s ATP are up the most? Makes sense. If you drop all of your long time economy vehicles (and piss off your consumer base) and have nothing left but oversized overpriced bland CUVs and SUVs (which the public loves for reasons I still don’t understand), then that’s all your going to sell. But they won’t be selling me another VW.

The elephant in the room for EV’s and the needed buildout of the electrical network to power them is the high and rising price of copper. I Just purchased a couple of bars of copper 3 days ago for a customers project and I was floored at the price, double what I paid a few years ago. When I was done machining up the parts they fit in a shoe box but had $800 worth of copper in them.

I think this will put a floor ( along with other expensive commodities) under EV prices soon. It makes me shudder to think the cost of the copper in just a few high amp super charger stations.

Either that or it will be like the 70’s and they will start building all these things out of aluminum wire and conductors. Remember that aluminum house wiring ? That will give them a whole new reason to burst in to flames.

China has kept buying copper and associated minerals all through their current slowdown because EV and Solar are bright spots in their economy.

I agree. I don’t think the electrical grid is going to catch up with the demand anytime soon. I think Toyota has made the right decision by slowly entering the EV market. Personal opinion with no data to back it up is that hybrid’s will end up outselling all vehicles over the next 5-10 years.

“I don’t think the electrical grid is going to catch up with the demand anytime soon.”

Sheesh. To still see stuff after all these years is painful.

There is huge idle capacity in the grid at night. This is when electricity is cheapest too, if you’re on time-of-use pricing. And this is when most people plug in their EVs at home, at their condo and apartment garages, and I now see EV chargers in hotel parking lots. To take advantage of the idle capacity in the grid at night is a massive trend, and utilities love it, and only anti-EV morons haven’t figured it out yet. You can see this in San Francisco, where the electrical grid isn’t all that great either, but EV penetration is already huge, with zero problems for the grid. EV are everywhere here.

For 10 years, people have regurgitated the same copy-and-paste BS about why EVs will never work, and now EVs are all over the place, and they’re working just fine, and what causes the grid to collapse is a cold wave in Texas, or a heatwave, or a hurricane, but not EVs. Get a grip!

Fair enough Wolf. Having a little EV for commuting seems smart. It is on the road trips that you run into trouble like Biden’s Sec of Energy who had the cops called on her for hogging rechargers. Or towing. Do you recommend that people overnight every time their EV needs a charge?

I suggest selecting the the right solution for the specific problem. Too many fanatics in this for me.

You only need to top off your vehicles when you do it every night. That doesn’t take long. Minutes. Not many people drive 300 miles every day. Most people drive 10-40 miles a day, and that’s all you have to charge, which doesn’t take long. The ignorant clickbait BS out there in the media about EVs is just astounding.

I am not saying they will never work. I am saying the world hasn’t caught up yet. I see lines at charging stations on the east coast. In the middle of the country there are many older homes still on the older 100amp service. Recently, the secretary of energy got into hot water sending a gasoline engine vehicle ahead of her to tie up a charging station for her EV.

Right now, I think hybrid’s make a lot of sense, I guess you disagree.

On another note…I heard you are a sailor. I am too. I like having sails and a diesel engine to power my boat. When the wind isn’t blowing, that diesel gets me home. I like not having to pay the fuel charges my power boat friends do. Although, some might argue having to replace the sails every several years adds up. Nothing is free in life. :)

Anyway, I don’t expect we will always agree and I will continue to send you a few bucks every month because I do appreciate your articles and the time you take to research the data and present it to us.

“Recently, the secretary of energy got into hot water sending a gasoline engine vehicle ahead of her to tie up a charging station for her EV.”

LOL. Government official have gotten in trouble for doing a lot of idiotic things, and that’s all you can come up with?

Buy utility company stock. I would think this EVs should be bullish for utility companies?

Just think if of all those EVs that used to go to gas stations now need to to find an EV charger whose energy is now electricity and supplied by utility companies and not gas supplied by oil companies and refineries.

Telsa charging network is just the middle man for electricity just like gas stations were the middle man for the oil company products.

At the projected rate of EV market share, charging station buildouts, and new solar buildouts, there has been studies for copper and silver consumption.

By 2030, using the current projection for copper and silver mining, there will be a deficit. Supposedly solar panel projection will need all of the mined silver by 2030. There will not be silver left for anything else. Of course this is not how it works and something has to give. So most likely result is more silver will be mined or we cannot produce as many solar panels as projected.

ru82- About two-thirds of silver is mined secondarily as a byproduct of base metal mining, reducing the elasticity of the supply.

But who would bet against advances in technology negating the need for silver in photovoltaics?not I

Hubberts Curve – I agree concerning aluminum conductors in building cable. It’s too difficult for poorly trained persons to make safe connections with aluminum wire. It’s more practical in industrial environments. Transformers and line reactors are pretty much all aluminum windings other than government jobs that spec copper. Lots of motors and VFDs too. It’s probably going to be necessary for ev chargers to be mostly aluminum for affordability, installed weight, and to keep copper thieves from toasting themselves.

Geez. Elon Musk’s secret weapon is …….. common sense.

Elon’s “secret weapon” is the guvmnt. People who buy a Tesla in California get TWO taxpayer funded rebates: One from the feds and one from the State.

Tesla’s original federal rebates of $7,500 were used up shortly after the introduction of the Model 3 in 2018. And sales have SOARED ever since, and it became very profitable without them. Tesla doesn’t need the incentives, no one does, which is why they should be abolished. It’s a stupid policy to incentivize what is already in hot demand.

There’s a Union 76 gas station near my house that has been owned by the same family for many years. The owner has always parked his grey Lexus LS 400 right next to the cashier’s kiosk.

Yesterday when I walked past the station there was a grey Tesla model S parked where the Lexus used to be parked.

I think that might mean something.

Is he putting some EV chargers on the side of the property where the air hose used to be?

I don’t know any stats, would be interested in how many commuters have the ability to charge conveniently at home. I think a substantial amount may live in dwellings such as older apartments or shared houses (street and yard parking) where dedicated level 2 chargers don’t exist and there may be no plans or likelihood to install them in the near or even long term future. I think the expense burden of housing exacerbated by the easy money era (yes, I know things are tightening in the right direction now) is a headwind for EV adoption due to fewer people with access to dedicated chargers. Yes, I know there are a lot of charging stations but does fast charging significantly decrease battery life? But it seems some aspects of easy money may be seen as beneficial to EV makers so it’s an interesting conflict of effects.

So here are some nubmers:

65% of households are homeowners. So there’s that.

Many renters rent houses (15 million rental houses in the US), and can charge at home as well. So there’s that.

And apartment buildings for “renters of choice” offer nicer amenities, including increasingly EV chargers in their garages.

The magic happens when you have your EV and solar panels…Then you really get to enjoy free fuel….I drive to work 62 miles 3 times a week. Spending $0 for fuel. So I don’t care what the price of gas is. I hear coworkers talking about how much time and money they have to spend refueling their car (specially the ones owning trucks….laughable…) …So when I tell them that my refueling cost is….$0… they think I am gaslighting them…But it is true. Some of them that is a waist of money to buy and install solar panels….I see it as insurance against energy inflation.

How many thousands of dollars did you pay to get your “free fuel” in terms of solar panels and charging hardest and instally?

I’m guessing more than $30,000 in total for which you could have bought gasoline in the neighbourhood of $1500 a year just from earned interest and still had your capital left to invest.

EV’s are still a waste and not in terms of cost they are just plain boring to drive. I’ll take my 12 MPG Italian any weekend and unless gas hits $250 a gallon any time soon I’m driving it until someone takes my sight or license.

Most of the EV’s I drove were just boring iPads to drive, maybe in a few years as more options come out they’ll be a better choice for an A to B route car until then I’ll daily my older Mercedes 4 door.

Maybe next round of government solar subsidies I’ll look into it.

Anyone see the review of the Malibu over at TruthAboutCars? GM’s last stand in an affordable sedan is powered by a miserable 1.5 liter 4 with 0-60 times that would have been slow 30 years ago and less charming than the cars of those times. This is why we have an affordability crisis and lack of good choices.