The flow of cash under QT and government deficits.

By Wolf Richter for WOLF STREET.

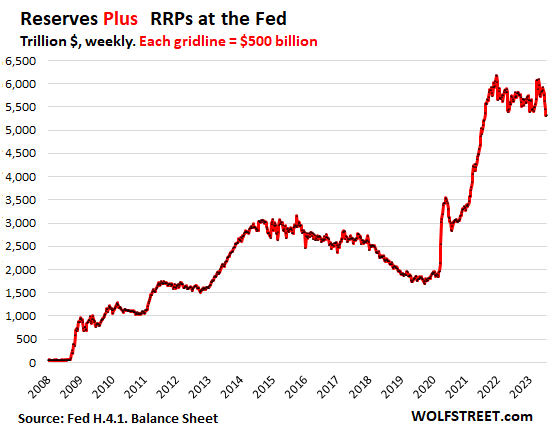

Quantitative Tightening drew down two big liabilities on the Federal Reserve’s balance sheet: Reserves and RRPs dropped by a combined $865 billion from the peak.

At the same time, the other two big liabilities on the Fed’s balance sheet went into the opposite direction: the government’s checking account (TGA) and currency in circulation rose.

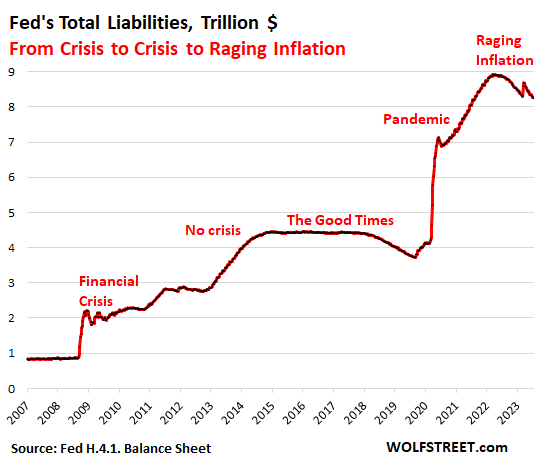

And so total liabilities dropped by $669 billion from the peak, to $8.25 trillion, according to the Fed’s weekly balance sheet released Thursday afternoon. We often discuss the Fed’s assets, such as Treasury securities, MBS, and banking panic loans. Today we’ll take a look at the Fed’s liabilities.

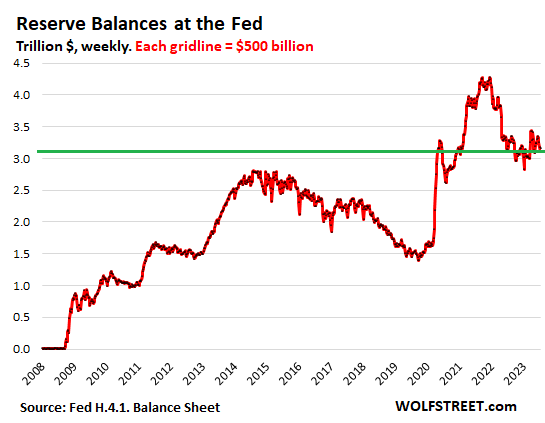

Reserves: $3.17 trillion, -$1.11 trillion since December 2021 peak.

Reserves are cash that banks put on deposit at the Fed; banks earn currently 5.15% in interest on reserves, as of the May Fed meeting.

Reserves are a manifestation of liquidity in the banking system that is not chasing after other assets. QT is draining liquidity from the financial system, and the first place the drainage showed up was in reserves.

In late 2021, when the Fed began “tapering” its QE asset purchases, reserves peaked and then began to fall. QE ended altogether in March 2022. QT started in July 2022. You can see the sharp drop in reserves through March 2023, and then upticks following the banking panic.

Reserves are the most liquid, risk-free interest-paying asset banks can invest in. “Reserves” is Fed lingo. On bank balance sheets, they’re assets called “interest-earning deposits,” “interest-earning cash” or similar.

Banks use their reserve accounts at the Fed to transfer money between banks and to do business with the Fed. Reserves are a liability on the Fed’s balance sheet since the Fed borrowed this cash from the banks.

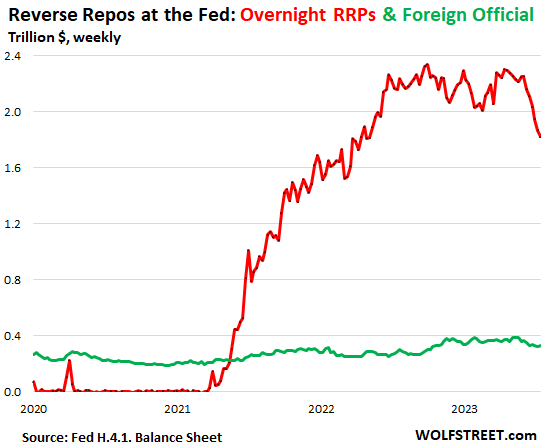

Reverse Repurchase agreements (RRPs), All: $2.15 trillion; -$490 billion from Sep 2022 peak.

The Fed offers reverse repurchase agreements (RRPs) to two groups:

- “Foreign official” accounts, where other central banks can park their dollar cash;

- Overnight RRPs where US Money Market funds, banks, and government-sponsored enterprises (Federal Home Loan Banks, Fannie Mae, Freddie Mac, etc.) can park their extra cash.

The counterparties earn 5.05% in interest risk-free on Overnight RRPs. So that’s a good deal, but not as good as reserves (5.15%). And not as good as Treasury bills (up to 5.5%); but RRPs are more liquid (overnight) than Treasury bills, which have to be sold for liquidity.

So banks park some of their cash in their reserve accounts to earn (5.15%). But money market funds don’t have access to reserve accounts, and so they park the portion of their cash that they want to keep liquid in RRPs to earn 5.05%

Under these RRPs, the Fed takes in cash and hands out collateral (Treasury securities). RRPs are a liability for the Fed because they’re cash that the Fed owes its counterparties.

Foreign official RRPs: $328 billion, -$56 billion from January 2023 peak (green line in the chart below).

Overnight RRPs: $1.82 trillion, -$547 billion from Sep 2022 peak (red line).

The Treasury Department is now issuing a flood of Treasury securities at higher yields than RRPs or reserves. And for some time, money market funds have switched some of their cash that they need for liquidity reasons to RRPs, from their bank accounts since banks are so stingy with the interest they pay.

In addition, bank depositors yanked their deposits out of banks and invested them in money market funds. So banks reduced their reserves, and money market funds increased their RRPs.

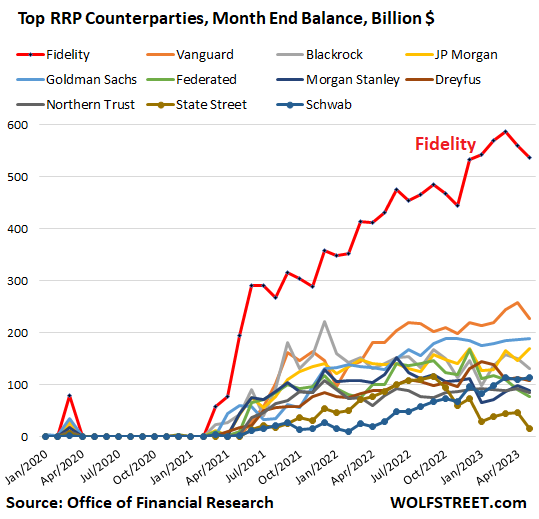

The government’s Office of Financial Research publishes RRP balances by money-market funds on a monthly basis with a one-month delay. The most recent release was for May. At the time, about 25% of RPPs were with Fidelity ($536 billion):

So there was a flow of cash from reserves to RRPs via money market funds, and they should be looked at together…

Reserves plus RRPs: $5.31 trillion; -$865 billion from Dec 2021 peak.

The pandemic-era QE had inflated the combined total of Reserves plus RRPs by $4.2 trillion, to $6.18 trillion at the peak in December 2021. Roughly 21% of that surge has now been worked off.

The Fed has shed $664 billion in Treasury securities and $202 billion in MBS, for a combined QT total of $868 billion. At the same time, the combined “Reserves plus RRPs” have dropped by $865 billion. QT in action.

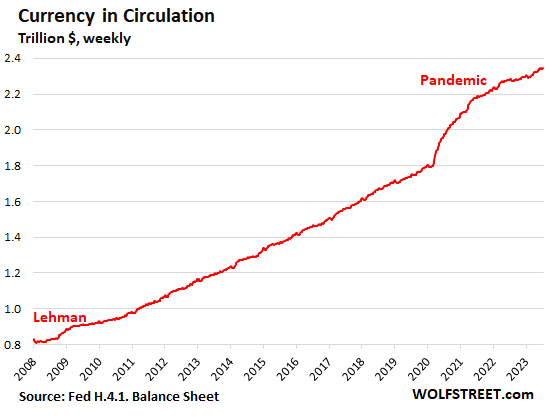

Currency in circulation: $2.34 trillion; new record.

Currency in circulation reflects the paper dollars in wallets, under mattresses, and in safes in the US and globally. It is demand-based through the US banking system. If customers demand paper dollars, the banking system must have enough on hand. Foreign banks have relationships with US banks to get dollars for their customers.

These “Federal Reserve Notes,” as they’re called officially, are a liability for the Fed (“notes”). Banks get those paper dollars from the Fed in exchange for collateral, such as Treasury securities, which are assets on the Fed’s balance sheet.

Before QE, currency in circulation was the primary driver of the increase in assets on the Fed’s balance sheet through the collateral (Treasury securities, etc.) that banks have to post to get these paper dollars.

Currency has been phasing out as payment methods for legitimate purchases as electronic payment systems have taken over. But demand for currency has been huge. A big part of it is stashed around the world for legal and illegal purposes, and part of it is spread across US households.

When there is fear of a crisis, demand for paper dollars surges: It spiked before Y2K, after the Lehman bankruptcy, and massively starting in early 2020.

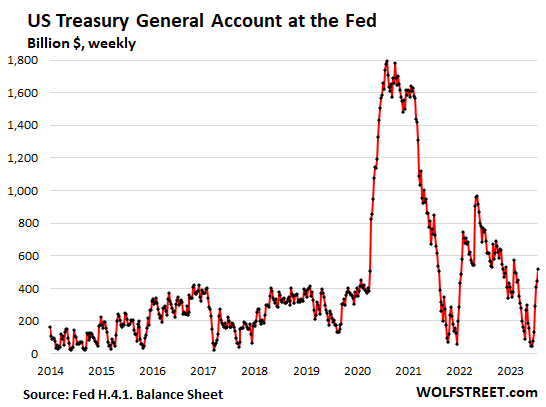

Treasury General Account (TGA): $517 billion.

The Treasury Department has been issuing a flood of Treasury bills and Cash Management bills plus the scheduled notes and bonds since the Debt Ceiling was suspended at the beginning of June to refill its checking account at the New York Fed – the TGA.

The amount in the TGA is money the Fed owes the government and is a liability for the Fed.

June 15 was the due date for estimated taxes; it brought in a pile of tax receipts, which fell short, but boosted the TGA nevertheless for a little while. But deficit spending that must be funded is a huge daily drain on the account.

For the current quarter, the Treasury expects to borrow $733 billion to pay its bills and get the TGA balance to $600 billion by the end of September. We discussed the national debt, deficits, the flood of new issuance even while QT is happening, and the TGA in greater detail here.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

5) Consumer spending might be down for years, but real income will rise.

Just watched this video, then I checked the value of US dollar relative to Euro, British pound and Canadian dollar. Looks like there is some volatility going on! If the US dollar tanks, how would we live day-to-day given our reliance on imported products? Would like Wolf to comment.

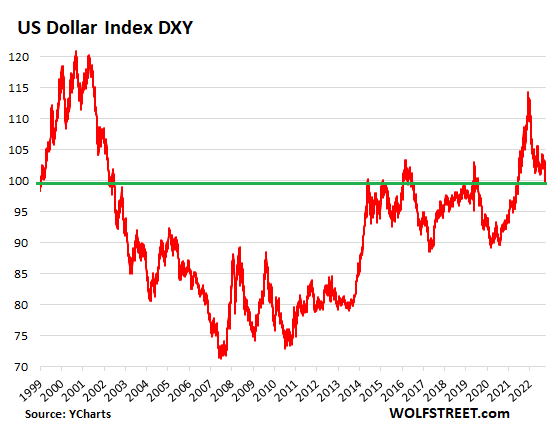

LOL, hearing the same thing for 20 years. The Dollar Index (DXY), which tracks the USD against a basket of currencies, dominated by the euro and yen, is back where it was at the high in April 2020 and at the highs in the years 2015-2017, and it’s back where it was in 1999. And it was a LOT lower in between.

The dollar is still at historically high levels, it’s just down from the huge spike last year.

Seems it’s time for me to lean against this silly dollar-collapse narrative again. Time for an article on it.

Yep, time for a doozie dixie article!

In 1999, the DXY was the same as today but gold was $250 and now close to $2000. That’s the real measure the loss of value of the dollar, not against other fiat currencies.

LOL. How much yield (interest) did gold pay over those years???

I’ll tell you so you don’t have to look it up: 0%.

You’re comparing “paper dollars” to gold, which is stupid. Compare dollar-investments (stocks, bonds, RE, etc.) to gold, and then you’re on the right track, but the results will be different.

“LOL. How much yield (interest) did gold pay over those years???”

You’ll find out in the not to distant future ;)

Gold better have some yield asap because the price hasn’t really gone anywhere in about 12 years despite a lot of nerve-wracking gyrations in between. Because if there is no yield, and the price is kind of stuck for 12 years, what else are you going to get?

Look, I love gold. Gold serves its purpose. But I just giggle about these silly comparisons to hype gold and diss the dollar. That’s what gives these dollar-collapse gold-sellers such a bad name.

“You’re comparing “paper dollars” to gold, which is stupid. Compare dollar-investments (stocks, bonds, RE, etc.) to gold, and then you’re on the right track, but the results will be different.”

Actually he’s comparing the “paper” price of gold, so he’s not really off base. Wolf worships the state person who made the comment, you’ll find no succor here.

Actually gold was more like $468 in 1999. And vs today’s price is an increase of 439%. The SP500 from then until today with dividends included has gone up just about the same at 437%.

Average price of gold was $268 in 1999 and $1954 today. And since then it has done better than the S&P including dividends. Why does it matter if it doesn’t have a yield if it’s outperforming the broad market?

What that tells me is that the stock market has gone nowhere in the last 24 years as the price increases of the index if just due to inflation and the increase of the money supply.

Yes, but 1999 coincides with nearly the lowest gold price since shortly after the gold window closed during the Nixon administration (it got a little lower in 2001). In 1999, the S&P was in bubble territory. Looking at the return on an asset since roughly its lowest point in 50 years is likely to show pretty good returns, particularly when compared to an asset that was grossly overvalued at the same time. I have no real issue with investing in gold as a hedge, but it’s more about stability than appreciation for me.

Why not pick 1971 when gold was $35 and you get the same results?

You won’t hear it on CNBC, but gold has beaten stocks so far this century. Or looked at the other way around, stocks have lost ground in terms of real money.

That’s what happens when they get way overvalued … you have to price them in depreciating currency to make them look good.

DM,

LOL, that’s my point. It always looks good if you pick the bottom of a cycle.

“Goldbugs” would do well to reflect on the number of occasions it’s been explained to them how fiat is going to crash, (almost weekly,) going back two decades, but also how it’s never happened.

Predictions have been made of the IMMINENT demise of fiat and a return to a gold standard of sorts, time and time again. The more intelligent ones, by now, would at least wonder why it hasn’t happened! That many predictions and they’ve basically all been wrong! Gold is insurance, have a bit for sure, but don’t let it rule your life.

Not a silly narrative at all, Wolf. The dollar is DOOMED, along with all fiat currencies. The collapse is IMMINENT.

Weimar Germany! Zimbabwe! Argentina! The dollar meltdown will be 1000x WORSE than any of these.

So protect yourself: buy, NOW, the ONLY secure store of wealth – DOGECOIN!

/s (or whatever the notation is for sarcasm)!

I know your post is sarcasm, but what makes it so funny is that it is hard to tell. I am constantly amazed how many people are on here making posts that sound similar to what you are sarcastically doing. Problem is that they are serious.

The best form of humor bites deep because it rings true.

Wolf,

You should also talk about the “Dollar Milkshake” Theory, about how a lot of the QE by foreign central banks ends up coming to the US because of its reserve currency status.

Japan is a good case study– I can get a US 10 year at around 4%, hedge the currency risk back into yen, pick up the currency arbitrage and be at least 5% ahead of a 10 year Japanese bond.

This could be the missing piece as to why the Fed’s tightening program isn’t working as fast as expected.

It’s the QT milkshake theory now.

Bank of Japan’s balance sheet has been roughly flat for two years. No one is doing QE anymore, not even the BOJ. They’re buying bonds and shedding loans to keep the balance sheet roughly level. It had already done QT until the yen came under attack in mid-2022.

The ECB and Fed combined destroyed over $2 trillion by now. Bank of England, Bank of Canada, Reserve Bank of Australia, etc. they’re all doing QT. That little thingy that the BOJ does is minuscule. There is no more QE. QT rules.

I live in Mexico most of the year and the Mexican peso is strong against the dollar. It’s gone from 20ish to 16.75. On top of inflation it’s a bumpy ride. Mind you I’m making 11% on my peso account in Mexico. Any thoughts?

Bank of Mexico did a great job front-running the Fed’s rate hikes by a year with big rate hikes starting in mid-2021. We covered it at the time. Brazil did the same thing with monster-hikes a year before the Fed started. We also covered that.

It worked. They knew what they were doing: protecting their currencies.

Both Mexico and Brazil have experienced what a currency crisis can do to them economically.

The ECB and the BOJ failed to act, and their currencies cut crushed. The euro has recovered after ECB tightening and QT. But the yen is a mess.

> 11% on my peso account in Mexico.

Such flashy offers have preceded currency and banking crises before. I remember tons of flight capital out of Mexico into my SoCal region around 1976 (50 percent peso devaluation) and 1982 (30 percent). My pal Rosa made a mint as she had a legal secretary job paid in San Diego in US dollars, but a contract to buy a house in Mexico payable in pesos. I’m not as familiar with the 1990s crisis but something big happened then too.

Meanwhile my pal Ross went for the 9 percent interest account across the border and got his clock cleaned.

Phleep,

You must have missed the point in Richard’s comment that the Mexican Peso is appreciating against the dollar. It’s a different era with, so far, different economic stewardship in Mexico.

What evidence do you have that the value dollar is at historically high levels ?

Look at a long term DXY chart.

New “currency” the BRICs are creating that allegedly will be pegged to gold is supposed to arrive in Aug. That should be interesting.

I can assure you that there is no new currency coming in August.

Its all a big hype.

It’d be a non event irrespective

I will bet a lot of money nothing will come of it.

Basing a currency on the price of a metal dug out of the ground is the silliest thing in the world.

If you even occasionally peruse goldbug blogs you will often see a theme of banks manipulating the price of gold. What amazes me is that despite the fact that these goldbugs think banks can manipulate the price of gold, they somehow still think that the dollar should go back to being based on the price of gold.

If a bank has the resources and ability to manipulate the price of gold, what do they think a nation state with far more resources and ability could do? Why base our economy on something that could be easily manipulated by our enemies?

Interesting from whom? The dollar-fearmongers? For the rest of the word, including the BRICS themselves, there isn’t going to be a new currency in August, LOL

Ha ha ha, Brazil with a stable currency, like that is ever going to happen.

No, not crashing but not at historically high levels either.

It’s been in a long-term downtrend. It just doesn’t show up in the period you covered.

Hot off the press:

https://wolfstreet.com/2023/07/14/honey-the-dollars-collapsing-again-the-usd-against-the-yen-euro-peso-and-other-currencies-amid-inflation-rate-hikes-and-qt/

And here is your “historic downtrend”

@Miatadon,

Sounds like you were watching a Peter Schiff video?

Crazy to look at the chart of currency growth in circulation. And all the while with government efforts to switch to electronic non cash card usage.

Is this cash primarily outside of USA?

If I’m reading the chart right, it looks as though money in circulation has tripled since 2008! Is there any wonder why consumers are out there spending, and inflation has amped up?

Majority is held in foreign countries. The Fed does a study on this periodically. Not much actually “circulates” in the US these days. I mean, you can’t even pay with cash at our parking meters here anymore.

Today, currency in circulation is not inflationary because it’s not being used to buy stuff. It’s “hoarded” — and largely overseas.

More importantly, currency in circulation is not money creation since the Fed exchanges physical currency for Treasury securities and other collateral. It doesn’t just hand it out; it essentially exchanges one piece of paper (currency) for another piece of paper (securities). I explained that in the article.

Currency in circulation is a interest-free loan to the Federal Reserve. Unlike as it does for bank reserves, it does not pay interest on this liability.

If the US we ever to opt to outlaw cash, a large portion of this currency in circulation will potentially turn into bank reserves as people deposit their cash hoards into their banks thereby increasing the Fed’s interest expense and by extension to the federal government.

Do you have any indication how much of the currency is Eurodollar vs. in circulation in US?

Most of Latin America and Africa has de facto dollarized, and some other countries are heading that direction.

Would help understand the currency markets.

This just goes to show, however, how the Fed must protect the dollar at all costs. If those foreign dollars come back to the U.S. to buy assets, THAT’S when we’ll get hyperinflation.

People only hold cash overseas BECAUSE they have faith in the Fed to get inflation under control.

That’s why they can never adopt the 5% “target” or whatever is being proposed by the shills.

If the currency in circulation has tripled since 2008, does that not mean the dollar is really one third the value it was in 2008. Would that dilution caused by printing more dollars make the dollar less valuable than any other currency, or gold?

No, read the article. There is no dilution or money creation. When banks obtain paper dollars (Federal Reserve Notes) from the Fed, it’s an exchange of Treasury securities and other collateral for Federal Reserve Notes.

The FED’s research staff estimates that foreigners hold one half to two thirds of all U.S. currency.

Currency? Do you mean actual, literal cash? Because that is a small fraction of the sums in deposit accounts.

The government isn’t making an effort to switch to credit cards, banks are. Because they make money from them. The government could care less.

No true. The government much prefers credit cards, as it’s a lot harder to not report income.

A question:

If RRPs are a tool for the Fed to drain liquidity from the system, then a reduction in the level of RRPs seems to be a reversal or a halt of that effort or need to drain liquidity, yes?

(Understood is that Treasuries now sold pay a higher interest rate)

And, if the Fed has less RRPs, then they have “taken back” the Treasuries involved, yes?

The liability of the RRP drops, but the level of Treasuries held by the Fed seems to increase as the RRPs reduce , yes?

Thanks. (this is complicated)

Yes, RRPs are very hard to understand. I believe the Fed alson uses them to help keep the FFR within its current 5-5.25% band.

Also, keep in mind that in March 2020, the Fed ended all reserve requirements for banks. To my knowledge, I don’t think they’ve re-implemented specific targets. From a layman’s perspective, it seems like RRPs have assumed part of the reserve requirements role in the banking system, but that’s certainly just a guess.

You can look at this URL by clicking on the ALL option to see how RRPs have evolved since the Fed/Congress jumped all in on Modern Monetary Theory.

https://www.newyorkfed.org/markets/desk-operations/reverse-repo

A lot of the RRP money comes from money market accounts held by companies like Fidelity. These are extremely unproductive liabilities for banks, so the Fed paying 5.05% on anything Fidelity et al RRPs with the Fed is a really nice, zero risk bump to their bottom line, ~$100B annually.

Basically, there wouldn’t be any RRPs without all the QE the Fed has engaged in over the last 15 years. That mountain of $$$ in the URL represents an enormous gain to the affluent who have benefited the most by all Fed QE & Congressional deficit spending.

Most believe the Fed is running off its treasuries and MBS too slowly and would like to see them at least sell MBS to meet their $37B monthly target that they’re undershooting to the tune of $15-20B a month. Selling treasuries isn’t likely to happen either. To do so, I believe, would push up both treasury & MBS yields.

Just ask Depth Charge his thoughts on the Fed.

1. Reserves and RRPs are essentially the same, for different users (banks v. money market funds). And there are flows between them, as outlined above.

2. Demand for both is market based. The Fed pays over 5% on each, and both are risk-free and very liquid. So there is demand for this product. This demand is determined by the market participants. The Fed could influence it by changing how much it pays on them.

3. “The liability of the RRP drops, but the level of Treasuries held by the Fed seems to increase as the RRPs reduce , yes?”

No. In general, when liabilities drop, assets drop by the same amount.

I spelled the specific situation out for you in the article just above the 5th chart, with actual numbers of the drop of Treasuries and MBS. This is what I said:

“The Fed has shed $664 billion in Treasury securities and $202 billion in MBS, for a combined QT total of $868 billion. At the same time, the combined “Reserves plus RRPs” have dropped by $865 billion. QT in action.”

So, RRPs are covering the reduced dollar availability, and that is why the DXY did not spike, but fell?

This gave me laugh, the question does not make any sense AT ALL.

You make premise about wasps, and then you asked why bees were effected in specific way? And mingled everything together throughout.

There are different types of insects, as there are different types of currencies. Go study basics on RESERVE currency, INVESTMENT currency, and FOREIGN currency.

Yes BeeKeeper, chuckle intended, and was hoping for (at least) a Wolf forehead slap.

Why did “Reserves” in the Fed account grow so much during the 2013-2015 period? Is this what kept the increased money supply from causing inflation?

That was during the end of QE3. But real interest rates rose, inflation subsided, and unemployment fell. And it was because the FED tightened monetary policy, while it the banking system released savings. Thus, we had the “taper tantrum”.

Reserves and Excess reserves were where nearly all of the so-called QE funds were put when the Federal Reserve purchased existing assets consisting of US Treasuries and MBS instruments from member banks. Excess Reserves grew from nearly nothing to around $3.5 trillion and banks get paid IOER (Interest On Excess Reserves) from the Federal Reserve for those funds on deposit inside the Federal Reserve.

Reserves are a constant flow in and out. In the most simplified schematic way: If I use my cash to buy Apples shares from you, my bank sends the money from its reserve account at the Fed to your bank’s reserve account at the Fed, and it stays in the reserves. So I bought some stock, and you sold some stock, but the cash stayed in the reserves, just at a different bank.

But reserves are only a small part of total bank cash. Banks do not have to deposit cash at the Fed; they just need to have enough on deposit on a daily basis to fund the transactions, and if the daily inflow doesn’t arrive before the outflow goes out, they can borrow for a few minutes the amounts from the Fed. There are huge amounts of money flowing through the reserves every day because that’s how banks pay each other for any transactions.

So when you buy a house, all the transactions associated with that purchase and loan flow through the various banks’ reserve accounts at the Fed. The reserves are the central payment point between banks. And whatever balance a bank has in its reserve account at the Fed that day earns interest, just like an interest-bearing checking account.

” whatever balance a bank has in its reserve account at the Fed that day earns interest, just like an interest-bearing checking account.”

Well…except Fed-QE-created, high powered unanchored fiat doesn’t get injected into JP Nobody’s checking account, whereas JPM’s “checking account”…(I know the fig-leaf of over-lending against badly impaired collateral was frequently invoked to obscure this dynamic)

As I mentioned elsewhere, the IOER “throttle” on the Fed’s Rube Goldbergian QE machine does seem to have more less mostly worked…but it also works as a stealth re-capitalization of the TBTF banks (interest money-for-nothing…idle gifted funds at riskless Fed ain’t exactly “work”) and it does *nothing* to address the “originating sin” of fiat being injected without an ounce of incremental real asset backing.

A very good article, Wolf, I just worry whenever the ultimate bottom-line gets omitted in recitations of “what happened”.

Sorta like *everybody* needs to be using year-over-2019 in inflation discussions rather than yr-over-yr (otherwise the marionette MSM will be all too happy to scroll inflation into mystical oblivion – “Golly, my $100 egg is only up 1% from last year…”).

If banks don’t have a lot of cash that they can deposit at the Fed, they cannot earn the 5.15% in interest. So where do banks get their cash? From depositors. So if I pay 0.1% to my depositors but earn 5.15% at the Fed, I make a lot of money by screwing my customers…

So now customers figured out that they’re getting screwed, and they’re yanking their money out, and the bank collapses.

So now, to prevent that fate, the bank has to offer higher rates to just stay afloat, and forget depositing money at the Fed.

Only banks that are deposit-rich benefit from the IOR.

The interest that the Fed pays on reserves and RRPs is the reason we’re now earning over 5% on our money. Anyone who wants to borrow money short term (CDs, Treasury bills, etc.) will have to outbid the IOR and the interest on RRPs. This is the opposite of a bank recapitalization – not sure how you came up with that. Lots of banks are seeing money leaving, and they’re having to offer higher rates to keep and gain deposits, which increases their cost of funding.

JPM being the TBTF bank has a lot of huge uninsured corporate deposits that it pays almost no interest on, but that’s one of the exceptions. For most banks, this is a difficult time, and the Fed did it to them.

The free-money era was a great time for banks. That was the time the banks recapitalized by screwing their customers. But that’s over.

Yes, higher idled reserves at Fed meant less inflation (because those reserves were *not* being used to make highly leveraged loans on already overvalued office buildings, malls, beanie babies, pet rocks,

As to timing…interesting isn’t it…what else was happening in 2013-15?

Collapse in oil prices.

Exactly. Unfortunately, I predict that the “Fed” will effectively get bailed out of its self-created troubles not just by the accelerating collapse of its cronies, the CCP’s poorly run, “suicided” economy, which will reduce commodities demand but because liquid neural networks will arrive in a few years and enable wealthy nations to reshore many, many factories.

Upcoming, embodied AI (liquid neural networks that constantly learn from feedback while operating drones, manipulators, and even robots) will be the next source of even cheaper, untiring, quasi-slave labor. That technology will increase the supply of most, manufactured goods and will finally decrease the bankers’ profitable (for them), beloved, Fed-created-by-reckless-money-creation inflation in 2027 or so. Most people do not realize how fast AI tech is advancing and will be shocked, as they were by the pandemic.

My mistake. That was QE4.

If I understand all this, there is more liquidity sloshing around now than before. I don’t know if the Fed can actually drain liquidity if it depends upon issuing more debt. Debt that functionally is not needed for Congress to pay its bills. Congress can drain liquidity by raising taxes. This supposedly opens up ‘fiscal space’ where Congress can use its spending power to invest to benefit the nation. To me this all looks like a shell game that enriches those who can buy Treasuries by the millions. Congress is AWOL.

I’m not the sharpest tool in the shed but if the fed pays 5% on reserves they have to print that money it right? That would put more money in circulation and be one more contributor to inflation. If I take out a loan I must find some way to use that money that is profitable or pay it back with personal earnings, both come out of the existing money supply and no way inflationary.

That’s not how it works. The Fed has a large interest income from the securities portfolio. That interest income not “QT.”

So when the Fed pays out interest (interest expense), it’s not “QE” either.

For the past 20 years, the Fed has had net income of $1.3 trillion — and that was not “QT.” So now it’s going to have a few years of losses, and that’s not “QE” either.

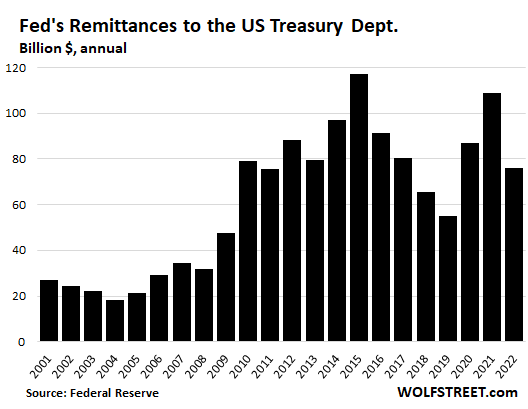

The Fed remitted its entire income to the US Treasury Dept. (100% income tax bracket). So now it will lose money for a few years and not remit anything, and that’s all:

How much is the total Interest the fed pays out?

Is that a data point somewhere?

Thx

I report on it annually in early January, every year. Here is the one for the year 2022: The Fed had $170 billion in interest income and $102 billion in interest expenses.

https://wolfstreet.com/2023/01/13/despite-losses-since-september-the-fed-still-made-a-profit-for-the-whole-year-2022-remitted-76-billion-to-us-treasury-dept/

Wolf and the crew that have left comments… I appreciate the Q & A after Wolf’s complicated subject matter (at least for me)… :) Wolf thank you for doing such a great job breaking down and explaining!! The current and historical data helps so much… Wolf wondering if you could do a piece on the Current S & P 500 earnings against the historical averages. Reason I ask is the last 40 year average is much higher then the prior 40 years… Is this because there are more dollars chasing equity assets? Business are indeed making that much more profit?

Not going to do an article on it. People are going to figure out on their own that the last 14 years were an abnormality that won’t be repeated for many years. Other countries went through this too. Abnormalities eventually revert. Look at the stock markets of China, Japan, and many European countries. They have not returned to their peaks from 15 to 33 years ago, not anywhere near. That’s how abnormalities are being worked off.

Wolf,

Actually, the abnormalities are even more extreme.

About 40% of the gains in the S&P 500 over the last 30 years are attributable to declining interest rates and tax cuts (rate cuts plus tax credits for R&D, etc.). Add that another 20% or so of the gains were buybacks (enabled by low interest rates) and the picture becomes even clearer.

There was a case study on McDonalds (stable revenue over 30 year period) that proves this out.

If interest rates are in a long term up cycle, and taxes need to go up, these trends all reverse.

“Abnormalities eventually revert. Look at the stock markets of China, Japan, and many European countries. They have not returned to their peaks from 15 to 33 years ago, not anywhere near. That’s how abnormalities are being worked off.”

Not seeing your point here. European markets multiples above 1990 levels, well above 2007 highs. Another +10% and Nikkei will be at 1990 top. Only Shanghei lagging at half 2007 top.

Last 14yrs certainly an abnormality. Does reversion = big bear of 30s that permabears keep expecting? Or 40s war years?

Look at the peaks of those markets.

Shanghai was 8,000 in 2007, now 3,237.

Nikkei was 39,000 in 1989, now 32,300;

French CAC40 surpassed its 2000 peak in 2021, 21 years later, and only due to pandemic money-printing;

Italian MIB is still 35% below its peak in 2000.

Spanish IBEX 35 still 40% below its 2007 peak.

German DAXK back up where it was in March 2000, and only due to pandemic money-printing (you can’t compare the DAX because it’s a total return index).

Just look them up. The abnormalities are the US stock indices.

If inflation reaccelerates later this year the bond market will do a swan dive and fleeing investors looking for an inflation hedge will likely choose the stock market. One abnormality could be succeeded by another. Where else do you go? Physical metals are illiquid, bitcoin is volatile and a threat to fiat, bonds are in the crosshairs, and cash will likely underperform inflation.

Ultra short term (<6mo) T-bills. Hold till maturity and chase rates higher.

If rates keep rising stocks prices will suffer along with long bonds.

Sounds not dissimilar to the US residential real estate market.

This is only the 2nd time since the GD that commercial bank credit has contracted.

Wolf,

This is a very strong “explainer” type article (although likely to be under appreciated by the peanut gallery).

It clears up a few concepts that had confused me (you’ve probably done similar posts before, and I just missed them or your info didn’t register fully).

One example (I’ll mention some others later) –

“Reserves are a manifestation of liquidity in the banking system that is not chasing after other assets.”

This is a major point about a major latent indicator.

Basically, reserves deposited at the Fed were money that banks *could have* lent on (at, say, a 3% spread) and with a *large* money supply multiplier effect…but chose not to (because of the risk profile of proposed private sector loans).

Imagine how much worse inflation/future defaults would have been had Fed reserves been lower.

Essentially, even when interest rates were ZIRP’ed, banks (awash in idle USD deposits…conjured up by Fed QEasings) found it more prudent to take a tiny handful of riskless Fed basis pt payments rather than risking (even more) money in dubious loans at 3-4%…Now those riskless Fed payments are over 5%…drawing way more money away from inflation-fueling private sector loans.

Those riskless Fed payments to the banks are one “throttle” that allows the Fed to influence just how much money (printed by Fed, given to failing banks during Ye Olde QE…and earlier…) gets “lent on/multiplied” via private sector loans.

Added “goody” (ahem) – Fed “payments on reserves throttle” also allows for stealth recapitalization of banks that had performed capital circumcisions on themselves during Implosion 1.0.

Basically, banks were (and *are*) being paid many billions to do absolutely nothing…which apparently is a safer outcome than when banks actually do things…

It is a “system” and it sorta works (so far, sorta), but you get the feeling that Rube Goldberg is feverishly pouring his life savings into AltCoin…

And, notice, all these peregrinations are employed to “manage” just the “paper overlay”/incentive structure of the underlying real economy.

What are we to make of all this?

Even by their own numbers (which are probably skewed to the upside because they lag by around six months) “Inflation” (that is, the loss of purchasing power of the dollar) is now at around 4%.

At the same time, the Fed pays the banks 5% in risk-free interest.

That means the banks now are solidly in positive real yield territory, risk-free, and probably have been for some time.

This is crazy monetary policy.

No bank, under these circumstances, will take on any risk lending to a business. Certainly not when the Fed at the same time hammers its balance sheet assets down by raising rates. Plus, the Fed is now the very source of the Inflation they pretend to fight. The logical Outcome: stagflation.

The Fed is Killing the US economy.

Core CPI = 4.8%. Energy, whose price plunge pulled down overall CPI, is in the process of flipping. So overall CPI will pretty soon return to its normal place higher than core CPI. I’m pretty sure, just based on the mechanics we already know, that overall CPI will be 5%+ by year-end.

“The Fed is Killing the US economy.”

That has been the same-old same-old red herring that the Wall Street crybabies and Corporate America throw out there when the Fed hikes rates because it threatens their incomes. I’ve heard it all my life, during every rate-hike cycle.

Everyone loves free money, and they start fear-mongering when the free money is taken away from them. But the economy itself can deal with higher rates just fine.

The Fed has only paid interest on reserves since the GFC. Take that away and what happens to those funds? To inflation? To the economy? I think that might have been his point about a crazy monetary policy. The Fed is trapped in a quandary of its own making and all the financial rules of history are being overridden by these cretins. It’s no wonder they are moving deliberately and slowly, just like the teens in the haunted house. Don’t open that door Jerome!

The Fed grew their balance sheet by 3 trillion in a matter of a weeks in 2020, then another 2 trillion over the following year and a half or so. Now they’ve heroically managed to draw down a whole $0.86T which has taken well over a year? And maybe refilling the TGA removes liquidity for a little while, but realistically how effective is that when the government turns a lot of that money around to the tune of $2+ trillion a year in deficit spending injected back into the economy with interest?

Wolf, I can’t for the life of me understand why you seem to have any faith in Powell and his crew. I feel like marrying oneself to the idea that he actually means business is a risky proposition. There’s a high probability he’ll leave you standing there at the alter one of these days.

Some people hate the Fed when it does QE (me included), but then they also hate the Fed when it does QT at the fastest pace ever and hikes rates at the fastest pace in 40 years. I just don’t get it. You might quibble over the pace, but you cannot hate the Fed in both directions. That’s just nonsense.

QT is VERY risky. Stuff blows up when you withdraw liquidity. It blew up last time late 2019 (repo market). We already had a banking panic earlier this year. Who knows what blows up next. The idea of QT is to withdraw liquidity without blowing stuff up. I totally get that. And people who don’t get it are just wanting everything to collapse — so that the Fed restarts QE all over again?

I guess what’s frustrating is that QE is always performed grotesquely faster than QT… Lightspeed followed by a snail’s pace. I think a lot of us understand that QT is the more delicate operation, but in retrospect it seems like the Fed could be going a good bit faster. They’ve been doing QT for a while, but the economy is still red hot, so clearly there’s some headroom on the rate of QT. Rate hikes have choked off the housing market a bit (barely affecting prices), killed a few irresponsible banks, and amplified problems with commercial RE and zombies.

Indeed, who knows what blows up next? What we can say with reasonable certainty is that something will blow up next and the Fed will respond with an immediate $400B, or $800B, or a trillion+ or whatever of not-QE. They will negate months or more of QT just like they did in the March 2023 panic. When the little guy makes a bad decision, he gets crushed. When the Fed’s buddies make hundreds of billions of bad decisions, the fed steps in with hundreds of billions of not-QE, also crushing the peasants with inflation. That’s why I hate the Fed.

Since 2008, Fed never i repeat never undid QE. They just do little bit QT and then start even bigger QE next time. Rinse and repeat.

Hello, Wolf,

Like most of your readers, I really appreciate your data, graphs, and analysis. However, from time to time, I find myself disagreeing with one of your points. For example, you wrote that “The idea of QT is to withdraw liquidity without blowing stuff up.”

In my opinion, the idea of QT is to reverse (as much as possible) the effects of the Fed’s evil QE policy. Put differently, the idea is to deflate the asset bubbles that are causing pension plans and younger workers to invest their retirement money in overpriced stocks and bonds and causing renters to pay far above FMV for a house. House prices in a retirement community near me increased more than 50 percent in less than two years, which really blew up my retirement plans. Those house prices have retreated slightly, but mostly for houses in a bad location. I don’t know anyone who wants to see QT implemented so quickly that the world economy is thrown back to the Dark Ages, but implementing QT too slowly allows the effects of QE to linger on and on and on. I think QT is being implemented too slowly. At a minimum, the Fed should sell its MBS within a year in an effort to get the housing market back to normal. Of course, I might be wrong.

Well said. They printed $3 trillion in one month. They have withdrawn $700 billion over the last 15 months. It’s way too slow. I get that they don’t want to blow things up, but it seems to me that they consider stocks and housing returning to its pre-pandemic prices to be “blowing things up.”

I don’t.

Once you realize for whom the fed works then your perception would change and then itd make sense with what fed is doing

Amen. The asymmetry in the QE vs QT is outrageous. If Congress has any fortitude whatsoever they would permanently outlaw QE.

QT should be compared to new government debt issued. If the government deficits are growing faster than QE, liquidity is easing, not tightening. Not to mention those zombie banks they’re keeping alive with more not QE.

When liquidity is quickly added to the system (in so-called emergency situation), isn’t it prudent to take that liquidity out quickly, not slowly? Otherwise, the financial system will leverage out and grow into that liquidity, creating a heightened level of leverage and financial instability.

I’m not a fan of slow-walking QT. It supports excessive inflation and excessive debt. Asset prices and debts need to revert back to a reasonable baseline. The time to start is now.

Bobber,

I agree with you if QE had been reversed within a few months of QT.

QE was applied for over 2 years. It was long enough for the economy and people to become accustomed to the extra money.

As a personal analogy, my life would change if they doubled my salary over 2 years. I might leverage into a mortgage for a house or an investment rental. I might decide to have more kids. I might pay for a more expensive school for my kids. My spouse may stop working. I might buy the car I’ve always dreamed of. My life could handle massive QE very easily no matter how fast it was applied. Nothing would implode. :-)

If in 2 years QT was applied, and my income was halved immediately, that would be a disaster. If I had over-leveraged into mortgages or decided to have more kids, it would be hard to unwind that after drastic QT. That would ripple into the economy with foreclosures and bankruptcies.

I would never over-leverage like I described above, but if I had, I would need a slow QT to survive for a soft landing.

“…isn’t it prudent to take that liquidity out quickly, not slowly?”

Yes. But you can’t with bonds that you bought (QE) because it’s hard to sell them. The Fed should have never ever used asset purchases (QE). You cannot sell $1 trillion of bonds in a month and expect the financial system to remain upright.

The Fed should have handled the turmoil in March 2020 with repos alone. Repos mature the next day or in a week or a month, and just stepping away from the repo market brings repos back to zero. You don’t have to sell anything. That’s how the Fed used to do it before 2008 QE. Such as after 9/11 when the markets were first closed, then frozen. The Fed threw liquidity at it for a few days via repos, and that was it, and within two weeks, its repo balances were back to normal.

But once you buy bonds (QE), you cannot just sell them in large quantities. It’s even hard to sell $1 billion of bonds that were originally issued a few years ago… there just aren’t a lot of buyers for that kind of bond, and you have to do a lot of discounting to sell them to some hedge fund or something. QE was a terrible thing.

I can see how people hate the fed in both directions. I tend to like free-er markets and keeping government to governing…

Einhal: Houses in particular and basically: NOTHING will return to the “pre-pandemic” pricing!

“Stuff blows up when you withdraw liquidity.”

Sure, but there’s army of Stay-Puft Marshmellowmen Assets that are first against the wall when the revolution comes.

(Although Otto-the-Inflatable-Autopilot-NASDAQ-Equities are incredibly…re-inflating)

Mark my words..

After few years FEDs balance sheet would be higher than today.

FED would always find some excuse or serious situation to come and bail out by printing trillions.

Govt is running trillions in deficit and the spending would go up and up.

Who is going to fund unless the rates sky rocket .

I know recently Wolf has become a fan of FED but I am sure time would redeem my stand.

As of now.. FeD has been super fast to turn on qe spigot and cut rates.

When it comes to qt and rate hike they have been very slow in comparison.

On top of it.. Per Wolfs articles inflation is not coming down in meaning ful way.

I just got my home insurance renewal and it is up by 77 percent with no claims or so.

Otoh.. JP Morgan Reported record profit because of them acquiring of failed bank assets .

Far and away my favorite installments of Wolfstreet document the completely inadequate effectiveness of QT to solve the grotesque Balance Sheet or provide liquidity restraint necessary to challenge inflationary pressure.

Augmented by pitiful .25% rate hikes and pauses that seem designed to encourage inflation, that alone would be sufficient to convince even a fear monger like Tom Lee to stop fighting the Fed and get leveraged long. /s/

But throw in the IRA and IIJA and the tsunami of stimulus they portend and you can only conclude one thing….

Markets will rally to ATH by year end. S&P to 4700 by Labor Day.

If the market has its way, it would be 20% from current level of 4500, or 5400. The whole market right now is just unbelievable. Forget 5% TBills, you can retire on that. Hahaha. Who are doing the pumping, I want to know.

AV8R,

I’ll just repeat it here:

Some people hate the Fed when it does QE (me included), but then they also hate the Fed when it does QT at the fastest pace ever and hikes rates at the fastest pace in 40 years. I just don’t get it. You might quibble over the pace, but you cannot hate the Fed in both directions. That’s just nonsense.

QT is VERY risky. Stuff blows up when you withdraw liquidity. It blew up last time late 2019 (repo market). We already had a banking panic earlier this year. Who knows what blows up next. The idea of QT is to withdraw liquidity without blowing stuff up. I totally get that. And people who don’t get it are just wanting everything to collapse — so that the Fed restarts QE all over again?

A comparative of QT by the ECB and other CB’s would show an interesting picture.

If the dollar milkshake theory is correct, QT is even harder than it appears because foreign liquidity flows into the US because of reserve currency status.

A lot of the Bitcoin action is likely moving from currencies which have flow controls (China) to move into dollars.

This means the Fed’s job is actually much harder than I appreciated.

Maybe there are a few things that desperately need to be blown up. Things like the housing market, which is well and truly broken–to the upside. Nothing short of blowing it up has worked.

If I am reading this right, cash that is hoarded is considered “in circulation”.

Us geezers have a propensity to have a respectable wad of cash laying around in a home safe or other rat hole because we heard the stories regarding bank runs, long lines, restricted withdrawals, etc., told by our parents or grandparents. I also recall being in South Dakota in some small (and I do mean small) burg (population 8 proudly displayed on the sign) where the gas station did not accept credit or debit cards. Another time, in Indiana, I had a tire fail and the repair shop didn’t want no stinkin’ credit card either. Might have to do with the income reporting… but, just the same. No cash? No gas. Next gas? Farther than I could go with what remained in the rental car tank.

To wit: When we cleaned out my wife’s parents house we found $30K in “mattress money”. Recently, while cleaning out my sister’s house readying it for sale, we found $8K in an old suitcase. When I took that wad to the FL bank (didn’t want to carry it on a commercial flight for obvious reasons), the teller immediately identified it as “mattress money”…. so, apparently, it’s not that uncommon. How did she determine it was “mattress money”? Old style bills. I knew there was cash in her house because her wallet contained an old Benjamin – much of which has been removed from circulation.

If you ever need help moving, let me know. Ready to volunteer!

“If I am reading this right, cash that is hoarded is considered “in circulation”.”

Yes. That’s why I prefer the more modern term, “paper dollars.”

Paper dollars used to circulate, but that was a long time ago. Now they’re mostly being hoarded, much of it overseas.

Like in Argentina and Zimbabwe

Very common for the “Silent Generation”

I had a friend clean out his grandfathers home about 20 years ago after the grandfather passed away.

They ended up finding over $95k hidden all over the house. Even a lot of uncashed pension checks.

Silent Generation grew up during the depression and their parents saw a lot of bank failures and probably told them not to trust banks.

“Silent Generation grew up during the depression and their parents saw a lot of bank failures and probably told them not to trust banks.”

Yes. The old days. Now with Central Banks and Modern Monetary Theory, individual banks are prevented from failure. In the end the total system collapses.

Four banks collapsed just fine this year in the US, and a big one in Switzerland. They weren’t “prevented from failure.” Investors got wiped out. The failed banks got dismembered and some of their pieces were sold off, and the FDIC is still selling off the remaining pieces. Depositors were (unnecessarily) bailed out. Life goes on.

I’ve gone back and forth in my head as to whether the bailout of unsecured depositors was unnecessary.

On one hand, they were large enough that they should have been doing diligence, but on the other hand, the last thing we want is a bank run on every smaller bank, leaving only the behemoths with no competition.

There might not have been a good option.

Banks are prevented from failure only if you literally ignore reality.

I get the feeling some people will not be satisfied unless the whole world is burning around them. They want to see others hurt.

JimL — Most of the comments on here of the nature to which you allude strike me more as the disgruntled but sober murmurings of the annoyed designated driver for a crowd of wet brains.

bul – this. (…as the drunken clowns seem to jam themselves into the car faster than they exit…).

may we all find a better day.

DM: Only a tenth of mortgages have an interest rate above 6% — that’s a big problem for the U.S. housing market

This is why MBS rolloff will remain slow.

Why would anyone with a sub-4% mortgage make any more than the minimum payment when they can earn 5+% on CDs and T-bills?

They won’t. But if they sell for whatever reason, they won’t have a choice.

Not everyone requires a mortgage. Some pay cash. Some younger folks have parents that will float them. We took equity in one of our kids’ houses…. got her mortgage down to where she could handle it on her own. She paid the taxes, etc.. When it sold, she got her equity and the profit and I only took my fiat back plus my tax liability.

I’m in the process of selling a relative’s $1M+ house in hurricane country. Most of the folks looking are from the NE and have buckets of cash. They could give a wet crap about mortgage rates.

Part of what I’m hearing from some of the posters are laments about themselves thinking they could outsmart the housing “market” and procrastinated because the misread it and now they’re kicking themselves because they missed the run up. Rather than taking their “you snooze, you lose” medicine, they blame “da fed” and everyone else for their failure to act.

Oh… and the Fed buying MBS? Might have something to do with the “community redevelopment act” where people who couldn’t qualify for a loan on a cheese sandwich were hocked on a $500K house. No banker or investor, in their right mind, would hock such a person. So along comes Uncle Sugar to the rescue.

Sorry, but this I nonsense. The idea that a 28 year old wanting to buy a house now missed the “run up” because he was “snoozing” is absurd. There are tens of millions of people like that. The idea that people should have known the Fed would act as recklessly as it did is ridiculous on its face.

Einhal,

Yes, it’s ridiculous. There’s certainly a cohort of people that were prudently saving a down payment (many of whom can’t go to the bank of Mom and Dad) who were left behind by the Fed’s recklessness. To blame them and suggest they “take their medicine” is to further encourage speculative behavior and discourage prudence and good judgment.

Also, the Fed’s purchases of MBS has nothing whatsoever to do with the “community redevelopment act” or any similar program. Those loans are guaranteed by the Federal Government so bankers have no problem making them. The Fed didn’t even purchase MBS until the GFC, over thirty years after the CRA was enacted in 1977. I wonder where this stuff comes from.

I’ll tell you why somebody with a sub-4% mortgage would sell.

In a declining market, your home loses value, potentially in the 20-40% range. It doesn’t make sense to pay any amount of interest for the right to lose money.

Potentially, somebody could lose 100%. What’s your point? You could do that with a stock or totaling a lease vehicle without gap insurance. On the other hand, someone could leverage their money and make a literal eff-ton of bongo bux. There is little reward without risk.

I’ve owned 8 houses. All were bought in various economic conditions… on one I carried a 14% mortgage. Never had a mortgage south of 4%. Bought whether there was a recession, a downturn, or whatever. I had to do what I had to do as I worked in an industry where you moved every 3-5 years. I rolled the bones, took calculated risks, and never lost a nickel because I knew what to buy, where to buy it, and how much I should improve it. Even in the last downturn. If you’re not logic challenged, you realize that renting also has a cost… beyond just the rent that is purely an expense. And that “cost” is the potential loss of appreciation and whatever tax benefits ownership offers beyond renting. Then there’s the feeling of permanence and commitment to a community… adulting.

Buying a house is an art…. community vibe, schools, crime, location within a tract (if you’re a city dweller who has ambient noise), smells, proximity to ratty hoods, proximity to the “fancy people’s” amenities, road networks…. all come into play. Many people get blinded by “granite” and “luxury vinyl plank flooring” – chasing their HGTV dream – rather than look at where the real value lays. I have bought what some people think are bizarre properties in nutty areas…. only to have those same people wonder how I saw what was forecast to happen in the community demographics, then tailoring the structure to that demographic. (You can change the house, but you can’t move it). That’s what working in dealer placement for an auto manufacturer buys you…. being able to identify population migration, who’s going there, where the people with assets and income are going, and what else is moving there (like employment and amenities). It’s all available for free if you know where to look. (Pro tip: Start with the county planning commission)

None of this is rocket surgery. It’s common sense.

Plus you have to know the difference between a hammer and a screwdriver and it helps to know how to use them. That is unless you’re independently wealthy. Then none of the above matters because you’re living Palos Verdes, CA. Oh. Wait. The land is subsiding there and houses are falling into canyons. Or Anaheim Hills where the geniuses don’t want to pay money to keep the pumps running to stabilize the hills. (I looked in both communities but studied land movement… and passed.)

El Katz,

This sounds very much like the typical boom generation mentality of “I did it, so you can too.”

You people grew up in the most prosperous time we’ve ever seen, all while interest rates dropped every year and globalization’s benefits accrued to the elite here.

Yeah, it was easy to “work your way through college” when tuition was $1,000 a year.

I’m so tired of the boom generation thinking that the world they’ve handed us is the same world they grew up in.

Einhal,

“Yeah, it was easy to “work your way through college” when tuition was $1,000 a year.”

Yes, and we worked our way through college getting paid $2.30 an hour.

I bought my home to have a roof over my head. My roof isn’t any smaller or less reliable if the theoretical resale value of my home goes down by 10%, 20%, 40% etc.

As an added bonus, when my home price crashes, I can petition my city to re-assess its value and lower my property tax rate.

My house isn’t for sale, so I don’t care what it would theoretically sell for.

Yes, so you needed 435 hours to pay for a year of tuition. Now, tuition has gone up by about 30 times while pay has not gone up by anywhere near it. 19 year olds today are worse off.

Einhal,

The $2.30 was real. Your $1,000 in annual tuition was your imaginary figure. So don’t just divide one by the other. I don’t remember what I paid in tuition, fees, and other costs. But I went to one of the cheapest colleges in Texas (in Wichita Falls), lived in a horrible dump, drove the worst POS without A/C, and ate the cheapest food (lots of rice and beans) because that’s all I could afford. No cellphone, no computers, no internet, digging through microfiche in the library instead of googling it… And we HAD to pay back out student loans plus 10% or whatever in interest.

People who say that young boomers had it easy are either malicious or ignorant. I don’t tolerate this shit here, just like I don’t tolerate millennial-bashing here. Young people out on their own never had it easy in this country – not today, not back then, not ever.

ElK – what you well-illustrate, and what is so difficult and exhausting for so much of contemporary ‘Murican humanity to accept, is that SOMETHING always has, and always will, change, and then skittle into other things, ‘disrupting’ an preexisting period of ‘stability’. Large brains developed to deal with this inherent instability, but speed and scale of a change will often defy our general ability to SWOT-analyze and adapt.

Adversity will never be fairly distributed. Our wonderful minds and their ability to cooperate with others in understanding, and existing, in our surrounding environment are our only armor…

may we all find a better day.

Katz,

My point was obvious but you chose to ignore it.

Housing prices just entered a downward trend after a decade of huge outsized gains.

If you don’t appreciate how that elevates home price risk relative to what we’ve experienced in the past, I can say nothing here that will help you.

Denial is not a viable strategy in finances or life.

What do young people know about the lives of us, the older generation?! Obviously nothing…..

Wolf,

I agree young people in the US have never had it easy unless perhaps their parents were wealthy and helped them, but my experience in college and watching changes over the last several decades is very different than your experience. I never had a car with AC and lived in the cheapest places I could find when I went to college. However, I was also fortunate to have a union job at a grocery store so I was paid relatively well. In 1988, my tuition was $545 a quarter and dorms with 2 meals per day were $325 per month. At the same time, wages for a journeyman clerk were $12.55/hr. At the time, it took 2,080 hours to reach the top pay bracket and we were paid time and a half on Sunday. Under the current contract it takes 9,800 hours (nearly 5 years at full-time so you’ve already finished college) to reach the top pay bracket of $25.50, and you get an extra dollar per hour on Sunday. I also didn’t pay anything for benefits, which isn’t the case today. I was fortunate to have a job that allowed me to pay my own way through college without taking out loans.

That’s simply not possible today as the estimated in-state cost of attendance at the same school is over $41,000. (my son will graduate high school next year so I’m looking into this). It’s not that young boomers, or even old Gen Xers like myself, had it easy. We didn’t. I worked my ass off in college, often going to class or finals dressed for work because I had to run there afterwards. However, kids today in similar circumstances simply can’t work enough to go through college the way I and others did 30 and 40 years ago. At least not at the same job I did. I think college costs have inflated at a rate so far above wages in the intervening decades that it is very hard to compare our experiences with those of students today.

On the other hand, from friends whose kids are already in college, I know the dorms today and related food is more like a resort than the utilitarian accommodations I dealt with. It seems that all perspective in keeping college affordable has gone out the window. Given my background, if I was graduating high school today I would have had no choice but to go to city college, and I would have been fine. But I’m grateful for the opportunity I got in 1988 because nearly everything I have today can be traced back to my college experience.

Hence the reason for FED to sell MBS.

They had no need in the very first place to buy MBS.

Zillow predicts 6.3% home price appreciation for 2023.

They should sell MBS, but they won’t. Wallet reiterated that last night. So the insane housing market is propped up, and propped up it shall remain–just a tiny, tiny bit less propped up every month.

They’d do this to get their mortgage paid off before they retire. Much more peace of mind that way.

If you’re going to retire, you should have zero debt. Debt eats you alive.

If you start preparing for retirement when you’re 21, it’s a lot easier than waiting until you’re 50. Or 60.

Go read the article relating to Charlie Munger talking about how important it is to get to your first $100K in the bank… and how that changes the trajectory of your future. Once you learn and understand the power of compounding (both interest earned and interest paid) you’ll get it. If you dismiss it, sucks to be you. Hope you win the lottery (or as it’s known in my circles, “the stupid tax”)

It did mine. (My wife’s nickname at work was “Same Suit Sally” due to her limited wardrobe. Now she can have whatever she wants and we don’t even blink). It’s the old “pay me now or pay me later” thing.

We’ve been our own bank for going on 20+ years…. (I think it’s 25). When you borrow from yourself and pay yourself back plus market interest rates, you get an education in finance – virtually for free.

MW: UnitedHealth stock is adding more than 200 points to the Dow’s price today!

Small typo:

“So there was a flow of cash from reserves to RRPs via money market funds, and they should be look [sic] at together…”

Open market operations should be divided into 2 separate classes (#1) purchases from & sales to, the commercial banks; and (#2) purchases from, and sales to, others than banks:

(#1) Transactions between the Reserve banks and the commercial banks directly affect the volume of bank reserves without bringing about any change in the money stock. The trading desk “credits the account of the clearing bank used by the primary dealer from whom the security is purchased”. This alteration in the assets of the commercial banks (the banks’ IBDDs), increases – by exactly the amount the PD’s government securities portfolio was decreased.

(#2) Purchases and sales between the Reserve banks and non-bank investors directly affect both bank reserves and the money stock.

Your #1 just describes the first step. So now the primary dealer has the cash in their reserves account, but they want to buy something else with it, so they buy Japanese stocks with it, and the cash leaves their reserve account and goes to a Japanese broker-dealer or whatever…

Wolf, does the $3.17T in reserves include what the Fed owns that it bought up during QE? From their balance sheet table 1:

Total factors supplying reserve funds: $8.347T

Total factors, other than reserve balances, absorbing reserve funds: $5.18T (currency, RRP, TGA)

Reserve balances with Federal Reserve Banks: $3.17T (the difference between the first two above)

The second line, $5.18T, is the lowest the Fed balance sheet could be if they got rid of all their QE since that is others peoples funds, right? My MMF, the TGA for the Treasury, and currency in circulation make up that $5T+.

If I’m reading that right, when the reserve balances go down, so does liquidity? The chart of just that factor seems to match up when liquidity shot up and since gone down from the peak, but somewhat went up recently with TGA draining until June…

RTGDFA. I explained it. Not going to re-explain it in the comments.

I’m willing to teach you how to read and understand the Fed’s balance sheet. My fee for “Fed balance sheet” 101 is $1,000 per hour. If you don’t have an accounting background, it may take 50 hours ($50,000) and it may take forever ($∞).

I wrote the article so that you don’t have to learn how to read and understand the Fed’s balance sheet.

I did real it in full, thanks. You said that reserves are cash from banks to get the 5.15% and I know the other part ($5T+ on balance sheet) does not belong to the Fed as it’s RRP like my MMF, TGA, and currency. So people here and elsewhere always refer to the $8T+ balance sheet as if it’s all the Fed’s buying when you (me and a few others) know it can’t go to $0 because it’s not all the Fed’s. I’m just trying to see what the actual amount of the $8T is Fed buying and I figured it was the “reserves,” but you said that it’s cash from other banks. I was using that as my marker for watching liquidity as it takes into account TGA and RRP movement (Total balance sheet minus- TGA minus RRP = roughly reserves). I won’t be sending $1k/hr so I guess I’ll pass thanks though. :)

In the 3rd paragraph I said this: “We often discuss the Fed’s assets, such as Treasury securities, MBS, and banking panic loans. Today we’ll take a look at the Fed’s liabilities.”

A balance sheet is always: assets = liabilities + capital.

Fed’s balance sheet (rounded): assets ($8.30 trillion) = liabilities ($8.25 trillion) + capital ($42 billion)

People have to be able to understand what assets are and what liabilities are. They’re not that same thing. I highly recommend for everyone to take a basic accounting class at the local junior college. Best money ever spent.

On CNN today:

“Homebuyers must ‘learn to live’ with near-7% mortgage rates, says RE/MAX chairman”

No, you clown, home SELLERS must learn to live with it, as it’ll cause a major reduction in prices after the pivot fantasy goes away.

Good one,

Zillow predicts that for 2023 ( IIRC ), home prices would increase by 6.3%.

After Zillow lost money attempting to flip houses in the greatest real estate bubble we have ever seen, they have no credibility with respect to their predictions.

I agree but you should also agree that hoke prices are on fire again and are flirting with all tike high.

The current mortgage rate is not able to bring prices down substantially although volume is down.

Same with other asset markets.

We still have too much money

Aaaaaaaaaaaaaany day now

Currency trivia before an actual comment:

As WR said the US $ is held around the world as a store of value. In unfriendly places it is held as cash under mattresses etc.

Quite a while back, the US did a rare update on the 100$ bill, the standard for the hoarders. The update was to introduce anti- counterfit strips etc., in the image.

This set off a panic around the world including Moscow. This was soon calmed with a statement along these lines: ‘No, no folks, this is not the old switcheroo so favored by other regimes, like say yours, all the old bills are still good’

Next: re: the pace of QT, including the rapid rise in interest rates. This is because the Fed fell behind the curve or pace needed and has to make up for lost time. It started to raise rates in 2018, but then in the infamous Powell Pivot, it reversed course.

Why was that?

2918, December

Inflation was 2%

Powell did the right thing and took FF to 2%.

But the ECB had rates well below.

The arbitrage was enormous

The Dow lost 5K in just a matter of weeks

then Trump jawboned Powell to pivot…as I recall

Today as well inflation is falling down quite a lot and I am sure govt metric would show inflation at 2 percent or so in next few months

Otoh.. my home insurance renewal notice I just received have increase of 77 percent

…insurance premiums = price discovery?

may we all find a better day.

In 2018 Powell reversed course because he started getting a lot of heat from Trump (who wanted to politically benefit from easy money).

Yes, it would have been nice if Powell hadn’t reversed course in 2018 and it is nice and quaint to think the FED is above political pressure, but in the real world that simply isn’t true. If the person with the biggest politucal megaphone starts attacking you for doing your job, you are going to feel immense political pressure to cave. That is simple human nature.

That is why anyone who cares about having sane monetary policy in the U.S. cares about making sure a certain someone doesn’t win the next presidential election. If elected, he will put immense pressure to continue the insane policies of the past 30 years, only worse.

To keep this as non-political as possible, I will say I don’t care which political party wins the next election. Republican, Democrat, Green, Libertarian, whatever.

As long as it isn’t a certain someone who is set on destroying the very institutions that made this country great.

In 2018/2019 inflation was at or below the Fed’s target. It’s pretty easy to stop hiking (rates were above core PCE) and stop QT. That’s a huge difference. Back then, they were just trying to normalize rates and the balance sheet, not fight inflation.

Yet the dictator in charge now ignoring statutes and court decisions isn’t destroying the institutions that made this country great?

You need to use better sources of information. Ones that do not take advantage of you.

Fed is part of the government and reports to congress and works for the wealthy.

If you look at the bigger picture fednand congress all work for themselves and the wealthy people under the facade of democracy.

Hope the sooner we understand the better it is for us .

Both parties are same they want to make money for themselves and their wealthy donors .

Just name and face changes the thievery remains as it is

They keep changing 100$ bill because of forgery ,and we probably forge there currency also .Den of thieves

Good article, thanks. It addressed two issues. The Fed balance sheet and inflation.

I’m having trouble getting past your first graph which shows the increase of the Fed balance sheet since 2003 or so until the present. It also shows the minimal chunk that QT has reduced this edifice that has controlled the world economy since the GFC. Someone has too pay for this shit. Someone else has paid for it.

It seems to me, like a fully charged battery, the Fed balance sheet is behind the improbable, simultaneous resurrections of asset valuation bubbles in the equity, bond, and housing markets.

Wolf can correct me although I think he has said it here himself fairly recently, too. The TGA used to be in commercial bank(s) until the GFC or so and the Treasury moved it to the Fed so the balance sheet went up in part from that move.

Correct

Just ruminating but whom is exactly in charge of monetary policy, the mothers milk of the state of the economy. Janet Yelen and Brainard, formerly big wigs at the Fed are now with the administration with Fed governor, Austin Goolsbee , expected to adhere to an administration economic point of view.

There are no hawks on the Fed FOMC board. There are only entitled people who vote the way they were raised to vote on whether too decrease the money supply and instigate a financial reckoning with the accounting department.

Inflation has been declared defeated, while, it is just as likely it is only pretending to sleep. Waiting for the right political moment to increase prices again, every year. What’s not to like for the stockholders who have an indifference about other people who didn’t work as hard as them.

That being said, it is a good time for workers to earn what they’re worth. With benefits just like Pepsi and Coke, heh heh, and GM, Ford, Tesla, and especially the sociopath, libertarian tech industry who fight tooth and nail against paying their employees like the type of customers they are trying to sell too.

There is a social event unfolding that I think has, undoubtedly, long term ramifications on the future structure of society.

AI has just invalidated digital presentations as sufficient legal evidence.

The death of digital as we know it.

I’m probably wrong as usual. Greetings all

dang – a significant observation, but will the public’s usual embrace of ‘convenience’ moot any revulsion to the ‘amoral hazards’ posed by AI and it’s apparatchiks?

(…as you stated, we could be wrong, but I doubt it…).

The FED has raised rates the fastest in 40 some odd years. QE has been reversing for the first time in decades.

As for your statement about there being no Hawks on the FED board, it should be noted that there are more Hawks on the FED board than there have been in 30 years.

The U.S. economy does not turn on a dime. It will take a while to undo 30 years of easy money.

I believe I heard somewhere nvidia AI semiconductor costs 5K to produce , sells for 183K I know this is very specialized stuff but seems like there raping the willing

We mistakenly believe that all inflation is due to higher input costs. But half the story is business raising prices because they can. From NYT….. “We’ve been able to raise prices and consumers stay within our brands,” Ramon Laguarta, chief executive of Pepsi, said on a call with analysts Thursday morning. Pepsi’s prices overall were 15 percent higher in the second quarter than they were a year earlier.

Consumer price inflation is ALWAYS by definition a result of companies raising prices because they can.

They can for a variety of reasons, including because the inflationary mindset has taken over when people and businesses are paying whatever, instead of resisting price increases.

Corporate margins have been dropping. Yes, they are historically high and way above historically averages, but they are dropping. Of course businesses are raising prices because they can. They are also raising them because they need to. Costs for them are going up faster than they are raising prices.

It will take a while to balance out

And sugar commodities are way down,of course cans and labor way up .Let’s look at executive compensation. By the way quit buying there products ,because of prices unless on sale

I have completely given up on soda and sugar laden drink and food

I only drink and eat minimally processed food for the last 20 years.

Works for me.