While, for the first time, the Fed’s QT and refilling the government’s checking account (TGA) pull liquidity from the markets simultaneously.

By Wolf Richter for WOLF STREET.

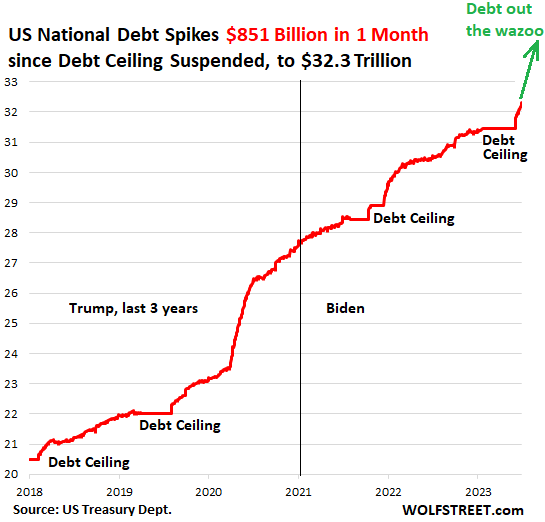

So this is a special day: The U.S. national debt spiked by $851 billion since the debt ceiling was suspended a month ago on June 3, and now hit $32.32 trillion, according the Treasury Department on Friday evening. This is just an amazing freakshow:

The US national debt is composed of two types of Treasury securities: “nonmarketable” Treasury securities that cannot be traded in the bond market; and marketable Treasury securities that the government sells via auctions to the public and that can be traded in the bond market.

“Nonmarketable” Treasury securities include the inflation-protected “I bonds” that Americans can buy directly from the Treasury Department. Government pension funds, the Social Security Trust Fund, etc. also invest in nonmarketable Treasury securities. The outstanding balance of nonmarketable Treasury securities rose by $123 billion since June 3, to $6.89 trillion.

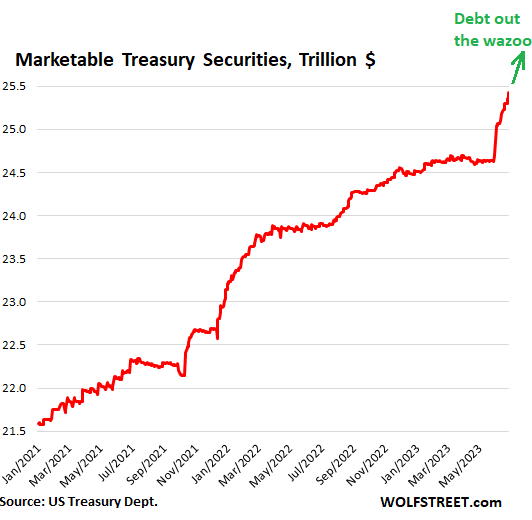

“Marketable” Treasury securities spiked by $728 billion since June 3, to $25.43 trillion.

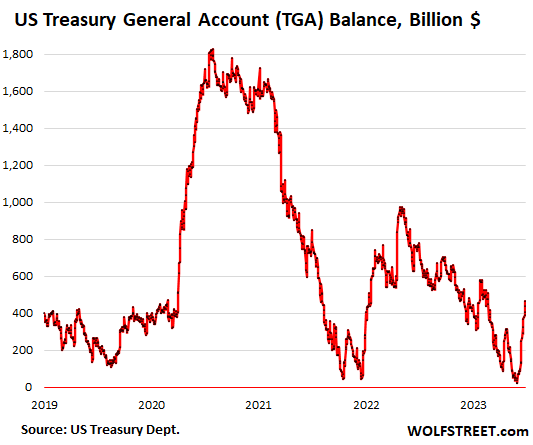

The Treasury Department has been selling vast amounts of Treasury bills and Cash Management bills (CMBs) since June 3, in addition to the long-scheduled issuance of Treasury notes (2 to 10-year maturities) and bonds (over 10 years), to refill its checking account. This “Treasury General Account” (TGA) at the New York Fed had been drawn down to just $23 billion by June 1, nearly nothing compared to the huge amounts that flow through that account on a daily basis.

The Treasury General Account has been partially refilled, from the low on June 1 of $23 billion to $465 billion on Friday, through a combination of this huge wave of new issuance of securities and the quarterly estimated tax payments that were due on June 15.

But wait a minute… For example, in 2022, the June 15 tax payments caused the TGA balance to jump by $140 billion. A month later, the balance was down by $200 billion. This year too, deficit spending will outstrip quarterly tax receipts by a wide margin.

In its Marketable Borrowing Estimates, released on May 1, the Treasury Department expected a TGA balance of $550 billion by the end of June. But Friday was the end of June, and the balance of the TGA was only $465 billion, thanks largely to lower tax receipts.

The Treasury estimated that the cash balance will increase in July, decline in August, and increase again in September (due to quarterly tax payments due on September 15), and by the end of September approach $600 billion, the level that is “consistent with Treasury’s cash balance policy.”

A wild ride of new issuance to get there… In the quarter starting July 1, so right now, the Treasury expected to borrow $733 billion in marketable securities to get to the $600 billion TGA balance by the end of September, assuming tax receipts don’t fall short again. That $733 billion flood of new issuance will start this week.

Draining liquidity.

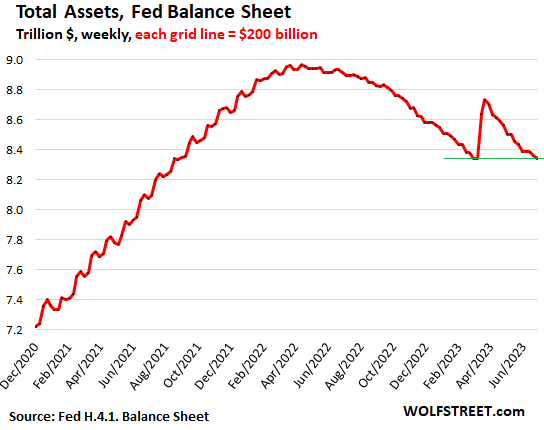

Refilling the TGA pulls liquidity from the markets, in the opposite way that drawing down the TGA had added liquidity to the markets. Stocks had soared during the drawdown phases, and they had swooned during the first refill phase from late 2021 through April 2022, when the TGA absorbed nearly $1 trillion.

In addition, the Fed’s QT, which also pulls liquidity from the market, is running simultaneously with the refilling of the TGA for the first time, with both now pulling liquidity from the markets together. In terms of the Fed’s total assets, the brief bank-bailout spike has been worked off completely.

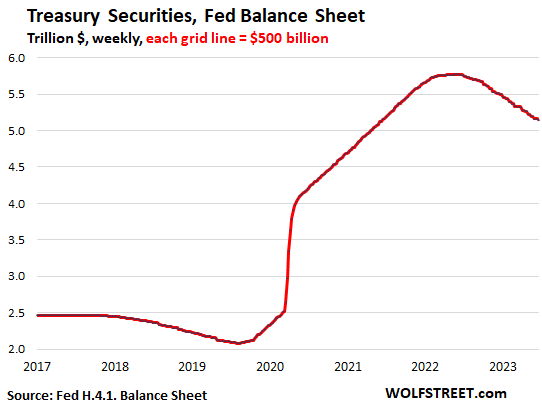

More relevant to the flood of issuance of Treasury securities by the government: The Fed has shed Treasury securities at a rate of about $65 billion a month; its holdings of Treasury securities are now down by $625 billion from the peak a year ago. And it will continue to shed $65 billion a month in Treasury securities:

Who’ll absorb this flood of new issuance plus the piles the Fed is leaving behind?

Don’t worry, it seems. So far, the Treasury market has been amazingly sanguine, amid juicy short-term yields that are beginning to price in a couple of additional rate hikes this year, and long-term yields that are, amid blistering demand, pricing in rate cuts and a return to 2% inflation ASAP.

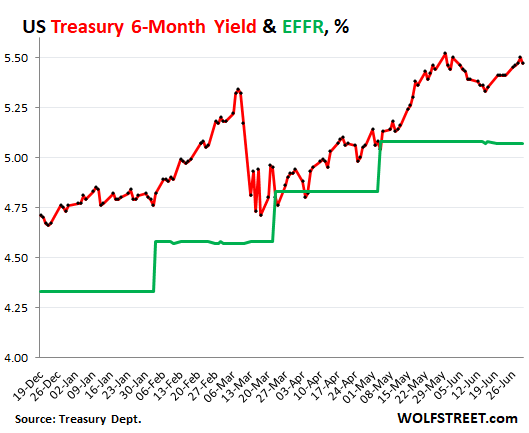

The six-month yield (red line) has bumped into 5.50% over the past three trading days, while the federal funds rate, which the Fed targets, has been at about 5.07% (green):

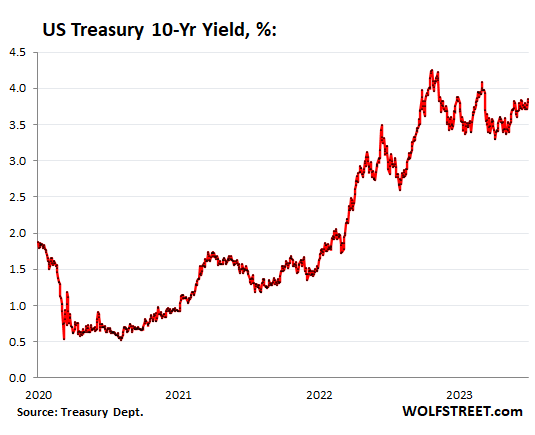

The 10-year yield, at 3.81% on Friday at the close, is pricing in rate cuts and a return to 2% inflation in no time. With similar omniscience back in August 2020, the 10-year yield had dropped as low as 0.5%, pricing in negative interest rates by the Fed, which was, turns out, a complete idiocy that caused some banks that believed it and loaded up on long-term securities to collapse. Since October, the 10-year yield has essentially gone nowhere.

Yield solves all demand problems. If demand sags at current yields, yields automatically rise until sufficient demand emerges. If the yield is high enough, there is always demand:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What is most amazing is how low junk bond credit spreads are.

Since we have a massive zombie company refinancing period coming up in 2024 and 2025, and you never want to be the last zombie in line in case the morons running the world’s bond funds somehow run out of cash, one would think credit spreads would start moving.

But they aren’t.

Thoughts on when this will happen (or at least what to watch to get a sense of when this will happen)?

Most of the shenanigans in markets are not driven by bank lending, but by the idiots in charge of bond funds, which I think is why the interest rate hikes have had limited effect (so far).

So the government printing more money is now supposed to tighten the liquidity?

So if I had cash and I bought newly issued treasury with it, I can always post that treasury as a collateral and borrow against it (think repo). Treasuries are regarded as pristine collateral. So essentially my cash situation doesn’t change.

Meanwhile the government took my money and spent it in mainstreet. Now thats an $851 Billion dollar of liquidity hitting mainstreet and so the Inflation must rise.

The way I see it is that printing money increases liquidity. I may be missing something.

The problem with only looking at US based liquidity is it disregards one of the most prolific and shameless liquidity providers in world history– the Bank of Japan.

The Fed looks like a profile in courage compared to them.

Hopefully Wolf has some ideas on when the BOJ will have to actually start doing their jobs and hike/do QY/liberalize yield curve control.

Given his time in Japan and knowledge of the culture his insight would be appreciated.

Keep in mind that even if the Fed is tightenting, the BOJ can undo a lot of that tightening with their behavior.

Given also we now have both American political parties interested in shameless vote buying by promising tax cuts, debt forgiveness, targeted government spending etc., etc. the fiscal liquidity combined with the BOJ can effectively undo the rate hikes’ disinflationary effects.

Shocking and sad.

Maybe Wolf can give us some guidance here.

Agree.

The BOJ started all this yield control and yield suppression back around 2000.

If the game falls apart, it will be them first.

Meanwhile, their stock market is soaring…..

go figure

Bond Vigilante Wannabe,

Despite the breathless reporting in the media (esp. Bloomberg), the BOJ’s balance sheet hasn’t grown much over the past two years.

It actually declined from Apr 2022 through Sep 2022 (= QT). When the attacks on the 10-year yield started in response to surging inflation in Japan, the BOJ started buying bonds as part of its yield curve control. At the same time, it shed some loans.

Over the past 14 months, its balance sheet has risen by only ¥6.9 trillion ($47 billion), or by less than 1%.

So on average, its balance sheet has risen by only $3.4 billion a month over this 14-month period.

Over the past 24 months, its balance sheet has risen by only 2.9%.

So on a global scale, these recent QE amounts are nothing, and people need to quit fantasizing about it, LOL.

Japanese stocks are soaring because it’s the latest hot thing for US hot money, similar to AI, SPACs, and what not. Buffett further manipulated them higher with his highly touted investments in Japanese stocks. That’s the reason they’re higher – just more mania from the US.

I saw a recent panel with the new BOJ chief on it, along with Powell and other central bankers. The BOJ thinks they dont need to start QT because their core rate is still somewhat low. Powell and Legarde seemed to be smirking while he was talking.

William Mitchell, who has personal contacts at the BOJ, has lots to say about Japan — but I doubt either you nor Wolf would like it very much. His blog is at billmitchell.org

eg,

1. Mitchell is the MMT moron in Australia. He’s an old tenured economics prof there, so I guess, people just let him be.

2. I don’t allow MMT promos on this site because MMT is the most insidious economic BS around these days. It’s designed to appeal to morons.

3. I had Mitchell’s MMT trolls on my site ever since I first opened the comments. It took me a few years to figure out what was going on. Then I cracked down.

4. I was able to reach out to one of those MMT trolls, and he said he was an old guy in Australia, and he got paid a little to post these MMT promo comments on sites around the world, and he was doing it to make a little extra money to supplement his meager pension (so OK, I get that). Mitchell’s trolls showed up in the comments all over the place. And they posted entire articles, etc. That’s how everyone started talking about MMT.

5. I block MMT trolls. So be careful.

6. The surge of global inflation killed the enthusiasm for MMT.

7. Mitchell is also a euro-hater. Sits in Australia and hates the euro. Even wrote a book about how much he hates the euro, that it was “destined to fail.” He published that nonsense in 2015, and 8 years later, the euro is still doing just fine, is the second largest reserve currency with a share of 20%, behind the USD, and far ahead of all the others, and it’s roughly on par with the USD in terms of paying for international trade transactions with the rest of the world, and it’s the second most important international financing currency…. And the Eurozone has expanded over the years to 20 countries as of Jan 2023 because more countries were eager to be part of it, and more countries still want to accede to it, LOL.

8. I haven’t read Mitchell’s stuff about Japan — nor would I waste my time doing it — but it’s likely just as much BS as his insidious MMT BS and his silly euro BS.

“Just more mania in the US”

Is Wolf’s reason for stocks going up in Japan.

I totally disagree.

The reasons shares are going up in Japan have something to do with financial fundamental concepts such as good earnings, low PE ratios, low book to price ratios, and lots of cash on the books (except for bank shares).

It may also have something to do with a highly educated population, low crime rates, low drug use as and a country where the rule of law is better than most other places.

It might also have something to do with no lock downs during the virus pandemic and no rent control or stopping evictions too.

The government debt is bad, but not growing as fast as other countries either.

So IMO there is no mania, just better value than in other countries especially the USA.

Hawaii Sushi,

Wrong moment to post this, LOL. Nikkei -1.8%

But the treasury is not printing more in this case, but simply selling securities to the open market without the fed buying, increasing supply of securities and reducing liquidity as it increases TGA balance.

Supply of FRN’s in circulation is decreasing as fed’s balance sheet decreases, while supply of FRN’s in circulation is also decreasing from TGA balance increases.

Once the treasury spends down the TGA on mainstreet, they would then add to liquidity, yeah. You could borrow against your collateral, but wouldn’t your rate increase due to a new lower level of liquidity?

Where does the Treasury invest its TGA funds?

It doesn’t “invest” the funds. They’re in the TGA, which is a huge checking account at the New York Fed. The TGA used to be at JP Morgan, but during the Financial Crisis, it was shifted to the New York Fed.

Like all banks, the New York Fed considers bank-account balances a liability (amounts owed the customers); and so on the Fed’s books, the TGA is a liability, along with reserves, cash in circulation (paper dollars), RRPs, and some other items.

You can even post it multiple times. it’s called “rehypothecation”.

Ain’t that sweet.

That’s BS. YOU cannot post the same collateral multiple times to different lenders; that’s “fraud” – not “rehypothecation.”

“Rehypothecation” means a CHAIN of debt among a chain of lenders, secured by a chain of collateral.

In the most simplified example: If I borrow $1,000 from you and give you a $1,000 T-bill as collateral, YOU can borrow $1,000 from someone else, and post that $1,000 T-bill as collateral. So now you lent $1,000 to me, and you borrowed $1,000 from the third party, and you pledged the collateral for your own money to a third party. So you have a chain of loans of $1,000, which net out to $1,000, and a chain of collateral postings of one T-bill also netting out to $1,000.

There is no problem with this until one party defaults, and then the entire chain might break. These debt chains create contagion. That’s the problem with them.

So rehypothecation is regulated and limited in the US. Generally, it needs to be disclosed to the client, and the clients needs to allow it, and is often paid a fee for it or gets a lower loan rate.

In a real-world example, this is a lot more complex and leads to a derivative-type product that can make lots of money or bankrupt the company. For example, securities that have been posted as collateral in a margin account by a hedge fund with a prime brokerage are used by the prime brokerage as collateral for its own risky trades. This caused hedge funds a lot of grief when Lehman (prime brokerage and custodian of their collateral) collapsed.

Main street, Khreshchatyk, Kiev ?

How is it that the vaunted “savings” which rose during Covid, and dropped off this past year, can ever legitimately be called savings.

On the one hand you have personal cash given to you by the Government, on the other your Personal Liabilities increased as much or more by virtue of your Personal Guarantee on Federal Debt.

Yup. If I have a dollar in my hand and then print another one, the first one is now worth 50 cents………in theory. It turns out that consumer confidence is what makes my theory not so. That is why the $US has not plummeted, apparently.

Wolf,

Any ideas on when credit spreads will start moving?

Bill Gross is estimating 10 year above 4% late July/early August since Janet needs to place a bunch of longer duration paper then. He’s not sure how much higher for the rest of the year.

Looking at implied volatility on puts for meme/junk companies does indicate upward skew in September, but still not enough of a signal to really bank on.

Yen/dollar pair showing some movement, but too many prior false starts to give confidence.

No other real good market indicators jumping out, unless you can think of something.

1. Gross 10-year yield above 4%: Yes, I can see that coming. I discuss this in detail here:

https://wolfstreet.com/2023/06/26/longer-term-treasury-yields-to-rise-amid-flood-of-issuance-while-fed-foreign-buyers-us-banks-unload-short-term-yields-already-surged/

2. High-yield (junk) spreads should widen. They’re still narrow right now. They’re not showing much in terms of tightening financial conditions, which are still loosey-goosey. To answer your question: I have no idea when they will widen; they should have widened already. There’s still way too much money out there chasing after all this stuff.

Wolf,

Excellent write up on Japan, bond yields, etc. Very well done.

On a psychology note, at the recent central banking conference in Portugal or wherever, the head of the BOJ stated something to the effect that “Japan has not engaged in any meaningful restrictive monetary policy for the last 30 years”– your write up puts that in context.

That comment was like ringing a bell for the Pavlovian conditioned FOMO driven bulls. I feel that there is a huge FOMO trade that occurs when a central banker actually says something like that, even if they aren’t loosening.

Maybe that is part of the reason why credit spreads haven’t widened– him being on stage with the rest of the central bankers gives hope to the junk bond bulls.

Do you think the credit spread situation is kind of like “people seeing what they want to see until they hit a wall”? Or is there still enough dumb money out there really chasing these assets?

I would expect the first signs of credit spreads tightening would be offering junk bonds with warrants for the underlying stock, so that junk bond holders could benefit in a meme stock scenario.

But that hasn’t happened yet.

It started materializing in 2001 and 2002, so maybe still early in the cycle.

Thanks for all you do.

Remember the Federal Reserve bought up junk bonds in 2020. Investors are expecting to get bailed out again in the next recession.

There’s no risk in any investment when there’s always a buyer of last resort.

Some where in the not so distant future…this going end very badly! I will stay away from bonds..this is going to get incrementally worse as time goes on. It’s not if but when.. there are consequences for bad behavior.

Short term bonds are paying nicely. Stay away from bond funds perhaps.

”short term” bonds are called T-Bills, and you are correct re paying nicely these days dz.

Question is WHY some folks are saying ”bonds” are going to be bad?

I suppose, and actually have some hope the ones called bonds by Treasury selling these days for 4% plus or minus, might end up lower yield than ”later” when those bond yields catch up with reality…

In any and every case, US Treasury bonds appear to continue to be the ”least dirty shirt” of all long term conservative, as in safe, investments out there these days.

Would welcome any suggestions otherwise.

Thanks,

Bond traders say that, since rising rates make their mark2market valuations go down.

If you treat bonds like CDs, and only buy duration that you’re comfortable holding till maturity, there is no risk.

I don’t have a clue what to expect in the second half of this year and that 5.5 six month T Bill is beginning to look mighty attractive.

I think you may have said it best, ” This is just an amazing freakshow:”.

Which suggests that the chronically incompetent Fed is the perpetrator of said ” freakshow”.

The data suggest that the policy, as presented to the public, is more of a white lie as opposed to a promise. The change from Bernanke’s unproven monetary freak show to a more coherent emphasis on reducing the gambling going on.

Or is there more ?

As I grow old I have to select which of the twins, hope or futility, makes the most sense.

But hope is a virtue, whilst futility is a condition. Different parents, seems to me.

u might be better off trying, on the basis of careful and extensive trials, deciding which of the best USA wines are better or ”best for you.”

I can testify that challenge is a TON more fun…

The Fed is going to have to pick a side at some point. Inflation, or the debt bomb.

They can’t save every one.

They have already picked a side – inflation. Just a few days ago, there was a quote from Jerome Powell which said something to the effect of “inflation will not get back to 2% until 2025.” Bernanke once said “we can stop inflation in 15 minutes if we wanted to.” This inflation is 100% INTENTIONAL. 100%. They are f***ing people raw. END THE FED. END GLOBAL CENTRAL BANKERS FOR GOOD.

Laughably false.

“The Fed is going to have to pick a side at some point. Inflation, or the debt bomb.”

Yep, ultimately it’s going to have to bring inflation down much more aggressively to protect what’s left of US consumer spending power and whatever remains of respect for the US dollar. Again like our professor said when it comes to central banking, if in doubt, Paul Volcker is always right.

The whole fantasy of “inflating our way out of debt” is pure delusion in a country and economy like the US. Any initial reduction in debt burden from inflation is quickly offset by higher government expenditures costs and COLA adjustments. Not to mention the USD starts to crash on international markets and lose demand and appeal–it’s already less than 50 percent of currency reserves and being quietly substituted esp in Asia (India and Modi oddly enough are the main drivers of this now), uncontrolled inflation just gives the de-dollarization hawks a much stronger excuse and receptive audience to block exported inflation. But most of all, persistent inflation erodes the most basic connecting threads of a society, steals from the savings of the citizens and devalues hard work and innovation, and creates the simmering resentments that make a powderkeg. A bad thing in any society, but especially an already polarized USA with 400 million firearms.

It is most certainly not any ‘incompetence’ by the Federal Reserve, but rather 100% incompetence by the US Congress for its drunken sailor and unbelievably stupid reckless spending in excess of revenues that is fully responsible for this absurd and incomprehensible debt debacle that is getting worse and worse every day.

EXACTLY! The Fed is playing a bad hand well… and frankly they have had to do this for about fifteen years now. The elected government has been in “Spend Wildly and Stupidly Mode” ever since 2008.

Skip being a Reagan Republican and talking about balancing the budget… instead you can be a dedicated Keynesian and say the same thing. In an economy as hot as this one (with neither a war to fund nor a pandemic to deal with) the TEXTBOOK answer is to be running budget SURPLUSES.

Instead, the latest budget bill approved by Congress and signed by the President was a $750 billion budget buster that they named the “Inflation Reduction Act of 2022” … which is pretty much an example of pissing on the people and telling them that it is raining.

I read somewhere (this might be a rumor) that Powell talks to the head of Blackrock multiple times per day.

Powell is a lawyer, not an economist. He is just taking orders and executing.

The Fed deserves a ton of blame. The FFR should have never been dropped to 0.25% due to the pandemic. They should have slowly brought it down 25-basis points at time. Within two months, we were out of a recession, and the Fed should have known that the trillions of dollars that Congress authorized was going to cause inflation. And they own the whole “transitory” inflation debacle. Yes, Congress deserves about 50% of the blame while the Fed deserves the other 50%.

“Never let a good crisis go to waste” is the mantra of these filthy thieves. This was the biggest looting of a country’s treasury in the history of the world. The wealthy stole everything.

Define “rich.”

Anybody with an account at one of the big banks/brokerages that owns the Fed?

That’s a lot of Americans of all ages who don’t consider themselves “rich.” They just put what they can risk to work against the financial repression of last 20+ years. Which includes 401k, IRA accounts.

Central banks do what they have to do to finance government deficit spending.

Get rid of central banks?

Let the spenders run financing themselves? That sounds like a good idea to them.

They’ve been doing it in alt energy. V.P Cheney under Reagan said deficits don’t matter. BushII blamed Fed for his father’s re-election loss.

Next crash, goodbye Fed. Could be a unifying idea.

FED is not independent of govt.

Govt can’t run deficit if FED does not cooperate.

FED has already chosen the side of wealthy and thus inflation and rightfully so.

After all FED works for the wealthy.

In next few years, FED balance sheet would be much more than what it is currently if Govt does not cut spending.

Eric, are you making the arguement that since the federal government lacks responsibility,that they should continue to force everyone to accept private IOU’s in payment of debt?

Wolf, do you ever take vacations? Or do you blog during your vacations, or queue up pre-written articles (as some blogging software allows authors to do) to go live at a specified future time?

Coincidentally, earlier today I placed an order to buy 6 month T-bills at tomorrow’s auction. It’s tough to beat a 5.5% return, state-tax free, and no-risk (I hope). It looks like Wolf suggests some of this new debt will be funded by stock market selling or not buying, not that I care much about the stock market. I like to watch it.

Seems like a logical decision. When stocks get this high you can easily have a 10 – 15 year time period when stocks underperform t-bills.

Believe or not there was a 19 year period that t-bills beat stocks and a 30 year period that a 10 year treasury beat stocks.

Buying stocks at peak valuations ensures pretty awful long term returns.

Which periods were those?

I am pretty sure both have been within the last 50 years. Both might have been in time period ending at the SP500 low of 666 around 2009 which was a brutal bottom.

I guess this news is either no impact or bullish for stocks .

Stocks can only go up

/sarc off

Wolf-

Where are the liquidity sources for this? In normal times, how many dollars are going to stocks, commercial bonds, state/municipal bonds, etc? Which of these normal inflow recipients are losing out?

I’m really baffled by how the market had $851B to lend the government in addition to the $65B of QT. This is more debt in one month than was issued annually in other nonQE years (2013-2018). Without QE, what is the upper limit on issuable debt?

Ironically, no one can take liquidity out of the stock market. The only thing than can change is buying pressure and selling pressure. But if you want to cash out of the stock market by selling your 1,000 shares of XYZ, someone else will have to put into the stock market the exact amount that you’re pulling out in order to buy the shares that you’re selling.

What happens is if more stockholders want to lighten up, the selling pressures increase, and prices fall for everyone holding those shares.

People can pull their cash out of banks (which may lower reserves at the Fed) and they can draw cash out of money market funds (which may lower RRPs) — and both are happening — and they can buy Treasuries with the proceeds. And we’re seeing some of that, even among our commenters here.

Wolf,

A ton of 60/40 funds will need to sell stock and buy treasuries if yields rise substantially. This is likely the impetus for lower stock prices, given the amount of assets in and flows into these funds.

The question is what is it going to take for that to happen?

Bill Gross thinks the 10 year is headed above 4% in short order, but really need to hit around 4.5-5 to get major rebalancing.

How do you see this playing out?

But as an individual I can sell XYZ for $1000, and then buy a T-bill for $1000. So I took $1000 out of the stock market. At the macro level, if a lot of people sell, the Dow (for example) will drop. So that in a way is money being removed from the stock market.

If I bought XYZ at $1000, and sold it at $1000, but at one time it was worth $1200, where did that $200 go? It never went anywhere because I never had it. It ain’t real until you sell.

It’s like people who say their house doubled in value in three years. I say tell me how much you made when you sell it.

A tangent: Unfortunately the property tax assessor looks at a current valuation every year or so. But any increase could go poof a couple of years later. Too bad you can’t get that property tax back. The only fair way is to be assessed on the cost basis (what you paid for the house) plus the capital gain (or loss), but you can only get a capital gain (or loss) when you sell it. The IRS only cares about what you paid for property, and what you sold it for. It doesn’t care about any fluctuations in between. Property tax is nasty, it taxes your unrealized gain, which might disappear in a few years. But you will never get back that property tax on the unrealized gain.

Property tax is a wealth tax. So are stock and bond management fees. You are taxed/charged once a year on the value of your wealth which could disappear and you may never experience the value of your wealth.

Income or sales taxes are more fair if they are set correctly in my opinion.

If you sell $1000 worth of stock, someone else bought that stock. So net liquidity is zero. If there’s a lot of buyers compared to sellers, the prices might rise, but every transaction in a stock market is balanced.

In contrast, if you withdraw $1000 from your bank account, no one is “selling” you that deposit. The banks overall deposit base just goes down.

That’s the difference between stocks and deposits.

Wolf,

Thank you for responding. I may be thinking about this too simply, but consider this:

Imagine there is an island with 5 workers, one retiree, and a government that needs funding. Each worker makes $1250 per month. Of that $1250, they save $250 with $50 going into government bonds and $200 into stocks owned by the retiree. They can all live on $1000 per month.

Now, if the government starts to spend more so that it borrows $500 per month instead of $250, the price of stocks goes down because there is less demand. The retiree has to sell more stocks, and the best he can do is get $750 per month, unless the stocks become so attractive that the workers are willing to live on $950 in order to buy more stocks. An equilibrium will be reached.

But what happens if the government borrow $1000 per month? The retiree still has to sell his stocks to live. He lowers the price, so the government increases their interest paid. At some point, though, the government could take so much that the workers will not provide more, and the price of stocks would go so low that the retiree would have to sell all of his stocks to live one month.

Government bonds steals liquidity that would go else where. My question is how much can the government steal from stocks/corporate bonds/other investments? Which productive member of the economy had $926B sitting around to soak up the new debt sold + QT selloff? Historically, we have never seen a sale of more than about $60B/month without QE. Where does this money, about $100-150B/month come from? Clearly it is not being taken from the stock market. Corporate bonds can still find funding. Who has that kind of money sitting around since it’s not the Fed?

“Which productive member of the economy had $926B sitting around to soak up the new debt sold + QT selloff?”

I was about to say banks that have money in RRP at the fed, but you added the productive qualifier.

Wouldn’t registering shares directly reduce liquidity in the same way withdrawing funds does?

It is very simple:

There are way more dollars out there than anyone would imagine in their wildest dreams. Think the grooms in “The sorcerers apprentice”. I recommend the Disney version of it -before they went “woke” – to get the idea.

Jay would be Mickey Mouse.

u mn ”brooms” eh FB???

helps me a ton to review my posts on wolf’s wonder AFTER adding the name and email…

try it,,

If you smooth out the first graph, omitting the “ceiling” games, it’s clear that real interest is doing what it’s meant to do. Slowing down borrowing.

Really need a curve that goes back before 2018, and preferably a log curve to see this.

No you don’t. Just look at it. Borrowing is slowing down only from the crazy spring of 2020, but the rate of growth is soaring from pre-2020.

In addition, before the year is up, there will be another $1 trillion added (to over $33 trillion) which completes the refill of the TGA and the added borrowing for the deficits. You won’t know the rate of growth in 2023 until that $1 trillion is also on the books.

Criminally insane, how our so-called leaders have so wrecked the balance sheets of our country.

All those leaders were voted in, largely by running for lower taxes. As someone has said of California with its Prop 13: ‘What Californians want is services but not to pay for them’

Context: When Reagan took office, the accumulated debt of the US since Independence was one trillion dollars. Reagan ran on smaller govt and lower taxes.

But as David Stockman describes in ‘The Triumph of Politics’, he did the second part first. No problem, sailed right thru. Then came time for the spending cuts to pay for the tax cuts.

For younger readers, there actually was a time when people thought like this, balancing a nation’s budget. Including at that time the youngest Budget Director in US history, David Stockman.

Stockman did everything to explain the budget. Aides asked for briefs to be briefer, then one page, then pie charts. None of it worked. Lower taxes are popular, cuts aren’t.

4 years later the debt accumulated over more than two hundred years, including WW1, WW2. Korea, etc. had doubled. So, electoral disaster?

No. This began the modern era of ‘deficits don’t matter’. To either party.

The problem with that analysis is that Reagan had to spend money to defeat the Soviet Union. Nobody complained when FDR blew out the debt limits to defeat the Nazis and Japan… so I always laugh when people complain that Reagan did the same thing to fight Communism… they are just telling me which flavor of totalitarianism they prefer.

Nor were the American People surprised by any of this. As Chris Matthews of Hardballsaid, Ronald Reagan’s 1980 campaign platform was so simple that school children could recite it to you…

1) Cut Taxes

2) Rebuild the Military/Defeat Communism

3) Balance the Budget

Forget the old phrase that “two-out-of-three ain’t bad”… EVERYBODY knew that Reagan would have cut social spending to balance the budget. But there was no way that Tip O’Neill and the House Democrats were going to allow that.

Lo and behold, the Berlin Wall falls and Communism implodes just after Reagan leaves office. All of a sudden military spending gets slashed (ending MY time on Active Duty) and the nation gets a “Peace Dividend”… which Congress TRIED to spend but the Gingrich Republicans managed to seize control of Congress in 1994 and enforce the spending limits Democrats had negotiated with the first George Bush in 1991 in exchange for tax hikes.

Voila! Budget Surpluses! Only time in the last 50-something years.

That spending discipline lasted until about 2000 when the internet implosion (and recession) hit. Since then it has been wars that never end, Great Recessions that we never quite get out of, Pandemic spending that outlasts the pandemic by years, and Green Energy spending that somehow or another never seems to solve climate change. There is always SOMETHING that spending tomorrow’s taxpayers money on will “help.”

Feel free to blame Reagan and George HW Bush for adding three trillion to the national debt if you like. But they achieved what they set out to do with that money… and the world is a vastly better place because of it.

Waving your wand and blaming THEM for how the Baby Boomer presidents and congresses added the NEXT 30 TRILLION in debt is just a bit bizarre.

“As someone has said of California with its Prop 13: ‘What Californians want is services but not to pay for them’”

Whoever said this doesn’t understand state taxes generally and California taxes specifically. States primarily rely on at least two of three types of taxes: income, sales, and property. California has all three. California has high income taxes (highest marginal rate in the country) and relatively high sales taxes, exceeding 10% in some places. Property taxes subject to the Prop 13 2% annual increase cap are relatively low as a percentage, but high property prices offset this to some degree. When all is said and done, according to the Federation of Tax Administrators, California ranked 2nd in the nation among states in per capita tax revenue in 2021, at $6,325. Vermont led the nation at $6,356. The national average was only $3,841.

Californians pay a lot for the services, such as they are, that they get from the state.

…the bigger the herd of cats, the more it costs to herd them. (Something I think the states that have recently gained population are discovering…).

may we all find a better day.

91B20,

Yeah, you’re probably right. I should have made it clearer that while Prop 13 limits property taxes in CA, many states only have two of the three types of taxes to begin with. I really haven’t heard people say that Texans don’t want to pay for services since they don’t have an income tax, or Oregonians because they don’t have a sales tax. Californians pay through the nose on 2 of the taxes, and somewhat less on the third. The idea that Californians don’t want to pay for services because of Prop 13 is just not true.

1) QQQ dead cat bounce might be over in July/Aug.

2) In June 2022 inflation was 9.1%. in June 2023 the y/y might be minus 5%.

3) In the next recession the hyperinflation might deflate. CMBS multifamities delinquencies rate might inflate.

4) The 10Y might popup above 4% for an UT, before the plunge.

5) Since Oct 2008, when the Anti Regulatory Act of 2006 was applied, the

Fed control both the front end and the long duration. US gov zoo gates are wide open. The Fed is taking about two more hikes on the cusp more regional banks collapse.

6) The Fed balance sheet Treasuries security might popup to $8T/$10T.

The Fed is taking a break.

Typo in your screen name automatically sends your comment to moderation.

If I’m understanding the numbers in the article correctly:

– US Debt has expanded from $20.5T in 2018 to $32.5T today

– Of that, Marketable Debt grew over the same period from $21.6T to $25.4T over same period

So “Nonmarketable Debt” grew by $6Trillion in 5 years?! That’s a lot of I-bond issuance and/or Trust Fund “investment”…

More details and your viewpoint on the implications of this remarkable number would be much appreciated.

Thank you for this important article!

Take another look at the Marketable Securities chart. It only goes back to Jan 2021, not 2018. I did this to show you the details of the surge of issuance in recent weeks.

So since Jan 2021, the total debt grew by $4.64 trillion

with:

marketable securities growing by $3.8 trillion

and nonmarketable securities growing by $0.8 trillion

What will be the make up of the Treasury sales?

IMO they should be raising money out the curve which would tend to flatten or even put a positive yield into the curve.

But then we must consider the banks and their long end problems…

They have really put themselves in a trap…

The Fed has been painted into a corner that is getting smaller by the day.

Back when the Fed’s rates were near 0%, people kept saying that the Fed painted itself into a corner and can never raise rates, LOL.

That figure of speech needs to be taken to the landfill and dumped.

The FED has painted the working class and poor into a corner. And they have endless paint.

LOL… “But, but, but… they are going to pivot any time now!”

We may have reached fiat escape velocity, where most everyone with investable assets plus the politicians realize that the Fed can create infinite amounts of money at a keystroke and that Fed independence is a myth. Federal debt and deficits don’t matter; they are just bookkeeping entries. Every worthy cause and need can be fully funded, and it is cruel and unnecessary (or dangerous in the case of defense) to deny them their due. The end game for such delusions is customarily a currency crisis or runaway inflation but the premier reserve currency is usually immune from them, and so our big party is just getting started. Don’t worry about the next crash because if it ever happens the Fed’s policy response will be truly awesome and all will quickly be well.

Wolf,

How do you know that the ten yield “is pricing in rate cuts and a return to 2% inflation in no time.”? What do you think it would yield if it wasn’t pricing this in? What will happen to the yield if rate cuts don’t happen?

Thanks in advance!

The long end is pricing in a recession at some point beyond that 6 month window

The 10-year yield would run about 1-2% over the long-term expectation of where inflation will be. So if they expect 2% long-term inflation, they’d want a yield of 3% to 4% to commit their money for 10 years. That’s where the 10-year yield is now.

No one would commit money for 10 years at 3.8% if they expect inflation to stay in the 5% range and short-term yields at 5.5%.

If inflation is expected to be 5% over the long term (such as if the Fed raises its inflation target), then the 10-year yield would be in the 6-7% range.

Unless of course, they expect the Fed to start buying long treasuries again, which’ll mean that inflation is irrelevant, as long as they can flip them to the Fed for a profit.

Wolf,

The current upswing in yields appears to have been caused by GDP revisions upwards.

Most bond market participants were expecting growth around 1 to 1.5% long term, but now are getting more bullish on the economy and appear to be raising to 1.5-2% under a soft landing/no landing scenario.

This likely explains the increase and means we should get 50 basis points or so in increases from the revision date in short order.

The next shoe to drop is capitulation on inflation estimates, which despite all of the sticky inflation reads still hasn’t happened.

If we get a hot CPI print on August 10, that would probably be the next catalyst for a second upswing in rates.

What do you think about timing and how are you thinking about market capital allocations?

I have become convinced that in the very short term supply and demand is what drives all financial metrics, more than the actual “expectations”. You said in a previous article that you thought long term rates would rise once the Treasury is forced to issue more long term debt, not just the short duration debt it is now issuing.

1. Do you think that the Treasury might break the normal 20% threshold on short term debt if it thinks that inflation will soon fall, therefore not locking in higher rates for a longer duration?

2. Do you think that the expectations for lower long term inflation will provide ample demand for long term debt, such that rates will not really move up, even with alot of issuance?

3. What is the percentage of debt that is owned by bond funds? Since investors can lose money on long term bond funds due to yield increases, do you think that investors will “sell the chart pattern” by selling bond funds to limit losses, causing more pressure on yields to rise, or are bond fund investments not driven by chart patterns in the way that stocks seem to be (in the short term)?

The charges on debt are related to a cumulative figure; and since the multiplier effects of debt expansion on income, the ingredient from which the charges must inevitably be paid, is a non-cumulative figure, it would seem that the time will inevitably arrive when further debt expansion is no longer a practical or possible expedient, either to provide full employment or to keep debt charges with tolerable limits.

For me, the question is: when do we get to historic real interest rates of 3 per cent above inflation?

Bond buyers continue to lose in the battle. Today the 10 year would need to be at 8+ percent.

B

1) The Fed wants your money. The Fed is raising rates to get it.

When your money park in the Fed roach motel they control the long

duration.

2) The weekly Dow had no close > Dec high. The Dow is 7 months inverse H&S. It’s bullish. A 4% 10Y is bullish for stocks and gold, but not for the banks.

3) In the next 15/18 months US gov might rise to $36T. The Fed will not tolerate high 10Y. With your money the Fed can suppress the 10Y and save the banks.

A four percent ten year has not been bullish for more than 20 years. It fell below 4% before the market turned around in Sept 02. It was well below 4% when the market turned around in March 09. It didn’t even get close to 4% in the lead up to covid.

What did these recoveries have in common? Not 4% rates but an all time low in the ten year. You might say it’s different this time. What is different is that stocks are 3-4X higher than they were the last time we sustained rates around 4%(late 2007).

We are at ATHs relative to the ten year. Markets do not sustainably recover when this relationship is at ATHs. If rates stay at 4% it would take a huge crash before the markets recover. In other words rate must fall(a lot) before stocks meaningfully recover.

So we will have QT in conjunction with massive debt issuance.

Hopefully, Powell will sit back and watch the market attempt to digest these auctions. Would the Fed allow rates to rise due to market forces? Imagine that!

Maybe Powell will make a point about Federal Debt creation by allowing some turbulence due to the increased supply…send a message to Congress.

Maybe. Here’s hoping.

@Wof Richter

I was reading another article in Financial Times today which states that Chinese corporations and semi-govermental agencies unofficially hold some $2T to 3T and what the effect would be if they start using or unloading them. It looks there are too many unknown puzzle pieces lying around. And even the AI has not brought everything to open yet (last line sarcasm). More I think about all the financial engineering that has gone on for last 40 years (when we decided we can give up manufacturing and shine on services ), and we had a pandemic, I wonder if we are traveling fast towards a repeat of 1930’s.

I think that $2-3 trillion refers to total USD holdings by China, which include Treasury securities (about $1 trillion), agency securities, MBS, corporate bonds, etc.

What is your take on Janet’s trip to China?

China going on a bond buying strike?

Hopefully she gets lost and never returns. Ever.

Happy Fiscal Responsibility Month everyone!

Maybe I have this wrong, so some guidance here please…but with the Treasury targeting short term treasury bill sales to replenish the TGA, is that sufficient for the money market funds parkings in the reverse repo market to buy and thereby reducing the reverse repo market balance resulting in no liquidity drain from the broader market? With $2T still in reverse repo market, the only ways for draining liquidity from broader market are from sale of notes/bonds and QT (and then offset by non-Fed central banks adding liquidity)?

Thanks as always Wolf.

Sadly, my eyes just cross when I look at all of this debt. I only understand debt from the point of view of my car and house loans. Yet my job in retirement is to protect my savings from inflation and not lose it to recessions.

I can only imagine how the half of America that has no savings and cannot do basic algebra or write a decent sentence feels. It’s no wonder people invade the capital and shoot up neighborhoods. Now we have AI’s that are going to make all of this so much more complicated.

I can’t believe our economic system is sustainable but I don’t know how or when it will fail or what to do for myself or the world.

But, I keep studying because quitting is never the answer.

I think it is geopolitics. It was a big decision when US allowed China into WTO. I think it basically meant US could run huge deficits and import cheap goods as the Chinese labor came out of subsistence farming. That has mostly played out for several reasons.

This is the first 4th of July Weekend in the last 30 years that the largest Realtor here in the Swamp didn’t put mini American flags on every property owner’s property. I wonder if this is a signal that that something is brewing in the Real Estate market. This just can’t be a coincidence. Maybe the Realtors are starving because of near zero listings and can’t afford the flags anymore. Or maybe they have all quit the profession and don’t have any mules to put the flags out there.

Where is the Swamp?

Tom Curtis

The Swamp is another name for Washington DC. and the neighboring suburbs inside the beltway, where I happen to live. That’s why I use “Swamp Creature” as my tag name. The outer suburbs don’t qualify, as they are inhabited by more traditional Americans and their families.

Good tag and a good observation especially for your neighborhood.

America, as we older folks remember it, is a thing of the past. Maybe some flags at the properties representing the new owners/renters homelands would be more appropriate?

I was reading the article today about Australian brokers leaving the job in droves and turning to other professions.

Juliab

No one can make a living here in RE anymore. There are no listings except estate and corporate moves. People refuse to sell and give up their 3 1/2% mortgages, and pay the rediculous settlement cost which just went up 10% last week. There are so few listings that properties get snapped up immediately even at 7% + mortgage rates.

Swamp creature

As we all know sooner or later there will be a recession. The second shoe to drop is the labor market. Then there will be no salvation even for those who have locked themselves with 3 percent interest rates on mortgages.

There are many other reasons that can drive them out of their properties.

As the Wolf says, this market is slow and requires a lot of patience.

“there will be no salvation even for those who have locked themselves with 3 percent interest rates on mortgages”

Homeowners need to make their own salvation. If I stop rolling over my CD/T-bill ladder, it will cover a year of my mortgage payments even if I found myself penniless tomorrow.

It certainly is, but if you have not taken a loan at the edge of your possibilities and if you have money invested in CD. If not, good luck!

EVERY house has a flag in our hood in the saintly part of the TPA bay area,SC,,, if same as last year, w a biz card on the same little stick. TBD..

WE, in this case the thrifty spouse and I WE, keep them in our outdoor lounge, AKA carport, at least until the next xx-07-04.

Happy INDEPENDENCE day for all youse out there.!!!

YEAH, I no it’s tomorrow, but at my ancient condition, ya never want to bet on any tom., except for ”treasuries”…

And, far damn shore,,, don’t even bet much % on them.

Supply and demand have not gone out of favor, nor will it ever. With that said, fixed income demand is largely a function of price versus risk. Regarding spreads to junk, before too much longer spreads should start to widen dramatically since higher interests are zombie companies’ kryptonite.

Bloomberg: Spread between 2- and 10-year Treasuries at deepest inversion since 1981

Long-term bond market is in total denial. Back in August 2020, the 10-year yield was 0.5%, as the long-term bond market fantasized about the Fed cutting rates into the negative, on the eve of the steepest rate hikes in 40 years, LOL, and banks failed because they believed it. There is nothing dumber out there than the long-term bond market.

Wolf There is nothing dumber out there than…wrong !

LOL…

“There is nothing dumber out there than the long-term bond market.”

It really amazes me how these bond managers are SUPPOSED to be competing with each other… and yet they engage in the kind of groupthink that brings down companies if not whole societies. Are ANY of them warning their clients and their clients just aren’t listening? Or are they all singing the same chorus from the same songbook… and their clients are just enjoying the music?

We all hear about the Bond Fund managers who succeed (like Bill Gross). What happens to the ones who fail? Do they go get jobs at Taco Bell?

ahh….the long term bond market has a cunning “belief” system: their “pivot coming shortly” relatively inverted 10 year rate helps equity valuations! Otherwise the stock market woulda crashed a long time ago! It’s a cunning long term bond market

In spite of my very recent beginnings, due to education on here from WR and commenters, of actual investment in treasuries, short term so far to be sure, I really don’t think ”dumber” is the right word for long term USA bonds, etc.

Prudent, cautious, hesitant, etc., come to mind as appropriate.

And WE, in this case actual ”Swabies” of the tin cans and other floating representatives of USA, at least this one, would appreciated no more references for those who might imbibe a drop or two, of our brothers and now sisters hood who serve.

Thank you,

It is my guess that stock market is more mispriced than a 10 year treasury if you look out to 2033. It is routine when stock market hits bottom the yield on SP500 exceeds yield on treasury. That is about a 3:1 yield gap that needs to close before bottom is put in.

I know I watched long-term bond yields for years and could not understand why people would accept a negative real return. I still can’t understand the return they accept unless there is a depression coming soon and don’t see it.

Wolf – You say, “ There is nothing dumber out there than the long-term bond market.” I agree with you, and my outsized move to short-term Treasury bills is the proof. But my entire investment hypothesis relies on the Fed behaving responsibly in the coming years and not caving to political (and societal) pressure. Woe unto me, and unto our nation and way of life, if you and I are wrong.

Thanks for your tremendously insightful analysis.

We don’t know what will happen in the future, or what the Fed will do in the future, but we know what it did in the past, and it rolled right over the long-term bond market that was trying to pick up pennies in front of a steamroller.

I don’t know what to make out of that in this era of quantitative tightening. If the Fed is decreasing holdings of short term bonds disproportionate to long term bonds, that will affect the yield curve.

So, I don’t think the yield curve as a predictor is as reliable as when we had a more free-market debt market, without all this micromanagement of yields and price discovery.

“Roll over at auction the amount of principal payments from the Federal Reserve’s holdings of Treasury securities maturing in each calendar month that exceeds a cap of $60 billion per month. Redeem Treasury coupon securities up to this monthly cap and Treasury bills to the extent that coupon principal payments are less than the monthly cap.”

They state that long duration takes priority.

$SJB is on my list along with $GLD, for hedges in this environment. I’m waiting for an unusual volatility signal. We are in very new territory with the risk of speed added to everything else. Unethical AI from the “dark” side may also be in play. Anyone have any other strategies that might work in this ultra new normal?

Short term bill/CD ladder. I have somethihg maturing every two weeks, and my average yield is >5.2% right now.

If you’re gonna buy gold, eliminate the counterparty risk and hold it yourself, rather than buying shares of a trust.

I cannot see how this ends well. It reminds me of the Argentinian peso graph of the last 20 years. Which matches the misery of Buenos Aires.

Be of Good Cheer! The United States is inhabited by the most success-driven people on the planet. It may take us a while to recognize that a problem needs to be addressed… but then we go do it.

Unlike Argentina, our national debt problems would go away overnight with a five percent cut to the budget and a five percent increase in taxes. It may take three years or so of 7-9% mortgage rates to focus our attention on Washington spending… but we will get there.

I don’t think so because politicians going to keep spending.

Then the American People will need to find themselves some new politicians… or the existing ones will need to get with the program.

I’ll have what he’s having…

ROFL!

Question:

Stan Druckenmiller recently spoke at USC. There he mentioned the “off-balance-sheet” liabilities of social security, Medicare and medicaid.

He said it’s as high as $200 trillion.

I’ve never heard how this and the $32 trillion deficit are intertwined. Are they?

TIA

My understanding is, no. $32 trillion is money that has been borrowed for spending. The “unfunded liabilities” of the entitlement programs refers to money that would need to be spent (whether collected from taxes or borrowed) if the programs continue as the CBO projects them to. But as I understand it, Congress can change the eligibility for these programs at any time, so they’re not a “debt” per se.

Anyone, please correct me if I’m wrong.

1. $32T is just the beginning of what is out there E;

last read up on this, world was approaching the BIG Q for every and all levels of financial instruments, that was several years ago.

2. Similar and worse these days, with some recent examples of unknown unknowns appearing out of nowhere or nowhen.

3. MAYBE not a ”debt” on any financial reckoning, far shore,,, BUT,

might be some kinda ‘other than financial’ debt that must be paid off before other kinds debt can be done with for eva.

You are 100% correct, Einhal.

Michael, et al

Those are not “off balance sheet liabilities.” That’s nuts.

Those are “unfunded liabilities” — a concept that assumes that everyone stops working today and no one contributes anymore to any pension plan or Medicare and that then everyone spends the rest of their lives drawing benefits. It’s used normally as clickbait because it works as clickbait.

Also assumes that all of these programs would leave the requirements unchanged.

“I am altering the deal, pray I don’t alter it further.”

ISM contracted for 8 months. TNX in a trading range for 8 months and the Dow had no weekly close > Dec 2022 high. Something is wrong.

TNX might be in distribution.

1. The ISM index contracts a lot, recession and no recession (below 50 = contraction).

2. And it contracted down from its historic biggest-ever manufacturing bubble…

3. This is month to month, executives are asked how was June in relationship to May. So when you come off this huge bubble, you have these dips month after month as you step down from the bubble, because effectively, you’re returning to normal in monthly increments:

Nyet the yield curve, long bond market “transmission”…and probably ISM and the everloving coppock curve.

All the metrics bears love.

We’re running out of metrics.

Your pick(s)?

Is there a limit to what the Treasury Department can issue for building the TGA? Could they build the TGA to $5 trillion (or whatever) to in effect make a future debt ceiling fight meaningless?

The TGA doesn’t pay interest. It’s just a checking account. But issuing interest-bearing securities produces interest expenses for the government. To use your example, to push the TGA to $5 trillion, the Treasury would have to issue $5 trillion in new debt, perhaps at an average interest rate of 5%, and so the total cost in interest payments for the government to sustain this $5 trillion TGA balance would be $250 billion per year in interest, and it would serve no purpose.

Thanks, Wolf, I somehow forgot that interest is no longer 0%! 😧

Well. it seems that as long as people are willing to lend their cash and let the value get crushed by taxes and inflation the party will continue.

Of course if liquidity available was normal this might not be true but as long as the central banks keep liquidity abundant…….. cash can be used to heat the house in the fireplace. I’am told the paper it’s printed on burns rather well and the ink lets off an attractive odor.

The gold laminated paper printed in Utah seems to be becoming more valuable each month. Texas appears to be moving in that direction also.

Legally they can’t call it currency but it seems to appreciate unlike the rags the Bureau of engraving issues.

Wolf,

What are your thoughts that a non-negligible amount of Bond Buying is forced.

I.e. – Pension Funds, Social Security Trust Fund, Target Date Funds, Annuties, 401k auto-invest etc.

That is… they will buy bonds regardless of it’s a rational price.

Same with BND or SCHZ or whatever. Buying 10 year+ bonds even when it makes no sense.

I’ve seen this argument for Passive ETFs but not Bonds.

In terms of the pension funds, Social Security, etc., bond buying is very predictable. They buy and hold to maturity, and collect the coupon interest until then. They know what they need and when they need it.

Btw. the SS Trust Fund hasn’t been adding to its balance for the past three years, it dipped a little, so not a net buyer.

Pension funds buy a lot of corporate bonds, including junk bonds, because they have a higher yield. They also buy CRE (equity), and CLOs, CMBS, CDOs, etc. because they have a higher yield (we’ve been discussing the CMBS angle of this, 🤣).

All this has relatively little influence on prices because it’s mechanical and smooth and predictable.

Than who are all the crazies buying the 10 yr+ bonds!!!

Must be SVB wannabees or Hedges who are gonna be down 50%.

I saw Blackrock recommending the “…belly of the bond market…” at the 5-7 year.

Took a look and… Nope. TIPS and short end for me!!!

All you commenters are mad…

I just thinking of how I’m gonna load up on bonds at crazy highs!!! Gimme that yield Arthur F. Burns!! I’ll still be alive in 5-10 years when inflation is lowered.

My new motto for the FED is:

Pause away, you’ll eventually pay!!!

That debt chart is crazy. In its May report, CBO is projecting an accumulation of another 20.4 trillion from 2024 to 2033. Yes, you read that correctly. The CBO usually underestimates by 10 to 15% when the look at the actual data in 10 years. So expect the gov debt to be $55 trillion in 2033. We are talking about over a 70% increase in debt. In 10 years, i don’t now how assets like housing is 50% higher in price.

Government debt is inflationary. The Fed has a lot of work ahead of them in keeping inflation down.

From post WWII low of 32% (1981), US gross debt as percent of GDP is now over 120%.

In 1981, Fed balance sheet was about 4% of GDP. Today its close to 20%. (Could these two factoids be related?)

I believe I read that CBO numbers don’t include contingencies for credit crises, war, sustained higher interest rates, health threats, or energy crises. We will be fortunate if Federal debt is only $55T in 2033, IMHO.

(Source: https://www.whitehouse.gov/wp-content/uploads/2023/03/hist07z1_fy2024.xlsx )

According to Lynn Alden, all this deficit spending is inflationary and since the fed has no control over either spending or revenue collection, it’s only choice is to crash the economy by increasing the cost of credit through repeated interest rate hikes.

High interest rates on 33 trillion of debt is unlikely to be sustainable, since the interest payments alone require further deficit spending and make the inflationary deficit spending problem worse than it already is.

Also, since most of that debt is held domestically, the holders of that debt are now seeing their interest income increase. If they spend that extra money into the economy, it’s likely to be inflationary.

SG – Climate Change does not lie in the purview of a ‘solvable’ problem. That doesn’t mean it isn’t happening, or that anyone can be excused from its very-real short/medium/longterm effects on the natural (and often considered ‘free’ ie: freshwater, healthy air (cleanliness and temp), arable soils) planetary systems that allow our species to exist. 200+ years of anthropomorphic atmospheric/oceanic chemistry experimentation has appeared as an accelerant on the rate of climatic change. Done is done-our adaptation to that rate, while mitigating what is possible, is the best we can do as long as we continue to ride this amazing spacecraft…

that said,

may we all find a better day.

“Don’t worry, it seems. So far, the Treasury market has been amazingly sanguine, amid juicy short-term yields that are beginning to price in a couple of additional rate hikes this year, and long-term yields that are, amid blistering demand, pricing in rate cuts and a return to 2% inflation ASAP.”

Please clarify: Is This blistering demand for longs (dumber than dumb?) causing their prices to rise, yields to fall creating this inversion?

does this inversion indicate there is less demand for short dated treasuries , falling prices, rising yield? coupled with the fed raising rates rapidly?

Yes: “Is This blistering demand for longs (dumber than dumb?) causing their prices to rise, yields to fall creating this inversion?”

No: “does this inversion indicate there is less demand for short dated treasuries , falling prices, rising yield? coupled with the fed raising rates rapidly?”

Because short-term yields are bracketed fairly well by the Fed’s 5 policy rates and their effects on the short-term market, including its overnight reverse repo rate, which kind of sets a floor for short-term yields.