Personal income solidly outpaces inflation.

By Wolf Richter for WOLF STREET.

Income provides fuel for spending. And the income of consumers, all thrown together into one bucket, has been outrunning inflation since July last year, and did so again in May. Adjusted for inflation, so “real” personal income from all sources, rose by 0.3% in May from April, and by 1.6% year-over-year. This includes wages and salaries, income from interest, dividends, rental property, personal business, and transfer payments (Social Security benefits, unemployment insurance, VA benefits, etc.).

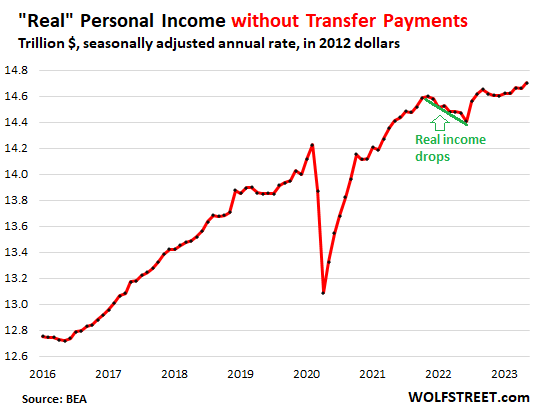

Excluding transfer payments, “real” personal income from all remaining sources also rose 0.3% in May from April and by 1.6% year-over-year, thereby also outrunning inflation. This income growth beyond inflation is a function of rising employment (the rising number of people earning money), the amount they each earn, and the amounts earned from interest income (up quite a bit), dividends, rentals, and personal business.

Between November 2021 and June 2022, during the worst of the inflation spike, real personal income fell behind inflation. But in July 2022, as plunging energy prices pushed down headline inflation, this income measure pulled ahead of inflation and started growing again in real terms, and has continued to grow in real terms.

Spending, adjusted for inflation…

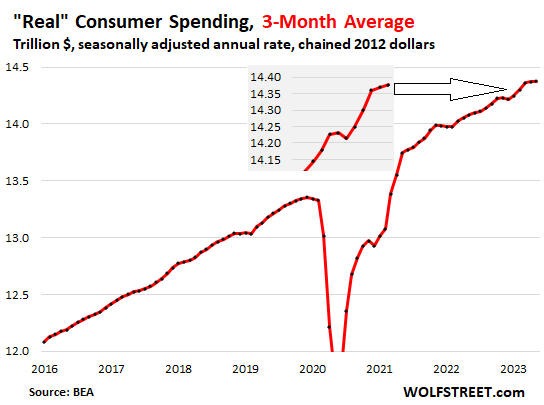

Consumer spending, adjusted for inflation and for seasonal factors, so “real” spending, was essentially unchanged in May from April. Year-over-year, real spending rose 2.1%, compared to the average growth in the eight years before the pandemic of 2.5%.

The three-month average of month-to-month spending, which irons out some of the month-to-month variability, rose by 0.1%.

Negative month-to-month readings crop up just about every year even during the Good Times: In 2019, there was one; in 2018, there were four; in 2017, there was one. But during recessions, negative month-to-month readings pile up and get deeper. For example, in 2008, there were nine negative month-to-month readings, and they went as deep as -0.6%.

What we’re seeing is a normal-ish uptrend of consumers outspending inflation, with some variability, despite high interest rates, that “credit crunch” everyone is talking about, layoff news, bank turmoil, and what not:

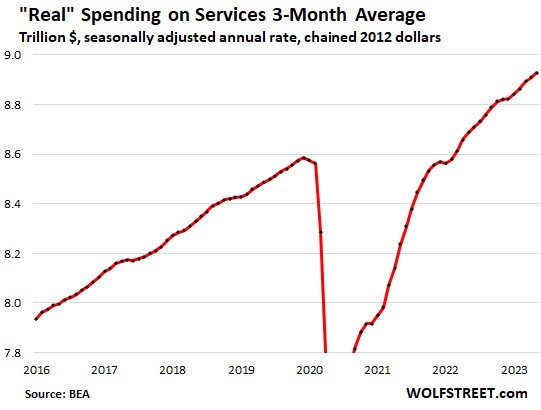

Spending on services, adjusted for inflation, rose by 0.2% in May from April, and by 2.6% year-over-year, exceeding the five-year average growth in 2015-2019 of 2.3%.

Services, which accounted for 62.1% of total consumer spending in May, include housing, utilities, insurance of all kinds, healthcare, travel bookings, concert tickets, streaming, subscriptions, repairs, cleaning services, haircuts, etc.

The three-month average rose 0.2% for the month and 2.2% year-over-year. There was a near-flat spot late last year, but there’s no sign of a flat-spot so far this year, all adjusted for inflation:

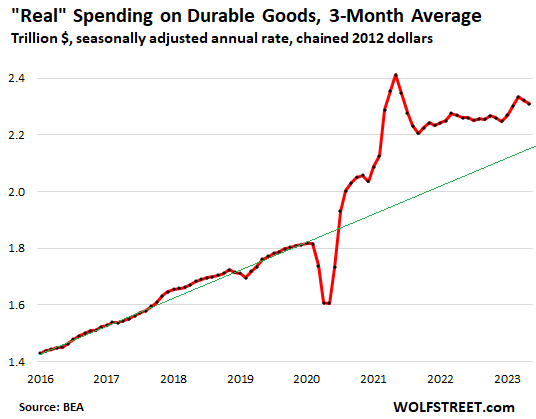

Spending on durable goods, adjusted for inflation, fell by 1.2% in May from April, after the big jump in April from March. Year-over-year, spending on durable goods rose by 2.4%, which is truly amazing given the historic stimulus bubble that durable goods spending is supposed to be coming down from. Durable goods include new and used vehicles, appliances, furniture, electronics, tools, etc.

The three-month moving average in May dipped 0.5% from April and was up 2.4% year-over-year.

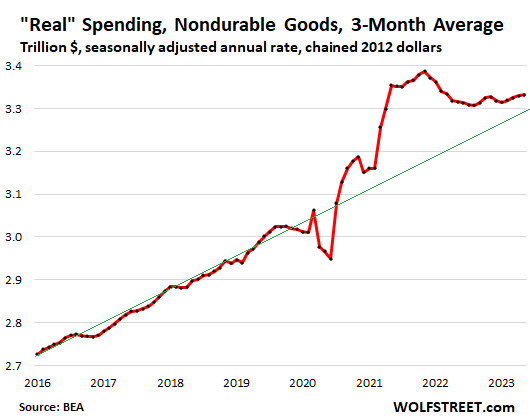

Spending on nondurable goods, adjusted for inflation, was unchanged in May from April and up by 0.7% year-over-year. This includes food, fuel, clothes, shoes, and supplies. The three-month average rose by 0.2% for the month and by 0.4% for the year.

Just to note a growing but still small structural shift here, in terms of spending on goods or services: Gasoline is a big component of nondurable goods. Electricity is in the category of services. As consumers buys EVs to replace vehicles with internal combustion engines, the energy spending by these consumer for these vehicle shifts from nondurable goods to services. About 7% of total new vehicle sales in the US are EVs at this point, so we’re going to see energy spending shift ever so slowly from goods to services – and we already saw the first signs of it last year.

For now, consumers are out-earning inflation, and they’re out-spending inflation, and they’re not really in a mood to slow down. They’re now throwing their money at services, though spending on durable goods has been holding up amazingly well, following the crazy spike during the pandemic.

Energy prices have plunged from the spike last year, and the red-hot food inflation has largely burned out, bringing down the overall inflation rate. And that’s a big help for consumers.

But underlying inflation has essentially not changed in half a year: the Fed’s favorite “core” PCE price index has remained at about 4.6% for the sixth month in a row, and core services inflation, in May at 5.4%, has remained near the 38-year high for the fourth month in a row, as we learned today.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Many of these sailors don’t realize they are on the titan submersible.

I just want to solve a rubix cube with my son at the ocean floor

Testing out that deep water submersible with billionaires was a great idea.

More billionaires and a few members of congress need to take the trip…. we can setup a gofundme for the congress critters… pretty sure the whole country would contribute.

Yeah, it sure was! I enjoyed that one immensely!

And Sir Hairdo (The British one) now has has rich people space trips going, and there is always Everest, rapids, and touching sharks, etc, etc, etc, for the lower level wannabes, which seems to be taking out quite a few more every year. Hope they get more creative!

And I REALLY hope they don’t get chicken, and keep all this stuff up!

Us peons are still ultimately screwed first, but every little bit of helps. Beats Springer.

Might be a good show for his kid…..”Watch fifty rich people die horribly impressing EVERYONE who can’t see all their other stuff.”……..naked?

Some-thing…..

Hope that wasn’t just another cheap general anti government shot, merely proving your extreme ignorance.

Congress critters are mostly all extra ambitious lawyers and businessmen…..bottom line, still just low level hired guns.

Go for their employers, you moron!

Who wastes time killing/trashing the mob’s “soldiers”?

Just other mob soldiers.

Besides, lobbyists do most of the dirty work, trust me, I KNOW and VERY first hand.

Doesn’t the fact they get on the Congressional Baseball team tell you SOME-THING?

I don’t know about food but it keeps getting higher and higher in San Francisco. Looks dead out here.

SF is packed with tourists around me. We just went to a restaurant for dinner. Packed (mix of locals and tourists probably). Lots of people on the street going places. I went swimming in the morning, and the entire area was teeming with people. Big lines outside every breakfast place too (I walk by four on my way). No sign of “dead.” Drunken sailors everywhere.

Obviously SF (and CA in general needs help). If these red states were truly Christian, instead of just doing nothing but criticizing CA, they would be sending thousands of missionaries to help us out of our savage and evil ways.

Perhaps start with the tourists passing out bibles? If each one brought just one out that is a LOT of them.

This economy needs a Titan sub event and then the same kind of media coverage, so wallstreet can get the message that party is over.

all I can say is I can’t seem to get break this year

had 1/2 months with $10k+ cc bills

finally thought I had caught up and was ready to go on vacay

brakes on truck $1,700, bearings/brakes on 5th wheel $1,300

now I’m putting tires on truck $2,500 – gonna pay 1/2 and take out 0% interest cc and pay off in couple months from income

total interest paid since 1995 = $000,000.00

sure glad though I can afford this and take out of income

now I need to plan that vacay as it’s gonna be 111 this weekend

Going to be 115 here and the glass company wants $673 to repair a dual pane window. I’ve heard that the cost of glass has gone up but this is ridiculous.

Same, my CC “summary” spiked 400% last month due to unforeseen costs. There goes all I saved this year. But anywho, my violin recital is up. ;)

As usual, diddley’s post is the funniest one in this little humor thread he started……so far.

He’s really damned hard to beat when it comes to starting a good laugh thread.

Bunch of 20’s and 30’s racking up the card about to get shafted pretty hard.

Jim Cramer will be giving Wolf a free 3 month membership to his investment club based on the bullish comments in this article.

If Jim Cramer can convince investors to extrapolate what they see in the rear view mirror, Wolf Richter’s reporting of the truth could be construed to be bullish, but I see no mention of the student debt, commercial property refinancing, publicly held retailers guidance or the declining hours worked affecting the future.

Moral qualms aside, taking pleasure in the misfortune of others can be quite thrilling.

bullfinch wrote that: “ … taking pleasure in the misfortune of others can be quite thrilling.”

Unfortunately, the seeming majority of commenters here are HOPING for a

1929-style Great Depression.

Why do they want others to be miserable? Is it because they, them themselves, are miserable and want company?

Personally, being an optimist, I want everyone else to be as happy and contented with their lives as I am.

No economic maladies for anyone.

I guess that puts me in the minority. … sigh …

Pangloss weighs in. Why would we ever doubt the Magic Money Tree? Heaven is ours now if we just accept newly sprayed trillions. Don’t worry be happy.

Anon-

“Unfortunately, the seeming majority of commenters here are HOPING for a 1929-style Great Depression.”

I’m just hoping that asset prices come back down to earth. I would like to buy a decent house at a decent price before I’m 80.

Anon — I confess. I am a pessimist. No surprise then that I am a lousy investor.

No. What we want is a return to normal so that we can rebuild. We know the status quoa isn’t sustainable, so we want it to reverse and begin recovery before it’s too late.

“Why do they want others to be miserable? ”

Probably because they’re sick to death of seeing those “others” have cash bazooka’d in their direction for years and years on end, no matter how stupid, risky, or antisocial their behavior, and they feel like it’s time for the “others” to get a taste of what it’s like to be chosen as the loser for once.

Not saying that this is the correct response, but it’s certainly understandable in that context.

“Personally, being an optimist, I want everyone else to be as happy and contented with their lives as I am.”

It’s a brave new world, anon. Universal happiness keeps the wheels steadily turning, truth and beauty can’t.

Geezus — I was being facetious, but the responses here really do capsulize the general sentiment of the WS comments section overall: no-one wishes for the suffering of anyone else; people are simply sick of the greed-is-good, smash-n-grab mentality. It’s bad for our humanity.

My hope is that we can pry free whatever is left of the working class from the maw of the market before the death roll is complete.

There is a very old German word, “schaedenfreude”. This word specifically means taking pleasure in the misfortune of others.

Because some of us perform jobs that are essential for society. We see that no one wants to do these jobs anymore as we drown under the workload and get our miserly wage increase that does nothing to keep up with the cost of living. Meanwhile, it seems that everyone else is a tiktok/onlyfans influencer, marijuana dispenser, “senior” something-or-other for fintech/bank/realty/insert-bloated-middleman-business. They have “unlimited paid time off.” They “work” from home only doing 10 hours of work a week and pushing the mouse around the other 30.

We need a reset very badly. Everyone who understands this sort of thing can see the reset wants to happen organically but the politicians keep finding one more jug of fuel to dump on the ashes if this fire.

That’s a side effect when you act responsibly year after year and get shafted while reckless, irresponsible, degenerate behavior gets rewarded. When you see that for a few decades you start wishing ill on people. After that comes scorched earth mindset…

SomethingStinks, it’s not even just that. It’s that many of the people who have been rewarded for stupid and antisocial behavior brag about it, as if they’re some genius entrepreneur.

SS/E

Wow…a REAL meeting of the minds…with nearly perfect meshing………of course that’s outside opinion, but then neither of you understand a happy irresponsible economic loser like me, anyway.

…reasonably happy in general……it varies in time…..

If the government during Covid injected six trillion dollars of thin air money into the real economy, and let’s say that there are three hundred million Americans, then that works out to $20000 per person of free money. Many got nothing; some got millions. It’s a testament to how inflation is underestimated in the US that inflation purportedly peaked at 9.6%. Helicopter money did its job in igniting inflation and the “transitory” thesis was just an excuse to let it burn. Bernanke claimed that the Fed had the tools to stop inflation in fifteen minutes. What he forgot to mention was the absence of any intention to hit the brakes as hard and fast as they pumped the gas pedal.

It’s been estimated $200 billion COVID funds was lost to fraud.

Most of the legal money went to to well off companies and individuals that shouldn’t have recdeived anything, while real small companies went out of business.

Same old same old, the larger companies can afford the accountants and lawyers to grab the free money legally before it’s gone.

I read a law office in Boston got $10 million

And what of hedge funds whose income is not repetitive per se, but based on current decision making. Did they collect on last years income?

If baseball games had been stopped, would the guy with the big contract be able to tap into the PPP?

The Fed govt loves to spill money….. that is the only lesson. How much is being spent to recover some of the Fraud? About nothing I would suspect.

PPP was freely available and simple to get for … anyone. They did not even check your documents (no need to verify) if you claimed under a certain (high) amount. It is no wonder fraud was rampant.

Yeah, people are a bit miffed about that. There’s currently at least one social media thread with info on how to report your employer for bad faith PPP loans with 1.8K comments on it. I’m sure there are more.

Well, if you are throwing it out of a helicopter, who cares?

By whom????

What produced inflation in America was people getting free money who didn’t need the money. In Canada people who didn’t work got nothing from Covid free money fund unless they were deemed handicapped.

Who could have predicted such high persistent inflation? All the Fed and government did was print $6T and give it people and businesses, with nothing expected in return. sarc.

Those unforced errors aside, what happens from here, assuming the Fed is too timid to remove $5T of the $6T before the sun burns out?

The initial money printing helicopter drops were highly inflationary. Lots of high-spending consumers got cash for nothing, and they spent a good portion of it (and it continues). After the initial spending by these lucky or fraudulent recipients, the cash transferred to businesses in the form of excess profits (profits the businesses would not have otherwise obtained), and a good portion of this transfer is a windfall that gets eagerly spent as well, contributing more to inflation. From there, the excess liquidity continues to move through the system, but with each iteration people have to earn more of it by providing goods or services, so the windfalls and spending propensity decreases over time.

Ultimately, the excess cash migrates to the wealthiest of business owners who use the cash to trade passive investments back and forth, like we saw during the pre-pandemic period. This does not cause CPI inflation, but it does exacerbate wealth concentration, which is already at astonishing levels.

Unfortunately, the Fed will say that situation is OK, like it has in the past, so long as CPI inflation is controlled, and the masses have one or more servant jobs.

In the end, the 90% are left with a disastrous situation. Prices of everyday items and services will have adjusted upwards of 30% permanently, over a short 5-6 year period. Stocks, RE, and LT bonds will have risen another 100% and kept at an artificially high price plateau, via Fed policy, thereby eliminating equality of opportunity for anyone who didn’t have the foresight or capability of buying assets before the Fed embarked on a stealth-like wealth concentration campaign.

One can reasonably argue that current Fed policy IS a driving force that suppresses equality of opportunity, in violation of the country’s founding principles.

It is easy to have a great economy for a short while when you just pile on more debt. It is like throwing a party, times are good.

But then comes the clean-up after the night.

It is going to get really bad within the next two years as we have a choice of either completely melting down the value of the dollar or cutting government largesse.

We really need to just fire ALL the current politicians, and someone needs to destroy K-Street, where the constitution goes to die.

I agree. The difference is, I don’t think this time they’ll ever get CPI inflation back down without knocking down asset prices. Also, it was one thing when the top 1-2% were using their Cantillon effect printed money to buy stocks (still very, very bad), but now that they’ve been rampaging through the housing market, you’ll have a situation where the top have eight houses each, while a huge number of people can’t afford anything. This isn’t a recipe for societal stability.

Yellen told her team QE would make the wealthier more rich. But they needed to drive down unemployment.

It is no surprise.

The Constitution (and the democracy effort) is essentially DEAD at the entrance to every large Corporation. Won’t be long now. Government is well hated by it’s OWN citizens and ever closer to “bathtub size”……..and it’s worldwide, too.

Long live the CEO!

Occam:

Cutting to the chase of the matter.

Nominal “Incomes” are a direct function of the Fed conjuring money. Money which, in turn, is multiplied via the Banking System.

Last days of Rome, enjoy it. Your children and grandchildren almost certainly won’t.

Well done, Minutes.

Everybody realizes. Especially the Fed. The rate hikes are FUELING inflation. MMF’s are outpacing real inflation.

MMF’s are giving people 5% on their pre-tax income this year. The amount of money put into circulation the past 3 years isn’t going anywhere and accruing interest while they do so. That compounds.

Housing inflation doesn’t matter if you aren’t buying, selling, or renting a house. That’s the majority of inflation at this point.

But a lot of folks do rent. And even if you own, taxes, insurance, and other costs of homeownership have gone up.

Oh and don’t forget utilities.

Also maintenance ,supplies and labor

This is interesting… This article on Bloomberg seems to be about the same data as your last two posts but with the opposite conclusions:

I wrote these two articles — the first on the PCE price index and the second on consumer spending — precisely to shoot down this kind of BS in the headlines in the media. 🤣

All you have to do is look at my charts on inflation and consumer spending, but of course that would be too much to ask of you since all you do is read headlines – the dumbing down of America knows no limits — including on the Bloomberg piece, of which you only read the headline, or else you would have noticed that the article agrees with me on inflation and disagrees with its own clickbait headline, LOL.

The Bloomberg article says this:

“Excluding food and energy, the so-called core PCE price index increased 4.6% from May 2022. That’s in line with annual readings back to late 2022 and shows minimal relief from elevated price pressures. Economists consider this to be a better gauge of underlying inflation.”

LOL. Exactly what I said. You headline-readers are a never-ending source of amusement for me.

Whatever happened to the recession we all seemed to expect? I just got a 20% raise with the state and i suspect many workers in high inflation areas did too.

I will keep looking for it and waiting for it. Someday maybe…

Bloomberg will write any BS.

If the corporate overlords need a puff piece they call them. They write it, you buy it. The corporate marketers have done their job.

If Wolf keeps it up with these bullish comments, the MSM will be inviting him on nightly.

I’ve been called bearish because of these kinds of articles.

The New Bullish is if you clamor for a huge recession, 10% unemployment, and a collapse of the financial system that will cause the Fed to unleash forever-mega-QE and forever-deep-NIRP.

The 5.25% Fed rates have a funny impact on people’s brains, I think 🤣

Wolf,

You are the embodiment of what Yogi once said.

“You can observe a lot by watching.”

I do recall that couple years ago, your observations were quite accurate, describing the actions of, “The most reckless Fed ever!” Times change, eh?

“All good writing is like swimming underwater and holding your breath.”

― F. Scott Fitzgerald

Bay swimming must be a close second.

I’ve been following you for a few years now. Honestly your tone is a lot less bearish compared to say…2018.

So long as ZIRP continued, there was a huge anvil over the head of asset valuations – which were inflated by the printed money regime of ZIRP (DCF/NPV calculations being distorted by ZIRP’s phony interest rates).

Now that rates have been along to semi-normalize upwards, that hanging anvil shrinks a bit…thus a bit less bearishness.

Allowed not along.

His tone isn’t bearish at all lately. He’s one of the few prominent Fed critics who seem to actually notice that inflation hasn’t gone away, spending hasn’t gone down, and risk markets are on a tear. The rest of them are making absurd claims about inflation being sharply down and a recession already being here.

Over many, many years, I’ve learned that depressions simply aren’t going to happen any more. But for good reasons: corporations want sell more products, hire people, become more efficient. Working folks want to work harder, make more money, collect more stuff. Investors are always ready to step in when they see something dropping in price below perceived value. There is a floor to economy that is hard to break through. Especially when the Fed is quietly standing behind the bad investments banks occasionally make. Folks waiting for the great collapse, are always going to be disappointed.

1. depressions simply aren’t going to happen any more.

2. Folks waiting for the great collapse, are always going to be disappointed.

Ask yourself what is the magic about a Central Bank? Set up your own Central Bank on an Island and see if an economy and nation arrive.

The Fed is in the Last Days of Disco.

I’m a bit guilty of waiting for small crash like downturns in like cmbs. But, the fed has always created some.talc.like program. But part of me doubts they can contain all of it so I’ve held drv.

It’s different again, folks 🤣

It’s probably true that incentives and policies today are set up towards permanent inflation.

However, people and society are still subject to the laws of physics and psychology. In fact, the world is more unstable today than it’s been in the last 50 years.

Still waiting for the last bear to throw in the towel 🙄

It’s Different This Time™!

danny g – “waiting for the last bear to throw in the towel.” Reminds me of a comment by the late Alan Abelson (Barrons): “…when the last bear sprouts horns.”

Be sure to count me in on your disappointed group. I love hiring former millionaires looking for a job.

Blam,

“Derivative contracts, swaps, and repos enjoy super-senior status in bankruptcy: they are exempt from the automatic stay and, if collateralized, they are effectively senior to virtually all other claims. We propose a simple corporate model to assess the effect of this exemption on cost of borrowing and incentives to engage in derivative transactions. Our model suggests that, while derivatives are value-enhancing risk management tools, effective seniority for derivatives can lead to inefficiencies because it shifts credit risk to the creditors, even though this risk could be borne more efficiently by derivative counterparties. In addition, because senior derivatives dilute existing creditors, [greedy pigs} may take on derivative positions that are too large from a social perspective.” -from Cal Berzerkely paper

Not worried about you, but these things are moral hazard city.

I read the history of how they legally changed over the years….lotta lobbying.

Anyone ever see the sculpture outside the old B of A monolith in SF called (unofficially) “Banker’s Heart”?

I’d be happy with 6.5% unemployment, no QE, an FFR that stays at or above 2%, a national 20% drop in real estate values, and a 30% drop in markets.

The reality is that inflation doesn’t get sorted out without housing, nationally taking a 20% hit with the 30YFRM not dropping below about 4.5%.

And we all know this doesn’t happen with a mild 4-6 month recession that sees unemployment rise to maybe 4.3%.

Overall, the US economy is clipping along fine. There’s near zero chance of a recession this year.

The Fed should not have taken their foot off the gas. They should be crystal clear that a 6% FFR is about 85% and that it may take upwards of close to 7% to really solve inflation.

And then, they need to explain to everyone that we’re not likely to see anything more than a mild recession in 2024 that will turn around quickly, meaning that the FFR may not drop below 5% for years to come.

To date, they’ve gotten EVERYTHING wrong, but I’m wanting a meltdown just a nice 80% GR2.0.

They really need to put a cap on foreign, offshore and large corporate investing in SFHs. By taxes or laws.

And very very heavily tax and fine vacant houses.

Everything else they do just ends up screwing up the entire economy. For chrissakes workers can not even afford to live in many places. They move out. Where the heck they move to and if they can even manage to make a living there is a hard nut to crack. This is not a functioning economy. In California some end up moving onto BLM land. En mass. Or like near the Salton sea. Does anyone seriously think they are even counted in homeless censuses? Salton area looks like mad max from the photos I’ve seen.

Agree with Lynn, like totally dude or dudette…

Crazy bad when ANY of the help must commute such long distances that they don’t bother, eh?

Some cities in FL that I keep somewhat in touch with through, mostly websites these days, are getting the idea that WE, in this case the WE who need help due to age, disability, or just too spoiled to soil our hands, MUST have local help, no more than a local bus ride or reasonable walk away, etc.

Hard to believe, but it appears both the RED and the BLUE city folks have begun to propose taxpayer subsidies to be used for ”’affordable”’ housing for teachers, first responders, and even, non government employees….

Both Red and Blue!!! Amazing, eh

Lynn,

I heard biker gangs run that place.

Maybe this is just me imposing my views on your words (i.e. I am putting my views onto your words). But I don’t read your words as being either bullish or bearish. I read them as more as “this is what I am seeing, and this is where I think things are going”.

Sure, maybe more bearish than bullish, but not “end of the world bearish” that some on here want to see.

Nobody wants an apocalyptic dive. Not really. What they want is a return to sanity and stability, and they realize it’ll take a significant downturn to balance things out.

I’m all for some planet saving austerity….as long as it is spread around MUCH more equally.

Already told y’all Constitutional max net worth is the solution….let’s put some boundaries on this here playing field. The rules to the game will then pretty much take care of themselves.

Howdy Folks. Wonder where spending the Interest Income comes into this. Some folks may be spending every bit of the higher income earned due to the interest rates. I sure is and proud to be a sober sailor spending.

One side effect of higher rates is just this. More money going into the pockets of generally older Americans who are spending like everyone else. Another contributing factor to sticky inflation.

Seems to me more aggressive QT and an asset draw down would be the actual fix to inflation. Or raising taxes and cutting spending which seems unlikely given our crocked leadership smh

Howdy AD, This old gezzer has waited a long time to spend a little more. Just want to properly time my long term T Bills ….

” folks may be spending every bit of the higher income earned due to the interest rates.”

I sorta wonder if interest revenue/expense doesn’t more-or-less net out to zero on a macro level (at least within private sector)…after all, if creditor is receiving more interest income that means that debtor is *paying* more.

In aggregate, a change in interest rate levels might have distributional consequences…but few net *macro* ones (at least in near term).

The biggest debtors are governments at all levels and companies. Household debts ($17 trillion total, most of it mortgages) are much smaller than debts by governments and companies. The easy parts of government and company debts to add up amount to about $65 trillion. But there is a lot of “private lending” to companies by PE firms, nonbanks, commercial mortgage REITS, etc. There is a huge amount of interest-bearing leverage in the financial sector. There are all kinds of other commercial debts out there that pay interest.

So these government and commercial borrowers are paying most of the interest. And some of that goes to households.

But what does happen is that the households that earn interest (typically households with few or no debts) are not the same as households that pay interest.

So the households that earn interest get to spend more. Most of the household debts are mortgages, and something like 95% of the mortgages outstanding are fixed rate. Those households do not pay more interest until they get a new loan. Auto loans are more expensive now, but most of the outstanding balances are with low rates from a year ago and earlier (auto loans are long these days). Credit card rates have gone up, but most of the credit card balances are non-interest bearing because most people use their credit cards only as payment device and pay them off every month and collect the 1% or 2% cashback, or the mileage or whatever – roughly $5 trillion a year is paid for with credit cards, and only a tiny portion gets stuck as interest-bearing debt.

So based on these facts, consumers will not be the ones that go into financial duress, it is going to be companies and government agencies.

Seems like we need to see companies go bankrupt and much higher unemployment to cause any distress.

It is obvious that nothing domestically is going to stop the runaway inflation. Those alive during the 1970s and 1980s know that nothing short of Volcker will fix this problem.

We don’t even know what the problem is; all these charts and graphs are nice, but the methodology of calculating inflation has changed. What good is a graph with the left half of inflation calculated differently than the right half.

Three truths of the Federal Reserve:

1. It was created by Congress

2. Their biggest worry is deflation

3. They don’t like to mention gold

Volcker screwed up 3 different times.

Yes. He’s a hero now but was hated back then. And it’s not as though he managed to create a “soft landing”. It was a very hard one, maybe not necessary, but it worked. But in retrospect, he’s regarded as being a savior.

We twist and turn things to fit our bs narrative of how things “used to be”.

I think people revere him now because he realized that there was no magic bullet, that there was going to be pain.

History tends to look more fondly upon people who choose the least bad option than people who bury their heads in the sand and pretend that there is a good option.

Einhal – very well-said.

may we all find a better day.

Einhal +1

Thank you both. I see Powell as Chamberlain and Volcker as Churchill. Yeah, it would have been nice to eliminate Hitler without a costly and deadly world war, but it’s not realistic, just like it’s not realistic to expect to get inflation under control and not have a recession.

We don’t have runaway inflation. Full stop.

We have high inflation (especially compared to recent years (decades)), but no where near runaway inflation.

I think we got exactly what the FED is shooting for, a slightly high inflation rate to inflate away all of the public debt, but nothing out of control (let alone runaway).

Yes, it will completely suck for those thinking inflation would stay low forever. Those people will be punished, but it isn’t Weinmar Germany or some shithole 3rd world South American country.

It is simply slightly high inflation.

The world will adapt. There will be winners and losers, but the world (and the country) will go on.

Anyone with fixed, low-rate debt is in a position to benefit from inflation.

Housing prices have tripled in 14 years in many places. If that’s not runaway inflation, I don’t know what is.

Yes, it’s not as bad as it in Argentina or Turkey, but that doesn’t mean it’s not runaway.

our house has quadrupled in 8 years if one believes the ”comps” as presented by the z folks!!!

others in this small hood even more

Yeah, I think engaging in dramatic understatement just makes some folks feel like the coolheaded one.

Tis but a flesh wound…

Bought my house 20 years ago 4 bedroom 23/4 bath inground pool 147,000$ now taxed at 307,000$ . Only thing I got was devalued money in Omaha ne and a rediculios property tax bill

Seems like quite a lot more consumer driven growth to come. Wonder how well distributed this income is though, higher earners tend to save more.

Change in median household income shows that. Haven’t looked at it recently.

I presume it’s going up in “real terms” due to rising wages. Concurrently, most people are still actually broke or near it which isn’t fully evident due to $2T+ in deficit spending, loose credit conditions, and the job market.

“… most people are still actually broke or near it ”

I’m so tired of this most-Americans-are-broke BS. Post this stuff somewhere else. It shows you’re totally utterly clueless and will never understand the US economy. There is a huge wealth disparity in the US, but lots of Americans have plenty of money.

13% of households are “broke” — the rest are not, and many of them are pretty well off:

https://wolfstreet.com/2023/05/27/americans-ability-to-pay-for-emergency-expenses-or-three-month-job-loss-with-cash-or-cash-equivalent-by-selling-assets-by-borrowing-or-not-at-all/

Debt burden is small:

https://wolfstreet.com/2023/05/16/household-debt-as-of-disposable-income-fell-to-good-times-lows-on-much-higher-incomes-despite-breathless-omg-headlines/

Households far from “tapped out”:

https://wolfstreet.com/2023/05/15/households-far-from-tapped-out-credit-card-balances-burden-credit-limits-available-credit-delinquencies-collections/

If most people were broke, the stock market wouldn’t behave the way it is.

Money flows come from people with money, and as unemployment went down, more money went into the markets.

This can’t happen if everyone is broke.

Directing people who keep repeating this to a chart of the SPY might help. The tape tells the story.

Bond,

You are completely ignoring the influence of one of Wolf’s favorite villains…the stock buyback.

Corporations (via real earnings or borrowed money) can prop up their stock prices (in the near/intermediate term at least).

So, stock market advances don’t necessarily require widespread stock equity ownership…in fact, I think maybe only 51% of US households own *any* stock equity…let alone a significant amount.

Wolf,

Have you considered telling these people that this isn’t a support group for frustrated bears?

That is what ZeroHedge is for.

I’ve never seen so many homeless tents popping up all over the place here, and panhandlers on every main intersection. This was not the case 3 years ago. I would say these people are broke. It’s in your face. I agree that the wealth disparity has gotten much worse. A lot of people still have a lot of money and are spending it like drunken sailors.

SC,

I too see (seemingly, subjectively) a lot more panhandlers in my area. At the same time, nearly every shop on Main st has a now hiring sign.

I don’t get it – these folks would surely earn a lot more even doing a part time job at min wage. Must be some psychological reason for their chosen path, not just economic.

MM – mebbe in part, and supreme irony, a reverse replay of the Opium Wars…

may we all find a better day.

Thirteen percent of 334,000,000 is more than 43 million people. I don’t know what an acceptable number is but that seems pretty high in an affluent country like the US. Just saying!

Gabriel,

You completely missed the statement that triggered my reply, and thereby you completely missed the point.

The statement by August Frost that I replied to was this: “… MOST people are still actually broke or near it.”

And that is BS. “Most” is not 13%. “Most” may be something like 90%, or if stretching it, 80%. Anything over 50% is at least a “majority.” But 13% is a small minority, not “most.”

MM I once knew a panhandler.

He would laugh so hard about the morons who gave them money for just standing there.

He didn’t want a job, he wanted to be free. He wanted morons to hand him cash and tell him some random stuff about their life.

He totally was just using everyone at the stop light to go buy drugs with the money. And then laughed at how dumb people were.

“It’s so easy!!” He would say.

So if anyone here ever gives money to those people. He thought you were dumbasses, he’s dead now btw

Things look like they are gravitating back to a prepandemic setting, which the Fed touts as optimal. Corporate profits were high, wages were low, investments were in a bubble, interest rates and growth where suppressed, and debts were growing.

The best part is the wealthy could accumulate tons of new wealth and spend in luxuries without creating inflation. The masses would gladly serve via low wage jobs, so long as Apple produced a new shiny phone every year and people could follow the NFL salary negotiations.

Goldilocks period, they called it.

The problem is that the human race hasn’t improved much since the Neanderthals. The only change is the standard of living. Lots of idiots running around & buying sh*t. Come on, they just want to be cool.

Mm most of these people panhandling,have addiction,or mental issues . Or there lazy

Guy who stood most days on same corner in SF bay area, late 1980s, told me he averaged $200 per day.

That was a living, minimum sure, but a living, even if he was not augmenting with drug sales, pimping, etc.

Wasn’t dirty, had a gentle vibe.

Apple borrowed billions at cheap rates ,there balance sheet of cash is borrowed money ,executives stold the rest In compensation

Oddly msm seems to eschew all the covid spending. But, an arg can be made that it had a “wealth effect” across all classes that buoyed the economy. Based on my modest economic training that was true keynesism, not tax cuts for the rich. Tax cuts in a mature credit rich environment does not spur prductive nvestment but money to the working classes drives consumption because they have a much higher propensity to consume not the rich unless one sells yachts.

Government printing of little green pieces of paper does not increase a nation’s real asset endowment by a single 2×4, hubcap, or handful of grain.

Cas, you ALWAYS find the government to be the root of all evil. Have you ever considered the population that’s being governed???

Governments(the Fed) create inflation, everyone else just reacts to inflation.

HN,

You see people as the fundamental problem, but governments are made up of… people.

Blam35 – If the government found a way to make this happen without adding debt, fine. We are simply borrowing from the future.

Yeah and Keynes also said we should run a surplus in the good times.

Someone turn off the lights ,when parties over .

Funny, considering the government(fed) are the creators of inflation. Everyone else just reacts to it.

Apparently, there is still a lot of cash out there and money earned. Let the good times flow. Life in the states is like a beer commercial: “Boy’s it don’t get no better than this!”

U.S. dollar is king. We can print all we want. Enjoy! Just ask Congress.

The “apparently” part in your comment is right; cash is created by your signature at a bank or when you get credit cards.

The technological financial instant transactions coupled with JIT global manufacturing creates near instant balances throughout the global industrial system coupled with many people —7.5 billion — who are willing to get credit and work. It’s just that simple. Describing simple complex integrals and demand derivatives as in calculus economics can look impressive BUT in the end the system is simple. The hard part is tracking instant happenings across all categories and nations all at once. That would be omniscience.

Wouldn’t much higher federal income taxes solve these issues 100% while putting the US government on a sound track towards repaying it’s massive public debt which is now moving towards 180% of GDP?

SoCalBeachDude- Stop gaslighting, lol.

Please run for president, SoCalBeachDude.

No, because the elite buy elections. Nothing new about that.

Any belief that the masses are ever going to plunder the elites (the actual dream of every progressive) is a complete fantasy.

Wrong. The “elites buy elections” is correct. The “plundering” of the elite is the fantasy of the communists, not the progressives. Too bad that you can’t recognize differences. Your distortions are ever present. It’s the “when all you have is a hammer…” syndrome.

One more note. Your post also assumes that fake “wealth” can be converted into spending in the real economy with limited or no consequences. What you propose would crash the markets, eliminating this fake “wealth”. At scale, it isn’t real.

So Cal…

“Wouldn’t much higher federal income taxes solve these issues 100%”

First, history will show you that for every tax dollar collected, the Federal Govt spends 1 + X. There likely would be no reduction in national debt.

Secondly, with people and businesses being already harmed by inflation, to then TAX them on top of that is absurd.

You essentially are suggesting “shuttering” the private sector to fund the irresponsible spending of the Federal Govt.

I disagree with that notion.

Sure, if you ignore the parts of history that run counter to your claim

There are no parts of history that run counter to the claim.

Are you planning on bringing up the fallacious “We had 90% marginal tax rates and the 1950s and everything was great” line?

Or were you planning on bringing up the equally banal “Clinton ran a surplus” line?

The fact is, both of these things were accidents of history and resulted from a series of factors that are not likely to ever happen again.

The federal government has grown out of control because the people demand it. No one cares about reining in spending, as long as they get theirs.

This is a fundamental flaw of all democracies.

Einhal:

The United States is not a democracy. It’s a constitutional republic.

A democracy is two wolves and a sheep deciding what’s for dinner.

The US needs more than 2 parties. It is always left or right and rarely anything i. the middle.

Defense/offense is comparable big slice of the budget.They would just find a new war to support, or add more $ to the present one. Both parties would vote yes.

“I don’t need to spend less on takeout, you just need to increase my allowance.”

SCBD:

The government has a spending problem. That needs to get fixed first. Your assumption appears to be that the government can better spend your income than you can. I find that hilarious.

Wolf had me months ago with the 6 to 7 millions backlogs of vehicle demand waiting to be upgraded. Americans still have pent up demand post COVID, and all the $FOMO streams daily across social media showing neighbors on extravagant vacations and what the .01% are spending their money on. I call it the perfect storm create by 12 years of QE, the Smith and Barney commercial is in full effect “we make $ the old fashion way”. Travel, Hospitality, and Entertainment sectors are still short employees. 14 homes for sale in my east Denver suburb, 10 under contract. Glad to see the Shock and Awe Recession Bullshit is just that.

How are all the commission sales reps doing out there? Every hourly employee in my company has enjoyed significant raises and sales just got cut. I’ve heard this at multiple other companies too and since it’s been softening already, this is concerning me. We’ve cut back on discretionary spending but my 3 boys won’t stop eating:). I have this new party trick while out for cocktails. I turn a $1 into a $10 by topping off my vodka rocks with my trusty flask.

“Wolf had me months ago with the 6 to 7 millions backlogs of vehicle demand waiting to be upgraded. Americans still have pent up demand post COVID, and all the $FOMO streams daily across social media showing neighbors on extravagant vacations and what the .01% are spending their money on.”

I call BS. A lot of demand has been pulled forward. I have never seen so many new vehicles/RVs/boats/side-by-sides/motorcycles/2ndhomes/vacations in my life. This is like 2006 on steroids. Wolf himself talked about the fact that Yosemite was busier than he’s ever seen it in his life. That’s what I’m seeing, too. This is like a blow-off-top economy. At some point, it has to crash. You can’t have a boom without a bust. And this bubble is unlike anything ever seen in this country. There is no such thing as “it’s different this time.”

Roaring 20 s replay

I agree on this. I’m seeing car dealerships parking lots largely full again. RV distributor lots (there are many where I live) are fairly full again.

I’m hearing anecdotal evidence of people who bought boats and RVs in the past few years trying to sell them.

The fact is, America didn’t generate any new wealth over the past 3 years. It just printed money and caused massive malinvestment. There’s never a scenario where you don’t pay a price for doing that. It’s just a matter of time.

“I’m hearing anecdotal evidence of people who bought boats and RVs in the past few years trying to sell them.”

For more than they paid for them new, naturally. It’s almost like they were speculating in depreciating assets or something. And KBB and NADA values seem to be of little importance to these people, as they have no problem pricing them $10k above private party value. Yeah, good luck with that…..

DC:

KBB and NADA are “wish books” as in “I wish my car was worth that much”.

Vehicle auction values change daily. They’re regional, seasonal, color sensitive and body style specific. Dealers use Manheim online or BlackBook to buy your car and NADA or KBB when they try to sell one to you to convince you of what a “good deal” you’re getting.

Sooner or later, we will come to the end of the string, because we can’t ‘push on a string’ any further.

But they can destroy a currency and the standard of living over the course of a lifetime. We have THE WORST human beings in history in charge of everything. Just vile, irredeemable filth.

No one is short of employees. Quit thinking that. Short of employees means corporate wanted more profits and won’t hire anymore.

The signs are a show for their customers.

I’m not so sure about this. I just saw an article where Gross Domestic Income over that last year has fallen 2.6% while GDP over the same period rose 2.3%? Or what the financial industry is calling “out of sync or just plain doesn’t make sense. It seems all our stats are screwed up since Covid. In any event, from what I see the boomers, with money or assets, are spending, while the younger people are not, because they have no assets and their incomes are being eaten by inflation. I think it’s really about “who’s inflation”, and this differs by income class. For the poor, I think food and rent are still rising, and inflation is very real.

Real Gross Domestic Income (GDI) and Real Domestic Product (GDP) are completely different measures. Discrepancies, up and down, are normal. They rarely every match quarter to quarter though over the long term you can see parallels.

For example, GDI includes corporate profits which fell for the third quarter in a row. Falling corporate profits has been one of the most discussed topics out there.

Jack Webb-

“Just the facts, Ma’Am”

Joe Friday, Badge 714

“GDI includes corporate profits which fell for the third quarter in a row.”

“…the story you have just seen is true. No names were changed, however, as there were no innocents to protect, and no one brought to trial, convicted, or sentenced…” (…DUM-DA-DUM-DUM…).

may we all find a better day.

DM: Some good news! Gas prices have plunged 27% down from record highs last year – as 43.2 million Americans prepare to hit the road for Fourth of July celebrations

Motorists will finally have some respite from sky-high gas prices this Fourth of July weekend after costs plummeted by 27 percent.

oil is sticky at $75 dollars, meethinks it will rise with a pond full of black swans swimming around Brics

Oil could fall to $-33.00 (negative $33.00) per barrel as it did only a few years back as the world is awash in excess oil supplies.

I doubt the lockdown thing will be tried again, so that’s highly unlikely.

The good thing is there seems to be plenty of oil and nat gas. Funny how money printing brings down commodities prices but jacks up prices everywhere else.

At the start of the Biden administration, gasoline prices where I live where $2.29/gallon. Then the “inflation” took hold and gas ran up to close to $5.00. Then 6 months ago, it was down to $3.29. Thats about as low as it got. Still $1/gallon higher. But the 3.29 counts as disinflation ?

In the last 6 weeks, gasoline went from 3.29 to $3.69. I’m not seeing how that translates into a 27% plunge ?

That is a pretty strange starting point you choose to make your comparison on. Why choose the middle of a once in a century pandemic as a starting point? Of course numbers are going to look wonky based off of that.

Narratives need to be fed. Pay no attention to OPEC production either. If you compare OPEC production to FRED average cost of a gallon of gas they are almost inverted.

JimL

Instead, you can use 2017 when I moved to our little slice of paradise. Regular top tier gasoline was @ $2.50 a gallon. It was just $4.87 and recently “reduced” to $4.39 just prior to July 4th weekend. Same physical gas station. Same brand. Same operator.

No pandemic need apply.

There is nothing wrong with using the start of a new administration as a benchmark. For anything really. But the problem with measuring inflation in the oil markets is that they aren’t independent markets. OPEC is a cartel that tries to control the price of oil… and the Saudis are the principal cornerstone of that organization. In the past five years, oil has bounced around based on…

1) The Kingdom of Saudi Arabia lowering the price of oil to try to bankrupt the American fracking industry

2) Iranian oil being sanctioned by America and thus unsellable except in small amounts off the radar screen

3) The sanctioning of Russian oil in response to their invasion of Ukraine

4) The Crown Prince of Saudi Arabia raising the price of oil to rub Joe Biden’s nose in it for calling him a murderer

I am sure that I am missing some events… but the point is that oil prices are not the result of a free and open market allowing buyers and sellers to find the natural price. Which is why it is typically excluded from “Core Inflation” calculations.

We’re draining SPR.

I live in Maryland. On July 1st the gas tax went up 5 cents a gallon. Not all inflation is in the product.

Credit provides fuel for spending.

Rather than a velocity of money indicator how about a credit to debt velocity indicator.

I would like to see an indicator that demonstrates how quickly newly issued credit is being converted into debt and how this relationship has accelerated over time.

” how quickly newly issued credit is being converted into debt”

It’s not immediate?

No such thing as nations real asset endowment, it’s all about distributive assets. My comment.was directed at the sacred cow cut taxes for growth fallacy, how true keynesiism was about money to the many and creation of melt up from.bottom growth not tax cuts, that’s basic trickle down econ

If trickle down was at all real, we wouldn’t have the continuous growth of wealth and income disparity, now would we?

And the tax cuts Reagan wanted with the highest level of defense spending at that point in time raised the deficit to the highest ever during his Presidency. Well, at least he served in the military. Not so for guy who had heel spurs.

Trickle down isn’t the cause of wealth and income disparity. Poor monetary policy, uncontrolled unskilled immigration, and our outsourcing low-end manufacturing to the third world is.

When Reagan and GHW Bush left office, Communism had been defeated, inflation was under control, unemployment was minimal, economic growth was consistent and the highest it had been in decades. In short, a massively improved economy (and world) for a measly $3 trillion in additional national debt.

By the end of Biden’s first term, the Baby Boomer presidents will have added an ADDITIONAL $30 trillion in national debt. Feel free to tell the class what we got for THAT debt.

This is the kind of information and insight I get from Wolf and nowhere else in the financial media. Thanks for another great post.

1) Consumer spending is up in real terms, but motor vehicle sales are down 6% m/m seasonally adjusted annual rate. Brand new 2022 pickup trucks are still around. A $7K/$8K discount is offered on new 2023 pickup trucks, after raising prices. Online car sales are down. The boomers and the impaired, Subaru best customers, are taking a hike. The drunks left the party.

2) Consumers rotation : less on big ticket items like housing and durable goods – more on service and crumbs. Student loans cancellation will reduce Gen Z and millennial real income. They will compete with AI and millions of new immigrants.

3) The up and coming don’t care. They spend $60K/$100K on EV, because that’s the trend. They spend less on fancy Rolex, Piaget and Patek Philippe. Dozens of high end Swiss watches disappeared in the last few decades. Japanese watches for the middle class, who took over the world and dominated sales in the 80’s and the 90’s, are still hanging around thanks to China. Mgt have to gamble and adjust to survive in the business casino.

4) The stock market punished Ford and GM for their inconsistency and stupidity : AAPL market cap $3T, GM $50B.

5) The blue zone ukulele party is on July 4th 2023.

“…but motor vehicle sales are down 6% m/m seasonally adjusted annual rate.”

LOL. Reading BS websites again? I hate it when people drag BS into here that they pick up at some ignorant shit website. It just wastes my time.

Part 1, new vehicle sales (actual, not seasonally adjusted annual rate):

1. In May, 1.3633 million vehicles were sold

2. In April, 1.3618 million vehicles were sold

3. So in May, more vehicles were sold than in April

Part 2:

1. In May new vehicles sales soared by 23% year-over-year (to 1.363 million vehicles from 1.108 million in May 2022).

2. March, April, and May were the best months since early 2021 (before the industry ran into inventory shortages). In all three months, over 1.36 million vehicles were sold. Last time we saw those kinds of sales was in May 2021.

I am still hearing chip issues with the car manufacturers…

I am surprised as it seems the issue had been resolved, supply not an issue.

It has gotten a lot lot better. But some companies are still having problems. So shortages with some brands, and plenty of inventory with others.

Some service departments at dealerships are still breaking records as well.

A friend of mine runs the service dept. at a Toyota dealership. Just hit a new record of ~$380K to close out the month of June. He was aiming at a number thought to be unrealistic of $370K and exceeded expectations.

He could probably do even better if he could hire more good techs (they’re in short supply, and always have been).

In May 1.3633M vehicles were sold. Sold by whom.

Auto dealers to their customers. Automakers directly to large rental fleets. These numbers are “deliveries to end users.”

Typically, the fleet business is about 20% of total. It collapsed over the past two years because automakers had shortages and prioritized high-end models through the retail channel because they made more money that way. The fleet business has started to grow back toward normal-ish levels, which is a good thing because that’s where the used vehicle supply will come from in 1-2 years, and used vehicle supply is now getting tight.

I second that….I rarely see any old junky cars on the road here is SoCal

Don’t know where ME got the numbers. But last week I deleted an email from the local Ford dealership offering $8,000 off MSRP on new 2023 F-150 pickups and 0% on some new cars.

In 2008 I bought my F-250 with an employee discount so am looking for the same offer in September/Fall time frame.

$25,000 off msrp would barely be a deal with as much as they have hiked the prices.

Yes, deals are back! That’s how it is supposed to be. These addendum stickers we saw in 2021 and 2022 were just freaking nuts.

///

People spend because what they earn is not worth saving.

///

… until it is.

Howdy LDLSmart, Amen, ZIRP should NEVER have happened….

Local personal trainers and gym owners feeling the inflation pressures . No health insurance and grocery at Walmart vs Sprouts. Smaller town in East Texas population 110k . At the same time neighbor across the street traded in duel fuel (EV and Gas) BMW that was 3 years old (15k miles) for a 2023 Mercedes SUV. Plus he just finished a landscape maintenance and new fence at a cost of 40k. He is 71. Pension from Federal Government helps a bunch. Drunk sailor and sober poor service gym owner. Wolf has been signal no recession for longer than I can remember. Higher for longer and don’t forget his mantra on higher long term rates .

Does the final rate hike start with an 8? to kill it even low it is slowing down.

What is missing in all this data is the fact that the entire burden of the monetary collapse and rate hikes is falling on the shoulders of families and small businesses, while large corporations and governments are virtually unaffected. The drunken sailors are out there spending money they don’t have and getting poorer and poorer every day. They are drunk 24/7 and don’t realize what is happening to them. The media won’t tell them, until every dime is taken out of their wallets, and they are no longer useful for anything.

“…are out there spending money they don’t have and getting poorer and poorer every day.”

No. please read the first part of the article and look at the first picture.

“…and look at the first picture.”

Geezus! I just pissed my pants.

Now, just the teensy problem of inflation’s coming second wind.

Prices are now falling substantially in nearly all areas.

Not in services. That’s the only area that matters in the long run, since it is tied at the hip to wages.

I have come to the conclusion that I must be economically obtunded. Ever since this financial fiasco(covid shutdown and fed/gov interventions related to it) I have been losing ground to inflation. It is like I am sailing upwind and against the current.

And yet we have articles like this……..

ugh

I hope America can learn from Canada. If too many people emigrate from the third world countries spending and wages always lags the inflation rate leading to a lower standard of living for everyone. The laws or rules of economics have never changed.

That is simply not true. In fact it is wrong more often that it is right.

Get better sources of information. Once that don’t try to scre you and take advantage of your bigotry.

It’s very much true. The West has not been made better by mass immigration of unskilled people from the third world.

Einhal – where is ‘the West’ ? (…and is it that ‘the West’ is now dealing with the inevitable long-term consequences of its various colonial activities, as other empires have? – ie: paying work and relative stability for the human creature are where you find them…).

may we all find a better day.

See *France*

Immigration isn’t bad. However, failure of the immigrants to assimilate is.

El Katz, chicken and egg. If you allow too many immigrants in at one time, and don’t force them to assimilate, they won’t.

Check your family tree.

You’re an immigrant.

Your great grandpa was probably a poor unskilled farmer.

Criminals come in all flavors and plenty are “native.”

Consumers spending is up. Debt service payments as percentage of

disposable personal income is 5.7%. Add student loans payment.

The total might be 10% to 15%, a new all time high > 2000 high, a recessionary level.

LOL.

Why don’t you read some of the articles here, instead of the nonsense circulating out there?

https://wolfstreet.com/2023/05/16/household-debt-as-of-disposable-income-fell-to-good-times-lows-on-much-higher-incomes-despite-breathless-omg-headlines/

1) Total household debt as % of disposable income is up to 90%, well below 2008.

2) Total debt service is up to 5.7%. Within few loans payments as % of DPI might exceed the peak. Add $1.8T student loans to the actual debt.

3) The extra $2T in noninterest bearing bank deposits plus other people deposits and CDs are fuel in the tank. It can keep the economy running for 2 – 3 more years.

4) Drugs infested SF is no bs.

“Total debt service is up to 5.7%.”

That doesn’t match the data available from fred, which shows a slight uptick from covid response lows, but overall pretty low going back decades.

https://fred.stlouisfed.org/series/TDSP

Who decides what part of my income is “disposable”?

Consumer A makes X, lives high on the hog, has a big annual “nut”…

he spends all his money on fancy house, mortgage, car maintenance, expensive clothes

Another consumer with the same income…. lives a modest life style and has what would appear to me more “extra” money which he banks. His disposable income is high. The first guy’s isnt.

Isnt what’s “disposable” a decision by the individual?

Disposable income = total income minus income taxes and social contributions.

They just raised property taxes by about 10% in Mont Commie County Maryland. My disposal income just went down. Wolf needs update his charts.

What about the Supreme Court knee-capping Biden’s student loan forgiveness plan? Nobody has been required to pay on those things for going on 3 years now. Over 43 million Americans owe student loans and the average debt is nearly $38k. That’s a small car payment on an extended loan plan that around 15% of the population hasn’t budgeted for. Might not be enough to cause a recession, but could put a damper on increased spending. Unless of course grandpa Biden kicks that can further down the road.

As you can see from some of the comments here/prior article: the White House already announced a bunch of steps that would allow student loan borrowers to not make payments, to extend further, to get them forgiven sooner.

As I said, I will just wait until I see borrowers actually making payments. This administration is hell-bent on buying votes from student-loan borrowers.

I keep hearing this bit about a ‘bunch’ of programs to not pay student loans and I’m left scratching my head exactly what and where all these programs are. Biden helped create this disaster in the mid-00’s and he’ll soil the bed one last time before any future success to discharge loans.

As far as delaying repayment, the big red flag is after 3 years, government contracted loan servicers still aren’t prepared to resume payments. Why? We all knew the Supreme Court was gonna shoot Biden’s plan down. Hardly a shocker.

The PSLF is still a huge joke at best and a massive lie to its core. The ones bailed out so far are people on Disability who should have been discharged all along and hadn’t been, a relatively small amount of people who were in scam universities like DeVry, and maybe a few more actually got their PSLF processed, again, as it should have long ago. Plus another small group whose federally contracted loan servicers scammed them.

Everyone slags the teenagers who signed a bad contract, bit who’s looking at the ones who jacked up tuition through the roof then slid the bad contracts under their noses? By $ amount of loans owed, these teens are now in the 35-49 age range, and they still can’t repay. Saying its a personal responsibility issue and not a systemic failure of the colleges, employers who demanded advanced degrees for entry level positions and poor paying professions, and a government who failed oversight and borrowers for decades is disingenuous and political divisiveness. But blame the teenagers.

I’m fine with repayment of my origibal balance owed plus interest, not the 150% increase of initial balance due to tacked on ‘administrative fees’. It should have fallen on the colleges and servicers to pony up, not the taxpayers.

Of course, taxpayers should only bail out the PPP beneficiaries and of course the poor folks in the banks, auto and airline industries, bless their destitute hearts. (/s)

I agree 100%, Lili. There are zero consequences on both sides and that is contributing to the moral decay of this country. Protecting yourself from scam after scam after scam is tiresome.

The demand for degrees for poor paying positions is a result of well intentioned laws that prevent employers from asking certain questions or administering certain tests because they, allegedly, were discriminatory. Now you have complex systems breaking down because people hired to keep those systems operating are incompetent.

I worked for a large corporation and made hiring decisions frequently. To me, the degree was nothing more than an indicator as to whether or not that applicant could actually finish anything. It was not an indicator of their being the best and brightest. A 4.0 in PE had little value for the positions I needed to fill unless an aptitude in math and well developed logical thinking was included in the package. I wasn’t hiring seeds for the division softball team.

The meat of an email sent to Federal student loan borrowers today from the Secretary of Education Miguel Cardona:

“…First, we are taking action aimed at opening an alternative path to debt relief for working and middle-class borrowers. We started the process to provide relief to as many people as we can, as fast as we can, through rulemaking. Under the law, this path will take time, but we are determined to keep fighting for borrowers and we will keep you updated in the months ahead.

Second, the Administration is releasing the details of the most affordable repayment plan ever created, called the Saving on a Valuable Education (SAVE) Plan. Later this summer, borrowers will start saving money under the new plan, which will cut monthly payments to $0 for millions of borrowers making $32,800 or less ($67,500 for a family of four) and save all other borrowers at least $1,000 per year. Additionally, it will stop runaway interest that leaves borrowers owing more than their initial loan.

Third, to help borrowers back into repayment, we are creating a temporary “on-ramp” to repayment for one year for those struggling to make payments. For borrowers who still cannot make their payments, we are creating a temporary “on-ramp” period that will help borrowers avoid the harshest consequences of missed, partial, or late payments. During that time, missed, partial, or late payments will not lead to negative credit reporting, default, or loans being sent to collection agencies. Borrowers who can make payments should do so, as payments will be due and interest will accrue during this transition period. Additionally, missed payments will not count toward loan forgiveness under any of the income-driven repayment plans or Public Service Loan Forgiveness…”

After all the traps we walked in on, if Millenials still buy into this tripe and vote this in again, they deserve their expensive degree from Bovine University. Yeah I said it.

“I’ll have those students voting Democrat for the next 200 years.”

If three years hasn’t been a long enough “on ramp” period, while employees were getting wage increases hand over fist for the last three years with record low unemployment, I don’t know what will be sufficient. Remember, all those loans taken are in nominal dollars at the time the loan was signed, so the massive inflation adjustment to wages over the last three years makes those payments much cheaper.

The logic of “making those payments cheaper” is great… until you realize that everything else went up and they’re either marching in place or going backwards.

How many degree-holders make less than $32.8K? I’d think the point of a degree is to earn more than that.

The entire point of a college or university degree is to LEARN HOW TO THINK and comprehend the world better and not for some sort of compensation for doing so.

There was only one criteria I had for my kids if I was going to pay for their education and that was: The major had to be in something that you could leverage to earn a living. If they wanted to minor in something that had no commercial value, fine. But their major mattered.

Reminds me of a friend of my son. She went to Texas A&M and continued on there to earn her Master’s Degree in bugs. Spent over $100K she didn’t have (but she did buy a nice pickup with the loan). Now she’s up to her eyebrows in debt and teaching elementary school in some low income area so the State of Texas gives her an additional stipend. Don’t think she makes $30K…. and the pickup died about 10 years ago from a lack of maintenance.

More than they should, that’s one of the main problems. For example, in the past two decades teachers in many districts have been forced to take on Masters Degrees (not eligible for Financial Aid — only student loans and whatever grants you can manage). Teachers aren’t exactly swimming in salary.

Positions like public defenders & social workers also require expensive degrees. And the PSLF lie failed them all big time.

The student loan finance business has been horribly executed and continues to be so. Imo quasi-blanket semi-forgiveness at taxpayer expense was intentionally designed to incite anger and division to avoid any true needed overhaul.

Lily, is a master’s degree a requirement for teachers in most states? I know it is in New York, but teachers in the NYC suburbs are paid very well, especially when you consider that they get Cadillac health plans and can retire with a full pension after 30 years.

Einhal quick googling can answer all your questions. Average Westchester teaching salary per Google is $45k-120k, broad range, in Westchester, average is $76k.

Lets say you commute in to work because $76k in Westchester gets you some rich slob’s 90″ TV box to sleep in. Average house in Dutchess County is $489k. Rent is about $2500 unless you want to live in the spiciest parts of Poughkeepsie. Now factor in car/commute, student loans, and groceries and tell me how $76k is going to be a salary you can live on, save for retirement, etc.

Not sure about your High School but in mine, the students had nicer cars than the teachers.

I think you’re looking at old data. AS an example, I Just googled it, and New Rochelle (hardly the richest place in Westchester) is an average teacher salary of $109k.

Your Googling one town that falls into the average range of the entire county does not old data make. Not sure last time you were in New Rochelle, but it ain’t remotely cheap.

$90k salary of a family of 3 could qualify you for the lottery in one of the lower-income apartments in the new high rise that went up a few years back. Forget the name but have the application somewhere. Backed out when they wouldn’t accept dogs.

For jollies, Salary.com:

New Rochelle School District (9,990 students)

How much does a Public School Teacher make in New Rochelle, NY? The average Public School Teacher salary in New Rochelle, NY is $64,743 as of June 26, 2023, but the range typically falls between $54,066 and $78,959.

Ossining School District (4,800 students)

How much does an Entry Level Teacher make in Ossining, NY? The average Entry Level Teacher salary in Ossining, NY is $49,353 as of June 26, 2023, but the salary range typically falls between $41,213 and $60,188.

Yonkers School District (25,488 students)

How much does a Public School Teacher make in Yonkers, NY? The average Public School Teacher salary in Yonkers, NY is $65,452 as of June 26, 2023, but the range typically falls between $54,657 and $79,823.

Chappaqua (3,563 students) kinda surprised me:

How much does a Public School Teacher make in Chappaqua, NY? The average Public School Teacher salary in Chappaqua, NY is $65,269 as of June 26, 2023, but the range typically falls between $54,504 and $79,599.

That isn’t Masters Degree salary, that’s ‘here’s my WCC degree now deal with it’ money.

I think the age differential is going to come into play here as well. 50’s and 60’s exited the workforce en masse earlier than usual during covid – and the ones that stay around are increasingly discriminated against for high earnings positions. The CFO of Zillow is late 30’s. That’d be unheard of even 5-10 years ago. Countless other examples.

So you have many late 30’s and early 40’s making incredibly high salaries right now (and since they think they have many more years of high earnings…spending a ton of it – and spending it differently than a demographic 20 years older would).

When you take a gross measure like consumer spending – I think there might be enough here to drown out the people out there who are struggling. Each trip to Mexico City with 5 star accommodations and dinners at 3 star Michelin restaurants offsets thousands of households living paycheck to paycheck and trying to cut back.

Thanks again Wolf! You make the macro much simpler.

It looking like a softish landing to me… I am surprised to be saying that. I was short all last year. With Q1 GDP decently positive, employment strong, bank failures mostly corralled, and spending outpacing inflation I can conclude nothing else.

I am buying back in. Nothing fancy, just safe dividend paying commodity plays that should benefit from long term 2.5 – 4% inflation.

Wolf,

What is your thought on Oil/Energy and Base Effects?

Won’t CPU-U potentially spike higher towards Christmas?

Barring recession/further oil drop or energy shocks.

Yes, the CPI base effect will swing the other way starting in July. In October, the CPI insurance adjustment will end and possibly swing the other way. Energy may not drop a lot more.

Jerome Powell knows this, which is why it was a chicken sh!t move to pause. He’s stalling. I think the administration is involved, telling him they don’t want him to slow the economy down. They want the inflation. They are evil.

The FOMC of the Federal Reserve is very wise and deliberate and makes all policy decisions including interests rate by consensus of the 12 member FOMC.

Every thing they do just sinks the ship faster

SoCalBeachDude, yes, although the impression I get from all of the “unanimous” decisions is that there is a lot of groupthink going on.

Noninterest bearing banks deposits are down $700B from $5.5T to $4.8T,

or $700B/$2.5T = 28% of the 2020/2022 tsunami size. Lending is shrinking, but banks charges tripled.

The large regional banks swallowed guppies assets. During the next recession the regional whales might grow and compete with the primary banks.

Money market funds and Treasury bills, where yields are higher than at banks, find lots of buyers. Banks need to pay more to retain their deposits, if they need the deposits (lots of banks are awash in deposits and don’t need them, but others do).

Wolf,