Even Wage Growth for Nonsupervisory Workers Accelerated. Powell is scratching his head, after all the rate hikes.

By Wolf Richter for WOLF STREET.

What we see in today’s jobs report: Some blowout numbers – job creation blew past expectations – and some other unexpected signs of heat, such as accelerating pay increases for nonsupervisory workers; along with signs of a little heat dissipating, such as the number of unemployed that ticked up but remained at historically low levels, and the unemployment rate that rose but remained at historically low levels.

For over a year now, we’ve been waiting for the labor market to show real signs of slowing down in a significant way, not just monthly ups and downs. We’ve been waiting for the landing, and the labor market has refused to land to this day, and employers keep hiring at a surprisingly strong clip, though the Fed has jacked up interest rates to over 5%. It seems businesses and consumers have gotten used to those rates. Wages, other costs, and prices have been rising at a hot pace, now centered around 5%, with inflation having shifted from fuel and food to services. And consumers are spending their wage increases, and they’re still outspending inflation – the “drunken sailors” just won’t slow down.

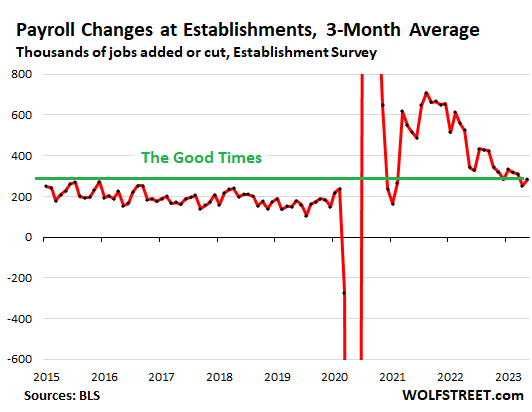

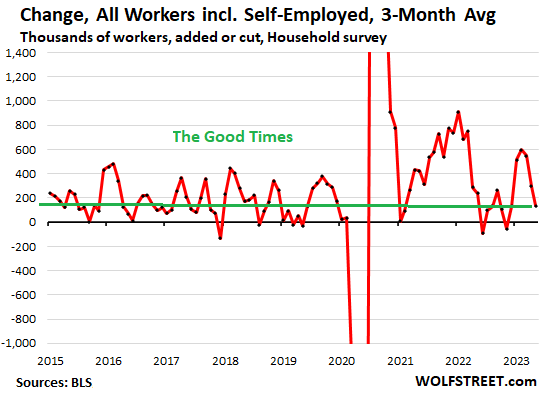

In May, 339,000 jobs were created by employers. Over the past three months, 850,000 jobs were created, pushing the number of payroll-type jobs to a record 156.1 million, based on surveys of establishments by the Bureau of Labor Statistics today. The three-month average, which irons out the month-to-month variability, is above the range during the hot labor market of the Good Times before the pandemic:

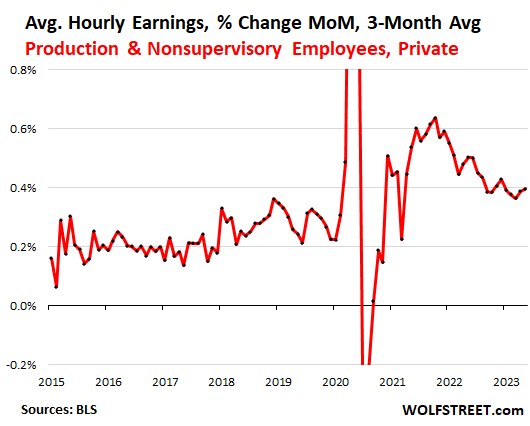

Average hourly earnings of production and non-supervisory employees rose by 0.45% in May from April, the fastest growth rate since November. Annualized, it comes in at 5.5%. The three-month average rose by 0.40%, also the fastest since November.

These workers are engineers, teachers, bartenders, technicians, drivers, retail workers, wait staff, office workers, construction workers, nurses, etc. in non-supervisory roles. They make up the bulk of total employment.

The month-to-month re-acceleration in nonsupervisory wage growth might be an indication that wage growth is now stabilizing somewhere around 5% year-over-year in that category, rather than cooling off further.

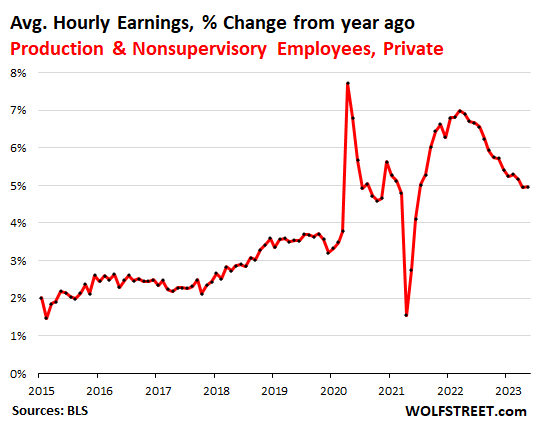

Year-over-year, wage growth remained at 5.0% for the second month in a row, for now ending the downward trajectory:

Average hourly earnings of all employees rose by 0.33% in May, the second largest increase all year, behind only April’s increase. This includes supervisory roles.

The three-month average rose by 0.33%, the highest since January. Year-over-year, earnings increased by 4.3%, roughly in line with the past three months.

The higher wage growth in the nonsupervisory roles than in total employment indicates that there are bigger wage pressures and a tighter labor market below the management levels, which has been the case for months. Part of this difference in wage growth may also be due to higher minimum wages in many states and municipalities.

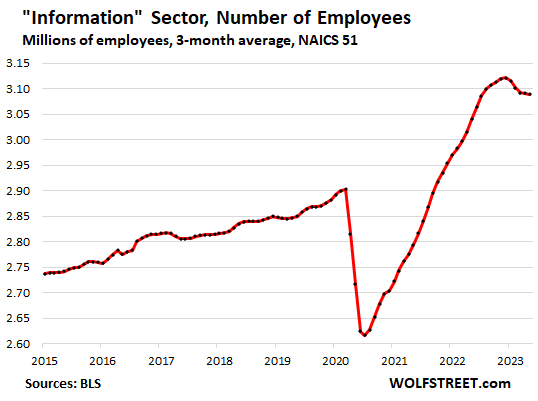

In the small Information sector (which covers some tech and social media companies, while others are in different sectors), the number of jobs peaked late last year, then tapered off earlier this year and has now flattened out just under 3.1 million jobs. This comes after a huge hiring boom of the past two years. Now companies are rebalancing their work force to trim off the excess in some corners and hire in others.

So here, in this small information sector, the heat has started to fade:

Total jobs, from payroll-type jobs to gig work, fell by 310,000 in May, after a huge jump in March and a smaller increase in April, according to the Household Survey by the BLS that tracks all types of work.

The data is very volatile from month to month, with some huge spikes, for example in January (+894,000) and March (+577,000) and some big drops, for example in May this year and in October and June last year.

For the three months combined, the number of jobs rose by 406,000, for a three-month average of 135,000. It shows a slowdown in growth from earlier this year, but it’s far higher than a couple of periods last year with negative readings.

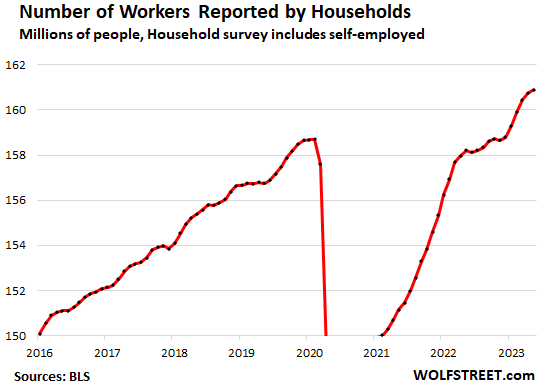

The total number of workers, from employees at companies to the self-employed, exceeded 160 million for the first time in January 2023. This is the three-month average of total employment, which irons out some of the ups and downs

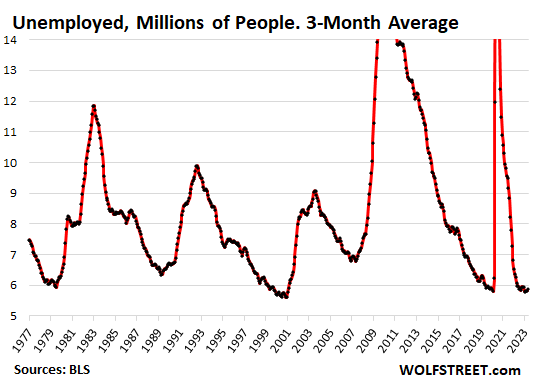

The number of unemployed people who are actively looking for a job rose in May from the 22-year low in April, to 6.1 million unemployed, according to the Household Survey.

The chart shows the three-month average, which irons out some of the monthly ups and downs to reveal the trends, which are still wobbling along historic lows:

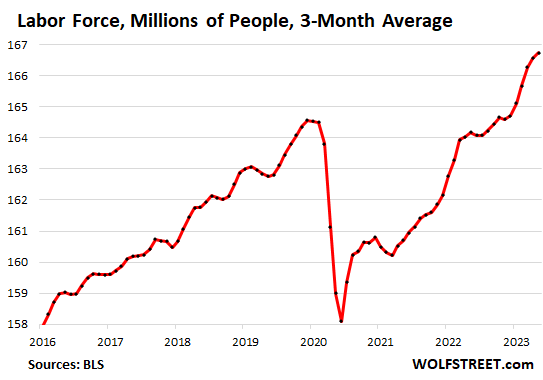

The labor force continues to grow. In May 130,000 people joined the labor force, which rose to 166.8 million people who are either working or actively looking for work.

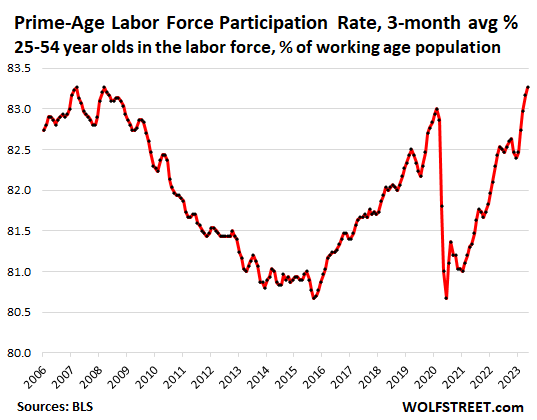

The prime-age labor participation rate – people aged 24 through 54 either working or actively looking for work – rose to 83.4% in May, the highest since 2006. The three-month average rose to 83.3%.

This means that people in their prime working age are now participating in the labor market at a rate not seen in 15 years. The prime-age data passes by the issue of the bulging ranks of retirees.

The unemployment rate rose to 3.7%, as tracked by the narrowest unemployment measure, from 3.4% in April, which had been a historic low. The rate rose due to the mix of a larger labor force and more unemployed. The rate has vacillated up and down in the range between 3.4% and 3.8% since February 2022.

The employment-to-population ratio ticked down to 60.3%, from 60.4% in March and April. All three are the highest since before the pandemic. It too points at the bulge of people who retired recently.

Other labor market data also confirm that that the labor market isn’t landing, though some aspects may be cruising at a somewhat lower altitude, and there are the occasional bumps:

- The private-sector ADP National Employment Report yesterday: 278,000 jobs created in May, wages up 6.5%.

- The Job Openings and Labor Turnover Survey (JOLTS) by the BLS: Job openings rose and remain sky high, discharges and layoffs dipped and remain very low)

- Initial claims for unemployment insurance: Dipped recently and remain in the historically low 230,000-range (350,000 might be the beginnings of recessionary levels).

- Continued claims for unemployment insurance: Dipped recently to below 1.8 million after having edged up for a few months (recessionary levels might begin at around 2.7 million).

Here is Fed Chair Jerome Powell reacting to the jobs report after all the rate hikes (cartoon by Marco Ricolli for WOLF STREET):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Where is Powell? How can a “pause” even be on the table? Real life inflation is raging higher than the CPI, housing is incredibly resilient, price sure are down a tick in high crime/high cost areas, unemployment and jobs are strong…where is this “pain”? LOL. Powell is Mr. “Tuff and Bluff” vs inflation. He refuses to get rates meaningfully higher well above inflation in a true effort to defeat it. Everyone knows the FED went soft last Fall, and ever since stocks, housing, unemployment, on and on have roared back. Oh I forgot Powell is the new Volcker. LOL. OK sure.

Agreed, the very idea of a “pause” was ridiculous before but with the recent data it’s beyond foolish to even consider it. If anything, the Fed should be moving towards not only another 25 bp rate hike for June but up it to 0.5% for June 2023, and make it clear that more hikes are coming and (just as important) speed up the pace of QT, finally shedding some of those MBS’s it should have never picked up in the first place. It isn’t just the jobs report, it’s also the spending and the pickup of very sticky inflation, showing the Fed’s actions so far have been totally inadequate.

It isn’t even surprising when you think about it (or read Wolf’s articles), the pandemic stimulus from 2020 continuing into this year is the biggest level of government spending and stimulus in American history by far, in both fiscal policy and monetary policy. (things like the student loan repayment pause and SNAP benefits a huge stimulus too) Put it all together, and it was well over $10 trillion in fiscal stimulus (part of why the US is headed for $35 trillion in national debt soon), on top of the massive monetary stimulus of unneeded QE on top of ZIRP, a huge portion of every US dollar in circulation printed in just the past 3 years.

There’s just way, way too much excess liquidity in circulation still, and it’s why it’s not just a meme that Paul Volcker’s Fed really is the best model for Jerome Powell’s now. And it’s not just about reducing inflation to the mythical 2 percent (always something of a made up number), Americans need prices to drop in several key areas like rent, housing, food, healthcare, child care and education–wages will never keep up with these price increases. If any of us in our “real jobs” did those jobs as incompetently as the Fed so far has managed US inflation, we’d be fired in less than a week.

This inflation is absolutely crushing Americans and it’s only getting worse, we had a couple cross-state business trips over past 3 weeks and never, in decades, have we seen so much homelessness across the US, and it’s everywhere–wealthy high tech cities to suburbs to rural towns. People just can’t afford the rent inflation anymore and rising insurance and property tax are eating homeowners alive. Then also major store chains and small shops changing policies due to record shoplifting and looting–not even criminal gangs, it’s just people desperate to get food and basics with prices soaring. And then the writers strike basically choking off American TV and Hollywood and several other strikes looming–this is what happens when Americans are squeezed by higher prices everywhere they look.

And actually that’s just the domestic effects, even Bloomberg and Forbes are now having to report that countries across the world are dumping the USD for transactions and reserves in any way they can practically manage, esp in Asia (even the Philippines)–demanding payment in their own currencies, doing swaps, stocking up on gold and silver, using currency baskets, accumulating commodities or even bartering. It’s not even about a single other currency as a factor, it’s the death by 1,000 cuts when countries lose confidence in a country’s money–who wants to use or store up US dollars when they’re devaluing daily and clearly lost the basic reserve currency role of actually being a storehouse of value?

And even worse, when the Fed up to now has still seemed too timid to take the necessary action to halt inflation and preserve that value? Why should other countries and asset holders have any faith in the United States dollar when Powell and the Fed clearly show so little faith in it themselves with their half-hearted inflation-fighting so far? It’s another reason Powell needs to show the world he means business about protecting the dollar, right now, otherwise the rest of the world (and also plenty of Americans) will see less and less reason to hold them.

Then in addition, the CDC just reported that the US birth rate has dropped to the lowest levels ever for the USA and are headed even more downwards, ever faster. Been hearing from our adult cousins, nieces and nephews (most with very good jobs well into 6 figures salaries) and the common sentiment is that prices are soaring way too much to even consider kids. The cost of healthcare and baby delivery, education, diapers, food are crazy enough, then add soaring child care on top of that? This is why economic historians talk about how inflation destroys nations more effectively than any war ever could. And we Americans in the current era get to witness that decline and fall first-hand, unless Powell and the Fed actually do their jobs and take tougher action to get this inflation under control.

The link between inflation and unemployment is broken. IF there ever was a link.

2%-3% inflation may be gone for good. People and the economy will adjust.

You’re missing the biggest maybe somewhat not fully evident motive behind it, totally deranged off the rails US foreign policy.

No foreign government in its right mind should trust the USG with any of its foreign reserves after what the USG has done by freezing Russia’s FX reserves and before that Venezuela’s gold.

Yes, I know the political reason for it.

It’s irrelevant to anyone but ignorant or biased Americans.

Weaponizing the currency will do more than anything else to reduce or displace the USD as global reserve currency. Countries are stuck with the reserves they have now (someone has to hold it at all times since the US has nothing to sell worth buying of equivalent value) but not true of the future.

The link between inflation and employment seems to exist. The Fed white papers attempt to deny the correlation, while university white papers state it exists.

Seems like a simple concept:

Private jobs loss = private debt issues = deflation

Govt debt issues = printer go brrr = inflation

So in many ways, the push/pull of inflation/deflation is a battle between private and public debt.

Thus the Fed needs to increase the unemployment rate in order to increase private debt issues and create future deflation.

Yet Fed has enabled the govt to print another few trillion and hand it out to the citizens, which stops the natural deflation cycle and places the economy back in inflation cycle mode.

Such Fed monetary perversion has created a perpetual govt fiscal circle jerk for the ages in attempt to buy votes, and thus inflation will boom/bust/reflate in sequence with the debt cycles accordingly, with the Fed and govt as prime suspects in the murder of the average citizens standard of living.

And only the Davos Elites are cheering for the upcoming Great Debt Reset , the other 99.9% not so much.

Yet the USD remains as strong as ever kicking sand in the faces of alternative currencies and precious metals. It’s the Charles Atlas (Arnold Schwarzenegger?) of currencies. It’s going to be a long time before the beach bully gets his comeuppance!

No. The US Dollar has never been stronger nor more important than it is today in the global economy and it will continue to get increasingly strong and is used in more than 80% of all global transactions.

Well, they could start by going after the huge corporations who are price gouging consumers. So many of them used supply chain issues and the bird flu to justify jacking up prices. The supply chain issues are back to normal, and the bird flu has long since passed, yet prices have not gone down as quickly as they should have. In fact, the San Francisco FED had indicated that labor cost has had only a negligible effect on inflation and that the bulk of it is due to corporations raising prices to expand their profit margins.

“Yet the USD remains as strong as ever kicking sand in the faces of alternative currencies and precious metals.”

This is the kind of myopic thought process which the FED and .gov love the sheeple to adopt. Nevermind the fact that its purchasing power has been greatly diminished by money-printing, leading to a rapidly declining standard of living. Hey, as long as it is performing well against electronic tulips, who cares if a loaf of bread is $20 in a few years?

>If anything, the Fed should be moving towards not only another 25 bp rate hike for June but up it to 0.5% for June 2023

After this jobs report, I think that not only raising by .50% percent makes sense (or even .75% or 1.00% to get everyone’s attention), but that it should be done after an emergency FOMC meeting over the weekend instead of waiting for the scheduled meeting on the 13th/14th. Shaking things up requires being a bit unpredictable.

You’re not wrong, but don’t you (and other people) get tired of talking about how the Fed should call an emergency meeting and do a REAL rate hike this time and sell all their MBS because that would REALLY get the market’s attention, etc., etc., when you know that there is exactly zero chance of any those these things happening?

REAL PROBLEM

uncontrollable SPENDING

by CONgress and MILITARY

Powell takes orders from his masters not from the data or for the common people

If you look at the bigger picture

Dollar has been losing it purchasing power for last fee decades and wages are in general not able to keep up with it

It go worse after covid

Powell is not going to raise rates forget about 50bps.

We all know for whom he works for

I even saw squatters and homeless in the Wells Fargo Lobby the other day. I asked the bank manager if it was a new policy to allow this. Wells Fargo has gone “Woke” so I didn’t know. I didn’t get an answer. AT the ATM machines you get a big “Woke” lecture every time you need a few bucks to buy groceries. Then I decided this was the last straw with them. After they closed another branch which was very convenient I decided to cut them off for good and closed my large account with them. They are as bad as Citigroup, BOA and JPM if not worse.

Get real woke Swampy and open a Credit Union account!

This wet lettuce ditherer Powell is not fit for his post.

Question: Who in their right mind would step up to a job like this? Would you? I didn’t think so. You really don’t have any place to criticize these public servants unless you’re willing to step up and do the work.

Lol

@MikeR…..you forgot your sarc tag.

The FRB absolutely has the ability and authority to crash the economy and crush financial markets, therefore creating deflation. Powell loathes QE and government profligacy. He now has the opportunity to exit as a Volcker. We have to crush the economy in order to save it.

hahaha he said “public servants”. The Fed is a private bank.

Common misconception here. The Fed is a hybrid organization.

The Federal Reserve Board of Governors is a government agency, and all its employees are federal government employees with a government salary and a government pension, including the seven members of the Board, including Powell and Brainard. These seven members of the Board of Governors are appointed by the President and confirmed by the Senate. The Board of Governors has lots of employees, and they’re all employees of the Federal Government. They’re working in the Eccles Federal Reserve Board Building, the main office of the Board of Governors of the Federal Reserve System. This is a federally owned building on 20th St. and Constitution Avenue in Washington, DC.

The 12 regional Federal Reserve Banks are private organizations that are owned by the largest financial institutions in their districts. They include the New York Fed, the San Francisco Fed, the Dallas Fed, etc. All their employees are private-sector employees.

The FOMC – the policy-setting committee – consists of the 7 members of the Board of Governors who are federal employees and have permanent votes on the FOMC. The New York Fed governor also has a permanent vote. The other 11 regional FRBs rotate into and out of 5 voting slots annually.

The FOMC is designed to give the 7 government employees a voting majority over the 6 presidents of the regional FRBs

In this sick world someone with over $30M Net is NOT a sissy. A 300 lb pro football lineman with only $1M Net is the sissy. And most people like him are in jail if they are also ambitious enough.

But if they don’t hold this system fraction of a fraction of a fraction banking system together to EVERYONE’s satisfaction….things will change…..and FAST.

bidding wars for houses where I live

Whatever lol!

That’s because the housing bust got cancelled. I don’t believe it will happen anymore as long as Powell is in office.

I don’t think the housing crash has been reversed. This article is about the labor market. The housing market is going downhill. They are not stocks and crypto this one and the way down is slower and longer. There’s nothing abnormal about that.

Awesome

A new phrase TUFF and BLUFf wolf add it to repoiter

As is true with most things financial, we’re on a pendulum. The pandemic swung us up in one direction as the economy stalled, businesses closed, earnings got nailed, and people put off spending while at the same time got government money. Now we’ve swung far the other way. People are spending those savings, businesses are hot and hiring. But those savings are diminishing, personal debt is up, inflation is biting into savings and the Fed tightened. I’m hoping they pause, people go back to spending their diminished savings more like the pre pandemic and the pendulum hangs around the middle. I guess that’s a soft landing.

Nick “Nickileaks” Timiraos is already tweeting that the Fed will likely pause or “skip” a rate hike at this next meeting, Powell’s headscratching notwithstanding.

There has been quite a bit of talk about “skipping” a hike in June and then hiking again in July, including right here on Wolf Street, in an article on May 20, based on what the bond market was contemplating: “Six-Month Treasury Yield Begins to Price in One More Rate Hike. Either mid-June or possibly in July.”

Wolf, what are your thoughts on the “lag effect” where the theory is that rate increases take 12-18 months to be reflected in the economy. Based on that theory we are only feeling the impact of the first few rate hikes from 2022. Thanks!

“economy” is not what the lag effect says. It says there’s a lag of 12-18 months between changes of monetary policy and changes in INFLATION.

Inflation is the last item to react, if it even reacts.

Some aspects of the economy react nearly instantly to higher interest rates, and others such as mortgage rates and housing anticipate the rate hikes and they started reacting even before the rate hikes came.

Here we’re talking about the labor market. If higher rates (but still around the rate of inflation) don’t throttle the economy, there may not be much of a hit to labor. You’ve got to remember that interest rates are NOT high compared to inflation. This is still a slightly stimulative environment.

Thanks Wolf, I always thought about the lag effect incorrectly.

“You’ve got to remember that interest rates are NOT high compared to inflation. This is still a slightly stimulative environment.”

And the FED knows this, yet a pause is on the table. That’s why they have ZERO credibility. Jerome Powell even bringing up Volcker’s name was a disgusting act. He is no Volcker. He is worse than Arthur Burns.

today’s stock rally confirms the insider “pause” whisper

Stonk market is a casino. There is no reason for anything the stonk market does period. If anything, it’s due to the debt ceiling dog and pony show being over. Stonks can’t make it without uncle sugar. Can’t wait for some catalyst to crash it for good.

Exactly the opposite. Friday’s job report and Dow price increases practically GUARANTEE that the Federal Reserve will raise their Federal Funds Rate by least 0.25% in June because the markets are totally ignoring the policy guidance set by the Federal Reserve.

Where is the painful massive QT and MBS sales?…wait for it….insert crickets chirping noise here.

Actual sales are not going to happen. For one the Fed would loose a ton of money, which Wolf says isn’t a big deal since they Fed will just carry the losses until they start to remit gains back to the Treasury. I for one think it would be a bigger deal that he’d admit. On the MBS side, I think the Fed would be concerned that it would push up 30YFRM even more. Personally, I’d love to see the Fed sell MBS, but it’s extremely unlikely that this will happen. I think JPowell is fine with this $17-20B a month runoff. And, they’re certainly not going to do any sales in the next 6-8 weeks as the Treasury sells $700B in treasuries to finance our what will be $32T+ in national debt.

BENW:

“On the MBS side, I think the Fed would be concerned that it would push up 30YFRM even more.”

MBS need to be re-priced. A little “price discovery” wouldn’t hurt.

Besides, Powell supposedly wants to cool shelter costs. Didn’t Canada or Europe sell MBS???

Honestly it might keep the Fed Funds Rate LOWER if they sold some MBS to spike mortgage costs to 7-7.5%. (less hikes needed)

The curve needs to normalize

More Qt and some long maturity sales might be warranted

When the government spends at the level it’s spending…….fed policies will affect a historic small piece of the economy. The rest keeps rolling along.

Heck, Intel is spending 20 billion in Columbus Oh just to build its portion of the chip recovery. Battery plants are going in everywhere. War production is rolling.

If the fed seriously wanted to slow the inflation it needs to start selling bonds by the bushel……but they will not.

This country is at war all over the world and at home with its own people. Look at the homeless and nearly so everywhere you go, the drug addicted and those just scraping by. A sick economy and a sick culture.

Flinstone is right. Powell is not even surprised, let alone scratching anything. Congress is borrowing/spending $1.5 trillion a year. Fed chairs have been warning about this since Greenspan in the late 80s. It would take at least that much QT just to be on an even keel. This is still a very accomodating fed and treasury.

Large international corps can still borrow at nearly zero percent in japan. Without digging into annual reports, I think we can safely assume intel’s massive investments are still at very low rates. They borrow from around the world, where every they can get the best deal. For now, a lot of the spending is in the US since congress is giving out incentives (what else is new).

The current tightening cycle has been puzzling. I thought market cannot handle even 3% fed funds rate. But here we are at 5% and with QT.

I guess the fiscal stimulus during pandemic was the wild card, and that stimulus is still being digested by economy. Once in 100 year pandemic and modern economic response seem to through all existing patterns out of window.

through=throw

Not only is it still being digested, IT’S STILL HAPPENING. 45 million Americans with an average monthly student loan payment of $400 that still hasn’t been turned back on. It’s hard to expect the economy to dramatically respond to higher (but still negative on a real basis) rates and QT when fiscally stimulus of this magnitude has been going on for 3+ years and still hasn’t stopped.

I view it as a bailout for all the non-performing degrees that colleges handed out to unsuspecting kids.

When I was a student at the U of MN Twin Cities studying aerospace engineering in the 2000s, I found out in one of my internships that my education was almost useless. I was sizing a hydraulic piston for a moving metal frame at a machine design company. I thought I’d use my knowledge of statics to figure out the amount of force on the piston at peak extension, and size it accordingly.

The owner of the company caught me doing work by hand, and personally grilled me for doing it by hand when the company paid big money for software that can do it way faster. He was a cool guy, and he talked to me about the disconnect between industry and academia and how it takes him 2 years to train a productive engineer.

By 2010 I’d given up on climbing the engineering ladder and got into the trades. I worked hard, started a construction company, bought a house, got married and I’m relatively happy. I mistakenly trusted the system to get me to where I wanted. Maybe I wasn’t smart enough to be a rocket scientist, and I realize I’m just one person but I think college is a somewhere in between a gamble and a scam for most people. Colleges and universities shouldn’t just be allowed to pump out however many degrees the professors feel like conferring. There should be a stronger feedback loop between industry and academia.

>but I think college is a somewhere in between a gamble and a scam for most people.

The notion of college as being an almost required extension of high-school causes a lot of problems, not the least of which is people not really knowing “the real world” and what they want to do while they are there. I’d favor a law that says before you can take out federally-backed college loans, you had to have worked in the field of your declared major for at least two years. (And yes, these might even be pre-intern level jobs.) That way, we’d have students with at least a partial clue of what the field entails to see if they really want to go into it or not. (And, not unimportantly, whether that field will pay off the loans.)

Bryon Caplan in the book “The case against education” argues that most degrees are a net loss in terms of the money and effort required to obtain them; even STEM and business degrees provide a modest return, contrary to the hype. The remunerative return to most non-STEM/business degrees is so low because there are so few actual paying jobs specific to most liberal arts majors.

The main return to degrees is their signaling function of intelligence, conformity and ambition for which employers still pay a premium. But separating out the ability bias of those who would do well in college but choose not to attend is tricky. And the historical salary data used to claim college graduates earn so much more is beyond stale. That salary premium has shrunk drastically the last couple decades. Even more so for degrees beyond a bachelors.

Even the BLS admits employers request college degrees twice as often as justified by work requirements. According to IEEE, even in STEM, half of graduates enter other fields due to better pay and working conditions, and after ten years half of remaining STEM workers drop out. A stunning attrition rate.

The US has two to three times the number of grads needed for the real economy. And continue to graduate at least twice as many grads as needed for the actual labor market Higher ed is an enormous bubble that needs to get popped.

When I read about grads owing tens of thousands for degrees with low economic value, I wonder why weren’t the parents or some other supposedly responsible adult warning against debt peonage. Because the kids are clearly not getting the unbiased advice needed for wise decisions. The push to send all kids to college is totally bonkers.

This a good topic for more Wolfian analysis for sure.

With two offspring who went the two main different routes, one with Engineering BS, then MS math teaching, the other carpenter to general contractor, both seem happy with their choice.

GC makes ton more money per ”net hours”, works as much as he chooses, the other teaches HS and MS math and loves the work, especially the satisfaction of getting kids ”turned on” to math.

”De gustibus non disputandum est” comes to mind, eh

My favorite pro-college argument is Healthcare. Certainly, a doctor would need college, and maybe throw in nutrition courses which are suspiciously absent from their current degree requirements. But the nursing profession successfully churned out highly competent nurses for decades through highly affordable, job-securing hospital diploma programs. Nurses educated and trained directly in the clinical setting from Day 1. $omehow it changed to the college classroom setting as being the superior option, and then came a push to mandate BSN.

I’ve seen a BSN student make the bed the wrong way, not particularly impressed by the Magnet status push. When I decided to go back for a BSN for a quick advanced degree, was thoroughly disgusted at the cirriculum, very little to do with actual nursing science (patho, advanced assessment – neither requires paying a college to learn) and instead a slew of unnecessary liberal arts credit requirements and continued indoctrination of the toxic blind empathy self-exsanguination culture of the profession. Further indebting HCPs unnecessarily and not benefitting patients in the slightest.

Financially breaking and professionally burning out HCPs is doing not a lick of good for patient care, yet most patients if asked would say they want a BSN to do their care over a hospital trained diploma RN, or an ADN who spent significantly more time educated in the hands-on clinical setting. College-educated nursing is a prime example of misleading the public. Unless you want to go on into Administration, the BSN is not necessary other than it looks good on paper.

Shouldn’t be a surprise. Historically, NORMAL interest rates correlate with prosperity. Investment is starting to move back toward productive channels.

It’s like paint drying! So slow going even if the hikes were historically fast. It looks like a 10 trillion lb. Black Swan is the only thing going to de-rail this economy! 911 had the markets closed for two weeks and that didn’t bring it down. We will just get a larger government spending more and more with just inflation as a by product, Amazing to me.

Markets were closed for 4 days, not two weeks, starting 9/11 to 9/14.

low mtg applications = low level of home construction = lots less employment in that ‘heavy employment’ area.

Student loans re-start of payback requirements will take serious cash from the economy.

Wealth destruction from CRE will, gradually filter through economy.

I’d pause for a few months….allow time for the above to take affect, and the effect, and the multiplier….which is powerful.

Our error is expecting, because of the speed of the rate hikes, is to think the responses from the economy would also be sped up…..apparently not…it’s taking a more normal amount of time.

Speed of the hikes? They acted like attempting a first .25 increase would end the world, yet here we are and still flying high.

The 25bps hikes are equivalent to a pause. They are inconsequential.

Much of what has happened as a result of rate hikes and QT was also inconsequential – a couple of badly mismanaged banks going under.

No real pain (yet). Euphoria has returned. Might be another great selling opportunity.

“The 25bps hikes are equivalent to a pause. They are inconsequential.

Much of what has happened as a result of rate hikes and QT was also inconsequential – a couple of badly mismanaged banks going under.”

Well said, that’s exactly how to look at it. We’ve already had the “pause” so far from inadequate Fed action, which 0.25% rate hikes and tepid QT are. If anything we need a 50bps hike and above all, much stronger quantitative tightening.

Isn’t this the same delusion that happens before every recession while waiting for the hikes to take effect? Everyone thinks all is clear since they raised but most haven’t even hit yet.

WOLF: Great charts – great info !!

2 Questions:

1) What is the difference between

“Number of Workers Reported by Household” and

“Labor Force – Millions of People”?

2) How does the unemployment rate go up when 339K jobs get added to the economy? Does this basically mean more were added (during the time measured) than the number of workers who were added to the population during that same time period?

Your #1:

“number of workers = number of people who’re working.

“labor force” = number of people who’re working PLUS number of people who are not working but are actively looking for work.

Your # 2.

339K jobs created = payroll-type jobs (get paycheck), but it doesn’t include the self-employed, gig workers, etc. These jobs created are tracked by the Establishment Survey (how many people on net that they have added to their payrolls).

The Household Survey tracks all types of work, from people with payroll-type jobs to people with gig-work type jobs. This is the total number of working people. But it’s from the household’s point of view. The Household survey data is also used to track who is unemployed, who is actively looking for work, etc..

the unemployment rate = the number of unemployed as a percent of the labor force, all via Household Survey.

The Establishment Survey and Household Survey always differ. As I pointed out, the Household data is HUGELY volatile. So you cannot really hang your hat on a single month’s move. You have to look for longer-term trends, and you cannot compare it to the Establishment data which is a completely different survey and data set.

I don’t think Powell is scratching his head that much. While he has hiked interest rates, they’re only reaching the inflation rate, which would be a neutral rate. Meanwhile, on the fiscal side, we’re running deficits, which are stimulative. Of course, there is QT too but that may only offset the fiscal stimulus.

So, the net effect seems to be neutral at best. A part of me thinks that the public is being strung along, and that they’ve decided they need to inflate away some debt. That stringing along started with this “transitory” nonsense. I call it “nonsense” because I don’t believe for a second that the government decided to run a $2.7 trillion deficits in 2021 without a commitment from the Fed to monetize debt in order to keep interest rates under control. That left the Fed two choices, either explain that fighting inflation was subordinate to monetizing debt, or carry on about inflation being transitory.

The greater the govt debt and spending the better for stocks

Today’s rally confirms

Average Fed Funds Rate 1971 to 2022 is 4.86%, with much variation. Not much different from where we are now (5.00% to 5.25%).

Average Core CPI 1971 to 2022 is 3.90%. Notice there is about a 100 basis point difference between Fed Funds Rate and Core CPI.

Current Core CPI is around 5%. Fed Funds Rate should be around 6%, based on historical averages.

30-Year Fixed Rate Mortgage Average in the United States, Weekly, Not Seasonally Adjusted 1971 to 2022 is 7.76%, compared to around 7% today.

The economy has done pretty well from 1971 to 2022, so it is no surprise at the current rates that it is churning along. Fed Funds Rate must go much higher to slow the economy and presumably reduce inflation. Many think interest and mortgage rates are much too high, when in fact they are fairly normal or below normal. Compared to ZIRP, they are high, but ZIRP was a huge anomaly.

Note that I am using static (cross-sectional) data to get a sense of a dynamic process. This is always risky, and sometimes leads to wrong conclusions. If I have time I could do some time series analysis. I would hope the stat-boys at the Fed have already done this.

As an aside, I appreciate Wolf’s two decimal point precision where appropriate.

I notice that you ignore asset prices and debt levels which are the mirror of each other and the opposite of “normal”.

Increasing debt is a substantial reason for the US economic performance during this period. No different in much of the rest of the world.

It’s also taken increasing debt to generate any “growth”, where subsequent to the GFC most US “growth” is correlated to above trend federal government deficit spending compared to pre-2008. In other words, fake. It’s not like 2001-2008 deficits were that low either.

What is a “normal” asset price? . . . . . I couldn’t calculate it either.

The price that someone is normally willing to pay.

The price of *anything* in this world is “fake”, made up on the spot. What’s killing the world right now is that the central banks further decouple people from reality with every action, resulting in “pay whatever” pricing where the variance in pricing can go sky high without anyone caring.

The Fed Funds rate does not have to rise appreciably from here to slow the economy. It is already happening. One also has to consider where we’ve come from (incredibly low rates) to properly assess the impact of the current rates.

Lags are always a problem when dealing with time series. Employment, real wages, and real consumption have not slowed significantly. They might next month or two or three or four, then again, they might not.

America’s job growth is becoming increasingly confined to low pay industries like leisure and hospitality. The leisure industry accounted for 75% of the months total job gains from a report I read yesterday on the ADP data. The higher paying jobs in manufacturing, Finance, Information, and Professional Services, all lost jobs and these are the higher paying jobs.

“America’s job growth is becoming increasingly confined to low pay industries like leisure and hospitality…”

That’s just nonsense. You heard a tidbit about a month-to-month move. That’s why I give you charts that span years. So here are just two that you mentioned: “Construction” and “Professional and Businesses Services,” from the BLS data today:

The one sector where employment has dipped since mid last year is Information (see chart in the article). And in manufacturing, employment has flattened.

Follow up question Wolf. Saw elsewhere that according to the Fred there is a discrepancy in employment between native born and foreign born employment. Foreigners employment numbers spike higher while natives employment just reaching peak before COVID. (See links to charts below) Any idea why?

https://fred.stlouisfed.org/series/LNU02073413

https://fred.stlouisfed.org/series/LNU01073395

Since the Covid crash — per the charts you yourself linked. You could have just done a little math instead of spreading BS:

Foreign born added 4.96 million jobs (from 26.28 million to now 31.24 million)

Native born added 19.38 million jobs (from 111.36 million to 130.74 million)

BTW, I’m foreign born. So is my wife. We’re both working. So what?

The charts you show are in number of people. So sure, young foreigners came years ago into tech, construction, ag, and other sectors, and they’re coming in order to work, and they’re now working.

Native-born includes proportionately more retirees than foreign-born. That is always the case. So yeah, they worked hard for 40 years and now they’ve had it, and they’re retired. The big wave of “excess retirements” during Covid was therefore much more concentrated on native born populations simply due to the age difference.

What’s the big effing deal? Why even bring it up? What kind of point are you trying to make?

Without trying to put words in his mouth, I suspect he’s saying that it’s not so good for Americans (especially workers) if a new service job is created but immediately snapped up by a migrant who entered Texas six weeks ago. Foreign born really isn’t the right metric here.

Einhal, let me fix it for you. It’s good for Americans wherever they were born if a new service job is created that no American would ever do at any wage if a migrant who came to Texas six weeks ago takes the job and spends his wages in the American economy.

Escierto, you are either lying or ignorant. Which is it?

If you were informed, you’d know that availability of cheap labor drives down the wages of Americans and costs Americans far more in social spending and other transfers.

Cheap migrant labor is not a good thing for America and anyone who argues otherwise is a liar or stupid.

Einhal, if I was informed by who? I think the sources that you rely on have an axe to grind. So you keep on hating anyone who doesn’t look like you and fearing the future and tell me how that works out for you. The source of America’s vitality has always been newcomers and the day that we become like Japan will truly be the day that America is finished.

No offense meant, my wife and I are also both in the foreign born category. Was just curious why there might be the difference and appreciate your perspective

Google unemployment rate history and you will see that unemployment rate was making new lows til about 4 months before the Great Financial Crisis recession began. People were calling the recession in in 2006 and 2007, but it finally came and it was a doozy.

There is only one recession in my lifetime that came when unemployment was already higher, and that was the second dip of the Double-Dip recession. All other recessions came after unemployment was low, which makes sense, because a recession by definition is part of the business cycle and follows, again by definition, an expansion.

I see the similarities old school is on to something here.

According to our data everyone is working, everyone is hiring.

Unemployment factors are low. There is no unemployment per say.

As the great Jimmy said years ago “There ain’t no life nowhere”.

I don’t live today.

Hi there inflation….guess you’re staying for the long haul after all? With a potential rate skip…perhaps we need to build you an extra guesthouse out back….Job market this strong will only keep you come back over and over…really miss you since the 80s..

The Dow was up over 700 points today despite this news. I see chatter on other places I follow talking about “rate cuts”, “pivots”, “rate pause”. Seems Wall Street thinks they’re going to get back their free money punch bowl this year again. It’s lunacy.

The more the govt spills the higher the stocks go

The debt deal opened the spigots

You really think it will last. Lol Stonks will realize the Fed is not playing along. Kneejerk reaction, only thing the corrupt casino can hold onto. Can’t wait until it implodes for good.

“You really think it will last.”

The govt spilling money? Yes.

Thanks Mr. Wolf.

Higher for longer, excited for the new dot plot. Can hardly contain my excitement for history to repeat itself. Fever nights, fever nights, fever, we know how to do it….. 4 more trillion just added to the insanity too.

The landing was canceled last fall, and everybody knows it. The FED wimped out and dialed back the rate hikes. They want to entrench inflation to devalue debt. EVERYBODY KNOWS. They are destroying the working class and the poor for the benefit of the rich and well connected.

What’s humorous in a sort of morbid sense is that the FED is continuing to absolutely destroy their credibility and reputation. They have been reduced to a laughing stock. They are the Baghdad Bob of the US. Inflation is accelerating. I am seeing shocking new price increases in both services and durable goods.

Anyone notice the cost of servicing the greater debt didnt make it into the negotiations and discussions?

Later, all that voted for the raising of the limit will be suddenly “shocked” at the cost of hauling this debt

I’m seeing the same and I don’t care what the charts say. Inflation is getting worse.

The matter is not really what “things are worth”, but rather no one seems to know what “money is worth”.

Whimsical decision making by the Fed is the problem. We need a hard rail monetary policy…..ie Fed Funds = 3 month avg of YOY inflation.

Inflation is running over 15%, I don;t care what the government is reporting. I’ve got the receipts.

Reminds me of France,at least they got enough balls to protest ,while Americans walk around with there balls in wives purse.

bUt muh ReCeSSioN!!??

Aren’t average number of hours worked per week decreasing?

They’re back where they were before the pandemic. During the labor shortages in 2021 and 2022, they increased as everyone was pushed to work extra time to make up for the lack of staff. Now they normalized.

Hot job report==> stock market is up

Lousy Job report==> market is up that FED pivot.

“We’ve been waiting for the landing, and the labor market has refused to land to this day, and employers keep hiring at a surprisingly strong clip, though the Fed has jacked up interest rates to over 5%. It seems businesses and consumers have gotten used to those rates.”

Yes, thanks to the still very near loosest financial conditions in history, substantially the result of loose monetary and fiscal policy.

Powell has to get to 6 ASAP. If he doesn’t there is something wrong. Wolf thinks slow is safe but it ain’t working. The economy can still smoke at six, at least for a while. Haven’t we seen this movie before?

Reality is, truck traffic is has high as I’ve seen. Prices are up 30, 40, 50% on a lot of stuff. Some stuff I close my eyes and buy. Some stuff I’m out. I have a cd renewal I was going to go 3 years, I’m going 6 months.

Just watching news and they said public works in this city has a 25% vacancy rate. Can’t get help.

You’re not considering the fact that people will ultimately adjust their spending when presented with higher prices. Businesses will lose sales volume, businesses are going out of business, products will be bypassed. The economy will adjust to these higher prices and that adjustment will create a net overall drage on the economy.

I retired from water and gas utility,went to retirement party guys I used to work with making 110 k ,all the overtime u want ,not a word spoken about efficiency.All workers said same thing it’s a shit show ,.Management has lost control

“Powell has to get to 6 ASAP.”

The Fed Funds Rate is around 5.25% and about 0.7% higher than annual or 12 month inflation (Personal Consumption Expenditure). PCE is more comprehensive for measuring inflation.

I don’t think they need to raise it at all as long as 12-month PCE (and also CPI) continue to decline.

Very Respectfully, AD

Honestly I don’t have absolutely any faith on govt manipulated metrics.

Inflation in last 3 years have been more than 50 percent cumulatively and most people have been priced out and having trouble essentials of life.

We need higher for longer

Agreed.

Inflation is much higher than the government reported metrics. In the last 3 years it’s been double digit every year. If you had $100,000 saved you just lost $30,000 given the zero interest rate environment. Last year I got a 1099 from Wells Fargo for $4 interest on $30,000 savings at .0000000001% interest. I had to pay taxes on the $4.

I think that there is only so much the Fed can do via monetary policy, and that the ball in in the fiscal policy arena.

We’re in new territory with the Fed’s past use of Large Scale Asset Purchases to manipulate interest rates. We’ve already seen the burps in the banking sector in response to the Fed’s rate hikes.

The debt ceiling issue gave the perfect cover for fiscal policy to be modified to reduce the stimulating deficits and they blew it. Right now, I see fiscal policy counteracting monetary policy. That’s where the problem is. The inflation fight has been left to monetary policy to counteract, and right now, fiscal spending reductions is off the table.

Canada sold MBS but it didn’t work detached home prices in Canada are approaching new highs again.

What on earth difference does it make who owns MBS instruments?

The faulty premise is that interest rates are high

Historically they are NOT

And it doesnt take much effort to confirm that.

The Jerome Powell cartoon was interesting, but he is not actually pulling his hair out. He has guided the economy to stagflation; stagnation to stop a runaway Weimar Republic, but the inflation he so desperately needs for the Trump area tax cuts, a Cold War 2.0, and what is different from the 1970s a bailout of anything and the huge accumulated national debt. Think back to the Chrysler bailout and all the national debate, now even more money is bailed out and is hardly mentioned.

About all the population has is President Ford’s WIN (Whip Inflation Now), whose premise was stop buying things. WIN didn’t work, but perhaps it could be modified to stop buying non-necessities.

If one lived through the 1970s, they don’t have to wait for any “policy lag.” No wonder Jerome Powell seems to be shaking as he is the poster boy for giving inflation (stealing) to hundreds of millions of people, with the non-envious job if trying to fool all the people all the time, wordwide even. Perhaps the economies of the rest of the world can rein the Federal Reserve in, because the citizens and their elected representatives have no authority by design for over a century.

One last thing we are missing, due to the agreement between President Clinton and Russia’s Yeltsin, the atomic ICBMs are pointed to open ocean targets. When this agreement is dismantled and the weapons are realigned to actual cities, we can all break out the disco records again.

Even Google is hiring again, albeit slowly after the last layoff. A couple of people over at Blind were talking about offers from the company. Someone got laid off from a role in Microsoft only to be offered a different role at …. Microsoft. Granted these are all anecdotes, ………

“Head scratching?” : when there has been a concerted effort to entrench systemic dysfunction for well over a decade (with multiple criminal policies), how can one possibly expect it to be turned around within a year without being seen to be insane?

More Boomers coming to the Les Schwab party and getting retired. Hospitality and Services will continue to be strong hiring base. $YOLO to anyone over 45 who is not enjoying their life and money. I’m thinking about opening up restaurant and live music entertainment spot, will be a 50% up charge for services. AI robot waiting tables and pouring shots, Americans are filthy rich post COVID, unleash the beast.

Americans are dirt poor. They just don’t realize it quite yet.

Large Retailers will shut their stores first down in cities because of the theft problem this time. You can see already that the unemployment rate for African Americans is rising. It looks like African Americans are getting the worst end of the stick. In this area, a number of firms have shut down recently. Do not be surprised if this accelerates over the next few weeks. Also, yes, the Household Survey may be volatile; remember, the unemployment rate is also calculated from the Household Survey. So don’t get so confident that something will not happen in June even though some longer-term indicators for markets are pointing up. Also, the fact that we had the Covid Epidemic can mess up many things. A severe downturn can happen here at a moment’s notice. Everyone should be hedging their bets.

“You can see already that the unemployment rate for African Americans is rising. It looks like African Americans are getting the worst end of the stick.”

Wait a minute… don’t draw ridiculous conclusions from one single month: In April, the unemployment rate for African Americans dropped to an ALL-TIME RECORD LOW OF 4.7%, and in May it bounced off that low. This is very volatile data. It’s still below where it had been in February.

Your connection of this one-month bounce off the record low unemployment rate for African Americans and organized retail theft triggered all my red warning lights about your comments.

Here are the rates since Jan 2022:

Jan/2022 — 6.9%

Feb/2022 — 6.6%

Mar/2022 — 6.2%

Apr/2022 — 5.9%

May/2022 — 6.2%

Jun/2022 — 5.9%

Jul/2022 — 6.0%

Aug/2022 — 6.4%

Sep/2022 — 5.9%

Oct/2022 — 5.9%

Nov/2022 — 5.7%

Dec/2022 — 5.7%

Jan/2023 — 5.4%

Feb/2023 — 5.7%

Mar/2023 — 5.0%

Apr/2023 — 4.7% all-time record low

May/2023 — 5.6%

And yes, brick-and-mortar retail stores are going to shut down, I started saying that in 2017, and called it the brick-and-mortar retail meltdown, and tons of retailers went bankrupt, most recently Bed Bath & Beyond, because THEY CANNOT COMPETE WITH THE INTERNET. When retailers blame that meltdown on shoplifting, rather than the internet, it is the height of self-serving idiocy.

There are only a few categories of retailers that will survive the internet, such as grocery and beverage stores, auto dealers, hardware stores, etc. Service providers (clinics, restaurants, bars, nail salons, etc.) may thrive.

Wolf auto dealers see to be in big trouble can’t sell 100$ trucks

Auto Dealers will cease to exist. Nobody liked them before and now with all those shady markups it will be their final nail in the coffin. Younger generations don’t want to deal with dealers, they don’t like or even know how to negotiate with shady dealer tactics. They want to press “order” and go pick their car up.

Unless dealers restructure somehow, but I highly doubt that.

Nissanfan,

LOL. To get your wish (and my wish), you need to grease the palms of state legislators in 50 states to get them to repeal their state franchise laws that protect new-vehicle dealers. Until then, you cannot buy new vehicles from anyone but franchised dealers.

Tesla is the only exception. Back in the day, when it was a nothing, it got a bunch of states to agree to exempt it from their state franchise laws, but you still cannot buy a Tesla from Tesla in all states.

Good luck trying to get states to repeal their state franchise laws. The auto dealer lobby has a lot more money with which to grease palms than you do.

Flea,

Nah, they’re just reverting to their old strategy of cutting prices and making deals. That’s what auto dealers and automakers used to do, but stopped doing during covid. Instead, they pushed up prices, took off incentives, and added addendum stickers. I have railed about this many times. Now they have inventory, and they need to sell it, and so they’re FINALLY making deals. And those sky-high prices are now FINALLY coming down a little. And that’s GOOD.

“The auto dealer lobby has a lot more money with which to grease palms than you do.”

How is this legal?

The U.S. has codified corruption. As long as you follow certain rules, it’s call “lobbying” and “campaign contribution” etc. Just don’t give the lawmakers any suitcases with cash. That might get you and them in trouble.

A new business model in forming right before your very eyes.

I see a lot of mom & pop barbershops operating on the porches of residents of DC. It’s a booming business. The barbers are paid in case and have zero overhead.

Ms Swamp’s hairdresser is doing one hell of a business out of her townhouse. The salon where she used to work is boarded up and out of business. The strip mall is nearly vacant.

This is how CRE and taxes get circumvented. A response to inflation. Just like gig work came from circumventing taxes.

People are not aware of these processes they seem illogical to predict but this is just equilibrium at work Call it a covert operation, like homelessness and depression. There will be more of these covert processes to equilibrium, like AI or climate change or black swans but be certain, equilibrium will come, it is a mathematical certainty. You dont think someone cant invent a new living model to circumvent rents? Doctors? Lawyers? Engineers? chatgpt/AI will. Because when the time is right it will be FORCED TO, like WFH.

Nobody ever thought working from home would be a thing but here we are. The more the Fed or Washington intervene the more unexpected the causes will be. Equilibrium can not be stopped, only postponed Indefinitely? Even if the Fed has unlimited cards, its still a house of cards. And no one has ever stopped the wind from coming indefinitely.

Buyer beware.

Not sure I buy into the ” shoplifting is making us shut down ” political statement. I think that home delivery has hallowed out their expensive mark up model. ie, they’re losing money.

When the federal govt continues to run trillion dollar+ deficits, that is a powerful and unbalanced stimulus to our economy that interest rates cannot contain solely by itself. The question for me is when will federal spending drop and allow the natural economy to rebalance? How much will our interest payments be by then? There is a deep and persistent push to keep the federal spigots flowing as fast and as much as possible.

The answer to your question is “never”, until we are forced to. And that, my friend, will be an ugly adjustment indeed.

I don’t know about, “never”. When the U.S.S.R. collapsed, they actually started cutting government spending.

David S

Mr Wolf will correct me should I be wrong, but, Government has never gotten smaller or spent less in my lifetime. More like a cancer that only gets bigger and bigger and nothing can stop it.

Seems to me we don’t want reserve currency status anymore,so destroy currency ,but china doesn’t want it either . Because it’s a huge albatross around your neck ,while swimming in shark infested waters,.

How many times are you going to flog this horse? Destroying the currency wah wah wah… The USD is annihilating most of its competitors including precious metals. You think the reminbi is going to be the alternative? Gold? Bitcoin? Wannabes all of them.

I bet there were reckless people in Weimar Republic talking boldly out their asz just like you.

Lol, it’s always Weimar with you. You must be so disappointed every day you wake up and people aren’t using wheelbarrows to carry their money for lunch. Don’t you get tired of this negativity? The glass is always half empty for you. To tell the truth, sometimes I agree with you but you gotta play a different tune on that guitar sometimes.

The debt limit *deal* was to raise it $4 trillion for the next 2 years. So the idea that fed funds controls this is totally obsolete. How many extra jobs is 4 trillion? How much more consumer spending is all those jobs created by the extra spending? How much will go into ramping up the stock market.

In order to be inflation neutral the fed would have to QT all this excess spending. They won’t ever come close. And don’t forget large corps can borrow from japanese banks where rates are still zero ish. This situation is a helluva lot more complicated than just the fed funds rate.

Not so fast! Without QE, who’s going to buy this debt? And at what rate? The Fed used to be the enabler of government overspending, but they’re out, for now. At a minimum, they will need some cover (recession/depression) to go back to QE. Without QE, stonks go down 😢

“The question for me is when will federal spending drop and allow the natural economy to rebalance?” – David S

You have too many people dependent on the federal government spending from Lockheed Martin to VA disability payments and Social Security disability to DARPA, NSF, etc. grant recipients.

They could enact palatable reductions in spending like increase spending at 0.5% below annual inflation for the next 10 years. And have tax increases that expire in 3 or 4 years. That could help to reduce the debt load (relative to GDP), and debt service payments in the future.

What is hopeful is I see the percentage of employed Americans returning to 2006 levels (i.e., the happy days). This will help to add to the federal coffers especially Social Security trust fund.

Very Respectfully, AD

A little known factoid is the American economy has to run at least a 6% deficit to offset the trade imbalance according to the famous Keynesian formulation GDP = +++ – the trade deficit. Without a US budget deficit we would have to report a negative GDP growth. Something that is unthinkable for the median American inspired too contemplate.

“Some blowout numbers – job creation blew past expectations” in the glow of the summer inflation sun.

America is about to re-industrialize to a certain extent. Collapsing bubbles be damned !

The Fed has this. Even though inflation is running at over 5%, the idiots are promising a pause in the increase of the FFR which has suspended several overpriced asset markets from declining to an affordable level for the median American family.

I think that a pause in increasing the FFR by 25 bpts is a strategic mistake. I think they should increase the FFR by 0.25 pct and announce that each increase in prices will be met with an interest rate increase.

1) For two decades, between 2000 and 2020, the average Quits is

about 2.2M/m. Quits are well above at 3.6M for funfunfun. Workers are too complacent.

2) 1D : the Dow had a rare +2.12% day.

3) 1M : for seven months the Dow isn’t quitting. There is no close

above Dec 2022 high and there is no close below Dec 2022 low. Breaching it isn’t good enough.

4) A close above Dec high might increase Quits. A close below Dec 2022 low will humble the arrogant workers. We need is a trigger to send Quits to 2,2M/m, or below. Layoffs will give them hell.

5) The Fed will stay put, waiting for data. No cutting/ no hiking.

6) For six month, since Jan 2023, AAPL is rising without tripping. In

June/ July AAPL might stumble. No harm is done. After recharging AAPL might reach/breach $3T again.

Protection fee reduce organized theft, it’s cheaper. No baseball bat

for collection.

I don’t have an Engel-to-American English translator; its like Picard trying to understand Darmok in Star Trek Next Generation.

Can someone please help me to understand this ?

“Protection fee reduce organized theft, it’s cheaper. No baseball bat for collection.” – Michael Engel

Very Respectfully, AD

Okay, let me take a whack at the baseball. First off, one has to free their mind of all preconceived ideas. Then allow your mind to try to organize the information transmission.

Which, obviously, will fail unless one looks at in the fuller context of there is a logic to it, I think.

Love Micheal’s synopsis even if I rarely can understand them. They seem like reality in a strange kind of way.

Like the structural order that every Jackson Pollock painting probably has.

You just have to fill the gaps with your imagination.

The protection racket is an organized crime tradition. The gangsters in your city made merchants pay a monthly fee to avoid having the mob rob, vandalize, burn, trash etc. the stores. ME is suggesting that our contemporary shoplifters and merchants return to the old days because it was less expensive and less disruptive to business and society.

Collection of the protection fee could also be enforced by beating the store owner with a baseball bat. ME is clearly urban old school; very 1950s.

It is a fact that there will always be certain parasitic elements who are going to steal your wealth. You can pay protection money to the thug to leave you alone, or you can deal with a burned-down business. You can pay taxes to fund welfare, or you can deal with poor people who will climb through your window to steal your stuff. You can keep the citizens pacified with massive government spending, or you can deal with pitchforks and guillotines. Your choice.

Well, since you put it that way, I’ll choose massive government spending.

I thought it was just me

Isn’t that what happens when people “talk in tongues”? The congregation begins to doubt their own thinking because they can’t understand the gibberish. It’s a form of gaslighting.

The landing got cancelled because the Fed monetized $4T of government debt in two years and has no real intention to reverse it. It caused 20% inflation so far, but it will likely be 30% cumulative inflation before 2025 hits. In the 2026/27 timeframe, expect another big monetization of $5T or more.

They couldn’t get any significant spending cuts or tax increases passed with the debt ceiling deal. This crazy bus won’t stop until it’s jumped the bridge and sinking underwater. That’s what it will take to wake up the so-called “leaders”.

Hold on a minute partner the Republicans significantly impacted the future growth of the Federal deficits by increasing military spending and protecting Trump’s tax cuts for the rich. They savagely attacked such wasteful, spendthrift programs like food for children.

Ahh yes the old “food for hungry children” canard.

Leaving aside moral hazard of incentivizing people to have kids they can’t afford, the fact is, the “poor” in this country still have many luxuries they could do without to pay for food for their children.

Any comment on the moral hazard of the TJCA that republicans protected or are morals only for “poor” people?

So dang is saying that the entire 2021 increase in government spending went to feed children. Is that why childhood obesity is so prevalent?

Isn’t it true that the increase only went to the Hostess Cup Cake bakeries?

Food deserts abound in poor neighborhoods. Good luck getting your fresh fruit and veg at the Dollar General. Even if the poor had the time and gas / bus money to shop with the more well off, they still wouldn’t have the means to get consistent healthy calories.

But do go on with your astute commentary on the realities of poverty.

Until you stop seeing the fake divide between parties, you will never see how DC works, grasshopper.

Yes, and the way the two parties have split the entire nation is such that a third party cannot get anything done unless Congress is overhauled by third party candidates, too. A change of President won’t be effective.

I wish I believed in conspiracies. If I did, I’d think that the two parties enter doors that lead to the same room, divide the waring political factions into perfect halves, and keep upping the political outrage every four years.

dang

“increasing military spending “…?

Biden’s defense budget request of $886 billion for 2024 and $895 billion in 2025 results in a 3% nominal increase in 2024, but Biden’s number is a real reduction in defense spending after inflation and expenditures on the military could fall below 3% of the economy for the first time since the 1990s.

We’ve seen travesties on the tax and spend sides. Corporate taxes were cut 40%, without appropriate spending cuts. That was completely irresponsible. Billionaires aren’t getting taxed in accordance with the value they pull out of the economy. Spending is out of control. PPP program was a pure giveaway to fraudsters. Maybe 25% of it went to the right people. Budgets for everything automatically go up, without any rationalization whatsoever, or expectation of anything improving. Government has become a grab pot.

No wonder trust in institutions is low.

I’m not Republican or Democrat.

The USA is the world’s superpower at the moment. Spending on the Military is less expensive than World War.

It’s nice to see someboy else gets this.

There are so many issues that you raised that are fundamentally important to the only thing that is important, the standard of living of the median citizen in the US.

The first thing we all have to realize is the US is a debtor nation. The trade deficit is not a result of good governance, but corruption. The Reagan legacy whereby wealth begets wealth.

“Trickle down” was a complete con job. I don’t know which is a better con: trickle down or the invisible hand?

I used to work in a cabinet making factory. The older guy who worked on the drum saw had several invisible fingers. But no one there had an invisible hand.

Agreed. The $4 trillion added in 2020 is structural, and will never be removed. Basically, holders of dollars paid for the entire pandemic splurge.

It should have been paid by society as a whole.

Einhal.

Agreed.

The $4 Trillion “spilled” into the economy/markets will never be retrieved. And, IMO, we will never see a “7” handle in front of the balance sheet.

The Fed already removed $580 billion of the $4 trillion. Read my Fed articles, instead of spreading BS here?

https://wolfstreet.com/2023/06/01/feds-balance-sheet-plunged-by-348-billion-in-the-10-weeks-since-peak-bank-crisis-and-by-580-billion-since-qt-started/

Wolf,

I went back and looked at the Fed’s numbers. On February 26, 2020, right before the pandemic, the Fed’s balance sheet was $4.158 billion. The peak was around 8.965 trillion on April 13, 2022. That means the Fed printed over $4.8 trillion in a little over two years. The $580 billion removed over the last year isn’t even the amount that was printed in two weeks from March 11, 2020 through March 25, 2020. Whatever the Fed’s intentions NOW, it’s WAY TOO SLOW. There’s no two ways about it.

If someone sensible was running the Fed, $3 trillion of that $4.8 trillion would have already been removed, the stock market would be done at DOW 15,000, job losses would have accelerated such that unemployment would be at a minimum 8%, houses would be selling in foreclosure for half of their peak price, we’d be seeing real deflation (not disinflation) and we’d be on our way to hitting the low so that we could recover.

This slow walking is not working. Period.

IMO the full $4 Trillion will not be retrieved. And IMO not even half will be retrieved. Just my opinion.

Many posters here feel the same way. QT is painfully slow, and the Fed is trapped.

The whole debt ceiling deal was a bait & switch con job. The Speaker sold out his base of support at the last minute and gave the big spenders nearly everything they wanted. Look forward to runaway Stagflation in the next two years, and further income inequality until the civil society breaks down. The people have had enough.

If they “had enough”, they’d stop buying shit. They keep buying.

The landing got cancelled and it looks like the collapse of all asset bubbles have been cancelled as well. It’s time for Biden to take notice and cancel Powell.

Yep. Stocks are up 25% since the fall and based on bad economic data. The fact is, the markets, both bond and stocks, are taunting Powell. They don’t believe these 5.25% rates (which will destroy a lot of zombie jobs) will last more than a few months after pain starts. That’s why the asset trade is on.

You’re describing the stock market as though it has a brain, a mischievous attitude, and maybe a set of genitals.

The first problem is accountability,fed was blatantly front running stock market ,members lost their job. No big deal they made mMILLIONS . Shit show all ponzu

It’s the plan for policymakers to successfully trick the bond market into thinking that high inflation is off the table… while secretly manifesting high inflation. Any more than a few years of this deception and the bond market will have fully wised up, causing a tremendous sell-off of bonds and the destruction of our entire debt-based economy.

I think it’s more granular than that. The common sense that the Fed is not controlling long term interest rates is nonsense. With the ballast they have on board, with a blank check to pay for it, they are fully in control of the rate curve, rendering the historical interpretation of the interest rate inversion inaccurate.

Hey, dang, I really enjoy your commentaries. You have a way of treating your many observations as epic theatrical events, or large oil paintings on canvas, or ornate tapestries.

I hope I’m not complementing an AI chat bot.

The so called “bond market” has been rendered impotent these past 15 years of the rogue Federal Reserve Bank of the United States of America redefining risk as holding the risk free security.

Now that that QE policy has been shown to be the mess that it is, the Fed is reluctantly moving back towards a more conventional understanding about whom their responsibilities were granted and why.

Their responsibilities lie with upholding the virtues that the people we just honored over the Memorial Day weekend, who paid the ultimate sacrifice for this great nation.

It makes me feel sick to my stomach watching the entitled class take credit for the valor that nameless American soldiers fought and died for.

dang

agree.

“redefining risk”….. by their own admission…..pounding long rates to “force” investors to take more risk. But also, driving banks to the abyss with the holding of long maturities with costs set at record rate lows. Essentially the Fed pushed these bank to short interest rates at all time lows, and then many banks could not move fast enough, or would not move at all.

So now the inverted yield curve is managed to stay that way…ala BOJ…so banks dont get hurt more by higher long rates. How will this end? How does the Fed do QT and also normalize rates and the yield curve without causing further banking woes?

Maybe the Fed should never have delved into yield curve management and stayed out of the long end like it did for decades prior to 2009.

The Fed is trapped by the policies of the Nobel Prize winner, Bernanke.

In reality, the market is about to cliff dive.

1) Suppose US treasury issue $1T Bills, which is a lot, but only 25% of the debt ceiling increase, at around 5%/5.5%. Option #1 :

Demand will be high. The 2Y will be down dragging the 10Y with it. Banks unrealized losses might decline from 2% to 1% out of total assets.

2) The Fed will stay put. The 5% is incentive to move your money

from the banks. Non Interest Bearing deposits will decline. Banks

profit will decline. Banks P/E ratio and Return on equities might fall in 2024.

3) Option #2 : investing in US roach motel for an IOU became too risky. Investors might put their money in the stock markets, in value stocks that fell a lot, with good fundamentals, especially those that opay high dividends.

4) For some value beat 5% divided by 4 for US 3M. The two options are valid.

Some will invest in the stock markets. Others will chose the “safest

vault” in the world and put their money in US treasuries.

Wolf is it true that “All New US Jobs Since The Covid Crash Have Gone To Foreign-Born Workers”

Another question, is it true that “much of jobs created in recent years have gone to “multiple jobholders”, meaning that not every “payroll” has been assigned to a unique individual, but instead there are now people who hold two, three or more jobs to make ends meet.

Or that much of the recent job creation has gone to low-paying part-time workers while full time jobs have stagnated.

1. “All New US Jobs Since The Covid Crash Have Gone To Foreign-Born Workers”

Total utter BS. I have no idea who is spreading this braindead BS.

Since the Covid crash:

— Foreign born added 4.96 million jobs (from 26.28 million to now 31.24 million)

— Native born added 19.38 million jobs (from 111.36 million to 130.74 million)

2. “much of jobs created in recent years have gone to “multiple jobholders”, = total utter BS.