“We’re going to be looking at those factors to determine whether there is more to do.”

By Wolf Richter for WOLF STREET.

Fed chair Powell was bombarded by essentially the same question over and over again today during the press conference after the FOMC hiked its policy rates to 5.25% at the top of the range. Reporters were trying to nail him down: Has a decision been made about “pausing” the rate hikes in June? And he was asked if there will be “rate cuts” this year?

Over and over again, he refused to lock in a pause for the June meeting – “A decision on a pause was not made today,” he started out with. Over and over again, he said that a pause would depend on the incoming data.

And he brushed off the rate-cut question – “If our forecast is broadly right, it would not be appropriate to cut rates; we won’t cut rates,” he said.

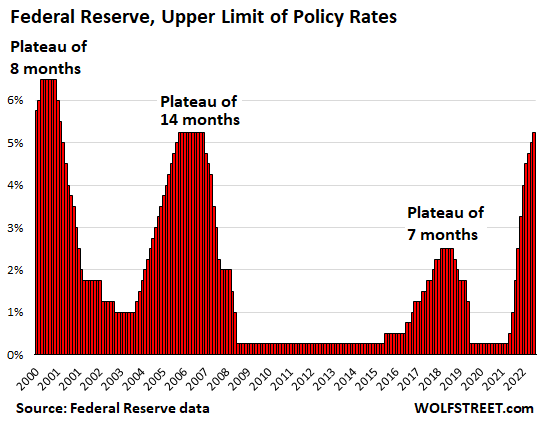

Timing for a rate cut this year is getting tight. First comes the pause, and then, later, comes the rate cut. Over the past 22 years – the prior three tightening cycles – the pauses lasted between seven months (2019) and 14 months (2006-2007). If the Fed pauses the rate hikes in June, there are only six months left in the year.

But this time, the tightening cycle is dealing with the worst bout of inflation in 40 years. And Powell has once again expressed the Fed’s leeriness about inflation’s nasty habit of resurging: “We have seen inflation come down and move back up two or three times since March of 2021,” he said. And in this inflationary environment, a rate cut just isn’t appropriate, he said.

Here are the prior three tightening cycles and their plateaus. If the Fed pauses in June and does one rate cut before year-end, it would be the quickest rate cut of any of them, in the most inflationary environment of all of them:

What Powell said about a “pause” in June.

“A decision on a pause was not made today. You will notice in the statement for March we had a sentence that said ‘the committee anticipates that some additional policy firming may be appropriate.’ That sentence is not in the statement anymore. We took that out. Instead we are saying that ‘in determining the extent to which additional policy firming may be appropriate,’ the committee will take in to account certain factors. So that’s a meaningful change that we we’re no longer saying that we ‘anticipate.’ And so we will be driven by incoming data meeting by meeting and we will approach that question at the June meeting.”

“The assessment of the extent to which additional policy firming may be appropriate is going to be an ongoing one, meeting by meeting. And we’re going to be looking at the factors that I mentioned that are listed in the statement, the obvious factors. That’s the way we’re going to be thinking about it.”

“There is a sense that we’re much closer to the end of this than to the beginning. If you add up all the tightening that’s going on through various channels, we feel like we’re getting close or maybe even there. But then again that’s going to be an ongoing assessment. And we’re going to be looking at those factors that we listed to determine whether there is more to do.”

Why it was necessary to raise rates today...

“With our monetary policy, we’re trying to reach and then stay for an extended period at a policy stance that’s sufficiently restrictive to bring inflation down 2% over time. That’s what we are trying to do with our tool. I think slowing down was the right move. I think it has enabled us to see more data, and it will continue to do so.

“We always have to balance the risk of not doing enough, and not getting inflation under control against the risk of maybe slowing down economic activity too much. And we thought that this rate hike along with the meaningful change in our policy statement was the right way to balance that.

“We have seen inflation come down and move back up two or three times since March of 2021. So I think you’re going to want to see that a few months of data will persuade you that you have got this right.”

Markets are pricing in rate cuts by year-end. Do you rule that out?

“So we on the committee have a view that inflation is going to come down not so quickly. It will take some time. And in that world, if that forecast is broadly right, it would not be appropriate to cut rates; we won’t cut rates.

“If you have a different forecast, and markets have from time to time been pricing in quite rapid reductions in inflation, we would factor that. But that’s not our forecast.

“If you look at non-housing services, inflation really hasn’t moved much. It’s quite stable. And so we think demand will have to weaken a little bit, and labor market conditions will have to soften a bit more, to begin to see progress there. In that world it wouldn’t be appropriate for us to cut rates.”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, it’s eerie how you publish exactly what I need to see. Have you hacked my Amazon echo? Just kidding. Thx!

Wolf publishes the content without applying a spin on it. Its unlike the mainstream media where headlines tend to contradict the substance to fool the meme investors and greedy algorithms, and establish a pro-wallstreet narrative.

What Wolf does is what “journalism” used to do…or try. Journos today don’t want to get into P.R., they are P.R.

Now that we’re at the point where a pause is likely to start, the 30YFRM will continue its trend downward. Housing has already started to form a trough. While prices are not likely to see double digit growth this year, we’ve reached the bottom outside of a recession and prices in many areas will start to creep up. Inflation will zig zag some over the next few months and then start a slow trend higher by late summer. The labor market will soften slowly and pickup later this year. The question is when does the pause end and we see the first 25 basis point increase in the FFR? The mid Sept or late Oct meeting sounds about right.

This stuff is just totally amazing to me. I mean, it’s like a report from another world. A world in which inflation just vanishes. The presser was all about inflation, inflation’s nasty tendency to bounce back, services inflation that was refusing to go down, and that the Fed wouldn’t let this one get away, and you’re just blowing it all off to create your own reality? Amazing.

Maybe he forgot /S in his comment

I’m not sure about BENW’s assessment of the housing and labor market, but his call for inflation to trend higher by late summer and an FFR rate “increase” in the Fall indicates he thinks inflation will remain an issue. I interpret his comment to mean the current FFR is too low to slow economic activity enough and bring the inflation rate down, necessitating further increases.

To many dollars coming home to roost. Impossible to get rid of without making new loans.

Yeah I think that’s what he meant as well. I’m seeing it too where I am (UK) – the rate is still too low, and people in secure jobs are starting to figure out that they can expect pay rises that at least match their mortgage rates – i.e. real rates are still very low. No tick up in house prices here, but a lot more robustness to prices than I expected.

But, things seem to be getting wobbly on the job market – I know people who are being made redundant. But I also know people who still cannot get enough workers. So very mixed and my Friday night going out-o-meter suggests the party is not over by any means.

My assessment is based on the following assumptions:

The Fed knows a core PCE inflation rate of less than 3.5% is nearly impossible over the next 2-3 years without a recession.

The whole equation hinges on the labor market. The Fed wants the unemployment rate to increase up near 4% just by the economy seemingly moving towards a downturn that forces people to return to the labor market.

This means rates will either need to slowly creep higher towards 6% over the next 12 months or they’re going to have to reassess what’s reasonable in terms of core PCE inflation. My guess is they prefer a little bit of both. They know a terminal rate of 5.75% is likely in the next 9-12 months and they’ll start resetting inflation expectations in the coming months with updated dot plots that minimize the need for a return to 2% core PCE inflation.

The Fed wants housing prices to fall further, but they don’t want them to free fall. For this to happen, mortgage rates have to stay around 6%. They’re okay with this playing out over the next 3-4 years.

Housing is unequivocally starting to firm up. Despite large sales volume decreases, the national price of housing has only dropped 5%. That’s nothing. It’s a blip, given the totally of increased rates and fewer sales.

Demand is shifting towards new homes where builders have a TON of profit margin to spend on extras, rate buy downs, small price reductions, etc. At this pace, it will take 18 more months just for builders to get to the point where their profit margins are even modestly squeezed.

Tomorrow’s employment numbers will continue the trend over the next 2-3 months of letting us know how back half of 2023 is going to go.

As noted up through March, my expectation is for the labor market to continue to surprise to the upside.

Again, there’s $13T reasons why a recession isn’t imminent. There’s still a lot of money yet to be spent. Uncle Sam is going to run a $2T deficit this year. That’s a lot of extra juice to the economy. And property values aren’t really falling to any great extent, so local governments still have lots of money to spend.

And there has to be about a 3-4,000 point selloff in the Dow that ushers in the final notice of a recession. I see the DOW zig zagging throughout most of 2023. There may be a 3-5% downside at some point but that big drop that spells trouble just doesn’t seem likely yet.

A lot of people are beyond eager for rate cuts because their livelihoods depend upon it. Even the “conservatives” and “libertarians.” It clouds their judgement.

I just got out of the market and will take advantage of higher interest rates on safe investments: the first time since 2008 that this is possible. And try to figure out what investors will do in the meantime.

The comments section is useful in assessing how people who are interested in markets mis-react to news.

I scan the comments for your replies, and then I can see how incredibly bull-headed investors are.

It doesn’t matter what is really going on, or what so called “experts” think, just how the markets react.

I highly recommend Michael Pettis on Twitter if you are interested in China, which is after all a big part of the world economy.

Thank you.

I’m like 98% in brokered CDs. I sold a small holding of QS and SLDP that I held for about 2 months before they recently started to fade. A couple of Stop Limit orders ensured I bagged a little profit. I just put $20K away for 5 years at 4.45%. I’ve about $130K rolling over in June that I’ll stash away for 3-5 years. A couple of those CDs are going to go from 2.8% from last June up to close to 5%. I’ll probably shy away from the regional banks and try to stick with bigger banks. I’m doing research on each bank that I plan to buy into brokered CDs. But, I don’t expect to have more than $250K with any one bank across multiple CDs, so the FDIC is my backstop.

“and you’re just blowing it all off to create your own reality? Amazing.”

I have no idea what you’re talking about. Unless you’re talking out of both sides of your mouth, it sounds like WE BOTH see a real chance of inflation rebounding.

And my description about the current housing market is SPOT ON. Housing, in terms of prices, has troughed. It’s either going to zig zag or it’s going to start creeping up slowly in terms of prices over the summer.

Yes, as it was pointed out here, I misread a portion of your sentence: “…then start a slow trend higher by late summer” I read as something like “start slowing this summer.” Apologies.

In my (very modest) neighborhood houses are still selling very quick rarely more than 7 or 8 days on the market and usually for well over asking price. I’ve realized that redfin and zillow underestimate home values in less expensive areas and overvalue those in more desirable areas. That’s the correction that’s happening now

There are serious people arguing persuasively (charts too) that the OER trend change (now down) is very lagging but will soon put a spike in the heart of inflation.

Whack A Mole Everywhere All At Once nature of the beast.

They don’t want Powell to be Volcker yet. But Volcker paused, inflation took off again and he went nuclear. It wasn’t just Burns that got fooled…publicly.

Sombody has to take the fall when we get too close to the sun. But Volcker fooled them. Is that possible again?

I’m going to post an article on single-family rent growth so far this year through April, as reported by the largest single-family rental REITs in the US, for renewals and new leases. They’re hot. Tenants and prospective tenants are paying those 7% rent increases!

I’m very skeptical about this now fashionable dismissal of OER or rent of residences CPI data as “lagging.” They never picked up much of the surge in asking rents, and so they won’t come down much either. Very few tenants actually pay asking rents. There isn’t that much turnover, and asking rents are skewed. The CPI measures of OER or rent are very good at picking out what tenants are actually paying.

Cool story bro.

Yes,

A San Francisco office tower worth $300 million on paper is up for sale and seller expects to sell it at 80% down at $60 million.

While houses are not commercial real estate and they should correct slower and to ~50% only from peak, I am pretty sure that house prices will not fall only 10% and rebound.

Why 50% down over next 3 years:

1. They are still 20% higher than 2020 in San Francisco.

2. The 6.5% mortgage rates, when compared to 3% in 2020 still causes EMI to be 50% higher for the 2020 price.

3. Population of San Francisco is decreasing, and many tech workers are moving out.

4. Inflation has caused living expenses to go up by 15% leaving lesser to pay for houses.

Cool. A perspective from a guy who loves the sound of his own voice.

> Housing has already started to form a trough.

The housing market is so seasonal. Drawing directional inference from April is not valid.

The spring selling season for housing has been a bust, and you’re expecting prices to go up AFTER it? When, in a normal year, the prices drop?

I’d say if the spring selling season sucks, the rest of the year will be abysmal for real estate.

“The assessment of the extent to which additional policy firming may be appropriate is going to be an ongoing one, meeting by meeting. And we’re going to be looking at the factors that I mentioned that are listed in the statement, the obvious factors. That’s the way we’re going to be thinking about it.”

Ummm… how about everyone not making 150k+ per year are getting crushed? Data driven… yeah, okay. Here’s some data: I found a receipt in an old shopping bag from 2019. House brand pizza for $4.99. Same pizza two nights ago $6.30.

Times everything, everywhere in America.

Shopping should be no brainer to anybody. You go to a grocery store and you are not leaving without paying less that $100. When I see the total, I look through receipt to make sure something didn’t get scanned multiple times or has a wrong price. I also don’t see shopping carts filled up to the brim like I used to see in 2020/2021. That’s what low interest rates and insane QE looks like for normal schmucks.

They should go out in field and analyze that type of data.

My groceries are flattening lately, a few going down, after steady increases for many months. But I sub out anything that goes up too much. Also having a backdrop of low (especially adjustable rate) credit lowers the anxiety. I haven’t had a raise in nominal terms in more than ten years (that’s right, so a wage cut in real terms), from a low baseline to begin with, but am getting by alright. So much is expectations one is anchored to, and liabilities one is chained to: both CHOICES one made.

Nissan fan ,I buy a gallon of milk under $2 ,shop sales and stock up,buy a years worth of canned goods at a time ,egg under$2 a dozen .If you do a little work can save a lot of money. But my kids order online = getting raped

I just got a 10% pay cut. Plus 16% layoff coming following 8% already on Nov. No bonuses next year or focal increases. Last raise was in sept 3%. In total my compensation is down over 25%. We supply hardware to the cloud. I’ve noticed fang revenues going down but they have maintained eps via layoffs and greatly reducing purchases from suppliers. Suppliers are getting wrecked. Worst is yet to come. No bottom in sight. A lot of people with no money to spend.

Our son is an engineering student at a top 10 (public) engineering university. In the past 60 days, more than 2 dozen of his graduating friends, with engineering degrees, have had their offers rescinded due to RIFs. Hardware, software, mechanical and electrical engineers were leveled. Ironically, in the new green economy, only the petroleum engineers escaped unscathed. It is hard to believe this is not a national problem.

The petroleum engineers didn’t get slaughtered likely because there were fewer of them and the field for the others was crowded because they were lead to believe “that’s where the growth will be”…..

House pizzas are short on the pepperoni.

In January Powell spilled beans in Russian prank call about two more hikes (one being today)… Just like during that January call, Powell still stressed today good job market, which needs to be normalized. Looks like the “pivot” crowd got so desperate, that they will settle for pause instead of a cut, but once they get the pause, they will cry for cuts…

I guess there is something amazing about this mindset. Is manipulation the goal? Or, would that be giving them to much credit?

They’re really pumping a “rise in RE prices” but I don’t see it. Still a slow decline in sold prices.

Lots of agents with time on their hands.

If the Fed today had said that it was pausing Wall Street would have thrown a big party and financial conditions would loosen again. Instead the Fed reserved judgment on a pause and signaled that it might not be done raising rates. Add this to how the Fed and FDIC have been nimbly parrying the Street’s bank runs while continuing to raise rates, and it seems that the Fed Put is now reserved for something really big. If there is a sell off on Friday a quick trip to SP 3500 in the next two weeks might be the next move by Wall Street pivot sniffers.

As long as Consumers are accepting of inflation, it will continue. Once Consumers start to think about monthly budgets, the mindset will change. But for the past few years or longer we didn’t care – me included. We get what we deserve. Somewhere in Psychology there is the enabler. The Fed is the enabler and I don’t understand the reasoning. But we are the consumers and have huge impact. Beef is expensive so buy chicken or pork. Or eat veggies. 2 years back I had to have the expensive grill on my deck. For each of the $20 steaks so far, add the grill cost of $100 for very expensive food. But the grill looks cool- hurray. A bit of sarcasm but people have an entitled mindset. And that will keep inflation going until people don’t. Good luck to all.

Consumers are the enabler of the Fed.

This is why rate cuts all come down to the net consumer greed/fear position.

The Fed, for all their blabbering, just have a couple of levers to pull depending on their view of the net consumer greed/fear o meter.

All you need to do is get a feel for the prevailing consumer mood. Easy haha.

Consumers are also the enabler of (currently very strong) pricing power in corporations, permitting constant price hikes. I always look for the dynamics of mob/crowd behavior before pointing any finger of blame anywhere. It is not as if the Fed is just some isolated entity — it is somewhat riding and reacting to these tides too.

Our government has several million problem-makers and exactly one problem-solver. It’s amazing how much good one man can do if he’s in the right position at the right time with enough raw GUTS.

Well, considering “let inflation run hot” and “transitory”, it wasn’t long ago that we had a million and one problem-makers. I think Powell is trying to redeem himself here.

It makes me think of the dramatic moon landing in Airplane 2.

He’s trying for a soft landing too.

Forward guidance withdrawal.

I do not feel the Fed can do much of anything until Congress begins to address how the debt ceiling crisis is going to be resolved.

In less than 30 days, the Fed’s problems are going to be compounded exponentially.

Among the things I think and/or worry about, the last one is the debt ceiling. For me, it’s just a Kabuki puppet show playing out on a big political stage. The reality is, the money pulling the strings isn’t ever going to allow a default. Period. But it’s a fun show and an effective distraction.

I think the debt ceiling show is a ploy to channel the frustrations of the poorer classes into votes (because the rich are too few, they have to wrangle the suitable numbers of angry, scared poor, aligned with their political team). But as you suggest, the rulers are not going to destroy the asset value that is their power base. They will loosen the chain on their lackeys in Congress before then. Nobody in the markets seems fooled by it (though I have my plunge insurance in place, maybe for a quick pop). However, there are a few interesting twists this time, to raise that entertainment value.

I agree with the “Kabuki puppet show” assessment. Neither side is willing to let a default happen and, as usual, each will squawk loudly about the evils of the other side’s position and then will negotiate a rather meaningless compromise to raise the limit when the clock starts ticking below T-minus 24 hours and counting. Political theater at its best. (Or worst, depending upon how you look at it.)

Always a treat to read comments from Boomers calling for real estate to be forming a bottom at these bubble levels. It’s sooooo 2015. 😬🤭

Those are only the boomers that wish theyd bought more, or bought at all, when the market was crap and they were crying about real estate going to zero.

Those of us who have seen this movie before and listen to the market know the most important thing right now is to be patient. Sell, if you havent already, and prepare to load up again at the end of the show.

“Please save my unrealized gains so I can cash out later!”

Not many buyers at this current mortgage rate, so they want their gains solidified.

How do you know they are boomers. Not all boomers are the same just as not all millennials, Gen X or Gen Y are the same. Go back to reading your 15 minutes of hate propaganda from Business Insider and other such clickbait garbage. I’m sick of it.

Powell was asked a question about moving the inflation target higher, which made him extremely evasive and agitated. I got the impression that Powell believed they might not make the 2% inflation target.

Yes, it seemed like he saw that the 2% was the Holy Grail that no one could ever get to. But he was firm and direct about NOT moving the target higher.

I was impressed by Powell saying more than once that we need to get inflation down to 2%. Not around 2%, but 2%. That will be a lot of work and will take time, and might never happen.

The markets hear only what they want to hear from Powell, and ignore the rest. It is like he is talking to a drug addict.

Well given him and his last 3 predecessors are hell of a drug kingpin when it comes to liquidity and to a point of force feeding the addicts even when they weren’t looking for a fix at times, of course now all the addicts can hear is more binge is coming soon, 20 plus years of conditioning playing out

I think it’s rather funny that the pusher is now trying to cure the addicts.

I noticed this: ” to bring inflation down 2% over time”. Bring it down 2% is not bringing it down to 2%.

You should hear me screw up talking in an interviews. It’s super-easy to drop a syllable, and suddenly it changes the meaning.

Lol

I notice Wolf encloses his comments within a black rectangle, an embellishment usually used to indicate an obituary. Amusing.

The banks are winging it. Nuff said, this for many will be a summer of discontent long live Richard III.

In one of these sessions Powell should say that inflation has run way above 2% for some time and so it will take some sacrifice to achieve the 2% average inflation.

That should silence the crybabies like a bat to the head.

The whole world is moving away from the dollar, rates will have to continuously move higher now as long as we print more dollar.

Thanks for the summary. I think there will be no rate cut this year. Before that happens, unemployment would have to increase substantially.

Powell sounded less confident today than back in Jan/Feb.

I didn’t hear anything about a “disinflationary process” being underway. Instead I heard him say that inflation is moving up and down and we’ll just have to wait and see what happens.

And when asked about letting inflation languish at 3%, I sensed a bit of emotion in the way cast a look over his glasses and gripped the podium more tightly than with the other questions.

I find Wolfs’ blog fascinating. But I feel like I need simple investment advice. Should I purchase CDs now ? I think someone mentioned to buy them from a brokerage? With banks collapsing where should I purchase them?

I do not believe this is not an investment blog, per se. However, I will say this: Never take investment advice from a stranger online. The internet is not your big brother trying to help.

I think there’s some legal reason why you’re not supposed to provide explicit financial advice over the internet, but I bought a mix of 3-6 month CDs and T-bills this week with an average yield of 5.25%.

The only thing that could put these assets at risk is a USG default, and if that actually happens we’ll all have bigger things to worry about…

We will find out at the end of the month.

You can open an online brokerage account like TD Ameritrade or ETrade etc., and buy all kinds of bank CDs there that currently pay around 5% on 1 to 12 month maturities. You can also buy US treasuries there, which pay about the same.

You can buy T-bills straight from the Treasury without a brokerage account. Go to treasurydirect.gov. You can link it to your bank account. The whole process takes about 5 minutes to set up.

Treasury auctions are held weekly. No commissions, no fees.

I think you need clark howard – “2023 + clark howard + short term investments.” Also, he has a daily podcast.

It’s interesting but if you look back to 1940s, in the USA, since then every recession has started with very low unemployment with people spending away.

By definition! You don’t start a recession when you’re already IN a recession.

Recessions are part of the business cycle. There are ups and downs, which form the business cycle. For a while, spending is good, and then eventually something changes and spending gets reduced from the high levels before, and businesses react by trimming their staff, etc.

I question the “YOY” window of measure.

Lets look at inflation for the past two years…..circa 15%. (pick your metric)

So, a successful follow up would be a smaller gain, say 2%?

17% over 3 years is, without compounding, almost three times the state inflation goal (3 xs 2% = 6%). How is that a success?

Disinflation is called for…..retracements of the SPIKE, yet we never hear it. We just get the smaller increases ON TOP OF the spiked prices.

Not good enough, IMO.

And the ten year is 3.36%…..and the complaint is interest rates are too high. Historically, the long end is STILL near all time lows.

There is still an entirely false narrative of an anchievable soft landing with enough nuanced tweaking of interest rates and QT. Chomsky would consider this controlling the debate. The only thing worth discussing is the rate of dollar devaluation, the timing and how extreme it will be in the end.

Actually, QT should have been done first before base rate increases. This would have increased borrowing costs for specifically the government, in the form of higher treasury yields and further losses on their “deferred assets” through Fed remittances. That interest rates are used while QT isn’t finished is to move higher borrowing costs from the public sector to the private sector, so even these relatively insufficiently lower rates are mainly shielding US government debt IMO. Even this however would be to miss the point.

As said prob a year ago, the playbook hasn’t changed from Volckers days and as Volcker carried out an organised dollar devaluation, so will Powell, because its the -only plan possible-. All of these “maybe a smidge more”, “just a tad”, “a touch” on the principal policy lever which is blatantly in way negative territory whichever, this is the circus frontman, “Nothing to see!” “All under control” “Nearly done”.

Inflation has now been compounding at over 5% to 10% since mid 2021. The game for Powell is to avoid embedding a spiral, NOT to control inflation. Hence all the interest in NAIRU. The fact that some of the banks are now blowing up is a potentially dangerous sideshow because the light at the end of the tunnel is 20-25% value off the dollar as you head into what is hopefully a relatively low unemployment recession from malinvestment/low savings. That <- is the reset. Then its start again time for the US. There is no other way out and there never was. The dollar is literally worth considerably less already!!! That value is never coming back.

Same plan for the UK, the south of the EU, Turkey, Argentina, Japan because devaluation is the only workable plan. Nixon in 1971 was a dollar devaluation. The UK's Wilson in 1967 devaluation of the pound etc

” Volcker carried out an organised dollar devaluation,”

By taking rates to all time highs?

Taking rates up doesn’t necessarily make the dollar more valuable. Look at the value of the dollar at the start of Volcker, compare to the end. There was a devaluation.

At no point during Volcker did the dollar increase in value, only the speed of devaluation changed.

Powell is raising rates to the extent that banks are failing, but nobody thinks the dollar’s going up.

Why people imagine Volcker squeezed inflation “out” of the system, I have no idea. All that inflation during his time compounded and is embedded still today.

Yes you could get a higher return on the dollar to compensate you for holding dollars, which is the moot point i guess, but -thats is different from inflation as in the loss of purchasing power of a dollar-.

Who actually got this Fed fund rate during Volckers period? Was it the guy in street? No.

Fifty years from now somebody might look at the Fed rate and think ooh went up to 5%, Powell really sticking it hard, how like Volcker he is, but the reality is the US commercial banks only offer around 1.5% to mom and pop. A hugely negative rate. It will have been the same losses on savings during Volcker, his rate won’t have gone to domestic cash savers. Savings in dollars lost purchasing power as a deliberate result of policy, this statement is absolutely true so how is it not a devaluation? Only if the inflation target was changed to a deflation target to correct for the past losses, and it never was.

My grandparents got 18% rates in their savings accounts during the Volcker period.

Many banks had promotions where you got free toasters and other things to move money there.

If anybody is getting 1.5% today, that’s their own fault. I get between 4.65%-4.85% with my savings accounts.

Yes, I could get slightly more by buying T-Bills directly, but this is easier, and I live in a state with no income tax anyway, so there isn’t that advantage.

” All that inflation during his time compounded and is embedded still today.”

Disagree. The expansion of the Monetary Base M2 (jumped in the last TWO YEARS by the equivalent of the entire supply in 2009) and the National Debt (from $9 Trillion in 2009 to $31 Trillion) are to blame for where we are now.

My parents put a goodly portion of their retirement savings in CD’s during the Volker period for as long of a term as they could lock in. Income from those CD’s funded their retirement as my father did not have a pension and SSI was insufficient to support them.

If one has any savings and a functioning brain cell, the higher rates can make it down to John Q Public if they pay the slightest attention and can pull themselves away from the Tiktok cat videos long enough to take action.

Will the USD drop hard against the EUR, Yen, etc.? That’s the point you need to address.

In 1967, Harold Wilson went on television to reassure the British public that the “pound in the pocket” would be unaffected by the devaluation of sterling.

I had an epiphany a few days ago regarding inflation, and it happened while at the grocery store. Of all consumer goods price increases, soda has taken the cake, and it can’t be explained by gas prices (today), avian flus, or anything of that nature.

The price of a single bottle of soda has risen from $1.99 to $3.59 over the past three years, an 80% increase.

I don’t think this can be adequately explained by stimulus or the total money supply, but purely about the improvidence of the American consumer.

Wolf has written numerous times that the stimulus from 2020 and 2021 ignited the “inflationary mindset,” which led to consumers being willing to pay asking price, no matter how ridiculous, for numerous things.

My theory is slightly different. My theory is that the American consumer has always been this way, at least for the past several decades. It’s just that the producers of goods and services didn’t realize just how much pricing power they had.

In other words, Coca Cola could have raised prices pre-pandemic as well, but didn’t realize that they could so with so little pushback from the consumer. Now they know it (as they’ve stated numerous times on their earnings calls) and are taking full advantage.

I blame the availability of credit. If people had to have the money they were spending, they’d be less inclined to pay ridiculous prices and go into debt buying things they can’t afford. I don’t know what it’ll take to break this improvidence, but I know that it won’t be easy.

This is why I no longer BUY soda or beer. Not easy to give up ,Got to draw a line in sand

Decent beer by me is 10-13/sixpack which is not vastly more expensive than it was 5 years ago.

The higher price beers are not up as much as a percentage, but beers like Yuengling have doubled.

He did not mention beer, only soda, and Bud Light will not go up in price now. Beat inflation and buy Bud Light. Be smart, not emotional with beer.

I think that is correct, and it applies to housing as well. Many folk in the millennial and Gen Z are accustomed to receiving everything they want, no matter the price. That’s how they were raised. They’ve never been forced to save or budget. And for many of them, their wealthy parents are still there providing financial support.

That doesn’t apply to all of them, but if just 20% of them are differentiated from prior generations, it will make a noticeable difference as generations transition.

I doubt anyone is going into debt to purchase Pepsi.

Assuming that’s true, whose fault is that? Who raised the Millennials and Gen Z?

The last thrifty generation seems to be the Silent Generation (people who still remembered the Depression).

Savers indeed. When my grandmother turned on the hot water tap she saved the cool water coming out first for her garden. No sense to waste water, she said.

That “pricing power” thing works just fine until their volume falls to the point where the ROI on their plants goes upside down due to a drop in production, and stonk price craters. Then it hits the bottlers, which then have to chase market share or figure out how to pay their loans and leases with pop top rings.

The snack manufacturers appear to have received the message loud and clear as the $1.97 sales on cheezy poofs are back with a vengeance.

Stopped at a local restaurant we *used* to frequent for a quick bite while running errands. Nothing fancy. A local mom and pop. Three street tacos were $17…. and a soft drink $5. The place was a ghost town. Spousal unit and I were the only customers.

A few short years ago, the fritos “big grab” bags snacks like Doritos, Cheetos, were 75 cents. Then they went to $1 and increased the size. Fast forward 5 years and they are $2.59. Wonder how the Frito Lay company has been doing in that period where they exercised their pricing power? Pepsico (frito lay) has gone from $100/share in 2015 to almost $200 today, with a slow bend upward from its old linear growth trajectory. Raising prices in excess of inflation has been a good strategy (so far).

Key operating words…. “So far”.

People can live without cheezy poofs. Just like they can live without $75,000 pickup trucks.

I’ve noticed the soda price increases too. I rarely buy soda, but occasionally enjoy a bourbon and coke. With sales tax and the deposit for cans, 12-packs by me are now about $10. The stores have specials, but you need to buy absurd quantities, like buy 3 get 2 free. It would take me 2 years to get through 5 12-packs. I’m pushing back with little effect. I’ve been out of Coke for awhile and refuse to pay the inflated retail price or buy enormous quantities. Given how little I drink I should probably just shut up and ignore the price, but I’m too Dutch. I refuse to give them pricing power.

If it’s that occasional, you’re better off buying a fountain soda from a place like 7-11 or Racetrac. Their prices haven’t really changed.

At current interest rate levels, 25 basis points has minimal effect either way. The difference between 5% and 5.25% is much less significant than the difference between 1% and 1.25%. So raising again in June will have little direct effect on the economy, but would signal that rate cuts are not going to happen. And crushing expectations of a near-term rate cut is key. In the meantime, all of this talk about rates distracts from QT, which continues under the radar…

QT at a snail’s pace when you consider how average to low income people suffer with inflation. QT seems the real driver of overall tightening in markets. And QT hasn’t really hit any meaningful milestone. We are still 4.4 trillion above pre-pandemic level on the Fed balance sheet.

I agree rates make news but they cause much less credit restriction in my opinion. Banks want to keep lending at these higher rates. They would be stupid to purchase longer term treasuries at their relatively depressed levels instead (although a default on the US debt could change that quickly).

Active QT could have started solving this inflation problem much sooner perhaps without nearly as many rate increases. Zombie companies would die much sooner without indefinite credit renewals. Most things would cool down with stricter lending protocols inherent with a reduced monetary supply. Effective loan rates would rise anyways without manipulating the federal funds rate and the discount window.

Banks cannot lend as much if:

1.) capital requirements are raised by regulators

2.) they book their existing massive losses in bonds to market value for some reason such as being forced to sell those assets (2.2 trillion was the value I saw in a recent study).

3.) there is less free money floating around due to QT.

TLDR: Increasing the Fed Funds Rate caters to the big banks in the USA at the expense of doing little to tame entrenched inflation.

QT would hurt all of the banks and the money makers and their ilk and would cause a recession in the economy more directly but would fix the inflation problem.

I’m not sure about this ‘soft-landing’ approach is feasible.

The reason 30 year mortgge rates are different than the fed funds rate is the duration. The market doesnt expect current rates to last 30 years and they wont.

That said, this doesnt mean rates will make a U turn anytime soon, rmthe way so many people would like. If they do, you should be very afraid because thats always when the sh1t hits the fan.

The fed has been doeing exactly what they said they were going to do since 2021. For some very self destructive reason, a lot of people dont believe them and have lost a ton of money, banks included

There is a huge amount of demand destruction going on behind the scenes. It is starting to look ugly.

Many workers in this inflationary spiral won’t get anything close to a wage increase that cancels out the cost increases. So bye bye to the “wants” just to stay up with the “needs”. It takes some time for this to occur as Americans today don’t spend with cash like earlier generations. Back then, if you didn’t have the cash, you didn’t buy it. And it might take a number of months for the credit card bill to finally get some attention/action.

We are living in incredibly dangerous times with respect to the financial order of things in the world. We all know that that the US has been living way beyond its means. But now, a good part of the rest of the world is fed up propping up our greedy, self-indulgent, wasteful lifestyle.

If/when the dollars come rushing home, it’s game over for the US. Powell has no choice at this point but to hold firm on trying to keep the dollar as strong as possible and to tamp out the inflation.

Its time to play America’s favorite game, “Fill in the blanks”. Wolf has provided 3 clues to our contestants to help them “fill in the blanks” for an up coming article. The winners will receive a pallet of slightly beyone fresh dated Bud Lite.

Here are today’s three clues from Wolf himself:

1) With Mortgage Rates Stuck at 6.5%, Spring Selling Season Turns into Dud by Wolf Richter • May 3, 2023

2) Fed Hikes by 25 Basis Points, to 5.25% Top of Range. Says, “Extent to which Additional Policy Firming May be Appropriate,” instead of “Pause.” QT Continues by Wolf Richter • May 3, 2023

3) Powell Swats Down Rate Cut in 2023, Purposefully Leaves in Doubt a “Pause” for June Meeting by Wolf Richter • May 3, 2023

Here is today’s “Fill in the Blanks” future head line. You have 30 seconds to “fill in the blanks”. Good luck to all of our contestants. (The Jeopardy theme starts gently playing in the background.)

“With Mortgage Rates Stuck at _______%, the________ Selling Season Turns into _____. by Wolf Richter • ______ 3, 2023”

Mr Wolfman Sir. In your opinion, could this current FED cycle resemble the FED cycle of the 70s and 80s? Higher for longer and years to go?

Inflation is the great unknown. Once it reaches this level, it just keeps dishing up nasty surprises. So I wouldn’t be surprised if we get more nasty surprises… But I don’t think we’ll see the 15%+ CPI inflation we saw back then.

If you look at core CPI, which removes some of the incredibly volatile energy and food components, it had three peaks back then, spanning 15 years: 6.5% in 1970, then dropped to 3%; then spiked to 12% in 1975 then dropped to 6.5%; then spiked to 13% in 1980. Those were the three huge waves, with large “disinflation” in between which had lulled everyone to sleep. There is a real risk of that, and the Fed is aware of it and Powell and others have discussed it. They don’t want to go through these three waves again. So they’re saying that they don’t want to be lulled asleep by temporary declines in inflation, like it happened back then. The problem is that the valleys lasted a few years, and if inflation is headed down for 2 years this time, everyone will be lulled asleep, and then it starts all over again.

THANK YOU WOLFMAN

I can’t believe the ecb only raised 0.25 when yesterday’s results showed eurozone inflation rising.

I can’t believe the ECB only hiked 0.25 when yesterday’s results showed inflation in the Eurozone rising.

Wolf, I am asking for a brief comment on what you think about this move by the ECB.

The fact that they raised, despite the banking turmoil, is remarkable. Stock markets didn’t like it at all.

That’s what they said they would do. They raised 50 once plus 75 once plus 50 three times in a row, as they said they would do, and now they slowed their rate hikes, as they said they would do.

Lots of people thought that they would not or should not hike at all today due to the banking stress.

Thanks Wolf!

Regarding the last paragraph, I think it’s more accurate to say:

“Lots of people thought they would not or should not hike at all today due to the pain it would cause to their portfolios, and used the banking stress as their pretext.

For a rate cut this year there will need to be a substantial crisis, probably globally systemic in nature. JP seems to assume the banking crisis that continues to build has been handled and the worst is behind. Many beg to differ as deposits continue to search for yield.

Not everyone is rushing into Treasuries or money market funds. MMF’s have been known to “break the buck” and even lock up (limit withdrawals) when the SHTF. I recall that from the GFC and many people got blind-sided by that. The current crop of geniuses probably don’t even know that happened. Read the prospectus statements for further details.

The point? The money I *don’t* have in my local bank goes to another bank via brokered CD’s. We have too much liquidity to sit at one bank and there aren’t enough banks locally to stay reasonably within the FDIC limits. The solution is to spread it across multiple banks through the use of brokered CD’s, and it thereby stays within the banks.

Of course, we have some funds “under the mattress” in the event that the ATM’s have “network issues”.

You are “banking” on the FDIC staying solvent. It probably will although FDIC has been acting sort of irratic lately. But CDs are no safer than Treasuries or money market funds that hold only Treasuries, maybe less so. Commercial banks are in serious trouble and if your bank fails, yes, you will likely get your CD money back. But it might take time. If fraud is involved or there are clerical-bookkeepping problems, it might take longer. As we have just seen, regulatory supervision of commercial banks leaves much to be desired. I trust the US government to pay on Treasuries more than a commercial banker to pay on anything. It’s the usual lesser of two evils kind of thing.

It amazes me people tell everyone on internet ,they have cash,gold, silver . Silence is golden ,old saying goes if 2people know a secret it’s not a secret get it

Today the shares of the medium-sized banks fall, but what did you expect if they rescued the clients and not the shareholders?

A huge gift for the big banks. Or am I wrong?

You’re wrong if you think the shareholders should be rescued.

Sorry, I expressed myself badly. I meant that the big banks get a gift

If the 60 million SS recipients can get a 5% cola this year that $1000 to 2000 a year will help.

Especially if inflation is tamed to 3% with interest rates at 5 and unemployment at 4.

Wolf,

The Treasury just auctioned $51 billion in new 28-day T-bills at a bond equivalent YTM = 5.964%.

https://treasurydirect.gov/instit/annceresult/press/preanre/2023/R_20230504_1.pdf

Yeah, that was wild. Especially since the 1-month Treasury yield is trading at 4.5%. That June 1 default date is now spooking some people, it seems. Why buy a bill that will mature a few days after the estimated X day?

Two weeks ago we were all wondering why the investment rate was 3.3% on the 4-week T-bill. Today it is 6.0%. Some attribute both aberrations to the x-date.

“For lust of knowing what should not be known,”

-The Golden Road to Samarkand.

Still no improvement in 10 years and 2 years yields.

I just saw a new headline that says “FED signals pause.” The billionaires continue their spin through their bought and paid for media mouthpieces.

Bloomberg quote today, that “the severe downturn in housing appears to be over”. Severe? Did I miss something?

I think it is strange to see some mid-sized banks “exploring a sale”. Why in the world would a bank purchase another bank including its stock when they can wait for it to fail and not have to spend the capital on stock?

Thomas Hoenig said in the WSJ on March 18, 2023 “Another Banking Crisis Was Predictable”

A second quarter 2022 report from the Kansas City Fed notes that “since year-end 2019, U.S. commercial banks increased securities holdings by $2 trillion…The increased holdings were in longer-dated maturities, extending portfolio duration and exposing banks to heightened interest rate risk.” The report notes that rising interest rates have “led to historically high unrealized losses on bank’s “available-for-sale” (AFS) securities portfolios”.

Funny thing, very few complained about the Fed overstimulating and over inflating monetary supply back in 2020 and 2021. Now those same Fed cheerleaders have switched sides by joining the Fed hater chorus. The Fed massively screwed up and now the entire country will pay the price. They should have done about 1/3rd of the monetary expansion and allowed a recession versus printing until the cows come home.

I keep saying the markets are junkies. They used to say “Don’t fight the Fed”, when money (fixes) were cheap and easy. Now that things have tightened up, all they say is “Fight the Fed”.

Looks like Federal Reserve Chairman J. Powell and the FOMC are defying the Wall Street crowd. The current US treasury yield curve is inconsistent and contradictory with the Fed’s actions. The current CD yield curve is more representative of the FOMC’s actions.

Fixed Income Rates link

https://fixedincome.fidelity.com/ftgw/fi/FILanding

Everything is “PIVOT, PIVOT, PIVOT!” today. Powell is too yellow to hammer the speculators.

I find it more interesting that the rates dropping after the “plateau” took 17 months, 6 months, and 12 months before we see a return to baseline interest rates. I had to explode the graphs Wolf provided on my iPad so forgive my crude estimates.

In light of Powell’s desire to see inflation return to 2% “over time”, I suspect it will be around 18 months from June 2023 before we see a return to pre inflationary interest rates. Meaning sometime near the end of 2024.

For someone whose lump sum retirement payout rises 10% for every 1% drop in interest rates I am no longer in the pit of despair. The despair has been based on the opposite being true with interest rate rises. Note, I regard interest rate rises as a necessary evil that is far less dangerous than inflation.

Appreciate your data driven objective article Wolf.