To shed some additional light on the jobs report.

By Wolf Richter for WOLF STREET.

In the comments about the jobs report we discussed on Friday – “Landing Got Cancelled: Job Market Still at Cruising Altitude with Some Bumps” – lots of questions came up about what types of jobs had been created, whether these jobs were mostly low-paid jobs in the Leisure & Hospitality sector or wherever, and whether “multiple jobholders” inflated those strong jobs numbers. So today, we’ll get into the jobs by industry. As we’ll see in a moment, jobs in retail, and Leisure & Hospitality, and State & Local Government (mostly educators) are still below where they’d been before the pandemic.

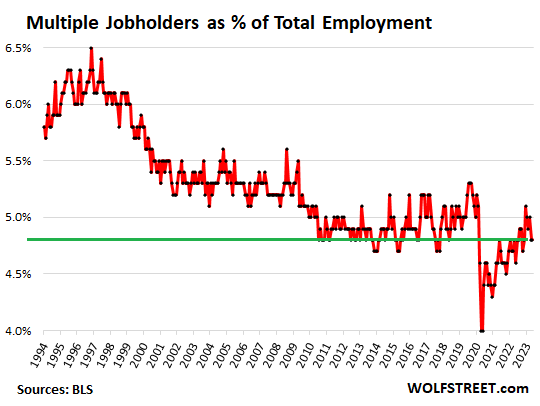

But first to the multiple jobholders. Their number fell in May by 323,000 from April. So that didn’t inflate the job numbers; on the contrary. During the pandemic, the number of multiple jobholders had plunged, but since mid-2020, it recovered and is now back to pre-pandemic levels. Compared to May 2019, the number of multiple jobholders is down by 139,000.

But the more important metric here, given that the number of overall employees has grown, is the number of multiple jobholders as a percent of total employment. It dipped in May to 4.8%, which, except for the plunge during the pandemic, is at the low end of the historical range. It had peaked in 1996 at 6.5%:

Jobs growth by major industry classification.

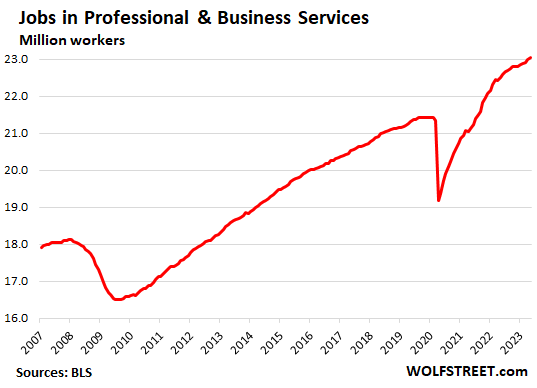

Professional and business services include Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services. Some of the tech and social media companies are included, others are in “Information” or in other categories. This is the largest sector in the US by employment and includes many highly paid jobs.

- Total employment: 23.05 million

- May growth: +64,000

- Three-month growth: +174,000

- Growth since Feb 2020: +1.61 million

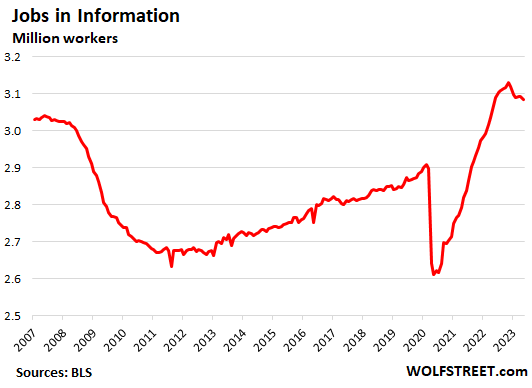

“Information” is a small sector that includes web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications. Some of the tech and social media companies with big layoff announcements are included here.

In this sector, the heat has started to fade, after a huge hiring binge in 2021 through late 2022. The number of jobs peaked late last year, then tapered off earlier this year and has now flattened out just under 3.1 million jobs, as companies are rebalancing their work force to trim off the excess in some corners and hire in others.

- Total employment: 3.08 million

- May growth: -9,000

- Three-month growth: -5,000

- Growth since Feb 2020: +176,000

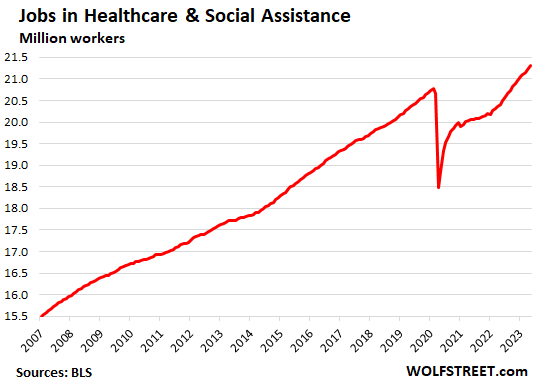

Healthcare and social assistance:

- Total employment: 21.3 million

- May growth: +74,600

- Three-month growth: +200,000

- Growth since Feb 2020: +523,000

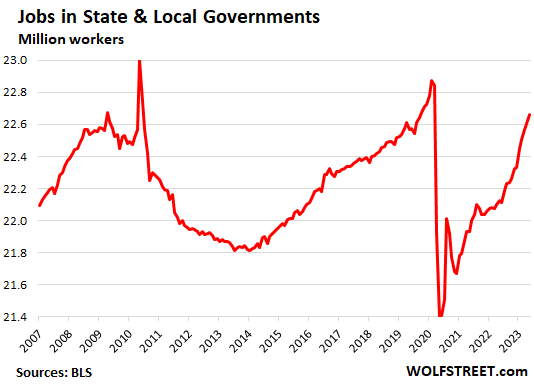

State & local government – mostly education: still struggling with teacher shortages, employment still below February 2020 levels, with 870,000 job openings, up by 52% from the same period in 2019.

- Total employment: 19.7 million

- May growth: +49,000

- Three-month growth: +134,000

- Growth since Feb 2020: -272,000

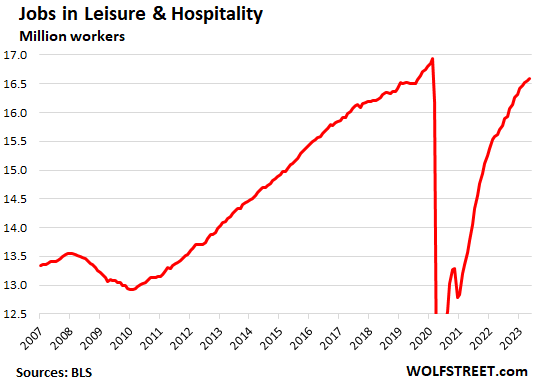

Leisure and hospitality – restaurants, lodging, etc. – is marked by often tough working conditions with odd hours and weekend work, at a relatively low pay, and so the sector has had trouble competing for employees, and it still has 1.42 million job openings. And the level of employment still hasn’t caught up with pre-pandemic times.

- Total employment: 16.6 million

- May growth: +48,000

- Three-month growth: +124,000

- Growth since Feb 2020: -349,000

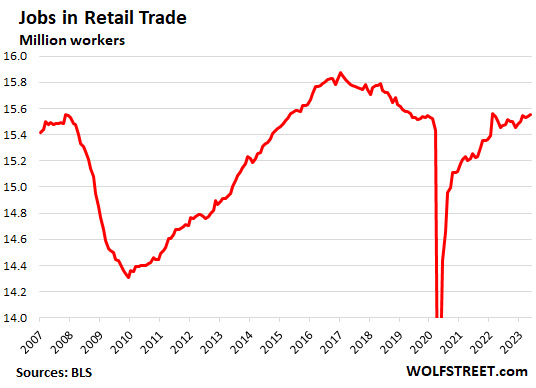

Retail trade includes workers at brick-and-mortar retail stores and other retail locations. It does not include the tech-related jobs of ecommerce operations, and it does not include drivers and warehouse employees, who are in their own respective categories. This sector has come under heavy pressure from ecommerce operations:

- Total employment: 15.6 million

- May growth: +11,600

- Three-month growth: +3,000

- Growth since Feb 2020: +31,000

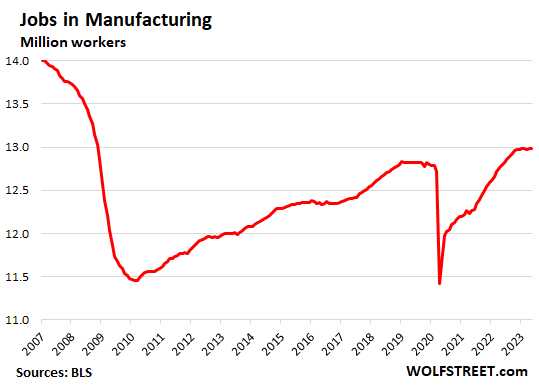

Manufacturing: job growth has leveled off, after a massive hiring binge and the highest employment since the middle of the Great Recession, when manufacturing was gutted.

- Total employment: 13.0 million

- May growth: -2,000

- Three-month growth: -4,000

- Growth since Feb 2020: +199,000

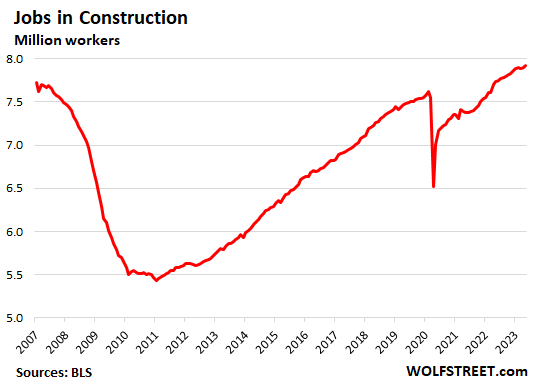

Construction – all types of construction, from powerplants to single-family housing:

- Total employment: 7.9 million

- May growth: +25,000

- Three-month growth: +29,000

- Growth since Feb 2020: +304,000

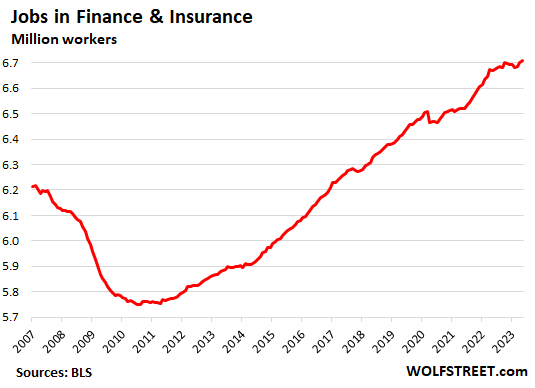

Finance & Insurance:

- Total employment: 6.7 million

- May growth: +7,100

- Three-month growth: +29,000

- Growth since Feb 2020: +206,000

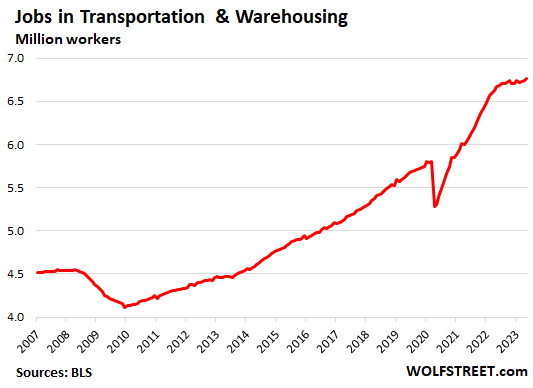

Transportation and Warehousing:

- Total employment: 6.76 million

- May growth: +24,200

- Three month growth: +44,000

- Growth since Feb 2020: + 977,000

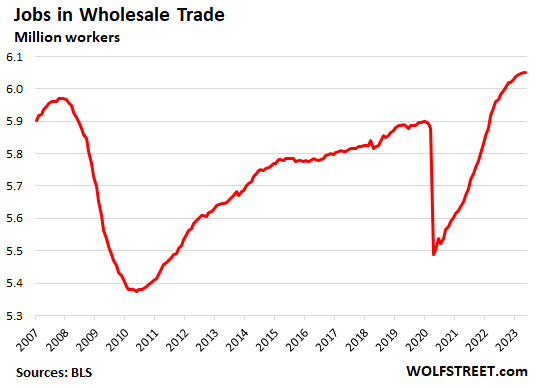

Wholesale Trade:

- Total employment: 6.05 million

- May growth: +1,100

- Three month growth: +7,000

- Growth since Feb 2020: + 159,000

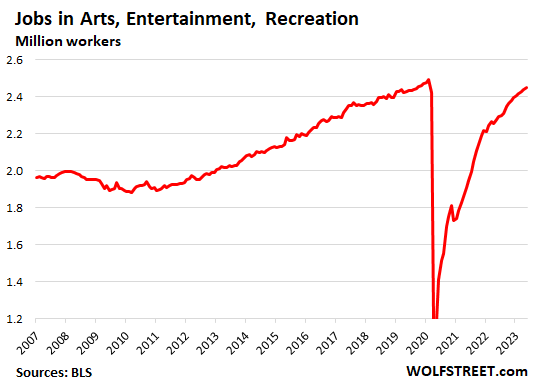

Arts, Entertainment, and Recreation, a relatively small sector that includes spectator sports, performing arts, amusement, gambling, recreation, museums, historical sites, and similar. This sector, part of which had been shut down during the pandemic, is now seeing huge demand as Americans are splurging on “experiences,” and the sector’s job openings have exploded to 233,000 openings, up by 111% from the same period in 2019. Employment is still not back where it had been before the pandemic:

- Total employment: 2.45 million

- May growth: +13,700

- Three-month growth: +37,000

- Growth since Feb 2020: -42,000

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Looks like the “data driven” Federal Reserve should have no problem continuing their fight against inflation with these robust job graphs; unless of course their commitment, integrity, and word were “transitory.”

I still don’t understand how people think the Fed is getting it wrong, but then by their own standards, spout the Fed’s dogma, that inflation and employment are intrinsically linked, with few other factors, and no good alternatives.

Personally, it looks entirely possible for inflation to come back down, and unemployment to stay lower than inflation.

In fact, it makes complete sense, that if low supply and opportunistic price setting is what is driving prices up, the more people employed, increasing supply of goods and services, then that would bring prices down, as each business is producing, and now has to compete on price.

There’s something wrong with people who look at employment numbers and think “we gotta get those back down, using the almighty power of the state” and “we have no other choice.”

We all should become believer in following wallstreet mantras after the recent30% Nasdaq rally:

1. While there was a yoy decrease in EPS of biggest Nasdaq companies, it doesnt matter. Only thing that matters is that earnings beat the lowered estimates of wallstreet analysts.

2. The 10 year remains below 3.7% despite fed rate going to 5.33%. This is proof that Fed is expected to Pivot soon.

#Sarcasm

Adding mantra 3 justifying the 30% nasdaq rally:

AI will change world and triple the value of tech companies. It has already blessed Nvidia.

#Sarcasm

Too many people are looking in the mirror to the 1970’s.

Guilty.

Christof, I agree there’s something crazy about destroying jobs to get inflation down. The way I see it is that some people have income but not much savings (younger folks) while others have savings but not much income (older folks).

If service providers raise prices on everything for a while at first, wages catch up later, and inflation is steady afterwards. At least that’s what I’m hoping!

I, too, hope that the purchasing power of my savings is destroyed!

I assume Mitry is in the younger folks camp…

@Mitry

Nothing crazy in “destroying jobs to get inflation down”, just the hard reality. I live in NYC, most of my friends have not changed their consumption habits since prices increased, and they won’t until some extreme event will cut their high paychecks.

I am on a consumer strike since I’ve seen prices for mains in normal restaurants reach the level of $35-40. I can afford it without any problem but there’s a limit to everything. The result is more eating at home, I love cooking, and a better lifestyle. Covid didn’t push me start baking my own sourdough bread, it was inflation.

Yeah. How about using the booming self storage industry as one good index for asset destruction? They are building one close to me NOW on Hwy 12 that could be a 250+ unit apartment complex like mine.

Things aren’t all black and white, except basic human needs.

Make that asset and “production” or “growth” destruction. We all know there isn’t a useful 40 hrs work for everyone right NOW. Hasn’t been for quite a while.

But Comprehensive Green New Industry sure would be.

You don’t get anywhere near the Fed’s 2% core CPI target without a recession and modest job losses. Between now and if/when real job deterioration occurs, the unemployment will rise just from people re-entering the labor market.

As a HS math teacher, I’m fully in favor of a real recession, since my job is recession proof. Everything is out of whack in terms of cost. EVERYTHING! And only a recession is going to break the stranglehold of that inflation has on the economy. Nothing less is going to get the job done. And the Fed, at least, knows this. Wolf knows it too, but he’s not a prognosticator.

You could reduce liquidity & inflation byy selling mbs and treasuries heavily which would disproportionately affect top half of 1%. It won’t cause a recession as the rest of the economy spend what they make and that would keep.consumption and many employment sectors high while reducing inflation. It would reduce stock and hoke prices which would be healthier in the medium & long term.

Switch to serial number accounting where every dollar have it s own serial number and stop issuing new serial numbers. Wait a little ans see prices frezee.

With no monetary inflation, pries can only adjust relative each other, they can not all rise.

Cristof,

The inflation is caused by fiscal deficits combined with monetization of the debt (a.k.a., money printing).

You don’t attack that with high interest rates. Better to attack that with deficit reduction and reversal of the money printing.

Solution is very simple, but the Fed fails to recognize it and is making another huge mistake, in an attempt to correct its other huge mistakes.

Why do the “mistakes” always help asset holders, at the expense of wage earners?

Good points expect that the Fed isn’t responsible for the deficit spending. That’s Congress as you well know. And WE ALL KNOW that the UniParty isn’t going to cut spending in a meaningful way anytime soon. That’s why they just suspended the debt ceiling until 1/1/2025.

Great write up, Wolf.

Congress just agreed to raise the debt limit by $4 trillion over the next 2 years. Imagine how many jobs this creates, along with all the consumer spending which is already in record territory. Think of how much will flood into the stock/bond/real estate markets. Inflation will be on a tear for at least that long, IMHO.

Many think the fed is solely responsible for the way things are. It’s more complicated than that. Congress is growing debt at $2 trillion a year. They added like $8 trillion during the pandemic. This is all sloshing around driving up prices at your restaurants, grocery stores and everything else.

Not only that, but large international corps can borrow for near zero in japan, where their funds rate is still around 0.25% . So, you can see now that the fed’s QT is only balancing out a small fraction of the excess debt.

We’re building chip manufacturers,battery manufacturers and restoring jobs . Taxpayers have to pay for this .Corporations are on welfare,so executives and shareholders get the casino payout

restoring jobs = for foreigners maybe

since current crop of tech workers NOT ABLE TO PERFORM at TCSM standards – only finding 6% of applicants qualified

surely we’ll see push for H1B visa’s

Is there an article? My Google search came up blank.

If I work as Software Engineer at a major Bank, where does that put me? “Professional and Business Services?”, “Information”, or “Finance & Insurance?”

The data from the “Establishment survey” goes by location (every business location has a NAICS code). If you work at the headquarters building of the bank as whatever, you’re falling into Finance & Insurance.

Same if you’re a software engineer working at a manufacturing plant, your job falls into Manufacturing.

If fed start selling bonds and mbs hand over fist, the stock/housing market will be down more than 50% and unemployment will be up, wealth effect and inflation will be down in no time. Everything and any other augment is just noise. Just simple fact.

I know I know but doing this is too risky because it cause disarray…. Blah blah blah….

Common people and most companies don’t go to japan to borrow. As I said too much noise.

Someone wants the inflation to be high for debt devaluation even though it means lot of people will be become poor.

Last thought, if you or any one don’t understand this, please visit places such as North west/north east states to see how much poverty had increased. Again not just going by numbers published by agencies but 10+ years ago even with gfc vs now how much homeless people you see, Just one example. Ya there are some who did great but there are also lot others who got pushed to poverty. There are lot more I can cite as anecdotal…. And this not about just an individual but lot about us as society where we are going…..

How will you explain the fact that the ECB and BOC and BoE each own a significant amount of mbs from the Fed and even sell some of them, but housing prices there are still not 50 percent down?

Rates-of-change in long-term money flows, the volume and velocity of means-of-payment money, the proxy for inflation, in American Yale Professor’s truistic “equation of exchange”, is still RISING. So, asset prices, the price level, are still being supported.

many reasons, but as an expat, living in France I see many differences. among them:

1) capital gains taxes are reduced 5%/year of

ownership(after 20 years zero tax on gain)

2) real estate transactions are fee intensive-3-

8% on the purchase price.

3) mortgages are based on income stream.

mortgages are limited to monthly payments

that cannot exceed 1/3 of one’s monthly

income.

4) mortgages are required to be insured for

death and disability which limits eligibility to

younger and healthier borrowers.

5) demographics–european populations have

on balance been in decline since ww2.

France is expensive vs USA when comparing apples-to-apples real estate, especially if then comparing against income levels.

Same as most of Europe and the developed world.

Transaction costs in the USA are in the same range. No difference.

In most major US cities, home price to income ratios are less onerous than equivalent markets in Canada, most of Europe, Australia, developed Asia.

The reason we won’t see a big reset in the US is because the market reset heavily in 2009/2010. No, it didn’t take years to correct that time either (bottom was effectively within 2 years from peak). We may have some markets contract more (California) but there will be no national house price collapse.

Truth – r u a housing shill or troll? your post has so many inaccuracies. Even wolf had in the past refuted some of your claims such as “No, it didn’t take years to correct that time either (bottom was effectively within 2 years from peak)”.

I don’t have energy to argue with an troll. Go ahead keep posting your propaganda.

And as wolf has suggested to you in the past comments, please select an appropriate screen name.

Unless you live or work in the said countries please don’t comment on things you don’t have knowledge on (as local factors etc as clearly shown by Craig post).

This comparison between US housing market with other countries housing market without taking local other factors in consideration is stupid.

Good point IMO cg:

While Wolf does his best to keep the comments generally on point and accurate, it is difficult to tell when someone is BS n if one has not been there and RECENTLY.

For example, I lived in London for a while in early 1970s, but I know full well today’s scene there is MUCH different, just by reading the Spectator newspaper articles written from and about there.

I don’t claim to be an expert like you. What I observe in my life (generation of the 70s) is that the markets in the USA and Europe are connected like jumped vessels. That is, what happens in one of the two places sooner or later also happens in the other.

How will you explain the fact that the ECB and BOK and BoE each own a significantly LESS amount of mbs from the Fed and even sell some of them, but housing prices there are still not 50 percent down?

“If fed start selling bonds and mbs hand over fist, the stock/housing market will be down more than 50%”

What if the Fed just sells a little bit of their MBS holdings?MBS rolloff has been painfully slow.

Concerned guy, I spend a lot of time in the PNW. I agree with your observation regarding the small towns especially. I drive back roads in OR and WA, and I am saddened by the state of many of the small towns. I love both states and the people. Wish things could be better. It seems like the nation’s policies, both monetary and fiscal, have enriched the rich and slammed the poor. I remember healthy small towns 50 years ago where I grew up in the great lakes region. The policies that have fueled the wealth divide today are disgusting.

Those small towns have done nothing to stay current. You can’t live in the 1950’s forever.

Apple- even if you look at large cities like Portland or Seattle, the number of people pushed into poverty or homeless has increased quite a lot over the last 10 years specially. I know that some homeless people move based on the season but my observation has been across all seasons. As SocalJon said the divide is getting larger.

Also in my conversation with the regular people (who are did well due to these Monterey policy) they have no empathy/sympathy for others (the have nots). It’s like I got mine f u. You can also see some of that in the comments section too.

Truly sad.

Many states jail their homeless, so they are kept out of sight.

Vagrancy laws….whether they call them that or not.

Besides, private prisons need income like private k-12 schools.

And everyone knows a corporation is far better for all of us than the useless government….the sooner it’s gone the better, they say.

Still don’t know how they BSd people into that one……but I know WHY.

Concerned_Guy

@Walmart and Dollar Stores effect. There are almost no more mom and pop businesses in many small towns. These were the upper- middle class for small towns and they are gone.

Maybe work from home will save some small towns by having middle class people return.

The Eisenhower Interstate highway system also trashed many of the small towns. US Route 66, which ran from Chicago to LA, was one of the prime roads for transcontinental travel. Now it’s all interstate and the small towns were bypassed. Few travelers caused the Mom and Pop restaurants and motels to all but vanish, replaced by chains located on the exit ramps. Farms were eaten up by agribusiness and many families were pushed out because they couldn’t compete.

So, yeah…. they couldn’t stay “current” because they had their legs cut out from under them in the name of progress.

Just look up the 1960 tax rate schedule……there were a HELL of a lot more than 4 brackets, topping at about 35%, like today’s.

I’m sure estate taxes either were, or would have been higher if the wealth gap was so severe as it is today.

It was because of that damned Commie Eisenhower, but the Reagan-actor’s script writers hated FDR and put us back on track for Gilded Age #2.

Please don’t waste time on the tax deduction argument BS…….it’s worse now.

…make that ONLY topping out at 35%…like today’s…

If you want a good picture, I remember the houses in our middle class subdivision assessed at $12K in 1960. Most everyone worked for huge Kaiser Steel mill.

SWING AND A MISS!!!

There were 26 tax brackets in 1960… topping out at 91%…

you read that right… NINETY-ONE PERCENT!!!

Which is why noted fiscal conservative John F. Kennedy passed a tax reduction law lowering the top rate to 77% in 1964 and to 70% starting in 1965… to which Ronald Reagan two decades later said, “Hold my beer.”

https://taxfoundation.org/historical-income-tax-rates-brackets/

Spencer, how do you make the extra black words?

It’s the ONLY thing I see of value in your post….other than making my usual point about creating needless destructive human planetary pigs and the beginning of the need for deficit spending to pay for said destruction….which everyone (especially at this website) KNOWS is bad and causing one problem after another….not to mention the ongoing destruction.

And thanks for making my usual point…..though likely too late.

Just wondering…you weren’t stupid enough to think I said 1960 taxes topped at 35% were you…..you seemed so overjoyed at proving me “wrong”.

Well, thanks again for doing that research work for me, anyway.

Yes that is EXACTLY how I read it. If you are now saying that you meant to say that 1960 tax rates did NOT top out at about 35%, like today’s… then you left out a pretty important word.

Be that as it may… the bigger picture is that the economic growth of the 50s was petering out. The five years preceding Kennedy’s tax cut proposal had seen GDP growth below 3% whereas it had averaged 5.3% from 1950 to 1955. The DJIA had barely budged In Kennedy’s time… after exploding upwards under stodgy old Ike. Inflation was going up… and so was unemployment. JFK needed to goose the economy and so he did.

Unfortunately he just tinkered around the edges of tax cuts. As a result the next 18 years were a stagnating economy. The DJIA dropped by TWO-THIRDS in that time span (as negative as most WolfStreet readers are about today’s economic environment… they would jump out windows if that happened to them). Jimmy Carter didn’t CREATE the economy that got him tossed from the White House… he INHERITED it.

It took Ronald Reagan (the first elected President with a college degree in Economics) to come in and slash the top tax rates down to 28% (and just TWO tax brackets) to transition the economy from relying on failing “conglomerates” (like Kaiser) to the “entrepreneurial” juggernaut that it has been in the past 40 years.

-The DJIA was at 3300 when Reagan took office… and is at 33 THOUSAND today.

-Inflation has been (until recently) a non-issue since Reagan left Volcker alone to bring it under control

-Unemployment is the one thing that seems to defy being tamed… some years it is above the “Natural Rate” of 5% and at other times it runs for years below it (bringing the whole idea of a “Natural Rate of Unemployment” into question). But the same was true before Reagan arrived… so there is that.

And oh yeah… let’s not forget that Reagan saved Social Security for 40 years AND brought us the indexation of tax brackets to the inflation rate. He basically created the economy we all live in today… not bad for a President whose critics could only think of as a washed up actor.

Interesting delusion.

Think I’ll just trickle away from this interaction, remembering Twain’s words on who not to debate……please excuse me.

Chuckle.

As a guy born and raised in Michigan, who now lives in Bend, I couldn’t agree more.

Fascinating that of all the charts, “Jobs in Finance and Insurance” was the only classification that didn’t see payrolls get whacked. Even government employees saw declines of 5% or so; every other group was down over 10%. Some of them dropped so much that you have to guess where the bottom was, because they literally dropped off the charts.

It may seem like the headline numbers are strong, and pundits scratch their heads as to why the Administration isn’t polling better for handling of the economy. Don’t know what world they’re living in, exactly: do they not know anyone who lost their retail or service business? Or had their hours cut from 60 a week to zero, for over a year? For all the great numbers being posted lately, unless you’re in the FIRE industries or a government employee, all of them are below the trend lines that were firmly in place before 2020.

“…unless you’re in the FIRE industries or a government employee, all of them are below the trend lines that were firmly in place before 2020.”

Nah, Look at the charts again:

Below 10-year trend: Government, Leisure & Hospitality, Retail

Above 10-year trend: Professional & Business services (the biggie, highly paid jobs), Construction, Manufacturing

Also note that Government, Healthcare, Arts, and others are still having trouble FILLING jobs. There’s still a labor shortage! You can check that out here.

I know a bunch of folks who lost their businesses and jobs. But that was in the prior administration, not the current one.

Continue to rewrite history to suit your narrative.

How do they figure out if someone is a multiple job holder? I’ve been over-employed for over two years, and don’t share this with anyone as it could be grounds for termination.

This goes via the household survey. It’s a survey that goes to about 50,000 household. We got one of them a few years ago. Lots of questions on it.

I’ve been looking at the BLS site and my eyes are going crossed. I’m having a really hard time making sense of this – esp the 339,000 jobs created and this:

“The unemployment rate increased by 0.3 percentage point to 3.7 percent in May, and the number of unemployed persons rose by 440,000 to 6.1 million. The unemployment rate has ranged from 3.4 percent to 3.7 percent since March 2022. (See table A-1.)”

How do we reconcile this? How do you create that many jobs and have 440,00 more people unemployed?

Not a mystery. By formula, the unemployment rate = number of unemployed as a % of the labor force (working plus looking for work). Both increased in May, and so the rate jumped. I discussed this in the prior article, with charts for the labor force and the unemployed:

https://wolfstreet.com/2023/06/02/landing-got-cancelled-job-market-still-at-cruising-altitude-with-some-bumps-even-wage-growth-for-nonsupervisory-workers-accelerated/

Be careful, there is an equifax system that has paycheck information in it. End users I believe can have their data removed but unclear if employers continue to get access.

Planned layoffs for the first 5 months of 2023 reached 418K. In

the tech sector announcements (not actual layoffs) reached 137K.

Layoff announcements spread like cancer. Last year total layoffs announcement reached 364K.

Banking : 37K. Media : 17K.

AI puke puke workers.

ME,

On the subject of AI, I would consider it an honor (from an institution here such as yourself) if you would comment on Moravec’s Paradox. You might find good material.

Very sincerely, NBay

1) Great charts. Well beyond the scope of M/M, Y/Y, or since

2019.

2) Most jobs are in Professional & Business Service. Most layoff

announcements are in high tech and finance, The high tech sector might rotation to mfg and the health sector to support AI, to enhance productivity.

3) In the banking sector : the Non Interest Bearing (NIB) is down, but so far retained earnings are up, at least for some, including the regional banks. Retained earnings is #1.

4) SPX 3M : if Apr (Apr, May, June) close < Jan 2023 high (Jan, Feb, Mar) we might get a trigger for "correction".

Where is transportation like truck drivers fit in? What about gig employees like uber?

Transportation and Warehousing. I didn’t include it for some reason, now updated. Thanks.

Great work as usual Wolf!

Answers many questions with the details.

Looks like many categories are heading back to long term trends, some slower than others.

Gonna be fun to watch and see if this FRB and Congress will be able to pull off a soft landing, as opposed to my experiences in the various slow downs, recessions, etc., since 1956-57 when dad had NO WORK for six months, almost to the day.

Gotta admit that we are waiting with bated breath to see if we will be able to buy treasury bonds, etc., at the rates, or at least close to what they went for in the early 1980s…

The charts are beautiful and put everything in perspective.

There’s a gigantic shortage of workers in health care. Massive.

Can confirm. Churn rate is crazy high. This is only anecdotal, but speaking strictly from a hospital perspective, it’s hard to keep staff and hire staff in ancillary departments when your competition is Target, Walmart, and so forth. Why turn patients and change poop when you can work elsewhere for a happier/better wage.

If only there was a way to compete for those employees….

That’s C suites pay grade decision stuff…..I sure have no ideas.

I wonder what impact the traveling nurses have had on staffing stability?

I can tell you; right now, none. Staffing stability has just gotten worse but it has moderated over the last year. It’s going to remain unstable fore the foreseeable future though. It’s estimated that since Covid, 20% of nurses have left direct patient care or left the field altogether. This is for a variety of reasons: some have taken early retirement after years of feeling underappreciated by upper management and subpar working conditions, other nurses left direct patient care to do other clinical roles; here in California many nurses have left because of the cost of living and mandated covid boosters.

There have been several reasons why there has been a huge decrease in the number of nurses and hospitals can’t hire/retain nurses for long enough. Unless you run a hospital where you are the top tier of pay, you likely have a high churn rate in staff who leave for better opportunities.

In the last twelve months or so there has been a drastic drop in the need for travel nurses but staff needs are still elevated from pre-pandemic. Travel nurse companies are not expected to have their revenue revert to the mean of pre-pandemic levels either and travel RN companies now have a secular tailwind. Also, current staffing needs are being fought back against from hospital CFO’s who have tightened the budget due to pandemic era funds expiring and the higher costs of capital associated with higher interest rates. So, staffing is currently strained and this cycle usually plays out every few years or so with CFO’s eventually giving in because they can’t operate without sufficient staff and they need to pay up for travel nurses.

1) Mfg : real wages are catching up with 1973 high. Mfg jobs are flat

above the 2019 plateau, well below 2007 and US, Canada and Mexico NAFTA agreement highs. We are in China & Mexico pockets.

2) XLI made a rd trip to 2020 high, but failed to close few gaps below.

3) XLI weekly BB : May 10/17 2021, 106.81/100.67. // Fri (C) : 100.94.

XLI moved inside after building a cause. Fri demand bar gap up on a huge vol above dma50 and dma200. That’s bullish. Example :

4) Ingersoll Rand 1W : Jan 3 2022 hi/lo, 62.64/59.11. // IR closed inside > May 15 high. That’s funfunfun.

5) IR channel : Aug 15 to Nov 14 2022 to Mar 6 highs. Parallel from

Sept 2022 low.

6) Speed : half a year down to Sept 26 low, a year of rolling hills up.

I live in Florida, and we have some of the worst numbers in education all around. We have an often elderly population who retired from out of state here, and they have no desire to “pay for other people’s kids”. Our starting teacher pay at one point was the lowest in the nation, even lower than Mississippi’s. So our ever inspiring governor sponsored and passed legislation to move Florida’s starting teacher pay to be about mid-range in the country. Unfortunately, not being the best at employee relations, he didn’t expand the more experienced teachers pay commensurately. So some new teachers were coming in at higher pay than folks who’d been in the force for 5 years.

Worse, he didn’t want to raise state taxes to pay for it, so he just required local County governments come up with the money. Which meant that they had to make massive cuts in maintenance to make up the difference, or take a beating for raising taxes.

Teachers are leaving in droves. Classrooms are out of control. Parents are ticked off and thrashing around trying to figure out where to lay blame. My daughter and daughter-in-law have both quit, one is now a stay at home mother, and the other got hired by a book publisher for double the pay she had been making. Both commented how they got into a groove as workers, and preferred to complain than go somewhere else, which is what most people do. Once they felt they were forced to look for something different, they found out just how much better life could be. And they’re not going back. I’m betting that’s a common feeling among working class folks and a big cause of our labor shortage.

With WFH, cost of day care, and quality/direction of public education,

home schooling has taken off in my area.

In the past our state used to allow these ” elderly” retired to teach in

public schools. Maybe time to revisit with the current shortage.

As an “old folk” that doesn’t live in FL, I am of the opinion that no one with an IQ larger than their shoe size would choose not to invest in education.

However, one must be clear what “education” really means – and it’s not solely available funds, but more the mis-allocation of them. Much of the money in educational budgets goes to the ever increasing “administration” expenses and never gets to the classroom where it belongs. I don’t know how old you are, but if you think back to when you were in high school… how many administrators were there? How many “deans”, assistant principals, counselors, etc., ad nauseum were there? Compare that to today’s number and you’ll see where the money goes. Most school districts are “local rule”. It’s better to mount your challenges there than waiting for the governor or president to act.

Then there’s the “sports” stadiums and coaches salaries. I’ve traveled through TX and when I see the monstrous football stadiums at some podunk high school, I have to scratch my head as to where their priorities are.

It also must be noted – from the spouse of a retired educator – that teaching is a passion, not a path to riches. My wife taught honors English in suburban Chicago (Hinsdale) for several years. She retired to raise our son and, subsequently, our daughter. She put the same passion into teaching our kids and supervising their studies as she did in the classroom. She – to this day – still gets cards and letters from her ex-students thanking her for kicking their a$$ to excel.

I know, firsthand, the hours that a good teacher spends on curriculum development, lesson plans, preparing for parent/teacher conferences, grading papers (hard to computer grade a composition), making constructive comments on a student’s work, meeting with students after school to help them achieve their potential…. but, even then, in a relatively affluent school district, her hourly pay (contract pay divided by actual hours spent, not just classroom time) was less than she could have made at McDonald’s serving up french fries. However, she wouldn’t trade those experiences for the world.

In our experience with our own kids, we also know what damage a lousy uncommitted “teacher” can do to a child. The world is better off when those people go somewhere else to spread their toxin. If you’re unfamiliar with the song “Flowers are Red” by Harry Chapin, those lyrics are a good example of what damage a lousy teacher can do.

As the most quoted from book over a decade said: “The mind has an enormous capacity for error, self-deception, illogic, sloppiness, silliness, and confusion. All of these tendencies tend to be diminished by training, and that, of course, is the function of education. – John Gardner

EK,

Agree 100% with everything you say, my spouce is also a teacher (middle school ELA).

Frustrating that admin is such a black hole for funding while not actually supporting teachers thr way they should.

Same here EK, good comment.

Sister taught MS English.

Was also on board that dealt with Social Studies textbook content/complaints. Was on cover of teacher Social Studies mag with Lynn Woolsey. (taught FT the whole time, though). Endless energy…..no idea where she gets it.

Told me some funny stories about groups that paid a LOT to get their 2 cents on the agenda. The one I recall now was from a group of Indian-Americans who wanted all references to the caste system removed, as it reflected badly on their community.

When she went to Sac I jokingly referred to it as a “book burning” session.

Hard to please everyone….makes democracy a bitch…..but look at the alternatives.

I believe the teaching profession is one of the most important jobs that we could invest in. Teachers are the role models for our future generation of leaders. Unfortunately, as my past experience can attest to, most of the teachers I had in high school were completely incompetent in their profession and nearly destroyed my interest in learning. At the University of Wisconsin, where I graduated college, the education department had the students with the worst academic records. Need I say more.

Maybe learning, but taught you top notch creative writing.

Know the song well. My former employer also had the same “that’s just the way we’ve always done it” attitude toward things. Utterly demoralizing to those of us who gave a damn about our jobs.

Go Red Devils! (Small world :)

Kent,

What you describe is what happened in Illinois. The state mandated so many changes we lost our small school many years ago. Our son was in the last groups to graduate. Our daughter was in the first group to transfer to a larger district. This was the only solution as our school tax rate was the highest in the state. We wanted to keep our school. To entice the change the state absolved our debt when we transferred.

Our daughter and her classmates were better educated and more rounded than those in the larger district. They had the credits to graduate and found they had to only attend a half day so applied for part time jobs. Where the larger district students complained as our kids were being hired as they were more qualified. A direct result of less students per teacher and a more rounded education.

What I’m attempting to stress here is Florida may be on the same path as Illinois took many years ago. We are now deeply in debt and corrupt as a state. We are losing population and jobs at an alarming rate.

Our current property tax rate is in excess to what we had before the school transfer. So the county has increased taxes to handle the mandates.

All of this is anecdotal as I won’t dig out supporting data. It is what I remember during those years.

Much of education deteriorated further with the state competency tests. Teachers started “teaching to the test” as it impacted funding and teacher evaluation. However, it obfuscated the fact that the kids weren’t learning, but were merely parroting.

On another note, we moved from CT to OR in 1996. Our kids went to a public school in an upscale suburb of Hartford. When we arrived in another upscale suburban school in Lake O, OR, I came home to find my daughter (who loved school and was an exceptional student) sitting in her room crying and telling me how she “hated school”. Those words had never left her mouth up until that day. Her complaint was that the books and curriculum in the OR schools were two years behind her present grade in CT (she was in 8th at the time). She had already skipped a grade and was an early admit to elementary school. She was all of 12. They tested her and found her ability to be that of a high school sophomore in their world…. so she went into high school at 12. Graduated high school at 15. Went to University of Oregon on a scholarship and turned 16 in a dorm – as a sophomore due to her AP classes. In retrospect, we let her “grow up” a little to fast and she missed out on a lot of the emotional growth a young woman should experience. The point of all that rambling is that all “edjumacation” isn’t equal, despite per student spending and school budgets. The OR school had a higher spend per student, but produced an inferior product.

The entire US educational system produces a inferior product compared to school systems in other countries.

And at higher levels it produces lots of educated idiots as a result of having idiot educators at the university level.

Imagine being taught by someone like Elizabeth Warren who gets paid multiple hundreds of thousands of dollars to spew nonsense.

Kent,

I home schooled my son using the Florida Virtual School home schooling program. It is free for residents and the best thing I ever did was not to put my son in public school. This program uses teachers who live all over the country to “monitor” the students. Many of those educators are not Florida residents and your tax money is going to them. The teachers all work from home or anywhere there is wifi.

BTW, I loved the Florida Virtual School program. I believe out of state people can pay to use it if they are not residents of Florida.

AI will fix it. One robot teacher and one security guard.

Right, Lisa. Let me elaborate: the robot teacher teaches an entire nation simultaneously, and the security guard is also a robot. Infinite improvements in productivity and safety. But what’s the curriculum? And who is it for?

Yes – this!

“Welcome to Elysium” .. in my best johannesburgian accent…

But how could he keep trumpeting no state income tax if he didn’t cram it down the local government budgets instead?

Seriously, this whole “no state income tax!!!” Thing is deceptive advertising. State income comes from 3 things: income, property, and sales taxes. If a state has low taxes in one category they’ll generally have higher taxes in the other categories to make up for it. there’s no free lunch. In the end, the actual percentage of a state’s gdp that is extracted as taxes (the way that economist’s actually measure a state’s tax burden) is surprisingly similar among most states (there a few outliers)

For example, Texas has no state income tax but has high priority taxes. California is the opposite. Thanks to prop 17, property taxes are low so income taxes are high to compensate.

I’m not a Florida resident but in this case, you get what you pay for. Flock there for the low taxes, then wonder why the schools are crappy. Buy a “cheap” house but then pay out the wazoo for home insurance. Again, there’s no free lunch.

I have always questioned the ability of our government to detail employment numbers down to 4 signficant figures.

Employment changes in the 1000’s for a work pool of 7 Million?

Household survey sent to 50,000 people; huge room for fudging there.

I don’t dispute the trends (particularly looking back), but I take any movement at these lower levels with a very large grain of salt.

Maybe I’m wrong on this, but my doubts persist.

Finally, with regards to employment overall. My on the street observations is that it is holding up. There are jobs everywhere. That’s really not the big issue going forward. It’s what people are making relative to the impact of inflation. That is having a grinding down effect on consumption.

Construction workers, both the craft and the staff managing the craft, have the most power in decades. Pre COVID, a new Civil Engineer graduate would come on board for $60K per year. In about 2-3 years, they would get a company vehicle. Today, we’re having to offer $75K plus a company vehicle just to get them to THINK about coming to work for us. This is in DFW.

On the craft/trades category, we would hire carpenters at $18 per hour pre COVID. Today, it’s $25 per hour and they expect 15+ hours of OT per week otherwise they quit and are working for someone else the very next day.

With that, we are less productive which translates into needing MORE workers which exacerbates the problem. The workers have the power, and they know it.

The workers always had the power ,now they just enforce it. By the way you never stated your salary ,scared

Back in 2009 after the housing crisis hit, workers had zero power. Unions gave big concessions and we instituted a hiring freeze. The power shifts, as it should. It keeps the system in balance.

Nunya,

Carpenters buy a 50K/70K vans, while new single family constructions are down and the multi might flip to beyond peak.

Preserve capital.

Wolf, anecdotal here: I’m in information technology, ~30 employees in my company. I just went through the process of hiring 4 new staff for expansion.

Plenty of candidates in the pool, and a few very clear trends that I noticed:

1. Those job hopping were generally being very poorly paid/entry positions: $35k – $45k where we’d be offering $55-$72 for the highly skilled ones.

2. A number impacted by tech downsizing (Salesforce); I’d say that at least 50% of those impacted by downsizing were cut for good reason: deadweight.

3. This round of hiring I found far fewer unrealistic salary expectations that I did when hiring in August 2022.

4. Two of the entry level positions actively told me they were looking for in-office opportunities, NOT remote. Both that I hired had worked fully remote and were / are entry level, and both felt that fully remote was alienating, and stunted their opportunities.

Take the anecdotes for what they are, but this round of hiring was markedly different from when I hired in May and August of 2022 and 2021.

I never understood how those who were committed to remote work exclusively could possibly expect any kind of career growth. Work is not just what you produce but building the connections and having the social interaction that have people think of you for opportunities. In my mind, not having any relationships and only being a remote “droid” can severely limit advancement.

But that’s just me. (By nature, I’m an introvert. However, the only time opportunities appeared was when I overcame my default position and put myself out there.)

Yup. WFH is an unfortunate thing. It seems like many companies are shifting away from it. Hopefully it will join shag carpeting in the graveyard of bad ideas.

Part of me thinks the real reason for the drive to return to the office is for old men to have pretty young girls to look at again.

Social John: Where is the “Graveyard of Bad Ideas” located? We have some ideas here that should be laid to rest. Sweden’s “Museum of Failure” was our first thought, but that’s going to be an expense getting there.

Maybe that idea should be buried, too.

Depends on what you mean by a “career”. And not everyone is interested in “advancement”. I started my small tech company in August, 2006 and we’ve been all remote work from the beginning. Also, no debt and profitable every year. Employees are hired and retained based solely on work ethic and performance. I don’t care where or when you’re working, or how many hours, or how much time you take off. The only thing I care about is that the work gets done on time and the customers are satisfied. Good people seem to respond well to this approach.

As far as career “advancement” goes, my employees occasionally get approached with employment offers by big tech firms [who routinely ignore non-solicitation clauses in our contracts] so it would seem that all-remote work experience does close those doors.

But you’re a “small” and likely don’t have office space in a downtown San Francisco or Manhattan high rise.

My son works in a similar environment as you describe. It’s sort of a “land of misfit toys” as he, his co-workers, and the principal are all unlikely to thrive in a traditional corporate environment. However, they kick butt doing what they do because of their being the individuals they are. Imagine what working in an organization of Asperger’s adults might look like. However, the principal is also of the same cut of cloth and understands the needs of these people and how awesome they can be when turned loose. They get stuff done because they work at weird hours to suit their personal preferences, not a clock on the wall.

Thanks for answering the questions about that report for us. You do a great job Wolf.

In TX 3 teachers for every seven/eight babies 1Y and under, 3 or 4 teachers for eight kids between 1Y and 3Y… multi classes, multi kids, multi teachers. Mamma can work and pickup her kids. Schools are good, the cost is very reasonable.

American schools in foreign lands are different story. For the same age group in UK, China, Arab countries… each kid cost about 40K/y. Three kids ==> 120K/Y. Co support are subjected to local taxes.

The cost is very reasonable in Texas…if you can stomach paying property taxes of 7000 per year on a house you bought for 195k. No thanks to that, and the dreadful climate too.

Stereotype much?

I pay $3600 on $300k ranch house and $256 on my large agricultural acreage in North TX. So it mainly depends on the location and school district. And the TX government is currently working on reducing (or eliminating) property taxes in special session.

And there are three months of heat in the summer but with A/C and pools it goes by fast.

Hi Wolf the charts here is very insightful. It’s strange that Information Services has barely grown from 2007 to 2023 while US real GDP expanded by 30% from 2007 to 2023. This only means this sector is operating at full efficiency and unlikely to lay off further. Most of hiring from 2007 to 2023 seems to be in Healthcare and Leisure. This doesn’t bode well for those sectors if the US debt growth is reduced going forward.

Are the software engineering jobs under Professional and business services category or they are under Information services? Wondering which sectors will be hit most in next recession??

The Federal Reserve’s policy to shift wealth from wage earners to asset holders has been a terrible injustice, similar to a back door theft. For decades, wage earners trying to save for retirement or save for a down payment were continually flogged with repressed interest rates and wages, QE, and artificially propped home prices, which still continue today.

What good is a job if you’ll never afford a home, education, or retirement on wages that are paid. All the freebies have been given out, asset prices have skyrocketed, and we have 5-10% inflation. People entering the job market today are facing the highest cost of living in many decades, thanks to the Fed’s wealth giveaways to today’s asset holders. The affordability of a home is roughly 50-60% of what it was just a few short years ago in many markets.

The Fed needs to correct this injustice. It can start by aggressively selling MBS on its balance sheet, which never should have been purchased in the first place because of the distortions it creates.

It doesn’t matter the slightest bit of a hoot who owns MBS instruments or whether the Federal Reserve owns them all or none of them. Moreover they are only comprised of low-end ‘conforming’ housing mortgages and are self-liquidating securities.

Bobber

Asking Government to fix a problem it created?

Fed along with other politicians won’t do anything of this sort unless we have revolution like France.

This is all happening by plan

Yep, houses have become so unaffordable that people are buying properties here which contain major defects in location and quality of life. Like a house with a freight train running through the backyard. Another one with the equivalent of the SFO “Tenderloin district” right across the street from the high priced condominium project. There’s a house in the suburbs near me that sold in just a few days even though it was the site of a grisly murder of the entire family in there a few years back. It’s getting ugly out there. This will not end well.

I directly know at least 4 people who don’t work very hard. They leveraged into rental properties and live off the rent. Occasionally they sell the property they live in, pay no capital gains tax. I guess this the sort of economy the fed wants. Most people aspire now to be landlords and RE investors, reap all the tax benefits and fed policy benefits, and not contribute anything beyond that to the economy. God forbid the fed sell any of those mbs. If I personally know 4 people…this phenomenon has to be very wide spread.

I know a guy that has been trying to buy a home for his family for 8 years. He thought prices were too high back then, and he wasn’t willing to risk his family’s financial future on overpriced housing, thinking prices would come down to trend line. He never expected the government would ignite home price increases of 10% per year for a decade or more, or 10% rent inflation. He’s being forced out of the area, and he just found out his kid has a major health issue.

He’s ready to head into Washington DC with a flame thrower.

Bobber

Bring him here. He will fit right in.

Hard to believe this isn’t what the fed wants. Manufacturing economy destroyed, replaced with a rent seeking and speculator economy – rewarding those who are willing to leverage themselves the most. People don’t even do maintenance or improve their homes anymore but they expect 100% gains on their leveraged purchase from 3 years ago with no capital gains tax.

What the fed has done is criminal and should be punished.

I know a lot of people like this.

Real estate is like religion in southern California

People believe thst it does not go down in meaningful way and thru have been right for last 12 years or so.

Good old-fashioned grassroots mom-n-pop landlords — as American as apple pie or Donald Duck.

I know someone in the UK who immigrated there from India. Works for a tech company, but his real goal is just to move to the USA to buy a bunch of places to rent out. If you got nothing to lose and can escape then it’s easy to take on a crazy amount of risky loans and roll the dice.

Needs laws to prevent hoomers from collecting homes, no corporate SFH ownership, no foreign ownership of houses by non-citizens.

1) WFH, pcs workers, get paid for their job, no matter how

long it takes, as long as it’s done on time and in a decent performance.

2) Some get 5/10 cent/job, others get $50/$500. They might work

for one co or have multi co. The pyramid above these workers is low. Owners provide minimal support.

3) They can transfer data and switch loyalties for higher pay/ more pcs work promises.

4) Entry levels are useless. They need schooling. They have to work in the office or the shop.

Was self employed since 20 years of age. Always thought small business was the economic engine of America. Just an old fool I guess.

R_M, way to say it dude

Wave of defaults looming – Deutsche Bank

A cycle of boom and bust will return this year and a wave of corporate debt defaults is imminent, particularly in the US and Europe, Deutsche Bank has warned.

According to the bank’s annual study released on Wednesday, defaults by companies will become more commonplace compared with the last 20 years.

Deutsche expects default rates to peak in the fourth quarter of 2024. The bank projected peak default rates to reach 9% for US high-yield debt, 11.3% for US loans, 4.4% for European high-yield bonds, and 7.3% for European loans.

The estimated US loan peak default rate is a near all-time high, compared to a peak of 12% during the 2007-2008 global financial crisis and 7.7% during the dot-com bubble in the late 1990s, the study showed.

Aggressive interest rate hikes by central banks, including the US Federal Reserve and the European Central Bank as they continue to fight runaway inflation, have raised global recession risks, Deutsche warned. The EU’s largest economy, Germany, has already entered recession.

“We suspect the next recession will be the first since the US tech bubble to inflict more pain on credit markets than the real economy,” experts cautioned. “Corporate leverage is elevated. And global credit markets derive more of their revenue from manufacturing and the sale of physical goods than the real economy at large,” they concluded.

Wolf – What is your theory of why “Retail” jobs are having such a hard time getting back to previous peaks? Even “Arts, Recreation, Entertainment” has come back to peak much faster than “Retail”.

Have the corporations figured out that they can run with skeleton crews after the pandemic gave them a trial run?

Is tech the reason, self-checkout, better inventory management systems, etc?

Is it Amazon “online” taking jobs from brick and mortar stores?

TBH, I’m surprised that there are STILL THAT MANY retail jobs, after all the bankruptcies we’ve had as part of the brick-and-mortar meltdown.

Ecommerce is killing big sections of retail, which I’ve called it the brick-and-mortar meltdown since 2017. I have covered dozens of huge retailer bankruptcies such as Bed Bath & Beyond.

The tech, warehouse, and delivery locations of ecommerce are not considered “retail.” They have their own categories.

Question 1: Does the “Retail Trade” category include grocery stores? If so then there is a baseline there that e-commerce can’t really punch through.

Question 2: Are the “huge retailer bankruptcies” really complete yet? I went to a local BB&Y recently and they were busy as all get-out. Gotta keep their employees until they for real shut the doors.

Question 3: Have you done any research into how strip malls and retail centers are being utilized these days? I know you have looked into converting office towers (and the difficulty in doing that). But when I pass by most retail centers there don’t seem to be many empty store fronts… however, there do seem to be enterprises in there that I wouldn’t have expected to see 20 years ago… churches, day care centers, urgent care clinics, etc.

Good questions. I’m going to answer them in an article for all to read. This is a topic close to my heart.

All the older strip malls in my area of Seattle have been converted to apartment buildings, with some small retail on ground floor.

State and Local Gov, our invisible dictators, up from nadir to 22.7M, on the way up to become #1, to exceed the shrinking Business and Professional Service.

The best way to cut US gov debt is to shrink this sector. Those bureaucrats rule this country, have more power than the president and congress combine. But the trend is up on the way to 25M/26M,

recharged by a new generation that replace the old, with new blood

My hunch is that the proxy war in Ukraine is being waged to protect the connected in the U.S. from having their wrongdoing exposed.

This isn’t a war with “NATO”. Ukraine isn’t a NATO country. It’s a “Let’s get ’em….. Here. Let me hold your coat!” kind of war. Lots of money to be stolen. Lots of money for the military industrial complex to make. The Ukrainian people are merely the canon fodder.

How does a comedian end up with a net worth such as he does? Think about it.

What a bunch of low paying jobs? We exported all our manufacturing. 13 million manufacturing jobs, isn’t even 1% of the work force.

Wealth is Manufactured NOT Imported | Every $1.00 Spent In Manufacturing Adds $2.74 To The Economy (NAM data)

Manufacturing is the most important, and the highest-paying sectors of any economy.

Manufacturing is a true measure of a nation’s wealth, and it is the backbone of all Middle Class.

Under the Derived Demand Doctrine, for every manufacturing job created, there is on average an additional 3.6 jobs created elsewhere – no other economic sector comes close.

The US is still the second largest manufacturing country in the world, far larger than Germany, Japan, and South Korea. Manufacturing today is automated: far fewer jobs, but far more skilled jobs, many tech jobs.