The dream of a return to QE was fun while it lasted.

By Wolf Richter for WOLF STREET.

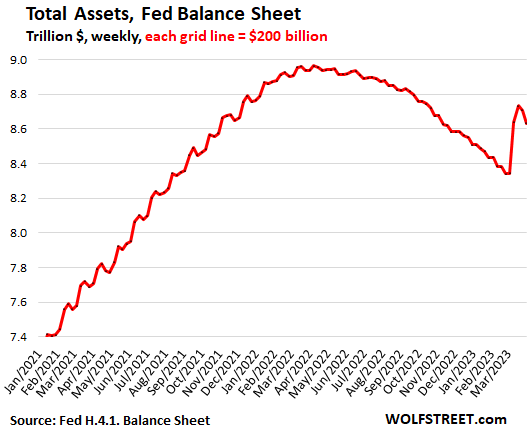

The Federal Reserve’s balance sheet plunged by $101 billion in two weeks – by $74 billion in the current week and by $27 billion in the prior week – to $8.63 trillion, as quantitative tightening (QT) continued at the normal pace and as banks have started paying back the liquidity support offered by the Fed when Silicon Valley Bank and Signature Bank collapsed, and a week later when, under pressure from Suisse regulators, Credit Suisse was taken under by UBS.

During the last post-meeting press conference, Powell explained this new regime – the distinction between ongoing tightening and brief liquidity support for the banks, and that both can run simultaneously.

Looking at it with a magnifying glass to see the details of the past four weeks:

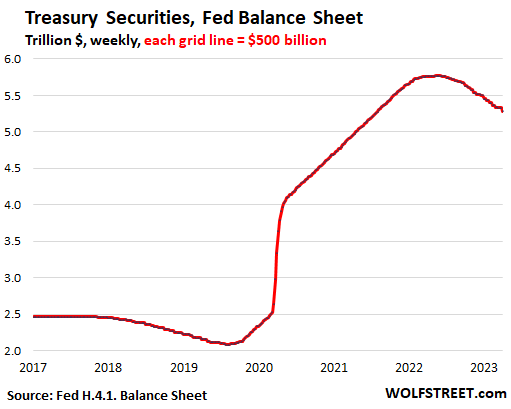

QT continued with Treasury securities: -$56 billion in four weeks, -$491 billion from peak, to $5.28 trillion, the lowest since August, 2021.

Treasury notes and bonds “roll off” the balance sheet when they mature, which is when the Fed gets paid face value for the maturing Treasury securities. Maturity dates fall either on the middle of the month or at the end of the month.

The cap for the monthly roll-off is $60 billion; in February, the Fed exceeded the cap by a hair, in March, it was a hair short.

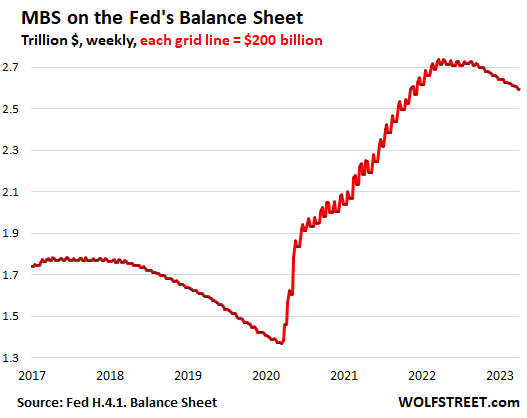

QT continued with MBS: -$16 billion in four weeks, -$146 billion from peak, to $2.59 trillion.

The Fed only holds “Agency MBS” which are all backed by the US government, and the taxpayer carries the credit risk.

Mortgage-backed securities roll off the balance sheet primarily through the pass-through principal payments that all holders receive when mortgages are paid off, such as when mortgaged homes are sold or mortgages are refinanced, and when regular mortgage payments are made.

The cap for the monthly roll-off is $35 billion. The roll off has been below the cap as home sales have plunged and as refis have collapsed.

Liquidity support begins to unwind and shift.

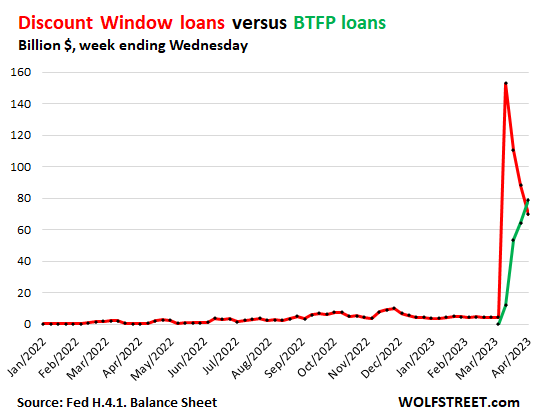

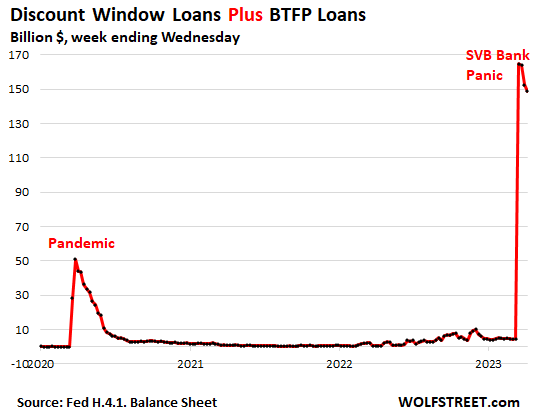

The Discount Window (“Primary Credit”) has been available for banks for a long time. Being lender of last resort to the banks during a bank panic is one of the Fed’s functions. But this is expensive money for banks. After the rate hikes on March 22, the Fed charges banks 5.0% to borrow at the Discount Window. In addition, they have to post collateral valued at “fair market value.” So after the initial spike on the March 15 balance sheet, the banks that had borrowed at this facility started paying down their loans quickly.

It seems – we don’t get names – some banks are paying down their discount window loans with funds they borrowed under the new liquidity program, the Bank Term Funding Program (BTFP), that the Fed rolled out on March 13.

Under the BTFP, banks can borrow for up to one year, at a fixed rate, pegged to the one-year overnight index swap rate plus 10 basis points. This rate is currently somewhat lower than the 5% discount window rate. Banks also have to post collateral, but valued only “at par.”

To be eligible for the BTFP, per term sheet, the collateral has to be “owned by the borrower as of March 12, 2023,” and banks cannot buy securities at market price and post them as collateral at par.

For banks, the BTFP is still expensive money – though less expensive than the Discount Window – because they have to post collateral, when they could normally borrow from depositors or unsecured bondholders without having to post any collateral.

Discount Window: -$18 billion in the week, -$83 billion in three weeks, to $70 billion (from the peak of $153 billion three weeks ago).

Bank Term Funding Program (BTFP): +$15 billion in the week, to $79 billion.

This chart shows both, the loans at the Discount Window (red) and the loans at the BTFP (green):

Discount Window plus BTFP added together: -$4 billion in the week, -$16 billion in three weeks, to $149 billion.

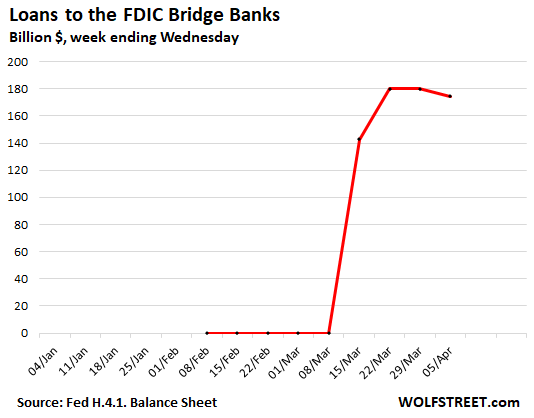

Loans to the two FDIC bridge banks: -$5 billion in the week, to $175 billion. These “Other credit extensions,” as they’re called on the Fed’s balance sheet, are loans to the FDIC-owned bridge banks that hold the assets and liabilities of the collapsed Silicon Valley Bank and Signature Bank. This facility is part of what the Fed announced on March 13.

The FDIC is in the process of selling some of the assets and transferring the deposits to other banks. In addition, it announced today that it has selected the world’s biggest bond-fund manager, BlackRock, to sell the MBS and Treasury securities that SVB and Signature Bank had held. It estimated earlier that its total loss, after everything is sold off, will be $22 billion, to be paid for by the FDIC-insured banks.

As those sales close, the FDIC will use the proceeds to pay down the advances from the Fed, and this balance will eventually go to zero.

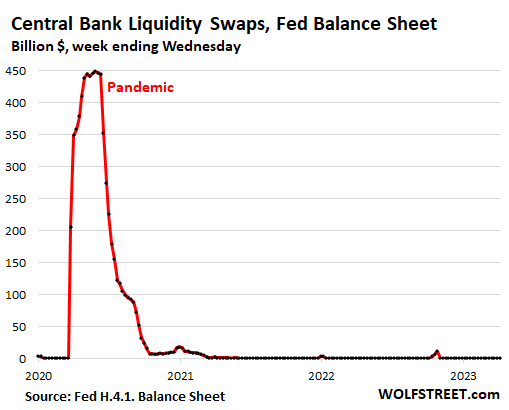

Central Bank Liquidity Swaps: No activity. These swap lines have been open for many years, and the Swiss National Bank has been one of the central banks on the other side. But the SNB did not use this facility to obtain dollar liquidity during the Credit Suisse panic, when Suisse regulators forced UBS to take Credit Suisse under. It likely used repos instead (see below).

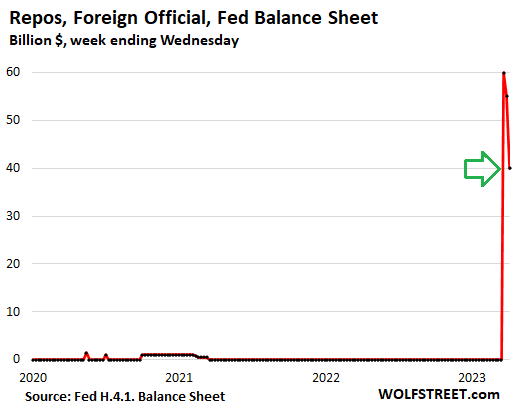

Repos with “foreign official” counterparties: -$15 billion in the week, -$20 billion in two weeks, to $40 billion. The Fed has for years offered repurchase agreements to foreign central banks, where they can get short-term dollar liquidity against collateral of eligible US securities, such as Treasury securities that they’re holding.

This is likely where the SNB got $60 billion in dollar-liquidity two weeks ago to support the CS takeunder, instead of using the central bank liquidity swap lines, and then paid down the balance by $20 billion:

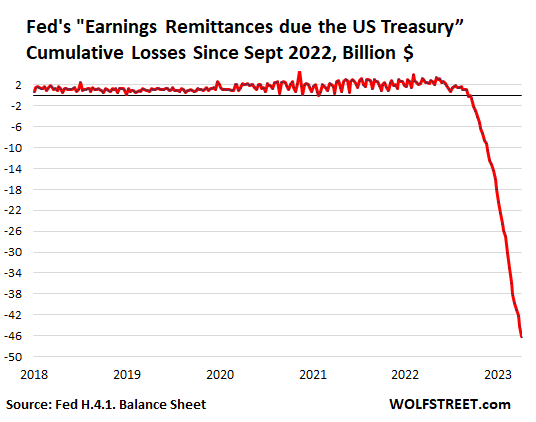

Other balance-sheet stuff: Fed’s cumulative operating loss since Sep 2022 = $46 billion.

These are not “unrealized losses” from the Fed’s portfolio of securities, but actual operating losses where it paid out more in interest to banks on their deposits at the Fed (“reserves”) and to money-market funds on reverse repurchase agreements (RRPs), than it takes in interest from its bond holdings.

From September 2022, when the Fed first started making operating losses, through today’s balance sheet, the Fed lost $46 billion.

In 2022 up to September, the Fed still had made an operating profit of $78 billion, which it remitted to the Treasury Department, as it is required to do – a sort of 100% income tax. Since 2001, the Fed has remitted $1.36 trillion to the Treasury. This ended in September with the operating losses.

The Fed tracks the operating losses in the same liability account, “Earnings remittances due to the U.S. Treasury” (chart below).

At some point, either as QT shrinks reserves and RRPs enough, or if the Fed changes its interest rate policy, or both, the interest expense begins to decline, and eventually, the Fed will make profits again. Those future profits will be taken against the cumulative losses in this account. The Fed will not remit any profits to the Treasury until the cumulative losses have all been covered, and the account starts having a positive balance again.

Just to be clear, losses don’t matter to a central bank that creates its own money because it can never run out of money, and therefore it can never run out of capital. The Fed’s capital is set by Congress and it has not fallen since the Fed started making operating losses.

But for the government’s budget deficit, the missing remittances from the Fed, that were taken against the deficit, are an additional burden.

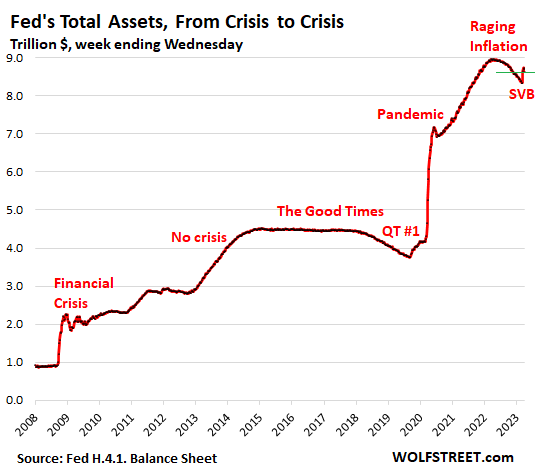

And here is the long-term chart of the Fed’s assets:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Happy to ser that the shit is unwinding.

Still worried that rate of decline doesn’t match the obscene rate of increase.

I’m not worried about that at all. $100 billion in two weeks isn’t bad. That’s one-third of the spike gone in two weeks.

The FDIC bridge banks are now the biggie ($175 billion). That money never went anywhere. It’s just sitting there for the FDIC to use if there’s a run on the bridge banks. As the deals close that it made recently, the money will go back to the Fed, without ever having been circulated.

Wolf…

Next first digit in the Balance sheet…

7 or 9?

7

A WSJ article said Banks are under pressure from MM funds and the RRP with 2T daily transactions. I note that I receive 4.9%, the IORB rate, from my Fidelity MM account.

I checked my broker’s “brokered CDs” yesterday to see how desperate banks are in getting funding. There were zero offerings of 5%. They’re all gone. Not a single bank offered a 5% CD. The desperation is gone. All offerings were 4.9%, 4.8%, and below. Similar to MM fund yields.

All banks have to do is compete, rather than trying to rip customers off with low deposit rates. The banks can shut down the flow of cash to MM funds if their interest rate offerings are high enough. They just don’t want to do it because they prefer to rip their customers off for as long as they can. And customers are finally getting smart about it.

The article you cited was another piece designed to push the Fed to f**k savers. This has been going on since 2008. An entire industry has formed around pushing the Fed to f**k savers. The goons at the WSJ, Bloomberg etc. are part of it. They’re trying to get the Fed to put policies in place that allow the banks to NOT have to compete for deposits, so that banks can keep paying 0.1%. Their shit is pretty transparent.

“All banks have to do is compete, rather than trying to rip customers ”

That’s so true for so many companies today. For airlines and chip companies who were bailed out to fund share buybacks, you can even replace customers with taxpayers.

“designed to push the Fed to f**k savers”

If there had only been this level of outrage from 2002 to 2022 (20 *years*).

I get being mad about bank-rip-offery…but was it okay when the Fed blindly encouraged asinine asset speculation (now imploding) and immunized DC’s decades of budgetary insanity?

For 20 *years*.

Wolf,

+1. I held my nose and took 4.65% on a 2-year brokered CD yesterday. I got some with much better rates a couple weeks ago. Still better than a stick in the eye I guess.

Wolf: IMHO as a former ”totally ignoranti” before learning SO much on wolfstreet,,,

THE main warning signal is the chart showing the continuing lessening of ”central bank liquidity swaps.”

To me, that indicates at least, ”The beginning of the end” of the USD as THE predominate ”reserve” currency of global trade.”

Your and others proposal that that is a good thing not withstanding,,, IMO it indicates a lot of pain coming for WE the PEEDONs in USA.

And will just add, semiannual check will be in the mail by early next week…

And thank you very much for the continuing education…

All of this can be undone in a month. Fed is raising rates for show, to claim they did something to stop inflation. In reality, they are raising to have room to cut, when it hits the fan. The charade cannot continue without ZIRP and QE. The government loves inflating the debt away. Expect more inflation. Markets say pivot this year, and they are more honest than the FRB puppets.

Your “markets” have been saying “pivot” for an entire year, ever since the first rate hike, and they were wrong every step along the way. Why do you still pay attention to this manipulative stuff?

But yes, I do expect more inflation, and so higher rates for longer to go along with it. Enjoy!

Per Wolf – These are not “unrealized losses” from the Fed’s portfolio of securities, but actual operating losses where it paid out more in interest to banks on their deposits at the Fed (“reserves”) and to money-market funds on reverse repurchase agreements (RRPs), than it takes in interest from its bond holdings.

—–

Per Bloomberg:

Close to $2.3 trillion is stashed in the Fed’s reverse repo facility, which offers an annual rate of 4.80% for overnight cash and is primarily used by money-market funds.

The rate that facility offers is attractive compared to many short-term money-market instruments such as Treasury bills, and that’s helped keep usage consistently above $2 trillion since the middle of last year.

And because it’s being sidelined at the Fed, that’s essentially money that isn’t being put to any use — for now at least.

———–

Question: So us peasants purchasing trillions of Money Market Govt and Treasury Mutual Funds are actually screwing over the banks, as the banks lose trillions in deposits paying a measly 0.25% and thus customers in mass are now transferring bank deposits and getting 4.8% in MM short term treasury/govt funds.

Thanks Jay, as 4.79% is good enough for me, and I never much liked the banking cartel screwing customers. So the irony is we finally have proper recourse due to the Fed policies???

It just forces banks to compete.

If banks offered 5% on CDs and savings accounts across the board, instead of trying to screw their customers with 0.2% rates, they’d be chockful with deposits, and MM funds would fight to exist, and RRPs would be at $0.

But banks have gotten used to the “free money” they got from their depositors, and they didn’t want to give it up. People need to rebel against getting screwed by banks, and if a bank doesn’t bring its interest rates up, people need to yank their money out.

The entire finance industry – WSJ and Bloomberg included – are solidly in the camp of screwing savers, and that’s why they come out with BS pieces like the one you cited to push the Fed to screw savers again. They just don’t want to lose access to their free money from depositors.

Totally true, I had done a easy step by step video on my TY channel on how to buy T-bills directly from the Government website and bypass the bank.

Hell, the banks are probably using your money to buy T-bills and are not cutting you in in the deal, so better to bypass the middle man.

What I worry about is how much pressure to pivot the Fed can resist if kaka really starts splattering the blades of the fan in earnest, given how easily Powell pivoted back in ’18. This is NOT a pivot, though, nor QE. As Wolf has pointed out (just a few times), “this is expensive money for banks,” not a free handout to them.

Trump was the president in 2018 and remember the vast Trump real estate holdings. Most sources state it was Trump who made Powell pivot in 2018. Such is not the case with Biden today.

I remember seeing Trump on the news badgering Powell for minus interest rates, I was so disappointed.

That FED’s total asset chart is amusing.

Hardly a 10% reduction in the 5 trillion run up from 2020.

Its easy to see why many people do not take them seriously.

The balance sheet was NEVER zero, and it always grows with various liabilities, including currency in circulation (paper dollars = $2.2 trillion).

If you plot it out, you will see that $5.2 trillion is about as low as the Fed can go. I did some of the math here:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

Hey wolf! Homes prices are up in February. Have you seen the news?

Yes, but since you never read anything on this site, but only troll the comments with your braindead BS under a gazillion different logins (which I dutifully trash), you missed it:

On March 21, I wrote this, LOL:

https://wolfstreet.com/2023/03/21/home-prices-drop-year-over-year-first-time-since-housing-bust-1-sales-bounce-from-deep-dismal-to-just-dismal/

The median price of all types of homes sold in February, at $363,000, was down 0.2% from February 2022, according to the National Association of Realtors today. This was the first year-over-year decline since February 2012, when the market emerged from Housing Bust 1 (going into Housing Bust 1, the first year-over-year decline occurred in August 2006).

The year-over-year decline came despite a small uptick in the median price from January. But that uptick was far smaller than the increase a year ago, and so year-over-year, the price dropped:

“Oh look. They brought a cave troll.”

-Boromir, Mines of Moria

Bidding wars everywhere in Canada. Prices up a lot in February and March.

To: The Real Tony

Bidding Wars in Canada? You mean the same Canada where prices for average house is $1,000,000? Stop spreading nonsense. I’m guessing you are just a “friendly” realtor, who has no clue how to make money outside bubbly lala land…

Wolf, those numbers are very interesting. When I think of Fed money printing, I always think of figurative printing, i.e. conjuring money on a ledger sheet somewhere, not physical pallets of $20 bills!

Is it true the demand reserve requirements are still 0% for banks? I haven’t seen any updates indicating otherwise. I realize the previous 10% probably isn’t a large number in absolute terms, but it’s an interesting thought exercise to consider the difference between having a limit vs no limit.

Why doesn’t the Fed cap the amount that MMFs are allowed to park in RRPs? Seems like this would mitigate a couple issues: deposit outflows from regional banks (assuming some of this $ is moving into MMFs), and reducing net operating loses so remittances to the Treasury can resume sooner. Perhaps this is an oversimplification.

The Fed has already screwed savers enough. Pushing MMFs out of RRP would undoubtedly reduce MMF yields.

“The Fed has already screwed savers enough.”

Couldn’t agree more – I was loving when short term rates poked above 5%.

Plus, too bad for those banks losing deposits. If they’d been more competitive with retail deposit rates, the bleed would have been (and would continue to be) less.

There was a dude on Bloomberg today who claimed that after years of QE, they don’t have the return on assets to offer higher rates. He said a 75bp higher deposit rate at SVB would have wiped out their profit for 2022. His point was that regional banks are trapped by higher rates and the drain will continue.

Everybody piling into MMFs, seems like everyone crowding to one rail of the ship, could make the system unstable.

“He said a 75bp higher deposit rate at SVB would have wiped out their profit for 2022.”

Entirely possible. And largely because those chumps chose to run a heavily mismatched book. Had they loaded up on more floating rate and/or shorter maturities, their margin would have been thinner…but they’d not have been crushed and bankrupted.

@ phleep,

I’d be more concerned if what MMFs bought wasn’t so stable. RRP looks pretty innocuous in size. It’s not like they’re all buying mountains of dodgy corp paper….probably. ;-)

Exactly, they dug their graves by screwing over their customers at every turn. Burns me that the too big to fail banks who are some of the worst are not only still standing but getting increased money flows.

All Money Market Funds and not created equal, I’d suggest searching “Money Market Funds Are Surging in Popularity. Here’s What You Need to Know” at Bloomberg.

Some carry more risk than others, and why there are hundreds of billions in inflow/outflows between different MM fund types these last few weeks. Govt funds, primary funds, treasury funds, some are more stable than others, as some have corporate IOUs, etc.

I’m holding 90 days or less treasury bills MM fund myself, yet now even that is being questioned, as I’m reading the debt ceiling in mid-August could cause some issues, per Bloomberg:

Treasury funds: These funds invest largely in cash and Treasury bills as well as repurchase agreements collateralized by Treasuries. There are also Treasury-only funds that just hold cash and Treasuries. This could pose a risk in the near term: “Going into the debt ceiling showdown later this year, a Treasury fund can only buy Treasuries,” said Peter Crane of Crane Data. “Avoiding those Kryptonite days in mid-August or September when we’ll likely get a technical default will be harder for a Treasury fund than a government fund.”

—-

Wolf – since MM are not FDIC like savings accounts, there seems to be a slight risk of debt ceiling issues on treasury MM fund stability. Although I too agree there is a super high probability the debt ceiling will be solved before any damaging default, plus does anyone really think short term US treasury bills will default ever, and if so, will holding any fiat currency matter at that point if the reserve currency treasury bills go south. Honestly the “Kryptonite days in mid-August” seems unrealistic and fear mongering click bait material…

Ha, actually a default or near-default would likely sink the dollar. Might not be a bad time to go long Sterling, Yen, and Euros!

2 years back Pakistan was running inflation rate of 10% as its central bank boasted of very tight interest rate of 7%.

Now Pakistan’s central bank runs a very “tight” monetary rate of 21%, but the official inflation has jumped to 35%.

Worse is that Pakistanis are standing in miles long queues at food district centre’s for 10Kg bag of floor that often results in death from stampede triggered by desperation.

So I asked “J Pow” about this and here is how it went.

Leo – Can this high inflation happen in America in 2 years?

J. Pow – Our monetary conditions are very “tight” and we plan to tighten them further. But between you and me, They are designed to keep real rates negative, just like what pakistan central bank did, so that inflation can keep going higher as we print more money. So don’t expect different results.

Leo: But US has so much farm land. We can never be short on food.

J Pow: Pakistan also has so much fertile farm land, still they are now hungry. Never doubt the capability of central bankers like me to EFF things up!

Leo: But US is a nuclear power.

J Pow: So is Pakistan, even as it goes bankrupt.

Leo: But US is a capitalist country where free markets encourage productivity.

J Pow: Pakistan is also a capitalist country. My aim is to distort free markets just like it happened in Pakistan. See our trade deficits are already like Pakistan.

Leo: But we have so many rich billionaires that can open bisinesses to prevent poverty.

J Pow: There is no shortage of rich Elites in Pakistan. Even today the import many luxury cars, when thier central is out of dollars. The rich will be made richer at expense of others as per my plan.

Leo: US is a constitutional democracy that should result in good governments.

J Pow: LOL, did you miss how we now arrest former leaders. That shit was literally learned from Pakistan.

Leo: I don’t want Americans to die in stampede in food queues.

J Pow: Leo, you are so misinformed. Americans will not die in stampede. We have too many guns. People will just shoot each other to shorten queue.

Question:

With the obvious effort of some foreign nations to move away from dollar denominated transactions…..

Will the swap lines then become much less active?

Great information and insight as ever Wolf. You have been proved right on a few occasions now…QT, Interest Rates etc. Please take a bow !

“Please take a bow !”

A little early for “victory laps”, don’t you think ?

If inflation continues unabated RRPs will continue to increase regardless of QT tightening.

“Fed officials have said they expect reverse repo balances to decline as they drain reserves from the banking system by shrinking their asset holdings. If the balances don’t decline, central bankers could bump up against their goal that “ample reserves” remain floating around the banking system and raise questions over whether to prematurely end the portfolio runoff program.

Officials have signaled they would like to avoid that outcome. “

Question:

Why does the Fed have to run to Blackrock to sell those securities?

Blackrock is becoming, has become, part of the Fed, IMO.

“Blackrock is becoming, has become, part of the Fed, IMO.”

Um, yeah, no. You must not know much about BlackRock. BLK is just a very very large asset manager. They buy/sell a sh*tload of securities all the time on behalf of their clients. Their portfolio managers have varying opinions about the Fed and markets.

NOT the Fed!!! The FDIC.

The FDIC will have to sell through some kind of big broker. So would you prefer Goldman Sachs?

Managing huge bond funds is what Blackrock does. This fits right in.

Is there not a network of Primary Dealers, those who are pre-approved financial institutions authorized to make business deals with the U.S. Federal Reserve?

Lol you have never worked for the government if you think this is a good idea.

Just look at Defense Contracts and how GREAT, and TIMELY those are.

Then after the circus, they get sued by the loser.

Some articles:

“Legal battle over Army vehicle highlights contracting barriers”

“Amazon suing Pentagon over $10B cloud contract, alleging ‘bias’”

I briefly worked for the government. Nothing like GS-12 employees who can’t use Excel. Paper files like it’s 1986…

:P

longstreet

READ WHAT I SAID

THE FDIC — NOT THE FED.

The FDIC doesn’t have “primary dealers,” unlike the Fed.

And who are the “primary dealers”? They are: Goldman Sachs, JPM, et al. So you would rather the FDIC does business with a hedge fund like Goldman Sachs that trades against its own customers, than a manager of bond mutual funds? LOL

You say that “For banks, the BTFP is still expensive money – though less expensive than the Discount Window – because they have to post collateral…”. Please explain – why does posting collateral make it more expensive? I would think that the interest earned by the collateral still belongs to the bank and not the Fed. Is that not the case? Or is there something else?

Posting collateral ties up the collateral.

Banks like to borrow unsecured (not involving collateral). That’s everyone’s first choice.

The BTFP/Discount Window chart is interesting. If I remember right BTFP was supposed to be capped at $25B. It’s totally not a bailout!

“… supposed to be capped at $25B.”

You just made that up, LOL.

Some dude at JPM said three weeks ago it could reach $1 trillion, also LOL

damn, only 72 billion QT vs maximum cap of 95 billion a month. Only 16 billion MBS reduction. There is no reason for the Fed to not sell MBS outright. They are intentionally propping up the stock market bubble. This is criminal.

And one must ask…

Why is the Fed in the long end of the market?

The heralded “dual mandate” deals with two current and real time issues….employment and prices.

To have the Fed heavily invested in maturities ten years and out ($5 trillion) needs some explaining.

For decades and decades the Fed stayed out of the long end. The policy shift has skewed the yield curve, aided in spiking housing prices, and now has caused big paper losses at the Fed (1.2 Trillion) ( I know Fed losses arent supposed to mean anything, but those losses are balanced by somebody else’s gains, IMO)

I laugh every time I see someone use the term “mandate”.

The FED does not work for us. It is a cartel of privately owned banks. They will always want to do what is in the best interests of their real owners (subject to some political pressure).

Some people chatter about “pivots”. I see them as merely changing the rules when necessary to suit the interests of the 1%. SVB proved that beyond any shadow of a doubt.

I look at the government today and see something that is completely unaligned with what we think of as core American values, but maybe the government now reflects the new values of the country – greed. Not merely rewarding hard work and value creation, but just pure greed.

The only way the interests of the elites coincide with the will of the people is through propaganda and brainwashing. You too can be a temporarily embarrassed thousandaire! 😳

100%

It’s like our economy grew a weird appendage. Lol

Looks like an engorged leech, classification rebus oeconomicis latro

Nice. Now if the QT above 100 billion a month continues.

Exactly, I’m starting to believe there will always be some new problem and they have to just keep quantitative easing going.

In 2019 they tried to produce the balance sheet and he seen what happened and in 2022 They started reducing the balance sheet and got almost a trillion dollars taken off and then they had the reverse course again with the silicon valley Bank problem.

I would be surprised if they’re ever able to bring it back down. It’ll probably keep going up forever from here on out.

The feds balance sheet is supposed to be the borrowing a purchasing power from savers in case of emergency and then once emergencies over then they take that money back out of the system. Thus restoring purchasing power to the savers, but unfortunately it looks like instead of borrowing it’s confiscation.

“QT continued with MBS: -$16 billion in four weeks, -$146 billion from peak, to $2.59 trillion.”

Housing prices will not normalize at this slow pace with MBS until we have forced liquidation in the housing sector. Powell himself said during a recent testimony that the balance sheet should ultimately consist “mostly of treasuries,” so this place is just too slow for his plan.

Only mass layoffs, some currency collapse, or a major credit event can help bring inventory back to the market. The 10 year has been going down again, and significantly so.

On the other hand, if 15 million single family homes are indeed vacant, and Airbnb rentals are faltering, perhaps that will give some clues to Powell’s plans to increase inventory on the investor side without hurting home owners. (There are some reports that 40% of Airbnb rentals did not rent during the recent Super bowl, and I am in fact seeing lots of price reductions while planning for a trip to Reno).

Do you really think the Fed/Powell are that concerned about the details of housing?

Only a tiny bit more than the equities market which is zero.

Yes, they are. Their shareholders (e.g., Wells Fargo) can’t make money unless they originate mortgages. They can’t originate mortgages if people can’t buy homes any more (look at the sales volume year over year).

My translation of the BTFP acronym is

BUY THE THE FFFFING PEAK

as opposed to the official

Bank Term Funding Program

I thought it was “Be The First Pig (to the trough)”

Most of the finances I see in the USA, could almost all come from a Tolkien quote, …Things look good but feel bad….

Although I could better judge with longer timelines on those graphs, if I saw such huge and unusual transitions measured by sensors in an aerospace system, I’d say there might be something seriously wrong.

It’s like watching the development of the rocket in the 50s and 60s with all the control system “learnings” – but its the economy instead so everything is in slow motion.

Even though the Fed running a loss may not matter, the general public doesn’t have much insight into the workings of the Fed. A loss of confidence is all it takes for a highly leveraged system to come apart, especially when you can move money on a cell phone.

Excellent summary on Fed balance sheet activity!

I truly believe that this go around for tightening has more motivation than just controlling inflation.

There are seismic shifts occurring internationally (the most recent was Saudi and Iran reconcilliation moderated by China) that will have growing impacts on the use and value of the dollar. Washington knows this.

That is why I believe Biden will cave on his no negotiations on the debt ceiling. Deep down, they know they have to tighten the purse strings significantly to maintain future faith in the dollar. Same goes with the Feds balance sheet.

It is going to be a very interesting ride this year. I expect a strong recession but that is a small price to pay for attempting to preserve dollar hegemony.

I get your sentiment…

But I think you’re dead wrong, my friend.

From Apocalypse Now, “There’s no one in charge here, Chief.”

I look at our government and see nothing but clowns. I used to think one side had more than the other. But the clown ratio in DC might just be the only thing that’s actually balanced.

Well, I see two troubling things. One-it appears we really could lose dollar denomination of world trade if things continue as they are. This must be inflationary in the end. Two-now that OPEC and the Saudis have decided that if we are not going to replenish the strategic reserve, that they will pump less oil. This too is inflationary in the end.

More of a challenge this time than under other presidents.

So US frackers will pump more oil. They’re already doing it. They love these prices.

Wolf, fracking is an extremely destructive process for the environment not to mention extremely capital intensive not exactly the perfect match in an higher interest rate environment.

Furthermore, I done some extensive reading by people arguably having decades of experience in the industry and the so called “shale miracle” could be very short lived, a “flash in the pan” so to speak, the proven reserve official figures, according to what I read, are way too optimistic. Too much of that oil is simply not recoverable.

Fracking Oil Well productivity decline arrive very early and it is very steep so you have to continuously keep drilling. A geologist working in the field once told me it’s like when you move your straw continuously between the ice cubes at the bottom of your glass to suck every drop left of your drink.

The US ain’t Saudi Arabia.

What’s destructive for the planet is the growing human population and its desire to live well, eat the wrong foods, drive big fat motor vehicles, fly all over the place, use plastics for everything, etc. etc. That’s where this demand comes from. And instead of attacking demand, you’re attacking the SUPPLY to meet this demand? You’re being backwards. If you’re concerned about the environment, you need to attack demand, not supply.

Ever since I started covering oil and gas production in the US on this site and the predecessor site, people have been saying that fracking cannot work, will not work, will run out, will collapse, and the Saudis are going to win. It’s been 11 years so far and counting, and over this period, US oil and gas production has become the largest in the world. If Texans want to poison their land and ground water, fine with me. It’s their land, their water, and their choice.

Wolf

I totally agree with you that we are a hyper-consuming society and we should do something about it.

I was simply commenting on fracking, that’s all.

11 years is nothing in geological terms. Fast declining well productivity is well documented.

Some claims fracking oil has peaked already. For example, the Bakken play peaked in 2019.

Many of the wildest volume predictions of the early 2010 did not materialize.

Wolf is absolutely correct. To save the earth, we need to change the way the whole global capitalist system operates. Excessive consumerism is the problem. Online shopping, outsourcing of manufacturing to factories overseas, etc. The capitalist system is trying to perpetuate itself by trying to transition to electrification and renewable energy, but that won’t address the root cause of the problem.

From official figures Saudi Arabia will have no more oil in 5 years, its reduction in production can be understood in these terms

Fed total assets are down slightly above 2%, from 9T to 8.6T.

“down slightly above 2%”

Basic-math-challenged?

The correct answer: -3.7%

Peak: $8.965 trillion

current: $8.632 trillion

diff: -3.7%

His math errors aside, it’s still not acceptable. It should have been down to $7.2 trillion by now (which is roughly what it was after the initial pandemic response spike). Anything above that to me makes me doubt their sincerity.

Hey, easy, there’s enough turmoil in the banking sector right now. I know there are some folks here who want to blow up the whole financial system in one day and get it over with. But I’m not in that camp. All it would do is restart the whole 2008-2012 shenanigans. Easy does it.

And this $101 billion drop was just for two weeks. There’s a good chance that a month from now, the balance sheet will be down another $200 billion. And by another $200 billion in two months. You need to look at the mechanics of this, as I outlined in my article.

hi Wolf.

A couple of days ago you said:

“I mean, what were these people thinking when they leased this space? These big tech companies that think they will grow forever have big real estate departments, headed by highly-paid executives with titles such as VP of Global Real Estate, whose job is campus-building and office-leasing, and that’s what they did, and that’s what they ended up with.”

Are we not as deranged as they are? believing in a system whose main point is to grow and grow in a place whose resources have limits

The data and analysis is spot on here. The balance sheet sure is being drained. Which is great and I hope it continues, But I think all the cynicism that people post here is that all of us know that when things in the economy start getting rocky that the balance sheet will go parabolic again.

So yes drain the balance sheet. I just think when all is said and done the 2020 increase will pale in comparison to what is coming at some point, and that could be years from now for all I know.

And I admit. I’m an armchair finance guy. Just my two cents.

sorry, but I continue to not see the draining of the balance sheet as progressing rapidly enough. the rolloff in the MBS is pathetic and with a real estate market that is gone crazy, how did they not start selling MBS over a year ago, to try to restrain the bubble? they should have been draining all last year and there would have never been any inflation.

there really needs to be alot more criticism of the Fed, out in the open, screamed from media channels. but the media are just mouthpieces for the ultra-rich who want the Fed to keep pumping their wealth.

i dont think Powell gets a single question about the pathetically slow reduction in the balance sheet, versus how rapidly it was ramped up. there are also no questions about the hole the Fed is digging in terms of the losses and the unrealized losses that the Fed will have.

I agree. Inflation is being driven by the “wealth effect.” That means the only way to get inflation down is to get stock prices down. The S&P is 20% above its pre-pandemic high, which was a bubble itself. Unless you think the economy is 20% stronger (it’s not), the only answer is that assets are inflated from the ridiculous inflation of the money supply.

Until that is gotten under control, inflation will continue at 6-9% a year indefinitely.

Agreed. I would be happy with QT at the same rate they ramped up QE – 120 billion a month. That would be 2.4 trillion in one year, which would drain some of the hot air out of the asset balloon and be considered a really good progress in the war against inflation. But I know Powell would never have the guts to do that. Sigh…

The banking sector was already blowing up, and you want faster QT? LOL

Just blow it all up in one day and start the QE circus all over again? Lots of people are wishing for just that because it made them very rich. So this time around, easy is good.

Wolf, explain to me why, after the Fed has about 700 billion dollars withdrawn from the market, and the ECB has 1 trillion and 200 billion euros withdrawn from the market, in Europe only Credit Suisse is bankrupt and the other banks are fine. Yes, the Fed’s interest rate is 5 percent and the ECB’s is still 3 percent, is this the reason that makes EU banks more stable, at least for now?

I understand that people here are disappointed. They hoped to see this fiery crash of the banks, this hugely entertaining spectacle of everything going to heck in a straight line, followed by HUGE amounts of QE and getting rich. They hoped Deutsche Bank would be next, and JPM would follow down the shitter… What instead happened is that a few of the worst rotten risk-takers got taken out. And there may be a few more of those worst rotten risk-takers. But that’ll be it.

Deutsche Bank is a different bank today. The German government sat on top of it for years, forcing it to trim down, clean up, and raise capital, and it’s now half the size that it was before the financial crisis, and has over twice the capital, and it’ll be OK-ish. People are still stuck in their old dreams.

CS was a shithole of a bank, never got cleaned up, took huge risks, continued to be involved in every banking scandal out there and lost billions on each one… it was totally out of control and should have been shut down years ago.

In the US, the “banking crisis” is not because of bad assets as last time — these bonds are NOT defaulting. It’s because of deposit flight that forced banks to sell bonds whose market value had dropped. But all those bonds will be worth face value when they mature, and will get close to face value long before they mature, so this is entirely different than the risk of defaulting mortgages backed by collapsing collateral prices, which was the case during the Financial Crisis.

Those bonds today are pristine assets – Treasury securities and Agency MBS. The problem today is interest-rate risk that not all banks prepared for and hedged sufficiently; and the banks that failed also had “concentration risk,” that they were focused too much on just one type of big depositors that all ended up doing the same thing. Last time it was credit risk that then exploded and blew up the banks; that was entirely different.

Thanks Wolf,

I’m in the QT camp and no more QE and zero interest rates. And firmly against the ridiculous prices of assets and for some time of services

Bank credit has started to contract.

I’m a financial idiot, and just not that smart in general.

Can you help me understand why rates weren’t raised circa 2015? We had just moved out West and held off on buying a home cause we thought trends would reverse at the hand of rate hikes(that never came). Even in hindsight I can’t understand why the Fed let things go so far.

Don’t blame yourself.

Nobody with a brain expected the Fed would be so irresponsible with monetary policy the past 15 years. They’ve used it to pick winners and losers, bailing out speculators and debtors at the expense of savers and prudent decision-makers.

Yet here we are. The economy has been running on moral hazards far too long. Now, the Fed owns it all. They have to choose between inflation that is 300% or 400% above their target, or a deep recession. Prudent market participants have been beat to shreds. They can’t logically invest in a bubble. They simply listen to the whirring of the money printer, to decide where to put money for short-term gains. Their biggest decisions are not related to organic growth, but how to work the system. Stock buybacks or not? M&A or not? Plus, how to become too big to fail and qualify for corporate welfare.

Perhaps Congress should require the Fed to read Three Little Pigs, so they understand what happens to houses built with straw.

Asking questions can get you labeled as one of the Scareborne Rangers questioning the integrity of the ship’s design. Captain Powell Pot and his bank of Komehere Rouge officers do not want their authority challenged but do extend a hearty welcome to those who have chosen to sail with the Red Star Line. Cruise Director Wolf is limited to providing a schedule of daily entertainment for your pleasure and will hand out info received via the wireless and printed on the Atlantic Vessel Daily Newsheet. Women and children in Winternationalist class will practice life boat drills while the “real men” continue their poker game in the Lido Lounge bar. Passengers over on the portside cabins can find a fresh serving of milk toast any hour of the day. Starboard passengers are kindly asked not to stir up rumors of excess ice in their drinks. Coal shovelers are not to be permitted to go on strike and the electricity will stay on as we can always promise work for those in steerage at competitive rates set by us and issued in ship’s scrip at prevailing rates of exchange. Their will be free classes in polishing deck chairs and tying flotsam into life vests should you be bored with shuffleboard. Tea is served both hot and cold dependent upon the weather reports recieved from the ice watch bureau in New Worldland. Get your low cost blankets at the Costco outlet station on deck seven, or have them delivered direct to staterooms by filling in the blanks at the teletype office located by funnel two. Enjoy your cruise.

BTW..the bilge pumps are entirely at the mercy of the whole dynamo plant but, not to worry, we checked the tool cabinets last week and have only found about two hundred monkey wrenches unaccounted for this time. Things are looking rosy!

“Can you help me understand why rates weren’t raised circa 2015?”

They were. Rate hike cycle started in Dec 2015 (Yellen) and went through Dec 2018. But it was slow and timid.

Are any of the GSEs buying MBS? Doug Noland sees the Fed shifting the credit load back onto [other] GSEs. If spreads are blowing out everywhere, they are primarily in mortgage funds – which should get worse as long yields drop. A look inside the NFCI report shows that mortgages are one of the most heavily weighted factors in tightening of conditions. Jamie Dimon says the Fed should not play whack-a-mole with the banks, while the Fed defers consistent policy decisions, out of respect to the political will to make policy, that would protect [all] depositors. Okay protecting corporate depositors is not as morally urgent as individual depositors, but these guys are banking payroll and operating expenses. You mean that’s not important? I’m waiting for the debt ceiling extortion circus to come to town.

What happens when the Fed starts selling MBS in the open market??

Nothing, because they won’t.

Been thinking about whether this “liquidity support” is really just more QE. I think it really is. Here is my explanation.

Fed injects capital into banks that are backed by underwater bonds, at full face value. The purpose it to allow those assets to roll off the balance sheets of the banks as they mature. OK, so what really happens here?

The banks need the liquidity because depositors have pulled out deposits and the banks dont want to sell the bonds at a loss and lose capital. So the Fed is basically saying, we will give you the money for your balance sheet to just hold those treasuries until maturity. So this allows the banks to not sell their assets, even though the depositors have taken their money and put it somewhere else.

So what do the depositors do with that cash? They put it into other investments, such as money market funds, that invest in other yield producing assets, such as government paper, etc. Anytime you have investors purchasing an asset class, that pushes the sellers into other asset classes. So even if the money is flowing into the money market funds and therefore into low-yield investments, it pushes money out of those investments into stocks and other areas. Which is once again propping up the whole asset bubble that QE has blown. This is doing the same thing as when the Fed buys Treasuries, it is changing the supply demand curve in the financial markets (thereby decreasing long term borrowing rates and stimulating the economy).

I have been surprised that the economy and stock market have been holding up so well, but there is a simple reason. The reason is that the Fed effectively just performed another temporary round of QE (very rapid too). And the other reason is that investors have decided that the Fed will step in and rescue anyone who has a financial problem. Hence moral hazard is alive and well.

With bond prices having risen recently, the banks are given a chance to put in place some hedges that will allow them to be protected against further losses when long term rates resume the trajectory higher. So this is risk mitigation against bank blow-ups, but it will cost those banks interest payments to the Fed, so their performance is going to stink. On top of that, pile on the commercial real estate losses that will soon occur and the Fed has not really solved the regional bank crisis, just pushed it off for a later date.

So we will need to watch to see how quickly the banks eliminate these temporary facilities. If it happens rapidly, then that means the banks have been able to put in place hedges that reduce their balance sheet risk and outflows of capital have stopped. If it happens slowly, then it indicates that the banks are structurally so flawed that they must engage in activities that lose them money to prevent going out of business.

If banks do repay the liquidity rapidly, we will see bond yields rise rapidly and far, as that would mean the banks are liquidating the assets they have purchased, or placing hedges that would also impact market price.

Between now and the end of summer there is going to be alot more chaos, i just dont know if it will start in April, or take until later.

gametv

Your two weeks of QE fun ended two weeks ago because the balance sheet has been declining for TWO WEEKS.

Read the article instead of spinning these elegantesque theories! Repeat: Your QE ended two weeks ago and has been QT since then!

Thing is:

If you called the initial two-week rise of this liquidity support “QE,” you MUST now call the current reduction of liquidity support “QT” or also “MEGA-QT.”

Up is the new down.

“it isn’t QE”

PLUNGED = DOWN.

“PLUNGED $101 billion” = DOWN $101 billion = QT

What is so hard to understand?

Your “QE” only lasted two weeks and ended two weeks ago. It’s already over. The balance sheet dropped for the second week in a row. Get used to it. Your dream is over.

Chart says MOAR. Prove me wrong.

Not my QE. I’m team QT

“The dream of a return to QE was fun while it lasted”

Lipstick on a pig doesn’t change the fact that it’s still a pig. Massive spikes in the FED balance sheet during a supposed QT operation doesn’t pass the smell test.

The FED is running what would be best described as an “Inflation Entrenchment Operation.” They want to make massive asset prices stick as high as possible while supposedly bringing down CPI. You don’t slow a locomotive by gently applying the brakes while still running at wide open throttle. No, you first need to chop the throttle.

The massive bailout of SVB depositors and the associated spike in the FED’s balance sheet have given us a glimpse into the future – the FED fully intends to bailout the wealthy and uncork more QE when they see fit. This is why the megalomaniac Jerome Powell and his ilk need to be forcibly removed from power. They are committing crimes against humanity.

To be fair, braking an entire train is far more complex than just trying to retard the forward motion of the locomotive. The air compressors have been running wildly out of control while Powell reads diagrams on the construction of triple valves. Meanwhile, the seals on the reservoirs are leaking and there may be some rusty crap built up in the train line. We won’t even get in to the problems of numerous axels running with hotboxes, but not every car is equipped with roller bearings and disc brakes and the ban on interchanging old cars has been somewhat extended through repeated complaints of excessive expenditures. Tunnel ahead! Join the birds?

You lost me toward the end there but for the most part everything about a runaway train sounds right to me.

Boy is the US financial system a mess.

And here I had been reading in the comments that Japan was going to be the one to blow up and take everything down with it.

The yen was supposed to crash to nothing and gold was too expensive.

Instead the yen has gone from 150 yen to the US dollar to around 130, Japanese bond prices have stabilised, and gold is near all time highs in US dollars.

The Fed is doing QT on one hand and expanded its balance sheet on the other.

Since those banks blew up the Fed has increased liquidity in the system and until it’s balance sheet is less than it was before that blow up the moves are inflationary.

The Fed could fix a lot of the problems in the system by doing a couple of things:

1. Reduce the interest rate is pays on reserves held with it. This would force money out of those accounts. Say a rate 50 basis points less than the discount rate.

This would also reduce their current losses as well as they would have to pay less interest.

2. Reinstate the policy of mandatory reserves to be held at the Fed. Make the interest rate paid on these mandatory reserves zero per cent.

The bigger the bank the higher the amount of required reserves.

That would most likely stop the flow of deposits from small and middle sized banks to large money centre banks as well.

Dear Wolf,

It would be very helpful to learn your thoughts about few topics

Q1. How do you see Reverse Repo Balances evolving, and its effect on ongoing QT. In case RR steadily.drains at a similar clip, Fed can do quiet a lot of QT optically (perhaps B/S will still be well above your lower bound calculation, but nonetheless) . Am I missing something obvious here?

Q2. Now that rates are well above zero bound, does it.make sense for the FED to lower RRP to push money out of MMFs into bank deposits to stablize the deposit outflows?

Q3. In the ZIRP period of 2020-21 deposits flooded banking system, for some smaller banks B/S went 1.5-2x !. These were then invested in assets.. loans , mortgages bonds etc. at some of the lowest yields in memory (say yielding 1% – 3%). Given massively inflated asset base in the banking system yielding sub-4% , is it feasible for banks to compete with 4.5-5% interest rates? Even if banks make some spread on marginal new deposits at 4% because they can earn a higher rate at IORB, this is only true for marginal new deposits. However, if deposit rates go up, they will go up for all existing depiaits too which are currently yielding 0ish. Wouldnt that crush earnings? The solution seems to be borrowing through fresh term deposits CDs at competive rates, instead of increasing the interest rates for the entire depositor base. Banks in aggregate seem to be doing this

The rates that RRPs are paying are largely the reason savers and MM fund holders now get between 4.5% and 5%. That’s good. RRPs provide a highly liquid, well-paying 100%-secure investment option for MM funds. Now banks need to compete with that. I like that. I’m tired of banks relying on free money from depositors. That was the biggest Fed-engineered ripoff in a century. The Fed should keep the current spreads intact.