Labor market that’s less tight, where it takes a little longer to find a new job, similar to the Good Times before the pandemic.

By Wolf Richter for WOLF STREET.

A big hullaballoo erupted today when the Labor Department released the weekly initial claims for unemployment insurance with heavily revised seasonal adjustments for prior data. The pandemic wreaked havoc on seasonality across the economy, from retail sales to housing, including the labor market, and seasonal adjustments to correct for seasonality went awry all over the place.

Back in the spring of 2020, I screamed about how the horrendous unemployment claims data were being further messed up by seasonal adjustments, and in May 2020, I switched my reporting from “seasonally adjusted” to “not seasonally adjusted” unemployment insurance data. In August 2020, the Labor Department admitted that the seasonal adjustments had gone awry, and it changed its method of making those seasonal adjustments.

Compared to that mess back then, today’s substantial revisions of the seasonal adjustments were relatively minor. In essence, they fixed some of the issues that resulted from changing the method of seasonal adjustments during the pandemic (Labor Department’s discussion).

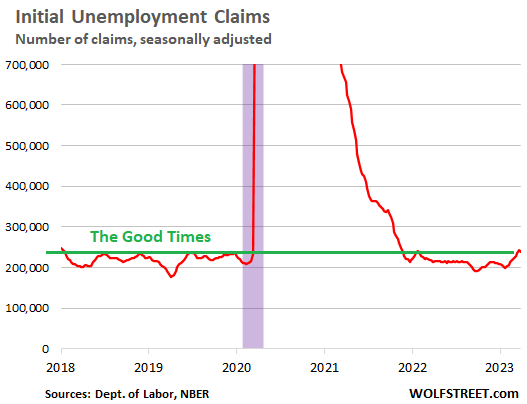

The number of initial claims for unemployment insurance that people filed in the latest reporting week with state unemployment offices fell by 18,000 to 228,000 initial claims, the Labor Department reported today. This was down from the previous week’s claims of 246,000.

But the previous week was revised up today from the previously reported 198,000 claims. The chart of the 4-week moving average shows that initial claims for unemployment insurance, after the revisions, are at the edge of the high end of the Good Times before the pandemic, rather than inside the high end, where they had been before the revisions:

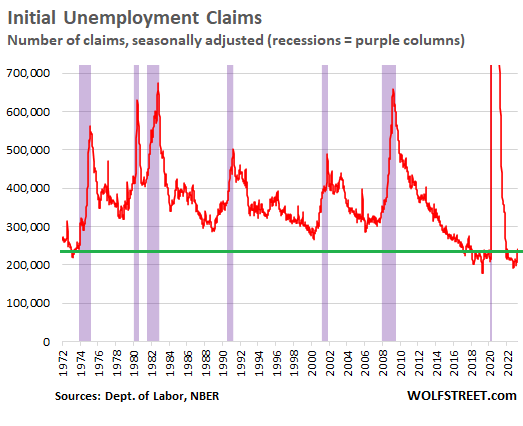

In the historic context, unemployment claims remain at the low end of the past 50 years:

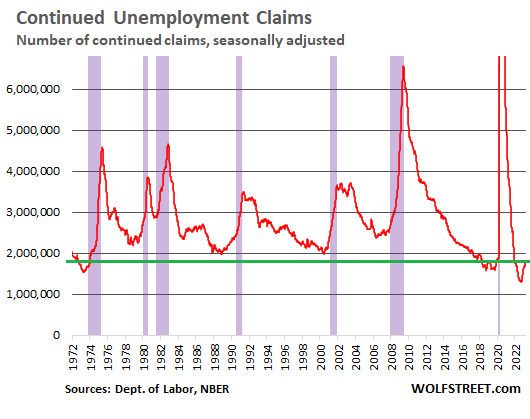

The number of people who are still claiming unemployment insurance at least one week after the initial application – people who haven’t found another job yet – rose to 1.83 million, the highest since December 2021, according to the Labor Department today.

They’re now off their historic lows from last year. But they’re still at the low end of the 50-year range, and back in the range of the Good Times in the years before the pandemic.

Recessions from the Great Recession back through the Double-Dip recession in the early 1980s began when continued unemployment claims spiked through about the 2.5-million mark:

This increase in continued claims for unemployment insurance shows that it now takes a little longer to find a job after having filed for unemployment insurance, and that the number of people on unemployment insurance is increasing off the historic lows last year.

So what we’re seeing in these unemployment insurance data is a labor market that is getting less tight, where it takes a little longer to find a new job, similar to the Good Times levels of unemployment insurance claims.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The pivot/pause talk has never been louder. The sky is falling according to the pause dreamers. It’s disgusting. 10 year dropping even more. I so hate this system.

At some point, the Fed is going to pause. Rates aren’t going up forever. They’re already higher than I thought they would be a year ago.

But how high exactly do you think they should be?

It’s easy to beat a drum about how interest rates are too low, and then beat a drum about they’re too high, but do you think you can hit the nail on the head better than the feds can do?

Hank,

I said “higher than I thought they would be a year ago.” NOT “should be.”

I just didn’t think a year ago that the Fed would be willing to raise as fast as they did.

I think short term rates SHOULD be above core CPI inflation. And they should stay there. But it doesn’t matter what I think they SHOULD be. No one cares. My job is to try to see where they might go.

Pause, sure, but the “market” has already priced in three or four cuts this year. That’s absurd.

Markets can remain irrational longer than you can remain solvent :)

Yes, I’m seeing that as well. I understand what is Wolf is saying that they can’t raise forever, but inflation is still high. Some are saying rate cuts as early as July. I agree that’s absurd. Wallstreet is acting like the sky is falling, spinning the unemployment insurance claims report as devastating and every other report of late as bad and warranting a pause and preferably a cut.

Yeap. If you are trying hard to see the bad things, you will end up missing the boat.

With all the bad news -> that mean “good news” — hahaha.

The failing of SVB et al is equivalent to another 1% FED hike.

Money will be tighter but there are still a lot of cash out there and have to go somewhere. The best thing in the whole wide world is the US stock market — where the pumping never stops.

Not really. Market can’t handle 5% rates very long. Too many projects got approved based on Zirp. If Powell can hang at 5% for 6 months things will look pretty bad. Who knows what is going to happen in next 6 months though. Might be peace, might be hot war with a tactical nuke.

Jerome Powell can gaslight all he wants about his Federal Reserve tools, but a look at any financial chart shows a roaring full inflating economy. Now there is a very small financial world section talking about price controls to stop windfall corporate pricing; this is exactly the scenario that occurred at the beginning of the 1970s stagflation.

Whatever the Federal Reserve does seems like noise lost in any kind of adjustment, seasonal or otherwise on any type of economic chart.

Seems like good news over all. It is interesting this is a flat number that seems to be getting lower, historically.

I’m interested in the total labor force participation since the 80s, or whether significantly more people are doing work that doesn’t pay into unemployment.

Go Figure. Housing my area is now above peak 2022 prices.

There was a dip from peak July 2022 of maybe 5% but houses are selling are higher at least peak 2022 and a few have been up to 5% higher than peak 2022.

I am in flyover land.

I’m so done with this country.

Right, but it’s this country relative to all the others. The corruption is everywhere.

Doolittle: Doesn’t make it okay.

I hear you — the best thing you can do is vote with your wallet. A one man buyers strike, if you will. Save your bread and be patient a bit longer. You can’t say it’s not been at least interesting in the meantime…certainly supplies Wolf and his comments section with some solid material.

My experience is similar. I’m in SoCal in a 22 year old suburban tract. Three houses went on the market in my tract in January and listed in line with peak 2022 pricing. I thought it was absurd. I was wrong. They all sold in a few weeks, two at list and the third for $35,000 over list, probably because it was the only one left. A fourth house just listed for $50,000 above what the other three listed for. We’ll see what it does. I’ve refrained from chiming in on housing articles because my limited experience is not the same as what CS and others are reporting. Three sales don’t mean much, but sellers are still getting peak prices here.

If interest rates stop going up, it may take a long time for prices to adjust. If inflation remains elevated, maybe prices will never come down much in nominal terms. I think it’s absurd, but it doesn’t matter what I think.

Not a healthy market with such low inventory and demand, at least where I live. Because inventory is so low, the few selling at over asking give the illusion of a hot market. That’s what I think, but who knows anymore. I give up on all of it. Going to continue to save and spend as little as possible. I won’t participate in this fraud anymore than I have to. What a mess they have created.

According to FRED, labor force participation was somewhat below 2% to somewhat more than 4% higher in the 80s, depending upon when.

Most probably attribute the change to demographics. I attribute much of not most of it to an asset mania. Millions by now living off of inflated fake wealth, across all age groups.

No one actually ever retires due to reaching an arbitrary age. Three choices: You support yourself, someone else supports you, or you starve.

When inflated asset markets legitimately deflate and stay deflated, I guarantee the participation rate will go up noticeably, across practically every age group.

Nope

IF assets deflate as you so endlessly repeat, it will not increase the labor force.

There remain massive amounts of principal to spend.

Perhaps enough for several generations.

I believe Augustus is right, and OutsideTheBox is wrong. Ultimately, the asset mania means that someone else is supporting you, in that people who are producing things are willing to trade the fruits of their labor for assets at an inflated value. For example, let’s say someone who works 8 hours in a day on a farm and produces 500 apples. They can sell those apples for $250. Because of the asset mania, they can trade that for 1 share of Widget Co. That means they effectively traded 8 hours of labor for your 1 share.

Let’s say without the asset mania the shares of Widget Co. would only be $100. That means that the laborer is effectively “supporting” the holder of the share of Widget Co. to the tune of $150 (or 4.8 hours).

This is a simplistic example, but the point stands.

OutsideTheBox, there is no “principal” to spend, unless the asset mania (which includes the dollar) continues. Ultimately, production has to line up with consumption. If it doesn’t, it means somebody is supporting someone else.

Unemployment in my area is still low enough that businesses that work with the lower end of the pay scale are struggling to find help. My favorite local restaurant has two locations and they have decided to throw in the towel and consolidate down to one because they just can’t even get people to apply for open positions. Looks like we have a ways to go before people get desperate again.

Is that because people won’t accept the job, or because the boss isn’t desperate enough to pay them enough?

In the brief conversation I had with the manager, he indicated that they couldn’t even get people to apply. They first trimmed the one location down to breakfast/lunch only, and now when their lease runs out on the building they are shutting that location down completely.

I know what will get people to apply.. it’s called more money. But I am sure the boss doesn’t think that it’s worth it to pay them even more.

Kurtis…and maybe the boss can’t afford to pay more. Folks always assume the company is ripping employees off. I know I dont, and would love to pay higher (over $20/hr) for retail. We just can’t justify with sales at 65% of prepandemic. I know I’m closing the business at lease end in 2 years. I’m in the business district of Boston, and the metrics for people returning to work in the city will be years before amenity businesses can prosper.

RE: Candyman

Then perhaps the business isn’t viable anymore. I never assume that ownership is “ripping people off”, I just laugh when people always want labor to not follow simple supply/demand.

God forbid, people wait until they get a job offer for a job they’re actually trained for and good at and get a reasonable income from.

Brain surgeons and rocket scientists should clearly accept the first offer McDonald’s sends their way, because they don’t actually deserve any dignity.

Is take-home & all the shiny baubles it affords the thing which dignifies a profession? God forbid anyone pursues vocation without thinking about the remunerative side of it.

I want a doctor working on me who wants to be a doctor in the same way that a kid practicing guitar over a Mel-Bay EZ Chord book til his hands bleed wants to be a rockstar; because they can’t help but want to do what they have a natural aptitude to do.

bulfinch,

The orthopedic surgeon who did a hip and then a knee replacement on me has designed some of the parts for hip replacement and repair. He’s written text books on the procedures also.

“I’m just a carpenter who went to med school,” he remarked to me after doing my hip.

As a side note, the Doc has two Porsche 911s. One water-cooled; one air cooled. “They’re both manual transmission. I like to work with my hands.”

That is the person I wanted to rebuild my body! Thanks, Doc.

I was in Havana a few years back when a female companion turned her ankle to a macabre degree after stepping off a curb wrong in silly shoes. Our guide raced us to the hospital downtown where we were almost immediately greeted in the ER lobby by a perceptibly caring & switched-on medical staff, including the resident orthopedist (no waiting for hours). They expertly reset her ankle and ensured she was able to make it by until we flew out a couple of days later.

I later discovered that a doctor in Cuba — including specialist practitioners — make little more than a librarian there. The only injunction to go into any field is to be good at it. I dig that.

I’m not propounding a failed ideology—but I do rate that philosophy as a far higher watermark than the money incentive for seeking vocation.

Your comrade in Havana also got a stipend to go to free med school which is significantly shorter. I incurred 300+K in student loans and spent all of my life in school and post grad training and should accept peanuts and trinkets for caring for the sick and dying? Meanwhile you all want to collect assets and sit doing nothing collecting interest or rents. Medicine is on the verge of collapse. No one wants to do this job at all. Administrative and PE take over, declining reimbursements, exploding volumes along with severe labor shortage is pushing many hospitals to the brink. Don’t worry insurance company profits are sky high. It’s funny when I see doctors getting blamed in the news as being greedy and any sort of driver for health care costs. This country is a joke. Do the math. Doctor payments down. Patient bills up. Insurance profits up. Who’s the crook? C level and MBA bloat in hospitals is out of control. These people have zero empathy and produce nothing of value to the patient whom they universally view as ‘customers’ and work not for good outcomes or patient health, but profits and press ganey scores. Be happy if you’re nearing death. In twenty years only the wealthy will see doctors in this country. The rest will see midlevels and nurses.

Oh wow. My “comrade”

Ok, Dr. Captain America…

I’m related to, have worked alongside, and dated a quite a number of medical doctors, radiologists, nurses, and one dentist in my life. Some were clearly money-driven hacks who flipped a coin and chose med school over law school, others were the overworked dysfunctional product of status-crazed tiger parents, while others were megalomaniacs with open God complexes. Only two that I know do it because they are as devoted to it as a deacon. Minus those two, I can almost guarantee that none of them would’ve gone into medicine for remuneration comparable/adjusted to that of their “comrades” in Havana.

The low cost of tuition in Cuba comes with obvious tradeoffs; one is the monthly rations, where you receive a fixed amount of protein, potable water and starches and a neat little leatherette book to keep track of it all. Fun. But again, the point was that these doctors could’ve studied for any other type of work and enjoyed a similar standard of living there. They do it because the only injunction to do anything is to do it really well.

What is not captured by these figures are the H1B workers who cannot file for unemployment, and if unable to find another job, must leave the country in 60 days.

While responses to their plights range from heartfelt compassion (what I feel, as many were my colleagues) to gleeful schadenfreude… the bigger picture is that their exit from the US workforce of highly skilled talent is not adequately reflected in the aforementioned unemployment figures.

Thus we may already be solidly past “The Good Times” in your above charts.

The cold bottom line regarding housing:

* Anticipate additional and persistent downward pressure on housing and rent in Silicon Valley and similar tech hubs (Redmond, etc) even if interest rates remain at current levels.

* Service providers to these departing formerly well-compensated customers will likewise get squeezed, with small and medium businesses needing to likewise have layoffs or shut down entirely, exacerbating above.

I searched but could not find any figures for how many H1B workers have been let go, though I believe the figure is in the tens of thousands; with perhaps half to a third of those being soon-to-be former homeowners. That’s a lot of houses flooding the market that will need to be sold quickly in this elevated interest-rate environment, further driving down housing prices.

Good news for some, bad news for others. And so it goes.

I also had many H1B colleagues and hope they are doing well.

But, I think a more significant misleading factor is the participation rate. 20 years ago it was about 70% but now it’s about 62%.

That’s 8% more unemployed but not counted as such.

Those 8% are not unemployed any more than they were back in 1980 when it was 62% or even back in 1950 when the participation rate was 56%.

The only chart that matters is the 25-54 employment rate. Go take a look at that chart, it’s at the same levels as other previous good times.

As one of the impacted H1Bs, I appreciate your comment. I was in tech although, in a STEM role but not software. Considering that even though there is a yearly cap of 85k people and 6 year max term, max impact should be 510k employees.

However, due to extensions that can be obtained with employer sponsored green card procedures, the actual count may be significantly higher than that.

Obviously not all H1Bs are getting affected as some are in roles that are mission critical. But from experience I can say that we are on the first line of sight, agnostic of performance if there is any level of redundancy.

One of the reasons I thought the spike in Initial Unemployment Claims was important, coming on the heels of the weak-ish ISM data was the data coming on the heels of the bank depositors run.

A credit crunch in March seems to be working its way through the economy and I think the market is seeing it that way too.

Yields have fallen massively. Few days ago I lamented that something was fishy with the yields. And yields have since then fallen even more. Are deposits still being drained from the banks and into the treasuries? Is there still huge demand for treasuries?

If yields are going down then there seems to be a demand.

There is a theory that once debt ceiling debate is done, TGA needs to refill its account thus selling 100s of billions of treasury bonds.. this may have effect of increasing the yield.

Inflation is 8% and the Fed is still loaning money at 5%.

While the Fed talks a big game, their actions are still stimulating the economy and fanning the flames of inflation. The only people dumb enough to not realize it are the Tech Bros doing layoffs. Everyone else realizes we’re still in an inflationary free money bonanza.

I really hope the fed doesn’t pivot (in my non-economist opinion, we need at least a few more hikes), but I’m not sure if I trust them to resist the screaming once asset prices start falling. I suppose I will find out.

In other news, the twitter logo is back to normal, so elongated muskrat has presumably extracted enough money from crypto idiots to satisfy himself for the time being.

Have the banks who borrowed (very expensively) in the last few weeks repaid the FED?

Sold my home in MD in 2015 and living on my sailboat in Southwest FL.

But the wife wants to move back to land.

Just starting to see the prices of homes dropping in both the new and resale markets.

Many resale homes go under contract only to come back on the market and then the price reduces. A high end custom home builder recently pulled out of a large planned development and Toll Brothers took over his section. But their lots are mostly sitting.

Many of the sold homes are not getting near full price as we are following the recorded sales in the public records.

That’s the good news.

Metal fabricators (and other trades) are back logged 3-4 months due to hurricane Ian damage. They are raising their prices because insurance companies are paying the going rate. Local guy raised his hourly price from $110/hour to $200/hour. A guy paid him $600/hour, for 3 guys to remove his severely bent bow pulpit. I doubt all three of his workers are worth $200/hour.

Insurance company totaled my neighbor’s (structurally sound) boat. He only had about $30K in damage. They gave him $95K for it and allowed him to buy it back for $25K. He is putting a lot of new stuff on it.

My damage is minimal and not structural so I can wait until the backlog runs out. Might be awhile though.

What I can’t wait out is my car insurance. It just increased by 25% for the next 6 months.

Bid it out to two more companies and they are close to the same rate.

Boat insurance renews in August and I am really worried about where that’s going to come in.

T-bill and CD rates are helpful but inflation is eating away at them.

First problem you live in floriduh,never ending storms that destroy everything,insurance companies are idiots,to pay these rates. But their business model is onset on costs plus 10% for profit. Why do you think WARREN loves them

A lot of them might be people getting free money and then retiring when their unemployment insurance money runs out or expires.

What if:

The Fed announced the rate will remain at it’s present level, not subject to change or review for 5 years.

Would markets, manufacturers, consumers, mortgages all adapt to a fixed Fed rate within 6 months?

Would the economy overheat or simply find equilibrium, and establish a stable capital investment rationale?

What would all the economists have to agonize over for 5 years?

Something I don’t believe is captured in the government figures is the number of unemployed people who have exhausted their benefits while still actively job seeking. After a few months, they are unable to file unemployment claims. Today’s job market numbers are camouflaging a more dire unemployment situation.

According to ZH, the labor market has been collapsing every day of every year since forever.

“…camouflaging a more dire unemployment situation.” LOL

Wait until you live it! Your LOL is BS.

Are you drawing a conclusion about the overall labor market from your own job situation? While ignoring the 160.8 million people who are working? is your individual situation so big that it overpowers the situation of 160.8 million workers?

The jobs numbers mean nothing, other than those employed do not have time to demonstrate or protest anything.

The only number that matters is what the wages from those jobs can buy to support a family.

Everybody knows of peak oil, where it takes more energy to deliver that the delivery produces.

Well, how about peak labor, where the money received does not cover the cost of maintaining the worker in a state where they can do the work.

And what those stats don’t show is the number of workers holding two or even 3 jobs.

At what point does peons living in tents,hungry,cold,desperate,turn to chaos ,this could be their plan turn people against each other,while fat cats hide out in safety.

Peak labor is an interesting framing, and I think you’re not wrong.