We find a good rubbernecking spot.

By Wolf Richter for WOLF STREET.

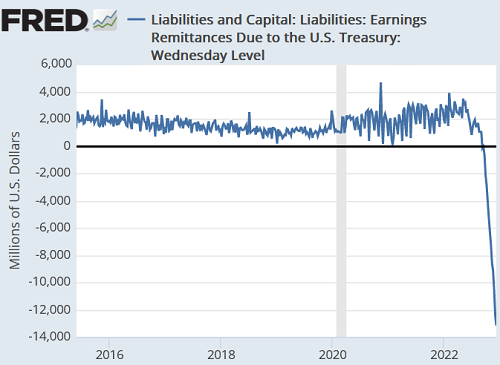

A collapse-chart has been making the rounds in the social media, financial blogs, and the like. It’s being handed around without context, as if self-explanatory, sort of like, look, the world is collapsing. It’s from the St. Louis Fed’s data depository. The title of the chart says, among other things, ominously, “Liabilities: Remittances Due to the U.S. Treasury.” Whatever this is, it’s violating the WOLF STREET dictum, “Nothing Goes to Heck in a Straight Line.”

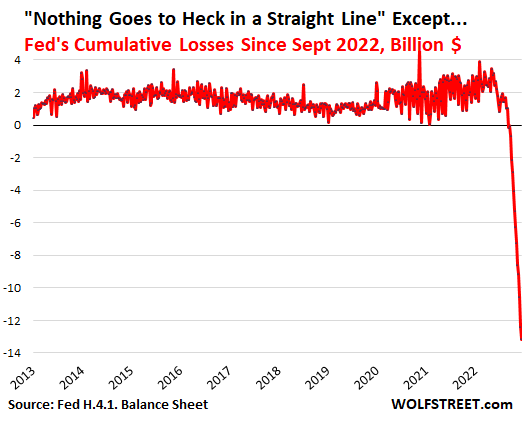

But beyond the funny aspects of the chart, there is something happening on the Fed’s balance sheet that is taking on momentum and heft: How much money the Fed is losing, where this lost money shows up, and how it derails a taxpayer gravy-train. The chart reflects that in a bizarre manner — it does a switcheroo — that we’ll get to in a moment.

A liability is money that the Fed owes some other entity – in this case, money that the Fed owes the US Treasury Department. But this particular liability account, “Earnings remittances due to the U.S. Treasury,” is kind of a funny creature.

It has a negative balance of -$13.2 billion as of the Fed’s weekly balance sheet released yesterday. On a balance sheet measured in trillions, this is pretty small. But it’s going to get a lot funkier.

The Fed’s income, normally.

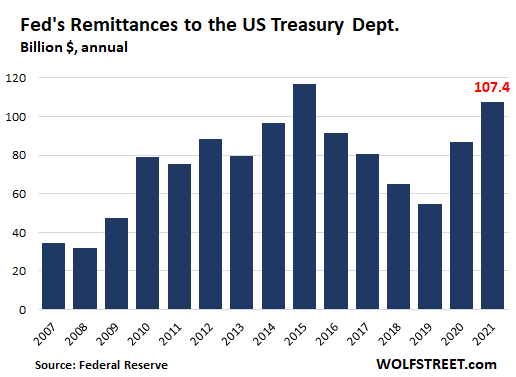

The Fed’s revenues come from interest and fees. The biggest source is the interest it earns on its $8.17 trillion portfolio of Treasury securities and MBS, which earned the Fed $122.4 billion in interest in 2021. The Fed also charges fees for various services it provides for the banking system. All combined, in 2021, the Fed had $123.1 billion in revenues.

The Fed’s expenses come from operating costs and from the interest it pays. The operating expenses of the 12 regional Federal Reserve Banks amounted to $5.3 billion last year. It also paid interest on reserves and on reverse repos. Last year, with the interest rate it paid on reserves at only 0.15%, the Fed paid $5.3 billion in interest on reserves and it paid $414 million in interest on overnight reverse repos (RRPs). And there were some other expenses. Total expenses amounted to $15.5 billion.

The Fed also paid dividends of $585 million to the shareholders of the 12 regional Federal Reserve Banks. The shareholders of the 12 FRBs are the financial institutions in their districts.

The Fed has to remit its net income to the US Treasury Department. Its net income (revenues minus expenses minus dividends) amounted to $107.8 billion. The Fed has to remit to the US Treasury Department nearly all of its income and any capital in excess of its statutory capital limit, set by Congress. It announces these figures every January, and I dutifully covered it every January, including in January 2022.

Over the past 21 years, the Fed remitted $1.28 trillion to the Treasury Department! Since the start of QE in 2009, it has remitted $1.07 trillion. In this respect, money-printing was a gravy train for the taxpayer.

But this whole thing is going to end because the Fed will have a net loss this year, and for years to come.

How much money can the Fed lose?

This year, the amount in interest that the Fed pays on reserves (to banks) and that it pays on its overnight RRPs (mostly to Treasury money market funds) has shot up, as the Fed has hiked interest rates from near 0% last year to 3.9% on reserves and 3.8% on overnight RRPs as of early November.

Currently the Fed pays $2.4 billion a week in interest on $3.2 trillion in reserves. And it pays $1.6 billion a week in interest to the counterparties of $2.15 trillion in overnight RRPs. At current rates and balances, that’s a cash outflow of about $4 billion a week ($208 billion annualized).

QT, which destroys money in the financial system, has the effect of shrinking the combined balance of reserves and RRPs. Both of them have come down from their highs, and there are shifts between them. And on a combined basis, both will continue to shrink during QT.

So the balances that the Fed will pay interest on will shrink.

But the interest rates that the Fed pays on those balances will rise by probably 50 basis points next week, and by more next year, and only God knows how far the Fed will go. But each time the Fed raises its rates, it has to pay more in interest.

So if the average combined balances in 2023 of reserves and overnight RRPs is $4.5 trillion, and if the Fed pays an average of 5% on these balances, it will shell out $225 billion in interest.

At the same time, QT will shrink its portfolio of interest-earning securities, and its interest income will dwindle.

In addition, there may be the losses that the Fed would incur if it starts selling outright about $15 billion a month in MBS to bring the runoff closer to the cap of $35 billion.

To summarize:

- QT reduces the Fed’s interest expenses by bringing down reserve and RRP balances that the Fed pays interest on. Enough QT will eliminate the Fed’s losses.

- QT also reduces the Fed’s revenues but by a much smaller amount as it reduces its holdings of interest-earning securities which mostly have low yields from the ZIRP era.

- Rate hikes caused the Fed’s interest expenses to jump and created the Fed’s losses, and further rate hikes increase the losses until QT brings down the reserves and RRPs.

The switcheroo in the collapse-chart.

The chart tracks the line item, “Earnings remittances due to the U.S. Treasury,” on the Fed’s weekly balance sheet (second “Table 6,” Liabilities). This is normally a line that tracks the weekly increase in the amount that the Fed estimates it owes the US Treasury as the year goes on.

“Normally” means in times when the Fed is making money. Each week adds up. For example, in 2021, all the 52 weekly amounts, each in the range between $500 million and $4 billion, added up to $106 billion that the Fed would owe the Treasury Department. Close enough for an estimate of the $107.4 billion in remittance for the year.

But when the Fed started losing money on a weekly basis in September, the account did a switcheroo. Instead of showing the “weekly change” as during normal times, it shows the “cumulative loss since September 2022.”

In other words, when the Fed started losing money on a weekly basis in September 2022, the account shifted from showing a weekly change of a positive balance, to showing the total cumulative negative balance. It now no longer shows the weekly change but its total loss since September 2022.

This shift from “weekly change” to “cumulative balance” is kind of a funny way of doing something? But it sort of makes sense, and here’s why:

In theory, if the amount that the Fed owes the US Treasury is negative, it would mean that the US Treasury owes this amount to the Fed and would have to pay the Fed. But that’s not their deal. Their deal is that the remittance is a one-way channel, from the Fed to the Treasury.

And when it turns negative, the Fed will just sit on the negative balance that will grow over the years as long as the Fed is losing money. And when the Fed is making money again, the Fed will not remit its net income to the Treasury Department, but will apply it to this pile of accumulated losses until the pile is gone. When the pile is gone, the Fed starts remitting its profits to the Treasury again.

The Fed calls this growing pile of losses a “deferred asset.”

Nope, that wasn’t one of my infamous snide remarks. The Fed calls this growing pile of accumulated losses a “deferred asset.”

Storing losses on the balance sheet as a deferred asset, rather than showing the loss on the income statement right away, and booking the loss to capital, is an old corporate accounting trick, encouraged by GAAP, and includes such infamous accounts as “Goodwill” and “Intangible Assets.” The Fed is sort of just sticking to devious corporate accounting 101 here.

The Fed explains this in footnote #8 of Table 6:

“Positive amounts [from January to early September] represent the estimated weekly remittances due to U.S. Treasury.”

“Negative amounts [since early September] represent the cumulative deferred asset position, which is incurred during a period when earnings are not sufficient to provide for the cost of operations, payment of dividends, and maintaining surplus.

“The deferred asset is the amount of net earnings that the Federal Reserve Banks need to realize before remittances to the U.S. Treasury resume.”

In other words, each week going forward, the chart will show the Fed’s total losses starting from September 2022. The bigger the negative number, the bigger the accumulated loss.

And the chart will keep violating the WOLF STREET dictum that “nothing goes to heck in a straight line” and by 2024 could be a hoot.

Sometime in the future, when the Fed starts making money again, the line will begin to curve upward as the Fed’s income is applied to this pile of accumulated losses. And when the Fed has earned all the money back that it had lost, the line will re-enter positive territory, and then the Fed will begin remitting its income to the Treasury Department. And we’ll back to normal. Whew!

The Fed, which creates & destroys money, cannot run out of money.

I mean, we knew this all along. The Fed is not Enron, though the loss-accounting might look similar. The Fed creates its own money. And the Fed’s losses – no matter how large – will not cause the Fed to run out of money because it can always create more. So we can take that off our worry list. For the Fed, a loss is just an accounting entry, not an existential crisis.

The Fed won’t print money to pay for its losses — it won’t need to. But it’ll use some of the money from the QT roll-offs that would have been destroyed and pay interest with it. And so that money for interest payments goes out the door, and the balance sheet will shrink on track with QT.

A new addition to my monthly QT reports.

I discuss the effects of QT on the Fed’s assets on a monthly basis (most recently, “Fed’s Balance Sheet Drops by $381 Billion from Peak: December Update on QT”), and just for our theoretical amusement, I will add the chart of the pile of accumulated losses which should become a real hoot as we go forward, so we can do some rubbernecking here:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sometimes things do move in a straight line!

“The Fed, which creates & destroys money, cannot run out of money.”

I feel Real money is only created when work is done to create a product or service of value. Rest is only currency that runs on trust.

Agreed.

Wolf really should pair these kind of posts with posts tracking real asset prices.

DC is not some sort of magical unicorn that can poop real wealth.

All it can do is print unbacked fiat currency that raises the prices of real wealth producing assets and redistribute wealth/power to the favored constituencies that keep the current generation of DC worthies in power.

This isn’t magic – it is Germany 1922.

And it has been for decades.

It is just that now the wheels are badly coming off and there is a mechanism for 260 million US adults to point out the lies of 2 or 3 million political class nomenklatura.

“there is a mechanism for 260 million US adults to point out the lies of 2 or 3 million political class nomenklatura”

The vast majority of them have no knowledge of the specifics shown here or would have any idea about what it meant if they did. They are mostly ignorant about economics and the fiat monetary system. They will only pay attention when their games and circuses are taken away at which point it’s too late and they probably won’t come up with or, at least, succeed in getting a proper fix when they finally do pay attention.

Is black black, or is it white? Just as in Spy v. Spy, Real versus Reel. Both for money and assets. Time itself is immeasurable whenever the observer is suspended with no outside reference points. The fog machine has done a very good job of fooling both the participants and observers alike. Only when a bicycle falls from the sky does anyone start to ask if something is wrong with the frame of “reality”. By then it’s raining live fish.

Actually for all 3 of above comments, for which,,, Like my regards for Wolf, I thank you folks:::

Been saying for decades now, that the whole SM thing is SO corrupted that I would not participate,,,

Turned to RE, and have been OK, with triple net a positive balance both short and long term…

NOW,,, NO WAY for either until the next bottom.

Having participated RE ups and downs since WE, in this case the family WE, lost the farm and one of the other houses to be able to keep the house we lived in,,, it always ”appeared” to be different each time, but was always, in the end, the same cycle of up and down…

May the GREAT SPIRITS bless us all!!

Leo – “Work”…”Product”…”Service”…”Value”…those are relicts of a capitalism’s peak long, long ago…

I propose that today we live in an economic simulation at present, sort of a sub-simulation beyond the base reality simulation that Elon Musk believes we possibly exist. But unlike the base reality which can never be known by those trapped inside, the economic sub-simulation is mathematically obvious to eyes wide open individuals, but not yet as a collective society…

The base reality of our economic simulation is that according to Steen Jakobsen of Saxo Bank, in 1975 “INTANGIBLE ASSETS” made up around 17% of the world’s wealth, and the rest was “Real Stuff”. By 2020, that number surged to 90% as currently the global wealth is simply an “economic simulation”, something from nothing, a story we collectively tell ourselves to deal with the self-inflicted complexity we have created which is beyond our cognitive abilities to process as a collective society.

We are well beyond our human limits at the moment to even begin to understand how the future will unfold on numerous levels, and at this point luck will play a greater role than logic for the future existence of humanity, which I find disturbing. This is the point in “the movie” in which we need some omnipotent, empathetic, alien society to visit and save humanity from itself…HA

As wolf stated, I concur:

…“Goodwill” and “Intangible Assets.” The Fed is sort of just sticking to devious …

——————————————-

In summary, enjoy those “INTANGIBLE ASSETS” while they last!

So be it 1,000 years or 24 hours of existence, “INTANGIBLE ASSETS” are “something for nothing”, which breaks the fundamental laws of the universe in which we are forced to exist. In the end the Universe’s rules of existence will inevitably prevail over humanities attempt to not exist within, so again, enjoy all those ephemeral googolplexes of “INTANGIBLE ASSETS” while the Universe allows humanity to pretend…HA

Great thought, but I have to point out that intangible assets are driving profits today. Big Tech generates tons of cash flow from extremely high margins, because there is no effective competition, and massive wealth concentration allows big players to cut out the little guys via buyouts and too-big-to-fail mentality of regulators.

Intangible assets have more value than ever because oligopolies are flourishing and wealth concentration is at extremes. A small portion of the nation is capturing all its wealth. You need more than great ideas, energy, and execution to compete in a business today. You need billions of capital that can be burned.

Once oligopolies have the power, the situation is difficult to reverse. They pay their soldiers well.

With you, like totally dude or dudutte,,, until:

” In the end the Universe’s rules of existence will inevitably prevail over humanities attempt to not exist within”

VERY clear if one wants to take the time to study thoroughly the available published experiences of those of many stripes who tested the limits of the theory(s) of human conciousness and found very clear indications contrary.

Certainly NOT easy to get beyond the current concepts of limits…

Certainly available to those willing and able to do the work to get beyond any such limits.

Certainly well documented in many such cases.

As Wolf says constantly,,, ”Don’t be listening to the ”nay sayers,”’ etc., etc.”

There are intangible assets, unfortunately fiat money isnt one of them. The Fed is just holding the world & america’s future generations hostage with its financial gimmicks! One wrong move on the QT return…and the world goes down with it. God bless us all.

Do not keep this corrupted Fiat money includes USD,,,Buy real money for that ,silver/gold , Fiatmoney has ALWAYS failed in history

In a word: WOAH!

That line is going to look very much a plunging curve going forward ,especially as the scale to adjust to hundreds of billions of losses carried forward will compress the scale of the positive balance years by a factor of 20 or more. Keeps the wow factor in there.

Small typo: “Normally” means in times when the Fed is making money. Each week ads up.

GREAT explanation, as usual…

“GREAT explanation, as usual…”

Concur! Wolf must have huge neck muscles to support that huge cerebellum of his.

I think there is a typo in the title: …”and where can we go TO see them”

n/m, it’s just a different way to phrase it.

I’m going to be hugely curious as to how serious of an impediment this will be to QT going forward. The Fed printing more money to paper over cumulative losses will leave the QT bicycle pedaling backwards, wouldn’t it?

I admit I need to study this more intensely over time.

Not that I would expect any political motivation for such an act, but does this mean the optimal way to keep QT running like clockwork would be to literally raise revenue or find federal budgetary room to send money to the Fed to literally extinguish into thin air?

A trillion dollar taxpayer gravy train from years past turns into a trillion dollar tax albatross? Otherwise inflation-fighting QT would be impossible to continue? (A potential disaster in itself with our already high inflation).

The only other option I could see aside from printing more money is to have the political will to take on new government debt to pay the Fed’s losses so inflation can still be battled against effectively through continued QT.

Ugly!

I believe you have missed the point of this article. The Fed doesn’t HAVE to print any money to cover these losses. It’s just a ledger entry for them, in exactly the same way as the money they print.

I believe Wolf’s point is that the stories about these losses are yet another media attempt to declare that QT is nearly over, when it has really just begun. These losses are not a surprise in any sense; FRBNY wrote about them in a note earlier this year.

The effect on QT is zero.

drg1234,

I’ve mostly been reformed of my initial ignorance as a result of Wolf’s responses to my inquiries, both public and private.

You are right that nominally QT will not be affected; I was only wondering at this point if the growing interest payments serve as a counteracting inflationary force even though the nominal balance is reduced as scheduled.

Nice comment before the FRBNY plug who haven’t been right for at least 20 years.

Lap dogs of the “finance” industry.

Zero Sum Game,

QT reduces the Fed’s losses because it brings down reserves and RRPs that the Fed pays interest on.

The Fed won’t print money to paper over its losses — it won’t need to. I said this to show that the Fed cannot go bankrupt. But it’ll use some of the money from the QT roll-offs that would have been destroyed and pay interest with it, and so that money goes out the door, and the balance sheet will shrink on track with QT.

Rate hikes created the Fed’s losses, and further rate hikes will increase them until QT brings down the balances of reserves and RRPs.

If the Fed does enough QT, RRPs will go close to zero and reserves go down to $1.5 trillion. At this point, the problems is gone, and the Fed is making money again.

OK Wolf, thanks. This largely hammers out any misinformation lingering in my brain except one final thing….

What about the interest that ‘goes out the door’ from some of the QT roll-off money? Does that indirectly work as a significant natural force against the scheduled $95 billion/month since it’s money going back into the economy, especially if interest rates go much higher?

You do make it sound as though the whole process will be relatively benign for the Fed as an institution, so that’s a plus it seems.

I don’t see it that way. The banks and money market funds are going to do something with their cash, and someone is going to pay interest on this cash, whether it’s the Fed or someone else isn’t all that important.

One things is for sure: when they put their cash on deposit at the Fed, it’s out of circulation and doesn’t chase after other stuff, including other assets. And that takes some inflationary pressure off.

Depending upon coupon rates, duration of the remaining portfolio, and current market rates, the FRB could still be underwater even after QT ends.

Agree

wolf – arent there losses, or potential losses on the sale of bonds? so if the Fed purchased a bond or MBS in the market at lower interest rates and then sells that asset before it matures at a time of higher interest rates, the market price of the bond will have declined from the purchase price.

so wouldnt a faster pace of QT, assuming that interest rates must stay high, lead to much higher principle losses?

i think the period when the Fed was purchasing those bonds, it was driving interest rates much lower, so I dont see how it can sell them at the same price. or maybe instead of selling the newer bonds first, it sells the older bonds first, bonds that were purchased at a time of lower interest rates, to minimize capital losses.

imagine if the Fed was forced to mark their bonds values to market versus liabilities?

gametv,

You’re addressing two different types of losses — if I read your comment correctly.

1. the losses selling bonds outright. The Fed won’t sell its Treasury securities, and so there won’t be any losses. It might have some losses if it sells MBS, and I address this in the article.

2. the losses from buying bonds at a premium when the market yield is lower than the coupon interest, and holding them to maturity and getting face value, which is something that all bond buyers encounter.

I address this #2 in my monthly QT updates, most recently here, and I’ll just quote from it

https://wolfstreet.com/2022/12/01/feds-balance-sheet-drops-by-381-billion-from-peak-december-update-on-qt/

The Fed bought its securities in the secondary market, and when market yields were lower than the coupon interest of the bonds, the Fed, like everyone else, had to pay a “premium” over face value.

The Fed books the face value in the regular accounts, and it books the “premiums” in an account called “unamortized premiums.” It then amortizes the premium of each bond to zero over the remaining maturity of the bond. By the time the bond matures, and the Fed receives face value for the bond, the premium has been fully amortized.

Unamortized premiums have dropped by $39 billion from the peak in November 2021, to $317 billion:

Z S G,

When competing in match sprints on the velodrome, and the first lap has been completed at a minimum speed of a walking pace, it is against the rules to pedal backwards from a static “track stand.” It is up to the discretion of the race commissaire if and when to warn the riders that they are holding their track stand too long. When warned, riders must move forward.

The Fed doesn’t have a race commissaire to warn them if they’re breaking the rules.

Thank you Wolf for breaking down of the “Earnings remittances due to the U.S. Treasury.” It seems that the Fed will wait until all the “losses” are recouped before kicking any more cash back to Uncle Sam.

Since Uncle Sam is already $31 trillion in the red, that won’t help things, I reckon.

Ah, but if I’m understanding right that $31.9 trillion national debt, inflation-adjusted to March 2020 dollars, is only $27.6 trillion, a relatively modest increase over the $23.2 trillion debt the US actually held at the time…

Thank you, Wolf, this is an excellent dissection of the ‘Fed Implosion’ pivot argument that has been making the rounds

That’s when your taxes will increase.

The FED like all central banks were created by private banks to serve the interests of private banks, so they should all be shut down immediately.

Pretty soon they’ll just confiscate our savings to pay off debt. Again my sweat for there folly ,this probably won’t end well.

“they” won’t confiscate your savings. Inflation will :-]

Suck in that gut and prop up that chest…it’s General Inflation to you soldier! Now tuck in those pajamas and get that Pledge Pin off your uniform! (Of course, these days I’m personally saluting the officer class with middle finger extended. May they all rot in the hell they created.)

Who don’t ‘they’ just use our savings to find their share buybacks!

Oh, they did ‘find’ it.

Why don’t ‘they’ just use our savings to find their share buybacks!

I understand that losses are basically meaningless to the Fed, but isn’t the lack of remittances to Treasury a problem, for example in regard to a debt ceiling fight? When the Fed sends billions to Treasury, the latter has funds it doesn’t have to seek from Congress to support federal expenditures, right? I know it’s relatively small potatoes.

Well, taxpayers were on this money-printer gravy train. And the Fed kicked them off.

The real gravy train isn’t the accounting entry remittances, but that the amount of UST on the FRB balance sheet doesn’t have to be financed in the public markets.

Concurrently, I wouldn’t call it a gravy train for the taxpayer because it isn’t actually free,

There are consequences to monetary policy. The first is over a century of almost perpetual currency debasement (mostly except the 30’s) and the biggest asset, credit, and debt mania in human history, which is substantially the result of monetary policy. The cost of the second is yet to come, in much lower living standards.

The real winners to date have been those feeding at the public trough who benefitted from increased government spending and artificially low borrowing costs.

AF: the advocate of restoring the Great Depression and keeping currency clean and honest. Return living standards to cave dwelling, where they belong, unless you’re “productive”, that is, AF approves.

Austerity uber alles.

More of your ridiculous replies to my comments.

I disapprove of theft, plain and simple. That’s what monetary policy does. Yes, I believe that savings should not be stolen, obviously.

So, you are in favor of it, picking winners and losers?

what is interesting to me is that the people who advocate for environmental policies also seem to be the people who consume the most stuff and generate the most CO2. If you really care about the environment, stop buying stuff you dont need.

i just think a good market crash is necessary, like a forest fire wiping out an overgrown forest and allowing new growth to take place

You, asking me for a reply? If my comments are “ridiculous”, then why ask me anything?

Your logic/reasoning ain’t as good as you think it is.

gametv

” If you really care about the environment, stop buying stuff you dont need”

SPOT ON!

I have been commenting on the very issue In the major financial media including WSJ, Barron’s+

Our ‘consumption economy has transcend slowly into ‘sustainable/re-cycling’ economy. Very few interested on this issue.

Without ‘consumption’ economy with borrowed money, the economy and the mkts will tank. The vested interests don’t want this b/c it is a threat their assets.

Climate activists like John Kerry and Leonardo DiCaprio are hypocrites considering the carbon print of their personal/family JETS (Kerry) and 150M yacht of DiCaprio burning 300 gallons of diesel every day! So are the Davo crowd.

I don’t see AF “advocating” anything. He’s just pointing out that you can only plug the hole in the dike for so long before the water rushes in and floods everything.

Funny…I get the sense he is pointing out that the entire dam is sinking with the subsidence of the marshlands it was built upon, and that the water will soon be lapping over the entire lip for its’ full length. “No one here gets out alive.” Nor “guts out” either.

Wolf, the question that popped into my head after reading this great explanation of the Fed’s P&L and distribution deal w/ the Treasury is:

It seems that when a spending bill occurs (usually calculated over many years), such as the 2021 Infrastructure bill and the so-called 2023 inflation bill as just a few examples, doesn’t the Federal Budget Office calculate costs vs how it is paid for. Wouldn’t they, as they calculate the total US Treasury revenue being paid in by the Fed ($1.07T in the last 12 years), now find themselves without the revenue they already budgeted to spend? Wouldn’t this end up just increasing more deficit spending that WASN’T planned for?

I guess I’m just wondering (even though it isn’t a HUGE amount of money), isn’t increasing deficit spending with the backdrop of decreasing revenues (income tax revenues will no doubt drop over the next several years as well) actually just add to the inflationary pressures?

I don’t know if these thoughts make sense or not, but I figured I’d ask the question under the guise of…. there are no stupid questions lol

In that regard, I just saw that the 1st batch of the $94 billion (from the Infrastructure bill) for union-brokered pension plan bailout was announced…with $34B going to the Central States Pension Fund….

$36bb to cover plans for 350,000 workers so $100k bailout each. Per PBGC, still nearly $1T in unfunded pension liabilities. That covid stimulus bill to bailout pensions and support them to supposedly to 2051 is not even remotely possible. Expect more bailouts and more inflation.

Well, I would hardly refer to the shit show occurring at the Federal Reserve Bank as a zero sum game.

I prefer to view the Fed’s zero sum game as a side show, diverting attention from the real pile of excrement they produced over the past few decades.

On the plus side the Chair of the FRB announced last week that the FRB will raise the FFR by 50 bpt on Dec 14 and went further into his cups to hint that the FRB would be raising the FFR at the February and March meetings.

All of this in the face of a roaring inflation that shows no sign of receding. In fact shows that it is more likely to increase, or at least, remain at the ravenous level where it currently resides.

If the FRB raises the FFR rate by less than 75 bpts, we will know they are bought and sold, just another corrupt institution of the American mob.

So, the long term, zero interest rate bonds the Fed issued during the stimulative era have become worthless and the Fed is paying the FFR to a gang of deadbeat banks that are “holding” the $5 Trillion of phony money issued by the FRB over the past two years.

I’m glad the books balance.

Somehow, I’m not feeling the vibe of satisfaction that the Fed’s crooked books, balance.

Dang, do you get some kind of ‘compounding interest’ by laddering your comments? /s

I accused him of hitting the sauce the other day because of it, which was kind of mean. But he does go on a rant with himself from time to time. I am learning he is older so he gets a pass now.

+,,,

With you most of the time,,, but

WE, in this case WE the Commenters of Wolfstreet, must continue the Wolf’s policy of being accepting of strange and even stranger comments as long as they adhere to the rules,,, for which rules — and his articles of course —

I am sending support to WS at least twice a year,,, may have to increase to 3 times per year based on how much WE, in this case the family WE have saved so far because of Wolf’s wonderful reporting,, and the commenters…

Great discussion, Wolf, but you might also mention that the Federal Reserve Banks’ combined net worth is only $42 billion, so their operating losses are rapidly running through their capital, and with honest accounting, they would soon be reporting a large negative net worth, which might grow very large indeed. To avoid this accounting result, the Fed made up the phony “negative liability” account you correctly highlight. In other words, on honest accounting, the Fed will soon be technically insolvent. Does this matter? It does to taxpayers and should to the Fed’s stockholders. All the best, Alex Pollock

No, the Fed is not running through their capital. Read the article. Alex, I love you, but you’re spreading nonsense.

Because the Fed is NOT taking a loss; instead, it’s setting up the loss as an asset and will carry it on the balance sheet as an asset (“deferred asset”), similar to Goodwill or Intangible Assets in corporate accounting. Taking a loss as an asset to the balance sheet is done all the time in corporate America, under GAAP. The article explains this in detail. READ IT.

Just check the capital account. It didn’t drop with the operating loss! Total Capital:

Aug 25 (before the losses): $41.8 billion

Dec 8 (after the losses): $41.8 billion

People need to get a grip on reality of modern central banks.

Speaking of spreading nonsense, CNN’s front page article is “The Fed will raise rates again. But it’s playing with fire.”

It seems that the entire media apparatus is on the side of Wall Street and other “investors” who the Fed to pivot to save their stonks. It’s really pathetic.

That’s funny. The headline should have read: “The Fed will raise rates again. But it’s playing with a fire extinguisher.”

Alex, whether or not a central bank is ‘insolvent’ accountingwise is immaterial: I know of no central bank which has a minimum capital requirement, a negative net worth prohibition or a requirement for shareholders to replenish capital. A central bank can operate perfectly well with a negative net worth. The only thing which can get a central bank into trouble is foreign currency. As long as a central bank has no foreign currency, it can never become illiquid and a negative net worth does not limit its proper functioning in any way. If it has foreign currency liabilities, it can get into trouble in a hurry. By the way, the interesting thing about the Euro is that only the ECB is a ‘true’ central bank. The national central banks are not true central banks because they cannot create money on their own. In fact, the national central banks could become illiquid and/or insolvent.

Forget the accounting arcana for a moment … I want to look at it as a black box … just what goes in and out … all netted out. If the Fed uses created-from-nothing money to pay interest on reserves, it could in theory actually be expanding the money supply just by paying interest. In which case higher rates would mean more, not less, monetary accommodation … ? …

No it doesn’t. It doesn’t create money to pay interest. It uses some money from the roll-offs to pay interest, instead of destroying this money.

The balance sheet will continue to decline at the same rate (QT).

I wrote a comment last year that the Fed Res positive remittances to the treasury would turn into losses in the hundreds of billions $$$ and Wolf, with one of your famous snide remarks, you said I was wrong. Anyway, good article.

One point I would make is when pays the 300 billion or more in interest on reserves and RRP from QT $$$, the Fed is actually not deleting that amount of $$$ out of existence but it is still in circulation. If the interest paid reaches a point higher than the monthly QT then there will be no QT and will switch to QE!

“The Fed is not Enron, though the loss-accounting might look similar.”

This sentence made me laugh uncontrollably! You are mult-talented indeed ;-)

Keep up the fantastic work!

Your post does a great job of explaning the Fed side of things. Can you give a brief explanation of what, if any, the repercussions are for the Treasury Department of no longer receiving any net income remittances from the Fed, at least for the foreseeable future? Is missing out on a hundred billion or so per year no big deal for the Treasury?!

Faster increase in the national debt.

But it’s not a huge impact, given the massive growth of the national debt. Total national debt = $31 trillion. It grew by $2.5 trillion over the past year; it grew by nearly $8 trillion since March 2020. So that extra $107 billion that the Treasury is not getting, will increase all this by $107 billion per year.

Does the Fed not have to “mark-to-market” its assets? During rising interest rates, the market value of the treasuries which the Fed holds declines. That “mark-to-market” should be another most substantial sources of losses for the Fed. Would appreciate an answer!

PS: the Swiss National Bank “marks-to-market” its assets which currently is a huge source of losses.

Klaus Kastner,

Even regular banks don’t have to mark-to-market their securities that they intend to hold to maturity because at maturity, they get face value. I buy Treasury securities at auction and hold them to maturity. I don’t mark them to market either. That would be silly. I just forget about them, collect my interest, and when they mature, I get my money back. That’s how bonds are intended to function.

The Fed does that too. It doesn’t intend to ever sell its Treasury securities, and when they mature, the Fed gets face value.

MBS are treated the same way, but the Fed might eventually sell SOME of them to get closer to its monthly run-off cap of $35 billion. And there would be some losses involved. I mentioned that in the article.

The SNB owns a lot of STOCKS. Stocks have no face value, and they don’t mature, and you don’t get your money back at the end. So they MUST BE marked to market. There is a huge difference between stocks and Treasury securities.

The SNB also dumped a whole bunch of its biggest stock holdings, including Apple. So when you look at the plunge in its foreign currency holdings, it’s in part because of dropping stock prices, and in part because it unloaded a whole bunch of stuff. I give you the details of how many shares per stock it unloaded here:

https://wolfstreet.com/2022/11/11/the-swiss-national-bank-began-unloading-its-biggest-us-stock-holdings-incl-apple-microsoft-amazon-alphabet-meta/

Thanks for the clarification. I have been in retirement for too long to remember the details but I was under the impression that IFRS required corporations to mark all financial assets to market, i. e. including “securities held until maturity”. In fact, I remember that before IFRS, a lot of ‘games’ could be played by moving securities between the trading and holding accounts, particularly where sovereign restructurings were concerned. Obviously, stocks must be marked to market but that alone can’t be the explanation for the SNB’s losses. Stocks ‘only’ account for 20% of their foreign currency assets. Out of 142 billion CHF losses for the first 9 months, the SNB attributes 71 billion to their securities portfolio. That can’t all be write-off’s. So I guess a strong case can be made that the SNB also marks securities with fixed rates and maturities to market. Would you not agree?

Klaus Kastner,

If the SNB’s portfolio of US stocks lost 20% by the end of Q3, it would mean a loss of $35 billion, for its US stocks alone. So that’s about half of its loss from securities.

But the SNB holds stocks globally. It doesn’t disclose its holdings. We only know what it has disclosed in the US in terms of its US stock holdings. Given that its primary focus is the CHF exchange rate with the euro, it would hold more euro-denominated stocks than USD-denominated stocks. I also assume that it holds non-euro European stocks (esp. British stocks), plus Japanese stocks, Chinese and HK stocks, etc. Some of those have gotten totally trashed.

So to me, it looks like – just guessing – that all of the CHF 71 billion in losses could very well come from its global stock holdings, with about half of those losses incurred with US stocks, and the other half from stocks denominated in other currencies.

As of Q3, stocks accounted for 25% of the SNB’s foreign currency portfolio; 75% in securities. The 71 billion CHF portion of the total loss of 142 billion is explicitly attributed to the securities portfolio (54 billion are explicitly attributed to the stock portfolio). So this year, the SNB lost much more on its securities portfolio than on its stock portfolio (albeit the stock portfolio is much smaller). Like you, I can only guess but my very strong guess is that the SNB is marking to market its securities portfolio. Perhaps that makes it unique (apart from the uniqueness of having a balance sheet total way in excess of GDP!).

Klaus Kastner,

I should have said this up front, but forgot in the heat of the battle: The whole discussion about whether or not the SNB marks to market is irrelevant in the context of the Fed and other QE central banks. Comparing the SNB to the Fed is total nonsense because the SNB is a hedge fund that buys foreign-currency denominated securities and holds the for sale, in order to push down the CHF; and it sells them when it needs to push up or stabilize the CHF. This is a trading portfolio of a hedge fund.

The SNB didn’t buy CHF-denominated securities to do QE.

It bought foreign-currency securities to manipulate the CHF down. This doesn’t do QE in Switzerland. If anything, it’s doing QE in those foreign countries.

To push down the exchange rate of the CHF, it created CHF and sold CHF for foreign currency and with the proceeds bought foreign-currency denominated securities.

And when it has to push up the CHF, it’s starting to sell those foreign-currency securities. And Jordan said as much months ago. This is a hedge fund set up for trading purposes, to move the CHF, and not to do QE.

So it holds those foreign-currency securities for sale, and it sold a bunch of them (I listed the biggest stocks that it dumped), so it may mark-to-market those foreign-currency debt instruments that it holds for sale.

The Fed’s QE assets are all USD denominated securities it bought for QE purposes and planned to hold to maturity.

The Fed’s SVP assets (corp bonds, bond ETFs, etc.) that it bought in mid-2020 were designed as a brief bailout measure, and it stopped buying them in 2020, and it sold them in 2021, and they’re all gone now. It did mark those to market, and I covered that at the time.

Thanks for the clarification!

The Fed’s current mark to market loss is $1.1 Trillion, as disclosed in the footnotes to its Sept 30 combined financial statements.

But mark-to-market is irrelevant. Just like the Treasuries I have, the Fed won’t sell the Treasuries, and so mark-to-market is nonsense because the Fed gets face value when bonds mature.

IN ADDITION, as the bonds get closer to the maturity date, their value gets closer to face value, and on the maturity date, their value = face value. So a 10-year Treasury with 1 year left to go trades at near face value, though five years earlier, it might have traded at a big loss to face value. This means that a big loss due to mark-to-market WILL INEVITABLY TURN INTO AN EQUAL PROFIT DUE TO MARK TO MARKET LATER. That’s just how bonds are. And that’s why mark-to-marked is nonsense if you don’t sell the bonds. It’s just mental masturbation.

That’s why I LIKE bonds. Because if you hold them till maturity, to heck with the market. You can sleep well!!! That’s what bonds are for – that’s what they’re DESIGNED TO DO.

That’s why I LIKE bonds. Because if you hold them till maturity, you don’t have to worry about the market. To heck with the market. You can sleep well!!! That’s what bonds are for – that’s what they’re DESIGNED TO DO.

Bond’s weakness is every payment and the final return of funds is done in a dollar that buys less and less and you can’t know today’s value of that.

To me it’s all relative risk.

I like SP500 when dividend yield is greater than 10 year Treasury.

I like certain dividend payers when they pay 3% more than 10 year.

Right now best relative value for what I want out of investments is the short end of the Treasury curve.

1) Next week Fed hike. Next year the Fed will pay the primary

banks between $225B and $250B, for doing nothing all year, on RRP, Banks Reserves and Excess Reserves, but the banks might pull out some

money, making more money on loans, increasing liquidity in the econ..

2) The Dow is down since Jan 2022. It’s 8% below the peak.

3) The Dow Anti BB is May 12/17 2022.

4) After making a S-wave to Feb 2020 top the Dow bounced back up forming an inverse triangle, a megaphone since May.

5) The Dow might drop to the Anti and popup to a new all time high.

6) Jamie Diamond and Brian Moynihan induced recession for fun

and entertainment only.

The Dow is down 13% since close Dec 31 when you use market cap of the companies since it’s a price weighted index otherwise and not accurate that way (7% otherwise). $11.6T to now $10T.

Roberto Manchini of W. VA became the most powerful senator in DC.

I just found out he is the son of Henry Mancini, the dead composer of music and stuff like that. Runs in the family.

“Recorded in Hollywood, 1958, ‘The Music From Peter Gunn,’ Composed and conducted by Henri Mancini.’ A New Orthophonic High Fidelity Recording, from RCA Victor is now spinning on my turntable.

Mancini brought modern jazz to soundtracks on TV shows back in the day.

eric, thanks for the reminder, been a while since I’ve listened to the album.

You should have heard Steve Douglas playing close up when he was still alive. That chance will never come again.

Seems to me that Congress uses the Fed to impose regressive taxation in the form of inflation, versus some combination of higher taxes and government austerity to pay down debt. The Fed, in response to the pandemic, really solved a social problem, in the way that insurance companies do when there is a personal disaster (“You’re in good hands with Allstate”). In a crisis, nobody wants to hear about the adulting that will be required in the aftermath. We now have inflation, and on the political front, we now have an effort to tame it, but of course it was understood that it was the only palatable way to pay down the debt. Everyone is looking to the Fed to cut inflation with higher interest rates, but wouldn’t higher taxes and government austerity do the same? I guess this would trigger loss aversion, since it would be direct, versus inflation, which is a more subtle form of financial pain on individuals without a specific cause (compared to Congress raising taxes and/or cutting government services).

This article just backs up what many economists have been saying for a long while while now. The Fed needs to slow their roll on rate hikes and accelerate the rate of QT. There is no good reason to artificially prop up asset prices.

Yes, a good case can be made for that, and the Fed will eventually slow and then halt the rate hikes (at 5%? 5.25%? 6%? Who knows), and if it starts selling MBS, the roll-off will speed up.

But too fast of a roll-off will cause markets to seize up. Markets need time to adjust and work through this, and liquidity needs to shift slowly, not all at once, and so prices will adjust and head lower, but they need to do this slowly, not all at once. And so I think a “measured” roll-off pace is a good thing.

Fingers crossed the Fed can continue this slow, controlled demolition of the “Everything Bubble”. I still think they will need to increase the 2% inflation goal to 3.0-3.5% as the odds are stacked against a controlled demolition if this process takes more than 1-3 years, as the unpredictable “black swans” revisit our global intertwined economy on schedule per previous history.

Yet Bullard’s 5%-7% FFR comment is very risky, but if we do hit the 6-7% range for an extended period, it will be the opportunity of a lifetime to obtain certain highly discounted “real” assets that will prove very lucrative once inflation settles much lower…

So cash is not trash moving forward with the Fed! All I read is the fed is trapped, painting themselves into a corner. I believe it’s more like the days of practically free money to those first in line is over! As you would say Wolf, “crybabies.

What I’m thinking about is how much more leverage is in the market.

The Fed’s current mark to market loss is $1.1 Trillion, as disclosed in the footnotes to its Sept 30 combined financial statements.

“The Fed also paid dividends of $585 million to the shareholders of the 12 regional Federal Reserve Banks. The shareholders of the 12 FRBs are the financial institutions in their districts.”

I wonder what “financial institutions” that might be in the district of New York and what effect that has on the wheelings and dealings and the general, let’s say – although one hesitates to use the word – “ethical” standards and accountability in the Land of Oz with Jolly Jay behind the Machines.

Well, i don’t. Just kiddin’.

Institutioanal Investor Magazine, 2-24-20 article on New York Fed Capital Stock Master Report for 2018:

“Under the Federal Reserve Act of 1913, each of the 12 regional reserve banks of the Federal Reserve System is owned by its member banks, who originally ponied up the capital to keep them running.

“Citibank, the No. 1 institution on the roster, held 87.9 million New York Federal Reserve Bank shares – or 42.8 percent of the total.

“The No. 2 holder stockholder was JPMorgan Chase Bank, with 60.6 million shares, equal to 29.5 percent of the total.

“In other words, the two banks together control nearly three-quarters of the regional bank’s capital shares.

“Each bank, after all, has only one vote when it comes to electing bank directors (their only shareholder responsibility) regardless of stock holdings. And New York Fed shares cannot be traded, shorted, or pledged as collateral.

“Morgan Stanley Bank owning 4.8 million and its affiliate Morgan Stanley Private Bank 2.8 million shares, for a combined 3.7 percent stake in the New York Fed.

“Goldman Sachs Bank USA owned 8.3 million shares, equal to 4 percent of the total, and Bank of New York Mellon held 7.2 million shares, or 3.5 percent.

“It may surprise observers that some big holders are affiliates of foreign banks: HSBC Bank USA, part of London-based HSBC Holdings PLC, owned 12.6 million shares, or 6.1 percent, of the New York Fed’s total. Deutsche Bank Trust Co. Americas was the owner of 1.7 million shares, and Deutsche Bank Trust Company 60,678 shares, for a combined 0.87 percent stake.

“Mizuho Bank (USA), an affiliate of Tokyo-based MizuhoFinancial Group, owned 819,344 shares. Industrial & Commercial Bank of China held 221,278 shares.

“There are scores of smaller owners, from Bank of Cattaraugus, which held 180 shares, to Cayuga Lake National Bank, with 375.

“Still, it serves as yet another red flag for those concerned with the power of too-big-to-fail banks that the top two banks hold nearly three-quarters of the New York Fed’s capital shares.”

This story appeared just as WS was melting down in early covid hysteria.

“Institutioanal”…Investor Magazine,.

Typo or Freudian Slip?

Jolly Jay knows who his Bosses are.

Astoundingly, everybody else obviously doesn’t.

In case anybody is curious, the QE foolishly conducted by the bank of England does require actual funds to flow from the government to cover the interest payments on the printed funds.

So rather than what the Fed mechanism of just directly crediting themselves in a ledger, the UK method was that the central bank borrowed from the commercial banking system (which is them writing a ledger entry instead of the BoE) so there is an actual loan outstanding and interest is due.

This means that all of the money that went to the government must be repaid, about 140 billion can’t remember exactly. Its about 6000 USD per worker (also not exact). There are mumblings about how to deal with this and the main theme appears to be to tax the banks because to not pay would constitute a default.

Also although the situation of the US looks different and they cannot default etc because of the ability to create money, in real terms that means the transfer to the USA commercial banking system comes from people who have to hold dollars i.e. the poor without assets, so its very regressive.

The reality is that although its simply a deferred asset for the Fed, its real money with real spending power for the banking system.

On the plus side although most, probably the majority, don’t understand how crooked having an inflating fiat currency with negative real rates is, probably they can understand the financial system receiving free money from the central bank and there may be another Ron Paul.

The Fed and the Treasury are out of control.

Congress no longer controls spending and monetary discipline.

The last chapter of this story will not be pretty.

Cheers,

B

It’s called Modern Monetary Theory, and it’s getting real-world testing with $13T in EXTRA spending over the last 2.75 years.

Ah, so suddenly deficits DO matter. Didn’t Congress get the memo?

They did but they don’t care and it didn’t sink in.

Reality will be sharp, if the bank tries to reduce rates, while inflation remains high, and bond buyers expect to earn above inflation.

The scale of losses for savers in world today with zirp and inflation is staggering. Inflation is the hidden variable. Accounts can actually be growing but in reality dropping in the straight line that exists on the Fed balance sheet “asset” .

One of the most important factors for any financial cash flow calculation that has an inflation factor built in is an average inflation. What is not available is an annual input that allows for the first 3 years and then adjusts.

CPE is real but so is food and energy that is backed out .

And as a retiree I don’t have the ability to replenish losses and inflation is a loss !

Looking at the magnitude of the drop in the Fed balance sheet and the rapid pace of the drop makes me wonder how fast the leverage we have built into the asset side of our global economy can contract.

Stock market margin goes first then home prices and ability to pay those debts . Retirees have medical expenses food and beverage and utilities all growing faster than CPE .

I do hope the Fed ignores wallstreet and bankers and continues on this deleverage path.

I swear I read TGDFA (now, whether I understood it all or not is open to question) but I’m still not sure that I understand whether or not Fed “losses” (or for that matter “profits”) actually mean anything?

Or if they do mean anything, is it remotely what is inferred by our normal understanding of the terms profit and loss or are they actually misleading?

I know that you point out something to this effect in the section where you say “the Fed is not Enron” but I could for sure use more help understanding the extent to which profits or losses at Fed in $USD has anything like a “normal” meaning for those terms or indeed any meaning at all?

“QT reduces the Fed’s losses because it brings down reserves and RRPs that the Fed pays interest on.”

Again you lie, Wolf. ‘Reserves’ are money and NOT bonds. Retiring bonds through QT therefore does not lower reserves, i.e. reduce the quantity of money. In fact your beloved QT surreptitiously increases the money supply by permanently injecting currency into the markets through making “interest payments” with the proceeds of the bonds being rolled off.

And you are a troll. I may not always agree with Wolf but I would never question his integrity. He has proven through volumes of writing that he is forthright and honest. Your lack of etiquette proves you are not someone who should be listened to by anybody.

Laughably and totally false. Wolf is 100% correct.

The bank buys Treasurys from primary dealers, using the bank’s reserves.

Reserves are reduced, when the bank no longer owns the Treasurys.

The Interest on Reserves is also, obviously, reduced, when reserves are reduced.

you dont understand this. QT reduces money supply. when the Fed sells a bond, somone has to pay them money for it, and that takes the cash out of the money supply. QE is basically crowding out private investment from government bonds, which forces those funds into other assets, such as the stock market. the fed’s balance sheet remains balanced by offsetting reductions to the liabilities on the balance sheet

another impact of QE on the economy is that by forcing investment into other assets and inflating those asset prices, there is a wealth effect that leads to increased consumption, which is inflationary. so the effects of QT are both increasing interest rates, which slows down borrowing and investment, but also the reduced wealth effect

i have found it interesting that the Fed chose to increase short term interest rates rather than just sell off the balance sheet. seems to me that they want to impact the economy (and slow inflation) but dont really want to pop the asset bubble. which means they care more about the rich than the poor (who own no assets)

” QT reduces money supply. when the Fed sells a bond, somone has to pay them money for it, and that takes the cash out of the money supply.”

What bonds are the Fed selling?

Rusty Blade,

Your level of ignorance and idiocy is inappropriate here. Go find another place to spread your manure. Adios.

Hahaha, and I just looked it up: troll sitting in a distant country.

Yes Blade, please go away. There is only room for one Rusty on this site.

Why the name calling?

Quantitative Tightening removes money from the real economy.

Because when the central bank no longer owns the Treasurys, another party has to spend cash, to acquire it.

A fraudulent graph for a fraudulent monetary system.

Thanks for educating me.

Not being financially sophisticated, my question is what are the chances of not getting my principle back when a t bill expires? I recently got a notice from Fed to renew an expiring t bill. Never had that happen before. Wondering if perhaps there will come a point when Fed will simply say, you MUST renew your t bills until further notice. As an old duffer I jumped into t bills as interest rates started rising. Was about to withdraw CDs at lesser rates, pay the penalty and go all in on T bills, which now give me several hundred dollars per week more. But this article makes me nervous, that maybe it’s not a good idea if Fed is “broke”? Anyone have a clue?

1. “what are the chances of not getting my principle back when a t bill expires”: 0% chance.

2. “I recently got a notice from Fed to renew an expiring t bill.”

With T-bills you have an option to sign up for auto-renew. If you sign up for it (check a box in your account at Treasurydirect when you buy the bill), it means when the 3-month bill matures, the principal will be used to buy another 3-month T bill at whatever the new auction yield will be at the time. I do that if I don’t expect big moves in interest rates because it saves you the hassles of having to buy it manually. But when yields jump up a lot, like they’re now, I want to have more control, and so I don’t do it.

3. “Wondering if perhaps there will come a point when Fed will simply say, you MUST renew your t bills until further notice.”

A. It’s not the “Fed” but the US Treasury Dept that you buy your T-bills from;

B. it will never happen. It’s just nonsense. Don’t worry about this kind of stuff. If you run into a fear-mongering website that preaches that, don’t ever go back there.

4. “But this article makes me nervous, that maybe it’s not a good idea if Fed is “broke”?”

Read the article all the way down. It says that the Fed CANNOT GO BROKE. if you read the article instead of imagining what it says, you will see that it will do the opposite of making you nervous about your T-bills.

Wolf, out of curiosity since you brought this up. When you don’t auto-renew your tbill, do you transfer the money back to your bank account or leave it in TreasuryDirect in Certificate of Indebtedness (C of I)? Transferring back to a bank and then back to Treasury Direct seems to take a few days and you may have to worry about FDIC limits if you do this but you would accrue interest in your bank account. On the other hand, does keeping it as a C of I have benefits such as being able to participate in an earlier auction or something like that? (I am thinking if you are going to buy something again in a matter of days/weeks and not months in which case you most certainly want to move the money back in a bank to get the interest).

@SWE Josh,

When you don’t automatically renew, upon maturity your principal will dump back into your designated bank account. FDIC worries…just have more than one bank. Your principal can be deposited to a different bank, or account than the one it was taken from. You can also delete automatic renewals up until the time that a purchase is pending. As far as I know to change maturity lengths, you have to let a bill mature and deposit back into your bank, and then reinvest for a different term as a new purchase. (Such as changing from a 13 week to a 26 week, or vice versa.)

SWE Josh,

The way I set it up seems to work for me: anytime a security matures if I didn’t set it up on auto-renew, Treasurydirect will automatically transfer the amount to my bank checking account via ACH transfer.

Just like when I buy a security, Treasurydirect will fund that purchase by automatically transferring the amount from my bank account via ACH.

So this is really a no-hassles solution.

But as you mentioned, I could leave the cash in a non-interest-bearing cash-management security (the C of I’s you mentioned) in my Treasurydirect account. This avoids the transfers, and the issues of FDIC limits. But the way I look at it, the cash is usually in my bank account for only a few days before I buy something else or do something else with it. But it’s something to think about.

The thing for me is I don’t always buy Treasuries again. I want some flexibility. I might buy something else, and so the cash may go to my broker or into a high-yield savings account (3% now) for a period until something else comes along.

Ok Wolf. Thanks! Reassuring.

“The Fed also paid dividends of $585 million to the shareholders ”

As I recall this is 6% specified in the Feds charter, paid to the commercial banks that own the Fed. I wonder what their ROI is? Since they do not seem to participate in any funding of Fed losses.

Alternately Lloyds of London partners are personally on the hook for losses.

They’ve had those shares forever. Those shares cannot be sold. Think of it like your Microsoft shares that you bought 30 years ago. Whatever little dividend they pay today, it’s a huge ROI on our acquisition cost 30 years ago.

Congress sets the dividend, which is why it’s called a “statutory dividend.”

Great analysis Wolf! Question: During this period where the Fed is increasing its “Deferred Asset” account, does it continue to pay “dividends of $585 million to the shareholders of the 12 regional Federal Reserve Banks”? If not, is the impact on those shareholders/financial institutions meaningful?

We will find out in January, when we get the preliminary financial report from the Fed, and I’ll cover that.

Many companies continue to pay their dividend even if they lose money. So that’ll be interesting.

the Fed’s Q3 Z.1 report. As expected, Credit growth slowed somewhat. At a seasonally-adjusted and annualized (SAAR) $3.284 TN pace, Non-Financial Debt (NFD) growth slowed from Q2’s SAAR $4.318 TN and Q1’s SAAR $5.438 TN. NFD ended September at a record $68.463 TN, or 266% of GDP. Unless Q4 Credit growth surprises to the downside, 2022 debt growth will be second only to 2020’s onslaught.

Given this mad growth in credit if the fed doesn’t aggressively sell MBS into the market, they never will. Powell is failing to follow his own 35 bill mbs shed, limiting to pass thu payments, it just further clarifies fed action is for the benefit of high lords of finance not for price stability.

Wolf

You said: “The Fed creates its own money. And the Fed’s losses – no matter how large – will not cause the Fed to run out of money because it can always create more. ”

My understanding is slightly different and a bit more nuanced. The Fed cannot go bankrupt (run out of money) not because it can print more but because it does not have to obey capital rules like any other private corporation and it can operate with negative capital as long as is necessary.

When the Fed creates money it does so increasing its balance sheet (it buys an asset and it creates a liability). When the Fed find itself in a negative capital situation, “creating money” technically it does not resolve this issue (the balance sheet expands, assets go up and so liabilities, capital still negative). Sure income earning assets the Fed buys can overtime “refill” its negative capital position, but the power of creating money is not alone the reason the Fed cannot go bankrupt. The ability to run with negative capital is.

Am I correct?

Your definition of “bankrupt” is not correct. “Bankrupt” has nothing to do with capital rules. Capital rules apply to banks; if a bank’s capital falls below the capital requirements, it doesn’t go “bankrupt.” But it will cause bank regulators to step in, and may involve all kinds of things, including forcing the bank to raise more capital (issuing more stock), etc. and ultimately may lead regulators to take over the bank.

If a financial outfit made a lot of bad bets and they blow up and suddenly cannot pay back its obligations (Lehman, FTX), it’s not an issue of capital rules, but of the inability to service its obligations. A bankruptcy court will then have to sort through who gets what.

Bankrupt means you cannot service your debts, you default on your debts, and you hand your company to your creditors. Bankruptcy laws regulate that process of who gets what.

What I’m saying is that the Fed will ALWAYS be able to service its debts, and will never run out of money to service its debts, and will never default, because it can create its own money, and therefore it cannot get pushed into insolvency and bankruptcy.

Thank you Wolf!

There is a great article on this subject on Seeking Alpha. It points out that in the footnotes of Federal Reserve reporting there is an unrealized loss of 1.1 TRILLION on the portfolio of assets the Fed purchased over the past couple years. Basically, the market price of the bonds that the Fed currently owns are all less than the price they paid during that time period.

This is a FAR WORSE situation than Wolf has indicated. There are real problems here. If the Fed does not want to realize those losses by reducing the balance sheet, then they cannot decrease the balance sheet aggressively.

In many respects, the Fed NEEDS interest rates to plunge again, so they can sell those assets without massive losses. But will anyone want to buy them? It seems that the best way to achieve this goal is going to be to crash the economy and with a recession, inflation will stop and they can lower interest rates. But to crash the economy and stop inflation they need to first increase interest rates and that will increase the unrealized losses.

The only way I see out of this mess is by crashing the economy intentionally, which means that many of the company stock prices that are trading close to their all time highs will need to come plummeting down – hard.

Or the Fed can simply pile up the losses and just say that it doesnt matter. But it does matter. At some point, the markets might get real concerned about this. Just think what happens if inflation does not come down and interest rates need to go up by another 2% or even higher (as in the 70’s)???

The window of opportunity to see a soft landing is getting smaller and smaller. But Wall Street is NOT going to tell you, they are going to reduce risk and the financial media will tell you to buy stocks, etc. Any bounce is a chance to sell

every central bank in the world probably has a similar problem.

People who say said are clueless about central banks. People need to get a grip on the concept of a modern central bank.

And don’t believe this BS pushed by bond funds and hedge funds on Seeking Alpha.

gametv,

But that article you cite is stupid fearmongering pushed by bond funds and hedge funds because they’re losing their shirts on higher interest rate: the Fed WILL NEVER SELL ITS TREASURY SECURITIES. It will hold them to maturity and collect face value, just like I do. Just like pension funds and life insurers do. And there are no losses involved. Just forget that nonsense.

In terms of the premiums the Fed paid: the Fed is amortizing them over the life of the bond to maturity. I addressed this in reply to your other comment above, along with a chart.

There is a lot of idiotic BS floating around. Much of it is pushed by bond funds and hedge funds that are losing their shirts on higher rates. The crap article that you cite is one of them; and you’re eating it up too, as depicted in your phrase:

“the Fed NEEDS interest rates to plunge again, so they can sell those assets without massive losses.”

This is total nonsense. This is the garbage hedge funds and bond funds push because they’re getting killed by higher interest rates. Crybabies on Wall Street. Don’t believe this BS!

BTW, Seeking Alpha is full of articles pushed by hedge funds and bond funds, long and short, trying to manipulate markets their way. Chockfull of them.

thanks for the perspective, i still think those articles give some data on the scope of the participation the Fed took in the Treasury markets that is eye-opening, for me at least.

but i now really get why the Fed is raising interest rates as its primary policy tool. it cant really just sell the balance sheet off more rapidly unless it is willing to pile losses on the balance sheet.

It could shed its Treasury securities much faster by just removing the caps. That cap limits the runoff to $60 billion a month. There may be months when the runoff would be over $100 billion. By removing the caps, and just letting roll off whatever rolls off, even if it’s $150 billion in one month, well QT would speed up a lot without having to sell Treasuries.

It might also blow up the markets. That’s the biggest issue. QT is deflating all asset prices, undoing what QE had done — but if the Fed goes too fast, it could trigger a market nightmare. And then the Fed might be tempted to step in aging to unfreeze the markets. I think the Fed is very much afraid of that.

Markets need time to adjust. I’m fine with this pace of QT. I don’t want markets to blow up. At the moderate pace of QT now, QT will take years, and so markets will head lower for years, and people get used to it, and there is no panic, and things are just fine, and QT can reach is actual endpoint.

Wolf – how many years do you think it will take for QT to reach its end point?

cg – at this point, I think that might be akin to asking: “…how long is a piece of string?…”.

may we all find a better day.

What happens if the USD is no longer the reserve currency?

There has been much heat but little light about alternatives like Russian Petro-gold, RMB or others.

Someone deep in the Eccles Building sub-basement annex must have gamed out scenarios and implied adjustments. Now, what might those mean for Wolf Street readers?

The USD has NEVER been the only reserve currency. But it has been the dominant one, and continues to be the dominant one, though its dominance is declining. The euro is #2. “Russia-petro-gold” is a figment of people’s wishful imagination. The RMB is the red line at the very bottom:

Great article.

This is a great educational site. Might look into opening a TreasuryDirect account. Also, I didn’t realize I could invest in CDs thru my brokerage account – since learning that on this site have invested in a couple of 3 month CDs at different banks; paying a little over 3%. Better off losing a little to inflation than just sitting in cash. Time to make a donation..

Grimp – well done! I’ve had a similar experience here…who would have thought that we’d get so excited about 3 month Treasury rates. I’ll be adding to my new TreasuryDirect account again next month.

Good job Gimp. I have learned some very practical information by reading Wolf’s comments regarding treasuries, CDs, and that they can be bought through brokerages, etc. I also need to make a donation.

Sounds like the perfect system to fleece Americans, very Mafia-like.

Fleece or you mean lend them billions of unearned dollars they demanded?

Good article, Wolf.

I believe that there is a minimum capital requirement of around $42 B for the Fed. I presume if the “capital” at the Fed falls below that level, the Treasury will have to replenish such.

I am guessing that most of the secs held by the Fed are recorded at hold-to-maturity so that FMV’s are not recorded, avoiding FMV losses to the Fed. If there are sufficient secs recorded as available for sale, then market value losses could be reflected in capital levels. This may require some replenishment of capital at the Fed. I do not know.

The Fed can take actions to either increase deposit ratios (lowering excess deposits, not likely though), lowering rates paid on excess balances or providing for favorable risk-based capital rules for excess balances (incentivizing banks to hold excess deposits at below market rates). Still, the Fed will be in a pickle as to net interest income being negative for the time being.

Asset-lability management regarding interest rates is 40 years old for financial institutions. It is interesting the Fed allowed such a massive mismatch of interest rate sensitivities for maturity/duration buckets.

Would be interesting to get cash flow statements of the Fed and to see possible changes in net investments to address negative cash flow consequences in income statement. I am guessing the Fed will manage its cash flows by not retiring equivalent amounts of liabilities for maturing/sold securities and MBS pre-payments.

As you point out, these negative NII amounts will get addressed over time. Wish I could same the same for forever fed deficit spending.

1. Your paragraph #1: Opposite: It’s not a “minimum” — but a maximum capital limit, and the maximum is set by Congress. When the Fed’s capital goes over the maximum, the Fed has the remit the overage to the US Treasury Dept. I explained that in this article.

And I explained it in greater detail with actual numbers when the Fed released the annual financial report for 2021, including the amount in “surplus capital” that it remitted to Treasury:

https://wolfstreet.com/2022/01/15/the-fed-released-its-preliminary-financial-statement-for-2021/

2. The Fed has never had any intention of selling Treasury securities, and has no intention do so now. And it won’t. It will get face value when they mature. I explained this in the article. And I explained this in greater detail in my QT updates:

https://wolfstreet.com/2022/12/01/feds-balance-sheet-drops-by-381-billion-from-peak-december-update-on-qt/

3. The maturities that the Fed bought during QE were roughly in line with the overall Treasury maturities — this has been the strategy of this QE. This includes about $300 billion in Treasury bills, and up from there. In most months, well over $60 billion in Treasuries notes and bonds mature, in some months over $100 billion.

The fed and commentators keep saying they predict reverse repos and reserves to decrease as QT progresses, but is this really a 1 to 1 ?

It seems like this is what they hope. Reverse repos were invented to keep money markets from crashing. Reserve scheme was invented to keep commercial banks solvent on paper since they are bankrupt when you mark to market bond holdings.

Good news is that it looks like the deferred asset scheme will be transitory, just like QE.

12/11/2022

By even a low bar of Third World accounting, the Fed is insolvent for several reasons. Focusing on their Treasury and MBS holdings,

we can thank the FASB, for suspending FAS-157 bank mark-to-market accounting in March 2009, allowing investments to be held as “Held to Maturity” (HTM) – vs. “Available for Sale” (AFS), or “Held for Trading” (HFT). HTM securities do not have to be marked to the market. If bonds are sold at a loss from HTM, the rules say that trade will taint some or all of bonds remaining in HTM, meaning the balance of holdings has to be marked to market.

I agree that Fed Treasury holdings are not the issue as long as they are held to maturity. It is the MBS portfolio, including toxic waste from the GFC, that is an issue. If sales at a loss of MBS occur, those sales would “taint” the Fed MBS book from an accounting point of view. But most likely it will be rationalized away. What else can they do?

In my corporate life I spent countless hours on analysis of “reserves against doubtful accounts” and explaining them to countless new accountants doing our quarterly and annual audits. Your article referred to a “growing pile of deferred losses.” Are these not the same thing?

Does the Fed reserve against these losses or do they run naked in that respect.

Where are you netting out Fed interest income in your loss projection for 2023?

I can’t seem to connect the dots Wolf please help