The market finally gets it: The Fed is going to tighten to get a handle on its massive inflation problem.

By Wolf Richter for WOLF STREET.

Since February last year, the hottest most hyped stocks, many of them recent IPOs and SPACS, have been taken out the back and brutalized, either one by one or jointly. The stocks that have by now crashed 60%, 70%, 80%, or even 90% from their highs include luminaries such as Zoom, Redfin, Zillow, Compass, Virgin Galactic, Palantir, Moderna, BioNTech, Peloton, Carvana, Vroom, Chewy, the EV SPAC & IPO gaggle Lordstown Motors, Nikola, Lucid, and Rivian, plus dozens of others. Some of these superheroes are tracked by the ARK Innovation Fund, which has crashed by 55% from its high last February.

This mayhem has been raging beneath the surface of the market since February last year, and in March, I mused, The Most Hyped Corners of the Stock Market Come Unglued. They have since then come unglued a whole lot more. But the surface itself remained relatively calm and the S&P 500 Index set a new high on January 3 this year because the biggest stocks kept gaining or at least didn’t lose their footing.

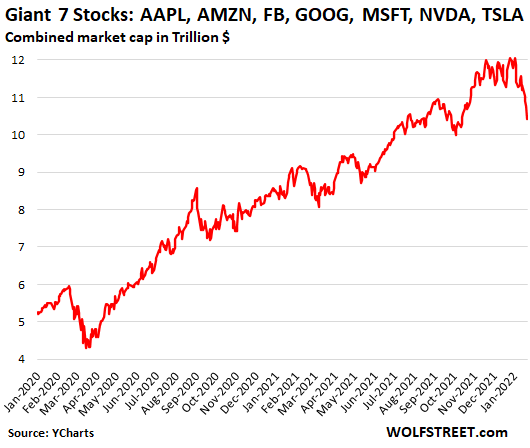

But now even the giants too are going over the cliff. Combined by market cap, the seven giants, Apple [AAPL], Amazon [AMZN], Meta [FB], Alphabet [GOOG], Microsoft [MSFT], Nvidia [NVDA], and Tesla [TSLA] peaked on January 3, and in the 13 trading days since then have plunged 13.4%. $1.6 trillion in paper wealth vanished (stock data via YCharts):

This is obviously still no big deal, a 13.4% decline, after this huge gigantic run-up. During the March 2020 crash, these giants plunged 28%. But it’s the first time since then that this unappetizing event has occurred.

And it has occurred because markets finally get it: Inflation is a massive four-decade problem for the Fed, and the Fed is about to lose, or has already lost, four decades of credibility as inflation fighter that Volcker was able to build. And so it is going to tighten to get this under some sort of control.

This tightening will consist of raising interest rates moderately, and by firing up Quantitative Tightening (QT), as the Fed governors explain at every chance they get. QT does the opposite of QE, and QE was responsible for driving up asset prices to these ridiculous highs.

And this notion of QT finally sank in – even among the biggest names.

The Nasdaq managed to make this four-day work week its worst week since March 2020, dropping 7.5% in those four days, to 13,768, the fourth week in a row of declines. It has now dropped 14.3% from its closing high in November.

The S&P 500 also booked the worst week since March 2020, dropping 5.7% for the week, to 4,398, the third week in a row of declines. It’s down 8.3% from its closing high on January 3.

The Dow Industrial Average dropped 4.6% during the four-day week, to 34,265, and by 6.9% from its January 3 closing high.

But this is really no big deal. On a long-term chart, these little dips can barely be seen. It’s just that markets have been spoiled by the relentless climb.

And folks are now re-familiarizing themselves with two essential concepts:

- Stocks can lose money, and they can lose all your money.

- Cash is trash, until it isn’t.

It is, however, a big deal for folks with a portfolio full of the most hyped stocks, IPO stocks, and SPACs that crashed 60% to 90%. If there was any margin involved, it may now be time to update the LinkedIn profile and look for a job again. Maybe some of the 11 million unfilled job openings can find some takers. And that would be a good thing.

Given the repeated ugly action at the end of the trading day this week, where dip buyers were taken out on stretchers, the meme is now starting to circulate that the market has shifted from “Buy the F&%#ing Dip” (BTFD) – the rallying cry since March 2020 – to a new rallying cry, “Sell the F&%#ing Rip” (STFR).

Which is of course nonsense since every sale must have a buyer on the other side, and every buy must have a seller on the other side, and lots of people must have jumped in to buy the dip at the end of those trading days – it’s just that the dip kept dipping.

Dip buyers have long been brutalized by their most hyped stocks and by their IPO and SPAC stocks. Month after month, BTFD was lethal for them with these stocks. But since January 3, dip buyers have also been brutalized by dip-buying the giant stocks as they kept on dipping. And now, there is big money involved.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I believe the graph will track upward again after this downward correction. Right now, people WANT TO BELIEVE IN SOMETHING. As children, we believe in the Tooth Fairy and Santa Claus. As adults, we go for the stock market. Money is the motivator. Tech is supposedly a “game-changer” and a be-all-and-do-all. From the starting point in one area of tech, the giants have the capital resources to branch out. That’s another reason tech is worshipped. Because they can land in different sectors of the economy (like amazon.com doing movies and apple doing watches).

Nothing goes to heck in a straight line. That has been proven correct every time, well, with some exceptions. So yes, the line in the chart will bounce a little for sure. Maybe Monday morning. Maybe Tuesday. But this party is over.

That party, maybe.

But the Bears are starting to get a wiggle on…

“ Maybe some of the 11 million unfilled job openings can find some takers. And that would be a good thing”

WeWork becoming We(havta)Work…

Dear Wolf and fellow commentators,

If the party is indeed over, as it appears, the main question is at what levels should you start re-entering the markets. There are any number of views regarding that, Grantham feels the long term trend for SPX is 2500 and FED would struggle to stop a fall to trend when this unravels. Then you have 2020 crash which was all of 20 days and 35%. 2018-19 FED pivot from tightening to easing with around a 20% fall.

So when does one start? My gut tells me that large falls follow a step or waterfall type of pattern. For instance in 2007-08 markets didnt fall in one large sweep. Broader index kept dragging along then fell a bit , then rose a bit from there and did not capitualte fully untill Lehman. FED kept announcing easing at that point (Oct 2008), most notably TARP but there were others interventions, constant jawboning, yet in that phase market kept falling and only stopped in March 2009 when mark to market accounting rule was scrapped.

I would be grateful if you guys could share your views on when you plan to invest back in equities. I suspect it must have to relate to time as well as % drop in value. This should not be a March 2020 like 20 day event (IMHO). While it may not go to heck in a straight line, one wonders what strategy one should use to begin entering and then pacing subsequent cash deployment so that we can track the fall to some plausible worse case levels.

What I mean by that is that say you feel 95% confident that the fall could be between the range 30% to 60% .. then one could devise a strategy to start nibbling at -30% and gradually accelarating purchases as market dips more in order to make optimal use of your cash. This in my view is more important that a stock picking shopping list which many people try to prepare. ETF picking list for those more circumspect is mkre to my liking.

Dear Wolf a post on this issue would be immensely useful.

JP Morgan said it best, and has never ever been proven wrong by ”investors” ,,, as opposed to ”gamblers”’…

BUY on the way down, but only IF you can hold through ANY possible bottom based on fundamentals…

SELL on the way UP because you can never ever know in advance the real actual top…

’nuff said” for us old and older,, pre ”boomer” types, etc., etc.

Thanks again Wolf, really and mostly,,, for keeping me out of trouble, AKA major investment losses!!

And BTW, money order in hand, and will be,,

“””In the Mail asap”’

Everyone’s emotional and financial pain/gain tolerance and thresholds vary immensely when investing in any venture.

For example, I currently have 25% of my cash in the markets even though I’m losing some money on the way down, as I tend to control my investment emotions better if I have constant skin in the game. If I’m at less than 25%, I tend to be too conservative to get back in as I find it much easier using a certain cost average method I’m comfortable with to decrease my percentage loses on certain stocks and indexes I’m confident will still be around in 20 years. I have everything automated as that helps too. I made those buy/sell choices when my emotions were stable (usually on weekends researching), as I tend to make less logical choices when there is panic or euphoria in the air via MSM chatterboxes.

Everyone has emotional limits…attempt to find yours first before investing/gambling in any venture…because if you don’t find it first, it will find you unexpectedly at the most inopportune way and time possible…

VintageVNvet,

“BUY on the way down…nuff said…”

Looks like you’ll be getting the chance to put Pierpont’s theory to work…with real money, I presume, and on the downhill slope of the most over-inflated market in history. Please do give the readers updates.

It’s not about percent down. It’s about when PE ratios are good. When sticks you like hit 20, buy them even as they go down to 15. And again as they go up to 20. Sell at 30.

I’ll be adding next week. This is a head fake. We still have more than a year before this goes south. The Fed hiked 8 times 2016-2018 before the markets let them have it.

Djreef,

“The Fed hiked 8 times 2016-2018 before the markets let them have it.”

But back then, inflation was below or at the Fed’s target, and economic growth was moderate, and the Fed was acting just preemptively to get back to normal.

Now the Fed has a big-ass inflation problem on its hands, and that changes everything.

I would be grateful if you guys could share your views on when you plan to invest back in equities. I can see what the real estate patterns will be for up to one year. I cant tell what stocks will do for 1 second. Just gonna continue investing in stocks the same amount no matter what the rollercoaster does. My time line until death allows for this.

Which bottom are you trying to time? The one from the last five minutes or the one since at least 1720?

Repeat after me. This is a mania. This is the greatest asset, credit, and debt mania in the history of human civilization. It’s not just in the US and not just in stocks but worldwide across the three major asset classes and numerous alternative “investments”.

The dot.com bubble wasn’t

a predecessor (and was smaller anyway), as it never ended. It’s the same mania we are in now. There was also no widespread debt mania, no real estate bubble, no fake economy, no Bizarro world monetary policy, and commodities were dirt cheap.

It’s far bigger and/or broader than the British South Sea Bubble, French Mississippi River Scheme, Dutch Tulips, 1920’s US “Roaring 20’s”, and 1989 Japan.

Add it all up and it equals one thing, the majority of Americans (and residents from many other countries) are destined to become poorer or a lot poorer in the future than they are now. Most “wealth” is actually someone else’s debt with the remainder vastly inflated stocks and real estate.

TweedlumDum

Just last week Jeremy Granthum Pronounced that Vampire phase of the stock mania will end soon and result in 50% loss in S&P 500! B/w he is NOT ruling out unprecedented intervention by the Fed, at and or before that. I tend to agree with him.

During GFC (2008) S&P nearly lost 60%, ( in approx 18 months) Would have lost MORE if the ‘savior’ Fed had not jumped in the March of ’09. During dot com (2000) Nasdaq lost almost 90% ( in a 2.5 yr period – peak to trough).

S&P zoomed over 300% b/c of insane credit creation by Fed and Buy-back shares ( lead to 50% rise in S&P since ’09) by global corporation borrowing at ZRP.

Reversion to the mean and then some down AGAIN is the path of secular Bear mkt from peak to trough as evidenced in the last 200 yrs of mkt history. Time frame is hard tp pin down in the presence of possible ‘remedial’ actions (at least they will attempt) by Fed/CBers. Furious volatility is guranteed!

No one could guess the peak of this ‘surreal’ bull mkt (devoid any fundamentals) of my life time (Been in the mkt since ’82). So no one should or can predict the bottom. Mkt started sliding. the moment it realized, when there will be NO longer Fed’s put.

One should be willing to buy when all the bulls ( turned into Bears) have sold off everything including kitchen sink and no one has very little of any kind to sell any more! The macro indicators (fundamentals) ‘might’ indicate but again that too is speculative (easier said than act!) It will be crystal clear, only retrospectively!

The week(s) before I stated, clearly in previous threads that secular BEAR mkt has begun and the sentiment has changed. Before last week or 2, I was selling more than buying, although buying was more against the mkt with puts (hedged with calls). The CASH pulled off the table, is the dry powder to invest when the time is appropraite(!?)

By my reading in Barrons,WSJ, ++ there is STILL a lot hopium there. Apparently hedge fund and MFund managers are investing net long!

There is a strong sentiment that Mr Powel will re-enact his 2018 Q4, turn around down the road after 20% or 30% mkts plunge.

I won’t bet against Fed/CBers from buying stocks, indexes/ ETFs like Bank of Sweden and BOJ have done!

Hence the path ahead is NOT black and white. Adopting risk management tools like Option trading is very vital in navigating unknown waters ahead.

Djreef, as Wolf there says, I too believe the dynamics are showing themselves to be a bit different now. I too held on a bit longer than than Captain Hindsight now tells me I should have, and only got my final bit of rotating done just now on Friday.

I also thought this whole situation would take longer in unfolding, but so far it appears to be happening a lot faster than I previously believed it would, and, if anything, even more hikes are getting priced in…

Not to say you won’t get a big boost up next week or next month, of course. I don’t know. But I don’t have the stones to bet on it as things look currently.

Stock prices can be irrational and tend to boom and bust and most people do poorly.

Determine your allocation and set and forget it and go live life and rebalance once a year.

Or think about it as the only true value is the dividends and only buy when the dividend stream makes sense. SP500 dividend is $60 growing at around 5%. Plug the numbers into a dividend discount calculator and safety margin you want over a 10 year Treasury. At 3% cushion of 4.8% then you get about $1600 is what you should pay for SP500.

That method would have said the SP500 was worth about 700 when it bottomed at 666 during last crisis.

“only stopped in March 2009 when mark to market accounting rule was scrapped.”

Does mark to to market accounting rule remain scrapped even now?

“This should not be a March 2020 like 20 day event (IMHO). ”

As of now it appears not and it is likely to remain so as long as inflation remains hot.

While the Fed would have liked to stop it by now the inflation has proved to be party spoiler.

“While it may not go to heck in a straight line, one wonders what strategy one should use to begin entering and then pacing subsequent cash deployment so that we can track the fall to some plausible worse case levels.”

IMO, inflation is the item to watch like a hawk along with the state of the financial system. The moment inflation gets down to levels where politicians and the Fed are comfortable is the time when you can expect the Fed to come out and buy the house of cards with a string of acronyms. The Fed might also come in if it finds the financial system is getting unglued.

In short, entry point would be when inflation shows a downtrend or the the financial system comes unglued, which is when the “arsonists & firefighter” Fed will come all guns blazing. Yellen has said the inflation will be down by year end. If that comes out to be true, then this could be a 200 days event.

I hope this happens when all the indexes have been taken to the back and shot as was Nasdaq in 2000. This time hopefully it will be all the indexes.

Thank you everyone.I fully appreciate the futility of timing the market. I also understand the expected forward 12 years returns of the market at current valuations are not consistent with standard long term upward drift in equities that is the source of compounding magic.

I am certainly not trying to time any bottom, especially not from 1720 :). I have a 30 year investing horizon at my age. I do not think that gives a happy reading if I have a lost decade like post 2000s. I agree with Hussman that market is likely to go nowhere in an interesting way over the next 8-12 years.This is my prior, and it could be wrong, but one has to hang his coat somewhere (bootstrap assumption based on historical performance after excessive overvaluation as measured by CAPE, Buffet Indicator, Price to Sales , Inflation expectations, anything at all really that meaningfully correlates with forward decadal returns).

As Wolf mentioned, it is substantially different setting this time due to inflation, so any FED pivot would have to counter tightening inertia(no matter how mild the tightening is). At 6-7 percent inflation, doing QE will be far more difficult than doing QE at 1.5 percent inflation with markets tanking. The investing when terrified (Grantham) playbook is important because falls are sharp and paralyzing. While one may not time the bottom, it is difficult psycologically to buy when the stocks have been going down month after month for say 18 or so months.

As for to mark to market rule, it was in existence only for a very short duration around GFC and has never been restored.

Buy when there is BLOOD IN THE WATER.

There is BLOOD IN THE WATER now – ie, NOW is the time to get into the markets.

Don’t miss this once in a life-time opportunity to get in at the bottom and ride the markets up for the rest of the decade.

There will be no interest rate rises. Inflation is already on the way out.

I see a lot of talk of inflation, but in a personal sense I haven’t seen any. I don’t believe the narrative.

There’d be multiple factors that’d indicate the bottom. There’s nothing that’d tell me the exact moment but considering that this is a humongous inflated bubble -thanks to Mr. Powell & his bumbling cronies- I’m expecting the downside to be 50+%.

All high flyers are already running for the exits with at least three major news still to come: the CPI numbers for Jan and Feb before the Fed drops their hammer of rate increase. So, this is just the start of the turmoil IMO.

I’d get my 401k off the stable fund and start getting back into the stocks I have list of when their P/Es get back down closer to 25 and I’d also watch for the S&P500 P/E to get close, or below its mean.

Monthly table of this S&P P/E is available on the Net.

As a biotech investor (I focus on short targeted, late stage clinical or early commercial companies) I’ve watched market caps in my companies sink below cash in hand, even annual revs. ATLs everywhere I look. It’s felt like one of the crazy bush parties from my youth, where fuel has run out and drunks raid surrounding campsites for muskoka chairs and picnic tables. Here’s the thing: I’m not sure I’ve ever seen shorts target ATLs so thoroughly before. Meanwhile more and more people I know are actually jumping on the short bandwagon. Im wondering what you think the role tech plays in this: what happens when all these new tools allow investors to switch long to short in a heartbeat. What happens when shorts equal longs? Isn’t there some kind of Kantian ‘condition of possibility’ here, some uber systematic crash possibility, involving mass shorting?

Love the blog. You and Zen Second Life are my contrarian muses

Scott,

“more and more people I know are actually jumping on the short bandwagon. I’m wondering what you think the role tech plays in this: what happens when all these new tools allow investors to switch long to short in a heartbeat.”

There are enough crazy rallies during every bear market to wipe out shorts that got it wrong.

The craziest rallies happen in bear markets.

Here is my chart from the March 2020 crash, S&P 500, daily percent moves, posted March 21, about the time I covered my short. Note the huge daily spikes:

It makes perfect sense for a lot of companies in this market (whether biotech or not) to sell for less than cash on hand. After all, it’s been incinerated like never before with no realistic prospect of sustainability once the capital markets cut funding off.

I just looked at Zen Second Life he reminds me of Wolf only more a flavor of from Chicago and done with this shit.

How about in GFC when the treasury issued a list of stocks you couldn’t short? Financials I believe. I about fell out of my chair.

Unless they’re tacitly permitting naked shorting, all the shares still have to have a long-side owner. So for every short seller (share-borrower), there will be 2 long-side owners: the share-lender and the one who bought from the short.

But: the more shorts there are, the more wicked the short-covering upside rallies will get. See e.g. KODK in July 2020.

Let us know which stocks are best to squeeze the shorts in, and Team Wolf could get together to reddit-them…

Then there was the Gamestop phenom. Bunch of pros short it cuz its a stupid company but a way bigger bunch of Robin Hooders buy it cuz they love it, hang there ( the comic book store) and create a short squeeze, which forces some shorts to buy which drives price higher forcing more shorts to cover…with shares ending up 2000 % higher.

If all the pundits are correct about technology stocks being so rate sensitive, then FAANG & MSFT are due for some really bad stock price news over the next 2-3 years.

It’s not rate sensitivity but changing sentiment. The idea that a measly increase of something like 50bp on the 10YR since the NASDAQ peak a few weeks ago is ridiculous.

Pure Wisdom served fresh daily and available (in the future) in mug form.

Although futile, the market believes it has until Wednesday to convince the Fed to change course, particularly as the next FOMC skips a month, delaying the next scheduled mass protest to March. Tantrums seem all but inevitable to occur on Monday and Tuesday.

Earnings season is barely underway. The die is cast. Performance below expectations will automatically deduct 10-20% from individual stocks within a matter of minutes. Contemplate the implications of this for the major indices.

Day trading aside, Netflix’s earnings demonstrate that the rotation argument has been beaten to death. It now bleeds out into the S&P 500 and beyond while the vast majority of participants waste valuable time frozen in shock as the market plummets.

Understandably, participants have become accustomed to assessing when the Fed will decide to levitate asset prices. The apparent historical success of the Fed Put is inviting both the uninformed and the savvy to identify the next reversal point to seize the next leg up in equities.

My advice is they urgently need to heed your advice. You have described the situation as it is. Your explanation is timely, cogent, sober and accurate. It has history on its side.

BTC is acting like it is going straight to heck.

Oh wow, were their earnings bad? Take a hit on ROE?

Are you contemplating shorting the market again Wolf?

As you’ve likely inferred, I remain long the precious metal sector.

I’m STILL short. And every time the stock market rallies, I get harassed about it.

“Longest Short Ever,” is going to be the title of my future book, hahahaha.

Laurence Hunt

Even Michael Burry was a little early in his bet preceding the RE meltdown in 2006/2007. He lost a little early on but was right when the dust cleared. This was not brought out in the movie, but was so in the book “The Big Short” which I read twice.

@ Wolf –

Wolf said: “I’m STILL short. And every time the stock market rallies, I get harassed about it.”

___________________________________________

Didn’t you post above that you covered your short about March 21, 2020?

“Here is my chart from the March 2020 crash, S&P 500, daily percent moves, posted March 21, about the time I covered my short.”

“Didn’t you post above that you covered your short about March 21, 2020?”

I published two short sales.

The first short I published, I entered into in early Jan 2020 and covered very profitably on ca. March 21, 2020 (operating on memory here, could be off by a day or two). I published two articles about that: on the day that I sold short, and on the day that I covered it.

In June 2020, I published a new short that I have still not covered, which is the short that everyone has been harassing me about.

Wolf

It may not be a straight line this time. It may be a wide gap like 1987 or 2001.

“Look how often the unexpected happens – yet we still never expect it.” ~ Ashleigh Brilliant

Perhaps amazon dot com should start making money in place of making movies.

They do make money. $21 billion of net income in 2020.

Then they should continue with the series ‘The Expanse’. 😁

You will get more income on your babk deposit.

$21 billion net income translates to $300 billion company value at current inflation measures. This compares to $1490 billion current market cap. This stok might have some correction potential.

How do you compare the current economics against any historical data? We are in uncharted times and not just the US but globally. If the dollar falls what will take its place? If American loses its leadership position ( already has in the mid-east, NATO is a shell) who will step in. Why did so many politicians across the globe run on the theme Build Back Better? When to time the stock market might be the least of your worries.

The too many PE ratios left this universe long ago and now are from Fantasyland. If this is not the start of the huge crash that has been avoided for years, that huge crash is coming, sooner or later.

There is just not enough future income to be had to support the current valuations of the high-flyers. I have invested in value, utility stocks that have modest PE ratios, so they will not decline much over the long run, even though they declined now. However, when the crash occurs, for months or years, I would not be surprised to see even the stock prices for those stocks crash, because that is human nature: most of us can go into an emotional stampede that causes us to sell stocks with decent valuations.

“emotional stampede”… I like that expression. RH.

The Nasdaq leads the way down. Hold on to your knickers…

The NASDAQ has gone up about 1000% in a decade. Just unreal, literally.

And mostly artificial…

The NASDAQ QQQ has risen little more than 3X since 4/1/2000.

My I Series inflation adjusted savings bonds are outperforming my stocks and ETF’s.

My cash is not trash, at least for awhile.

David Hall

Making $ in a secular Bear mkt is to go, against the MKTs with some hedges. Many investors are NOT educated, experienced or trained go against the mkts! I use Option trading and leveraged ETFs both short * long, ‘gingerly’ ( Not for the novice!) I NEVER lost a penny during GFC but lost ALL my built up profits, once the game of rules got changed by Fed in March ’09.

Mind you in it’s entire history, Fed NEVER bought MBSs, QE(s) was seat of pant plan ( no prior record or research!) by Barnake! It had NEVER suspended Mkt to Mkt acounting standard! Against these odd I was trying but failing miserably b/c untill 2008 I followed the RULES set in this land of Genuine Free Mkt Capitalism which got replaced by Crony & Predatory Capitalism!

Boy, was I NOT ready for the whiplash and shock of entire my investing experience (in the been mkt since ’82!)

Now I am relieved that the REALITY is bursting through all the BS bult up since ’09! It is a breath of fresh air and I am all for the changes pouring in!

Investing was SO EASY, When Fed’s PUT was in persistent action since ’09. Every one thought s/he was smart investor. Unless profits are SOLD aka Cashed out, many will have bitter experience of those, who lost during 2000 and 2009. Bear in mind Your MFund managers(unless it BEAR funds) will NOT protect your portfolio! Read the prospectuses of those funds.

GREED will be replaced by FEAR!

@Sunny – really appreciate your voice of experience!

I too was shocked when the losers-in-power changed all the rules in the middle of the game in 2008-2009.

Those of us familiar with the old Calvin & Hobbes comic strip remember “Calvinball”, where they’d argue while playing (anything) and change the rules midge to favor their own side. Hilarious then, tragic now. The rule of law may have died long ago (or maybe it was always only an ideal) but the corpse was exposed for all to see in ’08.

We should be prepared for any and all possible shenanigans as the Everything Bubble unwinds.

Dividends on the SP500 have roughly doubled since 2009 when SP500 was 666. That tells me stock market could go to 2 x 666 without too much of a problem. We all know the debt problem is worse.

Old school

Dividends won’t remain UNAFFECTED when the earnings go down in a secular Bear mkt!

Read mkt history of 200 yrs!

Remember the old saying “money always returns to its rightful owners”

The choices in front of you:

Stay in stocks and lose in long bear market.

Go to cash and lose 10%+ per year in inflation.

Go to cryptocurrencies and lose 30% in a day.

Go to gold and pay 20% premiums.

Go to real estate and watch the bubble implode.

You forgot shopping malls.

Plastics?

It is kind of like the passage in the bible where fire consumes all the useless works of mankind and only the pure things survive.

In the very long run only the things of value endure and those that did proper economic calculation and didn’t overpay will have done ok. In the short run it’s a crap shoot

I have other choices. One is to continue investing in good companies with solid balance sheets, and continue ignoring the bulls and the bears. IMO, time is on my side.

Just factor in a recession in your analysis – which will occur when the dip continues. Even a very solid company can run into trouble then…

In a one hundred percent rigged market anything could happen. The consensus seems to be inflation will accelerate as the spread between the Fed funds rate and inflation widens eventually leading to a collapse in the U.S. dollar.

Not so sure, myself, Sean.

We’ve had the best part of a century now of markets going up, which understandably leads to this sort of assumption. But the expansion was highly abnormal seen in a longer term historical context, and wasn’t sustainable, but rater based on stored energy from past aeons.

And since we passed peak conventional oil we’ve been on a debt fueled binge to drive a further acceleration in consumption, draining our natural, financial and social equity, that has left fixed income earners in the dust whilst asset owners pop their best champagne.

I guess it may be pushed on for some more years if additional monetary easing and even more stimulus gets back on the agenda, but barring some miracle breakthrough in energy conversion technology, I would suggest that we will eventually be forced to move from expansion to contraction over coming decades, and I don’t envisage equities (and many other bubbles) overall responding too well to that, at least not in real terms.

There are almost no solid balance sheets today able to withstand any kind of extended economic contraction. The economic distortions now are worse than 2008 and look what happened then. Is the FRB and UST going to bail out everybody forever? The answer is they can’t, not without crashing the USD.

Compared to the past, corporate balance sheets overwhelmingly suck. Interest coverage ratios are currently high substantially or entirely due to the fake economy (inflated earnings) and yield suppression since 2008.

Less cyclical companies should do better in the intermediate term but if the bond bull market from 1981 really ended in 2020, it’s all headwinds from higher rates going forward too.

Theoretically, that would be the best tactic. However, be aware that Enron-style accounting scams are common now in the US, even though they are much more frequent in stocks from mainland China, etc. Do not trust their financial statements even 50%.

Thus, while there may be a collapse in values even for the stocks of good companies, because investors will stampede when the market collapses, many, many corrupt companies will go bankrupt in the next crash. Like Maddoff faced too many calls for withdrawals of capital in his Ponzi scheme, so he had to give it up and seek governmental protection, many corrupt companies will get too many demands on their capital and have to reveal their frauds when sued.

While the level of corrupt accounting scams in the US cannot match the corruption in the mainland Chinese companies, or the companies of some other countries, you will be shocked at the number of US companies that will collapse. Too many companies have been operated by corrupt control groups, who are often among the ultra-rich, to fake accounting records, get over leveraged, issue too many dividends, buy back too much stock, etc.

It is too bad that the ultra-rich members of corrupt control groups cannot easily be made to bear personal liability for such, common frauds. They usually get away with it, as they and many companies have gotten away with not paying US income taxes for DECADES through tax avoidance schemes. Read how Apple avoided paying $50,000,000,000.00 or more in US income taxes in Gizmodo.

Salt-as usual, a crystal observation that the physical universe’s team always bats last in the contests with the human economic one, carrying an average well over .400…

may we all find a better day.

Not a lot of choice really, but if everything goes to heck, I’ll gladly take cash, PMs and real estate.

Because if it all does go to heck at least I will still have cash, PMs, and real estate as opposed to nothing, nothing, and nothing.

A house is a house regardless of value.

Yes, but US equities are not the only choice here.

Many international and emerging markets provide much better valuations and thus would fall much less during an extended bear market. Not only that but as US equity investors begin to get wiped out, that money would begin to rotate into these other markets at which point they would most likely begin to significantly outperform the US markets.

I recall the mantra was the same in 2008.

I held everything and it was all fine within 13 years by 2021.

I’ll probably just do the same again.

Wake me up in 13 years at the peak of the next bubble.

I hope you can still wake me up in 13 years.

I’ve read your posts on another blog if you are the same poster.

Let me guess, you believe in the government’s ability to prevent declining living standards, don’t you?

If you do, you are wrong. It’s not true in the US and it isn’t true anywhere else either.

The US has experienced extended social decay my entire life and I’m 56. It’s not the same country it was in the past and contrary to those who believe today’s environment is an improvement, won’t lead to increased future prosperity later either.

Since 2008, even with the fake economy and the loosest credit conditions in history, median household income and net worth have flatlined since the late 90’s. And no, attempts to more equally distribute the economic benefits from a fake economy and asset mania aren’t a solution either because it isn’t real wealth.

The country has effectively been eating its “seed corn” for decades and no, Americans don’t have a birthright to minimum or perpetually higher living standards.

There is no “deus ex machina” hidden in a closet available to policy makers to escape the consequences of what I am telling you.

Augustus

I have 20 more years on you. Watching the same things. Couldn’t agree more with what you wrote.

Augustus,

I am likely the same poster on the other blog. I don’t know of any other.

I believe the government can stabilize the potential wild swings of capitalism. I don’t believe it should control it to the level it has with the Fed. On the other blog, some call me a commie for saying this (In a nice way, mostly)

Are we better off today than 50 years ago?

I think 50-60% are better off. These are the professional jobs, accountants, engineers, computer scientists. nurses, … Some didn’t exist 50 years ago. Doctors and lawyers are are slightly better off but they had done well back then also. The CEOs and corporate board members have reaped the majority of the gains. They are the top 1%.

The lower 40% are definitely worse off. Lower wages have not kept up with inflation. Unions have been driven out.

As an example:

My grandfather was a union manufacturing worker in the Midwest. He had an upper middle class life in the 1940’s-70’s.

He had a new house along with thousands of other union workers in the same neighborhood. He retired on a comfortable private pension and lived the rest of his life in the same house. His job is what the lower 40% do now. Today, these jobs do not offer the same wages, pensions, or quality of life.

My dad was the first person in the family to go to college. As an engineer, he lived a slightly better life than his parents. A little bigger house and a generous private pension. Engineering, with the computer boom became a much more stable job and wages increased over time. As a kid, I remember boom and busts in aerospace which employed most of the engineers. Companies like Boeing laid off thousands at one time. If you were lucky, like my dad, you kept your job and lived well. We even lived next door to a VP at an aerospace company because VP wages were not 100X an engineer wages like they are today.

I am also an engineer and benefited from a high demand field.

We are doing slightly better than my parents. However, private pensions do not exist anymore so it remains to be seen how our retirement will be. It depends on the risk that I am currently taking with investments. Am I lucky?

My daughter is a nurse. They are paid very well. She bought a house (not in CA). She lives better than I lived at her age. Bigger house, more vacations but no pension so she has to plan ahead.

The lower 40% are doing far worse. Lower pay, no pensions.

The upper 60% are gentrifying the traditional working class neighborhoods pushing the low wage workers into what used to be the slums. The people who used to be able to afford the slums are now homeless. Business is seeing real estate as an investment as rentals, driving up the RE prices and rents. The lower 40% are in a tight squeeze. I wouldn’t be surprised to see unions making a comeback unless automation or outsourcing wins the battle.

I believe wealth disparity is a huge issue.

I apologize if my initial statement seemed dismissive or arrogant.

I have a dark sense of humor.

However, since I invest fairly conservatively, riding the roller coaster instead of jumping off at the wrong time has been a long term strategy that has worked for me.

The only thing I jump out of is my Mad Money risky investments. I jumped out too early on those last year. Better early, than never!

Gotta be a a way to go to gold without taking physical delivery?

Buy one of the two biggest miners. They are leveraged about 2.5 : 1 to the gold price so you don’t need that much. Balance sheets are currently very strong.

If gold goes below $1200 the gold stocks will not be worth anything. If gold goes to $2500 you should double your money. You will collect a dividend while you wait on your fate.

Red, you might look into an ETF: PHYS

Many many ways.

2banana

Another choice, if you care to excercise it1

Go against the Mkts make $ with risk management tools like Option trading, only the avenue left for retail investor, against the sharks and barracudas, out there!

One cannot learn it in a zippy. you cannot buy house insurance when one’s house is on FIRE!

I don’t pay 20% premiums over here in Turkey I’m buying kilo bars at a couple percent over spot I’m sure you can buy gold for WAY less than that in the states as well Just shop around alittle

Watching the RE implode will give you opportunities to buy.

Look, I know you guys hate RE but I have doubled my equity in 5 years by just letting a good property management company do all the work, plus generate 450k a year in NOI. Plus all the tax advantages. And you are 100% owner, not a minor shareholder.

It is like free money, even with the eviction moratorium. I bought in a college city with an active retirement community on a bay [lots of boating]. Smaller city with people flooding in from the big cities.

Long term loans at 4%, short term renters on their up, leases backed up by parental money, new tenants every 2-3-4 years as they move up and out, no children to destroy the place.

I am just trying to point out an opportunity that worked very very well for me and my family.

An opportunity? To net $450,000 per year in real estate?

You can do that with about 10 to $12,000,000 cash in Southern California. Possibly 1/2 that in other areas. Or you can leverage, but it still takes a lot of cash for down payments.

If it is so easy, of course you will duplicate your efforts and push your collected NOI to $900,000.

You sound well intentioned, but the post rings a bit ridiculous. Of course it could be my ignorance of your methods.

Or buy PM miners at a steep discount.

What premium on metals? Buy PSLV, you pay SPOT no premium… then you just pay taxes on gains, vs paying premiums at a Broker. If you buy from PSLV vs SLV you are buying a physical commodity backed asset… vs the funny money money games SLV plays…

SLV being run by JP Morgan who has been fined hundreds of millions for manipulating the metals market… Most people don’t know how they defeated the Silver short last year… They ‘found over a million oz’ out of no where… and then late last year they had to admit it was an ‘honest mistake’.

I’m of the opinion that hard assets are the safest place to be, metals, land and the like. I know folks who think bitcoin is the place to be. I suppose a stockpile of cash is good for quick liquidity, but it’s losing value each day. What do you think is the safe haven?

My cash just got a 25% return on Bitcoin today. ONE DAY. Am I buying that garbage? HELL NO. I’ll take all your cash. Do you have any?

Does Mr Wolf have any thoughts on this question? In a nutshell, where should we be protecting our money? I would suspect a post on this very issue would be a great one.

Bet on a collapsing U.S. dollar especially in 2023 as the spread between the Fed funds rate and the inflation rate continues to widen. I seems to me inflation will begin to fall in the second half of 2022 but accelerate in 2023 leading to a falling U.S. dollar. A better question might be will the Fed funds rate ever be higher than the inflation rate again in the future?

The trouble is in seeing where any choice ends up over time. Quick money is certainly there to be made by those that are open to risk. I tend to be in the slow and steady camp and will always see hard assets as a slow but certain way to grow value and protect those gains. I’m not in a hurry.

Where to protect money has many solutions depending on one’s appetite for risk/gain and personal financial position. It is different for everyone. The trick of course is to find the one that fits your overall plan.

Anyone who buys Bitcoin is a complete sucker. The only real use is to launder drug money. When regulations kick it it will be game over. When it crashes and goes below zero, I’m going to go to my local Pub and get trashed to celebrate. I’m going to need Uber to take me home.

Just don’t try to pay the Uber driver with Bitcoin. :-)

Whoever bought Bitcoin, Dog coin and other crap coins at their peak are losing over 50% of what they paid for during the Buy High sell low times.

It gets worse…

Over 40% of BTC owners are now underwater… Then when you throw in the fact that over 30% of BTC is parked due to losing access…

We are now talking about an ‘asset’ where effectively at best 30% of it’s owners are not underwater…

So who exactly is going to buy into that dip? That parked 30% has created an artificial floor that has given BTC a unjustified seeming stability…

When BTC goes, its hard to imagine it does not do irreparable damage to faith in crypto…

I think Mr Robot got this right, it’s going to take a state backed Crypto for it truly to take hold. My guess is an YuanCoin…

Grantham recommended emerging markets specifically value stocks in emerging markets.

This was a little surprising since emerging markets sold off more than developed ones the last time the Fed tapered QE (taper tantrum).

Also emerging markets have a larger exposure to commodities where Grantham also identified a nascent bubble.

But he is an expert on valuation so might be worth some serious consideration.

I’m dazed and confused by Grantham’s advice, too, a good year ago, on going with EMs. Glad I sat on my hands on that one. But, I have the highest regard for him in spite of that.

Grantham is a fool who just ran his Boston based asset management into the ground and fired most of his employees.

He certainly is not a fool. If you ever read his writings you understand that he knows financial history and statistics very well.

His calls were so bad that his firm GMO is struggling and cutting staff to trim expenses. I know some of the people who were cut.

For example, the cut equity exposure in mid 2020 … just before the big rally.

If you allow someone else to manage your money, you have no one else to blame, but yourself, if your money is lost.

On the other hand,

If you manage your own money, you have no one else to blame, but yourself, if your money is lost.

Grantham’s plight afflicts everyone who has been rational and value-conscious in the midst of this epic bubble: fighting the bubble costs you returns and (for fund managers), that also costs you investors and AUM.

But then again, Michael Burry of “Big Short” fame also lost most of his investors, before he made the rest very, very rich.

You only have to be brilliantly right once, to be set for life and forever regarded as a Market Genius. Unfortunately those Market Geniuses are often wrong for the rest of their lives, and if you follow them it can cost you a lot of potential returns.

I think Grantham is of the opinion like myself that market didn’t put in a true bottom in 2000 so any gains since then are going to be temporary.

In a way modern money management is mostly a joke as they have to shoot for short term performance which isn’t really investing.

Oops. Should have said not a true bottom in 2020.

that’s my belief too. that the march 2020 drop wasn’t a bear market at all, but a flash crash. it didn’t really change investor mindset. rather than the despair you normally see at bottoms, “investors” were giddy at the prospect of all of the “cheap stocks out there” even though they were still historically overpriced.

Grantham exemplifies what has happened since 2008 where anyone who made rational decisions based on fundamental concepts you’d learn in school or just common sense … got crushed or didn’t make anything and all the people who did the most irresponsible things possible gained the most.

The choice has been to either go with the ponzi scheme you know isn’t justifiable … or make no money.

Now could finally be the comeuppance but the problem is that we have to make this choice in the first place. He was “wrong” for doing the “right” things.

He said to buy commodities gold, silver and cheap Japanese stocks. All of this relates to a falling U.S. dollar but I don’t think the U.S. dollar will implode until early in 2023 when the Fed completely loses the handle on inflation and it starts to turn to hyperinflation.

If the US Dollar falls, more than likely the rest of FIAT will fall even more and before as anyone that has doubt of the economy of government converts to US Dollars.

Maybe the Swiss Franc will outperform the US Dollar.

Cashboy, don’t count on the Swiss francs. Their CB will dilute their currency to keep their exporting companies from getting boxed out. They devalued back in ’09 and forward, as needed. Incidentally, the Swiss central bank actively invests in U S equities. What’s disturbing is that they can simply print money and buy ownership in U S companies.

@ HowNow, Socaljim

Grantham was playing by the RULES of our good ole genuine Free Market Capitalism until Fed murdered it. Congress was complicit in it. It was replaced by CRONY and or Predatory capitalisn run by top 1% and Wall ST! This is the most SURREAL Bull mkt of my life based on NO fundamentals, just insane credit creation! I have been in the mkt since ’82! I sympathize with him and also John Hussman!

I was also affected by the same deceit and betrayal of principle ‘ FREE Market CAPITALISM, by the Federal Reserve owned by mega global banks running to their advantage. ( See my comments in this other threads on that issue) No one challenged them b/c every wanted to be on that gravy train of ‘Easy-Peasy’ with no questions asked. Boy, what a deal!

Only those who entered the mkt since ’09, think that Stocks can only go up! Now comes the time, to show how ‘smart’ you all are, without Fed’s put or the ‘Easy-Peasy’ dollars!

“I have been in the mkt since ’82”

And soon after came the “Maestro” Alan Greenspan!

KPL

What are talking about?

fyi

-Paul A. Volcker became chairman of the Board of Governors of the Federal Reserve System on August 6, 1979. He was reappointed for a second term on August 6, 1983, and served until August 11, 1987.

-Alan Greenspan is an American economist who was the chair of the Board of Governors of the Federal Reserve (Fed), the United States’ central bank, from 1987 until 2006.

-The expansionary monetary policy of “easy money” attributed to Greenspan’s tenure has been blamed in part for stoking the 2000 dot-com bubble and the 2008 financial crisis.

(Investopedia)

So, what you are really asking is where to hide in something that is not in a bubble and pays a decent dividend or interest rate. Or has a decent chance to gain value.

Tobacco stocks

Miner stocks

Pipelines stocks

Certain healthcare and pharma stocks

Defense stocks

Booze/beer stocks

Coal stocks

Casino stocks.

Off the top of head.

Feel free to add.

I like bank stocks, at least for a while longer.

Volvo P-1800The banks are already technically bankrupt.

If interest rates go up, surely the banks are going to have bad debts.

Tobacco stocks such as BTI has had a large runup why I haven’t a clue? Smokers are dying off and with Covid more people stopped smoking. The birthrate is falling and there’s very few next generation smokers outside of China. I guess people desperate for yield will buy anything.

Check Morningstar on BTI = 5* rating. Even though their revenue is declining, their profit margins are huge. Their PE is historically low. And, most importantly, when the poop hits the fan, BTI will probably serve as a safe haven – unlike almost everything else, including gold. Just my take on this…

@2banana

There’s not really anywhere to hide once the bear awakens. Sure there are fine companies that generate substantive free cash flow. The problem though is that these companies too have been caught up in the mania of free money and now sport unsustainable P/E’s. ALL P/E’s sustain significant haircuts in a secular bear market, regardless of the underlying business model (with very few exceptions).

The other BIG issue is leverage. Rate increases bring about a credit crunch. Kicking the can is no longer the simple wash-rinse-repeat solution to resolving looming debt maturities when the cost of capital is rising faster than the CFO can model. There will be liquidity issues which devolve into solvency issues which causes other dominoes to tumble. This is when we discover how many more Archegos funds are out there.

Of your list of sectors, coal is a solid bet. However try finding a publicly traded entity (domiciled in the U.S.) that isn’t leveraged to the eyeballs.

The only real place to hide appears to be inverse ETF’s.

HRO1

Please be CAREFUL with investing in inverse ETFs. Works wonder when your timing & Trend are ‘cooperative’ otherwise it is ‘suicide’

I have used them since 2003. Came very handy during GFC but NOT any more after, unless one invests in leveraged long ETFs!

There is daily decay and reset at the end of each day. They are in fact a kind of ‘derivatives’ to be used by the experiened ones and definitely NOT for the Novice. I lost quite a bit during last decade.

After having said, one can use them but only in TANDEM with the long leveraged ETFs ( mixing is an art than science but also long experience) to avoid the whiplash. But great to profit using them during ‘expected’ bounces in an going secular market. It is definitely NOT a panacea, b/c of hidden risks!

Suny129,

Agree regarding inverse ETFs. A derivative of a derivative, designed for those with cash accounts and who want to attempt to profit in a down-trending market. Cash accounts cannot short stocks.

Inverse ETFs are not truly the inverse of their antiderivative. Take, for example, QQQ and SQQQ or IWM and TZA, place the two in separate charts, on top of the other, and compare.

If you compare IWM and TZA, (you could even invert one if your charting service has that functionality), you’ll see that IWM has clearly dropped below major support but that TZA has not yet cleared resistance. In other words, the two are not mirror images of each other.

If the antiderivative is tracking sideways, the inverse ETF will be drifting lower. So there definitely is some decay going on there, as you mentioned.

On days when there is little positive percent change in the antiderivative, the inverse ETF will show a negative percent change.

Inverse ETFs will reverse-split when the price gets low enough.

You can bet your bottom dollar market insiders monitor inverse ETF statistics because they know those are retail investors buying in and will rally the market to try and shake them out.

For those who have margin accounts, such as myself, buying into an inverse ETF requires I use 100% of my margin, which means I cannot barrow money from my broker to buy an inverse ETF.

Therefore, I prefer to short stocks in a down-trending market, and without the use of options. I avoid shorting stocks that pay a dividend.

If you are short stock on the dividend holder-of-record date, you pay the dividend, not the company. In the past, I’ve lost money not only on my short position (squeezed), but I had to pay the dividend and pay the commission to get out (when there were commissions)!

“He who sells what isn’t hisn’ must buy it back or go to prisn’ ”

-Reminiscences of a Stock Operator

One last thing, I must disagree with you regarding the use of options as a safeguard against the sharks. The shark is your broker and as your broker, is obliged to blow out your account by whatever means available.

But to each his own, that’s what makes a market!

Profit from the comments made by the Prophet. Amen.

Thank you, HowNow.

Correction to my comment:

Dividend holder-of-record date should read:

Stockholder record date

Prophet

‘ Cash accounts cannot short stocks.’

I agree!

‘One last thing, I must disagree with you regarding the use of options as a safeguard against the sharks. The shark is your broker and as your broker, is obliged to blow out your account by whatever means available”

Definition of a BROKER- S/he will stick with you untill you are BROKE!

I manage mine my family of 5 portfolios.Absolutely NO traditional brokers. Only I use options (PUTS) executed via online discount brokers Schwab, Etrade and Vanguard. they work wonders if one’s timing and trend agree, like NOW! But I also use calls as hedges against ‘always’ expected whiplashes in a secular bear. I use both leveraged ETFs ( both short paired with few long ones) It worked wonder during GFC! I also use to a lesser extent BEAR MFunds, held over my buying in 2018, again protecting mine and my family’s portfolio.

I made more money during BEAR than BUll after 2000! Now the reversion to the mean has started, I gaining slowly my lost profits! Those who know option trading NEVER fear Bear mkts. I never SHORT stocks ( naked or covered!) NOT my cup of tea!

B/w during my MBA course the professor of ‘Financial management ‘told me that ‘VERY FEW’ brokers know how to trade options, effectively! Long time ago I became the ‘master’ and excutor of my financial destiny. A lot investors will be better off learning investments (+options) on their own!

Suny129,

” A lot investors will be better off learning investments (+options) on their own!”

Yes, I concur! Provided they (or you and I) don’t get monkey-hammered along the way. Always something new to learn, gotta stay on your toes and be ever vigilant!

The mining stocks? Oh give me a break. Those fools are making money. No one wants a company that actually makes money. We are living in bizarro world. Of course we might come back to the real world at some point!

It’s good to under stand duration and match it up to your needs. Cash is mainly for spending in the next six months or to manage duration in your portfolio so you don’t get wiped out in a draw down.

Bitcoin made its high the first week in November, this is very much like a repeat of the mortgage crisis, (an off market speculative industry which dragged down the market) however in this instance the size of the bitcoin market is very much smaller than the size of the stock market/economy. While crypto is highly speculative, it’s effect on business is limited. The crash started here. and the market is just dropping in sympathy (Musk owns a lot of it, and companies like MicroStrategy moved their entire market cap into digital. (Down more than 50% starting in November which is when Tesla put in its last high) The dollar index put in its high a few weeks later, and you might ask that question, is this a currency issue and not a stock issue? The Yuan has been rising against the dollar and what’s that do for INFLATION and trade deficits??

Under sufficiently adverse conditions, it’s not just what you have your assets in that matters but where it’s domiciled. This depends upon where someone lives but don’t think the US is completely exempt.

One of the best “investments” someone can make is in a second passport.

People took on a lot of debt recently and if government doesn’t dole it out next time there is a problem, people are going to need a whole lot of cash to make their debt payments.

Government saved everybody once, don’t know if they will do it again.

I hope that Toronto real estate collapses along with the rest of Canada.

I believe they’re going to end blind bidding but the Chinese have zilch in the stock market so the recent fall doesn’t affect them. All the Chinese know is inflation back home in China so if they see the word inflation all of them will still pile into buy.

Hello Gen Z

I have been looking at Toronto and the GTA since 2017, thinking there will be a crash. It hasn’t happened yet.

However, the laws of gravity will act someday and it might just be around the corner.

It has been irrational exuberance squared for the RE, the politicians have simply let it go crazy.

Copper and oil top my list

In Gold I Trust

Yes, the time for gold has definitely arrived.

Ahh yes. The flapper days of the weimar; The Great Depression; WWII. Such wonderful memories of the golden days.

Yep, most people carry the shingles and gold fever virus, they just don’t know it yet.

Family,food,shelter,

Half the Nasdaq stocks have NEVER made money and the P/E for the combined Nasdaq when you include their price in the mix is about P/E of 70+. Shorting the QQQ (Nasdaq) EFT is a way to protect yourself :-) This bubble has to burst….as does the Chinese Real Estate worth $55 Trillion- Both are NOW simultaneous unravelling – Even the I.M.F. chair and Winnie the Pooh (Xi-JinpinG) have both come out to ask Weimer Powell “NOT” to raise rates…. REALLY????

Yes, the great recession of 2008-2009 led to this as the Federal Reserve lowered rates to nearly 0% and bought Treasury securites and mortgage-backed securities (quantitative easing). A lot of the gains are artificially created due to the Federal Reserve, not due to gains from innovation and productivity.

A lot of mega and large cap stocks are down from their all-time highs

Disney down 32%

Google down 14%

Apple down 12%

Microsoft down 15%

Amazon down 25%

Netflix down 43%

AMD down 28%

Facebook down 21%

Ford down 20%

Tesla down 25%

Bitcoin down about 47%

“A lot of mega and large cap stocks are down from their all-time highs”

Good!

That has little significance when they all are higher on a year over year basis.

@Bobber: You might recheck your charts.

AMZN, DIS, NFLX are all down year-over year.

BTC is hanging by a thread and could fall off your list this weekend.

interestingly it’s F that has had the best performance and is the only one still genuinely holding it together…

And down 50% means it takes up 100% to recover.

As tempting as it is, I am not so sure that shorting stocks and protecting yourself should be in the same sentence.

if you’re gonna do it, the best way in my opinion is to buy out of the money puts or to buy a reverse etf like sqqq. you do that, your downside is limited to whatever you put in.

You don’t go net short. You do pair trades. You would have made a killing shorting ARKK and buying APPL or MSFT, and you would have been neutral from a general market standpoint.

If that was a neutral trade, then I guess shorting APPL and buying ARKK would have been, too.

Wolf – you are so right, the party is over, and the hawkish talk by the Fed and rate hikes will be just 1 of many catalysts for this ongoing correction/crash, of markets that are so ridiculous, – I saw that movie in 2000, but this by far will be worse. You have posted countless examples of this undoing, and why.

Seattle Guy – that’s right about Xi of China and I thought at 1st it was kinda of amusing, 2nd thought was OMG, that means that China is in bad shape too – US rate hikes scarring them? – that to my knowledge has never been said by them to the US.

Here’s a another biggie below, and this is on top of several posts I made about many other hedge funds selling like it’s 2008.

Jeremy Grantham, co-founder and chief investment strategist of Grantham, Mayo, & van Otterloo (GMO) said in a report called “Let the Wild Rumpus Begin” that stocks are now in the midst of a “superbubble,” that it won’t end well.

Grantham, who has been running the firm’s investments since it was started in 1977, was similarly bearish at market tops in 2000, and during the Great Financial Crisis of 2008.

“Good luck! We’ll all need it,” said Grantham, whose firm manages about $65 billion in assets.

He noted that US stocks have experienced two such “superbubbles” before: 1929, a market fall that led to the Great Depression, and again in 2000, when the dot-com bubble burst.

He also said the US housing market was a “superbubble” in 2006 and that the 1989 Japanese stock and housing markets were both “superbubbles.”

“All five of these superbubbles corrected all the way back to trend with much greater and longer pain than average,” Grantham wrote.

Many investors don’t want to believe that the stock market is overdue for a broader pullback, Grantham argues, especially since the market fell into bear territory — albeit briefly — in March 2020 at the pandemic’s start.

“In a bubble, no one wants to hear the bear case. It is the worst kind of party-pooping,” Grantham wrote. “For bubbles, especially superbubbles where we are now, are often the most exhilarating financial experiences of a lifetime.”

Grantham believes that the Federal Reserve’s moves to cut rates to zero — and then keep them there for nearly two years — is a main cause for the market’s current frothiness. The Fed is widely expected to begin raising rates at its March meeting.

“One of the main reasons I deplore superbubbles — and resent the Fed and other financial authorities for allowing and facilitating them — is the under-recognized damage that bubbles cause as they deflate and mark down our wealth,” he wrote.

Grantham added that “as bubbles form, they give us a ludicrously overstated view of our real wealth, which encourages us to spend accordingly. Then, as bubbles break, they crush most of those dreams and accelerate the negative economic forces on the way down.”

This speak volumes and is a very bold statement and sums up a lot of what has been said here way before him.

Excellent post Martok. Grantham is one of the few credible commentators who calls it as he sees it. Interesting to note that his views frequently echo what Wolf has been saying here for months.

Greenspan’s old phrase of “irrational exuberance” comes to mind. Part of that irrationality is overspending based on the artificially inflated value of one’s assets. Some of the people who have done that will receive an unpleasant cold reality shower in the near future.

The Emperor has no clothes. Will be interesting to see how this situation plays out in the fall midterm elections.

yep. i’ve been saying that for a long time, that people are not buying houses with their stock or crypto wealth, at least not in the traditional sense of cashing out and buying houses with that cash. it’s just giving them the false confidence to borrow and spend more with other sources.

Consider: a $300,000 mortgage, at about 4%, is a monthly hit of only $1000, and that’s a tax write-off (or it used to be). If you have a 20% down payment, you can get a house priced at about $375K. That sure as hell beats paying rent, although the buying and selling of a house, annual taxes & insurance, and the all-to-real maintenance costs have to be factored in. But avoiding rent servitude is a good reason why housing prices should have skyrocketed. When will it end? Dunno… But that increase in inflated equity will trickle down to the next of kin anyway.

there have been many places and times when renting was far cheaper than buying. a few years ago, i rented an apartment for $2k a month that had just sold for $500k, as an example.

How now,

I disagree. The main decision is how much you are going to spend on shelter and whether the rent vs. life style is best for you. If you don’t use the money for a down payment, it can be used for other investments.

Practically I think it has to do with family size. If you are single it can often make sense to rent as 1 bd sfh are not a common thing. If you have family and need 3 or 4 BD then probably a SFH purchase makes sense if you feel you can stay there 7 years or more.

Just my thoughts having been a homeowner and a renter.

In Southern California, a big reason to buy is safety. People are paying a premium to buy homes in zip codes where the police still respond and arrest criminals. This is very true.

Listened to an hour long presentation by an apartment developer yesterday. He said developers and their lenders are closing up shop in a lot of progressive cities that are talking about price controls and have busted budgets.

When you build a development, you have to make an assumption on rent increases and property tax increases to plug into a calculation to see if there is going to be a positive return. If the numbers don’t work,you go somewhere else.

The dude next door to me is renting for $2,500/month on a house that is at lease worth $700K. Good deal for him. The owner doesn’t want to sell and have to pay capital gains taxes.

Jim Cramer bought a farm pretty smart move

Old School, I, too, disagree… with your comment about property developers who are thinking about long-term rental issues. Many developers sell the complexes asap, if they ever really owned them. Besides, the tax scheme is such that they maximize depreciation in the first several years. Swapping them out every 3 years is common practice. They fish where the fish are biting, not whether a city is “progressive”. Propaganda for the “right”? Look what just happened to Aaron Rogers. Bad karma.

If you don’t mind me adding, this time has been “irrational exuberance squared”

It has been total madness worldwide.

““One of the main reasons I deplore superbubbles — and resent the Fed and other financial authorities for allowing and facilitating them — is the under-recognized damage that bubbles cause as they deflate and mark down our wealth,” he wrote.

Grantham added that “as bubbles form, they give us a ludicrously overstated view of our real wealth, which encourages us to spend accordingly. Then, as bubbles break, they crush most of those dreams and accelerate the negative economic forces on the way down.””

this says it all. the “wealth effect” is a farce, and always has been. while it is true that it might cause people to spend more during the “good times” when they have a lot of unrealized paper wealth, all of the extra economic activity and then some is canceled out by the slowdown that occurs when the game finally falls apart. and it always does.

This cycle washed out a lot of value money managers, but if you manage your own money it’s easier to stay the course as your clients don’t pull their money if you under perform for a year or two.. Have to admire Grantham for sticking to his knitting.

Buy Buffett value investing on the cheap and one of best

Flea,

Yep. Best to buy it in a recession when it gets close to 1.0 book and then sell roughly 4% of shares per year in retirement for income. I tried to buy at book and sell at 1.4 book, but it meant I sold too early at about $185 six years ago. Now $310.

Tried to buy it back in 2020 at 1.0 book, but I was too cheap and missed out by $1 per share, cost me $130 per share. Oh the heart aches of an investor.

Buffet does give good advice, one thing he said is people don’t usually regret holding brk for the long term.

The Wealth Effect along with it’s conjoined twin, the Poverty Effect, has always been a Central Bank slight-of-hand.

The appearance of increasing wealth, which is simply increasing prices from depreciating value of local currency.

That was a very helpful summary of where we may well be positioned. I have been bearish since Nov. ’19, but timing is always nearly impossible. You just have to wait until it happens.

Thanks for that very astute post. I have many friends who’ve been spending like drunken sailors in Hong Kong, thinking their newly-found wealth is a result of their financial shrewdness or prowess or whatever.

I stopped listening to them months ago to save my own sanity, as I was a lone “voice of reason” in a hurricane of hubris. I shall now remain smugly silent and let the chips fall. As Ted Geisel said… “You can’t teach a sneetch.”

“Grantham added that “as bubbles form, they give us a ludicrously overstated view of our real wealth, which encourages us to spend accordingly.”

Which is why, as I’ve said many times in the past, there is going to be the biggest sale in history on cars, boats, planes, RVs and the like. When money gets tight, the first things to go are the extra toys worth the most money. But there are no buyers at that point, only sellers, so prices get crushed into oblivion.

People have short memories. I remember the first crude oil spike back in 2008. Once fuel hit $5 per gallon, the town was littered with “For Sale” signs on trucks and large SUVs. People didn’t want them. Now we have nearly $5 per gallon fuel and people buying these dinosaurs like they’re going out of style. Won’t last, especially once everything melts down. The carrying and operating costs of these things are absurd.

The crypto day traders are the ones who will be having the biggest garage sales. Once their electronic tulips crash into oblivion, and stay there, their whole fantasy is over with. Time to GET A JOB. Thinking you could sit on your ass and produce nothing for the rest of your life while getting rich was 100% due to the most reckless FED of all time, as Wolf has put it.

“Which is why, as I’ve said many times in the past, there is going to be the biggest sale in history on cars, boats, planes, RVs and the like. When money gets tight, the first things to go are the extra toys worth the most money. But there are no buyers at that point, only sellers, so prices get crushed into oblivion.”

So true! I saw that specifically in the RV industry around 2009.

Back in the mid 80’s, we lived next door to a guy who was a commodities broker and owned a seat on the CBOT. They were living the high life… new Jaguar and Mercedes in the driveway, 3 karat rocks, new “headlights” for the trophy wife, etc.. You name it, they had it.

Then something abruptly changed and the cars turned into rusty Chevy’s, trophy wife went south, and the house went back to the bank. I think he even had to sell his seat – and it still wasn’t enough.

Since then, I’ve never looked at life as an all you can eat buffet.

Yes, true, Mr. Mushman: look right now at what’s happened to the RV companies: WGO, THO, LCII. The market is starting price-in their fire sales.

Hopefully I’ve been waiting for a good sale on sailboats I suspect one is coming shortly from what I’m reading and feeling in my gut

When people start dumping all these expensive toys as you are predicting, would that not cause inflation to fall, and perhaps turn into the deflation ?

Yes. The question isn’t if, or how, but merely when.

no. because expensive toys don’t get figured into inflation calculations. cpi doesn’t account for boats, private jets, or rvs.

Very true In 2008 I took my gas guzzler off the road and started using my bike a lot more Unbelieveable how shortsighted these people are buying these bohemoths And fuel is almost certain to go much higher from here unless of course we get a severe depression then all bets are off

Anyone with money in the market well knows what has been going on the past 10 years. Just hang it on your shoulders. You own it.

Yes, the great recession of 2008-2009 led to this as the Federal Reserve lowered rates to nearly 0% and bought Treasury securites and mortgage-backed securities (quantitative easing). A lot of the gains are artificially created due to the Federal Reserve, not due to gains from innovation and productivity.

A lot of mega and large cap stocks are down from their all-time highs

Disney down 32%

Google down 14%

Apple down 12%

Microsoft down 15%

Amazon down 25%

Netflix down 43%

AMD down 28%

Facebook down 21%

Ford down 20%

Tesla down 25%

Bitcoin down about 47%

Your money in banks not safe either, in 2010 congress passed a bill to confiscate your funds ,we savers will pay off the debt and starve

BS. Grow up.

I think Flea is correct on the banking legislation. You fiat in the bank is a liability of the bank and I think the legislation means anything above FDIC amount is truly not safe in a crisis.

FDIC insurance is bank funded and I suppose would be back stopped by government which these days means if needed Fed would print it up, but that is just socializing the loss to savers.

There is a very small risk to keeping your money in a bank as they are down a notch from owning treasury bills, but usually you are compensated by an adequate interest rate. In the upside down Zirp world, the risk/reward is up side down.

If a bank bails in the deposits, they are not technically insolvent, so the FDIC won’t be triggered. You will not get a penny of your bail in money back. You will get shares in a bank that had to rob you to survive. You can thank the left for that wonderful piece of legislation, Dodd Frank.

Petunia,

“If a bank bails in the deposits, they are not technically insolvent, so the FDIC won’t be triggered.”

That’s BS. A bank is a regulated institution, and it cannot bail in anything or anyone. The FDIC decides when a bank runs into trouble, and then the FDIC swoops in and takes possession of the bank and runs the show, and it decides who gets bailed it.

The stockholders and preferred stockholders and holders of contingent convertible bonds are INSTANTLY bailed in by the FDIC when the FDIC takes over. In other words, the entire equity capital gets bailed in first. That’s the capital buffer, and it gets bailed in by the FDIC by design.

Then the FDIC sells all the assets to other banks, and it shifts deposits to other banks, making up the difference with deposit insurance.

Bank bail-ins are entirely appropriate. We are talking about unsecured creditors.

Most people presumably know their bank lends their deposits out. That’s why they get paid interest, traditionally anyway.

Well, everyone should know what this means. We don’t have “money” on deposit. It’s a loan to the bank.

Augustus Frost,