How often do we get a Bear Market after a strong bull market plunges to the 200-day moving average?

By Wisdom Seeker, WolfStreet Commenter with a physical sciences Ph.D., living in the San Francisco Bay Area, employed and anxious about his retirement portfolio.

Wild Bull: As measured by the S&P500, a stock market that has risen more than 30% in 18 months.

Hibernating Bear: The Wild Bull’s manic-depressive “dark side”, which often awakens when the market falls below its 200-day moving average.

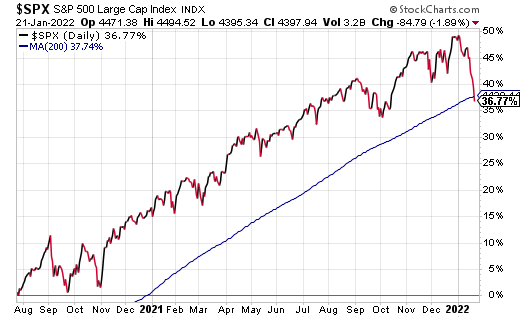

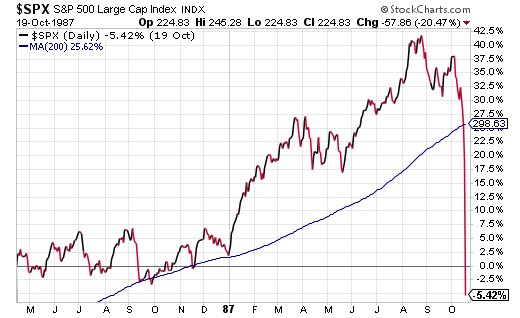

Since mid-2020 the S&P500 index of large US stocks has been a Wild Bull, raging up over 40% in just 18 months. But as Wolf reported yesterday, over the past 3 weeks the Wild Bull stumbled badly. The figure below shows the 18 months up to yesterday, when the S&P fell to its trailing 200-day “moving average”, a common measure of market health. Such stumbles are both rare and frightening, since trillions of dollars in digital wealth evaporate in only a few weeks.

Worse, a drop below that 200-day moving average often reflects stark changes in market behavior – Hibernating Bear awakening – with potential for a long & deep bear market as in 2000-2003 or 2007-2009.

So when the Wild Bull stumbled into the Hibernating Bear’s cave yesterday, I wondered: Historically, how often does a Wild Bull awaken a Bear market?

S&P500 data since 1980 shows several Wild Bull episodes where the market was up over 30% in 18 months (more or less). Like yesterday, many of those episodes end with the Wild Bull stumbling and hitting (more or less) that 200-day moving average. What happened next?

The graphs below show examples of the 4 basic outcomes:

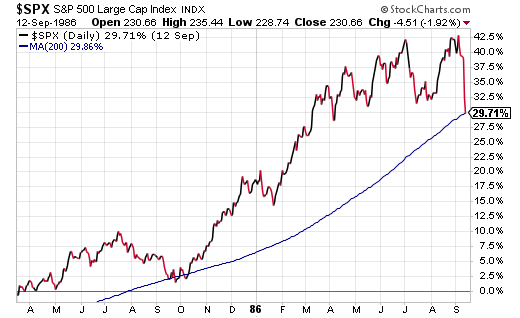

Scenario #1) The Bull Carries On.

In the mid-1980s, 2010, and early 2018, the market managed to carry on upwards after a bit of a pause, but often the wildness was gone. The figure below shows the 1985-1986 episode.

But the Raging Bull of ’86 didn’t awaken a Hibernating Bear. The figure below shows how the bull bounced up along the 200-day average and then took off again. (This led to 1987 – more on that event in a moment.)

There were similar Bull Survival Stories in 1996, 2014 and 2018. But often the bear grabs the bull for a while and a fight ensues.

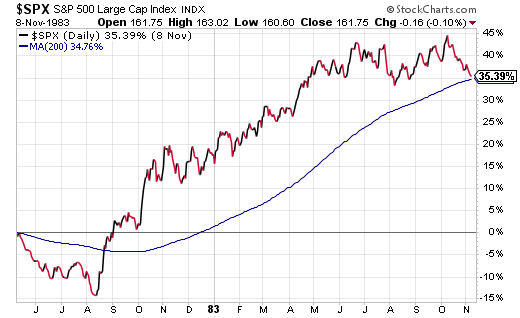

Scenario #2) The Bull Wins a Long and Turbulent Debate.

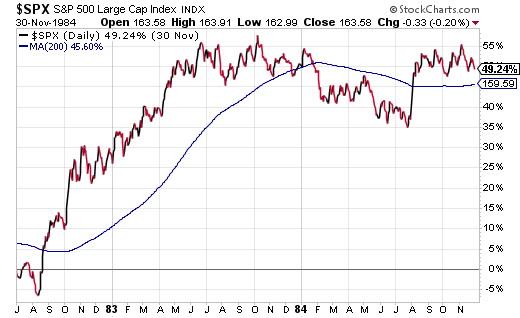

The early 1980s was a good example. The figure below shows the 1983 bull rally off the 1982 low:

That led to an extended bull-bear market battle on either side of the 200-day average through most of 1983-1984, as shown below.

The bull won, leading to the Wild Bull of ‘86 as shown above in Scenario #1. And the Bull won similar tug-of-war battles in 1998, 1999, 2004, and 2010.

But 1982-1986, 1999, 2004 and 2010 were auspicious times for stocks: the surge following the 1982 recession, the surge of the dot-com boom, the surge after the dot-com bust, and the surge following the Great Recession. At other times, the Bear awoke…

Scenario #3) The Bear Wins A Long and Turbulent Debate

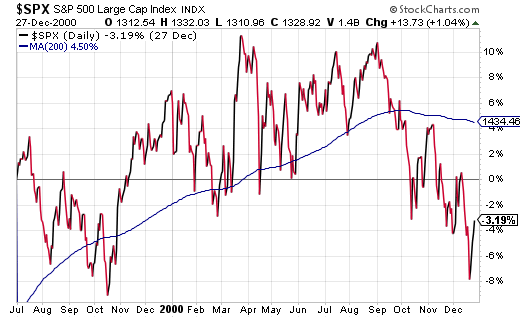

In the peaking of the dot-com bubble from 1999-2000, the Wild Bull of ’98 slowed down in 1999 then bounced along the 200-day average for a while into 2000, but then finally awakened the Bear.

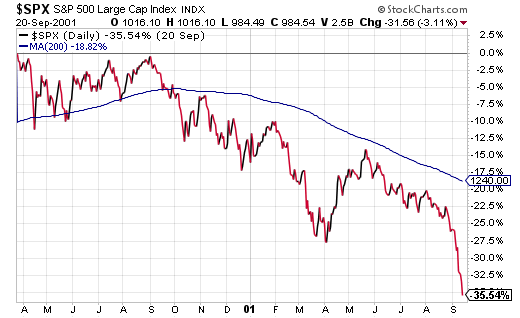

That led to the steep crash in 2001 (below) – that didn’t bottom until 2003.

(There was a similar bull-bear battle at the peaking of Housing Bubble in 2007-2008, but the market advance in 2006-2007 was more gradual and didn’t qualify as a Wild Bull for this study.)

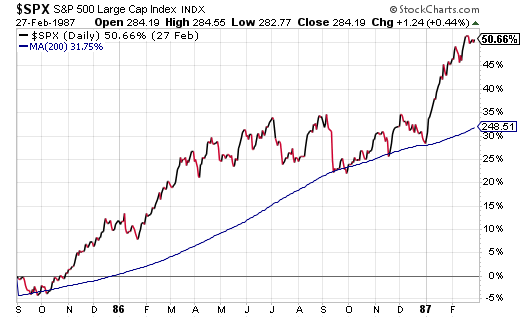

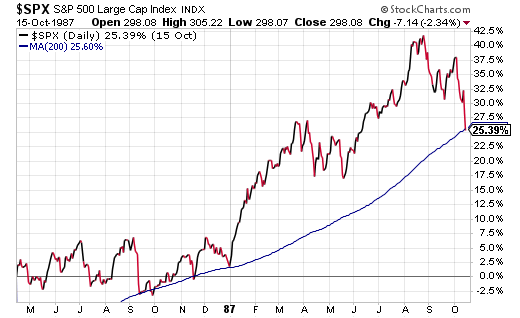

Scenario #4) The Bear Slaughters the Bull (Crashes in Fall 1987 and Spring 2020)

The COVID crash in March 2020 is fresh in our minds. But there was another Slaughter of the Bull that not everyone remembers so well: 1987. And the chart from 1987 looks almost like the one for 2021-2022 (first in this article)!

But back in 1987, it was a huge surprise when the Hibernating Bear woke up fast and slaughtered the Wild Bull in just 2 days!

Bottom Line: The Wild Bull has again stumbled on a Hibernating Bear. The Bear could wake up, and it could wake up fast. Today’s markets have circuit breakers and other protections to arrest a crash, but as we saw in 2020 the market can still plunge over 30% in just a few weeks. Or the market could rally onward – employment is strong, credit is still abundant, COVID is on the wane – who really knows? But when the market stumbles down to the 200-day average, there’s more risk out there: Beware of Bear! By WisdomSeeker.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What if the bear awakens from a well deserved slumber and sees the bull and does a bluff charge on it and the bull doesn’t realize the bruin is only going to go about 20 feet and then stop, and the bull unloads all it’s ‘equities’ in a panic?

Please everyone remain calm. Buy the dip. I have this totally under control. Stocks are not a bubble. This is the new normal of unrealistic valuations. I encourage everyone to just go out and buy an NFT or roll the dice on a random cryptocurrency. Dog coin should be valued higher than it is for example. A nothing can be worth something if everyone believes it. Markets can handle higher yields. We will all get through this together.

The warnings of tanks rolling west have been shouted for 12+ months now.

Lucy and the football was more entertaining.

Nice sarcasm I almost bought it

Aw, you were doing so well until you said ‘…roll the dice’

Sort of gave it away :)

Took you that long? “Stocks are not a bubble” twigged me…If PBV’s >1.2 & PER’s >14, it’s a bubble.

Frito Lay makes a serviceable onion dip, should I buy FL stock or more chips?

J-Pow!!!

Whenever I hear the words “we’re all in this together” I run for the hills.

We are all in this together!

*only business owners will get PPP loans (that they don’t have to pay back), and also, asset holders will get a direct deposit of 6 trillion $ of fed balance sheet expansion in thier stonk and property holdings

But seriously, we’re all in this together!

Madoff did u come back ,2 ne best ponzu guy

Your pitcher must be empty. You need more kool-aid!

J-Pow!!!

Also, whenever I hear “I’m from the government, and I’m here to help you” I run for the hills.

I would too! I would be afraid it was Reagan’s ghost.

I just barely clawed my way out of the class warfare script written for that B actor puppet’s recession, and finally found a living wage 40 hr job in mid 85.

Half the country (or more) never did.

@Xavier: The bull cannot unload equities. Whenever someone “unloads” what they have, those shares are sold, not destroyed, so they end up with someone else who “loads” them.

The only way shares disappear is through buybacks, mergers, bankruptcies etc.

Put another way, individuals can take turns being on or off the bull/bear manic-depressive market, but for better or worse, someone has to ride it at all times.

One of the biggest mysteries of the equity market is why does there have to be a buyer for everyone that wants to sell?

It doesn’t work like that in the real world, but I get it, Wall Street plays by different rules.

Xavier Caveat

‘One of the biggest mysteries of the equity market is why does there have to be a buyer for everyone that wants to sell’

B/c if there is NO BUYER for the asking price of the seller aka NO BID even for a few seconds, Mkts go hay wire!

Does any one remember, a few years ago, there was a FLASH CRASH with NO BIDS even for blue chips like PG, for a few seconds. Bid for PG was a few cents! Then immediately corrected. SEC made the reversal of buy orders on NASADAQ> They couldn’t stomach it!

WE could have a similar situation but in a modified way down the road. Mkts went UP crazily and then it can also go DOWN crazily!

WS

RISK cannot disappear but got shifted to some one else ( who thinks it is a bargain, NOW!) Value remains the same but PRICE went down!

When the PRICE goes down crazily, way down, way below the market VALUE, some hardy bargain hunters may venture to buy from some one, willing to sell at ‘fire’ sale price!

Different market participants have different time horizons as well.

At one end are the super computer front runners like Ken Griffey. At the other end are value investors like Warren Buffett who claims his favorite holding period is forever.

Value investors like shopping when there are no buyers.

WS, nice job of putting this historical perspective together. It’s something to dwell on for a Sunday morning.

I’m retired and fortunately not heavily invested in individual stocks so my “damage” is not too bad. I’ll just dollar cost average into my S & P ETF when I do my quarterly rebalancing as I usually do.

Fyi. Tesla and many other volatile high risk stocks are a good part of that ETF.

It’s not as “diverse” as you think.

I didn’t say it was overly diverse. So what’s your plan? I’m doing the best I can given the options.

Anthony A

Just diversification won’t prevent your portfolio getting hit badly during secular BEAR mkt. One needs UNCORRELATED assets besides diversification. Diversification didn’t prevent S&P losing almost 60% during GFC!

Uncorrelated assets means R-correlation minus -1.0 with respect to S&P! Means going against the MKT, NOT many cannot stomach that idea after being ‘pavloved’ since ’09! Hence destined to lose most of their profits if they keep invested. Just study previous BEAR mkts!

Anthony A.

Tune into “Mad Money” hosted by none other than Jim Cramer Himself. He has a segment called “Are you Diversified” . A lot of people thing they are diversified when in reality they own investments that are in effect the same trade.

Swamp, I watched Mad Money since day 1 of the show. Its a hoot and he is a showman without a good track record.

I know exactly what diversification is. I have been in the Market since 1981 and have done very well. Well enough to put two kids through college (no loans), fund three 529 programs for the grandkids, own two houses free and clear, fund our retirement, and we will be leaving an inheritance that will astonish the two daughters. All this done on an engineer’s salary and a wife that worked part time.

But I am sure that others here are way more well off than we are. And smarter, too!

BTW, my S&P 500 ETF is only one of my holdings (probably my largest) and is only in my traditional IRA. The Roths and the brokerage account are more diverse holding energy ETFs (and some Exxon). Oh, holding NO BONDS or BOND FUNDS at the moment.

Anthony A.

“I’m doing the best I can given the options”

This statement is not going to cut it either. A better answer is “i’m going to access the situation and take the correct actions to WIN”.

Anthony A.

Buying on the way down ain;t gonna cut it this time. You need to come up with a new strategy.

When catching falling knives, try for the handles.

Exactly. People like Anthony exhibit sheep like behavior, trained to “buy the dip.” I mean, we haven’t even had a downturn for but a week or so and they’re already talking about “buying opportunities.” That’s not how it works when bubbles pop. Things crash and then stay down, for years. Sure, some day traders can get lucky buying and selling dips and rips, but over 80% of day traders lose money. That’s not investing, that’s straight up gambling.

You mean the Utube videos on Buying the Dip are not a good recommendation? (If i would have checked in with you earlier!)

Anthony A.

In 1930 people jumped in and bought thinking they were buying on the dip. Then they lost 80% of your investments. The Depression consumed everyone, including those who thought they were smart asses. Be careful.

I would rather go to the racetrack and bet of horses that gamble on the stock or bond market right now. We’re facing 4 or 5 potential Black Swan events any one of which could tank the market. And I’m not talking about a straight line down. I’m talking a gap, where the entire markets are closed because ordinary trading has to be halted.

I currently own no stocks and no long term bonds. If I want to get my kicks out of gambling I play the sports betting game which is booming here as it has just been legalized.

Youse guys are picking on me again!

Whew. I’m glad you’re financially comfortable, have been thru it before, and have a plan!

Your original comment didn’t have too much context and read a bit like a 30-something with only a few 401K options, stuck with a basic financial planner’s rebalancing system. Those guys are sheep headed for the shears if/when crash happens.

I’m often amazed at how casually many people treat their life savings, when it’s abstracted into a 401K balance…

Anthony.

You left out the part when Cramer was screaming get out of everything in 2009….right at the bottom.

You have been a beneficiary of an inflating Fed…..and the 22 Trillion in new debt creation subsidized by fake rates.

Cramer is the “monkey with the typewriter”…. whatever he promotes (types) for a “buy” in a Fed accommodated market is a winner!

Good analysis, WS

The time period, coincidentally or not, covers the bull market phase for bonds.

I wonder what enlightening scenarios would be revealed by looking at the bond BEAR market from c. 1940 to 1980. Those charts might be more pertinent to the present, assuming the Fed is serious about normalizing its morbidly obese balance sheet…

I’ll put up a steak dinner bet that the day the Fed finally raises interest rates 1/4 point, we get a stock rally.

You sound exactly like Mannarino

2banana,

You’re probably right — unless the hike is accompanied by an orchestra playing the Hawkish 5th Symphony.

Wouldn’t ‘O Fortuna’ be even more appropriate to the situation..?

A 1/4 point hike is a joke.

Hence the inevitable rally.

“Hence the inevitable rally.”

Oh really? Then why is the sell-off right now?

Depth Charge,

“Oh really? Then why is the sell-off right now?”

Stocks move in advance of news made available to the public. You’ll have to wait and be patient for the news to come out. With the current selloff, who knows what could be lurking beneath the surface, ready to explode? But I’ll tell you this: If there is something brewing, somebody knows, and whatever it is, it has not yet been disseminated to the public.

Depth Charge,

I hate to be the bearer of bad news, and you may not realize it, but your comparison of price movement in the absence of news is a fundamental tactic for many traders. Traders take notice and act on such subtleties. Traders don’t wait around for the news to be made public. Seasoned traders can smell a rat from a mile away and run! Depth Charge, you’re a natural-born trader!

My understanding is debt levels are so high real economy can’t handle a real interest rate.

Fed has led us into no man’s land where borrowing at negative real rate and buying million dollar house is getting to be standard policy. Where a 1% gold coin goes for about $2000 and the bottom 50% are broke and are politically divided by race, religion and gender.

It’s going to be 1/2 point.

The analysys is missing some very important information. And that is how far (in standard deviations) each of those instances deviated from the mean, before stumbling on the sleeping bear.

Still, better homework than I ever did.

Btw, already made ten-fold on some of my puts (e.g. Shopify). Took some porofits and rolled some into Tesla/Nvidia puts.

A wild rally can come at any moment.

Which standard deviation would you use? Would you use the std dev of the 200 day average?

You can chart that if you like, pretty sure StockCharts has indicators which do that.

I personally don’t believe standard deviations have much value when the underlying distribution is a function of whether one’s in a bull or bear phase, how crazy the market was prior to the transition, and more. I’d just use absolute percentages to gauge moves, you can read those off from the charts in the article.

Put another way: 3,4,5,8, 10-sigma moves should almost never happen (statistically), but they happen quite often when the bull turns bear.

Yes, agree. Good article, and good research. Did not mean to criticize. Cheers.

John Hussman covers this in his blog. Most recently, it was 3.4 std deviations above median.

John, great question, a longer time period would be informative. Another big difference is the gold standard until 1971. The charts in the article were limited by the data availability in StockCharts.com. I do have the S&P data since 1950, but couldn’t graph it easily.

However, I did that analysis this morning and I believe the times of interest from 1950-1980 break out like this:

Scenario 1 (Bull Bounces Right Back): 1951, 1952, 1972

Scenario 2 (Bull Wins After Debate): 1959-1960, 1965 (but then bear got revenge on a non-wild bull in 1966).

Scenario 3 (Bear Wins After Debate): 1956-1958, 1962, 1973, 1976-1977, 1981

Scenario 4 (Bear Slaughters Bull): None from 1952-1980.

Well, the DJIA peaked on February 9, 1966 at 995 or 999 and then lost about 23% (in nominal terms) until August 13, 1982 at 776. So we know that.

To my recollection, the bond bear market started in 1946. The DJIA rose from 92 on April 28, 1942 until the February 1966 peak.

Everyone says the Fed put will prevent large scale asset price declines. The Fed must know their credibility is shot and may try to regain some of it by not riding to the rescue as quickly as they have before. This forever-QE has moved into “don’t trust this currency” territory. If further market declines occur post rate-hikes, and the talking heads demand QE but none is forthcoming, everyone will really panic then.

Or….

Tech stocks that never made a profit and never will and cryptocurrencies continue to tank. Boring old stocks that make ooodles of profit and pay dividends wonder what all the fuss is about….

Aren’t they overvalued too?

Some international did not seem so overvalued. But they had all the Tencents and Alibabas in them. Those are now down 60% on average. So that is perhaps a less insane space.

Do realize that Apple could lose 20% more and just be where it was at 1 year ago…

In markets pre 2008 that would have been called Tuesday.

I think something that many trader types don’t recognize is the panic reaction of the collective retail trader could overwhelm the ongoing big bank and company buyback attempts to break/slow this crash.

You could see it happen Friday when they slowed the mania by bringing markets even. Saves the money makers from paying out the ass on their options and shorts.

Not everyone, just the people with significant portion of their wealth in stock market. IMHO these people are fairly narrow group (most of folks

store main part of their wealth in their homes). My feeling is that Fed is going to sacrifice this narrow group of people while doing what they can to protect the wealth of the majority of population (housing market). This will restore the credibility of Fed, preserve wealth of majority of population, reduce wealth disparities in the society, reduce inflation down to lower level, and still keep interest rates fairly low as to avoid bankrupting the government. The bloodletting will be confined to the top 10% of society.

I dont know if this plan is actually workable. It depends on which market is more sensitive to raising interest rates – stocks or houses. If stocks are more sensitive, then this plan may work.

But doesn’t that narrow band include a lot of boomers who live off pensions and 401k? I keep hearing about the pension crisis if markets crash and stay down.

but remember, the boomers 401ks were worth half of what they are today only as recently as 2016. unless those people have recalibrated their ideas of retirement and spending habits based on the last 5 years of inflated equities, they shouldn’t be any worse off than 2016.

Jake W already answered your question. I can add that pension crisis will surely follow the stock market crash, but will probably affect only the small percentage of American population that has generous pensions. AFAIK most of Americans don’t have that, so they won’t be affected in any significant way by pension crisis.

“My feeling is that Fed is going to sacrifice this narrow group of people while doing what they can to protect the wealth of the majority of population (housing market).”

IMO, that feeling is delusional. The Fed system IS that narrow group of people. The Federal Reserve Board of Governors represents people who own stock in the regional Fed banks. Their decisions consistently allocate wealth to themselves, as would be expected of anyone.

The Fed, which along with other major institutions (e.g. the Supreme Court) have a very poor record of protecting the collective wealth of the majority. When the welfare of the average citizen conflicts with the Fed’s private cartel, it’s not hard to predict who usually wins.

Bulls v Bears …

Deceptive marketing and complacency v Peak Oil.

Everyone knows who is going to win.

The commentators on Wolf’s recent post (Jan 20, 2022) have determined that peak oil is fake. See “Big Drop in Home Sales, Surging Mortgage Rates, Tight Supply: The New Dynamics Shaping Up” for details.

Before «peak oil» there will be «peak cheap oil». The price point may not even be “cheap oil”, but at some price point oil will be to expensive for todays economic system to function. An economic crash may follow.

Another important measure, energy return on energy invested to extract the oil. With this going down, prices will eventually go up.

I lean towards the idea that peak energy will lead to volatility and boom-and-bust cycles as the price vacillates between too low for the producers and too high for the economy that evolved under cheap oil. Economic stability will then only be achievable when the economy morphs into a simpler and less energy intensive version of itself, or we find a new energy paradigm.

Call me a conspiracy theorist, but I think a lot of the policy measures being taken today are geared towards managing the transition to resource scarcity.

If they get nuclear fusion going, then there will be plenty of energy. And a few people will hold all the marbles, unless it’s nationalized.

Some fusion energy concepts (generally not those that show up in the media) have potential, but the “front runners” will. be expensive and have potential deployment constraints they don’t want to talk about.. Concepts like Helion could be a big deal if they work – but I remind my colleagues that the first nuclear fission reaction was in December, 1942 and we do not yet have fusion that as produced net energy..

1) Putin will visit Shi Shi ping winter for the Olympic opening.

2) The real spark might come from busted, desperate nations, attacking oil field

Is it Turkey?

This is just a market top blowing off. Any gambler who got caught up in it deserves the consequences. Lots of it was spare invented money anyway.

A strengthening dollar/rate CAN stress the world’s debtors. How bad it gets, who knows? In 1994 the USA’s rate hikes crashed a lot of business in the USA and across east Asia too. Weak players got weeded out. (I bought my house for a song.)

The fog of propaganda around China is so thick now, bullish and bearish, I can’t tell what’s going on there.

Russia has oil. Who would attack them? Who is poised to successfully attack Venezuela? Iraq? Iran? Those are messy places and hard to govern. Not sure about Saudi’s robustness.

China does not have oil. China needs Russia and Russia needs China to counterbalance the USA/UK/Australia/Japan/South Korea, etc.

Iran, China and Russia might hook something up with oil and manufactured goods exchanged. They are still second-tier and below, globally, despite their Potemkin military parades. They never got the financial chops together we have, despite the conspiracy tirades posted here sometimes. Their institutions never grew to the strength and robustness of ours. Ours have a long way to degrade before we are as shabby and crooked as they are.

Crazy as we seem, the USA is still the best house on a bad block, where it counts. And we have domestic oil, nukes, big weapons. And FAANG tech that will survive this (maybe absent the “N” now — Netflilx).

I keep imagining the 30 something stock brokers who have never seen a Bear Market (2018 December drop and March 2020 both knee jerks rather than Bear Markets)

There is going to be a tremendous amount of hand holding and whining.

And the rates havent even risen significantly, and the “predictions” are really mild for increases. (1/4 pt raises, 3 or 4?)

I remember 1987 well……on the Friday before that big break on Monday, the Dow fell 50 pts in the last 30 minutes. Seems trivial now.

And people in the markets swore the Fed bought index futures to support the market the following Tuesday opening.

But we should not underestimate the geo political tinder box out there….and the big risk to all investors going home long over a weekend or even overnight. This hesitancy is a big part of the technicals rolling over IMO. And if one assumes the algos and AI are the great drivers of market direction, technicals are everything. They can tap the Sell button just like they tapped the Buy button for no reason at all except some technical signals. The talking heads on cable will still be bullish.

31 year old market newbie here and I definitely had to hold my hand while selling out of my crypto positions a few weeks ago. Wish more people realized the HODLing ideology is suicide in “speculative” markets.

Not sure many people on this board will know what hodling is.

Are you dollar-cost-averaging back into your crypto positions on this dip?

No I am not. Things are too uncertain for me to re-enter. I’m happy you knew what HODLing is. 😂

Getting out too early is nearly always better than getting out too late.

Only if you sell

The fact that you even had “crypto positions” is the problem. The entire space is a giant PONZI scheme.

come on bro, you can buy a bitcoin for $35k today. since it was $67k a few months ago, you’re getting a bahgain!

if i put my crusty old mattress on sale for $1 million, and then drop it to $500k, that’s a good deal for someone right? after all, it’s 50% off!

It’s been a good way to make money.

“It’s been a good way to make money.”

I don’t consider reckless gambling “a good way to make money,” so you and I can agree to disagree.

sunny, cryptos don’t make money at all. they aren’t companies that theoretically produce profits. they only transfer wealth from a greater fool to someone who got in early. that doesn’t mean you can’t personally profit from it if you get the timing right, but it mathematically, it can only “make money” for a limited group.

Crypto’s are heading for zero or even below zero. I can see a point where you have to pay a fee just to get out of your position. And the IRS will disallow any capital loss deductions. Investors in this asset have turned to lemmings who believe any bulls$it they they hear on the main stream media.

I wouldn’t consider it gambling, more like following a trend. The trend broke and now I’m out.

I was able to pull out of my positions with more money than I had before, which is a win for someone who’s been climbing out of poverty.

If I was gambling, I would still be holding and hoping.

The comparisons pre 2008 are tough.

At no time have we seen trillions in Fed printing/buying, trillions in new government debt and inflation at least 10% higher than interest rates.

This is uncharted territory.

The DOW is a measly 6.8% off record highs.

Pre 2008….this would have been called a normal Tuesday.

I agree, we’ve gotten too comfortable with the Fed-managed artificial stability, which has made people take on too much risk, has made the system too fragile.

There’s a Minsky moment ahead the question is when and how.

Wisdom

” which has made people take on too much risk,”

Please watch the “Power of the Federal Reserve” documentary on PBS.

You can google it.

Around the 7 minute mark, former Fed Gov Fisher admitted that the Fed decided to pound down the long end, flatten the yield curve to FORCE (his word) investors to take more risk.

FORCED. MORE risk. More than what? More than would be prudent is my take. But since when was the Fed involved in FORCING any behavior? Is that their charge? I dont see it in the Federal Reserve Act. They are supposed to keep the economy in good shape, not FORCE investors…manage markets. The markets should take care of themselves if the economy is good, not the other way around.

This little throw away line by Fisher LEAPED out at me and demonstrates, IMO, how far off the rails the Fed has become.

I totally agree. We are into unchartered territory this time. Too many trillions this time likely means large swings of gains AND losses now.

In ‘bull & bear’ fights in Cali in the 19th century, the Grizzly usually won.

Who can say? It is impossible for moral men and women of good faith to predict the future of wealth preservation and even staying alive in these times. It seems anything is possible due to fallen standards and outright greed. In desperation the old proverb ‘I came to a fork in the road…and took it’ best describes it as our choices now.

Robert Frost poem The Road Not Taken. Possibly more about “To choose, or not to choose” than the outcome of which route at the divergence was taken. But we definitely have come upon the blockade of a “yellow wood”, if not in his sense of the meaning. William Blake’s London might be a better description of where we are at. Or perhaps Withnail’s solution, “Throw yourselves in the road, …”?

Well, then a Frost NFT ought to perform admirably.

“I came to a fork in the road…and took it’ ”

that was Yogi Berra, wasnt it?

And “morals” has little to do with trading decisions. IMO

Yogi Berra would be happy you describe his pithy saying as an old proverb:

“When you come to a fork in the road, take it.”

He was giving Joe Garagiola directions how to get from New York to Yogi’s house in Montclair. It was a short way of saying that it would take the same driving time on either fork.

However the first recorded use of the phrase was back in 1913. The humor was based on wordplay and referenced the additional meaning of ‘fork’ as a dining utensil. This was printed in the Correctionville News (Iowa):

Wise Directions

“When you come to a fork in the road, take it.”

“I will, if it is a silver one.”

Agree with Historicus = I ALSO remember 1987 well. And people in the markets swore the Fed bought index futures to support the market the following Tuesday’s opening = The Fed was active cause CREDIT FROZE AS DID THE BANKS AS THEY ALL WONDERED WHO COULD/WOULD MEET ALL THE MARGIN CALLS??

As for this week . … A Fifth of the S&P 500 and nearly half 1/2 the Dow Jones Industrial Average are set to provide their quarterly updates starting Monday – Tesla – Apple – MSFT – and unless they can birth some golden “unicorns that can fly” … All three will report their HIGHEST ever earnings…it is just the future guidance that will SUCK….cause what do you do AFTER that?? A Netflix moment for any of those 3 will tank the NASDAQ and then the SP500 …. just in time to review Dec Fed minutes that show the hikes planned and Taper are Unanimous.

Complicated times we live in…

” And people in the markets swore the Fed bought index futures to support the market ”

Those in the SP pit at the Merc saw it….. and will swear by it.

There were orders to buy ALL CAN.

The Fed wouldn’t have needed to do it directly, they could just have given a nudge-wink to a few big banks to splurge that day and all would be forgiven after.

Thanks, remember 1987 before that drop a realtor made 300k on a house. New construction was booming bought for 300k sold for 600k. A hedge fund blew up too, forget the name.

That was the S&L crisis. One third of the US thrifts failed. 10% mortgage interest rates.

There is so much blowing-bubbles junk out there now, in and out of funds, all sorts of “assets,” if this does spiral down hard enough, enough of a margin call, there will be crowds of hedge funds, investors and zombie firms seen stranded on the sand, tide out, trying to swim very nakedly like beached fish, gasping for liquidity. That’s what the pop of a credit cycle looks like. Banks suddenly close ranks and hoard cash, remember 2008? So who can roll over their credit? Credit lines get pulled. Margin call baby! Frauds will be dragged into the disinfecting sunlight.

I still remember a joke after the 87 crash. What do you call a stock trader? Hey, waiter…….

Upscale estate/yard sales known as “Dead Stockbroker Sale”, especially anywhere near Suicide Bridge in Pasadena area of SoCal (mostly urban myth).

Well, let’s see:

Interest rates are rising, and with it interest payments on the debt will be skyrocketing,

QE is soon ending,

Stimmies are spent,

Mortgage forbearance is ending,

Rent moratoriums are ending

Extra child tax credit payments are ending,

Energy prices are rising along with everything else,

Supply chains are severely constipated,

Biden’s spending plans are DOA,

Congress is in gridlock as midterms approach, and

Consumer confidence is falling quickly.

Meanwhile, the military and NatSec agencies are sucking $1 trillion annually out of productive investment but apparently that isn’t enough, so new Cold Wars are are being rolled out with both Russia and China.

We are witnessing in real time the collapse of the American imperium.

In today’s world of a near Modern Monetary Theory FED and unchecked Congressional spending, all of those QE, stimulus & stopgaps can and will come back with the next downturn.

Would that collapse be a good thing for majority of US population ? No more costly imperial wars that drag on and on and are never won, no more rampant globalization, no more davos men etc. Will hurt national pride for sure, but in a longer terms could bring a very welcome relief from deprivation and insanity of globalized imperial America.

In 2005 the bankruptcy laws were reformed, making it close to mandatory to pay down the debts (not anymore to casually toss them off). There was credit card reform saying people could not carry those huge balances with micro monthly payments. Interest rates were raised (and arguably predatory adjustable rate mortgages were everywhere). Household debts were relatively worse than now. The housing boom would soon start cresting. Soon would come a boom in oil/gas prices. So overall, a new set of stressors arrived. It seems not all that different from now. We, or anyway I, survived.

and yet, no Black Swans in sight…. If one of those turns up then…………………

“In the business world, unfortunately, the rear-view mirror is always clearer than the windshield.”

Warren Buffett, 1991

“Prices are not going to go down. The question is when are they going to stop going up.”

Jeremy Siegel, Wharton Professor of Finance, 1/12/2022

The Fed remains out of control.

IF they decide to maintain the “Greenspan/Bernanke/Yellen put, who knows how big their buys will be?

Should get interesting.

B

I love historical analysis. Thank you.

I think the historical analysis is off as DC is now a giant wildcard. We do not know if they will come up with a reason to feed the market at future taxpayer expense. Only time will tell.

The main problem with the stock market is it has no business being at such lofty heights to begin with. It’s been artificially inflated by years of enforced ultralow interest rates and money printing.

So returning to more terrestrial levels wouldn’t be a disaster, it would be going back to normal. That would be a Good Thing.

Finster…agree. Spiked prices are expected to be defended? That is nonsense. Let the markets find their REAL levels without Fed “stimulus”, etc.

Corrections are called corrections for a reason…..THEY CORRECT.

Grerrrrrrrrr!!!!!!

Run Jay Run! …….QE today, QE tomorrow, QE forever!

but……this time the political winds are blowing against him.

This time the man is in a box of his own hand. Even the admin wants higher rates in spite of a possibility of slowing due to omicron. The inflation tax is extremely unpopular.

Just to be clear…..I am very sad to write that our fed is so stupid to have place itself and us in this position….but….political hacks are always doing dumb things.

I kept a Toronto Globe and Mail newspaper from Tuesday October 20, 1987. Headlines from the front page show a confluence of very serious financial, geopolitical and domestic events and anxieties:

– “Panic sweeps financial markets smashing records of 1929 crash”

– “Iran plans revenge for US demolition of 2 oil platforms”

– “Market crash may mean a cruel Yule, depending on interest rates, recession could be on the way”

– Quote of the day reads: “Nobody’s taking lunch today. This is a sure sign that the mustard has hit the fan.” Wall Street hot dog vendor.

Incidentally, the PPT (Plunge Protection Team or officially known as the President’s Working Group on Financial Markets), was formed a few months after the 1987 crash on March 18, 1988 to physically and psychologically ‘support’ the broader markets.

Thanks for adding those details about 1987!

The market action recently has been a near-clone of the 1987 moves.

If the 1987 pattern holds, the US market goes down 5% tomorrow and then it hits circuit breakers on Tuesday in lieu of the 20% decline on Black Monday, October 19.

As I understand it from talking to people who were on Wall Street at the time, the 1987 crash was made a lot worse by “portfolio insurance”, which was supposed to protect people from sharp losses (similar to options hedging nowadays), but which didn’t work when it was most needed.

Judging by the 2020 crash I’m not convinced that the stabilizers in place are up to the task. But I’m a very risk-averse investor.

What does the S&P 500 look like relative to the 200 day MA if the high flying tech stocks are taken out. I’m guessing “not so good.”

There are several factors that are affecting and ir will affect the stock market this year and maybe beyond

*Pandemic.

*Stimulus Money.

*The “Everything” shortage.

*Posible actual War with Russia.

*Economic War with Russia and China.

*Regulation of Big Tech.

*The Congress and or the FED being idiots

And that’s just what comes at the top of my head.

So good luck!

1.October 1929. Stock market plunged but quickly recovered

2.Real economy started to unravel

And then:

“As 1930 opened, markets still bubbled with cautious optimism. Many companies had booked record-breaking profits in 1929, so the spring shareholders’ meetings were pleasant affairs.

There were no more “crashes,” but nearly all the economic indicators turned decisively down in the second quarter, and financial markets slipped into a state of catatonia, a slow-motion death crawl that finally bottomed out in mid-1932 with the DJIA at 41, just 11 percent of its 1929 high.”

(From the “Rabble of Dead Money” by Charles R. Morris,author of many insightful books on various subjects spanning 1960-2010)

Thank you, Brent, for your historical perspective.

“If I have seen further, it is by standing on the shoulders of giants.”

(said by one very good scientist and very bad investor, who later on gave up both – risky investing and low-paying science – and secured a nice Gov job with full benefits as Director of Royal Mint)

I like the way Hussman explains it so you are cautious about buying the dip. In great depression stock market went down 2/3 and then went 2/3 again. That second 2/3 wiped out a lot of wealthy people.

To my recollection, DJIA temporarily recovered half of its initial losses into the April 1930 low.

You are right. I think he was just using the example of when you lost 2/3 your money you think it’s over, but it wasn’t in great depression.

Who said we don’t have investing options? Cash, short positions, and puts did fabulously well last week.

Remember, even if you’ve lost account value, you’ve gained wealth if your piece of the pie has gotten larger. In other words, the key is to lose less than the next guy.

$SARK

Shake out of it Bobber.

I finally had a good week. Cash may be king again before long…

Somehow over time I have gotten into this crazy portfolio as Fed does more and more. Trying to miss the the big draw down that may or may not come. I added the two stock holdings recently as real rates went highly negative.

2% precious metals

5% CD in credit union

15% cash in credit union

55% Vanguard short term treasury fund

3% Vanguard international index

15% Barrick Gold stock

5% PETS stock- no debt, dividend payer

After GFC I was 99% in stock market.

This down move is nothing more than a long delayed pullback to monthly supports.

It only looks scary because of the crazy parabolic insane unsustainable move up

The last 18 months. NFLX fell back to the 2020 level at the start of the fire hose of money on steroids. I expect all the rest to Do the same. Toonces going to be driving quite awhile longer. Expect the face ripper rallies. Take those opps to sell. Hard and fast on the way up. Harder and faster on the way down

“This down move is nothing more than a long delayed pullback to monthly supports.”

The game is the 200 day MA……pullbacks havent flirted with that for a long time.

The monthly 10 ema was hit. Ergo monthly support. The problem is this move was WAY over due. It is a Normal move but looks more drastic and scary because the prices were moonshot straight up.

Technical analysis doesn’t work. No one can consistently beat the market. So, buy and hold unless you are bored and have nothing better to do. In that case go ahead and gamble. You will do worse than if you did nothing at all.

I pulled up a chart of the S&P. It just crossed the 200 dma but is very over sold. It should have some kind of a significant bounce the first part of the week…. Just saying, if it doesn’t, that would be very bad for those holding. Could start the margin call spiral. Very risky right now.

It better have a bounce or else I will have to redo my dictum: “Nothing goes to heck in a straight line.”

We live “in interesting times. Wisdom comes from Experience, Experience comes from Mistakes. How bout a little different look at things. Forget the Fed, the Virus , the Politcos, etc. Why not get paid to just wait?

If you have to be in the market, there’s plenty of decent companies out there that pay good dividends. You can easily earn 5% while you wait in preferred stocks–even more in commons.

Or, if you want to go outside the box, try Real Estate (in reasonably priced areas like far Northern California as in Butte, Tehama,Shasta ,Glenn counties) The Prices are cheap and everybody has to live somewhere, and the income is adjusted for inflation. It does take effort, and can be frustrating, but it can make you a ton of money if you are willing to work at it, especially if you can do some of the work on fixers.

But what am I saying, nobody wants to actually work anymore–but if you do, you will be richly rewarded—“the harder I work, the luckier I get”

@Cowboy – Amen, and Good Judgment comes from the consequences of earlier Bad Judgment.

The worry for all the items you suggest is that their prices drop when interest rates rise, and the income stream (at current prices) may not keep up with inflation (if the 1970s serve as a guide to the present). But if you can find the right assets at the right prices (which takes work), avoid being forced to sell at the wrong time, and do the work to improve them – and especially if you’re living in beautiful country to boot – then you’ve got a good life!

As for the financial markets, now definitely doesn’t seem like the best time to jump in with both feet. Momentum has been stalled (except for the last few defensive sectors) and value hasn’t really been restored by price drops.

How do you get a 70% decline in stocks? Easy: three 1/3 declines in a row, each of which is followed by a brief pause or minor rally (bull traps), followed by the next leg lower. Compounded, that’s about 70%, which would still make the market only fairly valued, not ridiculously undervalued.

So what is fair value for the SP 500 and how much would you expect we first overshoot to the downside?

To answer my own question – at least the first part – a 70% draw down would bring down the SP 500 to 1,439 from the closing high of 4,796 set three weeks ago on 1/3/2022. Ouch!

There are so many common sense things now that tell you the stock market is no long term bargain.

Earnings yield around 3%.

Dividend yield 1.3%

Price to sales at roughly 3X long term average.

Committed stock market historians Jeremy Grantham (GMO) and John Hussman (Hussman Funds – Advisor Perspectives) have reviewed the forward chances and a very large crash is more likely than not. See Scenario #4 above. Both of them have consistently stated that nobody can predict when the crash will start. It has started. Wolf has eloquently documented the collapse of speculation. We are using SRTY and SQQQ as vehicles.

I would like anyone who has an opinion about Harry Dent’s conviction that, of course the market is going to crash, but inflation will reverse. It kinda makes sense if the “wealth affect” of asset inflation is quickly reversed, consumers will tighten their purse strings quickly and stop buying used cars for more than they sold for originally. Consequently, he believes U.S. Bonds are a good place to put money as opposed to FDIC insured money market accounts (just inflation risk). Jim Grant – Interest Rate Observer notes yields went to a 4000 year low – but now even the German Bond has lost enough face value for a positive return.

Since I like to take financial advise from people who have more money than me and I respect Harry Dent’s demographic work (which was compelling in the 1990 Japanese peak), I am intrigued with his conviction.

In 2009 after the real estate bubble collapse in Florida, every ad on Craigslist offering $10 an hour for property work was met with hundreds of responses, many of which penned by wives and girlfriends. Today, just try to find someone to do yard work for $15 an hour. You will be barraged with insults.

Bulls make money.

Bears make money.

Pigs go to slaughter.

There is little doubt, by market history, that this monster bubble will collapse with sharp, breath taking rallies that we should try to profit from. That is our challenge. The wisdom enshrined on Wolf Richter’s mugs, “Nothing Goes to Heck in a Straight Line” should be taken to heart.

How many books Harry Dent has already published on the imminent crash? :) I remember browsing one maybe 10 years back.

Like Robert “Conquer the Crash” Prechter, he will be right once :)

Yard work for $15/hr.:

First-Quit looking for labor on the gol dern internet. No one with a work ethic and a strong desire to avoid some uncle who looks over their shoulder for a cut of the pay is going to be found hanging around that public alleyway.

Second-Are you paying for labor, or does this include tools, transportation, hauling your waste to the dump, etc.? It’s not the workers setting all the exploding add on costs…that’s all coming from the top down where the incremental jumps are accruing in their pockets. Laborers are waking up to the fact that they can’t afford to support this pyramid with beans for the bottom and steaks at the top, paid for with them going into unserviceable debt. Things really are different this time.

In the ’70’s, two hours of hard yard labor at a then whopping $5 per would buy you a pair of American made 501’s which could last. $30 today gets you a down payment on the same, only they ain’t the same product….no matter what the ads say.

Hussman is brilliant, but also idiotically wrong where it matters most. His analysis is sound but he’s been on the wrong side of the mania, predicting crashes that didn’t happen, for about 8 years now.

Among the other major injustices of the Fed-funded mania is that speculators who insanely kept buying are currently a lot wealthier than investors who sensibly held back due to nosebleed valuations.

I hope that reverses, because we need a sound economy led by sane people again.

P.S. In addition to bulls, bears and pigs, one must also include sheep (who get shorn), and cats (who just do their own thing, and are much happier without being in the market at all).

Market is really high. Hussman could go from zero to hero in one year. But Buffet has proven to play the game better over time.

I find the idea that inflation moderates with a market crash very beguiling. Personally, if I had lost a great deal of “wealth”, I think my behaviour would split. I would still bring forward purchases of inflating items with a utility over a multi-year period like cars, wine, shirts etc but I might stop going to restaurants i.e. I’d moderate my day to day expenses.

However I don’t really buy into it, because, and I realise the situation isn’t identical, the UK stock market fell -73% from 1 May 1972 to 13 Dec 1974 concurrently with an inflation rate of 1972 7%, 1973 9.2%, 1974 16.04% and finally flaring after in 1975 at the astonishing 24.21%.

So for that period specifically, going to cash at the beginning of the inflation only made sense if you were anticipating a sharp correction in the stock market -and- intended to get in at the bottom i.e. you correctly played the markets. Not immediately offloading cash though, on long term stuff shirts, whiskey, pants, shoes, washing machine, laptop, kids teeth braces would have been a bad idea. The problem is that a lot of stuff has multi-year utility, so it makes sense to bring forward a huge amount of purchases.

Clearly few here remember the bear market of 1974-1982 (approx dates). In 1979 Business Week published an issue with a picture of a crashed paper airplane on its cover, and the headline “Death of Equities” (Google ‘business week death of equities cover’). It’s often mentioned as marking the end of that bear market, but in fact it wasn’t until several years later that the next bull began.

I suspect a significant factor was the Greenspan Commisssion’s causing Social Security withholding to rise to about 1/3rd more than required to fund SS on a pay-as-you-go basis. With SS buying that amount of Treasuries and socking them away in the Trust Fund, that amount of cash was freed in the financial markets to buy other securities

Also, around that time U.S. companies began switching from defined benefit pensions to 401k plans, essentially forcing many to buy stock mutual funds, who would not otherwise have bought stocks, or at least to buy more. So the baby boom generation was pushed into the stock market, and in recent years has been lured in even more to ‘story’ stocks, because dividend yields have gone so low.

We are now moving into an era where to get retirement income boomers are going to need to sell those stocks — and the expensive homes they’ve bought as ‘sure investments’ (the real estate taxes some are paying are daunting, and will rise if the current bubble prices hold). Can the younger generations step up to buy these at the prices the boomers have been expecting to get?

One sees lots of articles attributing the current inflation to the shipping and supply chain problems, but I’ve seen none perceiving how significant the bull market has been as a factor. All I’ve seen has been an occasional comment that perhaps people’s gains in their stock portfolios have made them more willing to pay higher prices. But I suspect it’s been a much larger factor driving demand in general.

Digitize dollars (inflation 1) and push them into the economy and you get price inflation (inflation 2). Prior dollars have been made worth less.

A critical issue is whether the incredible P/E ratios at the recent top were the equilibrium level for the unsustainable rate of asset purchases in which the Fed was engaged. If so, they could be boosted higher only by an even higher rate. But if the market were merely to go sideways from here, that would be unsustainable because many in the market are depending on prices going steadily higher. With no dividend stream, they can’t use the wealth except by selling to someone else. With inflation rising, and beginning to pinch for a significant fraction of the population who vote but don’t own much in stocks, is the Fed going to revert to expanding its balance sheet at an even higher rate? It seems barely able to deal with the amount of money floating around out there even now (witness the repo gymnastics Wolf has described so well).

I think this market can’t go sideways, because with no dividend streams the only way stockholders can use the gains is to sell, and unless the companies are cashing them all out via stock buybacks, many of which are currently being funded through junk bond sales, not cash flow, they, too, are dependent on Fed largess.

April 1931.Happy days are here again:

Demonstrating his tin ear, Hoover insisted that apple-selling attested to the power of American Enterprise, and later claimed that many of the apple sellers “had left their jobs for the more profitable one of selling apples.”

Nowadays they sell apples on eBay…

I find Grantham’s pessimism well-supported by evidence. Unlike JHussman, who has argued (also with strong evidence) that the market COULD have collapsed years ago (but didn’t), Grantham only started predicting a bust about a year ago. Correct me if I’m wrong, but prior to 2021 ish, he was in the “this monster bubble could still get bigger” category.

The fundamentals are terrible–and have been for years–so it’s really just a question whether the insane optimism of the market can be sustained in what appears to be an inflationary (stagflationary?) environment.

Hussman made the mistake of not considering the Fed would go off on a do whatever it takes policy that pumped the biggest bubble in US history. For 13 years Fed has basically ran a Zirp experiment that did nothing for the real economy. Wealthy, military complex, tech Ponzi’s and universities did ok though.

What will be very interesting is if the Fed does lose its backbone and steps in to try and stop the fall but the Markets continue to sharply drop.

TOTAL loss of confidence in the FED

Well, yes, absolutely. That would be a disaster. Mind you, investors have been conditioned (in the determinisitic Pavlovian sense) to respond positively to the Fed.

Nonetheless, a huge risk.

Roubini and others seem to think that the Fed would, certainly, “wimp out.” But if you’re in the inflation-is-perminent camp, then the Fed is screwed either way.

They might, I suppose, go explicitly negative on rates.

Marco

“continue to sharply drop.”

After they have “sharply risen”….

maybe “sharp” is the problem created by the Fed…both ways.

Perhaps the $4 Trillion insertion of new money was “sharply irresponsible”.

The Fed has absolutely no confidence in free markets, YET, have complete hubris and arrogance as to their own whimsical manipulations.

A physical sciences Ph.D is an impressive accomplishment Wisdom.

How useful have you found technical analysis?

Well… I’m not a pro trader like Michael Engel or some of the others here.

But as someone with a quantitative orientation, I find charts a lot more informative than biased news stories trying to sell me a hidden agenda.

Prices are about the only reasonably reliable data that isn’t stale. Although I’ve played around with most of the technical analysis tools I’ve found, I don’t actually use very many. There are too many, most aren’t intuitive for me, and you can train your eye to see a lot without putting 10 overlays on a chart. But sadly you can’t train your eye to see the next day’s prices!

I mostly use moving averages and a few specialized charts to look for major tops & bottoms.

I’m long-only, and a downside break of the 200-day average is a big warning flag for me to quit being long (if I haven’t already), and start looking for new opportunities. Friday put the market right on my pain spot where I might have to take major portfolio actions, but I don’t know what to do yet, and that has left me in agony all weekend. (So it may be that technical analysis is not useful at all, just allows the market manipulators to drive us all crazy?)

Anyway, that’s why I was motivated to make the graphs for this article!

I am far from being a pro !

Why 200-day MA? Why not 185 or 207.39 days?

And there are at least six methods of calculating any MA irrespective of the # of days.

TA is primarily a tool for selling investment advice. Something along the lines of:

“we favor the 255.897 day exponential harmonic MA. Extensive retrotesting shows this predits the next trend 51.3% of the time”

If TA were really any good, every one would be a billionaire.

The trouble is just about any strategy where you take risk has worked until the last few months. Market shock or rapid drawdown will expose that a lot of us were lucky and not proficient market participants.

‘Worse, a drop below that 200-day moving average often reflects stark changes in market behavior – Hibernating Bear awakening – with potential for a long & deep bear market as in 2000-2003 or 2007-2009’

I hope many newbie investors (45y and below) read and digest this paragraph seriously, but many won’t as the mkt history indicates

” Those who cannot or ignore the past or condemned to repeat it”

-George Santana

Fed is still buying billions in MBSs and Treasuries this month, next and even until the end of March! The rates are STILL to go up! Still at 0.25%

But look at the markets now! Imagine after QT starts and the rates inching up. Inflation cannot be tamed in a few months. Supply chain squeeze will be there for more than a couple of months. So is Omicron!

No one rings bell for the start of BEAR mkt than these!

Good luck to those who decide to ‘ride it through’!

Sell the rumor, buy the news.

J Powell will put the bear to sleep again soon. How? He’s going to ride the bull and drive those sharp bull horns into the bear’s torso.

J Powell for President!!!! J Powell for Supreme Court!!! J Powell for Galactic Emperor!!!!

Hope Senator Powellpatine has a good plan for dealing with that occupying robot army…cloning is off the table for now.

I am still on the side of all these fancy central bank programs are just digging a deeper hole. I think history shows you can buy some time, but you are destroying the productive economy as you do it and you have a Minsky moment.

J Powell is going to get even for not being the favorite pick for Fed Chief. He was essentially “sloppy seconds”. His ego took a big hit. But not for long. Look out! He is going to raise Fed Funds rate by 1/2 point or even 1 point in March. Markets are already discounting this.

Unless we begin to see broad based liquidations of everything, so far this is just a mega tech sell-off. Ja? Money managers bid these stock up in the fall to receive mega bonuses. Bonds, the US dollar and many value stocks are stable. The Fed is good to hike once this year, and probably it will end there. ( wait and see)

I watched the Fed cut rates three times in 2019 for no particular reason other than to goose the markets and possibly spur inflation. Inflation is the end game and the Fed does not care if you’re a renter whose rent went up 20% in the last year.

Always remember the Fed is trying to inflate away the debt. The rich can’t be harmed by inflation as their net worth is asset based.

When the market whacks the growth stocks (especially in tech) but leaves the value stocks standing (especially in utilities and consumer staples) – watch out!

A rash of observant investors commenting “But value stocks are still stable” is actually one of the warning signs of an anticipated, imminent market downturn.

There’s still a lot of money in long-only, actively managed mutual funds. These funds can’t go to cash or bonds or gold. They have to stay in stock. So when they see things looking grim, they shift into the value sectors where prices will fall less in the crash.

This is longstanding market lore you can read in various books. It was true (anecdotally) in 2000, again in 2007-2008 (and you can see it with charts of then sector ETFs) and most recently in 2020. Utilities, healthcare and consumer staples are the usual favorites. This time around, given the inflation situation, it looks like energy has taken the place of healthcare. (It’s interesting that utilities are holding up despite the rise in interest rates; utilities are normally very rate-sensitive.)

When the final market drop happens, those formerly-stable sectors will finally get whacked too, as the whole market finally panics, and also as the active fund managers switch over to whatever’s already plunged and starting to come back up again. This is one of the market-cycle “sector rotation” strategies.

Disclaimer: I am long a utility fund and 2 energy-related funds.

Re: “ When the final market drop happens, those formerly-stable sectors will finally get whacked too…”

As my dear departed dad used to say (lifted from some other Wall Street wag, of course) “When the paddy wagon shows up at speakeasy, it picks up the good girls along with the prostitutes.”

He also was fond of this line: “What this country needs is a good depression.” This was usually uttered when forced to wait for a table at the local restaurant.

“I watched the Fed cut rates three times in 2019 for no particular reason other than”

…that the then President publicly threatened to give Jerome Powell an atomic wedgie if he didn’t cut rates.

Yep. Trump jaw boned Powell and even stated he was for negative rates.

Trump hates two things for certain…interest rates (he is a perpetual leverager) and the Fed (put him out of business in 1981)

But what was different then was that the ECB was stuck on zero while Powell (to his credit) had Fed Funds at 2% to equal the then inflation. This created quite an arbitrage between the Euro and the Dollar.

Klaus

“The rich can’t be harmed by inflation as their net worth is asset based.”

The rich won’t be harmed by inflation as long as it is UNADDRESSED by the Fed. If the Fed lets inflation run, and they have and still might, the Rich win.

BUT, if the Fed acts as previous Feds have had the duty to do, raise rates to meet the inflation rate, which was the course for 7 decades before 2009, the Rich will get hurt also….and big time.

And the mantra becomes “We can never do such a thing”. Well, as Hayek said, ” When central planners decide, they intentionally assist one group at the expense of another.” For 12 years it has been the asset holders winning and the workers/earners/savers losing. How long can this go on? Will it change? Is it changing?

I suggest this….if it doesnt change, the societal makeup of this country will change, and drastically so, and perhaps not peacefully.

1) Fri, when traders usually cut positions, the DOW volume was higher on a smaller bar. Something is wrong.

2) The DOW might close Dec 1/ 2 gap, breaching Dec 1 low, a swing point between Nov 8 high and Jan 5 high. SPX might close Oct 13/14 gap, before moving up.

3) The DOW built a 7 months Lazer tilting up, since May 10 high. It was breached.

4) There is hope that the DOW will cont to make new all time highs, expanding the Lazer for at least additional 4 – 6 months.

5) The DOW might produce a dbl humps around Oct 26 high/ 27 low, closing one or two gaps above, in leg 4 of 1 before moving down to complete the first wave down, Leg 5 of 5.

6) We are a 250 years empire. The 60’s to 80’s were an inverse H&S.

1987 was backup to a channel coming from 1974 low to 1982 low.

7)

8) Large co give executives an option to buy co shares, with a discount, no margin, twice a year, six months apart, at closing prices. During the accumulation periods prices rise. After the wash rule, the selling start.

9) Satya Nadella Nov 22 started the selling. Satya sell highs / buy lows.

ME,

What is 7)

? The null hypothesis?

That was a very relevant historical summary. In perspective, 1982-2022 can be viewed as one massive bull market, accelerated by Greenspan beginning in 1987, and an easy Fed ever since. At some point, this four decade bull market will end. If not now, likely sooner rather than later. Real bear markets last more than 2-3 years.

Secular-Cycles, Credit-cycle theory, Kondratiev waves – These are all (related) explanations of the market’s tendency to have long cycles like the one you pointed out.

I think the interpretation depends a lot on whether you measure from top to top, trough to trough, or trough to top. (Also matters whether you price in dollars, gold, or another stable foreign currency, whether or not you adjust for inflation, dividends, etc…)

But if we go with “trough to top”, “dollar”, and “inflation-adjusted”, then:

1932-1968 was a long wave up-cycle, call it a “Big Bull”, but with lots of little bulls and bears inside.

1968-1982 was a “Big Bear” trough, completing a 50-year wave from 1932. (But: with interest rates in 1982 at extreme highs, rather than the extreme lows of 1932, there is a separate interest-rate cycle which plays into the market-price cycles…)

1982-2000 was thought to be a Big Bull, with 2000-2009 being the Big Bear. But maybe 2000-2009 was just a pause in the Big Bull, similar to 1937-1949 in the earlier Big Bull. One argument in favor of this is that valuations in 2009 weren’t low enough to qualify as a final trough. Another is that rates didn’t bottom in 2009 like they did in 1932.

In that case, 1982-2022 (40 years) is about the same length as 1932-1968 (36 years), making both Big Bulls similar.

This outlook suggests that we’re due (many would say “well overdue”) for an inflationary Big Bear similar to the 1968-1982 timeframe.

Over 150 years the stock market has grown about 6% more than inflation. When you get a period when stock market grows at 2X – 3X that rate you can be sure it’s going to be followed by under performance.

Why Fed chose to blow a bubble is hard to understand?

You obviously missed something between 2000 and 2012. The rise in markets in the last decade is on the back of an expanded global monetary base. Then we added some currencies, Euro and Crypto, so investors could park cash wherever they were inclined. All this was facilitated by electronic markets, (1990s?) Clearing house settlements are still too slow and this may be hampering the market. No fee trades, instant access and packaged investment products which trade in volume. You can’t call it a bull market. The bull market is predicated on emerging market producers, and new middle class consumers, entering the global market. That much remains in doubt.

So does this mean the “Fed Put” is now a “Fed Call”?

Fed to Market: Don’t Call Us, We’ll Call You

??

Federal Reserve Credit last week

surged $88.6bn

to a new record $8.826 TN.

Over the past 123 weeks,

Fed Credit expanded $5.099 TN,

or 137%.

With Fed Credit setting new records,

the end of QE remains at some

unspecified date in the future.

During an election year with

Dumbocrats in charge, and their

popularity low, there will be HUGE

pressure on Fed members to keep

QE going strong.

Richard Greene,

On a week by week basis, the Fed’s assets drop and rise. You carefully didn’t mention when they fell. So Compared to one month ago, total assets rose by only $77 billion, for the whole month, compared to $120 billion month-over-month increases before the taper.

In terms of the rest of your comment, sheesh.

@ Richard Greene

@ Wolf

———————-

What is FED credit???

Do we mean when the FED creates dollars from nothing to buy Treasuries and Mortgage Backed Securities?

If so, why call that credit and add to confusion surrounding the FED’s actions?

“What is FED credit???

He means total assets.

11) Another option : when Leg 1 will be over next week, prices will rise in stepping stones to the resistance line between : May 10 and Jan 5 high, forming ==>

a megaphone, a one year plus expanding triangle, cancelling the taper.

Hard to tell, precisely, but it looks like the article says…

* Bull = 6 wins

* Bear = 3 wins

A 67% chance the S&P will rally back up…

The odds for the current situation aren’t really established by the historical data, because there are so many other factors which are not in the analysis.

Disclaimer: I am definitely not qualified to give investment advice, and even if I was, even I wouldn’t believe my advice!

Bonus: including 1950-1980, the score comes out at Bulls 11, Bears 8. And in most cases there was a running battle before either side won.

Thanks, WS.

So, about 58% bull, and 42% bear. Roughly 60-40.

Will be interesting to see how this Q1 2022 bull-bear tussle pans out.

Good article. Stimulated some thoughts.

SPX megaphone :

Nov 5/10 backbone divide between higher and lower waves.

Titanic option #1: Hard to port, reverse engines.

Titanic option #2: Hard to starboard, reverse engines.

Titanic option #3: Ignore crow’s nest panic. Stay the course, add forward power. Hope the collision lifts the ship’s bow up and embeds it in the safety of the iceberg. Then drift with the flow in the hopes there’s time to get to safe ground. Officer in charge comes up smelling like roses. “I made the only logical decision in the face of the overwhelming circumstances”. Case dismissed. Lunch time. Could it be?

The world has found an awful lot of ways of not ending. Meanwhile, humans have found an awful lot of ways of hypothesizing the world is ending (pretty much constantly). Well, any individual’s world ends. So they claim.

Doom scenarios are attractive to our brain’s desire for narratives, especially prophetic ones.

My experiences (not a good sample) have displayed outcomes somewhere in the middle of my various guesses about the future. Volatility does not simply go up and keep going (same as prices). Some Taoist said a couple thousand years ago, a strong storm does not last all day. But it can last longer than many over-anxious punters can remain solvent.

Asked for a market forecast, JP Morgan said, “It will fluctuate, young man. It will fluctuate.”

I’m about as certain as I can be that most Americans are going to be poorer or a lot poorer 20 years from now.

14X increase in the FRB’s balance sheet and a 5X increase in the national debt this century while median income and net worth have flatlined. This is with a fake economy where increased deficits (as a percent of GDP) account for most or all “growth”. Let that sink in for a minute.

The “back-up” plan isn’t going to work either. What is it?

More political motivated redistribution of the fake wealth from the asset mania and inflated incomes from the fake economy.

This is feasible in isolation but not to a structural problem where the country has lived beyond its means for several decades and the production doesn’t exist to support inflated living standards borrowed from elsewhere.

If the Fed kills the rest of QE off that will be -1.4 trillion sugar water removed in the following 12 months. Knocking off a measly 400 billion off the 8+ trillion balance sheet during the same period removes a total of 1.8 trillion over the 12 month period. If Interest rate hikes climb to 1.5% it will bounce the rubble. Wall Street talking heads are trying to convince “investors” ( speculators) that the market is going to cull the high flyer’s and leave the ” value””stock intact. Bullshit. Fools are already rushing in to ” value” influenced by the snake oil merchants on you tube with multi-screen displays in their bedroom offices and ditto for the cable talking heads. They will be harvested. There ain’t no “value” stocks in this bubble everything market. If you are 28 go long on the ones that survive. If you are 68 and do not need the money it doesn’t matter, buy more and make your heirs happy if 50k happens. If you need the money, get the hell out. Dow 50k is possible after it bounces off of 15k and the Fed kills the dollar with inflation in the process of pumping it back up.This Fed may be that stupid or reckless or both. The jury is still out on those counts. Remember, they may fail if they try a second time. Shit happens. You need a young persons circulatory system to survive that shit storm. A 70 yr old pumping system might not stand the cycle. Full disclosure. This comment fueled by 10yr old Speyburn single malt.

Dr Doom

” A 70 yr old pumping system might not stand the cycle. Full disclosure. This comment fueled by 10yr old Speyburn single malt.”

Well played sir!

Ethiopian inflation 35%

We had 2% Fed Funds in 2018. No recession. Stocks didnt like it, but the stock market is NOT the economy.

If 2% is “too big a hill”, the market is irreparably fragile, IMO.

Interesting that those of a certain age have similar observations. We’ve seen the movie before.

We are coming up on a big decision. In order to keep the status quo of asset prices high the government is going to have to dole out more and more to to bottom half of society to help them afford the basics of food, shelter and entertainment. We are going to become more like France or we are going back to the wealthy not running public policy.

The bifurcation of financial status will be the great divider of the country.

Some have blindly been made wealthy, while some work their a$$ off to break even. Too “automatic” for some, too insurmountable for others.

I repost Wolf’s wealth disparity chart

https://wolfstreet.com/wp-content/uploads/2021/10/US-wealth-effect-monitor-2021-10-02_category-per-household.png

Let ’em eat cake.

Nothing has changed in > 100 years. Rates-of-change in monetary flows, volume times transactions’ velocity = roc’s in P*T in American Yale Professor Irving Fisher’s trusitic “equation of exchange’.

Unless you predicted the fall, as I did, you can’t have anything meaningful to say.

Anyone can predict the fall in January, can you predict the winter?

Somebody wake up Powell. Tell him he’s got a job to do today.

Oh, I get it. A buying opportunity. Why didn’t anybody call me?

@Wisdom Seeker

Thank you for the compilation.

However, it is incomplete. What were the Fed talking points and actual Fed behavior following each Wild Bull –> 200 day moving average incident?

I would argue in NONE of the examples did we have a Fed confronted by both rising inflation and a political establishment (POTUS and Congress) clearly endangered by said inflation.

Yes, every situation is unique. I deliberately limited the analysis to just 2 quantitative factors. That limits the number of cases to a place where we can discuss individual scenarios and tease out other factors like you suggested.

I believe the 1970s scenarios (summarized in the chat but not plotted in the article) are most-similar in the respect you indicated.

And inflation was also a factor in the 2007-2008 timeframe. Oil was higher then than today, even in nominal dollars.

Today’s bubble is even larger than the 2008 one. A big difference in the politics is the greater level of wealth inequality now. Back in 2008 a lot of people were feeling fat&happy with their real estate wealth and didn’t clue in until too late that they were sheep about to be shorn. But those people who were screwed over in 2008 have long memories about the injustices they faced, and that definitely changes the politics this time around.

Rates unchanged 0% to .25% yep thats the way to reel in inflation. And more talk on reducing the balance sheet. FED can talk the talk but cant walk the walk. All talk no action. Oh but there reducing there buying spree by a pitence or so they say, well see February is not here yet. Still seeking 2% inflation is still inflation(reduced buying power). Defintion of money: Store of value, Unit of account, medium of exchange. Well it sure misses that first defintion by a long shot. It surely is not a store of value since the creation of the FED the dollar has lost 99% of its value. A Dollar isnt worth a penny.